The Financial Psychology of Moral Hazard and Strategic Defaults: How to Destroy the Economic Fabric of Society by Providing Benefits for Financially Irresponsible Bets on Housing.

The housing boom and bust has created one of the most corrupt financial systems in history. Now this in itself isn’t the shocking news since throughout history countries have proved over and over that connected governments and toxic businesses will siphon off money from the productive classes for exercises in bubbles (i.e., South Sea, tulips, technology stocks, housing, etc). Yet this is probably one of the first financial collapses where nothing was really done after the knocks were taken. The vast majority of Americans are scratching their head ever more impatiently wondering when the real reform is going to come down the pipeline. Wasn’t it only in March of 2009 that the global financial system was melting down like the Wicked Witch in Oz?

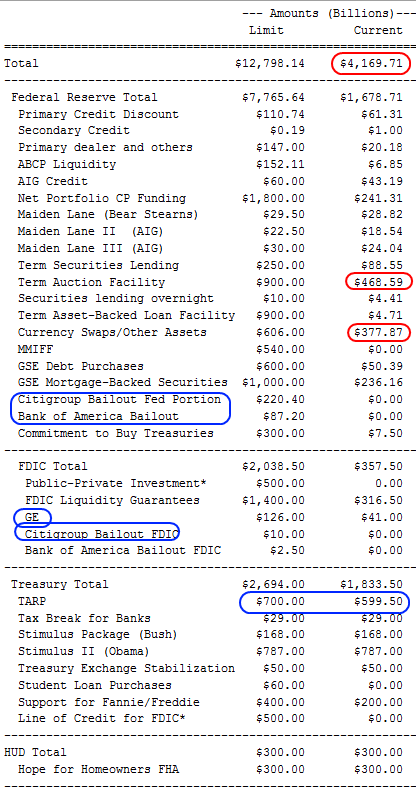

Many are now referring to the optics of the current situation. The fact that banks received $14 trillion in financial backstops, backed by the American taxpayer and government, has left many believing that our government is willing to backstop the most ill managed companies in the entire country. If you look at a list of who received bailouts, it looks like a list of the primary culprits of this economic mess. When people think about the bailout, they usually only think about the TARP list:

TARP is merely a tiny sliver of the entire financial bailout. Keep in mind that banks indirectly benefit from the U.S. Treasury and Federal Reserve cooking up schemes to buy up mortgage backed securities and artificially lower interest rates. In fact, anyone looking at current actions would assume that the U.S. government and Wall Street have a mission of keeping home prices unaffordable for most Americans. The reason Americans went off and took on such enormous amounts of debt is because home prices were simply distorted and much of this came from the irresponsible banking sector.

In the past such excessive risk was punished by those perpetrating the bubble being annihilated. The market in some sort of disjointed way would wipe this excess out. However, in this case those responsible have actually gotten bigger and infiltrate the way policy is done. This is like you crashing your Geo Metro and getting a Lexus as a replacement. Crash that Lexus and who knows, you might get a Ferrari. There is very little in the way of payment protection insurance in the current market.

I’ve been getting many e-mails from readers and what they share tells me a lot about the current housing situation. People, like banks are looking for the easiest way out. Not everyone is looking for this obviously but many that I have talked to in California are. Some quotes that I have gotten go like:

“Unless the banks work with me, I’m not paying anymore on this mortgage.â€

“How dare we bail out banks and we get nothing back. I’m going to stop paying on my mortgage and see if they still want to negotiate.â€

“I’ve been sitting in my house making no payments after 1 year and the bank hasn’t contacted me. I’m just saving up and when they come, I am out and getting a rental. No way am I paying for this.â€

This or a variation of the above is usually what I see. Rarely do you see someone say, “I take full responsibility and even though my payment is high, I’m going to stretch it out to pay as my rightful duty.â€Â And why should homeowners do this? Banks are the most irresponsible culprits in this mess and look at the amount of bailouts they are getting! So any outsider looking at this system would find this gleaming rule:

Take as much risk as possible to the point that if you fail, the government has to bail you out. If you succeed, all the profits are your own.

