Young and living at home – Record percent of 25 to 34 year olds living with parents. Los Angeles employment figures back to 1990 levels. Rents rising are merely a sign of a squeeze on standard of living.

When it comes to real estate, California seems to push things to the extreme. When the nationwide market was booming California was booming with even more bells and whistles. When things went bust, we went down like a boxer with a glass jaw. Now with housing values going up, some areas are having bidding wars and a touch of mania buying. Expectations are always hard to manage and people adjust their expectations based on their small circle of influence. For example, the median home price in Southern California peaked at $505,000 back in 2007. Today the median price is $309,000, a 38 percent drop even in the face of incredibly low mortgage interest rates. Yet many want to buy their homes in tiny niche markets chasing the hot money and hipster vibe. If you can snag a home with a $250,000 mortgage at a 3.5 percent mortgage rate your monthly payment might be lower than a comparable rental in L.A. given the jump in rental prices coming from investors and lack of inventory. Yet overall, many still cannot buy because of the weak employment market. The young have certainly not pushed the housing market up recently. They are dealing with student debt the size of a mortgage in some cases.

Moving in with the parents

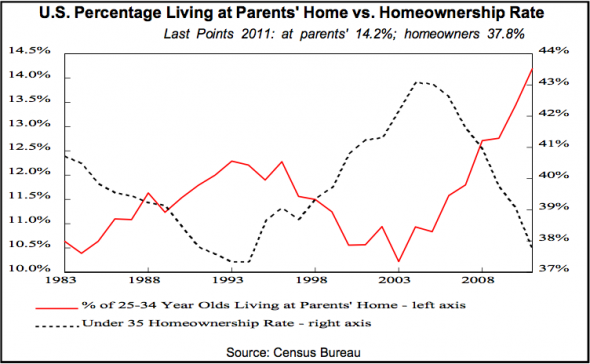

Contrary to the mania occurring in some markets, home prices have fallen significantly and pulling up modestly from the trough. Of course this reversal is occurring because of the Federal Reserve and banks leaking out inventory selectively. Yet the trend for young Americans is unmistakable when it comes to housing:

The homeownership rate for those under 35 is heading back to levels last seen in the 1980s. The percent of those between 25 and 34 living at home is reaching record levels. This is an important trend to recognize because it highlights that many of these people are not seeking rentals let alone out in the market to buy a home. Do you think higher rental prices will pull these people off the sidelines?   Â

In California some are only focused on their niche situation. They try to justify a timely purchase/sale or complain against certain policies while they send their spouses off to subsidized state colleges. In other words they leech off the system as long as it is a benefit to their own cause and disregard that higher rents for example that are harming younger Americans because of these policies (i.e., controlled inventory, selling bulk property to private equity investors, etc). They like to believe that they are participating in some sort of open market but that is clearly not the case. It is a clear example of what Nassim Taleb describes in his Fooled by Randomness book. That is, they lucked out but like to think it had something to do with their own skill set.

I’ll give you an example. There is this person in their 50s with two kids in their 20s. He was fortunate to go to a California state college when it was practically free but now, his kids who have average grades are shut out from many of the competitive majors. They want to go to a private school that will cost roughly $50,000 for year. It is that or try the community college lottery where classes are being slashed. With a liberal arts degree he was able to land a good job and made a career out it. He is bitter now about his kids not getting in. The kids meandered for a few years working odd jobs and now realize it is necessary to get a college degree. A liberal arts degree like his will not do them much good in this job market especially at the private school cost. At the same time, this parent is furious about paying one more cent in taxes even though this is how his education was funded! This is a very common California mentality. Expecting a Mercedes-like system on a used Chevy budget. The kids currently live at home and are likely to go to a private college. I’m sure this story is playing out over and over with many baby boomers across the country.

