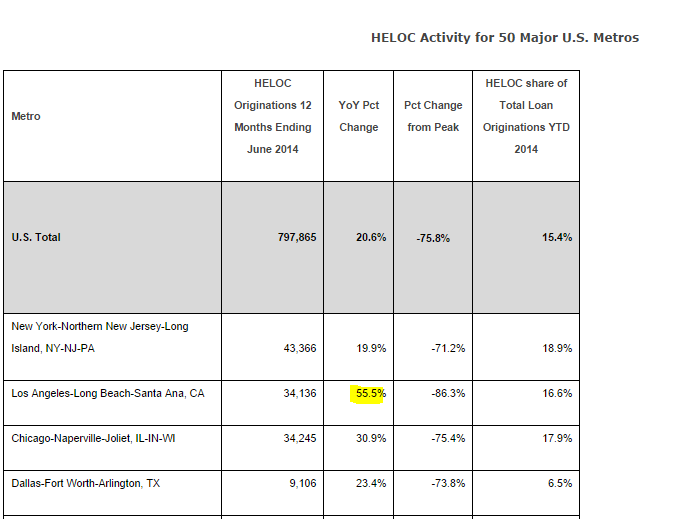

Home ATM is open for business again: Home equity lines of credit up 21 percent from last year. Up 55 percent in the Los Angeles and Orange County metro areas.

I love the antiquated notion that most people buy their homes to live in forever. To setup roots. But the underlying reality is very different. Most people stay in their home for 7 to 10 years. In places like California, a first home purchase is considered a “starter†home until you property ladder your way up to your dream home. We recently noted that Los Angeles and Orange County are the most overpriced rental markets based on local wages and employment prospects. People live beyond their means to different degrees. So it is no surprise that recent home equity line of credit (HELOC) data shows that HELOCs surged 21 percent year-over-year. Not at all surprising, HELOCs for the Los Angeles and Orange County metro areas jumped 55 percent. We barely have one manic year of prices and all of sudden homeowners are ready to tap out their equity. Setting roots? More like leveraging your way into a life built on debt that crumbles once the next recession hits.

The HELOC is back

It comes as no surprise that HELOCs are surging on the back of the strong surge in home prices in 2013. People are quick to tap out equity to purchase goodies. In a #YoLo economy, debt is the passport to consumer delight. The only problem is that people are already leveraged to the hilt in a variety of different ways. You have people buying or leasing cars way beyond their means. Younger people are leveraged to the max with student loans and as a consequence, many are finding it necessary to move back home with mom and dad after school is done. And with one year of gains, many homeowners are simply itching to tap out some of that juicy home equity.

Take a look at this data:

Source: RealtyTrac

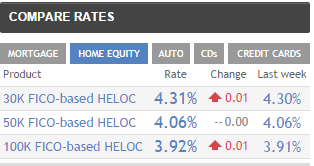

HELOcs are up nearly 21 percent nationwide. Yet in the LA/OC metro areas they are up 55 percent. Keep in mind that when you tap out equity, you are essentially locking in more debt secured by your home. Say for example this is your situation. You purchase a home for $300,000 and the home is now worth $500,000. You tap out $50,000. That $50,000 does not come for free. Take a look at some current rates:

All you are getting is essentially a low rate loan. You are also tacking on more debt onto a home which longer term, means you are going to pay more for that home. You can see from the data that if you give people the chance to go into massive debt, they will jump right in.

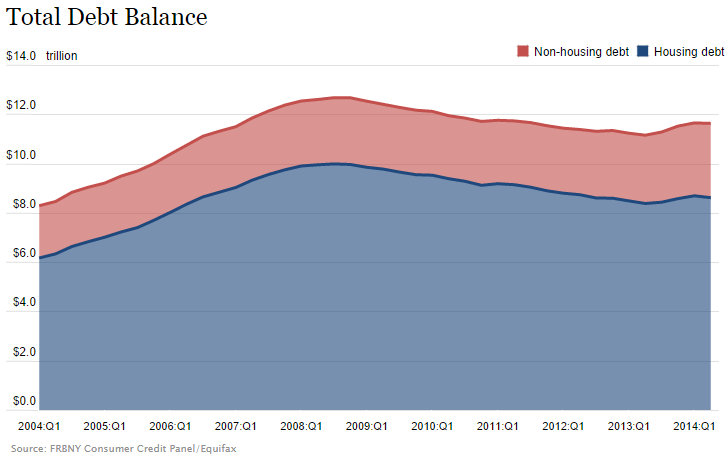

Take a look at total debt here:

2004

Non-housing debt:Â Â Â Â Â Â Â Â Â $2.12 trillion

Housing debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6.17 trillion

2014

Non-housing debt:Â Â Â Â Â Â Â Â Â $3.02 trillion

Housing debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $8.62 trillion

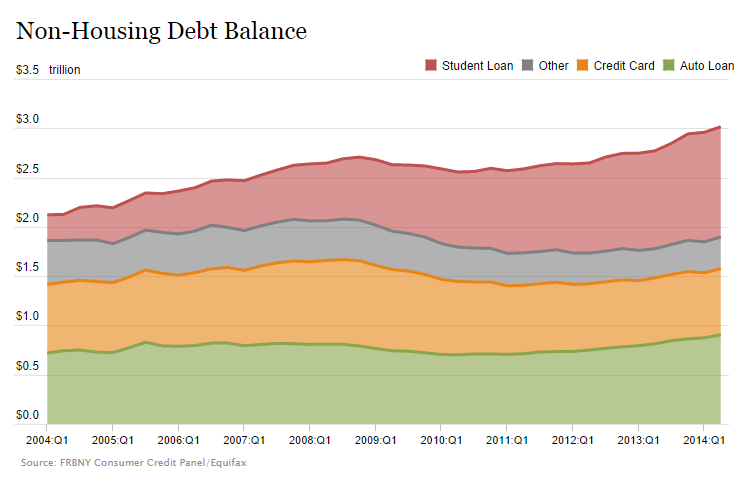

But then, when you look at where the growth in non-housing debt came from, it was largely with student debt and auto debt:

Student loan debt in the latest report is at $1.12 trillion (versus $260 billion back in 2014 2004). That is a massive jump in 10 years and of course is hindering the first time buyer market dramatically. That is why we have a big trend to more households becoming renters.