In other words socialize the losses and privatize the gains. A perverted form of corporate welfare. The Alt-A and option ARM products are only one example of what occurs when people believe in the above system. Now think of someone that took out that option ARM. Implicitly they were believing housing prices were going to go up (a bet). Many went zero down so this was the equivalent of a call-option. That is, if the home price went down your only loss was your credit (which at this point matters little since crony Wall Street with all their horrible bad bets seems to have access to more and more money). On the other hand, if home prices went up which they were for decades you would make out handsomely with no money down. A very hard bet to resist especially if you are not familiar with economic history (and many aren’t).

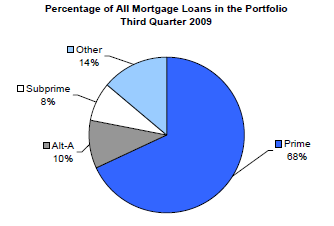

If we look at the overall composition of loans in the U.S. we will find many toxic mortgages are still outstanding:

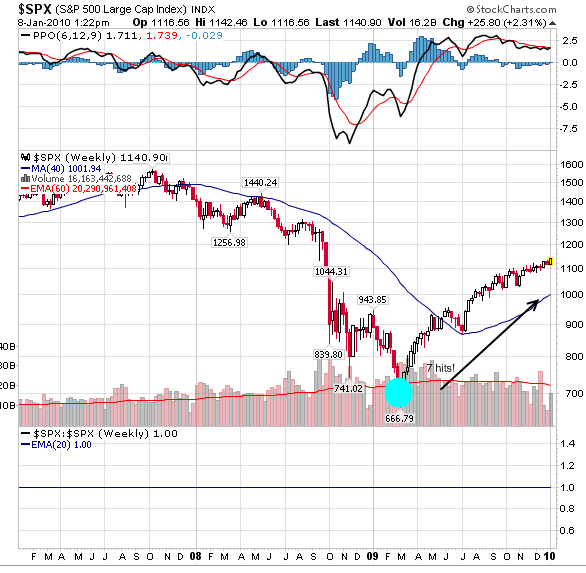

I find it to be the height of hypocrisy that banks are now “discussing†principal reductions as if they are doing some kind of favor. These banks would have been nationalized long ago without taxpayer funds! Their record profits have come from gambling in the recent Wall Street rally. So now, after they placed all their money (taxpayer funded) on 7 red and won, they now want to give some money back to underwater homeowners as if they were doing the nation some kind of favor. You really can’t make this kind of thing up:

And guess what happened? This mega bet paid off for the banks:

So now the issue of strategic default, that is not paying your mortgage even if you can, is becoming bigger and bigger:

“(NY Times) John Courson, president and C.E.O. of the Mortgage Bankers Association, recently told The Wall Street Journal that homeowners who default on their mortgages should think about the “message†they will send to “their family and their kids and their friends.†Courson was implying that homeowners — record numbers of whom continue to default — have a responsibility to make good. He wasn’t referring to the people who have no choice, who can’t afford their payments. He was speaking about the rising number of folks who are voluntarily choosing not to pay.

Such voluntary defaults are a new phenomenon. Time was, Americans would do anything to pay their mortgage — forgo a new car or a vacation, even put a younger family member to work. But the housing collapse left 10.7 million families owing more than their homes are worth. So some of them are making a calculated decision to hang onto their money and let their homes go. Is this irresponsible?â€

This perception is permeating throughout the country. People ask, why should I be paying on my bad bet if the financial leaders in this country not only are ignoring their bad bets but getting handouts as well? It is a good question to ask. And thanks to the flow of information both manias and busts spread much faster. I remember when Zillow was in its infancy during the bubble and people kept looking at “Zestimates†to confirm their bias that housing prices only go up. Then they would e-mail that link to friends and families and say, “look, I made $100,000 in equity in one year!â€Â In California this was common yet never in the e-mail would they say, “and all this was due to the help of my Alt-A and option ARM.â€

