How will mood be impacted for the next decade because of the real estate bubble bursting? Lessons from the Great Depression Part 35. The changing psychology on American housing.

Purchasing a home is a highly economic but also gut-wrenching emotional decision. A large number of new home buyers are couples seeking to establish their roots for their family. The biological clock keeps ticking in normal markets but also through manic bubbles. The desire to buy has not been removed from the current market but the psychology surrounding American real estate has definitely been shattered. It is no longer sufficient to have the desire to buy. The household income figures need to work out as well in today’s market. Some are also competing with eager investors that typically do not have the emotional attachment to housing and approach a purchase on a colder and aloof manner. Housing prices in many markets still resemble the bubble markets of a few years ago because those couples still looking to start their families have waited long enough (in their own opinion) and “need†to purchase now. This segment of the population has shrunk in tandem with the economy. Yet this change in mood is nothing new and is something akin to the mood that rose up during the Great Depression. The irony of all of this is that this housing crash is deeper and more widespread today than that of the depression era.

This is part 35 in our Lessons from the Great Depression series:

30.  Economic déjà vu from the 1937-38 recession

31. When government and financial institutions become one.

32. Housing prices continue to fall as other costs eat up disposable income.

33. The McDonald’s and paper-mill education economy funded by a too big to fail bank.

34. Tracking housing values from 1940 to 2011.

The fastest housing crash ever

Mood is a fickle thing in bubbles. Psychology becomes the biggest driver of price and speculation in any sort of bubble from real estate to tulips. When things do inevitably reverse to the winds of history, prices can move faster than one would expect:

Source:Â The Economist

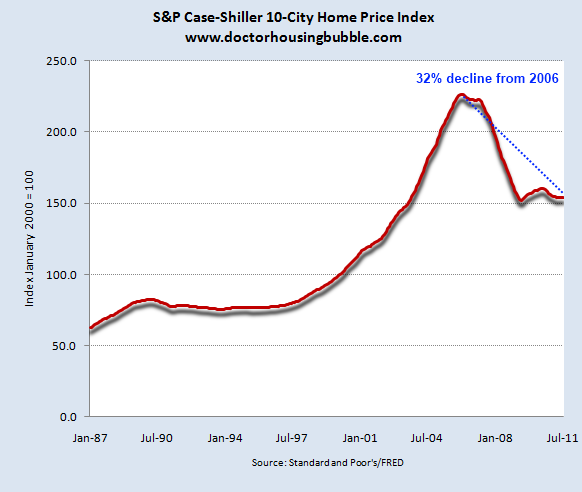

Even in the worst year over year real estate decline during the Great Depression, prices fell roughly 10 percent. During this recent crisis home prices fell year over year by roughly 20 percent. Prices have been shattered in most metro markets around the country:

So far this housing correction has seen real estate values plummet by 32 percent from their peak nationwide. This is astonishing and I think few people understand what this does to the powerful housing psyche in the United States. Before this implosion in real estate, it was rare to find anyone that had actually lost money in the long run with real estate. The mantra of “home prices only goes up†was taken as self-evident. Yet the era of the aughts brought on massive mortgage security speculation courtesy of the Wall Street bankers. This transformed an otherwise mundane investment into a speculative casino. This combined with the powerful desire to buy and many people were suckered into the mania.

How bad is this crash and what will it do to mood going forward?

This price decline is far deeper than the Great Depression:

Source:Â Economy.com

What is fascinating about the real estate market in the early 1920s is that the real estate fervor hit earlier in the decade while stocks bubbled up in the late 1920s. For example markets in Florida boomed prior to the stock market bubble in 1928 and 1929. This housing bubble was the opposite. We had the 1990s technology bubble pushing stocks to the sky, then popping in the early 2000s while real estate started rallying late in the 1990s and throughout the aughts. As the chart highlights above however, in no time in history have prices surged so high with no underlying economic fundamentals. This manic real estate bubble will transform the buying mentality for an entire generation.

This is why even with low interest rates and many homes available to purchase, home sales are still anemic. John Kenneth Galbraith sums it up rather nicely:

“Far more important than the rate of interest and the supply of credit is the mood. Speculation on a large scale requires a pervasive sense of confidence and optimism and conviction that ordinary people were meant to be rich. People must also have faith in the good intentions and even in the benevolence of others, for it is by the agency of others that they will get rich. In 1929 Professor Dice observed: “The common folks believe in their leaders. We no longer look upon the captains of industry as magnified crooks. Have we not heard their voices over the radio? Are we not familiar with their thoughts, ambitions, and ideals as they have expressed them to us almost as a man talks to his friend?â€Â When people are feeling of trust is essential for a boom. When people are cautious, questioning, misanthropic, suspicious, or mean, they are immune to speculative enthusiasm.â€

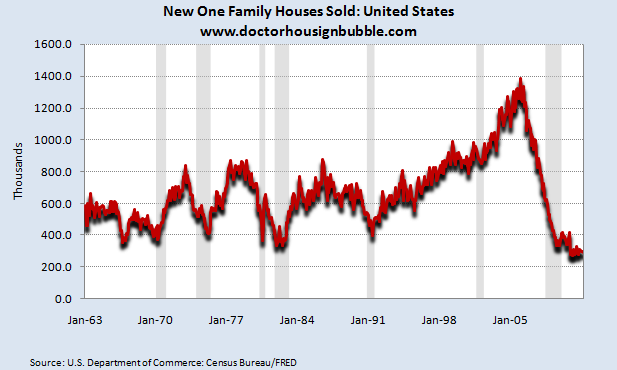

For the above deep change in consumer psychology this is why home sales in the U.S. remain poor. There is definitely more supply than demand at the moment so prices will move lower (this in spite of the even larger hidden supply through shadow inventory). Combine social mood with weak household balance sheets and you get something like this:

New home sales are at their lowest levels since the early 1960s even with a much larger population. How can that be if home prices are going much lower and the Federal Reserve is artificially pushing rates to historical lows? The reason is more psychological as people become more cautious and wakeup one by one that there was a big bubble and con that just occurred in the aughts. At the core of the con was housing but more importantly, the mortgage which was used as a pawn in the game of investment banking profits. Was any of this financial innovation really good for the country? Who really prospered here? I think these are the questions that are being asked more and more. Ordinary people are starting to realize on a larger scale that politicians for the most part are essentially paid legislation writers for these big financial corporations.

