If you haven’t noticed, Los Angeles returned to its previous median record price of $550,000 last month. Before you scratch your head in dismay, let us take a look at what is really happening. As you know, higher priced homes are still moving while lower priced homes are stagnant thus skewing the numbers. If a home doesn’t sell, it doesn’t show up in the data. Similar to taking an immensely hard mathematics course where half the class drops out, but those that remain push grades higher. When calculating the final overall class performance the statistics show the best of the best and those that stuck the course out, but what of the students that dropped out? Well as you can see from the Real Homes of Genius examples, prices are coming down. So what do we make of this seemingly contradictory information?

The Sales Cycle

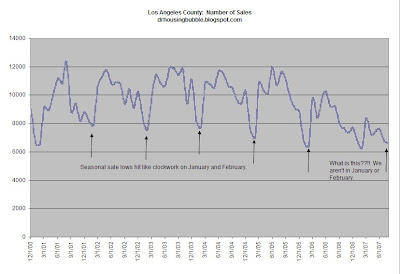

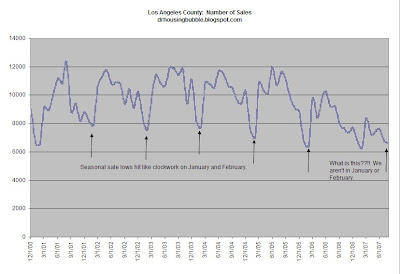

This chart shows sales for Los Angeles County over the past 7 years. As I point out in the above chart, each January and February we hit a trough because of the slower selling brought on by fall and winter. This has been the case for each consecutive year since 2000 and is actually part of the normal housing cycle. But what do we have here appearing in summer of 2007? It appears that we have hit a trough 5 months early. In fact, summer sales numbers are looking more like seasonal sales numbers of winter. This chart is also telling because it shows a consistent pattern over time. Those that don’t believe in housing cycles are spinning in their chair wondering what happened this summer. Normally a strong spring and summer selling season allows for the lower numbers in the fall and winter. This will not happen this year. Unless of course we see a radical jump in sales in the next few months. This data is also a good indicator of where we are heading. Keep in mind the data reported is from sales that close after escrow. This data can lag 1 to 2 months. So what we are currently seeing in the actual finalized recorded sales is probably from July to early August. Well of course the mortgage blow out just occurred and credit standards are much tighter since then. So guess what this will do for sales at the slowest time of the year? Either way, this is a much necessary correction and that is why any housing pundits thinking we are going to have some bounce back in the next few months is simply hallucinating and not following the trend.

I’ve been getting some e-mails about timing the market. There are many ways to valuate housing prices. As we previously discussed with 3 housing valuation methods, every city in Southern California is overpriced. If you haven’t noticed the media is now using the terms “housing slump†and “credit crunch†as if they’ve been talking about it for years. Too bad even as late as January and February of this year, they were still carrying the housing banner. Using rhetoric such as “booming†and “amazing†when talking about housing. I’ve seen a few articles pointing out that housing bears have unfairly criticized the media as this New Yorker online piece. Since they link up to a few places including our site, I feel it is important to state why I have been critical of the mainstream media in the past. Clearly, they are now carrying the housing bear flag and there is no problem finding populist information outlets dissecting the housing market. My main issue was during the boom, they kept giving air time to raging housing bulls that have led us into this current market. Dean Baker’s recent study does a great job researching the entire housing bubble and also pointing out that media airtime in the past few years has not been fair and balanced. I recommend you read the entire paper as a primer to this housing bubble. But here is some of the data found regarding media citations:

Media Citations (New York Times and Washington Post) on the Housing Market, 2005-2006

|

Bulls

|

Citations

|

|

David Lereah, NAR

|

1796

|

|

Doug Duncan, Mortgage Bankers Association

|

397

|

|

Bears

|

Total

|

|

Robert Schiller, Yale University

|

516

|

|

Edward Leamer, UCLA

|

88

|

*source: Dean Baker, Midsummer Meltdown August 2007

And regarding the New Yorker, I do agree with the author that many journalists are now scrambling to be first in line to disseminate housing information to the public. In fairness, the media reports what is happening yesterday, today, and tomorrow. Historian and prognosticators they are not.