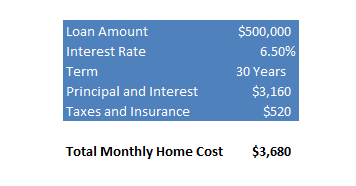

What is more troubling is the inconsistent amateur hour at how banks are handling this mess. One major issue is in some areas, banks are moving on foreclosures in eradicate patterns. That is, they seem to take over homes in the normal fashion (NOD-NTS-Auction-REO) in timelines that make sense in some cases and in others they don’t follow any pattern. Here in California, we have some homes that go 18 months without payment and finally are taken over! The timeline discrepancy is huge and probably encourages many to opt to do a strategic default. I mean think about the actual numbers. Let us assume a best case scenario where you bought a home with a 30 year fixed mortgage and your loan was $500,000 at 6.5 percent:

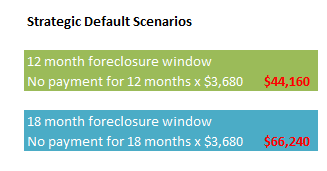

You bought at the peak in 2006 or 2007 and now that home is worth $250,000 to $300,000. In other words, you are massively underwater. But now knowing that you have 12 months to even an 18 months of a window before you are kicked out, what do you do? If you are smart, you can play hardball with the bank and flat out stop making your payment. Now, you are even in a better spot than a renter since most people that stop paying their rent face evictions rather quickly. In this case, you have bought yourself some time. How much can you save with a strategic default?

Now here is where it gets interesting. Say that your current monthly payment consumes a large part of your net take home pay. You were always planning on selling the home for a massive profit. Now you are underwater like 30+ percent of California mortgage holders. It is unlikely that you will see your peak price anytime soon. Short of the bank dropping your home price to market value (aka principal reduction) it might make sense to stop paying. Just look at the above chart and see how much money you can “save†before the bank kicks you out. Many people never get a window of 1 to 2 years of no housing payment (rent or mortgage) once they enter their full adult life. So you can understand why so many people are gearing up for strategic default.

And this psychology stems from one item that seems to be ignored. Upping the down payment requirement. Assume we had a minimum 10 percent down payment someone walking away from the above mortgage is leaving $50,000 on the table. That is a sizeable amount and would make someone think twice. But with zero or little down, the numbers are very beneficial to those walking away and many in Alt-A and option ARMs are running the above scenarios (assuming they can even pay their mortgage).

And banks with shady one sided information hubs know this:

“(Bloomberg)  When principal reductions were granted for pay-option adjustable-rate mortgages — loans with high default rates because they enabled borrowers to pay less than the cost of interest as the principal increased — the re-default rate after 60 days fell to 6 percent, according to Mortgage Metrics.

“In terms of incentive, you have more skin in the game or less negative equity to deal with,†said Fred Phillips-Patrick, director of credit policy for the Office of Thrift Supervision.

Many banks don’t want word to get around that they reduce principal. They fear that homeowners who can afford their payments will demand better deals. John Lashley, a 44-year-old salesman in Huntersville, North Carolina, is making his payments. But he is thinking about walking away from his four- bedroom home unless his lender, Sun Trust Mortgage, agrees to cut the principal on his $345,000 loan.

The house next door recently sold for $260,000, and Lashley doesn’t see the point of pouring money into his house when he may never recoup the investment he made in 2007. “Why should I stay in my house?†he says. “It’s not a moral decision. It’s a financial decision.â€

Well of course re-default rates fell. You cut the loan! Cut my monthly expenses by 30, 40, or even 50 percent and life would be much better. Of course banks don’t want this kind of idea to spread because they want to suck dry struggling/non-struggling home buyers as much as possible while leaching off the U.S. government which only gets its funding from the same exact source of people. Banks are screwing people on both sides of the fence. And look at the above quote. They are right, this isn’t a moral decision but a financial one. Those in the banking and housing industry that argue the morals of paying your mortgage are absolute hypocrites and really have a major source of cognitive dissonance.

If we want reform we first have to institute a minimum 10 percent down payment requirement. Period. No government tax breaks etc. For most of the good healthy history of housing 20 percent down payments were required. No wonder why we didn’t have ridiculous bubbles. This also moderated price inflation. Plus, people will be walking away from a sizeable amount of money they saved if they decide to walk away. That is why even in the previous bust in California we saw people walk away but it was more painful. Now, psychologically people are walking away and sleeping like babies at night. Nothing wrong with that. Banks have been sleeping like babies in a gold crib for decades.