The new home sale chart above is really telling. Only a few days ago the 30-year fixed rate mortgage broke into the 3 percent range. Unheard of in our generation so why aren’t new home sales bustling back up? Like Professor Galbraith stated, low interest rates are the least of concerns when psychologically people are more suspicious of speculation. In some parts of California the speculation continues but will end at some point as well. Some will be naïve enough to dive in because of spurious arguments like “this zip code is immune†or “the good schools here†forgetting that those areas had those attributes in the late 1990s before the bubble even took off. Why are home sales so weak with all these perks? Because the mood has shifted from speculative mania to one of caution and deep mistrust. Sadly, the current mistrust is fully justified as the too big to fail have hidden millions of properties deep in their balance sheets.

Changes in this kind of large scale bubbles take at least one generation to workout. Have you noticed colleagues, friends, or family members become more suspicious to the real estate market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

94 Responses to “How will mood be impacted for the next decade because of the real estate bubble bursting? Lessons from the Great Depression Part 35. The changing psychology on American housing.”

I’ve still noticed massive ignorance. I know a young couple that is buying a 400k house in Virginia and is borrowing the 3% FHA and still have large school loans to pay off. There is not swaying most people from believing what they want to believe.

“Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are even incapable of forming such opinions. ”

Albert Einstein

I too, unfortunately have to agree with DarkAges. One example – even AFTER pointing them to this sight, some friends (new baby, emotional) bought a house, alleged bidding war, paid $130,000 over the Zillow estimate. Dropped several $100k down, borrowed from 401k…then laid off.

Still I see houses selling in my neighbourhood for far beyond the 3x median income of my city. Watching a family right now paid close to $900k over the summer remodelling. More money down the rat hole. And all the while the foreclosures sit vacant off the market, crumbling.

There is definitely a con game going on with the Banksters withholding a tremendous amount of inventory. However, I’ve heard stories of people having a hard time trying to get a loan from the Banksters. Now, they require a lot of paperwork and much more skin in the game, via down payment. So, the question is, the ones that are buying now, at still bubble prices, are they putting down 50%?

I have been suspicious of real estate since 2005.

I probably talked one friend into holding off on buying for several years. He finally succumbed to pressure from his wife and bought a townhouse this year. He knows he’s probably in for some further drops but the family pressure finally got to him. At least he avoided jumping in at the peak.

The attitude change is coming fast now. I think it usually takes people about 4 or 5 years to start thinking things will stay bad for a while. Here we are about 4 years after the CA real estate market started to crash. I now hear almost everyone saying that real estate is a dangerous animal. I estimate that if we see another 2 or 3 years of mild declines, which is probably going to happen, people will be bad mouthing real estate all over the place. Even Time Magazine recently stated that it’s probably better to rent than to buy these days. Hating real estate will be mainstream pretty soon.

I agree that “everyone” seems to think that home prices will only go down from here, and that real estate is now a dangerous animal. However my experiences with the stock market, as painful as they are, tell me that when “everyone” thinks that a stock or sector is on a one way ride, up or down, that that is when it changes direction. I also learned that when a trend reverses, you don’t realize it right away, and you missed the opportunity to buy at the bottom. I’m not saying that things are about to turn around, just that when it does, and it will someday, “everyone” will miss buying at the bottom.

I have to disagree. I see little to no capitulation in Socal. Folks are still pricing homes well beyond even inflated Zillow estimates.

Look at the Case Shiller Index chart from the Doctor’s previous article. Eerily similar to Nasdaq Comp Index from the late 90s to the early 00s. We have one more massive leg down. It’s barely end of 01 from the COMP’s point of view in my opinion. The next two years should see the Case Shiller into the 90s and possibly 80s. Watch out below.

Edit to last post: The chart is actually in this article, showing a 32% decline. We’ll be back to mid 90s pricing in two to three years.

Real estate is a financed investment. That financing now requires full documentation of income and assets. The economy is not generating qualified buyers at this price level and the cost of ownership cannot be sufficiently reduced in interest rate to offset the daily depreciation. Factor in the depreciation, which is not deductible like interest, and you’re actually paying 8, 10 or 12 percent except the depreciation is deferred until you’re buried in negative equity so deep that when you need to sell and come up for air you gurgle on the water in your plywood prison.

I agree that everyone will miss the bottom. One should never try to catch a falling knife. And I agree with your observations about social mood. I’d like to point out that there’s something as important as social mood, though. Namely, Credit. People can be in a wild, speculative euphoria all they want, but without Credit, the upside is limited.

Note the upside during the Great Depression; and keep in mind that this was when the Federal Home Loan programs were created. New Credit boosted housing prices.

Now consider today. The Banks have almost completely stopped lending, and the Government is the only one handing out loans. About 95% of all home loans are backed by the U.S. Government (and you’re on the hook for it).

Now consider what happens when the U.S. Government stops home loans. How are people going to buy homes without Credit? They will, but not at the current price level. They’ll have to pay cash.

Most here probably think that it’s crazy talk to have the Feds stop writing loans. I suggest that it’s crazy to think otherwise. And for proof of what’s coming down the line, I suggest you only look at Europe for a glimpse of our future. This is what happens when Governments have excessive debt, and can’t service it. Austerity and cut backs in everything is what they’ll try to impose.

I’ve said it before, and I’ll say it again. You can’t solve a problem with excessive debt by piling on more debt. Seen in that light, yes, Credit for housing stands a very good chance of disappearing. And the impact of that on the economy will be significant.

you assume there will be a bottom, and that is not a given. The seeds have been sown for a gradual decline in the world economic order. The model of Wall Street creating another housing bubble will not happen again in our generation, which is a demographic maelstrom. The next generation is mired in college debt. Fed has shot its wad and is now impotent. We are in for a gradual decline–which may be good. No one will have any money to start WW III (except China).

Questor is correct. Just try and get a 30 year, no money down, mortgage in Greece. Short term rates, the only ones available, might be a little high for you, like 170% for the one year government bond. How many houses have been financed in Greece this year?

Many boomers who have lived through recessions and mini-recessions always lived like the next one was around the corner. They scrimped and saved in flush times and avoided debt…like the squirrel stashing nuts for the cold winter. Their Depression-era parents and granparents were models for their personal financial traits. The key is to always mistrust the ” experts ” and exercise common sense. Then it is easy to spot these mania-driven, get rich quick schemes. Sadly, many have learned this lesson too late. And many will never learn it.

ummm no, many boomers did not do this and that’s why we’re in the mess we’re in now.

