Triple digit increases in real estate inventory: Las Vegas inventory up 106 percent year-over-year.

The housing market is in a state of adjustment. Inventory is up dramatically in many places. In the last housing correction, Las Vegas was a leading indicator for California and we are now seeing some dramatic increases in inventory in the area. Las Vegas inventory is now up 106 percent year-over-year. In Seattle, inventory is up 168 percent year-over-year. For anyone looking to buy, the market has dramatically shifted. There is no urgency anymore and the tides have turned as affordability has collapsed. In California, many counties are now renting majority areas and the government is looking to cater to the majority of voters. Last time inventory rose this sharply price adjustments followed. What is in store for the housing market in 2019?

Las Vegas a canary in the real estate mine?

Markets across the U.S. are seeing a sharp rise in inventory. One key area:

“(Calculated Risk) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,352 in January 2018 to 8,957 in January 2019. Note: Total inventory was up 106% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.â€

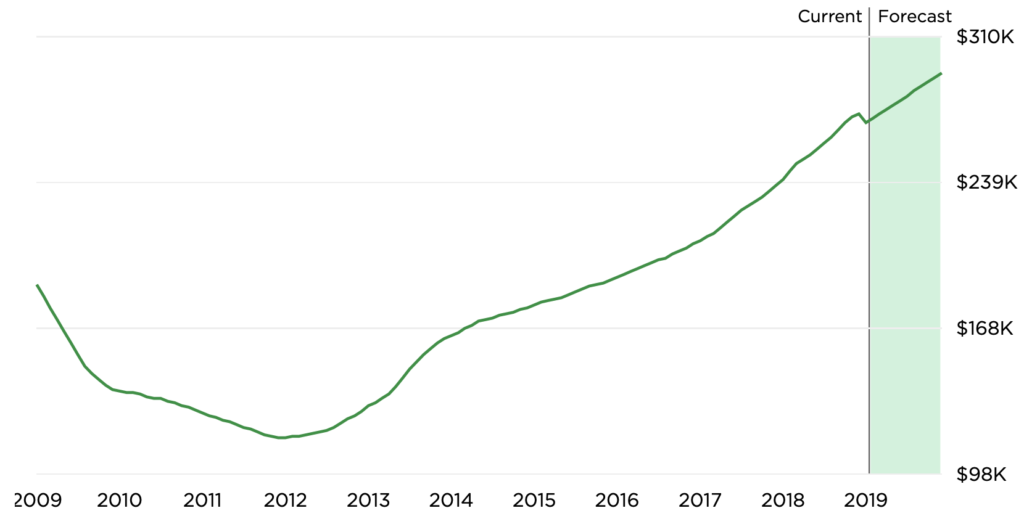

First, the Las Vegas market has been on an incredible uptrend like many markets:

Prices have more than doubled since 2012. This market has been incredibly hot. However, the Las Vegas market is highly dependent on the overall economy doing well. The nature of Las Vegas employment is highly linked to people feeling wealthier to spend on vacations and entertainment. This is a cycle that was seen in the last housing bubble as well. Speculation has been happening for a couple of years now but to a lesser degree from the last housing bubble.

Looking at things as they stand today, why would you expect any sort of correction? The only thing we are seeing is that inventory is rising sharply but prices are still holding steady. However, having inventory rising by 106 percent year-over-year is definitely going to add more supply to the market which means buyers will have more options.

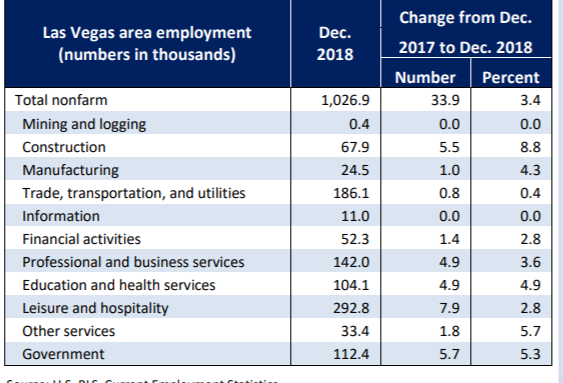

As mentioned before, a good portion of the employment in Las Vegas hinges on people spending freely:

Leisure and hospitality alone is 30 percent of the employment market. The Las Vegas market reacts quickly to changes in the overall economy faster than other areas because it is a barometer on people’s non-essential spending. Obviously someone is going to cut back on taking the family to Las Vegas first before cutting back on other essentials in the home. And since this market is heavily tied to California, it also signals what is happening in the adjoining area.

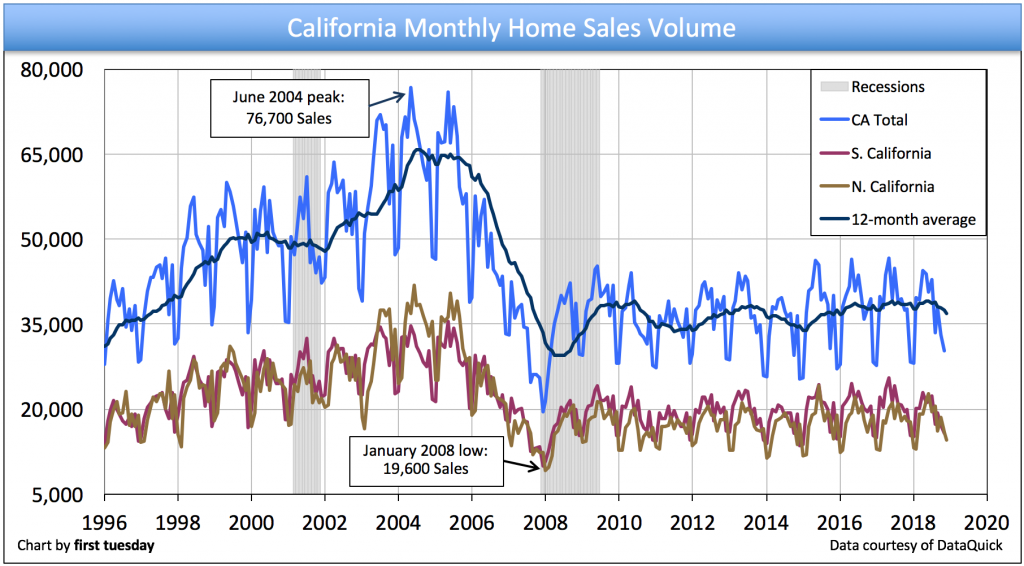

Sales volume is tapering off a bit in California while inventory is up:

It will be interesting to see if there is any significant bounce in the housing market in spring as winter is usually a seasonally slower period as the chart above highlights. The large rise in inventory in Las Vegas is very telling and signals that a slowdown is here. The only question that remains is if this rise in inventory will translate into price corrections.      Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

265 Responses to “Triple digit increases in real estate inventory: Las Vegas inventory up 106 percent year-over-year.”

Doctor,

Thank you for posting the full inventory charts for California…. it’s ridiculous when people just site year over year without the context of how low inventory has been.

Same goes for Las Vegas, inventory went to record lows. As your Calculated Risk quote cites, months of supply are still somewhat low in Las Vegas.

The interesting thing about Las Vegas it that it was always recession proof until the housing bubble. Before 2008 Las Vegas sustained very well in all previous recessions. People still had their vices and it’s an easy trip. People may down scale to a Las Vegas vacation during a recession.

I expect similar for Las Vegas in the next recession… Las Vegas will be less impacted than other areas, the economy will take a hit but it won’t be that big of a deal.

The Las Vegas mass shooting tragedy is a good recent example… the next week it was back to business. Tourism is at record highs in Las Vegas.

The only problem with Vegas and other towns in the desert is water. I suspect water is going to be a long term concern for any cities to thrive for the next decade and beyond.

https://www.express.co.uk/news/world/1005117/Las-Vegas-latest-news-drought-warning-colorado-river-nevada-news

Vegas did better in previous recessions because it was seen as a bargain town and a way for people to be able to vacation during the bad times still because it offered tremendous value. That simply isn’t the case anymore since it’s been overrun with corporate nickel and diming (resort fees, parking fees, lower gambling odds, etc.). Vegas is going to be screwed big time (at least The Strip) when the next recession hits as they have totally pivoted to the type of consumer they cater to.

turs12,

You could be right about that. Las Vegas is still a bargain town but it is definitely not what it used to be. Nothing is.

Inventory here in Orange County is also up substantially since last year. This fact coupled with higher interest rates will definitely slow down price growth.

