The plague of all-cash buyers: Massive market distortions being created by easy money policy. 42 percent of recent purchases recorded no conventional mortgage.

A plague on both of your houses. Unless of course, you are buying a few extra homes as investments and then the market is conveniently setup for you. The Fed has created a housing market dominated by a herd of investors. There is no hyperbole in this statement when the latest report shows that for the latest month of home sales, 42 percent of sales went to “all-cash†buyers. Keep in mind this data reflects sales where no loan is recorded at the sales date thus eliminating most traditional home buyers. The all-cash segment of buyers has typically been a tiny portion of the overall sales pool. The fact that so many sales are occurring off the typical radar suggests that the Fed’s easy money eco-system has created a ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields in every nook and cranny of the economy. This helps to explain why we have such a twisted system where homeownership is declining yet prices are soaring. What do we expect when nearly half of sales are going to investors? The all-cash locusts flood is still ravaging the housing market.

A peak in all-cash buying

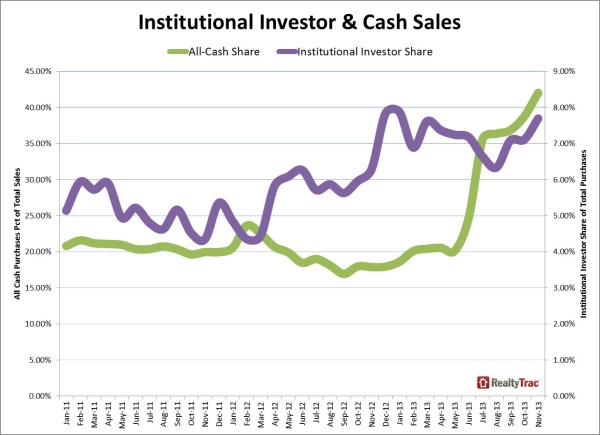

Reports vary in the amount of investors buying. Yet the difference ranges from “a lot†to a “ton†of investor activity. The latest data from RealtyTrac shows 42 percent of November sales coming from all-cash buyers, a new record via this dataset:

Source:Â RealtyTrac

According to RealtyTrac an all-cash purchase is labeled as:

“All-cash purchases: sales where no loan is recorded at the time of sale and where RealtyTrac has coverage of loan data.â€

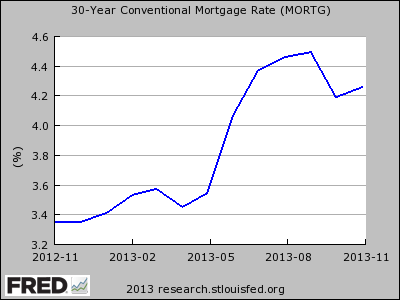

According to this, all-cash purchases went bananas once rates spiked in the summer. Or more to the point, they were the only group not living on a razor’s edge when the interest rate on 30-year fixed rate mortgages soared. Examine the chart above closely. Starting in May, all-cash purchases went from 20 percent to the latest figure of 42 percent. From 2011 all the way to the end of spring 2013 all-cash sales accounted for roughly 20 percent of all sales (a very high amount to begin with). This figure went through the roof with the 100 basis point increase in interest rates:

There is no coincidence that the share of investor buying shot up through the roof once rates went up. Your typical American household is financially strapped to the max and is once again living in a world of easy debt. Once rates went up (still at historically cheap levels) the number of people buying with mortgages fell through the floor. This is reflected with the collapse of mortgage apps hitting a 13 year low:

Source:Â Bloomberg, ZeroHedge

The problem with all-cash buying dominating the market

The cash segment of the market is fickle and we started seeing a pullback in California as the year ended.

“(MarketWatch) While cash buys help explain the surge in home sales over the past year, some experts say it’s an unsustainable trend — and one that should be greeted with caution. “The rise in cash sales is not a good long-term trend for the housing market,†Blomquist says. Although RealtyTrac doesn’t identify who has cash-in-hand, experts say wealthy Americans and downsizing retirees account for some of these all-cash deals. Investors who are keen to make a profit by buying low and renting those properties — or flipping them — also drive up the number of all-cash deals, he says. None of these three groups — flippers, retirees and the wealthy — are big enough to sustain the market in the long run, he says. If it remains dominant in the long run, cash buying “will have a chilling effect on home sales and prices,†Blomquist says.â€