Oh Bull pucky. I am so tired of you boomer bashers. Half of you have us as the greed gangsters holding all the assets and the other half like you have us taking on debt and blowing bubbles like kids with soap bubbles. Sorry Fred but this housing bubble happened in 2002-2006. First born boomers were 56 in 02 and the last born were 38. Children of Boomers were around to buy houses, generate debt and run up prices since at least 92. Because one person from a class does something it does not mean all do. Your comment is like saying all Hispanics are illegal aliens.

I think we need to change “many”, which might simply mean many of the people you personally know, to “an underwhelming minority”. I know very few boomers who did this. The ones I know who accomplished something like this are VERY wealthy the recipe for which was strong income/jobs (think top 1% or company founders/CEOs) in the 1970s and early 1980s where they accumulated a lot of investment assets (real estate, equities, operating businesses) and then rode the wave through today enhancing that wealth.

Still the reality is that this is a minority of boomers. If boomer balance sheets were remotely decent, you’d see them snapping up retirement properties en masse as they’ll need them in a few years so why not buy now with great financing and much better pricing? That fact that this isn’t happening tells you everything you need to know about boomer balance sheets – they are illiquid, have low savings and already stuck in one or more overvalued and oversized properties hoping to get out and have no more carrying capacity for debt. It is all they can do to try to repair their balance sheets out of income cash flow.

I am 29 years old, I do not know one Boomer that lived within their means over the last 20 years. My folks included in that observation.

I have nearly 30K saved in US Bonds, I’m waiting for the markets to rebound before I put that money into the housing market. I’m not going to help try to stop falling knives. Once I see a year go by that shows a year over year rise in values, I will start thinking about it.

Dan, Sadly, most boomers did not learn the lessons of their parents. one did. I have always lived within my means. Worked damn hard at school to secure a high paying job. Then did not leverage at all with the exception of my first and only house, paid off after four years.

Please understand, I take no joy or smug satisfaction over the problems faced by so many Americans and Europeans. We and they got played by the siren call of Keynes and Greenspan and easy money. For a while it worked. I can’t tell you how many times I was disheartened at my own fear of leveraging. I very nearly broke down several times. But always this little voice kept telling me, “No way this shack is worth 1.5M”. Now comes the time to pay the piper.

100% right on zig, that just how we played it, living poor with a n.w. of 2.3 and 500k sitting in the bank waiting to strike, at 60 we wont need the money, but our son and granddaughter will, things don’t look good ahead fr our young people.

me too – at 55 i have several hundred thousand in the bank – own the house, and am happily driving my 10 year old car, have never been in debt. Of course I smartly didn’t have any children either . . .

I’m 58, that makes me a boomer. I worked in several factories during the recessions/layoffs/broken contracts of the 70s & 80s. Most of my managers were liars, it was easy for me to believe their media puppets were liars also. We always believed the next recession was just a few years away, & we were right, over & over. Both my parents were scarred for life by the Great Depression. Right now, we are 3 years from being mortgage free. Zero home equity loans. Zero credit card debt. I’m glad my kids went to community college for cash, they have no student debt. I am ashamed of the behavior of many of my fellow boomers.

In my experience I know people who have bought a home and THEY KNOW HOME PRICES WILL DECLINE FURTHER. They still believe deep in their heart “its better to own and than to rent”. Also, they feel buying a home is still part of “the American dream”.

Remember, this is the biggest asset that a person will purchase in their lifetime and they still will buy even though they know prices will decline. However, they are convinced that “in the long term prices will go back up, they always will”. You can’t just change that sort of mentality/way of thinking.

I don’t think you have to look very carefully at the “Worst Price Correction Ever” plot above to see that housing is not a good investment. Its average rate of real appreciation is less than 1%. On top of the pathetic rate of return, you have to maintain the place, buy insurance and pay property taxes.

Since that is obviously the case, I think it is a mistake to criticize people too much for buying in the face of expected price declines. We do not criticize people for new car purchases, though the depreciation of new cars is well understood and to be expected, and is far worse. Home ownership gives you control over your life and there is a premium to be paid for that.

It’s also a very expensive premium if you have to move. The average time period between moves had been around 7 years, and the good Doctor recently had an article which showed that 65% of all loans were made within the past ten years or so, IIRC.

I hope those buyers are also saving enough money to cover what they may have to bring to the table in order to get out. That adds a further premium to this very expensive option.

Wait a second, I have criticized people for new car purchases since the day I could talk!

…except that many Americans still believe that their house is their savings. Instead of having liquid assets, they have a home that will be underwater unless they make a classic down payment of 10% or really 20% and stay in the house a while.

They still think Europe has debt problems and somehow we don’t. Probably most here realize that, but not most of the general population, I would suggest.

I forgot to add: The mistake of the Naughties was not buying in the face of price swings, but buying into the notion that a house is a good investment at all.

When your mortgage is far less than your rent, then a house is a good investment. There are now some areas of the USA, and even in California where that is the case. But of course, if rents start to fall today’s good deal can become a bad deal.

@ Tim – In this environment, rent payment vs mortgage payment is far from the only consideration. You need to factor in depreciation. If your home purchase goes down in value by $120k over the next 5 years, that’s $2k per month of additional expense each month to the ownership side of the equation.

Yes, you can change that mentality. It just takes about 10 years.

The mentality of the masses keeps feeding itself. But the good news is , it always reverses .

Decided to start my own blof focusing mainly on San Diego country housing

thanks f Dr Housing bubble for the inspiration!

La Jolla Dreamin’

– La Joe la’s house of pain

http://caliscreaming.com/

“the good schools here†… how long will it be until this meme dies? Why? Cause the good schools will allow you to get a better education, to get into a good University, which will cost you easily over 125K in student debt, and with no jobs when you get out, you’ll be lucky to work the counter at the Dollar Store.. So the idea that ‘good schools’ make a neighborhood more valuable, will have to be less of a consideration at some point.