True, inventory is up, but it is not high. True, it will slow down price growth. I expect slow price growth, with the exception of lower priced well located properties … those should do very well with big price jumps. But, I expect the higher priced stuff to see slow price growth. Possible that higher priced stuff in inland locations that compete with new homes will actually fall a little in price. Higher priced stuff in coastal locations will likely see slow price growth. But low to moderate price homes in any location should be fairly hot. This is a good scenario for the first time buyer … possible their first purchase may gain a little ground on higher priced properties.

But, lower end properties in high priced zip codes do seem to be doing well … possible tax law changes pushed wealthy buyers down market.

Inventory is up and sales are down. At what point will you cheerleaders admit that the market has turned and is headed south?

https://www.ocregister.com/2019/01/30/southern-california-home-sales-drop-20-percent-amid-housing-market-shift/

RE was in a bubble world wide not just in SoCal and Las Vegas. With interest rate increasing and QT on autopilot, liquidity started to be mopped out. The effect of that is felt everywhere world wide:

https://sports.yahoo.com/vancouver-home-prices-fall-floor-194259360.html

https://www.seattletimes.com/business/real-estate/seattle-area-home-prices-drop-to-lowest-point-in-two-years-down-116000-since-last-spring/

https://www.businesstimes.com.sg/real-estate/home-prices-in-londons-most-desired-districts-at-6-year-low

I think these examples are enough without going to Australia where prices are in free fall.

The QE pumped too much liquidity in RE world wide. The QT will drain it. Yes, prices will hold somehow as long as unemployment stays low, but unemployment will be eventually affected by QT and RE. When and how much I can not tell because I don’t have a crystal ball. Not even the FED can answer these questions without waiting and watch.

The 30-year mortgage is about 4.4% and the peeps can’t handle it with affordability as it is. Something’s got to give.

The Fed has said they are open to a hike or rate cut depending on how the economy does. That’s a big change from the set schedule of interest rate hikes. so there’s that.

Lower housing costs in the Western States (where CA is the 800 lb gorilla) would make it less likely that the Fed would raise rates, since the inflation rates in the other 3 sectors of the country are already at or below 2%/yr.

I’m looking for a dip to high 3’s myself to refinance. I don’t mind price drops as well, I would buy a nicer home in a nicer location.

As far as limiting the amount of interest you pay it’s almost never worth it to refinance your house. If you do refinance the only real way to win is to lower the term length. Half of all interest paid on your 30 year mortgage is in the first 10 years.

My general rule was to refinance once the rates dropped at least 1%. Move to a 15 year loan if the payments were almost the same or less than the prior loan.

Moving from a 30 year loan to another 30 year loan at less interest generally meant the payments were less (That may be OK if your spouse stopped working or you took a job with less pay), but in the long run, it took longer to pay off the loan and you likely paid more in interest over the life of the total home loans.

I refinanced from 8% down to 3.25% in 3 refis. 30 year to 15 year. Refinancing saved money and made sense in this case.

When you have at least 20 shows on cable about flipping homes you know the bubble is about to burst

Maybe prices will come down because of higher supply and also because people will see prices coming down and want to sell at the top. This will cause more supply and even lower prices, hopefully. Great for buyers like us!

I think there is no reason why prices should come down just because people can’t afford it. Since when does anything in this world care about the little people affording anything?!

This is taking to long TANK!!!! already……

As long as the gov keeps inflating the dollar there’s gonna be no tank, what’s the real rate of inflation?

It depends on which inflation index you are talking about. If we measure the inflation the way we did in the 80s, it would be really high. The way the government calculates today, it is low. They try to cap the the cost of living adjustments for entitlements.

The vast majority of potential home buyers do NOT have an unlimited time horizon. I don’t think this will ever change. People will buy because life happens not because numbers on a spreadsheet line up. This is why we will continue to have booms and busts in CA from here on out.

wasting time reading about things is keeping you from improving your income and obtaining those things. What have you done today to improve yourself towards your goals?

I’ve stopped reading Millie’s posts. Does that qualify?

Jed, I understand. Instead of reading, maybe you like to listen to the inventory articles/data. Here Logan Motashami on the outlook for 2019 on recent Bloomberg interview. Sounds like he Expects YoY declines in housing prices for coastal areas.

https://assets.bwbx.io/av/users/iqjWHBFdfxIU/vXrxle2ok.U4/v4.mp3

Interest rates will not go up because the federal budget can not handle it. Central banks will continue to print money to kick the can down the road. Keep on partying like there is no tomorrow.

It is true that interest might not increase. However, that does not mean that QT will stop. If QT continues at current rates, that is a moping of about 600 Billions/year. That is a lot of money to mop from the economy. The effect will be sizable and something will snap; then they will call it a black swan.

Of course, the FED might crash the whole bubble and then start to inflate again with another round of QE. Actually, one of the FED top guys this past week said that FED might start to use QE/QT as a normal tool the way they used interest rates so far. We surely live in a bizarro world of market manipulations. With these manipulations nobody can plan anything with the exceptions of those connected at the very top (with inside information). They will get rich beyond imagination and the rest poor. However, this is not capitalism; this is typical of a communist market with the FED playing the role of the Central Committee.

A smaller government would never have been able to do this level of manipulation, definitely not before 1913.

I compare government intervention with a pilot flying a plane.

One you are in the air, someone has to guide the plane to a level flight. If you rely on capitalist random winds, the plane will likely crash. Or at a minimum soar to unstable heights never before see only to plummet 10,000 feet when an errant black swan flies into the windshield.

Someone who actually knows how to fly with an unbiased point of view should be the pilot. That may be the problem today.

Seen it all before,

If you want to use that example, based on historical data, I would compare the “pilot” with an Al Queda terrorist who will smash the whole plane into Pentagon. If you don’t like that comparison, then I would compare it with a pilot who gets a billion in the bank for every 10,000 ft drop or raise in elevation. I would never vest so much power in either of them. Power corrupts and absolute power corrupts absolutely.

It is true you can get random winds in a capitalist system, but overall the system is stable and self regulating. We don’t have a capitalist system in reality, only on paper. A capitalist system implies free markets, which we don’t have. With the FED inserted heavily into the system, what we witness is a crony system for the oligarchs who are connected to the FED. It is a rigged system to the max. The 2008 exposed this system in all its glory. The owners of the FED were deemed to big to fail, although they became so big not by wits but because they own the FED and implicitly have the politicians in their pockets. I see that as a feature of socialism/communism/fascism (big government and massive amount of power concentrated in few hands) not capitalist system.

None of us like what we see; we are on the same page on that. However, we look at the same thing from different angles.

Interest rates may oscillate to find some parity with growth and sustainability? Who knows. However, the FED probably likes large bell shape curbs to create crashes and signal to the tribes the gig is up.

Mortgage rates have fallen. 30 year Treasury bonds under three percent.

Most expensive residential sale in U.S. history — $238 million for a New York City penthouse: https://www.nytimes.com/2019/01/24/nyregion/238-million-penthouse-sale.html?module=inline

Blert said that record-breaking, big spending by the super-rich indicates an impending financial collapse. He said the late 1920s saw similar unprecedented spending by the super-rich.

What ever became of Blert?

I miss Blert. Not the best writer but he was very perceptive. He always had good insight!…

And he was Always wrong, despite his flowery language.

According to him we should have crashed and burned 8 years ago.

Same with Mr. Slumlord. Life ain’t going quite the way he so arrogantly predicted.

Jed, you are wrong on these two bloggers. Bret was always doom and gloom like you say. However, Mr. Landlord was always bullish, exactly 180 degrees from Bret. Mr. Landlord is the eternal optimist and he always saw everything bliss. However, there was something you could learn from both of them. The reality was always somewhere in the middle between the two extremes, at least for the average guy like me. Personally, I enjoyed both of them even if I disagreed with them sometimes. After all everyone is entitled to his own opinion.

I am patiently waiting for Sacramento housing inventory to go up and prices to drop 30-50%. Now sure if that will ever happen or when. Would love to see the same for all of California real estate.

Same here, patience is key and will be rewarded (market crashes occur every decade).

I am ready to buy (sitting on cash) and now that inventory is skyrocketing YoY you have the opportunity to check out open houses each week to identify the right neighborhood, floorplan etc. it’s also a great way to “shop for the right realtorâ€. I had contact with many, many realtor and test them (knowledge, strategy etc) I have only found about 3 out of 50 that qualify to be my guy/gal.

In terms of discounts, i am buying when we see a 50-70% crash. Price cuts are the only way for seller to unload:

https://wolfstreet.com/2019/02/11/liquidity-in-new-york-citys-housing-market-dries-up/

Millennial, 3 out of 50 good realtors is a very good percentage (6%) for SoCal (very liberal). In midwest (a more conservative area), you might be able to find a larger percentage (like 20%) because there are more honest people.

