No Country for Housing Inventory: Housing inventory continues to remain near record lows while Bay Area housing gets even nuttier.

Last week I was driving throughout the Inland Empire and one thing becomes rather apparent. There is a ton of building out in the Inland Empire – this applies to work on freeways, new housing communities, and new commercial development. Also, traffic is a nightmare. Westside traffic is also horrendous. There are many people that make the commuting odyssey each day from the Inland Empire into L.A. or O.C. and that commute is only going to get worse from what I was seeing. I was also in the Bay Area recently and prices there defy gravity. In the Inland Empire you can get a McMansion while in the Bay Area you will get a crap shack for one million dollars if you are lucky. It really boils down to a lack of housing inventory and uncertainty that has made builders anxious since the housing bubble is fresh in their collective memories. But alas, the public is drawn to housing like moths to the light. Being stuck in mind crushing traffic for a brief period only highlights that people are willing to sacrifice quality of life for a piece of the American Dream.

Housing inventory, where art thou?

Home prices have been moving steadily up for a few years now and typically when prices start moving up and inventory is tight, builders get building even if this means converting apartments into condos in areas where NIMBYism rules the day. That is simply not the case this time around (not in mass and only now does it seem like building is accelerating). Builders look at demographics and realize that renting is going to be the bigger trend moving forward.

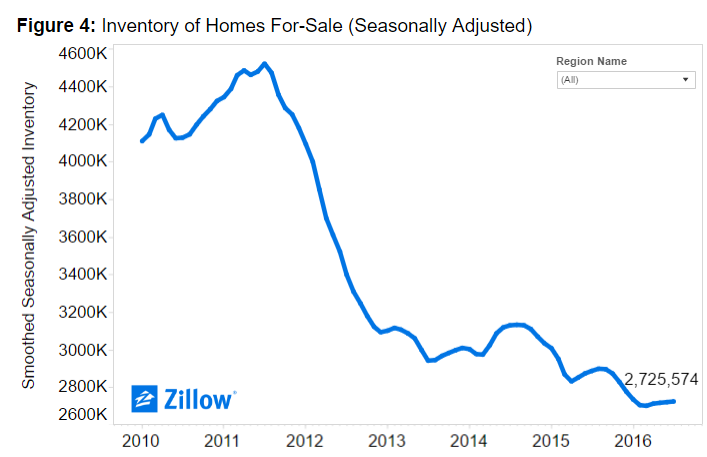

And this is apparent when you look at existing housing inventory:

Back in the summer of 2011 there were 4.5 million homes for sale. Today it is down to 2.7 million. That is a big drop in available inventory. It also helps to explain why people are desperate to spend ridiculous amounts of money on a crap shack.

Say you buy a $700,000 crap shack with 10 percent down. You take out a $630,000 mortgage at 3.5 percent. The true cost of the home is going to be $1,018,433. In other words, even when housing cheerleaders house hump the low mortgage rate, you are still paying $1 million dollars for a piece of junk over a 30 year note.

Okay, but maybe you have an eye for deals. Look at this place in Oakland:

2682 Parker Ave, Oakland, CA 94605

“Great opportunity for first home buyer and investor.2 beds/1 bath main house & Studio w/full bath.Updated kitchen w/granite counter & SS appliances.Remodeled both baths w/tile and inlaid Mosaic.Laminate floors throughout,Dual pane windows,new fixtures,fresh paint.Nice deck for relaxing.Long driveway.â€

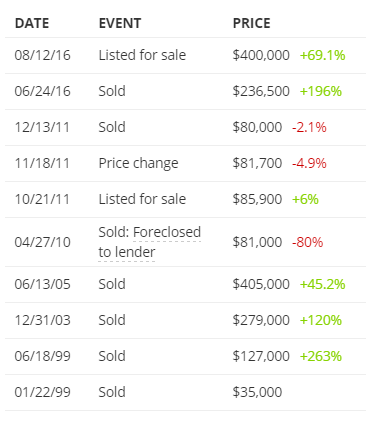

Okay. So you can be a homeowner and investor in one shot here. And this is all yours for $400,000. The main pad is 2 beds, 1bath and the studio has a full bath. The property is listed at 998 square feet so you can imagine that the studio is small. You are also close to a zoo so there you go! This is a Bay Area flip. Look at the price history:

It sold for $80,000 back in 2011! Then in June of this year, someone paid $236,500. Some HGTV house porn later, the property is now “worth†$400,000. Yeah, low interest rates and rental trends explain this kind of behavior away. No, what is going on is house horny action and manic like pricing behavior. Say a minor recession hits. You think collecting rents is going to be easy?

Another Bay Area company, Google lets us get a more realistic view:

Yup. Good deal. Keep on drinking the Kool-Aid.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “No Country for Housing Inventory: Housing inventory continues to remain near record lows while Bay Area housing gets even nuttier.”

Hi DOc;

I may have missed something… WHY is inventory so low?

because of low unemployment and an ever-increasing population?

thanks

Daniel

Increase in population, and no lots left.

QEA, low inventory is likely a function of many things.

-Population growth.

-Many desirable parts of CA built out.

-Builders simply not building due to economic circumstances.

-CA’s draconian anti-growth/environmental measures.

-Few move up buyers due to stagnant wages and economic uncertainty.

-Prop 13 keeps people in place…especially in desirable areas.

-Ultra low interest rates and increasing rent prices have created many new landlords.

-Retiring baby boomers not selling and staying put.

-The Fed/PTB/Government have made it clear that homeowners will be favored over renters.

-Homeowners know that squatting and not paying for years is likely an option if shit hits the fan again.

I’m sure I left out a few, but you get the picture. Many homeowners simply won’t sell because they are in good financial shape in house terms (have equity, below rental parity, benefit from Prop 13, etc).

Here’s your bubble guys. Read this article on the IMF by wallstreet and tell me shits not about to hit the fan.

http://www.wsj.com/articles/imf-signals-another-downgrade-to-global-growth-1472738405

I’d say you left out the fact that all those landlords are not going to sell because the rents are so damn good. Wait until the next recession and watch how the whole thing unravels once people cant afford high rents anymore. My guess is there will be a landslide of landlords trying to unload.

