Beverly Hills short sale selling for $2.15 million and below the $3.3 million in loans. Beverly Hills has 3 foreclosures listed on the MLS but 107 are currently active.

Banks are getting more serious about pricing short sales and this falls in line with the trend of moving more shadow inventory. We already know that investors are gobbling up low end homes all over the state typically purchasing with all cash. However the higher end of the market has seen slower home sales volume but that seems to be slowly changing. Only a few months ago you would see short sales on the market and they were absolutely a joke. In many cases the short sale was only a few dollars below the actual loan balance making it seem like another delaying tactic by banks. We already know that banks are pricing homes at the low end for movement. Condos that once sold for $300,000 in Arizona are now selling for five figures. Inland Empire homes once selling at $400,000 are now in the $100,000 price range. Today we see a serious move in Beverly Hills.

Beverly Hills short sale market

It is odd to see a short sale for a multi-million dollar home. But that is what we have today. This home was listed on the MLS back on 3/14/2011 so it is fresh. Let us take a look at it:

1341 N BEVERLY DR, Beverly Hills, CA 90210

Listed   03/14/11

Beds     4

Full Baths            7

Partial Baths      0

Property Type  SFR

Sq. Ft.  3,678

$/Sq. Ft.              $585

Lot Size 7,160 Sq. Ft.

Year Built            2005

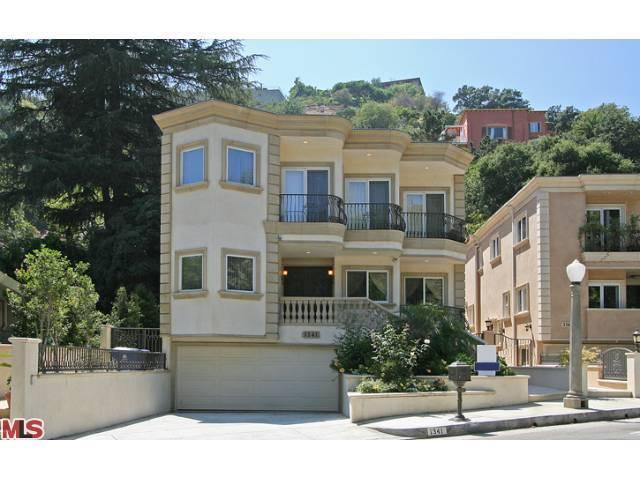

This is a nice home. From the side angle this is what you would expect when you shell out a million dollars in California:

Even at this high end of the market you have to make your housing payments. This home is now listed as a short sale but is also scheduled for auction. Let us look at the note history here first:

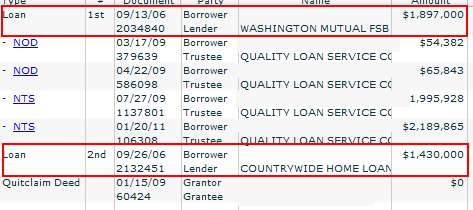

Good old Washington Mutual and Countrywide Financial. Two of the most notorious banking geniuses here in California. The first notice of default was filed back in March of 2009. So this home has been in limbo for some time now. Nothing shocking with the home equity withdrawal machine here. These people knew trouble early on since we can see this in the listing history:

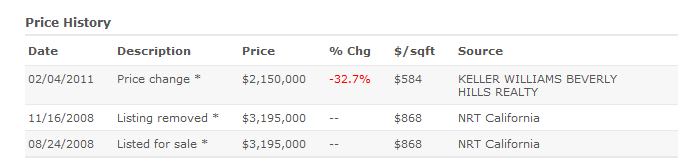

Back in August of 2008 the home was listed for sale at $3,195,000. This was almost enough to cover both mortgages:

1st ($1,897,000) + 2nd ($1,430,000) = $3,327,000

Of course the home did not sell even with these nice amenities:

The home is currently listed for sale for $2,150,000 which sure is a far cry from the $3,195,000 of 2008. The current list price will still kick some money to the second mortgage holder but not much. It’ll be interesting to see what action results from this Beverly Hills short sale. The auction is scheduled for April 25, 2011 so it is likely the lenders are trying to sell and get a bit higher price than taking on a giant foreclosure onto their balance sheet.