Unlike you, I never bashed ALL realtors. They have a very large percentage of dishonest and uneducated, or not so smart ones in their group. They bring down the reputation for all of them. However, once in a while, you find a diamond – nice character, honesty, hard work, knowledge, experience, reliable in communication and brains. If you find all of them in one person, they are a goldmine. If you will be a good communicator to tell them what you want, they can help you all your life to become rich. Oh! I like also the one who are brokers and owners because they have a lot of flexibility in what they can do. Also, if they are too poor or full of debt, they tend to do dishonest things to stay in business and they are not going to look for you. Now, you can see why it is so hard to find very good agents; not impossible though. Most of the good ones I found, I can count them on the fingers of my hand. They were rich but they had a passion for what they did.

My advise: don’t dismiss ALL because 90% are they way you describe them. You need a good one, trust me. Over decades, they helped me a lot.

Thank you Flyover!

“My advise: don’t dismiss ALL because 90% are they way you describe them. You need a good one, trust me. Over decades, they helped me a lot.â€

Appreciate the advice. I agree.

It’s true, I was bashing all of them for a looong time as it was freakin hard work to identify a good one out of that huge pool of bad ones.

Patriot, it is now certain that home prices in California are dropping and will continue to drop for many years. The only mystery is whether the drop will be 20, 30 or 40%. The bottom is at least 2 1/2 years away. Already, I see price declines of 4-5% in Orange Co. by the smart investors who sell before the greedy competitors realize that they will never sell at their high asking prices. The smart money is selling right now slightly before the asking prices of their competitors.

Re: Patriot , Re: the 30% price drop. Sacramento has been mentioned as one of the most favored retirement places due to the low home prices. I you drive just 20 miles away from the State Capitol Bldg. , the ex-farmlands are now awash in new housing construction.

At this moment , just 15 miles from 12th & J , 1600 sq ft homes, single story ( for us oldsters with bad knees ) can be had from 350-425 thousand. Heck , I own five of them and they provide me a nice bump in my retirement. The main problem is people of today are living paycheck to paycheck because they love to keep and sometimes get ahead of the Jones. They just can’t save any money for a down payment, and they rely upon the Gov’t programs for down payment assistance , but they don’t have any problem’s paying the $ 1600 per month rent. But then again , they have a ski boat and two new cars , and I don’t , I guess it is just priorities.

Inventory going up from record lows is hardly an indicator of an upcoming collapse. Introducing more volume to an already hungry market just means that multiple homes compete for the same buyer and over-bidding comes to an end. Big deal.

Interest rates are low, unemployment is low, dual income household spiking, millennial and Gen Z potential buyers are ever-increasing, corporate profits are at all time highs, dollar is strong and loan delinquencies are low. IF the market goes into a recession, it will take quite a bit of major events occurring at the same time to throw it off it’s rails. And even then, housing prices won’t come close to the 2009-2012 depressed housing market. Inflation is much higher than what’s reported. If housing prices were adjusted for REAL inflation you’d see that prices are actually within a normal range. I can’t believe how quickly people forgot just how ridiculous the 2006 housing boom was with prices due to lax regulations. That’s a real bubble. A real estate market backed by real wealth is not my definition of a bubble. Go out and buy some property and take advantage of the many options it now presents compared to the years prior.

You must be a realtor because telling someone to buy in this market is the worst advice I’ve heard. Careless and downright ridiculous. Two people I know have sold their homes this month and both took the offers 20k under asking price(best offers). The ship is sinking.

Cute. I love hearing predictions of the future by looking in the rear view mirror.

Those who cannot remember the past are condemned to repeat it. To covet truth is a very distinguished passion. –George Santayana

I am not realtor, I actually have a great disdain for them. I am, however, a realist. I used to be just like you guys preaching about the “bubble market” since 2013 but then I realized I was just introducing my own emotion-based wishful thinking into my investment strategy so I started thinking about actual factors that drive the market up and down.

Basically you’re saying you bought a house and are now trying to justify your purchase. We get it.

Nope. I did, however, buy a 5 unit complex for $270K with severely low rental income and over a two year period built the rental income to $4500/month and just closed escrow on it for almost double what I paid. You can either sit on the sidelines and pray 2008 happens all over again or learn to play the game and win at it.

Congrats! You brought at peak bubble price! What timing? You’ve got to roll with it right!

If I bought it $275K and sold it for $495K then was it really peak bubble? I’m guessing you think that the profit isn’t “real” money either? And yes I reinvested it back into real estate to avoid capital gains on a nice house with a pool and a beautiful view listed at $480K offer accepted at…drumroll…$375K. Bought some land using the rest of money. Going to sit on that one for a looong time. This is the discount market everyone on this blog is looking for. It’s not the best market but little windows of opportunities like this small hiccup in can bring in some serious asset acquisition. You can hold me to it!! Our forecasts are all documented on here right?!? How many of you bubblers made a dime in RE over the last 5 years? Anyone??

Bubbler Mentality

A house for $400K today: HELL NAW TOO EXPENSIVE!!

A house for $650K in 2039 after reaching a $1.3M peak: OMG 50% OFF!!

The data shows Gen Z and Millennials are saddled with debt and little to no savings with no hope of propping up houses on the back end when current owners downsize. At some point, something has to change — renters for life, property collapse, or a spike in wages. I’d pick a property collapse over the others.

This statement from the Good Dr is interesting.

“Looking at things as they stand today, why would you expect any sort of correction? The only thing we are seeing is that inventory is rising sharply but prices are still holding steady. However, having inventory rising by 106 percent year-over-year is definitely going to add more supply to the market which means buyers will have more options. ”

More supply typically would mean a drop in sales prices. I think there has been some drop sales prices in some areas. I haven’t seen hard numbers for S. CA.

I don’t think a drop in asking vs selling means much (ie the greedy person who lists a house for $3M and only sells for $1M (66% drop Millennial!) doesn’t mean much when they bought the house a year before for 700K.

Now that the stock market is roaring back to within 10% of new highs again, the people who held on to their stocks now have more money for a down payment. Will house demand soar again to meet the new supply in Spring? Or, will the stock market drop 18% again leaving buyers without a paddle?

There shouldn’t be another rate hike before Spring and mortgage rates have been falling. We can’t blame that.

If I was over weighted in stocks and saw my net worth plummet 18% in 2018 but is now back up again, I might consider diversifying into a rental house purchase if the rental parity made sense.

This is like a slow motion roller coaster ride.

Having some experience with controls engineering, did you know a jetliner with a skilled pilot+computers can fly for awhile without one wing? As long as the air is smooth and their is some uplift all is good. Given a sudden downdraft, or a black swan taking out the pilot or remaining wing, a crash is likely.

I think the stock market and housing market is in this position. As long as the economy remains good, and there aren’t any unforeseen black swans, or any intentional disturbances (ie war). The plane can keep flying.

Where is the black swan? Who is the most likely to create a disturbance? These are the real questions.

I don’t foresee an imminent crash yet. However, probability says we will have one at some point. I predict it will be a big one. Hold on to your parachute (enough cash) and hope it gets you to the ground (bottom).

“If I was over weighted in stocks and saw my net worth plummet 18% in 2018 but is now back up again, I might consider diversifying into a rental house purchase if the rental parity made sense.”

THats the problem! It doesnt make sense!!! House on sale for 1.3 millions in Silicon Valley and the next house they are trying to rent for 3.1K per month. No way this math works…maybe if Chinese Money Launders speculating in the market but they are long gone…

I agree that at first glance, it is hard to achieve rental parity in the first year.

Even the curmudgeonly Mr Landlord admitted that it may take 7-10 years to achieve rental parity.

However,, with tax rules, it is a great long term investment. It is a business so you can write off repairs and improvements, all taxes and payments, and depreciate the house over 27 years. You will likely be putting money into the rental the first few years and taking a passive loss, but history shows, eventually, you will be making a profit. When it is paid off, it is a good retirement revenue income source.

curmudgeonly????

Dude I’m, barely 40 years old!! 🙂

Oops, I didn’t know you were back. That’ll teach me.

Looking forward to your wise advice.

The cheerleaders have all of the same excuses that they had prior to the last crash. “This time is different.” I guess some people just never learn.

What is your definition of a ‘cheerleader’. Most of the so-called cheerleaders were saying that 2011, 2012, 2013, 2014, 2015, 2016, were good times to buy a home. I was one of them. and they were good times to buy. Does that make someone a cheerleader? I would not say that now because I know the market moves in cycles and next few years wont be good times to buy.

Cheerleaders are those who make the argument that “real estate always goes up” and “you can’t predict the market so anytime is a good time to buy and hold real estate.” Also those in here who despite the mountain of evidence that the market has peaked and is headed south, continue to argue that it will go up from here.

