Trillions in Financial Bailouts: After 2 years, the major Beneficiaries are Banks and Wall Street. What other Proof do you need that we are Focusing on Bailing out the Banking Oligarchy? Foreclosure Filings at All-Time Record High.

Banks, take the blue pill. Public, please take the red pill. If I had to characterize the current economic environment, it would have to consist of two completely different sets of beliefs. On one hand, you have banks and Wall Street receiving massive bailouts from the U.S. Treasury and the Federal Reserve, bailouts of the magnitude that would gear up for a Great Depression and imply that the banking system of our country is insolvent. Then on the other hand, you have Wall Street and the crony banks trying to convince the public that this is a minor recession and all will be well in Q3 and Q4 of 2009. The problem of course is that this is not your typical recession yet the public is being led to believe that all is well while bailouts are being dolled out by the truckload to the wrong locations. The actions we are taking keeps in place the banking oligarchy and sacrifices the public under the guise that this is good medicine for the general economy.

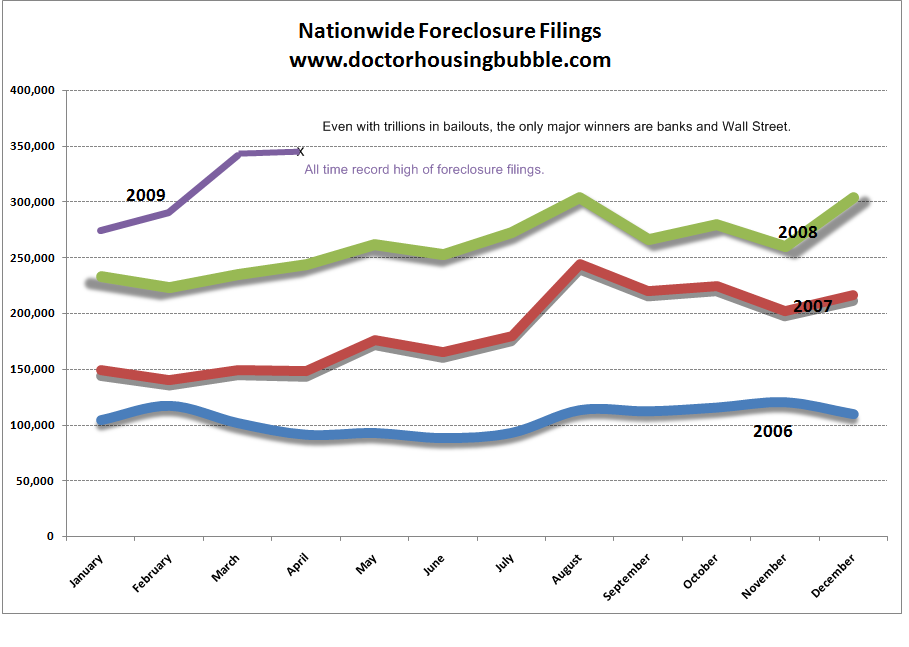

Nothing proves this point better than the current nationwide foreclosure issue:

The latest housing data shows that nationwide we have just shattered all records for monthly foreclosure filings in one month. Take a close look to the chart above. Foreclosures are moving higher and higher. We are now approaching the 2-year anniversary of this housing and credit crisis yet the core issue of housing is still not being dealt with. What we are doing is bailing out banks while the public is left to deal with the fallout. The hypocrisy is creating deep anger, as it should. When TARP 1 came out, banks were given the first $350 billion with no questions asked. That money of course has been squandered. However, when it comes to modifying the mortgage of struggling homeowners, banks conveniently find every excuse to avoid reworking the mortgage. And when I say reworking, I mean cutting the principal down not extending the term out to 40 years or cutting the interest rate by a point. This is their idea of working with the public.

The foreclosure chart above tells us one thing. We are not helping the public. We are not solving the housing crisis. The notion that bailing out banks would somehow trickle down to the public is absurd. How many issues of systemic failure did we deal with? AIG? Fannie Mae and Freddie Mac? Lehman Brothers? The list goes on and on. With the AIG bailout, we used systemic failure as the premise to funnel money through the firm as a conduit to Wall Street firms like Goldman Sachs. Can’t allow them to lose a penny because that would be systemic.