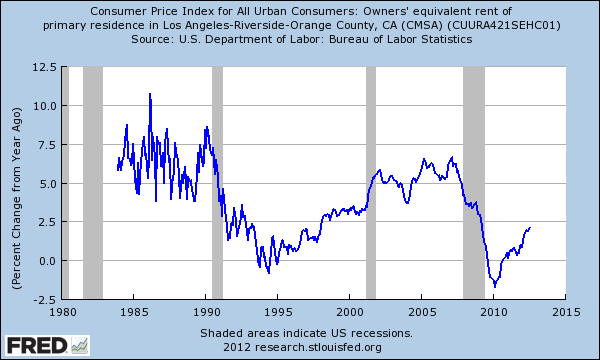

Let us look at rents. Rents are going up in SoCal yet incomes are not:

People try to act as if this is some sort of open market. It isn’t. We suspended mark-to-market accounting to benefit the banks and here we are having the Fed purchases billions of dollars a month in mortgage backed securities simply to keep interest rates low. The Fed is trying to pick winners and losers via monetary policy so those that think that they can plan a purchase or a move based on some kind of market timing are simply entering a guessing game. But know this; household incomes are not going up.

The employment situation

I saw this article on CNN Money this weekend about the employment market in Los Angeles:

“NEW YORK (CNNMoney) — The unemployment rate has been falling lately in Los Angeles County, but not for the right reasons.

Last month, the jobless rate for the county fell to 11%, down from 12.4% a year earlier.

While that’s far higher than the 8.1% unemployment rate for the nation as a whole, it nevertheless seems to show progress for the City of Angels… right?

Wrong. In Los Angeles, the falling unemployment rate is slightly misleading, just as it has been for the country overall.

When surveyed by the government, fewer L.A. residents say they’re unemployed compared to a year ago. But it’s not because they’re finding jobs. It’s because they’re dropping out of the labor force altogether.†Â

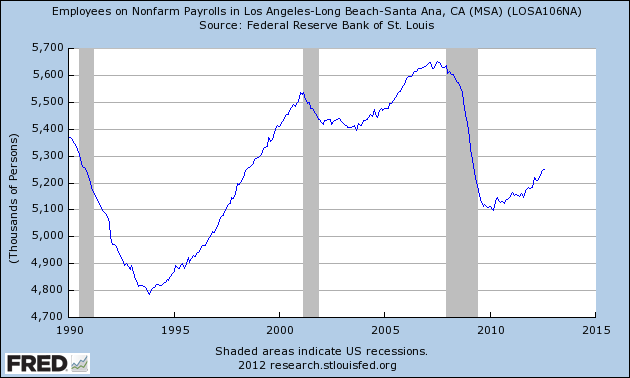

This is incredibly important to understand. We are entering demographic headwinds and the way employment figures are calculated, the headlines can be very misleading. People are back to buying homes in some L.A. neighborhoods as if no bubble even occurred and are even going into bidding wars like folks wrestling over Tickle me Elmos over Christmas. Take a look at the employment figures for LA/OC:

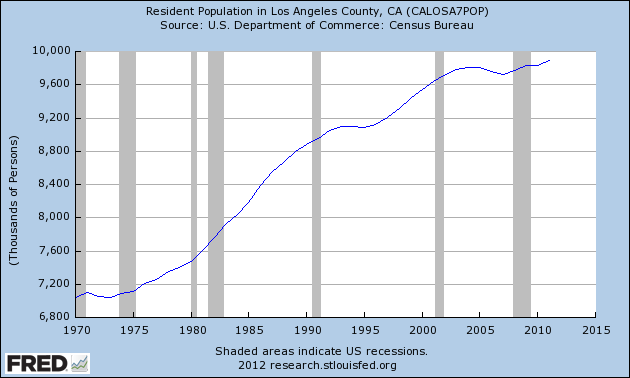

The chart is actually helped by the OC employment figures. In Los Angeles County for example, we have the same number of people employed today as we did back in 1990. The difference is the population has increased:

As carmageddon is reminding us we are a massively dependent car culture here. Many that work in Los Angeles don’t necessarily live here. As the previous article reminds us:

“L.A. has hot industries, but those people may not live in Los Angeles,” Levy said. “They may live in surrounding areas like Orange County.”

