Living Large on $25,000 a Year in Southern California.

First, I want to thank everyone that participated in the discussion about the hypothetical family making $100,000 a year with 2 kids and showing how $100,000 doesn’t go as far as many would expect especially in high cost areas. I also noticed that most of the comments that went something like, “cut out the entertainment!” or “brown bag it!” or “why give to charity when you need it?” were from folks that simply are not from high cost areas. I thought most would quickly see that combined housing costs from the mortgage payment, taxes, and maintenance were eating up over 47 percent of their net take home income. Keep in mind that this is on a home that was bought for $385,000 which I know seems absurd to anyone not from the area; but for all of you out of state that is enough to buy you a Real Home of Genius here in California. The purpose of the article was to highlight that this couple wasn’t your typical Southern California so-called “upper middle-class” couple with a Range Rover and Lexus in the driveway. In that case, they would have a car payment of $700 or higher on each vehicle and adjusted insurance rates and higher fuel costs.

Anyone here in Orange County and Los Angeles understands that many people think of being middle class as having two luxury cars, all rooms remodeled, and every upgraded gadget that’ll make your entertainment system seem like NASA central. How many friends and family do you know that have similar budgets yet drive ridiculously expensive cars and are still struggling with debt? Not only that, how many jumped into this absurd housing bubble bonanza to keep up with the Joneses and have now seen 10, 20, 30, or even 40 percent of their equity evaporate? Is it any wonder why folks are moon walking away from their mortgages as if they were contestants on Dancing with the Stars? I was a bit perplexed by the comments. I think the majority of people realize that the reason middle class Americans are feeling the pinch is because of a few major reasons:

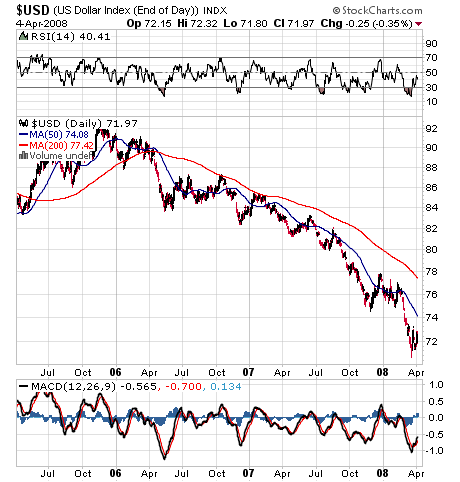

#1 – The Crashing Dollar

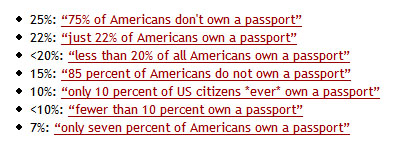

During the past two years the U.S. Dollar Index has declined by a stunning 21.7 percent. So who cares right? Well the fact that everything is now costing more, you should be concerned. Nothing drives this point deeper than traveling abroad. Anyone that read the comments saw that many were angry over the $250 a month (or $3,000) for vacations but do your realize that for a family of four, this probably means 4 to 5 days in Europe (if that) or a trip to Disneyworld in Florida? If you were to go outside the country you will see how savagely beaten the dollar is but guess what? Not many Americans travel outside the country:

Source: Phil Gyford’s website

The author of the article references a few different articles and studies and arrives at an optimistic conclusion that 20 to 34 percent of Americans have passports. How many of these people actually travel beyond Mexico and Canada is another issue altogether. But nothing will drive the point faster and harder that your greenback is no longer worth as much as you would think. Another major factor now slamming the American budget is rising fuel costs:

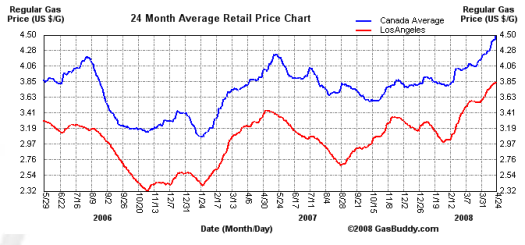

#2 – Spiking Fuel Costs

For a gallon of gas in Los Angeles, since October of 2006 the cost has increased a stunning 64 percent. Now beyond the fact that fuel is used for your automobile, rising food costs are directly correlated to this rise since many transportation companies simply push the additional cost of the fuel to the end user. So this impacts the bottom line of your budget as well. And here in Southern California especially, as highlighted in the previous article housing costs are what totally ruin your budget:

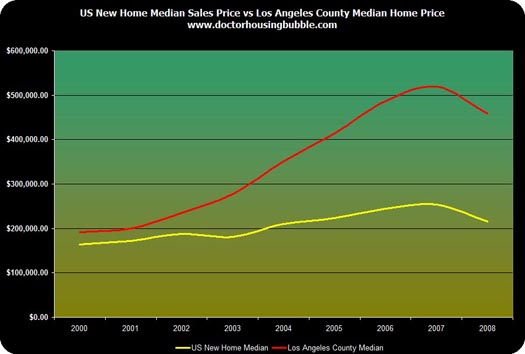

#3 – The Housing Bubble

Just take a look at that graph. The cost of a median priced home in Los Angeles County went from $200,000 in 2000 to a peak of $550,000 in August of 2007. That is a stunning 175 percent rise in 7 years! It almost tripled in value and this is something that many states (fortunately) did not have to go through because the correction is now coming fast and furious. As of last month in March, the median price is now at $440,000 for Los Angeles which amounts to a drop of $110,000 in 7 months for a county with 10,000,000 people!

