Groundhog Day – California budget deficits pop up once again. California hyper cyclical with tax policy. What does a normal housing market for California look like?

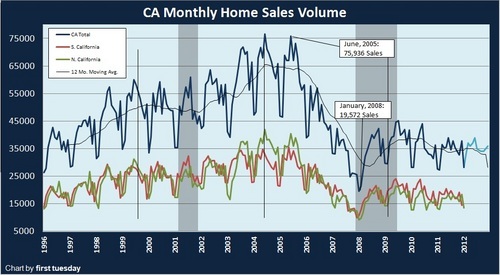

The California housing market faces additional headwinds in the next few years. Lower prices have lured many investors and first time buyers into markets like the Inland Empire where prices in the $150,000 to $200,000 range seem to be drawing strong interest for valid reasons. Yet sales volume across the state is still anemic and mortgage rates have never been lower. FHA loans are now a giant player in the market requiring very little money down. These factors are only one side of the equation. If we look at figures for household income, job growth, demographics, and more distressed inventory making it to market there is considerable pressure on home prices for the next year at least when it comes to mid-tier markets in California. 2011 showed a strong price drop in mid-tier markets in California while the lower range held steady. There are a few big factors at play in the housing market, one local and one federal that are simply unsustainable.

The manic budget of California

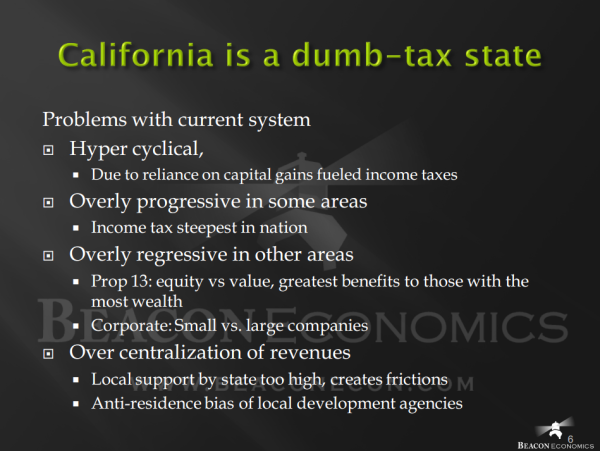

California has a tax structure that favors boom times but contracts heavily when recessions hit. California heavily relies on income, sales, and corporate taxes and these are heavily volatile during periods of economic distress. For those of you following the saga, California still faces massive deficits:

“(State Controller) The State ended last fiscal year with a cash deficit of $8.2 billion. The combined current-year cash deficit stands at $21.6 billion. Those deficits are being covered with $15.2 billion of internal borrowing (temporary loans from special funds) and $6.4 billion of external borrowing.â€

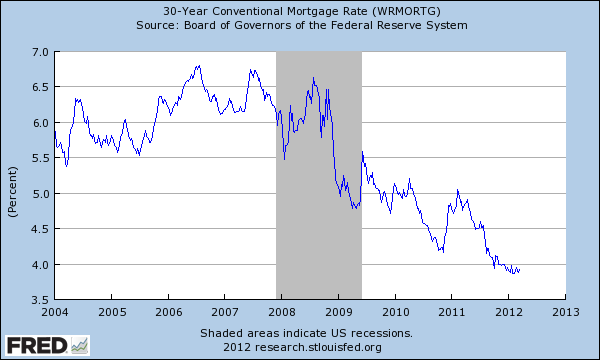

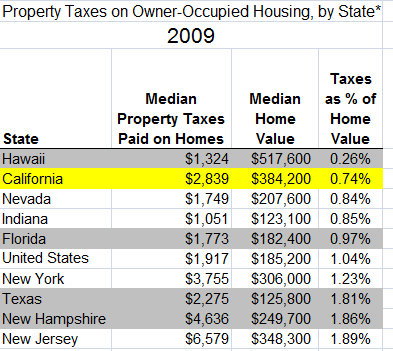

Last month revenues came in $146.3 million below projections. If things are booming wouldn’t you think tax receipts would be higher? Apparently something in the math isn’t computing here. California has one of the lowest property tax rates in the entire nation. Since housing is politicized by the Federal Reserve and the financial industry, states with budget short falls are looking at other options. The Fed has done everything it can to control interest rates:

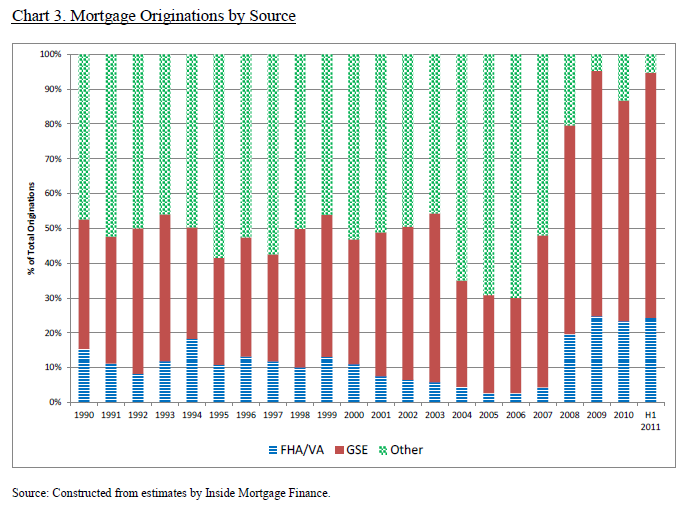

So far it has succeeded at pushing rates to artificially low levels but this has come at a heavy risk for future generations (i.e., potential future home buyers). 4 percent is comical and unsupportable given the debt climate we are living in. If you think the private market is buying this up just look at where mortgage originations are coming from:

More recent data shows that the mortgage market is virtually 100 percent driven by the government. FHA insured loans that now make up over one-third of all loans are now facing record default rates. In other words, this is another unsupportable path. Debt piled on top of debt. Would you lend out $500,000 to someone at 4 or 4.5 percent for 30 years and only require a 3.5 percent down payment? Of course not and banks are not either and that is why we have a chart that looks like the one above. Just run the numbers on a $500,000 loan going from 4 percent to a historically low 6 percent.

At 4% the principal and interest is:Â Â Â Â Â Â Â Â Â Â $2,387

At 6% the principal and interest is:Â Â Â Â Â Â Â Â Â Â $2,997 (25% increase)

The low interest rate becomes more of a leverage tool on more expensive markets. But how long can this last? The chart above with a very short timeframe shows that this is anomaly.

Back to the budget property taxes are back on the radar. California obviously has a problem with the budget process:

Source:Â Beacon Economics

The above assessment on California taxes by Christopher Thornberg is correct. California has a very high personal income tax but is regressive when it comes to property taxes. This is simply a reality. Yet more and more we are hearing the subject of property taxes come up. The California budget process will be back on the radar again this year and people can count on that.

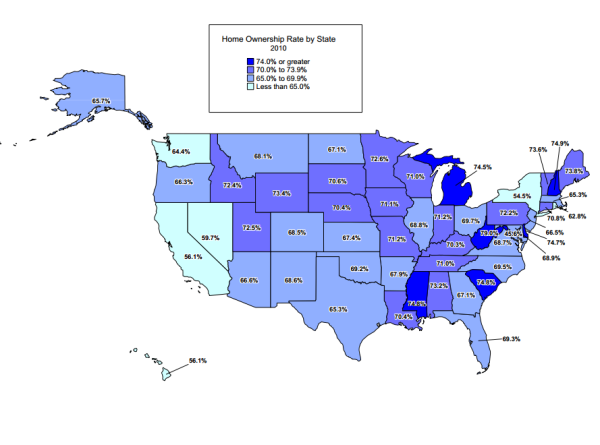

One thing is certain and that is the public in general is frustrated with the political process. When politics boils down to frustration people will vote more with their own interests in mind, more so than other years. Now playing to the home owner crowd is good politics nationwide but not necessarily in California:

California at 56.1 percent has one of the lowest home ownership rates in the country. Keep in mind of those 56.1 that “own their home†roughly 30 percent are underwater. Now federal policy can push for subsidies to home ownership but some states clearly differ in property taxes. Just as a frame of reference, here is some data on property taxes on various states:

California has one of the lowest property tax rates in the entire nation because of Prop 13. I pulled a few markets for comparison here. The above data is from 2009 and the current median price for the state is $239,000. It is unlikely that anything will change this year, but the fact that property taxes are subject to debate in California is showing that a cash starved state is touching a third rail of politics.

What does a normal market look like?

You have to realize that a foreclosure is typically a rare event outside of once in a generation housing bubbles. The fact that we have millions of homes in the foreclosure pipeline tells you that many are unable to meet their financial obligations. Most data suggests that the bulk of these people are unable to support their mortgage because of lack of resources (i.e., insufficient income). If we want to look at foreclosures over time we get a better picture:

The normal rate of foreclosures at any given time is below one percent. Keep in mind the above does not highlight homes likely to enter the pipeline but actual foreclosures. In California even last month over half of all sales transactions came from the distressed pipeline.

