Zillow Pauses Home Purchases and Example of it in Action: Competing Against the Home Buying Algorithms.

If you thought it was hard enough to compete against regular home buyers and sellers, now you have a new competitor in the market, algorithms that are looking for a quick profit. Now it might seem like the battle between the haves and the have nots is ramping up and many are looking for get rich quick outlets like options trading and crypto currencies, the reality is the market is dramatically changing. People are feeling left out and for many buying a home seems completely out of reach given that the supply system is completely out of whack in many ways. Part of this has to do with artificially juicing the markets and moratoriums that stalled regular demand from hitting. We have this corporate welfare bailout mentality that is simply creating externalities in the market and because of that, we are seeing soaring prices with toxic fundamentals (which is what we are trying to avoid). During the last crash, you had hedge funds gobbling up homes and making bank and now this time you have things like Zillow Offers and Opendoor making offers on properties. Zillow is pausing home purchases and you are seeing examples where the algorithm is having issues.

Zillow Offers

Zillow has an immense amount of data on real estate and understands what is happening in local markets. Are searches high in the area? Do people prefer renting or buying? 3 bedrooms or 5 bedrooms? All of this data is being gathered and given that real estate is local and driven by a few comp sales in an area, if you are able to corner a few properties and sell them for higher prices you can effectively make an entire zip code jump in cost. You are the market maker. Unlike a stock that has extreme liquidity and price discovery, real estate is set by the last buyer in a market where there is very little liquidity. Which is an odd way to adjust prices for an entire area but that is the way it goes.

Of course, Zillow with the troves of data, was buying homes at a premium and selling them back to the market. But like most things that go up way too fast, there are adjustments. The algorithm is much smarter than most people and definitely has more data than the average Taco Tuesday baby boomer, so it is interesting to see some “failures” where the algorithm did not work.

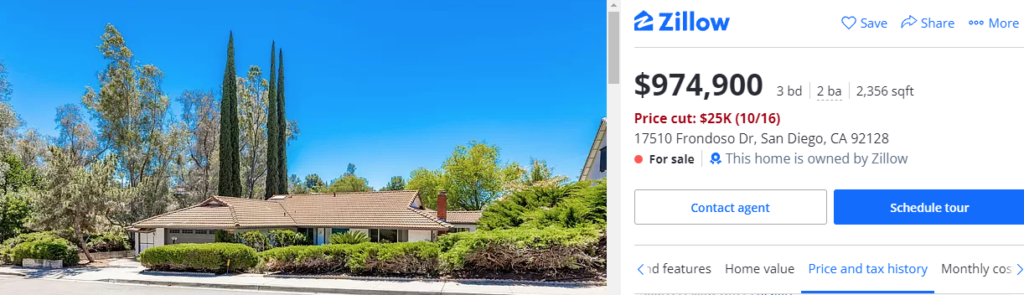

Here is an example:

Zillow purchased this home via Zillow Offers back on 5/19/2021 for $1,103,700. But since then, has had to adjust pricing:

That is a $128,800 price reduction since May. Now you can argue that the algorithm is much smarter than you or myself but basic math will tell you that something is going on here with this property. It seems like Zillow overpaid here. And of course, this is only one example but it is interesting to examine here since this is in hot California.

Markets do not go up forever in a straight line and the stock market has been in a raging bull run since 2009 – one of the longest rallies in history. Real estate had its best year during a pandemic. Yet things like this do happen when things get too frothy and corrections are normal in most markets. You have many Millennials not working through the Great Resignation and not buying homes. Zillow has now taken a pause on home buying to “adjust” but I’m sure they are examining the algorithm a little bit more in light of these challenges.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

196 Responses to “Zillow Pauses Home Purchases and Example of it in Action: Competing Against the Home Buying Algorithms.”

It’s been fun over the past 3 weeks or so going through Zillow with the “zillow-owned” checkbox checked and looking at price histories in my local area. I’ve seen a few listed for a similar price as they paid, but these are rare. The vast majority are just what you showed in your post – a high potential profit initial list price, followed by reduction(s) to below their price. Minus of course their transactional costs for the flip.

Seeing the news today about Zillow was a treat; that’s about as close to a “Michael Burry moment” as I’ve had – since I’d been figuring the houses in my area meant something big and bad was going to be announced soon. Actually they are still underplaying it as a “pause”. If it is 3,800 homes in Q2, and they lose an average $25,000 per flip, that’s a $95 million loss for this venture in just a quarter.

Imagine how many millions they made on previous flips.

This action by Zillow, being a major player in the housing market, to pause on home purchases certainly signals caution and cooling off. But if you read the WSJ article (https://www.wsj.com/articles/zillow-gets-outplayed-at-its-own-game-11634551201), Zillow points the blame at supply constraints having to do with on-the-ground workers and vendors. We do know that labor and material prices have been on the rise. Also, the articles notes that other competing iBuyers have not had to hit the pause button across the board, so it certainly could be isolated to Zillow’s poor management of flipping houses.

@JoeR

In the previous thread you mentioned about the ones moving to and out of CA. While the numbers are close, the quality of the people is more important. You might get a small business owner moving out with his wealth and experience and providing services in a new state or you might get Musk relocating taking his billions and experience with him.

At the same time you might get another 20 illegals from Haiti with no money, experience or education. Just because the number does not change, the situation is not static – CA is becoming more like a third world country with very few uber rich and the rest equally poor. Even if they want to work hard, all the taxes and inflation takes all their purchasing power away from them, leaving them poor with a low standard of living.

I said that the statistics were for Americans coming and going to and from California. There were also the millions coming in from abroad that weren’t part of the statistics. And again there you have H1-B visa and other legal immigrants with skills and sometimes money, and the border jumpers with few skills and very little money.

This is a quote from my post about the OC Register columnist’s articles:

“He does acknowledge that foreign arrivals more than make up the difference in population due to more Americans moving out than in”

“there you have H1-B visa and other legal immigrants with skills”

Have you ever met an H1B with skills? Cuz I sure haven’t.

I have worked for companies that hired non-US citizens for skilled positions similar to the kind of work that I do. I don’t personally know what kind of visa they held. I usually only find out about their status when they announce that they have become US citizens with much fanfare!

I know from personal experience that immigrant workers are replacing skilled labor or at top tech companies. Ask anyone who works/has worked for Elon musk. A lot of automation and dummy proof procedures have replaced much of the skilled labor. It’s crazy to see people in the 30s/40s-hr get replaced by unskilled button pushers making mid-teen-hr wages.

I posted on Joe R’s comment on the last article.

In my small bubble of Tech, I am seeing:

1) Younger single engineers and programmers moving to CA for the pay, sun, and beach.

2) Older tech workers debating on moving out since they are closer to retirement with a huge windfall in their current house. Most of their kids have moved out and are not working locally. Only one of them has moved and the rest just talk about it. Most will likely stay awhile because they are currently making a great salary where they are with a low mortgage(or no mortgage) and Prop 13 property taxes.

The grass is always greener elsewhere for both groups.

This is great news for those of us looking to buy a house using a mortgage.

@Dr Housing Bubble

Thanks for another article.

” many are looking for get rich quick outlets like options trading and crypto currencies, the reality is the market is dramatically changing”

Some advice…..

It took me a few years of dollar cost averaging and HODL’ing Bitcoin and other cryptos before I became a crypto millionaire (on paper/digital wallet)….And….if I dont cash out….I might end up with much less than a million.

The crypto market is designed to take money from the impatient and transfer it to the patient investors. Patience is everything in life….especially in stock and crypto investing. Dont get into crypto with the idea to become rich overnight.

Bull markets can make you money. Bear markets can make you rich (DCA and HODL).

Using “HODL” acronym is clearly a sign you do not understand what are you doing.

Thank you for the question Surge.

Bitcoin has surged tremendously! New all time high baby and the first US Bitcoin ETF is trading on the Nasdaq!but to your question: HODL means hold on to dear life.

What it really means for stock and crypto trading: buy the dip instead of panicking and selling your precious Bitcoin/altcoins.

DCA’ing (dollar cost averaging) and HODL’ing (don’t sell during corrections) are an excellent strategy to become wealthy. This is true for stocks and crypto!

If you need more help to get started, download the coinbase app and purchase Bitcoin, ETH and Cardano. Thank me later 🙂

Thanks for the tip, M. I will be trying your strategies. Is coinbase available on iOS?

you are still clueless as using “HODL” term gives you away.