So you have these odd sort of trends all coming together at once. Even the Los Angeles County median price is at $335,000. Of course many want to live in handpicked neighborhoods chasing after hipster money and pent up demand mixed in with a dash of hysterical mania (after all, who calls a routine freeway closure carmageddon?). Don’t forget that nearly 27 percent of all SoCal purchases are financed with easy money FHA insured loans that only require a 3.5 percent down payment. So for that median $335,000 home all you need is $11,725. Like I discussed before, many have it in their mind that they are somehow missing bubble version 2.0 and are not going to let it slip by this time. Goodness gracious they are going to get a seat in this musical chair sequence! So you have a rush into the market in 2012 and massive government intervention combined with banking accounting magic. Ultimately this is more of a narrative of what is occurring because when the government is the housing market trying to act as if this was some sort of open market is naïve.

Yet the bottom line is household incomes are stagnant and the cost of many items like sending your kids to college has gone up dramatically. You might not pay for it in one sector but you will pay for it in another. For all those buying homes in these areas with kids hopefully they are setting money aside for that expensive private school education down the road. Did we mention that college costs are increasing at rates higher that home prices did during the bubble?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “Young and living at home – Record percent of 25 to 34 year olds living with parents. Los Angeles employment figures back to 1990 levels. Rents rising are merely a sign of a squeeze on standard of living.”

This current crop of kids are going to have it way tougher than anyone else in the last 50 years. The Boomer generation saw the bubble of the US standard of living. Not only has that bubble now popped, but there’s 2B people now coming on line from Asia to compete with them in the new global economy. And these people are used to a much lower standard. The great rebalancing is underway.

From what I can tell, the current housing situation is mostly getting people off the fence or the sidelines, to buy a house. Most of the sentiment I still hear and read is pretty negative. And the real unemployment levels and wage levels are just too lousy to really get another housing bubble like we’ve recently been through.

A lot of folks blame NAFTA, but it is just a subset of ‘globalization’. That, plus the internet, pretty much assures that wages won’t go up here much. Manufacturers can search the globe for the cheapest workers, and customers can search the world for the cheapest goods.

Then you have the end of cheap oil. Many of the super giant fields, such as the monsters discovered in Saudi Arabia 60 years ago, flowed pipeline quality oil right out of the well head without a pump, for a couple of dollars per barrel. A lot of the stuff they are bringing on line now, like Alberta tar sand oil, has a very high cost of production. Gasoline prices have no where to go buy up, unless we have a complete economic melt down. This is a pretty serious headwind for the economy.

I just don’t see where the next driver for job growth could be. If it isn’t alternate energy at sustained $100/bbl oil, then what? Even if something comes along soon, they won’t be hiring millions of workers right out of the gate. I don’t look for household formation to rise significantly for quite some time, maybe another 5 or 10 years.

What about LaRouche’s platform: Global Glass Steagall, National Credit Banking, NAWAPA, Mars colonization, deep space exploration? Are you supporting that?

Yeah, I don’t see why the US isn’t jumping in the game faster on the renewables.

I read a study in an economic journal that concluded Germany will have cheaper energy in 2020, than if they had not gone all-in on the renewables. Basically, the big tariff subsidies get phased out, and some are being phased out faster than projected. Germany has some fairly expensive electricity, but there was a graph showing that they are currently paying wholesale, what they were paying in the early 1990’s (there was a price dip between then and now, making their energy seem relatively more expensive currently).

I’ve read several articles here and there where U.S. fracking isn’t playing out as well as was originally projected. One fella on Seeking Alpha, by scrutinizing over one big company’s data, said its fields had to put an unsustainable amount of new wells online per unit time (can’t remember – probably monthly), just to keep their current production flat.

Of course in CA trying to build anything to add more wind or update the grid to accommodate large amounts of wind is an uphill fight, ironically against environmentalists that don’t want pristine environments disturbed. Then there are those guys on the east coast that even though they look at power lines strung from house to house everyday, deal with the noise pollution of planes flying everywhere, and noisy, gas-powered autos everywhere, tuck their tails in when they fathom the idea of windmills off in the distance of a shoreline.

Then there are the fellas that accuse private wind investors of making too high of a profit on projects….

Automation and robotics has taken far more American jobs than China has. I’m not justifying China, but just putting the truth out there.

Papa toBe

“Automation and robotics has taken far more American jobs than China has. I’m not justifying China, but just putting the truth out there.”

