The typical home buyer is now a lot older than just a decade ago: Recent buyer and seller data shows an older population purchasing real estate across the country.

Here we are six full years into a recovery and yet somehow, young Americans are simply not buying homes as expected. This pent up demand is simply not materializing for a variety of reasons. Even the Federal Reserve, the engine of low interest rates acknowledges that younger Americans are having a tougher time buying because of wickedly large student debt and lower incomes. Taco Tuesday baby boomer parents think they have figured something out about college but many went to school during a time when college was ridiculously cheap. Some think they can send their kids to community college and then expect them to transfer into insanely competitive colleges. Good luck with that. In many cases, community colleges are over enrolled and many will take extra long to get general education courses completed. In California, you have 2.3 million young adults living at home and many already completed college. This is a big deal and even the National Association of Realtors (NAR) can’t deny the data. Take a look at the change in age for recent buyers.

The graying out of the American home buyer

In the past, the real estate industry was easily predictable. Folks got married, entered into a rental, got into house humping mode, kids came, and then new homes were built for this demand. The home building industry thrived on this and so did construction employment in the United States. That doesn’t seem to be the pattern any longer. People are waiting much longer to marry and the size of the American family is shrinking.

Most Taco Tuesday boomers did not envision having a multi-generational household. Certainly not with a grown adult living at home and then spending all disposable income on fancy cars and going out with friends. Some use multi-generational households as “free daycare†so they can keep having dual-incomes to support their expensive lifestyles. For the most part, many boomerang adults are coming into homes were this was unexpected. So let us look at the changing dynamics here by looking at typical buyer profiles from 2005 to 2014:

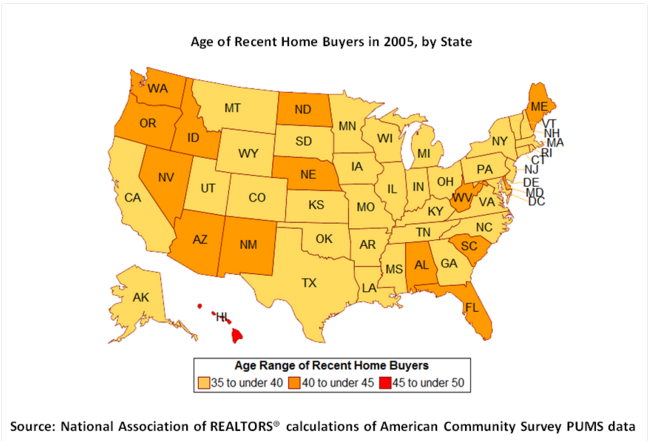

This shows a very uniform buyer profile across the US. Most buyers were 35 to 40 or 40 to 45. The range was clear across the country. Of course, much of the buying then was also juiced by toxic junk mortgages so incomes didn’t matter. Now that incomes matter, take a look at what has happened:

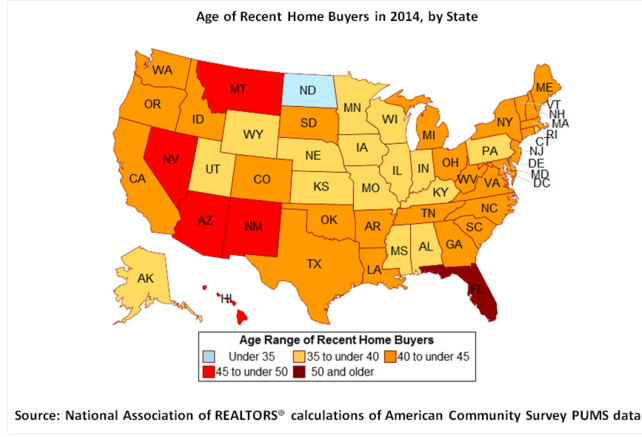

A much more colorful map but overall, recent buyers are much older across the country. For example, 10 years ago in California the typical recent buyer was between 35 and 40. Today it is now up to 40 to 45. Florida has gone much older over the last 10 years as well as more Purina Dog Chow eating baby boomers prefer to move to a low cost state with nice weather instead of living in a million dollar HGTV crap shack sarcophagus in a high cost state than living off one cucumber from Whole Paycheck with their Social Security check.

The trend is very clear. The young flood of buyers did not materialize. To the contrary, the typical recent buyer is much older. You can even see this with housing starts:

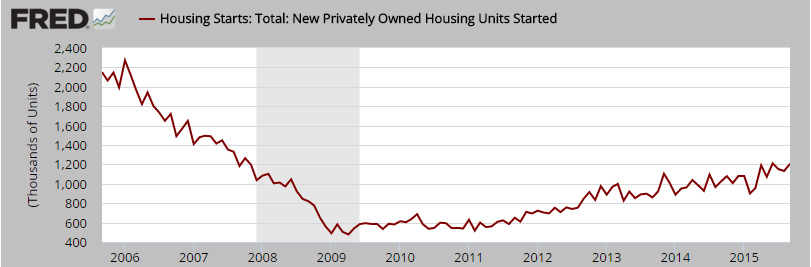

When buyers were younger a decade ago housing starts were running at 2.2 million at an annualized rate. Today it has picked up to 1.2 million – 1 million below what it was a decade ago even though we have a much larger population. And many of these housing starts are for multi-unit real estate (aka apartments). Why? Because many of the young can’t buy and can only afford to rent if they even manage to leave their parent’s home.

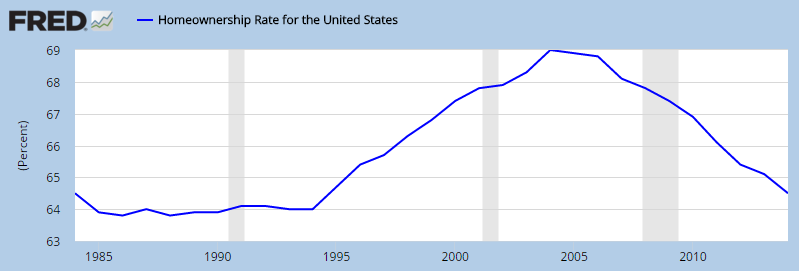

Even though older Americans are buying homes, the home ownership rate has cratered:

And do you expect young people in say California to purchase $700,000 crap shacks in mass? It simply isn’t happening. Volume is weak. Price gains hit a wall this summer and the momentum is shifting. The trend is clear and what we didn’t see materialize is the young home buyer. What we did see is massive investor buying and foreign money rushing into the market. Older buyers are dominating the market. There is your pent up demand.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

101 Responses to “The typical home buyer is now a lot older than just a decade ago: Recent buyer and seller data shows an older population purchasing real estate across the country.”

Baby Boomer Cultural Reference alert…

Daltrey: You know nowadays it’s the Old Man, He’s got all the money.

Townsend, Entwistle and Moon: THUMP!

Daltrey: And the Young Man ain’t got nothing in the world these dayyys!