Lower prices, artificially low rates, favorable property tax rates, and distressed inventory leaking out still cannot make home sales surge:

So what will a normal market look like? A normal market will be one where half of the sales are not part of the distressed pipeline (a mulit-year trend). A normal market will have a background foreclosure rate less than one percent. A normal market will not have the government originating 100 percent of mortgages. The fact that home prices in mid-tier markets are still moving lower shows us that volatility in this segment of the market is still a trend for 2012. Many that bought in the last few years think that home prices will surge miraculously without income growth. To the contrary, there are more potential risks:

-Sub-4 percent mortgage rates (how long will these last?)

-Low property taxes

–FHA insured loans (costs will be going up because of default rates)

In other words leverage is extremely high right now. Given the massive budget short falls, enormous government debt, and stagnant wages why would home values appreciate anytime soon in inflated California regions? The answer to that was seen in 2011 when mid-tier markets fell by over 5 percent. With banks putting out more short-sales and foreclosures expect a similar trend in 2012.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

71 Responses to “Groundhog Day – California budget deficits pop up once again. California hyper cyclical with tax policy. What does a normal housing market for California look like?”

The biggest and worst fundamentals going on in the US and CA, are the “unknowns”. Never in recent generations have so many unknowns come together to create uncertaintity. No surprise there, however. History repeats itself time and time again in humanity, most if not all pre-Great Depression people are gone, leaving the door wide open to repeat the mistakes.

Obamacare, taxation, budgets, layoffs…no wonder everyone is scared. The only upside is hope, and no not Obama hope…I’m talking about the historical hope that when you take a risk during bad times, that SOMEDAY it will pay off. Honestly, people thought housing peaked in the 1920’s and the 1960’s, etc etc. What we need for everything to be fixed, are clear free-market fundamentals, and for employers to know what the heck is going to happen in regards to taxes and future Obamacare costs. (If it survives the Supreme Court. Which would be extremely bearish giving the Gov precedent to now force us to buy anything it wants in the future. No it’s not like mandatory car insurance, as driving period is optional.)

The best current model to follow is Japan. Flat prices for 20+ years. Very possible considering everything around housing will be inflating for years to come, including property taxes.

I think you forgot to mention obamacare, because that’s what it’s really all about. Obamacare. I don’t know how housing will ever recover with that damn obamacare.

Shawn you’re extensive business expertise is clear…

The largest unknowns for single family homebuyers deal with the largest factors: first, future interest rates and inflation; second, future down payment amount required on homes; third, the marriage rate of young people (as they are by far the major force in the homebuying expansion). DHB has already shown the statistics on the young already being decimated as an economic force by excess credit card debt, excess student loans, uncertain employment. The huge unknown for Orange County for example, is the problem that it has more people and no more workers (and maybe many fewer) than it did ten years ago. If you look at City-data for Orange county, you will discover that younger women and men have not been getting married in alarming numbers. Add that up with the divorce rate, “baby bust” demographic, a substantially declining and deferred number of children to those lessened married couples especially, and it would appear that there will be a declining number, let alone percentage, of single family home buyers into the indefinite future in Orange County, and many other places in the country. Orange County especially may lose the one saving factor for home value of high end job expansion and thus homebuyer married couples if California passes even more punitive income tax rates this November. The unknowns are indeed impacting the homebuyers.

Papa, the biggest unkown in your post is your central point

Great point about Depression Era folks being gone. Most people have no concept of the economic times we are in. Fundamentals are just awful. Things really fall apart after the presidential election. Major headfake in housing this spring.

http://www.westsideremeltdown.blogspot.com

I agree.

Not knowing weather I will be forced to pay for insurance, and not be charged extra because I suffer a pre existing condition, chronic runs from drinking too much Kool Aid……….It is preventing me from making business decisions.

Before Obama care I could count on just going to the emergency room and get high priced treatment for the runs and when the insurance bill came for thousands of dollars….well, you can’t get blood out of a turnip! I could just toss that bill away knowing that the premiums of everyone else would take cake of my non paid bill.

Before Obama care, you only have to worry about financial ruin only a few times in your life, I mean, how many times can you file for bankruptcy?

Oh the good ole days.

Now, due to Obamacare, I have to worry about a monthly payment. I have to worry about my premiums remaining similar even if I have a heart condition related to too much Kool Aid. I have to worry about 7-11 being forced to pay for their employee, Juan’s, health insurance! Juan and I bonded while we waited in the emergency room for the most expensive free medical care. I worry that Juan’s business decisions will too be affected by Obama care.

In summary, I have to worry about peace of mind. How can I as a consumer make any long term decisions if I don’t have dieing due to lack of health insurance on my mind?

