How the Fed is creating another speculative market for housing: Fed balance sheet now over $3 trillion and low interest rates are causing speculation in non-traditional markets.

The Federal Reserve has made it mission number one to create a low interest rate environment. The PR campaign claimed that this was to help average indebted homeowners but in reality, it had more to do with providing incredible banking leverage and also to support our massive national debt. The Fed’s balance sheet recently crossed the $3 trillion mark. In essence, the Fed became the bad bank without any open vote or congressional debate. That much is obvious but what isn’t certain is where things go from here. The ability of inflation to erode purchasing power is a real problem. Since the recession ended it is clear that profits in the financial sector have soared. Yet household incomes remain stagnant. This is important to understand and Professor Robert Shiller has talked about being cautious about the unbridled optimism now being seen in the housing market. The housing market for the last few years has been supported by massive amounts of investor money. Is the Fed simply creating a different kind of speculative fervor this time around?

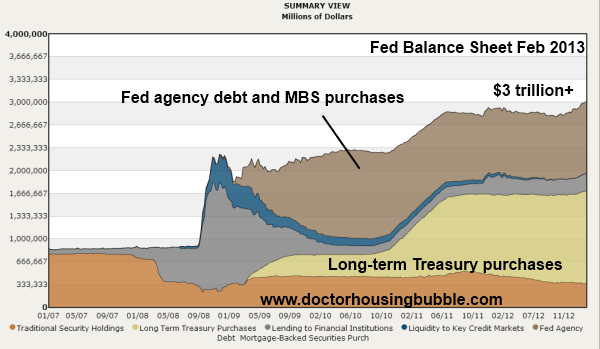

Exhibit Number One – The Fed Balance Sheet

One thing that seems to escape those that think this housing market is recovering organically is the gigantic Fed balance sheet. In essence, the Fed and government have become the housing market. When you think of a 30 year fixed rate mortgage at 3.6 percent they become giddy. Would you lend someone your hard earned $500,000 for 30 years at 3.6 percent? No freaking way. And apparently, the financial sector feels the same way:

This is the issue at hand. There is little private demand here. Those that are cheering on this kind of growth might as well take a trip to the former USSR yet ironically, these people claim to be “free market†thinkers. What we are essentially doing is favoring housing over other sectors of our economy. If we are going to subsidize something so deeply, better we do it in fields that will make us competitive globally and not a McMansion for a shrinking household. It is all fabricated and the Fed has not even adjusted its balance sheet since the recession ended way back in the summer of 2009 (in fact it has grown to record $3 trillion). Most of the current growth is coming from mortgage backed security (MBS) purchases. That is, the QE3 program directly targeted at the housing market that is now being engulfed by the same banks the Fed bailed out. The intent is to keep rates low although we might be hitting a lower bound here:

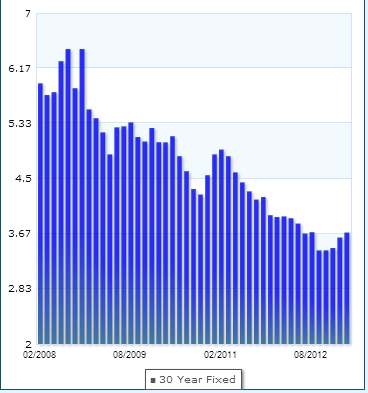

Rates on 30 year fixed rate mortgages have started creeping up although they are still at historical lows. Even in 2008 when rates were low we were at 6 percent. The problem however is that the market is now conditioned to these low rates. The Fed has to keep inflating its balance sheet to keep the gig going. Why? No other person in their right mind would fund a $500,000 loan at 3.6 percent especially when it is tied to housing. Since cheap money is abundant, we are now seeing unintended consequences where 20 to 30 percent of all purchase activity for the last few years has come from investment demand. This is a short-term phenomenon. When we say short-term we mean three to five years. People simply suffer from investment amnesia. We have flippers diving in head first in places in California and do not remember folks getting burned in 2008 or 2009. Those 5,000,000 completed foreclosures never really happened and happy days are here again. Who needs income growth when you have good old fashion leverage?

The Fed and unintended speculative fever

All of this action does come at a cost. We are seeing for example high yield bonds (in other words, junk bonds) pulling in very low rates for the associated risk. This is the issue of living in a negative rate environment. Large funds are buying up properties as rentals which tells you the hunger for yield is dramatic when you see Wall Street coming to Main Street to be your landlord.