No bubble here………

Dr. Housing Bubble,

How long have you and I been incredulous at the price of housing? I live in Toronto, Canada and I have been 100% completely wrong on housing. I have been saying ‘there is no way it can go up anymore’ for the last 11years and for the last 11 years, prices have gone straight up.

Same goes for the stock market – how many years have investors thought ‘we are going to see a correction’…and nothing…the markets have pretty well gone straight up since 2009 with a little blip here and there.

The bottom line is that it’s all about interest rates. That’s it. As long as interest rates stay low, everything else is going to trade at higher than normal valuations. We have never seen interest rates this low and that’s why we have never seen asset prices this high.

Everyone keeps saying ‘rates are going to go up’ and they too have been wrong. Interest rates have continued to decline. Everything is upside down. Investors buy bonds for capital gains and equities for income.

Yes, at some point house prices will stop rising, but are we going to see a big collapse in our lifetimes?

In Vancouver they are taxing foreign buyers 15%. This will dampen demand…let’s see how it all plays out.

EJ

“for the last 11 years, prices have gone straight up.”

^ That is patently false.

Apparently not in Toronto: http://www.randi-emmott.com/charts/chart10.gif

Nope, prices dipped in Toronto during the recession in a big way, no idea why your chart doesn’t show that.

http://www.canadianbusiness.com/wp-content/uploads/2015/12/canada-housing-market-hot-cold-national-bank-compressor.png

Your chart is only YOY change of the housing index, not actual prices. I’m not sure which line is Toronto, but it still only shows a 4%-8% drop in just 2009, so while there was a technically a drop, it was a pretty minor one compared to big cities in America. That being said, technically you’re correct in that there was a small hiccup, but the prices have effectively going up for a long time, outside of that blip for a year or so.

http://i.huffpost.com/gen/1747043/thumbs/o-BMO-TORONTO-HOME-PRICES-570.jpg?6

Comrade: where we come from, this is called “command economy.”

People have no memory. That’s all.

Inventory is low in part because of prop 13. So many people that even can afford to move up the housing ladder, often cannot justify the increase in taxes. Same thing applies to first time home buyers, just because interest rates are low, doesn’t mean you won’t be paying a small fortune in taxes, especially if there is mello roos. Unless you want to listen to this propaganda- https://www.firstteam.com/blog/ugly-truth-mello-roos-taxes-irvine-homes-sale.html

Actually the most wonderful thing about prop 13 is that as long as you buy in the same county your tax rate will not go up when you move up. My mom paid 13000 for her first home and had ridiculously low taxes. When we moved her into a much nicer home that cost much more her property tax stayed the same, thanks to prop 13.

The same county tax base transfer only applies to those 55 and older.

This sounds like a great idea until you look into the details. First, not all counties offer this and there are more that don’t than those that do. Secondly, you can only do this once in your life, so don’t plan to go skipping around. And you have to buy something that sells for less than or equal to the property you sold. So yes, it can be done, but like everything else, there are restrictions.

Many counties have sharing agreements too. San Diego will swap with Orange for instance. Inherit a home in one county, sell it, and get low taxes in the other county. The status quo intends to stay that way. Must be nice…

Why is the inventory so low in Burbank. Apparently our health care system is too good and the old folks are not passing on like they use to. The homes are too small for the children to move back.

Is inventory low everywhere? I have observed increased “For Sale” signs as well as listings on Zillow over the summer. Many do not seem to sell or go pending.

I live in Oakland, and this neighborhood is in the heart of East Oakland. The worst neighborhood in the murder capital of California and the Top 5 worst cities in the Country for overall crime. People love to dog on Oakland but there are great things here: weather, a giant lake, food and diverse culture, but I would only buy that place for $100,000- not more. I live in West Oakland: another slowly gentrifying “hood” area, but is at least a 1 stop Bart commute to the Financial District in downtown SF. On my block that had larger 1920’s Craftsman houses in need of repair going for $250,000-$350,000 back in 2011, they are now going for $800,000! These are houses on the same block next to abandoned houses with gunshots going off at night, kids with pitbulls hanging out on the corner, bums, liquor stores, and NOBODY walks on the street after dark.

My wife and I have reasonable rent for now and almost 50K saved. Were it 2011, we could’ve bought into one of these foreclosed fixer-uppers- but now: no way. Even if we did have enough down payment saved, we’d be fools to buy at the peak of this insanity. We’ll keep stuffing money under the mattress and continue to wait and watch…

Great things in Oakland?

Oakland is built atop the Hayward earthquake fault line and has a 63 percent probability of having one or more earthquakes over a 6.7 magnitude within the next few years.

Oakland must import about 90 percent of it’s water from the Mokelumne River watershed which is almost a hundred miles away.

According to 2015 statistics, Oakland is the #2 most dangerous city in the United States for the second year in a row behind Detroit.

Oakland does indeed have a “diverse” culture… which may or may not be a positive. There always seems to be riots going on in Oakland which has become the “riot capital” of the US.

Gertrude Stein wrote of Oakland, “there is no there there.”

What’s there mostly sucks.

http://earthquake.usgs.gov/regional/nca/ucerf/images/2008probabilities-lrg.jpg

https://localwiki.org/oakland/Water_Supply

http://lawstreetmedia.com/crime-america-2015-top-10-dangerous-cities-200000-2/

http://www.bayareacensus.ca.gov/cities/Oakland.htm

http://www.maskmagazine.com/the-anniversary-issue/struggle/bay-area-riot-culture

Well, there’s fault lines all over Cali. I’ve been in major earthquakes in both San Fran (’89) and LA (’94). If the Big One hits Oaktown along the Hayward Fault, it’ll devastate the entire Bay Area regardless. But yeah, the crime problem is terrible here. I’m glad you shared these links, it helps keep my rent low! (Or whatever now constitutes as “low rent” in the Bay Area…)

The statistic to ask is how many homes are swallowed up by refinance/equity removal. Not to mention all those suckers falling for the reverse mortgages. The death cross of having more people enter retirement than into the workforce starts next year.