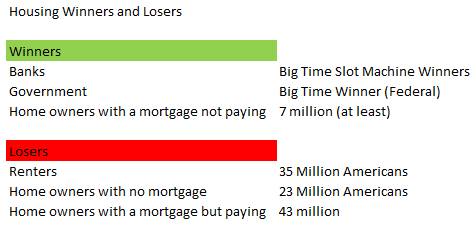

Yet the majority of prudent responsible owners are furious. Let us run the numbers of who is really getting screwed:

Should be pretty clear that our housing reward system is not functioning at all. The vast majority are not happy with what is currently going on and the numbers above show that something will have to really change, the number of those being fleeced is too big to those who are gaining.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

53 Responses to “The Financial Psychology of Moral Hazard and Strategic Defaults: How to Destroy the Economic Fabric of Society by Providing Benefits for Financially Irresponsible Bets on Housing.”

Just so good. Ave, DHB.

~

One thing we’re observing here is that there is a currency besides debt: it’s the human virtues of belief and trust. These have been the real currencies behind interest-based banking since the Sumerians. I.e., you can’t have a nation- or empire-wide system of banking unless everyone agrees to believe that this bulla of clay tokens with incised symbols on the outside actually stands for real sheep and goats and oil and grain. Manipulation and development of that belief is pretty much what the “history of capitalism” is all about.

~

My biggest concern about this economic fiasco is just that: that the global manipulators, the privatizers-of-gains/socializers-of-costs, now operate within a mostly psychologized currency, which is automated to boot. They manipulate “value,” but “value” is just individual psychology interwoven with mass psychology (what someone is willing to pay at a given point in time, given what others also are willing to pay).

~

Related to that and on the more personal level, my partner and I have been steaming at the ears that when we created our mortgage deal and budget, we did so with the utmost of conventional prudence. At present, we are fortunate not to be facing default or underwaterness. I always assumed that our house was overvalued and I did my level best to pay up front what I should have been worth, which led me to getting the seller to take a 10% cut; I bought in a dip just before the big run up, and the seller was “motivated” as they say.

~

But what this means is that, while others are figuring out how to game the system like the big boys–just as they did with their crap toxic lethal mortgages and HELOCs–we’re living prudently. We can expect no game or bailout short of really disrupting our lives.

~

This comes back to my point about psychology as currency. We literally balance the psychological costs of gaming/bailing against the psychological costs of sitting tight and steaming at the ears that responsibility is punished while recklessness is admired, rewarded, and even institutionalized.

~

What bothers me even more is that this human-centric drama of capitalized Belief bears no resemblance to how anything works in nature. This is why economics and finance as we have them simply are not sustainable. In trying to escape nature’s natural prunings and whittlings, we have created something more dire and extreme.

~

rose

The banks have created this mess, now it is time for the people to set things right.

What would happen if everyone stopped paying their mortgages and saved their money for down payments when the banks finally have no choice but to sell their foreclosures for properly adjusted market rates?

Dr.H,

Don’t be silly. These people living mortgage free aren’t saving any of that money. They’re spending it on crap like a new car when the old one works great. And those new 3D TV’s are going to be in stores soon. You can’t change a moron into a genius. When the banks finally evict them they will have nothing to show for it. Once a moron always a moron.

I’ll also add this: My family and I gave up our home in 2008 and got the bank to agree to a short sale nearly a year after we moved out. At the time I felt morally obligated to give the home to the bank since we could no longer afford it. I now wish we had stayed in the home and saved during that year. If we had done so, we could have kept our savings for a down payment in 2012.

Preach it Doc! If it wasn’t for my $100,000 down, I would have walked a long time ago. Now I’m just pissed that the money is gone, and I’m STILL upside down. I stopped paying and forced the hand of Chase (corrupt bankster institute) to get a 2% loan for 5 years, and then raise by 1% to cap at 5% for a 30 year amortizing loan. I’m *still* thinking of walking because I can RENT cheaper than own.

Now all we need is the Police State to start enforcing the corrupt bankster laws!