It is safe to say that 2013 will not be like 2012 in regards to the blistering housing market. A couple of reasons for this:

-1. Low rates are unlikely to make any significant moves lower.

-2. Investor yields are being crushed with the rush to buy (harder to find deals).

-3. Ironically with prices up, more people are in a positive equity position so they can actually sell if needed.

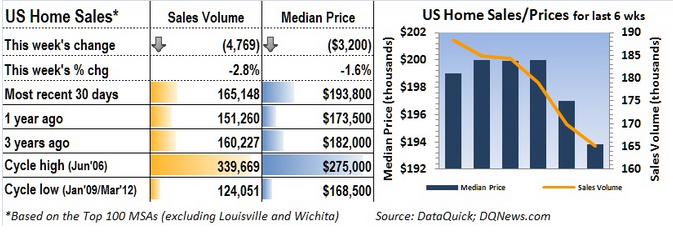

The overall trend plays out like this:

The most recent median price is $193,800. This is up from $173,500 one year ago and down from the peak of $275,000 reached in June of 2006. You have to ask yourself how is it that the median price went up $20,000 in one year when US household incomes did not go up? All of this is coming from the Fed’s added leverage and speculative demand rushing into the market where inventory is at historical lows.

Some of the positive signs however include the following:

-1. Household formation is picking up. However, this is likely to pull many younger people into rentals first before purchasing homes.

-2. Housing starts are picking up. Good since supply is so low but a good number of these are for multi-family units.

-3. Household debt moving lower. Although more people are leveraging up with low down payment products like FHA insured loans.

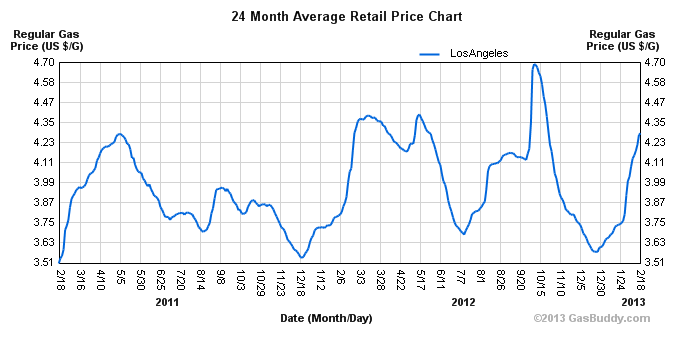

It is clear that all of this hot money is causing unintended consequences. Inflation is hitting in many areas including higher education, health care, and energy. Just look at gas prices in Los Angeles:

We had a post about the true cost of commuting in California and it was interesting how many people justified commutes of 1 to 1.5 hours each way.

On a side note, a few readers wanted to track some of the homes we highlight so I made it very easy to search for these posts. Whenever we feature a home, we’ll use a “Price Check†tag:

Price Check previous homes (28 featured homes going back to January of 2012)

Real Homes of Genius (167 featured homes going back to January of 2007)

Enjoy!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “How the Fed is creating another speculative market for housing: Fed balance sheet now over $3 trillion and low interest rates are causing speculation in non-traditional markets.”

While the Federal Reserve says that QE3 is about getting U-3 unemployment down to 6%, the real reason for QE3 is:

#1) Get non-performing loans off of the balance sheets of member banks and on to the Feds’

#2) title fixing/laundering.

Technically #1 and #2 go hand-in-hand. Due to MERS, Robo-Signing, sloppy paperwork and failure to correctly assign title to MBS’s, there are many broken titles floating around in which the the chain of custody was broken. QE3 allows the banks to fix these defective titles by flipping the mortgage backed securities to the Federal Reserve along with a corrected title transfer. The Federal Reserve can then flip these back to its member banks who can then foreclosure and all of the title paperwork is now clean.

“Is the Fed simply creating a different kind of speculative fervor this time around?”

Yes

What does the FED do, other than create money? (supposedly, it regulates banks…which I believe proves my point – that it doesn’t know what it is doing)

http://blogcritics.org/politics/article/this-time-its-bernankes-housing-bubble/

I thought I put the hyperinflation argument to bed. There is $600 Trillion floating around, what’s $3 Trillion going to do? Nothing. If it were going to do something it already would have.

