Less than 1 out of 3 California families can afford to purchase a home: The number of Millennials living at home continues to grow.

We are definitely into housing bubble territory. The latest California affordability figures show that only 29 percent of families can actually buy a home at today’s prices. This is why we are seeing products like the PoppyLoan coming about in the Bay Area trying to bring back the nothing down days of the last bubble. You also have companies promoting their “one-click†mortgages as if taking on $800,000 in debt for a piece of junk in San Francisco is a decision that should be made similar to liking a friend’s video on Facebook of a cat dressed up as a banker. The number of young adults living at home continues to stay at a record high. Of course this is being driven by affordability and more to the point that people simply do not have the incomes to justify current prices. The PoppyLoan in San Francisco, the hub of high income workers, actually states that this loan was made because people had a tough time saving enough for a down payment. That should tell you a lot. So let us look at the latest affordability figures.

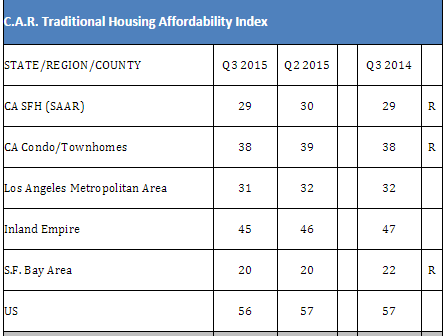

California affordability

The last time we were in the 20 percent range of affordability for California was when we were deep in the last housing bubble (on the manic mortgage days and also leading to the implosion). You need to understand what this means. Household incomes are fully stretched. We are now at the stage that companies are offering exotic products to circumvent the inability for households to save for a down payment. In many areas prices have been driven up thanks to foreign money and investors. I always find it interesting that local house humping cheerleaders seem to think that foreigners just want to flush money down the toilet. Don’t you think they care about their money more than some Taco Tuesday boomer? And let us be direct, in California this foreign money is coming in from China.  China’s economy has hit a big snag recently. We are yet to see how this impacts the overall market.

We should also note, most foreclosures occurred on boring traditional 30-year fixed rate products. Because when the economy hits a snag, a good mortgage or a bad mortgage is hard to finance when income gets tight.

But in California, housing affordability flat out sucks for local families:

Source:Â California Association of Realtors

How do we read the chart above? In California, only 29 percent of households can afford to purchase a home today at current prices. In the Bay Area that number is a pathetic 20 percent even with all the high paid tech cubicle warriors floating around. In the LA/OC area the number is 31 percent. The Inland Empire is still relatively affordable for local families.

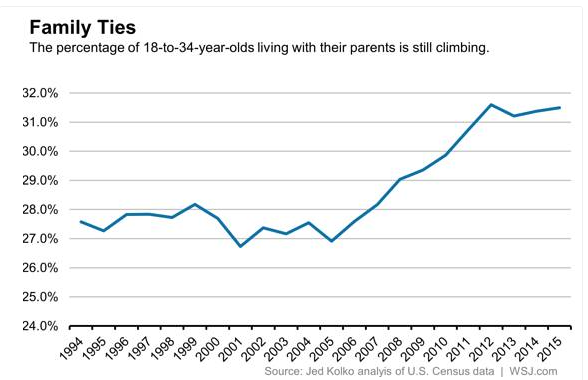

Of course many Taco Tuesday boomers are realizing there is no free lunch. Now, they are seeing many of their kids leaving college with insane levels of debt and unable to find good paying work. 2.3 million young adults live at home with their parents in California. This trend is actually hitting the country:

And while some homeowners might be loving their paper housing wealth, they hear the laments of their children unable to buy on their own. I’ve heard it many times in “prime areas†where current owners say “I couldn’t buy today if I had to†or “my kids have no way of buying in the immediate area†and somehow, that is as deep as the comment goes. In San Francisco where the typical home sells for $1.2 million good luck on buying a place there today. The comment of “look at how prices always goes up†fails to realize this affordability issue. The fact of the matter is only very few can buy today. It also misses the glaring fact that 1,000,000+ Californians that bought in the last 10 years lost their homes to foreclosure. What does that mean? Something like 20 percent of all home buyers in California lost their homes in the last decade. Yeah, that fact rarely comes up.

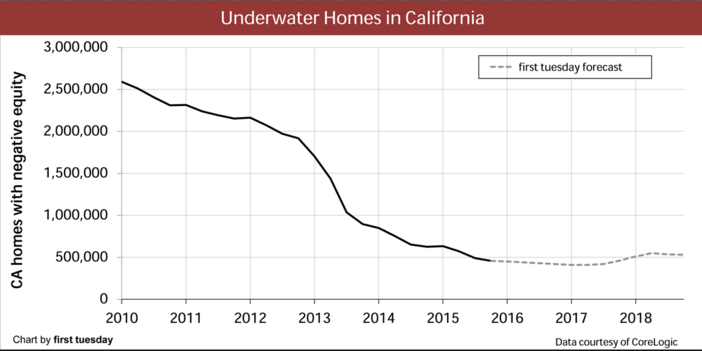

And believe it or not, we still have about half a million homes underwater even with bubble like prices:

Prices today are insanely priced for most Californians. The only way they can buy is with more leverage, artificially low interest rates, major down payment gifts from parents, or stretching their budgets into perilous territory. Keep in mind the stock market hasn’t had a major correction since 2009 and the housing bubble of 2007 is a distant memory to many. So get those zero down mortgages folks! Foreclosures never happen in California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “Less than 1 out of 3 California families can afford to purchase a home: The number of Millennials living at home continues to grow.”

Recent article in LA Weekly: “Who Lost the American Dream?” … apparently millenials and Latinos

http://www.laweekly.com/news/latinos-millennials-have-been-hit-hardest-by-the-housing-crisis-6593623

“Hispanics became renters at a rate greater than any other ethnic group,” Trulia states.

They were joined by “older millennials,” those ages 26 through 34, in being pushed disproportionately away from home ownership, the site said.

Nationwide, the post-recession housing crisis has pushed 5 percent of the U.S. population into rentals, Trulia says.

“While America is still far from becoming a nation of renters, the percentage of renters in the 50 largest U.S. metros who rent rose from 36.1 percent, pre-crisis in 2006, to 41.1 percent, post-crisis 2014. ” the site said in a statement.

