The overheating real estate market: Even the National Association of Realtors acknowledges that rising home prices without rising incomes is not a good thing. Deep analysis of Culver City home and surrounding properties.

The housing market is overheating and you can sense it when you speak to house humping enthusiast. The housing market can do no wrong and a correction isn’t even in the realm of possibility according to their views. But even recently, the National Association of Realtors recognized reality when they stated the obvious: rising home prices with no rise in household incomes is not good. This is why in California we are facing rental Armageddon. People are now desperate to buy and are getting all kinds of odd mortgages including those that come with zero percent down basically shifting a large part of the risk to the lender. These mortgages only make sense if you believe housing will never go down. Many Millennials are still struggling to buy given their weak income growth. Today we’ll take a look at a home in Culver City and see how far $1 million will take us.

The NAR acknowledges one piece of reality

The days are getting longer and the time to lust after housing is just around the corner. Spring kicks off the crazy days of housing that go all the way into fall. Those itching to buy are going to find inflated prices and are going to need to stretch those budgets. House lusters seem to forget that a mortgage is for 30 freaking years. 30 years ago Ronald Reagan was President and the space shuttle Challenger explodes over Cape Canaveral. Now that is how long you will be paying on that crap shack you are hoping for.

Even the NAR realizes something is off:

“The spring buying season is right around the corner and current supply levels aren’t even close to what’s needed to accommodate the subsequent growth in housing demand,” says Yun. “Home prices ascending near or above double-digit appreciation aren’t healthy – especially considering the fact that household income and wages are barely rising.”

In other words, buy now or be priced out forever. Let us take a look at what we can buy in Culver City for $1 million:

3130 Reid Ave, Culver City, CA 90232

3 beds 2 baths 1,415 sqft

Let us examine the ad:

“Lovely Culver City home located in a quiet tree-line street near Syd Kronenthal Park. This 4-bedroom home offers a remodeled kitchen with granite countertop, stainless steel appliances, large dining area, large master bedroom with master bath, central heat and air, 2-car detached garage and a cemented rear yard.â€

I also like that on Zillow they tell us “I love my kitchen and I love the quite neighbor.â€Â So what is this place selling for?

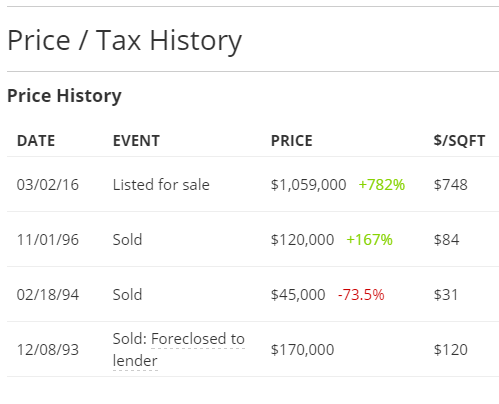

Someone is cashing in on that lottery ticket. The last sales price in 1996 was for $120,000. It is pretty impressive that someone got this place back in 1994 for $45,000. And this home had a foreclosure back in 1993. This is one of those cases that the current owners are unlikely to have the income to purchase this house back at the current asking price. So let us look at all the immediate homes around this property:

3134 Reid Ave, Culver City, CA 90232 3 beds 3 baths 1,914 square feet (last sales price – $0 in 1984 – looks to be a family transfer). House now has a Zillow estimate of $1,352,435

3126 Reid Ave, Culver City, CA 90232 2 beds and 1 bath 1, 1,040 square feet (last sales price – $135,000 in 1996. Home has been tapped out for some money. Was listed as a rental in 2012 for $2,450 a month. Current Zillow estimate of $1,007,881

3122 Reid Ave, Culver City, CA 90232 3 beds 2 baths, 1,318 square feet (last sales price $830,500 in 2014. Purchased with 20 percent down. Current loan balance of roughly $646,000)

3143 Reid Ave, Culver City, CA 90232 2 beds 1 bath, 933 square feet (last sales price – $235,002 in 1990. Still has nearly $280,000 in loans because of additional loans)

3133 Reid Ave, Culver City, CA 90232 3 beds 2 baths, 1,359 square feet (last sales price – $250,000 in 2000. Zillow estimate of $1,140,056)

3127 Reid Ave, Culver City, CA 90232 5 beds, 3 baths, 1,845 square feet (last sales price – $26,500 back in 1974. Zillow estimate of $1,327,277)

3125 Reid Ave, Culver City, CA 90232 3 beds 1 bath – 1,125 square feet (last sales price – $138,000 back in 1986. Zillow estimate of $1,046,267)

3112 Reid Ave, Culver City, CA 90232 2 beds 1 bath, 1,058 square feet (last sales price – $112,500 back in 1985. Zillow estimate of $1,030,879)

Welcome to the odd world of real estate pricing. In this area all homes are pulling in Zillow estimates of $1 million or more but look at the sales prices here. Only one property sold recently in 2014 and that place sold for $830,500. The buyers bought with 20 percent down and are still carrying a nice mortgage. The point is, real estate prices are set at the margin and the margin in real estate is thin. That is why we are seeing all these creative loans making their way into the market to justify these ridiculous prices. All of these current owners will be profitable if prices fall 10 percent, 20 percent, or even more because they have a large buffer. Also, the only reason these homes sell for these prices is because someone is willing to pay for that. But is that statement alone enough to justify value? One of the places was rented out for $2,450 recently – so you can either rent for $2,450 or pay $1 million). The mantra of “always buy real estate†doesn’t hold at bubble peaks.

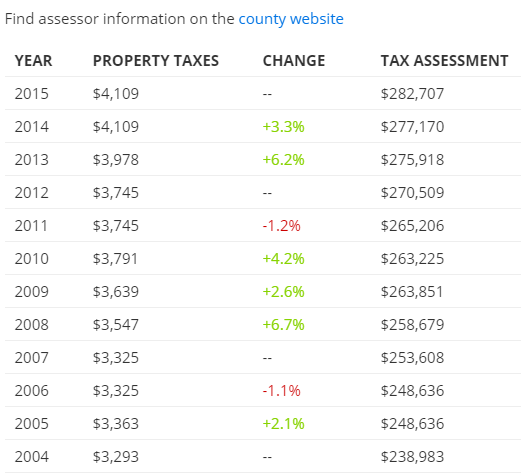

Say this place sells for the asking price. All of a sudden homes in the area are “worth†$1 million? Using comps and other methods simply shows how one or two properties can distort perception here – and this goes both ways especially when markets start trending lower. And here is another point – the new buyers are going to be paying 2 or 3 times more in annual taxes just because they are buying today:

The current owners are paying taxes on this property as if it were valued at $288,707. Say the new buyer pays the asking price of $1,059,000. You are now paying way more in property taxes for no additional services. This is why states love housing bubbles. More money for no net added benefits.