Hyperinflation is a political event, not an economic one. As we are a debtor society and nation, unless they release oodles of credit like they were doing in 2005, how will there be inflation?

Papa—Inflation and hyperinflation are two VERY different things. You are correct when you say that hyperinflation is a political phenomenon but it is defined as 50 percent inflation[roughly] per year. So we can have horrendous inflation without technically hyperinflating

Hyperinflation is 50% per *month*

Flipper is correct. Hyperinflation is not just really high inflation. It is the collapse in confidence in the currency itself. The idea is to dispose of the currency as quickly as possible in the rush to secure hard assets before the currency is devalued yet again.

Well, glad I bought a house. Mortgage way lower than rent. Yup, glad I locked in at 3.8%.

Glad I’m not a crybaby whiner. Best decision in the history of the housing market.

and I’m glad I’m not a transparently desperate RE troll.

Who’s whining? I’m paying under-market rent because unlike real estate in So Cal, there still is a true marketplace for rentals. My cash-flow is screaming and I’m smiling all the way to the bank.

If you are a true “owner” (free and clear), why is your 3.8% rate relevant? Didn’t you use cash for that great deal? Not so? In reality, then, if you’re in So Cal, you’ve probably attached yourself to an over-priced asset class. Kinda like bragging that you got a loan from grannie at 3.8% for those gold bars stored in your basement you bought at $1,800 per ounce.

Wonder if we’ll hear from you again singing the praises of your interest rate when you’re under water.

you’ll have to ignore DMAC. He’s a bitter old man who missed the housing bottom and is too old to get back in the game.

Your moniker is quite appropriate, BB – worst case of projection seen yet on this blog. But tell us how awesome your current RE situation is right now, and don’t spare us the details. BTW, how is changing one’s entire career and moving across the country to try something new somehow make a “bitter” person? I bought my place in ’98 and sold last year – the return was about what I the expected back when I got it. And your comment about missing the bottom where I live is hilarious – I don’t live in SoCa, the recession here is continuing apace, with no end in sight – with foreclosures finally back on the rise.

From what I’ve read inflation isn’t a problem we have in immediate worrying position.

Other than, yes higher education, health care! Not sure if inflation is really the right word when talking about those things though.

Otherwise, the biggest problems are unemployment and stagnant wages.

Neither of which can be solved by FHA loans nor holding interest rates low, nor lowering the federal deficit, I believe.

Of course it does seem like people in positions to do anything are more interested in creating a new bubble to try & fix things rather than seeking a true economic recovery.

The FT had a recent article that over the last few years of Obama, the Federal Reserve gave $291B of profits to the U.S. Treasury, and now they will demand it back as interest rates go up. Don’t worry about the FR(Fed). Ben is leaving soon, and his successor will get blamed when the bubble bursts. Have no doubt who dominates this country, the money interests(e.g. big banks and Wall Street) who buy both parties.

The Fed. is crushing the retirements of millions of people. A few years ago,

$1,000,000. in savings would yeild $60,000. in income. Today, it yields are $10,000.

Retirees are now running up credit car debt, and applying for social security at age 62- they have no choice.

This will have very negative impacts on the economy over the next 5 to 10 years

Speaking of retirees, (I am 53 y.o.) my benefits according to the SS online tools are as follows: if I retire at 62: $1500 per month. It I retire at 66: $2300 per month. If I retire at 70: $3000 per month. [Assuming of course, SS will still be in existence but that is probably the topic of a whole other blog somewhere].

It looks like the Labor Force Participation Rate is on the increase for older workers. Such a shame that people even in their late 70’s need to work in this country. Here is some info

http://www.ssa.gov/policy/docs/ssb/v72n1/v72n1p59.html

But that’s really the rub, isn’t it? I’m 52 years old, and I don’t know anyone in my generation who ever thought that they’d see a dime from all of the hundreds of thousands of dollars we’ve contributed to FICA over the past decades. Like him or not, I think Ryan is absolutely correct when he says that SS is going to be means – tested in the near future, and that the retirement age brackets will inevitably go up. It’s been nothing but a Ponzi scheme for much of our lifetimes, time to allow it to revert to it’s original intention, which was primarily for those in actual poverty.