Case and Point: High Priced Area and Low Priced Area

Back to the median housing price analysis, clearly housing sales have fallen off a cliff. In fact, Los Angeles County saw a 50 percent year-over-year drop in sales last month. Not exactly stellar numbers. Multiple converging factors combined to create a perfect stew of housing stagnation. For one, the credit markets are now tighter and sub-prime is now a thing of the past. Also, appreciation is now gone. So folks are deciding on holding off on buying homes especially with a sudden onslaught of negative media coverage. And something specific to California, August of 2005 saw the largest origination of adjustable rate mortgages at a whopping 70+ percent of all mortgages originated. Guess what was hot? 2/28 mortgages. And what was last month? That’s right, 2 years and now these people are facing larger payments with mortgages amortizing on different schedules. In addition, they no longer have the option of refinancing because this will push payments higher and the reason they took out these exotic loans is to squeeze into an overpriced home. Now why would they go for a higher payment even if they could? As I discussed back in July housing has hit its Minsky Moment.

Let us take at a few case examples for last month to show how higher priced areas are moving up while lower priced areas are getting hit.

Higher Priced Areas Moving Up:

Agoura Hills with a median of $975,000 is up 18.9 percent year-over-year.

Arcadia with a median of $752,000 is up 19.3 percent year-over-year.

Hermosa Beach with a median of $1,255,000 is up 15.6 percent year-over-year.

La Canada Flintridge with a median of $1,455,000 is up 7.4 percent year-over-year

Wow! The housing party is still going strong. Why look at data when all 10,000,000 folks in Los Angeles live in these areas. Let us take a look at some lower to middle priced areas:

Artesia with a median of $370,000 is down 26 percent year-over-year.

Baldwin Park with a median of $400,000 is down 11.1 percent year-over-year.

El Monte (South) – with a median of $381,00 is down 20.3 percent year-over-year.

Montebello – with a median of $535,000 is down 10,8 percent year-over-year

You clearly see the pattern and why the median price is skewed higher. For one, more sales are happening in the higher priced areas so they have a larger subset. Sales in lower areas are facing intense drops in sales and downward pricing action. Could this be because many of the past buyers bought with sub-prime loans that are no longer available? I doubt anyone in Palos Verdes would avoid buying their dream home because of a lack of sub-prime loans. An interesting thing to note is middle class neighborhoods are facing a stagnant market with prices trending down slowly but sales having a sudden stop. I expect that we will see the lower end get hammered first as it currently is and then have the middle areas tip over as well. The higher priced areas will be the last to adjust.

How low will we go?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “When the Housing Clock Stops Ticking: Why the Median Price is Going up While Sales are Going down.”

The low of this cycle will be very scary. We started the Winter Cycle of the Kondratieff wave back in 2000-2001 and should have cleaned out most of the bad debt by now, S&P dropped to 800, things were looking bad and then the we got really dumb and went further into to debt to cover up our old debt.

Our entire country is now one big debtor to the rest of the world. We all collectively signed up for a 2 year ARM on a trillion $$ Real Home of Genius

Those payments are gonna be a bitch when the rate goes up… I wonder if we can get a recording of the phone call..

“Ahh yeah.. this is Mr. Bush.. We are working real hard to come up with this month’s payment, but things have been hard… Laura got sick and my daughter is having a wedding… I was wondering if we can skip a payment?”

The Chinese are gonna love getting that phone call.

@steve,

There will be immense pressure on the Fed this week. Politicians are trying everything short of forcing the Fed by legislation to lower rates. They are concerned with having a stable economy for 2008. In addition, by many measures the Chinese currency is undervalued by 30 to 40 percent.