Have all the diseases been cured? All exploration done, all music and books written? All inventions invented? All bridges, roads and airports in no need of improvement? All children educated to best level possible? No one hungry or homeless? All elderly cared for properly? There is plenty of work to be done, robots cannot be blamed for long term unemployment.

Rumble, facts are facts. The charts don’t lie

http://globaleconomicanalysis.blogspot.com/2012/08/robots-to-rule-world-taking-all-jobs.html

I am going to put this out there on this thread too.

I don’t know if it is just seasonal but here in San Diego, sales above 650K have nearly stopped, sales 650K to 600K slowed drastically and sales 600K to 550K linger. Below that you have bidding wars still.

What I have noticed all spring was fabulous places above the FHA limit of 696 sat and sat and just average houses just at or just below the FHA limit fly off the shelf. I think we are seeing the signs of running out of those who can qualify for a 3.5% 675K. mortgage.

With my math, even with a 3.25% mortgage, your payment with mortgage insurance due to the low down payment, you are at around 4K a month and after accounting for the tax savings and the loss of the standard deduction, you are still around 3,500 a month not to mention up keep costs for a nearly 700K house. I would say your net monthly outlay is 3800 to 4K for just an average North Park, Normal Heights house, buzzing helicopters and all.

Maybe if you are someone who can easily qualify for a 4 or 5K payment and therefore you hang around people who also can easily qualify for a 5K payment, you might see things differently. The fact is, statistics show even 3K a month is a struggle for most families.

Taking out a 675K mortgage with only 3.5% down doesn’t make much sense. You won’t be anywhere near rental parity with those numbers. Like you said, when normal people start shelling out 4K per month for housing…there is little room for any failure. When that mortgage gets down in the 400K area with 3.5% down, you’ll probably be close to rental parity. Definitely one of the reasons anything decent below 500K is flying off the shelf.

The sweet spot will be buying anything over the FHA limit since you will have much less competition and won’t be close to rental parity. To be safe, this will require a large down payment and excellent credit. Now the big question is when is the correct time to buy for that price point?

to answer the question when is the right time to buy that 675k+ property, i think the right time is when you are able to pay atleast 50% of that house price upfront.. better start saving more and start earlier.. 😉

I think rental parity is what gets a lot of people to start considering a home purchase. I know that’s how it all started for me back in 1992. And then interest rates in the 3% range really helps push people off the fence.

The last couple of home purchase scenarios I’ve seen were looking a lot like 2006. The big difference is that there’s a much smaller pool of buyers and inventory for sale. So it’s like the whole thing has been scaled down.

All these unemployed people and the incompetent management at Microsoft can’t find Americans to do the work, according to this bird cage wrapper:

Microsoft Says 6,000 Jobs Open, Wants More Visas

Microsoft says it can’t find enough skilled IT workers to fill open positions, but critics say the company is merely trying to justify hiring foreigners.

http://www.informationweek.com/windows/microsoft-news/microsoft-says-6000-jobs-open-wants-more/240008011

This is a war on the American worker.

I can vouch for MSFT on this one. You simply cannot find competent talent these days. Incompetent people with degrees in liberal arts are abundant but they do not provide any value. Those who can actually produce and are bright and intelligent, yet at the same time don’t have the self entitlement to demand a corner office right out of college are few and far in between.

Stop it. Â MS is full of baloney. Â There are plenty of good prgrammers in America. Â And an abundance of them in the Seattle area. Â I know so many ex-MS employees with skills that left MS because I is horribly run by an abusive and incompetent management layer. Â MS has driven up the cost of programmers in that state. Â They have also gotten favorable labor laws for software companies. Â That’s why so many continue to flock there. Â Lots of taken if you’re willing to lay for it and haven’t already poisoned them against you. Â Â

As far as a liberal arts degree. Â It’s invaluable to our society. Â The fact that it’s not valued or devalued by people void or worthy sensibilities is what’s messed up. Â

What’s happening to the VFX industry is criminal. Â What’s forgivable is the greed of banks. Â That’s what they do. Â What’s unfogivable is our unwillingness to stand together, stand up for each other, stand up for ourselves.

