Mortgaging your way to a college education – the burden of student debt and the impact on the starter home market.

The Consumer Financial Protection Bureau (CFPB) came out with a report that confirmed what many of us were projecting. The CFPB has noted that both private and federal student loan debt has now hit the $1 trillion dollar mark. This is a big deal for a variety of reasons and will have an impact on the housing market for years to come. For new home buyers many are already stretching every dollar they can through loan down payment loans via FHA insured products. More and more Americans are attending college but at the same time, many more are plunging into massive levels of debt. Student default rates are surging at a time when the cost of going to college is at all time highs. Public universities are hiking tuition since state budgets are in poor shape. This is important because a college education is now becoming the second most expensive purchase for most Americans right behind housing.

The rise in tuition costs

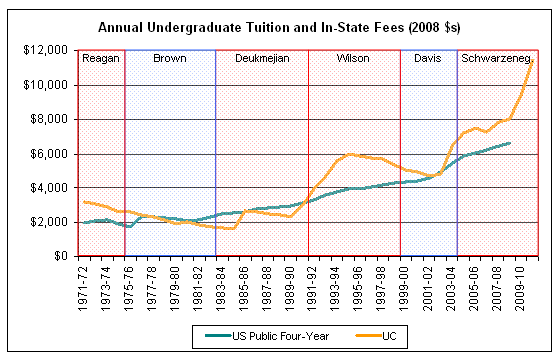

The University of California recently stated that should the November ballot initiative not pass, tuition is likely to increase an additional 20 percent:

Source: Keep California Promise    Â

“(Contra Costa Times) California voters know their K-12 schools will see dramatic cuts and perhaps the nation’s shortest school year if they reject a November tax increase. Now, the University of California has revealed its stake in the election: a 20-percent tuition hike for its nearly 182,000 undergraduates.

UC’s annual cost could bump to $14,670 a year — one more threat among many if Gov. Jerry Brown’s sales tax and tax on the wealthy fails. California State University students would see their tuitions leap 5 percent to $6,120 a year.â€

This is a significant increase. As recently as 2005 the annual tuition to attend a UC was roughly $6,000. It is now double that and should the tax measures fail, it is likely to jump to close to $15,000 per year. You also have many students enrolling in for-profit institutions and going into deep debt:

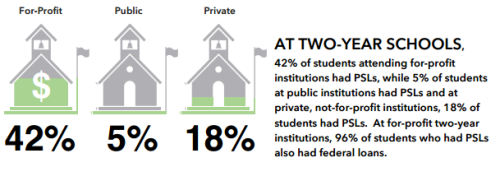

Source:Â CFPB

Most of the private student loan debt at two year institutions is flowing into the for-profit sector that is facing default rates similar to what was experienced in the subprime mortgage sector. This is important to note since the return on many of these institutions is minimal. It is hard to imagine but student loan debt is much worse than housing debt. Why? With a mortgage, if you have not noticed, you can stop paying and it will take some time before you lose your home. After losing your home in most states your liability on the property ends and your only penalty is a dinged credit score for a few years. Student debt does not go away. It will follow you around similar to unpaid taxes. This is why I found this part in the report interesting:

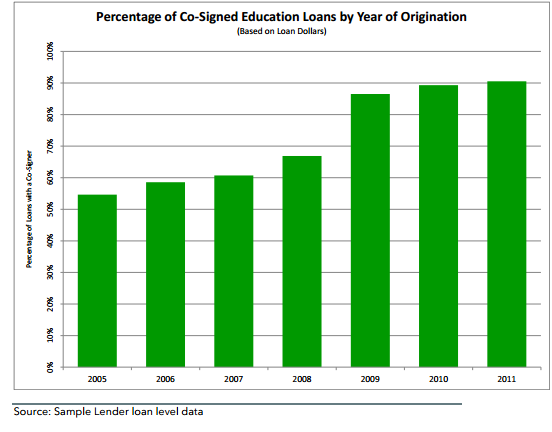

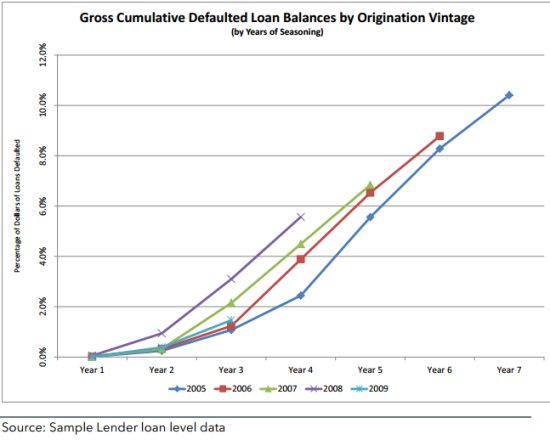

In California, many of those buying these $500,000 homes with low interest rates think they got a major deal. It is likely they are middle class so they are unlikely to qualify for many grants and aid. So many of these home buyers with kids are “school obsessed†so they are likely aiming for elite public universities or top private schools that cost upwards of $50,000 per year. As you can see from the above chart, many parents are co-signing the loans for their children. A student going to a private school might end up having $100,000 or more in debt when they are done and many are moving back home. That co-signer is on the hook as well. The data shows growing default rates:

There is no guarantee of a good paying job in this market even with a college degree. The unemployment rate of those with private student loans is 16 percent (twice the nationwide headline figure). Of those with a bachelor degree the unemployment rate was 11 percent. As previously noted, more private student loan debt is going to for-profit institutions so this is likely to push the unemployment rate even higher than the headline unemployment rate. So you have to wonder how eager will these young graduates be to purchase that first home and take on more debt?

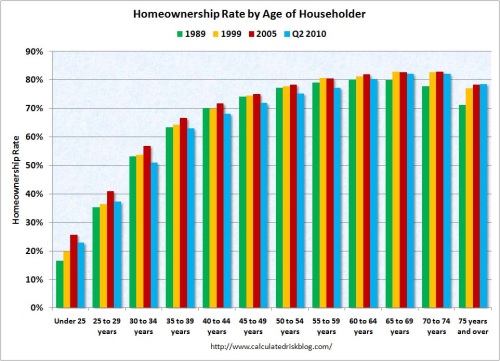

Homeownership rates have fallen significantly for those 34 and younger:

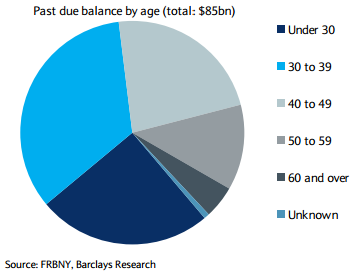

It is important to note most of the student debt problems are hitting the younger generation:

Over two-thirds of past due debt is hitting with those 39 and younger. A good amount is hitting the under 30 crowd. Remember those co-signed loans? There is little doubt why the housing recovery has been so tepid nationwide. In California, home prices are still out of sync in many locations but just think about a more realistic nationwide scenario. A young graduate comes out with $50,000 in student debt and the starter homes they are looking at cost $150,000. This is very typical. How easily can they shoulder that new debt amount? Are they even willing to take this new loan on? Virtually every other debt segment has pulled back since the recession hit outside of student debt. Home ownership rates for younger Americans have fallen dramatically in the last decade and this burden of “other†debt is becoming a big issue. It is also impacting baby boomers as kids boomerang back home. Another trillion dollar debt market with major issues. You don’t need a Ph.D. to know this is a big problem.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “Mortgaging your way to a college education – the burden of student debt and the impact on the starter home market.”

I’ve seen that the high school drop-out rate in the US is alarmingly high. This alone will condemn a large portion of the population to poverty.

