The wonderful world of command control US housing – 6 charts highlighting future trends in the housing system. Silent crashing markets, command style housing controls, and Fed top sponsor of maximum leverage.

The spring and summer housing season certainly brought many people out of the woodwork. Similar to the First Time Home Buyer (FTHB) tax credit gimmick that created a temporary bounce in 2010 the rebound may be short lived if household incomes do not move higher. By the way, for those that bought and sold in that time there are many circumstances where the FTHB tax credit needs to be paid back. Surprise! Today the big generator of movement comes from artificially controlled low inventory and stunningly low interest rates. The Federal Reserve has essentially gone Soviet Union on the US housing market. Without a doubt this has caused a mini-boom in the market but is this simply more fumes or something more sustainable? We’ll try to look at current data and try to examine where the market is heading for the rest of 2012.

Housing prices moving up

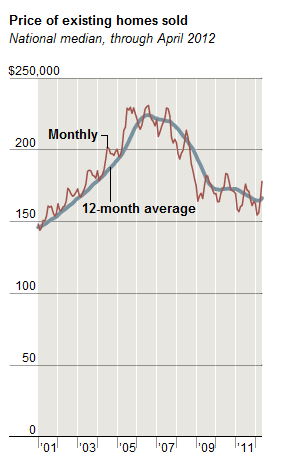

People may not realize that home prices rise and fall every year, bubble or no bubble based on seasonal factors. The spring and summer are very important in setting the tone for future home sales. On the psychological side of things, you are likely to get the best deals on dreary days deep in the winter when few people are actually looking for homes. Yet looking at the 12-month moving average it does look like a bottom is in place nationwide:

Source:Â New York Times

You’ll notice that the monthly price moves up and down based on seasonal factors. The 12-month moving average gives you a better perspective as to the current larger trend. Overall, you do see a move up in prices recently. We’ll examine this later but suffice it to say that it has very little to do with growing incomes or strong net worth figures.

Prices down from 2011 – net worth impact

An astute reader mentioned that the triennial Fed study only collected data from 2007 to the end of 2010. Since most Americans derive their net worth from housing and the big collapse in net worth figures came because of reliance on home values, what has happened since the end of the study? Nationwide home values have fallen over 3.5 percent so this is another kick to the net worth figures of Americans.

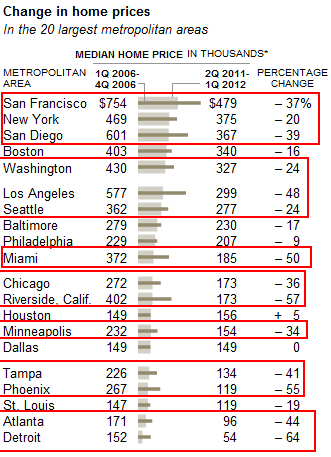

It is fascinating to see that from peak to trough, even areas presumed to be affordable where able to go even lower:

This is the large reason why net worth figures have been crushed for the vast majority of Americans.