Even Alan Greenspan is saying that the Fed will have to wrangle with political pressure and even mentions in his new book, that we may need to push rates up to 10 percent to curve inflation in the upcoming years. Of course he can openly say all this now that he created this bubble over the past decade. He even mentioned that he didn’t think sub-prime loans would cause such a big problem. Remember his ARM pumping? It isn’t so much a sub-prime problem but a revolving debt issue.

Yeah.. I expect a .25 rate drop. If Gentle Ben has guts he will leave it alone, but I doubt he can take all the pressure that would come with that.

Assuming they do drop the rate, other macro pressures will take over and devalue the dollar, eventually forcing rates back up again, with even MORE bad debt to pay off.

Either way we are screwed, it’s just a question of how many years we are gonna keep tacking on to the mortgage for our Real Country of Genius.

Great Blog! Keep up the good work!

Oh I miss the good old times when Billy Clinton helped me move to my Island I bought with my bubble stocks, Aunt Hillary baked cookies, Uncle Carter read fairy-tales to my children before bedtime…

Now all we have is a bad bad wizard with a secret wand manipulating illegal criminal Mexicans buying 700k houses on a UNTAXED 14k income, stupid people who cannot spell their name but know how to sign escrow papers and wannabe Hilton’s living the Real Life… he is the one who forces people to lease 2 BMW’s with a payment of $1000 a month but doesn’t listen to them if they cry and wine to pay for their health insurance… what a bad bad world we suddenly live in… bah bah bah.. It’s not fair…

TREND UPDATES FOR JUMBO RATES –

Jumbo rates are starting to drift down and lenders have found buyers in the secondary market for their bundled mortgage investment instruments!

In the second week of August I wrote about the “Liquidity Crisis†as the secondary market virtually shut its doors to new pools of jumbo Mortgage Backed Securities due to the high default rate in sub-prime loans that were sprinkled into these pools which also contained prime and alt-a loans. They basically said, “We don’t want these anymore!†and the flow of funds for new loans was shut down. Conforming loans are not having this problem.

Without these buyers, lenders are forced to hold new loans until the secondary market opens up again. That will not happen until the quality of the jumbo MBS pools improves and that is what has been happening over the last month.

The first thing the lenders had to do was jack up their jumbo interest rates to slow down the origination of new loans. That’s exactly what happened; hardly any jumbo loans were originated over the last four weeks due to higher rates.

Next, the lenders had to improve the quality of their loans by adjusting their guidelines, allowing only the best quality borrowers and the best quality transactions into their systems. They did this by requiring higher credit scores, a substantial down payment, verification of income and verification of assets.

The results of these actions are starting to be felt in the market as lenders have opened up the spigot of originations by lowering jumbo rates and have sold higher quality jumbo Mortgage Backed Securities to the secondary market.

Another result of the “Liquidity Crisis†is that many lenders who did not have the reserves or deposits to weather the storm had to shut down their operations. There have been 47 lenders who closed their doors since August 1! That is a major shakeout, especially when you see some major names on that list. And the list is not limited to just sub-prime lenders.

As has been the case with all financial turmoil in the past, the financial markets are fluid and adaptable to challenges. It just takes time for the challenge to work its way through the market as we are witnessing with this current crisis.

In the near term, I believe the market will move closer to what we experienced in 2001-2002 as far as sales volume and lender underwriting guidelines are concerned. What buyers need to do is get their eyes off of the national and state doom and gloom headlines and focus more on the local economy and housing market. It is a fact that local housing markets are supported by the local jobs market. During 2001-2002 the average unemployment rate for Santa Cruz and Santa Clara counties were 7.12% and 7.31%. We are currently running at 5.1% and 4.9% respectively. Look for this to support our market.

If you have any questions about the mortgage market and its impact on our local housing market, please know that you can call me anytime as I would be happy to strategize with you in this new old housing market.

SVplanner.com

@liberal

I referenced Bush in my post, but it could easily be the next President, Dem. or Rep. Just a question of when, not if. If Gentle Ben adds more money to the economy by lowering rates, we will just dig ourselves in deeper, but eventually people figure out what’s going on and stop digging.