This helps to explain the odd non-market like behavior of falling inventory and booming prices. Typically, when prices rise you would expect to see some subsequent rise in supply (i.e., building, people selling, etc). The recent rise in building permits has been largely driven by multi-family units reflecting a growing renting population. This is the multi-year consequence of the Fed’s favoritism to the banking sector combined with the banking sectors manipulation of inventory and accounting standards. Those in the know are not out building in mass because they read the same reports regarding household wealth and income. They are looking at the impact of a modest 100 basis point increase and how it put the brakes on the housing market. There is now talk of tapering as the Fed’s balance sheet becomes comically massive at over $4 trillion.

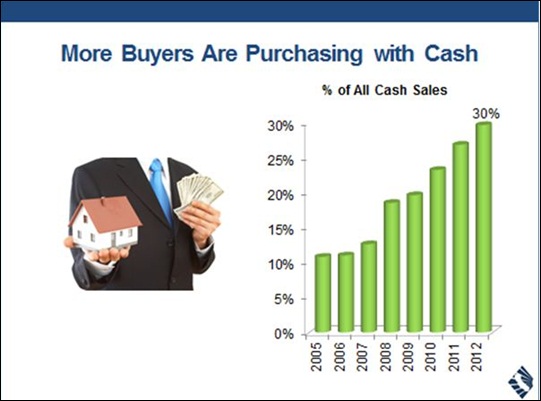

In California, the all-cash segment has also been enormous:

This California data doesn’t include this year which is the record year. The highest percentage of all-cash buying for SoCal occurred earlier in the year at 36 percent of all sales. In more “normal years†this figure should be around 10 percent. Prices even in hot SoCal have stalled out since June. Again, investors are a fickle group. There is no “setting roots†or “cheering for the community here†but a calculated and cold decision to make a quick buck on an easy interest rate environment. The problem with this eco-system created by the Fed is that it is favoring big money to essentially gobble up properties on the cheap over the last few years while the public is once again late to the table.

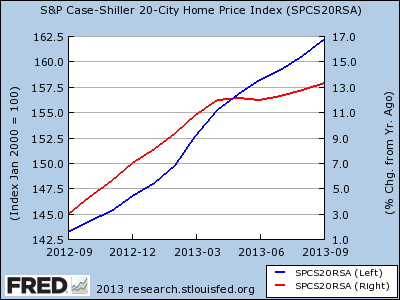

It is fascinating to see people root for higher prices while incomes are stagnant. It goes to show that people are still addicted to debt and leverage even after the deepest recession since the Great Depression. Over the last year, the Case Shiller registered a 13 percent increase nationwide:

In California home prices are up 23 percent year-over-year. What this means is that a typical home went up $69,000 (more than the median household income of a family living in California). At the same time, per capita income went up 1.5 percent (or $930 for each worker). Many years ago I wrote that there is little need to work when your home is appreciating more than the annual income of a family working in the state. Just sit back and cash in on the equity. There is one caveat however. You need to sell. In California, you have baby boomers hunkering down in their wood floor, granite countertop, and recessed lighting glorious sarcophaguses. I’ve started hearing some people quoting “summer prices†as if this was the true value of their property.

Easy money is coming from those chasing yields in this distorted Fed economy. Greed still looks the same even though we have different players at hand. It is likely that 2014 is the year we see a slow retreat from investors and get a taste of how well this market can stand on its own two feet.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The plague of all-cash buyers: Massive market distortions being created by easy money policy. 42 percent of recent purchases recorded no conventional mortgage.”

42% is an astonishing figure. And still we hear TV pundits say the housing market is “booming” again. I’m set up to start looking with pre-approval in the late spring because I can’t put it off any longer, and I’d sure like it if the prices went back down 20%.

Forget it, prices will not retreat 20%, there are plenty of buyers who realize rates will go up in mid 2014 . This spring the pent up demand will take off again., remember when the folks told you the stock market will collaspe if it hits 14k, now it is over 16k and lots of people made big money.

These people use that money to buy cars and houses, look at what is happening before your eyes, don’t sit at your computer and let someone tell you the sky is always falling because it isn’t? Some days are cloudy other days are sunny, get excited about a sunny day, there are always opportunities in a capitalist society.

You meant to say a centrally planned “capitalist” society, right?