In the end as the NAR mentioned, incomes do matter and with more banks and lenders pushing the limits, we are entering into a very frothy market. An area with million dollar homes and no one paying $1 million.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

128 Responses to “The overheating real estate market: Even the National Association of Realtors acknowledges that rising home prices without rising incomes is not a good thing. Deep analysis of Culver City home and surrounding properties.”

Just the beginning.

Housing To Tank Hard SOON!!

be priced out or buy now and enjoy your life and wait for the equity of your home to go up

Or rent now and enjoy your life until house prices return to some semblance of sane. Just because someone doesn’t own a house doesn’t mean that they can’t enjoy their life. In fact, life might almost be more enjoyable because if something goes wrong at the house, you just call the owner to fix it.

Jim is going to finally be right SOON!!!

It goes up FOREVER!

How soon jim you predicted it almost every year and the house prices continue to rise

Rent now and make your landlord rocher

It’s 2006 all over again, thanks to low rates and low down payments.

Unfortunately, rates and down payments can’t go much lower, if at all. Sure, NIRP could be around the corner, but only if the shit hits the fan.

Here’s my take: house prices continue to go up for next 2 years, in 2018 prices level off, 2019 market crash begins, 2020 full scale collapse.

your prediction sounds plausible, but begs the question: what do prices collapse to? i.e: do prices collapse to 2015 prices? 2013 prices? 2010 prices?

Since a ‘collapse’ is defined as 20% drop I guess we will just have to wait and see what prices are the baseline before the drop?

on another note, a friend of mine is a realtor on The Westside and he tells me there are LOTS of buyers out there but not a lot of good houses to choose from. Pentup demand may be more intense than we realize which is why we see these ‘crazy prices’ in Culver City “CxC” (Culver City gang logo)

Ajhhh, 4 more years of Jim Taylor predictions? Please….

It’s CxC13, or Ce Ce trece….

Why not? Jim Taylor is RE God, mark my words.

Thanks Alex 🙂

I believe in Jim! I do and I want to! Because I really need to upgrade and buy a house for my family. We are getting too tight in current living situation. Jim, please, speed up crash lol…I want a house for $600K, with 4 bedrooms, small yard and garage in a nice school district and not of my grandmas pre-birth age.

Prices should go back to 2000 levels. What they go back to is unknown. Depends on if the next administration allows the same level of coruption in the markets.

For all but the Prime of Prime I figure 2011/12 trough is a good bet. If only because that was the last non-mania purchasing period. The low rates will certainly still be in place, but in the absence of wage increases (and who here reasonably expects those) why should prices be much higher than this last benign period. I missed on the house I bid on in 2012 and surely I thought we had reached a sensible bottom. What I didn’t realize was that the FED was going to unleash Housing Bubble 2.0 on us. Helped Obama get a second term for sure LOL! In any case, just as with the first bubble, the credit expansion will run it’s course. I doubt we’ve got 2 years left in the macro market. Prices have been flat to declining and inventory rising in many spots in the IE since early last year. The exurbs are the leading indicator again. Steeper price declines by early next year with goo buying opportunities by 2018 in a “capitulation spring” is my guess. FED triggers it all because they have to pop this bubble and let some creative destruction take hold before the next credit cycle.

@QA Abyss I’m not being a stickler, but I just learned this the other day and found it interesting.

Begs the Question doesn’t mean what you appear to think it does.

http://begthequestion.info/

I recently “moved” to San Diego. I put that in quotes because I rented a place in North Park as a “Pied a Terre” just to have a forward operating base in the area. I have spent a lot of time this winter walking around the neighborhood and surrounding areas, as well as by motorcar. I have come to appreciate what you mean by “crap shack”. There are more decrepitating buildings, crumbling infrastructure and moldering hovels around here than one can believe and I’ve looked at realtors flyers outside some of these places and am amazed not to see local codes enforcement notices of condemnation on some of these structures, all brazenly priced at $600+ per square foot.

Rent is a comparative bargain and I have to wonder what would possess someone to pay over $1M for the example you cite in this article.

Welcome to Cowtown San Diego, Erik!

We moved to San Diego in 2013 and confirm your observations of the state of affairs here. Overpriced crap shacks, pot holes everywhere, bursting water pipes creating massive sink holes about once a week

And the biggest thing in the news is how to give Billionaire Dean Spanos a new football stadium.

Waiting patiently for a housing correction, since it just doesn’t make any financial sense to overpay for a crap shack and have that millstone around our necks for 30 years.

One of the primary reasons that we recently moved away from San Diego after 9 years. Not only ridiculously overpriced real estate, but most of it is garbage and you get relatively no space. It is just stupid and not worth it; even with an eventual price correction. Weather isn’t everything.

Prices in Culver City 90232 peaked at almost $950K in July 2007. Adjusted for inflation, prices are at or near 2007 prices right before the previous bubble burst. Prices on an inflation adjusted basis were similar in 1989. Nothing new here. That zip code is notorious for massive price swings when recessions and housing bubbles burst.

“Many Millennials are still struggling to buy given their weak income growth”

i just shake my head and do a facepalm…..why do you (or anyone for that matter) think this is just a Millennial problem? this is every wage slave in Americas problem.

BTW i was just visiting a friend in central Anaheim and i’ve know people living their for years and one thing i’ve noticed was all the cars. There used to be the “2 cars in the driveway” as a measure of success. Now i could hardly find a spot to park on this guys street. There must be 5-6 drivers per household and i think that’s indicative of no one making enough to actually buy without people renting rooms and/or those Millennials who are most likely never going to leave.

in Santa Ana they had to create laws that will not allowing parking on the front lawn since the occupancy density is so bad their it’s ridiculous. Every room is rented out….even the garage….not to mention just bigger families.

coming to a neighborhood near you.

One problem I see with these homes maxed out with renters it makes it a less desirable place to own and live in if packed between homes that have similar rent issues.

Homerun, you bring up a interesting point which is rarely touched upon. The reality of owning amongst renters. As more and more SFH are bought up by investors and LA turns into a city dominated by rental properties it is very likely that people buying starter homes will have neighbors for renters. Generally renters could care less about their property and take little if any responsibility for the neighborhood’s appearance. Furthermore renters tend to take more then their share of available street parking because they tend to pack in more people per a unit then owners. It’s not a good feeling when you plop down 500K+ for your LA crapshack and find out your surrounded by renters. Unfortunately more then one RE agent has pointed out to me that the future of LA is all about renting.