To the point about the Inland Empire. We are the first stop in Riverside County off the 91 (Green River). They are building more houses and trying to expand the 91 to catch up to probably 10 years ago. Traffic is horrid right now during the construction. Hopefully it gets a bit better when they are done.

I still don’t see how it doesn’t just keep getting worse. Lucky for me, I get to work at home most of the time. We still contemplate moving to OC though for future school needs etc.

Actually, OC is not great for schools. South County used to have all great schools there are now parts of Mission Viejo which have poor schools. Eastville is a little cheaper than OC and so is Santa Clarita in the LA side, both have much better schools than most of Orange County.

+1 what Don said. That’s a rough part of town.

Here’s one up the street from me – 612 ft2, 1 BR house in 1700 ft2 lot, listed at $399k, sold for $430k. A bargain by SF standards, I guess.

https://www.redfin.com/CA/Oakland/3810-Patterson-Ave-94619/home/1571408

It’s a better neighborhood than Doc’s example, but even with gentrification in full force, there’s been a lot of mischief this summer. One night in June or July, I was visited by the police banging on my front door at 3 am. They’d found someone bleeding on the sidewalk a couple of houses down and across the street. I later learned it was a fatal gunshot wound.

Not long after that, there was a police helicopter circling for hours one afternoon blaring an announcement over a loudspeaker. Two streets on the next block down were blocked off with police tape as they tried to catch a suspect.

Then, maybe a hundred feet from the house in my post, I narrowly escaped an attack a few weeks ago. I was walking at 9:45 pm and a guy jumped out of a car and ran at me. Fortunately, he and the car didn’t follow.

This kind of stuff won’t deter house-horny gentrifiers, though. I’m pretty sure we’re even getting some Google employees, and for them this area is a bargain compared to SF and Silicon Valley.

I’m in Alameda…renting. I agree that place is in the hood. From about 14th-ish down to the lake is looking better and better….but anything from 14th up to the San Leandro border is ghetto…maybe a few pockets that are ok around Mills College…and closer to I-580…It 100% not worth almost half million. Especially once all the building is done…there is tons of construction in Alameda, Foster City, Milbrae, Dublin, Pleasonton, Concord…just acres and acres of multi unit condos.

I used to live near that place on Patterson, on 39th Ave a little up the hill. It was an alright neighborhood with mostly property crimes. But yeah, the constant helicopters and manhunts were just too much. And we were paying all of this money to live there! I can sort of justify it with the big yard and bay views that we had, but that place in Eastmont? Good lord. That place might as well be in Baghdad.

Housing To Tank Hard Soon!

short the fork up

Hamptons, Aspen and Miami real estate markets are already tanking , Jim. A crackdown on hot laundered foreign money is one of the reasons … among others.

http://www.zerohedge.com/news/2016-08-27/%E2%80%9Ci%E2%80%99ve-never-seen-anything-housing-markets-hamptons-aspen-and-miami-are-all-crashing

Is this the bubble’s ceiling: https://www.redfin.com/CA/Santa-Monica/914-23rd-St-90403/home/6769161

A New Construction house in Santa Monica — $4.7 million.

No pool. And south of Montana.

Yes, it’s a nice house, in a still great area. But still, for $4.7 million I’d expect a mansion with pool, and tennis court, and a vast lawn.

One may ask anything they want in price when listing a home. There is no legal restriction. Foolish perhaps, yet who are the fools when the house sells and records, confirmed by public records.

They saw that the home on 11th st closed at 4.53 million,threw a dart landing at 4.6 mill. Why not 5 mill next or seven million.

Below Montana. Interesting to see the buyers profile of cash vs loan, what they do for fun on Friday eve. Whatever… As long as the house sells everybody is happy. 🙈ðŸ¶ðŸ´

Jim, the one trick pony, your last post was, ”It is happening!” and now you are walking back, again, to “Housing to Tank Hard Soon.” The fact of the matter is that housing is not tanking at all, it is getting even pricier and deals are going pending instantly.

The difference between me and many of you uber bears is that you only chant your negative sentiment and cannot see anything else. Even though we both agree that housing is insanely overvalued, I don’t believe that you are honest in your evaluations because you’re blinded by vitriol about the pie in the sky prices. Like you, I am annoyed by this market, but I don’t try and change it. Nor do I report it as being something different than it is. The market is not tanking, not even close, it is roaring. And picking up steam.

The market will continue to inflate because of monetary policy and other factors which have remained unchanged. Until inventory spikes, this market will have legs. It has been said before, but this is no longer your dad’s real estate market. The Fed has never manipulated to this degree. Until our elected officials change Jim may continue to be wrong. Simply raindancing for a real estate crash will do nothing to make housing affordable for you again.

It doesn’t matter what you say to Jim. By the next blog post, he will type out the very same thing, as he has been doing consistently for well over 3 years. He has too much invested in his EGO to change his tune, ever. I know one thing, for those who believed his mantra and waited, missed out.

When this is all said and done. The ones sitting pretty and feeling good right now will be the ones who miss out when they give back all their equity and wish they could buy at the new all time lows that are comming. Hang onto your hat. Its going to get rough out on the water.

Jim is correct. The bust will happen. Real estate is cyclical. However, if you buy a house for the long term, the next boom will happen again. Over the last 50 years, the next “boom” peak has been higher than the last “boom” peak. In the meantime, just enjoy your house with an ultra-low fixed rate mortgage which will mean that you won’t have to fear rent increases ever again.

By the time housing tanks the ones who profited off these gains or sold a the right time will be sitting more pretty than JT. Also will probably will own a whole community of properties at a rent that might not make sense since everyone is in a recession.

Bob, the buy and hold long term scenario becomes ever more unlikely as the years go on with an economy which offers an ever higher return on mobility than before. Of course it was a decent strategy 50 years ago when people also expected to stay with the same job and retire from it with a pension.

“you won’t have to fear rent increases ever again”

Instead, you get to fear big ticket repairs and all other sorts of cost increases.

