Brazilian Style Living in Southern California – MLS Inventory Creeping up, Section 8 Vouchers for Granite Countertops, and California Budget Going Mayan in 2012.

One thing is painfully clear about this housing bubble bursting here in Southern California and that is many of the 20 million residents never venture off their beaten path. Hit the freeway to work, stay inside, clock out, and head back to your segmented area. Variety is having lunch within a few minutes or miles from the hub. You have to wonder how many people are blind to the economic destruction that is hitting from all corners like a financial tornado. Foreclosures are raging and yet you have people gleefully acting as if real estate is heading back to 2006 and 2007 price levels. Those days are gone. If people would only venture out a few miles to see what is happening in their own backyard it would add a new level of perspective.

Many wealthy neighborhoods in Brazil are gated and heavily secured to keep out the poor. In many cases wealth and absolute poverty are only separated by a thin division:

Source:Â ArtRabbit.com

Many parts of California financed by ridiculous mortgages have created a caricature of the region. Some areas of the Inland Empire have fallen on absolutely tough times. Yet some investors here in Southern California like Wall Street bankers sit back from their laptop and air conditioned office looking at digital photos or using Google Maps to see investments in areas they have no idea about. All they need to do is put on some tennis shoes and hit the pavement and they’ll realize we are living in a different world. I’ve talked to a handful of these investors and many don’t care about the current rental price they will get because in three to five years they are going to flip that house for a tidy sum. At least that is the plan. Because as we will find out, renting in these markets takes a certain kind of landlord. But first, let us examine the steady growth in MLS inventory.

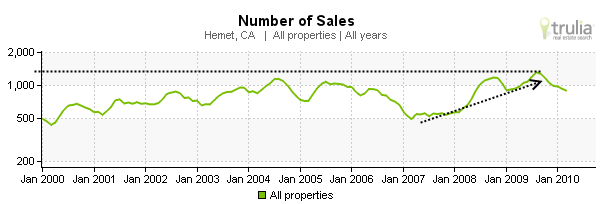

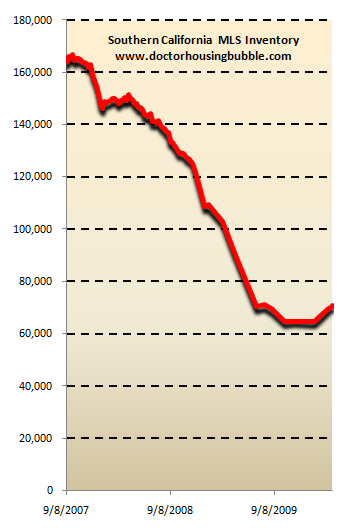

MLS Inventory Steady Increase

MLS inventory is steadily increasing as more distressed properties hit the market. As of Wednesday 70,900 properties are available to the public in Southern California. Another 160,000 are still sitting in the shadow inventory market. As the chart above shows, this rise in inventory is a relatively new trend in the last three years. Every imaginable gimmick has been put in place to stunt the market but here we are with prices near the bottom and trillions of dollars poorer (that is unless you are a too big to fail bank).

MLS inventory is increasing for a variety of reasons including more shorts sales, HAMP temporary mods failing, and finally banks pushing more properties out. It is also the case that inventory is rising because some homeowners simply do not want to stay in their over priced home. Many that bought were speculators just not in name. They had no intention of setting roots in the community but wanted to see the gravy train of price appreciation go on forward to an absurd conclusion.

Section 8 Vouchers for Granite Countertops

In discussions with a few investors about investing here in more depressed areas I see a few things holding money back. First, I have an issue investing in an area with massive unemployment. If you look at home sales a large jump has occurred from investors buying in Riverside and San Bernardino County. Yet here is the headline unemployment rate for both areas:

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14.9%

San Bernardino:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14.4%

Which means the underemployment rate is closer to 25%. This on top of having a market with lower incomes yet people are buying properties as investors many times without even looking at the property. Quality was not a main concern of many of these new homes because demand was pushing builders to skirt quality in place of speed. If you want to see a sharp contrast look at sales data:

Hemet Population:Â Â Â Â Â Â Â Â Â 70,991 (July 2008 data)

Hemet Home Sales Last Month:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 152

Lakewood Population:Â Â 88,253

Lakewood Home Sales Last Month:Â Â Â Â Â Â Â Â 43

This is where the sales volume is coming from. Lakewood is a working class area in Los Angeles County that saw home prices go over $550,000 during the peak. They are still hovering near $400,000 but a large number of foreclosures exist. This market will adjust just like many other cities in L.A. County that still have bubble prices. However Hemet is seeing home prices dipping into the five figure range. So is it time to buy here or invest? The L.A. Times ran an interesting piece on this which reflects what I have seen from my own on the ground research:

“(LA Times) Reporting from Hemet – The gated community in Hemet doesn’t seem like the best place for Eddie and Maria Lopez to raise their family anymore.

Vandals knocked out the streetlight in front of the Lopezes’ five-bedroom home and then took advantage of the darkness to try to steal a van. Cars are parked four deep in the driveway next door, where a handful of men rent rooms. And up and down their block of handsome single-family homes are padlocked doors, orange “no trespassing signs” and broken front windows.

It wasn’t what the Lopezes pictured when they agreed to pay $440,000 for their 5,000-square-foot house in 2006.â€

Now with these stories I always appreciate when reporters dig into the incomes and also mortgages behind these purchases. After all, ignoring mortgages and incomes is what got us here. We can only speculate what the income is and what kind of mortgage was used. But few places have gone bust so hard leaving archeological artifacts of the legendary housing bubble in Southern California:

“Vacant homes are sprinkled throughout Willowalk, betrayed by foot-high grass. Others are rented, including some to families that use government Section 8 vouchers to live in homes with granite countertops and vaulted ceilings.