Pasadena north of the 210 looks like a nice neighborhood, when seen from the street. But when you look down via Google Satellite, you see a surprising number of houses with five or six cars in the driveway and backyard, which you can’t see from the street.

Always important when house-hunting — check Google Satellite and see if any of the backyards are packed with cars.

Not sure how much the mix of renters contributes to this issue. I’m aware of more than one case in L.A. where non-rented households are packing in a lot of people with a lot of cars. Also aware of a lot of deferred maintenance and blighted appearance by owner occupants.

Install bunk beds, 4 guys per room.

Pave the lawn, put a driveway instead of curb, now it’s legal to cover the ex-lawn with cars. Be nice, paint it green – sets off the oil spots nicely.

In all honesty though, I got all over OC on a bike, the secret is to know the Santa Ana river trail, cuts through OC diagonally and is amazingly handy. Say “Hi!” to the Mexican dudes with bags of cans 6X as big as themselves for me.

and look at the price history……most of those people could sell for half of the zillow estimate and still make nice profit. If sanity ever returns, and i’m hopeful that the manipulation will cease, and prices starting coming down in line with incomes, how many of those people are going to be thinking they better get out…cash in my lottery ticket?

i’m sure this is going thru a lot of minds at the moment.

It’s too expensive to sell right now and not enough owner occupants are arbitraging to lower cost locales. The more prices move out of line with incomes, the more disincentive there is due to a high real cost to transact, which begets even lower volume in the marketplace. Sins still lingering from the past such as HELOCs and a high cost basis which continue to impact household balance sheets compound this situation leaving most owner occupants with an extreme lack of mobility in high cost areas. Even multiple rides on the refi boat isn’t helping, and quite possibly is also contributing to the issue.

Why trade one crap shack for another crap shack in the same locale at a high cost, especially if holding costs get lowered? If incomes were keeping up, there would be room for moving up, but asset inflation has severely outpaced income gains, so gridlock ensues.

The low inventory story, which is actually a reflection of a low volume issue, lends credibility to the point that incomes indeed do matter and it’s not so much about activity of the wealthy.

Investor class might cash out though, especially institutional entities. Rising rates could give additional incentive to do so.

“The current owners are paying taxes on this property as if it were valued at $288,707”

because that is what it’s really worth…….which is still a tad high but maybe not with 4% mortgage interest rates,

With negative interest rates just around the corner, and with a falling stock market, you will see a rush of stock investments headed into real estate. Prices should move substantially higher.

You might want to look into stock market-housing price correlation. You may want to do a little research on your statement. It won’t take much to realize the correlation coefficient of the two mentioned asset classes is closer to zero than one.

I meant closer to 1 than 0.

Broken record alert.

Rent at $2500.00 per month used to mean that the home was worth 250K or 100 times the monthly rent.

What does everyone think the proper multiplier should be now in a low interest rate environment? 150xs? 200x s?

That’s an old multiplier. According to Investopedia, if list price is greater than 180 times monthly rent (or 15 years of rent), it is “typically better to rent than buy,” but if list price is less than 180 times monthly rent it is “typically better to buy than rent.”

http://www.investopedia.com/terms/p/price-to-rent-ratio.asp

That makes 2500 rent equivalent to 450k sales price.

In Silicon Valley, I’m paying $2600 in monthly rent. The only properties available with the same number of bedrooms/baths for $468,000 or less are in neighborhoods with frequent violent crimes, or more than 30 miles from my job (I’m currently 6 miles from my job). Houses/condos I would even consider living in sell for $700k and up (269 times my monthly rent).

Hell I lived in Sunnyvale for a while and I can tell you all about violent crimes … Sunnyvale, on paper, is a relatively safe city, but in reality the crazy shit I’ve seen there is too real for COPS on TV. I’ve gone out to my mailbox to find cops with guns drawn, closing in on a murderer, had to call 911 for a gal in my apartment complex who’d been beaten (and I thought, maybe stabbed) by her ex-con boyfriend, there are all kinds of high speed chases and shootouts there. Sunnyvale cross-trains their cops and firefighters, essentially every Sunnyvale cop is a firefighter and vice versa, and there’s a reason for this – it’s high-tech Falluja there. So, you have the place crawling with cops at all times. I had to work with HUD’s Project Sentinel to keep from having to bump off some baddies myself; once you get the right cop, he does out and cages ’em quick. God Bless the Sunnyvale cops, I say.

Sunnyvale is considered a nice town, but only because there are a LOT of cops keeping a lid on things. And this is a “nice” town in Si Valley.

It is an old multiplier only because it was used in a higher interest rate environment. I guarantee that when interest rates normalize, i.e., 6% or higher, the “old” multiplier will become “new” again. The reason should be obvious: higher rates will require higher mortgage payments, and higher mortgage payments will then compare unfavorably to relatively lower rent.

Erik, welcome to California! I will give you the reason why anybody in the world would pay 1M for a crap shack. The deteriorating lumber, concrete and drywall known as the crap shack is worth next to nothing. That glorious California dirt is worth a small fortune.

Coastal CA RE seems to baffle many people, especially on this blog. What you see here is a true anomaly and I do not see that changing anytime soon. Now get back in that motorcar and enjoy the CA lifestyle.

MI2MP

Median Income 2 Median Prices

1996-2016 boom in prices has distorted that gap big time. Even worse for new homes, which are much bigger and more expensive now than ever.

This century once you look at the data with a clear eye you can see how bad the housing inflation story has been.

Harder and Harder … for single income Americans to buy, so you need that dual income factor model.

Even though adjusting to inflation home prices nationally are 20% below the housing bubble peak, nominally it’s basically there, much hotter for new homes as well.

Lack of selling equity has kept inventory below 6 months annual every year since 1999, except for the housing bubble bust.

Don’t listen to low inventory crowd… it’s a demand issue, it’s been here for 16 years, no more exotic debt garbage loans left.

Makes the entire cycle harder and harder to move ahead.

The growth we see in purchase application and sales this year, still tilted on the move up buyer, no where close to seeing the 40% first time home buyer metric and the last existing home sales report still had a 26% cash buyer metric, 16% above historical norms

It’s really perplexing. You can go on youtube and see a couple of videos featuring Logan Mohtashami (on his channel), and he speaks coherently. His writing, conversely, is not commensurate with his speech. I’m guessing English may not be his first language, and while he has learned to speak relatively well, he has yet to learn to write as coherently as he speaks.