The ONLY reason it was “a good time to buy” from 2011 to 2016 is because the Fed was pumping the bubble up artificially. People who bought then (myself included) got lucky. I cashed out after two years and am waiting on the sidelines for the crash. Yes, I sold too soon, but I did not want to continue gambling that the Fed would keep things propped up like this. It’s ending soon, and it WILL crash, as it always does.

The Fed sure was pumping a decade ago, but that doesn’t take away from the fact that buying in 2010-2012 was an absolute gift. 2010 was almost a decade ago, these buyers have so much equity it will make your head spin. Even the people who bought back in 2015/2016 are sitting pretty now. Buy what you can afford and plan on owning for the longterm. Timing markets rarely if ever works.

Prices are going back to at least 2010 levels, most likely 2000 levels. So that “equity” only exists if they sell.

“Prices are heading back to 2000s levels.” Highly doubtful. And even if they did, most normal people would have zero chance at buying. The ultra wealthy would buy everything and the working stiffs would just be lifelong renters. Be careful what you wish for.

The crash is imminent…

http://fortune.com/2019/02/12/americans-late-on-car-payments/

lol, it’s different this time, Yah, when people are kicked outta their homes, they wont have cars to sleep in. Inventory is climbing rapidly, incomes can’t keep up, we should see a nice 10-15% drop in prices, no crash, but a slide backwards.

The car dealers were giving loans to everybody and their mother when rates were low. Now they are going to pay the price for extending credit to people who can’t even afford to pay attention.

Crash? not so fast. I spoke to a friend here in LA who is a broker and he said that despite the glum predictions, YOY home prices in LA did rise. He said the problem was that last Fall, sellers were coming up with ridiculous high prices for their homes due to the ‘blind sellers market’. These sellers have realized that they need to lower their prices to realistic figures and many of these massive price reductions were over-priced to begin with NOT softening of the market. He said a properly priced home is still getting 5+ offers, many over asking and many all-cash.

Notice YOY for LA was +4%

https://www.trulia.com/real_estate/Los_Angeles-California/market-trends/

QE – Your broker friend is only telling you the half truth. I’m not denying it, certain markets saw a slight rise in prices. But you have to look at the obvious rise inventories along with what the majority of the houses actually sold for.

My area OC (Huntington Beach and Newport) saw a serious inventory uptick with majority of the houses being sold below asking.

You could argue that’s because the houses are million++ that’s why they are sitting. But inland OC same situations.

Big increase in Newport Inventory? FALSE.

Sorry, there’s no huge inventory increase in HB. I see the same homes sitting with small discounts because they were priced too high to begin with…

Let’s be real and quit the crap. The stock market is roaring again, unemployment is at or near all time lows, majority of people are going to pay less taxes this year, inflation is a non-issue, mortgage and long term rates have gone down recently, the fed has turned dovish on future interest rate hikes….I can go on and on. The crash is not here and is still a ways off. Yes inventory has increased, but mostly in the higher end homes 1 million+. The inventory of starter homes is still non-existent. There are still plenty of buyers out there, but some can’t afford to buy where they want and/or are sitting on the fence waiting for a reduction. Meanwhile rents are still high.

One thing that may start tipping the scales is the SALT deduction cap. I don’t think many CA property owners realize how this is going to effect their tax returns this year. Once the dust settles after April we may say inventory increase as some people unload their properties due to the tax burden, but again this will only have a real affect on people paying property taxes on homes assessed over a million+ or those owning 2nd homes and/or vacation homes.

but again this will only have a real affect on people paying property taxes on homes assessed over a million+ or those owning 2nd homes and/or vacation homes WHO BOUGHT RECENTLY.

Don’t forget to add that bit.

The SALT caps will NOT affect homeowners who bought long ago, and thus pay little property tax due to Prop 13. Indeed, these homeowners will be less likely to sell, which will further limit inventory.

Well said WheelinDealin. Despite all the doom and gloom we hear, the economy is firing on all cylinders. Low unemployment, high stock market, low interest rates, low inventory (relative to historic norms), record high rent. We’ll see what the new tax law changes do to high income areas. Just like all previous times, it takes YEARS to find a bottom in the RE market. I know guys like Millie have no problem staying put in their cheap apartments for another 5 years, I would bet money most potential buyers don’t have that luxury.

For those wishing for a massive housing crash, your also wishing for a failing economy. You can’t have one without the other. We won’t have anything remotely resembling the last crash without a landslide of foreclosures. Currently we have the lowest foreclosure rate in almost 20 years.

https://www.forbes.com/sites/alyyale/2019/01/09/foreclosures-underwater-mortgages-fall-to-lowest-rate-in-years/#dd9b46e11e98

Of course I am wishing for a falling economy!!!!! Why wouldn’t I? A crash in stocks and RE would be the best thing that could happen to us! Buy low sell high?! Never heard of it?

The stock market is roaring again. People with short memories have already forgotten the 18% loss in their net worth in 2018. Or, they remember and think about diversifying into real estate.

IMHO, a primary home is taken care with Federal taxes thanks to the reduction in in the tax brackets. A second home can easily become an AirBnB where the remaining stockholders can throw their immense gains for a nice vacation. Now with a rental, there are no restrictions on deducting taxes paid. The sky is the limit since the place is a rental. Do you think Trump would have neglected himself with the new tax law? Business is good. A rental is a business and should be able to deduct everything.

It is still the Roaring 20’s. Until it is not.

Exactly Bob. There is zero change to deductions for rental properties. Insurance, taxes, mortgage interest, etc. It’s all tax deductible. In fact the new tax laws have made owning rental property even more desirable while reducing the tax benefits of a primary residence. Isn’t Trump one of the biggest landlords in NY City? Go figure.

The lead story in the OC Register Real Estate section this week is that profits from selling houses is up for 2018 in California. The 5 top markets for sale profits are all in California, with 4 markets in the greater Bay area in #1-4, and LA/OC at #5. The average profit for our market was $227000. Nationally this was the biggest year for profits since 2006. Mr Lansner’s article quotes the source of his data (Attom Data Solutions) as saying that they are not expecting as big a gain in profits for houses sold this year with uncertainty and potential trouble in the future.

Note, they aren’t talking crash, just a topping of profit increases. So waiting to sell if you are planning to sell anyway is not a good idea., but not a panic sale time if you want to stay put.

The spring housing market is looking decent. Not great, but decent. However, low end well located homes are doing great. Expensive inland homes are struggling. Everything else is somewhere in between.

If the stock market stays up, the housing market will get hot again … but, that is if the stock market stays up. If the stock market shakes again, housing will slow. We will see.

Rates are down

Inventory is up

Sellers no longer in full control as before

Ask vs offer prices really depends on many factors: realistic seller, location, turnkey or dated, etc….

1 property may still get 3-5 offers as soon as it hits the market while another property may just sit for 3-5 months with no offers

Lending:

Conventional underwriting is tightening up.

Had 1 yesterday:

20% down

600k loan

Primary residence

Plenty in reserves

640 credit score

The desktop underwriter (computer algorithm I’ve alluded to before) kept declining. It just didn’t like the credit profile. Buyer still moving forward but had to go FHA.

Many FHA lenders have tightened up as well. More overlays which are lender instituted layered risk safeguards.

On the other side of the spectrum there has been a loosening up of Non-QM guidelines. So far nothing crazy, but, I’m keeping my eye on that sector.

All in all, no crash, but certainly some softening that’s for sure.

That 640 score won’t cut it. Both my Wife’s score and my score are over 800. Mine is 40 points higher than hers, maybe because we get the scores from two different credit card companies. If I were in charge of underwriting the nation’s loans, I wouldn’t make a home loan in CA to anyone under 700. Too risky. Of course I’m not in charge and I’m not currently looking for loans to take out or make.

Over-priced or a tank?

Consider this Santa Monica townhouse: https://www.zillow.com/homedetails/954-14th-St-UNIT-5-Santa-Monica-CA-90403/55325162_zpid/

Jan 2013 ….. sold for $1,200,000.

May 2018 ….. listed for $1,995,000.

Feb 2019 ….. sold for $1,595,000.

Seller was hoping to gain nearly $800k. Instead he settled for a $400k gain. So, is this a HARD TANK, or merely a delusional seller who was hit with reality?

It’s impossible to know what happened in any one transaction. The owners could have had a personal crisis and needed to sell ASAP. Divorce, death in the family, etc. Or the owner got a job out of state and his new employer covered r/e costs which allowed him to sell for less. I had a job offer once where my employer would have paid for all my closing costs including r/e fees. 7% closing costs on a $1.5m sale is $100K. I can see selling low to sell fast knowing there is $100K pocketed. Or he’s a regular reader here who figured, take $400K and get out while the getting is good.

