The Future of America Housing – 5 Charts Showing Continued Pressure on Home Prices for the next Few Years. Household formation, Trend to Urban Centers, Lower Prices, Over Construction.

Housing prices in most urban areas will face pressure in the upcoming years because of a variety of factors. Last month as prices fell in many areas including Southern California, some were surprised because a belief that a trough had been hit had already set in. This is not the case. For the most part the bulk of home sales are still coming from the distress side. These homes do not yield the bank the full balance of the mortgage and consequently push overall prices lower. In many troubled states like California, Florida, Nevada, and Arizona many of these homes are secured by questionable mortgages so the gap between the current mortgage and the market price is rather large.

We also have issues on the supply side. During the peak days of the bubble housing starts were running at a stunningly high rate of 2 million per year. This at a time when household formation was closer to 1.2 million. So this enormous imbalance occurred. The current stall in housing starts is simply allowing the overall market to catch up. That is one of the big questions regarding when housing will recover. When will housing starts pick up? Today we are going to look at 5 major trends that will keep housing prices low for the next few years.

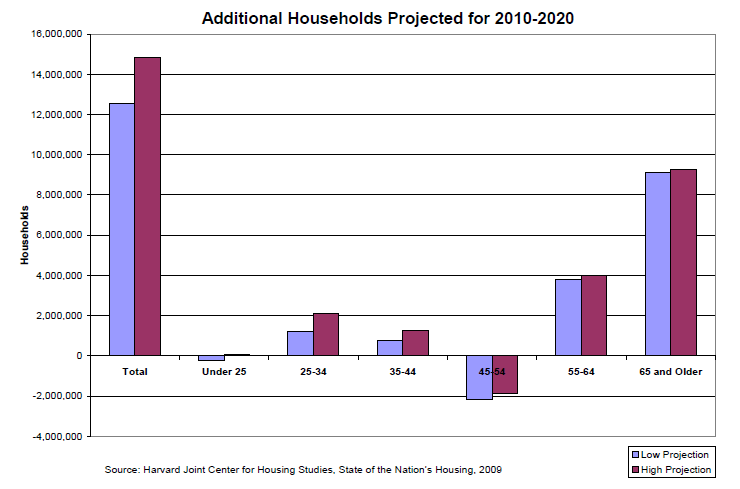

Reason #1 – Household Formation

Source:Â The Urban Land Institute

The Urban Land Institute put out an interesting paper in January examining the future of housing. One of the main trends they found revolves around younger generations living in urban centers. In fact, on their survey they found that many would accept a smaller living space in order to be closer to work, friends, and entertainment venues. Another important factor they highlight is those from 25 to 34, a peak household formation range, have seen wages fall in real terms by 12 percent for men and 3 percent for women. What this translates for housing is less money for housing.

Another big problem keeping households from forming in the current market is the high unemployment rate. Many of these people are doubling up, moving back home, or simply taking on cheaper rental housing. Once the employment market picks up we can see a pent up demand for housing slowly pick up but that is why we keep discussing that without solid employment growth, there is little reason to believe home prices will suddenly move up.

The unemployment rate for those from 20 to 24 is 15.8 percent and for those 25 to 34 it is 9.9 percent. Both of these rates are higher than the current headline rate of 9.7 percent. Until job prospects improve, the demand for more expensive housing will remain muted.

