The California Tax Break Window – Combining California Tax Credit with Federal Credit for $18,000 in Tax Credits. Southern California Housing Update. Giving $200 Million in Home Buyer Tax Credits While the State has a $20 Billion Budget Gap.

California in its infinite wisdom is allocating $200 million in tax credits for home buyers. This is a very generous credit since existing home owners can use the $10,000 credit on a new home and new buyers can use it on either an existing home purchase or a new property. And for a limited time, you will be able to combine the California tax credit with the expiring $8,000 federal credit (if you close escrow between May 1st and June 30th) for a stunning $18,000 reduction in taxes. But of course, most typical families will not use every penny of this credit and it is really a boost to a segment of our population that is doing better in this economic crisis (maybe we want to look at the 15 million unemployed first?). Do we also need to point out that California will now have $200 million less to plug the $20 billion budget gap?

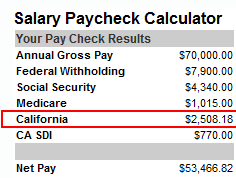

From the way the bill is posted, it looks like any unused funds will not rollover. So say you are a family in the Inland Empire looking to buy a home for $200,000 and make $70,000 a year:

The tax credit is actually spread out over three years with a maximum allowance per year of $3,333. So in the case above, it would not use the entire amount and whatever is “leftover†expires and does not rollover to the next year. So in essence for the above, the person is getting a $2,500 incentive to buy a home. This will of course lower tax revenues to the state for three years but apparently a $20 billion budget deficit means we can give out $10,000 tax credits like candy. This is also similar to an option ARM in a weird way. If you talk to a tax professional, they may recommend you adjust your withholdings and you will likely get $200 more per month in take home pay. But what happens after year 3? In reality, you will need to make more than $80,000 a year or more to reap the entire benefit if you are married and $60,000 if single. If you happen to close between May 1st and June 30th you can also add in the federal credit to reduce your fed income taxes since the national government is flush with money as well.

For all the nuances and legal language, this is misdirected policy and a large waste of money. This is not a good step in balancing the budget or putting our overall economy on the right track. And on Tuesday Southern California home sale data was released and shows a market that is heavily dependent on government subsidies and investors:

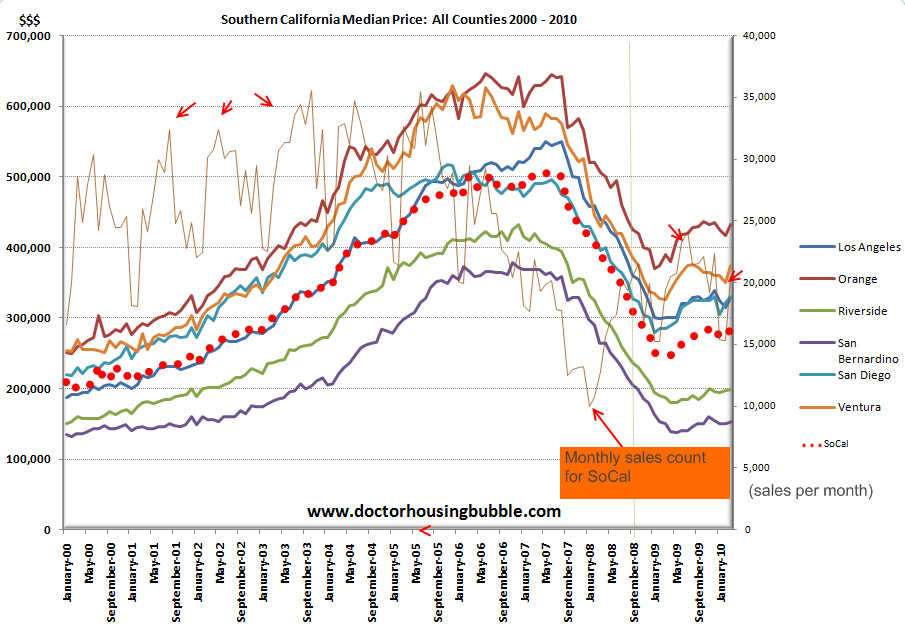

The median price in all SoCal counties went up for the month yet sales are still off of their bubble highs by large amounts. You would expect stabilizing prices with so much money being thrown into the market but the details are more troubling and show this may only be temporary. Nearly 40 percent of homes purchased in Southern California were with FHA insured loans. Using the $285,000 median home price that means someone looking to buy would only need $9,975 as a down payment. And from recent data most that use FHA insured loans are going with the absolute minimum amount (this has also contributed to booming delinquencies).

