No room for a garden in Los Angeles? Have your garden grow on your home in Culver City. 873 square feet of green love for $700,000.

People lose perspective all the time when it comes to housing. In California we have this deeply rooted #YoLo movement where people are willing to spend every nickel in their wallet for rent or leveraging into a crap shack. The buy now or be priced out forever rhetoric was strong in 2013 and 2014. Today it has waned as people regain their senses one by one. As investors pullback current prices are meeting a pesky wall of resistance called “income†even though all you need is basically five percent down and two working stiffs to buy. So it should be no surprise that when banks run the numbers not many families qualify because of debt-to-income ratios. Culver City is a perfect example of a mania in action. People want to buy crap shack number one to leverage into a bigger home. Of course this assumption is all based on a greater fool theory and California is boom and bust central. Numbers don’t adequately show the full story. Let us take a look at what we can buy for $700,000 in Culver City today.

Green does grow on Culver City houses

Money may not grow on trees but it appears that it grows on homes in Culver City. People forget that you actually have to live in the home and get caught up on the notion that past gains are going to continue so they can plan their escape. The idea that people stay put is baloney. Many buyers are house horny property ladder aficionados.

Let us take a look at our first home on the market for sale:

9052 Poinsettia Ct, Culver City, CA 90232

2 beds 1 bath 873 sqft

This certainly will take some getting used to. Of course the inside has all the HGTV upgrades an 873 square foot home can support:

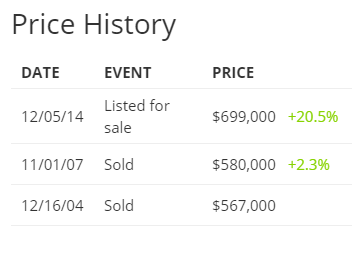

It might be useful to look at some price history here:

Timing people. From 2004 to 2007 this place actually fell in value. Those that bought in 2004 did not get the “never lose on real estate in California†memo or that buying in a city like Culver City makes you bust proof. Those that bought in 2007 are riding this out. They are looking for a $119,000 gain over seven years.

I always like looking at Google Maps since it gives you the non-Photoshop perspective:

Seems a bit cramped and the area has a large number of mulit-family dwellings. A home of similar size on the same street went for sale a few years ago but it ultimately didn’t sell:

9028 Poinsettia Ct, Culver City, CA 90232

2 beds, 1 bath, 896 square feet

“AUTHENTIC 1920S SPANISH GEM IN THE WONDERFUL RANCHO HIGUERA NEIGHBORHOOD FILLED WITH CHARACTER HOMES. NICE PORCH ENTRYWAY LEADS YOU TO A TWO BEDROOM, ONE BATH HOME FEATURING HARDWOOD FLOORS, DOUBLE PANE WINDOWS, FIREPLACE IN LIVING ROOM, CEILING FAN IN DINING AREA AND COPPER PLUMBING. BACKYARD HAS A DECK GREAT FOR PARTIES AND JOYFUL ENTERTAINING. DETACHED ONE-CAR OVERSIZED GARAGE OFFERS PERFECT STORAGE OR OFFICE OPTIONS IN R-2 LOT. WALK TO TRENDY SHOPS, HIP RESTAURANTS, SONY STUDIOS, KIRK DOUGLAS THEATER AND DOWNTOWN CULVER CITY CENTRE. PROPERTY IS BEING SOLD AS-IS.â€

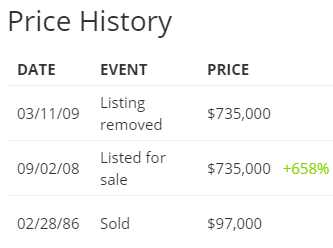

ALL CAPS! Trendy shops, hip restaurants, Sony Studios, and the Kirk Douglas Theater! And you get some nice trash cans as well. Someone was going for $735,000 back in 2008:

Ultimately it got yanked in 2009. The 2014 tax assessment valued the property at $160,976 so we can assume this is a Prop 13 winner. Someone tried to cash in on their stucco box lottery ticket. Sometimes living in a trendy area and eating Friskies is better than cashing in. Apparently money does grow on houses in Culver City.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

106 Responses to “No room for a garden in Los Angeles? Have your garden grow on your home in Culver City. 873 square feet of green love for $700,000.”

I’m looking to buy a house in LA for over a year now, looks like I can’t even afford a shack. According to many source, housing price will continue to increase. Houses over 700k are still being sold fast in LA. Who are still buying these houses? Investors?! Or maybe a lot of people are making 6 digits these days. People whose making under 100k should just rent forever I guess.

L.A. is a tale of two cities, but there are many high wage earners here. Couple that with a limited housing supply, and you hit the nail on the head. Usually the $100k+ crowd wins out, unless you have a trust fund or something.

@UnRealist, what is the LA retio between median HHI and the median home price? Is it like 10 to 1 or something?

Home buying is for successful people, not for everyone.

Yup, like those crap shack 400sq. ft. beaters on the pictures that require a double six figure income to qualify. Indeed, I worked and studies and saved all my life just to afford that crappy part of the Merikan Dreeeeem!