“This spring the pent up demand will take off again†This will only be the case if you are talking about investor speculative demand because the double shifts at Mickey D’s isn’t going to cover the new all time high bubble prices.

Most do not sell into a bull market they usually buy. So these cars and houses are financed based on perceived\paper wealth. What happens when there is a downturn? See dot com bust on back of box for answer key…

“…there are always opportunities in a capitalist society…†this is true but historically the greater fool eventually loses everything. I think we all agree the game is rigged…

And last but not least, why buy an asset like a house to maybe squeeze a 3% return if interest rates are rising which means you can eventually get a bond with a more definite 3% return?

Most unfortunate that i must agree with you Robert, as a buyer with over 40 years experience i see things pretty much the same. I must raise my hand and say i missed the bottom. This is not to say there are not some good buys out there, it’s just that they aren’t so easy to come by.

Is it possible to see have a reversal in prices, well no one can say that can’t happen. But i will say this as a builder, you can’t keep selling houses cheaper than you can build them, and here in southern California i saw a lot of this.

Robert, the S&P500 average earnings are up something like 5% over the past 2 year period, while the average PE is up about 45% or so during the same period. What does that tell you? Risk assets are not trading on fundamentals, they are trading on liquidity and yield reach. If risk assets were trading on fundamentals, the average PE ratio would be up 5% over 2 years, not 45%. Same thing is happening with RE prices…they are being pushed higher because investors cannot find yield in bonds or CDs or cash.

Your free market capitalism cheer may have worked in the 80’s, but not anymore. We don’t have a free market, we have the Fed. They are the market, period.

So, in a sense you are right that buying risk assets has been a good investment, but your reasoning is off. Don’t buy risk assets because “we live in a great country” or whatever stale logic you are using. Buy risk assets because the Fed commands you to buy them, period. And as Warren Buffet said, keep your finger on a hair trigger just in case the bottom falls out…and it will.

Although, I’m not sure how the Hedgies are going to sell thousands of SFRs on a hair trigger, that should be interesting to watch.

Prices won’t retreat 20% – probably not – as in not enough. Remember that little burst bubble in 2006? Housing prices in SoCal went down around 30-50% . back in 84 they went down 20%.

Foolish to think that this bubble won’t correct back to the proper Case-Shiller estimates for the area.

only if the cash buyers unload all their properties at once, which isn’t happening. I also don’t see how raising interest rates is an option right now, unless they want to deflate the market.

Don’t all Ponzi schemes come to an end eventually? Even the investor class will be hurt eventually when the rate on the ten-year bond outpaces the net profit on their condo rental. Then you gotta sell in order to shift your investment allocation. Uh oh…

KR: If you are waiting for the ponzi scheme to end, don’t hold your breath. The Feds, government and bankers have the system rigged against the common person. For example, the next trick up their sleeve is wage inflation. 13 states are raising the minimum wage at the start of the year. Now, all of the sudden the formulas used to assess growth see this artificial growth as real growth to justify continued rising (housing) costs.

I’m not “waiting”–I escaped to Florida and bought a “better” home at 2x annual income. I agree that the gov’t–Fed, DC, Fannie/Freddie–will do anything and everything to perpetuate the scheme. Bernie Madoff was trying to raise funds up through its last days as well. It’s just a matter of speculation on how long it will last, though–I think we agree that it’s a house of cards, ultimately.

We’ve reached nominal lows in interest rates.

Rising (nominal) rates destroy the price trend in the bond market.

But, by hyperinflating the money supply, the Fed is actually keeping REAL interest rates negative.

So, real estate can’t really drop back.

So long as the Fedsury is engaged in Financial Repression, debt instruments denominated in dollars are going to be debased… whereas all real assets soldier on.

The hedge-fund crowd is leveraged — but said leverage is laid on outside the ‘escrow box.’

It’s built into the structure of the hedge funds, themselves. Further, these massive pools of money have access to back-end leverage… which is what passing through the rental stream represents.

Such cash flow streams are MUCH more iffy than mortgage debts. Only the insane, or professional asset managers, would touch them with a ten-foot pole.

They represent a massive short on the US Dollar — and convert the entire mega-trade into a one-way bet. The hedge fund managers of such deals don’t intend to collect rents — they are going to ‘part-them-out.’ Sort of like selling off pieces of a wrecked car.

