What does $500,000 buy you in Southern California real estate? A look at Culver City, Pasadena, and Riverside.

We have a large readership from California but also many others that simply enjoy peeking into the mania that is SoCal real estate. It must appear to an outsider that all Californians ever think about is buying, selling, and flipping real estate. During certain periods of time the mania gets out of hand and the delusion runs rampant across the L.A. River. We reach certain stages like today where prices are reaching limits in certain areas and people are no longer clamoring at every open house like a hungry house lusting lemming. Inventory is picking up as would be expected to start the spring season but also because investors are finally pulling back from their half-decade long binge.   It is useful to look at actual home prices and what a certain amount will buy you in today’s market. Are prices justified? For many that question is merely answered by what a buyer is willing to pay. Can you fault a seller for trying to get as much as possible if a buyer is willing to foot the bill? The challenge with California real estate is that in order to reach healthy payment levels in certain targeted areas, a large down payment is required to make any economic sense. I can tell you that investors realize that any property will cash flow as long as the down payment is big enough. So what does $500,000 buy you in Culver City, Pasadena, and Riverside today?        Â

A look at what half-a-million dollars will buy you in SoCal

People in California have lost all perspective on big sums of money. It certainly isn’t because incomes in the last decade have suddenly grown at a healthy clip. No, what has happened is that low rates have allowed for prices to balloon thus making a massively expensive purchase seem cheap. I’ve talked about folks being able to go with an interest only loan on a $1 million purchase and having their monthly mortgage payment under $2,000 (minus taxes and insurance of course).

Buying decisions are made given a host of life circumstances; marriage, divorce, driving distance to work, schools, etc. Some of these carry heavier motivating factors than others. I’m certain that for someone with kids good schools are a priority. Biologically most parents want the best for their family so that helps to explain some of the financially back breaking moves some people make to buy certain homes in certain areas. Yet people wanted these things a few years ago as well. It isn’t like suddenly parents became better today.

With that said, let us go on a house hunting trip with half-a-million dollars in our budget. Our first stop is Culver City.

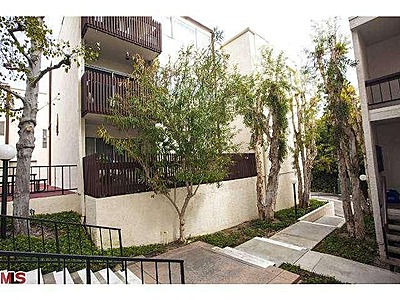

6050 Canterbury Dr UNIT F223, Culver City, CA 90230

3 beds, 2 baths listed at 1,208 square feet

List price:Â $475,000

A condo with 3 bedrooms is a good size for a starting family. The HOA on this place is listed at $377. This place appears to have a pending offer on it already. The last sale on this place occurred in 2004 for $375,000.

Good deal? I’ll leave that up to you.

Let us head on over to Pasadena to take a look at a home and a condo.

1704 Corson St, Pasadena, CA 91106

3 beds, 2 baths listed at 1,112 square feet

List price:Â $539,000

The price seems steep especially since the assigned high school isn’t all that great. The above photo does more justice than the actual location:

Your front-yard view is the freeway! As we have mentioned before only 1 out of 3 families in California can actually afford to buy at today’s prices. The last sale on this place occurred in 2001 for $205,000.

Good deal?

The next place is a condo in Pasadena.

2386 E Del Mar Blvd UNIT 310, Pasadena, CA 91107

3 beds, 2 baths listed at 1,492 square feet

List price:Â $499,000

Both of these condos look like they have some work done on them. I think the Culver City condo has some better work on the place. The HOA here is $380. I crack up when I get e-mails from people in other states when they think this is the annual HOA (no, these are monthly HOA dues). Is this what you have in mind when you think of $500,000?

Good deal?

Finally it would be helpful to look at something in the Inland Empire.

8195 Aliso Ct, Riverside, CA 92508

5 beds, 3 baths listed at 3,802 square feet

List price:Â $525,000

This is a giant home. The last sale took place in 2002 for $407,000. Interestingly enough, plugging in the 2002 sale price into the CPI calculator gives us almost the current list price. But one thing people fail to factor in with a big house is big expenses. Are you ready for $500+ monthly electric bills on those hot days (aka the entire summer and some spring)? Do you have the energy to clean 3,802 square feet? The modern family at most will have two kids so what will you do with all those other rooms and space?

Good deal?

Keep in mind that this Riverside property is less than one hour from Orange County and Los Angeles County. This is merely a sampling of properties that are currently listed on the market today. The fact that investors are pulling back dramatically should tell you something. There are likely better, worse, and in between deals out there. From what I’m seeing, inventory is going up because sales are weak. People are still house horny. They just have a beer budget (income) with champagne taste. This isn’t necessarily happening because suddenly a flood of people are ready to sell. There is a natural ebb and flow to housing that has completely been circumvented in California. Some will say that this is simply the new market. Yet we have discussed that in California, timing absolutely matters. Boom and bust central folks. Buying a home is more than simply saying “in the long run, real estate always goes up!â€Â In the long run we are all dead so simply looking too deep into the future probably doesn’t help with immediate economic decision making especially when it comes to real estate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

154 Responses to “What does $500,000 buy you in Southern California real estate? A look at Culver City, Pasadena, and Riverside.”

One of my more recent favorites, buy a foreclosure and do a no effort quick flip for a cool 32% price increase. I’m sure it’s simply an outlier and not a red flag for this market at all. Real sure.

There’s nothing quite like gray granite mixed with 1970’s cabinetry varnish, and just look at that amazing bathroom sink! I’d bet the housing cheerleaders would be quick to point out the skyline view as it’s saving grace. True, you’d have your very own smog reporting station. At least they left the bars on the windows.

http://www.redfin.com/CA/Los-Angeles/4431-Don-Ricardo-Dr-90008/unit-18/home/6878708

Cal. buyers I have pretty much little use for. They sell their trash house in San Jose for 1.2m then head to lets say North Las Vegas where for 500k you get 10 to 12ft ceilings, upgraded kitchens and nice locations away from the pit that is Vegas proper.

They complain it is to high they want to steal it for 300k sell it for a profit and try to rub their two quarters together to get back to Cal to play the ring around the real estate scam again. Why don’t they try to built a new life, I guess real state buying and selling is inbreeded.

Sorry folks I meant NE Las Vegas ( Summerlin) not North Las Vegas where every home comes with a direct dial to 911?

I think you meant to say NorthWEST Las Vegas, not NE. NE Vegas is the area around Nellis AFB, an armpit area of the city that is a no-go zone in some places (I used to live in NW LV, I know first-hand about this). North LV is nasty too. Summerlin is very nice, but if you look at a map, you will see it’s nowhere near NE Las Vegas. It’s basically the entire far West side of the city.

I saw a Culver City house last year, a quick flip that looked very nice on Redfin. But when I drove through the neighborhood, I saw some houses with bars on the windows on the same street. So I passed.

I refuse to buy in any neighborhood were even a few houses have bars on the windows. Those people live there. I assume they must know more about the neighborhood than I do. If they feel a need for bars on the windows, there must be a reason.

Indeed! Most flippers take the bars off. The neighbors leave them on.