True, some of his writings seem very stream of consciousness, but I don’t know why some of you guys give Logan a hard time for posting here. It’s more insightful than Jim’s tank or Lord’s dissonance.

I’m picking up what he’s putting down in this comment. Basically, housing asset inflation has exponentially outpaced income on the basis of unorthodox credit and stimulus, but the only thing that can keep the ever growing forces of deflation at bay is even greater market interference. Who knows how much longer than can hold without gushing out into the land of unintended consequences?

I’m with Hotel on this one.

If buyers are blind and dumb then they deserve such a fate of owning homes worth maybe 250k and that is stretching it. But then again, I see cars that are 50k and up sales going thru the roof and wonder how long the madness continues?

ZIRP money manifests itself differently based on economic strata. For the investor class, it took the form of the stock, tech, and real estate bubbles. For consumers, it’s the student loan and auto loan bubbles.

erik,

Well done. One only has to open their eyes to see reality versus the illusion.

Yeah, that’s a lot of money for a “crap shack.” Here’s the thing though: the Westside (including Culver City) is home to over 500 tech start ups and venture capitalists are funding these companies to the tune of between $500K to tens of millions of dollars. Plus, on the west side, established companies like google, yahoo, facebook, youtube, hulu have set up shop and have made major investments. Many of these companies are involved in symbiotic projects in conjuction with the move and tv business, which, by the way, has always had a presence on the west side.

The long and short of it is this: There’s a LOT of money pouring into the west side right now, into the area broadly referred to as “silicon beach.” This money is employing LOTS of people. They need places to live. And so, this is much of what is driving the high prices in places like Culver City.

BTW, here’s a link to a map of the westside start up community to give you an idea of what is going on out here:

http://represent.la/

As you will be able to see, Culver City is right in the mix of things.

Will this money keep flowing in forever? Who knows. But the point is, right now, this tech money, along with the tourist money, and the long present wealthy westside money that has always made the west side an expensive place (much of it from people that make or have made big money in the entertainment business), is helping drive up the rental and sales prices in places like Culver City.

After all, people need places to live, and they aren’t making any more land.

“Will this money keep flowing in forever?”

no, it’s already started slowing to a trickle.

The only way I can see making money in “tech” is through fraud. Set up a “startup” and make it look good, take that VC money and run.

You sound like every realtor in the Southbay. If one were to walk into Yahoo(failing) Hulu (getting by) or any of the startups (down round valuations and closed markets) one would notice the median age of the employees is around 27 years old. Yes. All these people need a place to live but the 26-30 year old making $100k would rather live in Venice and Santa Monica and rent. So for every 20 employees you have one manager making enough money to support a $1-1.5 mil mortgage. And for a person with a family commute and schools start moving the needle.

All one has to do is drive around Playa Vista or even hollywood to see where these start up employees are living. Higher-end, new construction rentals.

I think if I had boocoo bucks I’d rather rent. Because, what if I buy and end up with the neighbors from hell(tm)? Or I find there are opportunities say on the east coast?

The SFH rental market on the west side has been rolling over in terms of rent increases for nearly a year, yet the mainstream story is that rents are going to the moon. This is also happening with older multifamily units possibly to a lesser extent. Not sure about the new projects that have went up over the past year, haven’t focused in on those. Several more are coming on-line soon, only adding to the inventory at what might prove to be just past good timing.

Rents may be coming down a bit on the westside, but in my book, they are still pretty damned high. Hell, just to rent a room–not an apartment, but a room–in the Brentwood area will cost you between $1100 and $1300 a month. In Westwood, near UCLA, on craigslist people are advertising SHARED rooms for upwards of $700 a month. Go on Zillow or trulia and see what people are asking for rental units in the area west of the 405. With such high rents, if one has enough money for a high-enough down payment, it can still be cheaper to buy than it is to rent. And let’s be honest–the people on the westside are not poor. We’re not talking about the average “middle class” American here (if such people still exist in California, especially in urban areas). We are talking about upscale to wealthy people that have LOTS of money and/or resources. Hell, just in my looking for a place on the westside, I’ve run into at least four different buyers or owners that were in their 20s who’s parents essentially bought a place for them either as a starter place, or as a place for them to stay while they studied at UCLA. Plus, in numerous open houses, I’ve come across many, many Chinese families that are looking for a place to buy (who knows how much money//wealth of theirs came from China?)

This part of California (the Westside)–including Culver City–is becoming more and more the domain of the top 1 to 5% of the economically well off.

That’s just how it is.

Will all this activity end? Well, yes, eventually. When exactly? Who knows. When the sun burns out? When California runs out of water? When we have a big earthquake? When we go into the next recession (but even then, I’m beginning to suspect that much like it was during the 60s and 70s when I was growing up in SoCal and the rest of the country was in a recession, certain parts of California may be immune or relatively immune to such national economic downturns)?

Look. I get it. Prices are high here. They don’t make sense to most people. On the other hand, for all of its problems (and they are many) California is a very, very unique place, not just in the United States, but in the world economy. There are LOTS of things about this place that make it extremely unique and make it a very highly desirable place to live. And people of means are willing to pay big, big bucks to do it.

It’s because you DON’T want to live east of “the” 405.

If the employees are making low 6 figure salaries then the manager cannot be making that much more. Maybe at the best mid 6 figures. That does not afford a 1 million dollar house?

Wondering, that’s the same “this place is different” rhetoric we get from time to time when prices are out of balance. When prices correct as they have in the past several times and unless “this time is different” they will again, all of that same rhetoric goes out the window. Just because price on the west side increased by orders of magnitude in the past seven years doesn’t mean the same in terms of real value.

After all, people need places to live, and they aren’t making any more land.

That just means you can’t build wider. But you can often build higher.

The City of Santa Monica has a great scam going. SM has low-height/low-density zoning laws. But SM often waives those zoning restrictions for developers, in return for “community benefits” and “givebacks.”

So Santa Monica is thick with new construction, buildings going up ever higher, making the city ever more dense and traffic-congested and less livable.

In return, developers provide such “community benefits” as more low-income housing, and outright cash payments to the city. These payment are often called “environmental offsets” or some other BS. Ostensibly to offset the building’s greater “carbon footprint” or water usage, but the money really goes to city employees’ salaries and benefits.

So no, they’re not making any more land. But they are making buildings with more storeys.

They can solve the height for the building but not the parking issue. Might Need to build community garages.