The Fed operates like a parasitically infected snail: going its darndest to turn itself into food for predatory birds — so that the parasites life cycle achieves closure.

The collapsing Federal budget deficit mandates that the Fed taper off the narcotic much more rapidly.

A mild tariff against Red China — say 5% — is long overdue.

America needs to stop exporting plain vanilla jobs to Red China.

5% is low enough to not be distortive. The intent is to stop future and impending factory closures.

0-care is just going to have to be repealed: it’s too brutal a tax on American labor — a poll tax, re-labeled.

“A mild tariff against Red China — say 5% — is long overdue.

America needs to stop exporting plain vanilla jobs to Red China.

5% is low enough to not be distortive. The intent is to stop future and impending factory closures.”

Now where did I hear this before… oh, that’s right. This is what was done during the great depression… How did that work out?

We put a tariff on cheap plastic shit from China. China puts a tariff on cheap plastic food from the US. It’s all good…

“The collapsing Federal budget deficit mandates that the Fed taper off the narcotic much more rapidly.”

It depends on your definition of rapid. If rapid means QE ending of 2014, no way. If rapid means QE ending 2016 or later, maybe, if ever.

So far, the great taper has not exactly been rapid…going from printing $1,020,000,000,000 per year to $900,000,000,000 per year. As we quickly approach the 6.5% unemployment rate (which was the Fed’s original line in the sand), Ole Yeller is now saying that she will continue to provide “easing accommodations” well after that threshold has been reached. In other words, the Fed establishes a goalpost then moves the goalpost when it is deemed inconvenient. It turns out, the great taper won’t be as rapid as originally planned…imagine that.

Great point! Investors, hedge funds, and banks will be trampling each other to unload properties as fast as they bought them when this starts to happen. 10 year just eclipsed 3% today.

10Yr. T just hit 3.00%

http://money.cnn.com/2013/12/26/investing/treasury-yield-3-percent/index.html?iid=HP_LN

The 10 year treasury also closed at 3.02% on 12/27/2013. This means that the interest rate on the 30 year mortgage will be moving to 4.6% or higher by next week.

Higher rates on the 30 year mortgage means lower sales volume until sellers start slashing selling prices.

I was trying to explain to Nick ( Wall Street Journal) this topic over the weekend

Capacity to own is being left on “Main Street America”

All this housing inflation from April 2012 in an economy where majority of the jobs recovered coming from the low wage service going to be 50 and off will create Main Street America to hit their DTI and LTI limits much faster.

Normal market 90% Mortgage Buyers

10% Cash Buyers

40% First Time Home buyers % of Mortgage Buyers

Here… 67-70% Mortgage Buyers

33-30% Cash Buyers

27-30% First time Home Buyers

This are very VERY soft buying profiles and with the massive housing inflation we have seen already you better see profit to wage growth by 2015 or millions of Americans will hit their DTI & LTI limits ( X ing out those who already have hit them)

…”all cash buyer”… Well, at least you put quotes around it the first few times you mentioned it… I am tired of this argument.

Isn’t it just possible that the real change is that the conventional buying is decreasing at a faster rate than the non conventional buying? I know that the volume is decreasing much quicker than normal for this time of year.

http://www.redfin.com/research/reports/real-time-price-tracker#.UrxMR2RDsng

There are not enough investors to save our market only if you exclude that millionaire factory known as the “I” in “PIGS” Italy! The Red Ferrari Italians with Louis Vuitton suitcases filled with Lira. I know they don’t use the Lira anymore but it sounds much cooler than the Euros.

@What?,

You are correct.

If the number if all-cash purchases remains constant but the volume of total sales plunges by 40% then yes the percentage of all-cash purchases would then skyrocket.

If the volume of total sales were similar to 2006 then the percentage of all-cash purchases would be in the historical normal range.

I love this Blog and Patrick.net. I started reading when prices were near bottom 2011. Then I watched them skyrocket kicking myself for not taking the plunge. Gamble is a better word. Any practile advice for southern cal renters is much appreciated. There are armys of people in cubicles analyzing mountains of data trying to figure out how to squeeze every last dime out of the American public. Housing, cars, retirement, food,healthcare, taxes, etc…” Your resistance is futile”

You’ve it the nail on the head, Joe.

