The big money club and interest only loans: Housing bubble favorite of interest only loans back in the market for wealthy households.

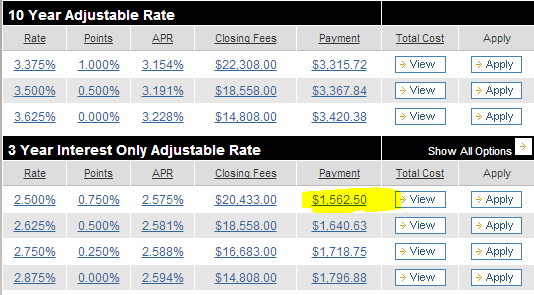

There is little doubt that growing wealth and income inequality is a reality in the United States. Even in California we can see this microcosm unfold dramatically. You have people being pushed inland from coastal areas and those near employment hubs have seen housing values reach near peak levels. What we are also seeing is that access to debt is the key measure of success in this economy. For example, the bubble favorite of interest only loans is back but with a different flavor. Banks like Wells Fargo, Bank of America, and Union Bank are back at it underwriting interest only loans to wealthier clients. The big difference is that you need to have money to play in this current market. Banks are holding onto these loans in their own portfolios. Not a bad way to earn money in a low rate environment. So this hits at the heart of the issue where Fed policy has largely aided those least needing it in a modern day feudal banking network. For example, you can buy a $1,000,000 home today with a 3 year interest only mortgage and carry a principal and interest payment of $1,562 per month. Impossible? Welcome to the modern banking system where low rates are accessible to those who least need it.

Welcome back to interest only loans

Housing is already an incredibly subsidized industry. You have mortgage deductions, tax benefits, and essentially a hedge against inflation given that the Fed is set on digitally printing our way into prosperity. Access to debt is paramount in this system. The interest only mortgage is a perfect example of what happens when we create an artificially low rate interest environment.

“(LA Times) Bankers don’t seem worried about affluent clients missing payments. With high-end home prices on the rise, they have recently embraced jumbo mortgage lending, including interest-only mortgages. That trend continued this week as the banks reported earnings, with Bank of America Corp. saying 36% of its fourth-quarter mortgages were jumbo loans, up from 23% of originations in the first quarter.

In a conference call with analysts Wednesday, BofA Chief Executive Brian Moynihan said the bank is making non-qualified mortgages to the rich and holding the loans as investments rather than selling them.

“We’ll meet the needs of our customers by using our own balance sheet,” he said. “We do a lot of mortgages today through our wealth management business.”

Programs like this of course only add fuel to the flame of wealth inequality. Banks are willing to leverage virtually free money and lend it out to wealthy clients. Higher up on the food chain, you have Wall Street now crowding out regular buyers in the residential housing market. Over time this big money club gets more selective and the currency at play here is access to cheap money. Some would like to believe that this system is rewarding hard grit and free market success but in reality it is more reflective of cronyism in the financial sector (have people forgotten that most banks failed in utterly dramatic fashion and were bailed out Soviet style?). Nothing free market about that narrative. Give anyone access to large funds of money for nearly zero percent interest rates and see how many takers you will get. In a way, the first round of the housing bubble was this and we saw what unfolded when accessible to the general public. Today, the doors to the public have slammed shut and now access to debt is more selective.

For example, let us assume we wanted to buy a $1 million home somewhere in California. We will put 25 percent down. How low can we make our monthly payment?

Assumptions:Â $1,000,000 home purchase, $250,000 down payment, FICO 740 and higher

An interest only loan for $750,000 (you still need 25 percent down) will cost us $1,562 per month (principal and interest) and we are nicely locked in for three years. Assume taxes and insurance run $1,000 per month and your monthly nut on a $1,000,000 home is $2,562. A similar rental may run $4,000 to $5,000 assuming many rentals are available in the area. So you are actually saving money here on a monthly basis on a big bet. Since many people believe that real estate will only move in one direction, after a few years and some appreciation, you just sell the place or refinance and off you go. Also, many are looking for those juicy deductions:

“Customers for such loans are often self-employed and capable of making big down payments and maintaining fat bank accounts. Banks believe such borrowers could afford traditional loans but want to maximize the cash available for other investments or ventures. Some borrowers just want the tax deduction available on the first $1 million a year in mortgage interest payments.â€

Given that only 1 out of 3 families in California can actually afford a home, this low rate environment is creating big incentives for people that largely don’t need it. It shouldn’t come as a shock that million dollar home sales are now back to levels last seen near the peak of the last housing bubble in 2006:

You can understand why big money is crowding into real estate when low rates are providing such generous returns. The above scenario doesn’t factor in the tax breaks you will get which are important for higher income households. The interest rate on the 3 year interest only loan is 2.5 percent but for the regular Joe and Sally looking at more traditional products, the current rate is as follows:

The 30-year fixed rate mortgage is at 4.34 percent, nearly 200 basis points higher than the 3 year interest only loan. This is a tiny niche market here but products like this fueled by QE addiction are merely speeding up the wealth divide in the country. Borrowing your way into millionaire status doesn’t seem like a late night infomercial catch phrase anymore.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “The big money club and interest only loans: Housing bubble favorite of interest only loans back in the market for wealthy households.”

Housing To Tank Hard in 2014!!

Jim, when I’d asked for specifics, you said that we’ll see housing start to tank in March — that’s next month.

I’m watching Redfin, Zillow, Trulia, etc., to see if it’s so.

Oh it will be so. It will be epic. You can take it to the bank. Big Meltdown starts in March.

This is really the problem with making short term predictions of any kind. It is much easier to make long term predictions like “eventually housing will come in line with income†or “eventually interest rates will reflect the cost of money plus anticipated inflation plus riskâ€. I hope that we have learned by now that markets can be irrational longer than you can be solvent…

Doesn’t really matter. In the long run, Jim will be right. Keep up those predictions!

“You can take it to the bank. Big Meltdown starts in March.” Jim 2/11/2014

Jim, you DO know that March is 19 days away, right?

I’m setting my personal countdown timer on. Can’t wait to see the fireworks! 🙂

Mornin’ Jim

I only see Housing tanking AFTER the 2016 elections!

Those crazy loans are making a come back.

besides, there is no shortage of people wanting to pay taxes on 500K+ POS dump. as long as the 3.5 down payment is available and the monthly pmt is doable

“I only see Housing tanking AFTER the 2016 elections!â€

I SEE a mysterious dark haired woman in your future… I SEE the return of an old friend… I SEE changes at you job.

Your crystal ball guess is as good as any other crystal ball guess, I guess…

This trend differs from the 2000’s bubble because as the Doc mentions, these aren’t available to anyone who can fog a mirror. I was just offered a 7/23 interest only loan product, and got a little more conflicted about it than I thought I would (I thought I’d hate it). The way these are being pushed for “wealthy” clients – AKA people who have some money – is that equity no longer matters. It’s better to save on monthly mortgage payments and invest that savings elsewhere. Also, borrowers have the option to pay off principal whenever they want with no pre-payment penalties, so they could conceivably build equity there. Few people stay in their homes for longer than 7 years anyway right? I honestly don’t know what to think of these products, but still lean towards a 30 year fixed.