@ son of landlord. Maybe I will be the first to admit I bought a home in a neighborhood with bars on the windows. I bought a home near LaCienega Ave in Baldwin Hills where about 30% of the homes have bars on the windows. I bought the house from an 85 year old couple who built the house and lived in it themselves since 1952. The house had with no bars on the windows, and no gate across the driveway either. Given my mandate was to get as close to the beach as I could for under $500K this neighborhood was my only option. And looking at LA Times crime maps and crimereports.com I could see the crime rates were lower than Fairfax district and Beverly District and far lower than east of LaBrea. Anyway, simply giving you the mentality of a life long LA resident and why he bought a home on a street where some homes have bars on the windows.

Not sure what the takeaway is supposed to be other than some people don’t mind bars on the windows.

The bottom line is that bars aren’t on windows for show.

Speaking of bars in windows, I saw a Spanish style house on Redfin, located in West L.A., that looked beautiful in the photos.

So I checked Google Street View. There I saw the same house as it was a few years ago. It looked shoddier without the new paint job — and yes, there were bars on the windows.

Sometimes Google Street View can be a real pain for flippers.

1704 Corson St, Pasadena, CA 91106, the price seems steep because the house has a very steep roof. Do you know how much it would cost to redo the roof. At least 40% more than normal. The workers comp is high on these steep roofs. Also, the attic could be turned into living areas. This place is reasonable for the area. The culture of Pasadena is very different than Riverside. I will not get into that. If you have parents that are going to live with you while you have 4 kids, then Riverside is the place for you.

Riverside, sounds so Texas. So do the electric bills to run the AC in the summer. The utilities in Riverside should be factored in as well as the long commutes in 20mph traffic on the 91 and 15 and so on. Those long commutes can kill a marriage. But then, if the little lady stays at home to take care of the kids and the parents, then you can have a traditional marriage, Carlos. In Texas, you could get that home for half the price, but the summers can be a bit more humid, in some part. If I lived in SoCal, it would be Riverside(where they are zoned for horses, like Burbank, Glendale and Corona).

Rivertucky

Riverside is just as corrupt as its neighbors, Scam Bernardino ( bankrupted ) and Moron Valley ( where the FBI just rounded up most of the City Council ) . The entire Inland Empire is owned and operated by developers …period. It has been that way for decades.

What keeps Riverside finances relatively solvent is the fact they own their public utilities, which is simply used as another stealth taxation mechanism and a transfer piggy bank for other non-utilities related government operations. Riverside is a wannabe Pasadena … something it will never be. But it will developmentally bankrupt itself trying to become a ” destination ” attraction instead of an 8 to 5 government employee town, which is exactly what it is.

I luckily got out of there, and CA, last year after 25 years.

We seem to be slipping closer to the abyss each day. The Fed plan to save us from the abyss was to stall, by printing money to give to American and World bankers and corporations in hopes of staving off massive bankruptcies and defaults. They hoped organic growth would return to the marketplace and save them and us all. They didn’t understand that DEBT, itself, was the problem. The Fed helped to fuel a second housing bubble and a stock market bubble; The Fed did not understand that the housing bubble, itself, was fatal to the global economy. Housing costs too much. Housing costs too much on either an overpriced mortgage or on a monthly rent that consumes most of the working poor’s salaries. There is no money left over for anything else. Americans chose housing first; then they lined up by the millions for government food stamps, so they could afford to eat.

Americans felt richer if they owned a house that tripled in value from 2004-2007, but this only allowed them to use that paper-wealth to borrow more at the bank. Clearly their children and their children’s children would never be able to pay three times what their parents paid for their ‘Las Vegas bonanza’ house unless their salaries were three times higher than their parents’ salaries – and their children were losing their jobs in record numbers, and their children’s children were settling for jobs in McDonalds for minimum wage. What is that FED doesn’t understands about this picture.

There is pressure on Europe to follow in the QE path. But it is not flying in Europe. Europeans understand that QE is stealing money from national citizens to give to failing banks who did not do their job right. That is a hard sell in Europe. In America, it was an easy sell. In America, businessmen (entrepreneurs) can apparently do no wrong.

American sheeples wake up.

Nice rant Wiz.

It’s called reality check. Someone like u may need it.

Wiz, no need to get defensive. I meant it as a term of endearment. I agree with everything you said. I take it you’ve never watched the show Dennis Miller Live in the 90’s, when he says, “I don’t mean to get off on a rant here, but…” Funny shit.

As long as Purina Cat Chow cans will be 3 for a $1.00, even less for the off brand usually 4 for $1.00, during special promotions (and extra discounted for dinged cans, just drop them on the floor in the super market) and Alpo dog food cans will be 2 for $1.00, plenty of Americans will continue to be house rich cash poor, living in those golden sarcophagus.

Debt is NOT the problem, it is a symptom. Today it is a symptom of a dysfunctional Congress. The Fed financed a Depression. That is why you are not on the corner ng pencils, instead you are speculating on real estate online.

In Iceland they actually sent their TBTF Banks CEOs to jail. They even prosecuted the Prime Minister for not stopping the insanity of the 2009 housing crash.

http://www.dailymail.co.uk/news/article-2134023/Icelands-Prime-Minister-guilty-countrys-2008-financial-crisis-avoid-jail.html

Iceland’s former Prime Minister found guilty over country’s 2008 financial crisis but will avoid jail

-Geir Haarde could have faced two years behind bars

-Former leader said he is considering appealing to European Court of Human Rights

-Special court finds him guilty of one out of four charges

-Haarde is the first leader in the world to face prosecution because of the banking crisis

The former Prime Minister of Iceland has been found guilty of negligence over the country’s 2008 financial collapse.

Geir Haarde, 61, was convicted for failing to hold emergency cabinet meetings as the economy went into meltdown.

500K that close to the freeway is especially nuts, but many people don’t realize there is much more than noise to deal with in that situation. I rented a block or two from 101 for several months and everything outside was covered with a fine black grit…diesel soot, brake and tire material, etc…not so good for your health and I would not to it again at any price. Some info on this is in the link and some is specific to Socal.

http://www.scpcs.ucla.edu/news/Freeway.pdf

In West LA, houses that close to the freeway go for $800-900k.

Yes, I think about that every time I drive down Montana near the 405 in Westwood. Wonder if they’re aware of what they’re breathing in their million dollar homes.

Perhaps it’s those very fumes and pollutants that they’ve inhaled that have gone to their heads and left them addled and light headed enough to pay those delusional prices…

Agree with Bluto and there are plenty of scientific studies (UCLA or USC come to mind) proving that respiratory disease esp for children is 50% higher when homes are within 300 feet of freeways or highways.

Not to mention the health risks of living near one of the many flight paths or downwind of one of the refineries.

Recent Inglewood flight path flips come to mind. What’s better than pollution billowing over from the freeway in through your windows? Why having it spewed down from above, of course!

I wonder what is the return on investment for the properties that were bought by investors. I can not comment for California. But here in Chicago, IL the return that investors thought they were getting and the actual returns are not that spectacular. Let me provide one example. A two unit building sold for 485K. After plugging in the numbers, the roi is a paltry 5.1%. I did not calculate the cost of vacancy on that roi by the way.

You can make a healthy return on investment properties, if you buy it at the right price, your rents are competitive, you know how to manage expenses, find and keep quality tenants and are willing to work on your days off to maintain your property.

