Venice mania – 667 square foot 1 bed and 1 bath property listed for nearly $1.5 million. Signs of mania putting cracks in the market.

The signs that the market is now deeper into housing bubble territory are becoming more apparent as each month passes by. In SoCal we have certain areas that rival the nutty tech driven San Francisco housing market. Take Venice for example. This once hipster and artist enclave is now largely being driven by big money. People are listing million dollar crap shacks in hopes they can cash out at the top. What many people fail to see is the real estate market is now a volatile asset class. Because of this, we have wild rides when it comes to prices. Some feel the Fed is godlike even though they failed to stop the last implosion. Some tend to think unlimited funds from China will keep flowing in. Some are still waiting for Millennials to buy even though many are broke or living at home with their Taco Tuesday boomer parents. For now, all of this is happening but however you slice it, middle class Californians have been priced out big time. What is certain is that in some markets people are speculating in epic fashion. Let us take a look at a listing in Venice.

Venice 1 bedroom with investor potential

Venice has gone bananas in the last few years. The market was expensive before and now it is crazy expensive. Venice was expensive before for working professionals and now it is a market for major wealth. People outside of California have no idea how collectively insane things have gotten here when it comes to real estate.

Venice is an interesting city. It is situated on 3 square miles. Venice has about 41,000 residents. Many are familiar with the vibrant Venice Beach and Boardwalk. But many are not familiar with the housing market of this area.

I saw this listing pop up in my feed. What is most surprising about this place is the square footage and also the price.

1147 Harrison Ave,

Venice, CA 90291

1 bed, 1 bath listed at 667 square feet

Look at the photos. Â The lawn in the back is not even kept up. Â Indoors it looks like it hasn’t been updated since the Nixon era.

Let us first read the ad:

“RARE OPPORTUNITY to own this Venice R2 ZONED property near Abbot Kinney, the Beach and Marina Del Rey. Situated on a LARGE LOT. Venice properties like this are FEW and FAR between that come on the market….don’t miss this diamond in the rough — Original California Bungalow with and enclosed yard offering both pedestrian as well as vehicle private access; a detached Large 2 car garage located at the rear of the lot; AND gated front yard. Built in 1948 and owned by the same family for approximately 60 years, this trendy Venice Beach local may not come around again for another 60 years!!! Sold “as is”; the Buyer is responsible for their own investigations regarding permits, alterations, et al, on this exceptional opportunity. NOT TO BE MISSED!!!!â€

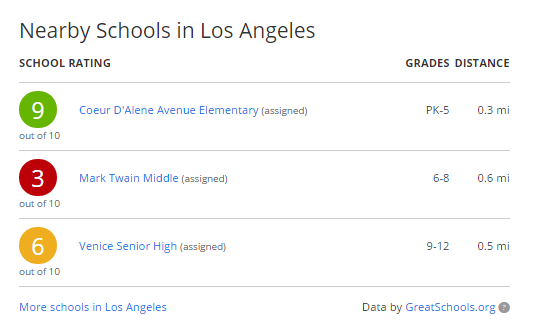

The place is listed at $1,495,000 and it is 667 square feet. Does the above look like it is worth $1,495,000? I also find it hilarious that the assigned schools are subpar:

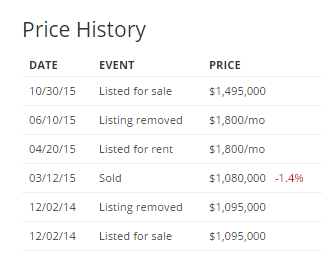

The ad is interesting because it states that the home has been in the same family for 60 years but there was a sale that occurred earlier in 2015:

I’m not sure why it was listed for rent at $1,800 as well. The tax assessment for 2014 valued the property at $52,754 thanks to Prop 13. In total $755 in taxes were paid while the new owner will be paying around $18,000 a year if it sells for the current asking price, all for the same Venice public services.

I’m not even sure how they arrived at the $1.495 million listing price. Similar to 2006 and 2007, people are just making a wild attempt to get as much as they can. Who can blame them? In a game of real estate musical chairs, it is worth a shot to ask for a ridiculous amount of money when the market itself is outrageous.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “Venice mania – 667 square foot 1 bed and 1 bath property listed for nearly $1.5 million. Signs of mania putting cracks in the market.”