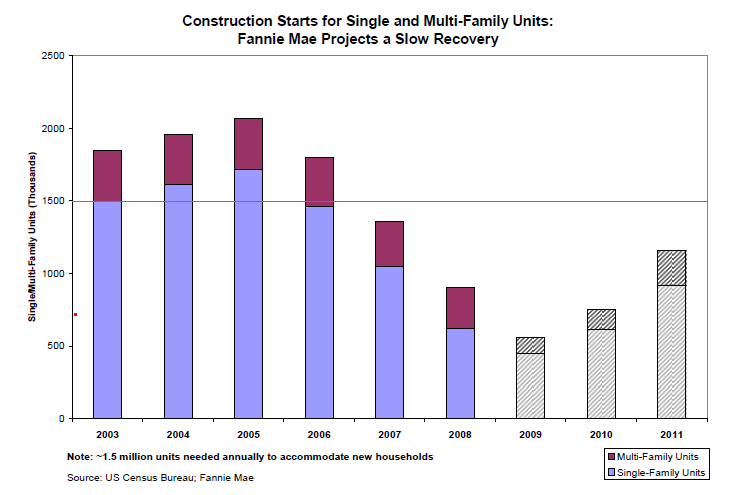

Reason #2 – Overbuilding and Housing Starts

The above chart shows the massive overbuilding that occurred during the housing bubble. With housing formation steady the rate is closer to 1.2 million but we were building closer to 2 million. Now, this has translated into a massive glut of housing. So the housing start rate plummeted in 2007 as we worked our way through too much demand. In addition, we added a large number of new homebuyers that were never qualified to own a home to begin with. This is the group that took out subprime or option ARM loans on homes that clearly were unsupported by their incomes. As we now know, most of these loans are now gone so now millions that once were “qualified†to buy are out of that buyer pool. So demand is also falling because people don’t qualify with tighter loan standards.

If we look at the housing start side of the equation, builders clearly realize that the demand side is still weak for new construction:

Although housing starts are up from their depressed levels, they are nowhere near a healthy market level. We still have inventory that we need to work through before builders start growing at a pace of even 1 million.

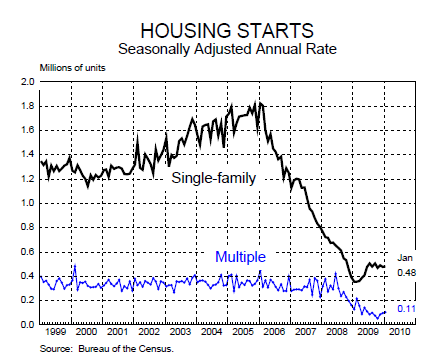

Reason #3 – Single Family Home Sales

If you examine the above chart carefully, you’ll notice that up until 2007 both existing and new home sales tracked very closely. For example, close to 5 million existing homes were selling on a seasonally adjusted rate while roughly 1 million newly built homes were selling from 1999 to 2002. Then even in the over building days both of these tracked together. The disconnection has started in 2009 where existing home sales have perked up while newly built home sales are still near the bottom. Why? The reason has to do with the amount of distress sales. The big driving factor in home sales is home price. In a price conscious market people are gravitating to foreclosure re-sales and short sales where prices are lower to meet with the new economics of households.

Newer homes that carry a bigger price tag have seen demand simply disappear. In areas even like California, areas that have lower home prices like the Inland Empire have seen sales pick up briskly but prices remain low. Those areas that still have higher prices have seen sales completely stall.