When the development opened in 2006, buyers were drawn to the area by advertising describing it as a “gated lakeshore community.” Now, many in Hemet call Willowalk the “gated ghetto,” said John Occhi, a local real estate agent.â€

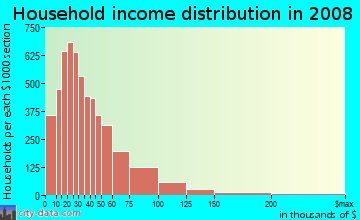

Section 8 for a granite countertop McMansion as if this were some kind of cruel economic joke. Those builders had no idea what the end product would look like. With toxic mortgages it was possible to build up cities like Hollywood sets only to have them exposed once the financial banking edifice was revealed for the sham it was. $440,000 is not cheap by the way. This family would need to be pulling $150,000 or higher to make that payment. I don’t know of many working families in Hemet making that much:

And of course this data is now worse since it is based on 2007 and early 2008 data that is outdated. But landlords are now finding it hard to rent these places out. And even if they can rent it, they better understand their market and how to screen renters because this is no market for amateurs:

“Many of the people answering a knock say they are renters, and won’t open their doors more than a crack to see who is on their doorstep. Red-and-white “for sale” signs dot the neighborhood, clashing with the golds and browns of the homes. The contrast between occupied and empty houses is evident on one block, where high grass in weedy clumps gives way to a neatly mowed lawn with handwritten signs pleading “Please do not let your dog poop on our yard.”

“Rented, owned, rented, rented, rented,” she said, gesturing at the gargantuan houses across the street, one after another. “It’s bad,” she said, shaking her head.â€

A quick search on Craigslist shows 948 listings hitting on Hemet. Looking at the listings many are in the city and many are near the area. This is a hyper saturated market for a population of roughly 70,000. The buying has been going strong in Hemet for sometime:

In fact sales went up nearly unabated for 3 years but it is now trending lower. Why? The market is completely flooded with inventory. If you lived here why would you rent when you can buy for much cheaper? It just doesn’t make sense. But how many locals are actually buying versus investors?  And those investors that think they can flip in three to five years better enjoy being active landlords because unemployment in Hemet is high and this will cause a lot of vacancies:

“Doing a check of the homes on a recent Thursday, he left his van’s engine running as he inspected a shattered window in one property.

“A lot of them can’t pay the rent, and they leave the house a mess,” Gomez said, referring to tenants.â€

Speculation of a different sort I suppose. Again, without jobs there is little reason to believe home prices will rebound. With so many toxic mortgages out there, it will be tough times ahead. A search of foreclosure filings pulls up 1,495 homes in Hemet. This if you have any doubt, is not good.

California Budget Mess Reaching Apex in 2012

You might have forgotten that the California state budget is an absolute mess. It is truly a Brazilian like mess with an ineffective legislature that can’t figure out what it needs to do so it feeds its crony’s with a $10,000 home buying tax credit. Absolute waste of money to appease the financial campaign backers. If we subsidized home buying any further we would be giving homes away for anyone will the desire to sign a mortgage. The mortgage interest deduction has taken a few hits in the last weeks with articles showing that it largely benefits the rich. Many with the standard tax deduction only get a small benefit compared to the Wall Street banker with the $2 million mortgage paying $11,000 a month in interest.

The State Controller does not mince words:

“(Contra Costa Times) State Controller John Chiang said Monday the worst of California’s budget crisis is still to come.

Although lawmakers are challenged by a nearly $20billion deficit, “the bad year’s 2012,” Chiang said.

That year, state finances will be hit with a trifecta of pain: The temporary tax hikes approved last year will be over; federal stimulus funds will be gone; and funds that the state “raided” from local governments will come due.

The deficit at that point will be some $25billion, according to Schwarzenegger administration estimates.

And finances in later years aren’t great either: Last year, the Legislative Analyst Office released a report projecting a $20billion deficit every year for the next five years.â€

And you should be happy to know that nothing has been done to solve this mess for the current fiscal year even though we are nearing April. In fact, we are creating a $10,000 outlay with the worthless tax credit! Mathematics is definitely not the strength of Sacramento. With this being an election year it’ll be interesting times ahead.

Yet the above brings up important points. Either taxes will go up or additional cuts will be made. With California’s underemployment rate over 23 percent this is not helpful. Both are not good for housing values.

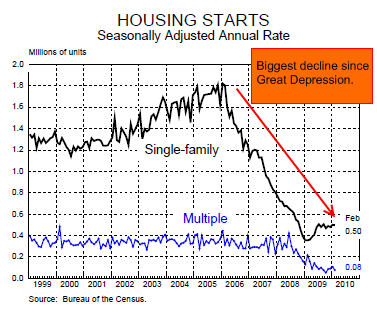

So putting this altogether shows a tepid housing market at best for years to come. In fact, builders know how much inventory is out there:

This decade long bubble reached uncharted levels in California with toxic mortgages, many that still remain and will cause damage for years to come. The bottom is not in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

67 Responses to “Brazilian Style Living in Southern California – MLS Inventory Creeping up, Section 8 Vouchers for Granite Countertops, and California Budget Going Mayan in 2012.”

Alameda, Ca added a parcel tax 6 years ago,to “save the schools” (money went for teacher raises and increased pensions).

An additional parcel tax was added 3 years ago”to solve the school funding problem, once and for all”(money went for teacher raises and pensions).

Houses pay about $600. more a year. Apts. and businesses $3,000 to $9,000 more per year.

Today, they want to add another parcel tax, larger than the two previous parcel taxes put together. It has to be a parcel tax, as school bonds are not allowed to use the money for teacher raises.

If your area is proposing a “temporary” parcel tax, fight it.There is no such thing as a temporary tax.

Teacher unions seem to have no end to greed.

Indeed. The bottom is not in for the U.S economy either. Think time bomb.

@ Bob- This is one of the most overlooked reasons for why owning a home is becoming so risky. I have a feeling that as the budget gets worse, they will come directly after property owners. Parcel taxes always have a good chance to pass since renters typically vote for whatever feel-good measure is proposed, at no direct cost to them.

The real tragedy of the Granite Ghetto is that people who moved there were most likely lured by the promise of a better life. One they could not make living in an area where the lowest common denominator sets the quality of life for everyone else.

~

The notion that carcinogenic growth in sprawl and prices will solve everything misses the boat entirely. The nation has been in a Depression of American character at least since the ’70s (Nixon was an early symptom of the eventual narcissistic breakdown of Boomer culture).