The HELOC jump is interesting because it shows how quickly people forget the past and how deeply ingrained our spending habits are in the US. We are addicted to debt. People are willing to leverage to the hilt for a crap shack but are less willing to invest over a long period of time. Part of this is simply human nature. Part of this is simply the mindset of current participants in the market. The fact that HELOC usage has jumped so quickly in the last year tells you that many believe the party is here to stay. As you are seeing with the return of volatility in the stock market, things can reverse quickly. Just take a look at the iShares Dow Jones US Home Construction ETF:

The index is down over 11 percent for the year (it was up 19 percent for 2013). Of course those tapping out HELOCs are basically betting that the momentum in housing is going to continue for a good amount of time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

119 Responses to “Home ATM is open for business again: Home equity lines of credit up 21 percent from last year. Up 55 percent in the Los Angeles and Orange County metro areas.”

Where’s that clown from Texas that used to come on this site and brag about how wonderful things were in Texas, and how everyone–especially those priced out by California’s high housing costs–should move there from California?

I wonder how he squares his point of view with the incompetence and ignorance apparently demonstrated at the Texas hospital where the ebola outbreak has taken place?

Concerned….What is puzzling, Texas is calling for a state of emergency. Many people in the state died of flu virus, how come no state of emergency called for the flu?

More well-paying job losses for Westside/SF Valley/Burbank — first Sony, then Dreamworks, then TBS/CNN, now Warner Bros. Business is tanking overseas now with the dollar surging after years of gravy train. Time for cutbacks. This sucks money out of the local economy. Doesn’t matter how low interest rates go, if you don’t have a job, you can’t get a mortgage. Watch for continued M-o-M SFH price decreases.

Here’s an eighth grade math problem for all you geniuses out there:

House prices are up 7% from a year ago. Prices start falling at a rate of 1% per month. How many months does it take before prices are negative Y-o-Y?

The winner gets a blue ribbon.

@prices falling, “House prices are up 7% from a year ago…”

There you go 🙂

The mortality rate for Ebola is between 50% and 70% . The mortality rate for the flu is 0.05% Mostly the elderly and immune compromised. Thus the concern. Millions of people get the flu and recover.

“House prices are up 7% from a year ago. Prices start falling at a rate of 1% per month. How many months does it take before prices are negative Y-o-Y?”

It actually can’t be determined from the data. If you’re setting to a 100% index, it takes about 6.5 months to drop to that point. But Y-O-Y comps are tied to a specific month, and we don’t have baseline data (or even a rate of growth to impute monthly data) for any of those other months prior to peak.

Can you imagine how many houses will be available when all those texasees die from Ebola? Ebola all the way, moar inventory!!! Moar housing to tank hard in 2014

/sarc, just for those who didn’t get it 🙁

hey Seattle Dude, here are some new figures just in. At the time I am writing this post there are 22 comments on this board. 8 of them are by you. That’s 36.36% — too many. Now shut the f-ck up and listen to what other people have to say. You’ll learn moar that way.

It is interesting how people who have nothing to say start to insult other who try to make any sense. Call others stupid, racist, sexist, antisemite, etc, tell the one to f.. off or shut up. The thing is, some have trouble accepting the truth or a reality as a whole or use their brain… How about to man up and, at least, post under your own name…

@quiet please, make sure you take your meds before you go to bed tonight 🙂

@Seattle Dude, what is your point?

Apples and oranges friend. What does that have to do with the price of tea in china?

Now, the Ebola in Texas is due to the incompetence of that boy in the White House. The four horsemen of the apocalypse are here and that boy just doesn’t know what to do. Thirty one countries have put an embargo on visitors from some African countries, but not that boy in the White House. I live near Kerrville, where Kinky Friedman lives, so we are out of the line of fire. LAX should get their share of the Ebola visitors, coming to America for a better life. Gov Moonbeam should welcome them in.

“that boy in the White House.”

Truly idiotic, racist thing to say. You guys want a border fence? Fine, only make it around the whole of Texas.

Tommy boy, we would like to go back and be a Republic again. But then where would all the California refugees go? The normal health protocol, as implemented by 31 other countries, is to embargo and quarantine. But I understand Tommy, that you are in the “politically correct ” crowd, like President Obola. The four horsemen of the apocalypse have arrived and you are afraid and just don’t know what to do.

According to Housesnap weekly update, home sales have ceased and inventory is building up in parts of SoCal. The stock market has crashed, and the EU is in recession, and the Chinese rich are staying home.

Tex…”that boy” I’m no fan of the President , but your characterization well lets say that is why I tell people be careful where you relocate to, house prices shoudn’t be the only driving force in your decision?

Calling the President “Boy” just diminishes anything you have to say. If you can’t discuss problems on an adult and intelligent level perhaps you should realize you don’t have anything to add to the conversation. Remember, it’s better to keep quiet and have people wonder if you’re an idiot than to open your mouth and remove all doubt.

Tex…Your take to Thomas has nothing to do with the disparging comment?

http://familiesusa.org/product/truth-about-budget-cuts

‘Tex…â€that boy†I’m no fan of the President , but your characterization well lets say that is why I tell people be careful where you relocate to, house prices shoudn’t be the only driving force in your decision?’

Yep. Agreed. I’m also no fan of Obama.