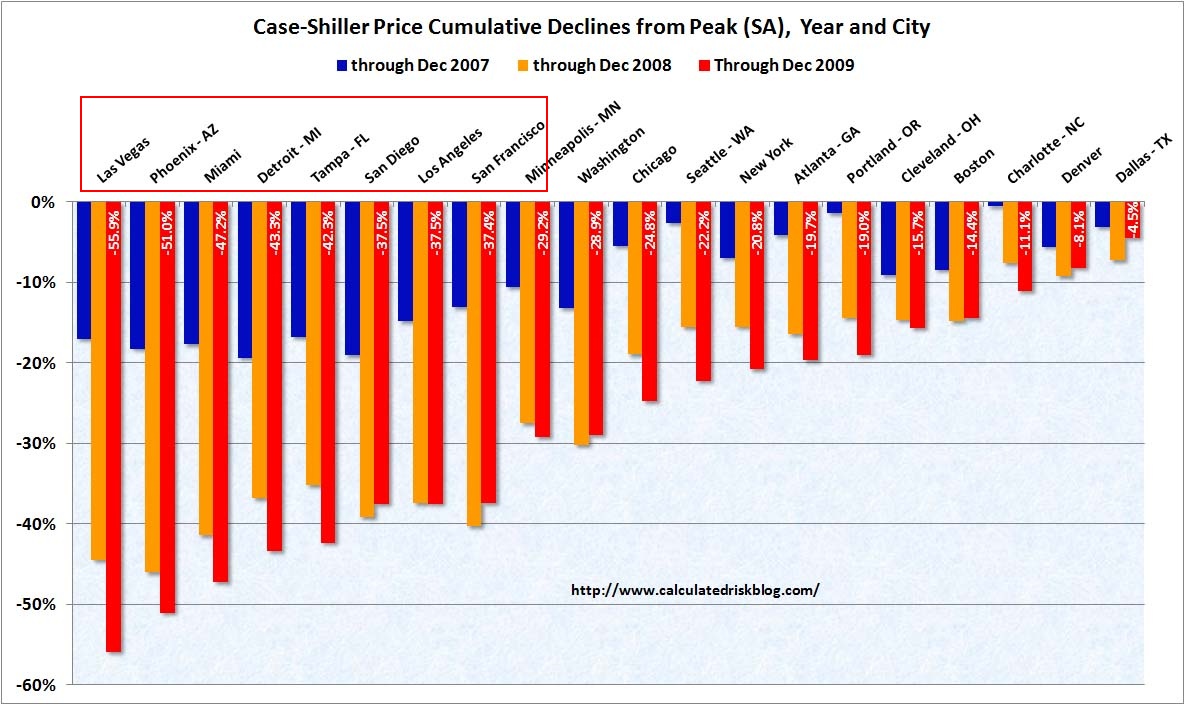

Reason #4 – Home Prices

Source:Â Calculated Risk

If you look at the above chart, the top eight areas with depressed home prices are California, Nevada, Florida, and Arizona. The one exception is Detroit but this area has seen low prices trending even before this current housing collapse. One recent stat shows that 70 percent of mortgage holders in Nevada are underwater. In California that number is 35 percent. So with these kinds of market indicators it is very likely that in these states prices will continue to trend lower. Throw in the high unemployment rate in these regions and you can understand why it is so important to get jobs growing in this country again.

Ultimately prices have to reach a level where local households can afford the mortgage. This crisis has gone on long enough where younger households, hit by a double whammy of low wages and higher home prices have seen older generations now lose their home or struggle simply to pay on a mortgage so big that nearly all disposable income is eaten by the mortgage. The idea that real estate is “always a good investment†is now gone for a generation. That is why in recent surveys many are looking to live in city urban centers as opposed to suburban tract homes. This is another reason why home prices will remain low for a good portion of time. I just don’t see a massive flood of the household formation generation heading out and purchasing homes in suburbs like baby boomers did. They will buy but nowhere close to what baby boomers did.

