In California buying is about timing and speculation: Since 2000 the California housing market has experienced more dramatic booms and busts courtesy of speculation, investors, and new financial products.

California’s housing market is a boom and bust machine tuned to attract the masses. Timing matters in a state where speculation is rampant. Since 2005 California home owners have received over 2,000,000+ foreclosure notices. Of course this goes into the graveyard of foreclosure information that we seem to forget each time the market booms. Since 2000 with shady mortgages, Wall Street financial shenanigans, and the Fed’s low rate policy the housing market in California has only entered into a more pronounced boom and bust carousal. People go into a deep herd mentality that fails to acknowledge even recent history. If you timed the market say two years ago and went with the record low rates at the time plus lower prices, then does that mean prices today are too high at 20 to 30 percent increases with interest rates 100bps higher? That $500,000 home probably worked at low rates but what about it at $650,000 with higher prices? Incomes certainly did not keep pace. Investors are still buying roughly 30 percent of inventory. This group is also slowly pulling back and it should be no surprise that inventory is rising and prices are actually stalling out. Since 2000, the California housing market is a wild ride of speculation. Buying and selling is a matter of timing, luck, and larger macro forces at work. We acknowledge this and for most, buying or selling is a decision that needs to be made in real-time. Is it a good time or bad time to buy today based on my specific factors? Yet let those 2,000,000+ home owners who got a taste of the foreclosure process serve as a warning that not all purchases are golden in the Golden State.

Going crazy after 2000

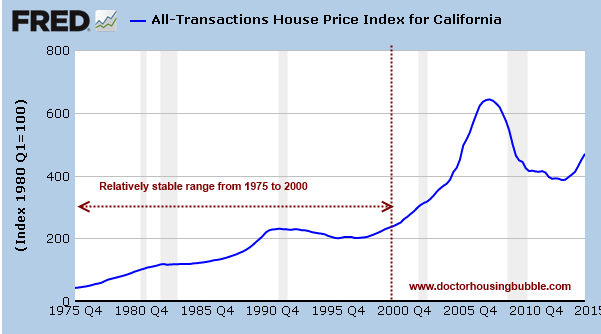

People have a hard time understanding the insanity of prices starting in 2000. The groundwork was laid for this in the 1990s as the mortgage market opened up to all sorts of nonsense products that masked stagnant income growth. Once this was unleashed, you also had in early 2000s the Fed stepping into their era of low interest rates. One of the results was massive housing bubbles across the nation. In California the bubble went Hollywood:

Examine the chart above carefully. Throughout the entire decade of the 1990s home prices in California stayed relatively flat. With the 1970s you actually had real wage growth occurring at the same time as rising prices. But from 2000 to 2006/2007 prices went from a starting point of 200 to 600 via the HPI measure by the Federal Housing Finance Agency. To make this simple, a $200,000 home went up to $600,000 in a matter of six to seven years.

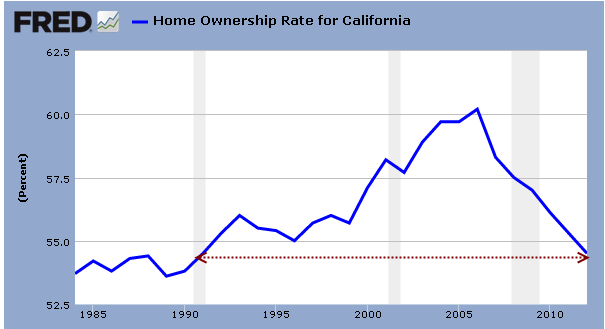

You also didn’t have such a massive amount of investor volume in the market as we do today. Large groups are buying big chunks of houses and pricing out regular families and that is why the current California home ownership rate is now back to levels last seen in the early 1990s:

Source:Â Census

From 2000 to 2007 the home ownership rate went up with actual regular families buying. Since regular families are largely cash broke and stretch their budgets like a Hot Yoga session, these are the people that bought with toxic mortgages and other low rate gimmicks (the 2,000,000 club). We don’t hear much about them anymore. No sense in talking about folks that poorly timed the market. What I find interesting is the herd mentality in the market again. The same attitude is back in full force today similar to what we saw in 2006 and 2007. The few that armchair the market are now trying to convince people to buy even though prices in many areas are up 20 to 30 percent with higher interest rates from the time they bought. Okay, it made sense at the trough that you bought but does it now make sense with higher prices? California is littered by buy and sell signals:

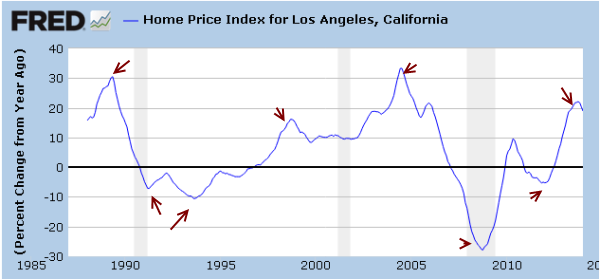

Source: Case-Shiller Index

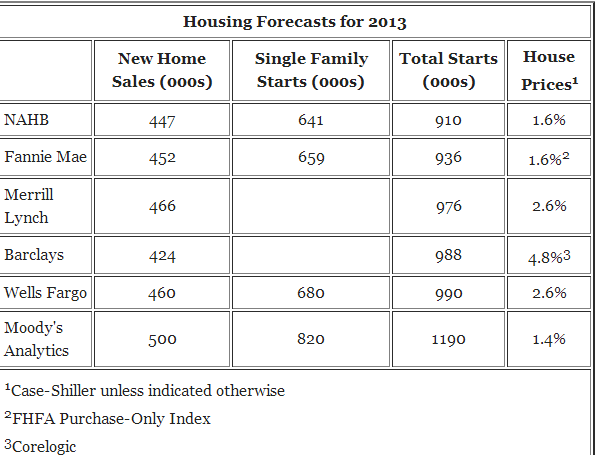

The hard part is picking out the turn. Take a look at this data examining Los Angeles and Orange Counties. The best time to buy in recent years was in 2009. Then again, the market was melting down completely but people forget that. The next time was in 2011/12. I find it funny to see what big banks were predicting late in 2012 regarding 2013 prices:

Most were predicting 1 to 2 percent price increases nationwide! In California prices went up over 20 percent and in some areas, 30 percent. This isn’t some ragtag group but banks like Wells Fargo and those that live and eat housing like the National Association of Home Builders.

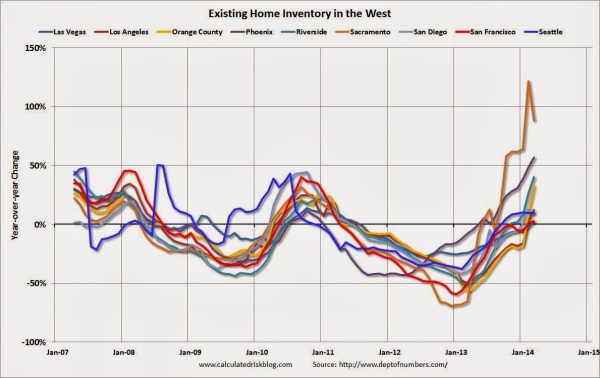

What they failed to account for was the mania of investors, the herd mentality of buyers stretching their budgets, and the power of momentum. But that momentum is grinding to a halt. Sales volume is pathetic. Home building? Not exactly tearing it up. Take a look at the inventory increase in the West:

“Inventory is up 88% in Sacramento, up 57% in Phoenix, up 40% in Riverside, and up 33% in Orange County.