Actually, the total home sales by units in the US (excluding manufactured/mobile) have been just about five million consistently. People are not pulling back or waiting to buy. Since the bubble peaked, almost 25 million homes have changed hands, wildly estimated. So no, people don’t learn and this is on a massive scale; the result is that perhaps 80-90% of that twenty five million homeowner couples (mostly) could not sell today without losing significant money. The young people I hear have not been deterred in the slightest from buying a home and will do so the minute they can get a minimum down payment together; debt doesn’t bother them in the least. That they haven’t learned, means that they won’t learn. The problem is there is no where else for a common person to play leverage; thus the hope that we are at bottom overrides economic thought and caution. Houses are unique in allowing zero to three percent down and all the leverage someone can handle and in the optimist mind, it can only go up! The limit on their buying out even bigger more expensive homes is the underwriting standards now have some bite; that’s the only thing holding them back, as has been pointed out here many times. Rather discouraging, isn’t it?

AGreed.

Is our future deflation, like Japan, or inflation, like in the past? We live in very uncertain times with the potential for wide swings.

The banks are unloading their inventory now. “Distressed home sales spike. Foreclosed homes and short sales are making up an increasingly large chunk of the local housing market, moving toward 50% in Glendale,… Sales of distressed homes made up 47.5% of total sales in Glendale in September, according to figures compiled by Realtor Keith Sorem with Keller Williams in Glendale. In Burbank, the ratio was almost 34%. The figures were far higher than a year ago, when distressed homes made up about 36% of total sales in Glendale and nearly 16% in Burbank. ”

http://www.burbankleader.com/news/tn-gnp-1016-homes,0,5836138.story

I’m reasonably bullish that our country will find its way out of malaise. 2008 knocked sense into a lot of people. Now that most generations are back on track to living their lives in a sane and sensible fashion, that is an excellent foundation to build our way into prosperity. Corporations are doing fabulously. Profits haven’t been better. We’ve had jobless recoveries at least the 2-3 previous recessions. That isn’t something new. Housing prices are nearly right priced again. They might drop another %5-10 to reflect low demand, but I don’t think it will last. If nothing else, delusional home sellers have shown they can wait it out in many cases, and likely will continue to wait. In many ways, this is a much larger scale repeat of the S&L crisis. We got out of that one.

The only headwind that I’m deeply concerned about is the retirement of the Boomers. We enjoy their productivity today. As they retire, we become poorer without it.

And I’m reasonably confident you are stunningly wrong over the near term (5-10 years). I don’t think we’ve seen the worst yet. What’s new here is the Debt/Credit issue. This has been declining in all areas except Federal spending and Student Loans. And subprime Car Loans are back significantly these past few months, but we all know how that’s going to play out.

Let me know when the other areas for the consumer have recovered. Until then, you’re not going to see an improvement in the economy.

I worry about all the SoCal Boomers I come in contact with that appear to have little or no savings, complaining of living paycheck to paycheck (if they even have a steady job at all) yet speak often of retirements which involve beach close living, mimosa filled brunches, weekends in Mammoth, etc. Not sure where the money will come from.

The average boomer has less then 15k in retirement savings. What’s looming is a giant welfare state

I agree with the sentiment of most of the comments above. It may actually take a full decade before it sinks in with the general public. We have all witnessed how long it has taken in most semi desirable to desirable areas to come back down to earth. This thing is not going to unwind for a long time no matter how delusional prices are related to incomes. Many people will try to catch the falling knife, double dip notwithstanding.

All the blogs and opinions are so negative about the housing, and in some areas I think the housing price is still too high. But in other areas the housing price is quite reasonable. You have to realize that people need place to live. If you don’t speculate, and only need a place to live and have a family. There is no reason to wait. Many factors affect the housing. many of the government incentives will not go away, although you think they may. bear in mind that the tax codes are not developed overnight. Herman Cain, Obama, Clinton cannot just go in there and change or abandon the tax codes. Fed Reserve will not increase the interest rate, if they say they will not. owning is better than renting in most cases.

Unfortunately, people pay what they feel they can afford, rather than what a property is actually worth. Cost vs value.

I was reading recently where Gore Vidal was selling his 4500 sq ft Mediterranean mansion in the Hollywood Hills for something like 4 million dollars; he bought it in 1977 for ~ 179K. Yes, really. The point being that most of the house buying public hasn’t been alive long enough to really comprehend real house values/histories, and aren’t much interested in much of anything that happened before they were born. The one’s that are old enough are already ensconced and in denial, waiting for all this to blow over so they can start their housing funded retirement.

And it’s STILL for sale..

http://www.redfin.com/CA/Los-Angeles/2562-Outpost-Dr-90068/home/7127011

“Ordinary people are starting to realize on a larger scale that politicians for the most part are essentially paid legislation writers for these big financial corporations.”

Indeed. And this will tamp down enthusiasm to do much of *ANYTHING* going forward. We have become subjects rather than citizens, the idea of self-governance and laws written for the benefit of the public is now a joke to most people – recent surveys show that less than 20% of the population now believes the government has the consent of the governed.

We are all subjects of Goldman Sachs now, and nothing short of violent revolution will change anything going forward here. The children of the U.S. will have it substantially worse than their parents did, as my generation has it worse than our parents did before us – the generational war in which GenX, GenY, and our children become slaves to the retirement of the boomers and the self-evident corruption of their ever expanding government has only just begun.

This blog post was a very interesting read to me on how “mood” might affect the housing market on a large scale. Not quite sure how much I believe that the collective mood of people will out-weigh the economic factors, though.

At the age of 23 in 2005, I bought my first condo in Chicago. In the prior year, I had just moved to Chicago to start my new career after I had graduated from college. After spending one year renting an apartment (and feeling like I was throwing my money away in “rent”, while watching real estate prices go up and up every year) I thought it was time to buy a Condo. In my one year of working, I had saved up the 20% requirement down payment on a modest condo that I could easily afford. Little did I know, and at the green age of 23, I was buying my condo within a year or two of the very peak of a real estate bubble. Fortunately for me, I did buy a “modest” condo — one which I was able to completely pay off within 5 years.

This year, I bought a second condo in the same building. It was REO and I paid 100% cash for that condo. It is turning out to be a fantastic rental investment so far. The rental condo I bought was very comparable to the one I live in — maybe a tiny bit nicer. I paid less than half the price that I had originally paid on my first condo that I bought in 2005. I guess I’m “dollar cost averaging” down 😉

In any case, I think I’m doing alright. Within 3 weeks of closing on the place, I have a tenant moved in and renting the place. After all expenses, it is over $600 cash flow positive per month. So I now own 2 condos in the same building with no leins/loans against either of them. I live in one, and rent out the other. Actively looking for a third unit to purchase, if one becomes available at the right price.