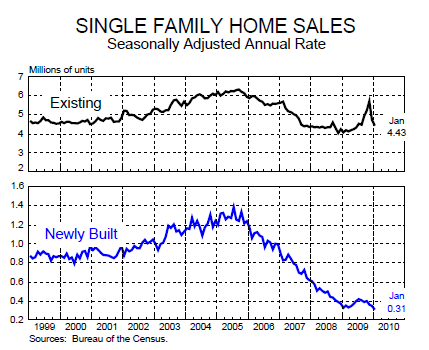

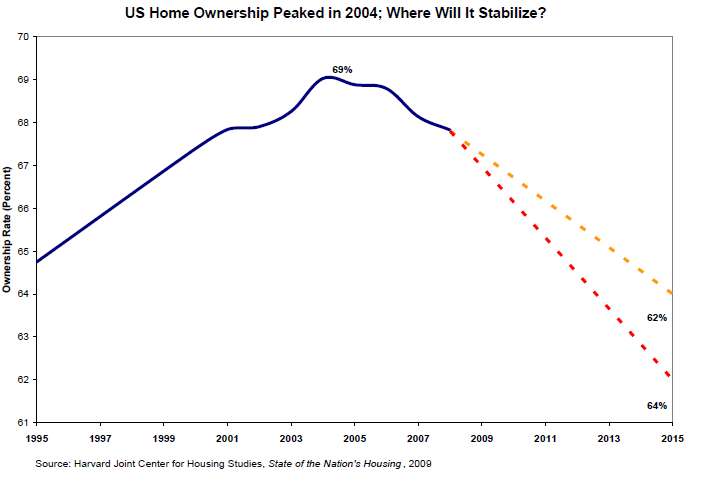

Reason #5 – Homeownership Rates

Buying a home is an opportunity that should be given to those that have demonstrated some ability to save and pay their mortgage. That is why down payments were so important. A 10 percent down payment at least demonstrates that you can save for a few months or years for a big purchase. This is how it was for generations. But with no money down loans and easy financing those who should have never bought were allowed to buy to feed the Wall Street beast hungry for any mortgages to securitize. Now, the only game in town is government backed loans. And as we saw on Friday, Fannie Mae lost in 2009 over $70 billion. I just keep recalling the day when we were told that these GSEs were going to turn a profit. Yeah right.

But we have bigger issues. The FHA with FHA insured loans is allowing people to buy homes with only 3.5 percent down. It actually is lower because people can use the tax credit in combination and make this close to a nothing down purchase. Is it any surprise that FHA default rates are now at historic levels? Homeownership is not a right but a privilege we have. This is no different from buying a luxury car. I’m sure many of us would trade in our current vehicles for a Ferrari if we could but that isn’t how the market works. But when you allow everyone access to mortgage debt they cannot support it shouldn’t be a surprise that people took on too much debt. The above chart shows that consumption part of the equation.

But now the homeownership rate is falling as millions lose their homes to foreclosure. Many more will lose their homes as toxic mortgages do what toxic mortgages do. The trend for the homeownership rate will be lower for years. Also, the weak economy is going to keep pressure on housing prices since people do pay for their home payment out of income they get from their jobs.

When we step back, the market is already telling us many things. Lower home prices will get more Americans to buy homes so having Wall Street and the government trying to prop up prices is a bad thing. In markets where demand is high prices will remain high because of supply and demand forces. Why the need for government backed easy money mortgages? Why the need for all these support programs that only prolong the misery? There is absolutely nothing wrong with renting and frankly, it is a shame that many in this country look down upon that. This is similar to those “keep up with the Joneses†folks that had to keep up with their neighbors jet skis, Hummers, and other items that sunk many families. Just look on eBay and Craigslist and you’ll see many people selling these items trying to downsize. Buying a home is the biggest purchase most Americans will take on and should be entered with caution.

There is a delicate balance to all of this and currently the market is still out of balance. How anyone can see home prices booming in the next few years is hard to understand.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

28 Responses to “The Future of America Housing – 5 Charts Showing Continued Pressure on Home Prices for the next Few Years. Household formation, Trend to Urban Centers, Lower Prices, Over Construction.”

I agree that housing prices cannot go up overall, but I am puzzled why the prices in San Francisco have gone up 15% in the past year according to Case/Schiller. San Francisco is already much more expensive than Los Angeles. Where do all these people get all this money to drive housing prices up? Anybody know?

Jobs, jobs, jobs…that is the answer. CHASE gets it, but they missed the location by a few hundered miles!!!

CHASE outsourced jobs to Costa Rica(call centers) to harrase distressed underwater homeowners here in the us. Deflation is in the works and no one can prevent it.

I have to wonder.

I am a common sense guy and everything you write is backed with facts that come to common sense conclusions.

However, something may be happening that few of us can really grasp and that is, money is morphing into something that is no longer REAL money.

What I mean by that is when you are dealing with REAL money you treat it as though it is real. If you part with it you make dam sure you are going to get it back, and you want a return for lending.