They also don’t make any more land during downturns, but isn’t it funny how we don’t hear that during those periods.

I’m sorry to say, but you’re probably right. People on this forum are hoping for some sort of dramatic crash similar to what we experienced in 2008 but if you are a student of history, you’ll know that in our lifetimes, a home price decline like the one that happened then had never happened before. It’s simply not a regular occurrence. If home prices dropped even 20% from where they are today, it would cause (or be caused by) some major dislocation in the economy and a lot of the people here would probably lose their jobs and therefore not be able to get a mortgage. So it’s a double edged sword hoping for some sort of crash, you are assuming you will be relatively unscathed, but that can’t possibly be true for everyone, or prices (by definition) wouldn’t go down. At this point, prices would need to drop by 30-40% for me to lose the appreciation in the condo and the house I own on the Westside, and that would get me back to my original purchase price, so there is another 30-40% of equity that is represented in my down payment. The take away is that you should buy a home if you have a stable income and fine something you like that you can afford. That may involve working harder and saving more money, moving to a lower cost submarket, or just lowering your standards! That’s life for you.

“but if you are a student of history, you’ll know that in our lifetimes, a home price decline like the one that happened then had never happened before. It’s simply not a regular occurrence”

apparently you are not a student of history, i bought in 1991 because i fell for the “they can build more land, interest rates will never be this low (9% and had to buy points to get that) again and buy now or be priced out forever” argument. i paid $180K and when the smoke settled on that crash the neighbors foreclose sold for $115K…..i was upside down till 2000

boom bust is the very nature of california realestate.

Here’s what I don’t get. Why would people who believe in the sustainability of this market even be on a skeptical blog such as this in the first place? Just for the hell of it? I don’t buy that. Something doesn’t add up.

@HC

My bet is that Dean is still apprehensive about his recent RE purchase (a few months ago). He probably returns to this board seeking justification and vindication for his purchase.

Great post! Here is my version with slightly different charts. And yes, I warned Yun and Bob Shiller about this over a year ago.

https://confoundedinterest23.wordpress.com/2016/03/08/bubblicious-nars-yun-admits-that-home-prices-are-growing-faster-than-wages/

When one of the heads of the sell side cautions about prices becoming unaffordable, he’s really worried that investor money in real estate is drying up. Owners should be upset at his flip flopping narrative potentially damage the value of their recent purchase.

based upon the RENT for neighborhood, its only worth $288,707. (rents gotta cover the mortgage, right?)

Please start commenting on the bullshit market in and around Boston, where a shitty old single-family in a good school district starts at $750K. My wife and I have a combined income of over $200K, soon to be over $250K, and we can’t afford anything that isn’t a pile of crap.

If you will be making a combined $250K, then you should be able to easily afford a $1M house. $1M is 33% more than $750K (the starting point you mentioned), and should get you out of the “shitty old single family†category of house.

With $250K down (which you should have if you are smart with your money and have been previously earning $200K+/year), your mortgage amount would be $750K. 4% interest rate, 1.25% property tax rate, and your mortgage is $4,622/month. Insurance is a few hundred more per year.

If you will soon be earning $250K/month, your pre-tax income is $20,833/month. Even if you pay 33% in taxes, you’re earning $13,750/month. You should have no issue affording a $4,622/month mortgage.

In summary, I’m not sure what the fuss is about. You clearly can (or should be able to) afford a decent house in Boston.

Now if you were complaining about having to live in Boston, I would understand. I visited somewhat recently, and that was enough. I’d probably stop by again if I were in the area.

The guy I work for makes $150k a year, maybe $175k, and he’s in a $1m+ house. You should see the house! Only standing up because the termites are holding hands! Nah, not that bad, no termites, but tons and tons of maintenance that should have been done years ago, not done. They had a bathroom “blow up” and the guy had to rebuild it, just got their kitchen done …. no wait … Sears Home Improvement …. kitchen projected to be done in another month or three … back fences falling down, garage door dated back to Brady Bunch days, paint falling off …. at least these people have $0 savings because the house consumes money faster than a Hollywood heroin addict.

Btw, I was looking at a Great Schools map for Boston, and excepting a (very small) handful of elementary schools and charter schools rated 8 or above, the schools in Boston generally suck. Many of them are rated 4 and below- (pretty awful). There are a (very) few schools rated 6 and 7, but I generally wouldn’t want my kid going to a school with less than an 8 rating.

So I don’t think it really matters what you pay in Boston- you’re not going to get a good elementary school, a good junior high, and a good high school in any Boston locale. If you want good schools for your kid from K-12, you’re likely going to have to go the private school route, or maybe charter schools if you’re lucky.

You’re not taking into account: (1) day care for 2 kids, $4K/month. (2) Retirement investing, $1.5K/month. (3) Bills, including health insurance, minimum $1K/month. Not to mention college savings, commuting costs, maintenance on a house, etc. FYI, I have $400K cash. Max I’m willing to buy is $800K with $350K down. For that, I’d get maybe 1500SF of non-shitty housing, maybe with a garage, if I’m lucky. And that would be fine, if I could find it. Sure, I can get more if I spend more. But the whole point of owning is to make my financial situation EASIER in the long term, not to be a debt slave.

Regarding shitty Boston schools – yep, you’re right. That’s why everyone with kids is looking to buy in Newton, Needham, Belmont, Arlington, Lexington, Winchester. All the towns inside of route 128 with decent schools. Where a shit shack sells for $750K (and they used to sell for $500K in 2007). Those towns are no farther than 9 miles from the city, and the commute by car is 45 min at 7am. Public transport isn’t an option because our light rail system is terrible. Trains are infrequent and unreliable, especially in the winter.

You’re right, I did not consider the day care thing. Although, $4K for two kids seems exorbitant- is the day care at Thomas Land or something? Geez!

Also, you’re going to be a debt slave no matter what. Given your combined income, another $200K ($1M vs $800K) for a mortgage might seem worthwhile in the scheme of things if it gets you what you want.

From what you’ve stated, it seems like an accurate assessment of your situation might be that you don’t want to afford a house of your liking because prices seem excessive, not that you can’t necessarily afford one. That being the case, I say welcome to the club. I and many people here seem to be in the same or similar boats as you.

http://www.theatlantic.com/business/archive/2012/02/the-end-of-ownership-why-arent-young-people-buying-more-houses/253750/ http://www.nytimes.com/2014/11/01/opinion/underwriting-the-next-housing-crisis.html?_r=2 http://www.rollingstone.com/politics/news/everything-is-rigged-the-biggest-financial-scandal-yet-20130425

Two separate articles, the 2nd one looks good but me no comprende, like the cartoon though, pigs, nice.