However inventory is only up 3% in San Francisco and 9% in San Diego (Las Vegas total inventory is up 3%, but non-contingent inventory has doubled).â€

This is year-over-year. Inventory is up a stunning 88 percent in Sacramento. Investor central Phoenix is seeing inventory up by 57 percent. Here in SoCal inventory is up 40 percent in Riverside County and up 33 percent in Orange County. San Francisco is the only area with a tiny jump in inventory and prices in the Bay Area make SoCal look sane. The only more banana area is Canada. So much for the “weather†argument of high real estate prices.

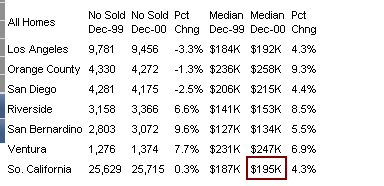

I was digging through some data and found home price information for SoCal back in 2000:

Source:Â DataQuick

The median home price was $195,000 for the region and the median income for the state stood at $47,493. 20 percent down payments were common back then as well. So $39,000 was the down payment which was less than the annual household income for the year. Let us fast forward to today. The median SoCal price is $383,000. The median income from the latest Census data has household median income at $58,328. A 20 percent down payment today would be $76,600 (or 31 percent higher than the annual household income of the family). Low rates don’t exactly speed up the process in saving for that down payment since you have to save from your net income.

So what are regular buyers left with? Going massively in debt with artificially low rate mortgages and battling it out with investors if they want to buy in today’s market. I still get e-mails from people about their buying decisions. My response may surprise you since I always tell people to go with what makes sense to them. I gave this response a decade ago, five years ago, and today. We all agree that California housing is one giant speculation circus with older folks sitting in golden sarcophaguses unwilling to cash in their lottery ticket of a house, Wall Street diving in for those deals, foreigners buying in certain enclaves, flippers going for that quick buck, and to take the phrase from a Canadian writer, “house horny†families willing to buy no matter where things are in the cycle. You can clearly see that there are times to buy and times to sell in California. The rhetoric usually heats up when the market is turning. This is why very few in late 2012 were talking about the massive upcoming run-up in prices for 2013.

Today all you hear is how this is the new plateau and you will do well (assuming a gigantic down payment but then again, you will cash flow at any point depending on what you put down). What is probably even more comical is these folks see the stock market as speculation and housing as a safe investment, just like those bonds grandpa bought to support World War I. They do realize that big money from Wall Street is buying up a bulk of homes going back to 2008, right? They do realize that the S&P 500 is up 170+ percent since 2009? That $500,000 home is now $650,000. Nice. Or that $500,000 in the S&P 500 is now up to $1,350,000. If we are going to speculate, why not go with the herd on the biggest gainers. Some folks just have a deep housing lust and fail to acknowledge that we live in boom and bust cycles and we just had a big boom in California. Those 2,000,000+ foreclosure starts in the state, a mere footnote! So what comes after the boom?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “In California buying is about timing and speculation: Since 2000 the California housing market has experienced more dramatic booms and busts courtesy of speculation, investors, and new financial products.”

“So what comes after the boom?” My vote is a bigger and better boom that will make all the “fools” on the sideline hold their heads in shame while the LB’s of the world will continue to spout rental parity with a $2,000,000 down payment. Quick everyone buy before you are priced out forever! You gotta live somewhere! It is a great time to buy! Housing is a great investment! Look at me! I bought a house and the value went up 200% so I must be a genius! Blah, blah, blah… There, I beat all you shills and trolls to the punch (Kool-Aid spiked punch bowl flavor of course)!!!

Never forget to chant this time is different, this time is different, this time is different while signing that contract that will make you rich, rich rich!!!

The S&P 500 unexpectedly went up 30% last year, same for housing(to varying degrees, in some places). Why did all the so called experts miss this? Nobody knows the future. The future is foggy. I have learned to stay close to the life boats in foggy(uncertain) times.

I am camped out in a life boat and you know what? It is actually pretty comfortable…

There is hope you know. Although living with nature can always benefit us, and I encourage you to keep living in a life raft or whatever, for all of our sakes and futures. But those of us with a little planning ability and foresight actually come up with amazing solutions to the “income problem”. After a little research I found a company that not only sold my house fast, but, in cooperation with another company, hooked me up with some investors to make my first wholesale deal, in California! There are houses that I have seen for $6000.00, in California. After I “Google Earthed” it, I saw it had a big yard, palm trees and privacy from neighbors. Even someone young and just out of the house, can flip that and have a net profit gain of 40% or more! By the way, this property is still for sale, In California!

Nothing like a strong earthquake to drive property values HIGHER!

when i was 24, i asked myself what i wanted out of life. it dawned on me i had 2 choices. a family or early retirement. i chose early retirement. i’ve been chill ever since. i watch my friends run in the hamster wheel with a mortgage and a family. amusing at first but gets boring after a while. i do love the intelligent posts on this informative blog.

Ben, have a hunch you might regret not having the family someday.

Baloney! It’s been proven, people with no kids are happier overall.

At 53 I’m nearing my early retirement while most of my friends with kids are planning to work until death. Still waiting to feel that twinge of regret for staying child-free, but somehow I’m not feeling it.

people without kids will never comprehend the joy they bring. yes, it’s very very hard work. it is not for the lazy. i used to think like pammy and apolitical scientist before i had one and definitely didn’t jump into parenthood all rah rah expecting great things. some might say i was dragged into it by my wife kicking and screaming.

but now i know. it’s pretty amazing. like falling in love over and over again every single day. sure, after the honeymoon period, you have ups and downs, but overall it’s a life experience i’d recommend for everyone that can afford it. this is coming from someone who’s traveled the world, been there, done that prior to getting married though. i would also recommend doing that and being financially stable before having your first child.

i can see how it may be better for those who don’t have high earnings power to want no kids, retire early, and chill out though. i wish more low earners would do that or at least limit the number of kids they have. like i wrote above, if you can afford it, having a child is truly an amazing experience.

I love my child, but parenting in modern society is a hard, hard road.

The exception would be if you had significant resources to get past many of the hurdles – either financial and/or family/social resources.

We’re stuck trying to get into a good school system in a market where the only ‘affordable’ housing (prices at 4:1 ratio to income) has pretty crappy schools, and the best districts would be closer to 7-10x income. And I make comfortably above the median in my metro.

And since we don’t have family locally and can’t afford to pay for more care on a regular basis, pretty much the entirety of every day is working and parenting, until that brief late evening respite after they’ve gone to bed. Some days it can be a delight, and some days it’s a total drag. Much like almost anything else in life.

It is fascinating to watch a young child grow, but there are other ways to trigger an oxytocin rush.

“people without kids will never comprehend the joy they bring.”

People with kids will never comprehend the joy of never having kids.

Works both ways.

Bah, it has not been proven that people without kids are happier. That science is horribly flawed, and the control experiment is impossible. The conclusion I came to from the studies I have read is that people with children have higher highs and lower lows than those without children. Additionally, there is good indication that those without children are happier than they would be with children. Furthermore, that those with children (that also wanted to have children) are happier than they would be without. Those who have children, but also did not want them are the true losers in the happiness game unless they chose to drop the responsibility.

“People with kids will never comprehend the joy of never having kids.

Works both ways.”

Not exactly. I’ve actually experienced 20 adult yrs without a child and can compare the 2 scenarios, with and without. You have have no counter factual.

“Not exactly. I’ve actually experienced 20 adult yrs without a child and can compare the 2 scenarios, with and without. You have have no counter factual.”

Bullshit. You don’t know the joy of what it’s like to never have kids since you now have them.

Emphasis on “never”, hence you have no counterfactual.

Ben, I wish you well in your life, and a long and early retirement.

I can personally vouch that a family is expensive, but rearing a family of wonderful kids is worth every penny and is a worthy challenge for every American.

My wife and I were very happy before kids, but I can’t imagine going back and having the loss of not knowing my kids. I don’t think you’ll fully understand my point unless you have some of your own kids.