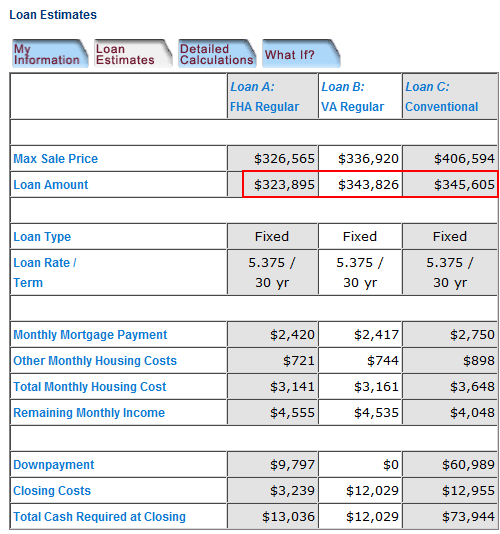

Ironically even the government websites tell us a general rule we already know and that is you should not take on a mortgage that is 3 times larger than your annual household income:

The above data is based on a household income of $100,000. As we have pointed out in certain cities this ratio is completely out of whack. It’ll be interesting to see what happens once government programs start pulling back.

So last month, roughly 40 percent of all home purchases in SoCal were FHA insured meaning absolutely rock bottom down payments. Another 27 percent were all cash buyers and I would imagine many are buying out in areas like the Inland Empire as investors. Most are looking to flip and this game is getting thin because the rental market is flooded in these areas. Investors are not looking to hold and are aiming to find a diamond in the rough, shine it up, and make some money on it quickly. This is the bulk from what I have seen. We do have cash flow investors in California but not many.

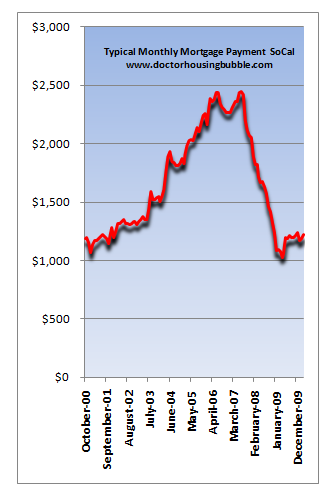

Looking at the typical mortgage payment we have to ask some questions however:

The typical monthly payment for those with a mortgage last month was $1,220. This tells us a couple of things. First, those that sell and have some equity use this to buy another place and pay down the new mortgage of the new home. Also, recent buyers with FHA loans are paying the minimum 3.5 percent down payment but are likely buying in lower priced areas.

Right now the market is being artificially propped up like a mannequin with all the following programs:

-1. $8,000 tax credit

-2. Federal Reserve juicing the mortgage markets (artificially low rate)

-3. New state tax credit (many will buy now so they can close escrow in May and June and double up the benefit between the state and federal tax credits)

-4. Massive amount of distress sales (nearly 4 out of 10 were foreclosure resales)

The above are not signs of a healthy market. I think many in Southern California still remember the $505,000 median price for the region so $285,000 must seem like a bargain. But there are many factors that won’t remain for long. Can interest rates remain this low in a market where risk is exploding? Just look at Greece and what happened to their interest rate. You think California is in better shape? Just look at what is happening in L.A. right now. They are fighting because tax revenues are extraordinarily weak. The $200 million tax credit will run out quick. Are we going to do this over and over in the face of a $20 billion budget deficit? You have to remember that the state lags the general economy one or two years. How? Take for example property taxes on homes that are now priced at much lower levels. In other words, we are building in lower tax revenues to adjust to the new reality and these are slower to react compared to general market sentiment.

