Fannie Mae and Freddie Mac Behind the big number of Canceled Foreclosure Auctions? $745 Billion Bailout to Erase Negative Equity for Every Underwater Homeowner. Fannie and Freddie Uncapped. Prelude to new Bailouts?

Over the last two months we’ve noticed an interesting pattern in notice of trustee sale auction cancelations. This is the last step before the home is either sold at auction or taken back by the bank as a bank owned property. As we have highlighted, this process can take 18 months from the last payment made on the home given the slow pace banks are moving at. The troubling thing is I have started piecing the data together and something seems to be emerging. The fact that Fannie Mae and Freddie Mac over the holiday now have “unlimited†support from the government may signal new methods of dealing with the foreclosure crisis that once again will destroy the prudent in our country and reward the Wall Street bankers with another gift.

So why have cancelations risen so much in the last few months? This has to do with Fannie Mae, Freddie Mac, Bank of America, Wells Fargo, Citi, and JP Morgan. All these lenders went on a foreclosure “holiday†that by their own admissions, ended on January 3rd. So that in itself would account for many of the auctions recently canceled. A few of you sent this over from the L.A. County Treasure and Tax Collector:

Source:Â L.A. County Treasure

Now part of this may come from the foreclosure holiday but why cancel February? It probably has to do with HAMP and also something with Fannie Mae and Freddie Mac now having unlimited support. Also, HAMP offered extensions for many loans to January 31st:

“(BusinessWeek) Mortgage servicers must give U.S. homeowners more time before kicking them out of the government’s loan-modification program, reflecting further struggles in the execution of the plan.

Servicers can’t cancel an active Home Affordable trial modification scheduled to expire before Jan. 31 for any reason other than property eligibility requirements, according to a posting today on a government Web site. They must write to borrowers to inform them about missed payments or needed documents, and give them at least 30 more days to submit them.â€

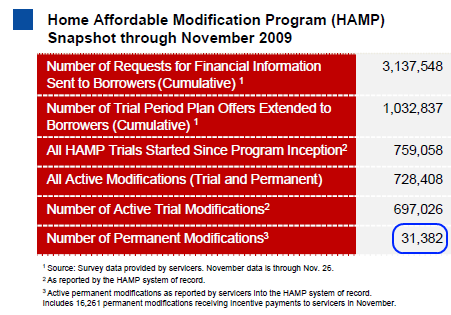

So that in itself must have set off a rash of cancelations. You have the holiday, plus the extension, plus banks ignoring non-payers. You can understand why the shadow inventory numbers are off the charts yet looking at standard data paints a deceiving picture. Part of this was spurred by the horrible numbers released by the HAMP initiative:

Of the number of active trial modifications (that now go out to five months instead of three) only 31,000 have been converted to permanent modifications out of nearly 700,000. In other words, about 4 percent seem to be entering into permanent modification status which is an abysmal number. Right now Los Angeles County has nearly 100,000 homes in the shadows if we include the MLS and all other shadow inventory. Just looking at the MLS we get approximately 19,000+ homes:

What is interesting that homes scheduled for auction between September and today, we find a large number cancelations:

Of homes scheduled for auction between September and today in L.A. County we have seen nearly 10,000 cancelations. This of course is due to HAMP and the above mentioned moratoriums. I really doubt that we’ve managed to “save†10,000 homes in this time but what is more likely to have happened is delaying the inevitable foreclosure or bailout. You can understand why the public is confused with all this information. I’m having to pull data from multiple sources and putting it all back together. What we find when we put it all together is this:

-MLS public view data is artificially low

-Many cancellations only mean that foreclosures have been delayed or put into HAMP which is showing a horrible success rate

-A large number of properties with non-payers don’t even have a notice of default but show up in 90+ days late internal bank data (this number in California is over 10 percent of all mortgages)

-In California 1 out of every 3 mortgages is underwater

And this brings us to probably the more nefarious connection of the foreclosure dots. Why over the holiday did the government implicitly back Fannie Mae and Freddie Mac with unlimited support? From the FHFA report released on January 8th:

“Washington, DC – The Federal Housing Finance Agency today released its third quarter

Foreclosure Prevention & Refinance Report, which shows that as of November 2009, Fannie

Mae and Freddie Mac (the Enterprises), implemented more than 405,000 trial and permanent

loan modifications under the Administration’s Home Affordable Modification Program

(HAMP) and refinanced 4 million loans. The report, which now includes data on

delinquencies, loan modifications and refinance activity for each Enterprise, details the actions