So far he is saying the right things.. Liquidity is what is key to preventing the markets from having a seizure.

More money just digs the hole deeper.. A lack of liquidity confuses even seasoned investors and extends the time it takes for people to see/correct the real problem.

The USA’s Platinum Card is almost maxed out, and even at 0%, you miss one payment and WHAMO, you’ve got issues.

So lower the rates to zero and folks that understand what is going on will make more money on a longer downturn. Raise the rates and we get thru this faster and all get on with the next phase of the cycle, either way it’s going to be painful for all but a few folks who are prepared.

Dear Doctor!

I´ve been reading your excellent blog for several months. I know you´re mostly interested in the Californian and the U.S. housing markets, but I´m sure the problems soon will materialize here in Europe too, especially in the UK, Spain and Ireland. In my country, Norway, the debt to income rate is about 1,9, and only 8% of the borrowers have fixed rates on their loans. Most first time buyers put no money down and do only pay interest for the first 5-10 years. Scary?! If you are interested in contacting me, my email adress is housingcrash@hotmail.com, and my humble site´s adress is boligkrakk.blogspot.com

Gotta thank loancruzer for that fantastic upbeat report. Housing market is recovering already! Nothing overvalued in California, in fact the damn houses are STEALS at these prices.

Can you Jumbo-size me please?

No one can do what Countrywide can.

Interesting that you mentioned Agoura Hills. There’s a cheap, rundown condo complex in Agoura called Town & Country. While the REST of Agoura is full of millionaires, Town & Country is a wicked cancer smack in the middle of all the decadence, replete with slumlord owners renting 1BR condos to 15 illegal immigrants, and drunks getting loaded in the parking lot and urinating right outside people’s windows. I am not using hyperbole, nor am I depending on hearsay. I used to live in this dump. I fled for the East Coast in 2004. I can no longer brag of living in a “prestigious” nabe like Agoura…but I no longer see drunks urinating outside my window either.

I would love to see a comparison of the median price fluctuations in that complex as compared to the rest of Agoura Hills. It would make a great case study, as it is a unique universe within a universe.

@Dr HB

Besides the lower end of the market taking it on the chin first, do you feel that outer suburbs will drop farther faster compared to areas more centrally located to the metrocenters like LA, San Diego, Miami, NYC, Boston? I have a feeling the outer commuter towns will be hit quicker and worse as these towns lie on the margin of where people would be willing to commute from.

I look forward to any changes you may have in store for us with the blog.

I live in Agoura and I can say unquestionably prices are NOT up. There are currently a large number of properties on the market for less than they sold for in ’05-06.

That 18.9% figure is based on 23 sales!

See this link for a bit of reality on the Conejo Valley. And with all the flaws of the “median” price, the declines are worse than the statistics show.

http://www.conejorealtors.com/salesstat.shtml

FYI for all the non-REALTORS in this group, NAR has 2x in the past 10 days requested by email from US agents to contact the reps and support the government backed changes for FHA loans…an INCREASE in the limits…to a whopping 125% of home value for those consumers “struggling” with their loans, allowing essentially for qualified refinances. My response to the request was “absolutely NOT”, the feds knew this was coming down the pike and failed to make policies that would protect the consumer…now they want to make an attempt at it, when all this will do is continue the trend of overfinanced, under-qualified, clean-up-the-mess financing for a generation of adults that should have learned it from their parents.

Why does the highest end markets take the longest to go down? When they do go down, do they go down the same percentage as the others? We sold our home and are renting in San Marino. A home near us was on the market for 1.325 and sold for 1.55. There were multiple bidders. In our area, what decline will we see? Can we find out what happened here in the last downturn? Thank you.

@Karen –

Remember the old real estate adage “location location location?” During the bubble, any house on any street in any city sold in days, if not hours.