True in 1957 when Mose Allison wrote it, true in 1970 when Live at Leeds was recorded and even truer today.

Eric Burden and the Animals.

“It’s a hard world to get a break in

All the good things have been taken…”

I was singing that refrain way back in the 80s. It has never been easy to make it in this world unless you have help, (parents). It’s seems like it’s easy to make it cause everyone we see on TV has made it. That’s why they’re on TV. But most of us are destined to struggle.

I recognized a reality TV show “actor” last weekend driving for Uber on the west side. I was surprised, perhaps I should not have been.

What amazes me is that I thought I was likein the 1980s, yet I could afford my own room while in college, had a motorscooter, and lived pretty OK. Later, as an employee, I had my own apartment, spent too much on motorcycles and restaurant food, and paid off my student loans.

Now I just feel fortunate to sleep under a roof (in a building zoned as storage) and have a decent bicycle. Since at 53 I’m becoming an old guy, I’m getting the old guy fun things like aches and pains where there were none before, and hit blood pressure. I’m working on this last by following the DASH diet and so far it’s working. At least the DASH diet is cheaper than a conventional one.

For most people the standard of living is down, down, down. However poor you think you are now, give it 10 or 15 years and you’ll be poorer still.

Hotel – Ouch! You know uber drivers only realize about $10 an hour.

I recently read that top porn stars are having to turn tricks these days to make ends meet. They used to just have to act in films.

Society is changing. Change and hope.

The past few years the MSM has focused on pitting races against each other. Perhaps Sexism will be the new Racism, especially if Pantsuit gets elected. If one disagrees with her policies, it is simply HATRED FOR FEMALES. Women vs. men. Young vs. Old. Gay vs. Straight. Natives vs. Immigrants. If one questions uncontrolled immigration they are RACIST. Concerns have nothing to do with overcrowding, skyrocketing housing costs, more competition for jobs, increased traffic, overtapped resources, rapidly decaying quality of life, and possibility that a lack of enforcement of laws may be eroding society. Most people I know concerned w/uncontrolled immigration could honestly care less about an immigrants race/origin; more a worry that it’s like an ever increasing population of lions competing for an ever shrinking population of zebra.

Divide and Conquer! Distract! BREAKING Kardasian news, what is Bruce/Catlyn wearing, maybe Clooney or DiCaprio will fly in from one of their estates to pontificate about climate change/global warming! What did the Real Housewives do today?

“Divide and Conquer! ”

Nothing new. Since the begining of humanity that is how elites dominate the masses. One example is the false paradigm of left vs. right, Democrats vs. republicans, when the REAL diference is between globalists (totalitarism) and constitutionalists.

The globalists are from both parties: Sanders, Clinton, Obama, Bush, McCain, Cheyney, Marco Rubio. The bankers will be equally happy as long as they get another globalist in the White House. To that end the presstitute has to tear down any outsiders to the establishment who might have a chance of winning. That is always the case without exception.

The masses, by and large, don’t have too much critical thinking and fall for it everytime and the elites know that. They go by emotions not logic.

I give the elites credit that they are inteligent, although evil.

Drinks – No doubt the Fox News crowd thinks that way, but I like to think the average voter is looking at the candidates, not their race or sex. We don’t care that the crazy neurosurgeon guy is black, we do care that he’s a loon.

Since biden ducked out, and Gore has apparently retired, were probably going to have a Hillary and Sanders ticket. Which will cut through the Republican clown show like a hot knife through butter.

It’s a case of simply voting for the least bad.

2015’s Best & Worst Small Cities in America

https://wallethub.com/edu/best-worst-small-cities-to-live-in/16581/

Sure, we can pick apart these types of rankings from nearly any angle, but the nice thing is how far more comprehensive they go beyond platitudes and generalizations around the idea of everyone wants to live here.

Looking at the top of the rankings, it’s so-called “flyover” country.

At the bottom, it’s full of speculating on gentrification riches crap shack towns of SoCal.

The problem is, in flyover country, stocking shelves at the local Walmart is an elite job.

Say what? If this is sarcasm, I don’t get it. If you’re serious, you’re wrong.

Alex has been breathing too many fumes. There are a lot of well-paying jobs that aren’t retail in the “flyover” regions of the US.

@Hotel California,

That list simply validates my point that 75% of SoCal is ghetto / barrio / garbage dump / armpit / third world hell-hole.

The rocket scientist SoCal real estate geniuses who proclaim that SoCal is “world class” merely focus on the top 15% of what SoCal has to offer which is out of the price range of 85% of the population, and most likely out of the price range of those who proclaim that SoCal is world class.

Blofield – 75% of anywhere in the USA is third world hellhole. Silicon Valley where I live is certainly that way, and its been true everywhere else I’ve lived.

Alex, where have you lived outside of California? After growing up in a medium sized Midwestern city, then spending a few years in Indianapolis, I moved to Los Angeles (where I lived for 15 years,) and I couldn’t believe what a dump most of it was/is.

Alex, I think you’re giving third world hellholes too much credit. Geographically, it’s more like 5% of the U.S. resembles such. Not sure where else you have lived, but perhaps the sample size is skewing the results.

All – I’ve lived in Colorado Springs, Colorado, Prescott and Phoenix, Arizona, orange county, California, all over the island of Oahu, Hawaii, and the so called silicon valley.

Yes all of these places have nice houses, nice scenery, etc. But all of them have a base layer of desperate or at least bleak poverty, people just surviving and essentially with about the same quality of life as working class Filipinos. It’s just that most of us just tune those people out, don’t consciously see them.

Alex,

You just contradict yourself. You said that you lived in SF and SoCal and many other places and that they look like thirld world (and I agree that many parts do), but then you talk that thirld world poverty is specific ONLY to flyover contry but not silicon valley. It doesn’t make any sense what you say.

Is poverty specific only to flyover country, or to all areas where you lived (SF and SoCal) included? Or you lived only in the poor areas of those places?

I would say that pour and rich places are everywhere. It just depends where you live. On the Big Island where you lived, starting north from the airport all the way to Fairmonth Hotel, north of Waikoloa, for tens of miles, is that third world or miles and miles of riches with over 50 personal jets at Kona Airport. Maybe you lived in a hole from Hilo?

It is the same everywhere. Can you say that the rich part of NE Phoenix (including Scottsdale) is a third world poverty? Even in Orange County, along the coast there are many areas nice. Expensive? Yes. Plenty of poor barios? Yes

See, everywhere it has to do with where you live not just the city.

For me, instead of living in a poor bario from SoCal, in a crap shack, for the same money I can live in a new house, in a very nice area in Pacific NW (on the sunny, dry side).

Flyover – I’ve not lived on the Big Island, but you’re not seeing the homeless camps, the people camping in the jungle, the fact that your cleaning lady, your nanny, your yard guy, etc live in 3rd world conditions.

