Calling on the Animal Spirits of Inflation: Forcing the Inflation Genie out of the Economic Bottle. Germany Hyperinflation of the 1920s.

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

–Ernest Hemingway

Anyone thinking that breaking a one-dollar bill into four quarters is a method of creating more money is simply trying to create something out of thin air. Yet that is the path that we are following. The Federal Reserve and U.S. Treasury who seem to be tempting the ire of the demons of inflation are now targeting the U.S. dollar with every weapon in their arsenal. As a nation, we still have a difficult time realizing that we have consumed too much for too long and debt only provided an illusion of prosperity. Some time ago, I walked into a staged open house. In the air the smell of bread baking, beautiful furniture adorned each room, and what would any home be without a nice mounted flat screen television? Yet none of this was real. The visceral feeling of this staging of course is to give you an idea of what you want. Or better yet, what you don’t have and should buy. The advertising machine is designed to keep you perpetually wanting. The staged home visually makes you forget the dollar and cents of the deal. Those that control the levers of power of our economic system have decided that tempting inflation is a small price to pay to continue on a spending spree that is clearly unsupportable.

Ernest Hemingway understood the problems of inflation even though an economist he was not. In fact, many countries have been burned by massive eras of inflation. Just ask Germany or Zimbabwe what printing money at a feverish pitch does to your economy eventually. As I have pointed out, we have seen an extraordinary amount of wealth destruction over the past 20 months. Some estimates have global wealth declining from $40 to $50 trillion; this has decreased with the recent rally. Yet the fact of the matter is much wealth is no longer filtering itself through the plumbing of our global economy.

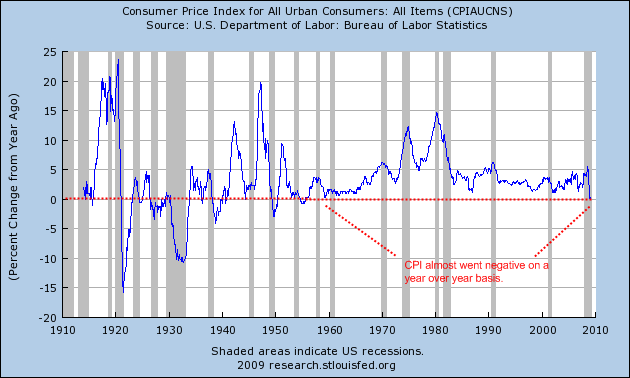

So what is the impetus of the recent rally? How can a market move up so vigorously when the fundamentals like deficits and unemployment seem to be rising with no end in site? The market is currently believing that the masters of the universe can summon the inflation genie out of the bottle and somehow put it back in once all things are cleaned up. That is the kind of hubris that brings down entire countries or puts then on a path of mediocrity. To think that the global economy can be systematically managed by a few people is on par with thinking we had no debt problems in early 2007 as many key leaders voiced. To understand where we currently stand, let us take a look at historical data with the CPI:

As you can see from the chart above, the CPI almost went negative on a year over year basis. Much of this had to do with a collapse in energy prices but also a decline in auto sales and the fall of prices in many things including commodities. This sounds more like the echoes of deflation. The CPI measures consumer price inflation. That is, the price of goods. We can get caught up in Austrian arguments about money and inflation or deflation but for our purposes, we are talking about consumer good inflation and deflation. For the last 20 months, we have seen across the board consumer price deflation. What items have been falling in price? Let us list them:

-Housing

-Energy

-Automobiles

-Commodities

-Stocks

In fact, it is hard to find anything that has gone up in price. Yet much of this has to do with the stubbornness of the U.S. dollar to yield to currency manipulation and also the myth of decoupling has fallen flat on its face and people have fled to a safe haven, which is still the U.S. dollar. With all this spending, the U.S. dollar has stood up relatively well:

After 20 crazy months of volatility, the U.S. dollar is virtually unmoved from when the crisis started in August of 2007. Yet now that the global markets realize that decoupling is unrealistic at least for now, markets are adjusting to this reality. In addition, the Fed’s new policy of buying treasuries outright is keeping rates on bonds unattractive for foreign investors. Many are only buying them because of the global flight to safety. But what happens if rates suddenly start to push up? A fascinating thing is happening with the Fed buying up this paper. That is, the rates have actually moved up a few times! Auctions have been weak because who in their right mind is going to lock in a rate of 2.7 percent for 10 years?

We have committed over $12 trillion in multiple programs to prop up the economy. This is the equivalent of nearly one year of U.S. GDP. Yet the problem with this commitment is 80 percent of the money is targeted to banks and Wall Street. The $700+ stimulus bill that was passed should have really been called a relief bill. It was needed. Yet it was merely a mixture of tax cuts, extension on unemployment insurance, funds for various programs, and additional funds to keep programs going. There really wasn’t much left to create a NASA like program to launch a new workforce. It was a tiny consolation prize to the public for $11 trillion of gifts to banks and Wall Street.