No matter what, the dude (dudette?) made $400K tax free by doing nothing other than living in luxury home close to the beach. Meanwhile, Millie and every other perma bear, lived in an apartment that entire time and made $0.

So tell me again how real estate is for suckers……

$400k tax free? I don’t think so.

California taxes capital gains the same as regular income. $400k puts the seller in the highest state tax bracket, which I think is 11%.

And if the seller is single, he only gets a $250k deduction on his federal capital gains tax.

California does tax capital gains the same as regular income but they do not tax the proceeds from a sale of your primary residence. So there is no California tax due on sale.

Son of Landlord,

The $400K is absolutely tax free. You must have never made that kind of money before.

Come on man, you’re nitpicking. It’s $400K tax free at the federal level. I keep forgetting some of you pay state income tax 🙂

And so what, now the argument against r/e investing is that you’ll make more money than the tax free threshold? LOL. That’s a nice problem to have.

We don’t know the circumstances for the sale.

If it was a married couple selling, they win 400K tax-free due to the 500K tax exemption for selling a house.

If the owner died, in May 2018, the heirs may be able to win 400K+ tax free (Inheritance tax starts at 12M) AND write off the 400K “loss” they had to suffer when they sold the house in Feb 2019. Inheritance tax laws are crazy. The house’s stepped up value is determined when the owner dies. The heirs get to use this as the new basis for the house. ie if the owner purchased the house for 1.2M, but when they died, it was appraised at 2M, if the heirs sell at 1.6M, then they have a 400K tax loss. They will not likely pay Federal taxes for many years with this carry-over 400K loss. I suspect Trump uses this so it must be good (for him). That is the game. Can’t complain. Trump uses it and people voted for him.

Mr Landlord has a point. A renter has lost all of their rent but the homeowners or heirs have walked away with at least 400K tax free after 5 years.

Well according to the Bureau of Labor Statistics they lost $111,683.17 to inflation.

So 395,000-111,683.17=283,316.83 Then you have the massive transaction costs (1595000*0.08=127600) so 283,000-127600=155400. When you throw in the opportunity costs of equity investments or highly cash flow positive real estate this albatross of a house in Santa Monica will end up as negative yielding.

All the statistics point to Feb. 2019 in the real estate market being the equivalent of July/August 2006. Just one example is what Joe R. said:

“The average profit for our market was $227000. Nationally this was the biggest year for profits since 2006.”

If the pattern holds, large price drops are close at hand, but not yet happening.

The rapid real estate market crash will not become obvious until the Fed. first drops interest rates, but that is probably a year away. Until then, the crash will be hidden in the delayed statistics and the fact that there are so few low priced homes to sell. If only $1,000,000 homes are for sale, prices will appear to be going up even if those homes are actually dropping in price.

Inventory seems to be piling up. I run the exact same query on Realtor.com periodically to how many listings there are: 3 bedroom SFR within 5 miles of Placentia. Around Thanksgiving, there were about 700 homes listed. As of right now, 831.

Any advice on housing situation in Redding, CA would be appreciated. As crazy as it may seem, with all the terrible fires, I may consider a job in the area. Looking to drop $250K on down payment on a house in the low $400k range. What areas should I avoid concerning the recent fires? What are areas in good high schools at that price range?

In the growing markets such as San Antonio and Phoenix, there is a glut in higher end homes. However starter homes are at about a 45 day supply. It is going to take builders another 3-5 years to meet that demand. Inventory may be up, but not the type that people want, so they are staying in apartments or not moving out of mom and dads house until starter homes become more affordable. It’s going to be a while.

The crash always starts at the top. The $2 million homes don’t sell and end up listing and selling for $1.5 million. Well the homes that were $1.5 million aren’t as nice so they have to lower their prices to $1 million. And on down the crash.

Anyone who thinks that the starter home market isn’t connected to the luxury home market hasn’t been paying attention.

The trend you describe provides an arbitrage opportunity for the move-up sellers to take advantage of the house they buy being discounted, before having to discount the house they are selling. I think this is further magnified as home as there are more buyer competition at the lower end of the market. I think prices are stickier at the lower end of the market.

Josh is correct, JD not so much. Think of the market as quintiles – if the top is doing price cuts, the next quintile is likely not moving at all. Perhaps the next lower/middle quintile is still moving but most likely you’d have to go to the bottom quintiles to see things still hot. No one in those lower quintiles will have enough profit to move up to the upper quintile and get those price cuts, unless they bought a bunch of low end houses to flip and in that case they probably already have a home in the upper quintile or are saavy enough to avoid it – you’re talking about the first year in a multi year decline of 5-10% declines, every year for 4-5 years. Buying a house, even with a price cut, in the first year of a multiyear decline is a disaster – it just makes no sense.

The Fed is trapped by its own earlier policies — the low interest rates spiked stocks and RE and now the Fed has to slavishly do anything to prevent asset deflation. Since all asset classes are artificially inflated, I think they are just trapped. I suspect the Fed will keep the money pumping until the entire system collapses as a result of lack of consumer demand/ability. It’s a horrible bind: the more money the Fed pumps into the system, the worse inequality gets, and the fewer consumers there are. I guess when the debt slaves collapse, we might see a universal minimum income, if only to protect asset prices?

Down $200k in 10 months, and it’s just begining House Bubble 2.0

Address: 24386 Vista Point Ln, Dana Point CA 92629

For Sale: $849,000

3 bds • 3 ba • 1,689 sqft

View this home on Zillow:

https://www.zillow.com/homedetails/24386-Vista-Point-Ln-Dana-Point-CA-92629/25656229_zpid/

After careful valuation I would place the price point at 420k.

Price cuts on a wishing price???? That’s what you are calling a decline?

That house will sell for more than twice it last sold for in 2002.

Just because someone over priced it by $200K doesn’t mean anything.

After $200K in price cuts it’s finally at the market rate. The owner is going to walk away with about $600K in cold hard cash.

“The owner is going to walk away with about $600K in cold hard cash.”

This is what the perma bears/renters will never understand. Or refuse to understand. Buy real estate, hold it long term and you will walk away with a ton of money. Short term anything can happen. You can lose money. But hold a property for 10+ years it is virtually imposible to not make money.

Even if there is 0 appreciation, simply paying off the mortgage month after month, year after year will build significant wealth, that renting makes impossible to do for a middle class person. Add in a few % points yearly appreciation and it’s hundreds of thousands of dollars for basically doing nothing.

Mr. Landlord: Buy real estate, hold it long term and you will walk away with a ton of money. Short term anything can happen. You can lose money. But hold a property for 10+ years it is virtually imposible to not make money.

By “make money” do you mean stay ahead of inflation?

This Woodland Hills house failed to keep up with inflation: https://www.redfin.com/CA/Woodland-Hills/4742-Westchester-Dr-91364/home/4230839

2005: Sold for $1,710,000

2018: Offered for $2,199,000

2019: Reduced to $2,149,000

According to the Inflation Calculator, $1,710,000 in 2005 dollars is about $2,230,000 in 2019 dollars. And some say the feds are underestimating inflation.

Either way, this house LOST value during the 14 years since its last purchase. Not to mention the holding costs (which include HOA fees, currently at $540 a month).

This is a response to Mr L. I know of a man who bought a lot of RE at tax sales and other auctions. His house in a beautiful wealthy area ~ten miles from Downtown LA he bought at auction for $40000 cash in the late 50s. He bought beach property in Ventura Co. and a boatload of crummy rentals in the deserts of North LA Co. The rentals were a cash cow, but the appreciation over time wasn’t all that much adjusted for inflation. The homestead property made his heirs a lot of money, even after a reverse mortgage. Location, location location!

My Wife’s relatives bought a farmhouse in the Dakotas for $500 back in the late ’80s as a place to hold a big family reunion. It probably isn’t worth anything more today as it isn’t near the oil patch. A lot of farms there were consolidated so there were a lot of surplus farm houses out there. A lot of rural property hasn’t appreciated at all, and probably has gone down in value in inflation adjusted dollars. Property in Detroit crashed and in a lot of areas is basically either in ruins, or is occupied by urban homesteaders who are holding out by banding together and running out the criminals (like the Wild West).

Mr landlord is back (aka slumlord from Spokane-istan)! We missed you!

When your amazon stocks hit 2k you were bragging like there is no tomorrow. Then it crashed and on the way down we only saw one more post from a “mrâ€. Were you too embarrassed with putting your full†mr landlord†on it? We believe you lost your shirt and would only come back here if amazon recovers. So what’s your story? Are you going to tell us you sold at 2k went on a big vacation and bought back in at 1.3k?