Beverly Hills currently has 107 homes in the foreclosure process yet only 3 show up on the MLS. This home is listed as a short sale on the MLS and not a foreclosure. Whatever the case may be, banks are now fully admitting the nonsense of the housing bubble otherwise they would be asking for the entire note balance back especially in prime locations with prime homes. That is obviously not the case.

Even at this price, a person will need to be able to carry an $11,000 to $13,000 housing payment per month so the pool of potential buyers is limited. Beverly Hills is showing that even the 90210 is not immune to the housing correction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Beverly Hills short sale selling for $2.15 million and below the $3.3 million in loans. Beverly Hills has 3 foreclosures listed on the MLS but 107 are currently active.”

Ugly house with tasteless, ostentatious interior. There’s no relationship between the exterior, that makes the house look like a cheap apartment building, and the overstated interior, which would be tasteless no matter what the style of the place in any case.

Yeah, I don’t mind to own couple of this kind

Architecturally HIDEOUS! I’m guessing the style is called “Quasi Comic Book”? The railings, both iron and concrete, are a very bad joke.

“Welcome to my fabulous singe-family mansion… crafted to look like 4 narrow mid-to-low-priced condos”. Just replace the planter box with another garage, file the paperwork, and you’re there, lol.

Bottom line: this “house” is Duh Bubble in a microcosm, and was destined to be a trainwreck the day the plans were approved. DAY-um, I thought City of BH had STANDARDS n’ stuff, oui/non?

Yet Another example of the “HIGH-larious” phenomenon, as seen in CA, AZ, NV, and here in FL. ;p

Oh now now Laura, it’s just your typical tasteless Beverly Hills “Persian Palace” McMansion…they all think it’s high end, fine taste, and high society…meanwhile we’re all laughing our arses off at them as they pay through the nose for the lots with 50-100 year old tear downs on small lots.

I don’t know which ones are more ridiculous – the ones the Armenians put up in Glendale and Burbank, or the ones the Persians put up in Beverly Hills and the Valley…

Absolutely agree. You sound like someone who has spent some time in architorture… 🙂

You think that one’s tacky and absurdly overpriced, take a look at this eyesore. A tiny shoebox that has been Persian Palace-ized into this…thing:

http://losangeles.craigslist.org/wst/reb/2278987257.html

Love the columns on a ONE STORY HOME. And the mismatched, hodgepodge architectural features like the exposed brick/stone cornering. Can you say, CHEE-to-the-Z cheesy? And be sure and look at the interior shots. LOVE the INTERIOR column, was that a leftover from the outside? And the glass/cheesy marble fireplace. And can’t forget the bar with the expensive brandy and cognac bottles…the owner probably bought the bottles empty from an upscale bar or off craigslist, then filled them with $20 cognac.

Because of a story I saw recently on TeeVee about a high end house sale I have to ask; Is it air conditioned? …There are actually people out there trying to sell million dollar houses with NO air conditioning. Sadly, I couldn’t pay the property taxes on this place though.

They can only stall for so long. The cracks are forming in the dam–don’t know if they open the floodgates or wait for the whole dam thing to collapse. There really is no happy ending here. And people are still asking if this is the bottom…this is the cliff…the coyote with the Acme anvil about to fall on his head is the bottom.

@DarkAges–

seriously, you are not contributing to the discussion. Would you care to join the discussion, or just cheerlead as CA wallows through this mess.

Another great article, Doctor!

All things being relative…for Beverly Hills, it looks like the banks are still honing in on the “sub-par” homes.

Betcha it’s not one of the better foreclosures.

This house : gorgeous on the inside + fugly on the outside = psychotic architect.

Should be discounted another million for being sooo ugly!

With 7 full bathrooms, you’d never have to walk far to take a leak! Maybe the architect had bladder issues (or worse!).

I’m sure that a bankruptcy filing is just around the corner for these fine folks… right?

Your data is incorrect.

“Beverly Hills currently has 107 homes in the foreclosure process yet only 3 show up on the MLS”

When I search 90210 for homes in foreclosure on Redfin, it shows 13 homes in foreclosure and 2 Condos.

Also, I have noticed homes for sale in my area 90277 that show as a normal listing, but are in some stage of default (short sale, foreclosure). I think if you look through every listing on the MLS that show as normal sales, you will find that they are not.