$2249/sqft … That’s going to be a tear down.

The smart money is getting out of real estate – “Real estate investing is all about timing, and Sam Zell knows this better than anyone. He sold his real estate firm, Equity Office, to Blackstone Group for $39 billion near the peak of the market. This was back in February 2007—only months before real estate credit markets started to spiral out of control. He’s doing it again.”

http://www.businessinsider.com/smart-money-getting-out-of-real-estate-2015-12

Better tear that down quick before Housing Tanks Hard!!

I agree. This price is probably just for the land value. Maybe the land is 99% of the value i guess? Must be looking for a developer to buy the land and build apartments if they can.

Its all “monopoly” money now.

Some 30 + years ago when in grad school up the road in Santa Monica – I had several class mates who owned dumps like this – the price then was outrageous – now – it is a flush of good capital down the sewer of Venice Beach into the few vestiges of the ‘canals’ that are still evident there.

Round numbers – 2250.00 a s.f. sales asking is just psychotic. Hammer to Fall.

Where did you go to grad school in Santa Monica?

Santa Monica Community College doesn’t offer grad degrees. I don’t know of any college in SM that does.

Not sure if OP meant this but the RAND Corporation is in SM. Wife went there. If you aren’t familiar, they are top notch.

SCI-Arc used to be in Santa Monica, It is now located Downtown. Design and Architecture School, Highly rated.

Southern California Institute of Architecture – back in the day it was near Rainbow Records – Bundy and Olympic is the nearest large intersection –

The building was a clap trap of old airplane parts, trusses and you name it. Now a yoga studio and a coffee shop there last I was in LA.

It was as recently as Year 2K that Venice was a semi-slum, very shabby, marginal, and cheap. Shows how areas can change. This featured property HAS to be a tear down, because I cannot imagine paying money to live in something like this, no matter what locale or neighborhood.

So some extremely affluent person is going to pay $1.5 just for a house lot, plus demo expenses, which means s/he will have to build something that cost $3M or more just to justify the price of the lot.

I mean, I sure as hell hope some struggling “hipster” with an income of $200K doesn’t intend to stretch to live in something like this. What’s the use of making a high income just to live half as well as you could live on $40K in another region? And what’s the use of living close to the beach and in the sunshine if you have to spend 80 hours a week staring at cubicle walls to just barely afford something that is unfit for human habitation?

Great post.

Good point, Laura!

I was trying to explain to Jon in the previous thread that how much you make is irrelevant. What matters is how much you have left after taxes and the prices you have to pay – purchasing power. That is what counts in terms of standard of living. Proof for that is the house above.

If you increase the minimum wage and everything directly or indirectly goes up in price, including the taxes (SS and medicare), the poor are not better off than before. The poverty line is just moved upwards. At the begining when SS started, it was an entitlement because people collected who did not contribute. Today I don’t see it as entitlement but as a forced savings account because people paid into the system.

After 50 years of war on poverty, how are the poor better off when 1.5 million buys you a crapshack???

The only beneficiaries of this system are 0.01%.

Flyover – SS and a house are supposed to work the same way. Forced savings plans. Not speculations.

You are so correct, but how can we expect the general population to understand how inflation does not equal an increase in the standard of living, but is instead, theft on a grand scale and a major obstacle to wealth formation for those not born to a position to profit from the “skim” on almost every transaction people make in order to live, when our Ivy League-trained economists don’t get it?

“Ivy League-trained economists don’t get it?”

Laura, how can you understand something when you are paid not to understand it???!!!…

The people who are educated in business or economics, think independently and have critical thinking are always a minority. Those from the top 0.01% know this and already prepared an army of useful idiots who do their bidding without understanding that they vote against their best interests.

Jon on this blog seems an intelligent person but he either speaks based on emotions or he didn’t think through all the ramifications of a minimum wage increase. 99.9% from people are not going to benefit from this but the 0.01% from the top will benefit tremendously. They don’t push for that from the goodness of their heart. I respect his desire and many people desire to eliminate poverty, but what seems easy is not so. Poverty is a very complex issue to solve and it has very deep roots. Definitely the raise in minimum wage is not going to eliminate poverty or the taxpayer’s subsidy. I can argue that it is going to make matters worse.