Yep,

The following apps allow you to purchase crypto:

Robinhood

Coinbase

PayPal

Binance

Venmo

Webull

Purchase and HODL! Thank me later!

Wow! It really looks like Zillow found the top of the market. I was looking at the Zillow owned homes in several markets (SoCal, Portland, Vegas, Phoenix, Raleigh) and the majority of houses I clicked on in all of those markets are now listed for less than Zillow paid. I highly doubt their “pause” is due to lack of labor, unless it’s in the pricing algorithm department.

Hard to tell if indeed there was a labor & supply chain shortage. I’m seeing similar things in Zillow-owned homes now for sale.

What I was also surprised to see was the lack of work done on these homes. I mean, the homes look clean and maybe had a coat of paint applied, but at the price that Zillow paid I don’t believe they had any intentions of renovating any of their homes, i.e. what they claim as, “carefully evaluated, repaired, and refreshed.” It seems Zillow was hoping to ride the tide of the (inflated) market.

I curious if anyone knows whether Zillow actual renovated homes in the past, when labor and supplies were not an issue. Is Zillow now unloading because their analysis says they can’t recoup their renovation cost and are just cutting their losses?

The first Bitcoin ETF starts trading in the US today! What a milestone for the industry! Congratulations to myself and other crypto investors who had the foresight and invested in a new asset class that is outperforming stocks and RE! Just wow! A day to remember! Let’s pause for a moment and celebrate the success!

We have been replacing old appliances, and there have been long waits for delivery. Prices are rising also. Home makeovers usually include new appliances that look stylish. A flipper who lives near us overdid a flip on a busy corner lot (too big and fancy for the neighborhood). Other flipped homes sold quickly. He bought a new place in a richer area and was planning on selling two houses to pay for it. The one house away from the corner that he had been living in sold a long time ago. Common sense is needed to flip.

It is pending now and had a termite tent over it. I’ll see if they got over $1 million. The Zesimate is more than the asking price.

Even if Zillow and other iBuyers aren’t purposely juicing the market through price fixing, I do believe that they are affecting the supply side if they are holding properties off the market that otherwise would be available as purchasable inventory.

Any way you look at it, these wall street backed corporations have their thumb on the scale one way or another and that does not bode well for the average home buyer competing against them in a rigged market.

Market cannot be “rigged” by definition. It is a collection of forces (strong and weak) competing/complementing each other.

Rigged is subjective and it is rigged only when it is against you.

As in many markets, some buyers simply do not have the power to compete.

The moment you stop using subjective definitions, that’s when you can understand the market. Then you either play or stop commenting on the sidelines.

Housing is not a game. Sitting on the sidelines means living under the freeway. This mentality is what is wrong with the housing market. We subsidize food, gas, and basic the necessities of life, but somehow having a roof over your head is regarded purely as an investor-class asset. It is this mentality/value system that is destroying us. People cannot be healthy, productive, good to their children, etc. without stability and security so we have an increasingly unwell society that harms everyone. But as long as you get your ROI who gives a f**k. Really discouraging.

Tabitha: We subsidize food, gas, and basic the necessities of life, but somehow having a roof over your head is regarded purely as an investor-class asset.

But we do subsidize housing.

* Rent control.

* Section 8

* Housing projects for low-income tenants.

* Mandatory low-income units in newly built apartment and condo complexes.

All of these exist to subsidize housing.

Plus, a person who receives food stamps, welfare, free education, Medicaid, etc. has more money left over for rent. So all of these entitlements indirectly subsidize housing.

Bitcoin new all time high!!!

Like I said earlier, this is the time to buy/lease a new car.

Buy MSRP and enjoy for next 3 years. Re-evaluate.

No other financial moves should be made in next 2-3 years.

It’s much better to be a bull and remain in the markets. Crypto will be crazy hot the next 3-6months. Stocks: the bears will be right evt. Out of ten years, the bears might be wrong once. I am rather right 9 out of 10 and add more during the downturn.

I missed your previous thread on this. Can you elaborate?

There definitely something going on with Zillow’s algorithm. For example, Zillow has had my house ‘zestimated’ at between 1.2 to 1.4M. over the past 5 years and the Rent ‘zestimate’ in the high 4K to low 5k a month. About 2 weeks ago the RENT estimate suddenly ballooned to 9.5 K a month. I figured it was a mistake but it’s still there. We’re in Woodland Hills, 5 bedroom 3 bath. I checked other single home rentals in the area and they were ALL listed, the RENTAL estimates, were all over 10K a month.

So rental prices suddenly doubled in my area. And it happened in a day.

Crazy algorithm if you ask me..

Zillow has all my rentals pretty much in line with what I know they’re worth. Funny enough though, my primary home’s Z-value is $200K lower than market value. So it’s hit and miss.

Z has my rental value estimates in line with recent sales for this area, but it brought to my attention that I am below market for the rents that I am receiving. I asked my property manager to increase rents in January.

* The Zillow estimate for my condo is 80% higher than its Redfin estimate. They can’t both be right.

* I often see properties selling way above, or way below, their estimates.

* I’ve seen estimates change after the list price changes, seemingly taking its new list price into consideration. Which is ridiculous.

I agree with Old M on this: Zillow (and Redfin, etc.) estimates are meaningless. There’s no consistency or rationality behind any of these automated estimates.

Zillow is pretty useful. It’s shows me that my house increased by 300k in equity since we bought (Q1 2020). I like that and agree with that. I also use it to hunt for my first rental. Buy RE folks!

I agree that Zillow can be very inaccurate:

1) Zillow versus Redfin / Opendoor / Mkt Listing

Zillow has my house listed 15% below Redfin’s estimate.

I have an Opendoor offer that was very close to Redfin’s estimate.

Homes around mine similar in sqft are also being listed at Redfin / Opendoor estimates.

2) inconsistent Zillow estimate example 1

Zillow has my home estimated to be few % below my nextdoor neighbor’s which makes no sense because 1) my home was newly renovated when purchased and then improved again with permits, 2) my home is 7% larger than my neighbor’s in sqft, 3) was purchased right after Covid lockdown (versus neighbor’s 10 years ago).

3) inconsistent Zillow estimate example 2

2 doors down from me, Zillow currently has another neighbor’s house estimated to be 9% higher than mine. This house was just purchased 4mo ago at a price 4% higher than the estimate for mine… yet is not upgraded and 17% smaller than my sqft!

F. Joe Biden is crashing and burning, now down to 40% approval. In less than a year of his “presidency” we’ve gone from no inflation to 6% inflation and super markets that look like USSR stores circa 1983.

You can thank him and the trillions if “stimulus” spending he and his fellow Democrats have been pushing. Buy real estate today or you will be poor forever. It’s one of the few ways you can protect yourself from this hyperinflation. Renting right now is financial suicide.

Watching the FJB train wreck is something else. I remember seeing the CNN talking heads last years saying Trump’s rally speeches were full of fear mongering and hyperbole. Just about everything Trump warned us about has come true. And meanwhile, guys like myself and Mr. Landlord are profiting from this hand over fist. Inflation is an absolute killer for those middle and lower class folks who are renters or own no assets. I have been preaching for years that owning a home in socal is almost a requirement…I don’t think anybody would disagree now.

Also contributing to inflation is that shoplifting (at least in blue states like New York and California) has become legal:

https://www.dailymail.co.uk/news/article-10058667/Rite-Aid-security-guard-shows-parade-brazen-shoplifters-New-York-City-stealing-WAVING.html

https://nypost.com/2021/06/16/san-fran-cops-walgreens-shoplift-incident-is-par-for-the-course/

Stores must raise prices, so that honest shoppers subsidize the stolen merchandise.

Mr Landlord is showing his inexperience.

He must not have been old enough to read back in 2012 when the good Dr posted this excellent article.

https://www.doctorhousingbubble.com/worse-ahead-for-housing-underwater-mortgages-foreclosures-5-to-7-million-by-end-of-2012/

Over 7 million foreclosures by 2012 indicates that buying a house without having back-up cash savings to avoid foreclosure was the worst decision these home buyers ever made.

There were also many who had cash, were able to ride it out, keep the house and are doing very well now.

I agree that not buying a house in S. CA is slow financial suicide. Buying a house and foreclosing is a much faster form of financial suicide.