Fannie Mae and Freddie Mac have taken to prevent foreclosures and keep people in their

homes.â€

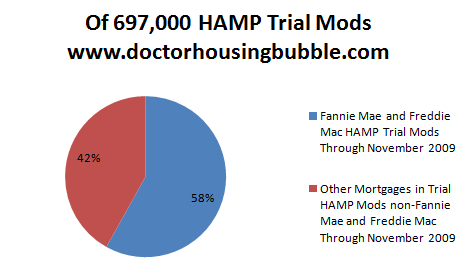

Wait, did you catch that? 405,000 HAMP trial modifications are with Fannie Mae and Freddie Mac loans. Look up at the HAMP data released by the U.S. Treasury above. In other words, this is what is happening:

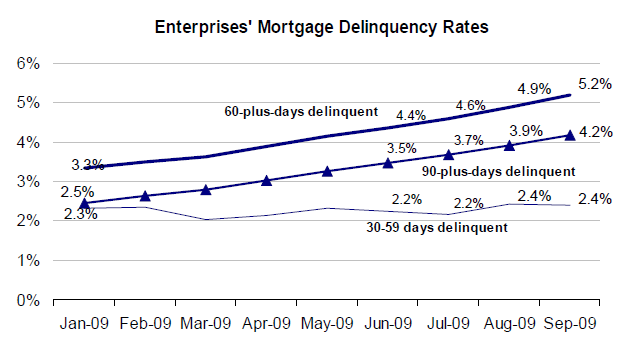

You see where I’m going with this. The bulk of the nearly 700,000 HAMP mods are backed by Fannie Mae and Freddie Mac. Since we own Fannie Mae and Freddie Mac, that means we own most of these loans now. And how are those loans doing?

In fact, of all enterprise loans the distress rate is 7.6 percent (the above chart doesn’t include bank owned homes). So what is really going on them? Why uncap the support to these agencies if they are dealing with more and more costly loans? One idea is with the ultimate underwater bailout. I ran the quick numbers here:

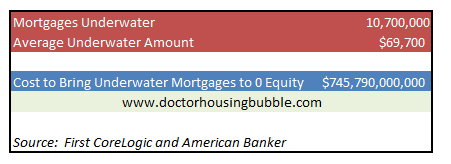

Recent data shows that nationwide, the average amount for the underwater homeowner is nearly $70,000 (much larger in California thanks to Alt-A and option ARM products). First American CoreLogic in their latest report had 10.7 million homes underwater. So to bring homes to basically zero equity, it would cost the government some $745 billion! Is this where the government and crony bankers are heading? I have no idea but why else would you uncap Fannie and Freddie and also allow the FHA to keep on making loans while the entire portfolio still shows signs of weakness. Why? Because these are the only products in town. Corporate welfare banks don’t dare touch the American consumer but are more than quick to take bailouts and make government backed loans. They will push the limit to whatever the government allows them to do and right now it is allowing them to continue the toxic mortgage game.

So it would take basically TARP II only to extinguish the current negative equity. And who would get this money? With HAMP, it has been a triumphant failure because it only seeks to protect the banks. The other option would be to erase this negative equity but the vast majority of Americans are not in this spot and this would politically not fly (as it shouldn’t). Banks should fail (did we agree to not let banks fail or is this something the crony bankers, Fed, and U.S. Treasury decided to do?). Current mortgage pricing is completely delusional of the risk involved. The global markets nearly imploded because of toxic loans and right now 30 year fixed mortgages go for 5.75 percent? Really? The only reason this is happening because of the toxic Federal Reserve and horrible U.S. Treasury policies. The recent AIG e-mails show who the U.S. Treasury is really working for.

Where does this go? Who really knows but anyone telling you things are good are in some form of delusion. And I’m sure the 85,000 jobs lost last month was also a good sign (actually the labor force declined by over 600,000). This data should shine some light on what is going on but should also show you how flawed the entire system has gotten.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “Fannie Mae and Freddie Mac Behind the big number of Canceled Foreclosure Auctions? $745 Billion Bailout to Erase Negative Equity for Every Underwater Homeowner. Fannie and Freddie Uncapped. Prelude to new Bailouts?”

Help me out here. Don’t the loan servicers maximize their profits and returns by floating Fannie and Freddie Mac guaranteed loans? If the servicers can get or borrow the money to make good on the late payments, in the end don’t the servicers get not only the late payments but the penalties and interest also from Fannie and Freddie?

The longer the servicers wait to give the NOD, the more money they make.