Purchasing is not always a bad choice, but the truth is that there’s no free ride either way.

Beware the Ides of March!

If Jim has had his cash parked in the stock market waiting for the housing crash, he’s probably in a good position to take advantage of it. As long as he sells before a stock market meltdown. If he’s had his money parked in a bank account at 0.1% interest, he’s probably safe but missing out. My Crystal Ball is melting down from trying to predict housing and stock.

Something is very wrong with this picture! While the cost of housing has skyrocketed, by one measure, household incomes adjusted for inflation have declined by 2% to 17% from their peaks, depending on which rung of the ladder your household finances places you. The lowest rungs have slid the most! This would of course help explain the boom in renting and the drop in ownership, but it would also seem to question the reality of these prices, especially in places like the ‘Inland Empire’. While Malibu for example, will always be posh and expensive, I doubt a lot of the other ‘burbs’ will be so lucky when a reality adjustment occurs!

Mr. Miyagi,

I do not see any conflict between Mr. Taylor’s “it is happening and Housing to tank hard.” The fever pitch is a sign the pot will soon be boiling over and as you have astutely indicated “The Fed has never manipulated to this degree.” We all know the FED could never fail

I for one like Jim’s consistency even though he is early.

The conflict is that after years of tourette syndroming “HOUSING TO TANK HARD SOON!!” he got giddy from some recent news and changed it to “IT IS HAPPENING!!” indicating that his years of faithful rain dancing had finally come to fruition. Well, the problem is that nothing has changed to support his chant. In fact, quite the contrary, the market is accelerating not tanking and there is more fever pitch not less.

I don’t doubt this market may turn violently at some point. It is not sustainable in a vacuum however with the Old Gov manipulating like it is, anything is possible. This housing market may keep running until our dollar is toilet paper. Or something else may happen. The point is that Jim’s chant is totally meaningless drivel and in no way enlightening. Of course I love the first amendment but it also allows me (and others) to comment on how Jimmy has been on the wrong side of history and will someday strike gold and claim his throne if he lives long enough to keep chanting, “HOUSING TO TANK HARD SOON!!!!!!!!!!!!!!!!!!!!!!!!!!!!”

Actually what is funnier to me than Jim are his cheerleaders the get giddy and chant, “Go Jim!!!!!!!” That and the people here that say, “You must be new here” to new posters as if this is some elite country club of economic geniuses.

I think Jim T. was one of those guys telling me I was a ‘knife catcher’ for buying a home in 2012 but at that time he had a different pen name. There were numerous others who laughed at all of us for buying homes in 2011, 2012 and 2013. They stated that the ‘dead-cat bounce was just a few months away’. In any case most of these uber bears left or are now lurkers. I ran into the broker who sold me my home in 2012 (for $470K) said it would now sell for about ($750K).

Of course home prices will dip at some point, but for anyone who purchased in 2011-2013 is probably sitting ok and if they can stay in their home for 10+ years is probably not going to worry about home prices whatsoever….

Those who are doing a rain-dance housing crash may themselves be in no better position to buy during any crash.

“Say you buy a $700,000 crap shack with 10 percent down. You take out a $630,000 mortgage at 3.5 percent. The true cost of the home is going to be $1,018,433”. This is a valid point ( ignoring the fact that there is a tax benefit for the interest deduction) but it is easy to be afraid of large numbers when you are an old guy like me. If I had bought a house in 1986 for the same price, the web online inflation calculator tells me that just due to inflation in the US, the house would be worth $1,383,281.11 today. In general, housing and stocks will follow inflation on the average better than any other investment. My point is that interest rates are so incredibly low, that any inevitable rise in inflation in the future will make a home investment today very lucrative. I was jealous of my parent’s 6% interest rates when I bought my first home in 1988 with an 11% interest rate. (My total payment if I hadn’t refinanced would have been 2,159,869 for a 630K loan.). Death, taxes, and inflation are inevitable.

inflation has been null for 8 years now?unless we talk about the real goal of the fed bubble

thus all the fed and rest of the central bankers thruout the world fixings..

the fed mantra since GR has been

inflation in things you need, deflation in things you don’t with little wage growth

US inflation has been averaging about 1.5% over the last 5 years (3.2% in 2011, 0.1% in 2015). 30 year loans are around 3.5%. If you count a 28% tax deduction on the interest, the effective rate is about 2.5%. If inflation ever goes back to the 3% of the 90’s or the 4% of the 80’s, having a 30 year loan at 3.5% would put you in a very good financial position. My parents in the 80’s would not pay off their 6% loan when they were making 8% in the bank. You can’t get 3.5% in the bank (though you can with dividends.) today but that was common 10 years ago and I predict there will be a time in the next 30 years when bank rates will be above 4% again.

This is an interesting topic as usually announced inflation is based on consumer price index and not the amount of money in circulation, what it should be. And what it was, at some point.

Why is that?

Because FED pumping 80 billions per month to banks (QE is the name) would otherwise cause ~15% inflation (defined as amount of money in circulation per stuff you can buy with it, not like FED likes to do) and FED doesn’t want to show that, therefore re-defined numbers which are basically meaningless for their announced purpose. Smoke and mirrors for the poor.

Houses and stock market, being based on actual amount of money and banksters/economists, are following that (real) inflation even everything else isn’t.

America will be bankrupt at 4% fed fund rate….

it will not see 4% until hyperinflation rears its head.

Thomas, sorry to burst your bubble, housing and the stock market are not an inflation indicator, they are a risk on, risk off indicator, with low rates and worldwide QE risk is on, when the music ends, risk will be off, housing and the market will come down, I have the market about to begin a significant correction. It will ruin many people….

no one said late stage capitalism would be pretty, get ready for the ugly real soon….

There is no inflation, thus why rates are at 0 bound…..

please don’t confuse hot-free money to IB and MM centers to be inflation…..

When will this insane housing bubble burst? Will the upcoming elections play a role in where housing is headed? Or is it all up to the FED ZIRP policy?