25% of all student loans are now in default status. Just imagine what this percentage will be in 5 more years as more and more service sector jobs become “off-shored”.

This is why the smart money is getting into the rental business. Sure it’s a risk, but the numbers indicate very strongly that we are creating a generation of people that will have no other choice but to rent their home. And the number qualifying for Section 8 assistance is growing quickly as well.

Smart money, and not-so-smart. I understand buying existing units, even developing for buyers (if you’re a builder), but paying to develop new units raises the basis hugely at a time of artificially low interest rates and with a future of lower incomes. There will be carnage.

Love this blog BTW.

There are bills emerging to re-instate exit from the loan burdens via bankruptcy. But do the rest of us have to pay off these loans, as they are federally guranteed? I don’t think that would be fair. No one forced the signatures. Learning is painful.

I don’t have the solution, but the problem with no bankruptcy student loans is that schools can now charge exorbant tuition rates with no repercussions because they know they WILL get paid. That’s not free market. I can see the reason that was started, to avoid giving kids a “free education” via BK, but now it’s swung the other way to corruption.

Exactly.

I don’t buy the “it’s not fair” argument WRT student loans and bankruptcy, because it can be applied to ANY type of debt discharged in BK: mortgages, auto loans, credit cards, gambling debts (my personal favorite), medical bills, etc. Except in cases where someone is 5150’ed or carted off to a hospital unresponsive, there is NO SUCH THING as a debt that the debtor did not “willingly” take on. Even in cases of 5150 holds and being carted off unresponsive, after the 5150 hold is over/the patient regains the ability to communicate, that patient can CHOOSE to refuse treatment and leave the hospital against medical advice. Going into debt for medical treatment is a CHOICE, just like all other debt. And in EVERY SINGLE CASE, the argument can be made that “the rest of us pay for it.”

My modest proposal to the “It’s not fairrrrrrrrr” crowd is thus: either allow all debts to be discharged in BK, or get rid of BK completely. You take on debt, you’re shackled to it forever, no excuses, no exceptions. BTW, this would include business debt. No BK for anyone, individuals or business.

I would rather see that than the situation we have right now, where some debtors are allowed relief and others are told to go take a long walk off a short pier. That is what is “unfair.” (I hate that word; it’s a loaded term.)

However, I don’t see BK being abolished. I do see student loan bankruptcy protections being restored, if for no other reason than the economy will not move forward without them. I believe the proposed legislation does require a waiting period of x years after graduation, so that debtors cannot simply declare BK the day after they graduate; that’s perfectly reasonable, as there are waiting periods on all other kinds of debt as well. You cannot run up a $75,000.00 tab in Vegas on Saturday, then file for BK on Monday.

Why not allow students to form a corporation and attend college as an expense of the corporation? This way they can just pull a Donald Trump and walk away. Business is business.

Its been a while since I was in college, but I thought schools got paid up front. Will they see any direct cost if their alumni are bankrupt? Also, I think it might be telling to compile a list of bankruptcy rates among universities. I have a feeling it is not the elite universities that are at the top of that chart, but rather the for-profit ones offering useless associates degrees.

I know a kid that lives a charmed life (on the surface) in La Verne, a wealthy suburb. The parents finance the entire lifestyle through credit, and now the first of 4 kids is off to college. They spent 4 high school years pumping him full of a grandeous college life over at Arizona State, however due to their debt, low FICO, and upside down house, there is no college fund. So Mr. Uncle comes in to save the day by co-signing the student loans. Two years in a row.

The out of state tuition is $30k. The same under-classmen classes can be taken locally at a CC for 10% of that, yet the kid is hellbent on going to ASU. So, multiple student loans later…

This kid will be $100k in dent and we told him, but he’s only 19 and never had a job. He doesn’t know what he signed up for, he doesn’t know the value of money. His $50k job (if he’s lucky) will have him paying off loans for 20 years or more. There will be no house in La Verne in his future, maybe lower Pomona. And how are the next 3 kids going to pay for college in a couple years if the family is scraping the barrel to get this kid in?