Â

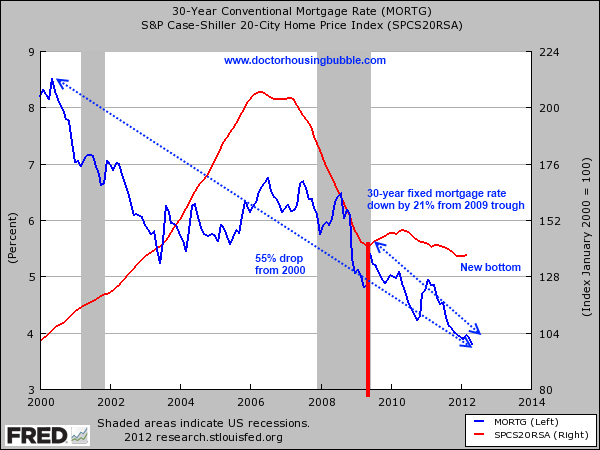

Fed now promoting maximum leverage

It might be hard to believe but in 2000 the 30-year fixed rate mortgage was at 8.5 percent. Not that it mattered since most were levering up with funny money no-doc, no-income, and no-pulse mortgages. Since 2000 to current rates, the conventional 30-year mortgage has seen rates fall by an amazing 55 percent. These low rates are here because of financial panic, horrible employment figures, and banking systems in ridiculous debt. Make no mistake, this is artificial and spurred on by a poor economy. The Fed now holds trillions of dollars in mortgage-backed securities and other archaic debt just to keep this game going. Those that think rising rates would be a sign of inflation or a rising economy need only look at Italy, Spain, and Greece to see if rising rates signal a good economy. No, rates can rise if people lose faith. Fortunately for now, the U.S. is the least ugly girl at the dance so we are able to keep rates ridiculously low. Yet is this a good longer-term strategy? Eventually investors will want their money back (when do we think we’ll pay off that $15+ trillion national debt?).

Even from the housing trough reached in 2009, mortgage rates have fallen another 21 percent from already low levels. Yet prices made a new bottom. The Fed realizes that households are in a much weaker financial situation (they just finished publishing their net worth data so of course they know what is going on!). They also understand that housing is the biggest asset of households. Their plan is basically to aid Americans in leveraging up to buy as much house as possible without breaking the monthly nut. This becomes much harder now that rates are essentially at the rate of inflation. In other words, the Fed with GSEs are pretty much the only game in town and how long can they keep expanding their balance sheets? The Fed hinted at more MBS purchases and possibly QE3 but is this really a solution? Make no mistake that the primary focus of support is to aid the connected banks and it is a consequence that the public will get help. The big danger is the Fed loses a sufficient amount of credibility and once that is gone, it is hard to put the genie back in the lamp. This is basically feeding the addicted debt ridden system with more debt.

Areas to see price increases from 2011

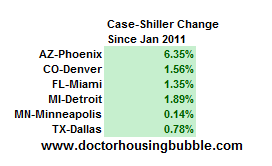

I was digging through the most recent Case Shiller 20-MSA report and looked at housing markets since 2011 to see which areas saw prices move up in this timeframe. Six of the tracked areas moved up:

It is interesting that the only area seeing a higher than 2 percent rise was Phoenix Arizona. All other areas barely moved up. Phoenix and Miami are largely up because of massive price crashes and investors swooning in to purchase homes. Even with this movement, prices are not flying off the shelves like Tickle Me Elmo. Detroit is up because at some point, people will be interested in buying homes at near giveaway prices. The Dallas area never really had a bubble so prices have simply moved sideways.

Areas to see price declines since 2011

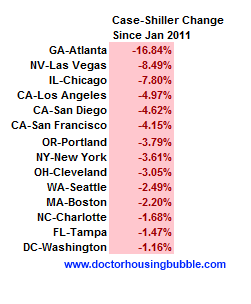

Of course the vast majority of areas have seen prices move down since 2011:

Atlanta has been crushed since 2011. Las Vegas has seen prices go even lower even though investors were plowing into the market in 2009, 2010, and 2011. Chicago has seen prices fall by 7.8 percent since 2011. All large California metro areas have seen prices fall by over 4 percent. What you are seeing on this list for the most part is inflated mid-tier markets correct even deeper. There has been a flurry of buying recently that has pushed prices up but this is based on more Soviet Union style behavior:

-Banks are leaking out properties from the shadow inventory

-Really good deals are snatched up by insiders before they even hit the open market

-“Normal sellers†are still delusional and are not selling because expectations are off or because many are in negative equity positions

-Banks are making good deals to bulk investment buyers (i.e., not the typical America although the entire banking system is subsidized by the public)

This massive controlled system has resulted in the above. The peak was in 2006 and here we are 6 years later seeing a new post bubble low and a short-term bump for prices simply because we have a controlled market. Yet are Americans better off? Obviously not if we look at net worth figures. Then again, the majority of people are into the all hat and no cattle club and are fine with going into massive debt. If you doubt this, just look on Craigslist or sites like Swap-A-Lease and check out where the bulk of “deals†are coming from for very expensive European cars.

