Double Bubble: California Compared to the United States. Vacancy Rates up Homeownership Down.

California, the epicenter of the housing bubble is facing difficult times. It is becoming rather apparent that this housing bubble has the risk of causing a worldwide recession. It is hard to imagine until you look at the facts how this bubble got out of hand so quickly. The foreclosure problem is now hitting squarely on the state. Last month for Southern California over 30 percent of homes sold were distressed properties. This rate is only increasing and will put future pressure on prices on the downside since first, we still have record inventory and it is harder to get a home loan. The latter part, getting a home loan is harder and for the right reasons. Folks simply do not have the incomes to support the prices in many areas. The only way they can purchase homes in these areas is with liar loans or sub-prime products but those are now largely absent and rightfully so. We are left with the reality that prices were fueled by egregious lending practices and lack of income.

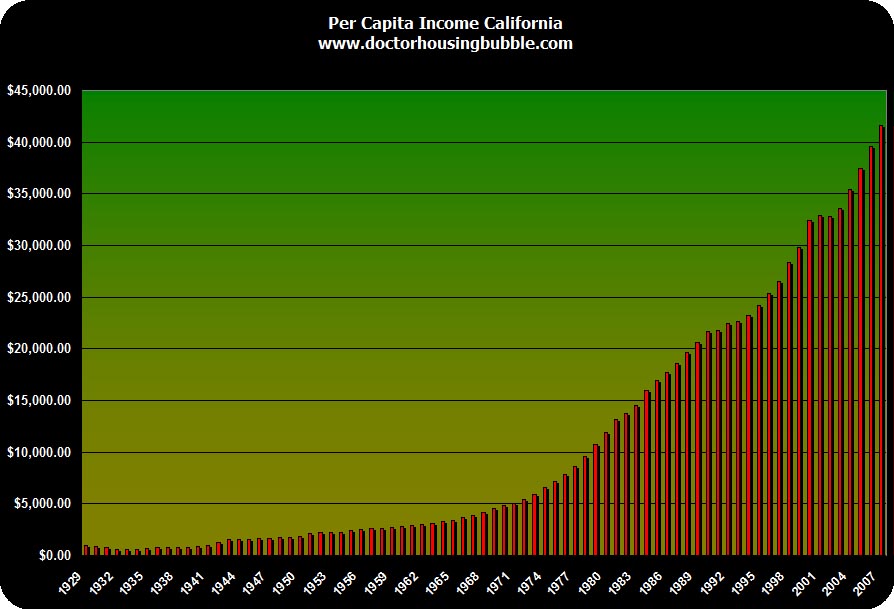

We can look at it another way. It wouldn’t be such a problem if in the last 10 years incomes had doubled as well. In California, per capita income went up 56 percent while the median home price in Los Angeles went up twice as fast. So how can it be that prices became so disconnected? In this article we are going to examine multiple facets of the housing market both in California and nationally and demonstrate that areas like California, are in fact in a double bubble much larger than the average US market.