That house is in the POST OFFICE and NOT in the CITY of Beverly Hills. I’m glad to see prices coming down and I can’t wait for prices to drop further in the CITY of Beverly Hills, as I would love to pick up some income property to add to my portfolio.

Hideous house. Vulgar interiors.

Hideous response. Vulgar attitude.

These types of mini-monstrosities are all over Beverly Hills, and often in small lot neighborhoods where they build out the lot as much as possible. U-G-L-Y you ain’t got no alibi, except for bad taste. Your honor I did it because of bad taste!

I would wager it’s most likely well-built (and yes with AC), but don’t blame the architect- blame the clients.

It needs an elevator. I can’t imagine climbing up and down those steps over and over day after day…..no matter the zip code.

I can’t imagine not being able to imagine that.

What a coincidence – I actually know the owner of this house (but not well). He’s an architect and this was his masterpiece. I believe it’s owner-occupied, while he built a couple other homes around town that are quite nice that are rentals. I remember him showing me the plans to this home 2 years ago – he was very proud of it.

While I don’t feel bad about anyone losing their home these days because they were grossly overextended, I honestly do feel bad about this particular situation (which is a rarity for me), as the owner of this house put his heart into it. I walked through (and almost rented) another one of his homes and the materials and workmanship was honestly very impressive. It might not be everyone’s taste but it is very well done.

Anyhow, crazy coincidence that I know this particular home. I hope the owner is able to find a buyer for the short sale, as that would definitely be a better outcome for him vs foreclosure.

Good luck to everyone,

Investor J

Oops I better take back what I said! ie lumping in the architect with some other bad taste around Beverly Hills. Based on what J says if I had the $ and liked the place I would wager this is a great buy. Architect designed and owned? I guarantee anyone- this one is built like a fortress.

This is not the City of Beverly Hills but is located just outside in what we call BHPO or “the post office’. No Beverly Hills schools or BHPD, this is The City of LA and called the post office because mail goes to 90210 and delivered by the same carrier, he doesn’t stop halfway up the canyon (Federal worker) just because the city changed. So all this area outside The City of Beverly Hills which still has a Beverly Hills zip code is worth way less than actual City of BH properties.

This one is a typical BHPO spec house, heavy on the marble and granite, light on taste and landscaping(buyers for this one usually come from warmer climates and do not have green thumbs) and still crazy overpriced at over 2 million.

There are a few of these coming on the market but the real question-remember this one already has a F/C sale date- is what happens to the market when 2 of these a week come on? 10 a month? There are close to 200 homes in 90210 scheduled for auction but postponed monthly in some cases for years. Why?

In the case of the subject above they only listed it recently as a short sale because the bank finally scheduled the house for F/C sale on the courthouse steps, the real question is how many months have they lived there for free? Have they paid their property taxes or are they living for utilities only, sweet deal. Occupants must be a real class act.

OK, being outside City of BH would eh-splain the lack of archi-standards. I’m guessing the architect-owner does most of his work designing latter-day shopping centers, mostly in Las Vegas, and had LOTS of the glue-on, stucco-over STYROFOAM exterior “features” left over from that venture, LOL.

I doubt this place will pull $2M, unless, of course, the lack of standards includes being able to sub-divide into 2+ condos. BHPO is the anvil at the end of the rope, which will eventually pull BevHills proper over the cliff too. Patience, grasshoppa!

If I had $2 million to spend on a house, there is no way I would buy one that’s five feet from other houses. You gotta be crazy.

Paula: Not to worry on this house you can still buy it as code has it at 8′ minimum from house to house. Please invite us to the house warming party. 😉

That funny washington mutual is out of business and still forecloseing.

Can you say FRAUD

This is happening EVERYWHERE.

What do you call an asset market where the price-setting rules of SUPPLY & DEMAND are completely THWARTED thanks to the fact that 99.9% of the assets for sale are HIDDEN from view in order to artificially boost the value of the remaining .1% that is shown as being available for sale?

A F@CKING FRAUD!!! THAT’S what it’s called.

No wonder the U.S. is falling apart at the seams faster than a cheap ladies summer dress under a torrential rain storm.

Yes, US of Fraud – it’s all a giant fraud, scam, deception, con game, deception, Ponzi scheme, hoax. It’s absolutely sickening.