Location was irrelevant. Or so the buyer thought. So you saw unprecedented price runups in even the most rundown neighborhoods, and in the far-flung bedroom communities of the IE, south bay, high desert, etc.

But once the credit spigot dried up, and buyers no longer would buy anything that had a sign plopped in the yard – well, the cliche’s accuracy has re-emerged.

Hence, high end homes sell since they are in desirable areas. The remainder are all-too-frequently Real Homes of Genius.

Doc, my question remains, not why people are buying even today – people get married, get new (non-bubble) jobs, get windfalls – but whether the government will have the guts to address some of what Greenspan mentioned in 60 minutes last night – lower tax revenues, higher government expenditures – while avoiding the moral hazard of bailing out lenders and homeowners?

Oh, and @Liberal – it’s good to see you making such good use of your adopted land’s ‘free speech’ credo. I’m curious, however, does your speech contain any non-invective adjectives to those who disagree with, or even simply question, your viewpoint? Yelling louder doesn’t make the deaf or non-language speaker understand you any better, you realize?

Great posts…..I see alot of talk about how the median price is wacked because of houses at the low end dropping out. However, this does not explain the data for my area (sunnyvale CA, 94087)

The data posted weekly by zip code in the Saturday Mercury news continues to show current year price AND VOLUME data exceeding same period of prior year by handsome percentages.

While I know that this closing data has somewhat a lag factor, I keep checking to see anticipated big drop offs, and they dont come.

Anyone care to explain how both price and volume data are holding up in the area of Jumbo only mortgages with prices averaging in the unaffordable 900K range?

@gip,

From mercury news, I see that sales were down in Santa Clara county.

http://www.mercurynews.com/ci_6891383

@exit and all,

Did you catch Greenspan when he was asked “are you buying real estate?†or “what are you investing in now?†He dodged the question and simply said something to the effect that you should diversify in currencies. Bwahaha! He’ll be using doublespeak for the remainder of his life. And then he had that stack of government reports including some BLS reports as light reading. Maybe he was reading the under reported gauges of inflation put out by the ministry of truth? I also think I saw a Real Home of Genius printout, but I could be wrong.

He said he missed the sub-prime game. Let us remind readers what he said about subprime risk a few years ago:

February 23, 2004

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country … With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. … Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.”

http://en.wikipedia.org/wiki/Alan_Greenspan

Effectively judge risk? He was off by a mile and now we are going to listen to him for sage advice? Sounds good to me! With 155+ defunct lenders I would say that they didn’t judge the risk appropriately but this is only my humble opinion and how can you argue with the head honcho at the Fed? Keep reading those BLS reports AG. The Fed is becoming a market tool. If you take a look at a few mainstream articles, it is already a foregone conclusion that rates will be dropped tomorrow. How do they know? I thought the Fed was supposed to act independently and this interest decision was only to be released at the meeting? Senator Dodd already met with Big Ben and you can only imagine how that meeting went. Then he met with builders in a closed door meeting (aren’t all meetings closed door?). To be a fly on that wall.

To answer your question, I’m not sure the government can do much aside from keeping this bubble going a little longer. Even with the BofE and BofA, we are seeing that big players aren’t afraid to throw money at failing companies. Until decisive action is taken to the contrary, we are still proceeding down this bailout rout, moral hazard or not.

@loancruzer,

Although much of what you say is true for loans, the issue isn’t the loans per se but the underlying value of the asset. That is, loans can hit 0 percent but if the home is disconnected from income and neighborhood fundamentals then it doesn’t make sense to buy. This means right now is not a good time to buy anywhere in California.

@buffet,

You are absolutely right. This is a global credit crunch. Just take a look at the problems over at Northern Rock over in the UK. This will impact many overpriced metro areas across the world. Of course, each market has unique pockets of prime locations such as our prime spots here in LA that will always carry a higher price.

@thamnosma,

We are already hearing this rhetoric of “buy now!†or “it hasn’t been a better time to buy.†Rates are only a small part of the problem. It is an asset valuation problem. The exotic mortgages came out with teaser rates, option ARMS, interest only, and every other imaginable configuration of avoiding a fully amortizing rate. Now, we are seeing conventional mortgage applied to unconventional prices. Something has to give and it looks like it will be prices.