You have to be very young or naive to vote Republican after the Republican controlled House, Senate, and President completely wrecked the economy in 2008 forcing 7M home owners out of their houses.

Interesting and concerning article that came out recently.

https://www.msn.com/en-us/money/realestate/what-is-a-subprime-mortgage/ar-BB14pNfN

At the top of the article:

“In the years leading up to the economic meltdown, lenders approved many subprime mortgages that borrowers were unable to pay back. In fact, approximately 30 percent of all mortgages originated in 2006 were subprime, ”

Bob Note: Whew! This can’t happen again. We will be saved from 7 million foreclosures that happened 9-13 years ago.

Then later down the article:

“How do I know if I have a subprime mortgage?

Around 33 percent of all borrowers (not just of mortgages) fall into the subprime category based on credit score, according to Experian.”

Bob Note: Wait! What??? I thought it couldn’t happen again?

Further down, it lists even more loan types that require less than 20% down and allow poor credit. The 33% above doesn’t even count these loans.

“Alternatives to a subprime mortgage

FHA loans – If your credit score is at least 580, consider an FHA loan with a down payment of 3.5 percent. If your credit score is between 500 and 579, you can qualify for an FHA loan with 10 percent down.

VA loans – If you’re a veteran or active member of the armed forces, look into VA loans. Guaranteed by the U.S. Department of Veterans Affairs, these loans require no down payment and could have lower credit score requirements.

USDA loans – USDA loans are designed for low- to moderate-income borrowers in rural designated areas. (Some qualifying locations are actually near large metro areas.) While some lenders might have a credit score minimum for USDA loans, others might have relatively lenient standards that can help you qualify.”

Bob Note: How many loans of the above type are on top of subprime loans? 50+%.

Possibly double the amount of loans last seen in 2006.

This was allowed through the Obama, Trump, and now Biden administrations so it is not political party related.

The article says it is not like 2006 because these subprime loans have higher interest rates. Is the assumption that when a house is underwater, that subprime mortgagees will be less likely to walk away if their mortgage rate is higher? Really?

I just broke open another bag of popcorn and sold some mortgage lender stocks.

Bob, how’s that “temporary” inflation? LOL. Bob is so wrong about so many things it’s har to keep track. Poor BOB.

If you’re a renter, you’re f00ked bigly right now thanks to people like Bob who voted for Brandon.

We’ll see, Mr Landlord

Lumber is down 80%

The issue I see is that the last time we saw short term inflation this high was 2008 during the last year of Republican President Bush. During the first year of President Obama, short term inflation was negative 2% as the Democrats had to bail out the wrecked Republican economy.

I hope history doesn’t repeat itself. We have seen it before.

Bob also thinks supply chains are 100% up and running. Bob is a silly man. But kinda entertaining.

It was down 80% for about 2 weeks. In the last 2 weeks it went up another 50% – that going into the slow construction season, when prices normally go down a lot. That tells us everything we need to know.

I’m happy Mr Landlord finally sees the problem.

It is a temporary Supply Chain problem. ie Supply and Demand is temporarily driving up inflation. Supply is down due to the supply chain. Demand is skyrocketing due to the end of the pandemic and Biden’s excellent economy. I’ve gone out to more dinners and concerts in the last month than I did in the entire 2020 under Trump. My demand has increased 10X. .

I do criticize Biden for 2 things.

1) Why isn’t he doing more to get the supply chain up and running again? That should be the first priority. Capitalism says this will eventually fix itself but that is no excuse for the government not to help it fix it faster.

2) I’m not sure if this is a Biden issue or an oil producer issue. After so many oil producing startups went bankrupt under Trump, the oil industry is shy about repeating that cycle and over-pumping. It does follow Biden’s green agenda so I see why Biden is not helping the oil industry destroy itself again.

The main reason for supply chain issues is caused by governor Newsom. His law prohibiting older trucks to come to CA to pick up containers from the 2 main ports on the west coast eliminated about 80% of truckers. The few left with newer rigs milk this situation for all it’s worth. It is a cascading effect from there. Even if the ports work 24/7, there is nothing to load on. Also, the deficit of truck drivers was about 80,000 before Covid. Now it is even worse.

The larger companies able to buy newer rigs also have serious issues with the vax mandates. If they enforce it, about 1/3 of the truckers will walk out. The shortages in the new year will be far worse, not better.

It all comes down to politicians trying to micromanage the economy. All central planned economies end the same – with major shortages and massive inflation. That was my point all along. I lived through this before under communism; Bob didn’t, therefore, he didn’t see ALL before. It is OK – he will learn a practical lesson in socialism. We should be more sociable and less socialists.

The larger companies able to buy newer rigs also have serious issues with the vax mandates. If they enforce it, about 1/3 of the truckers will walk out. The shortages in the new year will be far worse, not better. It all comes down to politicians trying to micromanage the economy. All central planned economies end the same – with major shortages and massive inflation. That was my point all along. I lived through this before under communism; Bob didn’t, therefore, he didn’t see ALL before.

On my own home I’ve seen Zillow values vacillate greatly in 3 mo. periods. Almost as if it responds to sudden changes by overshooting or undershooting. Probably best to only believe longer term averages, or better yet know your own neighborhood. In the past, Zillow couldn’t distinguish values that didn’t follow the neighborhood average. For instance, Hermosa Strand homes were priced more like homes 2 or 3 blocks up than like real Strand values. They’re correcting some of it, but have a ways to go.

For RE owners, question of the day. How will the opposing forces of inflation and possible higher rates play out ? Higher rates will depress prices but inflation will counteract that. I think the Fed can only raise rates sparingly unless they want to create a recession while inflation is not abating anytime soon. That would be a win for RE.

Higher rates? LOL. Not in the next 5 years, if ever. How do you think the feds will pay for the interest on Biden’s soon to be $30 trillion debt? You can tax Bezos at 100% and it will barely put a dent in that. Only way to to keep it manageable is to deflate the dollar. If you don’t own real estate you will be in a world of hurt.

Let’s Go Brandon!

This doesn’t bode well for housing. With the Fed about to taper and other central banks already raising interest rates, the world economy will start to enter a deflationary environment. God help us.

This doesn’t bode well for housing. With the Fed about to taper and other central banks already raising interest rates, the world economy will start to enter a deflationary environment. God help

^

Not saying you are right or wrong just curious if you have more evidence , data , math to support your deflation call. Anecdotally and mathematically I see piles of inflation with a timid fed that won’t raise rates . Much respect.

FLIP CITY

This home was sold for $1M a month ago and now its back on the market for $1.2M???

With a 5% commission, some flipper expects to make money?

Can someone explain.

https://www.redfin.com/CA/Los-Angeles/5773-Bowesfield-St-90016/home/6890464

Thanks

Good house. Schools are so-so if that one’s thing.

“Good house”? That house is tiny. I don’t think i could be happy in such a tiny house. I feel so lucky.

If you look at the price history on Zillow, it was listed for sale on 6/2014 and pulled off the market on 10/2014. The list price was 415,000. About a 3X ROI in 7 years.

At least you know the approximate real value if the housing market drops out like it did in 2008.

The add for Black Rock SMAs was beautiful and scary appearing beside this article.

Feds to pay illegal immigrants separated at border $450,000 per person: https://twitter.com/WSJ/status/1453799536615464971

That, while the maximum paid for a dead veteran is $400,000!!!….and Bob agrees that illegals to be enriched by 1 million per family for violating the law and Constitution of the country. That tells Bob everything he needs to know if wether Biden represents the interest of the US citizens or the globalists paying him to destroy this country.

Do you really think affected families will see anywhere near the advertised settlement sum?

Lol

Surge, a strong lobby behind Biden is the lawyer’s lobby. They will get about half of that – they split the profits with the plaintiffs.

Flyover, I doubt the lawyers will take as much as half. Back in the 1990s in Los Angeles, attorneys were charging 33% if a matter is settled out of court, and 40% if it goes to trial.

If that’s the norm in this case, the attorneys will get a third.

But I wish the attorneys would get 99% in this case. Much as I hate them, I can’t stand to see criminal invaders rewarded for breaking the law.

I am sure that Bob, seen it all, thanks Biden every day for the disaster he brought to this country. It is a very long list of disasters…and this is just the first year!!!….If the GOP doesn’t win the midterms, I doubt if we still have a country in 3 years.