Flyover – I’m fairly certain I’m to the left of Emma Goldman but I agree with you, it’s not the dollar amount, it’s the ratio.

There’s been a fair amount of buzz about how in some countries CEOs make 300X or so what their average employee does, and in others it’s more like 30X. Or even less. Take a small mom and pop company. They might be paying their workers about $30k a year, and it works because they’re somewhere where living is cheap, and they themselves might take $150k or so for themselves, that’s only 5X. And it works. They’re repairing tractor carburetors or something. Some basic thing that people need. Like an example might be a leather shop in Williams, AZ on I-40. Cool place. The lady who owns it makes just about all they sell there. She has people working for her, but literally she’s probably able to pay them about $30k, which goes far there, and I doubt she’s pulling down more than $150k herself, perhaps a lot less.

So it comes down to ratio, and that’s a lot harder to solve than simply increasing a number.

@FlyOver – The data can be looked at and manipulated any number of ways to prove ones own conclusions. One of the first books I read on the subject was ‘How to lie with statistics’. Several articles show how data can be interpreted from a partisan perspective-

http://seattle.eater.com/2015/8/13/9143329/is-the-seattle-minimum-wage-law-as-bad-for-restaurants-as-the

http://www.forbes.com/sites/timworstall/2015/08/10/seattles-15-an-hour-measure-the-unemployment-effects-and-there-they-are/

My point is we already have minimum wage laws. Why have them such that someone working full time with kids will receive not only tax subsidies, but direct housing, healthcare, EBT/food stamps, etc.. To clarify, I don’t support a $15/hr federal min wage, but think that any metro area where the actual cost of living has been well in excess of $15/hr, should vote in more progressive laws like Seattle. That being said I am familiar with the demographics that show the more liberal/progressive a city, the higher the cost of living, for which you could attribute several things to.

Jon,

I am familiar with Seattle (I lived there for 15 years after Microsoft expanded). I also understand business because I have an MBA and decades of experience of running a business (not just theory but experience, too).

I can tell you that no business can be successful in Seattle if they pay less than $15/h. The semi free market we have will take care of that business really fast – you pay peanuts, you get monkeys. You can not stay in business and be successful with monkeys. To say that you need a minimum wage of $15 in Seattle or Seatac, you state the obvious. You don’t need politicians to legislate that – the market will. For the mayor it was a political stunt to gain political capital. Seatac has a monopoly on the largest airport in NW, therefore they can stay in business with $15/h minimum wage. $15/h in Seattle is nothing.

Just because it works in Seatac and Seattle for obvious reasons, does not mean you can expand it in eastern Washington – it will decimate thousands of businesses who can barely survive on the existing minimum wage who are still profitable by exporting to other nations.

No kidding. Even in 2003, my buddy rented a two bedroom apartment a block from the beach in Venice while barely making any money. Rent was something like $1200, IIRC.

Yeah, I remember those days. I met so many people new to LA that wanted to live on the beach until they had to commute to Burbank for work. 3 hour drive each way.

For the want-to-be-owners that are desperate or need a time out I would hope they would rationalize what they see before buying anything in site Also watch out for realtard vultures is a sure way to make better buying decisions.

For all the people who rent there must be better ways to help the fellow renters find better deals to rent than get stuck with misinformation.

The key here is the R2 zoning. Devs will tear this down and build duplex to rent for top dollar or sell for over a mil each – that’s the going rate for new constructions. How many wealthy foreigners will it take to replace an entire middle class generation?

Why raze and build a high end duplex to net $400-500k for all your hard work when you can just buy this place and re-list it as-is in six months for another $1mil for hardly any effort other than calling up a Realtor?

Exactly. That’s what the last guy did, so why not the next guy? And if those guys did it over there, why not over here?

But it’s not a bubble because mortgage standards are different this time. Yeah, right.

A full mile as the crow flies from the beach and close up too “Marina Pawn” and RPM auto service, not to mention the local Halal food market. You might as well live in Riverside.