New home sales boom or cleaning out shadow inventory?

The new home sales market has seen a move upwards recently:

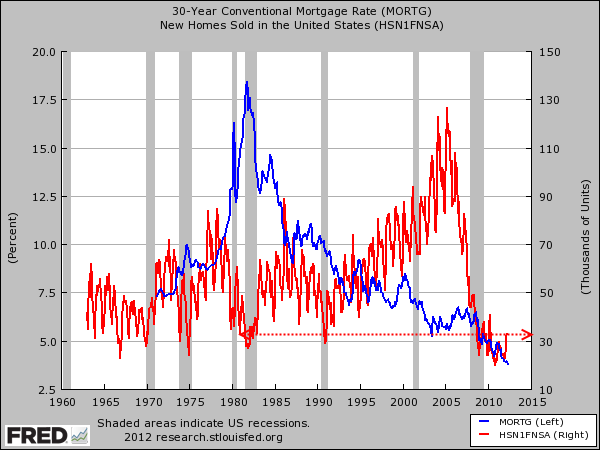

This is more significant in terms of trends for the market. New home sales also means a demand for new home construction which is good for the overall economy in the sense that it creates decent paying jobs. This is a more welcome trend to see. Yet it is hard to apply more market based economics or financial projections here since the backlog is really being governed by the Fed and their too big to fail colleagues. You’ve seen mainstream outlets that largely serve as platforms for cheerleading stating that there are bidding frenzies and supply is low but do not bother to crunch the numbers that are clearly available. They are in the business of having you spend your money, real or borrowed. There is little money to be had running stories about folks saving and paying off 30-year mortgages while living prudent lives. They want you to take on that $700 lease on a European car and to take on that $700,000 mortgage. Forget about the net worth data, if you don’t have it just borrow it. This is what always surprises me about those saying they “are calling the bottom†and somehow pat themselves on the back as if they were almighty financiers or economists. Is this really a bold call? How does this tie in with the fact that most Americans have seen their net worth deteriorate to levels last seen two decades ago. Who cares! We’re calling a bottom because we are narrowly focusing on home prices, artificial inventory, and a market that frankly isn’t a market anymore. The bottom may not look all that impressive given the larger picture:

Are home prices nationwide at a bottom? It looks like it. But what will be the big driver for higher home prices moving forward? That is the bigger call. How long will rates remain low? Are we looking at a Japan like scenario or can rates turn higher much faster? Will incomes rise in the current decade? These are more crucial questions to ask instead of claiming a short-term bottom is in place. We’ll get our taste of whether this is a more sustainable trend when the fall and winter hit and once the bread and circus of the 2012 elections are over. Most people do realize that both parties are largely batting for the same team right? In the mean time, go out, spend, and ignore those net worth figures. A 40 percent drop is merely a scratch I say.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

38 Responses to “The wonderful world of command control US housing – 6 charts highlighting future trends in the housing system. Silent crashing markets, command style housing controls, and Fed top sponsor of maximum leverage.”

This is merely a “pause” before we start going down again due to a world wide recession. The Chinese lie about their economy, for good reason. It is a year of political change. The underlings want to look good so they reported better than actual economic results. Brazil is in recession as well as the EU(which will fall apart over the next 24 months). Look at the price of crude oil.

As for our dear state of Greco-California, you know where we will be next year. The budget just passed is like a German fairy tale, but funny.

Yeah, all the happy talk assumes the economy heats up, or at least gets no worse. What if it deteriorates just a little? Or a lot? Don’t have to be clairvoyant to answer that.

I’m not expecting a crash. There is still too much pessimism / skepticism out there to keep things from flying into the nose-bleed zone, and there is a lot of recession-fatigue. A lot of people think we’ve been in recession for the last 4 years, though obviously, we haven’t.