Southern California real estate is looking more and more like Oahu did generations ago.

In the immediate post-war era, it was actually possible for GIs to use a VA loan to buy a new home in Honolulu County. (aka Oahu)

The super-boom of the jet age exposed Oahu to Mainland money in a major way.

The valuation surge was so profound that it became impossible for any generation to replicate that of the GI generation.

Sansei Japanese Americans have only been able to get their own digs with parental assistance. (with exceptions, of course)

For the last fifty-years residential real estate development has been so ‘managed’ / metered that no over-hang of inventory ever occurs. All that one sees is a swing in scarcity.

The last super-mania was during the Japanese bubble.

( It was as intense as the mania now gripping Beijing. )

Hawaii went through its own (one-state) depression during the 90’s. An entire generation has passed without a boom.

&&&

With this history as a guide, one should expect a total funk to fall upon Beijing, Vancouver and Sydney — to last at least a full generation.

In quantitative terms: Red China is built out.

[ For you history buffs: New York City had a super-boom from 1910 through 1930. Many of those structures still stand. Ever after, NYC has had only modest growth. ]

The only location — in California — that can sustain a major super-boom is greater Sacramento. Everywhere else is built out.

&&&

I would contend that the big boys have run out of bread and butter properties that fit their buying parameters. It was bound to happen.

For the real estate agents of California, I expect hard times for a generation. Turnover is destined to collapse. Digital media are sure to stunt the ride-around game.

Likewise, tract building is going to be hugely curtailed in California. Tracts turn on new employment — en masse.

The new (globalized) economy is going to make mass employment impossible.

Take a look at Tesla and its battery plant project. In a prior generation, it would’ve been built in California — for sure.

Public records suggest land in Phoenix and Las Vegas is being bought up at a dizzy pace. You are certainly right as far a California, it has always been about the land grab, and how fast and how many poorly constructed homes with bad zoning they can build.

California buildable land even at any price is just about gone. That is why I say if you have to stay in the Tarnished State, (I say that with trepidation, it is was beautiful then came the politicians and when a facelift was due it never came ) then buy a resale in as good as zip code because the future of housing in Cal. will be if you can imagine even worse.

Or rent in a great zipcode for as long as you care to.

Fantastic assessment, blert. Thanks for the most helpful and insightful comments particularly regarding Hawaii/Oahu. And agreed on China/Beijing particularly comparative with Japan and other super booms.

Hawaii boomed along with the rest of the country until 2007. Plenty of ninja loans and second homes went into default in the aftermath too.

But yes, in Hawaii saw by way of Japanese investors what CA is seeing now by way of Chinese and corporate investors.

I’m being notified every day of one or two “prices-lowered” on properties where I’m looking in North San Diego County. I mean every day. Down from 10 to 20 thousand off first asking price. I’m not seeing any major increase, or even minor increase, in new listings. Still about one new listing every 3 days average.

I get email updates daily also. In my outer Eastern suburbs of Sacramento area, I get approx. 5 a day “price reduced” and at least 3 new listings a day.

Everything at the lower end is still selling real fast, but the stuff priced over $450k is sitting, and sitting, then the price reductions start.

My area is somewhat not typical because just about every license plate holder in town is a dealer in the Bay Area – they are selling up and coming to Folsom/El Dorado Hills/Cameron Park – with a fistfull of cash, and they do not seem to fussed about what price they have to pay.

Still, I would say 85% of every new listing is rediculously overpriced. The agents are still drinking their kool aid I guess.

“My area is somewhat not typical because just about every license plate holder in town is a dealer in the Bay Area – they are selling up and coming to Folsom/El Dorado Hills/Cameron Park – with a fistfull of cash, and they do not seem to fussed about what price they have to pay.”

Isn’t that what happened last time?

Rewind … I could make a case for overpriced housing such as North Hollywood that to say the least are shoe boxes. $100k was just unheard in such cracker box homes, same thing was said 20 yrs. ago, nobody will buy them, today they sell for $600k?

As far as the bubble forget it “underwriting standards, which some believe are sometimes too strict, would never allow the return of bubble-era irresponsible lending.” A leading quote that one should heed.

BTW… houses are going to 5.5% and although price increases will be limited to select zip codes right now is the time make a offer to a underwater or a move up seller.

I study this I’m good at it, buy now, check public records for in trouble sellers, buy the best zip code you can afford. Don’t let a real estate lead you around by the ears, get in your car, don’t ever trust internet pictures, do homework deals abound don’t wait.

Better to buy a 400k house at 4.25% now, why wait to offer on a home that will be 500k, and you think you got a deal when it is sold for $400k @ 5.5%?

Buying a house today = buying a house back in 2005 or 2006.

Don’t you have any shame????????

“Buying a house today = buying a house back in 2005 or 2006.”

It’s possible you are correct. It’s also possible that buying today = buying a house in 2003, and there are 2-3 years left in the run.

@TJ

– Sales vol low

– Inventories rising double dig % except Bay Area. (Don’t worry, NASDAQ unwind underway)

– Rates rising

– Family starts down

– Incomes not rising

– Investors pulling back

– China credit bubble deflating/popping

– Something about Russia

You’re right. Everything is fine. Remember, BTFAH!!!

Momentum investing at its finest. They say that the average person has a financial memory of two years. Clearly we are witnessing it.

Buy now or be priced out forever, check.

Just remember, you bleeting sheep, dullard lemmings, and pigs to the slaughter:

BUY THE FUCKING ALL TIME HIGH!!! BUY BUY BUY!!! The big players are counting on you to cash them out and leave you holding the bag. BUY BUY BUY and say BUH BYE TO YOUR MONEY!

BTFATH, Forget to take your meds today?

No meds here, TJ! Did you forget to BUY THE FUCKING ALL TIME HIGH???

“No meds here, TJ! Did you forget to BUY THE FUCKING ALL TIME HIGH???”

We all have basically 3 options when it comes to real estate…buy, sell, or hold.

I would not buy at these levels, but i also wouldn’t sell (yet.) I am holding for right now. (I know…too complex for your pea brain.)

chill

With 500K in cash, you might have a chance of getting your offer accepted on a well located beach close fixer in a top zip code. But only a chance. It is harder to qualify to mortgage money thanks to the Obama administration and the Democrats.

Just think. Back in 07, you could have bought that Manhattan Beach fixer on a full sized lot for about 1.1M in the tree section. And, you needed nothing down.

Now, it takes closer to 1.4 for a tree section mortgage, you need a huge down payment, and it is hard to get the mortgage.

So, the smart money bought that Manhattan Beach home before 2008 with no money down, then held on. That MB tree section home is hitting new highs, are often selling with multiple offers, and should continue to rise in price for several more years.

Only a fool would have passed on getting in on MB real estate … bubble or no bubble. Now, you will never be able to live in Manhattan Beach. You missed your chance when mortgage money was easy to get before 2008.

Buy now or be priced out forever, check.

Everyone wants to live here, check.

Basically, if you do not own a home in a beach close zip code, the odds are you never will. That ship sailed a few years ago. Perhaps you will be wiser in the next housing downturn … perhaps you will have enough money and credit to purchase the next dip. But, it will be a long wait … and you had better start saving like a madman.

