California Solution for Budget Crisis: Minimum Wage and Laying off People. But Who Will Buy the $500,000 Foreclosures?

You really have to tip your hat to our politicians. The House approved the biggest bailout in the history of this country although they are trying to highlight the Congressional Budget Office report that the total price tag will cost approximately $25 billion. Yeah right. Yet what seems to be more astonishing is the vast majority of Americans seem oblivious to the entire bill. It looks like it will have Senate approval and will be signed into law by the President soon. Only a few of those in Washington sounded any sort of alarm regarding this. The greatest financial robbery in American history and few seemed to pay any attention.

Today is the first time in a week that people are coming back into reality. Sales of existing homes declined to a 10-year low and Ford posted their largest quarterly loss ever. Ford is now being forced to double their hybrid production and move away from their reliance on trucks like the F-150. So much for a second half recovery. Washington Mutual isn’t getting the benefit of the doubt like so many other companies that were getting a free pass these last few days. They are now quickly heading back to a 52 week low on their stock price. As people dig into the legislation it is apparent only a handful of institutions stand to benefit.

I’m not sure if any of you listen to the KNX Business hour here in Southern California but for the last few days, they’ve had a couple of bank Presidents, some who are on infamous lists, stating that all is okay and they are well capitalized. One of the representatives was saying, “we did not do subprime loans so we are okay.” Yet they fail to mention their extensive portfolio of Pay Option ARM loans and Alt-A products that will prove to be just as destructive.

For those of you still interested in following the $15 billion budget short-fall here in California, we are now getting fascinating ideas on how to solve the state’s problem. Keep in mind that the budget is now overdue by three weeks and both sides are digging in. It doesn’t help when the California unemployment rate has now skyrocketed to 6.9%. Just look at how quickly the curve is turning upward:

Â

This budget fiasco has brought out some of the most interesting solutions:

-Â Â Â Â Â Â Â Â Â Let inmates out early to save some money (fun for the whole family).

-Â Â Â Â Â Â Â Â Â Balance the budget via future lottery revenues (Big Spin baby!).

-Â Â Â Â Â Â Â Â Â Close public parks (who needs these?).

-Â Â Â Â Â Â Â Â Â Shut off healthcare to those who can’t pay for it (why not!).

-Â Â Â Â Â Â Â Â Â Raise taxes.

The list does go on. Well yesterday the L.A. Times got their hands on a proposed plan by the Governator on forcing some action by the state politicians to get a budget enacted as soon as possible. So what are some of the new solutions? Here is a brief recap:

-Â Â Â Â Â Â Â Â Â Cut 200,000 state workers pay to the federal minimum wage of $6.55 an hour until a budget is signed.

-Â Â Â Â Â Â Â Â Â Immediately lay off 21,855 part-time workers and stop overtime payments for almost all employees.

-Â Â Â Â Â Â Â Â Â Cease all hiring.

Now look again at the unemployment rate. What do you think laying off people will do to that rate? Also, let us say that 200,000 employees have to deal with lower pay checks until a budget is signed. So many people are living paycheck to paycheck that it will undoubtedly set many people behind on their housing payments. Politics aside, in the short run this will increase the unemployment rate and also create further stress in the housing market. This is checkmate folks. This is not a sign that things are turning around.

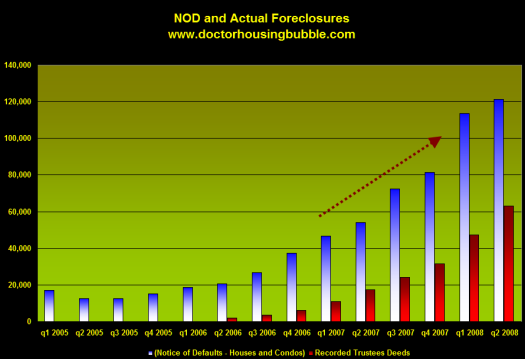

We need only look at the stress in the California housing market which had 120,000+ notice of defaults filed in the second quarter:

It really takes no rocket scientist to figure out that the budget fiasco and further job cuts are going to hurt the prospects of any housing rebound. WaMu is looking at major job cuts. Wachovia is looking at cutting 10,000 jobs, many that will be here in California. Just wait until Bank of America carves into Countrywide Financial. There will be nothing left except a carcass. Yet bear market rallies have a way of sucking people back in. Listening to folks during this one week bad news orgy was amazing. It was as if earnings didn’t matter anymore. These earnings reports are horrific. Here are some companies that have announced not so hot earnings:

-Â Â Â Â Â Â Â Â Â Washington Mutual

-Â Â Â Â Â Â Â Â Â Wachovia

-Â Â Â Â Â Â Â Â Â American Express

-Â Â Â Â Â Â Â Â Â Google

-Â Â Â Â Â Â Â Â Â Apple

-Â Â Â Â Â Â Â Â Â Texas Instruments

-Â Â Â Â Â Â Â Â Â Ford

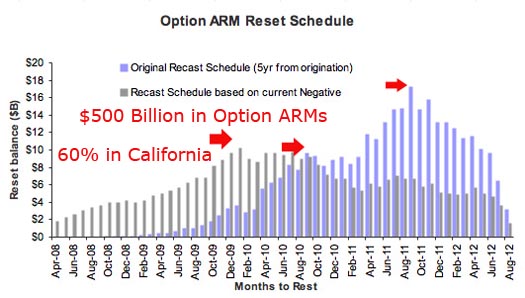

We can list more but this 600+ point rally (which just got a reality check) was completely removed from the reality on the ground. This budget stall is only going to further add fuel to the flame that we are currently facing. Why is this such a big deal? Because $300 billion of those $500 billion toxic Pay Option ARMs set to recast are here in California:

Â

What sectors are booming? The government is basically saying that they are not going to be hiring anytime soon and they are the largest employer. Housing and finance related jobs are being slashed (i.e., WaMu, Wachoiva, and Countrywide) and many regional banks are only months away from having the FDIC knocking at their door. The few fields that do have some hiring are in healthcare, engineering, and accounting. Yet those fields require hard skills that take at a minimum, a few years of college training. What are all those involved in the real estate, finance, and insurance sectors going to do now that they have a skill set that isn’t in high demand? Those jobs are being filled by currently trained workers. They can head back to school but that will take a few years. And with the cost of education going up and credit being tighter, the price of a college degree isn’t so cheap anymore. Consumption will fall even lower. You can spend (money you don’t have) on consumption items or go back to school.

*Source: State Farm Insurance

By the way, our two largest public university systems just hiked fees this year:

“(LA Times) University students will pay 10% more in fees at Cal State campuses in the fall and at least 7% more in the UC system to make up for what officials say are shortfalls in state funding.

The raises were approved Wednesday over the protests of students, who complained that charges have nearly doubled in a decade without regard to the escalating costs of textbooks and housing.”

I think the Governator is trying to force the hand of those in Sacramento. There is a lot at stake here with this budget. We aren’t talking about a $2 billion state budget. For California the Governor is proposing a $141 billion state budget. I know every year we get the same dog and pony show about the budget. The talk is always the same, “this is the worst budget ever!” or “I’ve never seen things this bad!” but sadly, this year those words are factually true. There will be some absolute difficult choices to be made. From the looks of it we can expect a combination of cuts and tax hikes. Even the Governor’s current move should it go through will add to the problems in the short run.

Let us say the budget doesn’t get enacted until late August and add in a few additional weeks to let the proposals filter through. Now we are talking September. That can mean two paychecks being slashed from over 200,000 people and 21,000+ job cuts. We already know how understated the unemployment data is gathered by the government. So those part-time workers are currently considered part of the employment force and now with this move, we’ll immediately add an additional 21,000 people onto the 6.9% unemployment rate.

This action practically guarantees a tight fiscal year. Now who in the world is going to be buying these homes? Maybe we do need some more subprime lenders to qualify people on minimum wages for these homes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “California Solution for Budget Crisis: Minimum Wage and Laying off People. But Who Will Buy the $500,000 Foreclosures?”

I remember 1991? when Pete Wilson had to issue ‘scrip’ ( IOUs) to state employees. California ( and other states) have been through these booms and busts before and you’d think they’d learn but they never do. They spend it all during the boom and raid the future during the bust. Interesting story in Central Virginia today. We were late to the downturn as we had lots of people and money coming into the area from Northern Virginia/DC. Houses here were very reasonable 3 or 4 years ago compared to Northern Virginia so speculators were investing heavily. Lots of Indian nationals showing up for some reason too. Anyway, one of the big shot speculators sent his girl friday in to terminate gas service to all of his properties. He was a mortgage broker who had built up an ’empire’ of 40 rental homes during the boom. I asked Dawn why was he cutting service to ALL of them. She said they are all being sold and the mortgage

broker was now going into a new business. I bet you all can guess what it is too. He is now going to ‘help’ people in foreclosure! The absolute gall of these people.

Spot on once again but I disagree on one thing. Most of these banks are weeks, maybe days, away from failing, not months.

When S&P and Moody’s but WaMu’s credit rating to junk it is all over. Their deal with TPG says that any capital raising over 500M at less than 8.75 a share has to make TPG whole. Well, then, how do they do it? The stock is at $4.00 right now, let’s assume they have to raise 3 Billion to stay solvent. If they offer 1B shares at $3.00 they owe PPG $5.75 a share, or $5.75B, which is more than they raised in the first place!

Stick a fork in them, they are done.

What is going to happen when the shit really hits the fan. Doc, try to figure out New York’s budget, I sware it is just like California’s.

Sorry if this is a bit off topic but I think you will understand. The MTA here in the New York area is perposing an 8% fare hike on tolls & transit starting July 2009. One of the major reasons is falling commercial real estate values, I’m shocked, truly shocked. What do you think was going to happen after the residential side started sliding last year? Any how the debt is almost $9 billion & our political leaters at all levels say there is NO funds to help the largest transit opperation in the country.

Now how are people who are on the verge of losing there homes going to get help if vital services like transit & the like lose there funding sources, dispite more users than ever?