Yeah, but if only all of those foreclosed folks knew about “over the long term…”

We are looking at negative interest rates. This means mortgage rates will be taking a historic plunge which will drive home prices higher. Some are already active trying to get into decent properties. Don’t get caught with cash when rates go negative. Stocks will struggle. Real estate will move higher. You have seen nothing yet.

No, no, no…you’re spewing nonsense. There’s no historical precedence to negative rates. In Switzerland, mortgage rates went UP not down when negative rates were put in place. The Fed might be exploring a way to take the rates negative but again, there’s no precedence to taking rates negative on the reserve currency of the world. Think about the following… US banks have about 7 trillion USD in deposits…there’s only about a trillion USD in physical bills circulating around the globe with the majority outside the US. IF rates went negative, some of that money would try to enter the physical plane, A few unintended scenarios could play out (Again, all theorical since there’s no precedence):

-Mother of all USD spikes as those digital dollars chase physical dollars.

-Mother of all bank runs in the global financial system

-Mother of all Hyperinflations if the government was stupid enough to convert some or all that digital money into physical cash.

The only possible way negative rates would work, would be if physical cash was banned which they’re pushing but I hope to god never materialises. They will try to use terrorism and money laundering as pretext to ban cash.

RATES MUST STAY POSITIVE AT ALL COSTS!

http://www.businessinsider.com/negative-interest-rates-increase-the-cost-of-mortgages-and-put-more-cash-currency-into-circulation-2015-12?r=UK&IR=T

There’s no historical precedence to negative rates. … there’s no precedence to taking rates negative on the reserve currency of the world.

The correct word is “precedent” and not “precedence.”

precedence — pertains to ranking or status in order of importance or urgency.

precedent — an example from the past that provides evidence for an argument.

See: http://www.grammar-monster.com/easily_confused/precedence_precedent.htm

Denmark not CH is where short term Mortgages have been running in the negative since Feb of 2015. And the only reason it treads water just below 0 is because the ECB has decided not to calculate the short euro rate with any consistency. They just copy and paste the rate from the previous week rather than risk mark to market. The frequency with which they use CTRL+C CTRL+V has gone into overdrive, with only a handful of re pricings occurring in 2015.

The ECB has already put in motion the cancellation of the 500 Euro note.

Pundits in the US have been instructed to beat the drum to get rid of Ben.

If anyone didn’t know already, it is against Fed law to store FRN in safe deposit boxes.

I am starting a mattress business specializing in beds with built in zippers.

Buy now or get priced out forever?

It makes me so sad to see something like this. The “buy now or get priced out forever” mentality is EXACTLY how housing bubbles are made. Everyone frantically rushing to buy at the peak of the bubble, and then it bursts, and there you are underwater. Please calm down, take deep breaths, and step back from the situation before you make a decision that will destroy you financially forever. I have seen this happen.

Well said Anise

Housing TO TANK HARD SOON!

They’re not making any more land! Your kids will pay $3 million for a starter home so buy now!

I miss 2005.

Negative interest rates are a disaster?

Anise I do not understand what you are saying. I saw the RE peaks in the late 80’s in SoCal and then again in ’05/06 and values dipped after but then came back up. If you bought in ’06 in a good area your house is worth more today and you are 10 years into paying it off – how is that financially ruinous? What are you talking about Anise?

Best of luck to all market timers, you are going to need it.

It could be financially ruinous if someone underwater needs to sell before prices come back up. Wouldn’t that be all of those foreclosed people Doc often refers to? I still come across listings in decent SoCal areas where people are selling at a net loss.

If buying has little risk of being a losing proposition, why would anyone need luck on timing? In that case it would always be a good time to buy.

@Falconator

Market timers like Morgan Stanley who walked away from their obligations during the last downturn? Definitely better to buy at the height of the bubble and remain underwater 8 years later and ignore the opportunity costs, right?

Uh, Morgan Stanley lost about $10B due to the subprime implosion. That’s B as in Billion. What are you talking about them walking away from losses, guy?

Uh, opportunity cost? What do you mean? Those poor foreclosed souls went in with zero down, even financed their closing costs. What are you talking about? What opportunity cost??????

Of course it is better to own than rent if you can afford the payments. Like the stock market, there are ups and downs in valuation, but the long term trend is unmistakenly UP in the better SoCal zips. UP means Higher. Not to mention you are paying down the debt = increased equity. Not to mention the tax shelter. Not to mention stability for the family.

Look if you bought in a solid zip code in SoCal at the highest peak in ’06 you are near or above that valuation today and you have paid down the mtg for 10 YEARS. If you were an idiot and lied on a loan app and got foreclosed on, you went in with zero skin, you probably lived in the house for years without making a payment, and you were back in business years ago to make a play for another property. Either way, you come out on top even having the worst “timing” possible….

Forget about “timing” any market. Invest in your 401K regularly and buy RE that you can afford and let the passage of time work its magic. Unless you think you are smarter than everyone and can time markets, then go ahead and learn your lesson the hard way.

Or just stay on the sidelines for yet another year, frozen. Like Jack Nicholson at the end of the Shining.

@Falcantor: You have some cognitive dissonance there amigo. First, you talk about buying a home as a win no matter what even for those that lost through foreclosure. Uh, okay. Your assumption that most went in with no skin in the game is completely and utterly false. Not everyone bought with zero down mortgages.

And by the way, foreclosure is a big hit on the family stability argument you talk about. What about the strain for those needing to stretch to buy? Most can’t buy because they don’t have the money. You mean your kids are going to be hookers and drug addicts if you rent?

Here is an article looking at the argument with more details and this coming from a millionaire which of course can’t happen according to you since they are now renters:

http://jlcollinsnh.com/2012/02/23/rent-v-owning-your-home-opportunity-cost-and-running-some-numbers/

Just because buying for you worked in whatever SoCal niche zip code you’ve picked doesn’t mean this applies for most people especially at currently inflated prices. It also doesn’t mean you are a genius. It means you got lucky.

Buy now and foreclose later should be statement for anyone buying at the peak.

@falconator

Correction: MS lost all those billions because prices became so high that even prime borrowers, the bulk of defaults, couldn’t afford them during an economic downturns. And it would have been worse for MS if they didn’t strategically default on underwater RE acquisitions like many prime borrowers did.