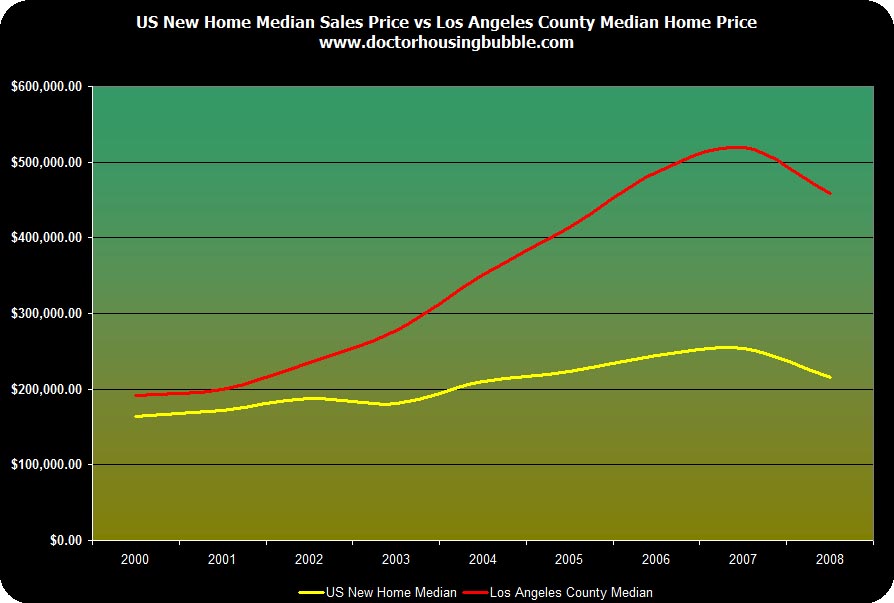

Los Angeles Median versus U.S. Home Median Price

Contrary to popular belief, buying a new US home and the median home price in California weren’t so much apart in 2000. Of course the new home of 2000 was probably a lot larger and nicer than the Los Angeles median priced home but the above chart gives us a good reference to begin with. First, let us look at the start date of 2000 compared to the peak January prices of 2007:

2000

Los Angeles Median: $192,000

US New Home Median: $163,500

*Difference of 17 percent

2007

Los Angeles Median: $520,000

US New Home Median: $254,400

*Difference of 104 percent

What happened during these seven years that sent Los Angeles home prices twice over the national new home median price? If in fact, the nation itself is facing a historic bubble which if we are to look at the above chart, is correcting quickly how historic is the California bubble? It is in fact unprecedented and there is really no model telling us how low prices can go since we never had a model showing us that prices could run up so quickly. This for the most part was fueled by lax lending, financially irresponsible loan products, a Federal Reserve that was asleep at the wheel, and an economy that was addicted to easy credit. No one really is without blame but some have a much larger share of the responsibility. Both the national market and the California market are now facing steep corrections. Southern California at the height of the bubble in 2005 was underwriting adjustable rate mortgages for 70 percent of all home purchases.

Even now with rates still at historical lows and Fannie Mae, Freddie Mac, and the FHA trying all they can to juice the market, have no products that make up for the gap that the NINJA products once took up. Unless government backed institutions are able to come up with methods of not checking income and greasing the wheels, the bubble burst still has years to correct especially in double bubble areas like California.

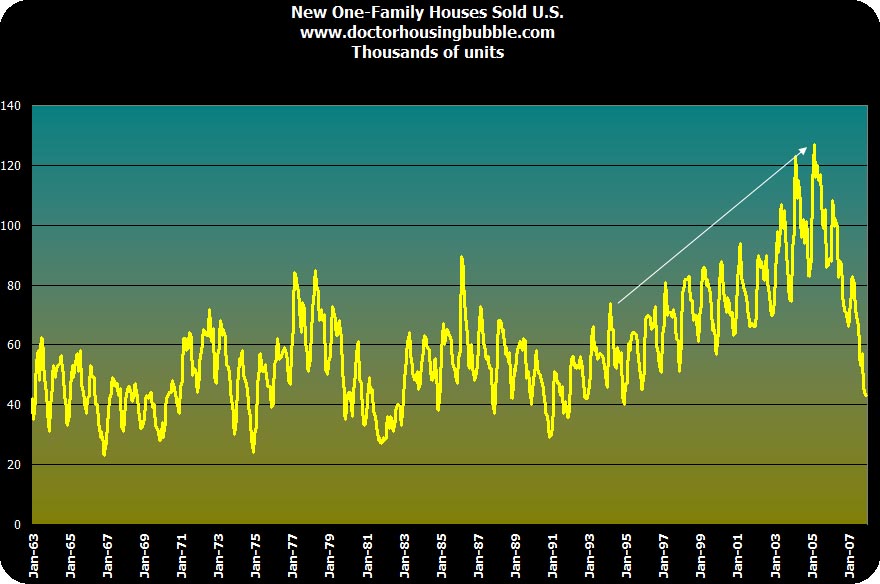

New Homes Sold

We have never witnessed a national housing bubble. It is the case that areas like Florida in the 1920s, Southern California in the early 1990s, and other cities like Boston have seen past bubbles but on a regional level. The subdivision assembly line of building new homes has been developed to a science. In no time in history were we able to build so many houses so quickly. The only problem with this was that it was fueled at the expense of future expected growth and credit. One thing to be said about credit and buying a home. Mortgages in their 30 year flavor came about in the first half of the 1900s. Previously, mortgages had a term of 15 years and at times, even 10 years. This changed as the product evolved and the 30 year mortgage has been status quo for the majority of the 1900s. The extension to 30 years made sense since many people, it was assumed, would be living in their homes long after their mortgage is paid off.