However, it isn’t unreasonable for the business cycle to turn over again and to see a downturn of some degree. Also, some “safe” assets like gold and T-bills are looking overvalued. T-bills have been paying below annual inflation rates for some time now. These could easily collapse. I suspect that Adam Smith’s invisible hand is attempting to impoverish the Boomers with yet another set of bubbles (tech stocks, real estate, gold/bonds), because that is what needs to happen. Otherwise, their claim on the rest of us in retirement will be ruinous.

Great article Dr…Lord forbid the rates get a little bit “wacky” and the FEDs already STAGGERING $3-Billion DV01 goes against them.

What’s DV01: “dollar value of 1 basis point.” A basis point is equal to 0.01 percent. An interest rate move from 8 percent to 9 percent is a 100 basis point move.”

So, the FED has a balance sheet getting close to $3 Trillion with a DV01 of about $3-Billion and rates hitting the unprecedented zero bound. What could go wrong?

FED balance sheet 1915-2012 (RED=MBS) http://media.resourceinvestor.com/resourceinvestor/article/2012/02/23/2-24-12-tgaog-Chart1.JPG

We might be at a housing bottom “nationwide.” No such thing in many overpriced areas of California (especially the high end places, 800K +). This mess will likely drag on for the rest of the decade and probably longer.

Just a little anecdotal evidence of the economy, I went to a friend’s get together yesterday and there were several recent college grads there. Let’s just say there is very little hope remaining with this age group. The kids who got degrees that aren’t really applicable to this new world are completely screwed. Even a recent civil engineering grad says he couldn’t land a job after a year of searching. And these are going to be the people who keep the California housing Ponzi scheme going? Give me a break, they’ll be living with mom and dad or quadrupling up in a small apartment for years to come.

I better go out and buy now before being priced out forever again. 🙂

Unless you live actually in Los Angeles, you are right, you have no idea of what the real estate market really is. Scams, fraud, extremely low inventory, short sales or the same crappy condos or overpriced homes are the market. If there is a “normal” house for sale, it goes into mutiple offers or some greedy so called investor pays cash and snaps it up. It is a sellers market here. Sellers are dreaming, agents are clueless and buyers are obviously uneducated and need to take emotions out and see if it makes financial sense.

@neverbuyhereinLA

The reason there is no decent inventory is the Federal Reserve’s ZIRP (zero interest rate policy) program. As long as these zombie banks can feed at the Fed trough at interest rates that are below inflation, there is no reason for these zombie banks to unload their shadow inventory. Hence, nothing but crap on the SoCal MLS.

If the Federal Reserve were no longer able to keep interest rates below the rate of inflation, the real estate listings would be flooded with excess housing inventory as these zombie banks would be forced to unload their shadow inventory.

As it stands, with real inflation running at 5% and the Fed lending to zombie banks at close to 0% interest, the banks are effectively inflating away their housing loses.

“…some greedy so called investor…”

I have every confidence they really are investors. Surely everyday families with children are not posing as investors in order to get the house. I also have every confidence that this investment isn’t going to pay off well for them. However, it might be better than the alternative of investing in their home countries.

Ernst, inflation is nowhere near 5%. It is about 2-3%. Don’t believe the government? Perhaps MIT is good enough:

http://www.calculatedriskblog.com/2012/06/different-look-at-inflation-mits.html

A friend went to his god-daughter’s graduation ceremony, said it felt like being at a funeral. They know they’re hosed.

Think they “will be OK” with the $16-$20 Trillion in debt we’ll be leaving them?

A lovely parting gift from the “Boomers” to go along with the destroyed economy they’ll inherit.

A niice sentiment on a Monday – it makes me want to run out and buy something for half a million.

“Most people do realize that both parties are largely batting for the same team right?” Based on what I’ve seen the last couple of years- they don’t.

So ture. Both parties are just a waste of time and count on us defending them, by throwing red meat issues -instead of us uniting and asking them to do something.