@ Clueless

You can forget buying a house less than 6 miles from the beach [West of LaCienega] for under $700K. Also forget about anything South of Ventura County Line all the way to Long Beach.

it might be helpful to know what your price point is to determine where to buy: $400K? $500K?

but notice I did not say ‘when to buy’

According to the loan broker, I could get approved for purchasing 700k house,.But I’ll be on a really tight budget for the rest 30years, not to mention if I lose my job. Are people still buying houses like this and putting all their pay checks into a shack they called home??! My realtor says if you don’t buy now, houses will be even more expensive. So here’s my question, should I wait for another year? Or be priced out forever. i mean some areas are more expensive now than ever… it’s like the housing crisis we had never happened to those areas.

Our household income is 2.5 times of the median in our county (King County, WA) and 1.5 of the median of my city (Bellevue, WA). Where am I supposed to buy if the median home price in the county is 3 times of my income (7 times of the county median) and 5 times of my income in the city (again, around 7 times of the median for the city). Where does this insanity stop? The FED cannot print the entire world to the prosperity!

Sleepless, you say home prices are 3x your income. Why don’t you just buy? I think that every time I have bought a home my income/price ratio was worse than what you’re describing.

Please read my comment. In the place I live home prices start at 5 times of my income. In the places where they are 3 times of my income, I wouldn’t buy!

Location – or No Location …. IT IS JUST “DIRT” with Concrete, Wood and dangerous Wiring …. Put your money in any Over-Priced property and you are a SUCKER.

If you’re in the Real Estate “Game” and you know how to turn a dollar, then that’s a different “profile” …. Otherwise the rest of the naive people are SUCKERS.

Love the large windows? A home like this worth $89,500 when you consider the real world of home quality, size, location, and the average person who looks at a home like this and the wages they bring home.

Which brings to me a point, where I see latest stats show about 75k wage earners have a amassed 1 million or more dollars in their 401k accounts. The avg I believe is about 95k for all workers. Consider that maybe 150 million people or more work and some are enrolled in 401k’s this is a pathetic number at best, a nation this rich in resources is falling so far behind with wage gap and savings it is more then worrisome.

You nailed everything except the keyword “location”. This home would go for about $89k in Minneapolis or Columbus, but not in a location that is 5 miles away from a very temperate ocean, 2 miles from Titos Tacos and walking distance to Trader Joes.

So you’re saying that being a couple of blocks walk to a Trader Joes and ONLY 2 miles from a popular taco shop is worth how much? I mean we’re talking a $600k differential here.

5 miles from the ocean, which has an enormous effect on the weather. And yes, walking distance to popular shops. Very green.

Inglewood, Hawthorne, Lennox, and portions of western Gardena are the same distance to the ocean as Culver City.

Culver City has always been bubbilicious.

In 1989-90, houses in Culver City were in the mid-$500K range before crashing to the mid $200K range in 1996-97. If prices had not crashed in SoCal in 1990-1997, and again in 2008-2010, assuming a 3% annual home price appreciation rate with no price plunge, those 1989-90 $500K CC houses should be selling for $1.1M today. They are in the $700K to $800K range today, so bubbles do correct.

Something can’t always be bubblicious. If the price is always high, it’s not a bubble. It’s just expensive.

Trader Joes financial analysts for new store location should be on anyone’s radar for future housing values within walking distance.

OK two types of people are going to buy this house.

1) Someone with equity, transferring it over toward this house.

2) a DINK couple, where each person makes $100k. In this neighborhood, with the studios, tech, engineering, internet and entrepreneurs that there are, this is common.

Nothing to see here, carry on…

I wonder how many couples earn $200K in LA? Seriously? 5%? 3%? 1%?

Number are irrelevant to some people. More fun to just say random stuff without facts. Nothing to see here!

More than you may think. 200k is not a lot in LA. Lots of people in places you mention, Bellevue, Redmond, bringing in that kind of money too. The premium on Tech talent puts the squeeze on. And, like LA, the Seattle area isn’t cheap so it doesn’t go far.

About 5 seconds with my mad search skillz yields:

http://articles.latimes.com/2014/feb/22/business/la-fi-inequality-la-20140222

As of last year being in the top 5% in LA required a household income of $218K. Presumably this number has only grown in the ensuing year.

Much as we hate to admit it, there really are lots of wealthy people in SoCal who can afford all the insane home prices we see.

Apolitical scientist, thanks for sharing the excellent data point. For some of the sought after areas (Westside, South Bay, Coastal OC), there is absolutely no shortage of qualified buyers who bring quite a bit to the table. The only shortage is “affordable” housing for sale in these areas. Supply and demand at work!

Apolitical scientist, thanks for sharing some random article that raises more questions than it answers. Even though the study in the article had nothing to do with the South Bay or Coastal OC, there is absolutely no shortage of supposedly sure thing betters like me out there in desperate need of confirmation. That’s why everyone should get in to those areas at any cost. Buy now or be priced out forever!