Nonetheless, we can designate Tex’s comment “Exhibit 2” (in addition to the ebola handling incompetence) as to why his state is a $hithole. A cheaper place to live, yes. But still a $hithole. Populated by redneck $hitkickers like ‘ole Tex here.

Um,

The incompetence is in Washington DC and Maryland, not Texas. It seems incompetence and high real estate prices go hand-in-hand.

No incompetence in Texas, huh?

Then why did the Texas hospital first turn away Duncan after he showed symptoms of the virus??

Also, why have they screwed up (judging from two infected health care workers that took care of Duncan) at least twice in following protocols?

How do you know whether there was incompetence and ignorance demonstrated at the Texas hospital where the ebola outbreak has taken place? Why are you blaming the nurses and other healthcare workers who never expected to encounter a disease that is endemic to West Africa? Many countries have banned flights from West Africa including England and France. Not only has the Obama administration allowed flights from West Africa to continue to enter the U.S., but he appointed a lawyer and a political hack with no healthcare experience to be the Ebola czar. If there is any incompetence and ignorance, it’s with the current administration whose open border policies has allowed Ebola to enter into this country!

As far as SoCal real estate, we’re cautious in the short term and bullish in the long term.

Boomers are spoiled and their kids and grandkids are paying for it

No, no, no! The Boomers on this board didn’t draft dodge the Vietnam war, they didn’t inhale, they didn’t buy into Reagan’s crap, they weren’t at all into conspicuous consumption, they weren’t part of “free love” or “drug culture,” they didn’t raise latchkey kids, they didn’t buy into Clinton’s crap, they didn’t HELOC, they never worked for the .gov, they were against social security until they relied on it for their primary source of retirement income, they didn’t popularize fast food, they aren’t fat, they didn’t wear bell bottoms or turtle necks in summer or leisure suits or platform shoes or disco to the Bee Gees, they started working at age 12 and never took a dime of .gov money, they were anti-union even when they were represented by one, they didn’t vote for prop 13 just because it benefited them to the detriment of future generations, they didn’t ignore global warming until they denied it, they totally, totally deserved the low cost health care and college they were afforded…today’s kids don’t, they saved prudently for retirement, and they certainly, most definitely, aren’t “I got mine, screw you” peeps. No sireee!

DFresh, that’s quite a rant.

As it happens, I’m a late Boomer, so I didn’t dodge any drafts. I was too young for the draft.

I never did any drugs. No smoking of tobacco or weed. I’ve never been a drinker. I only have a drink once or twice a year. No drink at all in 2014 so far. My most recent drink was some 15 months ago, while visiting a friend in New York.

I’ve always been frugal. No conspicuous consumption here. I bought a car in 1992, and it was my sole car until 2006. I’d have kept it longer — great car — but it was totaled on the freeway.

I bought another car in 2006, and still drive it.

I wear clothes until it wears out. I don’t replace electronic equipment (DVD players, TVs, etc.) until they break down. I bought a TV in 1987, and it was my sole TV for nearly 20 years. Only after it broke did I buy one of those new, flat-screen TVs.

I don’t eat at fast food places. Haven’t since the 1980s. I’m not fat. I only dine out about once a month, and then only in a family diner.

Never worked for .gov.

So, much of your praise of Boomers, albeit sarcastic, does actually apply to me. Don’t blame me for this financial mess.

Yes, I did vote for Reagan in 1984. I’d do it again. Never voted for Clinton.

Oh yes, I’ve always denied that man has any affect on this alleged global warming. If the earth is getting warming, it’s part of a natural cycle that’s too big for man to affect one way or another.

Excellent comment Son of L.!!!…

I also want to add, I am also one of the last of the late bloomers. I started working when I was 12 years old I saved and saved and purchased real estate because it was safe, & I didn’t want to risk my money in the stock market. However didn’t know that I wasn’t really getting a loan instead I was just being used in a securitization process in which my equity was stolen the day I closed escrow. So I ended up losing everything I worked for since I was 12 years old in the 2008 crash. Unfortunately it wasn’t in Southern California so I have had no recovery yet. I also drive a vehicle that I purchased in 2004 and paid off and still drive I take very good care of it. & I still love it. I also wear my clothes not only until they fall apart but even then when I patch them up sewl on buttons and mend repairs I still wear them. And I make them look good too. I don’t drink and not because I can’t I just don’t like it, I work every day, and never worked for the government. By the way it was Clinton who signed the 1999 banking and Modernization Act that destroyed glass-steagall that prevented depository banks and brokerages from becoming one in the same and destroying the protections that the previous Americans enjoyed since early 1930. Yeah it was Clinton that did that. and then it was George Bush who let the 2005 Consumer Protection Act and bankruptcy reform act Pass that destroyed a judge’s ability to force the lender to take current market value for the house in a protection bankruptcy case. If that had not changed in 2005, when the crash hit in 2008 all the people that lost their homes because they were deeply underwater would have been able to save their homes in bankruptcy, thus saving the economy from the crash. And the homeowners would have benefited from their homes that they purchased as opposed to the banks. It doesn’t matter whether it’s a Republican or a Democrat they all work for the banks! Everyone needs to read all the Presidents bankers so they can have their eyes opened as to why we’re in the situation we are in. Student loans is just the latest government scam and it can never be discharged. They will be slaves forever. I know people that owe more on their student loan from 30 years ago then when they took the freaking loans out to begin with! It all comes down to monetary policy. Until people understand that the rest is all just dressing.

Hahaha you crack me up

Tell that to a homeless Vietnam vet or to any of the other millions of boomers living in poverty, it may not go over so well.

All those Facebook, Apple , Twitter and the like, employees , racking in big bucks don’t look to be boomers.

Just what survey are you using to determine the younger generation is not spoiled and the older generation is?

My brain says your statement is very probably true but has nothing to do with age group.

Hmmmm… a new round of foreclosures seems to be in the works down the road?