Many don’t care, can’t afford to care, can afford not to care, or are not informed. The public is an inadvertent handmaiden to the lobby and bank interests.

DR HB Wrote: Their plan is basically to aid Americans in leveraging up to buy as much house as possible without breaking the monthly nut.

Let me fix it for you:

Their plan is basically to aid Americans in leveraging up to pay the most as possible for a house without breaking the monthly nut.

Fix #2: Their plan is basically to sucker Americans and help the TBTF banks in unloading their dog-crap balance sheet liabilities so that some greater fool eats the loss. Bon appetit taxpayers!

“Most people do realize that both parties are largely batting for the same team right?â€

Yes, this is stating the obvious, but I am glad to see the DR state it for the folks here. If people can get beyond their racist tendencies and the brainwashing-storms of Rush Limbaugh, Fox News and all, they will see that Obama differs little than the previous administration. When he chose Timothy boy to be his treasurer and brought in all of the other financial sector cronies, it was quite clear that all his rhetoric about change was nothing more than platitudes tossed to the masses for consumption. In reality, the system runs itself. The game is rigged and the average citizen gets screwed, but little does he know. His lobotomized brain zones out on reality TV and the lies drummed up by rabid pundits serving as the choir boys for looters and psychopaths.

The level of greed and chutzpah in today’s world is unprecedented. For all the talk of family values and being a patriot, most of those in power care only about themselves and to hell with the rest. I just can’t believe anybody making under $200,000 per year would support any Democrat or Republican. They are the same! Why are people so afraid to admit it? Because their whole value structure will collapse — just like the housing market??

Back to housing. The current situation reflects the same game of smoke and mirrors our government plays on all fronts to keep this sinking ship afloat. There will be a day of reckoning and no lies can cover up that truth. The system is rotten to the core and nothing will change that short of a revolution on the streets. Romney needs $1,000,000,000 to win the presidency — and he still may not win. Damn that black boy!

Yes, the two party’s are really one and most educated Americans will agree with you. We aren’t all ridiculous couch potatoes watching reality tv but professionals waiting for the right time to bail out of the country (sound similar to other migrations of mistreated peoples?). When the educated middle class start defecting to more agreeable (cheaper countries) hang on to your marble counter tops; the rich indeed are in for a bumpy ride.

When the educated middle class start defecting to more agreeable (cheaper countries) hang on to your marble counter tops; the rich indeed are in for a bumpy ride.

Problem is, the financial octopus and corporate-owned governments are a worldwide disease.

And if you’re looking to escape rigged and/or overheated housing markets and high cost of living, forget the UK, Canada, Australia or New Zealand.

There aren’t many good choices unless you have the means to be self-supporting in a primitive place.

The truly rich have been globalized for years and well diversified. That is how they maintain their wealth. It’s the locals that can’t make a move nor leave that always get hosed. This is historical fact.

So if B+rry loses it will be because of his white half?

The Dr., “platforms for cheerleading stating that there are bidding frenzies and supply is low,” keeping it real with another solid data-fed prognosis of the market symptoms and overall condition. Thank you.

Yes! Both parties should unite instead of having the mind set of two different countries. The Republican Candidate campaign gave the message what losers they each thought the other guy was. Bad message for the party. Same with both parties. Bad message for the country. I feel the public are pawns on a game board nit having a clue what game we are being moved around in. Same with Elections and this housing market and the banks. All loans, current and good standing for a time period, say 5 years, should be adjusted to current interest rates. Boom! More money into economy, more people stay in homes. There is a bail out for the people. How hard is that!?

What is your outlook for Phoenix Arizona in 2013?

Super hot in the summer, cold in winter, especially at night.

One minor quibble. You say, ” New home sales also means a demand for new home construction which is good for the overall economy in the sense that it creates decent paying jobs. ” We all know illegal aliens get a large part of the construction jobs, and we all “know” they only take jobs Americans don’t want, so they must not be decent paying jobs, right? Actually, I have a friend who got laid off from construction. The good news is they called him back. The bad news is that they cut his pay in half. “Take it or leave it.”