Thanks for responding there troll. Be a man or a woman and post under your real blog name. Buy now or be priced out forever? I have never claimed anything of that sort. These are generally blanket statements made when your argument holds little or no weight.

I don’t think you get it, so I will spell it out very clearly. We’re going to focus on TODAY’S buyers. It really doesn’t matter that your lazy uncle bought a place in SM in 1972 that is now worth 2M. Today’s buyers making north of 200K will not be looking in Pacoima, Inglewood, Norwalk, Norco, Hemet, etc. Their focus is largely on the Westside, South Bay or coastal OC. They can easily afford 700K crap shacks with their incomes. Supply and demand, long time owners not selling, no buildable land, close to job centers and amenities, good public schools = high real estate prices. Waiting and hoping for “affordable” prices in these sought after areas is an exercise of futility.

The lesson of the day is now complete. Hopefully you took good notes.

Sleepless – I’m realizing a lot more make about 200k than I thought. Average succesful professional (not in administrative or support role) makes at least 75k each. Usually in dual income scenarios I’ve seen, one of which may be in either sales, have an advanced degree (Mba, JD) or is in sales all making over 125k. These are folks in their mid 30s and seem pretty average for the homebuying demographic

Thanks for the backhanded compliment. The official blog police seem to have lost their real blog name registry. Although I won’t actually type the term buy now or be priced out forever, so that I can say I never claimed it, I’ll continue to infer it on the basis of everything else I respond with. Name calling and referring to important debate items such as blog handles are generally blanket reactions made when your argument holds little or no weight.

I keep yelling into empty spaces desperately hoping for an echo of confirmation. TODAY we’re going to focus on a narrow cohort of buyers to an audience of whom it doesn’t necessarily apply. It really doesn’t matter that no one is saying that they are waiting and hoping for anything in the Westside, South Bay or coastal OC as long as I can find a way to bring those areas into the conversation so as to obfuscate any larger points being made about the SoCal market. I’ll mention the usual hits that nobody is disputing such as supply and demand, long time owners not selling, no buildable land, close to job centers and amenities, good public schools = high real estate prices. I’m nervously awaiting and hoping for my big bet of late vintage in one of these sought after areas to not turn out to be an exercise of futility.

The decoding of the day is now complete. Hopefully you took good notes.

@apolitical scientist – http://articles.latimes.com/2014/feb/22/business/la-fi-inequality-la-20140222

Even using the provided link it says $218K was the 5% average. If you take some people from the top of that number that are millionaires, that means some people from the bottom of the 5% made probably less than $200K. So, assuming you have two 6 figure incomes in your household, that means you are in the top 5%. So, basically only top 5% can afford to buy a $700+K crap shack in LA? Does it seem normal? you have to be upper middle class to afford a crap shack? I understand that 5% is a big number, as some stated that the large number of folks make above $200K, but c’mon, 5%? Seriously? What about the rest of the 95%? Are they all losers?

I rent a house near this house and I almost threw up when I saw this place listed for that amount. The front is located in a dingy alley and is right next to a liquor store.

That said we would love to buy in Culver City (good schools, central location for us) but housing prices like these are pushing us to look elsewhere (we are $200k+/yr household).

2 miles from Tito’s Tacos, I hope that was a joke.

Hi Doc

So funny how many of the realtards cant move the trash cans before taking a photo!

You don’t need to because it’s going to sell anyway.

Doc, is there anyway you can add some motley flair to this clown’s posts so they’re more easily identified and passed over?

The homes sell themselves nowadays… why do you even need a realtor?

The question for us all … how many of those real estate transactions taking place now, in a highly inflated market and economically volatile times, will end up as foreclosures in the future? And, what will be the price to the rest of us to satisfy those needy/greedy or just dumb people?

A “dual income no kids” couple is probably going to buy it, and in this area they are making about $100k each so the house is not as much of a stretch as one may think.

It’s a matter of perspective! I am retired at 60, and am in an enviable financial place, including owning 3 properties. I only got to this place by being financially smart. First, I was frugal and saved. Second, I only invested when there was value. Those chasing L.A. high prices today, are too late to the current ‘bubble’, and are likely making matters worse by stretching the household budget for a ‘dream’ that will quickly turn into a ‘nightmare’!

Just because you’re making up stuff doesn’t make it true.

A dual-income family will probably buy this, and stretch their budget to the limits to do so, and then one will get laid off in this tepid recovery, and then they’ll lose the house to foreclosure.

See, I can make stuff up too.

How will they sell when rates rise just a question? I think about .

Since the rates will never rise, not in our life time at least, there is nothing to worry about. Remember, the further the fed postpones the rates hike, the more difficult it will be, so, technically, the FED can never raise rates. now it is only about whether the FED will continue printing or not printing.

Just a general comment. I am not the clown known as “The Realist”. I have stopped commenting because the comments have became so idiotic that I see no point in “contributing”…

Always enjoy your comments What? Seeing the number of housing cheerleaders posting tells me they have too much time on their hands. Don’t let the RealTards win!