I still look at the 12.5 percent headline unemployment rate and this gives me pause when looking at the housing market. Even if the private sector starts hiring (this isn’t happening yet) the state and local governments are already looking to cut (or raise taxes). We’ll have to find $200 million from somewhere else because we’ve just allocated that amount for people to buy more homes that they were probably going to buy anyway.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “The California Tax Break Window – Combining California Tax Credit with Federal Credit for $18,000 in Tax Credits. Southern California Housing Update. Giving $200 Million in Home Buyer Tax Credits While the State has a $20 Billion Budget Gap.”

Haven’t you seen the cover of Newsweek? “America’s BACK! The Remarkable Tale of Our Economic Turnaround”. Everything is fine! I read it in Newsweek? Where were you?

This is real simple. This is an election year.

1. Voters are angry with the Ca. Legislature for failure to pass a budget, or tackle the deficiet.

2. By passing a housing credit, every member of the Legislature can claim they worked to “save housing”.

Simple solution: Vote out every incumbent, WITHOUT regard to party.

Real change will only come with a clean slate.

Jobs are the issue. In this global economy, we are uncompetetive in pricing. Simple as that. Normally you would protect yourself in other ways, import taxes, quotas whatever, till we figure out what to do. But I guess free trade is a holy cow that cannot be touched. Oh well lets just see how this ends up. I hope it is a bottom, but without good paying jobs,lets see how it winds up.

Not that I think the economy has improved greatly but places are hiring. Several studios are hiring and all of my friends laid off in the past year have found work.

@ Mad- Amen! We’ve heard political cries for “affordable housing” for years. Now our legislators are doing everything they can to keep housing from becoming affordable. Do they really think that propping up housing prices is “saving housing”? I’d say its the opposite.

Defaults Rise in Loan Modification Program

Defaults nearly doubled in March, continuing a troubling trend that threatens to undermine the federal program.

The only way to get out of a hole is keep digging. Wait thats not how it goes.

If you buy now, we’ll throw in an extra $10,000 tax credit with your purchase! I think I saw something similar on an infomercial last night. From my experience, many of the people looking to take advantage of these tax credits shouldn’t be purchasing any houses right now, because they can’t afford them in the long run. That’s just from my experience talking to people I know. If you think about it, what’s the benefit of getting $18,000 in tax credits if you just overpaid $100,000 or $200,000 or even $50,000 on that new home of yours? Do some of you people think this isn’t happening, because it is. Do some research people. Looking at recent home sales in my area, I’m starting to wonder who in the world these purchasers are. I’m seeing homes that sold for $220,000 in 1999 selling for $450,000 this month. I saw one home that sold for 450,000 in 2004 sell for 475,000 this month. It’s making me think that some of these homebuyers have no clue about what is going on with the current housing market, and they are buying based on emotion only. People, stop watching American Idol and do some research before you buy!

This problem of subsidizing real estate until jobs and incomes bounce back is nationwide, even in the midwest:

“Program for rural homebuyers is nearly broke”

MINNEAPOLIS – A federal loan program that has helped hundreds of thousands of Americans buy homes in rural areas is about to run out of money, potentially crippling the real estate market in many small communities.

Since last fall, the loans from the Department of Agriculture have fueled much of the real estate business in some parts of the country. Real estate agents are pleading with Congress to find a way to keep the money flowing until more funding becomes available later in the year.

…

“It definitely helped me out,” said Lisa Kartak, who closed late last month on a new three-bedroom house in Annandale, a small town 50 miles west of Minneapolis. “If I didn’t get approved through them, I would have had to bring thousands of dollars to the table.”

http://www.msnbc.msn.com/id/36515489/ns/business-real_estate/

It’s a house! You’re supposed to bring thousands of dollars to the table! If you can’t, then you rent until you can! What am I missing?

