Condemning a Generation to Serfdom for Financial Irresponsibility: Home Mortgages, Loans on Cars, and Credit Card Debt.

You know what is shocking about the growing list of bailouts? It isn’t that we come out with a new bailout even before the ink is dry on previous action. What is striking is the amazing disregard for the future generations of our country. You do realize as a nation that we are broke right? So every action that we take to intervene in the markets is done via two methods. One, we borrow the money which has been the status quo. The second method is printing money which given the magnitude and the commitment of funds will shortly arrive at our doorstep. It doesn’t seem like many people care about the moral responsibility of leaving a better country for those that come after us and once again this selfish egocentric give me everything now mentality is dominating Wall Street and Washington. God forbid that consumers will have to watch their spending for even one freaking holiday season. You wouldn’t want your kid to go another year without that third edition of Tickle me Elmo.

What is disturbing is we have yet to hear from anyone for nearly an entire decade two simple words:

“Stop spending!”

Stop buying homes you can’t afford. Stop leasing cars that eat up 40 to 50 percent of your net income. Stop using your credit card as your personal loan shark. Stop taking on massive amounts of debt. Stop spending money you do not have!

Most reasonable people would agree with the above. But how can Wall Street and Washington ask this of our American citizens when they do the exact opposite. They spend more than they have. They run deficits as if they were going out of fashion. Fiscal responsibility is not allowed in Washington. Wall Street is the puppet master coming with hat in hand begging for money after they are the machine that created the ecological system for this credit fungus to spread. And why do they want this money? To feed the hamster so he can go back on the consumer wheel and keep on spending until he flies off it due to exhaustion.

Where is the outrage that rose up when the $700 billion TARP plan was initially announced? This is really a bipartisan issue here. In fact, much of the uproar around this came from both sides of the aisle. It is patently absurd that here we are, having Paulson announce another $800 billion with $200 billion of that going to support consumer debt! Does anyone pause for two minutes and think, “if people actually saved a little bit of money, they wouldn’t need credit to buy 2 Taco Bell Chalupas?” I saw someone using their credit card to buy a freaking $1 taco! And this is the market we are trying to unfreeze? No wonder why Wall Street and our enabling government are flat broke and begging like vagabonds for handouts.

New Home Sales and Prices Fall

You might have missed it but the housing numbers were horrific yesterday. The median price dropped to $183,000 nationwide, the biggest yearly decline on record. New home purchases in October were at their lowest point in half a century. You might have missed this important piece of information since it was a bailout free money orgy spectacular yesterday with the Citigroup bailout. Your head might have been spinning as if you jumped off a cliff with a bungee cord into a pool of money and had three bounces to collect as much cash as you can. That’s what things have been like these last few months. It has been a free money orgy. Even back in June, I recall having a debate about a $25 billion assistance to home builders and the uproar that caused. Now the U.S. Treasury can unilaterally commit us to $306 billion in one Sunday evening. What the hell has happened? Remember the outrage over the crony capitalistic FHA bailout for home borrowers? As it turns out, that program now looks like a blessing and something we should have in relation to what is currently being dished out in the buffet of stupid finance theatre.

If you carefully scour the data however, there was a piece of good news in the data. Prices in the west fell mightily. The median price dropped to $231,400 as reported by the NAR which translates to a 27 percent drop from last year. What a shock, that for the region sales are up 41 percent from last year. Who would have thought that pricing a home at a reasonable price would get people to start buying again? Seems like the market is clearing homes out so long as they are priced right.