Sure the emergency room took care of my runs, but when I told them I needed Chemotherapy for cancer, they told me to make an appointment with my doctor. Can you believe the emergency room tells you to make an appointment with your Doctor?

Anyway, without worrying about life, death and financial ruin, I can’t make business decisions!

What is this world coming to.

I’m assuming you’re a fan of Obamacare? Well I hope it passes too, because a lot of my clients are insurance companies and they are super excited to get it passed as well…

I agree Obamacare has got to go. Hopefully by the Supreme court. Then we will be faced with the same non-functioning system we currently have. A system that costs almost double of Canada’s despite not insuring 55 million people and with worst outcomes. Than we can get rid of the private insurance loser called Obamacare and do the the thing that works in every developed country on earth, Full socialized medicine, i,e Medicare for all. We already have it in the VA, For over 65’s etc. it has the lowest costs and highest satisfaction rates. That you so much to all you Tea Baggers who have fought Obamacar tooth and nail!

California is so broke that it is not only increasing motor vehicle violations of every kind, but increasing the bail (tax) for those violations. As an example, I received a speeding ticket in North San Diego county in late February (I was not speeding). The amount of bail on the ticket is $1,114! Talk about sticking it to the people! This state is going down in flames…fast!

that cant be right. were you going more than 25mph OVER speed limit?

The tax man…er policeman, said his Lidar (appropriate name) said I was going 76mph in a 55mph zone. No I was not! This just happened to be on highway 76. No, he did not show me the Lidar. The cops have to pay for their salary some way.

You received a speeding ticket when you weren’t speeding? Yeeeeeaaaaaah right.

aaaaand here we have the exact reason state can do it.

Works every time.

Basically a licence to print money and no-one will believe you when you say that you are innocent. Brilliant, eh?

That’s the way any fascism works and as we can see, it’s works very well: There are always naive people who think that police (or “governement”) is honest.

Why would they? There’s definitely nothing preventing them to rob as much they want.

So install a data recorder (black box) if you’re so paranoid about the police framing you for speeding. Basic vehicle data recorders (with a camera) cost about $250.

Also very handy for proving fault in states with at-fault insurance.

I’m sure you’ll speak differently when it happens to you…and it will.

Yeah, this happens all the time now. I just got a ticket for not having a front license plate even though my car has no mount on the front for one. This apparently was fine for the first 8 years I owned the car, but for some reason, last night it became an issue for the PD. $93 issue. The law used to be just the back was required. I guess it’s different now. Many cars are sold in CA without mounts for front plates. In my complex alone there are 6 models without it. That’s a lot of potential tickets.

Born and raised in SoCal, lived here, other states. Do not understand the premium people pay to live in CA. I get that families want to stay together, etc. but it’s incomprehensible living in eternal debt, paying outrageous rents, lusting for a 500K “contractors dream” on a small lot in an average neighborhood. Yesterday at a shopping center heard people complaining, panicking about “the storm”…when will it be over, they pleaded, as if they might not make it to their car alive if they got wet. Good Lord.

CA will always be crowded and overpriced because for many great weather a necessity; Trader Joe’s, the “cool” factor, lots of govt safety nets, the willingness to save little or nothing, in debt forever to continue living the dream. It’s part of the culture. It’s quite possible much of the population might be incapable of survival anywhere else.

where do you live now?

Oh don’t get me started on this! I’m a Midwest transplant. You will honestly not believe the way Californians talk to me about living in snow in the winter. They question my survival like I’m a nomad or something.

“How do live in the cold?” – You turn the furnace on, or your car heater. You know, where the dial goes to the red area. And you put on a coat. Inside buildings, the temp is always 72.

“How do you drive in the snow?” – You still push the gas and the brakes. Sometimes you have to give a little more time and space for those things to work. But they do.

“I can’t possibly deal with that. I’m too used to the sun, and get scared when it rains.” – I don’t respond to these kind of people.

California is a land for either the spoiled rich, or for those that have roots beyond the 3rd generation, and families are able to pass down legacy benefits like dwellings and jobs that have been in the family for decades. It’s a club. But hey, I can’t hate, life isn’t fair nor should it be, that’s capitalism.

I’m smart, educated, savvy, tasteful, yet blue-collar and proud. The world needs do-ers like welders, plumbers…and I am one. Unfortunately it seems CA prices are not welcome to that lifestyle.

I believe there is a place for people like me. It’s called Phoenix. Or Dallas. Or St. Louis, whatever…why I left the lands of $120k houses, I’ll never know.

Then please stop griping like those horrible Californians you look down on and go.

You think life’s not fair in capitalism, try nazism or communism? Duh, life’s got nothing to do with fair. You think it’s a game? Well it’s not a game, it’s real that’s what makes not fair special. You want fair go live on a monopoly board.