By the way I like to profit 600k on housing as well. First I got to buy in at 2002 price levels. 2012 would be acceptable as well. Remember, buy low and sell high. Not buy high and wait 90 years to make your money back.

Mille, my good friend. Why the hate?

I sold AMZN long ago. I also don’t believe I was bragging about owning it. I was saying $2K AMZN is a reason why Seattle housing is where it is. See also FAANG stocks and SF Bay real estate.

And you realize AMZN is up 7% YOY yes? So I’m really not sure what your point is. You keep talking about crash this and crash that, yet price keep going up up up.

How’s that 75% off sale going so far by the way?

Son,

You’re looking at things in a vacuum and as perma bears always do, forget about leverage. Let’s say the buyer put 20% down – $340K – in 2005. And say he got a 5.5% mortgage for the rest, which was the going rate back then. In 2019 the balance on that mortgage is about $950K.

And let’s say he sells for $2.1M which will be $2M after selling fees/taxes. Pay off the mortgage and he walks away with over $1M cash. Tax free.

What would have been the alternatives? In 2005 Dow jones was at 10,500 on average. So he could have invested that $340K in stocks and that $340K would be worth about $850-900K today, assuming dividends were reinvested.

Net return is $660K on $340K invested, tax free. And remember, this was done with zero effort. All the homeowner did was live in a house for 14 and earned $660,000. Maybe for you that’s a poor ROI. For me, I’ll take it all day every day and twice on Sundays.

And yes I ignored property tax and maintenance but I also ignored the fact that stock capital gains are taxed while r/e is tax free up to $500K profit and mortgage interest is tax deductible. So that balances things out.

And realistically the owner would have refinanced into a much cheaper mortgage of 3-4% in 2009-2010 which would have added $100K or so extra in profit.

You can spin all you want, but reality is long term r/e is about as solid an investment you can find.

Don’t kid yourself with “down 200K over the last 10 months.” The house was listed 10 months ago at a WTF price, there was no way it was going to sell there. Several price cuts later to get it back to reality where it has a chance of selling (zillow’s estimate is 868K). They should have listed it for 10M and your headline would have been down 9M in the past 10 months.

Nothing to see here folks. Move on.

The Snowflake Bear doesnt agree, lmao, it is what it is and thats that kids, get over it. Market is sliding, this house is a perfect example (sorry it offends you, this isnt a safe space), and the slide is just begining :)))))

I looked at your link and also noticed the house sold for $400K in 2002.

A sale of $800K+ is a good ROI.

When I opened the Zillow map, there are nearly 1000 houses in that area for sale. Most asking nearly or over a million. Most of them were purchased in the early 2000’s for 200K-400K. The red dots are so dense that it looks like 1-2 houses for sale on every street in Dana Point. There are also many blue foreclosure dots.

I think people are playing “Who Wants To Be A Millionaire?” and are trying to cash out and get out of Dodge. They likely are not forced to sell but hey, if they can be a millionaire, why not try?

Did Dana Point raise taxes on homeowners to fund that new Harbor Improvement Project? If I am a long-term homeowner and my payments are $1K per month and now Dana Point wants to make them $2K/month to fund the harbor? If I was on SS, I’d take the Million and run.

Nobody is going to take 450K for their house they bought in 2002 for 400K. Their payments are likely low and they will rent it out. The few who took advantage of refi’s to buy yachts, might do a short sale and the banks will sit on them until they foreclose. Then the banks will sit on them until the prices come roaring back in 5 years when the new Harbor is done.

Regarding the Dana Point listing, it’s all about the school. Although the high school ranks high, the elementary school is dragging down the property value.

Because i’m in a good mood, i will provide data, enjoy.

January numbers are out on Redfin if you want to check your local market, CA ain’t pretty. We’re now seeing YoY change in Months of Supply in some places higher than the data goes back. LA Metro is matching 2012 with 4.4 months of supply.

https://www.redfin.com/blog/data-center

Has Millie bought his dream home at 75% off yet? LOL

Probably not since Jan 19 prices nationally were up 3% vs Jan 18.

Welcome Back, Mr Landlord.

Your input has been missed.

Our Millennial has been waiting for the “End-of-the-world-as-we know-it” crash later this year.

It may happen due to outrageously inflated asset values..

However, when it happens, Our Jobless Millennial will buy a home only if he is brave and has lots of cash.

Seen it all before in 2009.

Hi bob, I would disagree a bit with your statement. Long term I am a real estate bull. I am not a perma bear by any means. I do believe in market cycles and in bubbles. It’s easy to see that this is the biggest (global) asset bubble ever created. The world isn’t ending when bubbles deflate. It’s normal. It’s healthy. A 50% discount in house values is normal when the housing market crashes. It happens during each crash. If someone could tell me why buying a highly overpriced home makes any sense, I would listen to it. So far I have only heard cheap sales pitches by the RE cheerleaders and no valid reasons why buying sky high makes sense.

So tell me mr landlord and bob: why should I buy now at highly inflated values and not wait for a discount? Name one reason?

Don’t worry. Millie’s wife loves dodging bullets and burglars and won’t mind waiting it out in the ghetto for another five or ten years.

Millennial,

I am a bear and a bull at the same time like you. But not an extremist.

I think housing is overinflated and would not buy now.

However, if prices drop 20-25%, I will be tempted to buy.

60-75% drop is 3 sigma and only seen twice in the last 100 years. Most of the drops in the last 70 years were about 10% or less. A 20-25% drop would catch my interest.

I also expect the stock market to correct again this year about 20% (just like last year). My lumpy mattress stuffed with 50’s is getting uncomfortable. I’d likely jump on that drop before housing.

In other words, you are correct, buy low and sell high. However, don’t be unrealistically greedy or you may have to wait another 90 years for your dream to come true.

Buying a house for the long term is a great investment. Buying a house at 20% off is even better. Buying a house at 70% off is as likely as winning the lottery. The big payout happened in 2009/10 when I already had a house and had young kids and less cash to buy another. I don’t expect that kind of payout to happen again for another 90 years. Who knows, through the miracle of modern medicine, we may both be there to capture it.

I’d also like to add:

1) My daughter bought a house in 2015. I looked at the Zillow sales history for the last 20 years before that. The house was selling for 15% more than the new selling price in 2002 BUT sold for 15% less than the selling price in 2006. IMHO, it was a fair price. I also looked at house selling prices on Zillow in the same neighborhood for similar houses.

2) The Bears seem to be jumping for joy when asking price reductions are happening now. When a house lists for 1M is reduced to 900K, that may indicate a change is happening, However, when Zillow shows it sold for 700K in 2017, I stuff my money back into my mattress and wait for something real to happen. I would not buy.

Also, look at the last peak in 2006.

I don’t trust Zestimates but I mostly trust prior sales. Some playing with selling prices can happen also, but looking at other similar houses in the neighborhood can uncover these.

A good deal is when the house is offered at 20% below the 2016/17 selling price of the house and the neighborhood data correlates with this. It is all one-stop shopping on Zillow.

I haven’t seen any of these yet and with the stock market roaring back, I don’t know if I will.

You also have to be careful. A seller will not likely sell at a lowball (or fair) offer below their current mortgage. They will likely be insulted and your real estate agent will fire you.

“You also have to be careful. A seller will not likely sell at a lowball (or fair) offer below their current mortgage. They will likely be insulted and your real estate agent will fire you.”

Then you need to find a better r/e agent who isn’t a complete imbecile. Over the past 10 years I can’t count the number of offers I’ve made that have been rejected and the buyers “insulted”. However over the same 10 years my r/e agent has made more than $100K in commissions from all the houses I’ve bought and sold with him. Plus I’ve referred several people to him as well who have bought and sold houses.

Any r/e agent who fires a client for being a prudent investor won’t last long in the business.

As for their current mortgage? Again who cares. This is one the fallacies of sellers. Not just houses but cars as well. Oh I can’t sell below $X because I owe $X on the asset. And my reply is I don’t care if you took out a stupid loan, your asset is worth $Y. Here is my offer. If you want to sell, that’s what you’ll take. If you don’t want to sell, that’s fine as well. But I won’t overpay for an asset because you made a stupid decision on your loan. And eventually the repo man or foreclosure agent will make that decision for you.

Mr Landlord,

If you offer lower than what they owe, it may be fair, but you turn the sale into an emotion for the seller.

You don’t want to do that.

If I was your realtor, and you continued to insist on lowball offers and continue to be rejected, I’d fire you. And blackball you with all of my RE friends.

Nobody serious want to waste their time with an idiot.