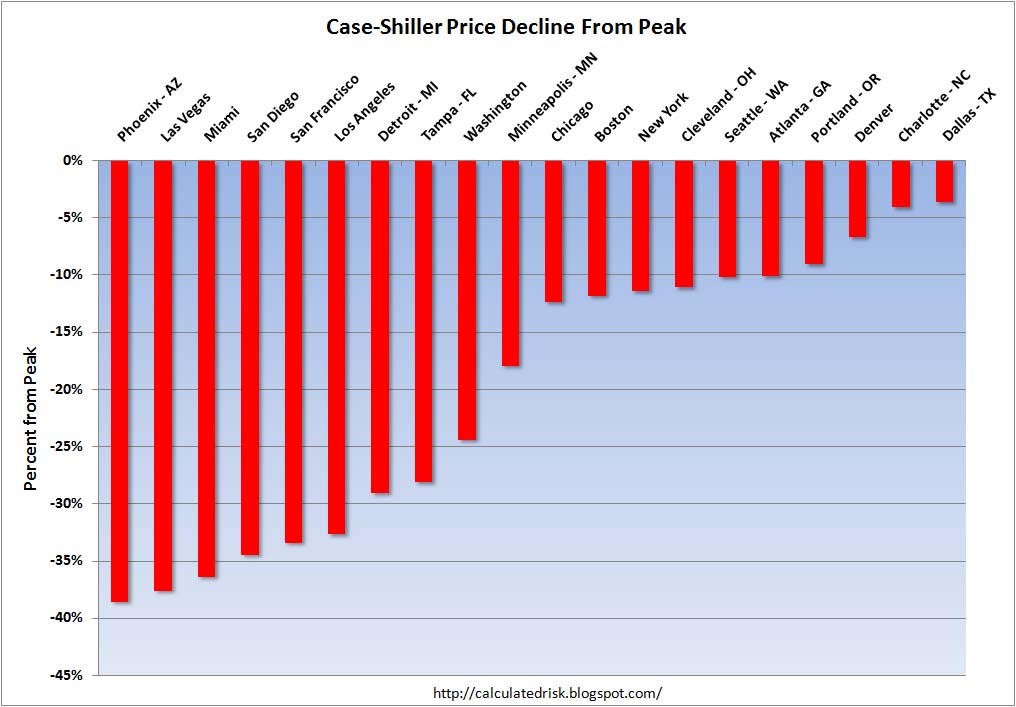

The Case-Shiller Index data was released today and once again shows spectacular declines:

*Source:Â Calculate Risk

The national index now has prices off by 21% from their peak. As you can see from the chart above, out of the 6 top declining cities 5 of them are here in the southwest. 3 of the 6 are here in sunny California. This once again supports my thesis that home prices will not bottom until May of 2011. You do realize that we have a boat load of option ARM mortgages set to recast next year? Next year will be our first test in terms of large numbers to see how the state can handle this oncoming tsunami of what is arguably the most toxic of all loans. People now point out that the government will suck these loans onto their books so all is fine. Well even if the government takes ownership of these loans it doesn’t remove the fact that the borrower is still in a load of trouble. So the government now owns the loan. All we have done is taking the problem away from an irresponsible lender to the U.S. taxpayer. It doesn’t solve the cash flow situation of the borrower. That is what we are left dealing with. And as I made the point above, we are broke.