I agree that it’s too bad SS is set up in such a way that many who have contributed will likely never see a penny. If you were planning to rely on SS for life, the rug looks like it will get pulled out from under your feet.

However for those currenlty in their 50s, during your earning years (last 30 years) you’ve had the good fortune of an amazing stock market and very good housing market. If you made a regular diversified investment, you’d likely be doing very very well.

MB- I have to agree with you. Most of the people I know currently around 70 years of age got a combination of “greatest generation”, and played their cards right. They were able to get homes cheaply, they have legacy pension checks plus whatever bonds and precious metals they bought. Maybe not a lot of the latter but most I know dabbled in them. They also caught the dawn of 401k’s, from the late 80’s to early 90’s assuming a mid-90’s retirement. All in all it’s an income of around $4000 to $5000 per month with only property tax, utilities, and healthcare to worry about. This is what younger generations are counting on to have something left to pass down!

@Dmac

“I think Ryan is absolutely correct when he says that SS is going to be means – tested in the near future, and that the retirement age brackets will inevitably go up.”

Ryan is just blowing it out of his rear, just like most politicians. Means testing won’t mean squat to 90% of Boomers, because 90% of Boomers will really really need SS to live on. The bar would have to be really low to exclude all but the richest Americans, who could care less, but, could hide most of their assets easily from some sort of this “means testing” accounting.

Half of Boomers have no savings at all. Zero. They will only have SS to live on. Of the other half, maybe 80% of them will have maybe their SS doubled at the most as an income stream to live on. It is pure fantasy that there is a substantial segment of the Boomer population to treat differently from most. Most elders will be scraping by until the last breath, is they don’t have a job. If any politician tries to raise age levels of those who are 55 and older right now will be voted out of office in a flash. Old people vote.

“During your earning years (last 30 years) you’ve had the good fortune of an amazing stock market and very good housing market.”

Very good from whose point of view? And “amazing”? Do you even live in same planet I do?

I see only huge bubble which collapsed and destroyed all/majority of your capital. IT bubble in stock market started and then the housing bubble did it again.

Assuming you _had_ free capital: Wages haven’t risen practically at all since 1980.

Tell me again, where that “fortune” is coming from? As ultra rich have wiped everything to zero, not only once but two times. In last 30 years.

So not only you don’t own anything but debt, you aren’t getting any pension either.

Focus on the ups and downs if you wish, but IMO, nearly 10% annual return in the DJIA the last 30 years is ‘amazing’

Homes haven’t kept up with stocks, but they’ve been very good in the last 30 years as well.

re: stagnant wages.

Sure, if you look at the overall picture, wages have been stagnant. Split the population by education and you’d see that workers with college/graduate degrees have seen their wages rise while workers without have seen their wages decrease/plateau.

It’s a reflection of the modern world we live in.

Fair enough, Mike M – but please tell me what the solution is to the forthcoming SS implosion. The CBO has been warning about this for years at this point, and no one’s going to tolerate another FICA tax increase to cover the upcoming deficit. I look forward to your reply, since you already feel Ryan’s plan is non – workable.

@DMac

Social Security is hardly as underfunded as Ryan as his ilk want you to think. You know, say something enough, and, it actually becomes the truth to a lot of people. SS is OK, just needs a few tweeks here and there, like maybe a little slow rise in age requirements, and a little freeze in COLA, and it will be well funded for years. It’s the right wing of the Republican party that has had a bug up their rears for decades after FDR instituted this program and wants you to think that all government programs are “entitlements”, when this really is an annuity, and well funded by the citizenry.

Now, Medicare is the big problem. That one is going to bankrupt us unless we figure out how to reduce medical costs, including drugs. I’m skeptical, especially when the party that shouts the loudest about government spending is the same party that followed their last president down the yellow brick road and signed that Medicare drug bill during his last term that saddled the nation with what some think is a trillion dollar bill for the next decade.

I don’t think social security is going to go to zero. It seems far more likely that it will be reduced to pay-as-you-go levels, probably gently through means testing and reduced COLA increases. That would mean perhaps a 30% reduction. Seniors will still eat, but some other important stuff might have to go. Car, heat, etc.