And by the way, do you remember those estimates last year that the GSE bailout was actually going to give us a profit in the long run or at worst, cost us $25 billion?

“(WaPo) The Obama administration has clarified what it expects the takeover of Fannie Mae and Freddie Mac to cost taxpayers: $171.1 billion.”

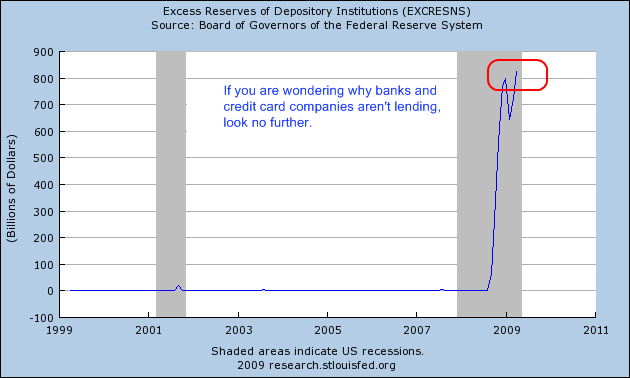

Whoops! Missed by a few hundred billion there. Yet someone that lost their job and lost their home has already faced systemic failure. We have in our country nearly 25,000,000 unemployed or underemployed Americans. And somehow, the market is shocked that retail sales contracted? Of course it contracted. The public doesn’t have an unlimited credit card to the Federal Reserve and U.S. Treasury like the banks and Wall Street. Ironically, it is the public that is now paying for the mess with no benefit at all. We have now committed over $13 trillion in bailouts, almost one year of our nationwide GDP. You would think that with so much money funneled into the system drastic changes would be occurring. They are not because banks are hoarding money:

And the above makes a lot of sense. If you look at the record number of foreclosures and defaults, banks are doing the right thing (according to their balance sheets). They are operating for their own survival. But that wasn’t how the bailouts were presented. Can you imagine if they told the public the real reason for the bailouts,

“Hi everyone. We are going to need to commit trillions of your dollars to bailout a banking system that failed you. A system that didn’t exercise due diligence. A structure that fueled the housing bubble. What will you get in return? You get to keep us going. The system that failed you appreciates your support.”

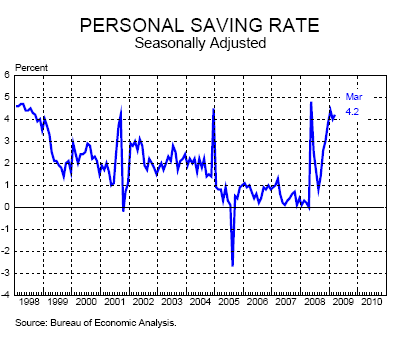

What the public was told is that these bailouts were required to keep lending going and to ameliorate the housing situation. Both of those objectives have failed as the charts above show. The public is catching on and that is why they are now forced into saving (thus not spending on consumption showing up in drops in retail sales):

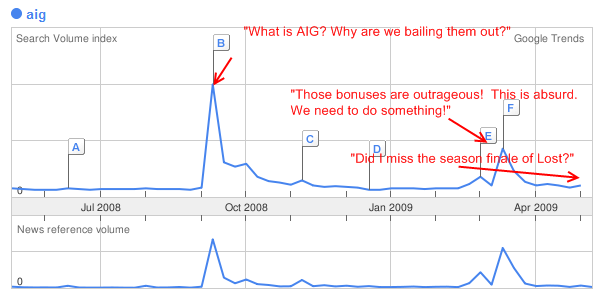

Doesn’t the excess reserve chart and the savings rate chart look the same? Of course. The public is doing the right thing and pulling back because this is the deepest economic crisis we have had since the Great Depression. When the public starts waking up to this, that we are only bailing out the banking system and Wall Street, friction will start to rise and you saw some of this with the AIG bailouts. But the public forgets quickly and this recent stock market rally is a testament to that. Let us see how long that AIG anger lasted:

All it took to forget the bonus mess was one month. In the last few weeks, cram-down legislation was introduced again and failed, again. Why? Because this isn’t your bailout, this is a bailout for the banks and the cronies on Wall Street. It is social welfare for the banking oligarchs. And guess what? Our representatives from both sides of the aisle voted it down. Wall Street and the banking system are the biggest contributors to both political parties. Who are they really representing?