There are so many forum members here that believe in the spontaneous combustion of the housing market. In other words, with the same old Fed policy and no shift in underlying economic fundamentals they believe housing will simply ‘tank hard soon!’ That is hogwash. Things have to actually change for housing to tank. Like spiking inventory levels, rates, etc. As of now those things are unchanged and housing (rents and prices) will continue to boom.

If you are someone that believes (and hopes) that housing prices and rent costs should be coming down, yet you simultaneously support Clinton, you should have your head examined. Truly you people are the golden unicorn of illogic. How can you raindance around the spontaneous combustion of housing while at the same time support more of the same with Clinton? Truly baffling.

Now if you are simply praying and chanting for a big correction, I can respect that, and agree it needs to happen. But don’t be an Alex in San Jose and hope for a big correction while supporting socialist and communist ideology. Folks in that camp are destined for “van living” for the rest of their existence.

There is no limit to human stupidity.

Language like “Housing to tank hard!” does not exactly imply intellectual.

I pretty much agree with everything you say in this blog, but I don’t think it matters economically, in regards to voting for Clinton vs. Trump. Clinton will be more of the same, but Trump is also too invested in this economy to blow it up and will want interest rates to remain artificially low. So, I’ll be voting primarily on social issues.

I agree that in all likelihood both candidates might be ‘more of the same’ in terms of the factors that affect housing. However Clinton is a guaranteed current status quo adherent and Trump is at least an unknown quantity in this regard.

Sorry, did not mean to take this political, but unfortunately the cost of living in America is now squarely a political issue. When the Keynesians stepped in on this level it became political. In other words, housing and politics is like ham and eggs.

I think it’s ok to go political, because, as you say, it’s intrinsically tied to the economy. I just don’t think either candidate will make a difference. I agree that Trump is an unknown quantity, but I almost worry about him possibly making things worse, rather than better, because of his personal business practices. He’s a rich guy who thrives on debt and uses (racial) vitriol to appeal to a large portion of the population who should have no reason to support him.

Might want to look in the mirror to get a real look at that human stupidity. Regardless of who wins, things will the stay the same and the economy will hum along as it has for the last 6-8 years? LMAO. This entire economy is a fraud, a jenga ponzi with very little backing it except fools who buy into the lies and apparently can’t do basic math. RE, stocks, bonds are all a joke but normalcy bias prevents most from wanting to see reality for what it is. Fine by me, I’ll continue to live it up while the herd marches off a cliff. I’ve seen this movie before and know all to well how it ends.

Rise Mortgage rates to 5 percent and most of OC and LA housing will dropped about 100,000. Its the low interest rates that allow prices to be jack up, sorry for the truth. Plus if Trump gets in, immigration levels might dropped not just Latinos but Asians as well, which means that places like Diamond Bar and Irvine will dropped.

You have to wonder how much worse things would be if milenials weren’t mired in debt and low wages.

Look away from SF and LA and the prices make sense.

From Bakersfield to Redding, housing is affordable, and plenty of inventory.

I live in Manteca just south of Stockton, and 350K will get you a nice house.

60 miles to SF, 60 miles to Sac.

It’s hotter than hell right now, but spring and fall aren’t so bad.

I would be happier in a coastal climate, Fremont, Costa Mesa, or SLO.

But I got priced out of that dream. everywhere I drive in Cali, I see mansions

Where is all the money coming from?

I ask myself that same question. Here in San Diego house prices keep going up, up and up! While wages remain lower than several years ago.

Maybe a large percentage is foreigners flush with cash and just buying properties to safely park that cash outside of their home countries.

Eddie89 – You are right, these are the new players in Cali RE, but also many cities around the world. Asian friends of mine in the bay area, show me ads in the Chinese Language Newspaper of Loan Agents offering 1 % loans from Chinese offshore sources. Easy $.

Back in 08, I was looking at crapshacks in Fremont. multiple Chinese RE agents had the prospective buyers lined up in front of the dumpy 1950 vintage house, only letting us in, one at a time. mostly young couples, college student age, speaking mandarin. That house probably sold for cash for 425K then, now worth 900K. I made offers on a half dozen properties during that time, only to be told “you were beat by a cash offer” so I gave up. The last house in made an offer on, was in Newark, I was overbid by 70K, and I overbid by 25K. That why I live in the hell-hole valley now. Something is better than nothing.

It’s wishful thinking, particularly by those that missed the 2009 bonanza, that they will “get another bite of the Apple”. Well, maybe but I’m not betting my hard money on it. The banks and the Fed think they’ve gotten smarter, well they’ve learned to manage the numbers at least.

There isn’t going to be a lot of inventory because no one that doesn’t have to sell is selling. Interest rates make homes affordable to those that can manage the nut. The employment rate is very constrained by the market, foreign offshoring, immigrants – legal or not and the California Coastal Commission CAL-EPA, and building boards that are all extremely reluctant to approve anything.

I had a family member selling his primary residence in Rancho Cucamonga. I tried to talk him out of it. The very minute he listed there were two all cash offers bidding up the price.

As long as there is a thin inventory, this can go on for a long time. Did I mention that the Fed is desperate to ignite inflation? Does this sound crazy? Only until you realize they can inflate away the debt and push monetary velocity. If they are successful – and yes, they are trying, then commodities or real estate will protect your money from shrinking.

Those that are perhaps too young might help from being reminded that in the 60’s my family bought a 4000 sq ft mission style hacienda in the Fox Hills area for $36,000. A new Cadillac in those days was $4000. The house in that area that I was renting ( much smaller) sold in 1974 for $11,000. It was a very nice Craftsman of around 1200 sq ft on around 1/4 acre.

Every generation resets expectations. Someday you’ll be able to tell your kids you could once buy a house for less than a million. I know it sounds crazy but in 1980 everyone was saying crazy when houses went over $100,000.

The financing of things have changed dramatically since then. 30 year mortgages, etc. Wages, not quite as much. Just an endless supply of credit to the point there are negative yielding bonds now. I believe I read over 40 percent of our GDP was in the creation of financial products.

So, buy now or be priced out forever?

I’m not sure that it’s prudent to look at the last 50-100 years of US housing as a primary indicator for the next 50-100 years. We’re in uncharted economic waters, and the current economy is very different than what it was in the 1970s.