If the GOP doesn’t win the midterms, I doubt if we still have a country in 3 years.

The GOP won’t be worse than Biden, but they will only slow the decline. A bit.

I heard an interesting claim recently. Most Americans are neither conservative or progressive. They are populist. Apparently, for decades, polls have shown that most Americans want:

* Immigration restrictions. Fewer overall immigrants, fewer from the Third World, and send illegals home. Not the open borders of free market conservatives and Left progressives.

* Protectionism. Keep good-paying jobs in America, for Americans.

* A basic safety net for those willing to work, but who have suffered a crisis and are unable. Neither a total free market, nor massive subsidizes for crazy Leftist projects.

* America First foreign policy. No foreign wars, no foreign subsidies, no global policeman.

But neither the GOP nor Democrats offer up this populist package. The Deep State will see to that. So Americans never get a chance to vote for what they want.

Would have thought that’s an article from the onion but it could be true… $450,000 per separated immigrant.

They also left billions of dollars of military equipment during the recent Afghanistan evacuation.

Let me put this in perspective…

$450k / person, that is 0.15cents (not dollars, fraction of a cent) per person in USA. You probably spent more on electricity writing these comments.

Also, billions and billions of military HW left. It is a metal scrap now. Billions and billions are left inside US economy; what’s left behind is pretty much non-operation scrap. It served its purpose.

Biden to spend $150 billion on “affordable housing”: https://thehill.com/policy/finance/578989-biden-framework-includes-150b-for-affordable-housing

Ethereum just hit a new all Time high 🙂 congrats to all ETH investors!

Few takeaways from the Zillow debacle. First, I was fooled into thinking that Phoenix was the number one market in the USA. Apparently it was partially artificial. Second, Zillow has some amazing data. And last, as good as the market was, construction prices and contracting cost even more. Their losses on these properties are a lot more than subtracting Purchase Price from the selling price.

I know it makes you happy that zillow is losing money on latest round of homes. However, I assure you, they did make a killing on previous rounds of home.

The losses you are so happy about are top of the cycle. Lots and lots of prior profits easily beat the losses.

It’s like selling a tesla stock on 5% dip after 30x gain.

Surge, thanks for the laugh. Let’s hear how you “assure us that Zillow made a killing”

Have you looked at Zillow’s financials yet?

“Zillow annual/quarterly net income history and growth rate from 2009 to 2021. Net income can be defined as company’s net profit or loss after all revenues, income items, and expenses have been accounted for.

Zillow net income for the quarter ending September 30, 2021 was $-0.328B, a 929.35% decline year-over-year.

Zillow net income for the twelve months ending September 30, 2021 was $-0.221B, a 28.71% decline year-over-year.

Zillow annual net income for 2020 was $-0.162B, a 46.91% decline from 2019.

Zillow annual net income for 2019 was $-0.305B, a 154.77% increase from 2018.

Zillow annual net income for 2018 was $-0.12B, a 26.94% increase from 2017.“

No, I have not looked at financials for zillow. I have you to do it for me, all I have to do is post a claim and someone will validate or disprove it.

“I have not looked at financials for zillow”

I know 🙂 you have no idea. It was low hanging fruit and funny 🙂

I have carpenters/professionals to update my kitchen (because I am sure valuing my own time doing much much higher than 8k). And I have M to research fairly useless (for me) information about zillow financials for me.

Thank yoy

Surge, if you let a contractor do all the repairs for you, you pay a premium on labor&material. Especially in these times where materials and labor costs are going up quickly.

There is a reason why a savvy investor who puts in sweat equity makes money on flips and why a company like Zillow doesn’t make money on flips. In fact, you thought they made a killing but in reality they lost money every year. It shows how disconnected people are from reality and how easy it is to sell them a story.

Good for those that do their due diligence. A market has its way to transfer money from the sheep to the lions. From the impatient to the patient. Dumb money always pays their dues to smart money.

//savvy investor who puts in sweat equity

🙂

Bitcoin looks ready for lift off! Yeeehaaaa 100k bitcoin soon!!!

I have never believed unsubstantiated rumors. However, there are many who do. Ask PT Barnum.

Especially rumors that would mean the politician in charge will have little chance of being re-elected if they were actually true.

Is it just a rumor that Biden pols are in free fall, or is it a FACT?

Is it just a rumor that prices for everything went through the roof in the last 10 months or is it a FACT?

Is it just a rumor that we no longer have protected southern border, or is it a FACT?

Is it just a rumor that hundreds of thousands of ILLEGALS are bused or flown by the current administration all over the country, with no vaccine mandates for them, or is it a FACT?

Are the facts and numbers favoring the incumbent politician, or are they just rumors?

I can go on forever, but I hope that if you are honest with yourself when you answer these questions, your eyes will open up.

The wheels are falling off, and the housing wagon is headed over the cliff. Enjoy :))

I remember “realist” was telling us the same in 2020. In Q1 of 2020 We bought a new construction. Since then, the home value has increased by 300k!! Buying a house is a way of beating inflation and winning in this market. I was even able to refi at zero cost to a rate that lets me save some money.

A renter faces higher rents over time

A homeowner can lower their fixed monthly payment by refinancing. A homeowner is also protected against inflation since home values are going through the roof.

Of course, investments in crypto and stocks are a must as well.

I remember Jim Taylor from 2012-2018 who posted:

“Housing to tank hard soon!” on every one of the Dr’s articles.

He posted again last year that he eventually purchased a house.

Realist can be the new Jim Taylor.

It’s mainly because of lumber costs/ contractor shortage / labor shortage. You can’t remodel a home for cheap anymore. it cost $10K to paint our 1600 sq foot 2 story exterior home this summer. A bathroom or kitchen remodel costs 2-3x what it cost for the same remodel in 2018. Inflation is real folks. We are just gonna live in our older home for awhile and do basic routine maintenance. Zillow lost money because remodeling them was too expensive.

I would have done it myself and saved about $8000.

Headline: You Can’t Trust Zillow And Its Estimates

https://www.financialsamurai.com/you-cant-trust-zillow-and-its-estimates/

Let me tell you an anecdotal story about 2 houses that had the same floor plan and separated by 3 houses on the same street:

Both houses were built in 1973.

House 1: New roof, asbestos tiles replaced with high-end hardwood floors, new A/C, New furnace, Kitchen and 2 bathrooms updated with quartz/granite and other updates, popcorn ceilings scraped. backyard beautifully landscaped. Sold in early 2019 for 890K

with 80K of recent upgrades.

House 2: 1980’s roof, original asbestos tiles, 1999’s furnace and AC, original avocado green kitchen and tile countertops, popcorn ceilings, former pool filled in with dirt. Zillow estimate in late 2019: 900K. Sold for 815K. They should have waited for a Zillow offer. The market seems to work even if Zillow can’t. After this 815K sale, House 1 Zestimate declined 50K. There were a lot of neighbors unhappy with Zillow.

Zillow does not know all. It can’t. At least yet. Not until there is a public record of all of the improvements to every house. Zillow AI also doesn’t have an “irrational curb appeal mode” or a “it has good bones” mode.

My condo originally had popcorn ceilings. And carpeting in the bathroom. I had both the carpeting and popcorn removed.

Whoever thought popcorn ceilings were a good idea? Carpeted bathrooms might be the only worse home decor idea.

zillow bashing (or relevation of zillow’s shortcomings) are amusing to me. Same as FB bashing.

Why would anyone ever assume that zillow was accurate is beyond me. It is a good reference/comparative tool, but ever expecting accuracy is pure laziness to me.

I ignore Zestimates. (Unless I want to get into an irrational bragging war with someone)

I find Zillow valuable to determine price history. Zillow has some sale data going back nearly 30 years. Sometimes you can tell that a major upgrade/addition was added by looking at the tax history.

The photos also often show how well the house has been maintained or upgraded.

The house I first mentioned on Oct 19, and updated a day ago as being pending is estimated at significantly lower than the asking price on Redfin, while as I mentioned before, the Zestimate was higher. When it closes, I’ll give a Redfin vs Zillow comparison to see who came closer to getting the price right.

Bitcoin at all time high!

Ethereum at all time high!

Note how quiet son of a landlord has been regarding crypto? Lol

Congrats to myself and all crypto holders!