The logic of the utility of a mortgage evolved in the 1990s but morphed into another creature in the 2000s. The mortgage product was viewed as a temporary bridge until you were able to sell your home, at a large profit of course, and were able to buy a much larger home in the parroted five to seven years. The home, as you can see from the new home sales above, was now a pit stop until you were able to buy a newer and bigger home. This psychology burned strongly and created the additional demand for new homes. No longer was a home valued for its stability but was seen as a commodity with only future appreciation and zero risk involved. The market created the consumer psychology which we are currently battling with. The consumer for the most part is still expecting easy access to credit because that is how they were conditioned for a decade.

Per Capita Income

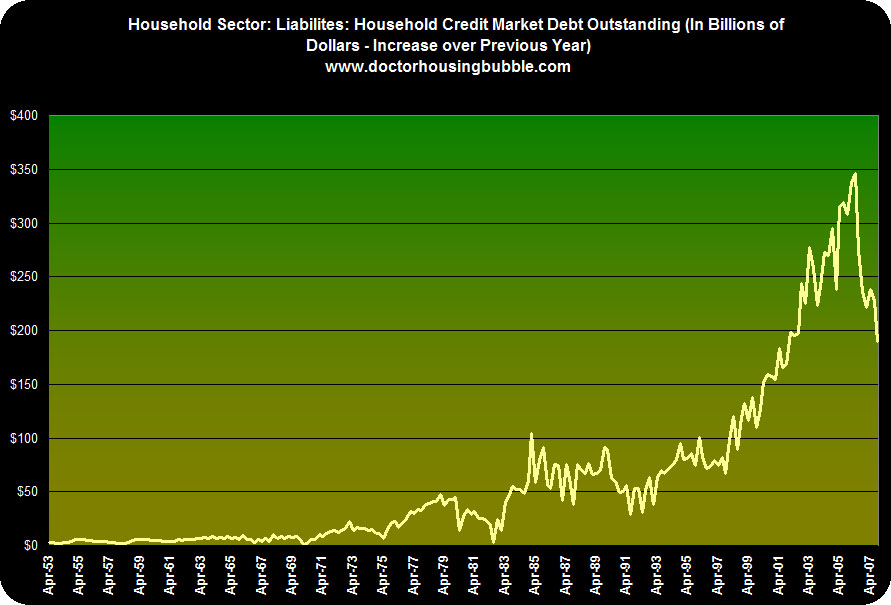

Let us look at the per capita income for California. During this mega bubble decade, per capita income for Californians went up by 56 percent. However, the median home price went up by over 100+ percent statewide. Take a look at the above chart to see how per capita income has grown. It may seem drastic but then examine that in conjunction with the first chart looking at Los Angeles County. Growth in home prices stripped any gains in personal income. Normally, we would see similar growth spurts if income went up as well. This has occurred in the past during inflationary times. Yet, we had a major disconnect here. So how can it be that incomes grew at a much slower pace yet people were able to support higher prices? That is where the bridge of toxic loan products comes in:

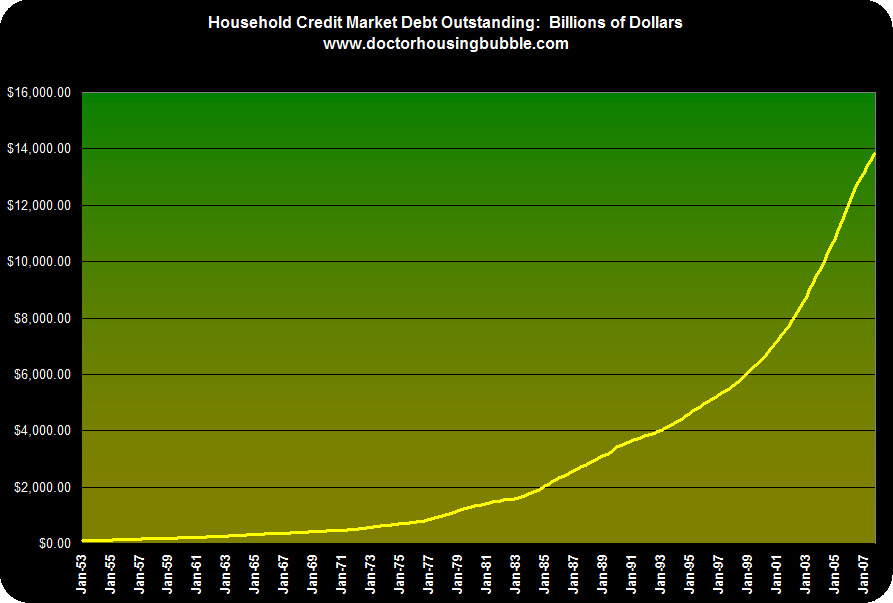

Debt has exploded in the last decade. Although it has slowly started to decrease simply because of a credit crunch, we are still in uncharted territory. The amazing thing is banks would still be loaning out these banana republic loan products if it weren’t for the house of cards simply collapsing on its own weight. That is why these bailouts and now there is talk of giving the Federal Reserve, a key culprit in this bubble, much more responsibility over Wall Street. How is that even an option? First, we have Greenspan slashing rates fueling the bubble and also encouraging people to take adjustable rate mortgages. Then, we have Ben Bernanke missing the mortgage debacle by saying in the first half of 2007 that sub-prime was contained and there was nothing to worry about. Now, the panic has set in and he is doing a déjà Greenspan by slashing rates and showing him up, but bailing out an investment bank. What makes anyone think that Bear Stearns is the only investment bank with problems? Does this mean that we’ll be bailing out every other investment firm with problems? After all, if you dig into their balance sheets they all have toxic products linked to mortgages with the only difference being how much each one carries.