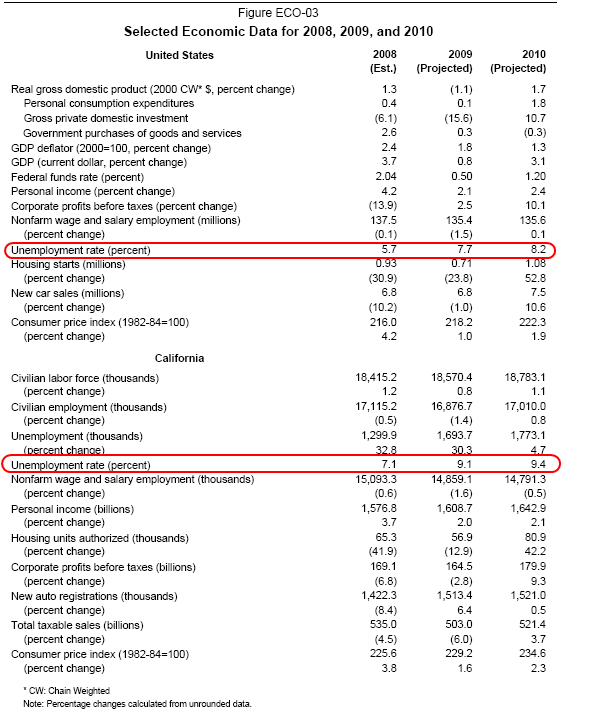

Our public officials have missed the ball so badly on this financial mess. It went from Greenspan praising the glory of adjustable rate mortgages, to Bernanke saying subprime was contained, to Paulson saying we need to give money to banks, no questions asked or the global economy will implode like a supernova in the matter of a few years. Let us take the glorious state of California for an example. After having a record budget impasse, we finally passed a compromise in California that left both sides with a bitter taste and unsatisfied. After only a few weeks of taking care of the 2008-09 budget, we find out that we have an $8 billion short-fall! This only after a few weeks. How in the world do you miss $8 billion? Okay, so we’ll chalk the $8 billion miscalculation to bad weather. Another few weeks pass and guess what? Our Governator now tells us we have a $15 billion budget short-fall and if the propositions don’t pass on May 19th, it will be up to $21 billion. You want to know why they are so off? Let us go back to the fall and see their projections:

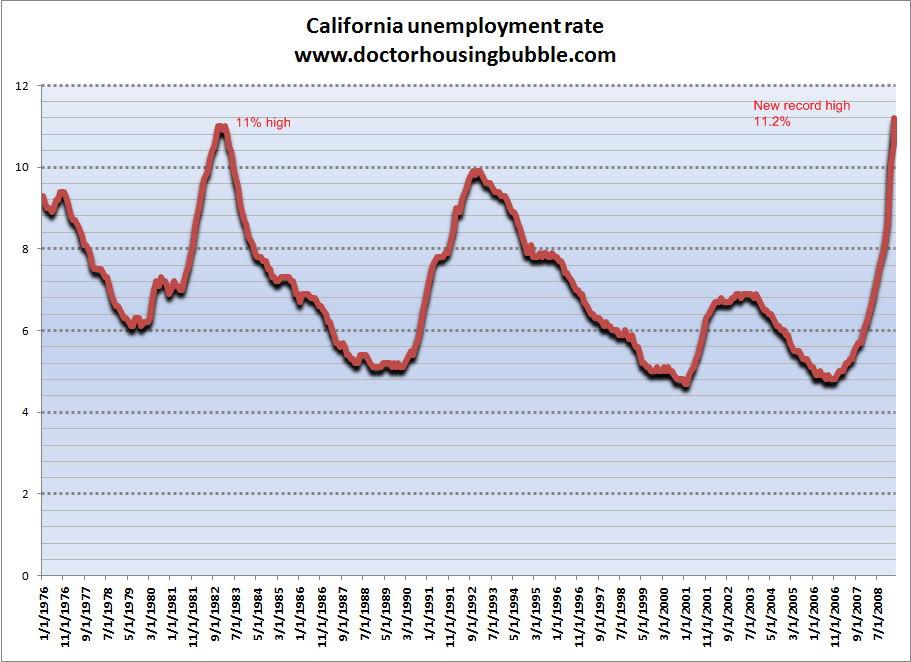

They were projecting a peak unemployment rate of 9.4 percent for 2010! Take a look how off they are on that one:

We are now up to an 11.2 percent unemployment rate. Basically, they have been completely wrong in all their assumptions and that is why we have gone from an $8 billion shortfall to a $15 billion shortfall in a few weeks. Utter insanity. If you ran your household like this, you would be kicked out to the street. They are operating under the second half recovery model that has caused the 30+ percent bear market rally. This is not going to happen. The new mantra should be, “things are getting worse more slowly.“ That is, unless you are a banking executive and then, you are getting saved on the taxpayer’s dime. Where in the world are the freaking prosecutions? Where are today’s Pecora Investigations? How much more evidence does the public need to realize that the current trajectory is not good for our country’s long-term sustainability? Over a year ago, I started mentioning that the U.S. is on path to a Japan like lost decade. This week none other than noble-Prize winning Paul Krugman is saying the same thing in China. We are zombifying our banks and setting ourselves up to a decade of stagnation. Is this really what we want? It isn’t too late to shift course and temporarily nationalize the banks and clean them up. We still haven’t jumped into the horrific public-private investment program (PPIP) which will be another transfer of wealth to banks and Wall Street of an additional $1 trillion. It will be a slow burn and before we know it, many will realize that they have been conned and this will make Bernard Madoff look like the epitome of conservative investing.

So where do we stand today? We have a crucial choice to make here. Do we want to make banking a utility like industry or bailout Wall Street and banks so they can go back to the global financial casino? So far, the path we are taking is keeping the casino alive. The issue of course is to find people at the levers of power in the government who are not soiled by banking industry money. This is a challenge and that is why trillions in bailouts are going to banks and Wall Street while the public gets the shaft. $100 to the banks, $1 for you. At times, I sit back and wonder why the public isn’t in a bigger uproar? Are they not angry that their money is going to bailout a crony oligarch banking system? Then I remember those times in college where I would hear peers say, “I hate math, don’t want to deal with it ever again.” Therein lies the problem. Very few in the public really understand what is going on. How many times have you seen CNN, MSNBC, Fox, or even CNBC go in depth about the Federal Reserve?  I’ll leave you with a quote from Henry Ford:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “Trillions in Financial Bailouts: After 2 years, the major Beneficiaries are Banks and Wall Street. What other Proof do you need that we are Focusing on Bailing out the Banking Oligarchy? Foreclosure Filings at All-Time Record High.”

People are not angry yet, because they haven’t had to pay the bill.

Like failed wars, without a military draft, it is a fade in the distance thing. Let others worry about it…

I hear the deficit is 50% of income, so we NEED an immediate 50% increase in taxes + a few % more for failed wars + a lot more % for the future.

And this is just to break even.

The true Conservative principal.

…well…

Like both failed wars, on borrowed money, and an entitlement society that thinks their 150,000 house is worth 900,000, while they pay pretend taxes like it’s worth 150,000, something has to give.

Screw the next generation, let them pay 4 times what a house is worth to the thieves from the parent’s generation, AND 4 times the taxes.

Rob the kids twice.

Remember waaaaay back when parents tried to improve the lives of their children?…not any more, you need to be a CEO to buy a “starter” home in skid row!

Sorry to sound so grumpy.

The weather is very nice today…

From the 1st Looted Generation, (we are now on Looted Generation 2 – bad movie!).

Keith in SF

Dear Doctor you’re the best at seeing through the smoke and mirrors. Take a look at Advanta. They gave me a loan at 3.99 teaser and it spikes to 35.99 in Novemeber. I knew they would fall before then like a house of cards. They are shutting down services on June 10. Chase just refuses to take off one 24 hour late payment. they are unalterble and unyeilding in their greed. They are entrenched like the end is near, I guess it is!

Great as usual. You wonder why there isn’t a bigger uproar among the public. I would refer you to your Google search graph for AIG and your line, “Hey did I miss the season finale of Lost?”