Good points, both Ian and Mike M. But I think what you’re both discussing is the lack of an adult conversation between our so – called “elites” and the general public that at long last, there’s no free lunch anymore. SS, Medicare/Medicaid, unfunded public pension liabilities, the list goes on and on. Europe is showing the rest of the developed world what happens when the state runs out of everyone else’s money, and it’s not pretty.

looking forward, I think a smart investment will be in kibbutz type living residences, since boomers are in no way prepared to afford single family living in retirement.

Well it serves them right for doing things like:

Living within their means

Prudently saving for their retirement

The economic reality is the only way to generate “growth” now is through mis-allocation of cheap money in the form of bubbles.

How are you going to tell crony capitalists and the tens of millions of parasite welfare queens they now have to fend for themselves?

Yes, Dale, you are correct. We are seeing the largest theft of money in the history of mankind, from the prudent savers to reckless financial sector rentiers. They have leveraged malinvestment to the max and now it is your job to bail them out. I find it highly ironic that people go nuts when taxes are raised a small percentage, but when a entire generation is being completely raped by the Fed, no one says a word. By the way, there is inflation all over the map. Take a look at gasoline prices, commodities and REAL ESTATE. All, accompanied by negative interest rates for savers.

To all who think buying before it is too late, good luck. The Fed, in a few years, will have to a reverse once the big boys are bailed out and it will start all over again. However, it is unlikely to work because the systemic failures of today are so large, there is no exit.

Jeff, I am totally agree with you. Sheeples are getting slow cooked in the pot of inflation. What we need to do is get smarter and try to save yourself by converting unless american dollar to hard assets. Go buy a rolex!

Why should someone who takes absolutely no risk in an FDIC insured savings account or Treasury bill recieve more than 1%. The FED is artificially propping UP interest rates, if it did not pay .25% to the banks on reserves (theft from the Taxpayers to the banks) interest rates would be negative like they are in Switzerland.

You’re right. Lets all take out our money from the banks and see what happens.

at sub 1% interest rates, you probably should take your money out of the banks and somewhere else. Chances are uou would have made a lot more money the last few years.

While it may be near impossible to say what interest rates would be without Fed intervention, saying the Fed is artificially propping up interest rates borders on ridiculous. The whole game at the Fed is to keep even the long term interst rate down and great intervention is needed to do so.

Lance,

I assume what you wrote was a joke. But, just in case it was not, I will respond. Regarding the 1% risk free return, of course rates should be higher to compensate for inflation that is at least 5% in the real world. Regarding the Fed propping up interest rates with a .25% rate on the bank’s reserves, obviously you do not understand how the reserve system works and what the banks are doing with it, please link below for an explanation. Negative interest rates like Swizterland? The FOMC hinted today that it will raise rates and look what happened to the markets.

If you really think the Fed is articially holding rates “up”, please buy all the 30 year Treasuries you can and set on them!!!

http://libertystreeteconomics.newyorkfed.org/2012/08/interest-on-excess-reserves-and-cash-parked-at-the-fed.html

“The Fed. is crushing the retirements of millions of people. A few years ago,

$1,000,000. in savings would yeild $60,000. in income.”

I would guess that you are talking about a very very small percentage of people who have anything near one million. Hardly “millions of people”. Millions of people, or, the Boomers you speak of, have been living a personal financial fantasyland for the past twenty to thirty years or so, not saving a dime, borrowing trillions collectively, and depending on their rising home value as some sort of retirement plan, which I never got. You gotta live somewhere. How could one possibly cash in that equity and live well? Anyway, the Boomers crushed themselves by not preparing for old age. The average retirement account in America is about $50,000, and that’s after almost thirty years of user friendly IRAs and 401Ks in existence, during one of the great stock market runs in history. The average net worth of a 65 year old is about 210,000, which is probably 90% home equity, therefore, illiquid. But, of course, for the next twenty to thirty years we will be hearing whiney sob stories from the poverty ridden seniors about how it wasn’t their fault. It was the Fed! It was the crooked stock market! It was the banks! It was my job going to India! China! Mexico! It wasn’t me.

They can’t even afford to send their kids to college. They didn’t even save for that.

$50k? $210k? Wow man, you’re hanging around the wrong people. I don’t know anyone that broke at that age.

And I believe the equity in the house is/was to be used in the selling of the original larger house and purchase a smaller home or condo and be mortgage free.