Homeownership and Vacancy Rates

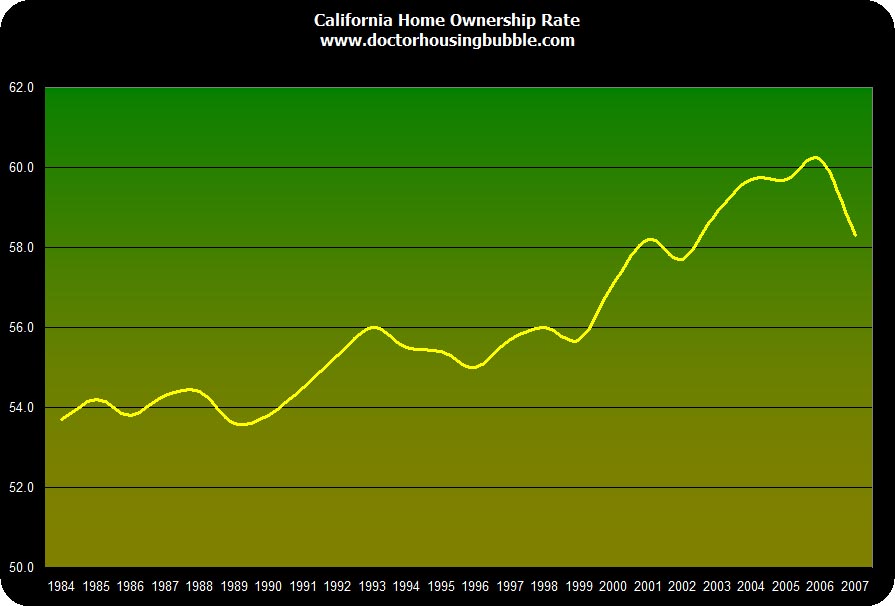

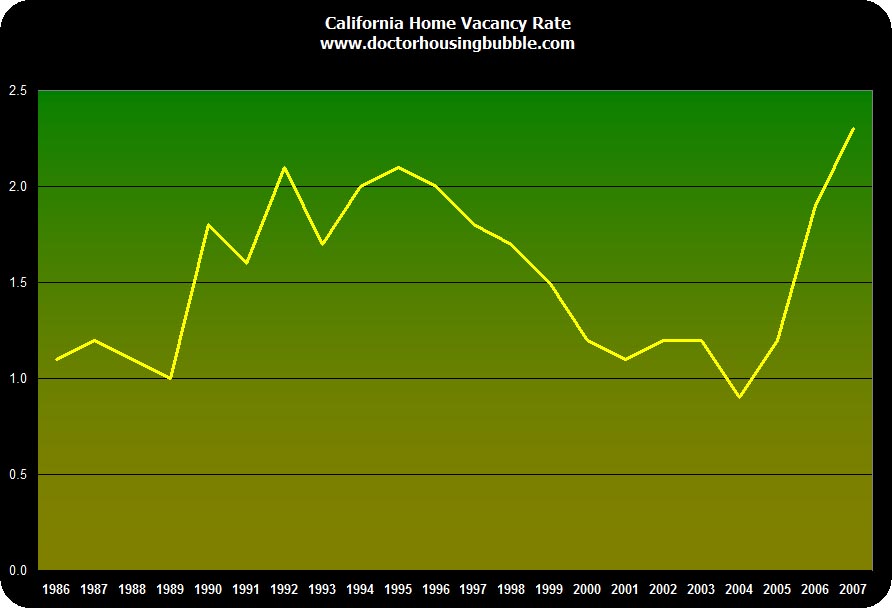

As expected, the homeownership rate is declining nationwide but also in California. With historically low affordability and stagnant wages, we can expect the homeownership rate to continue to decline. In fact, in areas such as Los Angeles County where the majority of people rent, we can expect prices to decline even further because there is a ready market to absorb folks that decide either voluntarily or involuntarily to leave their homes. In addition, from the graph above you can see that homeownership rates spiked from 1997 to 2006 in conjunction with the advent of toxic mortgage products. This is another good leading indicator of a future bottom. We can expect to hit 56 percent once again and then, we can start discussing if we are truly at any housing bottom. And in a further sign of market distress, the vacancy rate in the state is increasing:

Well this is also being caused by the state of the dismal and looming short falls in the California state budget. Keep in mind that many of the proposed job layoffs have not made their way onto the market. This will only further drop the homeownership rate and also keep vacancy rates spiking.

Trade Balance

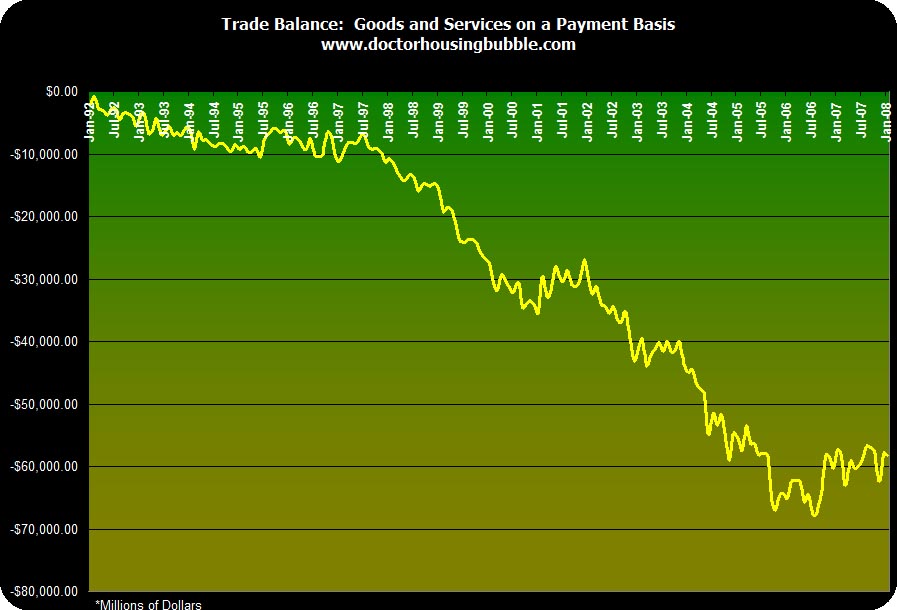

You may have noticed that many pundits have now been laying off the talk that a lower dollar will help us with exports. Take a look at the above chart and you’ll see that a lower dollar is actually doing very little in helping this situation. Now why is that? For one, Americans are hyper-consumers. Nowhere on this planet is there a people that spend so much money, usually on credit, and have a resiliency to keep on spending. Many other nations including Japan have a higher per capita income and also, a strong savings rate. Our savings rate is negative. So a lower dollar is a double whammy since imports go up in price relative to the dollar and exporters abroad see Americans consuming less hurting their bottom line.

Having a low dollar policy is pennywise and pound foolish. Most Americans get paid in dollars and consume very little domestic products. The market for our exports is nowhere as strong as the market here is for imports. To think this was going to be a remedy for our economy was somewhat baffling. I was looking at the hottest growth sector and it is healthcare. With an aging population, which of course isn’t out there producing and a younger population caring for them, which sectors are going to be producing these so called shadow exports? The market abroad is nowhere strong enough for it to avoid a recession.