We now have a situation where the government is printing new money like there is no tomorrow, banks that can borrow that money at 0% and if they lose that money quite often they are reimbursed. So….money is becoming less real every day.

It seems the government is bound and determined to spend us into oblivion to keep the status qua. The politicians in Washington who are bought and paid for are at the helm of this ship. Washington sees the repercussions of endless printing and bailouts…..and those repercussions seem to be NIL at this point. So, if they can get away with this, why not more and more until they get the desired results?

Common sense tells me that the more our “worlds reserve currency” is abused the less real it becomes and there will come a point in time that the rest of the world will see this and it will be violent and sudden. Most will have little time to avoid losses.

So, what am I getting at? I guess that if you have cash you ought to do something with it soon before it can no longer buy you real concrete things.

I hope I am wrong and cash will buy a person more tomorrow than today but I don’t think that is possible in a world where money can so freely be tossed around.

How many Kingdoms in history employed the greatest metallurgists and Alchemists to turn lead or iron into gold so that they could expand their empires in all the ways they wished? They all failed until the creation of Central Banks and the dollar as the “reserve currency”.

If the Kings had been able to make as much gold as possible would gold still be real money?

Housing sector won’t be healthy for next 10 years…… By the time US economy catches up by 2016 or so……there would be US deficit that will make dollar plunge and hyperinflation to kick in, if not the hyperinflation case, major deflation will kick in and we will be like Japan but even worse because we don’t don’t make things here anymore……I really hope US, Canada & Mexico won’t unite in the future….

Right now, government backed financing via FHA, VA, etc… is the only game in town. The government finances 95% of all mortgages in America. Eventually the government won’t be able to keep this game going (as Uncle Sam’s financial situation worsens, he will have to place priorities and the first priority is self survival and to hell with the housing market!) on and financing for a home will be the way it used to be. 20% or even more down with adequate credit and a stable source of income.

I bought a new home in Naples in ’07 for $360k. I currently have a pending short-sale on it for $160k to a buyer with an FHA loan. I went ahead and purchased a 1600 sq ft townhouse much closer to town for 36k cash. I feel lucky to have the opportunity to deleverage. I put 10% down on the 360k house and had a 15-year mortgage. My credit is taking a hit but a debt-free life is worth it. I only wish I had run across your site a few years ago.

U.S. demographics, Kress-cycles, reduced gov. housing support, increased future interest rates, Christ Martenson, structurally high unemployment for years, commercial real estate defaults, etc. all point to a true housing bottom in the 2012-2015 period. “Radical” predictions by people like Darryl Schoon a few years back of a 50% U.S. housing collapse and 70%+ stock market collapse do not seem so radical now.

I live in the San Francisco area- homes in this neighborhood are around $700,000 to $1,300,000. Several people in this neighborhood have been laid off, and out of work for over 1 year..These are management people, marketing and sales, computer people, all with 20 to 30 years experience. These are the people who buy new cars, buy new homes, eat at upscale restaurants, and take vacations.

When people like these can not find work, the economy is going to tank further in 2010.

You fail to mention the self perpetuating cycle of mortgage holders who are underwater or very close to that point, and cannot or will not sell the palace to uproot and move to the new job many miles away. This increases unemployment, and, therefore, more housing pain……

People keep saying we don’t make anything in America.. I live in LA and we make movies and television that the whole world watches… We create entertainment… It may not be automobiles with stuck accelerators and lead based toys.. But to say we don’t create anything is foolish!

The precarious state of housing is shadowed by the fact that California State debt has reached the crisis level …. bankruptcy is imminent !!!

MartinKronicle relates that Greece and California are ine a comparative death match:

“The spreads between Greece/German bunds and California/30-yr Treasuries are widening. Investors are demanding more for carrying the risk. The downgrade in CA paper yesterday will give the Greek bonds a run for their Drachmas …

“According to a Reuters report, the spread between 10-year Greek government bonds and the benchmark Euro zone German bunds has risen to an 11-month high of 298 bps, up from 265 the day before. The high is 300 bps set about a year ago. The equivalent for Spanish bonds is trading at 81 bps premium over German bunds.