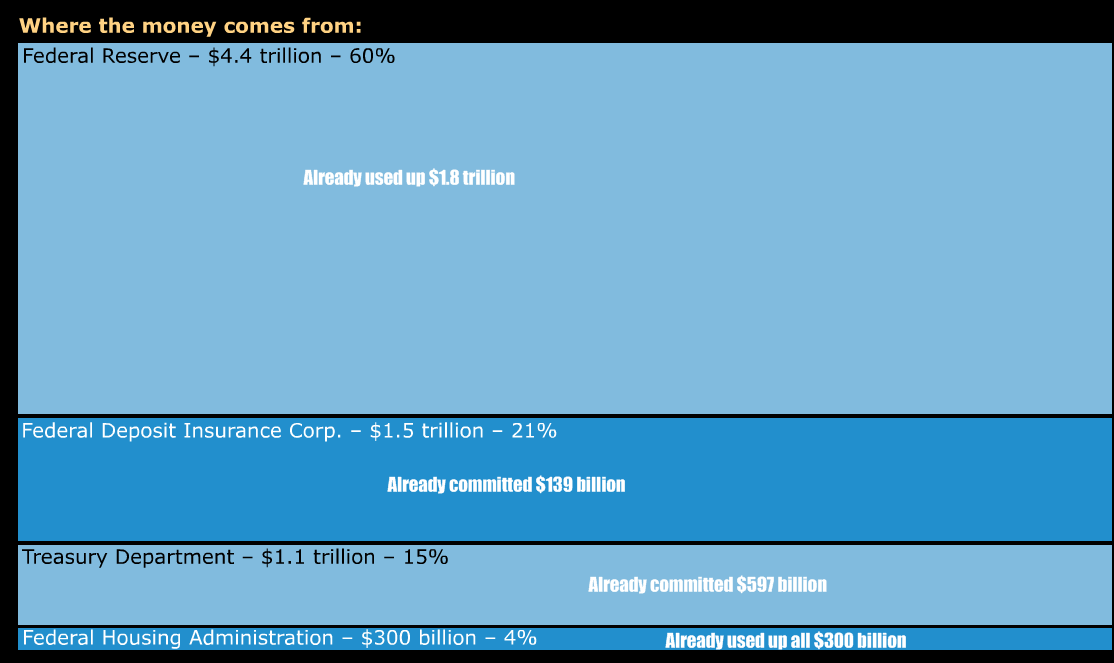

Bloomberg has a nice little diagram showing that the government has now committed us to $7.7 trillion in “assistance” to getting us out of this mess. Take a look at this chart:

Keep in mind the above graph doesn’t include the $306 billion committed to Citigroup and the recent expansion announced by Paulson. It is simply an insane amount. Given that our GDP is $13.8 trillion we’ve just committed over 50% of that amount to the toxic welfare mortgage credit boondoggle program of America. Or if you prefer, we’ve just committed the yearly GDP of Brazil, Canada, Spain, and Italy combined to these programs:

And even with all these commitments the markets are still down over 40% from their peaks! You imagine what kind of amazing rally we’d have if we just flat out injected $7.7 trillion into the stock market? It would be like a 4th of July for the markets and the ticker would be hemorrhaging green for days. We’d have to use a wheelbarrow with dollars to purchase bread but at least we’d feel better. Or we would all be issued U.S. Treasury Visa cards directly linked to the TARP fund.  The catch would be this. You have to spend as much as you can and as quickly as you can because it would be on a first come first served basis. The fund would be limited to $1 trillion so you’d have to act fast sort of like how Wall Street banks are right now. They have served as a perfect model of excellence if we institute a program like this.

You may think this idea is out of the box but look at what we are dealing with right now. Can you believe no significant perp walks have taken place? We need to hold those accountable and put them in prison. We need to demand this. A bank robber who gets away with $50,000 will face many decades behind bars. Here, you lose a few billion for your bank and you get additional funds. What a great message we are sending here.

Even Franklin D. Roosevelt went after the “money changers” during his inaugural address during the Great Depression:

“Yet our distress comes from no failure of substance. We are stricken by no plague of locusts. Compared with the perils which our forefathers conquered because they believed and were not afraid, we have still much to be thankful for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.”

There better be some justice here. But seeing how we have the money changers now running the show, how likely is this in 2009? Hopefully we can see beyond party lines and hold those accountable for the biggest financial mess since the Great Depression. Keep in mind that during the 1930s trial after trial held these masters of the world in contempt and put them in jail. We should demand the same today since their crimes are equally if not worse than those of that time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Condemning a Generation to Serfdom for Financial Irresponsibility: Home Mortgages, Loans on Cars, and Credit Card Debt.”

Another great post DHB!

Again, today in the New York Times, in an article about tanking home prices – the only solution put forth is to make home loans more affordable and easier to obtain:

Sensing the increasingly dire housing market, the Federal Reserve announced a pair of programs on Tuesday aimed at helping Americans obtain the money needed to make large purchases, like a home.