I wonder how long until free trade is rolled back. When you have the highest standard of living enabled by high paying jobs, introducing low cost competition HAS to cause a reset or massive protectionism. Unfortunately, jobs and incomes come and go faster than housing prices can keep up. We will keep propping up real estate so that citizens don’t vote incumbents out of office. Or, until they can let the air out of the balloon slow enough that we don’t notice.

America is purchasing everything from Walmart. Why can’t we purchase our homes from Walmart. Prices would be much lower, let’s not just blame the government for high prices; how about all those Realtors that keep brainwashing average folks to buy cause prices have declined about 40% since the highs? Why do we need Realtors anyways? What is so difficult about buying a home from a seller? I just do not see the use of a Realtor, which adds about 10 to 20 percent of the sales price, they themselves pocket close to 6% for practically doing nothing and another 10 to 15% on marketing schemes. On a recent poll I read Realtors rated lower than used car sales people.

.

Meredith Whitney… Housing set to fall again

.

Well I don’t think America is back, but even if most of America was back, CALIFORNIA is still down for the count.

To many of you who are trying to close before June 30th. Remember this saying: A SUCKER IS BORN EVERY DAY.

To those of you who read this blog and are only willing to purchase when it makes sense economically (3 times your income). To those of you who are not willing to pay “bubble prices” for a home. To those of you who have actually researched the housing market, rather than calling up your local realtor and asking him or her about the current market conditions. Remember this saying: KNOWLEDGE IS POWER.

Are you angry about the housing bubble?

<

Are you angry about the bailouts to those that caused the bubble?

<

Are you angry that millions of "home owners" haven't made any mortgage payments for over 12 months and the banks won't foreclose?

<

Are you angry that the banks and the government are colluding to limit foreclosure inventory?

<

Are you angry that the bank losses of the housing bust has been socialized and is now apart of the national debt?

<

Are you angry that the Federal Reserve just bought 1.25 trillion dollars of realestate investment bonds from the largest banks and bought them all at full face value and with no discount from those banks?

<

If any of this is troubling to you, I'll see you at the Tea Party tomorrow April 15.

See you there.

MikeM…. Realtors are worse than car sales people. The National Association of Realtors give/donate (buy off) A LOT of money to both Republican and Democrat parties and for this reason I do not think Realtors will go away….I also think that this helps keep housing prices up.

I sold my house without a Realtor, it was easy! I had a Realtor friend do the paperwork and nothing else. A real estate attorney could also help with the paperwork, which is a lot cheaper than a Realtor. More people should sell their homes without a Realtor, it is more money in the sellers pocket…..

sanderson and MikeM….

I have been working on buying a house in the Sac-area….my 1st offer on a short sell was accepted by the Bank, however, the Realtor was shady and the home had some un-permitted work on it (electrical was pretty shady). So, the mortgage broker and his underwriter, ended up shying away and became hesitant to lend me the money….so I backed out.

Long story short, I hated the entire experience of buying a house (this will be my first), and you’re correct there is really is no need for Realtor with all the websites and MLS/Foreclosure search engines.

So, do you or others know any good websites or have tips on how to find homes for sell by owner. Is there a clearinghouse website, are these types of home also on the MLS? Just looking for a few tips.

Vote out every incumbent, WITHOUT regard to party.

Real change will only come with a clean slate.

Yes, a bunch of newbies will get so much done. I’m sure they’ll pass on all lobbyist pressure and perks and get right to work bringing about change.

You will get no change until bribing (lobbying) representatives is illegal and there is real campaign finance reform.

There really is no other option than to keep pouring the koolaid, is there? This baloon has so many holes in it, it can’t fly much longer. The plan is for a soft landing. If free-market mechanics were suddenly implemented, the crash would be apocolypse now rather than a decade of unwinding and deflationary depression. It’s either fight to the death or die now.

Mark-to-market housing and waste-paper and the banks all fail. That’s probably justified, but it will not have a good outcome either. We just have to avoid WW III first (like when we reneg on a few trillion of debt and the Chinese try to annex Hawaii as collateral). But there’s a sucker born every minute and most of them move to California…the music’s still playing, so grab a chair.