I thought we ran out of all foreclosures completely, thanks to the rekovereee no one is underwater now… Something fishy is going on with the news (fox, abc, msnbc, msn, yahoo, cnn, etc) lately!

Got equity?

… Take a look at the NEW “low doc” or “no doc” LOANS

These are now called ” ALT – QM ” Loans. (Los Angeles Times Bus Section,10/12/2014)

*** ( “Re- Gifting” ) Different GIFT WRAPPING … SAME CRAP INSIDE.***

New mortgage applications are at 5 months high as mortgage rates keep falling. Watch the stocks rebound in the next couple of weeks. The show must go on, interest rates to tank hard in 2014, housing to tank hard in 2016.

So an increase of 0.2% is significant? Stop being a shill. The truth will set you free.

http://www.housingwire.com/articles/31657-mortgage-applications-for-new-homes-flat-in-september

Seattle… what makes you think interest rates are going down next year. The feds projection last month showed an increase to 1+ next year and 2+ the following. Seems like the only thing to change that is if job growth cooled down. I know they leaked potentially prolonging QEi just to prop up the market, but nothing on revisions to interest rates.

Forget what the FED says! No significant interest rate increase next year. Too hard to say about 2016 being too far out. Look what is in the FED interest not what they say. What they say is part of the manipulation, same as ECB (they control the market with words).

Mortage debt is very disturbing in this country. It eats up most of a persons take home pay, but to be devils advocate, people in general are not taught at a young age how to manage money.

Many don ‘ t realize what accrue interest is or even don’t know what Interest they are being charged at months end. They do know happy hour, botox, calorie counting etc.

Yes enjoy life to the fullest you only go around once, but being fiscally responsible actually extends your life, no worry about mortages, car leasing can be good for your health, peace of mind means you are rich?

But, but… they told me that a house is an investment, not a liability… I am investing in my future with “forced” savings, right, right???

Poor and stupid prole adults have poor and stupid kids while rich, smart fiscally responsible adults have smaller number of same

It is a very interesting observation. The poorer you are, the moar kids with lower quality of life you usually have, and the richer you are, the fewer kids with higher quality of life you have… It is just the opposite of the natural selection where sick and weak usually die first and the strongest survive…

“versus $260 billion back in 2014”

I believe you meant to write, 2004.

With credit card loans at 15% to 30%, and used cars loans at pretty much that same interest rate, a 4% HELOC can look pretty good to a borrower who doesn’t feel married to his/her home. Still, in a country whose domestic economy is becoming more and more about consignment stores, Dollar Trees, used tire centers and $1 dollar meals, it’s amazing that any bank would extend even more credit to the average debt serf.

Not that is makes a difference…But I’m younger-ish at 35…don’t have a home but a solid job and just a bit of debt (< 14K on college loans)…credit in low 700's.

I got a used car this summer for 15K…and my credit union here in the bay area gave me 2.44% and offered 1.99% if did a direct payment linked to my account.

±2% for an auto loan is easy to get if you know where to look. Two credit unions where I have accounts have had auto loans for years ranging from around 2.5% or less. One of them currently has 1.74% for new or used up to 60 months. That same credit union even has personal loans for 8.25 percent currently.

If anyone is paying 15-30% for any loan, they have terrible credit and/or are getting a loan from the wrong lender.

“With credit card loans at 15% to 30%, and used cars loans at pretty much that same interest rate”

I can get auto loans (new or used) 1.8% from my credit union, up to 72 months. As for credit cards, many companies offering 0% for 15-18 mos, no balance transfer fees.

Funny how the debts move in lockstep, up or down. Bottom line: people are hungry for money and will spend by any means necessary. HELOC, credit card, or 401k loan. My bank offers $10k personal loans for 9.9% now as well.

People shout capitalism but at the same time are desperate to go along with any government program that involves keeping their personal gravy train rolling.

The incomes were pretty much flat for the last 30+ years, where as the GDP was growing. How is it possible that people earn the same or even less, but spend moar every year? There you go, moar debt is what we need to fix “too much debt” issue (as per bernanke, yellen, greenspan)… it is like putting out fire with gasoline…

Got in trouble with too much debt, just borrow moar!!!

Good comments. I’m with you 100% on this. It’s insane. On a micro level, I have friends who are $350K income plus and can’t seem to scrape together enough cash for a vacation, are always refi’ing and taking money out, and are always buying stuff against their home which is probably tear down in a super prime location.

BTW, is “moar” instead of “more” a thing?

Moar is a thing but this guy is way overusing it.

I think, I just use it about right 😉

@a guy from Seattle wrote: “The incomes were pretty much flat…just borrow moar”

That is the whole key. HELOCs are a replacement for income/pay increases that never came. The default rates on HELOCs are so low that these loans are really no-risk for the banks. People will pay the minimum monthly payment on the HELOC all the way to their grave.

HELOCs are essentially early reverse mortgages for the younger crowd.

“How is it possible that people earn the same or even less, but spend moar every year?”

Incomes are flat when adjusted for inflation. Nominal income has been steadily rising.

http://research.stlouisfed.org/fred2/series/MEHOINUSA646N

GDP is up because of the BS accounting measures used to calculate it. It’s every bit as manipulated as the unemployment figures. Also keep in mind population gain impacts the GDP, even if salaries are (roughly) flat.

European countries have just started adding prostitution and drug trafficking estimates to their GDP to keep the figure from going negative.

“I think, I just use it about right ;)”

No, you vastly overuse it.

What? certainly went overboard as well in use of ‘moar’, but at least s/he did it primarily when trolling.

Are “What?” and “Guy from Seattle” one in the same?

About the time “What?” stopped posting, a “Guy From Seattle” showed up and started doing the same stand-up routine as “What?” (i.e. 30 posts per article, not as funny as they think they are, etc.)