Future Steps

We are going to face drastic changes in the next decade. The concept of credit is going to radically shift and we are going to need to prioritize as a nation. It is amazing how many people I talk to that simply cannot imagine coming up with 20 percent down for a home. Or many don’t grasp the idea that if you want to purchase a luxury item, maybe you should save up and pay for it in cash. My guess is that as credit becomes more scarce, people will have to determine what is a need and a want. Priorities are going to realign and maybe this double bubble pop will be a positive thing for the nation in the long term. After all, how is becoming consumerist hamsters really positive for our nation? Wouldn’t it be better if we were prudent, industrious, and financially savvy? It is hard to stomach when I hear the government tell us, “go out and spend those rebates” since this is such a wrong course of action. Hopefully people are now seeing through this and gearing up for tighter times and being positive that we don’t repeat these same mistakes again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

20 Responses to “Double Bubble: California Compared to the United States. Vacancy Rates up Homeownership Down.”

amen

I like the idea that we become prudent, industrious, and financially savvy. But it seems the government is going out of its way to punish savers through inflation and a tanking dollar.

Where is it etched in stone that we are to be insulated and protected from foolish, ignorant financial decisions? This country NEEDS a big wake up jolt and bailing out fools/speculators, particularly at the expense of more fiscally conservative folk, goes against every fiber of my being. Life can be tough. Learn from your mistakes and move on.

Personal responsibility has become a joke in this country. The next time I hear a talking head say “we must all share the pain” I’m going to scream. we already ARE sharing the pain through lower returns on savings and investments.

http://news.goldseek.com/MillenniumWaveAdvisors/1206857400.php- No its not about gold it is an interesting look at the housing bubble with some excellant charts that have data I had not seen before and indicate the housing correction is going to take far longer than most analysts have been willing to admit. For example there are some charts that show there were some 3.5 million excess homes added to US housing supply during this boom. QUALIFIED buyers will have to be found for this inventory and at a time when qualifying has become more difficult. In short the study authors estimate median sales prices will bottom sometime in 2010 nationally and that the sales pace will return to ‘normal’ the next year. Of course this is all predicated on historical economic patterns and we are in uncharted waters economically in many respects. The authors assume there will be some government bailouts as the wave of foreclosures grow in intensity over the next 12 -18 months. Whether or not the government can stay ahead of this bothers me a great deal. Financial problems can develop with such speed in an era of 24 electronic global trading that we could go to bed secure only to wake up to learn that there has been a run on the US dollar in Asia and the world we knew just yesterday is gone forever. Our big banks cannot just keep having multi billion dollar writedowns quarter after quarter

before people lose confidence in their solvency. Anyway I recommend the condensed version of this report to those interested. It tracks almost exactly what Dr. Housing Bubble has been preaching with some interesting new data that show there is no need to rush out and buy. There is plenty of time to buy if things don’t fall apart and if they do it doesn’t matter.

I have to challenge your graph marked per capita income. The numbers are far too high for per capita income and too low for median household income.

In 2000, the median per capita income in CA was $22,711, the median household income was $47,493, and the median family household income was $53,025. (‘Family household means a household of individuals related by either blood or marriage or adoption.) In 2006, the median per capita income in CA was $26,974 , the median household income was $56,645, and the median family household income was $64,563. (Us Census data.) (BTW, LA County incomes were slightly less than the state median.)

In 2000-06, the median per capita income in CA went up 18.77% , the median household income went up 19.27%, and the median family household income went up 21.75%. Over a 10 year period (’98-’07), incomes probably only went up around a total of 33-38%. (I didn’t feel like going in and digging out the data for ’98, ’99 and the preliminary data on ’07.)

Clearly house prices far outstripped income gains.

I would love to see the value of every home in the state drop to 56% of its current value. And in theory, that *should* happen. Incomes don’t support the inflated home prices. But there will always be the super rich in the Bay Area and Los Angeles (and San Diego) to artificially inflate the “average” price.

But make no mistake, that 35-year old couple driving the Prius & Jetta on their combined $120K household income will no longer be shopping for million dollar homes (as I saw all over the west side as recently as summer 2007).