Even moar everyone wants to live here, check and check.

This neighborhood / zip code / area is different / special / unique, check.

NOW BE A GOOD LITTLE CHUMP SUCKER AND BTFATH!!! BUY THE FUCKING ALL TIME HIGH!!!

The Manhattan Beach crowd gets extremely defensive when there is the slightest possibility that real estate prices might be headed for a correction. They lash out, intimidate, and insult people. It’s sad that the town has been infested with these idiots.

In their view, the whole world is beating down the door to get into Manhattan Beach. Yes, everyone wants to be just like them and wants exactly what they have. The rest of the world’s inhabitants, all 99.999999% of them are so missing out on everything! Big. Fucking. Deal.

You know what else Manhattan Beach is infested with? Pollution! I love how the MB morons think they are living the high life, with a MASSIVE petroleum and related products, byproducts and pollutants refinery, processing, and storage complex running along their north border.

Nope, not like anything toxic has been discharged into the air they breathe over the years, and discharged into the ground. Might as well have a toxic waste dump superfund site in your backyard.

@JQ,

The reason the Manhattan Beach crowd gets so upset is that they are future golden handcuffers. Median income in MB is about $150K year. This appears to be solid income until you dig through the data you find that MB is almost 100% DINKs. You then find that the average MB male earns about $85K year and the average female in MB earns about $65K year. Again, solid numbers but not outstanding numbers.

What this really implies is that the typical Manhattan Beach household is leveraged up to their eyeball sockets in debt. Any suggestion that home prices in MB will moderate or decline will cause a brain hemorrhage in the MB couples swimming in pools full of debt.

Just one little leak from one or more of the transport pipes running offshore from the complex to and from an oil tanker parked offshore, or some other inevitable environmental crisis from having the largest oil refinery complex on the west coast as your neighbor directly to the north, and Manhattan Beach’s cache will be knocked down a peg or two or a hundred.

Can you taste the Quaker State in Manhattan Beach? You can practically chew the pollution in the air.

@ ManhattanBeachshithole

what is shocking to me is all that wealth in Hermosa, Manhattan, Redondo, could not prevent Chevron from renewing their petrochem operations and oil tanker operations with the State for another 30 yrs.

http://blog.sfgate.com/green/2010/12/13/chevron-gets-30-year-lease-in-santa-monica-bay/

I’m with JT, housing is going to tank and tank hard. No one knows when but it’s getting much closer than it was a year ago.

It’s indubitably a year closer than it was a year ago.

JT is a tad too aggressive with his whole housing is going to tank spiel. When SoCal housing prices in desirable areas tanking in the early 1990s it took about 5 to 7 years peak to trough for that to happen. When SoCal housing prices in desirable areas tanked in the early 1980s it took about 3 to 5 years for the bottom to hit. When the banks melted down in 2007, it took about 2 to 4 years before the bottom hit.

Based on history, housing takes years to tank. The housing market is not the stock market where prices can swing 25% in one day.

Thats nothing. Have a look at Canadian prices. What a joke. Ours is mostly due to Chinese billionaires loading up on a Canadian government investment for visa program. What a joke- multimillionaire Chinese jacking our prices.

http://www.crackshackormansion.com/

Buckle up people. Dollar collapse is not far away.

TJ,

The only flaw in your logic, “2-3 years left in the run”, is when housing tanked last time, they didn’t just drop back to 2003 levels, they dropped to 1990 price levels. Oops.

^^^ In real terms/values, yes, at the most recent post bubble bottoms in 2009 and 2011/2012, home values did hit the levels last seen in the 90s. Obviously not in nominal terms. Just wanted to throw that out there before some dimwit chimes in about prices in 1990’s vs late 2000’s.

we’regonnaberich aka Captain Obvious…yes, prices will crash when the bubble pops. The real question is when will the bubble pop? If there are 2-3 years left, then I’ll wait to sell, simple as that. As of right now today, i don’t see interest rates rising or prices dropping.

Where exactly do you see 2-3 more years of this madness coming from? Expecting the stock market to keep up this pace?

Better pay attention to more than just interest rates and asking prices.

TJ,

You’re assuming that there will be a gradual correction and that you’ll have time to bail out. Few homeowners were able to jump ship in 08 in time and the next correction will probably be the same.

Quite a few economists in this country and outside are suggesting that the next crisis to tip over the US stock/housing market will be created outside the US and will be related to currency. If you can see something like that coming in time to offload your stucco box, I’d suggest you head to Vegas immediately.

This is my take. Yes, it is unsustainable IN THE LONG TERM. But when will is the correction? It has already been delayed for years. I have only my finite human lifespan to live, here. If this lasts for another decade, I am essentially “priced out forever” as far as my time is concerned, even if my instincts are proven right and things do eventually crash.

Keep in mind that this Riverside property is less than one hour from Orange County and Los Angeles County. At midnight maybe! From 5 AM to 11 AM I challenge you to go to these locations in an hour. I think the $500 /month for electric is a bit excessive unless you require your house to be 70 degrees in the summer. With a whole house fan and proper management you can easily stay under $200 even in July and still be somewhat comfortable at 78-80 during the day. A lot of houses these days have solar in the IE and you can typically get lower rates on Solar than SCE.

Absolutely right. I had the misfortune to drive from El Segundo out to Palm Springs last month starting around 2 PM midweek. 2 hours later crawling through Riverside I was ready to slit my wrists. If that’s what it’s on a typical weekday you couldn’t pay me enough to live out there… and this from someone who commutes daily on the 405.

Well, if you live that far out in the IE, you need a transportation solution. I’m in Chino, which is just outside the LA County line and almost halfway between Downtown and Riverside. I take a bus that I can catch right off the 10 freeway in San Dimas. It takes me about 10 minutes to get to the bus stop, and then about 25-30 minutes to my building downtown. Unfortunately, it usually takes almost twice that long to get home because of the traffic, but at least I can read books, do work, or play video games on my Ipad.

But living the SoCal dream means surfing and skiing on the same day, nobody told me about the traffic from the beach to the mountains. Oh wait, maybe there’s a bus one could take, you know, a “transportation solution.”

Ski and surf in the same day in So Cal? You can do it and if you haven’t tried you should.

you can run a swamp cooler all day long for pennies, I personally like the moisture it adds to the usual bone dry air around here

A swamp cooler, seriously? Those things fucking suck. You get what you pay for, pennies indeed.

Nothing has changed in So Cal. The farther from the ocean the lower the price. As we used to say “drive til you qualify”. Culver City is quite a bit closer to PCH than Riverside.

Not only is it distance from PCH to consider, but let’s call it the ‘micro-economies’ of Silicon Beach (Venice, SM, Marina Del Rey). Well-to-do high-tech and entertainment people who cant afford living in the aforementioned beach towns have driven up prices in WLA and Culver City. According to Yellow Pages, Culver City alone has 524 entertainment, production, tv, creative companies. Silicone beach probably another 2,000 companies. So, while we all sit in shock over the selling prices of these homes from PCH to Culver City, perhaps we should rather be in awe at the amount of money in the world and concentration of wealthy living on the Westside.