Ben keep an open mind about having a family, its easy to see your friends struggling with the responsibility, but the fulfillment that the kids bring is a little less visible unless you’ve experienced it for yourself. Despite the financial struggles for most parents, it’s what makes life worth living.

Studies are meaningless – and I can point to one that shows there is no difference in happiness anyway:

‘People with kids living at home tend to have more money and are more highly educated, more religious and in better health, said Stone, a professor of psychiatry and psychology at Stony Brook University. “All of those are factors that go along with people having better life evaluations.”

Once those factors were statistically removed, the study found no difference in how satisfied the two groups felt about their lives.’

Regardless of whether the study agrees with your point of view, they don’t take into account the fact that everyone has a unique personality. There are people who definitely should not have kids, who will probably be happier for it, and there are people who should have kids even if they don’t realize it. I fall into the latter category.

I had kids very late, so I’ve lived both lives. I was childless and single, partying and traveling, until my late thirties. Had a blast and wouldn’t change it. Now that I have 3 and 6-year-olds and I can compare the two lifestyles, I can say that my settled life is more stressful in some ways, less stressful in others (far better off financially now), but also IMMENSELY more rewarding. The happiest moments of my previous life don’t remotely approach the pride and love (and worry) I experience every day. I know when parents say this it sounds like they’re trying to justify their decision – but I say it to myself, privately, all the time. I can’t believe my luck.

From the outside, it might look like a “hamster wheel” – taking them to school and activities, the birthday parties, the conversations with other parents about what schools are best. The part you don’t see is when they’re at home having a hilarious conversation with a toddler, or a little girl cuddling up to daddy at night because there is no one else on Earth she feels safer with. Moments like that are joyful in a way that a hot date or European trip can never be.

Having kids doesn’t mean you can’t retire early, either. If you aren’t financially prepared for kids, or lack the empathy required, you shouldn’t have them.

thank you all for your kind words. my highly developed frontal cortex keeps telling me no money no honey and i am too lazy to work my ass off like my dad used to do to support his family. it helps that i have a low sexual drive.

QE is over in October as the bubbles have the FED scared. I actually think the stock market might have a pullback as opposed to a crash as the bull market has been partially fueled by companies doing share buybacks. These institutions aren’t going to dump their own stock at cratered prices. As I’ve said before residential RE is going to be sacrificed for dollar strength and commercial paper. Everyone says you can’t finance the deficit without these ultra low rates but in reality we’re likely headed to a Republican congress this year and that means gridlock and lower spending. Besides an increase in the dollar’s purchasing power vis a vis food and housing means lower social program spending doesn’t necessarily mean a reduction in benefits. We got 2010/2002 price parity in some areas at the last trough. I wouldn’t be suprised at 2016/2000 price parity given higher mortgage rates. This low sales volume illusion is coming to an end. It’s actually kind of funny that after all the FED intervention the best they could do was a one year run up in prices based on mid 90’s sales volume. But the Big 4 banks got their balance sheets scrubbed so mission accomplished. I’ll probably pull the trigger in 2015/16 just in case they find the need to manufacture another echo bubble 🙂

‘QE is over in October as the bubbles have the FED scared.”

“As I’ve said before residential RE is going to be sacrificed for dollar strength and commercial paper.”

“This low sales volume illusion is coming to an end. It’s actually kind of funny that after all the FED intervention the best they could do was a one year run up in prices based on mid 90′s sales volume.”

“I’ll probably pull the trigger in 2015/16 just in case they find the need to manufacture another echo bubble”

NihilistZerO – I think you are one of the most intelligent commenters on this blog but I am not convinced that your “prediction” makes sense and I think you answered your own question with the very last quote above…

What? I agree with you on the above. Also, I cannot see the Fed allowing rates to increase any more than they already have. NZ I frequently read your posts on ZH and am oftentimes in agreement however I think we are all underestimating the length to which TPTB will go to keep the Ponzi running.

Which prediction exactly as I’ve made a few LOL! If it’s for QE being over for this cycle that’s prediction I have the most confidence in. When I speak of them creating another echo bubble I surely think they might find a way to game the foreclosure process some more and get one last bump up say 3-4 years from now, but it won’t be with the QE monetary-meth of the last few years. In many ways I think we’ve reached peak FED. The FED is “this” close to losing the confidence of the markets. Better they scale back now than do “moar QE” which isn’t effective for lowering unemployment anyway than do more and bring on a currency crisis.

As we’ve said before the FED is owned by the BIG 4 banks and destroying the dollar system doesn’t benefit them. The only way to save the dollar system is to have some (hopefully for them manageable) deflation of asset prices. They know this and that’s why QE is over in October. However if RE crashes again you’ve still got a ton of liquidity out there looking for a return. With the SFH rental and flip game dead and buried (assuming a Bubble 2.0) pop. I wouldn’t be surprised if that money goes into stocks putting somewhat of a floor under the S&P. I mean the projected FED rate for the end of 2015 is still ONLY 2.25% if stocks don’t outright flash crash (and maybe even if they do) I see a lot of big $ buying a 2015 dip. We’ll see…

And if I got the prediction you wanted to discuss wrong it’s your fault as you weren’t specific LOL 😉

RE: CAB

Dude, letting rates rise is the ONLY thing that can keep the ponzi going! If they don’t deflate the credit bubble now the dollar system is toast. The only reason TPTB are TPTB is the fiat dollar system and you think they’ll blow it up on purpose? If that was the case they could have stopped raising rates in early 2007 and let Bubble 1.0 keep inflating… What is really amazing is that we’re in a place where you and others are seeing a 2.25% FED rate as a doomsday scenario. That in and of itself tells you how far off track from market realities we are.

Look at the world retreating back from globalization. Russia and China securing their interests jointly. China smartly letting it’s credit bubble deflate. It’s every nation for themselves to secure their interests. Continued QE and ZIRP destroys the dollar system. What else do we have besides are fiat currency monopoly???

I don’t think you have the FED’s interests defined correctly. Ending QE and allowing a sliver of interest rate normalization is the only tools they have left to protect their power.

“What is really amazing is that we’re in a place where you and others are seeing a 2.25% FED rate as a doomsday scenario. That in and of itself tells you how far off track from market realities we are.”

I agree with that. If the economy is only ‘functional’ to the extent that we artificially keep federal bank rates near 0% in perpetuity, then it’s not really functional in any meaningful sense.

NZ-

RE: rates rising, I hope you are correct!

Long term interest rates (10 year mortgages, bonds, etc.) are going to rise. The Federal Reserve controls the short term (i.e. Federal Funds aka overnight rates) rates. Short term rates will be at or near zero for the next couple of years. The Fed has made this point crystal clear they will adhere to ZIRP on the short end.

QE3 was all about the Federal Reserve acting as a bad bank and pulling the garbage off of the balance sheets of the member banks like Goldman Sachs, Bank of America, Wells Fargo, CitiGroup, US Bank, etc. Now that the Fed effectively owns $2.5T in junk mortgage backed securities, the Fed has run out of crap to pull off of the balance sheets of its member banks. That is why the Fed must end QE3 this year because the Fed has sucked the junk mortgage market dry.

Well put Blowfield. However I think ZIRP is in it’s death throws as well. Look at Bullard’s recent comments (Good article on ZeroHedge this morning).

The market is already pricing in a 2.25% FED rate by the end of 2015, 7 short quarters away. If they don’t have a semblance of normalization in what will be 8 years after the crash I don’t see how the FE doesn’t keep the dollar system from falling apart. Japan is not analogous for us as the USA has the reserve currency and id fundamentally “for sale”. Japan’s ZIRP didn’t re inflate bubbles because the foreign investment wasn’t their. In our situation we’re facing an even bigger credit bubble than 2008 and no job or wage growth. Outside of facilitating the FED as the bad bank ZIRP and QE have been total failures.