On the other hand, when the loan is not guaranteed by Fannie or Freddie, or the process of foreclosing is its own profict center, there are reports that Chase JPM for example has been going out of its way to do home invasions and otherwise expedite foreclosures at the drop of a hat.

Yes. We have the next bailout – this done stealthily through Fannie/Freddie to reduce principal of all underwater mortgages to make the mortgages whole. This will keep home prices elevated to its clearing value and allow banks to unload at par. Mortgage holders who took out “equity” and gambled get a bailout those that were prudent get screwed. The managements of banks not only get to keep their bonuses and outsized compensation during the bubble they get to pay themselves even larger bonuses now.

At some point the Treasury market blows up and once again the prudent taxpayer will be left holding the bag. Welcome to the banana republic of USA with crony capitalism where the prudent silently take their beating.

I could be wrong but isn’t the county treasurer’s auction for properties that are being foreclosed not by their lender but by the county, after nonpayment of tax for 5 years? Because “regular” auctions by lenders happen every day. I don’t live in LA but here in San Diego the treasurer also holds its annual tax auction in February. I would guess the postponement had more to do with county finances or manpower and nothing to do with Fannie and Freddie. Please correct me if I’m wrong because if the federal government or Fannie and Freddie are causing counties to call off their foreclosures, that is very, very wrong!

Anyone who is aware of all of this, the whole ball of wax from this to the purchase of mortgage backed securities to the FED buying our own treasuries to the 80 trillion in unfunded liabilities must be nuts not to be protecting their wealth with commodities and Gold.

The people who are in charge of the worlds reserve currency think about their reelection and their Party over the good of the American people and are bought constantly by lobbyists.

How stupid would you have to be to have your life savings tied up in the currency that is controlled by these nuts?

We now have an entire economic system based upon “moral hazard”.

Watch out, it ain’t gonna be pretty.

Now we’re getting somewhere – I commented that this was going to happen back in November. Based on the indefinite support the government is providing to the financial sector with taxpayer money, it seems painfully obvious that housing prices will not be going down significantly anytime soon.

**

This being the case, is now the time to buy? It seems to me that unless you want to wait another ten to fifteen years (a lost decade, just like Japan), now is the time to get into the market.

**

Sure, I agree banks should be allowed to fail and flood the market with their distressed properties. But will this happen? I think not.

**

Sure, prices are artificially high, but how long do you want to wait for the market to normalize? I can wait a year or two, but not ten or fifteen.

**

Me, I’m in the market to buy now. Please, somebody talk me out of this! Show me the error in my logic!

Soon everyone will be looking for the own personal bailout and cease making mortgage payments. Why should they, if the banks don’t foreclose for 18 months? Perhaps they should havebailed out all the homeowners in the first place, rather than bailing out the crooks who got us here. Makes you wonder if their is any division between Big Business and Government anymore. Apparently not.

So why do we keep paying our bills?

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Doc,

Can you investigate what the Japanese government did, including mortgage interest rate changes and bailouts, during the Lost Decade and compare them with what our government is doing now? I don’t think our government has any option other than simply following the foot steps of Japan. I don’t think Fed is smarter than Japanese counterpart. By studying past Japan’s history, we may see what our government will do and whether sideliners like us are really screwed now.

Thank you.

There are consequences to all these unlimited bailouts, the price of gold and silver will continue to skyrocket..

I wonder how a bailout of this magnitude will effect the value of the US$?

Linda, you are confusing a sale for unpaid taxes with a foreclosure of unpaid loan. Two different beasts all together. Yes… the tax sale is a result of unpaid property taxes after 5 years but you won’t find many mortgaged homes in that list. Lenders get notified when taxes go unpaid … and if need be will pay those taxes on behalf of the borrower …and then tack it on the loan.

@ Linda–

You are correct. Tax default sales are not the same as the lender auctions. The lenders still continue to hold auctions of foreclosed properties on the courthouse steps around the region. Postponement or cancellation only occurs if the owner is able to cure the loan in a certain time period prior to the sale, they have filed for bankruptcy, or there has been some other settlement arranged with the lender,

I wonder how many more bailouts we can have before inflation kicks in.

Only buy IF you meet the following:

-nothing over 3x your annual take home income unless your large down payment can make up for it in lower monthly mortgage payments

-at least 20% down

-monthly mortgage should not exceed 35% of your take home household income

-don’t count the wife’s income unless you guys already have kids who are school age

-18 months worth of mortgage payments in a savings account

Above is conservative, but with the present housing market, you have to be

Doc

>>

I checked based upon the info you provided.