The biggest issue for me is the huge down payments, since prices are so high partly due to low rates. I make good money, but I’m a small business owner, and giving up $100K+ in cash for 20% down on a fixer house is tough to swallow, when I can think of a zillion things to do with that kind of cash. I’d rather have a lower priced home and down payment with a higher interest rate, and then I could probably refinance during the next crash.

I’m just curious: but what would those dollar prices be today adjusted for inflation? It seems my parents (and aunts/uncles etc) were all able to buy property in Cali performing modest jobs on modest middle-class incomes in the 80s. Now, no way could they afford to buy the same houses they in. When people thought real estate was going through the roof for $100,000, how did that compare to the median household income at that time? Has California always been insane, or just the past 15 years?

Exactly. My in-laws stretched to buy using the GI bill in the San Fernando Valley in the 70s, but they certainly didn’t require the kind of jobs required now to buy housing. The middle class can no longer afford to buy in L.A.

I mean, I own a business, and I’m apparently in the top 5%’ish or so in this country, and, while I could probably afford to spend over 30% of my monthly income on a home (my rent is currently only 12%,) putting $100K-$200K down into a home in such a speculative market just seems nuts to me…and I have essentially no debt. How the heck are people making $90K a year doing it in L.A., let along anything close to the median wage?? Anyone I know these days who buys a house in LA and isn’t wealthy has an inheritance/cash gift to put down.

“It seems my parents (and aunts/uncles etc) were all able to buy property in Cali performing modest jobs on modest middle-class incomes in the 80s.”

Rich foreigners with boatloads of cash weren’t inflating the Cali real estate market back in the 1980’s.

“Every generation resets expectations. Someday you’ll be able to tell your kids you could once buy a house for less than a million. I know it sounds crazy but in 1980 everyone was saying crazy when houses went over $100,000.” – Exactly! The big thing that I worry about is the rate of increase over the last peak as opposed to the price. Rates have been falling. A 885K house at 4.5% 2 years ago has the same payment as a $1M house at 3.5% today.

In 1975, my parents bought a house in New York City (a fixer-upper in Queens) for $75,000.

Its current Zillow estimate, FWIW, is close to $1.5 million.

It was very different when the middle class, often with only one parent working, could still afford to buy a house. If you bought a house in 1895 and sold it in 1945, you may have been disappointed, anyways, when taking inflation into account.

Be real, go look at the velocity of money chart here

https://fred.stlouisfed.org/series/M2V

its called middle class destruction…..that is as plain as day….

As far as loans go, when rates do go higher (big if right now), homes prices will drop, speculators will leave and foreign owners will sell….

seen it before, will see it again….

The housing market is fixed as we speak but every fed move has lost it’s mojo….housing will just take longer….

2017 will be ugly for all markets….

thanks

Always entertaining to see how people are still bullish on housing. I guess it’s either a fake show or short memory. In a few years people will ask the question how some folk seriously thought that housing bubble 2.0 will go on forever. If you really plan on buying a totally overpriced crapshack at this bubble peak I wish you all the best. seeing prices go down while you are locked in with this overpriced crapshack doesn’t sound fun. Or how about sleepless nights when the next recession hits and you worry about your job and this huge mortgage? Will there be more foreclosures than last time? Let’s wait and see. In the meantime I will keep reading your comments about how this housing market will keep going up…..forever.

The new real estate paradigm: if it’s too good to be true, then it must be true.

I know if I had recently bought a house and was heavily mortgaged, I would feel the need to constantly reassure myself I made the right choice. I mean, talk about a boat anchor. I have come to terms that I am never going to buy a house that is nowhere near rental parity after putting at least 20% down

And if I hadn’t recently bought a house, I’d feel the need to constantly reassure myself I made the right choice. /sarc

If the math shows that renting is better, then so be it. I’m not sure how that can even be reliably calculated since on the owning side so much depends on price appreciation. I rented a home in South San Francisco for 1 1/2 years. At $3k/mo, that was $50k gone. If I would have bought and sold the house I rented for that same time span, I would have come out a few thousand ahead versus renting it.

I left CA because homes are/were too expensive. Best and most impactful decision that I ever made, seriously.

I have no idea where we are with housing. It’s all so confusing

If this was a traditional economy I would agree, do you think the market will correct if interest stay where they are or go negative?

I’m no expert, but it seems to me that there are several pillars propping housing up, so, even if rates remain low, the tech bubble popping/market crashing (causing lost jobs and the unloading of investment property, among other things), baby boomers dying, and the strong dollar (and regulations) hindering foreign investment could be enough to bring it down. I don’t think housing will be a leading indicator like last time, though, so we’ll have to wait for the chain reaction.

Interest rates were still under 4 percent five years ago, and housing was much less expensive, so there seem to be many factors at work that have built upon themselves, giving us this very high, but teetering, housing market.

My rent is about $32K per year, so I can afford to wait another year or two, because these drastic pricing swings make $32K seem like nothing. I can easily imagine spending $64K on rent over the next two years, but saving $100K+ from current home prices if I wait for the crash. If only I had a crystal ball. lol

The thing is… if rates go up, dont you think more people that have fixed rates below 4.5% will stay put. I would like to see statistics on the number of people that have fixed rates at or below 4.5% We have sold over 150 properties in the last 3 years and every buyer with a mortgage took fixed rates … some as low as 3.25%. I venture to say that 90% of homeowners in SoCal (that have mortgages) have fixed rates at or below 4.5% today. I think the market becomes “stable” in the event of a rate hike, because there will be less inventory for sale. If someone needs to sell due to relocation, it would be better to rent the house out and keep the low fixed rate.

Negative amigo.

It is not possible to make a house pencil as a ‘rental’ if your rate is in that low range because if it is then you bought it recently for it and overpaid it. Rentals only make sense when you buy them for dirt cheap. No solvent landlord ever built his empire by buying at the peak (no matter how low the rates are) and then renting them at inflated rental prices.

As a professional landlord, I have no touched a real estate deal since 2012. That was the last time a deal made any economic sense whatsoever.