This would be no problem if wages kept moving up but they have not. So what does the breakdown of household family income look like in the United States?

Household income (overall percent of US households over):

Percent of Households over:

$65,000 34.72%

$80,000 25.6%

$91,705 20.0%

$100,000 17.8%

$118,200 10%

$166,200 5%

$200,000 2.67%

$250,000 1.5%

$1,600,000 0.12%

So even that hypothetical $100,000 family is in the company of only 17.8 percent of all U.S. households. What about the other 82.2 percent of people? Wages haven’t even come close to keeping pace with a declining dollar and the rising costs of pretty much everything else.

So with that said, let us now look at living large with $25,000 in Southern California.

Living La Vida Loca with $25,000…Per Year!

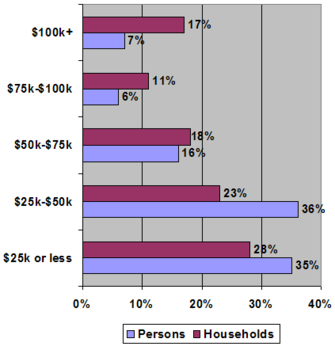

You may think this is some kind of perverse joke especially after talking about a six-figure family but 35 percent of people in the United States live off of $25,000 or less:

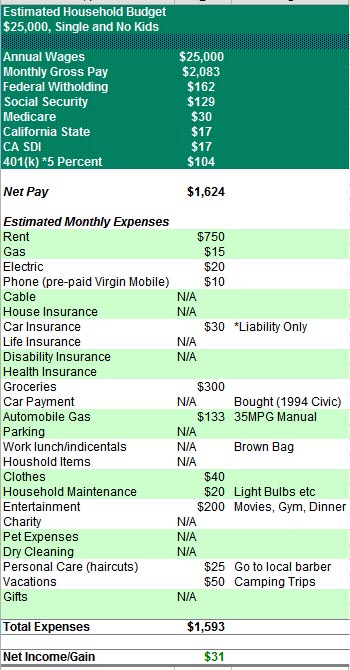

So in such a high cost area such as Southern California we are going to need to tighten our belts but let us put together a budget for someone making $25,000 or less:

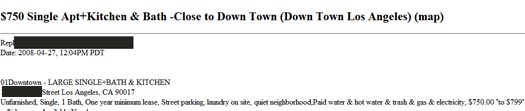

We’ll use the previous budget line items as reference points. In this instance, however we are assuming this is for a single person with no kids, which does make a difference. The first thing you may be wondering is, “where in the world can I rent a place for $750 a month in Los Angeles?” Not only will I show you a place but I’ll put you close to downtown baby!

This is for a single unfurnished place with 1 bath and a minimum 1 year lease. You have paid water, gas, and electricity but we’ll leave the above $35 in case the apartment you rent doesn’t have these amenities. So we’ve already taken care of the most expensive item for many people in California which is housing. Not only that, we’ve put you right in the middle of the entertainment so you can attend any free events (which are many) right in your neighborhood.

You don’t need a landline. We’ll go with Virgin Mobile and get a pre-paid cell phone that requires you to put in at least $30 each 3 months. With this, you can make enough calls and if you are making $25,000 or less you probably won’t be calling all over the country. This will be sufficient to keep you connected to the real world.

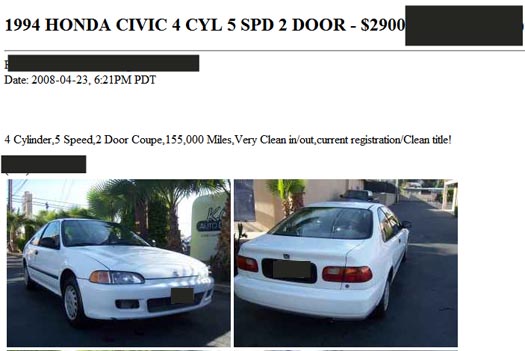

If you work near downtown, we can eliminate the cost of the car but we’ll assume that like most people in Southern California, you’ll need a car to get around. We’ll be paying cash for an excellent fuel economical car, a 1994 Honda Civic with manual transmission:

For $2,900, you can get yourself a car that with manual transmission and careful driving will get you anywhere from 33 to 35 MPG. Assuming you drive 15,000 miles per year, you’ll only be spending $133 a month on fuel even at the current $3.85 average price per gallon in Los Angeles. So far it doesn’t seem we are being thrown back to Great Depression like living. You hear how much people are complaining about fuel for their car yet they drive 10 MPG tanks designed for wilderness driving. We are also putting away a modest 5 percent into a 401(k) assuming our work place allows this.