Much of the public is outraged as evidenced by the recent teaparty’s, but for most of the horde, American Idol still appears so all is well. Oh and there would be universal outrage if it was Bush doing these things, but the chosen one can do no wrong…we just need to have faith and give him time. Seriously, the amount of political slack this guy has been cut is unprecedented.

The only thing that can save the housing market is hyperinflation, which will happen eventually. In the mean time home owners will go through a lot of pain.

http://www.totalinvestor.com

No one tells it better Doc!

Hey doc, as always, great article.

–

But I have to take contention with one of your points:

–

“The foreclosure chart above tells us one thing. We are not helping the public. We are not solving the housing crisis. The notion that bailing out banks would somehow trickle down to the public is absurd. ”

–

The way I understand it, the goal of the bailouts wasn’t to stem foreclosures but rather to restore and/or maintain the availability of credit. Whether or not that was necessary is certainly debatable — IMHO the bailouts were stupid idea, and should not have been done — but whole argument in place to try to convince us that they were needed was that many of the bailed out institution were so large, that if left to fail, they would drag the whole economy down into a recession deep enough to rival the great depression. (and lets be glad *that* didn’t happen, right? [sigh])

You are calling for nationalizing the trouble banks (i.e., most of the big ones). Never in the history of the USA have we nationalized a bank, but that is not really a reason not do it now.

What I question is how exactly would you propose to do it? The banks that are in trouble and are large enough to pose the potential for systemic issues are also international. Nationalizing would seem to imply that you have to break out the US entities from the non-US. While this is theoretically possible, albeit extremely complex, if you gave even a hint that the US was going that route, there would be massive intercompany transfers of every crappy asset to US entities. In effect we would end up owning a global issue at the national level.

Further, nationalization would only be more efficient if you are willing to blow up the bondholders. The equity holders will get diluted to near zero in any case (even if they do not know it yet). The problem is many of the bondholders are directly or indirectly pension funds and other investment pools that are critical to society as a whole. Certainly in the case of pension funds, blowing up the bondholders just shifts the problem to the PBGC.

Apparently, the public is calling the bottom. See the attached article titled: Zillow: Homeowners Think Worst is Over http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=966547 Interestingly, 30% of homeowners according to the article want to list their property when things turnaround. While there is truth to the argument that there are pent up buyers out there, it appears that between Joe Homeowner and the shadow bank-held inventory, there is even more inventory waiting on the sidelines.

In the United States of Delusion, perception is reality. When the smoke and mirrors clears, the public will be shocked, SHOCKED, at the disaster that lay before them. As Comrade Housing Bubble continually reminds us, this is not your garden-variety recession and we are years from the bottom. Invest accordingly!

In my mind, a sure sign of the bottom will be when 50% of national homebuilders now listed on the various stock exchanges are delisted.

Another fine post with all the juicy details conveniently packaged for consumption. Thank you DHB! I happen to believe that your “case” is on-target with what actually happened – and – in identifying the fatal flaws in our approach to dealing with it.

So, what’s up with the people? Where’s the outrage? I say it’s in the works – it’s building.

Those of us in the bubble states/markets (I’m in the OC CA) can’t help but face the REALITY. It’s everywhere we are! The unemployment/under-employment, foreclosures, underwater mortgages, ARMS ready to reset, reduced hours + pay, 401K’s crashed. Everyone I know is impacted in some way and many people are scared and or worried OPENLY. Finally people are talking out loud to one another and it’s picking up steam. In fact, a huge ripple will be felt next week when all of the CA propositions fail. They’ll fail because the people are mad. They’re ready to push back. They don’t care if they crash the system – ’cause the system isn’t serving them anymore.

Crowman, check out the recent /Atlantic Monthly/. MIT’s Simon Johnson:

~

The Quiet Coup

http://www.theatlantic.com/doc/200905/imf-advice

~

Here’s the squib:

~

“The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.”

~

As for greedy parents stealing the future from children who deserve (whatever), here is a chart to consider:

~

Distribution of income gains by income bracket, 1947-79 and 1979-2001

http://www.itulip.com/itulip_income_distribution_chart.html

~

What you will see here is that income gains have been limited to the top 5 percent in both of those periods, the bottom 75% since 1979 have gained nothing and in fact have fallen behind inflation.