Hey, What?, I do really miss you. I still stick to my opinion of you being a very intelligent person. I just think some “folks” (I really hate that word now, guess why) don’t understand your frustration and sarcasm (associated with frustration). Keep on posting!

Hi there What? Realist is performance art trolling, that’s why we thought it was you. His posting frequency is in the incredibly annoying territory though.

Anyway rate raise is in a few months and I’m betting its. 50 basis. Things should get interesting. Bubble 2.0 is deflating as we speak and the FED is about to poke another hole. Ignore the trolls and stick around. It’s gonna be fun. Unlike 2008 the only people who are really gonna hurt are the specuvestors. The rest of us have been in the shit since 2008. It’s gonna be fun welcoming them to the “New Economy” 🙂

No rate hikes in 2016. I will take your bet 😉

Easy money for me sleepless. There is absolutely no way the FED can walk back all they’ve said as far as a rate raise. All credibility would be lost. Not to mention the mal-investment correction would happen anyway and the FED would have no bullets. The market has been conditioned for 20 plus years to follow the FEDs lead. This would be the first time in the post Volcker era that the FED telegraphed a move and didn’t follow through. The only way they can even try to have an orderly unwinding of QE is to raise. Everyone says “Don’t fight the FED”. Well, they’ve told you what they’re going to do…

I agree, the FED can still deliver on promise and raise the rates. I am fine with your forecast of .5%. But will they stick with those rates or three months down the road they will come back and say that the economy has not recovered yet and now we need to reduce the rate again? I still don’t think they can even come up with .5%, they always said they can be “patient”. They have never given a definite date, it was always “data dependent”… so, shell we see? I am still taking your bet 😉

Heh, this is why me and the wife are looking in the South Bay now. We’d love to stay in Culver City but even with our combined 150k income and over 100k to put down we can’t afford anything in the area. Literally the only people that can afford even a crap shack in Culver City these days are the 250k+ earners. Bergh

“From 2004 to 2007 this place actually fell in value.” It actually increased $13,000.00 (567,000.00 20004 580,000.00). However, after buying and selling costs the owners must have lost money.

I wouldn’t even consider purchasing a house with all that growth trapping moisture. Possibly a lot of damage.

It’s value did not keep pace with inflation

But you’re still knocking down equity and making your way toward retirement. Good luck to those that want to retire at 65 and still have a mortgage, yikes.

(567,000.00 2004 — 580,000.00 2007)

Lot Size (Sq. Ft.): 1,086

Sale pending.

wtf?

Premium home in premium global location. I knew it would sell.

@UnRealist – Premium home in premium global location. I knew it would sell.

If everything sells in SoCal, why only $700K, why not $1.7Mil, or better $5Mil? Everything always sells in SoCal, right? The price doesn’t matter, the incomes don’t matter. Why sell so cheap?

I’ve noticed a high percentage of “pending sales” on real estate sites failing to go through.

This. A lot of failed escrows these days. Regardless, just because someone is willing to buy a turd doesn’t make it smell any better.

Historically, the 90232 (Culver City) zip code, 90034 (Palms) and the 90066 zip code (Mar Vista) have some of the nastiest bubble pricing. Look at the property records from 1989-1990, adjust for inflation, and you will need to change your underwear after running the numbers through a spreadsheet.

Buyers who are over-paying in Mar Vista and Sunset Park are gambling that Santa Monica Airport will shut down, to be replaced by a park, and thus nearby homes will skyrocket in value.

I don’t see Santa Monica Airport shutting down anytime soon. Even if it does shut down (not a certainty), it will only be after several decades-long lawsuits.

That sort of thinking sounds like work so I’ll continue to repeat the vague anecdote that there are a lot of people with a lot of money! I’m sure this time is different because there wasn’t anyone with a lot of money buying houses prior to when I mortgaged into my golden ticket on the hedges of the South Bay a few years ago.

There is an ass for every seat…..

Tulips come to mind….odd..

hopium has stretched across the land, all inhale and feel the crowded trade….

Why buy, water is little more important…good luck in your drinking….I mean chasing at the top….

I witnessed a fish frenzy in sea of cortez many times…they end silently, the the sardinas just tattered gills and flesh hopefully making it down to the bugs….the big fish just ate until their was no one left and moved on…

might as well play the tech bio bubble symbols with well timed campaigns…I could rent a nice little house for the rest of my life in Costa Rica and have lots of fun..with plenty of change to play with….to each is there own…but be weary when people say buy now it’s never looking back…patience is key in all investing…good luck to all you humans…

bot..//$$ terminate session

Costa Rica? Interesting. Lately I’ve been thinking Southern Italy or Andalusia.

great buys in Greece these days.

Costa Rica is overrun w gringos. The time to move there was the early 90s. Cost of living and taxes are now higher than many states in the US. The CR gov views gringos & gringo businesses as $$$$$$ just like Mexico. Just good for thought – you may be better off doing more research and picking a Cent Am homebase more friendly to American expats.

I would rent in Costa Rica, plenty of great deals…I like the food, water and people so it all works. I live in San Francisco, have a place, can’t understand it’s supposed worth…weird since I used to buy paper…I could rent my place here as were block to muni, great neighborhood, awesome view, it should cover most costs while traveling, living.