I expect the FED to acquiesce to this in action if not word more and more over the next 2 years. The options are a slow slog with moderate deflation in the absence of extreme stimulus or a ZIRP and QE fueled deflationary spiral that destroys the dollar system. I think they’ll take the former.

Meanwhile more big insurance companies are firing their older American workers and replacing them with young Indians on H-1b. Who will buy these houses? Certainly not me. In the meantime I will continue to rent my apartment in a rent control area as my rates continue to drop lower and lower against “the market rate.” I’ll take the difference and sock it away for when the whole thing collapses on itself. It should be pretty soon, IMO. I use the term “market rate” facetiously as it looks more and more like the “market rates” are being set by command all through the economy. Command pricing and private ownership are the definition of fascism. Maybe we will have some sort or “public private partnership” to “fix” our housing problems.

I live near Intel in Folsom, CA.. and no joke – every new housing development built is 95% bought and occupied by Indians. I don’t know whether they are on h-1b visas or what but they buy up everything in sight, they don’t seem to care what price they pay and they seem to have a preference for brand new homes. I assume its the low/no-maintenance lifestyle.

They just opened another new development on Saturday and I went to have a look. Cluster homes on 2400 sq ft lots priced at over half a million dollars. I was the only American there. There must have been over 100 people swarming through the models (extended family in tow in some cases). Meanwhile the re-sale homes inventory is growing and sitting with price reductions.

My question is: if they are on employer sponsored visas, how do they get financing and why would they want to buy vs. rent?

The Indian rupee is in the toilet, and heading down further still. Everyone knows it.

So the south Asians are borrowing back home — in rupee — and investing the proceeds in a much stronger currency, the US Dollar.

To make the game work, they have to be owners of American real estate. It hedges their exposure. Their American cash flow/ income is rising in a towering fashion compared to debt coverage requirements back home.

And, to top it off, you’re almost in all cases looking at extended clan funding. You may well find that — hidden from view — the home is a communal purchase. They don’t have to show anything to Americans if escrow closes with good money — and no visible debt.

Calgirl, here’s the scoop on the H1-B visas.

Tech companies love to bring in H1-B workers because they undercut the wages paid to the American workers. It’s a huge scam. Immigration lawyers council the companies how to place phoney help wanted ads, that will show no reply’s from American job seekers, then the company can employ a H1-B foreign worker at a sizable discount.

Currently Mark Zuckerberg, Bill Gates, and a host of “Tech”, companies are joining forces with the US Chamber of Commerce and working overtime for a huge expansions of H1-B worker programs, and a tripling of legal immigration rates to flood American labor markets with more workers to depress American salaries.

The service, construction, agricultural industries are also joining forces with the H1-B pushers for amnesty for illegal aliens, for the same reason, more workers flooding the job market depress wages.

Their proposal is called: “Comprehensive immigration reform”. and it passed the Senate in June 2013. Supporters have until January 1, 2015 to pass the House before the bill dies. John Boehner a handful of cheap labor Republicans and 100% of House Democrats support this amnesty / massive immigration expansion bill.

It should also not go unmentioned that we have over 25 million unemployed Americans right now, and many recent college graduates are living at home with their parents because they can not find a job.

Oh well another “American”, hope you never have a family tree that goes way back, you may be surprised, then again you may just go off the deep end if you find out those “Indians or those Asians” have blood running they your very all American veins?

Robert, we come here to work. Immigration Reform will make many members of my family “Legal”. I was born here, even though my mother did not have her documents. California is a great state. In California, undocumented people can be attorneys but they can not legally vote. This must change.

@GreginLA, Nope, you’re talking about Labor Certifications. H-1B visas have zero do do with job postings or recruitment. The requirements are basically a) the position is a specialty occupation (which mostly means that in most cases it requires the equivalent of a U.S. Bachelor’s Degree), b) that the alien has the equivalent of a U.S. Bachelor’s Degree, c) that the company is paying the prevailing wage as determined by the US Department of Labor, and d) that the company is not engaging is certain practices that violate collective bargaining agreements and other labor laws. And your assumptions about labor certifications are also misguided. Sorry.

Juanita,

“This must change”?! That entitled attitude is infuriating, especially considering other countries that wouldn’t remotely consider allowing an illegal immigrant access to education. Mexico, for example, won’t even deport you for trying to live and work there illegally – they’ll just throw you in jail.

Regardless, what you (and everyone else who is for “immigration reform”) need to realize is that while amnesty is great for illegals, it’s very, very bad for citizens – and by “citizens” I mean you, me, AND THE CURRENTLY ILLEGAL MEMBERS OF YOUR FAMILY WHO WILL BECOME CITIZENS. Democrats (and many Republicans) want an endless flow of illegals to win votes and depress wages, which is why they’re against enforcement of employment and border laws – which keep that flow going. Amnesty will completely screw your own family, just like it will the rest of us, when the NEXT uncontested mass immigration rolls over the border – the people anticipating amnesty number four.

So when do you suggest the madness should end? How many more amnesties do we grant before half the population (including your entire family) is paying for the education, groceries, and medical care of the other half, with wages so low and taxes so high that their own standard of living is in the toilet??

What’s the solution? REAL immigration reform. Lock the border tight. Extremely harsh penalties for hiring illegals, strictly enforced. Expand the existing immigration system so that becoming a citizen doesn’t take so long – but still tightly controlled so that we only legalize the workers we need. At first, there would have to be consessions for relatives, the elderly, orphans, etc., but many people would still be forced to self-deport. They can get in line like everyone else does, in virtually EVERY OTHER COUNTRY ON EARTH.

Unfortunately that won’t happen, because U.S. career politicians are more concerned about their jobs than the future of this nation.

@Juanita. You are right. Undocumented people can be attorneys in California (for now). This must change indeed.

My parents and I waited nearly 10 years for our visas to be approved before we moved to the United States. We came here because there was opportunity. And there was opportunity because there was order. And there was order because of the laws and because people here followed the law.

Your basic argument is that undocumented aliens should be legalized because the laws inconvenience your family. Who caused your parents to become undocumented? Not the laws. They chose to ignore the laws.

In the end, they are responsible for their situation.

Homage to Jim T: Housing to tank hard in 2014!

Thank you kind Sir 🙂

Housing to stay flat in 2014!!

Tell that to the already retreating prices.

Unwittingly, the authorities in Britain and America have set up the latest surges by cutting the rungs off the bottom of the property ladder — for bread and butter price thresholds have moved entirely out of reach of young adults. (With exceptions, of course.)

The only way that these rungs can be restored is by reversing course. That’s highly unlikely in the near term.

The UK will need a change in government.

America will need an absolute end to ZIRP. That may be even more iffy.

ZIRP is a spendist narcotic.

Withdrawal is brutal.

I love bread and butter especially if it is toasted sourdough and butter. mmmmmmm…

Toasted sourdough and organic butter– yum

What about toast and jam?

What I’m seeing here on the ground in L.A. is more inventory sitting around collecting dust compared to a year ago – with ample price reductions. Plenty of SFH flips in the riskier areas such as South L.A., marginal SFV hoods, and NELA environs have been riding the price wave down, week after week, month after month – last time I remember seeing this was on mostly organic inventory back in 2007-8. Are some of these flip jobs moving? Some are, mostly the cheapest ones, but not much folks. Even so, there is still a small yet steady stream of new flips arriving each week to two. Over the next month, we should get a good idea of just how this is going to play out. If the sales don’t start picking up soon, it’s gonna get real hot in hurr!