~

This is one thing that the conservatives usually get right, and liberals get wrong. There is a point where individual character–and the quality of family and community–are the most precious wealth a nation or society can have.

~

When everyone becomes a scammer, out to get theirs by any means, sanctified with rationalizations and enabled by politicians, ecclesiasts (religious or marketing), and bankers, the meltdown is generally quick. At least judging from the past 10,000 years of urbanized agricultural civilization. And our own.

~

rose

~

PS–Bob Griswald, nice axe you’ve got there.

Hi

I been checking this blog for last 15 months.Only message I got from your blog is “DO NOT BUY”. There is a pool of people who have good size down payment and stable jobs and those people are absolutley consfused. I have no problem renting but my main concern is sitting on “HARD CASH” might prove more dangerous in coming years. I would like to hear from other people too…. what you are doing with your hard cash.

Thanks

JS, I’m in the same boat and have been slowly accumulating precious metals (mainly physical gold and silver) and keeping it secured but accessible – NOT in a bank vault/safety deposit box. I’ve also been shifting my equities to mostly large domestics and internationals/multinationals, well diversified, that should be able to weather. Also, you can find absolute fire sale prices on antiques, heirlooms, stamps, 45+ year old comics etc. but you really need to know your stuff. I’m just trying to get out of US dollars as much as possible right now as everyone should be, but properties are still vastly overpriced in just about every remotely desirable area. Let the suckers without patience catch the falling knife because the other shoe is dropping…slowly but picking up speed. Good luck!

The main purpose of government seems to be to delay the inevitable. “Not on my watch,” seems to be their motto. The housing market should have hit bottom already, but because of all the tricks the government is coming up with bottom will not be hit for quite a while. The $10,000 tax credit will just delay the eventual drop in prices, and the tax payers will pay for it. And, the people who wind up buying and getting the $10,000 credit will realize that the value of their house will drop the equivalent amount after this tax subsidy is terminated.

JS, my family is in the same situation. last year we moved all cash to FDIC insured banks that we feel were not over leveraged with bad loans, what a pain, interest rates a joke. But we decided that if we found the right house we would work the best deal possible and jump in. We are worried about unfair Tax increases comming, but when our gov. Prints money, the dollar gets weak. Realestate is not perfect as an investment so you should love where you live, but live “Well” within your means. As for timming, we hope the end of summer brings lower prices and more choices. Good Luck all!

Sitting on “hard cash” for a few years is not a bad idea. First of all, you mention a “stable job”. Who has a stable job anymore? Two of my neighbors had stable jobs for 19 years and 28 years, up until the day they were laid off. Neither has had a job for year.

In Oregon, in the early 80’s recession, house prices went down for 10 full years.Those people who sat on cash were able to pick up tremendous bargains from people who were overleveraged. Be patient. No one ever regrets looking back and not having made a bad decision.

(1) Comment by Bob Griswald

March 31st, 2010 at 7:27 am

>

And if they want 2 bedrooms or more, the median price is $489,000

>>

So that means to live in Alameda and buy the median priced house, one needs an income of $158,333 – 163,333.

>>

And one thnk that people with at least a BA and often an MA and a few with PhDs might expect to live a little better than a 1 bedroom, 1 bath condo for the rock bottom $225,000 which takes a $75,000 income.

>>

Yep your brand new teachers need to make $75,000 to afford to live in that town. And a teacher who actually wants a house to raise a family needs that income of over $160,000…

>

Whining residents of commuities with such price seem to have no end to greed and avarice and their desire to return to slavery so highly educated people (the teachers of their kids) can not even live in their town. There’s how to do it – bus in the serfs, let them teach all day and then ship them out at night when you don’t want to pay what it takes to have them be able to live there. God forbid you have to associate with such drecky people who have 1 or more college degrees….

>

(2) Comment by Joe Average

March 31st, 2010 at 8:40 am

>

@ Bob- This is one of the most overlooked reasons for why owning a home is becoming so risky. I have a feeling that as the budget gets worse, they will come directly after property owners. Parcel taxes always have a good chance to pass since renters typically vote for whatever feel-good measure is proposed, at no direct cost to them.

>

__

Uh huh… last time I checked the RENT from a property has to pay the mortgage, insurance, maintenance and TAXES.

>

Raise the TAXES on a rental property and you RAISE the rent.

>

It is EXACTLY the same direct effect upon the occupant of the property no matter whether they rent from an individual/company or from the bank (called a homeowner.) That money comes out of the pocket of those who are living in the properties.

>

And a property tax increase typically hits renters HARDER in most jurisdictions. Raise the property taxes and it applies to commercial, RENTAL and owner-occupied. In most jurisdictions, RENTAL properties are treated like commercial properties and pay nearly DOUBLE the rate of owner-occupied.

>

So raise the property so that it adds $100 per $1000 of value. Most jurisdictions give owner-occupied properties a homestead exemption that cuts the tax in half. So the owner-occupied has an effective tax increase of $50 and the rental property has an effective increase of $100.

>

Anyone who can’t figure out that a property tax increase shows up in what they pay every month, be it rent or a mortgage, is definitely BELOW-average on reasoning skills.

@js: “what you are doing with your hard cash.”

Sitting on it. 🙂 And until I see (real wage, not price) inflation, that’s what I’ll be doing.

Also, I’m not sure the message is “DO NOT BUY”. I think it’s more Do Not Overpay. If you find a place you can afford and want to stay in for a while… do it. If you need to stretch, count on 2 incomes, have no down payment…. don’t.

@js – you shouldn’t buy just because you have cash. You should buy because it makes financial sense. Obviously it would be nice to get a bigger return on your money than the 1.2% savings accounts are paying, but I don’t see how having cash will become dangerous. Can you elaborate?

Up here in Santa Clara County, investors (largely foreigners) are snapping up properties. Our unemployment doesn’t seem too bad but taxpaying population does seem to be leaking away to other states.

Rental prices are about where they were in 1999.

Those teachers are so wealthy! How dare we invest in education!

Sarcasm off. Ever heard of Prop 13? That keeps CA property taxes at an artificially low level. I’d put it another way…. property owners in CA seemingly have no end to their greed.

JS-

Do your homework and invest in companies with a sound business model that you believe will appreciate.