Unlike CPI, which is crafted by bean counters at the government, PPI is based on actual information from actual producers of goods and services who must adjust their costs based on inflation or lose profits in the real economy…

Which is why the latest PPI data point is catastrophically bad, clocking in at 8.6% year over year (YoY) for the month of October.

The shills in the media are now claiming inflation is good for us. Meanwhile, for those of us who don’t get paid to spew propaganda, home prices are up 20% year to date, while apartment rents are up 8%-15%, agricultural commodity prices (food) are up 25%, and gasoline prices are up a jaw-dropping 65%.

So, provided you don’t need to buy a house, or rent an apartment (or your lease isn’t up soon), don’t need to drive anywhere, and can live 100% off the land, you’re doing great. Basically, if you’re a cow, your life is OK. For everyone else, your cost of living is up nearly 10% across the board.

This is going to implode the economy and take the stock market with it.

lmao @ the home debters on the titanic re arranging the chairs, ship is going DOWN :))))

and let’s no leave out the bitcoin fools, lmoa, A Fool and his Money are ALWAYS Parted 🙂

Look at the 10y Bitcoin chart. Bitcoin trends up over time. Ignore short term price movements and don’t expect to get rich QUICK. Expect to get rich by DCA-ing and HODLING.

Inflation is at a 30y high now.

Yes, don’t buy a house, don’t invest in crypto or stocks.

Follow the Strategy of the perma bears: Rent for the next decade and save money in your checking account! A housing crash will save you! Not

The last time inflation was this high was in 2008 (As the Republican President and Congress drove the economy onto the rocks).

What happened then?

Buying a house in 2008 was a very poor short -term investment. 13 million mortgage holders foreclosed and walked away and housing prices plummeted (many areas 50%) until it started to turn around in 2012.

It was an excellent time to purchase for the long-term. Most houses purchased in 2008 are well above water now.

The stock market also plunged up to 50% until 2012.

If you think Bitcoin has a store of value better than gold, then buy Bitcoin. Gold nearly doubled in value from 2008-2012. Bitcoin did not exist in 2008.

Buy a house or stocks now if you are in it for the long term and if you believe history does repeat itself.

Millie, you are spot on. Renting and having money sitting in a checking account is exactly what the PTB want people to do. They will be guaranteed to be poor and dependent on the government. Now that the inflation genie is out of the bottle, holding these assets will become even more important. Look at Europe where the majority are renters. You have a small group of the population that controls everything…and this is all generational wealth. Coming soon to a theater near you in the good old USA.

Good job on buying that house last year and not being afraid to make some risky investments. People never got wealthy without taking some risks.

“not being afraid to make some risky investment.”

LMAO. He inherited the money to buy. No risk at all to him.

When it was His money on the line, he was predicting doom and gloom!

M made an excellent long term investment in a house in Jan 2020.

However, at the same time, Bitcoin was around $8K. He made an extremely poor short term investment decision. Since Bitcoin is now around $60K, he could have had an 8X ROI in 1.5 years if he put his entire house down payment into Bitcoin. ie 20% of an 800K house = 160K.

160K * 8 = $1.28M. That’s a lot of rent! His house did not increase by 8X.

M’s crystal ball is as broken as mine and we are mostly all just lucky. Well, it isn’t luck when the everything bubble is inflating everything. You can’t lose. Until you do like in 2001, and 2008.

At least with a long term investment in a house, you will have a place to live. As the Lord has said multiple times, long term renting is financial suicide.

LOL.

In a bull market (+money printing times) like this everyone is a genius.

Thank you BOb!

I agree with all points you made.

Buying a house in Q1 2020 was an awesome move. It improved my quality of life tremendously. Life can be short. Renting an apartment sucks. You don’t want to do that very long. As an added bonus, the house appreciated by 300k.

Now to Bitcoin. I am a long term hodler in crypto. The value of my wallet portfolio is worth a ton. However, if I would have gone all in, it would have been worth a lot more. But I would still live in an apartment and would have to pay 300k more today in order to get into this house.

My point is: you need to diversify. It was a risky decision to invest in crypto and it paid off massively. But Never go all in and out of investments. Diversifying, dollar cost avg and hodling is a sure way to get wealthy. And be patient. Markets transfer money from the impatient to the patient.

A great way to stay poor is: don’t buy assets, rent and hold cash.

Surge, that’s right. During a bull market, those that are invested, look like geniuses.

That’s why I always say: bull markets make you money, bear markets make you rich.

When you look back, people like SOL always cheer when crypto is down. The next crypto winter will come at some point. SOL will be the first to post articles how bitcoin is down etc. those are the times to buy and HODL. During bull markets you scale out of your positions when price gets overextended from the 20wma. Or said differently during hype-euphoria.

Nobody can time crypto bottoms and peaks perfectly, that’s why you dollar cost avg in during the bear market and dollar cost avg out during the later stage of a bull market.

M is exactly correct. Diversification is the key.

I’m old and financially old-school. It allowed me to survive and prosper during the 2001 Tech Bubble and the 2008 Financial Crash.

I don’t mean to lecture anyone but I’m like Turtle (who used to post here). I’m not as strict as Dave Ramsey.

1) Own a primary home and enough conservative cash to keep it from foreclosing. Hold 1-3 years of mortgage/tax payments in a government secure savings account, CDs, or US Treasuries. Never lose the home. No matter how much it tanks like it did in 2008. If you can’t do this, save more and THEN buy a home. Don’t be a star topic on an upcoming Dr Housing Bubble series of articles on massive foreclosures. I know a few who resembled the good Dr’s 2008-2012 series of articles.

2) The majority of my savings follows Bogle’s advice. S&P, Dow, Bond low cost ETFs. Don’t pay exorbitant fees when Bogle’s advice usually wins the long term race.

3) The rest (20%) can be your Mad Money. Invest in Bitcoin, Tesla, Beanie Babies, Tulips, rental properties, etc. Be prepared to lose 50-100% of it if things go south like in 2001 or 2008.

Today reminds me a lot of both 2001 and 2008.

2001:

1) Many co-workers were mostly diversified within Tech stocks. They were extremely wealthy until the Tech Bubble burst (One thought they were diversified when they sold EPets.com at $100($100+ down to $0) and bought Lucent (AT&T) at $80 ($9 up to $100 down $6).

2) Most were wandering around the halls at work telling people how wise and wealthy they were at the peak but were strangely silent after the bubble burst. Many were planning retirement back then, but strangely, 20 years later, most are still working.

Diversification between a house and only Tech Stocks was not good diversification.

3) I was diversified within all sectors with some Mad Money in Tech. I only lost about 10% which recovered in the next couple of years. The NASDAQ took nearly 15 years to recover to the 2000 valuation.

4) Tesla and Bitcoin remind me of those days. Anything that can go up 8X-10X in a year, can drop far further. Often to $0.

2008:

1) Housing speculation and too many people bought houses with little down and no conservative savings to keep them from being foreclosed. See my post above on how similar we are today.

2) The housing crash rippled into the stock market and the employment market. Individual stocks dropped over 50%. Large banks, General Motors, United Airlines, all declared bankruptcy and their stocks went to $0. The ETFs which held these dropped 30%. Even being conservative was bad. Good thing I had a job and cash. Nomadland documents what happened to some of the millions who foreclosed. Living in a van down by the river.

3) Just past the bottom in 2014, I sold my primary house and bought a bigger and better house. I sold with some equity because I had paid off about 15 years on the mortgage. Housing values had dropped to about 2003 values at that point. It was still a fair long-term investment with the equity and no rent for 15 years. The new house was also a good long term investment. I noticed at the low in 2012, house values were at about the 2002 values. Holding for 10 years was a break-even in values (not counting the rent I did not pay.) Housing is a long-term investment and a place to live and enjoy. Ideally, your kids will benefit the most from the gains on your primary home when you pass into the great CA sunset.

Of course, now it is different. Back then, the Fed didn’t drive interest rates to 0%. (one irresponsible President was trying to force the rates to negative). The Fed today is driving a massive control system. Hopefully, a good controls engineer is keeping the system stable. It isn’t true capitalism anymore. It is Flyover’s worst nightmare.

M, you are making me proud and hit the nail on the head with diversification. That is the key to building wealth. The chances are much greater to lose big if you put all your eggs in one basket. Own assets and let the magic of time do its thing. This is not rocket science here!