I have lived in California for most of my life, this drought is not getting the respect from people across the US it so deserves.. If the central valley has dust bowl, all of the US will be affected…I hope it rains a lot…

this housing bubble has been an epic Fed induced manufactured rise. All here who praise the fed for creating pottersvilles thruout select cities to the PE, Hedge, Wall Street Pigmen that hurt their friends and neighbors but walked away with properties at 80% discounts on bulk buys, the same homes the bastards ran up via bad underwriting ala government agendas , see pennywide ownership, still FASB- 157-8 not reinstated etc..

all hail thee glorious fed…Viagra of bubbles…this will not end well either….

“I am losing precious days. I am degenerating into a machine for making money. I am learning nothing in this trivial world of men. I must break away and get out into the mountains to learn the newsâ€

― John Muir

Like I said, there are plenty of cities in the US where home prices are relative to incomes, and housing is not a problem. Unfortunately the SoCal metro area is not one of them.

Here are some normal starter homes, low $100’s

https://www.redfin.com/FL/Tampa/6812-N-Orleans-Ave-33604/home/47267291

https://www.redfin.com/NC/Raleigh/2916-Sylvester-St-27610/home/41141513

The interest rates where kept low too long which results in the high prices. LA is not that expensive compared to London, Hong Kong and hose countries. LA/Orange also use to be cheaper years ago since they once allow mobile homes. Mobile Home parks existence a lot more in the cheaper states like Arizona, Texas and the South and midwest. It makes rent cheaper because people can own a mobile home and rent the space.

A new type of genfircation. WHites moved back to Santa Ana and Anaheim and homeschooled their kids or send them to a charter school and gang activities dropped since the lations are pushed into Riverside. Anaheim and Santa Ana have housing below 600,000 and some inland OC does since the houses don’t get sold.

Im’ma keep it 100 with you, and put it out there that Riverside is quite diverse, not just latinos. Now gangbangers, they are moving to Hemet, Victorville, etc.

The people who have good jobs don’t always want to drive. Simi, Santa Clarita, Rancho Cucamonga, Riverside, all valid cities of rich commuters. But plenty want to buy in Culver City, Highland Park and places where they can be close to the city.

The Fed is trying hard to make the market believe that it is seriously considering raising the interest rate. I can’t decide whether they’re doing it so that they can positively surprise us when they decide not to raise rates, or because they actually believe that they have learned from their mistakes. They were late in raising rates in past economic cycles, so they are afraid of being late again.

They are already 6 years too late. The bubble of 2008 didn’t deflate in the first place because of the FED. And keep in mind, the 2008 bubble was the result of 2000 bubble. So, basically, we are still in 2000 bubble that the FED doesn’t allow to deflate and the market fundamentals to take place. Even if the FED raises rates, that I doubt, but even if it does, it will un-raise them quickly because the “rekoveree” will evaporate instantly. It is “despairing” now even though the FED has not raised rates yet. Add unloading the balance shit on top of it, and you see the bubble collapse everywhere – stocks, bonds, housing, etc. MOAR QE is coming. The FED will keep printing until the dollar collapses…

FAIL.

Back to ZeroHedge you go. Maybe come back when you have some real insight to share with us?

The FED will raise interest rates because the low rates are destroying the real underlying economy. Low interest rates discourages prudent investment and encourages speculation.

The Fed CAN NOT raise interest rates, EVER, because the Gov will not be able to service it’s debt.

This is the only thing I would agree with @UnRealist. The FED cannot raise rates without driving the economy into the ground. Period! They can talk the talk, but they cannot walk the walk!

For over a year I’ve been hearing that the consensus was for the 10 year yield to go higher from the 3% yield we had back in January 2014. Supposedly hedge fund managers and other speculators were mostly short the 10 year note in the futures market. Now we hear they are still short the 10 year note, so there is room for the 10 year yield to go even lower and Jeffrey Gundlach (the bond king) is quoted all over the place predicting a 1% yield on the 10 year.

The obvious excuse now for treasury bears is that inflation is so low. Just wait for inflation to rear its ugly head and we’ll see rates rise dramatically.

What I suspect will happen instead is that we’ll reach a point where investors will be faced with a choice of getting negative 1% real yield investing in stocks with high volatility, or getting a negative 2% real yield on safe treasuries. The bond vigilantes will never be in a position to demand higher rates.

Give it a rest, real-tard. Is it so slow for you that you have to reply to EVERY single post? Give someone else a chance….

Ahhhh the housing gods hath spoken.

Now that Realist and Sleepless (Mr Seattle) have taken over these blog comments, thou knowest the end is nigh. Have at it, trolls. Regurgitate your tired drivel to your hearts content. The housing end times cometh!

Occasionally the topic of AirBNB comes up and how some homeowners who would be otherwise broke here in LA are renting out rooms in their homes (or entire homes) on AirBNB.