And as far as college, I think NO parent should pay for theor kids college. “That which is given has no value” and I’ve seen it with too many spoiled rotten brats. I was allowed to live at home my college years, but I worked and my small student loans are mine.

Mike,

I guess you are a relatively young person. If you think the boomers are screwed, just what do you think your generation has ahead of it? Not paying an equitable return on savings has nothing to do with what generation one belongs to.

By the way, most of the boomers children are long past college age. The problem with paying for college has nothing to do with how much savings one my have, it has to do with ran away tuition inflation.

@PapaNowNoLongerPapaToBe

“$50k? $210k? Wow man, you’re hanging around the wrong people. I don’t know anyone that broke at that age.”

Oh, yes you do. They just aren’t telling you. Sure, they have the big house, the nice car, the cool vacation pictures, but, if you could see their accounts and total net worth, you’d be shocked. I’m not. I’ve read those figures over and over the past few years. You watch, as the Boomers age, it’s not going to be pretty. They have no money. Half of Boomers have no savings at all. And, a lot of debt. Why do you think Florida RE is still stagnant after eight years of housing price deflation? There are 10,000 Boomers turning 65 a DAY right now, and that will continue until 2013, totaling 73 million. Even if ten percent of them cashed in and moved down there, there would be bidding wars everywhere in God’s waiting room. Ain’t happening. They have no money. They spent it all.

And, really please explain the home equity as savings thing to me. Let’s just say that someone owns a home in SoCal free and clear. Well, right away, that’s a rarity, right? Not only are a lot of those homes mortgaged once, but, probably twice and maybe three times these days. But, let’s just suppose it’s free and clear at $600,000. Fine. Sell it, and, now what? Where are you going to go? Las Vegas, Phoenix, Reno, or Florida, or, gulp, Detroit? Those are the cheap housing markets out there right now. I couldn’t stand living in any of them, except for maybe oceanfront Florida in the winter. But, OK, let’s trade down to one of those markets. Something nice is going to cost you 250,000 minimum, probably 300,000 to 350,000, if you don’t want meth heads and gang bangers in your life. Change left in your pocket after transaction and moving costs? About 300,000. Try living on that and Social Security. Possible, but, tough. Especially with property taxes going up in poor municipalities. Public pensions are expensive.

@Jeff Beck

I’m 60. And, yeah, my fellow Boomers are screwed, but, man, sure glad I ain’t 40. Now, that’s screwed these days.

@Mike M, maybe it’s just me, I guess I seem to have responsible and somewhat wealthy friends. The scenario you painted does not apply to me.

Given this is a SoCal blog, I can see how your statement on home equity can apply to some, but it’s definitely not macro. In fact, take that $600k and move to Riverside for $200k then. And for many, Phoenix, LV, or Texas is a viable option. In most Midwest cities, you take your $200k 4/2 house and sell it for a $125k 2/1 house to retire in.

I don’t even understand your meth head / gangbang statement. Irrelevent to most, nobody lives like that unless it’s in the ghetto.

“In most Midwest cities, you take your $200k 4/2 house and sell it for a $125k 2/1 house to retire in.

I don’t even understand your meth head / gangbang statement. Irrelevent to most, nobody lives like that unless it’s in the ghetto.”

A $125k 2/1 house to retire in in a “midwest city” would put you right next door to some very unsavory people. Certainly not your rich buddies who scoff at what the average Boomer is worth.

@Mike M. Again, you are incorrect

http://www.iowarealty.com/aspx/findahome/listingdetail.aspx?list_numb=20125371

http://www.realtor.com/realestateandhomes-detail/232-Briar-Valley-Ct-S_Saint-Peters_MO_63304_M86162-75046?source=web

Just look at those unsavory neighborhoods!

And who said I have rich buddies that scoff? I’m talking responsible boomers with savings, paid off property, legacy pension income, SS, and whatever 401k they might have had a part off. $4000 to $5000 per month income with your largest bill being healthcare is pretty comfortable to me.

“According to Spectrem, there are now 8.6 million households in the U.S. with a total net worth (minus principal residence) of $1 million or more.”

http://blogs.wsj.com/wealth/2012/03/21/millionaire-population-grows-by-200000/

That’s aproximately 3% of the population. That means 1 out of every ~33 people is a millionaire. That imo, is a lot of people.