Yeah, the argument is that “he’s an adult who’s old enough to understand what he’s doing.”

My response is, “Then why don’t we let him drink?” Heck, if he’s mature enough to understand the ramifications of taking on $100,000+ in non-dischargeable debt, he’s mature enough to understand the ramifications of drinking alcohol.

OMG let me guess, the kid is majoring in International Marketing Business Finance Merchandising with a minor in Media Relations with a focus on Human Resources.

ASU where SoCal kids go so that they don’t have to drive 8 hours to go to Spring Break in Havasu. In order to have as much fun as possible always remember to never do anything that jeopardizes the ability of the locals to collect sales taxes on all the booze you consume.

Party yes, of course.

The degree is a normal business degree. Getting it is fine with me, and encouraged, but the method is pure madness. I would have went to CC here for 2 years, then transfered after I spent the summer up there securing employment. But hey, adults are clueless right?

You guys talk as if he was going to Harvard when he is just going to ASU, and of all places Arizona. The parents are terrible with their own finances so consequentially raised a stupid kid who will learn the hard way. The uncle is the dumbest of the three for co-signing that loan. You play, you pay.

Having spent the last four years in school with Echo Boomers, owning a house or having kids is not on virtually any of their minds. When I’ve asked a few of them about buying a house the response I get is usually, “yeah, when I’m forty and ready to have kids”. Home ownership is not even on the long-distance radar for folks in their early 20s, nor should it be.

Young adults have a choice right now between going into debt for an education or going into debt for a house. The education is a better choice. I, for one, am glad more people are choosing Higher Ed than home ownership. It’s a better investment for them, for me, and for the larger community.

Agree 100%.

With how much debt the younger generation has and the very dim hopes of landing steady decent paying jobs, I really can’t see how any of these kids (err young adults) will be able to live the life their parents did in CA.

With substantial debt and being lucky to get a 60K/year job out of school, these kids won’t be affording that 400K “starter” home anytime soon. Even teaming up with a bunch of roommates and doing the ramen/mac & cheese diet for five years probably won’t help either.

But home affordability is at a 20 year high. Bwahahahahahaha! 🙂

and 2 thirds of thec worlds population are willing to do the same job for a tenth the wage……. and buy their own husings at a tenth the prices..

I agree with you. Most of my friends their late 30’s and 40’s with good/great jobs (some doctors)living in LA don’t have a house but rent. Why the hell should a 21 year old with $75 in the bank be entitled to have a house??!! They have no spouses and kids, why do they need a house? The only thing they should be concerned with is getting an education that they could afford. If you are young but have a crappy job and started a family , too bad.

Young, crappy job, and kids? Too bad? Yes. Except…

Liberals entice them with socail benefits, further making them lazy and entitled. Next thing you know it’s welfare for life, in one form or another, and our taxes (deficits) keep going up.

Gotta cut the strings! Get the Gov out of people’s lives and let tnem fend for themselves. They will figure it out.

—–Why the hell should a 21 year old with $75 in the bank be entitled to have a house??!——

I don’t think anyone is saying they should be “entitled” to anything. But one cannot ignore the impact on the larger economy of *millions* of buyers being locked out of the real estate market.

I would like to agree… in theory. But after learning that some of these degrees people are getting are truly worthless, I’m not so sure. And by worthless, I don’t mean because of high unemployment, I mean because the education is sub-standard to the point where a degree in certain things from a certain for-profit schools, are considered completely useless for the profession.

Those little 9 month colleges don’t pay much after graduation, many minimum wage. I would hope it gets better after time. And the University of Phoenix’es are a complete joke, any employer should know that.

Our entire monetary system us corrupt and based on debt. If you understand that then you know if there were no debt there would be no money. It is a giant criminal organization. Is no one paying attention to the LIBOR scandal???