They’re schemers….

http://www.youtube.com/watch?v=Q9ElPLO9jZw&feature=related

Please don’t compare the state of the U.S. to such an appealing image. No sexism intended as I’m sure the ladies would prefer an image more on Nike warm up shorts and a six pack.

It is so deep you can only see the surface and that is bad enough. Manhattan spends all of their efforts from advertiser on Madison Av to investment gang-bankers all the way up to the UN. They eliminated direct slavery, but it is the nature of man to exploit the masses for their own good–what about all the televangel-millionaires? Just accept what you cannot change, for we are not an advancing species but a degenerating evolutionary cul-de-sac. We have gone so far down the wrong road we can’t even see the right road.

I heard Buffet on the radio blabbing about the American economic model–debt and bullets are the American economic model. We consume 1000 times what we produce. Might as well stay the course of voodoo economics, cuz there’s no going back.

But Paula……..It’s…It’s… It’s in BEVERLY HILLS! Just think – you could be 5 feet away from Paris Hilton or Brad Pitt. But seriously, yes Paula, a person would have to be crazy to blow 2 million on such a place.

Investor J…. yeah, quite a coincidence that you know the owner. It’s quite a shock to see people loaded with dough losing their homes. Makes you think that maybe much of this econcomy was just an illusion! Oh, and by the way, the INSIDE of the house is very beautiful. Too bad it weren’t located in a nicer location (not kissing the neighbor’s place) and didn’t have a more appealing exterior.

While I agree the property is overpriced, I find it amusing that people are slamming the style of this house. It is built and decorated to appeal to a very specific (and lucrative) sub-market within LA. I hesitate to call it this (cuz I don’t wish to offend) but his house is intentionally built to be a “Persian Palace”

Winner-winner, lamb dinner!!

Looks to me to be rather brownstonish. Like the brownstones in Brooklyn NY.

Usually when I see places like this it leads me to think that the designer/owner came from NYC.

~Misstrial

Oh, right… I fur-got… once your net worth (on paper) exceeds $2M, you’re no longer an Iranian, you’re “Persian”… LOL.

Seriously though, it’s no worse than what the East (Hindu) Indians put up on the Intracoastal Waterway here in FL when they “make it beeg in Ah-meri-kah!” I applaud their success (usually legit), but still scoff at their tastes.

Heh, the funniest thing is, these “Persians” are often too ashamed to even acknowledge being that, which they used to use because they were too ashamed/embarassed to be called Iranians. Now, they go around saying they are Italian. The Armenians and various Arabs pretend to be Greek, and the Israelis, oy don’t get me started on them. They pretend to be human. I forgot to mention the Israelis previously, as they are also responsible for various McMansion eyesores in LA, usually in the Valley all the way through to Topanga, Malibu, Beverly Hills, and Brentwood/SaMo/Palisades.

Also, they’re not called East (Hindu) Indians, please. The politically correct term is dot Indians or call center Indians. As opposed to casino Indians or fire water Indiansl.

Yes, this owner will lose money and everyone on this site will say hurrah! The whole housing bubble was created by wallstreet greed. Wallstreet swept in with their housing products and took their profits and left the wreckage for the average tax payer, who cannot recover like the big guys. We cheer when the big guys fall, but when the big guys fall and can’t get up, that’s when the rest of us are really screwed. This was a carpool question asked by some 13 year olds. Why don’t more people buy cars with high gas mileage or hybrids. I said because resources are still plentiful for people our age and most people are not thinking beyond their own daily situation, as long as there is enough gas for them, they are not too concerned about what happens to gas for future generations. Market pressures force change. They both replied oh no that is so mean! They thought it was so mean that we were wasting gas because we can. It made me think. Most everyone in this past housing bubble bought because they could even though it was not sustainable. Most people remember when banks scrutinized every loan and buying a house was a big deal till the mid 2000’s when anyone could get a loan. Banks gave their stamp of approval on loans that were nothing but junk. We still in our minds thought that the banks stamp of approval meant something when really they were selling us out. Don’t get tempted with these new lows, it’s hard to believe they are going to get lower.