You could also donate some money to build infrastructure in 3rd world countries.

Or, you could buy a house and we can laugh at you as your money disappears.

We have $900k HARD CASH in 2 TBTF Banks earning .5% with $500K/yr income $5000/month rent and in NO hurry to buy again until prices start to make $ense !

@js

I put my hard cash into my land. And if there’s any left, into gold or another tangible (saleable) asset. When inflation hits, and it will, and the dollar goes completely into the dumper, its going to be what you have and what you can do for yourself, that matters. Not what the bankrupt gov’t will offer/take from you.

To be honest, I’d buy, just find a place far enough out that won’t fall as precipitously as some of the closer communities, because they are suburb bound and will be subject to civil insurrections when things really bottom out.

Bob Griswald is right. They are going to attempt to take whatever they can, because they are still in the “tax and spend” mode instead of “reduce and save”.

Ah yes, the summer selling season is rapidly approaching. Just how many Zombie listings will come out of hibernation? The Westside of Los Angeles is chock full and will look worse than a MIchael Jackson Video. Dead house walkin…………

Caveat Emptor! (Buyer Beware)

http://www.westsideremeltdown.blogspot.com

Well the jury is still out if we are facing a Japan size bust. There 20 years later, prices have still not recovered.

That I guess is the million dollar question. Are we looking at the bottom or a prolonged malaise than can last a decade or decades? Job growth is simply not possible-unless we stop free trade and globalization. It was blue collar workers before and now it is everybody. Anything we do, India and China can do it cheaper and better. So what is the outlook?

JS, regarding earlier post… Life is what happens while we Day Dream about what might be. If you have the money and you find a safe area and a house with Good Bones and Location, then grab it. I’ve seen some of the best properties sell to people with more money than brains while I was sure the price just Had to Drop. If you have no rush to move then all the better for you as you can play alittle hard ball before comitting and if you loose the property another one will pop up in time. Also, Remember the folks that want to protect the value of the properties are fighting hard against us, ( along w/ the Banks, Government for taxes, real estate agents…)

@ AnnS- Sorry, you’re going to have to try again to demean my below-average reasoning skills.

–

Your notion that “rent has to pay the mortgage, insurance, maintenance and taxes†is incorrect. How many examples have been shown by the good Doc where the cost to own is wholly different that the cost to rent? Too many to count…we’ve even seen houses on the same street where the cost to own was double the cost to rent.

–

Would this happen one of the costs to own has “exactly the same direct effect upon the occupant of the property?†Of course not. Rental prices are based on supply and demand, just like the price to own. The two may be loosely correlated, but very loosely. This should be obvious after seeing what took place over the past decade.

This is really about unfair taxation, not teacher compensation. But since you brought it up, making $65,000 to $75,000. a year, for less than ten months work, retiring at age 55 with a pension of $33,000 to $40,000 a year (with 3 % annual inflation increases,of course),means that if you live to 85, you will collect well over $1,000,000. in pension checks.

Hardly pauper wages.

And 2 school districts in the Bay area have top teacher salaries of over

$100,000. a year.

@Caboy,

All true, and as DHB pointed out years ago, Japan has great education, trade surplus, crazy high savings rate, defense paid by US, mass transit. If with all that they can’t overcome a giant debt collapse how the heck can we? Americans are still so arrogant thinking we have all these skills and industrial infrastructure because we make iPhones, Starbucks coffee and 3-D movies. The great delusion goes on…until it doesn’t.

@AnnS Always enjoy another perspective.

20 years later for Japan, and prices have not only still not recovered, they are still at 25% of peak value on average (~10% of peak value for land/countryside property up to ~40 to 50% of peak value for prime Tokyo). Their prices on average had only JUST started to move slightly upward in ’06, after a 15+ year drop, when our recession/RE meltdown hit and Japan’s RE once again started sliding slightly/flatlining.

As for China and India, doing it cheaper? Absolutely. But doing it better? LOL, not even close. As the saying goes, “you get what you pay for.” The quality is not there. The ingenuity is not there. Sure, they can cheat, steal, and copy as well as anybody, but the quality of the work is on average CRAP.

Buy Gold and Silver coins. ASAP!

For some web surfing fun go to a county or town online GIS tax assessor database that allows searches by name of owner. Type in Federal, citi, bank, wells, deutsche, or wachovia as the owners name to see how many homes are bank owned. Then compare the ’04-’07 sale price to current listing price (if there is a listing). $100k losses are commonplace. Try it for counties around major cities in in FL, TX, AZ, CA, NV. The addition is staggering. FNMA and FHLMC home path and home steps listings are trying to keep prices inflated by offering 3% down payments. Why would I put 3% down on a house that will still go down in value by 20%?

You should have given the topic of where to safely park your assets BEFORE now. Like WAAAAaayy before now.

The U.S. economy was ALREADY locked in a financial death spiral back in the days of King George W the Turd. In fact the previous Retard-in-Chief is probably the person most responsible for stepping-on the economic accelerator to destruction with all his might; what with his tendencies to invade the wrong countries, bail-out his corporate masters and what not.

But I digress.

Most smart investors already moved into precious metals, commodities and foreign investments by now. That’s what YOU get for watching too much American Idol while the house is burning.

Hey, you people wanted “change you can believe in?”. Well, you can BELIEVE IT now MF’s!!!

would like to hear from other people too…. what you are doing with your hard cash.

js,

Make reading JMineSet and FOFOA part of your daily routine.

Learn the ways of FreeGold. 3-10% is all it takes to protect your wealth. Go beyond and you might make the rules one day.

Ann, just because your costs go up doesn’t mean you can raise your rents. People can only pay what they can pay. Your profit (if there was any) goes down, which means the value of the property goes down. Renters generally do vote for property tax increases in higher numbers than property owners for pretty obvious reasons. If Prop 13 gets repealed for apartment owners, do you think I’m going to be able to raise my rents because my taxes went up? How are my residents going to afford it? I may own the place, but I still qualify to rent a “low and moderate income” apartment myself. But you are right, there is no “free lunch” ultimately. There is, however, a stolen lunch.

I am tired of hearing “foreclosure crisis”. Foreclosure is not a crisis. It is a solution to the liquidity problem of the homeowners and the banks. The government does not need to be so afraid of it. Just let it fall and see what happens.