I sure as hell am, and the brilliant effects of the Austerians…

Austerians? Isn’t it the laws of nature, and mathmatics to blame?

Well Echo Boomers are split in two generations and this is looking evident. First part of the generation was born in the early eighties so they graduated around 2000. They knew mostly good times and when crisis hit, they were already employed and many were relatively sheltered. I’m from this part of the generation, working in IT and my life did not change that much in 2008. The same for my friends.

Those who were born in the late eighties, or beginning of the nineties had a slightly different experience with life. And from what I see, they are a different generation.

Both generation share a love with new technologies, but the later part is more “serious” and less likely to do shit as we were. When we were at school, we never tought we would have problems, so we did as much stupid things as we could. Many of us have created companies, some sucessful, some failed. I would say that taking pleasure in life was the primary motive for our generation and this lead to some pretty cool success story.

The new generation (started to get some in my company around 2010) is more serious because they felt they couldn’t afford the luxury to take risk at school and do shit. Given the circumstances, they are maybe right. Some of them do create company, but they do it in a far more “down-to-earth” and serious way that the millenials did. They globally take less risk because they fear things could be bad for them. As a result, they are better employees than early Gen Y (which were a pain to manage) but also less likely to produce amazing results. They pretty much remind me “the silent generation”.

As long as homes are concerned, they’ll buy when it’ll be cheap which is good for them. Boomers will end their live fine, but Gen X is going to be fucked big time.

I don’t mean to be rude but You’re a college graduate? In business? ESL I hope otherwise the kids I graduated grade school with were better trained.

Yes, it does seem that many portions of GenX is left in the most precarious position.

But that seems to be a taboo subject really… unless you’re a GenXer that wants to put your head on the chopping block as a scapegoat for everyone’s delusional desire to believe that could’ve never happened to them. *sigh*

I think until people can discuss the cycles that go on, in some kind of objective way without that kind of attitude of finger pointing… we will be stuck, as a modern society, in these cycles of boom & bust.

I am all for the discharge of non-federally guanteed loans in bankruptcy. But when the student loan is discharged, it is still paid by taxpayers. So it is basically a transfer of voluntary debt from the debtor to the tax payer. In the case of non-guaranteed loans, that it likely the end of it, there is no further recourse.

So as I do not want to pay someone else’s loan, I am against BK for loans that I am guaranteeing. And colleges can only charge exorbitant fees if the market continues to pay.

Get rid of the federal guarantee.

No one forced the students to sign for the loans. They knew they could not be discharged in BK. As did the parents, who should know better.

You realize the government has debt only because it refuses to print money to discharge it, right? The cost occurs when we devote production to support of a kid in school. When the kid can’t get a job, the loss occurs whether or not the bill lands on the government’s doorstep. We are all made poorer by the kids inability to contribute to society. The dollars are a mere score keeping gimmick.

Yes, but when you monetize the debt, it has very real ramifications.

That’s brilliant! Quick, get an e-mail off to the Greek finance minister and tell him all he has to do is extinguish the debt. The government, if they decided to pay off student loan debt, would do so through the issuance of new debt. This would transfer voluntary student loan debt onto the shoulders of tax payers. No thanks. I paid off my own student loans which was not easy. I don’t want to pay off anyone else’s.

I think I need to go back to school because I was under the impression that the Federal Reserve “prints†money by creating debt. Even when they really print dollars, they buy debt to distribute the actual dollars. What am I missing? The Fed does not print physical dollars and then drop them on the public via a helicopter. The treasury does not print money directly as far as I know.

Our society has done this, we’ve basically forced kids into a corner. Some cannot be blamed for being up to their necks in debt, while others can be. Choosing a state college degree and modest debt over vast debt and a private university is easy–don’t take on that debt.