Exactly what I was thinking. Same number of posts for every subject, Except ‘Wha’t is much more sarcastic, rude and condescending, whereas Seattle guy thinks he’s onto something by spelling moar like this. They both need and deserve a well-earned break. Take a few weeks off, Seattle, it’ll be good for you.

He-he, I am doing just fine, don’t need any brakes :p

… and I spelled the “brakes” correctly, just for those who wonder :p …

Nope. Whole other peoples…

I still believe they are same guy. So annoying…

Hey, some believe in the tooth fairy but that don’t make it true…

This is actually good news as far as I’m concerned more home debtors going full retard means a greater selection of properties after the bust. There’s a serious dose of reality coming it’ll be hilarious if it happens during an election year again. It took a crash of epic proportions to get a black(ish) guy elected president. Will another just 8 years later be enough to get a l;libertarian elected. If the GOP fails to nominate Rand Paul they deserve a Hillary presidency…

True, on one hand its so frustrating how fucking stupid and mindless people are in succumbing to the housing interests. On the other hand, let the sheep be led to slaughter and that’ll mean more for the rest of us who had some sense of restraint. Of course, the housing interests will claim that big brother Fed will be there to save them again. We’ll see about that.

Rand Paul is not Ron Paul, just want to be clear on that. He is not a true libertarian as Ron Paul was. I would still vote for Rand (in 2012 I was a Ron Paul supperter), since, after Ron Paul is out of the game, he is the best we have left with… 🙁 . If We the sheeple vote Hitlary in, that means this nation gets what it deserves…

… and I despite the both parties…

I actually voted for Ron Paul in 1988 — and had the honor to meet him and shake his hand.

I also cast write-in votes for Paul in 2008 and 2012.

I would vote for Ron Paul – true constitutionalist. If not on ballot I would prefer Ben Carson and if not on ballot then Rand Paul would do (better than Hillary). Rand is a little bit less principled than his dad.

Ditto!

The sad thing is that it, probably, will never happen and Rand doesn’t have a chance (even if I am not a fan of Rand, he is still the best we have…). I wish Ron Paul didn’t leave the politics, but the ages took over…

As far as “We the sheeple” is concerned, the sheeple of the republic will most probably just vote another crook in, just like every election after JFK was murdered… JFK was the last real hero president of the republic…

Texas could be in big trouble and Rand Paul is stupid. He basically believes in 19th century economics which caused the problems in the first place. No government regulation of the housing industry and the guy gets lots of money from the Koch brothers that pushed the US into an oil glut. That is why Texas in 2 years will laid off thousands of guys that are fracking now too much oil. In fact bye bye far right when Texas and North Dakota layoff thousands like they did in the last oil bust in the Libertarians will be a thing of the past. and Nilishists will be crying all over the place will no state income tax means you do good but Texas and North dakota lost thousands of jobs because of the oil bust. In fact Europe is deinfalting which means less oil to sell there too.

Cynthia… Koch brothers, seriously? I’m guessin you will have one of the Hillary bumper stickers soon?

Her husband was the first to pump air in the bubble, followed by congress going along with the mania. Financial institutions, took over, as the secondary mortgage market was created. Market forces finished the job. Yes, government regulations at work!

I’ll take a hybrid republican over the establishment favorite, Jeb Bush, anyday! However, both of the failed liberal/conservative paradigm, want the same thing… big government, more central control. They tell us what we want to hear, then follow their parties agenda.

There’s a lot we can learn from the past… smaller government, fewer taxes, less bureaucracy. More freedom and liberty! You know, all that constitutional stuff you progressives think are outdated concepts.

We have to start shrinking our bloated government, and get them out of our lives.

I’m sure, though, I’m flagellating an expired equine, with your economy destroying sentiments.

Rick I think I’ll have again hope for this country and RE when TSA is abolished, when you walk in the airport freely, when Patriot Act is removed or simply stated to have the Progressives (both red and blue) removed from power.

Till then expect more of the same manipulation, big government and hopelessness for middle class. Too bad the middle class, percentage wise, is king of ignorant of what is happening and vote against their best interests. Cynthia above is a clear representative of the ignorant middle class who votes based on propaganda and brainwashing taking place in public schools and universities.

You forgot to mention the role that left wing Democrats like former Congressman Barney Frank played in the role of the housing collapse by forcing banks to make housing loans to low income buyers with poor credit who would have never qualified for housing loans based on their income levels and credit histories. In a side note, Barney Frank in 1989 admitted a lengthy relationship with a male hooker who ran a bisexual prostitution service out of Frank’s apartment. His indiscretion was so great that his standing in Congress was greatly damaged and a House reprimand passed overwhelmingly in July 1990.

Tell me Cynthia, what exactly is 19th century economics?

Managed economies do not have normal business cycles.

The question is can the fed manage the economy as well as it has going forward. If it can, home buyers are really screwed for decades.

sorry to keep commenting here, but Martin is absolutely correct! The question becomes do we believe theFed can keep the charade going? Or are we going to bet that they fail? It’s a gamble, come on out here to Las Vegas it’s a lot more fun!

I am tired and worried.

So much cash and effort being misallocated.

People printing money that goes to the rich only.

Federal Bank policy destroying fixed income earning so that people are forced to become speculators and ultimately lose their shirts.

People not finding jobs and instead “attending” online schools, getting useless degrees and going further into debt.

The government purposefully undercalculating inflation so it can quietly inflate its debt away while eroding the purchasing power of the common person.

People thinking they can afford to borrow $29,800 on average for a car when the median hourly wage is $24.40 an hour.

A government that works to enrich itself rather than look out for the average citizen.

A whole economic system that thinks Quantitative Easing can save the economy and that fundamentals don’t matter.

The housing market’s distortions are only a symptom of all of these problems. The future looks grimmer than the past and that’s sad. What happened to the USA? How’s it gonna get fixed?