Think globally, act locally, and buy some gold. Â Â Â

The long and the short of what we are talking about is standard of living. I have a news flash for those that did not pay attention during history class. The overall standard of living in the US dropped for just about TWENTY straight years during the last century. Of course that could never happen again. And, by the way, even more recently, it has happened in Japan. Be my guest and buy that $600,000 California dream. What could possibly go wrong?

Let me give you a glue. If the Fed is scared sh##tless, how should you feel?

Of course, that typo should be clue, not glue. Don’t know if Dr. Housing Bubble can edit my post. Please do if you can.

What’s happening in So Cal RE is a lot like what’s happening in energy markets. Fracking and tar sands being analogous with Fed MBS purchases and mark to model accounting. Anything to avoid staring down reality.

As is often the case, conventional thinking conlates cause with effect. The commercial real estate blood bath has only just begun but the asset-owners think they can squeeze more rent blood from a stone, especially in California, a state in terminal decline due to its dependence on federal spending (and that includes so-called Silicon Valley, ground-zero for the military-industrial complex). But the empire is broke and the plug is about to be pulled. A high cost of living means a high cost of doing business and that means your products are uncompetitive on world markets; of course, if your main client is the federal government, it’s not a problem, they just print more money. But in the real world, business moves to lower-cost locales. The integrated circuit may have been developed in the Golden State but the hundreds of billions of trade that followed flowed to Asia where consumer products were actually developed and manufactured. Sic transit gloria!

Ah, hipsters…live at home or with $ help from family, ride fixie bike to vegetable co-op, BA in History but no jobs in Cali…only jobs available are where the uncool people live (unacceptable!), get another student loan, go for Masters so you can “teach”. Work retail/make coffee for living to pay for new car, tech gadgets. Upscale hipster with Hollywood gig, tech Rockstar or Bank of Mom and Dad financing buy trendy flip houses…FHA loan, low down, market craters, squat for months/years, bank (taxpayers) eat loss, sweet! Crack open another Pabst Blue Ribbon, enjoy the ride!

I recall back in 2008-9 angry people declaring they will march in streets, take the country back. Fast forward to 2012…complacent people sitting and snacking, watching Honey Boo or Real housewives…tired, defeated. We’re likely about to reelect the Image President who has done little to unify the country or create jobs; QE1,2,3, infinity the prime factor pumping the stock market, RE, etc. The Republican choice…meh…candidates are puppets, manipulated to dance by the Elite Puppeteers whose money, influence elect them. Every man for himself, what can I get for free, for me? Maybe Kathy Griffin will perform raunchy stand up at the Inauguration while the crowd roars, or Lil Wayne will rap the National Anthem. Dignified excellence.

There will be no revolution until people cannot buy bacon, shop or watch people fight or make fools of themselves on TV; then, their could be trouble. Otherwise, carry on.

I concurr 100%, written with style!!

I just saw my first Honey Boo Boo, and, my last, unless they put me in a chair and force me like that fellow in Clockwork Orange. We are all doomed, doomed, I tell you!

You’re not going to find a great home this side of the 15 for $250k. I do know a couple of single guys that bought in questionable areas of Pomona and Inglewood, but like I said they are single, they specifically said they are not worried about crime or school quality.

That being said, for the average Joe Sixpack who makes $50k to $75k per year, and is married to a similar lady, that leaves a price point of $150k to $400k which means commuting. Being a transplant, and working with many transplants, you would be shocked to find out how many people DON’T want to commute. Corona and Riverside are out of the question. Not for me though.

For $150k you can find a small older home in a reasonable area of Fontana or Rialto. Now yes, you will probably hear “oom-pa-pa” blaring on a Sat. nite or a mariachi laugh, but you won’t hear gunshots. For $250k you are getting into better areas or northern Fontana, Riverisde, etc…and $300k you can find plenty of newer tract-homes with good schools.

I’m pleasantly surprised with the quality of my daughters school, which is east of the 15. it’s not so much the schools that are bad anywhere, it’s parents that don’t make their kids study. My daughter is plenty challenged and up for GATE, already doing algebra in 3rd grade. I didn’t touch that at my highly prestigious and award winning Midwest school until 6th grade.

I beg to differ. I’m very familiar with the area living there over 2 decades and parents still live in the area. Rialto and Fontana are BAAAD areas. Stay far far away , heed my warning.