Bob,

That doesn’t work the way you explain it. I bough and sold hundreds of properties. First, to make sure we are talking about the same thing we have to define the words. “Low Ball offer” it means different things to different people and it is highly subjective to the property, time and market. It depends if the offer is made to a physical person or a judicial person (Bank, REO). If the property is priced 10% above the market and I offer 20% below listed price, is that a low ball offer? After all it is only 10% below market.

Second, if the market is dead and I offer cash, no contingencies, to a bank (foreclosed property) 50% below listed price, is that a low ball offer? I actually did that and the bank, after 4 months of negotiations, took the offer. With banks there are no emotions and they make whatever decision is in their best interest at a time. They were happy to get the liquidity and I was happy to get the place – win win! Actually the RE agent encouraged me to do that. I was younger and more shy at that time feeling embarrassed to do that. The agent actually did the papers back and forth countless time. She was one of the best agents I found (all qualities in one person). She was multimillionaire for a reason! She got lots of business from me after that and if I do again business in that market I would use her in a heart beat.

GET OUT NOW WHILE YOU STILL CAN. CA IS DOOMED!

I saw some crazy bearded guy on the street corner shouting the same thing. It must be true.

BTW, your CAPS LOCK seems to be stuck.

I am seeing quite a few properties go pending, some at high prices. In my opinion, the economy is doing well and people are buying homes. Nothing to see here … as long as the stock market and economy do well, prices should continue to grind higher slowly.

@jt,

Oh really? That’s interesting. In which state are you located? Here in California, houses sit and sit and sit. You see price reduction after price reduction. Then you see they try an auction or to rent it out. After 6-10 month they give up and move back in.

I am getting bombarded daily with price reduction for my searches I set up on Redfin and Zillow. No wonder each realtor to send you listing and to ignore Zillow and Redfin. They think they can somehow prevent the true state of the market. What most realtors don’t realize is that everybody has access to the same market data within a few clicks (sellers, agents, brokers and buyers).

Another thing I noticed (again I can only speak for California) is that foot traffic has dramatically slowed down at open houses. It’s in line to what the experts and the data says: buyers demand is in the toilet, inventory is skyrocketing, sales are plunging.

Education isnt free, but a beating in the real estate market is, DROP THE MIC

Davis, CA Housing Prices Crater 16% YOY As Sacramento Brokers Joke “All These Sellers Are Losing Their Shirtâ€

https://www.movoto.com/davis-ca/market-trends/

Naples, FL Housing Prices Crater 13% YOY As Florida Mortgage Debacle Expands

https://www.zillow.com/naples-fl-34109/home-values/

Salem, OR Housing Prices Crater 27% YOY As Portland Housing Market Staggers

https://www.movoto.com/salem-or/market-trends/

Culver City, CA Housing Prices Crater 18% YOY As Los Angeles Area Layoffs Push Record High Joblessness Higher

https://www.movoto.com/culver-city-ca/market-trends/

Santa Barbara, CA Housing Prices Crater 13% YOY As Housing Prices Plummet Statewide

https://www.zillow.com/santa-barbara-ca/home-values/

Denver, CO Housing Prices Crater 10% YOY As Major Cities Experience Double Digit Declines

https://www.movoto.com/denver-co/market-trends/

Westport, CT Housing Prices Crater 15% YOY As NY/NJ/CT Housing Market Staggers

https://www.movoto.com/westport-ct/market-trends/

Bend, OR Housing Prices Crater 13% YOY As Seattle/Portland Housing Collapse Expands

https://www.movoto.com/bend-or/market-trends/

Provo UT Housing Prices Crater 16% YOY As Double Digit Price Declines Ravage Salt Lake City

https://www.movoto.com/provo-ut/market-trends/

Potomac MD Housing Prices Crater 9% YOY As Washington DC Housing Market Implodes

https://www.movoto.com/potomac-md/market-trends/

Flower Mound, TX Housing Prices Crater 7% YOY As Dallas/Fort Worth Mortgage Defaults Jump

https://www.movoto.com/flower-mound-tx/market-trends/

Thanks a lot Jim! It’s great to see there are still realists on this blog who look at data. Has anybody noticed that RE cheerleaders don’t provide any reference to data, stats, charts? All they do is tell us the same thing over and over. “Buy now, buy now, buy now! The economy is great, buy now! “ I doubt most of them understand cycles and every time you mention cycles they call you a commie, socialist or perma bear. It’s quite funny and entertaining. One of the reasons I like this blog so much.

Misleading headlines (fake news):

Santa Barbara – Flat

Culver City – UP 8%

Santa Barbara, CA Housing Prices Crater 13% YOY As Housing Prices Plummet Statewide, but the data in the link states July 18 high of $790/ft2 and January 19 at $767/ft2, a 3% drop from summer highs. January 18 was $764/ft2 – Increase of $3/ft2. flat at best, not 13% CRATER.

Culver City, CA Housing Prices Crater 18% YOY As Los Angeles Area Layoffs Push Record High Joblessness Higher

but the data in the link states price/ft2 ‘today’ is $742 and 1 year ago it was $683. The reason for the drop in media price is because the size of the homes sold were smaller. Based on price/ft2 Culver city is UP 8% YoY price/ft2.

So now cratering is defined down to as low as 7%YOY?

As hard as Democrats and the MSM have tried, they can’t kill the Trump economic boom. Unemployment is at 4%, hundreds of thousands of jobs are created every month. Good solid paying jobs, not the McFlipper p/t “jobs” of the Obama years. Interest rates for mortgages are back to 4% and Dow Jones is above 26K. And gas is $2 a gallon in most of the country.

With this economy, a crash in real estate is pure fantasy. There’s a better chance I meet the real Santa Claus than a national real estate crash happening in 2019.

Having said all that, the country is also populated by tens of millions of imbeciles. And these imbeciles vote. Which means in 2020 they may elect a super imbecile like Bernie or Kamala who will blow up the economy. In which case, Millie may get his wish and buy r/e at 75% off.

That is if he still has a job and not just public assistance. Owning rentals might not be so great under a Bernie run government. And undeveloped land could be taken from you at minimal recompense for environmental protection. Better hope goofy Uncle Joe is the Dem’s choice.

How’s RE investment in Venezuela doing? These clowns like Bernie are defending Maduro against Trump. Venezuela with free healthcare but no MRIs or electrocardiograms and a measles epidemic. World’s best country at weight loss, too.

Things are not as rosy as Mr Landlord has described for everyone.

Otherwise, why has Ocasio-Cortez been elected? Why have an extremely liberal set of Democrats taken over the House.

Propaganda is one thing. Reality is completely different.

If everything was rosy, then this would not happen.

Related to housing, Housing in the US has become more unaffordable under Trump for the average wage earner. A correction is needed to save Trump in 2020 or his base will vote socialist.

Things are not as rosy as Mr Landlord has described for everyone.

Otherwise, why has Ocasio-Cortez been elected? Why have an extremely liberal set of Democrats taken over the House.

Propaganda is one thing. Reality is completely different.

If everything was rosy, then this would not happen.

Related to housing, Housing in the US has become more unaffordable under Trump for the average wage earner. A correction is needed to save Trump in 2020 or his base will vote socialist.

You are right, haven’t bought yet. I like to buy at 50-70% discounts when it’s comes to housing. Inventory is going up, sales are plunging. I think within the next two years you can buy at 2011 levels. And if not, the way to property is renting low and saving big. As we know: why buy high when you can wait a few years (or decades) and save half the cost?

Great report. Listen to it. Much more pain ahead for RE cheerleaders

https://wolfstreet.com/2019/02/24/the-wolf-street-report-who-wins-in-a-housing-bust/

Real estate sales are collapsing everywhere. Almost every day we see the proof. How can you argue the market is still doing fine?

https://www.zerohedge.com/news/2019-02-17/december-home-sales-collapse-sacramento-county

ZeroHedge has predicted 187 of the last 2 recessions. LOL

By the way did you actually read the article or just the headline? Talk about burying the lede.

“According to new data from CoreLogic, the year-over-year increase in the median sales price for all homes in the county was 4.4%, one of the slowest months in 2018. Of the 57 neighborhoods with at least ten homes sold in December, 41 experienced a slight bump higher in the median sales price compared to December 2017.”

So 70% of neighborhoods had price increases, and overall prices increased by 4.4% YOY. And yet this is proof of the great housing crash????? Whatever you say.

Nope, nothing to see here, “Home Sales Collapse In Sacramento Countyâ€

https://www.zerohedge.com/news/2019-02-17/december-home-sales-collapse-sacramento-county

The crash is upon us in DC!! And by that I mean, there is no crash to speak of whatsoever.

Poor Millie.