I grew up in a pretty nice are of So. Cal., RPV. I moved away for my career, but spend considerable time in So. Cal. each year since then. The transition, mostly to becoming run down, is staggering! Certainly, if you never venture much away from PCH or the beach cities for example, you will never know! But, drive across town on many surface streets from say Long Beach to Whittier/Hacienda Heights, or Harbor City to downtown L.A., and you will see how much of L.A. has changed, and it isn’t the Chamber of Commerce picture!

The shitty areas are where your landscaper, your nanny, your handyman , etc live. And they have to live within bicycle or bus range. Someone in socal told me that wherever you ave rich people, you’ll find poor people clustered nearby. I’ve observed and he’s right. Whether it’s Palo Alto and East Palo Alto, Newport Beach and the area around placentia avenue, what have you, the servants have to live somewhere.

A new 3,000 sq. ft. home with a view of corn, wheat fields, or prairie might look pretty good if you can get that for the same monthly amount you are spending on that studio apartment in L.A. and if you can find a job! Denver is going crazy with construction of homes, apartments, and condo’s. My modest neighborhood that has an elementary school and swimming pool, has transformed from all young families to about 1/2 families and 1/2 retiree’s like me … it is relatively inexpensive and lots of amenities in the area. And the notion that people live in L.A. for the weather and beaches is Chamber of Commerce hype! I grew up there and although I live in the Denver area, I have spent weeks and months each year since around the South Bay beach areas … don’t know how many walks I’ve taken along Torrance, Redondo, Hermosa, Manhattan Beaches. There are few people on the beaches or outdoors anywhere during the week … they are all in their cars or cubicles! On weekends, the beaches are only truly busy during a heat wave or later in the summer when the fog no longer blankets the beach areas! For most, life in L.A. just like most places, is just an existence, a rut, a routine!

Call it propaganda if you like, but I head over the hill to the beach in Malibu regularly every month of the year (a bit more in the summer). I usually go on weekdays to avoid the crowds and its typically about 1/2 hour from my driveway to the sand. It’s not the primary reason I live here, but I’d be lying if I said it wasn’t an inducement.

I grew up back east and remember feeling trapped inside by weather for half the year. Though I only have a little crapshack in Venture County I purposely chose a location adjacent to a county park so I could go running whenever I chose – every month of the year. As I’ve gotten older I don’t run much anymore, but I still hike and take my mountain bike out on the trails – every month of the year.

I know I must sound like a RE shill to the folks on this blog, but I chose a job in SoCal 30 years ago in large measure because of the opportunity for outdoor recreation and bought a house in a location allowing the same. The weather does really matter to some buyers and I was one.

The rational perspective is that for many observers, SoCal has some intrinsic added value of certain climate and recreational opportunities. The claim is not that these things are nonexistent.

Foregoing the usual exaggerations of said value and comparisons to other regions, the finer point being debated is that those opportunities are increasingly being devalued due to mitigating factors which give way to lowering the standard of living in this region. In other words, we’re concerned with today and what the future may hold.

One would think that it only requires a modicum of critical thinking to observe this, but the climate and topography continue to be a commonly first and last resort argument as to why other details don’t matter. That’s where this is coming from.

apolitical: I’m assuming you must have taken your runs/rides in early mornings or evenings during the summer? The weather in the valley often isn’t exactly pleasant in the summer, as you must obviously know. Still, I would tend to agree with your general sentiment that the weather (even in the valley) beats having to hibernate inside for the winter back east.

I will admit that the weather and lots of stuff to do are the only things keeping me in So Cal. So Cal is otherwise pretty undesirable unless you’re filthy rich.

Responder,

You’re certainly right about timing exercise with the seasons. On the hottest summer days I try to be back in from my rides by 10AM at the latest, while I may not ride/hike until the warm afternoons in the winter.

That said, with all the hills/mountains dividing the area there are many strikingly different microclimates. I commute along the 101 and it’s shocking how much hotter the SFV is than the Conejo Valley. Woodland Hills is about the hottest point and often tops 110F mid-afternoon in the summers, but on those same days it usually only gets up to the low 90s out in Thousand Oaks and often doesn’t even break 80 down in Camarillo. The trade-off is that the cooler towns often suffer from June Gloom (and May Gray, and Gray Sky July) while the SFV will be clear all day.

Of course the Valley is also 20 minutes closer to the whole music/art/food scene of LA (more important back when I was young and single) – as well as being an easier commute if you work near the urban core. So there’s that trade-off too.

apolitical scientist, I live in a condo on Ocean Drive in Santa Monica. I can see the beach from my balcony. I moved here in 1987. The last time I crossed the PCH to walk on the sand was in 1993.

Walking on the sand was a novelty when I first got here, but it wears off.

Anyway, if you like beaches, they got beaches all over the U.S. Beach communities all along the Pacific and Atlantic coasts, plus the Gulf of Mexico.

When I was a kid in New York City, my parents would drive us to Jones Beach. Sometimes to Sunken Meadows. You can also take the subway to Conney Island. Beaches and seaports all around New York City.

Nothing special about Los Angeles having beaches. Look at a population map of the U.S. Most Americans live within driving distances to beaches, rivers, or lakes.

Apolitical – same here. Born here and California has always had the best pay to expenses ratio for me. Why? Because I know people here. I know the job situation is shitty but I’ve lived elsewhere and its shittier elsewhere. I know the rent situation is shitty but its shittier elsewhere.

Demographics and the young not having the capacity to buy yet.

The age would probably be slightly higher if their wasn’t so much housing bubble debt left in the system that prevents selling equity from being part of the housing market

“Housing Debt Still Haunts Some Move Up Buyers”

http://loganmohtashami.com/2015/10/19/housing-debt-still-haunts-some-move-up-buyers/

With all that said, with the 2 year note at .90% above the key .80% level and now the Fed Fund future pricing the first rate hike in December at 70% and March at 90% +

Time to see the housing market with a rate hike cycle, yes… it’s just a .025% and it’s going to be interesting to see how the Fed handles the data and the 2nd and on rate hikes

“The Fed Rate Hike And The Housing Impact”

http://loganmohtashami.com/2015/09/10/the-fed-rate-hike-and-the-housing-impact/

You often spam your site here, don’t you?

How can this trend change until there is a reset to income to housing prices? We bought our first home about 32 years ago and the costs of the house was 2 X our annual gross income and we felt stretched in the beginning with rates at 13.5%.

Our present home is likely 12 times our gross annual income. I certainly could not afford to buy my home now, so why should it be any different for the kids?

Even if the combined income is $120k, at $700k that is about 6 times earnings. I just do not know how a person feels comfortable with that much exposure to a ton of debt.

If I was young, I would leave San Diego for sure.

Jim, housing will never be available again at 2x income, but I guess that’s stating the obvious.