Committing so much money to the financial sector may in the end become our undoing. It is obvious to anyone with two eyes that there is no inflation on the horizon. Yet close to $4 trillion of that money has been used leaving nearly $8 trillion untapped. We have deficits in budgets that project out until 2018. If we did not have the status of reserve currency and were any other country, would you really funnel your money here? Would you as an investor, give money to a person that has maxed out his credit cards, has been late on their auto loan, is arrears on their mortgage, only on the basis that they were once able to pay it? This isn’t to say other countries are immune. In fact, the countries of Europe are equally, if not in more dire problems. They bought into this same form of financial driven market economies.

How quick can inflation hit? Just take a look at inflation in Germany during the early 1920s:

There have been many cases of currencies collapsing leading to hyperinflation. Shanghai in 1949, Argentina in 1989, and recently in Iceland. But what caused the hyperinflation in Germany during the 1920s? Well initially the government suspended the ability for banknotes to be converted to gold. Eventually the government was freed from any restraint to print money at will and this they did to finance the war. Of course prices rose with all the printing. By 1918 the mark had fallen more than 50 percent against the dollar. As time went on, even from 1919 to 1923 the government continued to run massive deficits. The tax rate never was higher than 35 percent of expenditures. So this gigantic gap was covered by immense money printing. It also didn’t help that their were massive reparations to the Allied Powers. In the end, the German government defaulted on reparation payments. And as the chart above shows, things went from bad to horrific rather quickly. In fact, in early 1923 unemployment was modest yet by October 19 percent of metal workers were out of work and many others were only working part-time. When prices stabilized the damage had been done and so had the impact on the psyche of many in the country. Many blamed international financiers for the problems they were facing.

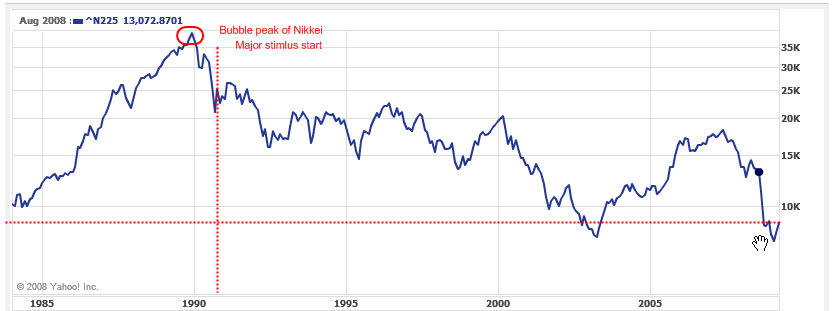

This isn’t too say we are even remotely close to seeing this. But you cannot print money at full speed and expect that nothing will change. Eventually, these actions should cause the U.S. dollar to lose further value and that will make Ben Bernanke the happiest man in the world. He would love to see nothing more than to see inflation. Why? This would make our massive debt seem cheaper and cheaper as time went by. The debt remains fixed while more money flows into the system. Bernanke has made it abundantly clear that he will do everything he can to prevent deflation. Yet Japan did everything it could during its lost decade and land values in many areas saw prices decline by 80 percent from peak to trough. And what has this left Japan with? One of the largest amounts of government debt of the global large economies:

Now we are a long way from Japan but we are heading down that path. Let us take a look at the impact of stimulus:

This chart doesn’t really highlight the entire story since this is government debt held by the public. In the U.S. we have a sizable chunk of debt held by foreigners. As we have also mentioned, with $12 trillion committed to various programs, we can expect our debt to explode in the next few years. So what has Japan garnered from this massive amount of spending?

Many don’t realize that over this timeframe Japan spent $5.5 trillion in stimulus, or 180 percent of their GDP. And the stock market slowly has fallen for nearly 20 years with short term moves up but overall a lower price level and an economy where nearly 1 out of 3 are part-time workers. Sure, unemployment is low but a large number are transient employed.

We have yet to see major down moves with the U.S. dollar because every other country is on a race to zero. We are simply outpacing each other. Yet what happens when we hit zero as many have? Quantitative easing? How is that going to play out? These are all things yet to be seen. There is no example in a global crisis where the solution was simple. I have yet to see an example that shows us that inflation is the healthy way out. The genie is out of the bottle but will it listen to us once we need to put it back in the bottle?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “Calling on the Animal Spirits of Inflation: Forcing the Inflation Genie out of the Economic Bottle. Germany Hyperinflation of the 1920s.”

DHB, I agree. It is amazing how our society is so quick to forget that with every decision made there is a consequence. It almost feels like every one is even more so concerned with the “moment” who cares about tomorrow, right now is all we need to worry about. The problem with that is tomorrow will be here before we know it, and all we are doing is perpetuating this enormous problem we are faced with. What do you think about interest Rates? I was listening to a couple Economist talking on the radio the other day, and the topic was inflation. They both seemed to agree we are going to see huge increases in the key interest rate. Consumers will be faced with interest rates similar to those seen in the 1980’s. If that is the case we would have 8-12% interest rates.. They seem to believe this would be one of the ways we would be forced to do to combat hyper-inflation? Do you think that is accurate? Coming from the real estate side of things, that will for sure put a big dent in things. Especially for my generation, we have never seen interest rates like that. Generation x, and Y are in for a big surprise…

Comrade Housing Bubble,

There is a subtle point in you post that needs to be emphasized. Many of our leaders are claiming success with the current fiscal and monetary policy. However, as you allude to, our “success” is being measured against much weaker international competition. Success should be measured by achieving a certain positive outcome, not by sucking less than the competition. The tragedy here is that our success is decoupled from reality leading some to believe that it is working and that we should do MORE of it.