Wow! Like many here, I am sometimes jaded to the corruption of society. After a while the assumption simply becomes embedded in your thinking. Its impact fades away like calibrating a Geiger counter to ignore background noise. But, a story like this really creates a psychological spike. The sheer magnitude and brazenness of the corruption is almost beautiful to behold. All I can say is “bravo” to the American banking-housing industrial complex. Bravo!

How is all this “corrupt”?

Listen, there are two kinds of people in this world these days (well, always). There are those who own assets, and those who don’t. What is being described here is a service to those who own substantial assets, and, because of tax planning and investment philosophies, those people prefer to buy homes with credit instead of the cash that they own. Mark Zuckerberg actually has a mortgage on his home, believe it or not. A lender certainly wouldn’t bother to do this for someone who has no substantial assets, because they would have no assets to seize if they weren’t paid. It’s pretty simple. Now, if more Americans saved their money and avoided credit as much as possible, then they too would have these sort of loans available to them. But, they don’t. Most Americans have no assets and consider credit currency.

Now, corrupt, to me, is banks getting bailed out and not one of the executives getting prosecuted as they lent money to millions of Americans and committed fraud because they sold these loans to other entities claiming they were safe, AAA rated. Then the DOJ just excepts a bribe negotiated in secret masked as a penalty payment five years later. Now, that’s corrupt.

don’t worry, the banks will steal from the rich as well.

“Mark Zuckerberg actually has a mortgage on his home, believe it or not.â€

This is actually very common. One reason why high profile insiders like Mark Zuckerberg do not sell facebook stock is because of the public scrutiny of trades and the impact it may have on stock value. Normally banks make loans to these high profile insiders using the stock holdings as collateral when they want to make a purchase. All is good as long as the stock value does not fall. As Ken Lay how did it work out for him…

“This is actually very common.”

Well, no, it isn’t, because there are very few people with as much as that man child. But, really, the dude is worth billions. What’s a ten or twenty million mansion loan to a bank?

His business is all about financial fraud, anyway, just like the pyramid scheme of so many Silicon Valley companies. It’s all about fudging numbers to those people, and America wallows it whole.

Ok, let’s try this another way for those who are reading challenged. This is common for high profile stock holders. Mr Zuckerberg is not the only “man child†high profile stock holder. I work in Silly Clown Valley and I assure you that there are many other high profile stock holders here never mind the rest of this planet. This is VERY common for these guys/gals. Not sure where I lose you but let me know exactly where I lose you and I will help you cross the finish line…

Cute. My point was, he owns so much stock, what would a ten million cash in be? These people sell stock all the time. What, do you think they just go visit their piles of certificates and pat them and water them? The SEC requires reporting sales. Look them up. Besides, he only has to pay 15% on the sale if he has a bad accountant and lawyer, but probably pays nothing if he has even a half assed accountant and tax lawyer. Hell, they probably figure out how to get paid by the IRS, over time.

I can tell from your response you probably do not know any paper millionaires. So I will walk you through each statement from the mind of a paper millionaire. I know many…

“…he owns so much stock, what would a ten million cash in be? “

You have to sell shares to get ten million out. Guess what? You pay capital gains taxes on your gains. This means your net wealth goes down!!! Why would you sell the goose that lays the golden egg and “leave money on the table� There is a lot of ego when you have a large net worth. It is almost impossible for these guys/gals to lose out on possible future gains in their pursuit to become the richest man/woman in the valley, the industry, the country or the world.

“These people sell stock all the timeâ€

Yes they do but generally only because they have to for cash flow or for new investment opportunities like IPO’s. These guys are in the front of the line with investment bankers and this is really how they get rich.

“do you think they just go visit their piles of certificates and pat them and water them?â€

Actually, yes! The old adage about rich old miser sitting and counting his money is as true today as it was hundreds of years ago…

“The SEC requires reporting sales. Look them up. Besides, he only has to pay 15% on the sale if he has a bad accountant and lawyer, but probably pays nothing if he has even a half assed accountant and tax lawyer. “

I believe I already addressed the only15%.

“Hell, they probably figure out how to get paid by the IRS, over time.â€

See Larry Ellison’s property tax battle in Silly Clown valley. These guys want to pay nothing no matter how much paper wealth they have.

All paper millionaires I know with maybe one exception still have a mortgage. The math is actually pretty good if you think about it. We know that 3 – 4 % interest on a 30 year is giving away money. This allows more leveraged paper wealth growth.

The really sad thing (well maybe not) is that when many paper millionaires lost everything March 2000 they didn’t even have a paid off house to show for it. I posted previously how some of my friends where upset that they had to sell shares for the 20% down. This was lost money to them at the time. Hindsight truly is 20/20…

You know, a million ain’t jack these days.

Do you even read my posts?

“It’s pretty simple. Now, if more Americans saved their money and avoided credit as much as possible, then they too would have these sort of loans available to them. ”

I call bulls*t on this: Masses will never have the financial “opportunities” created by the 1%, for the 1%. It’s a club and no, you aren’t allowed in. No matter how much you “save”.

We are at the point where you can’t fight stupid…

I read your posts but you still don’t understand how insider stock holders think. Well the facts prove me right and you wrong by your own admission. Enjoy!

The long term cap gains tax rate is 20% for higher income households ($400k+). There’s also an ACA 3.8% Net Investment Income Tax on top of this for married couples above $250k.

In other words, if a higher-earning household exercised stock options and sold after holding one year, they could face a tax as high as 23.8%. If the stock was sold within one year, the rate could be up to 43.4%.

And since we’re talking about techies in CA, there’s at least another 9.3% state income tax on top of both of these examples. So, the effective tax rate could be 55%+.

Keep on thinking that way, and you’ll always be a few paychecks away from poverty. You will certainly have a miserable time as an older, non working person.

Mike,

We are ALL a few paychecks away from poverty. You are kidding yourself if you think otherwise…. Unless you are in the 1%.. you are a few paychecks away from poverty.

All your money could be inflated away faster than you can blink.. and that gold stockpile will be confiscated by the government. The 1% is about power.. and they know that in a doomsday scenario.. they are the only ones that can “buy” their way out of the mess.

The 10%.. may last an extra few months of years at most in a total collapse… But they’ll be broke like the rest of the 99% rather quickly.

Not me. And, sorry about that gold bet. I know, I know, back in ’08, we were at a fork in the road. Inflation or deflation? Looks like door #2. Sure, sure, that hyperinflation thing is just around the corner, “you just wait, it’ll be horrible”. Meanwhile, equities are back big time, and commodities are nowhere. Too bad.

Ask yourself how in the world inflation can take off when there are billions more workers on line in the third world and billions more coming over the next decade. What, do you think the western worker will get a raise if prices go up? I don’t think so.

The wealthy are starting to buy more and more tangible assets. Real estate in desirable areas is looking like a target that they like. With little inventory and low interest rates, there’s plenty of competition for real estate prices to continue rising.

@CAE wrote: “…The wealthy are starting to buy more and more tangible assets…”

If you mean items such as Porsches, collectable art and physical gold, then yes.

“Porsche expects to hit a target of selling more than 200,000 sports cars next year, three years earlier than originally scheduled..”

http://www.foxbusiness.com/industries/2014/02/11/porsche-to-hit-car-sales-goal-years-ahead-plan-ceo/

“If you mean items such as Porsches, collectable art and physical gold, then yes.”

An expensive automobile is just that – a waste of money on a depreciating “asset”. Eventually, it will be worth nothing, unless it is an extremely rare example, and, even then, the expense of storage and upkeep negates the “investment”. I always consider Porsche owners, unless they are incredibly rich, poor handlers of their personal finance.