>>

That is a TAX DELINQUENCY sale – not, repeat NOT, mortgage foreclosure sales.

>>

HAMP (or those other nonsensical mortgage alteration programs) have nothing – nothing at all – to do with it.

>>

Using the tax sale auction postponement as part of an argument about mortgage foreclosure auctions is basing an argument about apples on data about green beans.

>>

Tax sales get postponed all the time. Used to be because there were very very few tax delinquncies going to auction and 95% of the delinquencies would be cured before auction. Now the number delinquent is growing expotentially. Could easily be that the tax office is having trouble getting together the final number to be auctioned what with having to sort out those that were or are being cured from those that are not; mailing notices; putting the lists together; publishing the lists etc. Not enough staff or time to deal with the flood of properties so they postpone.

>

two differnt dogs you wrote “the tax sale is a result of unpaid property taxes after 5 years but you won’t find many mortgaged homes in that list. Lenders get notified when taxes go unpaid … and if need be will pay those taxes on behalf of the borrower …and then tack it on the loan.”

>

Not necessarily correct. It depends on the jurisdiction and how any liens are recorded.

>>

If the lender did NOT require a tax escrow, they generally do not know about a tax delinquency. Typically they do NOT get notice of a tax delinquency. They might get notice IF the jurisdiction not only notifies the property owner but also all lien holders (and that would be mortgages, mechanics liens, judgement liens recorded against the property, etc.) Very very few jurisdictions notify lien holders personally as it runs up the cost. Tax offices simply do not have the staff to do a title search on every single property and prepare individual notices. In most states, tax delinquencies are published in the paper to avoid the cost of having to send out individual notifications.

>>

If the lender learns of the tax delinquency (generally through checking the notice in the paper listing all delinquent properties), then they will pay the taxes and add it to the balance. Further, if a property is in default, then the lenders normally check with the county tax office to make sure the taxes are current.

>>

Quite routine for properties with a mortgage but without a tax escrow to be on the tax delinquency list. In fact MOST of those on the delinquency list also have a mortgage – no different proportions than the number of properties that have a mortgage versus those that do not.

>>

20, 30 years ago, virtually all mortgage lenders required a tax escrow and included it in the payment amount. Being lazy and not wanting to bother with paying the taxes, lenders stopped doing that some time in the recent past.

>>

Even lenders that have foreclosed and now are the owner of record have ended up on the published tax foreclosure list around here. Pretty funny to see BOA, Countrywide, etc named as the owner of record for a property with delinquent taxes that is on the list of “to be sold at auction unless taxes are paid by 00/00/00 date.” The owner/lenders do get the taxes up to speed once they hit that list and it is published in the paper!

>>

Keep in mind that a tax delinquency auction is generally not final for a considerable period of time. The owner of record usually has some time to pay the delinuqent taxes, redeem the property from sale and have the auction set aside. This procedure varies from state to state.

THANK YOU DR. HOUSING BUBBLE FOR THIS DIFFERENT PERSPECTIVE OF AMERICA’S HOUSING ECONOMY. YOUR ARTICLES ARE WELCOMED READING.

Could it be that the Obama administration is strong-arming the banks that took bail-outs to hold on to their shadow inventory until this next election cycle has passed? If a flood of foreclosed homes go on the market right before the November elections it looks bad for the democrats….not that things don’t look bad for them already.

If this was happening in France the guillotine on plaza Concorde should have been working for more than a year to clean this mess.

Enjoyed this article as well:

“However, I must object to how Treasury has gone about this. Rather than being an advocate for the people of this nation Treasury has instead intentionally designed these programs and withheld critical information from the public with regard to their full intentions with the purpose and effect of inducing consumers to enter into transactions that are severely to their disadvantage – all to create yet another rip-off of the public for the benefit of the big banks.”

http://market-ticker.denninger.net/archives/1811-HAFA-Foreclosure-Warning-Dead-Ahead!.html

Dr. – Are you aware of the real estate bubble in Canada? Prices are hitting RECORD LEVELS while consumer debt loads are hitting RECORD LEVELS, and unemployment is RISING! How is this possible? We have the Canada Mortgage and Housing Corp. (CMHC) – our own version of Fannie Mae et al. which insures all mortgages where the down payment is less than 20%. CMHC allows as little as 5% down with 35 year amortizations (it was a maximum of 40 years for a while). We don’t have 30 year mortgages here in Canada. Most new mortgages are variable rate….