For the few organic sales coming on the market now, a lot of these are also sitting. A quick look through the price histories and there appears to be mostly three types of organic sellers – a) bought around 2009 and squeezing out a quick profit, b) bought around the last peak of 2007-8, finally just above water and pricing like the crash never happened, and c) bought around 2000 or earlier, going for the gold but generally willing to more aggressively price reduce for quick sale. For an organic competing with a flip jobber next door, it’s got to be tough. In some areas it’s easy to find these moldy old looking shacks pricing next to a remolded flip shack.

The bottom line is that it’s dramatically different than a year ago. Buyers don’t need to be in a rush right now. We went from bidding wars to stagnation in short order. Another observation is that while we started to see an uptick in inventory, it’s quickly been tapering down. My guess is that many sellers know the jig is already up. If this train can’t get turned around on its own volition, something is going to have to give. Either the price level is gonna fall further or some more manipulation will be cooked up.

Good take Anon…. “Either the price level is gonna fall further or some more manipulation will be cooked up.”

When there is a stalemate then selling anything in life means a price adjustment or more creative way to move product.

When I was in the car business and it was slow the factory would provide incentives to move inventory or we would extend warranties whatever to get it done.

I can assure you and everybody on this site if a car was msrp at lets say 30k, because it was slow times we didn’t discount it to 20k, other wise close the doors the party is over.

Same with housing, the days of 40 to 50% value reduction won’t ever happen again, the banking industry and gov’t will do what Anon said “cook up something?”

I’m reminded of GM channel stuffing.

May I speak for all the Bears and Bulls on this sight who actually have facts to debate and conjecture the meaning of. robert… you’re an idiot.

You seem to understand nothing of markets. You speak in absolutes as far as governments power to manipulate markets in perpetuity though this strategy has not worked once in all of human history. Comparing car sales to homes is an argument a knowledgeable person in either industry would never make. Though you admitting to being in the car business tells me a lot about your financial acumen and understanding of markets. Car salesman reside just below realtors on the charlatan scale.

So to further eviscerate your car analogy what entity vis-a-vis the car manufacturers can offer “incentives” to keep the specuvestors whole and keep the inventory from being discounted? The FED? They could and did do it for the banks, but that was only after an incredible crash and purposefully letting Lehman Brothers fail to get Congress to allow it. Do you think they will do the same for every Tom, Dick and Harry flipper? When the 7 million underwater homeowners get another million added to their number will .gov have the political will to go against 95% of the country that’s tired of bailouts and force through real cram down legislation? Will this happen with a lame duck president and likely a wholly Republican Congress???

I’ll debate with Bulls all day and have fun doing it but you need to take your car salesman schtick and go back to the kiddie table while the adults have this conversation.

average intelligence means you’re stupid. if you don’t believe me ask george carlin

I see much the same where I’m looking around Sunset strip / W H’wood / +H’wood. I too believe that TPTB will perform all manner of unnatural act to keep this going, but also share NZ’s doubts about their ability, do i’m looking to buy about half what I can afford, just to hedge my bets. I go to own houses, see absolutely tons of traffic, extremely confident agents “this week so this weekend for over the asking price”, but yet, it’s on open house again the following weekend. have tracked several down 10-15pct thus far. When I noted to one agent that the prop had been on MLS for a month, she had the audacity to blame the weather!!! (it hit the market that Friday last month that it rained. I told her that at least one of us thinks the other is an idiot. Anyway, I see we are at an inflection point, so waiting to see which way it tips.

Notorious J I would disagree that the FED will proceed in more “unnatural” acts to keep the Housing Bubble going. Will they do anything to save the dollar system? You betcha! But at this point they’re two different issues. I would argue that, much as in 2007, they have to pop the bubble to save the fiat dollar. The dollar is the only thing that matters to their power structure.

Now that said I think Hollywood and places around LA proper are likely to drop by a much smaller percentage in the coming bust. LA is an international city and even if CA continues to bleed residents, LA will likely continue to expand. That said in the absence of flipper and specuvestor mania (and a higher interest rate environment) I’d expect prices to fall by a minimum of the amount higher interest adds to the monthly nut plus a little more to account more market sentiment. My gut tells me were headed slightly below 2010 trough prices in the inland areas. LA proper should get back to 2011-12. All that inventory of distressed homes is still out their and the last round of flippers with no greater fool to sell to is screwed. Remember there has been NO fundamental improvement in the economy since 2008. It’s all an illusion. Remember 2007…

Today I went to a few Open Houses in Pasadena, including this one: http://www.redfin.com/CA/Pasadena/1357-E-Mountain-St-91104/home/7199979

LOTS of couples, some with babies, checking out the place. The realtor told me she already had “many” offers so I’d better hurry to get mine in if I was interested.

Was she telling the truth? Who can say?

As for the house itself, it was … okay. But not nearly as pristine as its photo-shopped images on Redfin. The walls could use a paint job. You can’t see that from the Redfin images.

When I drove through Brentwood and Santa Monica, on my way home, I saw plenty of Open House signs on sidewalks.

Contrary to housing beginning to tank, I saw indications that the Spring feeding frenzy has begun. Will there be offers? Closings? Or just lookiloos with pent-up desires but no down payments? Time will tell.

?

How come pretty much everyone says Y-o-Y sales are down 10-20% in the LA area? How come when you look at Pasadena sales on Redfin, there are no green shoots?

Pasadena is a terrible buy. Overpriced, loaded with couples who make 150K and are under the misconception that they are affluent, terrible schools and police with a trigger finger. And, let me not get into how they treat businesses (my business license is with this esteemed city, and shakedowns are the norm).

Background on me:

Status: Married

Age: Late 20’s

Income: DINK, 150k/year

Save: 50k

Debt: 25k, student loan

Thanks to the information provided regularly by DHB, my wife and I intend to pay off the student loan in the next 18 months at which point we will aggressively save for a house where we can put 20%+ down with intent on a 15 year mortgage. I’ve seen multiple friends and co-workers buy into the current housing market for two reasons.

(1) “It’s only going to go up because there is only so much SoCal land”, and (2) “It’s what families do…”

I find it hilarious that people rationalize buying at this stage in the game, and then the next sentance expand on how broke they are, or how they’re struggling to make $3,000/month mortgage payments. While its nice to own a home to have ownership/equity, the monthly payments and the amount of time one is required to stay a debt slave (ie, jumbo mortgage) seems insane to me.

On paying off the student loan, I’d say that strategy depends on what your weighted rate is and if they’re federal or not. If it’s comfortably under 5% and they’re federal, I’d probably lean toward maxing out retirement and building assets rather than paying down the loan.

If married you should still be just under the threshold to deduct the interest. Federal loans have a variety of benefits to them (deferments, forgiveness options) that I would only rush to pay it off if they’re not federal or carry a higher rate. Since they’re installment payments, they likely won’t really negatively impact your credit score either.

The population of California has grown quite a bit since 2000. Around 15% or so. Moving forward I’m not so optimistic that that growth rate will continue. I believe companies will seek cheaper overhead in other states. They are already doing it.

Just a side note: Prop 13 was a huge benefit to commercial property owners as well as homeowners. If Sacramento attempts Prop.13 reform they will go after Commercial property first.

I am still seeing homes sell inside 1-2 weeks, with multiple offers, and many times over list price. There still isnt a lot of inventory and there are a lot of people who still want to own a home. There are a lot of well to do parents helping out struggling kids with the down payment, some parents are buying the house cash and letting the kids rent/buy it from them. It’s win win for families who can do it. Asian money buys cash in good areas. The goal is to have a house so that in 5 years when their kids are ready for college the house has provided rental income, appreciation, and it will be perfect for their now older children. win-win-win for them. The other group of buyers are investors looking to fix and flip….buying rentals in the over 1M market makes little sense I think…

Heres a random sampling of some recent sales in some nice neighborhoods in So. CA (cities of Arcadia and Irvine)

400 Santa Rosa RD, Arcadia 91007 3 bed/1 bath 1200 SF, $980,000 sales price, conv financing, 1 day on market, buyer is an LLC might be a tear down because of the big lot

1410 SANTA MARGARITA DR, Arcadia 91006 5 bed/3 bath 3,040 SF $2,100,000 CASH, sold cash before it was listed on the MLS, buyer is an LLC might be a tear down or rehab?