I beg to differ as well. Anything north of Baseline is perfectly fine and safe. Sierra Lakes and Las Colinas ring a bell?

PapaToBe, again, I’m very familiar with the areas. There isn’t any section of Fontana and especially Rialto that is NOT ghetto, with the exception of the very small area West of the 15fwy.

Whatever the stats are for this age group, I’d probably say it’s 10-15% worse in reality. Anyone know where I can get a “Please don’t push me about marriage, kids or a house unless you’re going to subsidize it” t-shirt before the holidays?

The market will eventually rule the day. Just as in value investing in stocks, eventually value trumps rumor/hype/artificial propping.

Eventually the market will crash out and the pent up demand, all of these living at home, will create a new boom. How long this will take will depend on the party that takes office, but eventually it will have to all crash and burn.

Payment Buyer’s are still ruling the day artificially inflating prices, but when even this group becomes aware of the overall cost of the homes they are buying economic reality will take over.

I have a question, why is everyone living in cities anyway? Save for the incentive of poor freeways (transportation time) and gas (transport cost) cities are a thing of the past. With today’s technology there is no reason for massive central hubs. The lawyer, banker, manufacturer, customer no longer need to be concentrated within walking distance. Historically this is why SoCal is more disbursed than NY and why the future belongs to wider disbursement of populations. We are one energy innovation away from everything changing, there is no long term value in the Cities. This realization is around the corner and will come to fruition long before these new 30 year mortgages.

I agree that eventually market forces will rule the day. In the meantime, there’s a lot of market manipulation going on that’s turning many former bears on this board to bulls. Fascinating. There’s a saying in stock investing, “The market can stay irrational a lot longer than you can stay solvent!” Well, many on this bored just can’t put their lives on hold any more. They’re no longer satisfied in being “right,” they’d rather get on with their lives. I don’t blame them.

Regarding “cities are a thing of the past.” No, they’re a thing of the present. Maybe you’re a futurist and have some predilection about some “event” that will change things. But the trend right now is ubranization continues. Witness: http://www.reuters.com/article/2012/03/26/usa-cities-population-idUSL2E8EQ5AJ20120326.

Same goes for the “developing” world (China, India, Brazil, etc.). If cities are indeed a thing of the past, why are these economies of the future massively urbanizing?

We’re seeing this in LA. It’s called Manhattanization. And, it’s here in LA, to stay.

Well said. This former bear has thrown in the towel. Take all your rational financial thinking and throw it out the window when dealing with the Fed and other PTB that are hellbent on keeping prices inflated for their bankster/politician overlords. The housing market SHOULD have been allowed to correct and nominal prices should have been much lower. We all know how things turned out. I think all the manipulation and intervention will cause much greater long term harm, but what are you to do? Keep renting your apartment and stock up on ammo and gold? You need to look out for yourself, not what is in the best interest of the country or future generations (sad, but true). Either join in or get run over by the freight train. Good luck if you are going to hold out and wait for the big drop, you might be waiting for some time!

Without knowing a specific reference off the top of my head, I believe city living is less energy intensive than non-city living (unless you’re once of those guys that lives off the grid via solar and personal wind installations). Couple that with the need to become less energy intensive in the future (even with the revolution of renewables coming), and that’s probably why people are flocking to cities.

And incidentally, even getting the utilities to use all the energy they loose from not using the wasted heat generated (like 2/3rd of the energy produced at a plant is wasted heat) is a huge legal/political battle, since profitability is coupled with American’s being as wasteful as possible.

People dropping out of the tax withholding labor market are going underground. The Mole knows. The government revenue is going down, but the moles are happy. The advantage of being a mole is that you also get government benefits to supplement your tax free underground economy income. Life is good.

I see this where I live. Contractors, landlords, etc., all paid in cash, never reported nor seen by any bureaucratic entity. My first reaction was scorn (now my burden is more, etc.), but I’ve grown to be more respectful. After all, the best way to protest, may be to simply not participate.