“This action is being taken to reduce the cost and increase the availability of credit for the purchase of houses,†the Fed said in a statement, “which in turn should support housing markets and foster improved conditions in financial markets more generally.â€

Also, here’s a link to compilation showing Peter Schiff predicting all of this a couple of years ago and being derided by bozos like Ben Stein and Arthur Laffer.

It will make your blood boil…

http://www.youtube.com/watch?v=2I0QN-FYkpw&eurl=http://www.cynical-c.com/&feature=player_embedded

Keep up the excellent work!

I just read a piece written by Helicopter Ben(addressing a meeting at the FED), wherein he stated that one possible solution to fight deflation would be a currency devaluation, which is what Roosevelt did.

Imagine a 40% devalution. As a saver, they will have taken nearly half my hard earned savings away from me.

Anything to prop up the godamned bubble.

I’ve said it before and I’ll say it again; they should all be SHOT.

Really? There were trials in the 30’s over the economic mess? I did not realize that. Justice would be nice.

Great post, as always. But don’t get too worked up about credit cards for tacos- – I use mine for nearly everything and my wife and I have never, not once, carried a balance in 16 years. I pay no annual fee and AmEx pays me money to use it. I make 1K to 2K each year in rebated cash. So every dollar counts…

I’m afraid your message is falling on deaf ears, those being our elected officials. The new prez cant wait to take office and spend more money!! Doesn’t this HAVE to end in some apocolyptic doomsday scenario? There is no-way this is sustainable. It is unbleivable the economy has survived the last 70 years, as it has been outpaced by the growth of government spending. Perhaps soon, the masses will wake-up, and some sort of revolution will take place, hopefully reverting back to the principles on which USA was founded.

G, I wish Obama would echo those words of FDR. It is unfortunate, his economic team is just more of the same. I thought I’d have a heart attack today when I heard on the radio he wanted to give the economy a jolt. It’s dead. Leave it alone.

Don’t want affordable credit. Don’t want affordable debt. An affordable home. Affordable education. Affordable health care, yes. Affordable debt….no. Why doesn’t our government get that?

I have to echo what Waiting To Buy said. My wife and I use our AMEX for everything, including late night runs to the local Pollo Loco. We always pay off the balance, and we just got our first cashback credit for $815. Not bad.

Thanks for the great reporting DrHB.

What is this, Win Ben Stein’s Bail Out Money? This is not a game Washington, it’s our future your playing with.

So I have a nice chunk of cash in the bank I’ve been saving for the last 10 years. Should I just go ahead and spend that money on the things I want since it’ll be worth less than half of what it’s worth now in a year? This is a serious question. I have a lot of things I want to buy and if I’m not going to be able to buy a home I want to buy that stuff before it’s too expensive.

Getting closer to some good deals. Watching and waiting patiently for the sheeple to give up all hope so I can buy 3 houses for the price of 1….

I saw this morning the president elect wants to cut farm subsidies. Funny the demographics of the cuts, along politcial lines as always, and as with both parties. I don’t understand the complexities of subsidies but expect the cuts will increase the cost of food. My point being that we will all pay… one way or another, or that there is no free lunch.

We have lost fiscial responsibility in our country.

As always, thanks for the post Doc.

Oilwelldoctor, subsidies should be cut. No, it won’t raise the price of food. Subsidies allow farmers to grow crops for a profit that they normally couldn’t. Say a US farmer had sell a bushel of corn for $2 to compete with a Mexican farmer, only it cost him $3 to grow it. Good ol’ Uncle Sam steps in and pays the US farmer the extra dollar so he can compete in the market. Maybe Uncle Sam takes it a step further and pays the US farmer $1.50. Now the US farmer can under cut the Mexican farmer, driving him out of business and forcing his farmhands to emigrate North in search of farm work, which infuriates the corn eating US farmhands who are now out of a job and mad as hell, so they ask Uncle Sam to build a god damn wall along the border.