Also, the garbage degrees (sociology, history, etc.–degrees with terrible earning potential) need to be stepped back. I’m not so old but “back in my day” it was common to spend 4 years at college partying a lot, studying only a little. We’d come out with small debt and very good job prospects. It’s too bad that isn’t contemporary life, but it isn’t. You party now and rack up that debt you will pay in spades for later.

I simply hope this ludicrous college debt bubble pops before my kids have to go off.

History majors go on to be lawyers.

Only if they then go on to expensive law school and can pass the law classes. History Bach. degrees are often awarded to students who do not have what it takes to pass law school.

Re: “garbage degrees,” I have a BA in Philosophy. Went on to get an MBA. If I had to give one back it would be the business degree — learning to reason logically was of far greater value to me than the techniques learned at B school.

BTW, that MBA, from a top-10 university, cost me $12K twenty years ago. It’s grown to $136K last time I checked. Students appear to have a choice between huge debt and going without the diplomas they need to open the right doors.

Anyone coming from a blue-collar background and hoping to work their way through college without debt, as I did, is simply out of luck. The 1% win again.

Emma,

Your 2-3 year MBA program costed a total of $12k 20 years ago? Did I read that right?

Thanks

I think the value of a learned historian goes far beyond their hourly wage potential. I get very uneasy at the thought that all colleges ought to train people as worker bees, and have no other purpose. Or that only rich people born into lots of discretionary money, should be the only people allowed academic education like historians & scientists… whose research & work can be valued very highly in context at a societal level, but show a rather poor return in hourly wage and short-term gratification.

Let’s face it, there will be student loan foregiveness. These aren’t loans, these are subsidies, on taxpayers dime.

All you student debtors, move to niagara falls, they’ll help pay off your loan, so we don’t have to.

http://www.cbsnews.com/8301-505145_162-57471185/niagara-falls-to-help-pay-off-student-loans/

Is the 20% tuition increase merely a threat to get voters to accept tax increases? Why not have the schoools cut overhead by 20%?

The problem with allowing bankruptcy is the following: My oldest son is in a junior college and tuition is around $1,200 a year not including books. I get tax credits (American Opp Credit) which covers the cost so essentially right now and last year it was free. Well, taxpayer’s paid the bill. Anyways, with the thought of bankruptcy allowed I would be stupid to come up with the cost of the four year CSU. Instead he should just take out loans so they could be forgiven. If I am thinking like that, how many other people are too!

Bankruptcy isn’t “forgiveness.” It’s BANKRUPTCY. It mars an individual’s credit rating for 10 YEARS, and it even gets in the way of obtaining employment.

Your argument against discharging student loans is just like all of the other ones I’ve heard. They are not arguments against discharging student loans; they are arguments against bankruptcy, period.

As I said in my other post, I would be willing to see bankruptcy abolished completely–for individuals and businesses. You take on the debt, you pay it or carry it until you die, no excuses, no exceptions.

When I started school at a state institution, tuition was around $100 a semester (yes I’m old) and we didn’t have to go buy textbooks at a cost of $200 a piece. Now look at what it cost for an individual to attempt to get an education. I guess what I am saying is that an education is more likely to create marketable, contributing members of society than the ones drawing a government subsity check and food stamps every month. If the government hellps anyone, it should be the individual attempting to create a better life for themselves, their family and the community in which they live. I have watched people work all day and go to school four nights a week and their job just barely keeps a roof over theior head and food on the table. Without some form of assistance, they are shackled to that lifestyle. An education is the best thing a person can do to improve their station in life.

I believe that two year institutions should be state funded as training for individuals and the student should not have to bear the burden it. Those wanting to get the Bachelor’s, Master’s and Doctorate need to look at what it is going to cost them.

We have another bubble about to burst, but it is not the bankers and auto manufactors that are looking at losing everything, it is the small individual that is struggling in today’s economy, some without a job for the past three or four years that is going to hurt.