Like a lot of people here, we are also waiting to buy at a reasonable price. We are sitting on mostly cash and only investing a little bit in equities. We believe the price will come down more. It might take 2-3 years. But it will. My friend that owns a house bought for $146K in 1995 doesn’t want to believe the price will come down more. Her house in West Covina fulled paid for by now is going about $340K (based on the next door house sold last year). She often regrets that in 1995 she did not buy a house in Walnut that has really good schools. At that time, there was a house in Walnut going for $180K. Her agent recommended to her. Now the same house should still hold up to above $500K. There is very little supply and a lot of demand in Walnut school district for houses under $500K.

I’ve taken a look at Hemet too. Wow!

Not surprised to read in the LA Times that the police are being actively attacked by gang members there in booby trap style. The town has a very strong feeling that stopping is not a good idea in a lot of places (and I feel comfortable in South Central).

Frankly anyone investing there should be six foot six with a concealed carry permit and a bad attitude.

Some of these places might turn out to be a good buy but with no jobs and inexperienced landlords there will be some tears.

Dear Dr. Bubble,

Is this article an oversimplification or is this really the new Geithner plan?

http://www.smirkingchimp.com/thread/mike_whitney/27724/timothy_geithner_is_a_sniveling_scamster

I like that picture of Brazil. It’s shameful that they are separating the poor that live in shacks that actually own them and can’t get thrown out. From the rich that owe so much their teeth rattle. Wheres the outcry and hue in all of this. Soon they will be in America. Corri dining off the poor neighborhoods. So when the rich loose their cars and homes. They won’t be able to become garbage pickers in the poorer neighborhoods. America is the greatest nation on the earth. America also owes more money than anyone else on the earth. The former is a statement of national pride. The latter is reality.

For those sitting on solid resources – I’ve read many opinions advising to wait it out. Not only have we not hit bottom, we have no idea really, when it will arrive, and how far down it will go.

As to stable income – that is a huge part of the problem (remember, many in forclosure are not necessarily underwater.)

Japan’s economic history over the past 20 years might be a good indicator – but remember, they still have a manufacturing base, and actually earn trade balances.

It’s just a very volatile time, and may stay that way ’til who knows when?

As long as a home can’t be trusted to be a sound investment, well then, it shouldn’t be.

@ AnnS- You are way off base. The costs to own a place have very little to do with the rent you can charge. As a matter of fact….wait a minute…i think…that’s the reason for this entire website!

The City of Covina, CA, is increasing pensions for public employees by 25%, to get more to retire this year. The drop in payroll will balance the budget, for ONE year, BUT the increase in pensions will continue until the death of the employee AND their spouse. Over the next decade, property taxes will have to increase in order to pay for this long term pay out.

I walked away from a 3/2 in a decent school district in San Jose when I realized that I, a senior engineer in a hot field, couldn’t afford the payments (at 5.25%) and the taxes. If this house, a tad below my station (!) was unaffordable to me, then who else would or could buy it?

As Dr. Bubble keeps saying, it takes income to pay mortgages to buy houses.

I’ll leave the buying to rich Chinese, just like I left buying Pebble Beach and Rockefeller Center to the Japanese.

“Most smart investors already moved into precious metals, commodities and foreign investments by now. That’s what YOU get for watching too much American Idol while the house is burning.”

The ultimate in proverbial self-fulling proficiencies…

Comment by caboy

March 31st, 2010 at 2:39 pm

“… Anything we do, India and China can do it cheaper and better….”

Better, no. Cheaper, for now, yes. As long as China remains the world’s largest slavery-based economy, this will continue to happen. There’s not a whole lot the US can do about this either, unless we are willing to accept somewhat higher prices on the junk we buy from over there. We are clearly not losing our appetite for consumption.

Raise taxes, lower real estate values. It’s a cost that is constant. And as a landlord, I can attest that rental prices are mostly a function of supply and demand rather than costs associated with ownership.

Prop 13 is a very unfair tax as recent buyers pay way more than buyers 10 to 30 years ago, yet recieve the same services, etc…. So as more homes go into transaction, there’ll be less voters to fight the change of this tax law.

Foolio, how do you compare quality of Chinese products? Compare to what? What is that is left from American manufacturing to compare to? The quality of the Chinese products are getting quality etalon for the simple reason of the size of its manufacturing. China is the factory of the world and whatever the produce this is what we consume and no clear alternative. USA is not even second exporter economy in the world. It is Germany (90 million population), first is you know who… Japan is very close to us 4th (population 120 million). What do you compare here? Japanese were making crap (cheap crap) for a while in 70 and gradually improving the quality, so did the Koreans… That is the way it works the ascend of industrial power. As for the unfolding of a descend this is what we don’t know yet…

Whitehall, same here senior EE with wife combined making $140K. I have little hope for the end of this year if prices in South Bay do not show new trend downwards so be it renting, moving to Manhattan Beach – 2bed/2bath starting from $1600/month… Wow, what a bargain when 2/2 condos strart $700K! Discrepancy between price and rent is increasing when moving from crap areas toward beaches. If gov and stupidity of the Chinese investor succeeds to hold the prices they will make the choice rent vs. buy in upper-middle class areas very easy at least for the reasonable people…. California is still ridiculous out of touch with economic reality, but South Bay is beyond and I tried to give one explanation, involving Asian investors, many didn’t like it last time…ha-ha-ha

Thanks all. My lease is coming up in July and I am hoping something will change in next 3-4 months. I think demand in good areas is still very high. I have two kids and my criteria defining “good areas” is bunch of Schools with API score 9 or 10 (Example Cerritos, Walnut etc.). Today the issue is prices are high and there are very few houses on the market. So you have to buy whatever is out there rather than what you like.

Thanks

Question to PD- The state of CA does not disclose the name of a property owner over the internet or phone. CA GC6254.21 makes it illegal. Am I missing another way to find this information in CA?