This country didn’t lose fiscal responsibility, we never had it. American economic history made of boom and bust cycles. It’s like a giant game of whack-a-mole, only with asset bubbles. The only reason we are outraged is that each bubble succeeds in being bigger than the last.

I’m not at expert at farm subsidies, but my understanding is that it goes something like this: farm subsidies are limited to particular crops, such as corn and soy. Subsidies are provided to help produce excess amounts, so producers use whatever means are possible to maximize output: heavy use of fertilizers, pesticides, and machinery. A great deal of petroleum goes into farming. We produce much more of these particular crops than we’ll ever use, so we invent things like corn syrup, we use the grains to feed livestock, that kind of thing. Such large scale, technological production weeds out the small farmer leading to consolidation by humongous agro-businesses. Meanwhile, the vegetables that could contribute to health, like carrots and broccoli, are prohibited in order to qualify for subsidies. Farm subsidies already have a dramatic impact on our everyday lives and habits. Modifying farm subsidies has the potential to refine our relationship with food.

I also put everything I can on credit card and pay it off at the end of the month. I get a rebate and I don’t have to deal with change.

I agree with Ian – subsidies should be cut but I would add cross the board not just in farming.

From a handout I found on the web: for milk producers.

First sentence:

“USDA Farm Service Agency’s (FSA) Milk Income Loss Contract Program (MILC) compensates dairy producers when domestic milk prices fall below a specified

level.”

Plus the most interesting sentence i have read about the topic…

Eligible Dairy Producers:

“Dairy producers from a foreign country who have a working visa or other valid taxpayer identifi cation number are eligible for MILC

benefits.”

http://farm.ewg.org/farm/pdf/milc06.pdf

In debate over the 2007/2008 farm bill, the farm subsidy lobby insisted the payments continue over the next five years, even if crop prices and net farm income remain high.

Welfare payments? you bitcha!

Mucho love,

Dr. regarding your IMF chart. If we were to combine the outputs of the USA + MEXICO + CANADA = 16266452 which would place us right below the EU. So my question is have you started to buy ameros?

Mucho love,

Great video. Haven’t heard the permabulls spouting off lately. They should be put in jail for all the investment damage they caused. A punk breaks in you house and steals $100, he goes to jail. These malicous bassturds have riuined people’s entire retirement funds, probably while they were unloading there own positions (Merril–great buy at $85). Which is worse? Now that the paradigms have shifted, but the damage is done. People still think it will magically get better, or why else would the market be up 1200 points from the low Thursday, on nothing but bad news.

Comrade Dr. Housing Bubble,

~

I have a philosophical question for you. We are currently in the middle of a bursting housing bubble. At some point in the future, we will hit bottom. Will you still be writing about the housing bubble? Will you have to change your name and blog site? You know, why beat a dead horse?

~

You obviously have the great propensity to communicate on a number of financial topics backed up with logic, FACTS and humor. Maybe it is time to expand your universe beyond housing. I for one, will follow you wherever you go.

~

On this Thanksgiving Holiday, please remember the troops who are making the ultimate sacrifice for this Nation. It’s not their fault that their leaders have led them into this mess.

~

Be brave Comrades!

I have a simple solution to the mortgage crisis. What if all mortgages made in the last 3 years were given a permanent 1% interest rate?

Hi Dr. HB,

Long time since I’ve posted in your comments section. Not to worry though, I’m always reading.

At any rate, one of your initial sentences I found striking:

‘What is striking is the amazing disregard for the future generations of our country’

This is exactly what I’ve been feeling for a very long time.