People aren’t fed up enough, so I look to another year of people voting banana republican or defacrat. If your angry, look in the mirror, stare yourself in the eyes, and say aloud….”F You”.

And what about those who managed to sell their house at a loss to themselves but paid the bank back their free money, after paying for a massive mortgage for years and years?, with savings/money they earned through years of hard work and sacrifice?.

This is what I have just done in aussie, I can see the collapse coming but now “mortgage reductions” are coming to fruition in the US, they are bound to happen here as well when the sht hits the fan, this is why society is joke you do the right thing you get screwed!, no wonder it is a mess, fractionalised banking is a rort like no other.

Start again I guess.

What would happen? Those who overpaid and then went ‘deadbeat’ would be able to buy up the foreclosures for cash, probably outright or close to it. Those who were responsible mortgagees or renters would be locked out, having never had the opportunity to live rent-free and save like the deadbeats did. This is insanity.

There needs to be a massive 100% ‘windfall profits tax’ on those unmade mortgage payments to reclaim this money and move the irresponsible over-bidding deadbeats and get-rich-quick flip-failures to the BACK OF THE LINE. They shouldn’t even be allowed to bid until every renter, public-housing dweller, and homeless person has had a crack at the unsold inventory without competition from the deadbeats. They can then go back to wildly overbidding each other on the remainder and go bankrupt again without bothering the rest of us further.

I’m not sure the debt relief act is still available. If not, all those defaulting will get a 1099 for the amount they did not pay the lender. And try defaulting on the IRS.

Any underwater homeowner who could save 10% of the current value of their home in 4-5 years while renting a similar home should stop paying. In 5 years you will own a similar home to the one you live in now, and you will owe at least 10 % LESS than what it is worth today. An example — you bought in 05 for 500k and owe 450-500k, the home is worth 350k, you walk save 35k over 5 years and buy a similar home for 330k (modest depreciation), in 5 years you will have a 295k mortgage.

Doc you write “And this psychology stems from one item that seems to be ignored. Upping the down payment requirement. Assume we had a minimum 10 percent down payment someone walking away from the above mortgage is leaving $50,000 on the table. That is a sizeable amount and would make someone think twice. “

>>

Well no it wouldn’t – at least not in the example which you gave. Let’s do the numbers.

>>

Purchase price = $500,000

Downpayment = $50,000

Mortgage = $450,000

>>

Monthly payment (30 year/6.5%) = $2844 + taxes/insurance $520 = $3364

>>

Current value = (using an average of the numbers in the example) $275,000 (45% DROP in value.)

>>

Amount underwater (purchase –current) = $225,000

>>

As you can see, that downpayment is already gone with the wind and is history. It will be the LAST thing to be recouped when and if the house ever rises in value.

>>

Amount saved if stop paying and have an average of 15 months until bank forecloses = $50460.

>>

Right now they get back their $50,000 if they stop paying and have 15 months before the bank kicks them out.

>>

If they keep paying and have 27 years left on their mortgage, they will spend $921,456 more on that house.

>>

Say they walk away, keep the $50,000+ they would have paid during those 15 months and in 3 or 4 years buy another house similar to the one they let go and pay roughly the current market value of such a house of $275,000. They put down that $50,000 they had saved. Assume a 30 year/6.5% mortgage. Their payments would be $1942 ($1422 Principal and interest + $520 taxes/insurance.) Over the next 30 years, they will spend another $699,120 on that house.

>>

Walk away from this one. Save the money that would have made those 15 months payments and use for a downpayment in a few years. Later buy a similar house at a far lower price. Save $222,336 over the next 27-30 years.

>>

Pretty much an no-brainer on this one – even WITH a 10% downpayment. (And it wouldn’t really change if it were 20% down. Might if they had 35-45% down but that is unrealistic for the majority.)

>>

BTW all the die-hard right-wing Milton Friedman followers should see nothing wrong with walking away in such a situation even when the borrower can pay. Friedman assumed all human behavior is designed it maximize economic gains and is ‘logical.’ Ergo all that ‘moral duty’ stuff about paying up even when it is a losing proposition is nonsense by his theories. Walking away is only logical . It is, after all, a situation of “tell Michael, it was just business.â€

>>

And did you hear any of the Wall St nitwits pratting on about the ‘duty to pay’ when Morgan Stanley walked away from those office buildings in San Francisco because their value had fallen and MS owed more than thy would ever be worth in decades? That ‘moral duty to pay’ seems, in Wall Sts eyes, to be reserved for the Main St suckers.