188 E Las Flores AV, Arcadia 91006 5 bed/5.5 bath 6848 SF, $3,700,000 CASH, SOLD BEFORE IT WAS LISTED ON THE MLS, ASIAN BUYER

18 Meadowsweet WY, Irvine 92612 4 bed/3.5 bath 2921 SF townhouse, $880,000 conventioanl loan, listed for 46 days +/-, asian buyer

6162 Sierra Palos RD, Irvine 92603 4 bed/2.5 bath 2100 SF sold for $1,190,000 conventional loan, listed for 4 days, asian buyer

17 Balcony, Irvine, CA 92603 4/3.5 4225 SF, sold for $2,250,000 (full list price), conv. loan, listed for 5 days, asian buyer

2039 ELKINS PL, Arcadia 91006 3 bed/2.5 bath, 1813 SF, sold for $1,388,000 CASH, LISTED FOR 9 WHOLE DAYS, asian buyer

1100 Fallen Leaf RD, Arcadia 91006 4/3 3,892 SF, sold for $3,450,000 CASH (over asking price), LISTED FOR 9 DAYS AS WELL, LLC IS BUYER DONT KNOW IF IT’S REHAB/FLIP OR TEAR DOWN, looks dated inside, probably a fix and flip

Moral of the story location, location, location and have a big lot, so whoever buys your house can build something bigger that they like

Way to cherry pick. Of course, one can always find a few floaters in a bowl full of crap.

I didn’t cherry pick, I picked all sales over the past 3 months in cities of arcadia and Irvine (126 closed sales) and just listed the first few I saw on the list

You most certainly did cherry pick Arcadia and Irvine.

CA appraiser-

I believe he means cherry picking cities. All Irvine and Arcadia? I would have to agree.

CA Appraiser is obfuscating.

Looked around today on our favorite housing websites. I got my laughs for the day. I won’t waste the time for awhile. Good luck sellers.

Only odd things were a few dropped listings. Inventory generally filling out, but shifted up in price. If this is a game to find the sweet spot then realize the amount of money in my pocket has no baring on what the price should be. That would be extortion.

Yellen just went pretty close to all-in in her remarks just now. Can’t say for sure what will happen obviously, but it kinda seemed like she would untaper QE in a heartbeat if need be/soon enough. Markets loving it (as I type this at least). For those that say the whole goal if QE is for insolvent fed member banks to get bad loans/mortgages off the banks’ books and are also predicting the end of QE this year, how does that jive exactly? It seems to me banks still have a lot of homes on their books…so maybe thats why the fed untapers. who knows. All i know is that percentage wise, the odds of QE ending for good have been diminished by today’s remarks…..I think. 🙂

Too early to gauge her M.O. She could be bluffing… or not. The Fed has demonstrated time and again that they will flip the script whenever it suits them.

Dr: Great article as usual. For comparison, compare the US to UK. US has a flat-lined resi mortgage market while the UK has a thriving home mortgage industry. And US/Cali home prices are rising 2X UK’s house prices. http://confoundedinterest.wordpress.com/2014/03/31/uk-home-prices-rise-5-7-london-home-prices-up-7-5-still-half-of-us-case-shiller-home-price-increase/

>>If we are going to speculate, why not go with the herd on the biggest gainers? Some folks just have a deep housing lust and fail to acknowledge that we live in boom and bust cycles and we just had a big boom in California …

BECAUSE people with Housing Lust want a nice place they can call their own. People need a place to live, and this investment kills two birds with one stone in the long run. It doesn’t matter the the prices are going going up and down, since over the long run, the jagged line trends ever upward.

So how does that “long run” work when the average time for owning a house is seven years? Not so well for many, many people. The blindness to life changes is incredible too. Why do some people think that they will be in a house “10-15” years when 50 percent of marriages end in divorce, people die, etc.? And making such a potentially hugely ruinous financial decision, all because the sheeple are doing it and we’re all in this together? There is such a massive blind spot when it comes to buying a house for some people. And for some smaller segment, buyig a house works out (financially anyway), even if they only hold it 8 years like I did. But for the rest, many face foreclosure from divorce, job loss, etc. If only people were more conservative with buying a house than investing (see all of the people who have CDs yet gamble on a house), we’d all be better off. In other words, if housing was truly affordable and in-line with incomes, I think everyone would benefit (everyone except the banks and skimmers like RE agents, of course).

Yes, good points, and i never meant to say or imply that buying a house is a good move for everyone. When I bought a two bedroom condo in 2000, i wasn’t even thinking about any appreciation– never occurred to me at that time that a condo could appreciate as much as it did ($120k to $360k). I just wanted a nice place to live and build equity over thirty years — and then 15 years when the interest rates dropped dramatically. I bought beneath my means and didn’t “max-out” on my buying potential, leaving me with extra funds with which to travel or save. I didn’t get greedy and trade up to a bigger place in order to “make money” on a house that “would appreciate more” as people would say (before 2007). It should go without saying that if someone doesn’t have a stable job history or marketable skills, then maybe they shouldn’t be buying a house with the thought of “making money.” It’s only an “investment” for those who can weather the financial downturns and keep making their payments for the long term.

I know that shit happens to people, but if you don’t have a solid relationship, then don’t get married– especially those who may be getting married so that they can live a bourgeoisie lifestyle with a nice big house and all the trappings that go along with filling up the house with stuff. But then again, who said that common sense was common . . .

I believe Yellen’s remarks are in line with projections. No policy changes. She has to have all this strong talk to cover the housing maniacs, especially going into the spring. She clearly isn’t going to state that her hand is somewhat being forced by geopolitical forces. I am sure she is ready to do whatever she can, but there are limits to this. 6.5% unemployment is pretty good. The jobs lost aren’t coming back because skills have been lost and the labor market has changed. This economy is as good as it gets minus high inflation. FOMC wasn’t going to raise rates yet. It would be bad for banks til they unload their crap. With the past low sales volume engineered to maintain high prices they won’t clear inventory for a looooong time. Talk is cheap.

http://www.bloomberg.com/news/2014-03-31/yellen-says-extraordinary-support-needed-for-some-time-.html

Look no matter how hard you folks try to tear down the housing market in the end housing is never retuning to 100 sq ft or cheaper. When the present administration leaves, you will see a pro business climate return and a boom in the economy.

If you are old enough I remember when 100k for a house was unthinkable, 1 million dollars for a house in good zip code is just the way it is folks and the way it will be.

Calling out what doesn’t make sense and questioning long held assumptions can hardly be construed as “tearing down” the housing market. If you find the status quo as acceptable, good for you. However, as the returns continue to diminish for increasing numbers of folks, expect to hear about it.

I think you miss the point robert. I don’t think many people in here believe they will buy a good SFR in a good area and good schools for 100K in Los Angeles. A $1 million house would have a mortgage of $4500. You can rent a very nice place for that cash.

Personally I rent and spend less than 10% income on housing. I could easily buy a 1 million plus home but why would I. You think I want to swallow loosing 30% of my money for a good deal of my working life on a crappy home in SoCal. F that. If you wanna do it fine.

For me it would take a 20% drop on many houses before I would consider buying in this region. Most of LA is a neighborhood in transition. I hope not to see the final transition. 1 Million dollars and you are lucky to get a pool out of it in some areas. Good luck making the house look like you want HOA’s (in nice areas to keep them “nice”) make sure you are stuck with a blah investment. If I get tired of my place I can just move, no trouble. I am Gen X/Y and I doubt I will end my days in the local region I am in now. In fact at some time I might want to live in an area that doesn’t look like a post apocalypse movie backdrop.