I know this is a housing bear blog. But I will throw this out for some of you ardent housing bears. A favorite thesis of why housing prices would continue to decline dramatically from 2010 to 20125 was because the baby boomers don’t have enough money to retire on and thus they will sell their largest asset (their home). This will result in a flood of homes on the market and prices will decrease for the foreseeable future.

Now that was a nice thesis. But it never came to fruition. What happened housing bears? Give me your best shot! In fact, from 2010 to now, housing prices have gone on a tear. I know, I know, some of you will claim that the housing market is rigged but you still can’t deny that home prices have gone straight up when they were supposed to come straight down. What happened housing bears?

Yes we were dead wrong. No way did I ever imagine they would ramp prices 100% in 6 mo. But open your eyes. Look at what is happening around the globe. This 100% gain is only a mirage. Look at the baltic dry index. Look at estimated 3q and 4q profits. This jig is up. People are going to try and unlock value and realize these 100% gains, but once the majority start selling and so few are left to buy we are going down so hard it will make 2008 look like a picnic.

Jim gets that it’s all an illusion. Those “cash buyers” will or already have refied into these bubbleicious mortgages. However with no real economic growth to speak of grater fools are in short supply. When these mortgages reset who will buy? How will the income streams of the wealthy and specuvestors look? It’s exactly the same thing that happened in 2008. But this time there’s fewer players and EVEN MORE LEVERAGE! The velocity of this crash is likely to be swift.

Actually Nimesh this is a pretty good question. I believe there are a number of reasons why we did not see the crash that the math suggested. I have been very impressed at the ability of the Fed, Treasury, FOMC member banks, etc. to not only stop the deflation of the mega debt bubble but re-inflate the bubble back to the prior peak. I believe there are a number of reasons that this occurred:

• Suspension of mark to market

• Suspension of bank real estate holdings rules

• Fed overnight rate at zero

• Fed’s balance sheet at 4 trillion with a “t†(QE)

• Housing authority working with Fannie and Freddie to take foreclosed homes off the market and sell to fund managers at a deep discount (these deals never show up in the comps)

• Foreclosure legislation

• Asset bubble euphoria

• Etc.

The result is that you get artificial cost/value of money artificial supply and artificial demand.

Now if you understand math, you know that the equation will need to balance. There is no free lunch and all of the actions that have created this “recovery†will have consequences. The real challenge is to “predict†what these consequences will be and to take action if possible to minimize their impact. The challenge is that sometimes the consequence is completely different than expected as was the case with the QE taper pushing interest rates down in the short term which was counter intuitive. Over the long term housing will come in line with income and interest rates will represent the cost of money plus risk plus anticipated inflation. What we are witness to is a short term blip that will be studied for generations…

BTW – the definition of short term is open for debate in this context.

I’m a pessimist, so I always expected housing prices to rise. Here’s why…

* FEAR OF HYPER-INFLATION due to money-printing. People with cash want to park their money in real estate. In an economic crisis, cash and stocks can plummet to near-zero value, but land, housing, food, fuel — those will always retain value.

* PENT-UP DEMAND. People have been waiting to buy, and are tired of waiting. They want a house, to live in.

* Couple that with FEAR OF MISSING THE BOAT. If home prices go up just a tick, people will panic, afraid of “missing the boat” on the next housing boom, so they’ll jump in to buy.

* Couple that with LOW INVENTORY. Many buyers suffering pent-up demand and a fear of missing the boat — not enough decent houses in nice neighborhoods. Supply and demand will naturally push up home prices.

I think there’s more of a pent-up supply issue.

Like somene else mentioned, there are fewer and fewer “greater fools” for these folks to swindle into buying their over-priced assets. They count on wearing them down until they throw in the towel and overpay. I have been waiting since selling in 2007, and I may have to wait a bit longer, but IMO not much. Once they run out of “greater fools,” as Jim Taylor says, “tanking hard” is gonna happen. As the saying goes, patience is a virtue. I hate renting for some reasons but love it for others. But I’d rather own in a place I want to stay, not some pit stop in AZ or NM or some other flyover spot. BTW, RE in many nice places like NM, CO, etc. isn’t particularly cheap these days either. Nebraska, sure. But not places like Boulder, Santa Fe, etc. I’d rather pay a million in CA than some of those other so-called “options.” But I will wait the rentiers out and I sense that the wait is getting shorter by the day.

RE: Bay Area Renter

I agree our wait is short. I vividly remember the satisfaction I felt in 2008 as prices crashed. All the Realtards eating crow was a site to see. I did feel bad for those people who just wanted a place to live and got suckered into the bubble. Luckily the blood in the streets during Crash 2.0 willama be that of Specuvestors and Rentiers so my schadenfreude will be guilt free. Knowing that the fascists at the FED and in our government ultimately control market forces gives me a sliver of hope for our future. I lived homeless as a kid but I built myself up and now own my own business and have a nice down payment. The FED and their cronies in the 3 branches have delayed my goal of a nice 4/3 in Upland, but it’s only gonna make getting those keys that much sweeter.

Meant FED CAN’T control market forces. Wish Doctor had a way for us to fix typos LOL

son’s assumptions rely not just on a public _willing_ to buy, but somehow _able_ to do so. There are a small percent of us sitting out b/c we don’t like the fundamentals, but most people aren’t buying b/c they can’t make the financing work.

And this financing trouble exists despite near-historic rate lows and many programs that allow purchasing with very little if not 0% down.

Unless you can lower rates to zero, or bring back NINJA loans or some other financing chicanery, the reality is that housing prices in many markets (not just SoCal) are out of whack compared to what people can actually afford to pay.

It’s hard to imagine many scenarios where sustained price increases from the current baseline are plausible. I’m sure there’s a way it could happen, but it seems highly unlikely.

I occasionally have conversations at work when someone is going crazy over seemingly insane (government) security rules. Some of this applies to the economy right now:

1) Your first mistake is thinking that there is a rational explanation for these rules (or decisions & events regarding the economy).

2) Your second mistake is in thinking that you’ve figured out a pattern to the insanity. There are certainly times when you see a weird rule or decision that is similar to another weird rule, but sometimes that’s actually a red herring, and the opposite occurs.

3) In general, everyone is just trying to make it through the day without losing it, and as usual, the security person being a hard-ass is thinking a lot about how to preserve their ass if they allow a mistake to be made on their watch. Unless they’re creating a crisis to prove a point and somehow look at their motivations as making sense to them.

Everyone seemed to be surprised that banks DIDN’T foreclose en masse, as this involved letting people live in their houses for years without paying their mortgages. That was new, and is part of the new insanity, at least for now.

The shame of being foreclosed is gone. I lost a condo to foreclosure in 2000 because I bought way more than I could afford in 1989, and I did not tell many people. Nowadays, it’s just a thing.

Switching from mark-to-market to mark-to-fairy-dust is bizarre, and at some point, it will cause really big problems. It’s unthinkable, yet we have it.

“Load Modifications” whose first step is: Destroy your credit and cut off all options OTHER than a loan modification. Insane. How could anyone, with a straight face, go back in time (or forward in time, I’ll wager) and tell someone that that’s a good idea? Insane, but it worked (until a couple of years down the road when it gets all painful again).