I guess this might be “tl;dr” — but the short version is: I was “screwed” by the housing bubble “just like everyone else” — but I came out alright because I never tried to live beyond my means. I never did any cash-out refinancing. I only bought places that I can afford.

Well, having a large income does make things easier. But living within your means is good advice for everyone.

Without knowing how much you paid for the rental condo, the $600 positive cash flow means nothing. As a wild guess, I would guess you paid about $125,000 for the condo. A return of less than 6%. I certainly would not recommend more condos, deversify. What people do not understand fully today is that having a job is best financial investment you can possibly have. A minimum wage job pays almost three times your return on the condo.

Well, I paid under 70k for it, and it is renting for $1175/mo. I’m getting about 10.5% per year profit yield on the purchase price. I can’t think of any other investment right now that is as lucrative and carries as little risk.

Of course, I do have a day-job too.

The social mood will follow the market. It’s a lagging indicator. Most people are slow to understand what’s really going on in any given market.

I still hear real estate investors talking like this is a recession and prices will be rising again in a couple of years. But they lack any data or evidence to show this except that the last few recessions only last 4 or 5 years. Whereas I can show a mountain of data that indicates the correction is far from over. Neglecting to understand the relationship between employment and the real estate market will be expensive for many of these investors.

Alot of you are calling for a new DARK AGES.. A world where you can only buy a home in CASH…

Hmm.. Well, why not live it up now then and buy and enjoy a house before the world goes to hell in a hand basket? When your in your 72 and on your death bed.. or younger like Steve Jobs.. What are you gonna do with your savings.. Money can’t allow you live forever? Steve had 6 billion.. he couldn’t take it with him.. I don’t think Steve regretted buying a house.

When you’re a billionaire, buying a house — even a nice one in Palo Alto — is like a regular person buying a tank of gas.

You won’t make it to 72 if you don’t have enough cash, either coming in, or in hand. Your suggestion is basically to continue dancing on the Titanic. My suggestion is to head for the lifeboats.

As far as Dark Ages goes, that’s an unfortunate metaphor that you chose in order to make your point. It’s a bigger concern than people realize. The periods of enlightened learning, which affected society in a positive way, have only lasted about 300 years on average, throughout recorded human history. Now consider that our own period was started by the Enlightenment back in the 1700’s.

It’s tough to pay for an educated society when you don’t have the money. As many students today know all too well.

I think you’re depending on your past experiences and behaviour to judge the future. This does not work well when your current environment is significantly changing. You need only to look around you in order to decide whether it is or not. My suggestion would be to make your decisions based upon your actual environment, rather than what you hope it will be.

Even if the fed is able to generate significant inflation, and housing prices move up, I doubt they will keep pace with inflation. In a highly inflationary scenario, interest rates will be rising rapidly, and this will disqualify a huge pool of buyers who might currently qualify for loans.

With respect to the ‘social mood’ angle, I think you will see huge declines in neighborhood appearance, over and above what one would expect from normal aging. I think a pessimism is setting in that will tend to wash out the normal social mood, which is ‘pride of ownership’.

My guess is that ‘pride of ownership’ is at least somewhat tied to the concept of building equity. People in homes with little, no, or negative equity are not going to get the same warm and fuzzy feelings about their homes, or will be less likely to sustain them.

I believe Dr. Housing or a similar site touched on this concept several years ago.

OUCH. Seeing just a teensy bit of that even in tony beachfront ‘hoods here in So-Fla… but a bit of grassroots political involvement, leading to stricter CODE ENFORCEMENT (incl., in rare cases, local.gov FORECLOSING on the negligent), can hold that at bay… I hope.

I got the pride, I just don’t have the cash for the gardener and repairman and ornamental horticulturalist designer, so everything that gets done to my house is up to me. And we need a coat of paint and a lawn renovation, but until I get the time and the money to rent the equipment, it’s going to have to wait. Sorry, neighbors!

If you can’t afford to maintain the house, sell it. I have plenty of lazy neighbors in my neighborhood. I give them plenty of time to fix their houses. When they fail, I send the city inspector over to nail them to the wall. I encourage others to do so as well. Then these lazy, broke idiots with their brand new cars can pay two or three times as much to get everything up to code. There’s no excuse for having a sloppy lawn or paint flaking off the walls. Everyone can pull weird and slap paint on a wall.

If you cannot afford to take care of your property, then please sell it to someone else who can.

~Misstrial

Now that housing is considered a poor investment, where does one put their excess capital or savings? Go down the list, equities, bonds, muni’s, cash -just about every investment vehicle has been savaged by hedge funds and investment banking. There are simply not enough productive investments available to match the huge amounts of money circulating in the system. ZIRP and past easy money policies of the FED and ECB, combined with shadow banking, has made it difficult for even the most informed individual to make good investment decisions.

Only PM’s seem to have held purchasing value, but with their historical volatility, is it wise to have more than 5-10% of PM’s in your portfolio? Pehaps in light of other investment options, investing in a home in is a not such a bad option.

Here Here dirtbagger. It is precisely the existence of large and growing pools of capital that give me hope that, eventually, housing prices will be forced to inflate – particularly for places with effective growth restrictions, clean air, and wealth.

The bidding war over natural resources and healthy places to live can only go in one direction over time, if exponential population growth is assumed (and that seems in the cards in the United States absent some kind of mass die off). The US could geographically acomidate one billion people without a serious problem.

“The US could geographically acomidate one billion people without a serious problem.”

LOVE to see your HARD data for that claim, to include the provisioning of fresh water, sewage treatment, electric power, and recreation. I mean, thanks to .gov and Marxist interference, we’re already out of adequate-quality teachers for the 300Mil peeps we got! No nuke plants for the past third of a century, etc.

I think in this, the 21st Century, it’s time to find the courage to examine econometric models that do NOT rely on infinite (and therefore UNrealistic and UNsustainable) population growth, eh?

Well, even in a bear/sideways market, using a dividend re-investment strategy with stocks with give 4-7% dividends, annualizes to 7-11% over a decade or two. Thus, it is possible to make one’s money work in a non-speculative way.