M, but we all worried if you have a pool/community pool now or you are still sneaking in someone else’s pool?

M: people like SOL always cheer when crypto is down.

I never cheered. I merely observe and express my doubts about crypto.

You’re the one who always cheers, mocks, and gloats. About anything and everything.

“I merely observe”

Thanks for making laugh.

So you only observe when crypto is correcting but never ever observe when crypto is doing well.

So dishonest and one sided. It reminds me of the media coverage of rittenhouse.

It would be more believable and honest if you just admit you always try to make Bitcoin and crypto look bad whenever you get a chance and you hope it won’t succeed.

M: So you only observe when crypto is correcting but never ever observe when crypto is doing well.

So dishonest and one sided.

Since you only observe (or rather, hoot, holler, and whoop) when crypto is doing well, and never when it tanks, by your own standards, you are dishonest and one-sided.

Thanks for your admission of dishonesty.

Thank you SOL for showing us how dishonest you are.I like when crypto is down.I buy dips. It’s all about dollar cost avg. I said for years that bull markets make you money and bear markets make you rich. You buy low and hodl. Have been doing this for years. You on the other hand only talk about crypto when it’s down and you call this observing. Lol.

Dishonest, one sided and blatant liar

M: Dishonest, one sided and blatant liar

This, coming from someone who admits (or rather, brags), about:

* Trespassing into his neighboring building’s pool.

* Lying to his landlady about how poor he was, so she would keep his rent low.

And your “new construction home purchase” tale is full of contradictions, as I’ve belabored in previous threads.

And more blatant lies by SOL. 🙂

M: And more blatant lies by SOL.

Which one?

Longtime posters here pretty much remember you bragging about trespassing into your neighboring building’s pool, and bragging about how you pretended to be poor so your landlady would keep your rent low.

M: ????

That’s not an argument.

For some reason, when I cut & pasted M’s smilely face, it came out as: ????

M gets key code from his buddy to visit/use his community pool.

SOL spins the story into a trespassing lie.

Smart by M

Business as usual for SOL

M: “M gets key code from his buddy to visit/use his community pool. SOL spins the story into a trespassing lie.”

YOU called it “househacking.” How is “househacking” different from trespassing?

Would you not consider it trespassing if someone “househacked” into your (alleged) home?

M said to Joe Schmoe (January 8, 2020):

“Is there something wrong with utilizing a nice, well maintained pool next door and not paying HOA fees? … I have a friend who lives there who provides me with the key code (keyless entry). … I walk right through the front gate. Some people actually think I live there. … You sound very jealous of my househacking skills.”

Source: https://www.doctorhousingbubble.com/millennials-home-ownership-rate-home-buying-young-americans-california/

Househacking. Because it’s against HOA rules to give the key code to people who don’t live in the building. M’s term for “trespassing.”

My condo has a community pool. My HOA considers this trespassing, not “househacking.”

============

Curiously, that same thread, M wrote: RE experts (me included) have proven time after time that inflated housing bubbles crash by 50-60% roughly every ten years. We will see those discounts soon. They are on the conservative sprectrum (a given).

M was urging people NOT to buy houses, less than TWO months before he announced his alleged inheritance and “new construction home purchase.”

On the next thread, M was urging people NOT to buy houses, less than ONE month before he announced his alleged inheritance and “new construction home purchase.”

M later claimed that his inheritance wasn’t “sudden,” that it took nearly a year for it to clear probate, and he’d been shopping for houses all that time (while urging people not to buy).

M’s comments are full of lies and contradictions.

Exactly. This has nothing to do with househacking. Trespassing and househacking are two different things.

I’ll help you out, SOL.

This is trespassing:

SOL Plans to take pictures and videos to find holes in M’s story. He puts on his camouflage gear and climbs over M’s fence. To his surprise, M’s dog smells him and runs after him. SOL was only able to take a few shots of M, his wife and his house. Highly distressed, SOL climbs back over the fence and drives back home as fast as his Chevy metro lets him. A cop stops SOL for speeding. M’s ARLO cams picked up the trespassing scene and he reports it to local law enforcement. Since the police hasn’t been defunded they are able to connect the trespasser to the guy speeding. The camouflage markings were identical. The police interviews SOL and he admits everything. M doesn’t press charges but gives his dog an extra treat (chicken jerky).

Even if an insider gives you the key, if you have no right to be there, it’s trespassing.

BLM loots and calls it “reparations.”

Antifa blocks off city streets and calls it “liberation.”

M trespasses and calls it “house hacking.”

I am glad you are admitting it, SOL. Everyone makes mistakes. I’ll forgive you!

Thanks, M, for admitting that you subscribe to BLM ethics.

BLM loots and calls it “reparations.”

Antifa blocks off city streets and calls it “liberation.”

M trespasses and calls it “house hacking.”

SOL

Blue life’s matter too. Actually all life’s matter.

Didn’t the head of BLM buy mansions with all the donations?

If I were you SOL I would not support BLM.

If you educate yourself on what’s really going on, you will find out that a ton of BLM supporters participated in the riots and looting.

I can forgive you for confusing the term trespassing with househacking but I can’t forgive you for supporting radical groups like BLM.

M, I prove my accusations against you by linking your own quotes.

Naturally, you have no defense.

So you play kindergarten games. I say Blue, and in the next post you accuse me of saying Red.

You’re not a married professional homeowner. You’re a basement dwelling troll.

SOL is known for making up stories and putting words in your mouth to fit his narrative. When exposed he lashes out and makes up even wilder stories.

But what else is new 🙂

M: SOL is known for making up stories and putting words in your mouth to fit his narrative.

SOL is known for linking the pages from which he quotes M, so that anyone can verify his claims.

Exactly, you just repost what I say (links) and then claim I lied or trespassed. It’s hilarious. You are the biggest troll on this blog.

I think you are just jealous that I have a house and crypto. And soon my first rental property!

Ok, Enough of sharpening M’s horns.

What is everyone’s opinion here about pay off primary mortgage completely.

Current rate is 2.5%, but practically not writing any of it because of very large standard deduction.

Option #1: Pay off home

Option #2: Invest in stock. Need to earn ~4% (after-tax) to equalize 2.5% mortgage rate which practically cannot be written off.

Opinion/Thoughts?

Thanks

Inflation runs at 5-6% and you even think about paying off a mortgage at 2.5%????

You are getting free money. Why would you not diversify the money into the QQQ or SPY and crypto?

Never pay off mortgages….refinance. I take 2.5% on a mortgage and invest the money for 10% on an index fund all day long. Ideally 80% in index funds and 20% in crypto. Thank me later

Pay off your house and operate from the position of “F.U.”

https://www.youtube.com/watch?v=rJjKP8vYjpQ

Surge,

I am in the same situation as you.

On one hand, I think the FED has driven the mortgage rates to an absolute absurd low at 2.5%. It is not sustainable in the long term. However, the long term may be longer than any of us imagine. Some Presidents wanted the Fed to drive the rates negative to keep the party going and housing prices shooting to the moon.

If savings rates ever become larger than 3.5% again, then the decision to not pay off the mortgage is a no-brainer. ie Earn a historically normal 4-5% in a government insured CD while only paying 2.5% for a mortgage? Nobody would pay off their mortgages. Lenders may go under, but since many of the loans are being held by Fannie and Freddie, maybe this is part of another long-term bailout plan. Or the lenders will cry and point to the 2.5% mortgage holders and claim they need a reset because they are too big to fail. The young will point to all of the Millennials with absurdly low 30 year mortgage rates and Prop 13 taxes and sympathize with the lenders who now have to charge 6% for mortgages to make up for these deadbeats.

My decision also depends on if I am diversified.

1) If I had 100K in savings for investments and a 100K mortgage, I would not pay off the mortgage (despite what Dave Ramsay says). I’d keep 1-3 years of mortgage payments of the 100K in cash and the rest I would invest in ETFs and have some Mad Money. Based on history, it is likely that gains on ETFs will continue to be 5-8% over the long term. Some years may be -30 to -50% but historically it comes back. As long as you aren’t forced to have a fire sale.

2) If I had 1M in stocks and 100K in a mortgage, I’d pay off the mortgage and possibly buy a second home/new primary home with my Mad Money. This would diversify my investments. Get another loan at 2.5% to 3% and rent out the paid-for house.