Why? This is just my take on it: people try to avoid pain today by any means possible, and various entities feel pain in different ways, at different times, and assign differing degrees of importance to their pain. Whatever happens on any given day depends on who’s feeling what pain, and which entities have an easier path to take to have less pain tomorrow, where others might have a different option with a similar outcome (less pain) several months later, when everything is different. And someone else who doesn’t actually have to make a decision might see a short cut that might possibly reduce their pain sometime down the road, and they may bork things up just because they didn’t think their plans through.

This isn’t a case where bears were wrong; they were right in being bearish, but wrong in assuming that the economy was run by sane people making rational decisions. It’s sort of like the old saw about how you can’t idiot-proof something because idiots are much more resourceful than you might think, and yet they’re still idiots.

Finally, there is Human time. This is a term I use to describe an inherent problem in many simplistic systems that try to predict people’s behavior. I don’t need 36,000 calories per month, I need 1200 calories per day, every day. I’ve got a good job, so I can certainly afford food, but I still have to physically acquire that food and, at least twice a day, eat food, both of which take some of my time.

Those are just illustrative, and perhaps obvious to others, but I can guarantee that some of my managers don’t have a full grasp of the concept.

What you think must make sense in the long run must also accommodate people in the short run; they need to live from day to day and from week to week, and they make decisions based on those time frames.

Getting down to tass bracks, I have two friends that completely called the crash and moved their assets to T-bills in early 2007 because the market was insane and unsustainable. They had to wait a few months, because they didn’t know what would trigger first, and they did a fantastic job of preserving their capital. On the drop, that is. Both realized too late that the “irrational actors” in our system were not going to let the stock market stay down.

They got one part absolutely correct, but they didn’t think through the fact that businesses needed to do something that seemed useful every three months, politicians needed to adhere to the spin cycle and election timelines, and the powers-that-be (literally) pulled out all the stops to make the market look like it bounced back. They had to; their bonuses were based on stock performance, or their reelections were dependent on looking strong, and they agreed to a lot of intervention. (I’m no genius; I left my 401K completely in an S&P index because I was paralyzed by indecision). So … in human time, every three months you release earnings, and many people had a great deal of motivation to cook those numbers, and many others were motivated to allow those numbers to be cooked.

I absolutely agree that in some long term, say 30 years or so, the housing market will track the rate of inflation. I believe we’re devaluing our money (duh), but how long can anyone make a bet to see when we reach the tipping point? Probably a lot longer than any of us as individuals. We still have to make our margin calls because we’re little ants with W-2s and cable bills every month; entire economies run by different rules, and some of them may not only look insane, but they may actually be insane.

Anyway, I have no fscking clue what the housing market will be like in two years, but I know that if you’re waiting for some macroscopic change because “it has to do this at some point,” I’d just say that we’ve seen a lot of decisions in the past six years that we couldn’t have imagined.

I think there’s merit in thinking about the forces acting on people at all levels in time frames that are meaningful to them both as humans and as business people. Or I could be wrong; I’ve been wrong many times in the past and probably many times in the future.

You are right that the Boomers don’t have enough money to “retire”, but, you were wrong that they would then go and sell the house. Why would they do that? Then what? Assuming they are no longer working, they would have to move to some god forsaken place like Arkansas, or, worse yet, Reno, to profit from that sale, far from friends and family at a delicate stage in life. Nope, old people in general don’t move, unless they have to.

But, many Boomers are still working, and delaying “retirement”. My guess is most, for obvious reasons. They have no savings to speak of, certainly not enough to stop working and live the credit fueled life they are living at the moment. Many will die in their cube, if the bossman hasn’t decided to throw them out on the street and give their job to an Indian or a robot before then. So, therefore, inventory remains tight, because all of the Boomers are staying put. No flood, more like a trickle from estate sales.

But, watch for a change in the market very soon. All of those HELOCs that were taken out in the late boom times are about to change to higher interest rates or balloon payments after ten years. Could be interesting.

Move to Arkansas or eat cat food. If home prices stick or go up in Ca wages will follow and inflation will happen. If you are on a fixed income you have to cash out if you want to eat.

“A favorite thesis of why housing prices would continue to decline dramatically from 2010 to 20125 was because the baby boomers don’t have enough money to retire on and thus they will sell their largest asset (their home).”

Who had that thesis? You’re mixing up two different ideas.

One popular argument was that there would be steep price declines in the short term due to supply outstripping demand. This was based on the idea that the shadow inventory would be put on market in short order. A lot of it wasn’t due to hastily introduced government legislation. The robo-signing fiasco didn’t help matters by backfiring on the banks. The clock is still ticking.

Another popular argument is that the baby boomer cohort will downsize and die off over the medium term, thereby adding more supply of existing stock than the market can absorb. The clock is still ticking.

Both bears and bulls are stupid. Wise people ONLY make such financial decisions when they make sense no matter what happens. Anything else is speculation.

Yes, but … (there’s always a but).

Making _any_ decision when the government is a puppet for banks and both are there to get you, is impossible.

Doing nothing is also a decision, so what ever you do, or don’t do, you end up speculating as there’s no way to make rational decisions in an insane environment.

Only thing you may choose is the method of speculation.

Folks, I want to add that in our current housing market, the banks are holding back inventories. They are not dumb enough to shoot themselves on the foot. Nothing is going to stop the banks from holding on to their housing stock for the foreseeable future.

The banks, Wall Street and our government own all the marbles. Oh and they own the entire playground too! I am a strong believer in free markets and freedom. But let’s call a spade a spade shall we? We don’t have free markets (only if they are right then they profit, if they are wrong everyone else gets to suffer the loss and yes the media says this is good for society and our economy).

The Government is conducting an monetary experiment Nimesh. It’s an attempt to inspire confidence in the system. No conspiracy here just read Bernanke’s papers. In my humble opinion, a confidence game is subject to extreme volatility. It doesn’t take much to send people running for the exits. Now, if this confidence game does indeed break down Government will likely follow in its place so if you’re thinking of buying a house go for it. You might get to keep the house for free.

Thanks for checking in Jim…

Regulators fear more bad mortgage practices:

http://money.cnn.com/2014/02/10/real_estate/ocwen-mortgages/index.html

Check out the stock chart for the company mentioned: Ocwen Financial (OCN)

ECB ‘seriously’ considering negative deposit rate:

http://www.marketwatch.com/story/ecb-seriously-considering-negative-deposit-rate-2014-02-12-74855442

“Canada is killing a decades-old investor program that had allowed scores of wealthy Chinese to move to the country over the years.

The program allowed rich foreign investors to apply for permanent residency in Canada if they had a minimum net worth of 1.6 million Canadian dollars ($1.5 million) and invested 800,000 Canadian dollars in the form of a multi-year, interest-free loan to the government.

But the government has decided to scrap the program after finding it provided little economic benefit.”

http://money.cnn.com/2014/02/12/news/canada-chinese-immigration/index.html

Hi Doc. Million dollar plus home sales skyrocketed last year in California and behind the Orange Curtain also.

http://www.ocregister.com/lansner/last-599575-million-sales.html

“Last year’s housing recovery was a boon to luxury home sales, with 5,506 million-dollar-plus home sales recorded in Orange County, up 52 percent from the year before, DataQuick Information Systems reported Thursday. That’s the highest number of $1 million deals since 2006.”