The funding pool is shrinking while demands keep growing. In the same vain as more banks & barroers go down the demands will keep rising for bailouts, and who is most likely to get one, hint it’s not someone who played by the rules.

Sorry for the rant, I just had a lot to say.

I’m sure there are more than a few employees that will be made insolvent by a cut to minimum wage. You can only raise taxes so much before you have to accept that mass firings will have to happen.

Although the FDIC is reticent to indicate which banks are on the “watch list”, one of my regular e-mail services has ferreted out those on the bubble, see web link below. There are about four in California on shaky ground.

http://www.agorafinancial.com/5min/archives/

… and go to 07.23.08 presentation.

.

All we need to do is let 10 million rom China and 10 million from India with briefcase full of millions in the USA in next 12 months to buy all those forceclosed homes and empty spec houses and the financial problems will be solved. USA has a negative birthrate for caucasians.

At the rate we are declining on real estate their going to need to come up with a second housing bill next year with the new big stink.

It is time that governments learn to live within their means, like the rest of us who (unfortunately) have to carry them on our backs.

It is time for them to cut out the perks (tax payer financed cars, etc.) and non essential crap in everything from education to the prison system. Let’s force them to cut their “carbon footprint” by turning off their heat and air conditioning. It would save a few bucks, and maybe get them out of their too comfy offices.

Schools? There’s tons of wasted money there. Sports programs. Bilingual education. All of it should go. They’re luxuries. I didn’t participate in football. I’m doing pretty damn well, unlike the schools highly touted QB who ate a gun after his high school career was over. Nobody educated me in my folk’s native tongues, and I’ve done just fine with English.

I personally recommend that they tear out the concrete and asphalt prison yards and replace it with dirt. Hand the prisoners some seeds and a watering can and tell them, “You better get busy. If you ain’t growing, you ain’t eating!.” Think of how much money would be saved if they grew their own food. Not to mention it would teach them a useful skill and it would be more healthy for them as well.

My husband spoke with a relative of ours who is an attorney for the state of California working in San Diego. The attorneys have been informed that the court has plenty of money to pay them and their pay will not be cut. Somehow I think that the ones who will suffer from this decrease in pay will all be at the bottom of the ladder, workers deemed easy to replace.

With so few buyers in the $500k range out there, you would imagine it would easy to pick up a deal for a cash-buyer. Has anybody taken a closer look where some of these screaming deals are to be had?

Check this nonsense out:

http://www.foreclosures.com/www/blog/

My favorite line is:

“This legislation is designed to restore trust in Fannie and Freddie, and therefore in the U.S. housing market. It will absolutely mean that the housing slump will not get worse, and will end sooner than most can imagine.”

Maybe she accidently hit herself over the head with that phone she’s picture with. I was upset enough to send her this email:

You’re right, this Housing Bill Does Have It All:

– Government intervention to inhibit recovery of the economy by socializing losses of speculators. (YEAH!)

– A continuation of unchecked inflation and devaulation of the dollar as a result of reckless rate cuts to prop up unsustatiable housing prices. You think falling house prices are a problem? Try feeding your family when food costs twice as much as it does today. (YEAH!)

– 300 billion + a blank check to bail out those who got us in trouble in the first place curtsey of the taxpayer. (YEAH!)

A government ruled by special interests will do everything they can to socialize the losses of companies and individuals who should have known better and ensure that housing will remain unaffordable for an entire generation of young Americans who have worked hard to save and were prudent enough to not live beyond their means.

YIPPIE!

Check This Nonsense Out:

http://www.foreclosures.com/www/blog/

I sent Alexis and email in response:

You’re right, this Housing Bill Does Have It All:

– Government intervention to inhibit recovery of the economy by socializing losses of speculators. (YEAH!)

– A continuation of unchecked inflation and devaulation of the dollar as a result of reckless rate cuts to prop up unsustatiable housing prices. You think falling house prices are a problem? Try feeding your family when food costs twice as much as it does today. (YEAH!)

– 300 billion + a blank check to bail out those who got us in trouble in the first place curtsey of the taxpayer. (YEAH!)

A government ruled by special interests will do everything they can to socialize the losses of companies and individuals who should have known better and ensure that housing will remain unaffordable for an entire generation of young Americans who have worked hard to save and were prudent enough to not live beyond their means.

YIPPIE!

I just finish reading the rules and qualification for the new bill and I see some escape holes that FB might be use. Unless I did not read it correctly I can see a situation that can beat the system. Let say that someone bought a home in California with 0 down at the top of the market in 2005-6 for $500K. Now that today value is $350 the FB with the new law will rework his loan with the lander at 90% of today value so the new loan is $315K. Now, with a rightly fear that the house will go down another $100K in the next year or two, I don’t see what hold the FB to put it on the market and sell it at or blow market value and exit with no credit damage that would have happened if he defaulted on the original $500K loan. Any thoughts…

Will the bailout keep the house prices artificially propped up? I’m FURIOUS about this. I thought that prices might come down to the point where a teacher could get a house.

What do you guys think? Is this going to stop prices from falling or is it just a giveaway to Wall St.?

Leave a Reply