It is precisely because of opportunity costs that many of the rich walked away rather than keep paying for underwater properties.

More on strategic defaults: “Morgan Stanley recently (circa 2010) decided to stop making payments on five San Francisco office buildings. A Morgan Stanley fund purchased the buildings at the height of the boom, and their value has plunged.”

http://www.nytimes.com/2010/01/10/magazine/10FOB-wwln-t.html?_r=0

@Jay

Totally agree. Even with no down payment, an underwater borrower will still be servicing his debt far longer before recovering their equity.

I still wait for a coherent explanation as to how all those who went in with zero down and lived in their homes for years without making a payment suffered an “opportunity cost” Please elaborate.

Strategic defaulters who did so to take advantage of other opportunities? Sounds like they took advantage of other “opportunities” – so again what was the “opportunity cost” suffered?

As for those who stuck out the crash and kept paying – well values are up dramatically off rock bottom. They could have bailed at the bottom to chase another non-RE “opportunity” – that course of action in my current neighborhood would have cost them about $400K in rebound value. Just for paying their mortgage.

Good luck to Renter Nation with all your ‘opportunities’!!

“Like the stock market, there are ups and downs in valuation, but the long term trend is unmistakenly UP in the better SoCal zips. UP means Higher. Not to mention you are paying down the debt = increased equity. Not to mention the tax shelter. Not to mention stability for the family.”

Putting aside the situationally debunkable cliches of equity and tax shelter, take note that the “long term” rationale is slipping in ever more as we approach stall speed on this market. Happens every time and therefore is a fun qualitative topping signal.

As market manipulation increases with each cycle, timing is unfortunately becoming an increasingly important variable for the astute than it used to be based on a number of factors which Doc tirelessly blogs about. Stability for the family these days requires a greater vigilance around timing as multiple household incomes have been pushed to the limit and the safety nets of yore have largely vanished. Perhaps not as big of a deal for the entrenched, but quite a different concern for the potential first timer of today.

“Look if you bought in a solid zip code in SoCal at the highest peak in ’06 you are near or above that valuation today and you have paid down the mtg for 10 YEARS. If you were an idiot and lied on a loan app and got foreclosed on, you went in with zero skin, you probably lived in the house for years without making a payment, and you were back in business years ago to make a play for another property. Either way, you come out on top even having the worst “timing†possible….”

Considering that most people are on a 30 year schedule, the first 10 years pay relatively little toward principal. Nearly everyone and their mother with a legacy mortgage refinanced from higher rates in ’06, in some cases more than once. I don’t know the statistics but I imagine the vast majority re-extended out to 30 year terms. In other words, still less going toward principal 10 years later for the ’06 buyers and less going toward principle even for a lot of mortgaged buyers prior to ’06.

It wasn’t the case that everyone who got a zero down loan used a liar loan. Subprime unduly gets the lion’s share of focus for that era due to the more spectacular extent that those failed. The real story is how prime products contributed to the mania.

What good does having bought at the last peak and being at or above that valuation today mean for most? It means if they want to move into another home of like or better kind, a likely net loss after accounting for transaction costs. How is that coming out on top?

“Forget about “timing†any market. Invest in your 401K regularly and buy RE that you can afford and let the passage of time work its magic. Unless you think you are smarter than everyone and can time markets, then go ahead and learn your lesson the hard way.”

Considering that none of us have stated market timing is easy or even simple, that’s precisely why buy and hold is the preferred strategy that most use which in turn provides the floor for market timers to profit from. I wouldn’t advise people forget about anything, but rather to do what they feel comfortable with and ask questions whilst exploring as much information as possible.

“Or just stay on the sidelines for yet another year, frozen. Like Jack Nicholson at the end of the Shining.”

No one is frozen, renters are free to move about while owners are free to take losses and gains.

@falconator

You continue to make bad assumptions to support untenuous claims. Those foreclosures or defaults that were actually put on the books caused the downturn. Those who are staying without making mortgage payments are doing so because banks don’t claim them as losses. And as been repeated over and over, subprime was not the culprit for the downturn.

The opportunity cost of continuing paying for an underwater property was investing that same money into something that did not lose value (or as drastically). Thus, an opportunity cost isn’t something that you have to “suffer” as you and only you claimed.

If the global outlook was generally positive, I would agree that real estate is a good long term investment. While in areas, owning is better than renting, everyone seems to look at real estate as a cash cow at some point! The problem is, our GDP has been slowing since the mid-70’s, and now the globe is catching the same cold! Add to that growing debt and liabilities just about everywhere, which threatens fiat currencies everywhere, and you have one big giant question mark??? While it is true that they don’t make anymore land, it is also true, that the number of potential buyers is shrinking along with economies, and major currency disruptions or recessions, while they may play to U.S. real estate, they may also work against it.

The US adopting negative interest rates would be a sign of the apocalypse. It will never happen. Furthermore there is very little hard evidence that negative interest rates helped the economy of any countries that have tried it.

i don’t think it’s the economy that matters to these assholes.

“The US adopting negative interest rates would be a sign of the apocalypse. It will never happen. ”

Hunan,

I agree with your first statement but not with the second. JP Morgan Chase CEO in Davos already made a strong statement about the necessity to speed up the process to NIRP implementation. You can not have NIRP, especially more than 0.25% without eliminating the cash, otherwise you have a run on the banks.

Chase is one of the largest banks who own the FED. If they want this, be sure the other banks want it, too. All large banks want NIRP.

NIRP allow the largest banks to become bigger and eliminate the smaller banks (competition). NIRP allow concentration of capital in fewer and fewer hands. Elimination of cash allow the largest banks and the government more control over the economy and individuals. It helps with the larger agenda of globalization and a new financial empire to control all countries.

In conclusion you can bet on NIRP. It is just a mater of time, but it will happen soon. Consequences of NIRP in a large economy like US are very hard to predict accurately. As a result of NIRP the 30 yr rate can go both ways (higher or lower) depending on many other factors – too many to enumerate and in a system too complex to forecast with any accuracy.

“Furthermore there is very little hard evidence that negative interest rates helped the economy of any countries that have tried it.”