And here is the article on California also

http://michaelcollinsrealestate.com/sales-of-million-dollar-homes-boomed-in-california-in-2013/

“2013 was a big year for the luxury real estate market in California. According to DataQuick, sales of million-dollar homes in the Golden State reached a six-year high last year and the number of home sold for more than $2 million reached an all-time high. The report cited rising home prices and an improving economy for the large number of high-end home sales last year. A total of 39,175 homes sold for a million dollars or more in 2013. That represents a huge 45.1% increase from 2012 and is the highest total since 42,506 million-dollar homes sold in 2007.”

Personally I think this year house prices will be flat or downturn 10%, but no tanking in sight.

QEA, the boom of the million dollar home market caught everybody by surprise. I remember reading various blogs back in the 2010 timeframe that made good cases for expensive RE being toast (no move up buyers, higher borrowing costs, etc)…we all saw how that worked out. In hindsight, there were a few things that prevented this. These high end markets didn’t have nearly the number of troubled buyers like Vegas/Phoenix/IE. The lenders let the delinquent borrowers in these markets skate for YEARS before foreclosing and realizing losses. People (foreign and domestic) flocking to the safety of high end RE caught many by surprise also.

There were deals to be had when blood was running in the street. You just absolutely had to have your act together to get a piece of the action (large down, excellent credit, no contingencies, etc). As DFresh succinctly put it, coastal California desirable RE was transferred from weak hands to strong hands. You had to have your powder dry and be ready to pounce at a moment’s notice.

At a national level, I agree that price / income will mean revert. But at a local level, it depends very much which way income is going. Median income may be stagnant for the rest of my lifetime in most locales, but I see no halt to the acceleration of the accumulation of wealth and income at the top. This tells me that the most desirable properties in the most desirable zip codes of Socal – which have long attracted those lucky enough to live wherever they want, and more recently at an international scale – will continue upward. These people are simply not subject to the bigger income trend (one could argue that they are on many cases the beneficiaries of domestic wage stagnation. Could this be only the beginning of an even more profound disconnect between the top 1% and everyone else? If we look to London as an example of a market fueled by the International rich, I would have been tempted to say 10 years ago that the central London market could not possibly become any more disconnected from the rest, yet it has, and the beat goes on.

100% correct, yet most people don’t see LA in the same light as London, Tokyo, New York, Hong Kong….but they’re blind.

In this context of the rise of global alpha cities, desirable LA RE will only continue to increase in value for decades to come:

Several unmistakable, long-term factors bode well for tony CA as a lure to the unprecedented rise in number of the global elite:

* Urbanization

* Build-out

* Proximity to economic and population growth centers of the east

* Supply/demand for Mediterranean climates

* Relative affordability compared to other global alpha cities

* Glamor

* Solid universities

* Innovation

* Ethnic/religious diversity

Los Angeles is more like Mexico City than London. It is not a destination city anymore like how New York is. He problem is that a lot of Angelenos remember Los Angeles of the 1980s, which was on the cusp of being a world class city, but have “frog in boiling water” syndrome and do not realize how unattractive the city has become.

Here’s a great overview of the headwinds facing LA that segue with my earlier point of LA not being a world-class city…

http://www.foxandhoundsdaily.com/2014/02/possible-sign-trouble-los-angeles-2/

KR,

There are 2 L.A.’s

One is The Westside, Torrance, Newport, Aracdia, et all…

The other is Lakewood, Covina, Canoga Park, Garden Grove, et all…

Money goes to one part but not another. This isn’t a world class NYC dominating city, but it’s a city everyone wants to have their second home in.

KR, it is very misleading mentioning “Los Angeles” so broadly. Is this DTLA, prime areas, the whole region? Everybody is in agreement here that most of LA sucks. The prime areas or near prime areas have become even more desirable over the years. Gentrification is happening at an alarming rate. The wealthy (foreign and domestic) want to own a piece of the pie in highly desirable parts of coastal California…I still don’t know who some people on this blog don’t understand that concept. The “big tank” may come, but rest assured the deriable areas won’t feel the effects like the lesser areas will.

@KR, you are definitely correct.

Los Angeles was challenging NYC in the 1980s for being the premiere U.S. city. Today Los Angeles is more like Pittsburgh or Cleveland by the Pacific. In many respects L.A.’s demise echos the demise of the Los Angeles Times newspaper. At one point in the 1980’s the LA Times was challenging the NY Times and Wall Street Journal for being the premier U.S. daily paper. Today the LA Times is best used for bird cage liner or picking up after your dog when taking your dog for a walk.

For those who don’t agree, remember Detroit. It wasn’t long ago that Detroit had the highest per capita and highest household income in the U.S. There are still many nice areas of Detroit but as a whole Detroit is a shadow of its former self.

Today the L.A. area has one of the highest U-3 unemployment rates and U-6 underemployment rates for a major metro area. It also has one of the highest poverty rates for a metro area, as well as SNAP (EBT/food stamp usage) rates.

The loss of one of the anchor industries (entertainment or ports of Los Angeles/Long Beach) and Los Angeles becomes the next Detroit.

Blofeld, et. al., but Santa Monica, Venice, Playa Vista … I’m constantly reading how “everyone” calls them Silicon Beach. That the future is moving to L.A.

Now, I think this Silicon Beach hype contains much exaggerated PR. Dozens of cities worldwide claim to be Silicon this or that. Several places claim to be Silicon Beach, including Santa Barbara and some city in Australia. Manhattan claims to be Silicon Alley. Yet San Jose’s Silicon Valley still dominates.

Even so, there’s some truth beneath the Silicon Beach hype. Tech companies are coming to L.A.

And the entertainment industry creates hundreds of hours of film and TV every year, promoting the SoCal lifestyle, simply by setting stories here (even if much of it is shot in Canada). Those shows will continue to attract home buyers, who don’t know any better, seeking the California Dream.

I moved to L.A. in the 1980s, largely because of all the TV I saw in the 1970s as a kid — Brady Bunch, Partridge Family, Bionic Woman, Marcus Welby MD, Medical Center, S.W.A.T., The Rookies — all of it set in sunny SoCal.

This doesn’t directly pertain to this week’s topic, but so often around here the mantra is “only fools buy when housing is so expensive – so rent” that I thought this article would be interesting.

Nothing like Manhattan rents to make Socal housing seem reasonable (and make me feel both frugal and poor):

http://www.nytimes.com/2014/02/09/realestate/finding-home-in-the-financial-district.html?hpw&rref=realestate

$7K/month + a $10K “finder’s fee” for a tiny 2 bedroom apt. Yikes!

Manhattan rents have been dropping as of late:

http://www.bloomberg.com/news/2014-01-09/manhattan-apartment-rents-fall-as-landlords-offer-breaks.html

http://www.worldpropertychannel.com/north-america-residential-news/manhattan-rentals-brooklyn-douglas-elliman-condo-sales-7865.php

LMAO! Yeah I was one of those that put down a huge down payment and had a decent fat account. Difference is I had a 30 yr. Fixed Note. I am conservative. Guess what the bank stole it all. That’s what they will do this time too. That 250k down. Gone. When the million Dollar house falls to 700K once interest rates tick up those folks will Lose their 250k first then if they fall to 400k like the million Dollar homes did here in Las Vegas, say bye bye suckers. Plus I’m sure the laws will change so that the Notewill be debt forever like student loans.

So what’s the rest of the story? What you’ve said here makes no sense. How does a bank go about stealing your down payment? By you not making your monthly payments?