When this housing bubble first started forming (I’m speaking 2001/02), I thought it was just foolishness, as it started to expand to absurdities (2004-2005), I really started to fear what policy makers would do once the bubble burst — as for me it was never a question of ‘if’ it would burst, only a question of when. And now it seems all my fears are turning out to be true. Granted I didn’t predict specifically all the bank failures by name, but, certainly was able predict FHM and FRE (no brainer because of the moral hazard of having a quasi-government company that’s only goal seemed to grow and pay it’s political hacks at the top, with utter disregard to the risk it assumed).

At any rate, I digress… Now I’m at the point beyond fear, I’m absolutely f’n p!ssed off beyond belief at what our government is doing to us, and especially my newborn daughter. They are opting to give golden parachutes to everyone of the politically connected players in the financial sector at the absolute destruction of the balance sheet of the USA.

What do you think of this article?

http://www.bloomberg.com/apps/news?pid=20601103&sid=arEE1iClqDrk&refer=us

This was one that really set me off recently, we’re talking $7.4 Trillion — with a ‘T’ of our money being committed to bailing out a whole bunch of banks, which I now really think should have failed, we would be so much better off for it now (especially since there are plenty of banks/investors out there that are NOT failing and could possibly get the opportunity to buy some assets at a discount, but are now being denied the opportunity to do so due to government intervention — so much for free markets).

I think this thing can be summarized as follows:

US Government borrows $7.4T at interest from the Federal Reserve, which btw created the money out of thin air.

Government lends the money to banks at give away interest rates, or in fact just gives it to them period.

Banks, after recapitalizing their balance sheets of course, lend out money to the American people at interest.

IRS make sure to collect the interest on the $7.4T debt from the US people, who are now having to borrow that $7.4T that was just given as a gift to the banks.

This is the sad thing, what all this money being committed, not once has it asked where this money is going to come from? As it is right now (not even counting the bail outs), we spend $500B more each year than are collected by taxes. If the population even had to pay for CURRENT CONSUMPTION there would be a REVOLT! So, the motive is ABSOLUTELY clear. They are not just mortgaging the future generations of this country, they are now literally CANNIBALIZING the future, all for the sake of copious consumption and assuring the Oligarchy remains intact. We are actually literally proving right now (and yet again) that a democracy is unsustainable in the long run. Eventually the minions will be turning to a despot type leader to ‘fix’ things, yet again, for us as things get worse — and they will.

What’s next? Currency devaluation, asset seizing (FDR already did it to our gold back in 1933), eventually civil unrest.

I’m literally at the point of getting ready to take all my savings, and move myself and my family to a different country — of course, I’ll probably be flagged as some sort of terrorist or drug dealer under the anti-money laundering laws — as we have already lost our economic freedom years ago. I’m not really suggesting there is a country out there that is much better than the USA, but, in all honesty, if we’re going to behave like a Banana Republic, I’d rather be able to enjoy the tropical fruits and sunshine.

Well, sorry for the rant, but it’s just that not only can I not believe what the government is now doing to us, but that the people haven’t figured this out yet and have not acted upon their 2nd amendment rights,

I’ll get off the soap box now,

Oh…

And yeah, I’m not entirely sure what to say about the Credit Card users. I’m another one of those guys who use mine for everything, but, pay my bill in full. I’d try to limit the impuning to those who run a balance on the credit card in order to pay for those tacos.

I just can’t refuse 5% cashback at gas stations, supermarkets and drug stores.

Heck, this past summer at the gas station, the credit card price turned out to be cheaper than the cash price.

They wanted $4.99 / Gal if using credit card, or $4.94 / Gal if using cash. Sure, I might save a nickle per gallon right now, but, my credit card company was reimbursing me 25 cents per gallon. The choice is simple.

You sure are hyper. I use my credit card for small amounts, and I pay off the bill totally each month. It’s a smart convenience for many reasons.

I agree that people need to be financially responsible, but not everybody makes the same wad of cash that you and some other people make. These lesser paid people might want to enjoy some of the material things of life too. If everyone keeps getting bailed out or extended ridiculous credit, it not just the individual’s fault.