3) If I was near retirement, I may pay off the mortgage to balance cash flow and achieve the mythical peace of mind. The banks can’t foreclose on a paid-off house. Most states have a path to postpone property tax payments until the primary house is sold.

4) If you have $1M in Bitcoin and Tesla and a $1M in a mortgage with no conservative savings, 2008 says you are a fool. See you down by the river. I’ll write a book about you.

My crystal ball broke in the 1994 Northridge quake and somehow I made it through 2001 and 2008 with minimal damage. Of course, I am still working because I don’t have a guaranteed pension and I do want to enjoy my retirement even during a 50% downturn.

My wife disagrees because she is far less conservative. .

I agree mostly.

My concern is 5%-8% ETF which is effectively 2.5%-4% after ~50% marginal tax rate.

My mortgage is 2.5% and I can’t write off any of it.

So, lower end of ETF income = mortgage rate.

Keeping money in ETF: Upside, slightly higher gain, liquidity.

Downside: Higher risk to the principal balance.

Where do we place 401k balance (diversified across stocks, etf, index)? Is it part of the investment? Value is overall 75% of the home value.

It’s has been over 25 years since 1994. You should look into buying a new crystal ball, the progress in crystal ball technology has been incredible in last 10 years.

Surge,

Some comments on your comments. These have more to do with my situation.

“My concern is 5%-8% ETF which is effectively 2.5%-4% after ~50% marginal tax rate.

My mortgage is 2.5% and I can’t write off any of it.”

I believe the tax rate on LT Cap gains from stocks and ETFs is 15-20% Federal and depending on your income there may be a 3.8% investment tax. + whatever state tax you may owe. I believe the marginal rate on LT investments is maximum 25-30% including state taxes. In a 401K, I agree, the tax is based on earned income. I hope not to have to be in a 50% tax bracket when I start withdrawing from the 401K/IRA.

Not many can write off any of their mortgage interest with the cap on SALT, the higher std deduction, and the fact that interest rates are so low that there isn’t much to deduct after having the mortgage for a longer time. I used to deduct SALT and interest when the std deduction was 13K. The SALT cap limit was politically motivated and changed very quickly. It may change quickly again to allow it. It doesn’t seem fair that I have to pay tax on interest earned in the bank but cannot deduct interest paid for a mortgage. That’s what the 25K std deduction is for, I guess. I certainly don’t have 25K (or even 15K with the 10K SALT cap) in interest to deduct.

“So, lower end of ETF income = mortgage rate.”

On average, in the LT, ETFs pay 8% and LT cap gain tax rates are 25-30%. 8%-2.4% tax = 5.6%

I believe safe, insured, 4+% investments are coming. When is the question.

Then you will need a higher ROR because interest is taxed at the higher earned income rate. I hope to retire in or below the 22% tax bracket ($83,551 to $178,150). I hope my wife agrees :-). 4% – 0.88% (Fed tax) – 0.4%(CA State tax 10% for up to 600K income) = 2.72%. This is still justifies holding a 2.5% mortgage for an extremely safe investment at 4%.

“Keeping money in ETF: Upside, slightly higher gain, liquidity.”

Hold 1 year for LT gains. Historic average has been 8% since 1957 for the S&P500. There have been a few -30% years. Don’t sell and have some cash to survive the down year.

“Downside: Higher risk to the principal balance.”

I think it is mild/moderate risk. There have only been a few years where this is true. Hold some insured cash/CDs to live and don’t sell ETFs in the down years.

I won’t get rich quick with this approach, but I also won’t get poor quick.

I get a lot of spam calls from “Investment Advisors” who claim to have a latest and greatest crystal balls. The PT Barnum model of crystal ball seems to be the most popular.

You’ve used the crystal ball reference way too many times over the years: I’m guessing over 100 times. You really need a new, fresh reference. Your crystal ball analogy has been played out.

I should have mentioned that extremely safe I Series savings bonds are now paying 7.1% for the next 6 months. You can order up to 10K per calendar year on Treasury Direct. 10K now and 10K in January. Double that if you sign up your spouse.

A safe investment of up to 40K for 6 months at 7.1% would safely help pay a 2.5% mortgage.

If you believe Mr Landlord and inflation will continue to be over 4%, then there would be no reason to pay off your 2.5% mortgage. Just keep buying I bonds for the life of the mortgage. Or if Treasury bonds start paying more, then switch to safer E bonds or an ETF that holds treasury notes.

Rich,

Sorry. I still have the Magic 8 Ball, Tarot Cards, and Ouija board but they don’t work nearly as well as the Crystal Ball.

I just miss my Crystal Ball.

If you can suggest anything better, I’m listening.

There’s many different investment paths- Speculation, Flips, short term, long term, etc.. But the keywords for those who don’t want to ride too high on the Risk Rollercoaster are “Stay invested long term and Patience”. My path – Surprisingly, I did NOT listen to the diversification advice and still came out ok. As a young novice investor I lost $ in equities and needed every penny I had just to get into RE. Then it was 20% down or they showed you the door. So I didn’t have the time or money to diversify. But I did stay invested, which required tons of patience plus a day job. Narrowing my focus also helped me spot RE opportunities and evaluate risk better. I never really trusted most fund managers. And most day traders, hedge and venture funds actually have mediocre long term performance stats. Once in a while one will hit gold, but that’s the exception. Financial advisors always tout diversification, but not too many people crash and burn if they don’t do it. However, if you pull out for a long term, you just might.

Great post

Diversification is great for passive investment and for the people who don’t know what are they doing.

What you describe is more like an active involvement into business; there you benefit by sort of going all in, controlling the situation and growing the business yourself. In fact, intense focus (which is opposite of diversification) is what is needed.

Thanks for the post Surge.

Surge says diversification “is for people who don’t know what they are doing.”

Surge is also the same guy who talked about Zillow: “Imagine how many millions they made on previous flips”

Surge thanked me later in the post for letting him Know that Zillow lost money pretty much every year. I guess he was too lazy to research. Pulling up the financials of Zillow takes like a few seconds in today’s world. Obviously you need to have a basic understanding of financials.

Bottom line here is: don’t follow the advice of surge. Said differently: when he says x is a great company and probably makes millions then sell. When he says don’t diversify and put all eggs in one basket than you can be sure that diversification is the way to go.

From Investopedia:

“In 2019, the failure rate of startups was around 90%. Research concludes 21.5% of startups fail in the first year, 30% in the second year, 50% in the fifth year, and 70% in their 10th year.”

Not very conservative odds.

However, I’d use my Mad Money if I had the passion and time for a good idea.

I’d still want to say FY if I lost all of my Mad Money like 90% do. I wouldn’t touch my diversified investments or my primary home equity with these odds.

M, while everyone can appreciate a bit of good trolling, you are going “full retard” on this one. And remember – “you never go full retard”

I just like to help people do the right thing.

Dollar cost avg and HODL crypto

Los Angeles to ban new wood-frame construction houses: https://www.pacificresearch.org/los-angeles-is-gearing-up-to-ban-wood-frame-construction-renters-will-soon-pay-the-price/

Over the summer, the Los Angeles City Council Public Safety Committee approved a proposal to expand Fire District 1, an anachronistic planning overlay that would effectively ban wood-frame construction in much of the city.

Superficially premised as a measure to improve fire safety, the motion has been heavily promoted by special interests in the concrete industry, who would heavily benefit from the prohibition.

Yet as less partial observers have pointed out, the motion would significantly increase the cost of constructing housing in Los Angeles, to no clear fire safety benefit.

Apart from increasing the cost of construction, concrete homes aren’t very earthquake safe.

Is the insanity the prices of homes or is it the amount of money people have???

Look at this home in Baldwin Vista, the least of bad neighborhoods east of LaCienega (low crime compared to Baldwin Hills or Baldwin Village, etc)

Sold for a crazy price of $1.005M then 1 month later with only new paint, sold again for $1.2M

WOW

https://www.redfin.com/CA/Los-Angeles/5773-Bowesfield-St-90016/home/6890464

but I guess since any home West of LaCienaga will sell for $1.5M or more, this was justified.

“The house I first mentioned on Oct 19, and updated a day ago as being pending is estimated at significantly lower than the asking price on Redfin, while as I mentioned before, the Zestimate was higher. When it closes, I’ll give a Redfin vs Zillow comparison to see who came closer to getting the price right.”