Here is a recent article in LA Weekly on the matter mainly focused on Hollywood, Venice and Silverlake as hot AirBNB rental locations.

http://www.laweekly.com/news/airbnb-is-infuriating-the-neighbors-is-it-time-for-new-rules-5343663

And of course, City of LA has 50,000 employees but no one to deal with AirBNB and zone violations.

f the govn’t. you should be able to rent out your rooms to whomever as long as you don’t over the occupancy limit and you don’t disturb your neighbors.

in case of a-hole landlords who disturb the neighborhood, their properties should be seized and sold.

>> in case of a-hole landlords who disturb the neighborhood, their properties should be seized and sold.<<

What about a-hole TENANTS?

Many of these AirBNB "landlords" are actually tenants who are subletting their apartments, violating both the law and their lease agreements.

Here in rent-controlled Santa Monica, a city in which 70% of the population are tenants, most AirBNB rentals are illegal sublets by rent-controlled tenants.

Such illegal subletting is common in rent-controlled areas such as New York City and Santa Monica. Rent-controlled tenants won't give up their below-market rentals, even though they no longer live in the area. Instead, they illegally sublet them at market rates.

Which defeats the whole alleged purpose of rent control. You end up with market rate rents, which go not to the landlord who technically owns the building, but to the tenant.

Yes, these a-hole tenants should indeed be kicked out of their rent-controlled apartments.

Something smells fishy. Can’t the landlord kick out the tenants for subletting or AIRBNBing?

Tenants don’t tell landlords if they’re illegally subletting. The landlord must 1. discover it on their own, and then 2. have evidence that will hold up in court.

Are there strangers staying there? Often? Longterm? If so, how do you know they’re not family, friends, or guests of the tenant? The tenant will surely lie and claim such.

Landlords often hire private investigators to gather evidence on tenants they’re seeking to evict. My late father did so on occasion.

Gathering evidence is difficult because of all the anti-“tenant harassment” laws. All the more reason to hire a professional.

And even with evidence, evicting a tenant for any reason is difficult in tenant friendly cities like Santa Monica and New York City. NYC tenants can stop paying rent, yet easily stay on in an apartment for six months or more while the eviction drags through court, the tenant always trying for more stays and continuances. And forget about collecting back rent once the tenant is finally gone.

Wouldn’t ads on aribnb be enough proof?

No. An ad proves nothing. Anyone can buy an ad. I can list your home on AirBnb. Or I can advertise your prostitution services on Craigslist. You won’t even know about the ad until people start showing up at your home.

An ad is merely evidence — weak evidence. It is not conclusive proof. You must still provide additional evidence on who placed the ad.

The tenant can deny placing the AirBnb ad. Maybe an angry co-worker placed the ad? Or a jilted lover? Or maybe even the landlord placed the ad to have grounds for evicting the tenant?

But the tenant needn’t offer a theory. The tenant can just deny placing the ad. The burden of proof shifts to the landlord to show the tenant placed it.

How? Do you think AirBnb will give the landlord the advertiser’s credit card number? I don’t think so. Why should they?

Do you think the judge will issue a court order for AirBnb for turn over the advertiser’s credit card number? I don’t think so. This ain’t terrorism. Eviction is a piddly civil case.

Even if you can prove the tenant placed the ad, placing an ad is not illegal. You must still show the apartment was actually sublet. Maybe the tenant didn’t go through with the ad for some reason?

So the landlord’s PI must gather additional evidence of an illegal sublet. Documentation of strangers — a string of strangers — staying overnight, for long periods of time. My father’s PI once discovered the tenant of record spent most of her time at another address, out of state. That was helpful.

Even if you can prove an illegal sublet, NYC is so tenant-friendly, many judges still won’t evict the tenant without first giving him an “opportunity to correct” the lease violation. So the tenant gets a stern warning and promises not to do it again.

And maybe the tenant will keep his word. Or lay low for a while before illegally subletting again. And evidence must again be gathered. This can go on for several cycles, depending on the judge.

Even if there is enough evidence for an eviction, and the judge is ready to do so, the eviction can be stayed if the tenant alleges a lease violation by the landlord. The legal theory is that landlords have no right to demand the tenant adhere to the lease’s terms, if the landlord is also in violation.

So, when faced with an eviction, tenants always — always — allege a lease violation by the landlord. Usually something pertaining to uninhabitability. Broken plumbing or appliances, lack of heat. The tenant will either break something in the apartment or lie.

So the eviction is stayed until the landlord either fixes the violation, or proves there is no violation.

At which point, the tenant can allege yet another violation. These allegations can run through several cycles — allegation, landlord’s response, another allegation, etc. How many, depends on the judge. Of course this will take several months, at best, and by now the tenant is no longer paying rent.

In NYC evictions are a long, arduous, and expensive process, with many rights and protections on the tenant’s side, and all the burden of proof on the landlord’s side. It’s certainly not as simple as coming into court with a printout of an AirBnb ad.

But my sole landlord experience is with NYC. I can’t speak as to how easy or difficult it is to evict tenants in other jurisdictions. NYC is one of the toughest on landlords, though I hear that Santa Monica and Berkeley are also pretty hard on landlords (i.e., very tenant-friendly).