This link to Mish describes what a crock the major outlets are feeding the public about the current state of our economy, and the severe challenges we face ahead. We have never seen a time like this in the current generation. There is no big boom (bubble) on the horizon to blow us out of this one. I think Shiller has it exactly right with a 20% drop in housing. The 450,000 fixer in Burbank will be selling at 300,000 by 2013. This economy is in serious trouble folks!

http://globaleconomicanalysis.blogspot.com/2011/03/us-petroleum-usage-new-home-sales-jobs.html

Am I the only one here who watches Million Dollar Listing? Three idiots making way more money selling houses than they deserve. Even in this market, they all seem to thrive. Last night a guy came down three million dollars to sell his house in Malibu, from 14 to 11.8 million. Another listing is a half-built home in B.H. that the owner is trying to sell. Interesting to watch these pipsqueaks wheel and deal in these troubled times.

I used to watch Million Dollar Listing. I got tired of watching little boys making out.

I watched one episode, and it stretched my credulity beyond the breaking point.

Even with the fruity, flaky makeup of So-Cal, I just couldn’t swallow that sellers with 7- and even 8-figure RE assets would trust these know-nothing pipsqueak punks to handle their business. Also, they did not make clear exactly what time period this faux-reality episode was taking place in, making it impossible to verify the pricing action portrayed.

HGTV is only loosely based on reality, but BRAVO is completely detached from said reality, with a heavy layer of gay-kitsch piled on top. Of zero use, even as entertainment.

I did a quick search of “Mediterranean Style Homes” and some of the links that came up are below.

So it’s official. This guy’s house is “plain Jane” homely. Ugly? Maybe. He probably made it halfway through architectural school. He finished the “interior design” portion, got severly ill, and dropped out before the “exterior design” semester.

Either that, or he used up all of his confetti bank “money” on the interior, and said “Oops, I only have $10,000 left, time to do the exterior.”

http://www.omahku.net/wp-content/uploads/2010/03/luxury-and-magnificent-mediterranean-house-plans.jpg

http://topdesigninterior.com/wp-content/uploads/2011/02/Luxurious-Modern-Home-Design-Mediterranean-Style-Houses-Villa-Mediterranean.jpg

http://www.amazingplans.com/images/landing/AR6835-0501.jpg

http://www.ventasalud.com/wp-content/uploads/2010/03/mediterranean-house-style-montecito.jpg

http://www.eplans.com/content-images/common/plans/images/LCA0/LCA352/LCA352-FR-PH-CO-MD.JPG

http://evstudio.info/wp-content/uploads/2009/09/med2.jpg

http://dailyhousedesign.com/wp-content/uploads/2009/08/Mediterranean-1.jpg

http://www.beckyonline.com/prop/BelmontHeightsEstates/23524BelmontCircle/front.jpg

Just say NO to Faux! 😀

This ‘Beverly Hills’ article was posted on 3/22/11. The very next day a news story came out that said that new home sales had plunged to 250,000 (annual rate), down 17% from January’s low rate, to the lowest level in 4 decades.

This is type of news item that indicates that a bottom is starting to form. First they must quit building new homes, then work through the inventory, shadow and otherwise, then prices can start to move back up. Home prices should bottom within a year or so, I figure.

the fact that houses are not selling does not mean we are nearing the bottom. it means that asking prices are not reasonable. prices have much further to fall before we hit the bottom. after hitting bottom i believe prices will be stagnant for years.

Question about “shadow inventory”? I looked on realtytrac and noticed that there were tons of bank-owned houses in my area that were not listed in the MLS. These are houses that have already been foreclosed on and just driving by, I notice that about half of them are empty and the other half appear to have people living there (e.g. renters?) Is this what DHB means by shadow inventory? What are the banks waiting for? Some of these have been REO since early 2009.

YES, that’s EXACTLY what he’s talking about, yet even that is not the ENTIRE shadow inventory. i.e. there’s additional homes even “deeper in the shadows”, that is, homeowners who are 90+ days delinquent, but against whom no official (recorded) action (NOD, Lis Pendens, etc., depending on State) has yet been taken… another aspect of “extend and pretend”… very hard to nail down.

Then of course there’s some properties so choice/juicy, that the banksters and their favorite play-along brokers just keep them for themselves–zero listing action… say it ain’t so.

Oh, wait… I think I just answered part of the “deeper shadows” mystery! Banks have NEVER (since the late 1920s) had as much latitude–i.e. PERMISSION TO LIE–as they do right now.