“According to an article in Bloomberg, the spreads between CA debt and the 30-year bond are also widening and PIMCO was quoted as saying that the CA debt crisis is headed back to disaster levels.

“Bloomberg: ‘A taxable California bond that matures in 2039 traded today for an average yield of 7.79 percent in blocks of more than $1 million, the highest since December 28, according to Municipal Securities Rulemaking Board data. That opened a gap of 3.15 percentage points between California’s bond and 30-year Treasuries, according to Bloomberg data.’

I predict that California will be unable to reach a budget agreement and even if it does it will have a big surprise higher interest coupon payments that will shatter its budget — bankruptcy is imminent — it will send housing and employment into the basement.

Furthermore I wrote the article A New Seigniorage For A New US Monetary Order And A New Currency Is Coming as the US has a very instable credit system … so yes get ready for “new money”

http://tinyurl.com/yfvwfd2

Nickhandle…to answer your question regarding SF pricing. There are a few things going on…SF does have many high paying jobs in finance and the nearby high tech area. Also, you have baby boomers who literally won the lottery by being born at the right time. Many of the boomers made incredible fortunes in CA real estate and the stock market. The boomer wealth is also being inherited by their children. Then you also have Prop 13 working, people who bought 30 years ago in these high priced areas will do anything and everything to keep their low tax basis and stay in their house; thus, resulting in fewer houses for sale.

Prices will eventually have to come down…you will run out of fools to sell to at these inflated prices eventually. Either that, or you will have long, long durations of zero appreciation…and I doubt most new buyers would be willing to put up with that.

The numbers for San Fran are probably skewed by the prevalence of higher-income buyers- the lower and middle tier buyers being totally priced out of the insanely expensive San Fran market. That is the most expensive city in the country to live in, never has been cheap, and is now outrageously overpriced and has been for decades.

It’s so bad there that you will pay $200K for a FRACTIONAL SHARE in a relatively ordinary high rise building. That is just insane. San Fran’s a lovely place but it is strictly for the mega-rich.

Thanks for the replies to my question. But, San Francisco is not the only expensive place in the Bay Area. Marin County and Silicone Valley also have very expensive houses. I don’t think that there are that many well paying jobs in that area. I think that these people are mortgaging their futures. They are probably using their retirement money, or something. I don’t know. It just doesn’t add up.

Also, Proposition 13 allows people over 55 to move and keep their tax basis if they buy a new house for the same value or less. (I think it is Proposition 90 that amended Proposition 13.) So, the baby boomers who bought many years ago can move without a negative tax consequence.

Of course, we make something in US like mainstream movies to Chatsworth the home of porn capital of the world but I am referring to mainly the product wise….Its all made in China and believe or not…just go to your local retail store and about 90% is made from China….. Don’t take it personally Trey, our US manufacturing sector is dead and even the service sector is about to go belly up….Lot of US customer service is going to India……. Just listen to the Wall Street to the main street, jobless rate is going up and taxes are heading to the roofs……..Gold bugs praising go will be $2000 troy ounce….. Come on people, don’t be a sheep and stop listening to MSM…… MK Ultra to our mind, wake up and lets fight the Matrix.

San Francisco is also skewed becasue of the huge immigrant population, in particular Asian families. In Asian families, owning property is extremely important to demonstrate financial stability and becoming prosperous.

Chinese families feel it is their duty to pass apt. houses, etc. to the nextt generation. North Beach used to be almost all Italian. Richmond District used to be mainly white blue collar workers. Both areas are not predominately Asian.

You can walk for blocks in either neighborhood, and not hear anyone speaking English. These are industrious, hard working people, building the American Dream.

Martin,

Your not alone with your opinion – I completely agree with. My dilemma is do I jump in and buy or continue to wait – both options seem to be high risk.