Did you see the “Deal of the Century†going on right now? Oh boy…

@son of brock landers,

Most definitely. We are already seeing this with Riverside County. It was expected that the Inland Empire was going to take a massive hit. Not only will they go down first but they will go down harder and faster. For one, they just don’t have the diverse employment base to justify current prices. In addition, the rental market in these outskirt places is weak. I’m tracking short-sales and foreclosures and every week the numbers are going up. In fact, still waiting for one week where foreclosures and short-sales drop in Southern California.

@charlie,

Just goes to show that the few homes that do sell make the numbers seem better than they really are. The homes sitting on the market don’t show up in closing numbers since they don’t sell.

@michelle,

I find it interesting that the NAR is trying to advocate continued practices that put us into this mess in the first place. Remember the mulit-million dollar “no better time to buy†campaign last year? If no one is buying homes, the business model is defunct. They make money from membership dues and guess what, they membership has radically increased in conjunction with the bubble. No bubble, less membership = less paying members.

I’m curious. Is anyone buying in California right now? And if so, why?

@karen,

More money and better locations will always carry a premium. Southern California has many people that earn good livings and to be honest, these people simply do not care about the housing market. A $100,000 price drop means nothing to them. The areas that will be hit very hard are the lower to middle class neighborhoods. You will see downward pressure at the top depending on the area. I’m not sure what area you are in but those selling prices indicate that you are in a very elite market.

A buddy of mine rents a 900sf place in Playa Del Rey for 2000 a month. It is manage by a trust for an old lady. She just passed away and the trust is going to sell the place. They asked my buddy and his wife if they wanted first dibs on the property at 850k. WTF. How the hell does 2k a month equate to 850k.

No, it’s not 1930, it’s 2007.

It’s getty dicey and scary out there.

Spread of banking panic forces ministers to guarantee savings

· Run on Northern Rock escalates

· Fears over other banks

· Intervention too slow, say critics

Larry Elliott and Ashley Seager

Tuesday September 18, 2007

The Guardian

The government last night issued an emergency pledge to Northern Rock savers that their money is safe, after a third day of queues outside branches threatened to spread across the banking system.

Northern Rock’s shares shed a third of their value yesterday and the sense of crisis heightened as shares in rival mortgage lenders dropped sharply – Alliance & Leicester by a third and Bradford & Bingley by 15%. The falls raised fears that the contagion from Northern Rock was starting to spread through the financial system.

Amid criticism that the government reacted far too slowly to the first run on a major bank in over a century, the chancellor Alistair Darling announced a government guarantee of all deposits in Northern Rock – thus overturning the system for dealing with bank collapses which Labour introduced six years ago.

He intervened just after news of the Alliance & Leicester’s mauling started to emerge. Mr Darling said the guarantee would apply to other banks in trouble. But he insisted no other had so far followed the Northern Rock and applied to the Bank of England for emergency funding.

“I want to put the matter beyond doubt. I can announce today that following discussions with the governor [of the Bank of England] and the chairman of the FSA [Financial Services Authority], should it be necessary, we, with the Bank of England, would put in place arrangements that would guarantee all the existing deposits in Northern Rock during the current instability in the financial markets,” the chancellor said, as Labour faced potentially its worst crisis since coming to power a decade ago.

Northern Rock chief Adam Applegarth added that the statement made it clear all savings were “safe and secure”.

Mr Darling had previously spent the day trying to reassure Northern Rock savers.

But the queues lengthened as customers discovered that under current rules only just over £30,000 of savings would be protected should Northern Rock collapse. There were angry scenes when savers were turned away at 6pm as branches closed. Malcolm Purcell, queuing outside the Moorgate branch in London for seven hours, said: “It’s absolutely dreadful.”