Hunan,

I agree with this statement. However, you start with the premise that the largest banks take decisions based on the good of the country. IMO the largest banks who own the central banks make decision based on what is in their advantage. They always do that. That is the reason that in the last few decades the financial sector dominates the US economy and gets a larger and larger % of the total GDP. In the last financial crisis, over 1800 banks wend under. That means less competition for the TBTF who grew even larger and more powerful to control the government and the democratic process.

So, yes, you are right that NIRP not only does not benefit the vast majority of the citizens, it is actually very detrimental to most of the people, especially the middle class.

If you do an extensive research on NIRP, QE or ZIRP, you will realize that all are just tools for the new feudalism – massive concentration of wealth at the very top (0.0001%) and misery and massive unemployment for the rest.

A sign of the apocalypse ?

I think that’s what they said about QE before it happened. I certainly didn’t think world markets would let them get away with it, but in fact, they ate it up!

never say never…. central bankers r out of candy?

Your premise doesn’t make sense. Why would stocks struggle in the scenario you present but housing go up? They independent variable in the price function for both is the interest rate and it’s a non-inverse positive relationship in both cases.

I think there are a lot of short memories in California and elsewhere in the U.S. I hired some of those Silicone Valley IT types after the dot com crash in 2000 … they gladly accepted offers for 50% of their previous pay! I had a number of IT people who couldn’t find work, had spent their savings and their 401k’s, and were desperate after 08/09! I also remember the impacts of the closing of the Long Beach naval station and finally the shipyard, and the shock when aircraft manufacturing finally ended in in So. Cal. Anyone who thinks their $200k paycheck is safe, and that they ought to indulge in over-priced real estate, simply has a very, very short memory!

Somebody is desperately trying to keep the drunken party going as it starts to wind down. Prices in previously overheated markets outside of California (i.e. NYC, Australia, Canada, Hong Kong) are falling already. Highly leveraged markets will not escape this contagion.

A hell of a lot of “silicone” valley types feel lucky to get $12-$15 an hour for programming.

This myth that you can come up here and get a great job is just that – a myth. You’re competing with H1B’s, some of which are housed in dorms and paid $2-something an hour, and tons of starry-eyed comp sci grads who don’t realize yet they’ve been rooked.

You keep posting that…it isn’t true. I live in Alameda and live with a tech worker for a company in Millbrae with about 20 employees. They basically hired all the employees at 45K salary and pay for BART/Clipper card (about $50 a week). All the programmers make more and they are younger kids…some with college degrees and some just self trained.

Another batch of expended friends in Tech simply tell me that a lot their hard core programming is done by contractors in Russian, S. Korea or India.

I have another friend that work in programming for Pixar…dude is rich.

Another guy (husband of a friend) is a CAl grad about 27 that works for Twitter…they actually are doing well enough to move INTO the city from Emeryville.

Being that the new minimum wage in Oakland is $12….your antidote continues to fall apart. I know waitresses in Temescal area of Oakland making almost 60K.

No one with a 4year degree CS or math or similar is make as little as you state.

I’ve called him on it, too. Coders who can’t find work simply skip town to greener pastures (of which there are many all over the country that pay $80k+). They don’t accept $12/hour unless that’s really what they’re worth – meaning they have major problems dealing with other humans and/or are very bad at their job. Companies that offer that kind of pay don’t get quality people and either change or fail. My company tried outsourcing. Once. It’s been 6 years of re-writing and repair since, and we’re still dealing with the mess.

I suspect the people Alex encounters frequently simply share the same boat as he – they are in the neighborhood or within biking distance, eating the same foods, shopping at the same stores, finding the same cheap/free services to use. The median salary data says something completely different and I gotta go with that.

On a sort-of related note – the majority of homeless quickly escape that situation unless there is a mental health issue involved. If you’re a programmer with a CS degree and living under a bridge, your problem isn’t that you can’t find work – although whatever the real problem is, it’s likely the cause of both your inability to find work and the bad decision to live under a bridge.

I think that many of us have tried to educate Alex regarding salaries in silicon valley, all to no avail. The receptionist at my company makes $21/hr. Programmers start at about 80k and almost all of them have a base of over 100k. These numbers are in line with my industry in general and just a little low for the bay area in particular.

And not just competing with low paid H1Bs here physically, but also offshore. The company I work for employs hundreds of programmers that live, work and play in India! They just remote desktop into our company and do their work on our virtual PCs, all while living in India!

I imagine that the cost of living in India is much, much, much lower that probably anywhere in the U.S., let alone California!

This is what we’re competing with! How’s that even possible!?

maybe those csee should teach in local hi school?? math , ap physics bc or c++…..

In the Silicon Valley’s tech, computer and STEM industries, 75 percent of the workers are foreign born.

http://www.jointventure.org/news-and-media/news-releases/1363-2016-silicon-valley-index-tech-economy-surging-to-new-levels

http://www.paloaltoonline.com/news/2016/02/10/silicon-valleys-year-amazing-but-with-perils

If you bought in 2012 when prices were still sane what do you do now? I live in 91773 and inventory is exploding, which was the beginning of the end on 2007. I think the “if I don’t buy now…” Fallacy will keep the bubble from bursting this summer, then the remaining inventory will start freaking everyone out and this bubble will be obvious no later than 2018.

Back to “if you bought in 2012:” I have $150k in equity thanks to buying a $330k home at the right time. Do I roll the dice on renting for a few years so I can put that equity into an awesome purchase or just thank the stars for my reasonable mortgage while I watch my imaginary wealth (equity) reduce down to nothing? I can afford to upgrade to a $600k house now but I don’t see the point in this market when 3 years from now $600k might get me my dream home…

Yep, that’s what I’d do … when RE looks like it’s about to hit a downslope, I’d sure as hell pawn my dog and sell my house to get into a house costing 2X as much.

Of course if I were really stupid, I’d treat the house I have $150k equity in as a place to live, and sit tight. But that’s crazy talk.

If your goal really is to cash out and then re enter housing at lower prices… Don’t try to call the top. Make sure your house is showroom ready. Get rid of things you don’t use and be sure the house shows very well inside and out. Then when housing makes it’s moves downward (not happening in central coast CA) put the sign in the yard. You might not get every nickel out that you had, but selling in the fall of 2006, thru 2007 would have been close enough to the top.

This is the best advice so far because none of us are going to understand your appetite for risk like you would.