JoeLunchBox, if you have been reading this blog for the past two years I assume you have a pretty good idea of what has transpired in socal RE. As you mentioned, the optimum time to buy was a few years ago. However, that doesn’t mean that socal RE should be avoided now…everybody’s situation is different. What the last few years has taught us is that housing affordability based on monthly payments and its corresponding rental parity is the key to determining when a “good” time to buy is. Back in 2011, monthly payment affordability was at its best (many places were at or below rental parity) and we made a hard bottom.

Here is a little checklist that I made regarding buying.

1. Buy in the most desirable area you can afford. No clarification needed here.

2. Use a minimum 20% down payment.

3. Keep housing DTI under 30% range.

4. Have job stability and plan on owning the house through the end of the decade.

5. Have at LEAST 6 months emergency savings.

6. Buy close to rental parity.

These might be a tough order to fill, but owning socal RE is not for everybody. If you can answer yes to those questions, you really need to think about buying. Good luck.

2011 was nowhere near bottom. 2008 was bottom 2009 was near bottom

Many of these “cash” sales are fueled by debt. Investors pool resources and get bank loans, then buy with the resulting “cash”. That said where I am living, in Utah, there are better thank bank returns on buying rental real estate. Many of these deals are true cash deals, but it depends on neighborhood. I am starting to see something common in California where houses stay in families long term. When no one needs the house it is rented, and as soon as family need it the renters move out and the family moves in. This saves everyone lots of money and keeps the family out of debt and living close together.

This will kill the FIRE industry which feeds off of churn… There will be no commissions, fees, financing, tax assessments, updates, permits, etc. This will never do…

“Get a degree, work hard, save, and you will succeed.”

LOL!!

Big John, those will likely always be good guidelines to being successful. However, I think you need to update your post. Number one should be get a degree in a marketable skill that is relevant in today’s society (i.e., engineering, accounting, computer science, pharmacy, nursing, etc.).

I am sick and tired of people complaining that they have a “degree” and can’t compete in today’s world. People generally steer clear of the hard majors because they require lots of work, dedication and sacrifice. That generally gets in the way when priorities are hanging out at the frat house, getting boozed up and seeing how many coeds you can nail.

Yeah, LMAOROTFL!!

Borrow up to $200,000 so you can live a lower-middle class (if even)lifestyle until you reach middle age if you are fortunate enough to be able to build a career in the field you trained for and work 12 hour days.

Somehow, that does not seem like “success”, especially when you are watching a rail operator or secretary who never set foot on a college campus live a decent middle-income lifestyle because, while s/he makes maybe $55K a year, s/he does not have college debt larger than many home mortgages to pay.

Laura,

Is your comment just a complaint or something more? It it’s just a complaint, that’s OK. But as I read it I’m not sure.

I’m not buying the idea that kids that take on massive amounts of debt to get through school don’t have any blame in this. When I went to school I was very aware of the amount of my student loans and knew that I would have to pay them back.

I went out and got one of those difficult STEM degrees and make use of it. If I had a child going to college, I would make sure they researched and understood the cost of their education and their financial opportunities once they have a particular degree. None of that is particularly difficult to determine.

My sister just started her first real MD job last month after many years of schooling/residency/internship/fellowship. She has $300k in debt but the salary means she’ll have no trouble with payoff.

All of these poor financial decisions/situations are going to get worse if the people making the decisions aren’t held accountable. That means that people who owe $250k for a liberal arts degree are going to have to work at Starbucks 12h/day 7d/wk to pay back the man…. How people can make these kinds of choices makes no sense to me.

The next big round of buyers is also going to be cash buyers – it’s going to go to reverse mortgages. Soon institutions will own (or have the rights to own upon death) even more of the housing market.

Don’t look for cheap housing in SoCal in your lifetime. I’ve been hearing about the housing crash since 2004, besides a little blip in 2008 and 2009 in so cal there has never need an ideal time to buy.

Investors flipping to one another Vegas Style in Northern California. Zero improvements made – check out the sales history: http://www.redfin.com/CA/Walnut-Creek/2406-Cascade-Dr-94598/home/1822215

Inanity.