Our “human exemption” (the belief that the laws of physics and all else common sense no longer applies to our species) will be extended just a bit longer. We are living in a world of delusion and alternative realities. The naysayers are labeled as Dr. Doom (that’s Doctor frikkin’ Evil to you) and dismissed outright (especially by FOX and CNBC). We’ve created the biggest bubble ever conceived by mankind and when it’s over, we’ll have the biggest hangover ever know to mankind.

Be Brave Comrades!

I find this very interesting. It amazes me that we as a society are so quick to forget that all of our decision pertaining to the economy will have a consequence, good or bad. This lays out some of those perfectly. DHB, I would like to know your thoughts on how this will effect interest rates? With interest rates at an all time low for the last 12 years, as inflation rises, wouldn’t the natural correction be to raise interest rates. I was in my car the other day listening to talk radio. A couple of economists were discussing this very issue. As they both had very different opinions, the one thing they agreed upon was that we will see interest rates in the 8-12% range within the next 12-18 months. This will be to combat the rise of inflation? I wonder what kind of shock effect this will have on the already damaged economy?

Good question, Spencer. Raising interest rates is the traditional tonic for inflation, but my bet is that they will not do this, for fear of a double dip recession, as the lesson of the 1930’s supposedly teach us. The powers that be are going to let the inflation grow for a long time.

I bought my first home in 1996–that was supposed to be a boom market then, right?–at 8.0% on a 15-year fixed loan. I’m old enough to know that that’s a good rate, and that anything much less than that you better lock in, because there will come a time over the next 30 years that you will wish you had.

I’m less worried about what 8% mortgages does to the housing market (not much, because there is still way too much oversupply in many areas) than I am what it does to interest on the national debt. That is now the third largest budget expense. It wouldn’t take much of a rate increase for it to climb into first. What happens then when from a third to a half of federal tax receipts are going to pay interest alone? That’s not encouraging to people who might be inclined to buy Treasuries.

The air escaping out of the burst housing bubble is going right into inflating the federal budget bubble. When that bursts, there are much bigger problems than worrying about 8 to 12 percent mortgage rates.

Oddly enough, I still haven’t seen personal behavior change all that much, except I know more people that get food stamps than at any other time in my life. More people getting laid off and more people asking me to help them find work. My company has a wage and hiring freeze, so I can’t help them. The 20-something kids at work for the most part still think everything is a joke, come in late, bs before they go to their tasks, take lots of breaks, long lunches, do the minimal quality and quantity…the only thing they excel at is loading up their tools and equipment to leave before five each day…Hope? that’s a four-letter word. There will be no hope until people’s mind-sets change. Government is so blatant about fabricating money rational people are stunned, but many think it’s great. Seen the greatest bear-market rally in 60 years? Some other charismatic leaders brought their countries out of economic disaster, but not without paying a terrible price. Hiroshima let the world know there will never be another all-out war with survivors.

Change? The only change is the bad solutions are just more extreme. Where do we go from here…

Do you mean house price will go up simply because of inflation?

I know there are “ten reasons” why house price will go down, but if inflation rate is very high, will house price go up? Of course, the real value will go down.

So, forgive my ignorance on this but what happened with Germany on 11/15/1923 when the new currency was issued? Did that just wave the wand for the “Marks” and now they have “deutchemarks”? Did they scratch about 6 zeros from the old stuff? Was the old currency non-redeemable? We obviously know that Germany as a country is still around. There’s a picture here of uncontrolled hyperinflation but…then what? It’s like the old pinball machines and video games when 50,000 was a high score woop woop, now it 50,000,000. Oops, just gave away my age 🙂

Hi Dr HB,

another good read.

Saw an interview from Peter Schiff of Geroge Soros. Two things that got my attention from Soros’ coments, Japan actually benefited from deflation; as things got cheaper they could afford more. And that no one knows what will happen to the markets when the government is acting so recklessly.

Best wishes

I haven’t spent much time studying Weimar Germany. But I’ve spent about thirty seconds reading the entry on Weimar Inflation in Wikipedia. Much of german industrial and mining capacity was seized by France and Belgium. This was followed by a general strike supported by the government, which supported striking workers with printed Marks. In effect, paid them to not produce. So what were they to buy with those markers?

If you look at Zimbabwe, there was an obvious destruction of productive capacity. Point being, that the Zimbabwe government was printing money, yes, but that it was doing this while destroying the nation’s ability to produce goods and services on which that money might be spent. Milton Friedman was an idiot. The value of money is not relative only to it’s supply, but also to the supply of everything else.

Leave a Reply