In regards to food, $300 for a month is sufficient for a single person if you know what and where to buy your groceries. Los Angeles is great since we have stores that are not your Vons, Ralphs, or Trader Joes that actually cost quite a bit. You can go to your local neighborhood market and buy fruits and vegetables at a very low price. Also, you can go to the local 99 Cent Store and load up on the following:

2 Loaves of Bread ($2)

Sandwich Meat ($2)

Condiments ($3)

Pringles ($2)

Granola Bars ($2)

Yogurts ($3)

2 Boxes of Cereal ($2)

Half-Gallon of Milk ($2)

Pasta and Sauce ($4)

2 Salad Bags ($2)

Juice ($2)

Frozen Chicken Breasts ($2)

Total for the above? $28 bucks and this should be enough for your brown bag lunch. You’ll have a sandwich, some healthy juice, a granola bar, and a yogurt. For breakfast you can have a bowl of cereal or some fruit that you’ll buy at the grocery store. You can buy a good amount of veggies for about $20 to $30 at your local market. For dinner, you can have a nice pasta dinner with a salad and mix it up with some chicken breasts which are easy to prepare. All in all, you’ll be spending $60 to $75 a week keeping you within the $300 budget. This suddenly takes me back to my college days!

For entertainment, you better find something to do in downtown Los Angeles! Free museums, people getting rid of Dodgers tickets on the cheap, movies, or simply renting a few movies to watch. This is the kind of entertainment you’ll need to adhere to given your budget. You have enough allocated for a few nice camping trips during the year since these are extremely affordable and most of your cost will go to buying the right gear and equipment. Some ideas for example include making a day out of going to the Getty which I absolutely love and is free aside from the parking fee which isn’t more than $10. In regards to healthcare, we’ll assume you have a job that covers that cost or join the ranks of the 47 million uninsured.

For clothes you can shop at Ross and get nice clothing on the cheap. If you work in a business environment you simply cannot go in looking like Swampthing so this is where you’ll shop. In regards to haircuts, simply go to your local barber and keep the hairstyle to something average and not your typical E! television styles. Most local barbers charge $12 to $15 for a regular haircut.

So there you have it. Living large on $25,000. We are in the lower 35 percent of all earners but we do not come close to living a life similar to those in the Great Depression. In fact, we have a car, a place in one of the most expensive places on Earth, and eat relatively well. I suppose this is the difference we are now facing. It is possible to live on a lower income as long as you manage your expectations. The above budget won’t even come remotely close to handling a mortgage payment or even a higher priced home which was the point with the six-figure family. Even they couldn’t afford that home yet they psychologically feel that this $25,000 person is living a bachelor life and they want the “middle-class” lifestyle and why wouldn’t this expectation be there? With their income they are in the top 17.8 percent of all households so clearly it is beyond the “middle” if we are to look at the raw numbers. Many homes in Los Angeles will rent for $1,500 to $2,000 depending on the area so this is not in the cards for the $25,000 earner but clearly many that make that $100,000 have elected to do so and many readers on this site fall in that category.

The bottom line is housing prices have become so distorted here in Southern California and that is why they are fiercely correcting. Anyone thinking we’ll be back at peak prices is as delusional as a earner making $25,000 and thinking they’ll be able to buy a home. But if you manage your expectations and don’t chase the crowd, you can have a good healthy life here in sunny California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

36 Responses to “Living Large on $25,000 a Year in Southern California.”

Relearning behavior is uncomfortable if not painfull. One day, future generations will recognize the conservetive financial nature of those of us who survive the Realignment, just as we recognize survivors of the Depression.

I live in north san diego county coastal (cardiff). We (my wife & two kids) fit the 100k profile almost to the tee, except we sold our property in late 2005. Currently we rent in a multi-unit building, about 1300 sq. ft. 3b/2ba.Thanks for your blog! Jim C.

Great article!

No health care costs at all? No co-pays, dentist, prescriptions? Your large liver had better be *very* young and healthy.

I think you forgot auto maintenance, which is going to be significant for a 1994 car with 155,000 miles on it. That represents a major risk to this budget.

If he’s only going 1100 miles a month, he’s within bicycle range. Ditch the car and use the bus or a bicycle. Take a cab to the grocery store once every couple weeks.

$35 a month for utilities?

This guy needs to move to the midwest.