I moved to MT and things were still cheap enough a year ago to buy into being a landlord. IMO they’ve just crossed the threshold where it no longer makes sense, unless you’re expecting valuations to significantly outpace inflation going forward.

I can see that pricing in Idaho is still low – both valuations and rents. I’m not going to be a remote landlord otherwise I’d be taking a close look at it.

Rates go up, Prices Fall, Rents drop. They would have to sell for a loss or rent for negative cash flow. Neither are great options IMO.

Rates go up, construction slows, people rent instead of buy. Owners will “hold” with their low fixed rate mortgages and high rates cause People to rent instead of buy. Rental supply goes down, rents go up!

Here in the IE, rents went UP during the entire recession because in 2008-10 unqualified buyers with ARM’s lost their homes in droves. They became renters again!

Mr miyagi,

The interest expense on a $400,000 fixed rate loan is $1200 per month and DECLINES for the next 30 years! Hard to believe someone would walk away from a median priced home here in I.E. . And that’s at today’s prices not the prices three years ago. Rents would have to go nearly in half from today’s rental rates before most that bought today would consider just walking away, … And that’s just assuming someone HAD to sell during the next downturn.

Also Remember, anyone who is gotten a FHA Fannie/Freddie residential loan loan since 2008 has faced very strict underwriting guidelines and are far less likely to default than pre-crash borrowers. Less defaults means less inventory. Lower inventory means stable prices.

Jim,

Let’s say interest rates went up to 6% (however unlikely) and market dropped by 20%. A a fair number of people became underwater again. I believe that most would stay put rather than sell for a loss because of thier low fixed interest-rate and net monthly cost. The alternative would be downsizing to a smaller property but with a much higher interest-rate… Net zero.

Agreed that not everyone is cut-out to be a landlord and put up with some potential negative cash flow. I woul counsel that favorable AFTER-tax cash flow benefits, and long-term equity buildup, makes a compelling argument NOT to give up the low 30 year fixed rate Money.

When did rents ever go down in S. Cali? I must have missed that, maybe I was sleeping?

When rates go up… rents don’t fall…. rents go up UP UP

rates going up means inflation

Jim, when you actually form a sentence other than “HOUSING TO TANK HARD SOON!” you make a lot of sense and I totally agree with you! 🙂

You are correct Jim, rents will get blasted soon enough and this will be detrimental to the rookie landlords who bought on easy credit.

Anyone who bought something as a rental in the last several years bought into a rent bubble, they also paid a higher price than they should for the property. Even if properties “look” cheap in Idaho or anywhere else they are still way more inflated than they were a short time ago, also the rents are goosed more than is sustainable. In other words, they were bad buys.

I constantly track the marketplace for rentals and have a pulse on it as someone who derives their income from rent checks. I’m telling you it is hard to make money in rentals unless you do it all of the work yourself AND buy cheap as hell. Exceptions apply, but for the most part that is the gospel.

I’ve managed property since the early 90’s in the san fernando valley. We were giving to 2 months free rent on a one year lease in 1995 thru 1997 in van nuys apt buildings. Same on commercial property in miami in late 90’s. Just you wait. Trees do not grow to the sky. I will buy more apts when cap rates make more sense. Now is not the time. Patience grasshopper!

Wait till CA minimum wage increase goes into full force. That just means more money to pay rent.

I agree with Mr. Miyagi about investment property, but I think you have a point about actual personal dwellings. The thing is, it’s the chain reaction from a higher rate environment that could bring things down, in terms of an economic collapse. While people may be locked into low rates, they’re also using more downpayment money and leveraging themselves like never before, so when jobs and companies start going away, affordability still becomes a big issue, wether the interest rate is 3.5% or 6%. They’ll still have to come up with that monthly nut.

GHETTO house offered at $849,000 — https://www.redfin.com/CA/Los-Angeles/3443-10th-Ave-90018/home/6887937

$849,000 for DA HOOD?

House is South of the 10. Isn’t this da hood? Maybe not the worst part, but still …

Hell, I could live in Woodland Hills, Topanga, Burbank, Glendale, or Pasadena for what this HOOD house costs!

Check out the street view. This place looks like someone died in it.

I like the remodel, It looks like a place where a young family like mine could enjoy it with friends for a few years. I hate the neighborhood, I would never buy in a dump like that, I would rather rent for another 5 years.

Da Ghetto? yes and no.

The house is in the Jefferson Park neighborhood which is definitely sketchy but not like South LA itself. However, I think there is some agreement that it is not a good idea to buy the nicest home in a lousy neighborhood (should be the lousiest house in the nicest neighborhood). Further, the home is over-priced – but what do I know. We have seen many ridiculous home prices sell at some point. It is just a matter of the listing agent lowering the price until it sells…

Even though last sale shows over a decade ago, it could be a recent remodel/flip – some agents know how to scrub recent sales activity from the MLS.

Also these large homes in questionable neighborhoods usually sell to multigenerational families of same ethnic background as the neighborhood they buy in. for example, if Jefferson Park is mainly Hispanic then you often times see the large homes in Jefferson Park selling to a multigenerational Hispanic family who are familiar with the neighborhood.

Neighborhoods change. I have seen many former reeking slums on Chicago’s near west and south sides become extremely fashionable and expensive, while their poor former residents are pushed out to nabes on the far borders of the city…. and areas that were totally prime just 20 years ago and that are stuffed with beautiful housing stock are beginning to disinvest, and grow increasingly shabby, with more dirty, disorderly, violent people moving into them on Section 8 vouchers.

If you want to gauge how well this “ghetto” Los Angeles neighborhood will do over the next couple decades, research investment being made in the area. If there is major investment in new, good housing stock and fine retail, it is a good bet. But if the only new businesses coming in are tiny, uber-trendy boutiques, and the occasional rehabbed house or building, you would probably want to pass on this nice house.

In any case, the price for the place you linked is out of line. There’s no reason to pay as much for the same property in an “up and coming” neighborhood as you would in a really prime neighborhood.