Doc, I have been watching this for a few years now from Newport Beach. I am renting and would like to buy somewhere in the near future (next 2 years, not immediate future), but your posts while great seem to neglect areas that are still somewhat in the bubble (or seem to be). For example, pricing for houses that were 200-400K 10 years ago are still at 1.0 mil. for “as is” houses. To me, a million for a 3/2 is crazy money. These houses (I rent one of them) to me are worth about 400-500K tops, and I moved here from an expensice DC suburb, so I know what expensive is like in other higher priced areas (though nothing seems to beat CA for $$$$$). My question is, is there any relief in sight for areas like Newport Beach? Are all of the people here on ARMs and under water, or are they going to retain their “cost value” (as opposed to intrinsic value, IMO).

In engineering this is called a cascading failure.

~

Tim puts his finger on the important mindset–everything feels risky at present. Because it is. What the mainstream housing people can’t grasp, or accept, is that this isn’t just a slow time for selling houses as usual.

~

Doc keeps trying to wake people up to the absurdity of resistance to housing price downturns and the dream that it’ll one day be 2006 again, and forever. He has often said, and many of us agree, that the only way this market distortion can continue to happen is either not at all, or if money ceases to have any meaning, which will then raise other problems.

~

So to go back to DHB’s point about “new household formation,” those numbers, formulas, and expectations were, and still are, based on notions of society, economy, family, etc., that are rapidly dying out. As is inevitable when people can’t afford in the present what they could in the past BY WORKING AND SAVING. And when the system is completely distorted into a scammer’s dream casino theme park.

~

Two years ago in a cafe I ran into a yachtsman from SF who was slumming it for the day in our backwater town and obviously eager to bend someone’s ear. He quickly brought up the economy. He opined that he was doing well (house in Marin, condo in SF), had nothing to worry about, an oddly telling thing to say to a stranger in a small town, I thought. He went on about this, I listened but didn’t volunteer anything, so I guess he figured I agreed.

~

At one point he said confidentially, “The thing is, it’s just as easy to ride to the top when things are going downhill. You can just stay put and end up on top. You can get even richer in times of chaos. And with things being so low, you end up even higher.” I was finished with my coffee, so folded my book closed, put on my messenger bag, and replied, “You’re correct. Though it seems to me that what you’ve won, from where you look down, would be of questionable value. As would the view.” He stared at me, and I’m afraid that although I said it gently, he might have taken it really to heart. He was staring at the wall when I left, and I looked back in the cafe window.

~

Bears don’t always roar.

~

rose

NickHandle and Crane,

If you travel to an area like Shanghi or Beijing, you will find it quite common for an 800 sq. ft. townhouse to sell for well over 1 million. To own a house with land close to work…..forget it! If there is an open house, there could be over a thousand people looking at the place in one week! People pay cash frequently. Their GNP is over 10% per year. The money we used to have here is over there now! So when they come over here, a house with land with a great school district is a steal for less than a million. Let’s face it, we have been sold out years ago. So there will always be small pockets of neighborhoods that will hold their value.

D1,

Those million dollar condos in Beijing and Shanghai are in a bubble too. If you go a few blocks away from the beautiful new buildings in those two cities, you will find severe poverty. The vast majority of the Chinese do not even have healthy drinking water. The Chinese communists are more capitalistic than anybody I have ever seen. There are a very few very rich Chinese and some foreign speculators who have driven up the prices in the central part of Beijing and Shanghai, but most of the people who work very hard are still very poor. The Chinese economy is booming, but the crony capitalists, or should I say the crony communists are the ones who are benefiting.

By the way, you can also go to Budapest and Prague and see million dollar holes in the wall. Those are bubble prices too. They have speculators and crony capitalists all over the world.

But, I agree with you. The Chinese are very industrious. It’s just that the people at the top keep most of the profits.

Well, I’m confused. All my coworkers are convinced now is the time to buy saying in two years I’d have plenty of equity. :p

My question is, how do we get past the cultural idea that you’re not a real adult until you own a home? I feel like I always have to apologize for being a renter, even though it makes sense in the current situation.