I belong to a third party that is now the largest in American political history, it is called ” Not Dumb Enough To Fall For it Anymore”. Won’t you join me?

I am a recovered republican, now a political atheist.

Collusion Corruption Criminal = TPTB

Reagrding the REIC, what ever happened to the Sherman Antitrust Act?

(Oh excuse me, laws are now suggestions. LOL)

I agree with all of you that think the R&D game is a waste of time. This country is over.

It really doesn’t matter who is president or what party supposedly wins the upcoming election. Washington D.C. long ago reached critical mass and functions dailey using the beauracracy operating system. The only thing needed is juice (tax revenue) or campaign contributions and the rest is automatic while politicians of both parties whip the masses into a froth. We really do need to take back D.C. Nothing would please me more than to see many agencies with “Building for Rent” signs hanging in the window.

Talk to your educated friends and see how many think the two parties are really controlled by the same special interest groups. I think you’ll be astonished at how many people you thought were intelligent and thoughtful…..really aren’t.

This assures me that, as history indicates, most people have no clue about the pending implosion until it is well upon them. Even that ones that seem smart.

TV ad: Can’t make your car loan payment? Get a loan from us. Quick, easy and approved in 20 minutes. Saw it two days ago.

While the wealth of Americans on average dropped 40%, what happened to bank assets?

“Two years after President Barack Obama vowed to eliminate the danger of financial institutions that are too big to fail, the nation’s largest banks are bigger than they were before the financial meltdown. Five banks—JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC), and Goldman Sachs (GS)—held more than $8.5 trillion in assets at the end of 2011, equal to 56 percent of the U.S. economy, according to the Federal Reserve. That’s up from 43 percent five years earlier.”

http://www.businessweek.com/articles/2012-04-19/big-banks-now-even-too-bigger-to-fail

5 banks OWN wealth equal to 56% of the U.S. economy?!!!!!!! This is what the power of money creation creates! And bank asset of those 4 banks are up 3.6 trillion or so.

THIS is what the Federal Reserve lent to those banks:

Citigroup – $2.513 trillion

Bank of America – $1.344 trillion

Goldman Sachs – $814 billion

JP Morgan Chase – $391 billion

Wells Fargo – $159 billion

http://www.goldstockbull.com/articles/federal-reserve-secret-bank-bailouts-topped-16-trillion/

Ok so that’s more than the 3.6 trillion the banks have increased in profit. HOWEVER the banks did not keep the money. They used the money to make profits but eventualy paid it back. So net profit: “according to a recent Bloomberg article, the big banks brought in an estimated $13 billion by taking advantage of the Fed’s below-market rates….” Ok that’s not that much when you are talking trillions. Except if it’s not the only funny bank business going around plus compounding profits etc.. They do owe us the taxpayers $13 billion dollars at least.

got ripped off at least 4 times trying to buy low by front running brokers.!

our heated economy brings or brought in a business cycle ..8 percent to 12 percent interest rates…at bad times..? 18 percent..?…now, just more destruction of a saved dollars value as dollars….

@Ernst – Agree, but what is the explanation for the dearth of non-stressed sales? Over the past few years, half of all sales are of stressed inventory one way or another. These sales are controlled by the banks, ultimately. But Half the “market” is still families selling their homes… where did they all go?

On another note… I thought rents would be rising more renters, less owners….I’m here in Marina del Rey, sold my condo last summer, renting now. When I look around the neighborhood, rents are high, but falling….

Did you say Japan?

Look at the future of the US housing market here!

http://patrick.net/forum/?p=1213032

Good luck home owners, even though most “owners” really just rent from the banks. The only thing they own is a mortgage, and a big one at that, with 0 equity!

i got some facebook shares for sale. wall street always looking for the next sucker.

Leave a Reply