“Quantitative Easing can save the economy and that fundamentals don’t matter.”

Fundamentals matter in a free market economy. What we have in US in the last 100 years since the FED was created is a central planned economy based on manipulation by the FED and for the FED. If you understand this you’ll be good.

You have to learn how this new system works – by the FED and for the FED. Who is in power is irrelevant. Look at any given moment what is in the best interest of the banking cabal owning this private corporation called the FED (as federal as Federal Express), because that is how thing are going to move. Learn how to surf those winds from the FED – the rest is just media noise. What you and I want is wishful thinking. What is important is how things are – if you want to preserve the fruits of your labor. Wishful thinking from lots of the commentators on this blog doesn’t help any.

The FIX is in, and has been for too long! END THE FED.

It seems to me that @Flyover is the only guy on the blog who gets it, besides me and @What?, of course. Like I said on many occasions, fundamentals don’t matter, incomes don’t matter, jobs don’t matter. If you think we will not see price inflation in assets, homes and food because people are broke, then you are very mistaken. The biggest problem of the folks on this blog is that they underestimate the power of the FED. They think we need to pass the election and everything will change. No shit!!! Everything will be just the way it was for the last 30-50 years – rigged. The rich will still get richer, the poor will still get poorer, the middle class will continue to cease to exist, the same crooks will rule the world.

How do I say it? Oh… there you go… Housing not to hard hard for the next 5 years 🙂

@Rick “END THE FED”

Sorry, but not gonna happen… First you need to throw 90% of the government to jail…

ak:

Our much more powerful mother country we defeated

The depression we defeated

Japan sneak attacks us we defeated

polio we defeated

9-11 well the jury is out, enter our woes

Iraq read above

Sub-Prime -Recession read above

Score, 4 we won, three in overtime still no end in sight

Solution better leadership, big question from where do we draw these folks any Winston Churchill’s, Mother Teresa’s, out there?

I think you are absolutely right Robert. It is about better leadership. With our natural resources, abilty to brain-drain the rest of the world to the USA and top research institutions, we should have no problems if we weren’t being sabotaged from the top. The problem is that the masses have been goated into complacency and are not holding our leaders accuntable the way democracy intends.

Robert, we defeated everything but we didn’t defeat the Creature from Jeckyl Island – the FED. That is the most important. The rest is just background noise.

Like the guy from Seattle is saying, to defeat that Beast you have to fire 90% of the government which is in the chains of the Beast. They are not going to give up their gig without the most powerful fight in the universe. What other gig can they find which transfers hundreds of billions per year from the middle class to themselves without doing anything?!????…and then you hear grandma Yellen “crying” for income inequality at the same time promoting the same policies which led to it. It is like me stealing and then crying for the victim.

You have to give credit to that cabal for naming grandpas and grandmas as public figures. They are good at people psychology.

Till that is defeated, expect more of the same.

Regarding people accessing HELOCs, this is exactly what the Fed and PTB want:

1. People use that money to buy goodies. That’s great for the economy and keeps tax coffers filled.

2. More HELOC debt means more interest being paid to TBTF banks…the Fed approves of this big time.

3. More mortgage debt for Joe Six Pack means he needs to be a good worker bee to earn money to repay said debt.

I saw HELOC abuse and cash out refinancing taken to new heights in OC during the oughts. It was mind blowing. “Liberating” 100K per year for several years straight was nothing out of the ordinary…houses were appreciating way more than that. All that money bought cars, vacations, shopping sprees, spa days, etc. And you wonder why the economy was booming back then. Taking equity out of house has its place in some circumstances (emergencies, health issues, potential home remodels, etc). Spending that equity on frivolous crap is just plain stupid.

“…I saw HELOC abuse and cash out refinancing taken to new heights in OC during the oughts. It was mind blowing…”

Welcome to our instant gratification society, in which the manufacture of financial crack cocaine is considered ‘the’ growth industry.

I live in the OC (Irvine) and am absolutely convinced that 90% of the population lives beyond their means to some degree.

Self-abuse ranges from not funding retirement (no contributions to 401(k), etc) to full on masochistic behavior like “liberating” 100K [as noted above].

How can this be? One theory I have is that this 90% carry a very poor self-image and spend money recklessly in hopes someone(s) will “love” them.

In the O.C, fear of rejection is almost primordial. To compensate, that 90% spend, spend, spend in a hopeless self defying death spiral.

I have observed countless examples of individuals overspending. I am sure other readers have too. Kinda sad, actually.

I know people who rent cheap apartments and lease beemers and benz its all hat no cattle

Joe six pack is a debt slave and a wage slave

The best invention of the 20th century was the microwave oven.

The worst invention of the 20th century was the credit card.

Who cares about the future, I want my “Merikan dream” now!!!

America is like the running back who got turned around and is heading in the wrong direction, somebody better tackle this guy before he crosses his own goal line?

Good analogy! However, no one knows how to tackle anymore.

Rick you got that right. I watched the UCLA-AZ State game few weeks ago, ASU I guess practices with bumper cars, they never wrap anybody up, it was embarrassing, but lot of players/ teams don’t know how to tackle anymore.

Housing to tank hard in 2014:

http://www.businessinsider.com/housing-starts-sept-2014-2014-10

I had a wake-up call the other day. A friend who’s 61 and who had been making a very good salary just lost her job. Chances are she’ll never make that much money ever again. She had the foresight to pay off her mortgage and all her debt a few years ago. Now she can live on a very reduced income if she has to. She never expected this to happen so soon and she realizes she could live another thirty years so she’s still worried but at least she knows she can afford to live in her house and still buy food.

Very good Marcia, I sit on a lot of cash but monthly income is okay, but no debt means living well and but watching monthly expenses. Now if it can’t be bought for cash I pass on the purchase.