It may have the right Zipcode, but it sure isn’t the beach. Even if you pulled it down and built a fancy duplex, once you were done the seller of this squalid little dump gets the buds and the developer gets the stems and seeds. So someone bought it a few months ago for a million and are looking to clear a cool $500K profit when they haven’t even picked up the trash.

Don’t throw away the stems: They still contain THC. Just put a pinch between your cheek & gum. Waste not, want not … 😉

You know it’s a bubble when someone expects to make a 38% gross profit on a seven month hold.

It’s not “make me move” pricing. There are quite a few examples of similar price activity not only in Venice but also in other parts of L.A.

speaking of home sold for land value, I know the scoop on this one.

You may know this area “North of Montana Avenue” in Santa Monica with crazy prices.

This home started with an asking price of $3.5M with no offers. Price was lowered tro $2.9M and received several offers within a week. Sold for about $3M for land value to developers. So, if the land sold for $3M then cost of demolition ($50K?) then cost of new home, it will have to sell for about $4M for the developer to make money…..

http://www.zillow.com/homedetails/547-16th-St-Santa-Monica-CA-90402/20477050_zpid/

Now THIS is a different animal altogether…. what a beautiful older house. I couldn’t bear to tear down such a lovely house. Look at the beautiful architecture, the well-proportioned rooms, and the wonderful vintage details, like the vaulted ceiling in the living room, the beautiful windows, the spacious, airy rooms, and nice millwork.

This is a form of damage that results from over “gentrification” that almost no one pays mind to- the destruction of charming and livable older homes AND older neighborhoods that ought to be housing middle to upper-middle class folk, for the sake of vulgar, over-sized, ostentatious “mansions”. There will be a much larger and more pretentious house built here, but it won’t have the grace and refinement of this charming house.

Doesn’t look like a tear-down to me. If I could afford it, I’d pay $3 million to live there.

I think $600K-$700K is more like it, but I’d way rather have it, than any of the horrid, bombastic “mansions” costing $50M or more that I see being built.

I just don’t see how prices will ever drop again. It’s all fixed. the gov needs the prop tax money,… the equity in peoples homes makes you feel rich and spend more. If you didn’t buy 2011-2013 you are virtually fvxked, as I am. heck it depresses me.

some explain to me how we could ever get a 20% dip in prices?

it’s all Hope and wishes!

There has never been a better time to buy than now or else be priced out forever because this time, unlike previous bubbles, is truly different, as they aren’t making any more land, which is the key to long term wealth.

Tokyo’s RE market tanked hard in the early 90’s. It STILL has yet to recover its previous values. Japan is also a country very little non-mountainous, open land to build on, and a pop. of 150 million. Worth researching parallels between their own housing implosion and our own boom and bust market…

Last time the market corrected, was it not a fixed game then or did the government not need the tax money?

That is a good question. Some people think that the government sometimes doesn’t need the tax money and they just let the property prices fall. I don’t know when that happens but in 2008 the government needed the tax money even more than today.

@Flyover: I think HC’s comment was more or less sarcastic, and rightfully so imo. It’s the same fixed game it was and always has been, and it’s the same government with the same want/need to tax as much as they can get away with. Nothing has changed in that regard, so it stands to reason that those in charge might not be able to prevent another significant downward adjustment in house prices.

I must admit that it’s pretty tempting to just throw in the towel and buy, especially when I see decent that I can technically afford. However, my gut instinct tells me that it’s a bubble just like all the others, and I just have to be patient to get what I want (a decent house at a more reasonable price).

Evidence of bubble: yes. But then what happens? Do we see a crash of foreclosures? What about those “all cash” buyers – do they need to foreclose or sell?

There is so very little decent inventory available. What does this mean? Spring will see large price increases when buyers compete for limited inventory. Some recognize this and are getting into something now before another round of bidding wars and price increases occur just after the new year.

after 83 n 98 el nino… I c surge in socal housing too. i used to live next to venice hi, is so so area…. for 1.5m i rather live in ww tiny shack for 1/2 of that….

jt: large price increases from the already sky-high prices there are now? Is your post sarcastic?