Also, although I have the money why would I want to rent out a property. It is too much work and can be dangerous. I also rather retire early than sweat it out in a SoCal beach house. I think you have the people pegged out wrong. Many have the money but say if this is the “market” F off. Like any rational person the deal is contingent on the price. If you can’t meet me then good luck.

If you buy a SoCal beach house, you won’t ever sweat. The weather is perfect.

This time is different with so many cash buyers not saying it won’t end the same though. The next crash will be major on all fronts. This cycle may last longer than one would think. They will do everything to keep this boat afloat. Housing bubbles everywhere, China, Canada, Australia, Britain.This is a global bubble not just the homegrown kind California is used to. The catalyst could come from anywhere.

Bitcoin has beat all real estate and stocks lately even with its down tick.

In late 2010 we bought a lot and chose a home to be built and completed March of 2011 in San Ramon by Shapell builders. For the Bay Area the price of the home was reasonable post 2008 bubble pop. After the house was finished my family and I were the first ones to move into our new home and into the neighborhood. As homes next to us and around us were completed our neighbors began to move into their new homes. As weeks passed we could not ignore realization that we had purchased and built our beautiful new home in “Little India.” It was a very sobering reality as this culture is very different from the American culture I grew up in…particularly here in the Bay Area.

By November of 2012 we accepted a job offer in Flagstaff, Arizona and were happy to accept so that we could unplug from “Little India.” Ironically, we sold right before the bubble really began to take off…

We returned last October to the Bay Area and are presently renting. We went to look at new homes being build by Toll Brothers yesterday. It was again very sobering to see that the frenzy of buyers looking at the model homes were primarily Indian and to a lesser degree Asian. I spoke briefly with one of their sales reps and they were helpful and very transparent regarding answering my questions. I am much wiser now and we do not want to repeat the same mistake and buy in “a foreign country” again.

In summary, we Americans here in California are rapidly becoming the “minority.” My definitive impression is that there is no sign of this trend slowing here in our beloved California. We are reluctantly considering moving to another state where we can thrive both personally, professionally and financially.

haha, you keep writing words like “American” but you really should just say “white.” We all know what you mean.

Americans are becoming the minority in California?? Come on.

Exactly. I hope the lady who posted this a great time in the Arizona desert. Good riddance. We don’t want your kind in CA. Find it funny that some white people can’t get over the fact that “American” has a shifting definition.

Given the enormous population of illegal and “legal” immigrants flooding California, it isn’t a stretch to say that Americans, i.e. U.S. citizens, are becoming a minority here in Cali.

Yep.. see my post above re: buying a new home in Folsom

Sir you know what you are don’t you? You call yourself a American, MY Marine UNCLE WOULD LOVE TO TALK WITH YOU, little India??? I guess in 1960 when blacks couldn’t eat lunch at a counter in the state of LA. but the next day got up at 5am to serve their country at Folk Polk, you would have spit on them right. “They don’t belong” right guy???

Don’t ever blame your shortcomings in life because you can’t afford a home or nice car on a race or religion, or ethnic slurs, I can assure you those “Indians” had to qualify to buy a home nobody handed it to them?

BTW those foreigners who you think don’t belong, they don’t want live near you either.

And who said the original poster had a problem with black people, or Latinos, or any other Americans who are not white?

Let me explain something to all of you politically correct nimrods. An American is someone who was either born in this country or has obtained U.S. citizenship through the naturalization process. End of story.

I don’t care if it’s someone who grew up here, went to school here, and spent their life working here. Until they agree to swear the oath of citizenship, that person is NOT an American and still has cultural ties and/or allegiance to their former country. There’s a lot of people in California, of all races and ethnicities (to include white Europeans) who are NOT Americans, but they live here and go to work here.

And I’m sorry, I wouldn’t want to live in a neighborhood where a group of non-citizens who are all of ONE particular ethnicity or culture have congregated. That’s just not America, and its not a place where either I’d feel comfortable or the majority group would feel comfortable with me or my family.

Check Martin Armstrong’s writing. He predicts Dow 25000 in 2015. Marty is very unique, and he sees the big picture. Just picture that in your head, and see where the RE should be. Yea, I know, it sounds nuts to me too.

Sure. Why not…

I predict the same thing! Dow 25000 by end of 2015 and 30000 by end of 2016. Housing to NOT Tank Hard in 2014, just a lull right now until it ramps up again due to extremely limited and tight inventory.

Housing may, may not tank hard in 2014.

Armstrong thinks capital will flight to safety across the globe, that’s US. All US assets will go higher, including bond, stock, real estate, and whatever tangibles. He thinks 2015 will tank, but it will be pension funds in trouble. He is a serious guy with a long track record.

From LA Times. Foreclosures in LA OC fall to lowest in 3 years, less than 1% of all mortgages.

What I dont get is why foreclosure rates in LA and OC are less than the national average?

———————————————

By Tim Logan March 31

The number of Southern California homeowners in trouble on their mortgage continued to shrink at the start of the year, according to new figures from CoreLogic.

The Irvine-based data firm reported that the share of homeowners in foreclosure and of those at least 90 days behind on mortgage payments shrank to at least three-year lows in Los Angeles County, Orange County and the Inland Empire. Those numbers have fallen steadily from historic highs as the housing market has healed and home prices have climbed.

In the Los Angeles metro area, 0.76% of outstanding mortgages were in foreclosure in January and 3.01% were at least 90 days delinquent. That’s down from 1.36% and 5.05%, respectively, in the same month last year.

In Riverside and San Bernardino counties, 1.03% of loans are in foreclosure and 4.06% are 90 days delinquent, down from 1.84% and 6.78% in January 2013. Rates have fallen even faster in Orange County, where 0.47% of mortgages are in foreclosure and 1.68% are delinquent. Both have dropped by more than half over the last year.

All three Southland metro areas now sit below national averages on CoreLogic’s measures of foreclosure and delinquency.

http://www.latimes.com/la-fi-mo-foreclosure-rates-ease-20140331,0,6460497.story#ixzz2xeX1yHtj

h/t ZH for posting. from LA times:

This time last year, investment firms raced to buy dozens of single-family homes in neighborhoods from Fontana to South Los Angeles to lease them out, transforming the mom-and-pop rental business into a Wall Street juggernaut.

The flood of cash helped spark a steep rise in prices, drawing criticism for pushing families out of the market.

But now the firms themselves have all but stopped buying in Southern California, the latest evidence that home prices have hit a ceiling. The professional investors no longer see bargains here.

The real estate arm of Blackstone Group, the largest buyer, has cut its California purchases 90% over the last year, a spokesman said. Santa Monica company Colony Capital reports a similar retreat. Oaktree Capital of Los Angeles, meanwhile, is looking to cash out by selling its portfolio of more than 500 homes, many of them in Southern California.

“Private capital made a lot of money early, and now they’re starting to pull back,” said Dave Bragg, who heads residential research at Green Street Advisors, a real estate research firm in Newport Beach. “Home prices are up significantly, and houses are definitely less attractive.”

The shift is giving regular buyers more homes to choose from, at least those who can still afford them. Experts say an expanding supply should help usher in a healthier housing market, with a better balance between buyers and sellers.

That’s a stark change from last year, when buyers faced bidding wars. All the activity drove the region’s median home price up to $385,000 by last June, a record 28% increase over the same month a year earlier, according to San Diego research firm DataQuick.

But prices have since been flat in Southern California. Many families are taking a pass on the more expensive homes. And the math doesn’t work on Wall Street either.

“Prices have gotten to the stage where we cannot buy a house, renovate it, rent it and still make a reasonable return,” said Peter Rose, a spokesman for Blackstone, which owns roughly 41,000 rental houses nationwide. “There was a moment in time where it made sense.”