It’s pretty crazy. People are just nuts.

All I know is that this crazy rents and housing prices can’t keep up forever… something will change. Super prime ares are protected because of globalization, but average wage earning working stiffs even if they make 100K a head, that could change.

IBM layoffs and termination started a LOT of them

HP follows suit

ebay

cisco

Amex

Chase

And of course a LOT cuts in the Oil and Energy industries will domino pretty soon.

1st people to go are high-earners, who are not key in the departments.

soon replace by HB1 cheap labor or cheaper recent graduate in debt. all American companies do the same…

New gimmick. Chia Houses.

Woke up at 5:30 and for some reason the TV was on KTLA 5. Did anyone see the show that was on? It was, verbatim, an infomercial about SoCal and the verbage used was “surf and ski the same day”, “rent segways everywhere”, and “entertainment capital of the world”. I thought of this board and chuckled, knowing I speak the truth.

They also did a segment on San Diego, which I forgot about. Gaslamp, Little Italy, and going to TJ, just make SoCal even more appealing. The woman even said “this is what keeps people coming back for more”.

I hope people cherish their SoCal lives and realize this is why housing costs so much and is in demand. This is truly the greatest city in the world.

I woke up this morning, smiled and knew I can play golf, snowboard, surf or drive to TJ. Then an even bigger smile followed knowing I can do all this AND eat because I don’t have a mortgage.

Putting aside hollow cliches borrowed from the Kindergarten sandbox and looking at what’s actually happening right now in the SoCal market, let’s see:

Carried for almost a year now, going on three months listed, $200K capitulated so far, and no bites. Maybe the listing agent should have pointed out the four Trader Joe’s nearby and Tito’s Tacos within a short drive and that would have returned the seller their >100% over last sold asking price.

https://www.redfin.com/CA/Los-Angeles/3615-Colonial-Ave-90066/home/6746753

Hopefully potential buyers won’t notice the nearby competition that is selling a former flip only after two years occupied. Don’t the sellers realize that you’re supposed to stay for 30 years?

https://www.redfin.com/CA/Los-Angeles/3635-Inglewood-Blvd-90066/home/6749142

Or maybe this nearby comp that’s been sitting for going on six months with nary a bite.

https://www.redfin.com/CA/Los-Angeles/3457-Beethoven-St-90066/home/6745341

Or this one.

https://www.redfin.com/CA/Los-Angeles/3753-Greenwood-Ave-90066/home/6746413

Why are these sellers lowering their asking prices in such a premium global location? Don’t they and potential buyers realize the premium global location benefits of being near Trader Joe’s and Tito’s Tacos means you should get whatever price demanded? Don’t they know that there’s a DINK lurking around every corner willing to pay anything it takes? Or could it possibly be that these things sit because the prices are too high? Just maybe the rhetoric of the equity boosters brigade isn’t living up to what’s really going on.

Gorgeous homes in a great location, and those backyards are an entertainers dream. Clost to Culver and the Promenade, not too far from Manhattan. They will sell over list as the trending in the data is UP. 101.9% to list and list % has skyrocketed up 10% since October.

The recovery has gained legs and hit its stride, sit back and enjoy 2015 and the next few years. They are going to do very well.

Speaking of Manhattan Beach and global prime coastal everyone is rushing to get in there along with every wealthy foreigner and their mamas, many houses are sitting around not selling at list and list keeps getting lowered because the prices are too high. Just like Mar Vista, it looks like they’ve run out of everybody in the everybody wants to live there equation. They are doing so well that there’s no one willing to buy them at these prices. To think that we were talking about teardown lots being all the rage only a short time ago to this:

https://www.redfin.com/CA/Manhattan-Beach/1007-Pacific-Ave-90266/home/6706686#property-history

https://www.redfin.com/CA/Manhattan-Beach/3005-Maple-Ave-90266/home/6708216#property-history

https://www.redfin.com/CA/Manhattan-Beach/3613-Walnut-Ave-90266/home/6707922#property-history

https://www.redfin.com/CA/Manhattan-Beach/502-Rosecrans-Ave-90266/unit-3/home/8112909#property-history

https://www.redfin.com/CA/Manhattan-Beach/48-Malaga-Way-90266/home/6657944#property-history

https://www.redfin.com/CA/Manhattan-Beach/1151-Magnolia-Ave-90266/home/6704280#property-history

https://www.redfin.com/CA/Manhattan-Beach/1226-10th-St-90266/home/6704803#property-history

https://www.redfin.com/CA/Manhattan-Beach/1501-Artesia-Blvd-90266/unit-4/home/6702313#property-history

https://www.redfin.com/CA/Manhattan-Beach/1466-Manhattan-Beach-Blvd-90266/unit-1/home/6704392#property-history

That house in the first photo reminds me of photos I’ve seen of Feral Houses in Detroit.

http://www.sweet-juniper.com/2009/07/feral-houses.html

I wonder if this new “green” look is a bold, hot, fresh Hipster Housing Trend we can look forward to seeing in the future?