I believe California real estate is still bound by location, location, location. The ocean communities and exclusive neighborhoods, will always be in demand! Prices may fluctuate, but there will always be buyers. Everything else however, is highly speculative … the ability to sell and the price will be subject to wild market swings! Most people still don’t recognize that we are living in a highly volatile economic world … job security is non-existent! Being chained to that home that you can no longer afford, can’t sell, or you can’t get what you’ve invested into it out, is a real threat that isn’t going away!

“job security is non-existent”

and yet in the same post you said their will always be buyers? Buyers with no jobs?

the RE is seriousness out of wack and at some point what one earns will matter again

Just for point of contention, London, whose housing market mirrors San Francisco’s in terms of insane pricing, has none of Cali’s great weather, ocean views, access to nature etc etc. And yet, and yet… London has become the #1 center for foreign expats to park their money. Either laundered and barely taxed in the city’s financial industry (something that to it’s credit, Wall St will not do), or it’s simply parked in real estate (much like wealthy Chinese here). These condos and local houses are, in essence, safety deposit boxes for shady Russian and Arab millionaires.

London is a financial city…hot money flows from everywhere into there…

The fed, govt. and Treasury are trying to do the same thing with US markets..select cities more so..

They changed all the rules to create housing inflation, auto loan inflation also has peaked…the deleveraging across the board in Junk bonds, China, Emerging Markes

etc. is guaranteeing a .50 rate increase at most and then lowering it again…

Deflationary forces can only be wiped out by price discovery not monetary gimmicks…

Housing today can come down to a block getting it price but the next block over doesn’t. Comps are out the window in many cases now, since cash all but eliminates the principal of a good deal, Location, sq. ft. value, condition, many of these overseas buyers only want a specific home in a certain part of town. Doesn’t matter if they are going to set up shop there or tear down, crazy money means crazy buying, and it hurts the realty of buying or selling in a sensible matter.

The neighbor who sees the house sell down the street for considerable more money and list there same home for the closed price, might just sit a year with no takers thus this scenario leads to a rather bad conclusion, a housing collapse of epic proportion.

The pending sales never tell the true story of todays market, many people are taking a huge hit to get away from there 2004-2006 overpriced purchase, this leads to these same people unable to afford the inlayed prices of today. Again, I’m always in contact with many a player in the real estate industry, over all it is at a critical stage, I’m the ultimate optimistic buyer and seller, but now I see and hear of a impending crash, not enough buyers and sellers who if they can’t sell soon will start to default again?

“Alaska is considering a personal income tax for the first time in 35 years”

http://qz.com/570780/alaska-is-considering-a-personal-income-tax-for-the-first-time-in-35-years/

When conditions on the ground suddenly shift, expect sacred cows to come into governments’ cross hairs.

This is a potential foreshadowing for Prop 13. SHTF and government leaders shrug their shoulders while claiming they didn’t “see” the catalyst coming.

I’m sure that just until recently, those folks counting on Alaska’s no income tax couldn’t “see” it going away anytime soon.

Make no mistake, government will throw its constituency under the bus in order to save itself each and every time. They will be as creative as necessary to get the job done.

I am from Alaska, born in Fairbanks, and spent about 15 years in Anchorage. Now is one of the better times to buy there, almost as good as 2000, or the crash that happened in the early 80’s. I have been watching things closely, and am thinking about buying a house in Anchorage and moving back there. When the California property market bursts again (as someone pointed out there is a stand-off between buyers and sellers, and the sellers are going to lose) They have not only RE agents working against them, since they need to sell for a commission, there is still a flood of balloon payments on HELOC’s that will peak in 2017. For those that are underwater, and can’t re-fi, or afford to right a check at closing, they will be forced to short sale, or into foreclosure.

Most properties I can get a good view of the price history on right now in Irvine, that are not new construction, are people trying to sell that bought after 2004, and are just trying to break even.

Agree HC, totally agree.

“If something cannot go on forever, it will stop”, (Herbert Stein).

__________

August 2015

~ They are going to throw the real estate investors under the bus at the first sniff of trouble and each lender will know that they mustn’t dawdle with the mercy killings as their competitors would seize on the error by getting hold of and disposing the assets on which their loan books were secured before the opposition did. The mechanics of all the leverage and the incentives for the lenders to murder their customers are extraordinary.