JS

You are correct about the Walnut /Diamond Bar area. It is difficult to find a presentable home in these areas for less than 500K. It’s amazing that in the north Diamond Bar area where the schools are located in the Pomona school district, foreclosures are quite common. Houses located close to Diamond Bar High (high API) bring quite a premium that are just 3 miles away. (Walnut Valley School District) Evergreen Elementary has an API of 947. Currently, they sell quite fast as long as they are not close to a main street or flag lot, etc. For the most part, the folks buying the house in this area, frequently pay half-down or all-cash. This leaves little room for foreclosures.

In the Cerritos area, it is much of the same. It is nice to drive through the area and see manicured landscaping and garages used for cars instead of expensive junk and toys where cars are sprawled all over the street. I think the credit-crunch crowd will have a tuff time waiting for houses to drop precipitously in these areas.

Comment by Edward Burns

April 1st, 2010 at 8:47 am

The City of Covina, CA, is increasing pensions for public employees by 25%, to get more to retire this year. The drop in payroll will balance the budget, for ONE year, BUT the increase in pensions will continue until the death of the employee AND their spouse. Over the next decade, property taxes will have to increase in order to pay for this long term pay out.>

>

__

>

So NOW you want to renege on your contract? Public employees make less than those in the prviate sector with the same education and degrees. They make LESS because the tradeoff was the pension in the end, (And that was how it was for private employees to about their pensions until jobs went to China.) So for all those years people with an MA or PHD or JD or even MD make less working for the public sector because they wanted to teach or do research or public interest law or public health or whatever and in exhcnage they had the written agreements (be it by contract or statute) that they would get the pensions.

>

And NOW the employers (the public) are whining about making good on what they agreed to pay?? Yep pension obligations go up as the workforce ages and retires. It is the fault of the taxpayers that they whined and moaned and bitched about taxes and wanted more and more and more tax cuts. If they had paid a higher amount all along, the money would have been put into the pensions funds along the way and would be there. But oh no…..god forbid money be paid in to dal with future obligations. And now the bill comes due.

>

And if that means havingt osuck it up and pay it…..well, enough posters on this board rant and rave about how people should honor their contractual obligations. Can’ only pay enough of a bill to squeak by and then scream when the full amount comes due.

>>

And for all those screaming that renters don’t pay a property tax increase through their rent because rent can’t be raised because people can’t pay more, there is a simple answer, The value of the property will fall. Households can only pay so much per month be it rent or mortgage, taxes and insurance. The higher the property tax bill, the lower the mortgage amount and thus the lower the price. (Works the same way higher interest rates force down the purchase price.)

>

Ergo if the rent for a property can not cover the property taxes and the insurance and the price of the property, the PRICE is what must fall. When prices and rents are in equilbrium, the rents reflect the property tax, the insurance, the price (mortgage), maintenance and 10% or so profit. If the rents can’t cover those things, you PAID too much for the property.

>

And that you PAID too much doesn’t have diddly squat to do with whether the renters have to pay the same – and usually more – of the property tax increase. The renters are paying the increased property taxes through their rent- you just committed to an excessive purchase price or mortgage so you (a) lose value in the property or (b) make less money when you can’t raise the rent. No one to blame for overpaying but yourself. When property prices return to a rational level (rent::price ratios and income::price/rent ratios) rents reflect property tax increases.

>

And if you want a certain level of services as does the 1st poster who lead off with the complaints – and teachers who live in the community so they know the kids and families – then property taxes need to go up. (And California’s property taxes are a national joke of irresponsibility when corporations have property taxes frozen for decades..)

@ Joe Average: Property Owners? If you are paying a mortgage you don’t own anything. You are a debt slave.

AnnS,

Be very careful regarding public employee pay vs. the private sector. The public sector isn’t hurting as bad as you claim. Most of these jobs are unionized which leads to another can of worms. Show me a job in the private sector that requires a high school diploma where you can make 6 figures, have bullet proof job security, retire at age 50 with 90% of your pay and get free health care for life. They don’t exist period.

The public employee pensions are a slippery slope. Many of these pensions have went through the roof in the last decade due to several factors. One is thinking boom times would last forever in Ca…and boom times won’t return anytime soon here. Another is that the corrupt government workers unions conspired with corrupt politicians to gift these extremely generous pensions. I don’t think tax payers had much of a say in this…they are unfortunatley on the hook if the pension fund runs short on money. Massive pension reform will have to be done soon because none of these state run pensions are sustainable. The next big leg down in the stock market will make these pension funds implode.

Raising any sort of taxes in Ca is simply not an option. This economy can’t function with the current amount of taxes being levied. We can drive all the businesses out of the state and have nothing left but government workers and illegals. How would that work out…

How dare teachers earn middle class wages! Give me a break!

They provide a greater service to society than any hedge fund manager I’ve ever seen.

About buying gold and the dollar collapsing, to Zimbabwe levels…I don’t think so.

Don’t forget that we have the biggest guns the world has ever seen, and the world know that we are not afraid to use them if we need to. To the wealth in the rest of the world (Asia, India, the Middle East,South America) that is the kind of security that gold just dosn’t buy.

<

My money is still sitting tight in my credit union, and I don't loose sleep at night because the world knows that the USA is to big to fail.

By the way, the problems in Hemet and California can be boiled down to two words, Illegal Aliens.

Pacoima, Van Nuys, Hemet ( filled with illegals, its practically tijuana) = bottom end cheap.

We are not Brazil, Millionaires here do not live next to third world slums, or have hords of illegal aliens for their neighbors. They live in areas far removed and unspoiled by the blight that these third world immigrants cause.

wheresthebeef…AHMEN!

“Show me a job in the private sector that requires a high school diploma where you can make 6 figures, have bullet proof job security, retire at age 50 with 90% of your pay and get free health care for life. They don’t exist period”

You exagerate. What you describe does not exist in the public sector except within public safety jobs(cops and firemen).

The rest of the civil servants can’t retire until age 55(at a reduced amount), generally don’t get more than 50-65% of retirement as salary, and don’t make six figures. For instance, in City of Los Angeles(where I work), a clerk typist starts at around $29K a year. Thats an entry level job requiring no college degree. If the person promotes to Sr Clerk Typist, their pay will reach about $55K after a minimum of 6-7 years. That ignores the effect of furloughs, night work bonus, bilingual bonus, etc. In aggregate, those bonus’ can affect salary by increasing it as much as 15% or reduce it by as much as the city implements furloughs.