How about a short, pertinent, movie?

http://www.shewhomeasures.com/

I’m from IL. Farm subsidies = welfare, plain and simple. As usual, it’s an outdated US policy from the 1930s.

Farmers make plenty of $ from corn which results in high fructose corn syrup (making us fat) and ethanol. Milllionaire farmers also can get paid for, sometimes, growing no crops.

Never met a poor farmer in all my life. Imagine taking all that free $ over the past 50 years and then investing it in what a farmers knows… ADM and Deere.

NATIONAL FORUM OF APPLIED EDUCATIONAL RESEARCH JOURNAL

Volume 23, Numbers 1&2, 2009-2010

FOREWORD

STRATEGIC PLANNING USING THE WAYS OF KNOWING THROUGH THE REALMS OF MEANING

By

Queinnise Miller

PhD Student in Educational Leadership, Cohort 5 – PVAMU

About the Issue

The year 2004 marked the inception of the Educational Leadership Doctoral Program in the Whitlowe R. Green College of Education at Prairie View A&M University. Since then over 32 educational professionals have graduated and joined the academy of Doctors of Philosophy in Educational Leadership. As the program grows each year new cohorts of educational professionals are established, and the future of research becomes brighter. This special issue contains the thoughts and theories based on research of Cohort 5, as it relates to strategic planning as a theoretical framework by utilizing the Ways of Knowing Through the Realms of Meaning (2007) by Dr. William Allan Kritsonis. These articles were a partial requirement for a course in the doctoral program taught by Professor Kritsonis.

In the first article, Queinnise Miller explores professional learning communities while taking a look at how they impact school improvement and their place in strategic planning in education. In the second article, Rosnisha Stevenson discusses ways school districts can meet one of their goals on their campus improvement plan and increase their standardized test scores by using the six realms of meaning in the classrooms. In the third article, Carmelita Thompson discusses ways in which strategic planning implemented by utilizing the Ways of Knowing Through the Realms of Meaning (Kritsonis, 2007) creates a high performing educational organization. In the fourth article, Barbara Thompson discusses significant aspects of the six realms of meaning as it relates to strategic planning in instructional leadership. In the fifth article, Kashan Ishaq discusses how school leaders’ understanding of the six realms of meaning can be strategically integrated in solving the educational problems of today and improving the schools of tomorrow. The sixth article, Christine Lewis discusses ways our educational leaders in public schools can incorporate the Ways of Knowing Through the Realms of Meaning (Kritsonis 2007) to take strategic planning from the modernism age to postmodernism age to improve our nation’s educational system. In the seventh article, Tyrus Doctor discusses strategies used within our current school environment, while implementing postmodern thinking. In the eight article, David Palmer shows the linkage between the realms of meaning and strategic planning and to show how symbolics, empirics, esthetics, synnoetics, ethics and synoptics has an under pinning value to the planning that is required for successful schools. In the ninth article, Sheri Miller-Williams introduces the concept of systems thinking and suggest two frameworks that could work to support comprehensive school reform. In the tenth article, Simone Gardiner discusses how postmodernism and the realms of meaning can be implemented in students’ learning with the use of strategic planning. In the eleventh and final article, Demetria Diggs apprises educators of how incorporating the six realms from the Ways of Knowing Tthrough the Realms of Meaning (Kritsonis, 2007), into school improvement and strategic plans to yield avant-garde results for all educational stakeholders.

Cohort 5 at PVAMU sincerely appreciates the opportunity to publish in the National FORUM of Applied Educational Research Journal. We thank the National Policy Board representing all National FORUM Journals for their confidence in our work. To be published as doctoral students in a national refereed journal is professionally rewarding. We thank our professor Dr. William Allan Kritsonis for providing outstanding mentorship in guiding us in our writing pursuits.

Queinnise Miller

PhD Student in Educational Leadership – Cohort 5

Prairie View A&M University

Teacher

Alief Independent School District

Leave a Reply