We all can’t own 7-11s or work as “contractors”, some of us are engineering PhDs who still don’t make enough for a house in a nice neighborhood (the little hispanic guy who pushes a cart laden with bags of fried pig skins is blowing clown horn in my alley, I call the police, they never come) can’t be moles. We have to pay taxes so the moles can enjoy the “social services” the state provides.

Taxturbation = enjoying public services while not paying any taxes.

Tell the cops that the clown horn guy is parked near a fire hydrant or doesn’t have a front license plate, chickenshait tickets are their priority.

Jobs are gone in bulk that support anything over a jumbo loans. That’s why there is a race to get the lower priced properties because that is the new normal. People in jumbo and over homes will have a hard time selling their homes once interests rates are forced up and value will further drop. Sell your big home before 2015 if you want to retain equity. I suspect that there will be a another huge buying frenzy to lock in lower interest rates before they adjust up. If you choose to sell or stay in your jumbo loan home after rates climb, just know that the likelihood of property values going up versus down is a bad bet. You could strategize and sell while interest rates are being kept low, till 2015, then rent for a while and pick up that big property again at a discount. There are no move up buyers…they are gone. Jumbo home owners have no where to go but down. Employment and home formation does not support the upper end of the market.

The hot market is anything that is affordable that employment can support. Investors are not picking off high end properties because they know that the high end will only depreciate in the future (even though there are “great deals” out there..ha ha) and the low end will appreciate because it’s the affordable price point.

Banks are not lending so it does not matter how low the interests rates go down-nothing will change. It’s still all government money backed loans. Local banks and seniors get crushed with low interest rate mandates and the big banks use these low rates to get more skin in the game to make more money for themselves. The big banks are not helping anyone in our communities except themselves.

I wonder if inventory is being held back on the low end and high end equally or if what I suspect is that the low end is being held back to create demand that pumps up the prices since this is where the money is.

Interest rates are not going up. They cannot, not with the amount of debt the US has to service.

Also, when they do, prices will fall. It is a monthly payment market.

a montly payment market makes sense. My brother, who lives in a more affordable and nicer area than here in SoCal, wants to buy a house using cash and fix it up. I talked him out of it. At 3.6% with almost no money down, the interest you pay is the walk away insurance premium I told him. If inflation, including wage inflation takes off, you have a very small monthly payment, plus! If the neighbor succeeds in rezoning and decides to open a pigfarm, you can walk away from the smell and devalued house losing very little. If you lose your job and need to move and housing prices fall, plus! You can do a shortsale, hurts your credit for three years and you are not out of pocket to sell the house you paid too much for. I told him to invest his savings in insured munis and he will just about break even regarding interest. I then told him he can probably get a zero percent down USDA loan, given he wants to buy in the sticks. His eyes lit up a bit. I feel bad in a way, he was being all responsible, not wanting to take on debt, but debt is so available and cheap and the consequences of default so small, the smart move is to take on debt.

I suspect this is the case. I know someone who lives in east Los Angeles who has not paid their mortgage in 3 years. The bank recently told them they “have another year” before needing to vacate.

Perhaps this is one of those zip codes (90402) that has bounced back… or this this realturd speak.

http://santamonica.patch.com/blog_posts/blog-prices-are-back-up

Dear DHBB:

I have been reading your work for years. I have a question. This article says Orange County only has 39 days worth of housing inventory. Is this BS? What sayeth ye? http://www.economicpolicyjournal.com/2012/10/orange-county-california-has-only-39.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+economicpolicyjournal%2FYZSb+%28EconomicPolicyJournal.com%29

To Mr. Jason Scott. RE: Why do people live in cities? You partially answered your question with two good reasons. Terrible commutes and to a lesser degree, gas price. To me, living in a place with severely under-funded or nonexistent transit options is “grinding poverty.” Wasting hours a day in a car in truly hideous concrete landscapes. Most everyone can not work from home, and even those that do must see “real” people to complete work sometimes. Another very big reason for the city life option is the ease of having a social life and lots of interesting things to do within walking/biking distance. It’s a rich experience that doesn’t exist in the car-oriented sprawl that comprises most of our built areas. Being semi-alone surrounded by anywhere-in-America sprawl does not cut it. Cities are not for everyone, but they are for a lot of us. Even with all the warts that come with denser environments. Then there is the whole other area of sprawl being very wasteful. But that’s for another day… Respectfully, Keith in San Francisco (willing refugee from sprawl Pennsylvania).