~ If the game is rigged, sometimes the only way to win is to not play. The government is trying to manage its insolvency. If circumstances change and there comes a time for a few owner-occupiers and real estate investors to join the corpses of the savers thrown under the bus, then under the bus they will go, depend on it.

~ For anyone who missed it, a US Census Bureau stats release a few days ago revealed that the US homeownership rate fell to a 48-year low in Q2 2015. This prompted a rush of articles and TV reports with the general theme that the American Dream is dying.

As in the UK, this is a growing political issue, and despite already introducing owner-occupier subsidy measures similar to Help to Buy, I don’t think anyone will be surprised to see US policymakers taking further steps to reverse the trend and quell the disquiet.

~ Political risk should always be taken into account when making an investment. Politicians don’t give a fig about fairness, and they certainly don’t care who they ultimately have to throw under the bus in order to achieve their aims.

~ Absolutely – and not to be forgotten that the government is not rolling in money, quite the opposite. It is managing it’s own insolvency and looking for people to toss under the wheels of the bus. Taking a cohort of tax dodging property investors to the cleaners makes political and economic sense, letting them off the hook makes no sense whatsoever.

__________

Always pay; for first or last, you must pay your entire debt. Persons and events

may stand for a time between you and justice, but it is only a postponement. You

must pay at last your own debt. If you are wise, you will dread a prosperity

which only loads you with more.

-RALPH WALDO EMERSON

By this time, there probably has been millions of young people, even married couples, many with good incomes, living for free with their parents for 4,5,6 years or more.

After years of this kind of savings, we’re talking about real money. Probably a couple hundred grand. Who knows. So if there’s any dip in prices, these savers will be ready from the sidelines, millions of them, jumping in, thus keeping housing prices high.

Jed: Do you really think that there are millions of young/married people, in So Cal, living at home with $200k+ in their bank account, just waiting for a dip in the market in order to make a purchase? I highly doubt it, given the absence of any evidence of this. There may be a few people like this, sure. But those people are probably somewhat uncommon.

Oh ya totally! These young people living with parents are rolling in cash with no debt and high paying jobs which is exactly why they are living with parents to begin with. After all, saving a couple hundred grand is pretty easy to do.

I’m not sure where you reside, but people that are able to save a couple hundred grand in only 4-6 years don’t usually live with their parents.

No kidding. If you’re barely getting by, and/or strapped with college debt, it could take a lifetime to save $100K. Nearly every single person that I know who purchased a home on the west coast in the past 10 years had a sizable cash infusion from family, outside of one guy who got an FHA loan in a bad part of Berkeley in 2010, so he only needed $15K. I keep telling him to sell, because he invested only $15K, and his house value has doubled.

I would agree, so long as they can qualify for am loan. Being a home owners a not all that great. I would rather rent.

Why wouldn’t they wait another 4, 5, 6, or 7 years to get off the sidelines considering the stagnant income growth coupled with increased housing costs since the last “recovery”? Why didn’t organic buyers swoop in when prices experienced far worse than a dip during the last downturn?

The sell side must be desperate when they resort to the same demographic that they helped throw under the bus in favor of investors.

Jed, are you serious? I’m looking for something in your post noting it’s sarcasm but I’m not finding it.

I hope you know how ludicrous your message is. If not, I want some of what you’re smoking.

living with parents at an $11 an hour job banking $100 grand…i laughed out load, i guess if the kid didn’t spend one dime of his own money.

like i told my kids, if you’re living with me and you’re not in school, we’re roommates and you’ll pony up some rent money.

@interesting: maybe you could give that collected rent money back to them when they move out (plus any accrued interest). One generation helping out the next (above and beyond basic parental responsibilities) is one way to contribute to the next generation’s financial success. That is, if you care about that kind of thing.

Responder, that’s exactly what my parents did for me. They didn’t tell me they were going to do it so it was a nice surprise.

Some people believe the (buyer-side) money never runs out, despite most impressive evidence to the contrary back in 2007-08 crunch. People see vast oceans of liquidity, where in fact there is mostly only repayment contracts, which can be subject to significant changes in underlying value.

Homes are FLYING OFF THE SHELVES. Just ran a quick search for the areas I’m looking at and there was only 1 page of listing. And 90% of them all PENDING.