Among the 20 firms buying the most California real estate since January 2012, purchases are down more than 70% compared with last year in each of the last four months, according to DataQuick. At the 20 biggest foreclosure buyers, including arms of Blackstone and Colony American Holdings, purchases have fallen at about the same rate.

Absentee buyers of all kinds bought 21% fewer Southland homes in February than they did the same month last year, according to DataQuick, which tracks housing market figures.

That’s not to say the big money is exiting the business entirely.

Many of the biggest players are adopting a buy-and-hold strategy, bundling their properties into giant rental companies, such as Colony American Homes and Blackstone’s Invitation Homes. They bought thousands of homes at or near the bottom of the market, setting up big profits from long-term price appreciation.

In the meantime, they can make money collecting rent.

“These are income properties for us,” Rose said. “Eventually we’ll exit, whether it’s an IPO or selling them off. But that’s years down the road.”

Indeed, the fledgling mass rental industry is taking on an air of permanence. Blackstone in October sold $479 million in bonds backed by the rent paid on some of its homes, a move other firms are also planning. On Wednesday, some of the bigger players launched a trade group, the National Rental Home Council, to advocate for their interests in Washington.

And most are still adding to their portfolios of rental homes — just not in pricey California.

In the second half of 2013, Colony Financial Inc. added nearly 1,000 homes to its rolls in Florida, according to regulatory filings, but just 210 in the Golden State. The firm declined to comment on its plans.

The next wave of buying, industry watchers predict, will be in second-tier markets such as Indianapolis and Cincinnati.

“They’re looking for $150,000 three-bedrooms that they can rent for $1,000 to $1,500 a month,” said Rick Sharga, executive vice president at Auction.com and former executive at Carrington Mortgage Holdings, which partnered with Oaktree in the rental business. “That doesn’t sound like Laguna Beach.”

In theory, the migration of big-money investors from the Southland should make more room for regular buyers. But it’s not quite working out that way, said John Husing, a housing consultant who studies the Inland Empire, where the buy-to-rent sector has been the busiest in the region.

Home buyers still face tight credit and a soft job market. And those who have been renting for the last year have already lost out on big gains in home equity.

“They missed the upside,” Husing said. “And now they’re priced out of the market.”

Those would-be buyers make ideal renters for the homes the big firms own in Southern California.

“People want to live here, whether they buy or rent,” said Gary Beasley, chief executive of Oakland company Starwood Waypoint Residential Trust.

That’s why Starwood, unlike most of its competitors, plans to keep buying in Southern California. This month, the company paid $144 million for a portfolio of 707 houses, about half of them in the Golden State.

The company is also still picking up houses here one by one, a sign that ordinary home buyers might still find bargains if they look hard enough.

“Most of the low fruit has been harvested, but there’s still plenty of fruit in the tree,” Beasley said. “And we’ve got fruit pickers.”

http://www.latimes.com/business/realestate/la-fi-wall-street-landlords-20140329,0,2899743.story#ixzz2xep4Rsfq

you guys have WAY WAY WAY too much time on your hands…..

Pot, meet kettle.

Said the guy who took the time to pull comps and post them…

I never claimed anything, rather I pointed out the how ridiculously hypocritical your comment was, so your response is moot.

Furthermore, your comment and follow-up response to my comment is simply an attempt to turn the discussion into a judgement about the debaters instead of debating what’s being presented.

LOL, sorry CAB I mistook you for CAA!

No one talks about the high end market here, but in California it has gotten disgusting. I myself have been looking at high end real estate for a while, not because I can afford it but because it’s interesting to see how far removed it is from all common sense. Take a look at this:

9380 Sierra Mar Dr

$25,000,000 | 5 Bed 6 Bath

http://www.realtor.com/search/listingdetail.aspx?mprid=2472015771

That’s 25 million dollars for a 6500 sqft home!

Let’s break it down:

Even if you spend $3M on a premier view lot in the best area of Hollywood hills that’s still 22 million that’s unaccounted for. 6500 square feet costs about 2-3 million to build with the highest finishes. The pool is maybe a million at the most. Some special structural adjustments to compensate for hillside terrain and we are maybe looking at a $7M cost for land and construction. Mark it up a million for profit and we arrive at $8M. Yet the listing is at $25M!!!!???!? What could this be other than a blatant display of greed? Someone hoping to take advantage of some idiot trust fund baby or someone so morbidly rich that money is absolutely no object?

I emailed the real estate agent and told him I thought it was disgusting and he replied that I didn’t understand the market and that he’d be happy to educate me. Of course I never heard back. Not that I really need to or want to, we all know the real answer. This is greed, and its happening across the real estate market. It just happens to be more visible in the higher end of it.

I occasionally like to search for the cheapest and most expensive houses in L.A.

About a week ago, I saw a Bel Air house listed on Redfin, selling for $43 million.

Yet I’ve read that some sellers with astronomical listing prices often don’t expect to sell for nearly as much. Often they simply try to be the top asking price because it brings attention.

There was a penthouse co-op in Manhattan that listed for over $100 million — about $125 or $135 million, I think — that broke the record for highest asking price in Manhattan. As a result, the newspapers wrote articles about it. Lots of free publicity for the egomaniac who owned the place. But it didn’t mean it was actually sold for anywhere close to the asking price.

Since generational differences are brought up quite frequently by the Dr. and respondents, figured some people might find this analysis of Gen Y amusing:

http://www.huffingtonpost.com/wait-but-why/generation-y-unhappy_b_3930620.html

Thanks for the link.

Thanks very much, that is indeed highly amusing and a great counterpoint to the frequent boomer bashing that goes on here and gets REALLY OLD

(am a boomer myself but grew up poor, inherited nothing and am fine with that, do not have kids, am not responsible for the current bubble (or the last one), and do not recall picking my birthdate)

The main factor since 2000 has been the stock market and straight up printed $$, especially by corporate insiders but also financial companies… with the Feds help they blew bubbles, which mainly hit the outsiders when popped, the big boys come in with Fed backed cash and buy up the assets, blow em up, pop when the music stops, continue ad-infinitum

proof = avg household income down since 2000, avg home price up 50%+ in many areas, avg gallon of gas + 100% etc etc

were pretty much screwed, rising poverty will sap all of govt $$ in less than a decade…

Currently Mark Zuckerberg, Bill Gates, and a host of “Techâ€, companies are joining forces with the US Chamber of Commerce and working overtime for a huge expansions of H1-B worker programs, and a tripling of legal immigration rates to flood American labor markets with more workers to depress American salaries.

The service, construction, agricultural industries are also joining forces with the H1-B pushers for amnesty for illegal aliens, for the same reason, more workers flooding the job market depress wages.

True, both the only hope is robotics will destroy about 500,000 farm workers jobs but smaller farms can’t afford them currently. Also, cleaning jobs could be reduce by a million if small robots are use more in cleaning. However, Tea Party folks against low immirgation are big supporters of H1B, Ted Cruz wants about 320,000 tech workers a year.

Everyone says you can’t finance the deficit without these ultra low rates but in reality we’re likely headed to a Republican congress this year and that means gridlock and lower spending. Besides an increase in the dollar’s purchasing power vis a vis food and housing means lower social program spending doesn’t necessarily mean a reduction in benefits. We got 2010/2002 price parity in some areas

Well, the Republican Party is basically toast, it supported outsourcing more than DemocraticsNAfta and trade with China was pushed more by the Republicans. And as far as illegal immigration, the Lincoln Club of Orange County supported it years ago, so if you think the Tea Party is so great on immigration they just don’t want to legalized folks but few of them support punishing companies that hire illegal immigrants. Leave the Republican Party if I was you and become Independent.

Leave a Reply