Land costs, material costs, labor costs, and rental rates would all have to collapse to see home prices collapse. I’m just about done building a townhome in MT. 47k for the land and about 210k in labor and materials. It should get appraised at 300-310k as values have been going up and the bids were all done about 10 months ago. So 300k gets somebody 4 beds, 3 1/2 baths and mid-level finishes.

I don’t see how this is crazy or unattainable – 65k salary would cover the mortgage.

Labor costs here have gone up 10 – 20% from 2-3 years ago. They could go back down, but that’s not going to change prices much. Material costs aren’t going to change much, neither is city fees.

Obviously CA has higher land values to consider, but the most of the country doesn’t have this issue.

So will we see a price correction? I don’t know, but 10 or 20% wouldn’t surprise me at all. 30% could happen, but something really drastic has to occur if we’re going to see 40 or 50% reductions. Even at those levels, much of CA will be unaffordable to the younger generations.

That all said, I sure see a lot more signs of affluence in the local high school kid’s parking lot than when I was a kid. There is no comparison.

Jeff, as a builder, would you say that rentals are in general more flimsy in construction than are condos and townhouses, or visa versa?

I heard that condos and townhouses are better built than rentals, because home buyers are more discriminating in how they spend their money, whereas poorer tenants can’t be choosers.

OTOH, I also heard that condos and townhouses are worse built, because the developer figures that once he unloads the condo/townhouse, he won’t have to worry about thin, noisy walls or construction defects.

Who in hell is making 5X what I make, in flyover country??

I’ve lived in flyover country and have seen poverty that’s not possible in California.

Alex, I don’t know what you make but within the construction business I can give you a few numbers. A highly experienced painter makes $45/hr and charges 70/hr if they have to travel to the ski resort area. Trim and cabinet install guys are just about the same. Entry level certified electrician is $25/hr here. In ND, most used to make roughly 100/hr. If you need to call for an electrical or HVAC repair, the rate is 90/hr. The head guy running a landscaping crew is getting 40-50 but of course don’t have a steady workload. The high school & college kids working for him in the summer get 10 – 15.

An experienced tile guy charges $20/sq ft for a nice backsplash. That’s approx. $40/hr. If you want prefinished hardwood installed it’s roughly $3 sq/ft. Install and site finish hardwood is $9 sq/ft. These are for simple installs, certainly no inlays.

Entry level positions in machine shops for kids with BS degrees start at 15/hr but go up fairly quickly.

Son-

I’m the ‘investor’ – I write checks to the general contractor but do a little bit of the work myself. My goal is to (obviously) keep the cost down but make a place that’s nice enough to appeal to an above average tenant.

It would be impossible to give you an answer with respect to quality of condo/townhome vs apartment or SFR. Every specification, contractor, sub, and city/county regs are going to vary. The townhomes that I’m building have the same ‘guts’ as the house I had built for myself. Here in MT that means 2×6 construction, blown cellulose insulation (much better IMO than fiberglass bats), vinyl double pane windows, 9′ ceiling on main floor 8′ upstairs, hardwood/carpet/tile/slate flooring, central heat/air, 6″ exhaust ductwork, rebar in concrete and between foundation/exterior patios/driveway. No vinyl on the outside, but there are no pricey materials either. This ends up costing ~$120 sq/ft for everything but the land.

The city mandates a 2 hour min firebreak between the two units. That’s done by making the common wall by fully insulating both unit’s walls plus a 4″ air gap between them. The only place the units contact each other is the roof. This also means you can’t really hear your neighbor.

Jeff – and all of those jobs depend on being related to the right people or having gone to school – and played football – with the right people.

“Even at those levels, much of CA will be unaffordable to the younger generations”

and that spells disaster, eventually incomes and home prices will align, it’s not a matter of if but when…..it’s the only way a market can function over the long term. And a $300K+ loan on a $65K income is fucking insane.

Alex, speaking from people that I know (i.e. anecdotes), these jobs do not depend on knowing the right people. There is enough demand in the trades here right now that people are being hired from out of town. And I don’t think you should find it surprising that most employers now expect a degree for an entry level position. A college degree ain’t what it used to be, and neither are the individuals that obtain them. (there is my bias, which I make no attempt to hide)

Jeff – I agree with you on the lower level of quality – in the instructors as well as the students – in colleges when almost everyone is expected to go to college. I was already noticing it when I was in college in the 80s.

If I were to do it again, I’d have gone into the trades, and not even messed with college at all.

I’m not sure how the trades can help me now, though, at age 53 with a bad back, a bad eye and a so-so eye, high blood pressure and God knows what else going on. On, and no car and no money for the tool kit, the training fees etc. I betted on electronics and I lost. I do have quite a lot of experience in dealing in electronics surplus, but that only helps me in working for my friend, who has a ton of it. If I were to go out on my own again I’d literally only make about $3 an hour.

@jim,

The important factor is interest rates, not the selling price of the home.

Case in point:

$600,000 @ 2% interest, monthly nut about $2,200 per month

$475,000 @ 4% interest, monthly nut about $2,250 per month

$300,000 @ 8% interest, monthly nut about $2,200 per month

$150,000 @18% interest, monthly nut about $2,250 per month

*Note: interest rates were above 18% in 1981

$600,000 house requires $120,000 downpayment and $7500/yr property tax at 1.25%.

$475,000 house requires $95,000 downpayment and $5937.50/yr property tax at 1.25%.

$300,000 house requires $60,000 downpayment and $3750/yr property tax at 1.25%.

$150,000 house requires $30,000 downpayment and $1875/yr property tax at 1.25%.

Now which house is the better deal? Also the $150k house has the better mortgage deduction at 18% than the $600k.

@jim,

There are really four factors that determine a home selling price in SoCal:

1.) Interest Rates

2.) Unemployment rates

3.) Welfare / Social Benefits (including pensions of government workers)

4.) Lending standards

When California has gone into a recession and unemployment rates spiked (#2), Sacramento cut welfare/social benefits (#3), and lenders clamped down on (#4) and home prices collapsed as much as interest rates (#1) would allow.

When the California economy is growing, unemployment rates drop (#2), lending standards ease (#4) and Sacramento jacks up welfare/social benefits (#3). This in turn leads to the boom-bust-boom-bust-boom-bust real estate environment that we see.

With these low interest rates, some people could choose to buy in “transitional” neighborhoods, which is code for gentrify, which is risky due to quality of life and school district concerns. But it is an option… I realize there is no easy answer.

I’m 32, been living here for 3 years in San Diego. Been thinking really hard about leaving for Southern Virginia. The juice just isn’t worth the squeeze.

https://www.washingtonpost.com/posteverything/wp/2015/11/05/baby-boomers-are-whats-wrong-with-americas-economy/?tid=pm_opinions_pop_b

yet another article as to why boomers are spoiled as written by a gen-x

“costs of averting catastrophic climate change or helping their grandchildren adapt to a warmer world”

that’s where i stopped reading, how can i take him seriously now?