~

THIS is the real story, as Doc keeps reminding us. By the time the Baby Boom was petering (ha!) out, and I and my generational cohort were joining the job force in 1979, unless we were positioned to be in that top 5-25%, income was a losing game from the get go, no matter how many jobs we had in a household. Yet people would still consider me a Boomer, generationally, and blame me for the gentrification that has run up housing prices in our ‘hood.

~

Reaganomics has been a disaster, yet somehow people born since then still think that clown was a hero.

~

haunted by a carnival…

rose

>”Never in the history of the USA have we nationalized a bank”

The United States has a long and overlooked history of “nationalization”

http://www.newsweek.com/id/183993

* Northwest Ordinance of 1789

* Louisiana Purchase of 1803.

* The continental shelves along our coasts

* The airspace above us

* Hundreds of thousands of miles of roads

* Trillions of other public infrastructure so essential to our private economy

* In World War I, the nations’ railroads were successfully nationalized to sustain the war effort

* In the 1930s, the Reconstruction Finance Corp. bought millions of shares in over 6,000 banks

in order to rescue them.

* During World War II, government took control of the economy’s entire pricing system for

consumer goods—a more complex job than taking over several big banks—and did quite well at it,

most economists agree.

* In the 1980s, the Resolution Trust Corp. seized hundreds of failed savings and loans in order to save the system.

* After 9/11, the government effectively nationalized the private-security firms at airports,

and replaced them with the federal TSA.

After all the spectacular failures of Capitalism, how much worse can the government running banks really be?

Don’t be an “economic girly man”! Nationalization is nothing to be afraid of…

@Rose,

I’m afraid of clowns now too.

Reality just came to me one night and now it all makes sense. The banking race enslaves the world by controlling the faucets at every point in the money flow. When their adversaries start to figure it out, they incite factions of their enemies to fight one another–divide and conquer. This strategy has worked for thousands of years, but the farmer may have killed the golden goose this time. Liberals think they can make the world better and conservatives are holding them back. Conservatives blame the liberals for all the nation’s woes. Meanwhile, the asset class with their ivy-league disdain for common people watch as they battle one another, while the real enemy steals their birthright. When will we figure out the obvious…

I live in a small city in the San Francisco area. A local blog,knifecatchers.com

focuses on real estate here. There are many comments from people anxious/excited/desperate to buy a home.They are in a panic mode- “interest rates are going to go up-buy now,or loose out forever!” They do not believe that they should wait. They do not believe prices will continue to fall. How can you explain something to people that lack basic knowledge of economics? We are in a worldwide, severe recesssion. It is not “different” here, although people in San Diego, Phoenix, and Honolulu all thought that. Until things crash and burn, many people are in denial. Good luck with that.!

After the propositions fail next week, it is only a matter of time before the state of California goes into bankruptcy. I recently bought a home in LA, before becoming a reader of the good doctor.The national deficit this year is fast approaching 2 trillion dollars. And I sleep well at night. Why? I keep my savings in gold and silver. But you say that gold seems terribly overpriced right now. How could anyone buy it at over $900? Just look at the World Almanac for 2009, and do a little math on a napkin. The total of all the gold mined on planet Earth last year? About 80 million troy ounces. At $1000 per ounce, how much is that worth? 80 billion dollars. How many days pass before we print that much money out of thin air? Maybe a couple of weeks? And we are just one country out of many who are printing money like crazy trying to create wealth again. Well, don’t be fooled. The only money that has lasted for the past 5000 years is gold and silver, and it won’t be long before American dollars are as valuable as 1990 Mexican Pesos, or 1955 French Francs. The world will go on, but if you have your money in American cash or bonds, your wealth will simply be transferred to someone else. Long live Doctor HousingBubble!

Agree 100%, Do not bail out Banks or Wall Street. But why would you want to bail out irresponsible homeowners? If you do, it would just keep home prices inflated. Let all the cards fall where they should. BAIL NO ONE!!! Keep Saving and only purchase what you can afford. Many homeowners still think there is a homeowner bail out program in the process, and that is causing mid priced real estate prices to stay inflated. LET THEM FALLLLLLLLL!!!!!!!!!!!