Another hit, DHB. And again to those that want to pick apart the hypothetical budget….this is just an example. Though, given the immigration trend in socal the last few years, I’m thinking that maybe the 35% of people earning less than 25k/year is a bit low. Seems many parts of LA are very close the 3rd world. Side note…Caught one of the house flipping shows last week. It was the tale of a coffee house manager (not even a Starbucks) who had bought a freaking 500k-600k house! The guy had next to no income yet ‘qualified’ for a mortgage! Planned on flipping before the first payment became due. Didn’t work out too well.

And you are VERY correct on travel outside the states…spent a chunk of Oct/Nov in Ireland. Stunning is all I can say. It will piss one off like nothing else. And I’m hearing from some friends that some of the smaller currency exchange outfits in Europe are not even bothering to exchange dollars these days, saying the value goes down before they can get ’em deposited. Friends had to make a trip to a large downtown bank to get their Euros.

Right on, Doc! I am glad you responded to the comments generated by the last “example family” budget. I was shocked when people began blaming this hypothetical family for the perceived budgetary malfeasance…. Wake up folks, the problem is not family budgets, its family wages vs housing prices. And yet our illustrious political leaders and financial innovators are looking for ways to prop up prices. Clearly, thats: notgonnawork

OK… sounds good… but now the economy really slows…

not a Great Depression… but a 10% unemployment rate as tracked by our government… (or 16-17% by shadowstats.com)

Your job sucked anyway… you move back in to your folks, with your two sisters who lost their job too… only to get thrown our 41 days later because your parents had one of those stupid ARM’s too….

And now the Depression is Great… no matter how you slice it in your budget!

I like the two budget examples; both are very illuminating. I’m a divorced mom in the $60K a year range, with two children in college. My saving grace – rent control! $1,002/month for a 2-bedroom apt. in Sherman Oaks, where I’ve lived for 11 years. Also, my car (Toyota Corolla) is paid for and only has 74,000 miles on it. I don’t know how people can sleep at night with ever increasing debt. I’m scared to move to a better apartment, because I’d be paying at least $300 more per month! Forget the idea of ever owning a home around here. Guess I’ll have to wait and retire somewhere else a lot less expensive! Even if houses drop another 35-40% in value, I doubt I’d ever be able to afford one and feel comfortable.

The $100K vs. $25K is totally slanted in order to promote a certain philosophy… even though it might not reflect reality all that accurately. A lot of the $100K items in the budget are excessive (and discretionary), and some $25K items are too conservative. Bottom line is, the $25K budget doesn’t have anything to cut. Whereas the $100K budget has a lot of discretionary items that won’t kill you if they were cut.

– The $750/mo in downtown LA might is in a ghetto area. I googled that Craigslist ad. I wouldn’t pay $5 to live there. The neighbors are probably thugs and/or drug addicts. I went to school near downtown LA. The only safe places to live will cost you $1500+ / mo for a 1/1.

– No retirement savings, life insurance, health insurance, disability insurance for the $25K budget?

– Automobile gas is easily $200+ for the $25K budget, and that’s if he only drive locally. More like $300-400 with today’s prices and some degree of social life.

– Add $100 / mo for automobile repairs to $25K budget. My 1994 honda is costing me that much in general maintenence and repairs.

Bottom line is, the $25K budget is also running a deficit in today’s world. The difference is, you have more breathing room with a $100K budget.

But wait it gets worse!! You see, the housing bubble is emblematic of an even larger overall credit bubble slowly expanding from the early 70’s. You may remember that you could have a nice middle class existence on a single bread winners salary. You could have 2 cars, a nice suburban house AND a wife that could stay home with the 2.25 kids, you remember? A mother that actually had time to bake bread?? When foreigners stop lending us money at 200bp BELOW inflation you will see a MASSIVE credit contraction that will show you how the OTHER side of the track has been living through our “Caligularian” existence. The developing world has “rising expectations” and now has the rising currency to boot. That puts us in competition for resources with formally undeveloped countries, enter the commodities boom and its persistence even though the American economy is contracting. EVERYTHING is going to get a whole lot more expensive, including things like “free” parks, library and bus passes, so plan on spending your free time PRODUCING and SAVING instead of consuming and spending.

Here’s the worst business decision any man could ever make.

1)Get Married

2)Have kid(s) with said wife

3)Get Divorced from said wife.

If you’re a woman, the opposite is true. If you want to be “Set For Life”

1)Find a sucker that makes lot’s of money

2)Lure him in and get knocked up

3)Get a divorce and take the sucker for all he’s got.

He’ll be working his ass off and you’ll be getting paid.