And this is the BAD side of Orange County.

What’s considered the bad side of Orange County these days? Is it still Santa Ana and Garden Grove?

I would probably say South Santa Ana before South Coast Plaza and parts of Garden Grove/Westmin. There are parts in Anaheim I wouldn’t want to live. You grew up there if I recall so I think you know.

It sure is a lot nicer than when I grew though but the people seem to stay the same.

I’m from the OC and I would say that you want to stick with South OC, which is Irvine/Tustin/Newport Beach on down. Certainly, there are nice areas of North OC, but once you get into South OC, you can pretty much pick any neighborhood you want to live and it will be decent. You can’t say the same for North OC.

i just did a refin search on my zip, 66 listings, i didn’t see any pending, longest on the list 557 days.

~10 under 2 weeks, tons in 50 day range.

Well, shit does have a way of rolling down hill in a bubble. Thanks for confirming.

Furthermore, a quick check of all Orange County listings shows a 40% reduction rate. Single family homes are at 45%

Nearly half of sellers have been forced to bring their price down, and we’re supposed to believe things are flying off the shelves?

@Andrew, you sounds like a RE schill. Just in my zip alone there are over 181 active listings that are not pending, and most that is not new construction has been stagnant even with price reductions. And trust me, they aren’t anywhere close to out of land here in Irvine-

http://www.zillow.com/homes/92618_rb/

https://www.dropbox.com/s/lgxobv45b85u20f/Irvine.PNG

The former El Toro Marine base made up about 1/4 of the land in Irvine, and most of it was to be preserved for a ‘Great Park’ to rival NY central park. Never mind it is a former superfund site, with god know how much jet fuel, and whatever else they dumped into the ground. After the crash the real estate developers made a deal with the city to drastically change the size/scale of the Great Park-

http://www.ocregister.com/articles/city-371212-park-haddad.html

Irvine Company has a hold on the land like the diamond cartels. Restricting supply, and forcing up land values. They also opened up a bunch of land along the 133, just south of the 405 to build 4000sq/ft $3-4million McMansions.

https://www.dropbox.com/s/nzqf5xajx51s24z/Irvine2.PNG

This is just anecdotal based on me driving around the area, but one way Irvine Company restricts supply of housing (single family and condos) seems to be via construction of apartment buildings. These apartment communities appear consume a large amount of space that could otherwise be used for single family and condos.

Regarding the El Toro Superfund Site, there’s a bunch of information here: http://yosemite.epa.gov/r9/sfund/r9sfdocw.nsf/ViewByEPAID/CA6170023208

There is a “Second Five-Year Review Report†on the page, which defines the areas of concern pretty well. One of the main contaminants of concern is trichloroethylene (TCE). Maps of the groundwater plume start on page 134 of the report. I wouldn’t trust that there isn’t at least some contamination elsewhere, though, given potential influence and incentive that developers and others might have to assess an area as clean.

Shill? I’m looking to buy but no way are the properties that are available worth $500k in this part of Garden Grove.

I’d say the real value is around $375k.

Since the house is worth about $10.57, that would make the land nearly 1.5mill. Unless there is gold under that house I wouldn’t trade it for a Big Mac.

damn, i couldn’t afford the property taxes on that place…..that alone is more than my current rent.

“Is the bubble popping? San Francisco apartment rents fell in November as Oakland soared”

http://www.bizjournals.com/sanfrancisco/blog/real-estate/2015/12/bubble-apartment-rents-fall-san-francisco-oakland.html

Seeing the same thing happen on the west side of L.A. Beginning this year, asking rents are readjusting down, not up–en masse. Have even seen a few cases indicating rental contracts pricing below what they did 2-3 years ago.

Apparently not everyone wants to live there (S.F.) or here at any price. These areas can subsist off of unicorn farts only for so long. In California the housing bubble bone is connected to the tech bubble bone.

Reminds me of the Mailbox hype train that just came to a screeching halt. The timing on both ends couldn’t be more relevant.