What people do need to take into consideration is that rising interest rates typically mean inflation is increasing (June treasury yields increased), subsequently markets rallied for 6 months. Inflation hasn’t even almost his us from all of the money printing – it has just begun. If anything, I anticipate the next 4 years of house prices stagnate or flat because the value of the dollar is increasing and the market is demanding rates to go up – meaning inflation is now occurring. Please factor inflation into the equation, and yes I do understand poor fundamentals and real wages are actually 1/2 of 1989 if you go look at FED data (because 2 people now work vs. 1 person in the 80’s). This is a debt driven economy and will likely stay that way until we get forced out of it. We may be dead when that day occurs.

“…rising interest rates typically mean inflation is increasing…”

This statement is true with key word being “typically”. We have had a negative interest rate over the past few years. The components of interest include loan risk, interest rate risk, anticipated inflation and the cost of money. The fed has been manipulating the interest rate with the hope of turning deflating money into inflating money. I would guess that the Fed can only control the negative cost of money so long. It is possible that the negative cost of money is the real culprit in the rising rate not necessarily inflation.

Blackstone’s Big Bet on Rental Homes and how the scheme works…

http://www.bloomberg.com/infographics/2013-12-20/blackstones-big-bet-on-rental-homes.html

.

Thanks for posting this. I was looking for something like this to show people what is going on. I hope Blackwater…er…Blackstone dies a very quick death. I picture a giant tick squatting over a bunch of little houses. It doesn’t seem like a good investment to me – small return for a lot of risk. Don’t know who is going to go for it, hopefully no institutional investors will rely on it.

“Blackstone dies a very quick death.” That is hilarious!

My money says that they will make so much friggin money on this trade it will boggle the mind. Their purchase prices for these properties must be peanuts, the carrying costs very minimal and I’ll bet they already have exit variations mapped out.

Yeah, they’re dumb….like a fox.

@itwasntme – if you meant to say, “I don’t see how this Blackstone investment will work out well for investors”…. I wouldn’t have commented.

But you spoke of hoping the company will croak b/c of this RE fund they created and that’s why I laughed. Blackstone will make out like bandits for the reasons I mentioned. That company was founded in 1985, has about 29 BILLION in assets and almost 1600 employees. They achieved all that in less than 30 years b/c they have continuously coined it big time (and don’t get left holding the bag). They’ll be around after you and I are dead.

I understand Blackstone has major assets (hotels etc) but think this foray into mass home ownership is very risky for the return offered.

Hey Prediction Reality Check, I got a reality check for you. I almost took a job at a company that was founded in 1913 and at their peak had 85,000 employees and 9.3 billion in annual revenue. I didn’t like the “culture†so I took a job at one of their rivals. Guess what! They are the company formally known as Arthur Andersen. How did that work out with all those smart guys with lots of money?

Yes… because we know that rents can only go up during wage stagnation… What a bill of goods our pension funds, 401k funds, etc. are being sold… I think we all knew this was the plan. No surprise to me. Hey, how did this work out last time around?

Blackstone is proposing profits of about 3.8% which is little more than bond yields and depends upon full rentals paying full freight with good management that is not stealing Blackstone blind, and good tenants that won’t trash the place. This seems like a bad investment to me, and I’d never go for it.

The Feds have accomplished the seemingly impossible, they re-inflated the So Cal Housing bubble. How long can they keep the wind and smoke magic trick going? No economic fundamentals, no free market forces….are we sure democracy won the Cold War?

In the central valley, nice properties in the 150k-180k range are still getting multiple bids over asking price, especially newer builds and flips. Newer build HUD foreclosures, meant to be open to owner occupants only, are going to investors who probably go in with conventional and pay it off as soon as they close. 250k+ range are sitting, and lots of owners putting out a ridiculous listing price to see who will bite, and usually end up reducing multiple times. Some homes are being put on the market above what it sold for in 2007-2008. Lots of new build sprawling on the edges of towns, and I predict many of those to foreclose in the next 3-5 years, if they even sell at these prices to begin with.

Chinese have a right to buy real estate. We sent you all the consumer goods that you enjoy and you gave us pieces of green paper, aka cash. Now we give you back your cash in return for Irvine real estate with pretty good schools. This is called, “free trade” that both political parties endorse. Congressmen and Senators also enjoy happy time in Shanghai too. Chinese in Irvine also give legal campaign contributions to the right people. We are all American and love America too(we show it with legal campaign contributions). This Irvine is really a great place.