True Story from experience

And now you see why there are trailer parks. It is here that people on modest incomes can afford to live. Instead of a car payment, they have a trailer payment and pay ‘rent’ to the trailer park. Maybe $500-600 per month. They get more bang for their buck than an apartment, two bedrooms, two baths, and a form of equity in that a used trailer has value. It can be sold if they have to move. I was reading that up in the Bay Area trailer sites are disappearing forcing many of these people into a rental market they can ill afford. Developers eyed the land for more lucrative office or residential projects and city officials salivated over the increased tax base. The developer of the trailer park I read about in the South Bay at least bought the residents trailers and gave them moving money as a sop

to public opinion but the hardship on the residents forced to move was real.

I notice your hypothetical budgets for both low and high earners includes a major chunk for entertainment.

This is the first place most people cut, and both entertainment budgets could be cut by 75%. Use the library- did you know that only 3% of our population owns a library card? Then, there are the museums and parks, available free or at nominal cost. Use the Free Day. Rent films.

The lower-income earner especially should cut that, and put the difference toward a health care plan for really serious illness or accidents.

High speed DSL for internet is available almost everywhere for less than $25, if you have a land line phone. If you are in CA, IL, or the northeast, you can get RCN for $25 a month (stand alone internet cable).

Nevermind the cab for the grocery store. Most stores deliver, and it is cheaper than taking the cab. Take the bus to the store, and plan for one big shopping trip a month that includes the heavy stuff like detergent, cat litter, cases of beverages, and have it sent up the road, which is cheaper than using the cab. You can stop by on your way home from work on the bus or train to fill in through the month. Buy a weekly or monthly transit pass, which permits you to do all your traveling without incurring extra transportation costs.

Electric can be cut way down. CFL bulbs make a huge difference on the meter, and cut my bill by two thirds.

With the respect to the hypothetical $100K household, the point was that in order to afford that house, they had to cut to the subsistence level on everything else. After I ran through the “what they have to give up list” , I noted that the reason for having to give up cable and vacations was they could NOT afford the house and it was killing them. (And Doc? My parents had that kind of comparable income in the 50s and 60s in the now $100,000 range for a fmaily of 4 and we did NOT go flying off to Europe for vacations or stay in hotels for a week at an amusement park. That is an unreasonable expectation. Hell, with no kids and that kind of income we DIDN’T go swanning off to Europe for a vacation!)

****@Subliminal writes “No retirement savings, life insurance, health insurance, disability insurance for the $25K budget? ” Exactly. None. Zip Zero Nada – and Doc’s allowance for a contribution to a 401K is dreaming. That money will end up going for car repairs and filling prescriptions that they ot from the nurse pracitioner at the free clinic or county health department. 94% of the uninsured have household incomes at or below 400% Federal Poverty Level ($40K for 1 person, $52K for 2, $68K for 3 etc) and 93% of the uninsured have household incomes of less than $60,000. Most employers pick up 75% of the cost of the premiums for an individual and about 50-66% of the cost for a family plan but for households below $60,000 (over 60% of the US), often they can not afford their share of the premiums so they have to pass on the employer sponsored coverage.

This guy may appear solvent but he isn’t if you look at the long term picture rather than just the short term. He’s one bad event away from financial ruin (which realisitically is probably how most people earning 25k in L.A. live). Eat, drink and take $50 camping trips for tommorow ….

The $30 car insurance even for liability only, probably assumes a perfect driving record. What if he gets in an accident? The insurance goes up. What if the car breaks down? It’s an older car afterall. He has no budget to fix it. It never gets fixed, the 401k gets raided, or the guy goes into debt he doesn’t have the income to pay back. What if he loses his job and is unemployed even if only for 2-3 months? The unemployment checks bring in even less income than his job, he doesn’t have enough to live off of.

He should probably change his behavior now rather than live on the edge, but there’s not much to cut. Maybe he gets a few roommates to reduce rent more (but with rent that low it’s hard to reduce it even with roommates frankly). Maybe he gets a second job so that he can actually save some money in non-retirement usuable funds for the normal events of life.

i guess one of the few benefits of growing up so poor and not knowing it, is living on less than $25,000 a year, having a car, enough food, and access to medical care, and glad we should remain above what was experienced in the great depression of the 30’s

after all, wasn’t it that experience that birthed the realization for social security? the kind that was to provide a minimal floor to live, and the monies not used for other general expenditures, leaving the program vulnerable to false accusations of inherent lack of funding?

I borrow movies from the library for free. I’ve already paid for them, with others, through taxes. Same with the newspapers. I read them at the library. Internet there, too.

This stuff is cracking me up. Jim, sorry, can’t browse porn at the library…it’s a quality of life issue! And heading to the library to read a newspaper? Not too many libraries in the $750/month ‘hood. I would imagine there are food banks though, so I’m guessing that when one takes the bus out for food they could be dropped off at a library in another part of town and check out the sports section. Then again, if this hypothetical 25 grander is working, most of this will be taking place after work, so he will probably be traveling a good distance to find a library open later. A lot of work to save 25 cents. Just my opinion.