“Silicone Valley vs. Silicone Beach”

http://www.cnbc.com/id/48082442

Nothing has changed? A hundred years ago when consumption/tuberculosis was running rampant and doctors were advising people to live at elevation/in the mountains (while telling them to avoid the high moisture, high humidity, foggy marshy swamplands and beaches of the Cali coasts, living inland was highly preferred and at a premium to the lesser and least desirable properties near the coast. Maybe when and if the sea levels rise and the seas and oceans erode and wipe out massive swaths of coastal properties, demand and desire will turn again…

Pasadena.

Everyone living in So Cal, Phoenix and Vegas better take a reality check. The real problem you guys have going forward long term, is the availability of fresh water. Not sure sitting in your 1.4M Manhattan Beach house, looking out at all that beautiful saltwater in the ocean will be worth it, when nothing will come out of your tap to drink.

Water….Please let’s get off Cal,Az,Nev. will collaspe because of water shortage. When land was .50 acre in the SFV in the 1940’s same nonsense no water don’t buy.

The only thing that can stop a Cal real estate catastrophe is a 8.0 right in the center of LA or Sf. Otherwise folks keep dreaming and waiting for the 1m house to fall to 250k ain’t never going to happen.

Ah, yes, the old strawman ‘argument.’ How many times does one have to tell you no one expects $1m to drop to $250k? Can you not read? Or are you so bored you just like to troll? Seriously…it’s getting annoying.

Someone suggests a 20% overvalued market. You come back with “$1m is never going down to $250k! Buy now or be priced out forever! It’s only going up from here!”

I guess when you have nothing rational to add to an argument, the strawman is your best friend.

Please now, stop the hyperbole. Did anyone here say they’d expect a precipitous 70% price drop?

Amusing that you mention an earthquake being the only think that can stop the housing run–as if a big earthquake is inconceivable. This is earthquake land, silly.

Regardless, a correction is coming. A trigger like an earthquake will only make it happen faster.

Saw an interesting stat last week that said 20% of CA state energy consumption (govt/private altogether) goes to pumping water down to SoCal.

robert is correct to a point, but ignores that the current state water system relies on diverting water from a large swath of the SW. As water declines over the region, that will become both more challenging and more expensive.

Massive desalination is probably the next investment project, but that likely won’t come cheap either.

California’s installed power base is 78,000 megawatts:

http://energyalmanac.ca.gov/electricity/electric_generation_capacity.html

The total amount of power actually generated is approximately 200,000 Giga-Watt-Hours

20% of that figure — or anything approximating it — is wildly beyond the pumping requirements for pushing water down to LA.

[The above figures account for 70% of the power California uses. The balance is imported from out of state.]

So, just stop.

Your 20% number is just one of another of those ‘pulled out of thin air’ figures that gets started by some airhead.

&&&

And, in other news, the Israelis have pretty much solved the sea water desalination. There is now no upper limit to the availability of potable drinking water at a competitive price.

So sorry, there’s no problem here.

So much for pleasant debate.

The article I’d seen it in was slightly off in describing it – looked up the citation and it’s 20% of all CA electricity usage is related to water delivery statewide. Though at first glance that would seem to include agricultural application.

http://www.epa.gov/region9/waterinfrastructure/waterenergy.html

AFAIK desalination is likewise still moderately energy intensive, and there are environmental concerns, which aren’t exactly a slam dunk to get around in CA.

At this point in time the EPA is totally political.

Barry is using it as his regulatory brown shirts to take on modernity.

There is NO WAY that the 20% figure was calculated from the ground up.

What you’re reading is PURE agitprop made to resemble science. The conclusion was ginned up first, no doubt.

The vast bulk of all potable water is pushed to and fro, namely the fantastic amount of water shunted south to LA. This is a low friction nearly equal elevation pumping job.

Tremendous energy is required to pump this flow up over the mountain — which is largely recovered by turbo-alternators on the southern down slope.

While agriculture uses the vast bulk of the water supply — plants never stop drinking — you’d be shocked to learn that valley farmers use diesel engine pumps instead of electric pumps. Why? The power utilities have to size their system based upon potential load. All of the farmers want to pump at the same time, more or less; it’s a seasonal thing. Consequently, farms are charged a capacity/ demand fee — whether they use the juice or not. This is assessed year round. (!)

When you do the math, it is evident that electric power — for water pumping — is too expensive. Thousands of farms depend upon diesel pumps — remotely controlled these days — that are fed via adjacent fuel tanks. They need to fire up only as needed — and pay no motor fuel taxes.

I would make bank that your EPA dude in Washington is totally unaware that the number one pumpers shun the grid. Instead, he whipped out his slide rule and ASSUMED that so much water lift had to come off the grid. X weight x Y height = work performed — he has a figure. And it’s wrong.

As impressive as a high rise is — and its water bill — such structures represent a trivial fraction of California demand. Most of the population — and industry — are right down at ground level.

In my county, most of the water pressure comes naturally. Gravity does the trick.

&&&

You have to just toss these off-the-wall agitprop — totally political — statistics into the dustbin. The 20% number is a FAKE. It’s very roundness should be a give-away.

Modern political policy is loaded with fake statistics. Scrambling them can provide justification for essentially ANY political nostrum to strike his fancy.

####

As a heads up: MOST of the latest EPA rants are contaminated by OPEC funding.

It’s on the record: Saudi Arabia is the number one funder of anti-Keystone ‘Green’ campaigning. Said funding is detailed within every non-profits declarations with the IRS. The Greens make no bones about it.

Of course, the idea that KSA actually wants to prevent the consumption of hydrocarbons doesn’t even pass the laugh test. It’s the official position of the King that American fracking represents an existential threat to OPEC profit margins and market control. The Arabs make no bones about it. They are frantic.

&&&

Now here’s the irony: Barry’s anti-drilling crusade is making the Koch estate fantastically richer.

Fracking is high cost oil, high cost natural gas. If Barry were to permit wide open conventional drilling in the Gulf, a general price drop in crude just might happen.

As long as Federal leases are not being let, the way is forward for a massive expansion of domestic fracking. At these prices, America is ramping production at 1,000,000 bpd- per year. That’s an international record of expansion. The tempo has surpassed even the most optimistic driller’s dreams.

&&&

Which gets us back to the EPA. By what logic is the EPA even calculating the juice required to move California’s potable water?

Right!

Not a reason in the world. It’s a TOTALLY political statement. It comes from a fusion of old time Puritanism and new wave paganism. Puritans held to economy in everything — just for its own sake. Pagans place nature equal to Man — and ultimately — above Man.

To show you where the EPA’s head is at, their number one man testifying on global warming to Congress — was the dude claiming to be on under-cover work for the CIA!

Yes, THAT guy! HE’S at the core of all of these blarney numbers.

http://www.frontpagemag.com/2013/dgreenfield/top-epa-global-warming-expert-also-lied-about-working-for-the-cia/

Everybody you’re quoting was working under HIM — and to his direction.

It’s a made up number.

The strange situation is that only higher interest rates can save our country and the global economy — but higher interest rates will not save overpriced assets like housing. Higher interest rates are needed to ‘dry out’ the alcoholic nature of our recent long-lasting ‘high’.

Low interest rates are a huge problem. Low interest rates bailout those with more debt than they should have. Low interest rates, in fact, are the blessing to crooks, frauds, con men and cheaters. The longer that interest rates stay low, the more crime and collusion and graft a nation has. No wonder you have all speculators having a party since 2009, flippers, the entire housing industry, wall street crooks and etc.