“Dropbox reportedly paid around $100 million for Mailbox”

http://www.theverge.com/2013/3/15/4110532/dropbox-reportedly-paid-around-100-million-for-mailbox

“Why Mailbox died”

http://www.theverge.com/2015/12/8/9873268/why-dropbox-mailbox-shutdown

I’m seeing more rental signs in my neighborhood of San Francisco for first time in 3 years, more tire boots too…

That’s how it starts. I remember hanging out in SF after the last bust, rent signs everywhere. The bust is baked in the cake!

Commodity price collapse and increasing junk bond defaults are symptoms of the incoming asset correction as well. Investors are becoming more risk adverse and pulling back as the economic prospects become dimmer.

I enjoy your posts HC. You’re a good source of market info/tracking and wider insight.

Landlords do not have the superior dominant market position. It would be like herding cats – any attempt to manipulate the market will result in a void. I’m hoping there is more weakness ahead.

__________

http://www.doctorhousingbubble.com/remaking-of-an-american-housing-bubble-real-estate-bubble-home-bubble/#comment-936371

“Something interesting is that this is also coinciding with a downturn in SFH rental demand in Venice, Mar Vista, Culver City, and Westchester. A plethora of SFH rentals continue to languish on market for the past few to several months with price reductions in lockstep.”

I’ll guess this will be sold to a foreign buyer/developer who will install a giant glass/concrete residence box(es) that resembles a department store/shipping containers.

Before that Silver Locals who bought their houses/rental properties decades ago in the charming beach town might demand the property be a HISTORICAL MONUMENT. Dusty Liberal Surfer will show up at city council weeping that the house should be preserved/restored to its original condition because he walked by the house daily on his way to school back in the 60’s and he feels sad; Silver Surfette will demand only a tiny house be permitted on the lot to retain the “culture” of the ‘hood, perhaps a vegetable garden and “reminiscing” bench might work so old locals will have a new place to relax in their surf shirts/floppy hats while discussing the “Zestimate” on their properties, reminiscing about the 90’s El Nino and “celebrities” they partied with in the 70/80’s. Younger generations? Screw ’em, we got ours.

Keep an eye on bill AB-1040 property taxation: change in ownership

More on this subject and rentals:

http://caanet.org/bad-bills-for-rental-housing-that-failed-in-the-legislature-in-2015/

576 sq. ft. shoebox in Mid-City LA pending for $499K

https://www.redfin.com/CA/Los-Angeles/1549-S-Burnside-Ave-90019/home/6904675

When will the madness end?

__________

Daily Mash

05-August-15

HOUSES are now worth so much they do not want people living in them and lowering their tone, they have announced.

With property prices at another record high, most houses now have a much higher socio-economic status than the people who want to live in them.

Three-bedroomed semi Donna Sheridan said: “I’m worth $1.4 million, so I don’t want a load of apes stinking the place out with their heated food meals while they sit around that screen thing. And I’m definitely past allowing anyone to have sex in me.

“Thanks to the housing bubble I earn more in a year than a dentist, so I can easily pay all the bills myself without a bunch of carbon-based organisms doing disgusting things in my toilet.

“If anyone wanted to move in they’d have to be a better class of person. Someone like Fiona Bruce would be okay, although she can forget it if she’s got a dog.â€

in full here http://www.thedailymash.co.uk/news/society/high-earning-houses-ban-humans-from-living-in-them-20150805100795

And all this time we though that that the biggest threat to humanity were nuclear holocaust, global warming, A.I., or . But it was the houses all along. The houses plotted our ultimate doom. They turned landlord against tenants. Banks against taxpayers. Politicians against their constituents. Corporations against consumers.

Nice reply Prince. Hehe. I like it.

We just sold our house, a triplex, in Venice – Over the last decade, it has mostly changed from the home of the homeless (After Santa Monica got tired of that farce) to being the home of Google and the high tech invasion – It was amazing to see the almost overnight transformation… we were pleased with the upgrades until they built a flagship Whole Foods at the corner of Lincoln and Rose… Then THEY came, people driving 8-series Audis, Range Rovers, and Teslas!!! They built a restaurant row on rose right at our corner, but we have to drive miles east to find a place that does not sell $18 tapas and $25 glasses of wine… A friend of mine left Sausalito years ago to move to Santa Cruz.. He said that the new people came and brought their own party with them…. Pretty much the same here in Venice.

Leave a Reply