Take a look at this property in Sherman Oaks. I was curious because of the price but what was more interesting is (1) the pricing activity when it was purchased for $350k in July 2014, then in October put back on the market at $529k. (2) Interesting fact is the purchaser and now seller, Berkshire Hathaway. I’ve seen shops popping up in LA and OC but still curious how their playing these. They’ll keep this process until rates are adjusted. Just interesting to see the a Buffett company use this strategy.

http://www.zillow.com/west-los-angeles-los-angeles-ca/#/homes/for_sale/pmf,pf_pt/19984529_zpid/days_sort/34.152958,-118.414571,34.13257,-118.456457_rect/14_zm/?view=map

The gentrification is definitely spreading, now as I said to Cypress Park. $500k, adjacent to the State Park

“Shopping, dining and entertainment opportunities are abundant — including the nearby Atwater Village — and the centrally located community is a short commute away from downtown, Glendale and Eagle Rock, with easy access to the 2, 5 and 110 freeways. The nearby Lincoln/Cypress Metrolink Gold Line station — with bus connections to Metro Local (#28, 81, 90, 91, 94 and 251), plus Metro Rapid (751 and 794) — provides important rail connections to Metro’s expanding 87-mile Metro Rail network throughout Los Angeles County.”

http://www.theeastsiderla.com/2015/01/long-awaited-riverpark-taking-shape/

The Eastsider is great website to get to know exactly why this part of Los Angeles is becoming so great, and trending.

*This Sponsored Post is an advertisement on behalf of RiverPark

That description of the Eastside left out the fact that these guys will be your neighbors: http://en.m.wikipedia.org/wiki/The_Avenues_(gang)

Good luck to the Dinks, hipsters and yuppies that venture there in desperation to buy a home.

It’s important to keep things 100.

75% of those who make less than $50k leave CA. The rest earn more, and the price is showing in the housing market.

http://www.latimes.com/business/la-fi-california-migration-20150101-story.html

San Diego is the bellwether. What happens there tends to dictate what will happen elsewhere in the region. And San Diego is trending up.

http://www.utsandiego.com/news/2015/jan/14/dataquick-december-realestate-home-sales-mortgage/

Speaking of keeping things 100, an important question is why do the incomes don’t matter crowd keep bringing up incomes as if they do matter?

I’m more familiar with the San Francisco/Marin area ( though I now live in Sarasota) but incomes are only half and perhaps less than half the story for expensive homes. My boss in Sausalito owned a business ( S corporation) and it paid most of his daily expenses from his Lexus to his lunch. His income in the 1990s was less than $150,000 per year but he sold his business for millions and could afford most any property he desired. My father’s boss lived in Columbus, Ohio and his wife always adored San Francisco. When he sold his business ( to CBS) he had millions and to San Francisco they moved. California has a lot of accumulated wealth ( inherited or otherwise) and it chased me out because I wasn’t going to live in a million dollar box when I could have a waterfront home in Florida and a $250,000 boat outside. Oh yeah, I inherited my father’s house in California and that paid for my set up in Sarasota.

Bought 540k sold 304k in CA before. Will wait for big earthquake to consider buying again. Company I work for merged with another company with bulk of our work in CM construction. We have layoffs coming and next two years are expected to be slow. Looking to move to mid west as home prices are affordable and you can raise a family. With families moving out what next generation will buy here?

I am 30 and my wife and I are DINK status of about $275K W2 income total for 2014.

We have 180K in cash making a pathetic 1.05% APR

We are waiting for a good opportunity to buy a small 3bd 2 bth culver city, Westchester, or 90025 west LA place for like $600K.

Feel like we should jump in or be priced out forever, but hard to commit to a crap shack going all in with life savings.

Starting to look at auction.com to hopefully save 10-15% off instead of waiting for that 10-15% correction which could take 3 years

What do you guys think?

Thanks in advance

You won’t find a single family home in 90025 for less than $900k, unless it’s a tear down. And is seems the going rate for 3/2 condos is about $700-800k for something decent.

It is what it is, buy now or be priced out. But I would do exactly what your doing, looking for a good deal in today’s prices. Albeit auction.com or going straight to the listing agent on a S.S., I’ve lost out on quite few offers back in 2012 with buyers heavy on the cash down payment like you. If you are waiting for a drop in prices like in 2007-2009 to buy, that won’t happen. That was an anomaly that should have never happened and have skewed the thinking for a lot of would-be buyers waiting on the sideline, thinking that would come back. Right now, the people buying homes, regardless of price, are well-qualified buyers with 20% down. They are not walking away from anything and can actually afford the payment. Some are eating top ramen every night with a high 45% DTI ratio, but they can still swing the payment. Sounds like you are ready to bite the bullet, just make sure you get a good deal in today’s proces, that’s all. In 10-30 years, you will be glad you did as long as you plan to stay in so. cal.

For all frustrated first time buyers! I suggest you look in West Adams or Jefferson Park near the new expo line. You can still find inventory for 3-400K.

This is the next Westside area to gentrify.

http://www.latimes.com/business/la-fi-property-report-20140501-story.html

Leave a Reply