Silent parents, one Boomer then a 4-year gap then 4 X’ers, about a year apart.

Gilt-edged prep-school cush life for the Boomer, Appalachian level poverty for the rest of us.

When I say Die, Boomers, I’d like to see my spoiled bitch older sister who’d not give you a sandwich if you were starving, go first.

Alex, you say Die Boomers? Yet if you’re 53, you’re a tail-end Boomer, born in … 1962?

You are living evidence that one cannot generalize about generations. You don’t sound like the stereotypical Boomer who’s had everything handed to him. You don’t sound like you’re feeding off the savings from the past, and borrowings from the future.

Alex, have you ever considered about counseling?

Son – I refer you to the excellent book “Revenge Of The Latchkey Children” by Ted Rall. It has all you need to know about genX.

As me tiones, myn5years older Boomer sister got it all. Prep school, show cats, she even had a couple of tiaras! You get the picture. The other 4 of us were truly latchkey kids. My one year older brother, myself, and the two younger sisters. It was F*ck you, sink or swim, the public school’s down the road, if you get beat up, Tough. If you want to learn to read and write, We’re not gonna stop you but we’re not going to go out of our way to help you, either. On yeah, and the day after your 18th birthday, you’d better have you bedroll under your arm and be headed out the door.

Boomers vs X’ers are a fuzzy line, some day the line is as recent as 1965, while some put it back as far as 1960. I’d say it’s back as far as 1961 anyway because that would include my older brother. It was shit-ass survival for all of except the oldest.

Ask yourself: Did you have a tiara, and private school, and like escargot, or was it fishing for dinner, fights in the school parking lot, and nobody really gave a shit if you graduated? If you were born 1960 – 1965, this will tell you if you’re an Xer or a Boomer.

Yep and older Boomer sister is truly a bitch. Severely lacking in empathy. Thinks the homeless should be put I to camps. Talks up Nixon every conversation. You get the idea.

This is exactly how I feel about the Boomers. What he didn’t mention, and something we talk about often here, is also that they are also the beneficiaries of the largest boom in asset prices in human history, just take a look where the S&P 500 and residential real estate prices went from 1980 up until today. In 1980, the S&P 500 was around 100. If you had invested $100,000 in 1980, you would over $2,000,000 today not including dividends. I’m sure you would get something similar with real estate investments. The baby boomers have left us a husk of a country and they’re not even done yet, they think immortality is an entitlement, they won’t “rest” until they take the entire healthcare system down with them so long as they get to live another 6 months hooked up to a machine. Hate to talk about “death panels” but you can’t get around rationing. You either ration healthcare for the young or for the old, unfortunately, that is the reality in a world of limited resources.

my dad bought his small business property in 1975 for $30,000 in gardena. after a major remodel in 1989, he is now the millionaire next door living in his upstairs 1800sq ft office which he converted to his mancave

Dean – man I don’t want to be hooked up to a machine for six months of more of a sort of life at huge expense. I’ll get à bunch of heroin from the local junkies and duck out via a nice OD, or at least hang myself.

Colleges have turned dorms into “resort style living” to attract the “best and brightest” and they just keep charging the students more and more money to maintain and build these facilities. High student debt is having and will continue to have a big effect on the economy and family formation. I’m lucky I graduated college in 2002, slightly before the explosion in tuition.

CSV – no kidding. Packard of Hewlett and Packard lived in a cabin in Hewlett’s backyard while going to Stanford. The cabin had a dirt floor.

Call it the continued crappification of the economy and the real estate market. The status quo has been so focused on privatizing all of the gains and socializing all of the losses (see last financial crisis), they have essentially killed the host (formerly known as the American middle class). It’s no surprise to see the average age of home buyers ticking higher, because this older cohort has more savings/wealth. Most recent college grads sure as hell aren’t going to rush out and buy a home when they can clearly see that we have an echo-bubble in home prices, and that’s assuming they aren’t buried in a pile of student loan debt.

Home builders have been feasting on the Federal Reserve’s crony capitalist experiment of ZIRP and QE to infinity, but it appears the low-hanging fruit has now been picked. I’m wondering what the home builders will build next, and who’s going to buy it?

http://aaronlayman.com/2015/11/more-third-quarter-earnings-releases-for-home-builders-show-stagnating-sales-environment/

San Francisco sells its soul…

http://www.salon.com/2015/11/05/san_francisco_sells_its_soul_money_rules_the_city_now_bohemia_be_damned_partner/

Opening paragraph of the article

“San Francisco voters on Tuesday showed once again that making money is more important than preserving the city’s bohemian and immigrant culture by rejecting one citywide ballot initiative that would have regulated homeowners who rent out units via Airbnb and rejecting a short development moratorium in the Mission District, a Latino neighborhood especially hard hit by gentrification……

Sounds like a job for the Bedbug Commandos 😀

I’m listening to Ric Edelman’s radio show.

A millennial (early 30s) first-time home buyer just told Edelman that millennials don’t like mortgages because they’re “debt averse.”

Edelman replied, “Debt averse? Are they also wealth averse? Because mortgages are a great tool for wealth creation.”

I’ll agree with good old Rice Delman assuming the mortgage is as little or less than rent, and you sit tight for years, and save money besides. Use your own money and labor to improve the place, and live frugally.

But the millennials are the new Depression generation, and naturally they are debt averse! They still have to pay off huge student loans and that STEM degree only gets them a job pouring coffee.

I understand these debt-averse millennials, and agree with them.

Mortgages CAN be a tool for wealth creation, but they have been used, instead, as a tool to spend beyond your means, and inflate house prices to levels unaffordable for first-time buyers, and out of keeping with local incomes and rents.

We would be better off if we’d never heard of the 30 year mortgage, and if buyers routinely put at least 50% down on mortgages with much shorter terms. House prices would be far lower, and while the home-ownership rate would be lower, the savings rate would be far higher, with the result that our population would be more resilient in the face of economic shocks, and we would have the savings that are necessary to fuel long-term investment in industries that long pay-back periods. Nobody has really benefited from housing inflation, or from the horrendous inflation of our currency in general since the early 70s.

Amen Laura! Inflation and debt generally just helps the govt and elite money.

Laura,

While I agree with your sentiment, you are incorrect when saying “nobody has really benefited from housing inflation”. I’m also not sure that “house prices would be far lower”, although I guess you’d have to specify just how much constitutes “far lower”. I can certainly see homes costing 20-25% less if mortgages were structured differently, but it’s hard for me to see them costing much less in the long term when taking into consideration construction costs.

I am one of the folks that has used the low interest rates of the last few years to invest in a number of properties. I would not have done so if rates were higher. Look back to 2011 – housing prices had collapsed from prior highs of a few years earlier, rates were low, and the stock market was unpredictable as it always is. I wanted out of the market and into physical assets. I also thought that historically low rates presented an opportunity – they were either going to go back up or stay about the same, they couldn’t go lower. My solution that used these factors was to buy/build rental properties. You know that I’m far from the only person that saw this and is pursuing this strategy.