All I understand is DON’T TRUST BANKS.

If you’ve got more IQ than I do and you probably do, read these articles.

The inventory out there in the sub-750k range in metro LA is terrible. Also the narrative that LA is now a renter state is common knowledge among everyone here and people I know are happy and feel wise being renters if they can find something within their means that they like. Should be an interesting spring and summer open house season, I wonder how the realtors and developers will react in an effort to entice more options/better affordability? Or at least change the narrative…sure feels like 2008 all over again with a looming election.

Renting’s the winning strategy when you know a RE tank is coming. Rent and save, and maybe in a year or ten be able to move to one of the places Flyover is always talking about – my only “diss” on the Midwest is the lack of jobs. Other than that, if you’ve got a huge nest egg saved up and can buy a place cash, the Midwest could be great. For one thing, the “ecosystem” is different, there are places with tons and tons of lakes and streams and neat stuff like that, and if you’re not running like mad just to survive, it can be very pleasant.

If I had a way to make a living that wasn’t place-dependent, I’d seriously take Flyover’s advice.

Yes, I know, I barely make a living now, at $10/k a year in glorious “silly-con valley” but if I were to pack up a bindle and hitch-hike out to the Midwest now, I’d be homeless and have to live in a hobo camp or something; it would be a step down. But if I can get something going that’s online and so people can’t tell where I really am, I’d be silly to stay where I am, where life is a caste system.

The housing market is broken, and there are going to be more unfortunate victims of this latest echo-bubble. When you have interest-only loans rearing their ugly head again, you know the sell-side establishment is gasping for air.

Here in Texas, things are getting very interesting as those homes priced at the margin go sitting without a bit. Sure, nice homes are still seeing demand, but the fluff is now being seen for what it is. The new home construction market is getting clipped because prices are simply too high, particularly when you consider we have some of the highest property taxes in the nation. Any savvy buyer who understands the market can discern that the sticker price on a new home is an inflated work of fiction that will eventually revert to the mean.

http://aaronlayman.com/2016/03/katy-texas-west-houston-real-estate-market-february-2016/

Here’s how to fix it: Once Bernie’s in the White House, he changes the law to utterly outlaw property ownership by non-citizens. Nationalize all foreign-owned property, and allocate it to people who need a place to work and live.

I have to say I am sitting on the sidelines PRAYING for home prices to drop. I as approved for a home loan in 2012, but couldn’t get an accepted offer. The cash buyers got it every time. Now, I am sitting in a rental for $1400/mo. hoping that the owner doesn’t raise my rent (there was just a $250 HOA increase that I am fairly certain the owner won’t absorb). There is NO WHERE to rent below $1800 in my area. I make 80k salary per year and feel broke as a joke.

Renters are being taken advantage of big time. People can’t buy because who has $100k saved up for a home and even if one does have that much money saved up, who wants to buy a 1100 square foot home for 500k? In my area, prices aren’t 750k-850k but more around 450-500k. But still, that is a serious investment for a house that is usually about 70 years old.

The median income in the area is about 71k. How are people supposed to be able to afford 1800 bucks for an apartment or 2600 for a house? It is just insane. I can’t not see a correction coming.

I told my mom that I am going to build a sun room off her backyard and live in the thing.

I hope a recession hits soon and hits real estate hard.

Poor in San Diego, I am in your exact same shoes! My husband and I both have stable jobs, credit scores over 800, and a healthy down payment. In 2012 we submitted numrous offers, none of which were accepted. They all went to cash buyers. Now we don’t feel comfortable buying at these exorbitant prices. Just like many others, we’re just hoping there is a correction in prices. But whow knows if and when it’ll happen.

I have been seeing “I hope we have a huge recession soon” smattered all over this blog lately. Be careful what you wish for. With recessions come massive job losses. If you have no paycheck, it doesn’t matter how cheap RE is. I don’t see it playing out any differently than last time, cash and connected will get the deals.

“If you have no paycheck, it doesn’t matter how cheap RE is.â€

It definitely does matter how cheap real estate is. If it gets ridiculously cheap (which it wont, but I can dream), I’m guessing many of us would be cash buyers. It seems like a number of people here have $150K to $200K+ down payment funds.

“I don’t see it playing out any differently than last time, cash and connected will get the deals.â€

I’ve seen this stated here many times (probably many times by you; I can’t remember). This is true to an extent, but that doesn’t mean that a non-connected, non-cash buyer can’t buy a house at a great price.

I know multiple people (including me) who bought houses in the 2009-2012 timeframe without being “connected,†and without buying in cash. Maybe they didn’t get quite as good of a deal as a cash buyer, but they all got a steal compared to 2006 prices. As I’ve mentioned multiple previous times, I was also poised to buy again in the 2011-2012 time frame, but backed out of several deals where I could have made a purchase (I only had 20% down, and I wasn’t a cash buyer). I’m kicking myself now, of course, but I’m patient and will wait for the next opportunity to try again.

Whut Lord Blankfein said. Recessions are when your neighbor loses his job, when you lose yours it’s a depression and there’s a good chance you will indeed lose yours.

What we need is what I mentioned above, a ban at the federal level of foreigners owning property in the US and the nationalization of foreign-owned property, to be allocated to US citizens who need it to live in and work in.

Responder, unless you are very wealthy, you won’t be buying a house if you lose your job during the next downturn. I’m constantly reminded here of the holding cost of owning a house even if you have no mortgage. Not to mention all the other necessities of life…food, insurance, health care, cars, gasoline, kids, iphones, 500 tv channels, etc.

There is no doubt you can buy a decent house if you aren’t all cash or connected, I did too a few years ago. However, if you want the smoking deals…you better show up with suitcase full of cash or have some serious connections.

Some FHA appraisers come in 10% of more below the agreed upon panic price, so what happens then?

Seller lowers price, or buyer covers the difference, or combination of the two.

In most parts of the country, when an appraisal comes in low, the seller would likely bring the price down to appraisal value. However, in LA (or Silicon Valley), if an appraisal comes in low the seller isn’t likely to come down on the price. Now you are out $500-600 for an appraisal PLUS $300-500 for inspections. I’ve been there and done that, this is a true story.

When a good tech job comes up in an affordable part of the country, we are out of here. This market is a bunch of silliness. I agree with this posting, why pay taxes on a million property when your neighbors are only paying on $200k. That’s California for you though, protecting the wealthy home owners and burdening the rest of us with high taxes on our salary and crazy sales tax.