Anyway, the REAL way to live in LA on 25k/year is to learn from our illlegal (and otherwise) friends. Move 10 guys into a one bedroom apt. I personally know prople doing this and they are saving almost all of their cash for families at home. Of course they are working insane hours for the most part, and the sliding dollar is hurting.

Hey Doc, you forgot to add Bullet Proof Vest in the budget. I guess you can make it, but to be on the economic safe side just get a roommate and split the bills. Thats an extra 400$ savings.

There is no budget for a computer, which is a major expense in itself, for both hardware and software.

I would wager that a high majority of the 35% in this income range do not, in fact, rent solo (as they should, per this example) but instead buy homes as family units with 4-7+ people making $25k all living under the same roof, each contributing their share to all expenses.

So now you have 4-7 people back on the original $100k budget and living an EVEN LESS enjoyable existience as the square footage, etc. they thought was worth going in on, doesn’t divide so nicely.

Laura Louzader writes “ The lower-income earner especially should cut [entertainment], and put the difference toward a health care plan for really serious illness or accidents. “

*****Hate to burst your bubble but $200 a month is not going to get any health insurance that does not have a $10,000 –15,000 deductible. Not gonna happen. If they can pay the premium with $200, they can not pay the kind of deductible and copays that such plan would have. A $25,000 income will not support spending much more than $100 a month for premiums, deductibles AND copays. A non-group policy that had a $1500 deductible would have 20-30% copays, no drug coverage or coverage for only $1000 worth of prescriptions, probably not cover office visits and cost around $300 a month. Someone with this income can not afford decent coverage (premium cost) and if they buy coverage where they can afford the premium, the deductible and copays will be so high and the cap on coverage so low, that they can never pay the bills and will end up in bankruptcy anyhow.

****This IS what the person serving your hamburger, ringing up your groceries and checking out your movie rentals makes. Nice to know the person cooking your food in the restaurant doesn’t have insurance, can’t afford to see a doctor or fill prescriptions and just has to keep coming to work even if they have untreated mononucleosis or TB, isn’t it?

Great writing, as always. It’s difficult to make a point because ignorance is so rampant. All the people listening to falx news thing since they make 40k, they are part of the asset class and are worried about capital gains and estate taxes going up…everyone hates me for even suggesting that this might be the land of the greed and the home of depraved. I just try to go along with the sitcom that American life has become…only they are laughing at us, not with us now.

Back in Irvine 2001, for two years I made $12K/year. It’s kind of funny this list describes my expenses back then (94 Accord that I’m still driving right now, V-Mobile for cell phone) minus some – I did not contribute to 401K and I also did not have health insurance. I spent $100/year on clothes, $600/year for car insurance, and ~$200/month on food. I used the internet for entertainment. Vacations? forget about it. I made $800/month and my rent+utilities was $460/month (I had my own room but lived with others – utilities was $60 split!). I was doing data entry part-time and was lucky with not getting sick. However, I broke almost exactly even – I’d relocate to where the work was to cut down gas and car expenses. Mind you, I was looking for a computer job freshly out of college and competing with a lot of the dot com people.

I think what this $25K and $100K comparison implies is, as you make more, you find yourself spending more for a higher quality of living. The person making $25K is basically forced into his situation to squeeze and give up stuff whereas the people making $100K chose to buy a house, chose to have kids, and basically chose for more expenditures. The people making more are supposed to be able to respond better in times of emergencies than the person making less, and what this article is saying is most people aren’t because of certain choices they made in the past.

Of course, being single and able to move, I would always relocate to where my job is just for that short commute and that’s paying off right now. When I buy a house, that’s one freedom that’ll be taken away. Can you imagine where the couple would be if they followed the $25K person’s expenditures as closely as they could?

I think the basic point is that people should live the bare minimum, and then some (have fun), but always save just in case, and don’t ever count on things not changing. I’ve been so traumatized, I’m always preparing for the worst.

I’m living like I make 30% of what I actually make, and I would like to own my own place one day because I’m tired of dealing with roommates.

And, just because I can afford renting a place by myself doesn’t mean I should. I think that’s basically it – needs vs wants.

Guess what, I can’t exactly afford this stuff, either, and I make a bit more than $25K.

I make a typical “managerial” salary for a small financial firm that offers no benefits at all outside paid vacations. Figure about $45K plus whatever commissions I might earn on the side. My health insurance is $400 a month, as I’m over 50. I’m thinking of cutting back to a cheap $100 plan that covers catostrophic care only, with the really high deductable, given that the insurers will do anything they can figure out to avoid paying claims anyway.