Simply put, I don’t like the way the gov’t intervenes in the economy, but I’m not in charge, I’m just dealing with the hand that’s been dealt.

>> Nobody has really benefited from housing inflation, or from the horrendous inflation of our currency in general since the early 70s. <<

That's a nonsense. Many oldies are sat on fortunes in equity which can be made real if they were in a real market and took selfish decisions to sell/cash in.

It's really playing down the gulf in extremes of positions between market participants.

__________________

Kilo Charlie, My World

We purchased a property in 1983 for $109,000………today it’s worth £980,000 plus.

Sam, Bucks

Bought house in ,74 for $24,000 added extension about $12,000 now valued at $725,000. You do the math.

__________________

That Ric does love mortgages. I would agree with him, if I didn’t believe the current government and American dollar could be on the verge of catastrophic failure. They may not last long enough to see the returns he’s counting on. On the other hand, the next totalitarian government (or Mad Max gangs) probably won’t care if I own my house outright or not before taking it from me.

Maybe I won’t pay it off.

http://www.theatlantic.com/business/archive/2014/11/why-its-so-hard-for-millennials-to-figure-out-where-to-live/382929/?utm_source=SFFB

the best place to find a job is also the most expensive and the most affordable place to live is the worst place to find a job

http://www.theatlantic.com/business/archive/2015/11/coliving/414531/

adult dorm rooms that alex in san jose might like

I think I would. I have this place to stay in for free, plus some work so I’m in a pretty decent p!ace right now, considering it’s a Depression I’m riding through.

Immediate emergency plan b is throw my stuff into a storage unit and invest in a tent and sleeping bag, and camp around. Better plan b is to rent a small office, I know of one building where they are reportedly kinda OK with people sleeping in, if they’re neat. But I’d have to get about $400 more a month coming in to play the rent. I can practice music here but in an office, I’d make use of the college practice rooms.

I’ve lived in rooming houses and they’re perfect for their purpose.

Son, my brother in law used to parrot Edelman to me 10 years ago when he’d say, “take every penny that you can out of your house, don’t leave any money in the walls.” Meaning, refinance until they won’t let you and pull out all you can. Well, my BIL did that and now he owes over 1.0MM on a house he paid $300K for, and listed it at 1.24, recently dropped to 1.19. Cannot sell it. So basically he is looking at breaking even or bring a checkbook to closing. How many cars and Ducatis did he buy these last 10 years? Yeah. I knew then it sounded stupid and lo and behold, it was. I sold my house 8 years ago that I had bought when he bought his (1999) and I made $500K. I still have most of it, have paid to put one child through college, and have bought another nicer house. All on a government salary that has not changed much in 10 years. And I didn’t follow that dope Edelman’s advice. But my BIL did. And he is paying the price.

Exactly, Alton. I listen to that gasbag’s show and just shake my head in disbelief. Debt is not an asset, I don’t care how he wants to spin it.

How many millions of people did exactly what your SIL did, and ended up losing their houses and credit after 2008?

I bought an inexpensive (but beautiful) condo here in Chicago in 2013, and paid cash. A couple of men I know told me I should have a mortgage, that the money was “trapped” in my unit and “not working for” me.

I said it IS working for me- it is putting a secure, economical roof over my head. It has been a great rent-hedge in just the short time I have owned it. I actually OWN the place, to the extent that you can “own” anything when your city has the ability to raise the rent, i.e. property taxes, you must pay for the privileges of retaining the title to what you bought and paid for.

I believe that the millennials will be very much like my grandparents’ generation, those people born 1900-1910, who were young adults and just entering the workforce when the Crash of 1929 and ensuing depression, resulting from the credit rampage of the 20s, wrecked half the adult population, wiping out fortunes, bank accounts, businesses, and jobs, and claiming ten career-building years out of the lives of my grandparents’ age cohort. My grandfather was one of the few people he knew who had a career-track job, or for that matter, any job at all, during the dismal 30s, and like many young people just starting out, he and my grandmother lived in his parents’ large house until my mother was about 8 years old. And, like so many of their generation, my grandparents learned early to be extremely frugal, and went on to become extremely successful.

Now a new “hero” generation is learning the same lessons they learned, and has learned to be frugal and careful. I do not doubt that these youngsters will become very successful in later life… but only if our policy makers and current ruling classes learn the same lessons that the powers of the depression era learned the hard way. Unfortunately, that does not look to be happening, and I fear that we will have to suffer a lot more, more than even in the 30s, before we truly learn that fake money and unlimited credit do not cure the problems caused by same. Let’s hope the country survives it so the young people can pick up the pieces.

Laura Louzader: While it would have been a bit risky, you would have done quite well had you invested in the S&P 500 instead of paying cash for your place, particularly if you bought in early- to mid-2013. From that perspective, these “men†were right. Of course, if the market tanked, investing in the market would have been a bad one- but so would have buying a house, since the real estate market would have likely tanked along with the market.

There is more than one way to skin a cat, and while your way seems to work for you, there are obviously many available avenues to financial success.

I decided that there was far less risk in buying a place I liked close to its bottom, than buying this highly rigged market so close to the top. The fact that it has gone up a few thousand points since 2013 means nothing to me- the actual gains most investors have seen in their accounts are very small, especially relative to the risk, which I figure is at least 30%. I thought, I need a place to live, and buying a place just up from the lows of 2011 seemed very low-risk in view of escalating rents here in Chicago, while the equities and bond markets are riding high due only to Fed manipulation of interest rates- everyone KNOWS this. I also figure that my monthly cost is so low relative to rent for a comparable, and I am saving so much interest over the life of the loan, that if it dropped 20% or so in value, so what?

In fact, I’m not interested in appreciation much at all- that just means higher property taxes, something I’d like to keep to the minimum as I close in on old age.

Sounds like a great move to me. Congratulations.

Laura, what you’re doing is not wrong, but you might consider a little bit of mortgage debt simply because it is subsidized by the state and federal government and will likely be the lowest cost of capital available to you, but if you don’t really need the cash, certainly people forget that (1) interest expense is still an EXPENSE, and (2) every (honest) investment carries risk and the higher the return, the higher the risk (that’s an axiom). Our primate brains can’t really grasp #2 and that evolutionary mismatch forms the entire foundation for the financial industry.

I fear for Millennials, they are no where near as resourceful as your grandparents were. Have you had a millennial as a tenant? They are pretty incompetent in fixing anything on there own, no clue. If it falls they will be caught holding a lot of baggage with no idea what to do. However, they are very highly socially connected and maybe that were they will succeed?

Tasty, the millies in my building, who live in the unit below, are GREAT at fixing things, and the male of the pair is a top roofing contractor. And my 23 year old nephew loves to build and tinker, built a fence, and is additionally a finance and business major and math wiz who graduated on the Dean’s list.