“Elsewhere in Northern Virginia, the median price of what sold in Fairfax County in January was $486,000 — up 3 percent from a year ago, with inventory down 15 percent. Loudoun County’s median selling price last month was $486,250 — up 8 percent, with inventory down 19 percent. Prince William County had a median selling price of $365,000 — up 6 percent, with inventory down 10 percent.Across the river in Maryland, the median selling price in Montgomery County in January was $400,000 — down 2 percent from a year ago. Prince George’s County had a median selling price of $285,000, up 6 percent. In the District, prices jumped 7 percent from the median selling price a year ago, to $533,000.”

The DC area is a nice cherry pick for location data. The DC area real estate doesn’t drop until the US government reduces it’s budget or companies reduce their lobbying budgets. It in no way correlates to the southern California market.

It’s all interconnected. If DC crashes, LA crashes and vice versa. They’re not immune to each other.

Oc county Inventory is increasing YoY. Buyers demand is muted. There will be a flood of houses coming on the market once we hit a recession. Can’t wait! The spring season will be a disappointment for perma bulls just like last year. This is like 2006/2007.

The OC Register’s RE columnist Lansner is writing this week about how housing construction is down 10% in SoCal for last year.The biggest drop is in expensive OC. Lansner is attributing a big part of the OC drop to the decline of Chinese buyers. They may have been 80% of the Irvine market for new homes. And Inland Empire new home sellers are ponying up big incentives to buyers (like $10,000 in closing costs). A shift to lower end building in 2019 may reverse this trend according to the people who are tracking sales. That and write-offs and incentives for the more expensive excess inventory. A “reality check” is what one expert is calling it.

I could go on busting you up all night, US Home Price Growth Weakest Since 2012

https://www.zerohedge.com/news/2019-02-26/us-home-price-growth-weakest-2012

https://www.advisorperspectives.com/dshort/updates/2019/02/26/s-p-case-shiller-home-price-index-annual-gains-fall

home prices will be YoY negative…soon. Hold the powder dry

February consumer confidence index came out at 131.4 today. That is the highest level since July 2017.

You know what consumers do when they are confident? Buy stuff. Including housing..

To put that number in perspective, between 2009 and 2015 it was under 100 and barely budged above 100 in 2016. We had an 8 year recession under Obama and we’re only 2 years into the Trump recovery. We have many years to go to make up for Obama’s destruction.

Stop watching CNBC and MSNBC Millie, you’re losing money every day.

Landlord, I am not watching these channels and I am not losing money. I am saving every two weeks a lot of money by renting a dirt cheap apartment. All these savings go into cash. I don’t buy stocks at these levels and def not real estate. Once we get a nice crash I start buying 🙂

“We had an 8 year recession under Obama and we’re only 2 years into the Trump recovery.” Was the Great Recession (December 2007-June 2009), and the melt down (September 12, 2008) fake news? If you’re rewriting history, support it with facts.

Mr. Landlord, July 2017 was just before the last recession started! A very high consumer confidence reading isn’t predicting good times; it is predicting bad times just around the corner. It is saying that consumers are so optimistic that they have already spent every last penny they have to spend. They have NO BUYING POWER LEFT to buy anything!

“Mr. Landlord, July 2017 was just before the last recession started!”

Are you saying we’ve been in a recession since July 2017? OK that’s an interesting spin on things. I’m curious to know more.

I thought this is an informative article:

https://www.marketwatch.com/story/why-bubble-era-home-mortgages-are-a-disaster-waiting-to-happen-2019-02-25

“Keep this in mind: The non-agency mortgage delinquency fiasco will not go away just because Wall Street and the pundits act as if it has. I am confident that this entire charade will start to unravel within six- to 12 months. It is wise to prepare now.”

Yikes

Price declines across the board. Downturn is here

https://wolfstreet.com/2019/02/26/the-most-splendid-housing-bubble-in-america-deflate-february-2018/

Even if a correction occurs, I don’t see Millie and his cohorts benefiting. When prices drop 5%, Millie will wait for 10% to buy. When they drop 10%, he’ll wait for 20%. Prices drop 20% he’ll wait for 30%. And so on. Other than buying for $0, he will never buy in because he will be sure more price drops are on the horizon. And when prices start rising again, he’ll think it’s a temporary blip and if he just waits it out for another 3 years, prices will fall once again.

It’s what we all saw happen 2009-2011. Perma bears could have bought homes that sold for $700K in 2006 for $500K in 2010. But they were convinced the mythical “true” price was $250K. So they waited, and waited, and they’re still waiting. Today that same home is $1M. Some day it may correct to $800K. But it won’t matter. They will be convinced it’s only worth $500K and will miss out once again, only to see the home go to $1.5M 10 years later.

Rinse and repeat for the rest of their lives paying someone like me a rent check every month waiting for that 75% off sale that never comes.

Nope, but 20% off is gauranteed, any fool can see that. If it walks like a Realturd and talks like a Realturd, it must be a REALTURD.

Jim,

So now w’re in the “if you disagree with me online you must be a troll (realtor) phase of the program. You forgot to call me racist, lol. It’s the lamest, weakest method of debate there is. If you disagree with me, fine. I welcome debate. But let’s debate facts and ideas and leave the childish name calling out of it. Mmmkay?

And for the record, I am not now nor have I ever been a realtor.

Millie has posted over the past years that he will share the moment he signs the papers to buy his first home……..He posts similar phrases over and over (“no crash, no purchaseâ€)…….Even I remember that and I don’t even spend that much time here……..Obviously, the market is turning…….We might see him buy within the next few years……I am also looking to add to my portfolio……..USUALLY……A good time to buy is right after the economy collapses. I am with the millster on that one…..

“There’s a sucker born every minuteâ€

Don’t be one.

I had doubts about this but it seems you are right. He is just a dumb mofo. Even if he got his 50% crash he is craving, he would wait for 10% more and miss out or simply be unemployed lol. The rest of us have equity or at the very least a locked in pmt. To me equity means nothing unless I cash out or borrow but its still nice I can sell and profit 180k in less than 2 years if I really had to sell. At the very least my kids have a 5 bedroom house to run around in.

Ha, and when stocks correct lower, you’re GONE Just like the past six months. You only comment here when we’re not in correction territory. And you’ll be gone again when home prices decline and stocks tank. So go ahead and school everyone but we all know your a fair weather commenter, and will disappear shortly when Trump finally crashes all the markets.

Jed, I know you don’t like my posts and views. Have to hand it to you though. 5 stars on your reply to landlord. Couldn’t have said it better!

Lefties like Jed would rather have people suffer economically than Trump get credit.

SAD

I know a few Tech co-workers who didn’t buy in 2010-12 when prices were 50% off in many areas because they didn’t have a job to qualify and didn’t have cash (They lost 50% in the Stock Market at the same time) so they missed out. There is a book on this

“Nomadland” describing people like this who lost everything in the Great Recession and are now living in vans.

The people who bought (a few teachers with job security and some Tech workers who held their jobs) and the people who did not walk away from their houses because they had cash savings to ride it out, are doing very well now.

“Widespread fear is your friend… personal fear is your enemy.” – Warren Buffet.

There were also a lot of people at that time who had personal fear that housing would continue to plummet and they might lose their jobs. Losing their jobs was a real fear and some of the lucky few, bought, kept their jobs, and are now doing very well. Some bought, lost their jobs, had cash to ride it out, and still did very well.

There is always a reason not to buy. Usually, they are short-term fears and not enough cash to survive.

My philosophy has been: When the markets crash, don’t sell, make sure you have cash to at least ride it out. When the deals become insanely good, more cash is better to jump in when the buying is good. The Investors Business Daily had advice in the early 90’s also. “Buy on the upslope” You may miss out on the bottom, but if you wait a year after the crash (ie 2012/2013) when people start buying again and it is not a local minimum, you can’t go wrong.

My Daughter bought a townhouse half way to the bottom of the last RE crash. She and her Husband then waited until early 2013 and bought a big house at the end of a cul de sac on 1/4 acre, then sold her old place as prices rose another $50K. Zillow says her place is worth about $210K more now and Realtor.com says about $250K so maybe it’s worth $175K more conservatively? Even at the conservative estimate, they are at >50% equity. A big yard, a pool and a bedroom for each kid. They couldn’t be happier with their RE deal. You don’t have to nail the bottom or sell at the top to get a good life.

Good advise Bob! I want to add another one – as much as you can, try to have multiple unrelated streams of income which can not go to zero. Yes, in a crash, income goes down. However, you still have income when most lose it all. Then, you feel like a kid in a candy store. That is the reason I said many times before “as much as you can, try to have your own business”. When you are very young you need both, money and experience. Then, it is understandable to have a job. Later, it is better to go on your own using both, the experience and the money you saved.