Also, if you buy real estate, you could probably do better if you manage the property & do the room-for-rent with tourists, at rates of $50-$120 per night, instead of looking for ordinary tenants.

The trick here is to treat your investments as business plans than just as assets which you sit on, until the market picks up.

Enzo – I didn’t say overnight. Look at the land mass and natural resources of China and India, both of whomeare over one billion. Now compare to the United States. Seems to me that we can eventually triple our population to one billion without trying too hard. And we will. And that is a long term driver of real estate values in the better climate/job market areas.

Not every recent buyer cares about the downturn. My husband and I are a couple of DINKS. We never bought a starter home, as that time in our lives coincided with the peak of the bubble. So instead we aggressively saved, paid off all our debt, and lived well below our means. When prices finally got down low enough we were more then eager to buy. We paid in the mid 400’s for a wonderful REO in Long Beach. We did pay under value for the home, and it did need a tiny bit of work. The house is currently worth more than we paid for it, but neither of us care if the house looses another 100k of value. Our payments are very affordable, and one day we will outright own it, and at that point we will only have to pay taxes on it. For us it was a very good investment in our future and later retirement as we don’t plan on ever moving.

Let us know how you feel when your home is $100k under-water. It’s easy to sit there at breakeven and say you don’t care if your home loses $100k (and eats up most of your down payment if you put 20% down), quite another feeling after it has happened and your husband is going through his midlife crisis and wishes he had use of that $100k that’s gone to buy a sportscar to go trolling for chicks in.

“… and your husband is going through his midlife crisis and wishes he had use of that $100k that’s gone to buy a sportscar to go trolling for chicks in.”

I didn’t think So-Cal was known for that sort of thing… 😉 🙄 😀

Seriously though, $100k underwater is ALWAYS a vulnerable position to be in… even .gov employees are having to redefine what a “safe” job is.

Still, the OP’s actions ARE, indeed, “creating facts on the ground”, i.e. propping up (healing?) the market in a real way, with real money, so… good for her neighbors. (Except the shapely, “augmented”, divorced neighbor, in the corner house, eyeing her hubby… my bad.)

Hey Enzo, maybe that was the plan, lol. Better Bank of America have the $100k than some blond bimbo spreading the herpes virus around……..

There are several groups of people whose moods have shifted MORE in favor of home purchases amidst this collapse. Crooked realtors flopping houses is one such group. Also people who sold close to the peak and now think they’re scoring huge “deals” since they’re buying for much less than the previous owners. Then there’s the cash investors crowding out regular buyers. Plus the trust fund kids who either inherited $$$ or are getting set up by mommy and daddy. I say let these ingrates keep the party going until the lights come on to reveal the nasty mess they’re playing in.

While crooked Real-tard floppers are scum who should be shot, then imprisoned in desert work gangs, the latter 3 groups are GOOD for the market, risking their own capital, and welcome to spend money in my area… AFTER I scoop my deals, lol. While the Real-Scum are arguably distorting/corrupting the market, the latter 3 groups are just reacting to the market, filling the vacuum, are they not?

I think what you’re saying though, is that all 4 of these groups are delaying young families and college grads from getting to Rung 1 on the (outdated) American Dream RE Ladder…? Again, blame the F.I.RE industry scum, not those private individuals who sold at the peak.

I agree that group 1 should have their own circle in hell. The investors can have a positive effect, as long as they aren’t amateur speculators. The other 2 groups aren’t necessarily malicious but I still think they’re very misguided in their cash allocation. They are helping to keep home prices elevated to a degree and that’s affecting other buyers. But the greater damage they’re doing is to their own balance sheets by basically throwing away their down payments on depreciating assets.

The reason they went up so much is that the stock market gained 17 percent a hear on Avesta until 1999. People had a lot of money from savings, investments, parents etc. It hasn’t move since….hence falling prices.

Also, I love the nar/ zandi articles that are trying to manipilate the mindset of real estate owners and potential buyers. 1. Rents are going up (they are not…only new high end complexes). 2. The housing bubble started in 2002. ( wrong again, it started in 1996. They say this to make people feel that when we are back to 2002 pricing we are at bottom……..wrong! When we are at 1996 pricing we will be near bottom). I thank god every day I dont own a house right now.

Here we are… well into Q4 of 2011! And just today, for the very first time, did I hear mention (and lightweight discussion) of SHADOW INVENTORY on our local PUBLIC RADIO station (WLRN), here in Bubble Zone II (Miami/Ft.Laud/Palm Beach)!! So if that’s how co-opted PBS/NPR is, imagine the MSM that actually lives on F.I.R.E. advertising!

The Sheeple are so far behind DrHB, it’s scary… but something to consider very much in the foreground of any market analysis, i.e. the topic of today’s post: public mood, and the massive LAG therein.

As far as catching the bottom goes, not all areas will bottom simultaneously. Realize, we’re entering an era of broadband, where being near formerly overpriced cities isn’t as useful as before.

Think about it, housing has been in the doldrums for much of upstate NY, from Albany to Buffalo for at least 20+ years. That’s partly because a structural change in the economy, from manufacturing to service/finance, has hastened it.

If you were to buy, areas with job growth: San Antonio, Houston, Dallas, Raleigh NC, would probably be a better plan than from Ohio to Michigan.

i senses if we can talk down another 15% we all be buying. you never walk on to a car dealership and tell the salesman the car you want to buy “how much you love it”. as for myself income property will be my game.

P.S. schools will be a factor in home prices.cut-backs on school budgets are bad and growing families demand premium schools.

I’m going to go out on a limb, and predict that most public school districts will NOT recover from The Great Recession, neither their budgets, nor their REPUTATIONS. Thus, this will become a non-issue for RE purchasers w/ “chillins”. Private/voucher/parochial schools don’t care where you live, so long as you get the pupils there on time.

I further predict that modestly priced private and parochial schools will arise/expand to fill the gap, many of them ingeniously saving big $$ by setting up shop in abandoned/bankrupt “big box” retail stores and office buildings, increasingly w/ local.gov partnership. (The “Little Red Schoolhouse” meme should’ve been pronouned dead when the NASDAQ bubble burst, circa Y2K.) Kids should remember great teachers, and lesssons learned, not whether their school building “looked funny”.