If she lives in one of those multi mils crap shacks, she can tap into equity to finance her retirement. Just your home as an ATM, spend into the system, increase the home value, rinse, repeat!!!

“I had a wake-up call the other day. A friend who’s 61 and who had been making a very good salary just lost her job. Chances are she’ll never make that much money ever again. She had the foresight to pay off her mortgage and all her debt a few years ago. Now she can live on a very reduced income if she has to. She never expected this to happen so soon and she realizes she could live another thirty years so she’s still worried but at least she knows she can afford to live in her house and still buy food.”

Good post. At 52 myself, I have vowed never to take out another mortgage again. Spouse and I have close to $150K saved. Whereas at one time we considered purchasing investment property, for which this $150K or so would have been a down payment, nowadays we just don’t think it would be prudent. I don’t think it is good for people to depend on borrowed funds for anything except their primary residence, because it is an appreciating asset. Using credit for anything beyond the primary residence reflects living beyond one’s means.

If spouse and/or I lose our jobs, we still have $170K in mortgage on our house to pay, plus taxes, insurance, maintenance, medical expenses, utilities, food, etc. So that is where our savings will go, if needed. We may not be business tycoons, but we have peace of mind, at least as far as our finances.

quicksilver: Hopefully you have 401k’s and other investments. $150k isn’t going to do much, even if you don’t have to use it to pay off your house!

Rick, the Federal Reserve is not needed and should be eliminated.

Since the FED is a part of the Constitution now, the only way to eliminate it is via the Congress vote. And 90% of the congress are crooks paid by the FED. How is the “FED elimination” supposed to happen? Sorry, pal, but the FED to stay here for a couple of decades longer until it runs, used to be the greatest economy in the world, to the ground… It will take a revolt to end the FED, do not underestimate what the money changers are capable of…

The Federal Reserve bank is a separate entity by itself. It is not part of the legislative branch, executive branch, or judicial branch. The book “The Creature from Jekyll Island” is approximately 700 pages long and written in layman’s terms with excellent footnotes on sources. The book is easy reading and the author suggests reading at your own pace. The Federal Reserve is pretty interesting in how it came about. The self dealing to perpetuate the existing family dynasty wealth is a complicated (the powers that be like it like that).

my limited understanding of the Fed is their basic job is to either take money out of the system or print money into the system in order to control interest rates…

On a different topic, I saw a few days ago that mortgage interest rates are hovering around 4.0%!!!

The only purpose of the FED is to control everything. It is mechanism of enslavement of the masses. There are only two known ways to enslave the one – via war or debt. This is why we always have either a war or a debt crisis…

“my LIMITED understanding of the Fed is their basic job is to either take money out of the system or print money into the system in order to control interest rates…”

QE, please read the book “The Creature from Jeckyl Island” by Ed Griffin. You will understand who is this Beast. Without understanding about the FED, who they are, what they do and why, you are navigating without a compass. In the end, you’ll be the one loosing and not understanding why. You’ll blame the guy in power at that time, vote another one in next time, and nothing will change. You are just rearanging the chairs on a sinking ship.

The real policy in US is done by CFR (Council of Foreign Relations) and the monetary system is run by the FED. The 2 work hand in hand and they are the real government. The rest are the public figures. Every single president in the last half of the century is nominated by CFR and comes from CFR. That is why year by year the whole system yields more and more power to the president. If people elect the red guy from CFR or the blue guy from CFR it doesn’t mater. The media is consolidated in the hands of few individuals and will attack (discredit) with the whole force anyone from outside. When you see an individual or group pummeled to the ground by MSM you know they are from outside the system.

If you understand the system or not, if you believe it or not, you’ll be affected.

AUDIT THE FED!

Well written article: “Blame the Fed for the coming wealth destruction”

http://www.marketwatch.com/story/blame-the-fed-for-the-coming-wealth-destruction-2014-10-16

“Give me the power to issue money in a country and I care not who make the lawsâ€

Rothschild

“I am a most unhappy man.

I have unwittingly ruined my country.

A great industrial nation is controlled by its system of credit.

Our system of credit is concentrated.

The growth of the nation, therefore, and all our activities are in the hands of a few men.

We have come to be one of the worst ruled,

one of the most completely controlled

and dominated governments in the civilized world.

No longer a government by free opinion,

no longer a government by conviction and the vote of the majority,

but a government by the opinion and duress of a small group of dominant men.â€

President Wilson

Oh thank you, Mr. Wilson, 100 years later we can see the consequences of the destruction.

For those who are over 62 and have their house paid or close to paid and plan on staying in their home either for life or at least ten years try a reverse mortgage if you are short on “cash.”

Don’t take or spend the whole amount you qualify for,get enough in the check book so you don’t worry

I helped a couple who wanted to sell their home because they are paid off but very cash poor. I got them a reversed mortgage with 6% closing and about $240k to draw on.

There house is worth about $510k now in a nice safe location in Inland Empire. They will either stay forever or if the market changes later they will sell pay off the loan balance and move on again.

Reverse Mortgages shouldn’t be paid off in the short term because of cost, but if you don’t take it all and get a check from the growth line of credit you can be in good shape, and make a better decision in the future if you want to stay in your home till death.

@guy from Seattle

“I think, I just use it about right ;)”

I’m not averse to a turn of phrase, but I’d reassess that (I mean that in the nicest possible way)

Thanks, but no thank you, I am just fine the way I am 🙂 …

The stock market is dipping already in anticipation of the end of QE (who knows if QE4 is coming but the idea is unpopular). If history is an indication, housing will follow within a couple years. It’s not real wealth, its wealth redistribution – the banks got to dump their inventory at a higher price and throw money at other assets without any risk to themselves. Once the risk is shifted to “investors”, they get left holding the bag.