Forget about a car.. I can theoretically “afford” one, but it would add hugely to my expense load and cut into my savings and debt paydown, as well as luxuries, such as nice furniture and a condo downstroke, that mean much more to me. It feels like an obscene extravagence for a single, childless woman who lives and works on the lakefront within blocks of 2 major rail lines and a dozen bus lines. But I understand that the transit is still spotty in many cities and that most people cannot make a living without a car, which is tragic when these are people who need every dime just to rent a substandard apartment and put food in their mouths.

I really can’t see how someone can survive in L.A. without sharing a cheap place with at least one other person, especially given the difficulties of public transit. I’m lucky I can depend on this, and never have voluntarily lived more than 4 blocks from a rail line that runs 24/7.

But the entertainment is the first thing cut. As I said, I make considerably more than $25K, and keep entertainment to less than $50K a month. The Chicago public library allows me to order the books I want, and I take everyone elses’ magazines when they finish- why waste paper? I have a $23/month cable internet standalone from RCN, and most magazines have FREE online editions. The museums have free days for locals, even though I contribute a small amount to the art museum. I’m sure L.A. has similar amenities.

I would suggest cutting the cable and depending on the internet for entertainment. You can get some video and watch DVDs on your computer,as well as do research, communicate by email, write and publish your books, and conduct certain types of businesses, but your television is good for nothing but passive viewing.

Cut restaurant meals and instead have get-togethers and make your own pizza, and chip in for a bottle of nice wine.

Again, I feel for someone trying to get by on this income, or less. It is not easy no matter how you cut it.

People who don’t live in California really can’t imagine the cost of living here. Even in the suburbs and small towns, the prices are astronomical and getting worse daily. We live in Northern California and even here to rent an apartment in a fairly decent area costs 700-800/mo., while even the “good” jobs pay less than $10 hr. With unemployment already higher than 10%, you take what you can get and do the best you can.

I feel sad every time I look around at Walmart and the grocery store and wonder how the parents feed and clothe their kids. We never made more than 50K for a family of four and only managed as well as we did because we were able to do our own house/car maintence and all the kids clothes and toys came from garage sales and the Goodwill.

The 100K family didn’t have exorbitant expenses listed – I have known many folks making less than that and living a much higher lifestyle. I never could figure out how they did it. I guess now I know – home equity loans and credit cards. We are lucky our current home is paid off (sold our Bay Area home in 05) and we own our cars and have no debt, but the cost of electricty, heating oil, car and home insurance, phone, cable, internet, food, gas, garbage, newspaper, property taxes come to over 1200/month. We don’t go out, we don’t buy many clothes or much “stuff”, there is not much extra to cut back on.

Inflation has eroded the dollar’s buying power and it is going to get worse. It is frustrating to watch your savings erode, but at least we have enough to get by on right now.

> I think you forgot auto maintenance, which is going to be significant for a 1994 car with 155,000 miles on it. That represents a major risk to this budget.

A civic with 155,000 miles? The maintenance costs are close to zero. Oil changes at 7,500 miles cost $20, brakes every couple of years cost $100 (front and rear). A new axle to fix a noisy CV joint can be replaced in a parking lot for $120. If our hypothetical 25k earner takes it to a dealership and says “fix it”, thousands a year in unnecessary work. I pity the non-car-guys (or the lower-paid folks who don’t know that they really need friendships with the car guys).

This article is forgetting about roommates. In 1998, I took a pay cut making $22,000/year (from 25k/year)- here is my actual budget:

($345.00) rent (nice 2br place, one roomate)

($250.80) car (having a good roomate, I financed a car- dumb idea, but I could swing it)

($25.00) water (roommate got the electric)

($30.00) phone

($200.00) gas (lots of driving for entertainment)

($300.00) food (this is spending a lot- could be much cheaper if I cooked more)

$1,412.81 net pay (large deductions- I used the refund to pay for insurance and a few toys)

($1,150.80) total bills

$262.01 left over

Things were different back then- I had a lot of low-wage company among my peers, and we mocked people who tried to appear like they were living large by living off credit (it didn’t last long). None of my peers had their own home- we *all* rented, many with roommates. 25k/year goes a long way with no car payment and $400 in rent.

In 1999 and beyond, we all started making money in Greenspan’s consecutive speculative asset manias. Some of us now have homes, two huge SUVs, and are a paycheck away from being homeless with shattered credit. Some of us have a few years’ cash in the bank and are waiting for everybody to remember that debt != wealth.

I travel extensively and can confirm that the dollar isn’t what you want to be exchanging these days. Even developing countries that used to be pleasure on the cheap are becoming expensive.

great job and fantastic comments.

AnnScott’s 3:51pm comment makes an interesting point! As people in general get poorer, public health will worsen. TB is already making a huge comeback in the third world and is cropping up even now in schools and other public institutions in SoCal. We can expect more TB, and also more hepatitis (so ya wanna eat salad, do you?), more of all of the “kid’s” stuff like chicken pox, measles, mumps, whooping cough. More of pretty much anything contagious, especially anything that thrives when conditions are less sanitary and people are more crowded together.