2DD, did you read my post? I do understand the difference and that is why I believe the post confused the two. The county treasurer doesn’t get involved in lenders’ foreclosure sales except to walk past them on his way in and out of the office. I believe the screen grab of the postponed Feb ’10 auction is an annual tax sale of tax-delinquent properties (often mostly timeshares), and has nothing to do with the daily foreclosure auctions that the various lenders hold.

You’re starting to get it (referring to me previous comments about this issue of shadow inventory).

Now consider the great increase in FHA loans (http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/2010/01/09/MN4U1BDH0K.DTL&source=patrick.net).

Now consider comments from Timothy Geithner (the government will be the backstop).

What do you see now?

What do I see? I see The Federal Reserve and the White House as one. Every president since Bush has proved that. I also see many mad people who didn’t game the system, and are watching the ones who gambled not suffer any penny. I see thousands and thousands of americans who did NOT gamble, but just happened to buy at the wrong time in a FRAUDULANT environment, and now these americans are LOSING THEIR HOMES, losing their credit rating, and becoming very detached from the system. I also see people angry at ANYONE who is losing their home and degrading their character. The people who cannot see who the real enemy is, but instead, alienate their fellow citizens.

There should be trials, people should be going to jail. The market should be left alone to correct itself. I would LOVE to see single family homes (1500 sq.ft.) here in OC sell for $250,000 or LESS. But it won’t happen, too many people want to “get in”.

For all those who feel you should “take advantage”…go ahead, buy, then default, see how much of a DREAM RIDE that is to your life.

I don’t understand how people can still qualify for homes on the market. If Fannie and Freddie are buying up all 729K loans or less here in So Cal, someone still has to go through all the documentation. That means $$ down and proof of income. I would think over time (even with low rates), that prices will have to come into line with people’s down payments and incomes.

I’ve been to those tax auctions. None of those properties are being auctioned because of their mortgages.

However, mortgages could have a lot to do with the delay. When a property sells at the tax auction, it has unpaid taxes for at least five years. By the time it gets to auction, usually six years. In the past, almost none of those properties were homes. Generally, they were vacant land, with an occassional commercial building or parking lot.

Now, it’s different. The single family homes which used to get paid off at the last moment often won’t be paid off. They can’t sell the home or refi to cover the taxes. Lenders/servicers often act shocked to find out that property tax sales wipe out mortgages. For example, take a home with a $500,000 mortgage, worth $250,000 at current market with an orderly sale. It goes to the tax auction and sells for $150,000, since you can’t inspect the house, have rules about how long to wait before taking possession, etc. Probably about $25-35k goes to the back taxes, interest and penalties. Barely $120k can go to the homeowner or lender. They also have a limited time to claim that money, and could easily screw it up for a total loss.

If it walks like a piggy, talks like a piggy, by golly it’s a PIGGY!

BofA and it’s CEO Brian Moynihan reminds me of that song by John Lennon and George Harrison titled “Piggies” I invite you to listen to this song on youtube and see if it appropriately fits.

http://www.youtube.com/watch?v=NTmeHM-Hojg&feature=related

Have you seen the little piggies

Crawling in the dirt

And for all the little piggies

Life is getting worse

Always having dirt to play around in.

Have you seen the bigger piggies

In their starched white shirts

You will find the bigger piggies

Stirring up the dirt

Always have clean shirts to play around in.

In their ties with all their backing

They don’t care what goes on around

In their eyes there’s something lacking

What they need’s a damn good whacking.

Everywhere there’s lots of piggies

Living piggy lives

You can see them out for dinner

With their piggy wives

Clutching forks and knives to eat their bacon.

Wright vs. Bank of America Lawsuit at: unitedlawgroup.com

When I filed my lawsuit against Bank of America, myself and United Law Group thought of the many others out there in the same situation. It was then that we decided to educate the public on what these piggy banks are doing, as well as unite us all together as one voice. Please help me turn this David vs. Goliath modification process, into a Goliath vs. Goliath.

Please stand with me and United Law Group and send an email to Bank of America that states that we will no longer tolerate their potentially illegal, fraudulent, irregular and abusive business methods.

Divided we might have fell America, but united we must stand!

Please send your email directly to Bank of America and include the following:

1. Your name

2. Your complaint concerning your experience with Bank of America.

3. Please end your email “I support John Wright vs. BofA Lawsuit!â€

4. Please send a copy of your email to johns-wright@hotmail.com

5. Please send your email to both BofA link below and the CEO email

BofA Linked Email:

https://www3.bankofamerica.com/contact/?lob=general&contact_returnto=&state=VA

CEO Brian Moynihan:

brian.t.moynihan@bankofamerica.com

Leave a Reply