Lynn lost “several” (her word) houses in Las Vegas. Which suggests that she was a house flipper. I wouldn’t call “house flipping” to be a “conservative” investment plan.

Many house flippers are Donald Trump wannabes. They wanted to gamble with the big boys. They traded in their tiny nest eggs for some chips, which they promptly lost.

If you can’t afford to lose big, you have no business gambling with the big boys.

S of a L: yeah, I’m guessing it’s something like that but I’m trying to give Lynn the benefit of the doubt and let her explain herself….

Everybody so worried all the time, my neighbor just leased a Aston Martin for 2,200 a month payment. They own business thru out America.

His company employs people with a avg salary of 169k. These folks can and wil buy 850k to over million dollar homes. There are people doing very well in this country, why be in envy of successful hard working Americans.

Nobody in this country owes anybody a life of low cost housing or anything else low cost.

This 2014 not 1914, America has many opportunities open every single day, educated citizens , enterptuers

You should go see the Wolf of Wall Street.

169K is not that much in SoCal. Sorry. And it certainly doesn’t inspire one to buy a house.

Any with a socialist in the WH, people in this tier are constantly in fear that Barry will do something to further dip his hands into their pocket.

This is not even mentioning how much people fear Jerry Brown and his constant pick pocketing.

“people in this tier are constantly in fear that Barry will do something to further dip his hands into their pocket.”

Further dip? Ha! The 1% have done better than anyone under Barry. Your comment has zero basis in historical fact. Not to say the 1% doesn’t hate Barry, as I would imagine is true.

You’re in a time capsule where Dems = common guy and GOP = wealthy. Both parties are run by the wealthy, AK. Wake up.

“hard working Americans.”?

“Hardly working” would be the correct term to use if they are in real estate business. Basically people playing Monopoly with Other People’s Money, OPM.

Sorry it posted for some reason you get the flavor of it, we are in a new century with new opportunities all will shake out , capitalism is ever evolving it is not a perfect system?

Is it possible that the “threat†of hyperinflation will push real estate values up indefinitely?

I believe there is a misconception on how money/debt is created. The belief is that savers make bank deposits and then the bank makes loans based on the deposits (reserve). Blert’s friend Steve Keen states that the real process is that banks make loans and then they later look for reserves to cover their outstanding loans. I believe the government does the same thing. They deficit spend and then they issue bonds to cover the debt. In other words, spending is not a function of available debt rather debt is a function of spending. I believe that this difference is very important.

In the case of QE, the Fed “prints†money by “purchasing†treasuries and MBS’s from FOMC member banks and then “pays†by increasing the reserves of the member banks’ accounts at the Fed. This act sounds like it is creating money but in reality it is only creating the potential to create money. There is really no new debt/money created by this action alone if blert’s friend is correct. So in a sense like many things the Fed does this is really signaling more than anything else. Why don’t we call this Fed saber rattling?

Is the purpose of this saber rattling by the Fed to intimidate the public with the fear of future inflation to move out of currency and into “hard†assets? The original crisis was a housing (hard asset) crisis not a currency crisis. Maybe the public is taking the Fed’s bait of hyperinflation to take the bullet of asset deflation.

So then the real question would be how long will the “public†be intimidated by the Fed’s continuation of saber rattling? I am not convinced that even the Fed believes that this will go on indefinitely…

But I’ve seen real inflation at the supermarket. Package sizes keep shrinking, yet the price stays the same. Less product for the same price.

Here are some charts of the various measures of money supply that I believe show that the reserves are growing M0 – M1 – M2 but as you notice the broader definition M3 is not really growing. The reserves are not making it into the economy.

http://www.shadowstats.com/charts/monetary-base-money-supply

There is a difference between price increase and inflation. I think we argue this all the time on this site. You state that rents are going up because of supply and demand right? It may be true that the supply of housing is constrained by some force say banks/government but this has nothing to do with money supply or currency devaluation.

Nitpicking, in the first chart for finance purposes you’d want to amortize the closing fees over the assumed 3 years of the interest-only loan (since the anticipated selling or refi would close out the loan not to mention incur a new round of fees).

Still, that only bumps the monthly cost to around $3k (still less than the $4-5k you’re assuming for renting comps) so your premise would still hold.

Robert….Your killing me with the third grade grammar…Use a spellcheck program!!!

“Your killing me with the third grade grammar”

Really…Your?

Funny!

Yellen is in the club and along with the rigged game. I think price/income/interest rate ratios are pretty maxed out for now, little room for strong gains in housing. Stagnation? Yes. But the crash may be farther off than we think, I’m beginning to think after 2016 elections.

The Yellen saga is just beginning.

As is typical with women, she’s taking the middle, consensus, road by tapering — which means the Fed is STILL injecting money directly through its spigot to the Primary Dealers and rest of the ‘top feeders.’

She will be judged on whether she reverses the taper. Ben did so twice.

If she stays steady on her course, the markets might actually muddle through 2014.

I expect disruptions from:

1) Puerto Rico — it’s issued more ‘municipals’ than Manilanders can imagine.

It pimped many for the dons of Wall Street.

Most Americans are not aware that PR bonds are/ have been DOUBLE tax exempt. This means that they sell very well to residents of NY, MA, RI, ME, etc. Many take the form of ‘sheathed’ corporate bonds. That is, they are actually backed by corporate enterprises. PR has over flowed with such ‘Revenue Bonds.’

Airport development bonds are a classic example of a Revenue Bond. The indenture will specify that the issuing government does NOT stand at risk for payment: only landing fees and duty free shop revenues are pledged.

A default by PR — which is really a junk bond issuing entity — should be the leading edge of wide spread municipal defaults.

I note that most stock market investors refuse to watch the junk bond market. The somnolent propaganda networks omit any talking-head action where they are concerned.

Somnolent propaganda: “Nothing to see here, folks. Move along. Move along.”

It’s the absolute inverse of agitprop. It’s to keep the proles with the flock: Baaa, baaa.

2) Overseas financial fiascos. Japan, Red China, Europe, Turkey, Venezuela … it’s a competition to see who can take their nation totally over the cliff.

It’s what you’d expect when you put Wile E. Coyote in charge. In the case at hand, he’s been cloned.

3) A cash flow crisis within the American Medical-Pharma-Insurance Cartel. Fundamentally, the cash is not flowing. The Insurance Cartel is freaking out over liquidity issues: retail defaults are a rash all over the nation. This reality is suppressed.

The Insurance Cartel is trying to force price rollbacks down onto the Medical Cartel. These are epic in scope. Because they are line-by-line price rollbacks, the specifics overwhelm public analysis and discussion. The Medical Cartel has as many price points / craft services as Walmart. We’re talking terrabytes of database detail.

As you might imagine, both Cartels love that grit. Like two lawyers in a small burg, they feed on it. Vast armies of paper chasers push the digits to and fro. This overhead is then passed on to the nation at large.

My dentist used to have but ONE office employee. That was thirty-years ago. Now every dentist in town has a staff chasing payment. A hefty percentage of dental charges are no longer going to him/ her — just to pushing bits.

4) Some hostile power is engaging in “Telefon” with our power grid. If it were to be as disrupted as Japan’s, the follow on impacts would be epic.