@Doug,

I heard TIm Robbins on one of those Chet Holmes radio commercials. Sounds like a great guy just trying to help people. I bet he started out selling koolaid on the sidewalk in third grade…probably tortured small animals too.

I believe that within a year or two the Govt will float the idea of creative a special “fund”, allocating millions of dollars for loans for people, oops, “victims” who were foreclosed or had a short sale. Anyone who lost their home, no matter how absurd the purchase price/outrageous loan or how poor their credit scores are could qualify for a special government backed low interest rate loan with little or no down payment so they can get back into homeownership and once again live and believe in the American Dream. It is embarrassing and insulting that anyone be denied the right to own a home and suffer the indignity of life in a rental. And no, I’m not being sarcastic.

I’m curious if anyone has an idea on why median house prices in california are climbing significantly coupled with unemployment and increasing taxes. My wife and I have been trying to buy a house this year but even though our income is well over average, we’re struggling to find a middle of the road house for a decent price.

We were out bid on a property for ‘owner occupants’ that was decent. The other buyer came in with cash and we couldn’t compete. Just not making sense.

Thanks for any thoughts and, as always, great site Doc.

@Greg,

You can have the median go up and still have prices falling.

The mean, or arithmetic average, of California home prices is going up because while there are proportionally fewer number of rock-bottom foreclosure sales in lower priced areas like Riverside, Sacramentento, Central Valley, etc., versus number of sales in higher priced area homes. Thus, even though sales prices are down in the higher priced areas, there are just more of these homes being sold, driving up the median.

Greg,

>

you may want to go back and read some of the archives on the Good Dr.’s site where he explains the median price issue. In a nutshell, the median home price rising in California is a function of more sales on the upper end and/or less home on the lower end. For awhile, the market in California was mostly driven by low-priced/foreclosure type sales in lower-priced areas. As this activity slows down and there are more sales on the higher end, the median price will rise.

>

I wouldn’t recommend basing your decision to buy so much on the median price whether it is going up or down. I think if you are looking at any given specific area you will be hard-pressed to find rising prices at this point save for a few short-term “flip” type properties that were bought recently at relatively low prices.

>

By the same token, local markets are where they are…some have fallen/are falling more rapidly than others. And just because the median price in the state has fallen by 50%, don’t expect that to be the case in a particular neighborhood at the moment. Historically speaking bottom in median housing prices usually hits around 3 years after peak unemployment. Looking at today’s numbers, I would suspect that we haven’t even hit peak unemployment yet. And considering how long high unemployment is lasting, I would expect the bottom to be further out (5-7 years?)

This week’s Real Estate stories

http://www.marketwatch.com/story/home-buyer-tax-credit-likely-wont-be-extended-2010-04-16

Those hopeful that the home-buyer tax credit will get extended may be disappointed.

Two groups that once lobbied strongly for the credit — the National Association of Realtors and the National Association of Home Builders — have no plans to make a push for its extension, according to spokesmen from both groups. And the word from NAR’s government-affairs department is that another extension isn’t in the cards.

The credit is set to expire soon: Home purchases need to be under contract by the end April and the deals must close by the end of June.

(more at link)

Thanks for the feedback.

To the extent that prices can be predicted, I agree with your assessments as to the true market bottom. I’m going to sign an offer on a house for 168k later this evening. This particular house sold new for 380k in 2006 but I still expect to lose market value for the next few years if we get it.

Interesting thing about this house is previous occupants showed signs of not having had to work hard for the 380k they ‘paid’ for it. One of their kids was learning to write his name on the walls of his room, practicing the same letter. His full name appeared several times higher up on the wall in the hallway and indeed, nearly every square inch of wall in the entire house below 4 feet was smudged.

So, when my wife and I were ‘priced out forever’ renting a broken down mobile home (leaked severely when it rained), these folks were living in what we could have bought had our real dollars been able to match the manopoly money everyone else was bidding with.

For Greg, 40% of the March sales were FHA; 30% were all cash.

That’s a lot of government-backed, toxic garbage out there. And the all-cash folks are gonna get creamed as the foreclosures increase 600%, as B of A has stated.