I predict that Asians in Cali (and other demographics that REALLY CARE about education), will drive this trend. Nothing breeds success like success. The trend will spread. There will be incidents of School Board Members and Teachers’ Union leaders being beaten about the head and shoulders by righteously angry parents weilding common everyday objects, in retaliation for the formers’ MALFEASANCE. (… and I will LMAO!… and contribute to their Defense Funds 😀 )

In short, the scales are falling from a LOT of Sheeples’ eyes, and–after long lag periods, that we’re finally near the end of–the ABJECT LIE that Duh.Gov has done a “good job” on K-12 education is something that even the most oblivious boob-tube parents will no longer be able to tell themselves.

The $1TRIllion student loan debacle, though based in post-secondary (college, votech) education–and the MASSIVE CALI.gov deficits–will serve to amplify the obvious.

The schools are still living in the 19th century. Why don’t they have the best teacher in each subject lecture via video conference? Class rooms can have a low paid assistant to make sure the kids aren’t killing each other, answer individual questions, and grade papers/tests. The assistant could even be a parent volunteer.

Instead of having massively ridiculous taxes to pay millions of average teachers, they could just have the best teaching every kid in the state.

Randy – I think you are overly optimistic on Equities. For long term investors, in the last 12 years, there has been no appreciation in the S&P 500. When considering inflation and current value one would have realized a loss.

Your dividend theory is fine if you are lucky enough to pick the right stocks. If one has held a diversified portfolio (such as 20% in FIRE) would the gains in dividends exceed

losses on equities? For instance, supposedly staid and reputable dividend payers like GE and BAC have gone from 35 and 55 to 17 and 6 respectively. Riskier equities with higher dividends (bulk shippers) have lost 50-60% of their value over the last decade.

My point is that equities have morphed from an investment vehicle into a playground for HFT and hedge funds. How many investors can determine the value of off-balance sheet transactions or the market value of Tier 2 and Tier 3 assets? The traders and speculators don’t care about balance sheets as they are in and out of their positions in seconds. How about management? Assets are marked to market during good times to boost stock option values and bonuses. During bad times like now, mark to market is discarded like yesterdays garbage and assets are marked to fantasy.

Pensions funds with full time managers used projected equity returns of 7-8% to detemine contributions necessary to maintain retiree commitments. That worked out well didn’t it. Going forward, many financial guru’s say that 3-4% is a more realistic expected pension fund return. To assert that one can beat expected market returns over the long run is a bit of a stretch. One should carefully review the time line upon which these claims are made.

Dirtbagger, thanks for responding. On the broad markets: S&P500, Nasdaq100, etc, absolutely, I completely concur. Those indices (w/ corresponding futures’ tickers) are really meant for trading systems, and thus, are in the terrain of hedge funds, institutional money men, etc. Part of the problem with the broad market is that dividends returns are paltry and thus, don’t offer an incentive for the average holder, except for the *possible* capital gains, which again, pertains to a bullish market. I think that’s the main issue.

On the other hand, certain stocks (Utilities, Tobacco, etc) consistently deliver 4+% dividends all the time. I think neither Reynolds America nor Philip Morris are planning on closing shop any time in the next decade. So when we live in a bear market channel, it’s better to think of each stock, as part-ownership of an income generating company, then something which accrues value, as a result of the company’s own growth and mergers/acquisitions like an Oracle Corp or eBay. Of course, since very few mutual funds think in this manner, you’ll have to create your own basket of companies which generate 4+% dividends, and then, re-invest the payout, after let’s say a big technical sell off, since you get ’em all the time in a long term bear market channel. Then, each time you buy, you increase your ownership of your target company. In the end, meaning a dozen years, you’ll discover that you’d made some money and if at that time, the markets become bullish again, you can look at the Oracles, the eBays, the RIMMs again.

Randy –

I’ve seen advertisements for a dividend paying emerging markets ETF. Have you checked it out? If so, what are your thoughts?

“for a dividend paying emerging markets ETF. Have you checked it out? If so, what are your thoughts?”

I think you’d answered your own question there w/ emerging markets. In essence, it’s another type of S&P tracker system, not unlike any Large Cap stateside fund, however, geared toward Intl portfolio of companies with high Cap and a dividend program. The problem, again, is that emerging markets is a type of bullish, speculative arena, right now.

So yes, if you’re looking for a trade, sure, however, if you’re playing defense, it’s highly risky as Intl P/Es can collapse a lot worse than in the US, where most real dividend (4%) givers are already in the 14-16 P/E zone.

Thus, even in a long US bear market, the worse a P/E contraction ever got, circa mid-to-late 70s, was 8-9. That’s at least a 10-15% dividend since these are companies (Tobacco, Utils) with real cash to give out, not Cisco or eBay, where investors have been screwed since 2002. With 10-15% payout, you can really load up on the stocks during the re-investment cycle.

And finally, markets will eventually recover and at that point, you’ll own a lot of big tobacco and be getting a nice income stream out of it in retirement. But even if they don’t fully recover, those stocks will still be generating income for you.

Nota bene: I don’t know where this meme/talk about “catching the bottom” comes from, as though there’s going to be a “bounce” and quick “recovery”…? EVERY SINGLE RE bubble of the past shows a LONG drawn out bottom, aka the “bathtub” curve. NO “hurry” whatsoever. Look at the 1920s-30s, examine the 1980s-90s… checkout JAPAN. How will THIS bubble be anything but WORSE?

The tiny “noise” squiggles on the floor of that LONG-lasting bottom are not worth worrying about. If you can plot a trend line with near zero slope, lasting 36+ months, you may then begin your long leisurely shopping season. 😉

Enzo-“I don’t know where this meme/talk about “catching the bottom†comes from, as though there’s going to be a “bounce†and quick “recoveryâ€â€¦?”

Correct. Hard to spot a bottom, except in hindsight, but who cares? You don’t see much mention here at Doc Housing, but many financial sights have quite a bit of discussion of ‘long wave’, or ‘k-wave’ (for Kondratieff wave), and similar concepts.

It is a very simple concept. It takes two full generations to completely forget the last horrible depression, therefore these waves are about 60 years long. In the present case it is a bit longer because modern central bankers have become more proficient at blowing successive asset bubbles. But all this does is postpone the day of reckoning, not avoid it. Also makes it worse, as Dr. Housing has pointed out with respect to the percentage drop in housing prices already in record territory, with no bottom even in sight.