Papa wrote: And your progressivism is the reason we as a nation are broke. Taking care of others is unaffordable, and the proof is in CA’s $20 Billion illegal supporting hole, and the Fed’s $16 Trillion welfare state. Minus a couple trillion for wars, but I digress…

You blame progressives and then you throw in wars? You really are clueless. You should stick to talking about your housing situation. Who started the Iraq war, the Afgahan war, the war on terror (a crime problem by definition – what happened at the trade towers was a crime not the first attack of a war) yer boy Georgie? Repubs are nuts for war. And as a nation half of all taxed dollars go directly to the war machine

Wydeeyed, I apologize for my articlulation being off, I am a stouch supporter of capitalism and by that am taking full responsibility for my situation. Which exactly means some people are better than others, many are better than I.

As far as the war opinion, as defense is the only Constitutionally mandated job of the Fed Gov, I do support them and their 6 million jobs although yes they are costly. They could be funded if we disbanded Medicare and every other nanny state program we have. Open life back up to individual responsibility and accountability.

P.S. military spending is only 4.8% of GDP

I moved to Vegas from the Bay Area. They can pay for the mess, I won’t. I had big long term capital gains in 2010, so I waited until I was in Vegas to sell.

“defense is the only Constitutionally mandated job of the Fed Gov….”

Read the peamble to the Constitution much?

Some of us prefer Progressive politics and communities. I would kill myself if I had to live in the midwest or the rural south. Yes, I have spent time in both regions. Depressing!

And your progressivism is the reason we as a nation are broke. Taking care of others is unaffordable, and the proof is in CA’s $20 Billion illegal supporting hole, and the Fed’s $16 Trillion welfare state. Minus a couple trillion for wars, but I digress…

The midwest seems ok. Where you don’t want to live is anywhere with a punative criminal justice system. I have seen too many punished for minor and victimless crimes. Of course the prison population of CA is absolutely massive.

Nice try…I’m not going to waste my time here with the wingnuts…

TJ’s is expanding nationwide. Not a reason to live in California anymore.

Great job exposing just some of the holes in what is surely one of the most inherently unfair tax laws in the country. Prop 13 is so in your face discriminatory I’m shocked it hasn’t ended up in the supreme court. Imagine this, property taxes in California were 2.0% – for everyone. What would that do for home prices in Agoura, Calabasas, Burbank, Culver city, Irvine and Huntington Beach?

The tax rate in newer Orange County developments is 1.8% including the Mello-Roos. If Mello-Roos was removed and property taxes were increased to 2.0% homeowners would make out better in new areas as Mello-Roos is not deductible.

If property taxes are increased with Mello-Roos, high income, sales and corporate taxes all we will need is a 20% VAT to perfectly copy the failing European countries.

I’m a Brit, and i have to say i was amazed when i heard about prop 13.

It’s an inherited tax advantage! Isn’t that the sort of thing your forefathers left Europe to get away from?

It actually seems wierdly unAmerican to me.

Prop 13 was approved by voters after we were being forced out of our homes due to high taxes. Actually very people still own houses who were able to benefit from it at the time. However it does keep the tax rate in check for all buyers. Without it I don’t know who could afford their home. If it goes away rents will go up proportionally to cover the higher tax. It is mostly elderly people left who have old homes who are benefiting while it allows all people to own a home at a better rate (i%) of tax. For example it would be $3,000 on a $300,000 home. I think that is plenty! Our state spends too much and is desperately trying to find money for inflated pensions we cannot afford. I see no wrong in being able to leave the benefit to your children. For some of us here the family home is all we have.

CB, the gripe with Prop 13 isn’t the $3,000 annual taxes on a $300,000 home. It’s his neighbor’s son paying $710 in annual property taxes from a $71,000 property purchased in 1978 by his parents (medium CA home price when Prop 13 was passed), since benefits to heirs can be passed along in perpetuity.

Property taxes start at l.5 the house price but go up 2 per cent per yr. If you had bought a house in Los Angeles in 1978 for 73,500 you would by today be paying three thousands dollars per yr. for that same house if you still owned it.

The City of Oakland allows hundreds of businesses to operate illegally, without a business license, and therefore, without paying any taxes.

There is an enterprise zone at High St., where employers (unmarked vans and pick up trucks), pick up day workers. All cash transaction. No workers comp. or taxes to pay for the employer. No income taxes to pay by the workers.

Go to any big box home improvement store, in any city in Calif., and that scene is repeated early every morning. Of course, it would be politically incorrect to make these businesses pay their fair share.

Is it any wonder the cities here are all broke?