There are some houses and condos sitting on the market in LA, these homes appraised for too low. Believe me, the greedy seller doesn’t care if you are out $1k for the above mentioned fees. No $ lost on the seller’s behalf.

Sick of greed,

You talk of greed on the seller part. What about greed on the buyer part? When you covet what belongs to another isn’t that greed? If you, as a buyer, are not greedy, why do you want to own? Why not rent?

There is no right to ownership in the Constitution.

Flyover- I was simply responding to what Ira asked since the other answer given was not applicable to the anomaly of the LA/Silicon Valley market. The reality is that this market is out of control and buyers get burned by the loss of $1k (inspection and appraisal $). I’m actually VERY happy that we lost that $1k, because we won’t have the noose of a soon to be upside down property hanging around our necks.

This market is going to crash. It’s simply not sustainable and BTW I have done extensive amounts of research on the hot California housing markets.

By the way, if you read the rest of my response, you would see that I plan to leave this state. Between the insane market and this not being the right culture fit, we are out as soon as the right job opportunity pops up back east. People in executive level jobs have to do their time at a job before they can leave and not have to repay a relocation benefit.

Home builder Hovnanian announced Wednesday it would exit the market, calling it “frothy†and saying that prices for land in the Bay Area are “lofty, almost speculative.â€

Oops, here’s the URL: http://www.marketwatch.com/story/why-a-major-home-builder-is-giving-up-on-san-francisco-2016-03-09

That’s ridiculous! They’re not making any more land(tm)

I remember thinking when prices fell to pennies on the dollar of last sold sale price in the middle of the last “collapse” before money printing of an amount enough to pay for all the mortgage debt twice, on the taxpayers, and before front running insiders and brokers and politically correct bribe paying corporations bought the “distressed” housings at those prices, that all houses seemed to be falling to a price of 25,000 dollars with the least desirable getting there first, o happy days…….now, i wonder about fascists……or NSA frame ups of the dissidents who wrote up agitations to internet sites as replies that were never shown anywhere but on their personal computer , and in NSA saved files, but like a great placebo, made them feel as if something was getting done and well, stung, into the for profit, private prison slave system, anytime the fascists and their toadie goons and enforcers say so …….and more looted high value properties…..ye haw….sorta like that….thanks to democraps and republiturds, and like a good oligarch government, Trumpie would execute Snowden as a treasoner, for telling this truth as warning…..ha ha ha ha……..suckers…………dissidents ..the majority killed in the grand Soviet…..we become our enemies…..propaganda for higher prices…ye haw….

What nearly a million dollars ($975,000) buys in Pasadena: https://www.redfin.com/CA/Pasadena/639-S-Los-Robles-Ave-91106/home/7188886

Described as a “Fixer with great investment potential.”

Good god, that thing needs a bulldozer.

Don’t you live in Santa Monica? If you’re looking at Pasadena properties, I’m assuming you might want to move there… Why would you want to move to Pasadena from Santa Monica? I can see some negligible benefits like slightly less traffic and slightly cheaper housing, but the relatively awful weather in Pasadena would seem like a deal breaker to me.

I live in a 690 sq ft condo in Santa Monica. Not very big. No washer/dryer in the unit. Only a community washer/dryer on each floor. Paper thin walls.

Yes, the location is good. I can see the beach from my balcony. But the building itself is pretty crappy. Old. Originally built as a rental, then converted to condos in the 1970s.

I want to live in a house. Decent houses are too expensive in Santa Monica, so I’ve been looking in Pasadena and Woodland Hills. I’ve also flown up to Seattle a few times. I hate hot and sunny. I love cloudy and rainy.

Ah, gotcha. Well, hot and sunny is pretty much what Pasadena is for 6 to 8 months out of the year!

Seattle has been really nice almost every time I’ve been there, even in the winter surprisingly. My wife and I have also talked about moving there (she’s originally from the area). I also dislike hot and sunny, but I don’t think I could deal with the rain/cold of Seattle (sort of a pick your poison situation); I have a feeling that the rain/cold would really wear on me after a year or two. At least with hot and sunny (as long as its 90 or below or so), you can put on some sunscreen, get a cold drink, and enjoy yourself. Not much (enjoyable) you can do outside with cold and rain… Just my opinion, of course.

Son – I’m guessing you can *see* the beach, but only actually get to *go* there once ever 2 years on average, because you’re working 60+ hours a week to survive.

That’s an $80-125k property in flyover country. It could probably be restored to it’s former glory, but who wants Des Moines flavoring in fabulous sunny SoCal?

High price, however, did you see the land size? 0.27 acres. That is probably a land value price. The neighborhood is decent as I recall, in that area South of the 210.

I lived most of my life in Santa Monica but moved into Pasadena to live with my girlfriend in 2011, prior to buying a home. Here is my take on Pasadena – if you are not concerned with living close to the beach and dont have to drive through downtown every day going to/from work (i.e dont work on the Westside) it is a nice place to live. For myself, as a life long resident of SM and avid bodysurfer – living in Pasadena the rest of my life with its terrible commutes through downtown LA to get to and from the westside and the beach was untenable.

You could learn to SUP and drive to Pyramid orCastaic Lake instead of the beach. Or Silverwood or Perris.

South Pasadena, (91030 zip) is even crazier..

you can list a home for whatever the fuck you want.

doesn’t mean anyone will buy it at that price.

for example, buyers in the UK are sitting out the bubble.

the real problem here are the inventory of the housing and less land to built additional houses so don’t believe that the housing market will tank hard soon

The bottom line is the underlying economy! If the global economic headwinds continue, housing will get hit! We already have statistics showing that large investors that bolstered the post-mortgage crisis housing market are leaving, and given China’s predicament, the supply of rich buyers from there, will also wane! If there is no significant turn-around in our economic future, it will be a catch-22 downwards. Stagnant wages, commoditized labor, technology, and intense competition, will conspire to erode demand, prosperity, and the value of assets including real estate! It all hinges on the fate of global economies and the ensuing ability of large masses to prosper!

With the global economy taking a dump, it’s only a matter of time before majority of people get spooked and pull out.

Renting isn’t that bad. Id rather keep saving money than own a home at the record highs (and take a loss if I outgrow it in 4yrs).