Sorry, the easy credit is gone. No one is going to buy your $1M 1100 sq ft cracker box. Drop the price to $600K and then you’ll get some nibbles.

Thank you Ann Scott. I too, thought the income figures showed too precipitous a rise but I don’t live in Socal so what did I know. I do know my own income ( earned) did not show such a rise, yet it only reinforces the point. DTI is way out of whack and no bailout or financing scheme can change this fundamental issue.

I think California real estate can enjoy a premium somewhat above its historical 20% level but not 50%. You don’t have the heating ( or airconditioning) loads that you do elsewhere. On an average sized home that is maybe a $200/month value in purchased energy cost if you live in the coastal regions. It is another few thousand dollars in capital costs. But it is not a 25% or greater advantage. Sure it is nice to walk out in January in shirtsleeves but you can do that anywhere south of Charleston, South Carolina too and about as often as it happens in Pasadena.Ca. The median price of a home in Houston, Texas is, amazingly enough, only $150,000 and change. OK, that is not River Oaks but $500,000 in that city buys you good schools, a decent house, and if the summers are hot the winters are not unlike Socal. People are getting hip to this. Texas or South Carolina are not Hades. There are golf courses, restaurants and museums. As I look across the nation for a place to retire too California does not strike my fancy even if I spent most of my life there. I can buy a nice condo on Saint Simons Island, Georgia for under $300,000. In the ‘Golden State’ for that money I would be in Fresno I suppose. So if your budget is $500,000 why not live in a beachfront condo in Georgia and instead of a ‘zip code’ have a 35 foot Carver Mariner down at the marina to enjoy.

I plan to run right out and spend my rebate — spend it on campaign donations to get some new leadership for this country.

If you do not read this article from top to bottom, read the quote by Orval W. Adams near the bottom.

http://news.goldseek.com/GoldSeek/1206716400.php

“This changed as the product evolved and the 30 year mortgage has been status quo for the majority of the 1900s.”

I think you should check your data, 30 year mortgages have been the standard since the 1950s.

Hi Scott

The data is easy to find if your know how to dig it out. I end up working with income stats a fair amount when doing such things as trying to explain to our clueless village council of recycled housewives that a development with startiing prices of $275,000 is NOT affordable for the workforce in the the area’s tourism economy (read: low wage jobs) nor for our EMTs and fireman making $15 an hour nor for even the median income in the county of $43,000. (That $275,000 buys a 50x 95 lot with a 1500 sq ft house – all tarted up in the best New Urbanist vision of circa-1900 with rear garages off an alley. The lot and development layout and house design violate every single land use and planning precept about maximizing land usage and minimizing costs that I learned decades ago in grad school.)

“why not live in a beachfront condo in Georgia and instead of a ‘zip code’ have a 35 foot Carver Mariner down at the marina to enjoy.”

HMMM…… A Carver? Well if the budget wouldn’t stretch to a Kady Kroegen, Vicem or Grand Banks Eastbay (I have VERY expensive tastes), I would opt for a 38′ Chris-Craft Roamer sedan with flybridge built between 1965 -1970 with either the steel or aluminum hull. Those hulls can move icebergs and will still be around long after most of us are gone. (And they handle like a dream in the wickedest sea and foulest weather. I often ran a 38′ steel-hulled Roamer without a flybridge through seas that were so rough with steep waves and troughs that waves would breaking at the bow and throwing water pouring back over the hardtop – and she kept on plowing ahead without hesitation or loss of stability.)

“But make no mistake, that 35-year old couple driving the Prius & Jetta on their combined $120K household income will no longer be shopping for million dollar homes (as I saw all over the west side as recently as summer 2007).”

DannyBoy:

If this couple was buying a million dollar home with that salary even during times of easy credit they were insane. Thats a little less than what we make and even though we were offered huge loans and teased that we were not leveraging ourselves enough thought that that kind of debt was irresponsible. Especially for 1100 sq feet (which describes our neighborhood perfectly btw.) If you are buying a million dollar home you need to have a 300,000 dollar salary, don’t you? I still wouldn’t buy that at 600,000. Try 230,000 and I’ll consider leaving my 1200 sq foot rent controlled (1400 dollar a month for 8 years) apartment. Why should I pay more a month for less space and more responsibility?