The youngsters look to me to have the full range of human talent and ability. I remember the elder generations saying the same things about my gen when we were dope-smoking “hippies” and “freaks”. Face it, young people are at the beginning of their adult learning curve, and it’s a little unfair to expect them to have the same skills and knowledge as someone in his 40s. Hell, my Silent Gen boyfriend didn’t know how to fix things and neither did my parents.

Dean,

In the reply you made to Laura L, you can not make a blank statement – one shoe does not fit all sizes.

There are different situations for diferent people, for different times and for different places. For example, In SoCal (the nice safe places) prices are very high and everyone knows that. Therefore, all buyers for those places need very high incomes (at least for the high property taxes). For those with high incomes, in a state with income taxes (not all states have income taxes), it makes sense to buy to decrease the taxable income. Even then it is on a case by case basis because of AMT.

For most of US, where prices and wages are lower, especialy in states with no income tax, there is almost no advantage for the tax deductions. Especially in this environment of low interest, for the most part the standard deduction is the same or higher.

Another factor to consider for people over 50, is the safety factor. Yes, the house is an investment, but it is also a roof over your head. As you get close to retirement, you don’t want any loan or a small loan. Otherwise, it gets to be too risky. If the loan is too small, standard deduction would be higher. If prices drop in half, but your house is paid off, it is in a nice, safe area, who cares about the drop? It is actually an advantage because you pay less in property taxes. In 2009-2014 I argued with the tax assesor that since they say that they base their taxes on market prices, they have to adjust the taxes downward. He did it, because it goes both ways. He doesn’t want to lose his job because he gets elected (he is not hired).

So, I can see Laura’s point. It makes sense to her at her stage in life. Finances are different from one person to another.

Personally I like to have no debt, the house paid off, investments paid off, good cash flow from various companies and stocks and bonds – even if I don’t have a house in Malibu with view to the ocean. For me, the debtor is a slave to the lender and I don’t like to have only one life and live it like a slave. I know that some people like it or they don’t mind. Finances DO NOT internalize in the calculations the COST of stress on the body. That COST can not be factor in the formulas. There is a reason why in the richest country in the world there is the highest consumption of anti depressants, drugs and high rate of divorce. This societal cost can not be quantified.

When I make investments for me, I try to take into account ALL factors, not just the rate of return. Rate of return without common sense is meaningless.

I’m pretty sure edelman meant to put that money into investments, not ducatis! 🙁

A lot of people do this type of BS because they don’t have patience. They want the “good life” now and make bad moves that hinder the very progress they are trying to make.

Another day, another depression era 713 sq ft Silverlake crap shack.

https://www.redfin.com/CA/Los-Angeles/1605-Champlain-Ter-90026/home/7056414

A quick look at street view ticks all of the hipster haven boxes…

Crappy cars parked on the block, check.

Stall-out steep street, check.

Deferred maintenance L.A. sidewalks, check.

Neighborly tarps being used for cover, check.

Appliances in the neighbors’ driveways, check.

Sky filled with smog, check.

Gang taggings in the alley, check.

Cheap looking horizontal board fencing on the flip styled property next door, check.

…not to mention, this area gets hot as hell in the summer and there’s no walking to the beach. But at least there’s taco trucks and artisanal organic local businesses nearby, because those sort of things always stick around forever.

Real home of genius indeed.

A good read Doc.

Mortgage rates are trending up.

http://www.mortgagenewsdaily.com/consumer_rates/

“Sick of rising rents?”

https://www.redfin.com/CA/Torrance/1925-Crenshaw-Blvd-90501/unit-29/home/101686830

Stop throwing away money on rent and instead throw it away on this trash heap for only $25K. It may be a depressing pile of garbage, but you’ll own something in the South Bay!

Stop fantasizing about the American Dream and be the king of your very own single wide trailer. With all the time you’ll be spending at the beach that’s just a quick drive away, you’ll hardly have time for the pride of ownership that comes with decorating wood paneling and rusted tin.

This trend is sure to extend — and become astounding.

Young couples are shut out of their first home purchase by the 0bamacare tax.

One now needs $100,000 per annum to sustain even a low interest rate mortgage.

The President wants to destroy the suburbs, to stop White flight.

One important issue this that age is NOT considered when making a long term mortgage loan. I know of several individuals who have 30 year fixed loans and are over 80 years old. First the banks handed money to people who couldn’t pay it back, now they are handing out loans that will outlast their customers.

As the government has chosen to back many of these loans, we are looking at yet another massive bank bailout.

I’m 37 and my husband is 43. We each make 120k and I have commission between 40-80k. I started looking for a house 2 years ago with a budget of $700k. Found nothing… Now my budget is 900k and still nothing in the South Bay. He closed on a house in Redondo in March 2011 right when we met for $510… Now valued at $760k. It’s a craphole! The point here is NOTHING in this area has fundamentally changed to justify these prices. There are no more people than 4-5 years ago, no improvements, etc. NOTHING justifies these prices. It’s all speculation, and you can see the trend reversing. I would love to look in less affordable areas, but they are so unsafe, especially with my husband gone 40-50% of the time. There is no place for middle class. I have to admit, I really want a house where we can live (the other house is 900sq ft) and have kids, and I want to just cave and pay these prices. But look at the big picture, these prices are clearly a joke. I also have NO job stability so I would be a fool to pay 900k+ for a 1950s or 1970s fixer. If you think these prices are justifiable, you’re a fucking idiot.

I basically said the same thing to my brother-in-law recently. ‘You’re a *-idiot’ – when he was talking about buying a house with my sister, the other day.

He gave me the talk about reaching the age where you should own a home. Then about is eagerness of doing a house up to the style they want. He thinks you can buy a slightly rundown house at a fortunes, and then ‘add value’ by spending even more geez.

During their engagement we had talked many many times about the bubble (although I had done most of the talking), and I thought he understood, but he must have just been disagreeing with me in his head the entire time, thinking he could get around me when wedding all passed and married for a while. (I had told him at the outset, days after meeting him, that there is no way I want my sister led into heavy debt).

My reply was that I wasn’t going to fall for any sentimental nonsense at these house prices.

I told him he knew nothing of the sacrifices my sister had made to save a sum to put down towards a house against runaway house price inflation, (month-after-month, year-after-year, of putting money into savings, doing without, instead of partying) and no way was I going to see her throw it all away by putting it down against a hyperinflated house, and jumbo mortgage, so they can ‘rent from the bank’.

Also told him no way would she carry him if he lost his job. What?! Pay his side of the jumbo mortgage and her own side? Into a recession? No-way. Do that, and there’s no money to spend on vacations, no treats.. no saving towards retirement, when carrying jumbo mortgage, from my point of view. And if you want to know stress, such a jumbo mortgage when recession comes in.