That may be. But next door in Alameda at my business there were literally somebody from the city, county, state every three days. They literally drove me out of wanting to have a business in California. Now here is the irony. In the book “the two Californians” it was pointed out the newly immigrant Hispanic communities are virtually left alone for health, trash, fire regs act etc… While Coastal California is being drivin into bankruptcy. In other words one half is Third World, the other on First world. What a HOPELESS mess!

Dr. Thornberg is a strong proponent of getting rid of prop 13. He is not alone. I am hearing it more all the time. CA has a lot of renters these days. I would not be surprised to see CA residential real estate taxes rising by 2015.

The battle cry will be “It’s for the kids”. I’ve seen this work enough times lately at the local level to believe it can happen at the state level.

Real estate investors better get ready for some cash flow squeezing.

Prop 13 has to be voted on by the Ca populace to be changed, and I for one lived through all the elders who were losing their paid off home to property tax increases. Sorry, I have to respectfully disagree. To those of us watching the housing market prior to Prop 13, it is apparent it is a good law.

Although I work in commercial real estate, I say my side should pay their fair share of property taxes. We have 78M baby boomers aging in this country. It is time the wealthy pay into the system. (I’m a recovered Republican/Political Atheist now)

Ca has 37.3M people. Many are baby boomers. IIRC, 25% of SFH’s are paid for in this country, many in Ca. People worked all their lives to set themselves up for retirement. They paid their dues. I don’t know the age group of the reform Prop 13 crowd, but I assume it’s the younger crowd want to appeal it. It needs reworking, but to tax the big guys. This country is aging. Lets get a clue here.Stop the needless spending, and get the illegals off welfare. They are baby machines for the bennies.Lets mop up the expense side.

Thornberg is a flip flop to who is his client, imho. He has no credibility with me. He’s bought, imho. When he first left UCLA Anderson and went on to start Beacon he was objective.

“We are finding that homebuyers are no longer expecting home prices to decline further, which is creating some sense of urgency to buy now,” says KB Home (KBH) CEO Jeff Mezger. A key reason for the Q1 miss is a “spike” in cancellation rates from customers unable to get mortgages, even those already with full loan approval letters.

I really feel so much better about buying a home now. I just don’t understand why the stock is down another 5% today? (sarcasm intended)

The hubris of some of these housing/stock market bulls is astounding. One bottom call after another.

Housing will not bottom until they [the Fed et. al.] let the bust takes its course. The only homes selling in my area are ones that are priced at or around year 2000 levels. And even then they are bought up by investors (before average joe even has a chance to take a look) and back on the market 6 weeks later for 100k higher. Thankfully, these flipped homes are on the market for longer and longer periods of time as these investors are running out of suckers to sell to.

I am curious: does anyone have an idea if prop 13 would ever be repealed?

Keep in mind that would mean instant hike in rents. Being a landlord in California isn’t exactly a walk in the park (too many reasons to count them here) – I know, I am one.

What will happen is, if property taxes go up, so will rents. The house prices will go down, because for homeowners, that’s basically higher mortgage by a different name.

Any thoughts on this?

In an ideal world, rents have to stay competitive with house prices – if rents get too high, then people will choose to buy rather than rent. Right now apartment and SFR rentals benefit from Prop 13 keeping their costs down, so they will either have to raise rates or expect lower profit margins.

I don’t see Prop 13 getting overturned until the number of renters far exceeds the number of owners. Current young people who cannot afford a home can still inherit their parents’ homes without incurring the tax assessments, and this can continue on indefinitely. Why would you vote down Prop 13 if you know you’re inheriting a beach house?

Pretty much sums up an earlier comment I made, that says CA is a club. You are either grandfathered in, or must come into it very rich.

Housing rental prices are not contingent upon operating costs. IT is contingent on demand. I was a landlord for 5 years and know this well.

It’s an open market. Rising property tax will not immediately equate to rising rent costs. I’m living through it right now. I rent and our city has passed two parcel tax increases in the last 5 years and my rent has not changed one cent.

I believe that’s 30% **with mortgages** underwater. A fairly large percentage of the 56% of owners are true owners – with no mortgage.

Most Californians that own a home have it with a mortgage. I believe only 24 percent of home owners in the state have it free and clear with no mortgage, a much lower figure than the USA overall.