Question: Are foreclosure transactions (when Banks take back properties) reported in the monthly real estate sales numbers. Seems to me that the monthly number in sales have a disconnect, i.e., sales are up but so are foreclosures.

Here in the Cascadian drip zone the local “news” “paper” had headlines of how wonderful it is that housing sales and sale prices were up last month from last year.

~

The RealTorz have this heaving, gulpling quality these days. Like beauty queen contestants.

~

Meantime, the local bombed giant acreage of old growth forest–which originally was laser-leveled by DR Horton, and advertising houses coming “starting in the mid-300s”–is now slowly putting up crapshacks…”starting at $189,000.” That mudlot has sat there for years.

~

Meanwhile the county and state are falling all over themselves to widen roads to Improve Congestion.

~

Bring on the doom. People won’t learn any other way.

~

sigh

rose

~

PS–Yah, they’re also honking about the median being up. In swarm the flies, and you can’t tell whether it’s because of the horse shit or Beelzebub.

“So, when my wife and I were ‘priced out forever’ renting a broken down mobile home (leaked severely when it rained), these folks were living in what we could have bought had our real dollars been able to match the manopoly money everyone else was bidding with.”

And now they’ve lost their home, taken a huge loss and that same kid will always wonder what went wrong. We’ve been renting too, but I don’t begrudge the people who were convinced they needed to buy now or be priced out forever as they’ve been screwed too. Those who didn’t buy in the frenzy of the bubble are few and far between and received lots of ridicule for not buying the hype that most everyone else did.

If you are trying to insinuate that parents who let their kids smudge the walls or write on the walls are somehow “bad” I hope you don’t have any kids because they all have dirty hands and tend to write on the wall from time to time. A sponge and warm water can fix that. It really isn’t the end of the world.

You are the winner in this scenario, do you really need to look down on people when they are down and out?

@Greg

As a realtor, one reason why I see the median price going up, atleast over here in Orange County Ca has to with investors purchasing *entry* SFR homes at roughly 2002 prices, fixing them up, and quickly putting them on the market where they are selling at 2003 prices, because the demand is there. That is enough to push up the median price. And the reason why the demand is there is because with all the hundreds of short-sales in and around the area (The investors home shows 10x better than the short-sale house, and there’s no waiting to buy the home!) plus you have ariticial low interest rates, banks not foreclosing on borrowers who should be out, loan mods , and buyers putting little skin in the game via fha loans and that right there are your main factors why you’re seeing the prices going up. It’s a bubble until interest rates go up and more distressed properties continue to drag on the market. All this during a never seen before 0% funds rate and a local unemployment rate at 10.1%. Man it’s going to get ugly.

Gael said,

“If you are trying to insinuate that parents who let their kids smudge the walls or write on the walls are somehow “bad†I hope you don’t have any kids because they all have dirty hands and tend to write on the wall from time to time. A sponge and warm water can fix that. It really isn’t the end of the world.”

—

Greg said,

“One of their kids was learning to write his name on the walls of his room, practicing the same letter.

His full name appeared several times higher up on the wall in the hallway and indeed, nearly every square inch of wall in the entire house below 4 feet was smudged.”

Something does not compute.

…and it’s not Greg!

“So, when my wife and I were ‘priced out forever’ renting a broken down mobile home (leaked severely when it rained), these folks were living in what we could have bought had our real dollars been able to match the manopoly money everyone else was bidding with.”

And now they’ve lost their home, taken a huge loss and that same kid will always wonder what went wrong. We’ve been renting too, but I don’t begrudge the people who were convinced they needed to buy now or be priced out forever as they’ve been screwed too. Those who didn’t buy in the frenzy of the bubble are few and far between and received lots of ridicule for not buying the hype that most everyone else did.

If you are trying to insinuate that parents who let their kids smudge the walls or write on the walls are somehow “bad” I hope you don’t have any kids because they all have dirty hands and tend to write on the wall from time to time. A sponge and warm water can fix that. It really isn’t the end of the world.

You are the winner in this scenario, do you really need to look down on people when they are down and out?

Leave a Reply