I havealways said that iuf we had taken that $787 billion and divided it up among the taxpayers it would have been a chunk of change that the people could have used to pay housenotes instead of losing their house, buy cars and other manufactured goods, and been able to pay thier bills. Instead we have an upside-down housing market and a real unemployment rate of around 20%.

We need to get the citizenship back on their feet, give them a job, and move this country in the right direction for the first time in 40 years.

I would say that we were already doing this in the first place. When a government spends more than it collects, it is juicing the economy as you stated. The problem is the economy will slow if we stop juicing it in the absence of real growth. Most governments want to continue to be in power so there is an incentive to continue the juicing. This then removes the Keynesian tool from the tool box when an economy slows. This is like driving a car at full throttle and when you need to pass another car, you have little to no acceleration available. This is basically where we are now. There is no stimulus big enough to “jump start†this economy. It is a similar story with monitory policy. We were playing both sides of the field, Keynesian and Classic. Now I guess we will have to just slog through this for quite some time…

Interesting article expanding on my post…

http://reason.com/blog/2011/09/07/one-reason-why-keynesian-stimu

This is a really good article on the failure of Keynesian policy.

http://american.com/archive/2011/november/our-two-keynes-problem

It is important to remember that we have had over a trillion dollar a year stimulus. I have no idea why anyone would argue that the stimulus was too small…

For those you don’t like reading…

http://www.khanacademy.org/finance-economics/macroeconomics/v/keynesian-economics

http://www.khanacademy.org/finance-economics/macroeconomics/v/risks-of-keynesian-thinking

This explains the long run effect of Keynesian policy regardless of how it is executed.

“When a government spends more than it collects, it is juicing the economy as you stated. The problem is the economy will slow if we stop juicing it in the absence of real growth. ”

A half-truth. If the money government is spending money to citizens, it juices up the economy as purchasing power increases.

If the money is given to ultra rich (banks, big corporations, milionaires), like now , it is not juicing domestic economy at all: Everything goes directly to international financial markets and investments abroad and the basic requirement of Keynesian policy does not realize: Domestic consumers don’t get anything and there’s no real growth regardless of debt increasing.

But the owners want it that way and citizens have nothing to say in this matter.

Trickle-down is even more faulted theory than Keynesian.

WF REO FEES trial business model

$12,000 and $195 to have the pleasure

to buy a “as is” pos.

We passed due to soil conditions of area among

other issues.

@What?,

The US Treasury issues debt, not the Fed.

http://voices.yahoo.com/how-does-federal-reserve-create-money-2183391.html

“To create new dollars, the Federal Reserve monetizes the government’s debt. That is, it simply buys Treasuries on the open market and credits the seller’s account for the transaction. This is the “electronic equivalent” Bernanke mentioned in 2002. The value added to the seller’s account does not actually exist except on the digital balance of the bank’s reserves.”

” The Fed buys in volumes that can only be met by large financial institutions, who, once the value has been added to their reserves, can then invest or lent these funds, which in itself is part of the creation of new money. ”

“The Fed’s printing press underwent interesting changes to confront the 2008 credit crunch. Whereas the Fed had previously only accepted government debt, such as Treasuries, it initiated new lending facilities where banks could exchange less secure collateral, such as mortgage backed securities, for cash. When the crisis worsened, the Federal Reserve acted in conjunction with banks around the world to guarantee all interbank lending, potentially monetizing all of the banking system’s “toxic” obligations.” – Many have argued that the Fed exceeded their authority in so doing, especially with the purchasing of agency debt, whih was never guaranteed by the US taxpayer.

There is no precedent of which I am aware, nor authority, to buy up individual loans. The Fed can likely buy up securities backed by student loans, but that still would not get the student debtors off the hook.

The notion that the Fed could just destroy the US Treasuries it held was advanced by Ron Paul, but I do not know if anyone has taken that idea seriously.