I wonder how many of those are homes bought by the worldly rich, used only weeks out of the year…

When I read these comments about Prop 13, I know that none of you are truly educated on how it works. Moreover, everything wrong with California is always blamed on Prop 13. Firstly, very few homes have the same owners in their home for more than 10 years. Therefore, the housing stock turnover(which in CA is quicker than most other states) takes care of updating the cash value for tax purposes. Secondly, since 1975, only 5 times has the tax not been increased by the allowed maximum of 2% per annum. Thirdly, when you add Mello-Roos and HOA fees, which most of the listed states shown above don’t have, you are fairly even regarding overall comparisons. Finally, the sheer high value of a CA home, even after this latest decline, generates significantly more tax revenue then all but a few states on the above list. And of course, my favorite stat is throwing Florida and Texas on the list (these states have no income tax) to make your case for higher real estate taxes. Hey, DR., trying comparing all taxes as an apple to apple exercise to see where CA ranks. We don’t have a tax problem in CA, we have a spending problem and until we seriously address the spending issue, raising taxes will just create an economic nightmare for our state.

I’m quite aware of how Prop 13 works. Keeping Granny from getting taxed out of her home was just a ruse so the corporations could greatly benefit. Say what you will about it, Prop 13 is NOT fair…it benefits long time owners often at the expense of new owners. It distorts real estate markets by limiting natural supply and keeps people in houses much longer than is practical.

I don’t think Prop 13 will ever get repealed, but it needs to be revised. No corporate welfare, no inheritance welfare, no investor property welfare. If you really want to protect Granny, Prop 13 can kick in when she is of federal retirement age for her primary residence.

I agree that California has a massive spending problem, but that is a topic for a different debate.

That’s ridiculous. I don’t doubt that corporations may benefit from Prop 13, but are you really saying that the very idea of people being taxed out of their homes is a “ruse”? I would think the benefits of Prop 13 would apply to anyone who is living on a budget and can’t afford to see their property taxes skyrocket w/in a few short years.

And when you think about it, property taxes seem damn well unconstitutional as they are. You own your home, it is your property, but if you can’t cough up the annual rent to the government, then they can come in and seize it, sell it for whatever they think they can get, and then give you what they think you deserve.

If you’re so concerned about wealthy people inheriting California at the expense of the blue-collar, wouldn’t a Prop 13 repeal do just that? Under the previous law, what the state government was really telling people was:

“Thanks for coming to California and helping build this state. We really needed you guys as carpenters, plumbers, firemen, electricians, and defense workers. And in return you got to buy new family homes at low prices and experience a reasonable cost of living. But now that California has become vastly wealthy, and there are lawyers and software magnates and Hollywood aristocrats who are driving up home prices, well, we don’t need you anymore. The rising property taxes will ensure you don’t stay here too long in the new Eden. I hear Idaho and Texas are just wonderful places for retirees these days!”

Well, you’re right about total taxation in CA. 9% income tax, 9% sales tax (in my town), 15% gasoline tax and 1.5% property tax on the most expensive homes in the US.

Not only this, but look at your phone and utility bills as well. Lots of “fees” slammed in them. Then there’s other local taxes that are added if you’re living in certain cities and counties.

WOW… Did I just post this… TOOK THE WORDS OUT OF MY MOUTH!

Great comment hstad6. We live in an entitlement state. We could easily move 15 million people to Idaho, montana, wyoming, kansas, and new mexico. We may have to mow our own laws, wash our own cars, and clean our own homes but this would dramatically reduce the welfare and social service burden put on the working class people of this great state who pay for all these leeches.

“Firstly, very few homes have the same owners in their home for more than 10 years.”

This is only your opinion only. Where’s your data?

This market will be anything but “normal for years to come. Here is what I’m experiencing on the ground in Burbank…

Low Inventory.

A million offers on anything that is reasonable.

Very, very few primary foreclosures, and the ones that are out there are tear downs.

Investor bought foreclosures with new paint, carpet and cabinets marked up to make flippin cash.

The new scam of properties having to have pre-approval from the listing agents designated mortgage broker.

So…despite all the downward pressure “free market capitalism” backed by “government socialism” is finding a way to maintain the insanity.

Will this turn around anytime soon? I think not barring some catastrophic event.

Is my rent currently at break even with the market median…yes.

Give me a Xanax, I’m playing a losing game.

BTW…BofA wants you to sign a letter that if your highest and best offer is over appraisal, then they will only loan the appraisal, and you will have to pay the rest in cash.

Not another prop 13 debate. I like prop 13 because it allows my older relatives who have very little retiremnet income coming in to staying in their houses. I agree with an earlier poster how the ticketing by cops has gottten out of hand, but $1K is insane. I got a speeding ticket on Hwy 5 4 months back and I paid at most $500, and I was going 85 mph. Its not the amount of taxes that CA is having problems with its the spending and retirement plan policies that have gotten out of control. By the way I agree with PapaToBe response on CA people in general about the weather–although yesterday there was a little rain some CA folks overacted, even my coworkers were talking about the great rain (aka for those who lived outside of CA as a just little light drizzle ).