I enjoyed this article very much but it totally neglected to discuss one of the very real reasons for this downturn and the housing bubble which were simply because of the securitization of the so called “loans” and fraud perpetrated by the banks when they formed Merscorp and it’s subsidiary corporation called MERS. MERS is the named the beneficiary of 60 million mortgage loans in the US alone. The banks seperated the Notes from the deeds and hid all of the transactions behind MERS ( Mortgage Electronic Registration System) they used the over stated appraisals and made loans to anyone with a pulse and then bundled the notes, got false triple AAA ratings on the Trust Pools and made a ton of dough off your promise to pay. They have already been paid back the money you owe on the “so called loan” and then when the borrower goes into default because they no longer wish to pay for an underwater house that will never recover the value that they were lied to about to begin with, then the bank as a member of MERS can simply name 2 of thier own employees as “officers” of MERS and assign your Note that has in reality been sliced and diced and they no longer even know where it is, back to themselves and proceed to steal your home and the borrower is none the wiser. The borrower was used, and abused and basically has no protections other than in bankruptcy courts and in judicial foreclosure states. My servicer Indymac is also a lisenced REAL ESTATE BROKER. Isn’t that a little bit of a conflict of interest? It all comes down to a handful of international bankers that own the privately owned company called ‘The Federal Reserve”. There is nothing Federal about it. It is as Federal as Federal Express. If you want to know the truth about why we are in the recession or any previous recession please do a search for The Money Masters at http://www.freedocumentaries.org Don’t be fooled by this talk about putting a larger amount down. I put 20% down and invested my life savings into my beautiful home on a half acre with horses pool putting green etc. etc. and I am still $250,000.00 underwater. I lost everything I ever worked for my entire life and had a low 30 year fixed rate! There is more to it than meets they eye! Don’t be a dupe. check out the documentary I refer you to above. Also, check out http://livinglies.wordpress.com

Dave –

The answer is…..we wait. Or, use your war chest to buy a rental in Vegas or Phoenix while the getting is good. You can something more culturally adult than home ownership — being a landlord!

Dave –

I’m not sure how our society will ever get past the obsession to own, which wouldn’t be a bad thing if the end result was to actually own the home. Unfortunately our society has equated home debtorship with home ownership, such that once you sign the papers you are called a home owner even though you are really a home debtor for years, if they ever end up “owning” the home. It’s not just cultural, it’s institutional with the government providing a tax break allowing you to write off the interest on the loan.

Dave-

I give up on explaining to people the economic and financial savings of renting vs “buying” (home debtorship). I keep telling coworkers, friends, relatives, etc… that it only makes sense to “buy” a home when the cost of renting an equivalent place of shelter is the same. Also, you have to run the numbers (the total expenses of home ownership like property taxes, insurance, maintenance, utility costs, etc…) and compare the costs to renting. Add up all of those numbers and you can see before your very own eyes which option is best for you.

Yet, every single time I present such an easy and logical premise most people will still disagree. Yes indeed in our country people are obsessed about “owning my own home” “it’s the American dream”, “do you really want to live in a stinking apartment your whole life”, etc….

Doc, no matter how inappropriate it sounds, but the fact is american empire is on dyeing bed and there is no bubbles is China or Prague to feel better. How much have dropped the RE prices in Spain with 20% unemployment? 10%!? How, how come, why only 10%?

There has never been empire on a down slope to get back… The big picture is quite more scary than your narrow minded topic RE bubble. Keep on preaching and fight the delusion of the American public with delusions that we just need that little twik in the system and America the great is back, just around that corner… Fight fire with fire!

This should be mandatory reading for everybody in Congress.

I Just received a newsletter from my Congressional Representative with a new plan they have been discussing with Nancy Pelosi on using “treasury funds” to help lenders modify loans to today’s true value of the home.

When the homeowners eventually sell after the modification … the Homeowner and the lender split the “profit”.

Amazing….

Leave a Reply