Fred,

You are wrong about us not saving it. I’ve saved $50,000 in the past 12 months while not paying my mortgage and still the lender has not kicked me out. I figure this will go on 2-3 more months, but who knows at this point. BOA still claims they do principle reductions under no circumstances. My biggest mistake was not investing that money into this phony recovery(short term) or I could have $100,000. I haven’t bought a single item over the last year and for gifts I always ask for gift cards. The doctor is absolutely right… if I had put money down I’d never walk away(I didn’t put 1 penny down). Of course had they required a 10-20% down payment I would not have been able to buy at bubble prices.

Real estate listings, filled with hyperbole, are not my favorites, but this may be the all time worst listing, EVER.

Go to knifecatcher.com and look for the listing for 23 Castlebar Place.

The listing is almost unreadable, and the house is just as interesting. The entire interior was designed to look like the interior of a Cruise Ship .(Think “Love Boat”,circa 1970.) And the front deck, which faces San Francisco bay, is shaped like the bow of a ship!

Dear Swiller, blame yourself not Chase. You signed the mortgage.

…or was it also the corrupt whoever who forced you to buy that great extended warranty, become convinced you needed the new air filter while at Jiffy Lube, etc., etc.

It’s not the banks fault (or the those who pay taxes) that you’re a moron.

I agree with you Fred, the reason they had no money for a down payment, is they can’t save money. They just spend until there is nothing left.

Hi Doc:

Really great post! I agree that if hard earned money was required for a down payment, most people will and/or would think twice before defaulting. It’s really ridiculous, how over the years we would have to read about homeowners on the verge of foreclosure who never put down any money in the first place complaining that they bought a huge house without factoring in affordability and in return they obtain governmental assistance to the detriment of those who choose not gamble and are waiting for affordable housing.

I really appreciate and thank you for all of your dedication and hard work on this important issue.

Ok, that is it. I AM GOING TO FUCKING LOSE IT. I read in Bloomberg news that banks may decide to reduce the principal balance owed by home debtors so they can stay in “their” house. So in other words, the irresponsible idiots will benefit while those who rent, bought a home they can afford and people who paid off their mortgage lose out.

Doctor Housing Bubble,

AHMEN ! ! !

Almost no one wants to talk about the moral hazards of all the bail-outs.

When one examins all the participants of this fiasco from the realitors, borrowers, lenders to the politicians what one notices through-out all these groups is sleeze. And in true Liberal form many of them get on their high horse and cry “vicitm”. Then stick their hand out for money.

Doctor what is the correct way to deal with this situation?

<

I think everyne here knows the answer. I do and it is not that difficult. It is the golden rule that has existed in western culture forever; With notions of self-sufficiency, honor, managing your risks, and staying within your means. Conservative and traditional values have always espoused these ideals, and if one lives, lends and governs by them one can't go wrong.

Conservatives understands the core of human nature, and know that no matter what changes in our world human nature dosn't change.

A conservative lender would always require minimum 20% down, good credit, and a solid conservative appraisal. What went wrong was straying away from traditional and conservative practices of lending.

<

The same straying has happened in the values and attitudes in country. Now many just want to claim the coveted liberal "Victim" status.

Here is an example of someone I met at a New Years party two weeks ago who is doing a great job of takeing care of themselves: They bought a 2000 sqft. house in Lancaster, Ca in 2006. (This area has been devistated and I have no doubt that 50% of the value is gone.) They are not living in it, instead they are renting the house out and they are renting an apartment for themselves. They are not doing a loan modification, and they are not doing a short sale and they are not defaulting. They are under a lot of financial pressure to pay the mortgage minus the rent, but they are doing it and are not asking for any hand outs from anyone. I told the couple my hat goes off to them and said that I respect them for their resolve.

I respect these people because they are acting honorably, and are not burdening anyone.