Here is the current reality check for Northern California:

Rent: $1150 – 2 bedroom 2.5 bath Townhouse in a very decent town

3 blocks away from my daughters highschool.

Commute to work: 30 miles round trip a day.

About 15 miles to get there and 15 back.

Gasoline: Yikes… we are at 3.85 to 3.95 a gallon.

Since I own Honda Accord, 6 Cylinder – my gasoline bill ranges

around $50 a week. No, we don’t make trips to Roseville and Sacto.

anymore…

Good news… I own my cars (2nd one is parked permanently)

Sorry, have a strange phobia – if one of them breaks down I literally

hyperventilate and have to have a back-up option.) There is NO way to

use public transportation to get to work since we only have city buses

and I work in another town.

Better Half has a an old Toyota Truck, 4 Cylinder. Commute to work:

3 miles round trip. Don’t know what he spends on gas… only know that

he usually uses my Honda whenever he needs to run to store…

we had multiple discussions about his and mine. Sofar he still insists

that his is his and mine is there to be used…. I grumble.. but at least

I am the Title holder of both of my cars…

Car Insurance for the 2 cars I own: $277 for 6 months. Have “perfect”

driving record, never had a ticket, etc. In 20 plus years of driving have never been pulled over. Knock on wood… I did get my license in Germany… and still don’t understand the definition of speed limit, but do use my rear view mirrow for more than the occasional glance…

Phone: Around $65 – this includes wireless internet.

When you have a 14year old with her own laptop you need wireless if

you ever want to be able to go online yourself.

Daughter also has a Cell Phone. Team Mobile contract – Favorite 5, 300 whenever minutes, plus unlimited Internet AND unlimited Text Messaging.

Around $65 a month. It was worth it… since Offspring decided to become

record holder in “text messaging” She sends/receives in average 5000 a month.

Could you imagine the bill if I had to pay 10 cents for each? Trust me, I know of other parents that have received the infamous $700 phone bill because their kids ran up the bill.

We do have satelite T.V. – another $57 a month.

Electric/Gas – ranges anywhere from $120 at it’s highest to $70 at it’s lowest.

Remember that both adults work full time and daughter does go to school.

We don’t run the A/C 24/7 and wash our laundry in cold water. Have done so

for years and it is a tremendous savings. Last winter we used the fire place

to heat the house – Firewood can be scavenged… and since heat rises it

warmed the upstairs bedrooms just fine.

Groceries: We go shopping a lot at places like “dollar store” – you would be amazed what you can get there. Shampoo, cleaning products, even groceries.

Better Half is a great “bargain hunter” and studies the grocery ads before making

a decision on what to buy. But main rule: No driving out of our immediate range to chase a stupid bargain – gas costs too much.

Entertainment – satelite T.V. – Internet – various game consoles

entertain a horde of Teenage girls on the weekend to keep daughter

occupied. Real simple… we don’t need alot of costly entertainment

and usually just happily loaf around the house and work in my garden.

Advice about cutting back on spending: Don’t stop at a store for no reason

or hop in your car to go and look at stuff…

Altogether – we don’t spend over our limits and manage to keep a comfortable

level in our checking accounts at all times. Another one of my phobias – If I don’t have at least 6 months worth of living expenses sitting in my savings accounts

I hyperventilate…

Rebate check? – Great – whatever. Consider it a Bonus. It will probably just end up in a savings account for a rainy day.

Reena

Most insurers give you such a big discount on car insurance if you carry two policies with them that renter’s insurance ends up being free.

I live on $0 a month. I lost my job so I conduct clandistine operations to get food, shelter and gas. Thanks to ops training, I learned to eat monkey dogs, cats and rates. For entertainment I collect cable from the neighbors. For clothing I visit dumpters. What a economy. My PC is the one i use at the local library. I use a razor and skin my head. I joined local Nazi group who provides two free meals a week.

Many points well made. Personally going down from over 40k for the past ten years to 25k for the past year has been interesting to say the least. Not whining, It has been a learning experience. Finished off a loan and even am going back to school for a better paying job as many people these days are now doing. Still eating a lot of ramon noodles and hardly anything entertainment, but thats ok. I learned how important conservitizim is.

.

I quit my corporate job to become a full time musician in my late 20s. It was a huge pay cut, but I am much more fulfilled now – and it’s not just because I’m doing what I love. It’s because I’ve had to learn to do so many things on my own in order to save money. Now I cut my own hair, grow and can veggies, cook from scratch, make minor home improvements and fixes to my car, and I have friends over instead of going out. Yes, it took a long time to learn to do all those things properly, but I feel so independent now. My income has been slowly rising as a musician but my expenses keep going down, so now I’m ready to buy a house 🙂

Leave a Reply