Low interest rates are the fuel of untalented con-men and rattlesnake oil salesmen everywhere. Cheap money always brings out the crooks and the gangsters in suits and ties.

Raise the interest rates and destroy those crooks, destroy those speculators who are having a party since 2009.

You are, of course, referring to Congress.

Great article, Dr. HB, and a few snarky, sarcastic comments regarding the specific properties mentioned:

First, that “Culver City” condo is more in Ladera Heights, and certainly NOT in the zone of the “good” Culver City elementary school (though again, “good” being a relative and subjective term as IMHO the “reknowned” Culver City school district/system might be [barely] above LAUSD but even ‘less shitty’ is still shitty).

Second, that Pasadena home might be across the street from the freeway, but that is some beautiful landscaping and treescape courtesy of Caltrans, hahahaha! Plus there’s probably a sound wall and the freeway is high up, although that offramp I’m sure produces plenty of sound and accidents. At least the assorted trees, bushes, and shrubbery will more or less protect the home from getting a car flying off the freeway and straight into it.

Regarding the HOAs being monthly, yes and that’s not even considering any special assessments which may (read: will) come up every few years, possibly even more frequently than that.

And finally, regarding hot days. In inland and valley areas like that Riverside home, you can expect them not only for most/all of the summer and a large chunk of the spring, but also for the bulk of fall as well. Hell, even winter time if our previous mild winter was any indication, where we had a couple of ridiculous heat waves as well.

Also, someone else mentioned it as well – no chance in hell will the commute from that Riverside home be anywhere close to an hour during rush hour (meaning 5am to noon coming and noon to 9 pm going) to LA County or Orange County unless you are talking just getting to the county lines.

And an added bonus for the Pasadena house is it’s right by the Metro Gold Line station at Allen, at least according to that map. Definitely worth half a million for that, hahahaha!

I expect real estate to pick from here once Main Street figure out that the depreciating dollar is the real war. The government wants a weak dollar to keep up the illusion that we have positive GNP. When currencies lose value, people rush to buy tangible assets. This is a boom bust cycle of a different kind of animal all together.

Foreigners come here to buy because prices and goods are so cheap compared to their homeland. We are the walmart of the world. Foreigners come here on buying trips to stock up at a discount. America is cheap compared to other top nations real estate and goods. If we paid what they paid for housing, goods and services our lifestyles would not be so good. We have it good here. So much is available and with such variety.

The government is going to keep chipping away at the dollar and the real crash will be a currency crisis. The dollar is starting to attract attention for being backed by nothing more than confidence. Countries are trading in their own currency. China and Russia could dump our treasuries when the time is right and they have secured enough gold. I know this is mostly a California housing blog but world events will affect all markets within the next ten years. The world is playing musical chairs and will keep doing so till the last chair is gone.

I think your expectation is wrong. The real question is if the growth is dead and the answer is looking like yes thanks to a strong move towards government and a managed economy based on unsustainable deficits and monetary policy that flies in the face of capitalism and rationality.

Indeed interest rates are rising but not because of inflation but simply because there is less and less investors willing to lose money buying our treasuries for what some call “safety” but in reality is because there is little else to buy. This is the same thing that hit England when it’s global empire collapsed due to the fact they made absolutely nothing and demanded everyone use their currency and pay exorbitant taxes.

The reason the frbny gets away with qe is the petrodollar. Oil priced in gold, aka real money, is getting more expensive. This is what killed growth, monetary policy followed to foster the illusion of growth. Recognition of such will precipitate a crash/reset.

To the extent it is possible to do so, Russia has ALREADY dumped the dollar. What Treasuries remain in Russian hands do so because there is not one man on the planet who trusts Russian courts — particularly when a commercial trade/ credit claim is at issue.

Red China HAS to accumulate US financial assets — Treasuries — as a DIRECT CONSEQUENCE of her mercantilist campaign against America.

Beijing has NO VOLITION.

She is in a policy straight-jacket.

To shift gears Beijing HAS TO ACCEPT ramping unemployment and a curtailment of exports.

A prompt national upheaval and civil war is the projected result.

Similar yucks are had WRT the “Petrodollar” agitprop — so chronic at ZeroHedge.

There is no such thing.

What the world is dealing with is the US Dollar as International Money / and the International Reserve Currency.

This latter status has NOTHING to do with the units of account used by a given cross-border trade … no matter how huge.

To be a Reserve Currency means to be that most unusual currency that ALL of the worlds traders want to have as a LONG position — over night — after they close down trading. That’s it.

ALL other currencies ‘cross’ against it. It’s involved in pricing a trade — even when it’s omitted from the trade.

Renminbi is cross-priced to rubles only after { Chinese renminbi:US dollar: Russian ruble } is calculated.

That such is so is betrayed by the consolidation ratios for the Euro. Each old, discarded, national currency was ‘crossed into the Euro’ at EXACTLY its US dollar value at the time. There were no exceptions. It made the math so much easier.

Such is the way of the world.

“Red China”? What is this, 1955? The country’s name is “China”.

“Red Chinaâ€? What is this, 1955? The country’s name is “Chinaâ€.

Seriously. I like Ol’ Blert, but he’s a throwback. He was talking about hunter-gatherer societies a couple of posts back. When was the last time sociologists used that paradigm?

I always get a chuckle out of blert’s prefixing China as “Red.” Although in all fairness, the PROC is ran from the top down by ye ol’ Central Committee of the Communist Party and you sorta can’t get much more “Red” than that.

How is the dollar depreciating? Against what is it depreciating and if it is, who really cares if every other currency in the world also is depreciating?

China can dump our treasuries but someone else will buy them and rates will go up slightly. Big deal.

So China and Russia are hoarding gold? So what? India has the most gold hoarded in the world and it’s a poor country. It’s just shiny yellow metal that not enough people own to make it a viable currency.

I agree with you, despite how shitty things are right now, we do have it good here in the USA.

I think debt service is a better metric than home prices as home prices are a function of interest rates. People get too caught up in prices on this site.

To all the interest rates are rising folks, 10s are at 2.62% today. That’s hardly “rising.” The street was forecasting 4% this year lol. We aren’t going to be above 3%.

“People get too caught up in prices on this site.”

That is a distractionary non-sequitur. Until absolutely everyone is purchasing with leverage, price matters. Until price is no longer an input to potential debt-serviceability, price matters.

Thanks for the reality check KeithR, the Fed is going to keep rates low, whether we like it or not. Most people on this board are emphatic that rates are going to rise. I don’t think they are…not with this economy…not with these central planners in control.

For safety’s sake, don’t remove your training-wheels.

1) HOA and property taxes are not a trivial factor. They are at absurd — and heading north.

2) Interest rates are so ‘political’ — so manipulated — that no-one should have your confidence.

3) Highly manipulated systems have a tendency to stay within parameters — and then fall entirely out of bed.

Towards that outcome I give you the stark action of 4-10-14 in the stock market.

BTW, it will be astounding if the afflicted ‘securities’ regain their ‘virginity.’

Forty-years ago the market had the Nifty-Fifty. They were taken out, one-by-one and ravaged. Do review that market. (1972-1974) It’s instructive.