>

My mother always use to say ” the people who truely need the help usually never ask for it.”

@Rose

Great writing again. You’ve expressed beautifully some of the thoughts I’ve had, as well. Wall Street has elevated itself to a deity status, even claiming they are “doing God’s work”. You just gotta believe. They are using the same tactics any governing religion had done through the ages–bleed the masses for their sport and pleasure.

We’re all becoming heretics though, I’m afraid. We don’t see Wall Street as the way and the truth and the light. The President has devolved to GS televangelist.

I am reminded that the S&P 666 was the final capitulation to the golden beast. We have delivered our sacrifice to the host of demons that have taken over from 85 Broad Street, the gates of Hell. Not to praise the CNBC wisdom is just Sach-religious.

@Fred

As Emmit Smith used to say, a leopard can’t change his stripes. I bet a lot are rationalizing that they will start saving that money soon, while dropping two bills on dinner and bragging about their 1080p 240 Hz Blu-ray home theater or blow it in Vegas. But some might pull out the granite countertop and sell it on craigz list, stash the unpaid mortgage and drop it in their money market account a pull a hefty 0.08%/year.

We can all cry and point fingers at each other…blah,blah,blah. We are humans only worried about ourselves. Damn humans always screw things up no matter what. 500 years from now nobody will care because we have other very real problems in life coming down the pike. Everyone, please do what you want because that is the way it will always be. And we wonder why we have not made any contact with other inellegent life because when they get within 100 light years of planet Earth they turn away and say, ” we will swing by in about 500 years to check for intellegent life…not going to happen.

Comment by Nimesh Patel

January 8th, 2010 at 11:39 pm

Ok, that is it. I AM GOING TO FUCKING LOSE IT. I read in Bloomberg news that banks may decide to reduce the principal balance owed by home debtors so they can stay in “their†house. So in other words, the irresponsible idiots will benefit while those who rent, bought a home they can afford and people who paid off their mortgage lose out.

____

Ah the “I hate (fill in the blank) are out in force.

(1) “the irresponsible idiots” – what does your attitutude about those who overpaid at bubble prices have to do with the current value of the property? (Must get lonely being so sanctimoniously nasty all the time.)

>>

Even if (and it is a HUGE if) banks decide to write down principal (something they will probably only do under pain of death), so what? The bank is NOT going to write down the principal any further than the current value of the property. If they don’t write it down now by reworking the loan, then they will write it down even more when the foreclosure finishes in a few months and they put it on the market after prices have slid even more. One way or another, they WILL write down their book value on the property.

(2) while those who rent, bought a home they can afford and people who paid off their mortgage lose out.

>>

Why are those who rent ‘losing out’ if the banks are forced to reduce their book value on a property to current value through rewriting a loan and reducing principal? Same result as if the property went through foreclosure – the bank has in its records a lower value for properties in that neighborhood. Prices STILL end up lower.

>>

Why are those who could afford a 30 year fixed mortgage for that house at a bubble price ‘losing out’? They will LOSE on the value of their home no matter what since they paid an inflated and ridiculous price because they didn’t figure out that it was inflated. Doesn’t change the result on the value of the house next door whether the new value comes through a write down of principal to current value based upon an appraisal or through a foreclosure sale. The value of the house next door goes DOWN in either case and the value of their house goes DOWN no matter what. Just because they could afford the mortgage for the bubble price house doesn’t mean they didn’t overpay for that house when they bought at an artifically inflated price and were not stupid for paying the bubble price – and now, if the price has fallen enough then it would only be logical for them to walk away.

>>

Why would those who ‘paid off their mortgage’ lose out? You can not seriously be claiming that there and throngs out there who bought at a bubble price in the years 2000 -2007 and have paid off the mortgage! LOL!!!!! And exactly how many households would have been able to buy and pay off the entire mortgage in 9, 7, 5 or 3 years? ! And if someone bought back in 1977 so that they paid off their 30 year mortgage in 2007, they would have been paying off 1977 prices – not 2005 prices – so what does it matter? The 2000 -2007 prices were so grossly inflated and out of touch with the reality of incomes that all the “equity” was a pie in the sky illusion that never really existed (and wouldn’t exist until they sold the place.) This assertion is utter claptrap

>>

I’m reading a lot of whining, hate and vindictiveness frrom those yelping “Me me me – I want mine and I want everyone else on the streets…….kick ’em out, punish em, off with their heads” I can assure you all that even if everyone who overpaid during the bubble were kicked out of their homes so that you could buy the house at a lower price, there would be more houses than you all could possibly buy up. All of this is childish and greedy as those who thought they could make money out of nothing and used an option ARM to buy a property in the hope that it would increase in price and they could sell.