Thank you Lee. We didn’t understand that buying all of that cheap stuff from China would mean you are moving in next door to our home. This is big trouble in little Irvine. I guess Americans will have to move to China to afford to live. I hear there are many single Asian women and they usually like American men. So it will quite enjoyable there.

There aren’t all that many single Asian women — at least not many single Chinese women.

Thanks to China’s one child policy, which resulted in girls being killed in secret so as to try again for a boy, there’s a male/female ratio imbalance. Many young Chinese men can’t find Chinese wives.

Some of those men are looking to North Korea for wives. And some, I guess, will look to other Asian countries, or even the West.

@son of landlord – on that note, here’s some interesting reading:

http://www.zerohedge.com/news/2013-12-27/how-ultra-rich-chinese-men-find-their-wives

did anyone see how the mortgage landscape will be impacted in 2014 by the new CFPB rules? Can DHB post an article on the anticipated impact? The only thing I can assume is this means more tough times for Gen Y, modern day debt slaves and neofeudal serfs.

http://homes.yahoo.com/news/tighter-mortgage-rules-will-soon-squeeze-these-groups-even-more-005538769.html

It’s going to be interesting to see if these new laws will be “postponed” or “cancelled” before they come to pass. I think the powers-that-be know they’re going to put a crimp in the economy.

The rules regarding obamacare keep changing, so this would just be more of the same regarding politicians and policy/laws.

Greetings of the Season, Doctor, and a quick update to your Oct. 23 post on “The Grand Republic of Santa Monica: 932 square feet for $895,000.”

Listed on 10/22, went pending on Halloween, and sold 12/03 for $884,000, per Redfin. That was a quick transaction for a little 1920 bungalow that sits on just 2,906 sqft of southern California dirt, but, then again, it’s just 4 blocks from the ocean. Wonder if it was all cash…

The FED and the other members of the tribe are looting the American people. It’s just like “The Matrix.”

0-care should make 2014 an inflection year.

I’d expect the frothiest speculations to melt down:

Social media, of all types, will prove to be brutally difficult to monetize.

At least some of the high yield/ junk bond market issues will trip up.

I don’t know how the medical-pharma cartel and the insurance cartel avoid a cash flow crisis.

====

It’s increasingly apparent that Congress left the US Territories entirely off its 0-care scheme. This means that everywhere from Guam to the Virgin Islands — insurance plans are lapsing. It’s already too late to address them.

====

The implicit wage-price controls embedded within 0-care — plus over control from DC on physicians — have 70% of the providers in contractual rebellion: they are NOT signing the line that is dotted.

It’s too late to change that, either.

====

So we have a maladministration that has shot itself in both feet.

2014 will be the year of the crawl.

====

Many’s the pundit who has averred terror for the S&P based on prior norms.

When the Fedsury is hyperinflating the money supply, prior norms go out the window. There is a new money engine running — and its spewing its lucre on the Primary Dealer network first. This spigot effect is directly responsible for the vaulting S&P.

New money is being created — via this hyperinflation engine — to buttress the trivial contraction in private debt-money — which is entirely responsible for the new ‘normal.’

This gambit will work — but only as long as the rubes don’t comprehend what’s going on.

Once that Rubicon is crossed, the classic final stage of hyperinflationary policy will kick in — with a vengeance: everyone will reject the currency in all its forms. It’s this phase that established “hyperinflation” as the term of art for money creation by way of government money-printing.

Whereas commercial lenders will always pull back from the brink, historically, governments are too self-involved to stop printing, and printing, and printing.

Not surprisingly, this tendency has caused many to term the process narcosis of those out of their depth… narcosis of the shallow.

De-tox normally involves outsiders stepping in to take the keys away.

(Constitutional Convention/ Reconstruction/ …)

http://www.americanthinker.com/2013/12/more_obamacare_devastation.html

^^^^ The ability of 0-care to screw up long standing American private arrangements seems unlimited.

Pelosi and K Street never thought this far ahead.

By making 0-care limited to each COUNTY — vacation homes all across this nation now put their owners through additional financial expense. This is going to impact the upper-middle class straight away — starting 1-1-2014.

Eventually, even the MSM will figure it out.

I had an interesting idea about this buying mania from the credit nation perspective: FED is pouring money to market and, at least banks, have to have some property to keep their property/debt in balance. (1:100 or so but still some balance.)