Interest rates mean little when you want/need to sell. Price matters.

One more thing Christe in regards to inflation. Higher oil/gas prices hurt the economy. Higher food prices leads to kicking out existing politicians and parties if not starting regime change and revolution. The Fed and the rich know that very well. That’s why we have all this double talk from the Fed lately. We will raise interest rates – we will not.

The truth is that Fed is backed up in a corner without any ammo left.

They can’t have higher interest rates but at the same time they have to maintain dollar as a world currency, petrodollar. Russia is already making deals with China and bypassing petrodollar.

So interest rates have gone up in the last year even though the Fed has never stopped buying. So I don’t think the Fed has ultimate controll over interest rates anymore.

Interesting times are coming.

Interest rates have gone up because of taper or any mentioning of this word. The market is front running the FED. Taper does worth about 3/4 % on the 10 year. Anything beyond has to do with other bond markets and the world economies. US is not the only bond market in the world you know.

so funny what found redfin buy a condo and try to flip in one week for cool 50k profit of course minus escrow, title and other fun stuff.

http://www.redfin.com/CA/Van-Nuys/7038-De-Celis-Pl-91406/unit-15/home/4505321

Sorta wonder if there’s some funny business going on with this listing.

Anyways, the bigger story here is that some sucker purchased it in 2005 for $415K!

I had the same impression as you Doc, about energy costs of a big home. However, hypothesizing and actually experiencing are two different things. Something I failed to consider compared to living near the beach where I had lived prior, was technology. The home I lived in near the beach was built sometime in the 60’s and had basically zero insulation. When it is 80f near the beach it feels equivalent to 95 in the IE, because homes such as the one you pictured in Riverside are brand new with latest technology in highly efficient insulation. Unless you experience one of those few weeks of humidity , the insulation is wonderful. On an 85f day, I don’t have to turn on the AC until sometime after 3pm and only a couple hours until the house cools down. When it’s humid tho, all bets are off. My home is about 300 sq ft shy of the one depicted above. During the HOTTEST months in the summer over 100f my record electricity bill has been $270. On average most of the year it’s about $75 and I work from home so I constantly have all sorts of gadgets pcs tvs running all day long. During the winter insulation is even more magic. Living near the beach it can get as cold as 20f middle of the night and without insulation it feels like sleeping outside and those wall heaters are inefficient and gas costs soars. Out here, the insulation keeps things pretty warm and the newly efficient heating systems really give it a huge advantage over an older home. On top of that a big home means a lot of surface area for solar but I’m not going to open that can of worms just comparing apples to apples. However if you have a NEW-er home on the coast you get the bet of both worlds but you’ve probably paid such a huge premium it probably offset the delta on cost of utilities you’re so worried about.

I rented an apartment two blocks from the beach in south Redondo for 15 years, and because of the layout, didn’t have air flow and needed a window air conditioner about 20-30 days a year. Now I’m in a house a block and a half inland, and in three years, I haven’t found reason to unpack the air conditioner and put it in. I’ve closed the windows in my house maybe ten evenings in three years, mostly on the rare days with high winds, but mostly it’s slight breezes during the day, with nice house-clearing winds for about an hour around sunset. I think the latter are because the house sits on a grade, dropping about two feet on opposite sides of my foundation.

The beach moderates all temperatures; we see 40F in the cold winter nights, and I keep several windows cracked open because I like the air flow. I’ve never seen it go below 40F. My house was built 92 years ago; a beach bungalow with little insulation. No HOA, but gas, electricity and water cost a total of $130 per month (1070 sq feet). I’ve lived in NYC, Chicago, Pasadena and the SFV, and I’ve never paid as little in utilities.

We live in a condo off Catalina and have experienced the same. No A/C, and we literally have our radiant floor heating breaker shut off 10 months out of the year. Windows constantly open.

I’m not sure we should be advertising this though.. 😉

But it’s airport adjacent!

That was meant as a response to jon’s post:

so funny what found redfin buy a condo and try to flip in one week for cool 50k profit of course minus escrow, title and other fun stuff.

http://www.redfin.com/CA/Van-Nuys/7038-De-Celis-Pl-91406/unit-15/home/4505321

Do you guys ever intend to buy? If so, do you intend to hold on to it or is it strictly an investment?

Mortgage rates are falling again, and falling fast. check.

Multiple offers on beach close fixers. check.

Sitting on many beach close fixers. check.

Making a small fortune. check.

Looking to acquire another beach close fixer. check.

Coming on a housing bubble site to proselytize keeping up with the Joneses in order to feed a self-serving status quo, check.

Making a faux fortune. Check.

The money is made when you sell.

a…I only go by from what is posted on this board, it seems to me many of these folks can offer 10%,20%off, they still can’t buy a home?

They are dreaming of a huge collaspe and stealing property like in 2008 where some homes dip 60%, all I say not going to happen so get over it?

Robert the housing market will have a long slow slog as affordability declines. There is no room to build out, just up. Lending standards aren’t going to suddenly get supper loose again and rates will albeit slowly, rise. Gen X/Y can’t afford or do not want the housing stock of their parents. Tough market to be in the business, get over it or try another profession.

robert (should be lowercase-clear that it’s you)-

“I only go by from what is posted on this board”

that explains much of your asinine comments, which lack any real data. you offer nothing but conjecture and anecdotal crap.

“They are dreaming of a huge collaspe and stealing property like in 2008 where some homes dip 60%”

the knowledgeable contributors here are not expecting a 60% drop in real or nominal terms. personally, i sold at the peak in summer of 2013. i would buy again in my market in the SGV as soon as the correction reaches 10-15% in nominal terms, all else being equal.

Also, 2008 was not the trough. Try looking at data. My last purchase was in 9/2012 and the purchase price was equal to 2002 pricing in nominal terms in the same zip code. In my zip the chart has flatlined and is now declining.

Housing to go WAY up 2014 bitchez!!!! F U Jam Tiylor!!! How is that for “conjecture and anecdotal crap�

I have a question which I think is the only pertinent question these days… When does a gambler walk away? When they are winning? Hell to the no! When they are losing? Nope, gotta win back the losses. Well, when then? When the big muscle escorts the losing bum from the establishment and roughs him up a little in the alley. Sorry it is human nature we have no other choice…

Well, Robert, if we’re all so stupidly unreasonable, what’s the point in coming here to debate?

Why come on the board you say? I guess I always have been the guy who believed very little unless I saw it, research it, or experience it.

My grandfather was a tough Southern Ill coal miner, never take nothing at face value and certainly never listen or come to a conclusion to a one sided argument?

Actually, I can afford a house right now, but I just think such a purchase today is unwise.

It’s an old sales trick to try to make people unwilling to pay ridiculous prices feel like losers or cheapskates.

Pipe down, R/robert.

Yep, it’s just a boring old tactic to attempt to focus the attention off of the question at hand and onto the participants in the debate. Usually pulled out by those without any substantive counter arguments to make.

Shhhhh We are supposed to be ignoring all roberts…

We have feudalism and most of you will never get to buy a good home in the “good neighborhoods”, so stop dreaming. Be happy with Riverside(Crackerville). So stop complaining. Big money has always controlled the state from the time of Leland Stanford to the present. Be happy with your lot. It will not get better. James has just told me that it is tea time.