So it’s a game of who gets the benefits of the risk-free fed money while the cost is left to everyone else. On the other end, “Student loan debt in the latest report is at $1.12 trillion (versus $260 billion back in 2014 2004). That is a massive jump in 10 years…”. Well, it’s actually a better way to finance a house because of income-based repayment options (possibly $0 payments, like if you can’t find work) and you can’t lose your house like with a mortgage in that case. When the market falls in a few years I should have about 50% down in cash, and I won’t care even if it’s 6-8% interest loan at that price. Banks are not the only ones who can arrange to get “printed money” (misnomer I know) – Dept. of Education does it every day and people go back to school just so they can hold on financially.

I hate that we are becoming more of a Marxist society day by day, but I have to provide for my family so I use what’s offered to me. Capitalism fails when wealth gets too concentrated and leads to corruption such as we have now, but Communism fails at every level. 5-15 years we are headed for revolution/split nation at this rate, we are already fractured enough as it is. This central planning is a total failure for the common man.

get ready for QE4

I just counted out 22 responses from “a guy from Seattle” out of 103 total responses. This guy is responsible for 20% of the posts on this thread.

“Capitalism fails when wealth gets too concentrated and leads to corruption such as we have now,”

Wrong!!…. Capitalism (if you understand by capitalism free markets) never fails. It is the best possible system and everywhere where it was implemented produced the most real wealth for most people. When we had capitalism in this country, we had the largest and the most prosperous economy in the world. the envy of the whole world. That was before 1913 when the FED was created and a little bit afterward because of the size of the economy and inertia and because the FED needed a little bit of time to consolidate their power.

What we had after 1913 is a planned economy (you may call it whatever you like: marxist, crony, etc., it is irrelevant what label you use). The wealth concentrated in the hands of a few through boom and bust created by the money changers. You can not have “too big to fail” in a free market system. That is a clear proof (if you had any doubts) that we don’t have free markets but a planned, manipulated economy. You do NOT have capitalism without free markets, therefore your statement is incorrect.

The wealth gets concentrated in the hands of the few money changers every year because we do not have capitalism. Don’t blame capitalism for income inequality. That is EXACTLY what the money changers want you to believe and what they repeat over and over in their controlled media till they brainwash everyone.

The money changers who control and enslaved the middle class and the young people don’t want capitalism because that is exactly the opposite of what they want. Capitalism means competition and the planners don’t want that, they want monopoly and total control.

Is it just a coincidence that the IRS was created at the same time the banking cabal created the FED????!!!!…. NO, that is the tool they use to transfer wealth from middle and upper middle class to themselves. As so many news stories proved it is also a tool for control and domination.

To know the truth shall make you free.

Pure capitalism is inherently unstable and always implodes on itself. Prior to 1913, during the 1800’s, the US suffered many recessions and panics with countless boom and bust cycles. During the Long Depression of the 1870’s 10 states went bankrupt.

There is not one single successful nation today that practices pure capitalism. The only proven economic system is the mixed economy: part capitalism and part socialism. Politics argues over the relative proportion of the two.

Fannie Mae, Freddie Mac, and other lenders are nearing an agreement with the Federal Housing Finance Agency (FHFA) that would make it easier to make housing loans with down payments of a little as 3% to borrowers with weak credit according to an article in the Wall Street Journal on Oct. 18th. FHFA’s new director Mel Watt, who took office in January after being nominated by President Obama and confirmed by Senate Democrats, has made expanding mortgage access a top priority. An black attorney from Charlotte, North Carolina, Watt also served one term as a state Senator and served as campaign manager for Charlotte Mayor Harvey Gantt.

Critics are worried about repeating the same mistakes that led to the last housing boom and bust. You think? Here we go again!

“Resistance is futile.”

Home equity loans? What equity? Meanwhile even though interest rates have yet again GONE DOWN the RE market in my area has come to a screeching halt. Lots of “cancelled/withdrawn” listings, even after multiple price reductions. The sellers brave (or stupid) enough to keep flogging the dead horse of inflated asking prices, must be pissed at their brilliant RE agents for suggesting the listing price.

Yesterday I drove through a new development in my zip code that had their “Grand Opening” back in March. Really nice master planned community but high HOA’s and of course, the obligatory mello-roos whacked on for good measure. I went to the grand opening in March and there was quite a lot of traffic going through the models. Priced at over $500k but they were finished with really high end fixtures, kitchens and appliances. 2 story cluster homes. So yesterday I drive through and 8 months later they have built 21 homes, NOT A SINGLE ONE has had someone move in, a few “sold” signs but the rest “available”. I was shocked. I thought there would be a few dumb dumbs silly enough to fork out a half million bucks on a box 4 ft from their neighbor, but it seems I was wrong.

I hate planned communities and HOAs, each for their own reasons.

Planned communities mostly look like those Speilbergian nightmares in such films as Poltergeist and E.T. I know they’re supposed to look like some idyllic suburb, but they look sterile and lifeless, with all their cul-de-sacs, and streets without sidewalks, and having to drive everywhere.

As for HOAs — I live in a condo. I wouldn’t recommend condos, or any community with an HOA, to anyone.

I’d prefer to live in a house and neighborhood with character, and sidewalks, where you can put whatever decorations and political signs and religious symbols you like on your lawn, without HOA interference.

Thanks Dr HB,

Being from Texas and witnessing the extreme low inventory of housing in the north Dallas suburbs (only a month’s worth in some places like Plano), it would be interesting to find out which banks process the most HELOCS in the DFW area. It looks like Dallas is keeping pace with SoCal wrt population since it’s five times more populated than Dallas and they have about five times more HELOCS. The commercial building and expansion just in the last five years in DFW is greater than anything I witnessed in SoCal during the late 80’s. However, this too shall pass and when it does, it’ll get ugly. Also, water’s going to be as big a problem here as it is in SoCal. However, we haven’t quite gotten to the Real Homes of Genius level yet but that’s probably on the way.

Leave a Reply