There were a lot of people in the few years leading up to 2008 who predicted a major housing market reset and timed their exits accordingly, I don’t recall any of them making assessments or moves regarding re-entry until after the down trend confirmation because they were focused on the exit first.

I quickly checked rents in 91773 and the situation mirrors what is happening nearer the coast, in L.A. and SF, which is that rent increases have stalled. Historically this is not a sign that the bird is flying significantly higher anytime soon.

Just to clarify, whiteknuckle’s advice for the OP is what I was referring to.

Dang it, meant to say that whiteknuckle’s advice is the best so far!

Put away your crystal ball Angelique. Pay your mortgage and enjoy your home.

Angelique, you should consider yourself lucky buying in 2012. As the Falconator said, pay your mortgage and enjoy your home. Nobody (and I mean nobody) could have predicted how the last decade played out. With that said, nobody has any idea what the future holds. You own a home with 150K in equity, likely below rental parity, go pop open a nice cold beer…you don’t have any worries.

I’m roughly in the same boat as you. I briefly thought of doing what you’re considering, eek. If you are happy where you live, I’d consider staying put like Lord Blankenfein and Falconator said. There’s nothing wrong with not stretching and actually being somewhat comfortable financially. Enjoy

If inventory is exploding in 91773 (in February), it will probably do the same in most zip codes. Traditionally, spring is when listings increase; and I think price reductions will be common in 2016.

So tell me….what happens when it becomes apparent that the drought is ongoing, in spite of current El Nino conditions?? that might help to let more air out of the bubble,no?!

what happens when it becomes apparent that the drought is ongoing, in spite of current El Nino conditions?? that might help to let more air out of the bubble,no?!

No.

The current drought will not cause a drop in RE prices. Only when the water actually stops flowing from their faucets will most people take notice.

I myself don’t think the water will ever stop flowing. There’s plenty of water for people. In California, 50% of the water goes to agriculture, 40% to the environment, and 10% for human use (business and residential). All we need do is divert water from the environment for the people.

We’re dumping billions of gallons of fresh water into the sea every year, to save a few fish (I say, let them go extinct):

http://www.wired.com/2015/04/california-spend-4-billion-gallons-water-fish/

http://www.wnd.com/2015/04/bone-dry-california-dumps-water-to-make-fish-happy/

http://www.reuters.com/article/us-usa-california-water-idUSBREA2C1MB20140313

Agree with son of a landlord. There is no doubt there will be water available in socal to flush toilets and take showers. The giant green lawns will be a thing of the past. Supplying water to one of the most economically important parts of the world (socal) will be at the top of the list for policy makers. I wouldn’t lose any sleep about the drought/water issue…

35 million people and counting……..all needing longer straws!!

Thanks Doc for the wonderful blog fodder! https://confoundedinterest.wordpress.com/2016/02/15/simply-unaffordable-less-than-1-out-of-3-california-families-can-afford-to-purchase-a-home/

” . . . somehow, that is as deep as the comment goes.”

Of course. Most people are not capable of connecting the dots between excessive population growth driven by immigration and price of real estate. One person even ventured the absurd comment that “poor immigrants don’t buy houses.” They don’t, but they do rent, even if it’s only part of a garage, and landlords do buy houses, and apartments.

Population density is the main driver of the price of land, and thus the price of housing. High immigration is the main driver of population density.

See, for example, Immigration and the revival of American Cities by Jacob L. Vigdor for the Americas Society/Council of the Americas and the Partnership for a New American Economy, in which he claims that more than 40 million immigrants currently in the united states have increased housing prices nationwide by $3.7 trillion.

ErikK,

Higher prices don’t mean higher standard of living. It means lower standard of living.

Higher densities also mean lower standard of living for everyone: renters and landlords, rich and poor. If not higher density in the house, definitely you will see higher density on the streets regardless of where you drive. That means inhaling smog for hours every day, less time with family and less free time. It also mean higher chance of accidents (statistically). Even if you have perfect driving, you have a higher chance that someone else will hit you.

Flyover, I don’t see where an argument was made regarding the standard of living as it relates to population density and/or immigration. What am I missing?

Jeff,

It was implied that prices will grow due to continuing immigration even if those immigrants are dirt poor. I am one of those who argued that increase in population without jobs or higher wages do not constitute increased demand. By that rationale, India and Brazil will have a higher demand than Socal because they have higher population densities. All they have is an increase in slums.

My opinion on increase in population is that all is increasing is the poverty, traffic congestion and density, like four families per unit.

Price increases, IF they happen, will affect in a negative way both renters and owners for reasons I already mentioned. The only beneficiaries will be those who sell high and move somewhere else.

If you or Erick see something positive in that, I am glad you are optimistic in SoCal RE. It doesn’t affect me. I am just giving my 2c for those who care.

Flyover – thanks for clarifying. We agree that there isn’t anything positive in the kind of population growth that we’re witnessing. Overall I agree with what you’re saying.

I guess it’s anecdotal on my part, but it seems like there is some impact on rental pricing due to immigration (i.e. put 2 or 3 families in one home/apt and the $3k or $4k per month rent gets paid).

Yes. Local house jumping cheerleaders also think parents may want to flush money down the toilet, too… Parents, keep your powder dry. It’s not time to buy.

What about this price reduction in ladera?

From 1.45mil to 900k! Talk about market reality setting in!

http://www.zillow.com/homedetails/17-Sea-Grape-Rd-Ladera-Ranch-CA-92694/63115684_zpid/

If you pause and think long term you will realize that the ONLY way out is to debase the currency. There will be fits and starts but the trillions in unfunded liabilities and the now 19 trillion in debt will be serviced with funny money.

Believe me they have tried to induce inflation, the FED aka Ben and now Yellen. The reason why is not working aka low inflation today is the last crash was to deep and most of the money goes toward recapitalizing banks. Many countries debase their currencies and the US is seen as one doing less debasing and the dollar did caught a bid (US dollar is one of few currencies that did not reset since its inception 240 years ago, most people don’t know this). US treasury still yield good values compare to EU bonds and, Japanese bond some of which has gone negative. Global growth is kinda shot, hence provide additional rush into US economy & USD.

Inflation these days is not due to demand but more of cost push because of higher taxes, salaries, other business costs etc…Plus due to expanded govt hand outs.