Have u guys seen this one on flippers? High concentration of flipper is bad, and L.A. is infested with flippers. I think they’re at their final stage though. They’re advertising on the radio to sell their “system” of flipping.

http://mobile.reuters.com/article/idUSKCN0W50CT

you know,….i think Ridley Scott was quite prescient. If things don’t change, and soon…., politically, socially and economically, LA (and every other megalopolis) may very well become what those scenes from the movie ‘Blade Runner’ depict………decrepit buildings and infrastructure, society filled to the gills w/ poor citizens, migrants, raging crime, and black market economics for the 99.9%

Meanwhile, the oligarchic 1%, who reside in opulence in their megatowers of mamon, will become even richer, whilst creating AI, advanced robotics, and, maybe, even ‘Replacants’ just to fuck with the rest of us!

“movie ‘Blade Runner’ depict”

Yes, we are getting to be Blade Runner society, but even more prescient is the Arnold movie,” Running Man”, where a game show host (Richard Dawson) has more power than the govt. Now let’s look at Trump. A game show host possibly to be our next Pres. This is even beyond Phillip K. Dick’s vision. We are living a 1960’s-type, satirical-farcical novel, that has actually come to fruition in 2016.

You want a job serf….well then..forget all about obtaining a home of your own…..here’s your ticket to prosperity…..a one-way transit to the mining camps in the outer worlds!

An old co-worker is trying to get me to work for a major energy company, like we used to when I worked with him for a company in Alaska. This time its in Birmingham, AL. And while I normally don’t entertain offers from out of state (although moving back to Alaska just for the real estate deals to be had since oil prices tanked, let alone family, homesick, etc…)

Anyways, though this contrast was nice.

What you can get in Irvine for $600k

http://www.zillow.com/homes/for_sale/Irvine-CA/fsba,fsbo,fore_lt/pmf_pt/2099409018_zpid/52650_rid/550000-600000_price/1989-2170_mp/any_days/globalrelevanceex_sort/33.697958,-117.736058,33.637025,-117.824636_rect/13_zm/

Birmingham (and for $100k less)

http://www.zillow.com/homedetails/3521-Chickering-Cir-Birmingham-AL-35242/184166_zpid/?view=public

I thought Birmingham, AL was a shithole consumed with crime and poverty mostly due to the huge drug trade there. Large portion of the residents live below the nat. poverty level, in fact AL is the 6th poorest state in the nation.

Yeah, you usually get what you pay for one way or the other. Either it’s out in the boonies in a flyover state with nothing to do, the location has terrible weather, terrible schools, and/or is in a crime-ridden area.

Reading through the post on this site and the expensive crap shacks then how does anyone afford to live in LA.

I am not from CA. So bear that in mind.

I read the poverty level in LA is 22%. Also 1 in 5 children in CA live in poverty. Where do these people live? Poverty level for the entire state of CA is 14%. So does the high house prices attract poverty? Confusing to say the least. Maybe all the crap shacks are near the ocean?

Birmingham does have a poverty level of 23% while the poverty level for the entire state is 7.3%. It is on par with CA.

I infrequently traveled to Birmingham for business in the previous decade and discovered that it’s generally a very nice town with many decent looking communities. There are probably bad spots like anywhere, but frankly didn’t come across the sort of undesirable pretentiousness so common to L.A. for which the aforementioned judgements of a place like Birmingham serve as a stark example.

If you think you can rent that house for $2450 you have not tried to rent recently.

The house is listed as “pending” which makes me think it got a cash offer. You have to understand what is happening in Culver City to understand the price changes in a few short years. The area where this house is located was dilapidated just a few years ago. Today it is a hot spot, with dozens of great restaurants, galleries, and in a few days a new, very hop shopping center called Platform. That’s all in walking distance of this home, as is the increasingly fantastic downtown Culver City. These homes come with an amenity you can’t see in the listing photos: An excellent, free public school education from K – 12 in Culver City’s independent school system. I realize people pay a lot to live in LA and it can seem ridiculous to outsiders, but folks, people aren’t stupid. They pay for these homes because they see a value there. This house is in an absolutely great location and is on a full-sized lot. You can build onto this house and have a $2 million property on your hands.

I bought my own home in Culver City in 2012 for $770,000; I could easily sell it for between $1.2 m and $1.3 m. But I wont sell it, because I can’t imagine a better place on earth to live. Seriously.

One reason Culver City — and Santa Monica, and Pasadena — are desirable is because they’re separate cities rather than part of Los Angeles. So in general, city services — schools, police, street maintenance — are better. You see the difference as you drive up Lincoln Blvd and leave Venice (Los Angeles) for Santa Monica. The streets become new and pothole-free.

That’s true in general. For some reason, Pasadena, for all its wealth, has very low-ranked schools.

However, these amenities come at a price — expensive city employees, with their looming health & pension bubbles.

From what I’ve read, Culver City and Thousand Oaks are two SoCal cities with especially dire city employee benefits bubbles looming in the future. Which means big future tax increases for Culver City, including on property.

Real estate can always be hit with “parcel taxes” because they’re not considered “property taxes” and are exempt from Prop 13 limitations. Every few years, Santa Monica hits us with another parcel tax, usually “for the children.”

On parcel taxes and Prop 13: http://lvtfan.typepad.com/lvtfans_blog/2010/02/proposition-13-and-parcel-taxes.html

I’m well acquainted with Culver City. It didn’t gain orders of magnitude of real value in the past few years, although the home prices have. Dining and shopping are not a foundational input. You have a point on the schools, although the degree of influence is debatable. Many people succumb to heavily mortgaging into a decent public school education in SoCal but Culver City schools didn’t suddenly go from good to a multiple thereof in the span of the past few years either.

If you amortize the additional cost of a Culver City home (versus someplace cheaper) over all those “hot spot” restaurants you’re going to each night the meals are rather quite expensive. 😉

I like Culver City a lot. In fact I was considering moving there last year before eventually deciding to leave LA altogether. I remember when Culver city was all industrial and factories 20-30 years ago. My problem with Culver City today is that I have experienced some of the worst traffic ever on more then one occasion while driving through Culver City. The past few times we went to see a movie in Culver we arrived over an hour early only too find the theater sold out. It is just too densely populated. I got tired of waiting for anything and everything.

Hunan, u got it right about traffic. Terrible. Then there’s parking, or lack thereof. The movie theater is ok, not amazing.

Not all of SoCal is expensive. Riverside, Temecula, etc etc. Dirt cheap!

Excellent writing ! I loved the points – Does anyone know where my business could possibly get ahold of a template CAR RLA version to work with ?

Hello XXX , my work colleague came accross a sample CAR RLA form with this link

http://goo.gl/Wc9XWELeave a Reply