My kid was living at home after college because his job did not pay enough for him to move out. The then thought of a great idea to live on his own: Go back to college. So he did and I am paying for his living expenses to the tune of $50k per year. Luckily my house has lots of equity so I am using my HELOC. Student loans are a total rip off.

Some very wise words stated by Hugh Smith today:

“The U.S. economy is artificial in three important ways:

1. The Federal Reserve has distorted the market for borrowing capital by reducing interest rates to zero. Those holding capital (savings) receive essentially zero interest income while favored borrowers (banks and large corporations) can pursue marginal-return speculations for free (when measured in real terms), creating systemic moral hazard of the most pernicious sort.

2. The Federal Reserve’s monetizing of Federal borrowing via the purchase of Treasury bonds has given the government a “free” hand to spend $1.3 trillion more than it collects in tax revenues, feeding inflation (The Source of High Inflation: Government Spending) and the moral hazard created by having essentially free money to dispense to cronies and to buy voter complicity.

In a real market economy, the cost of Federal borrowing would rise as bondholders would demand a premium for taking on the risk that interest rates would eventually rise under the relentless accumulation of stupendous debt. That mechanism has been frozen by the Fed’s monetiziation of Federal borrowing.

3. The housing market has essentially been socialized, with the taxpayers now funding the entire mortgage market (98% of mortgages are backed by Federal agencies) and endless subsidies of marginal buyers (3% down payment loans, etc.) The Federal Reserve has committed itself to taking trillions of dollars of impaired or dodgy mortgages off the balance sheets of banks and burying them in its own opaque balance sheet, while also maintaining near-zero interest rates (when adjusted for inflation) to incentivize refinancing and home buying–both of which generate billions of dollars in fat fees for banks.”

Kind of hits the nail on the head, I’d say. Instead of fixing our housing problem, we are onlymaking it worse. Once reality sets in, it will be ugly.

http://www.westsideremeltdown.blogspot.com

latesummer 2009

1. The Federal Reserve has distorted the market for borrowing capital by reducing interest rates to zero. Those holding capital (savings) receive essentially zero interest income while favored borrowers (banks and large corporations) can pursue marginal-return speculations for free (when measured in real terms), creating systemic moral hazard of the most pernicious sort.

2. The Federal Reserve’s monetizing of Federal borrowing via the purchase of Treasury bonds has given the government a “free†hand to spend $1.3 trillion more than it collects in tax revenues, feeding inflation (The Source of High Inflation: Government Spending) and the moral hazard created by having essentially free money to dispense to cronies and to buy voter complicity.

The Fed always distorts interest rates, it is what they do.

Please explain to me how the current level of government spending is causing inflation when we have over 8% unemployment and a huge economic output gap?

Rising rents are a sign of a squeeze on the owners of commercial real estate who overpaid during the closing days of the last expansion and are now going to be squeezed dry like a lemon by their creditors but not before they try to squeeze blood from the stones of their renters. Stupid is as stupid does, but after 50 years of inflation, these debts aren’t going to be rolled over. The hyperinflationistas are wrong also, because their model (Weimar Germany) is totally inappropriate to the USA: that historical touchstone went from zero inflation to hyperinflation in a few years before collapsing into deflation that brought about a constitutional crisis that resulted in you know who; the US has experienced 50 years of inflation during its world hegemony but that title has passed to the workshop of the world now located somewhere in another hemisphere. Adam Smith in the 18th century specifically excluded residential real estate from capital for a simple reason: nothing material to the general commonwealth is produced. The USA is now the consumer of last resort but its credit card is maxed out. Look out below!

Well, most of the young adults in La are hispanic not white and still come from the immirgant family which would have you live longer with relatives. Its more common for hispanic and asian families to have relatives live together than whites, whites started doing more because of the recession.

Just like the US in general, as long as exporters keep taking our credit, we’re not really broke. If you’re a counter-fitter, you’ll be fine until you get caught. As long as people don’t realize they are committing financial suicide they can feel and act wealthy for a season.

Leave a Reply