Just wait until the California raising RE taxes for their coffer and then we will see how prices would stand on top of a declining economy. I believe the upside to real estates is limited and the downside it’s a little riskier. But I don’t expect a huge crash though because we are not really in a bubble outside of some zip codes (due to high capital concentration). My guess is we just limp along for the next decade. These days I believe housing is more of a safe haven than a get rich quick scheme especially if we have NIRP.

Some of mine ramblings…

If you have a place to stay, then stay put. The sign of an unhealthy economy is when interest rates are manipulated to prop up a frothy equity market. In Davos, CEO’s were discussing behind closed doors, “recession”. That was several weeks ago, the DOW since then dropped 800 points. The markets directly impacts housing. Fear drives capital expenditure and hiring. If companies halt hiring then there is reduced flow of money in circulation. When companies halt purchases then ancillary businesses suffer. People only buy homes when things look bright on the horizon. Interest rates are great when people can refinance and get a lower payment. At these rates, a home owner will never be able to take equity from their home to absorb the financial loss of loosing a job. They will not be able to eliminate their PMI, they will not be able to buy a car. You would be amazed at how fancy the TUFF sheds are getting in front of Home Depot, because people are afraid, “could I live in this thing if I loose my job and my house”? Think about it, because it heading your way.

“You would be amazed at how fancy the TUFF sheds are getting in front of Home Depot, because people are afraid, “could I live in this thing if I loose my job and my houseâ€? Think about it, because it heading your way”

You’ve noticed that too? They are getting bigger/fancier; I notice many more people checking them out. Costco now has sheds, swear I saw one displayed in one of their stores (not in CA).

http://www.costco.com/sheds.html?ddkey=http:CatalogSearch

One marketed as a potential “yoga studio”.

http://www.costco.com/Stonecroft-12'-x-10'-Wood-Storage-Shed.product.100161778.html

“The roof dormer’s double transom windows, along with the two traditional windows on each side of the double doors, will light up your Stonecroft shed just like your home!”

On the Home Depot site, some people ask in the question/answers section if this product could be converted into a residence.

http://www.homedepot.com/p/Best-Barns-Arlington-12-ft-x-24-ft-Wood-Storage-Shed-Kit-with-Floor-including-4-x-4-Runners-arlington-1224df/203431903

This company is making it real easy to purchase a “fancy” shed. Up until yesterday they were offering free delivery and set-up but discontinued the “free” because of such high demand.

Rent-to-Own

No Credit Checks

Small Security Deposit

First Month’s Rent

Pay off any time, no penalty

Month-to-Month

*It can be used as a tiny house.

http://shedsbendor.com/products/

http://shedsbendor.com/blog/

Wow that is crazy! You guys are totally right!

Housing to Tank HARD SOON!

I’ve noticed the fancy sheds also. There is that one Bay Area man who rents out a tent in the backyard. Maybe people figure they can get double if they rent out a fancy shed.

Sign of the times

View “CROWDING INTO HOUSE FLIPPING” article at http://eeditionmobile.latimes.com/Olive/Tablet/LATimes/SharedArticle.aspx?href=LAT%2F2016%2F02%2F14&id=Ar03902

Married couple – neighbors of mine – both lost their jobs at layoffs a few weeks ago. House went on the market last week. They paid $260,000 in 2012 for it – listed it at $450,000.

Sale pending already. Everything in my Eastern Subs of Sacramento area is still selling fast and at insane prices. I don’t get it….

Maybe investors from the Bay Area are buying rental properties again at the height of the market like last time?

A “crystal ball” is hardly required when you’re in a bubble, there’s plenty of real evidence to rely upon. This could be the last year you can reasonably sell for the next few crazy years.

Rental parity is a good point, but no one addressed my concern of evaporating equity. I have $150k NOW but this money could easily evaporate in 1 – 2 years. In happened to many in 2007 – 2009. We do not have the same subprime risk, but there are signs that lenders are overreaching and factors that did not exist in 2007 such as the financial collapse in China. When Chinese investors start liquidating mortgage-backed securities to cover other losses what does that do to to banking behavior? Investor demand = looser restrictions and lowest possible rates, reduced demand = fewer qualified buyers because there is less incentive to originate a loan that cannot be sold. When those same Chinese investors sell their interest in REIT’s and other asset funds that own all that shadow inventory cash investors scooped up over the last few years that could result in an influx of supply. Add the two together and you have increased supply + reduced demand = falling prices. As long as residential real estate is a speculative market its not really safe as a long term investment unless you are also behaving speculatively in the form of buying low / selling high. The flip side is cash may be a poor choice compared to a hard asset during periods of inflation, but let’s be real: when you buy a house you don’t “own” a home, you pay rent in the form of interest and slowly buy it over 30 years. The bank owns it until then, you’re just a glorified tenant with all of the expenses and responsibilities of a landlord.

At some point we may arrive at the end of a bubble we cannot recover from thanks to baby boomers. Look at the most recent census data and you will see the vast majority of homeowners are over 60, and this generation seems remarkably uninterested in downsizing into senior housing. This cannot last forever: eventuLly that supply will be reach the market as well, and if it overlaps with high inventory / low prices the market may be much slower to recover than the ~5 years it took last time.

Equity you hold today is a guaranteed gain if you sell tomorrow and simply imaginary wealth if you hold on to your real estate.

You shouldn’t think of your house as “equity.”

That’s the problem. People today see houses as investments, and are always thinking of whether they should refinance, take out another mortgage, sell, or however else to maximize the value of their “equity.”

I think people should pay off their mortgages ASAP, and never take out another mortgage unless they have no choice. Pay off the house and LIVE in it. It’s not an investment, it’s a HOME.

If you like the house, and you like the neighborhood, and you can afford it, who cares whether the house’s value goes up or down?

As others have noted, your primary residence is a consumable product. You use it to make you happy, not as an investment.

That used to be a common outlook in the 1970s, when I was a young lad. It’s how my parents thought, way back then.

That’s sound advice. I don’t really like the house, neighborhood is meh, schools are excellent. Schools alone are reason enough to stay for the next 10 years, but its so expensive to get an older house to “loveable” status and we’d have a lot more expendable income if we rent.