I’ve got you beat. This little slice of heaven in a nearby hood costs 1.4 million!

https://www.redfin.com/CA/Los-Angeles/3506-S-Sycamore-Ave-90016/home/6889869

That house’s backyard faces the parking lot of a multi-unit housing development. Should be nice and quiet at night.

I have a theory that for the past four years Jim Taylor has been screaming “Housing to tank hard!” while buying up every piece of property he can get his hands on. This effectively scares off his competition and enabled him to become one of the largest & wealthiest land barons in the US. I tip my hat to you sir.

That is some funny stuff.

Jim just doesn’t get to vote with the rest of the Fed’s board of governors on monetary policy. FWIW, I still think there is historical precedent for the wheels to come off this sh!t show when a new president / administration comes into office

Rents don’t go up in a struggling economy no matter how high rates go. In the last downturn people doubled up, living with family, you name it, either way they were NOT renting apartments. I survived because I am a low leverage investor and do all the management myself. Other landlords got smoked. Same will happen again. Rents will come down, if you think rents will continue to inflate indefinitely you are in outer space.

Also, IE Builder, your analysis is flawed because you are assuming that there are no distress sales. You’re just saying that people will choose to stay and not sell underwater. Sounds like roses and puppies but the reality is that during economic contractions people lose jobs and are forced to sell for whatever market price is, which will be lower than bubble town right now.

Mr. Miyagi

I own over 100 rental properties and have been thru 3 recessions. This last one was the worst, and I never lowered rental rates. Granted they were a few years that I didn’t raise them but I’ve never lowered the rate on a tenant …ever. I have had tenants move from a larger home to a smaller apartment or condo, there by lowering their money rent.

Wheelin,

Agreed, but my point was “owner occupants” Which get low fixed interest-rates on a home today would potentially become landlords in the future. Higher rates in the future may compel them to keep the property and rent it out versus walking away. I was not advocating that someone go out and buy a few rental houses just because rates are low, but making an observation for those worried about buying in a perceived “Bubble”.

I frankly believe we were in a reverse bubble, and are returning to a stable market where home values keep pace with inflation. Wheelin is right, a few years ago in the IE prices for a median home were way below replacement costs and way below rent parity. It was a great time for investors to buy and I even posted that on this blog back then! Of course I got accused of being a troll or a realtor (which I am not)!

When rates dropped to 4% I encouraged every young person I knew to buy a home with a fixed rate mortgage. 30 years goes by in the blink of an eye.

The problem with being such an experienced landlord is that you’re relying heavily on history and experience, which may not be advantageous at the moment, because we’re in a time of brand new monetary policy experimentation.

On a personal level, I’d much rather buy my primary residence at a higher interest rate. That would push prices down, my down payment would be smaller, I can pay off the principal faster, and I could even potentially refinance during the next downturn when rates go low again.

IE Builder, I don’t want to tell you how many rentals eye own for two reasons. 1.) We are on the internet and can say whatever we want. I’m not suggesting you’re lying, but I’m just saying that the medium we are using is ripe for unverified statements 2.) I don’t want to embarrass you by telling you how many doors I own.

That being said, if you believe we are in a ‘reverse bubble’ then you must be buying feverishly and leveraging to the hilt, correct? Leverage is the great accelerator so I sure hope you are digging deep into debt to gobble up all of these tremendous value plays.

My hunch though is that you are not buying feverishly at all because you don’t really believe that. Or you have made a lot of recent buys at the top and you are trying to justify those purchases in your own mind.

I don’t know any seasoned investor that thinks we are in a ‘reverse bubble.’

there has been talk on this site about lack of skilled labor, indicating the ekonomy might not be as bad as we think.

here is LAT article on the topic;

“construction companies no longer fret over finding work. They increasingly worry about finding enough skilled workers…”

http://www.latimes.com/business/la-fi-skilled-workers-jobs-20160902-snap-story.html

The article just confirmed what I’ve been saying many times on this blog.

I gave up on LA a few years ago and started buying rental property in the IE. Up until 2015 it was still lucrative. You could buy a decent rental property for 200K or less and easily net 6+% ROI annually. Now I see these same places selling for 100K more to investors who are lucky to net 3-4% because of the inflated prices. The projected rents and returns are not keeping up with the increasing price tags, but that doesn’t seem to stop anyone. Investors from LA & Orange county see the IE as a discount sale. Unfortunately many don’t realize that the rents are at a discount too.

Wheelin,

Agreed, but my point was “owner occupants†Which get low fixed interest-rates on a home today would potentially become landlords in the future. Higher rates in the future may compel them to keep the property and rent it out versus walking away. I was not advocating that someone go out and buy a few rental houses just because rates are low, but making an observation for those worried about buying in a perceived “Bubbleâ€.

I frankly believe we were in a reverse bubble, and are returning to a stable market where home values keep pace with inflation. Wheelin is right, a few years ago in the IE prices for a median home were way below replacement costs and way below rent parity. It was a great time for investors to buy and I even posted that on this blog back then! Of course I got accused of being a troll or a realtor (which I am not)!

When rates dropped to 4% I encouraged every young person I knew to buy a home with a fixed rate mortgage. 30 years goes by in the blink of an eye.

I wonder what a recession will do to population growth in the bay area?

I realize that it’s a seller’s market, but there a couple things that I have to rant about. First of all, no pics of the interior on the listing. I have come across a number of listings recently without any pics of the interior. When I contact the agent they say things like, “I didn’t think it was necessary” or “This property sells itself”. Or they use pics from the previous listing years ago when the property was in better shape and usually a different paint color. How lazy can you be? Is it that hard to snap some pics with your phone and upload them? Second, clean the damn house. Why can’t either the agent or seller clean the place before they list it? I’ve lost count of how many places I have seen lately that are filthy. We are talking rings around the tub, toothpaste in the sinks, nasty kitchens, dirty floors & windows, pet odors, garbage in the yards, etc. Some of these places look like a crime scene. If you don’t want to clean it yourself, pay someone! The place will show better and you’ll likely to sell faster for more money.

Because they don’t have to. It will sell regardless. Period.

Leave a Reply