Dude, really. You expect someone to move from beautiful sunny California or educated, hip NYC or Boston or DC to………..those two places? Really? Please. Shoot me in the temple instead.

@BlahBlah

“That’s aproximately 3% of the population. That means 1 out of every ~33 people is a millionaire. That imo, is a lot of people.”

Well, first of all, you sort of backed me up. It’s ONLY 3%. That’s not very much, right? I mean, there’s some spending power concentrated in there, but, as I said, 50% of Boomers will have nothing at all, and millions and millions of others will just have comparable pocket change. Maybe Manhattan, Key West, Paris, Malibu, Hong Kong, London, and other playgrounds of the rich will do well, but, they better put up some barbed wire and broken glass on the walls around it all.

Second, most of that is real estate, and, I’ll speculate, real estate that is self appraised for various reasons. Is that ski condo at Vail really worth 500,000 these days? Maybe. If you find someone in the 3% to sell to.Limited market, though. Sounds like some accountants are still playing the shell games they played in 2004.

The sales volume is really small. And in my town of 70K people there are 20 homes for sale!! MSM is now back to the old mantra. Get it while it’s hot. Investors are 30% of the market. How far can this go? Another year? I don’t think too much.

The mania is back in the Inland Empire – the well priced houses have multiple offers over list price, and the over-priced and/or poor conditions have delusional sellers just like 2005 who want top dollar for their turd of a house. Appraisals and sale prices are all over the board on a price per square foot basis – but who needs an appraisal if you’re paying cash?

The IE is the most elastic isn’t it? Lower prices to start with so the flippers rush in and get things bid up the highest percentage wise… Only for things to crash the hardest when the speculation ends. Watching this pump and Dump is hilarious! I’m interested in a home in La Sierra Hills and I’m seeing houses listed 70,000 plus over Zillow. I’m expecting some deals in 2 years or so when Housing Bubble 2.0 pops 🙂 Prices will probably beat the 2010 lows…

I have a question for you. Why do you think the government will allow 2.0 and take down the entire economy and put us in a depression if not worse? Logic tells me, I don’t think so. This manipulation can’t and will not end.

“Why do you think the government will allow 2.0 and take down the entire economy and put us in a depression if not worse?”

You’re missing the point of Bubble 2.0 in the first place. The FED is fostering this bubble to clean bank balance sheets and further ease the losses of the Great Recession. Bank solvency is the ONLY FED goal. The economy is not headed towards a depression, but is already in a deflationary/inflationary (vis-a-vis assets/commodities) recession. The lower prices in Real Estate and lower quality of life is unavoidable. The only question was if Chase, Wells Fargo, etc would survive the downturn. The FED is using Bubble 2.0 to ensure they will. The losses will be socialized and the specuvestors on the bottom of the chain will lose big time.

We were never going to have a financial Armageddon like 1929. But sounding the alarms got the public to support saving the very system that screwed them in the first place.

It would be interesting to see any ‘intelligence’ on the relationship between banks and appraisers these days. I heard that back in bubble mania, there were plenty of shady appraisers out there that were giving appraised values at whatever was needed to please the sellers and buyers. Then after the crash, the appraisers were blamed for the fiasco. Now, supposedly the appraisers are more autonomous, have more power and less likely to manipulate appraisals to satisfy anyone and ‘desk reviews’ are happening on 75% of appraisals so that the lenders are certain the appraisal was not manipulated. However, first hand experience tells me that with the run up in prices in LA, appraisers are once again becoming part of the mania.

Eh, I’m not seeing anything that’ll make you rich quick. I have an investment that I bought for $260 at the bottom in 2009 and today investor flips sold high at ~$310. $50k gross profit probably $20-30k net profit isn’t anything that will make me raise an eyebrow unless I own more than 10.

What are your investments, and where are they located?

So obvious, but I didn’t see it before this article. No reason for banks to lend at 3.6% when inflation is rising faster.

And the zombies are out:

http://money.cnn.com/2013/02/20/real_estate/zombie-foreclosures/index.html

Posted this in the last discussion right before the new article was posted. Worth posting again.

Ladies and Gentlemen, introducing the next RE time bomb, REITS:

http://finance.fortune.cnn.com/2013/02/19/mortgage-reits/

Leave a Reply