Brian: (re: the link to article)

Well, of course the captains of industry were all for the gold standard, it limited financing for anyone trying to start up companies to compete with them. A gold standard guarantees abusive monopolies by restricting start-up capital.

I love the idea of a system that would be thrown out of whack if a solid gold meteorite were to land somewhere accessible. What a grand idea. Replacing the vagaries of Fed policy with the vagaries of mining isn’t a solution to what is really a problem of poor regulation and sloppy election financing.

This gold standard dream is just nostalgia run amok.

I also agree that the per-capita income figures are a bit distorted — in this post the author is comparing the growth in per-capita income to the growth in median home prices. This is not a correct comparison because per-capita income is a mean-figure — it is simply the total output of the state divided by the number of people in the state. It is a skewed statistic because the high incomes of the rich drag the average up. Median income is the appropriate statistic to look at in this case.

A previous comment argued this same point but the poster referred to median household income as “median per-capita household income” — but “median per capita is a contradiction — the latter refers to the average while the former refers to the middle point.

In any case I would bet that median household income did not grow anywhere near as fast as average income since the gains from this last growth cycle were heavily skewed towards the rich. The situation is therefore even more serious than the original post indicates.

Financial institutions are being protected from their greed and stupidity because the repercussions would be disastrous (probably, but possibly not a good enough reason to allow most to survive). It is generally accepted that housing is the cause of this crisis (ignoring the bubble on the way up and merely weeping and moaning on the way down). The solution so far is to protect banks by buying MBS’s (directly like from Bear Sterns or indirectly through the new Fed facilities).

The Other Big Shoe to drop is consumer spending. For the past ten years, CNBC, Bush, and Wall Street have lauded the US consumer as a patriot and a saviour of the World Economy. We know what the consumer was spending, debt. Now that spending will contract, leading to an economic meltdown which cannot be contained by a few buyouts or Fed facilities.

The small Bush rescue package puts a few hundred worthless dollars in consumers hands, hardly a drop in the bucket. If Wall Street and Washington want to keep this bubble going, they need to hand over lots of cash to consumers. The irony is that more needs to go to profligate, irresponsable consumers who will be more inclined to spend the cash on iphones, vacations, and plasma tv’s.

Our lenders (our children and foreigners) can do very little to stop all this.

Expat, I think the US consumer’s reckless spending was the result of the FED trying to end the business cycle. An awful lot of people got used to ever rising stock markets, housing prices and low unemployment since the last severe recession of 1980-82. If 9/11 both scared us and showed that America wasn’t immune to catastrophic events, the Fed and banks soon lulled the consumer to sleep again with low interest rates and generous credit. Now as the baby boomers face retirement and less generous returns on stocks and bonds and a falling real estate market and the problems of Social Security and Medicare are not in some distant decade I think the party is ending and people are realizing that.My guess is that savings rates will go up because people will come to the conclusion the government simply doesn’t have the resources to provide for our old age. Oh AnnScott re: boats. When I was living in Sausalito back in the 1990’s

a number of folks I knew lived on them. Not a bad way to beat the high cost of housing ( even then). You got no appreciation, in fact you had high maintenance

costs and berths were about $10/foot but you had a boat and million dollar views of the San Francisco bay. It wasn’t just poorer folks that lived on them either. There was a fellow who owned one of the local independant TV stations who lived on his 65 footer and a retired Pan Am pilot and drinking partner who lived on his 46 foot Grand Banks. Others managed to live on little 30-40 foot sailboats. I often wondered why more people didn’t go that route. Instead of paying a fortune for a conventional house in Northern Marin or Southern Sonoma County, fighting the traffic on 101 everyday spend a third of what you paid for your house on a 40-50 foot boat and live just across the Golden Gate from San Francisco. You could ride your bike to the ferry and be in the City in 20 minutes.

Doc-

Have you heard anything about what the future might look like for commercial real estate? A few “birdies” I know seem to think this might be the next melt down point. Keep up the great work!

OT, but you’ll enjoy this Real Homes of Genius 33% haircut in Panorama City.

I am a realtor and feel that we have seen the bottom in the realty market. Real estate will come back in 09. greg moser

Greg-sure you think its hit the bottom – that’s your new motto if you want to keep that job of yours. I’ll stick to good ole economics and wait for the math to make sense again. One point that is missing in all this – better standards for math education so even average educated folks don’t be made a fool of.

Leave a Reply