I told you it was tea time and unlocked the basement door for you, “Lordy-poo”. So get off the internet, get in your gimp suit and serve me my tea.

So by that logic Zuckerberg will run for Governor and open a new University… What it wrong with you people?

is that is….

Oh yes, Lord John, the 1% like yourself are here on a housing bubble blog posting about how the lowly 99% should get used to “our lot”. Whatever. Our lot is your is your lot too, poseur John.

Blert Ahha! your cynical historically laced comments are spot on. History doesnt repeat itself but it certainly rhymes. Yesterday I visited a clients 100 acre ranch in Santa Ynez, one of many tangiable properties they own. When the fiat dollar collapses like every other fiat currency in the history of the world the banksters will reach fufillment.

What an economy where a craftsperson able to build a structure that can provide shelter for decades is compensated .1 % of an economic hitman whom produces nothing. What does the collapse of debt based technological society look like. Time to stock up on nearly instant gentically modified microwave popcorn.

Jim Taylor is right! http://www.zerohedge.com/news/2014-04-11/whats-wrong-housing-recovery-picture

I’ve posted once or twice before regarding my search for a home in San Diego. To recap, I’m 25 y/o with $100k in savings and zero debt with a very secure $100k+ career. Prices just keep going up here in San Diego County and I’m at a point where I have to stop looking due to pure frustration and disgust. The only thing left on the market at this point are absolute dumps that won’t be able to be mortgaged, or cheap shoddy flips that have been marked up 3x the renovation cost.

To that end, what should I do with my savings over the next couple of years since I don’t intend to purchase a home in this market? I almost feel guilty leaving it in a savings account. My disgust with the housing market extends to the stock market and it’s distorted bubble-like valuations. I feel that we are on the cusp of something very painful in this country, and almost feel paralyzed with my situation. I can’t begin to imagine how others less fortunate feel. Anyways, rant over!

kristopher…i’m in almost the same boat.

i have $150K cash, zero debt, and am looking in long beach 90815.

i’m equally frustrated, and refuse to pay $600K+ for a 1500sq ft fixer.

all i can hope is that it comes down 25% or more so i don’t feel like i’m getting my pant pulled down on the price.

Kristopher and 450grig I am 35 years old in the same boat, i have 200K want to purchase around Burbank or Glendale area. it is very frustrating to see the market.

i feel like i leave in developing country, were all the rich foreigners come buy this homes, and i leave in small apartment

very sad

MICk818 — you should look in the Tujunga area. It’s going to be the next Eagle Rock, and there are some amazing areas. And some sketchy ones, too. Prices are high, but not as crazy as other parts of L.A.

I feel bad for you kids (I’m retired). Only thing I might suggest is a total stock market index fund for your cash, or maybe purchase an income property. I confess I am cash heavy myself, but do have some in total stock market index that I will just let ride the madness up and down. I’m searching north san diego county for retirement place, don’t need to be near the big city so I have more choice, but all any of us can do is ride it out. I hope you’ve got your retirement IRA fully stocked that should be the first thing.

It’s interesting how many people are cash heavy. The average high net worth investor is 45% in cash these days. Jamie Dimon of JP Morgan thinks interest rates will rise faster than most people think. If you are holding cash and want to play it safe there are few good options. I’ve shopped around a bit and this is what I’ve found:

1. One West Bank has the best rates for branch banking.

2. Capit One 360 for deposits. They bought IAG Orange

3. Ally Financial for creating CD ladders. They let you raise your rate in your Cd which is uncommon.

Many of us longtime DHB readers have a bit of a doomer bias that drives us to be cash heavy. While I’ve tried to resist this impulse I am nonetheless about 20% in cash these days. Though I did have enough self-discipline to let the S&P return to almost double its 2009 lows before pulling some cash out, the fact that it continued to rise another 500 or so points without me has been at least as costly to me as it would have been to buy a home at the peak of the last bubble and watch it decline to current values.

Just saying that being too bearish can be as costly as being too bullish. Sometimes it can be good to step outside of the echo chamber for a while to get some perspective on which is which.

Gamble in the stock market to solve a problem created by greed? No way.

ap – “…the fact that it continued to rise another 500 or so points without me has been at least as costly to me as…†This is the reason so many folks I know who were millionaires at one time are broke now. This thinking is the reason most will end up broke. A gain is a gain. If you sold your stock at a gain, it is a gain not a loss. If you sold your stock at a loss, then you lost. But it is NEVER a loss to not be in a market. It might be an emotional loss but it is never a real loss. I know I will get a lot of negative feedback on this comment but the reality is that you are talking about missed opportunity during a bull market. Well, there is another side to that equation which is a missed loss on a bear market. It always amazes me how folks see the missed opportunity and never see the missed loss. God bless all of you folks who feel that you need to be 100% in this speculative bubble. Your future losses will be my future gains and I would like to thank you all for your donations to my retirement. I am not against gambling per se, I just think we need to call it what it is and know that we have as much opportunity to lose as we do to gain. God bless monkey/lizard brains…

“what should I do with my savings over the next couple of years”

Continue to add to it…

I was once 25yo with 100k+ income and 100k savings..

But I lived in Colorado, so I could easily buy a house, and some income RE.

I am now 37, and because of career progression and accumulated savings it was not very difficult to afford prime area.

I don’t think there was ever time when 25yo could buy a property in prime area, unless they are backed by their parents.

Patience, grasshopper.

John… thanks for the correction on Vegas. That is one town where you buy definitely matters. I once got caught in North Las Vegas many years ago, a police officer told me you better turn around night is coming and you don’t want to be here.

I love the photos of those Sothern Ca houses. You know it has always been that way in So Cal.

Back in Chicago 1950’s you got a pretty nice home for 25k, shopping schools etc. Then you go to Cal (the SFV Granada Hills area 1955) and for 20k you got a 1,100ft., poorly constructed house, no shopping, no schools, no any thing .

But like the real estate agent said ” You got climate not weather, green lush plants year round and the notion you live and wake up in Cal. That is why millions came and that is why today there is always somebody still Cal dreaming at any price.

From the housing pumper’s handbook – repeat over and over that everyone wants to live here.

did corson drive by today. this article doesnt mention that it has two units! 1/2 block from gold line and goldmine as pcc/caltech and fuller rental property! sure its close to the freeway, though the high sound wall is effective. this is a busy two lane one way street and beggars are always at each of the closest cross streets. live? no. short term rental? yes. thinking about low ball cash offer…hmmm $205,000 ten years ago…pasadena does not have rent control… i forgot to mention art center….earthquake, drought, bubble….4th gen LA-ian…says prices always go up, and everyone wants to live west.

They* can make all those “investments” pay with** continued mass immigration.

**also requires mass restrictions of other land holders rights to build to eliminate competition.

What is the general feeling on how much of a drop in prices there will be if/when the bubble pops? 15% 25% 60%?

“China Property Collapse has Begun” Forbes, 4/13/14

http://www.forbes.com/sites/gordonchang/2014/04/13/china-property-collapse-has-begun/?partner=yahootix

Pet, thanks for the link.

Others, do you feel a Chinese property crash would be bullish or bearish for SoCal RE, and why?

Leave a Reply