If the person is driven, they can promote higher. However, they will usually lose most of the bonus'(different MOU for the supervisors). The highest they can promote through the clerical ranks is to Cheif Clerk, where they will supervise 30-100 employees and their salary is capped out at around $82K a year.

They can promote higher if they promote to Managment Aide in the Management series, but the number of people that make this bridge and then promote into senior management without a degree is minimal.

compass rose… dead on, straight to the point! Bravo…

Joe Ave, Frymann and Obvious…of course you are all correct that the taxes won’t be reflected in what someone will pay for rent. Rent is based on supply and demand. And right now demand is L-O-W…and rents are falling. If taxes go up, landlords can raise their prices, but no one will rent from them…and eventually they will foreclose if they didn’t save their pennies from the BOOM times to cover a few years of losses.

>

And then as the Queen of insults AnneS wrote (while completely contradicting her original point about renters having to pay even more than homeowners if they raise taxes)…a new landlord will buy at a lower price and rent it out at a lower price that will cover the PITI.

>

More $ will go to the state for services, and less money will go to banks, mortgage brokers and real estate agents…all while people will actually pay less for their homes and for their apartments. The credit bubble has finally popped and it isn’t coming back anytime soon.

Greg in LA

Concerning the biggest guns in the world-

The biggest guns in the world didn’t stop terrorists from attacking the USS Cole,

The biggest guns in the world didn’t stop terrorists from destroying US Embassies in Africa

Russia has some pretty big guns too, but they didn’t stop two terrorists from blowing themselves up, along with innocent bystanders, on a Russian train platform.

Putting your faith in the biggest guns in the world isn’t going to give economic protection to the US in spite of what many think.

As they say in real estate…. shadow inventory, shadow inventory, shadow inventory. I can’t even count on all my hands and toes the number of people including myself that I know personally who have not paid the mortgage for well over a year and are still not kicked out of their house. I’m BEGGING the bank to take mine so that the process can finally end and they refuse.

@Greg in LA – your script only works in Hollywood. you have no idea how much US depends on Asia/india. So you can not use your big guns. I am in IT and I know that whole USA (Banks, Airlines, Businesess etc…) depends on Indian IT skills. You pick up phone and call Cisco, Microsoft, Symantec or any Technical company call will route to Asia/India. Remeber USA spent last 10 years buying Hummers, 4500 Sq feet homes, Big screen TVs….. and Asia/India worked hard to earn those skills. So let us face the truth and admit that we made a mistake.

Thnaks

Bundee, good point about the terrorists. But they will always just be pesky fly’s that we can squash like a bug if we really choose to.

Bundee, what I am trying to say is that the industralized world needs us, we protect the flow of oil, we protect uninterupted international trade, and our strength insures that the world dosn’t devolve into another world war.

With out our might, china squashes Asia and India. The Arabs squash Isreal, and the whole world by cutting off the fuel. Africa devolves even further back into the stone age and South America, lets just say that the communist and the drug cartels take that.

Do you really think China, Russia, or the French will protect any of what I just listed?

The world needs the USA to keep order, and They will pay whatever it takes to insure this golden situation continues.

Hey, let’s keep comments related to real estate- real estate taxes, buying, selling local politics that effect real estate, etc., not political blogs about China and Russsia.

Plenty of other places on the internet to discuss that.

Js, I totally agree that the mania of the housing bubble and it’s mind set was and is a grand mistake and failure.

As for our dependence on Indian IT skills and professionals. Well I think that is also a mistake. Especially importing hundreds of thousands of cheap foreign IT workers, to undercut Americans in that field. Then again I also think it is even a bigger mistake to have opened the doors of our Southern border and allow 20 million Mexican and Central American illegal immigrants to come in and undercut the wages of American construction workers, carpenters, and every other type of labor. The illegal labor, h1b visas and a way too permissive legal immigration system is great for businesses to under cut wages, but a disaster for American workers.

Just like the easy money and the artifically low interest rates of the housing bubble, the importation millions and millions of cheap foreign workers to undercut the wages of Americans, as well as off shoring virtually all of our manufacturing capabilities to China is great in the short term but a disaster for America in the long run.

<

American manufacturing capabilities have been out sourced to India and China, American labor has also been insourced to illegal alien labor, But do the industralized powers of the world really want or trust the American millitary might to be out sourced to China, Russia or Brazil?

<

I don't think so.

“The rest of the civil servants can’t retire until age 55(at a reduced amount), generally don’t get more than 50-65% of retirement as salary, and don’t make six figures. For instance, in City of Los Angeles(where I work), a clerk typist starts at around $29K a year. Thats an entry level job requiring no college degree. If the person promotes to Sr Clerk Typist, their pay will reach about $55K after a minimum of 6-7 years. That ignores the effect of furloughs, night work bonus, bilingual bonus, etc. In aggregate, those bonus’ can affect salary by increasing it as much as 15% or reduce it by as much as the city implements furloughs.

If the person is driven, they can promote higher. However, they will usually lose most of the bonus’(different MOU for the supervisors). The highest they can promote through the clerical ranks is to Cheif Clerk, where they will supervise 30-100 employees and their salary is capped out at around $82K a year.”

Johng, do you effing realize how outrageously high $29K for a beginning typist is? Or $55K for a high-school educated senior clerk is, let alone $82K?

NO WHERE in the private sector can a high school grad aspire to these kinds of salaries, unless s/he is one helluva hot salesperson. I am a Compliance Officer of a small brokerage firm, and I was beat out of $52K at American Express for a compliance examiner by a man who had 30 years experience and an MBA. A bank branch manager makes $60K -$80K. Only by agreeing to the brutality and instability of a straight-commission sales job (no unemployment, no security, no base salary, no benefits) can most 4-year college grads in the private sector hope to get past $50K or so. The larger salaries go to people with post-graduate schools, and the top jobs to Ivy League grads. Lawyers are being decimated by the vast oversupply of JDs and many start at $35k a year these days.

Public sector employment pays MUCH more than private sector employment, and allows for much earlier retirement than private sector. Retire at age 55? Get REAL already. Retirement before age 65 is rare, and before age 62 rarer, in the private sector. We have no job security, benefits are disappearing, and the competition for raises and promotions is brutal. And we are the people who pay for the ever-expanding public sector.