Imagine a bankSter lets his play-along RE Broker buddy “buy” a choice prop, for little down, instead of letting it go to auction, THEN allows Broker-bud to NOT pay on the (off the books?) mortgage until some years later, “when things improve”? Broker-bud has very low carrying costs (mostly taxes), and BankSter is doing his job moving the shells around in the great shell game–getting rid of toxic assets, moving inventory, etc… say it ain’t so! ;p

Jason Emery – here is the bottom that is starting to form (in housing):

http://3.bp.blogspot.com/_PnGDRmMobXI/TPq1NCyenBI/AAAAAAAAAqg/wJhxikd7E0g/s1600/caves-sinkhole-1152.jpg

or try this one –

http://www.co.winkler.tx.us/images/sinkhole7.jpg

Sorry sucka, there ain’t no bottom forming. Not anytime soon. Not in 2011. Sorry.

Mr. yeah sure,

There are competing forces. As Dr. housing points out, the lack of good jobs is putting downward pressure on housing prices, and the massive foreclosure inventory isn’t helping. So I expect house prices to decline for another year or so, as I posted.

On the other hand, perhaps you have noticed that everything else that isn’t housing is going way up in price. This is due to the hyperinflation of the money supply. Eventually the hyper inflationary forces will win out, salaries will start to rise and housing prices will follow.

The wild card is interest rates. My guess is that the federal government will subsidize mortgage interest rates in some way, but I’m just guessing.

It is scary to think what a gallon of gasoline will cost at that point. College enrollment will decline, as tuition continues to increase.

On a different note (different area), what do you guys think of purchasing investment properties in AZ?

I think on the low to mid tier has essentially bottomed and will remain there for quite a while.

I have been looking into purchasing 2 or 3 properties cash out there in the 30-45k range, pulling in approx. 900-1200/mo in rent.

Phoenix and surrounding areas. Tenants/lease agreement already in place.

Thoughts? Opinions?

Personally, I think you’re trying to solve the wrong problem.

“Tenants/lease agreement already in place”

Yup. There’s tenants…and a lease. Too bad the tenants probably aren’t paying rent and the owner (aka BANK) would rather sell the place and let YOU be the one to evict them than get all that (cough cough) sweet, sweet cashflow.

Well these properties are actually approved by the county for Section 8. So they subsidize the majority of rent for the tenant. Essentially, the county sends a check directly to the owner the 1st of every month.

Just trying to get others opinions on this type of investment, as I dont see being able to put money into anything else these days (outside of PM’s).

I figure it would be wiser to use 100k as a cash flow instrument instead of waiting for 2-4 yrs to put down on a house here in CA once prices are within reasonable range.

Not trying to divert/hijack this thread, just value readers opinions on here. Been lurking for awhile. Thanks

Section 8 can indeed be profitable, but it can also be a minefield for newbies. Never done it (yet), but know a prop. mgr. who does. It goes without saying these are NOT desirable tenants (generally), and your “wear and TEAR” costs (even if covered by .gov) have to documented to the Nth degree… that’s a cost too.

But yeah, if the numbers you’re throwing around are even in the ballpark, the GRM is VERY juicy.

You could get some free education by approaching a mgt. firm experienced in Sec 8 props, and tell them you plan on buying certain props, and you’d like their firm to manage them. Pick their brains. It’s not dishonest–you may well decide you DO want them between you and the dubious tenants.

Everything’s negotiable, including the first mgt. fee % they toss out… and if it’s NOT, thank them and move on.

Socaldan–I don’t have any direct experience, but I can tell you with near certainty that those type of tenants put a lot of wear and tear on the place. If you are a handyman type of person, that might mitigate the risk.

It sounds like you have done a lot of homework. How long does the typical Sec. 8 renter stay in the typical rental? That is probably the deal breaker/maker in this situation. That and the present Sec. 8 occupancy rate in your area.

Also, I’d contact your Congressman and ask him/her where HUD funds stand in the current (and future) budget debate(s). The Federal Govt. needs to trim a huge amount of spending in the next year or three, and HUD would be a logical candidate for elimination, I would think. The folks in Sec. 8 housing don’t vote, I’m guessing.

Jason,

You make a good point in that, what happens if municipalities go BK? Or even the state? I think AZ is in better shape than CA, however that is not saying much.

Definitely a concern as I look into purchasing property with this program.

Leave a Reply