If the only reason you buy a house is to balance the credit you already have sold, the price of the house is totally irrelevant: It exists solely for bookkeeping reasons.

No wonder FED allowed mark to fantasy forever, basically letting the credit free. And profits, of course.

All this doom about the next real estate crash. They ain’t making any more land in southern CA. People are buying with all cash. How you gonna get hurt if the rents keep coming in? I can wait out a decline as long as rents do not go below property taxes,insurance, etc.

Besides, who would want to sell if the cap gains rate combined = 33%? TAXES ARE WAY TO HIGH ON CAPITAL GAINS!!! No way I’m going to sell. I refi before I pay these crazy taxes. Look to the Gov’t for creating this environment – they are the problem.

Can not get a return on CD’s – then you have to pay taxes on that income! That’s why investors are turning to real estate. Until the rules of the game change the entry level people who want to buy will remain renters. Unfortunate – and I feel for these folks – but I have to do what is best for me and my family….

Anyone in Ventura County interested in house hunting? After reading this I’m starting to reconsider the thought of buying a house…

http://m.vcstar.com/news/2013/sep/12/thursday-morning-housing-conference-covers-market/

Like everything that Wall Street gets involved in, there’s the pump and then the dump. We’re in the pump phase right now and they are starting to securitize rental flows. Smells very much like MBS’s.

The thieves know that the big money to be had is in institutional investors like pension funds. So when they create a “financial product” custom made for institutions to invest in, the dump will not be too far away.

Yup. I saw this coming when I first heard rumors of hedge funds buying SFR’s. There really was no other reason for this. SFR’s are really bad investments for a fund but not if you plan to pump and dump. Who cares what the underlying asset is if you plan to dump. The average Joe has shown an ability to absorb huge losses (up to 50%) in 401k’s and shake it off the last go around. I think it is really interesting that the only capitulation we have had is the bears. I did not see any real capitulation from the bulls. I think the phrase be greedy when everyone else is fearful and be fearful when everyone else is greedy should come into play. I think I am good with sitting this one out…

CAE that was my thought. Blackstone et al. making up a new “investment vehicle” and getting institutional investors in big time – a threat to yours and my pension fund (and lucky to have one). My hope is that the stated expected return is too low and nobody will be tempted. I’m having a hard time seeing how this scheme will float, but then I’m no expert in crazy greed-thinking. I want to watch this carefully and see how it plays out. As I say, I have to go ahead with my plans to buy next spring/summer so will just have to get the best deal I can under whatever conditions are in place.

CAE: These new securities ARE the dump… you’ve got nothing to wait for.

Housing to tank hard in 2014!

Always remember that markets can stay irrational longer than you can remain solvent. This is the only real value John Maynard Keynes added to our understanding of economics…

So you have rising rates and home prices, but incomes for the middle class and value of the dollar, just aren’t increasing as fast as the former.

Predatory lending secured those loans, but now with restrictions in place, who’s going to come knocking on the door of a $250K home for sale that really is only worth $175K?

LOl Mr Lee — we do NOT want any Chinese here, period

do not come, better off trying to annex Siberia

it wont work out, believe me

I predict prices in So Cal will rise 5% and similarly to last year, this will take place largely in the first half of 2014. Demand remains high in an improving economy and hedge funds ie: Blackstone, having created and entirely new REIT, are/will be selling shares in the new fund based on rental ROI, thus those units are not coming back on the market, maybe ever. This further constricts and already very tight supply. Moreover, there are fewer sellers than ever since there are some property owners still under water and many who refinanced or purchased at low 3% interest rates and not willing to sell and buy at near 5%. Additionally, based on the 35 year average, California is 770,000 units short due to virtually no construction over the past half decade, and no, people did not stop coming to California, on the contrary while not as high as in previous years, it had third highest population increase of any state in 2013 behind Texas and Florida. Given the population rise via, birth rate and immigration, coupled with the improving health of the economy and the direct effect that has on household creation, rents will continue to rise as the shortage of available housing falls increasingly short of demand. None of this even begins to address the rise in property value should core inflation ever exceed 2.0%. As for the bottom, 2009 and 2011 were equal floors with 2010 artificially showing some appreciation as a direct effect of the first time buyer’s tax credit. Remove the tax credit and what you find is a 3 year bottom from 2009-2011.

Leave a Reply