A lot of those families who just bought and stayed put in the 70’s are still in the same house 40+ years later. That’s idyllic and sweet, but it also takes up a lot of inventory: it is extremely difficult for a young (I’m 33) middle class family to get into a perfect neighborhood with great schools where you’d happily stay for 30+ years. Living next to your middle class parents is a joke, median price in my in-laws ‘hood is $700k and I can’t afford it despite being more successful than they were at my age. I bought the best I could afford, even near the bottom of the market that wasn’t much. It’s hard not to look at Zillow and think “FINALLY, this equity could be what moves me up to where I want to be.”

I see your point and it makes perfect sense, but I also wonder if the wisdom of that philosophy only worked when home ownership was on the rise and investors built homes instead of owning them and their mortgage backed securities.

Time travel back to 2012 when Greg Lippmann (who shorted the housing market during the bubble) called the housing recovery. His hedge fund comprised mostly of mortgage-backed securities was profitable from 2010 to 2015:

http://nyti.ms/y2xLNX

In 2015 that same fund sustained losses:

http://mobile.reuters.com/article/idUSKCN0UP26320160112

Elsewhere it was announced Greg Lippmann is fundraising for a new fund related to real estate but he isn’t revealing the exact components. I’m guessing he’s betting against the housing market, again, and not being public about it because it’s best to be first at that game.

Here’s a million dollar house: https://www.redfin.com/CA/Santa-Monica/3354-Virginia-Ave-90404/home/6764553

* Bars on the windows.

* Freeway ramp right in your backyard. (check the Google Street View.)

* Crappy, ugly interior.

All this, for only One Million Dollars!

Of course, it is in Santa Monica. Only 30 or so blocks from the beach.

Ha, nice find. If you picked up that house and put it in San Bernardino, it might be worth what, $50K? I know the value is in the land, but still, that is one crappy house. AS you stated, location is pretty crappy, too.

I drove right through that house less than a week ago on my way back from my business trip. I was making a U-turn to go to a Japanese grocery store located on the west side of 405 along Centinela. As I passed the house and drove under the freeway, there were at least 10-15 homeless camped right there with tents and shopping carts. I would not pay a million bucks to stay less than a block away from this… There were long lines and unfriendly people at the Japanese grocery store. That is why we left California.

That’s California’s biggest literally inconvenient truth – too many people. The financial cost is out of balance with the lines, crowds, and waits. The weather can only overcome so much, but forget that it was uncomfortably hot the past week and now it’s raining in SoCal. Everyone wants to live here is contributing a negative feedback loop. The much acclaimed diversity factor also becomes a negative as too many people from too many places translates into a disorder of expectations.

You forgot to mention the alley with it’s overgrown brush and discarded trash with attractive barbed wire running behind your home and pushing up to the freeway. What are they trying to keep out, or maybe in? Who wouldn’t want a 1 million dollar home with a view of a dark alley and a freeway from your backyard? Where do I sign up?

Well, somebody wants it. Listed for 4 days, and already, the house is Pending.

House horny indeed.

I can’t believe someone would pay 1 million dollars for a crappy house next to the 10 freeway. They can look forward to unrelenting noise at all hours of the day and night and a bad case of black-lung. I lived in a home that was much further from the 10 freeway then this one and every day we had to sweep the black soot off the porch.

Maybe the purchase involved money laundering looking for a place to park some cash? Maybe someone from China bought it?

Airborne black soot is a feature common to all of Los Angeles regardless of proximity to the freeway.

…and here’s what a million bucks can buy in other US cities…

https://www.redfin.com/FL/Orlando/1304-Delaney-Ave-32806/home/46931888

https://www.redfin.com/TX/Austin/8206-Bell-Mountain-Dr-78730/home/31288670

https://www.redfin.com/OR/Portland/2232-NW-Wheatfield-Way-97229/home/26683807

https://www.redfin.com/UT/North-Salt-Lake/633-Lofty-Ln-84054/home/91882413

https://www.redfin.com/CO/Greenwood-Village/9993-E-Berry-Dr-80111/home/34862774

https://www.redfin.com/TN/Nashville/9131-S-Harpeth-Rd-37221/home/101104931

https://www.redfin.com/TX/Hill-Country-Village/104-Powder-Horn-Trl-78232/home/48837127

I’m sure most will scoff at these locales, arguing not hot/sunny most days, few jobs/career opportunities, slower paced lifestyle, fewer museums, no surf/ski same day, maybe a neighbor is religious and/or own guns, maybe a bug or snake, perhaps believe those who live outside CA aren’t as “smart, cultural, cool, accepting, aware”, must make new friends, etc. Comparing everywhere to CA is like a person comparing everyone new they date to an former flame they haven’t gotten over, that person will probably never be satisfied with anyone new, “it’s just not the same as…!”. Perhaps best to stay in CA, enjoy multicultural elite lifestyle/sunny days.

Housing will be the last nut to crack. Lucky for them they were at the leading edge of the layoff wave.

Article from LA Times on use of Crowdfunding for flipping of homes

http://www.latimes.com/business/la-fi-crowdfunding-house-flippers-20160214-story.html

excerpt:

Between September 2013, when equity crowdfunding was first permitted under new Security and Exchange Commission rules, and September of last year, investors pumped $870 million into crowdfunding platforms tracked by New York data provider Crowdnetic. Nearly a quarter of that amount, $208 million, went into real estate projects.

That’s more than biotech, alternative energy, tech wearables, online gaming and social media start-ups combined.

Although data providers don’t track the number or dollar-volume of loans going to house flippers as opposed to developers of larger projects, more than a dozen real-estate-focused platforms offer loans to them. And a handful of Southern California start-ups specialize in the market.

Patch of Land in West Los Angeles made about $61 million in loans last year, mostly to house flippers, and PeerStreet in Manhattan Beach made $40 million, almost entirely to them.

“There’s a crowdfunder popping up once a month now, and the low-hanging fruit is the fix and flips,” said Jonathan Lee, a principal at George Smith Partners, a Century City real-estate-financing firm.

Entrepreneurs behind the financing platforms find house flipping attractive because banks don’t participate and there are no big, established players.

Traditional mortgage lenders want to know a borrower’s individual credit history and income, and probably wouldn’t allow a borrower to have loans outstanding on half a dozen properties at once, not an uncommon practice among flippers.