I would not rule out another asset bubble from Bernanke and company, of one form or another. It is not going to help housing, however. One could do worse than slowly averaging into gold and silver. Also, have you noticed how high the tab is at the supermarket every visit? It is hard to spot on some products, but the overall tab at the end is the giveaway. I expect the hyper inflationary endgame. But high interest rates will doom housing, so other tangibles are better bets, in my view.

I was struck by your comment on grocery pricing and noting it on the checkout not the items. It is such a cluttered market in terms of hundreds of items and sale prices pasted everywhere that it is hard to track. I keep a focus on tracking the cost of items as I shop the price of quantity I buy or what is the price per lb or per ounce. I note that in many cases the price looks the same the package looks the same but if you check the volume it has decreased. Grocery inflation is currently running well above 20%.

Because the mood has shifted from speculative mania to one of caution and deep mistrust. …

Or it could be that simply potential buyers still think RE is overvalued.

As I look at these charts, I see home prices rose around 125% from about 1997 to the top of the bubble. Wages certainly didn’t rise at that pace. And now HH income is decreasing. I think we’ve got a long ways to go before we hit bottom. As pointed out by someone smarter than I, “equity” in a home is not liquid. Except if you own outright, and 70% of the population doesn’t. This has effectively destroyed the middle class. We’re just still in denial.

The amazing thing is that the recession ‘officially’ ended over two years ago. For whom? The plane hasn’t actually crashed until the moment it hit’s the ground, but I think we’re one major hit from another crisis. The whole universal debt model the world has been playing had probably run it’s course.

I am convinced that housing is going DOWN, DOWN, DOWN. It has to.

The supply of homes is massive. Where I live in a California coastal town, many homes are very old and need 100k just to bring them up to decent, livable condition. The economy is in a major DEPRESSION now, and has been for some time. Will the depression worsen? I think it will, but time will tell. Many jobs, if you can find one, pay very little – certainly NOT enough to buy a house. This trend in itself will lower home prices. The days of paying $300k or more ARE OVER.

In California, auto dealerships are struggling now – big time. Malls have a growing vacancy rate – this is very scary – and to see homes selling for 400k, 500k, 600k, 700k, and much more is INSANITY! Believe me, I have been looking at home prices lately – they are falling, but SLOWLY. Homes in my town range from 400 to about 1.5 million. The BUBBLE MENTALITY DIES SLOWLY. There is one factor built into all bubbles that is hard to get out of the bloodstream – GREED. It’s human nature, I guess.

Homes are falling, but there is MUCH, MUCH more falling ahead of us. Buying a house right now is like being held at gunpoint by a madman and outsmarting him by disarming him and beating him to a pulp, but NOT FINISHING THE job. Just when you start walking away, he arouses, finds his GUN, and SHOOTS YOU in the back! By buying a house right now, many people will end up being shot in the back (financially speaking).

#1 Investing Rule: Do the opposite of what the majority does. The time to sell was in 2005 when everyone was buying. you cannot argue that. So, doesn’t reason and that same logic tell you that now is the time to buy? Also a glut of renters equates to higher rents. Landlords know this and they are buying rentals like crazy. lastly, when inflation comes, hold on because your monthly rent will skyrocket and the landlord locked in his low interest rates = big profits at your expense.

Subcast, a lot of investors will have to sit for a long while, before the market heads north again. But those with deep pockets can do that. The majority buy, using leverage, can’t afford to wait it out, paying exorbitant mortgages,.

If one were to buy … Dallas, San Antonio, etc, are the places to get into because jobs are going there and thus, there will have a long term dynamic for the rentals as well.

SubCast – I have said this before: the bubble has not deflated yet. Not entirely. No Way!!! We can thank the government and the banks for that. In 2010, the man who call himself the President said this in his State of the Union Address:

“That’s why we’re working to lift the value of a family’s single largest investment – their home. ”

First of all, it’s NOT the job of the government (or the banks) to try to ARTIFICIALLY prop up home values. If home values are trying to fall, it’s for a reason – they are overpriced and out of reach of most people. Secondly, while it was worded very slyly and sounds good, it IS NOT GOOD, NOT AT ALL. With the government trying to prop up home prices, who loses ?? – young families and people trying to buy a home. Who wins??? – BANKS AND GOVERNMENTS (through higher home payments, and higher property taxes). Think of all the money that goes into overpriced housing that could be going into other areas of the economy – starting businesses, put into savings accounts, spent on other goods and services. But instead, BILLIONS goes into ONE, NON-PRODUCTIVE, BLOOD SUCKING SECTOR – BANKING.

CHANGE WE CAN BELIEVE IN? GIVE ME A BREAK.

So No, Subcast – this is not the time to buy a house in many areas. I think there are some good deals to be found, but in a town like mine, where 98% of homes are still overpriced, home prices are in for much more punishment ahead. And try as the government may to prop up home prices, in the long run it’s a losing battle. The free market will prevail. How can people working at $10/hr jobs buy a $500K home?

Must See: BBC speechless as trader tells truth.

http://www.youtube.com/watch?v=lqN3amj6AcE

Hopefully DHB had trashed my initial post, but if not…

Sorry about that knee jerk post. I will follow up with this:

http://articles.businessinsider.com/2011-09-27/wall_street/30207202_1_youtube-channel-professional-trader-nyse

If you’ve seen “The Yes Men”, this definitely smells like it. Anyway this is definitely a lesson in “do research and don’t trust the media/Internets”.

“Enzo Mimo:

I mean, thanks to .gov and Marxist interference, we’re already out of adequate-quality teachers for the 300Mil peeps we got! No nuke plants for the past third of a century, etc.”

What are you talking about? Please explain Marxist interference and why and where we have no teachers. And why on God’s green earth (I am actually agnostic – God ain’t who they said he was) would you want to build nuclear plants after the debacle in Japan? Just saw a fascinating film “Carbon Nation” that talks about how hundreds of terabytes of power are available from wind and solar alone to provide for the 16 terabytes we actually need – not to mention that remodel and new design can reduce the power needs by easily more than 25%.

And yes I do not believe we are under “Marxist” influence. Just the opposite with the talk of mortgage scams of wall street here and elsewhere. Your comment reeks of an ideological bias of no merit. But show me how it’s real and how it’s bad and I’ll buy it. And oh please include why business with Communist China is such a great capitalist thing. Or more accurately how it is good for the American people.

Leave a Reply