Thanks for the macro econ lesson…

1 The money supply is controlled by the Fed.

2 The Fed loans the Federal government new money i.e. creating money supply. However you look at it, they create new money by creating new debt/loans. This is just debit versus credits but you get the same outcome. New money doesn’t just come out of the sky…

http://www.khanacademy.org/finance-economics/macroeconomics/v/monetary-and-fiscal-policy

3 The Fed only has direct control over the large firms. Remember when Bernake wanted to bring the smaller institutions under his wing claiming that “the visibility would help policy making�

4 Yes, the Fed purchased MBS along with Treasuries from the large institutions in an attempt to lower interest rates with the hope it would increase aggregate demand. This is not really pertinent to anything I was saying in this post but I have made many comments in prior posts about this activity. As for the money supply, this is really no different than creating money out of thin air by loaning it to the Treasury. I think the interesting point here is the government indirectly has ownership/control of the housing market.

5 The Fed destroying the treasuries on their balance sheet is basically the government forgiving their own debt which is an interesting concept. I would think that these treasuries are considered part of M1 money supply and destroying the treasuries would lower M1 which in theory could decrease aggregate demand. That sounds a little counter intuitive to me but I guess we can chalk that up to the magic of fractional reserve banking…

If those kids would put their money where their mouth is and live in a neighborhood where there are Negroes, they could have that starter house for $75,000. Hell, mine was $53,000 and it was a nicer house than most people live in, which means that it was probably a nicer house than you live in. Nicer neighbors, too.

Nice video on this subject by Peter Schiff…

http://www.europac.net/media/tv_interviews/peter_schiff_july_12_2012_cnbc_%E2%80%93_closing_bell

Young Gen_Xer here. Made it through graduate school by 2004 in the early stages of the dramatic rise of UC tuition. Graduated from a still dirt cheap CSU college before that. I got away from the whole seven years of college with just 50K in debt, locked in at 2.7% fixed interest. I estimate working contributed to about 30% of my expenses. Loans to another 50% and the rest paid for with gifts from family. I was not particularly frugal and partied, but I did keep my grades and professional acitivities up.

What I nice is that the youngest generation of labor participants – 19 to 24 years old – are much more serious and conservative than we were. They are cowed and willing to do anything to get very low pay. They do not question. I can understand that. Employers are taking full advantage. I’m more insulated due to my experience at this point but have felt the downward pressure on wages for some the past four years. Now, I’m basically making the same annual salary I was making in 2004. The peak for me was 2008 at a quarter million. That only happened becasue of a massive, tail of the party 2007 bonus paid out in 2008. I can’t see that ever coming back unless I get onto a much “higher plane” of employment. Anything is still possible in America but now you have to be the “right person. Basically, you must already have the eduction, training, connections, and be in the right locations (West LA, New York City) to get rich without having your own business. So many people are dropping off into poverty right and left, or are hooked on government aid in one form or another.

Last month I found and went through a box that dated from my college years (1970-76) and laughed at the following:

Check #109, 6/15/70: $108.00, tuition for 1st semester, Mississippi State

Check #941, 3/22/74: $304.00, tuition for 1st semester MBA Program, Alabama

I’m not sure what tuition is at either today, but I paid around $2,500/semester for my youngest daughter’s last semester at UNC-Chapel Hill in 2008. And she tellls me that she’s a rarity – about the only one of her friends that doesn’t have a student loan to pay off.

God knows what it will be for my grandsons 10-15 years from now.

“Liberals entice them with socail benefits, further making them lazy and entitled. Next thing you know it’s welfare for life, in one form or another, and our taxes (deficits) keep going up.”

Welfare life isn’t easy regardless of what kind of vision of it you have. If you think so, I’d suggest you try it a couple of years and then say about something of it.

Also, it’s a minor problem when FED gives _hundreds of trillions_ of corporate welfare to banks and other megacorporations, tens of times of that given to all citizens combined. None of that benefits ordinary people, ever.

Leave a Reply