The USA has many issues to resolve but many have no answers only choices that point to a lower standard of living which from a political point of view is unacceptable. Americans of all classes are spoiled, yes even Doc and those reading this Blog. Pointing fingers at the bankers,accounts feels right and is necessary but it doesn’t resolve the issues of the choices as a society we will be facing. Hopefully our society can generate the necessary political will to bring the required changes to the table but they will be painful for everybody.

The big problem here is that the public keeps reelecting mostly the same members of Congress. These representatives of ours voted for the Gramm Act in 2000 that got us in this mess in the first place. Also Congress voted for the Patriot Act. It is shameful for the average american to blame the banks while the political machine keeps getting re-elected to Congress. It is disturbing here in California that we have a Governor that has us now in a much worse situation than Gray Davis. He had 6 years to cut spending but he went ahead anyway and voted for budget increases. We have two life long Senators that are strong supports of the military complex, Patriot Act, and helping the Banks. We have immoral mayors of Los Angeles and San Francisco sleep around and then get reelected.

It is the public to blame for electing the sample people over and over again. It is time we stood up and elect fresh new faces with honesty and integrity.

1050espnradio.com just started a daily interview segment with ron ensana of CNBC this week on the Michael Kay Show. One of the questions asked today when should I get back in the market? Ron’s responce was last march. He said “the market although a little down this week is up 37% from peek to troff.” Oh btw no mention of the massive job cuts as of late other than the closure of the car dealerships of Crysler.

I wonder what it is like having a diet of cool aid, because Ron semes to be drinking more than his fare share.

The Michael Kay show airs at 2:00PM E 11AM P. this segment airs at 4:40PM E 1:40PM P. Locally it can be found on WEPN 1050AM or XM 141 nationally, or go to the link at the top of this post to stream live.

It is clear that your readers know what is happening. This happened once before in our brief history and we rebelled. Nothing short of an outright rebellion will suffice now. WE NEED TO RID OURSELVES OF THESE ONEROUS OVERLORDS WHO PRETEND THE REPRESENT US. If only the rich are represented, then only the rich should be taxed. REBELL!

[Repeat from ObamaNation, last article]

May 12th, 2009 at 8:42 pm

What if everything you thought you knew was wrong? Almost everything is a spin and meant to put yourself in the usury bondage? Did you know that the bankers started both world wars? Do you realize yet that it was a war against the bankers and we helped the bankers win? Do you realize we have lost this war to the bankers? They have pillaged our treasury and are about to do it again. Just as they secured their counterparty CDS positions with AIG ‘bailout’ money, they are doing the same with Chrysler–forcing them into bankruptcy so the taxpayers can pay their credit default swaps at 100% instead of maybe 35% in a reasonable cram-down. You people are missing the point–we’re worried about whether some house in a crowded desert is worth 500,000 or $600,000 while the treasury is looted by Lynch-America and Gold-Mine Sack-Sam. We are spiraling out of control while many of you are still wondering if you can get a granite counter-top with renaissance garbage cans at the next auction. These aren’t green shoots, they’re Charybdis’ green tentacles.

[Pretty bizarre, but compelling–SF]

This is one of those blogs that makes me feel extremely grateful for all the people who contributed towards forming and managing the Internet.

Without SOMEONE putting this all together, so that the average Joe can read it, we would be lost.

So hypothetically, if you were say, invested in one retirement annuity to the tune of 50K and another to the tune of 35K, and they were a mix of bonds/cash in one and the other was heavy stocks, WHERE do you go with the investments? These would be 401k and IRA’s….would it be more prudent to take the payout and take home the $$$ and invest outside the stock market and the banks? (Like pay off real estate).

There will not be any prosecutions because the politcians know the bankers defense would be “You told us to do this”.

@Pat

The Bankers obviously tell the politicians what to do–not the other way around. Their ego’s bruised, the politicians then flex their muscle on the automakers. Unless you call the Fed and Treasury politicians…which they’re not. Don’t buy that wedge argument. Mozilla knew exactly what he was doing and so did Goldmine Sacks and the rest of them. You’re watching too much Flock’s News I suspect.

two alternatives to the countrys problems. 1. neuclear annilation, 2. space aliens land, and discover politicians and big bellied bankers are are delicacy.

Leave a Reply