She’s not highly paid compared to some senior people in same sector but has a very secure, if high-workload pressure career. Wait for the correction and buy cheap. Every $20,000 off a house you can get, you can retire one year earlier, by my way of thinking. After all, after tax, you have to earn a chunk to save $20,000 into savings. So it matters.

You wait for the deals to begin coming to you, is the way I see it. You don’t join no queue to buy at silly high prices. Luckily she agrees with me, but I had to fight against him trying to ‘turn her’. I’m not happy with him about this at the moment. He fooled my by pretending he understood, but then turns around like some house price inflation forever air-head from some TV property show, so eager to load up with debt (and put it on his wife/my sister, as well). I don’t like the idea of him eagerly trying to guide her into danger.

And they’re actually quite lucky – my mother downsized but has just about enough space for them to share with her for a while, at low cost, whilst the market plays out. Okay it’s not ideal at all, and requires compromises. Yet him and his ego to be like other sheeple as a ‘homeowner’ with jumbo mortgage, when so many older owners have no debt.

I don’t envy your brother in law having to deal with an in law with such a proprietary attitude towards his wife…

You are fighting against his emotions, it will be hard for your brother in law to touch reality.

I’m sure this guy is glued to HGTV trapped in this fantasy world. Notice that these shows never discuss the owners job, household income, current debt, taxes and length of mortgage. These details are important they can bullet point that in less that a minute of airtime and it is not too personal, it important to learn how its structured. However its supposed to be a learning show right? Notice they will only discuss, total cost and how much they will profit creating this awing dreamland, of i can do that too and i’m missing out!

Roper; I told him from the outset no leading her into debt.

Also I don’t care – I’m there to protect her, not seeing some bubble boy lead her into danger. She can’t go bankrupt else it would affect her career position – in fact she may not be allowed to practice again. If he wants to know anger he will broach the subject with me again!

He led me to believe he understood the issues (prices/debt) when I was getting to know him. I was repeatedly clear about the issues and he agreed. If he had chosen to reveal his true thinking back then, as a bubble-lusting fool, I would have steered my sister clear of him. Instead he took easy option to win my friendship and only now outing himself the debt lover, with feeble top-of-market sentimental bubble-think.

So if anyone has done any misleading it is him, turning around to me with buying sentimentality now. He can get a mortgage himself. No way for my sister. She has future and children to raise (and spend on). Not be a mortgage slave.

Also there is a big prime house crash coming. In parts of the world the Government and Central Banks are openly passing legislation to decimate/tax the property investment rentiers.

Tasty Beverage; yes. He likes property shows. I’ve watched a few with him. He will be good at improving a wreck… but I insist they wait until there is some purchase value. His father is an architect and he has similar creative streak and ability in him. However there is no way to take jumbo mortgage just for an awful base, to then take even more crushing debt on to do up. Anyway I left him in no doubt of my views, and fortunately my sister agrees with me. I tugged her firmly back to my position.

Thankfully I’m in a position to help her/them out, financially, if I need to – and make it clear it’s best to rent (by paying ALL their rent myself if needs be, for a couple of years). And they’ve got it ‘good’ – they can squeeze in at my mother’s place for a couple of years to wait it out, and she lives in a fairly good area, near good schools. Just have to be house-smart; maybe turn dining area (which no one ever uses) into a bedroom area. With money left over for spending on themselves too, trips and meals out. Why massively overpay for a hugely overpriced wreck in a lessor area, just to have jumbo mortgage and ‘own’ and show everyone ‘success’, when they would actually renting from the bank, with huge debt.

I totally agree and liked reading your comment. Due to high prices where we live (Denver), we are considering moving to a less expensive part of the country. Nowhere is perfect, but as you say, trade-offs must be made in order to do things like…save for college, retirement, and some “treats” along the way. Home ownership can be a great deal and an awesome tool, if done in the right place at the right time, for the right reasons. I am not a savvy investor unlike some of the people on this site. I am seeking a place to live long-term and ultimately pay off. Unfortunately, big chunks of the west coast are becoming prohibitively expensive places to “invest” in RE.

Tajk: If you and your husband are making a combined $240K plus a minimum of $40K for a minimum total of $280K per year, you are not middle class. You are upper middle class at worst, and that’s an extreme stretch.

You can live in a very nice, brand new, 2,000+ sf house in Irvine (one of the safest cities anywhere) for under $900K. You will have to pay mella roos, of course, but it appears you can afford it.

I have to admit that it’s somewhat baffling that someone who is intelligent enough to earn $160K+ per year on her own is seemingly not intelligent enough to: 1) identify where you can purchase a house that meets your budgetary and safety criteria; and 2) classifies herself as middle class when earning a combined income of $280K+. Yeah, Irvine isn’t Redondo, but it’s much better in many ways, particularly for schools.

Sources:

http://www.hughcalc.org/midclass.php

http://greatparkneighborhoods.com/homes

http://www.latimes.com/local/lanow/la-me-ln-fbi-ranks-irvine-safest-big-us-city-10th-year-20141111-story.html

To responder:

Duh, I do my own taxes so I’m quite aware I’m “upper-middle class” technically. But essentially living here, or anywhere in CA coast, I’m middle class. My husband works in LA, for the county and has for 20 years at his dream job, so no way we can move. I commented from Irvine to Santa Monica for several months before I moved, and it nearly killed me. Almost 2.5 hours each way. Plus I need to stay as close to the coast as possible because I have health problems and the heat makes me sick.

A decent house in Redondo is 1.5m+. You could do it if your jobs were guaranteed stable. But really who has a stable job these days and wants to gobble down that large about of debt?

My guess is people that buy into this are not punching in the numbers and worrying about the what if’s. A home is such an emotional buy and there are so many suckers!

First house, 1978, at age 26. Duplex, lots of roommates and a tenant to make the mortgage payment.

Second house, 1980. An 850 sq ft two-bed one bath “crap shack” near the beach. Still needed roommates until I got a good-enough raise to make the mortgage. Even then, had to assume the loan as under Carter’s massive inflation and high interest rates, I could never have afforded a new loan.

Stayed in that house for 35 years. Saved up cash money the old fashioned way — after tax, in the credit union, on a weekly basis — instead of blowing it on super remodels, new cars, fancy vacations and debt. Actually paid off the little house in 2000. No seconds, no equity loans. No debt.

Found the dream house to retire in. In Arizona. Had the cash for the down payment and the credit score to drool over. New loan was a snap. Will sell the beach house and pay off the Arizona house.

It can be done. It just takes time, patience, frugality and something called “delayed gratification.”

The story is as old as Aesop’s ant and the grasshopper — some like to fiddle away their lives in fun and consumption. Others save for later. When later comes, those who frittered away everything somehow feel cheated. But they simply blew it.

It all sounded great until you mentioned moving to arizona. You poor stupid son of a bitch.

Alex, you poor stupid son of a _____

The story of our parents…

Try that again today, not a chance.

Leave a Reply