Let’s start with food: America is THE global exporter of food. Electric power is used at every step of the way. Foodstuffs can’t even make it onto the ship if the grid is down. Grain elevators are not wired like the Pentagon or your city hospital. It’s regular juice — or nothing.

That’d be bad news for the Ummah. The desert nations are, by far, the main market for food exports. Adverse price moves would re-birth the Arab Spring.

On present trends, the only thing that’s going to hold down Ummah food demand is a population collapse — the hard way. (Somalia, writ large.)

Globalization is leaving the Ummah behind. From Turkey to Kazakhstan, they’re living the nightmare.

I can see Yellen flip-flopping entirely if any of these nasty events unfolds.

She is also a top tier regulator of the American banking system — by statute. I await some attempt to rein in the pervasive corruption of the mega-banks. As it stands, the sociopaths are running the tables.

“…a lot of companies that under normal circumstances might have defaulted got to refinance instead.

*GUNDLACH TELLS CNBC ISN’T INTERESTED IN PUERTO RICO BONDS

*GUNDLACH TO CNBC: 10-YR TREASURY MAY GO TO 2.50% OR LOWER

*GUNDLACH TO CNBC: ISSUE W/JUNK BONDS, CORP. DEBT IS VALUATION”

From ZeroHedge…

http://www.zerohedge.com/news/2014-02-12/jeff-gundlach-sells-apple-warns-high-yield-bonds-most-over-valued-history

Gundlach sees what I see: High Yield issues are whacky, PR ‘munis’ are the new pariahs.

They are also not getting much exposure from the talking heads. I was really surprised to see Gundlach get the time of day.

Papa, I think you’re right about Yellen. Bernanke with boobs. I don’t recall anybody on this blog calling for big price increases…especially from here on out. We’re likely maxed out with how high prices can go; however, that doesn’t mean they will tank. Likely flat or small decline. And if rates go back lower, all bets are off.

Housing will definitely not drop if Europe goes through will another sizable bail in, the 10% wealth tax, or have massive financial control. Lots of people have realized that you deposit [in the bank] and paper assets is the least safe and wanted to get their wealth off the grid into PM, collectibles, or RE. In the San Gabriel Valley area, expensive homes are sold above the asking or Zillow prices anywhere from 5-20% and prices have even gone higher than 2006. Until Europe or many other expensive metros area like Hong Kong drop hard in prices, So Cal RE (good areas) will still be a bargain to the foreigners. The US have exported the dollars and so the foreigners is using this funny money to buy up physical assets. The fear is still of more funny money showing up in their account than they know what to do with. Oh well, it’s time to over bid on another mansion in Arcadia.

Papa, That’s about what i have been saying. But it seems most people just want to hear “housing to tank hard (insert current year ____).”

Actually, my current home loan is more like a “principal-only” loan – jumbo 15yr fixed @ 2.875%.

Refinanced in 2011 to 15yr 4.625% , then refinanced about a year later to current rate. Still frosts me that if I’d locked in 1 day earlier, could have gotten 2.75%. Oh well.

Knife catcher, that is something rarely mentioned here. Anybody and everybody who bought or refinanced at ridiculously low rates is paying off lots of principal. One more reason why housing isn’t going to tank hard. Americans are awful at saving, paying principal on a mortgage is viewed as forced savings. When the rates are 2.x or 3.x percent, there is lots of saving going on.

I am glad to see more and more folks stop believing in this ‘low on inflation’ BS that is being pushed by the big medias ever since the shameful act of QE1.2.3.

We are in stagflation while salary is remains flat, yet everything that necessary to keep your quality of living(food, energy, healthcare, education, housing) is getting expensive very quickly. This is the direct side effect of money printing, which I see no reason to be ended any time soon.

whoever brought property in 2010, 2011, and early 2012 are the early dis-believers of ‘low inflation’ BS. And they were awarded with low price and low rate, and with opportunity to refin to the lowest mortgage rate ever in US history. This was the opportunity of life time.

That’s bullshit Blank. I think you’re smart enough to know that it’s only “forced savings” when values are appreciating. If you have even a modest 15% drop in values (and it’s going to be more like 30% in many areas) then your last 2 years of “forced savings” are gone in an instant. Kiyosaki is an idiot, but he did succinctly state one misunderstood fact about residential RE. A home you live in that is backed by financing is a LIABILITY NOT AN ASSET.

Ask anybody in one of these mortgages how much principal they are paying down. It is SUBSTANTIAL. How much equity are renters gaining every month?

As I’ve been preaching, most Americans are horrible at math. If nearly half or more of the their mortgage payment goes to principal, that is a win win situation.

1040EZ…

We are not living through stagflation.

You’re witnessing an economic rip-tide.

At this time deflation is hitting wages, and, ultimately, commercial real estate. Commercial rents are getting absolutely hammered. I give you Sears, JC Pennys, Radio Shack, etc. This retail space deflation is the inevitable follow on to deflation in the wages-paid space.

Hyper-inflation is hitting Federal Reserve Bank oriented asset classes. Secondary, follow-on effects are hitting junk bonds — even investment grade corporates.

Stagflation — as a term of art — best describes the economic mix of the 1970’s.

It’s NOT appropriate today. I know that many a maven thinks it applies. They are wrong.

During the real stag-flation America and Britain were not hyper-inflating their currencies by printing currency and debt on a grand, nay, epic scale.

During that era, real estate prices were animated by the spirits of capitalism. Money creation occurred across the land by way of commercial bank lending against real estate assets.

Such wide spread money creation showered wage increases everywhere.

We not only don’t have wage increases, 0-care is trying to deflate medical wages!

The Medical-Pharma-Insurance Cartel has met it’s boundary condition: the edge of the Petri dish is at hand, no more agar, no more sugar, no more money.

This dislocation — in the MPIC — is as traumatic for that set as 2007/8 was for the F.I.R.E. set.

The DoD set is ALREADY being hammered. That’s why half the navy is in port — and the army is sitting on its tush back in the barracks. (Even the DoD budget is being blown up by the MPIC set.)

It’s even reached my dentist. His waiting room has gone empty. Denture sales must soon explode.

This is NOT stagflation.

Instead, we’re witnessing the leading edge of neofeudalism. What’s happening now is an echo of how feudalism got started lo those centuries ago. Immigrants were brought in to crush local wages. Land values exploded. Castle building became economic — for the lords at the top. It rather stunk for everyone else.

(BTW, not just a few of the dark ages wars turned on keeping newbies from settling down and setting up shop. Any merchant doing so was always shaken down for ‘rent’ to the lord and master. Some idea of how that would work out was shown in Rob Roy, the film. No hide nor hare was spared.)

Also rarely mentioned is that those refinancing are typically recasting their payments out another 30 years. Do you think most people refinancing are adding more to their monthly payment in order to preserve the original term?

So factor that into your idea that there’s a lot of “saving” going on due to low rates.

Blert: “The DoD set is ALREADY being hammered.”

I should hope so. The military can easily be cut by 50%. Most of those cuts can come from the army. Its personnel size can be reduced by maybe 80%.

We only need DEFENSE. Enough missiles and nukes, and the planes, ships, and subs to deliver them, to deter attack. The Marines will suffice for the occasional — and rare — need for a quick land incursion.

We have no need of a standing army. And our navy and air force are too big. We only need enough for DEFENSE — and NOT for EMPIRE-BUILDING. We should not be policing the world, or telling other nations what to do with their natural resources, or how to govern themselves.