Withdrawals are estimated at £3bn in three days, equivalent to an eighth of the bank’s deposits. Yesterday its shares dropped 155p, or more than 35%, to 283p, from a £12.58 high in February this year.

Alliance & Leicester issued a statement saying it had not sought Bank of England help, insisting its business was sound and that it had no idea why its share price had dropped so fast.

The City fears a lack of confidence in other banks using Northern Rock’s model of relying on short-term funds from money markets to cover long-term mortgage loans. Global fears over the British banking system and economy grew, and sterling fell back below $2.

The government, Bank of England and FSA were trying to find a buyer for Northern Rock last night. Sources said there was intense activity but there were no indications that a buyer had yet come forward in spite of the big falls in its share price. The Northern Rock name is thought unlikely to survive any buyout.

At a conference at accountants KPMG, Conservative leader David Cameron said: “This government has presided over a huge expansion of public and private debt without showing awareness of the risks involved.

“Under Labour our economic growth has been built on a mountain of debt. And as any family with debts knows, higher debt makes us more vulnerable to the unexpected.” He pointed out that former Federal Reserve chief Alan Greenspan himself, appointed by Gordon Brown as his economic adviser, made that point yesterday when he said that “Britain is more exposed” than the US.

Speaking at the Lib Dems’ annual conference, the party’s Treasury spokesman Vince Cable said he had warned Mr Brown of a looming debt crisis four years ago. The prime minister and Mr Darling last night held talks with US Treasury Secretary Henry Paulson to discuss the global credit crunch, with the possibility that the US Federal Reserve will today cut its interest rates to get banks lending to each other again. The reluctance to lend has been caused by the collapse in the US sub-prime mortgage market, where thousands of people with little ability to repay their mortgages have defaulted as interest rates rose sharply.

In fact, to really appreciate the situation, you should really check out photos. There’s one sample on this article link:

http://www.dailymail.co.uk/pages/live/articles/news/news.html?in_article_id=482347&in_page_id=1770&ct=5

Seriously, we are now seeing bank runs and panics. It’s almost unbelievable how fast the collapse is occurring.

We all need to think about protecting our assets at this point.

Dr HB,

Great blog. I was wondering about your thoughts on “desirable” areas of SoCal. You mentioned “More money and better locations will always carry a premium.” While that may be true, I’m not so sure people in these areas haven’t been stretched beyond their means. My gut feeling is double-digit percentage declines in even the most desirable areas along the coast. The low and middle priced markets have dropped first in previous corrections, but the higher end homes follow shortly thereafter. Thoughts?

Dr HB, respectfully disagree with you. The NAR membership increased due to media frenzy AND pure innocence combined with pure greed. In 2005 you didn’t need ANY skills or knowledge of market or conditions to sell…the public demanded it. Everyone and their aunt, brother, cousin, neighbor looked at real estate sales – and licenses- as the new wave/easy way to make their million. Much of that was done in complete ignorance, real estate sales AND real estate speculation. The NAR is a cocktail buddie to the government, the same as most major businesses and politicians conduct after hours business. Should they be at fault for that? Not sure…but I do know that I do not believe the NAR pumped up the consumers/pre-REALTORS in the motivation of making more dues money. The picture is much larger than that. I too am concerned that NAR is supporting disastrous practices, clearly they are following the leader…”Oh – increase the FHA limits? OK – that will make the public FEEL better about what’s going on”. But the fact is politics is a follow the leader game and we have to just hope that the leader is going in the right direction. Not happening here obviously.

Look, is NAR motivated by money? Of course, all business is. They have been lobbying for years to keep the banks out of real estate. I just don’t think it’s logical that NAR would sway the market in an effort to make dues. THE DUES ARE NOMINAL. What concerns me more is the follow the leader attitude that does nothing more than create frenzy. The same frenzy we saw in 2005…just in the opposite direction.

Look to, and be hard on, the media. It is the media that ultimately decides which way we will turn because unfortunately most people believe what they see on TV – whether or not it’s true or valid.

Leave a Reply