And we can pay no more. Here in Chicago, we are being blasted out of our houses for property taxes, which have been doubled here in the city, and are in the stratosphere in the suburbs. What are we getting for it? A steeply undermanned and underfunded police dept. and ever more redundant school buildings and teacher pay hikes, while the private sector work force is being reduced to third world pay and working condition.

Regarding retirements, the only public employees that can retire with 90% are Law Enforcement and Fire. they need to work 30 years to get this. Many Police officers die within 5 years of retirement due to the stresses their Job has had on the body! Yes, that’s correct, feel free to look it up. I’m sure the stats for fireman aren’t much better considering all of the toxic fumes they get exposed to, even with SCBA, just standing outside of a burning building, they are exposed. So they aren’t going to make nearly the amount of money one might think. They put their lives on the line daily and this retirement is the least we could give them. It’s hard enough recruiting quality police officers as it is…….try cutting their retirement and see what kind of applicants and officers you get. You will get a bunch of high school dropouts with criminal records applying. So please, stop the resentment towards public employee’s pensions, there’s nothing stopping you from applying to Protect and Serve.

@Greg – ever been to Venice?

@Johng – it’s funny that cops and firefighters tend to be Republicans. Talk about hypocrisy – supporting a party that cuts the government, while taking a big government paycheck, and getting a really good pension. I’m sure they laugh it up when they are out drinking.

$29k for a clerk typist is good. In the private sector it starts closer to $12 an hour. $55k after 6 years is great. You have to be a secretary/typist/gofer for someone important in the private sector to make that much.

Consider that the going rate for someone doing a more technical or public-facing job in the private sector is around $70k with significant responsibilities.

What happened is that government wages roughly tracked inflation, while many private sector jobs did not. Instead, private sector jobs got globalized, so labor is in competition with international labor, which is paid anywhere from 1/3rd to 1/10th as much, for roughly the same work, and for worker with the same level of education.

On the flipside – the managers in the public sector top out at a pretty low salary, while managers in the private sector earn a lot more if they supervise the same number of people. That’s because the labor force in government is stable and self-managing, in most cases, while the labor force in the private sector is unstable, international, and subject to being fired all the time.

The forces of the private market always impose themselves on the public sector, just later. We’re seeing this conflict playing out today.

Capitalism always innovates, and, this time around, it’s innovated this new system where production moves to where labor is the cheapest. They’ve upended Ricardo’s theory of comparative advantage.

They’ve defined the new bourgeoisie and petit-bourgeoisie: the wealthy, the upper management, politicos, bankers, military contractors, all who make big bonuses, and cops and firefighters and loyal government-worker lackeys.

There’s the old proletarian, too: wage workers, factory workers, “the middle class” who participated in the postwar boom, truck drivers, and the blue and pink collar workers.

And in between, the workers newly proletarianized by globalization: community college intellectuals, technical workers, scientists, accountants, architects, and even small business operators. They are barely able to globalize themselves today… but if they can unify, they will be a force.

These middle people are being stripped of their petit-bourgeois status. They’re being thrown in with the old proletarians, to form a new proletarian force. They’re shut-out, and pissed-off.

That’s why the Tea Party has emerged – the neo-proletarian are still confused, and prone to extreme nationalism and hints of Fascism, even while the moment demand further expansion of international communications between the wage and salary workers of the world.

The front-lines of the radical left are also girding themselves for the coming dark ages, and are starting to make pushes to create alliances with the new proletarians. Maybe, eventually, the old left (once called the New Left) will come around and figure out that the united front is no longer the peasant and the factory worker, but the clerk typist and the barista. (Right now, they’re too busy teaching at university and fretting over their pension to notice.)

@Nevermore,

Great piece. Learned a lot. Most of us get to a certain age and are sure we have it all figured out, so I like it when someone makes me see things in a different way.

I also noticed you used the term ‘Dark Ages’, which I have broached on a few occassions, along with my alter-egos Sabin Figaro, St. Alphonzo, and Obamanation. Don’t use the last anymore because I felt that Fox was trying to distract us from the crony bankers by focuing blame on the government. I want to keep my eye on the ball, even though it is so easy to find fault with the gov.

I think the dam might hold another year, but what I’ve read about the debt rollovers in 2012 makes me conclude that we’re sliding into the abyss of the next Dark Ages in 2013 at the latest.

I, however, hope that I’m dead wrong and that somehow all the impossible exponenetial curves find some new aritmetic algorithm and US is back on course to becoming a great and solvent nation. I haven’t had anyone suggest a scenario where this happens but, I couldn’t have imagined how things could have ever gone this wrong either.

There sure are a bunch of public sector whiners here and a bunch of misinformation. On average, the public sector makes much more than the private sector. Look it up for yourself.

The life expectancy of safety workers is almost exactly the same as non safety workers (per Calpers)…so lasting only 5 yrs after retirement is BS. The safety workers are appreciated, but over compensated. Ask any of them and they will probably agree that their retirement package is too generous. I’m sick and tired of that argument…don’t complain you can join them. I do not want to be a cop for numerous reasons. There is no shortage of qualified applicants for safety workers. It’s not uncommon to have 1000 applicants for an open firefigher position…why do you think that is? Because it’s a gravy train job. Sure the guys risk theirs every once in a while, but that doesn’t justify the insane benefits package. Our soldiers in Iraq and Afghanistan have a much more dangerous job and aren’t getting compensated anything close to the unionized fire fighters. Don’t forget the prison guards also…another tough union to crack.

The bottom line is that public sector is expanding at an alarming rate and their benefits packages eclipse anything in the private sector. This is a two tier system, plain and simple.

Here is just one example of those poor underpaid public sector jobs.

–

The city of San Jose’s employee pension plan:

Each employee puts in $3 and the taxpayer puts $8 into the retirement fund. On top of the over 200 percent match, the city guarantees an 8 percent net rate of return, which requires a gross 9 percent to cover expenses. (Average return over the last 10 years is 4.4 percent). Should the portfolio not meet the required return, taxpayers cover the difference.

Leave a Reply