Imperial overreach bankrupted the Soviet Union. It also eventually destroyed both the Roman and British empires. Napoleon too overreached when he invaded Russia. The Spanish Empire overreached when it attacked England.

Imperial overreach — and its contribution to hyperinflation — will do much to destroy the U.S.

Also if we have higher inflation and higher interest rates. Housing would still win as a dollar short along with the tax savings in the higher interest. We will only have higher rates if the FED want to control inflation. If they worried about stagflation (what we have now) than the low rates will still be buoying up the market. Deflation is still possible but do you think the FED will sit and do nothing in light of what you’ve seen in the last 5 years? The rest of the US might go down but not pockets of affluent areas.

What a lame circular argument. First things first if the FED had absolute control of the market in the ways that you say, why did the 2008 bust happen? If your thesis on tax breaks and fundamentals of housing were correct there would be a flood of ORGANIC buyers. There’s ZERO volume right now and what is left is the stupidest of late arriving specuvestors as well as uninformed home debtors believing the “priced out forever” meme. Bubble 2.0 is already over. 2014 is going to be just like 2007 with the talking heads telling you everyday the next upswing is minutes away. 2015 is going to be 2008 WITH EVEN GREATER VELOCITY as it’s not individual home debtors realizing they are fucked but a swath of Hedge Funds and RE trusts that will be making a mad dash for the exits.

The real purpose of the FED is to smoothen the business cycle and to inject liquidity in the time of crisis. However, the Federal government with its reckless spending habits has forced the FED into buyer of the last resort for the US debt and a facilitator of speculation due to ZIRP to keep the interest payment on the, ever expanding, national debt low. Yes they are being forced to shape the market more than they would like.

Unfortunately, I believe the huge hedge funds and institutional investors will be just fine and probably continue to hold any assets they can’t dump at high prices indefinitely – the F.I.R.E. cartel/GSEs/FED will keep them whole via the magic of “mark to myth” “value”. Remember, these huge hedge funds and institutional investors are all tied in, funded by, invested by, and owned by the huge financial/investment institutions and hence the FED, in one way or another.

Whatever they can’t dump for top pricing, they will continue to rent or at the very least hold.

I was reading the gloom and doom site (zerohedge) and noticed a lot of commenters making statements that include “printing money out of nowhere”. WTF does that mean? Are you telling me that other money is “printed out of somewhere”? When was the last time we printed out of somewhere? Are banks “printing out of somewhere†with fractional reserve funny money? Is it because it is a bank hence the printing is out of somewhere? If that is the case isn’t the Fed kinda a bank and they are printing from somewhere? On the other hand is printing paper money different than printing zeros and ones money? There is some cost of physically printing money and maybe the paper and ink have some intrinsic value…

I would be interested in knowing how many all cash housing purchases in SoCal come from recently repatriated money. I imagine this might be a hard statistic to track down. I’m not interested in pointing figures at particular groups. I’d just like to know how global money flows are affecting SoCal house prices. Its seems like there are some peculiar pricing incentives involved with this type of transaction that I’d like to see discussed as well.

If there is a significant amount of this type of transaction in certain areas, I would expect that prices would continue to stay elevated, regardless of various domestic policies and trends, e.g., interest rates, income levels, etc.

Getting back to interest only loans. The banks listed and the one I work at never stopped doing these ARM IOs. However what has changed is qualifying. Because of the DF changes, borrowers have to be qualified on the highest payment possible in the first 5 years. So, a 3/1 interest only , which typically has 6/2/6 caps, the lenders add 6% to the rate of 2.25% which is 8.25% and a fully amortized (P&I) payment. For 5/1, with 5/2/5 caps, 2.875% rate plus 5% is 7.25%.

So, these are harder to qualify than the 7/1 at 3.375%. If you have the income to qualify, you can use the IOs for higher leverage and better cash flow. Most borrowers are not going for the shorter term loans. My bank rarely does any 3/1 or 5/1, but the 7/1 is popular (it is not IO.)

My understanding is that the IO products of today require at least 20% or 25% skin in the game from the borrower. At 2-3%, that’s not an attractive yield of the parked money for the borrower. I’d rather borrow at a slightly higher rate and use the leftover capital to invest in something yielding higher to skim the spread.

San Diego has always been the bellweather, and their sales are tanking. Price appreciation has slowed dramatically.

2+2=4

Housing market has now officially split into two camps prime and non prime areas. Yes, if Wall Street grow tired of being a land lord than they will sell off and it will affect many US markets that are mostly non prime areas. For prime areas, prices might dip some due to the movement of foreign capitals but there will be no crash at least for some time to come. The US [California] is still viewed as a very desirable place to live for many people in other parts of the world. Just as the US dollar will be the last to fall, California housing will continues to chug along in the near future as the world become more chaotic. The US with all its problem still export food and soon exporting oil and is separated by two oceans. That make it very tough to invade and to the eyes of many a good place to take refuge.

One just have to take a look at California both from the local and global perspective to see what the trends currently are. High housing prices will bring up wages, just look at what Obama is doing. Soon we might have minimum wage set at $10 (from $7) across the US. Business will have to adjust and prices of everything will go up a long with rents and housing. Saying housing is in a bubble is like saying stocks are in a bubble with current 16x PE when the high in PE was 22 in 2000.

BS Bernanke…

There is a major bias in today’s S&P price to earnings ratio: it’s being juiced by ZIRP.

Namely, a fantastic fraction of the earnings is strictly due to interest rate arbitrage by corporate America.

Even Apple Computer ran out and borrowed large. It was strictly laid on as a dollar short.

Once the interest rate arb is discounted… corporate America has a P/E up around 28-31.

Hence, you can’t trust this metric at all.

In a world of massive money printing/ hyper-inflation of the currencies laying on massive currency shorts on a global basis makes perfect sense.

This zany situation is just as applicable overseas.

As for Red China, some of her biggest names are repeating the mania of the NYSE circa 1968. It was common at that time for corporate earnings to be juiced by the conglomerate craze. In effect, capital gains from mergers backed their way out onto the earnings statement.

In the case of Red China, some of the biggest players have admitted that 50+ percent of their corporate earnings come from non-operating gambits. They are playing at investment banker or commercial banker.

With the rates that are being charged in the ChiCom Ponzi, don’t be too surprised when mega-write-downs hit Shanghai.

BTW, the biggest bankruptcies in Red China seem to be involved in the coal extraction business. The players need relief. The rest of Beijing’s export engine still wants those ultra low-ball contract rates.

As you are probably aware, Red China has massive price control issues in: coal, electric power, and farming fuels. (Diesel and LPGs) Their gaming of electric prices is fundamentally responsible for Beijing’s air pollution. The top politicos are permitting the power generators to bypass their bag-houses… releasing particulates by the ton.

By so doing, they can shave $ 0.005 to $ 0.010 per kWHr. (Bag-houses suck down a lot of power, straight off.)

Repricing of Red Chinese manufactures would have a cascade affect on the S&P 400 as Chinese prices become American prices… heck, become global prices.

American econometricians have YET to figure out that America is no longer the Big Dog on the economic scene. Commodity prices are determined by Red Chinese buying pressure.

This also means that the NYSE is destined to follow the example of London — and become a ‘shadowed’ international market. Shanghai will come to replace its primacy. That process is already under way. Fortunately for those on the Street, it’s going to take a full generation to claim the summit.

Leave a Reply