Bad Luck on the ticket. I could never figure out how the Highway Patrol decided which car to pull over and ticket when everyone on the freeway is traveling at 80 mph.

Dr HB

FHA insured loans (according to the graph you posted) are one-fourth of all loans not one-third.

I thought this as well but keep in mind a good amount can be from refis. It is likely that FHA has an even bigger role for home purchases:

“Taxpayer-Backed FHA Guaranteed 40 Percent of Initial Home Mortgages in 2010″

http://cnsnews.com/news/article/taxpayer-backed-fha-guaranteed-40-percent-initial-home-mortgages-2010

FHA + GSE’s (ie. Fannie & Freddie) make up 95% of the mortgage market. This isn’t the sign of a healthy market.

my family owns a 3bed 1 ba house in Santa Monica, North of Montana ave. the house was last sold to my grandfather in 1957 for $18,000 thanks to Prop13 the taxes are about $2400 per year 🙂 Prior to Prop13 I think they rose to about $4,000. Today the house would sell for approx $1,7 Million wouldnt that make the new property taxes about $17,000 per year?

This is exactly what happens in desirable, coastal Southern California. It makes perfect financial sense for the family.

I think opionions like hstad6 are the minority on how P13 affects turnover in Southern California RE. It definitely incentivises homeowners to stay in their properties much longer than they normally would have, as well as creating a new form of wealth transfer to their heirs.

Sorry, wasn’t able to give you a timely response! Try this from Calculate Risk: http://www.calculatedriskblog.com/2009/04/first-american-economist-on-housing.html. It really doesn’t matter that it is dated! Moreover, even if I buy your comments about slower housing turnover – so what? Unless you are saying that every owner who has died since Prop 13, transferred to their relatives (that would be your opinion). Housing turnover exists, and the argument you people are making that Prop 13 is damaging to California is bunk! Accelerated turnover only helps ‘Real Estate Brokers’ and the idiots in Sacramento. The amazing thing that I read on this blog is this despicable discussion about commercial being different then SFR? But I’m not surprised, the anti-business climate so evident in California is part of the problem in generating decent tax revenues. California is a disaster because of these type of attitudes – I call it tribalism! If we don’t restrict the spending monster in Sacramento, all of this arguing pro and con concerning Prop 13 is quite meaningless!

To answer your question, if the house did sell for 1.7M today, the property taxes would probably be close to 20K per year.

Another hypothetical scenario would be if there never were Prop 13 (taxes are based on current market value), there is no way in hell that house is worth 1.7M today. Like I mentioned before, Prop 13 has helped inflate values in areas where there are supply and demand problems (SM is definitely one of them). You have limited supply to start with, Prop 13 just makes it worse and inflates prices.

Sounds like your family won the lottery by inheriting that house. Even if the taxes were 20K per year you could sell it or rent it out and make a bunch of money. For all the whiners on this blog supporting Prop 13 stating very few original owners are taking advantage of it, anybody who bought in a decent area prior to 2000 is taking major advantage of it. Now pay your fair share!

I think you are on to something here. It our very small circle of acquaintances we know of 3 homes in desirable parts of LA (Cheviot Hills, near Hancock Park, and Mandeville Canyon) that have been given to children or grandchildren as gifts.

Does anyone know if these types of properties can be transferred in some form of a trust that avoids reasseing the homes at their current value and thereby increasing the taxable value?

It’s a basic trust that you can set up with a decent trust and wills attorney and an accountant. Costs around $2000 all in. Basically, the trust allows you to grandfather in the property tax as well as avoid inheritance tax since the trust is the owner and the members of the trust can do what they please with the property. It also avoids probate if a trust member dies and passes along property or some other types of wealth.

@LordBlankfein – cosign.

If you’re on a fixed income and above retirement age and don’t have extensive retirement wealth then fine, you’re off the hook for property taxes at the current rate. Everyone else pay up.

Every time I have started digging into this it appears obvious that big businesses are the primary beneficiaries. Disgusting. Theft.

Prop 13 is creating land aristocrats. The guy across the street, who bought his house in 1978, pays $700 a year property taxes while I pay $700 a month. He rents the house out. Me, I will be forced to move when I retire, yes (I am an old person being forced to leave my home) because I cannot afford the property taxes. My sin? I waited until the 1990’s to buy my home. The present system is TOTALLY UNFAIR and anyone who thinks different is still drinking the Kool-Aid. Will it every change? I doubt it, as long as corporate interests benefit, we will remain slaves to the present system.

Leave a Reply