It’s in now and the house went for $30 K LESS than Redfin’s estimate. Redfin beats Zillow by $30K, but both were high.

“The house I first mentioned on Oct 19, and updated a day ago as being pending is estimated at significantly lower than the asking price on Redfin, while as I mentioned before, the Zestimate was higher. When it closes, I’ll give a Redfin vs Zillow comparison to see who came closer to getting the price right.”

It’s in now and the house went for $30 K LESS than Redfin’s estimate. Redfin beats Zillow by $30K, but both were high.

This house is a lesson to wannabe flippers. Don’t spend too much on a flip because you may not get it all back. The flipper told us he spent $150K on it, and that leaves $55000 for the flipper and the realtor to split. On a million dollar sale, I might add.

This house is a lesson to wannabe flippers. Don’t spend too much on a flip because you may not get it all back. The flipper told us he spent $150K on it, and that leaves $55000 for the flipper and the realtor to split. On a million dollar sale, I might add.

Powell today testifying before Congress: Inflation is here, it’s real, it’s bad and it s not temporary.

Poor Bob, wrong once again.

With this Biden induced inflation raging, if you’re not in real estate you hate money.

Let’s Go Brandon!

This is what Powell said:

““It’s also frustrating to see the bottlenecks and supply chain problems not getting better — in fact at the margins apparently getting a little bit worse,” he added. “We see that continuing into next year probably, and holding up inflation longer than we had thought.”

Again, supply and demand.

Powell will raise ease QE which will drive up interest rates slightly and level off housing prices. It is a good move. It should have happened long ago. This administration is doing the correct thing. Unlike the disaster of the last administration that artificially caused massive housing and rent inflation.

I still think we need more government intervention to free up the supply chain issues.

I haven’t been active on this blog as I used to be but I felt like entertaining myself by reading the comments section and that still hasn’t failed me.

“HeY gUyS this one house up the street sold for $995000 which is $5000 below asking price…the bubble is popping!!”

That’s what y’all said in 2017 right??

What about 2019??

What about 2020??

If I remember correctly, I was the ONLY one that took the aggressive buy position all these years and well….can y’all update me on how well that worked out for y’all?? Because it worked out quite beautifully for me! Goes to show that keeping yourselves in an echo chamber does nothing but stroke your egos so I thought I’d make a guest appearance to flex my own dollar-backed ego after being silent on this blog for while.

2021 been the best year to date for me. The SEVENTH straight year of exponential financial growth and 2022 is looking like it’ll make 2021 look like small potatoes.

It’s a New Age people! Get with the program!!

None of the real housing gurus say there will be a crash anytime soon – correction coming but thats it. Yawn.

Hi new age and welcome back!!!

You were spot on all these years!!

Inflation is working well for those that have home loans. Your debt is being inflated away while your asset value increases tremendously.

My stocks, RE and crypto are doing extremely well. People need to understand you can make money in any market. Waiting for a crash to get ahead is the worst thing you can do.

I did this for years! Now I am happy to admit I was wrong! Hopefully it helps people who think a future, potential housing crash is worth waiting for.

I agree with you that an individual house selling below asking price is not a sign of anything other than the owner was too optimistic or desperate (if they put too much money into a flip). Bubble popping requires Ponzi financing in the market where the cash flow cannot cover interest or principal. In other words, the owner has to sell at a profit to get out alive. I don’t think this is happening now with large down payments and very low interest costs being the norm.

We are currently in the starting phase of an inflationary cycle, which is death for cash and a lot of bonds, bad for a lot of stocks (see the ’70s) but good for hard assets like real estate. People with long term holding ability should do fine in Real Estate in the remainder of the Biden Presidency.

@New Age, I’ve been pounding the table for almost a decade to buy. There were SO many opportunities, I can’t count them anymore. You didn’t need an advanced degree to figure out that renting for the long term and holding cash is a very bad idea, especially in places like socal. Even today, if you can afford a primary residence and plan on owning for the long term…go out and buy. Do people honestly think that things will be cheaper in 2030 or 2040.

If people would just spend less, live frugal and save for a downpayment they could easily buy a condo to get started. No, people hope for a severe crash so they can buy at a huge discount. Meanwhile house prices and stocks are being pushed higher through our money printing policies. And rents keep going up and up and up.

I was a bear years ago…..don’t make the same mistakes. Buy a condo or small SFH to get started and then upgrade later. I was fortunate and was able to put a big junk down due to my savings and an inheritance. I am working on getting my first rental property soon.

Cheers and happy holidays!

In many areas in the US, prices will be nearly the same in the future in inflation adjusted dollars. But people will be poorer because no one paid in fiat currency will be able to keep up with inflation. That’s how inflation works as an insidious tax on workers. Other places with declining populations may actually be cheaper. The history of California is constant immigration. Once from other parts of the US, now from around the world. The inner cities will be good places for cockroach landlords to buy and the nice areas will be for people who can afford them. Respectable landlords will get hosed in the inner cities due to government imposed costs and following rules that guarantee losses.

I agree. Cost of everything keeps going up over time. People need to buy a house , if they can.

I know someone in CA who got a loan for 800k to buy a house and still can’t get one due to over-bidding he says. I don’t think he could make ends meet, per month, anyway though on a 800k house.

I also know a very lefty couple with high tech jobs and lots of cash, but they “believe in renting forever.” That’s what they say. Doesn’t make any sense to me.

We bought the cheapest house in nicest neighborhood we could buy. Literally put all our pennies together for our first house right after our cheap wedding. We knew if we didn’t, we could not afford it later. This was 2015. We left Califgornia due to the disgusting way it is run.

M, I’ve read so many of your posts here. I question anything you tell us. Maybe you don’t even have a wife.

“ M, I’ve read so many of your posts here. I question anything you tell us. Maybe you don’t even have a wife.”

Thanks for reading my comments! I read your first comment on this blog too!

Yeah maybe, it’s funny that you ask.

My wife used to be very frugal. We are hosting a Christmas party and after seeing all the decorations she bought I asked her. “Who are you and what did you do to my wife”?

Maybe she isn’t my wife anymore but she def likes to spent my money ????

That’s not fair. She works too but you get the point.

Millennials do the same stuff other generations do. They just started later. Wait, didn’t Mr Landlord tell us this for years?!

Crypto-Christmas-flash-crash.

Christmas came early for crypto investors that were looking to add precious coins to their portfolio. Crypto investors like me dollar cost avg and HODL for the long term. I loaded up on this dip!

Buying the dip and hodling is a very rewarding strategy to generate enormous wealth with crypto. (Same is True for stocks).

30% Off Sale on Bitcoin!!

This is better than the retail Black Friday sales but not as good as the historic Stock Market Black Friday sales of the early 2000’s when EPets went from $14 – to $0.19. 99% off!! I know some who got in at 30% off while it was cratering. Sad, since selling pet food online seemed like such a great idea. Their sock puppet mascot even made it as an ad during the Superbowl.

Thank you M for promoting both the ups and downs of Bitcoin in such an optimistic way.

If you can wait you can buy bitcoin @ 40,000.00

The 50weekly MA is around 47k and so far it’s been holding.

Right now is a great time to dca into BTC and ETH. We might not go down to 40k and you will miss owning some BTC. IMO: DCA is your friend + HODLING! Has made me wealthy over time. be patient.

Is $40K a low for Bitcoin?

Bitcoin was at $8K 2 years ago. That would be a 5X increase in price in 2 years.

If the value of the US Dollar went up 5X in 2 years, some would say that was hyperdeflation. They wouldn’t call it a stable currency. What is Bitcoin? A massive risky speculative investment?

If my house went up 5X in price over 2 years, I’d sell and run for the door (with my tent).

I’d count myself lucky and wealthy if I got out at a 5X profit.

Housing & Crypto CRASH HAPPENING lmao, you will learn, the hard way.

How do you define a crash realist?

Bitcoin is up 170% in the last 12 month. It’s an accumulation year for Bitcoin. Hold your horses when we see a breakout out of the accumulation range to the upside.

Housing is up as well. In our neighborhood houses are selling 300k above what I paid. Some houses sell for more, some for less.

If I were you, I would buy RE. Timing the market doesn’t work. You also have to be in stocks. Time in the market is better than timing the market when it comes to stocks.