That has forced most house flippers to rely on a hodgepodge of small private lenders, wealthy investors or friends and family for capital. Today’s crowdfunding platforms enable flippers to tap into a much larger investor network. The platforms are open to accredited investors, who have to make more than $200,000 annually or have a net worth of at least $1 million.

I agree that Los Angeles is unaffordable to most people. But why are you convinced that it will ever be affordable again? Most of the very best cities are not affordable. Paris, London, Milan, Manhattan, all out of reach of 90 percent of families, Take my advice, just accept that LA will never be affordable to you and if living in a nice house is important to you move to flyover where houses cost very little

“I agree that Los Angeles is unaffordable to most people. But why are you convinced that it will ever be affordable again? Most of the very best cities are not affordable. Paris, London, Milan, Manhattan, all out of reach of 90 percent of families,”

I find this statement funny, I’ve been to Paris, London, & Manhattan, and they are all nicer then LA. I haven’t been to Milan, but I assume it also makes LA look like a Tijuana toilet. I’ll admit there are nice parts of LA, but the traffic is so bad who can get there, or anywhere for that matter? I lived in LA for over 20 years. I left in 2015, and in the last 3 years I lived there I hardly left the house because it took hours just to get a couple miles. The poorly maintained streets & sidewalks remind me of a third world country. Just look at the shanty towns of homeless people popping up all around downtown and under the freeways. Last time I was downtown there were so many people sleeping on the sidewalks of Los Angeles St. that pedestrians has to walk on the actual street instead of the sidewalk, and that was just two blocks from the LAPD station. “Best city” my ass.

Exactly- although nowhere is perfect, just compare LA to those other cities (and NYC) with regards to two Major factors: 1. Violence and 2. Infrastructure. Sure, parts of London and Paris could resemble immigrant/3rd World ghettos, but the sheer level of gun violence doesn’t not even come close to LA- on a good weekend at that. Plus- any of these other cities have MASSIVE public transportation systems. You don’t need a car, and can find most local services all within a short walk in your own neighborhood.

I’ve also been to a fair share of European cities, all of which were much nicer than 95 percent of L.A. An exception might be Athens, but I think it was still nicer overall. Even smaller cities were nicer, and were also presumably cheaper than L.A. I don’t recall ever having to step over human feces in any European cities I’ve visited; it’s almost a guarantee when walking around L.A. I will concede that Vancouver has a fair number of homeless. But it’s still nicer than L.A.

Also, you don’t have to make an extreme choice like L.A. or flyover country. There are various compromises, as long as you have halfway decent purchasing power: condo near the beach in OC/LA/SD; house in south Orange County, etc.

We tend to see this straw man presented from time to time around here.

It’s not a question of cheap, but rather the cost being high relative to the value received.

On one hand we’re given reasons for why Los Angeles is uniquely positioned from other cities to justify the cost, yet as in this case, also provided with other “world class” cities as a basis for justification. Just one example of how this is contradictory, every city which was mentioned experience a dynamic climate and no possibility for skiing and surfing in the same day.

Los Angeles didn’t gain 45% better climate and comparative features in the last three to four years. It also didn’t improve its best known indisputable problems such as traffic and crime by 45%. What it did achieve was 45% higher home cost.

Surely there may be those who come along to claim that Los Angles was a bargain in 2012, and therefore not a good baseline for comparison. If it’s truly the case Los Angeles was a bargain only a few short years ago, and therefore also comparatively on occasions prior, how exactly can it not reach a bargain again?

First off, the warm seasons in LA for the past few years has been miserably hot. When I say hot, I mean hot like hell, rivaling Phoenix and Vegas (those places are WAY more affordable BTW).

I would like to see someone surf and ski in the same 24hr period. Due to traffic, you better leave at 12:01AM or get your own helicopter.

You claim that housing in LA was a bargain in 2012. Yes, compared to prices today it was. But compared to prices almost everywhere else in the country (excluding Manhattan and SF) it was still ridiculously expensive even in 2012.

Why did housing increase dramatically in just a few short years? Simply because of weak supply and house-horny buyers. LA is built out. How often do you see new buildings? Due to the powers that be, it is nearly impossible to get required permits to tear down some craphole for a new structure. God forbid Marilyn Monroe or James Dean farted there once and now it’s a landmark forever protected. Don’t forget about the NIMBY crowd who own, but don’t think anyone else should. Furthermore, there are only so many desirable neighborhoods and school districts in LA. There are plenty of undesirable neighborhoods and horrible school districts. Competition for the few homes available in desirable neighborhoods has driven prices through the roof. Leaving house-horny buyers searching for the next Echo Park or Silverlake (Like that’s something to aspire to.)

I think if people had similar job opportunities in other cities, many would migrate away from LA.

Wencil you are wasting your time, some people are simply delusional and cannot accept that certain cities/areas will remain very expensive. The truth is that the vast majority of the world is quite affordable to the Avg Joe, but some cannot accept that 100% of the world is not within their budget.

Some will slam LA, or SD, or SF, or NYC, on and on, but their views and others like them are obviously minority views because prices in the these cities remain high, which means there is plenty of demand. It is actually funny to hear someone slam LA when if they had the money to afford a nice area/lifestyle there, they would change their tune.

Misrepresenting the issue as one about price rather than value doesn’t change the possibility that L.A. home price prices are in a bubble subject to significant correction.

Blame the Fed for creating this bubble!

When you have a state that is over 40 million people and (who knows how many are not even counted) it tends to be chaos time, all the time. Just think that CA. has about 10 times more the problems and you get the picture, it is a one class state, rich to very rich and the rest fall into a wasteland of just trying to survive, they believe everybody in America lives this life, most have no idea what quality of life is?

NIMBY vs. BUILD BABY BUILD!

http://la.curbed.com/archives/2016/02/build_better_los_angeles_development_ballot_measure.php#more

I don’t know any1 notice or not, usually after el nino hit California, there is booms in California real estate??

when there is blood in middle east or paris or dprk,,, people lov their”inland empires??”

@falconator

I agree with you!

Forget about “timing†any market. Invest in your 401K regularly and let the passage of time work its magic.

Something doesn’t make sense. Why would anyone who believes in set it and forget it be reading these pages?

He might just want to be the only one on the courthouse steps with a checkbook form his self-directed IRA buying up all those multi units.

Leave a Reply