Well gang. Some of us are self employeed and can not get a refinance or loan modification even though we are paying our upside down (Paid $425,000 and recentely reassessed by County Tax Assessor at $277,000) monthly payment of over $3000 a month. Explain to me why we can not get a loan modification because we do not qualify for the reduced payment while we do qualifiy for the current higher payment. Banks will only help those that are not responsible, do not pay on time or at all, and can claim some imagined hardship. When our payment adjusted we went out and got a second job each. When everyone is talking about houses we are still living in our “home”. This is where we raise our children and grand kids, take pride in our ownership, mow our lawn, paint, etc. This is where we own businesses that benefit our local community. This is where we practice our faith. This is where we help those truly in need through charitable work. THIS IS OUR HOME! Not a cold financial investment that we need to figure out how to squirm our way out of our obligation to pay as AGREED when we took out our loans. By the way try to become a renter with no say in your enviornment, can’t paint the bedroom blue for your kids, every anniversary of the lease look for an increase, never and I mean never ask for a repair from the owner, have no security from the owners sister wanting the house and now you are moving every 12-18 months (costs a lot to move an entire household), let alone no continuity for your family. That’s how renters live and once you have owned your own home it is an entirely diffrent experience.

A large portion of the buyers could never muster the discipline to save even 10% down; those people would be out of the game. Without all the losers who can’t save a minumal down payment (let alone 20%), and minus all the exotic fraudulent ponzi financing schemes set up to allow those losers to buy a house with no money down, the housing bubble doesn’t happen to the extent that it did. The combination of no down payments, financial horseshit, political manipulation, and the Federal Reserve acting as an extension of Washington DC, all contributed to this disaster.

I don’t think you need a lot or windy moralizing to build a financial structure based on self-interest that actually works; but it must include consequences for stupid and risky actions. If you can insinuate your company into the tax trough when you face bankruptcy, then I say, “bet the farm,” you can’t lose.

Based on what I see as clear evidence of how the US financial and political system actually works, I no longer have any obligation to anyone but myself and my closest friends and family, and I recommend everyone else wise up and do the same. I will sign anything, say anything, and do anything to game the system and get ahead, and I don’t care what the long-term consequences are. If I know I can buy a house with nothing, live in it for 18 months free, save my money, and then use it to buy another house down the road for 200k less, and no one will put me in jail for this, then I’m going to take a long hard look at everything I do in society with an eye to getting mine. Either this collosal scam ends with something very close to a revolution, where the deadbeats, bankers, and political criminals are all prosecuted, have their assets seized, and are sent to jail, or I’m going to draw up a new set of rules for honest people to get their snouts in the trough before the slop runs out. I’ve got the black flag about halfway up the mast, once it flies, I’m going whole hog.

The endgame is the cessation of the United States as a republic, and I do not think I’m being hysterical; I see no way to have everyone acting like a bunch of pirates and still have a functioning liberal democracy.

I know one person who has not been paying her full mortgage for over 2 years. She makes partial payments every few months. This gives the bank an excuse not to evict her. It seems to me that some banks will look for any excuse not to evict people.

“Those who were responsible mortgagees or renters would be locked out, having never had the opportunity to live rent-free and save like the deadbeats did.”

Preach it!

Oh sure it’s easy to be able to save when you aren’t paying um RENT or mortgage. But when you have to pay the necessities of life and save it takes a little something called discipline (plus, lets face it, with the costs of housing in SoCal STILL, it also takes a high income to be able to save your way into a decent down payment).

But why not just live rent free for a year? Look at least be consistent, become a radical, overturn the whole economic system if you want, abolish property, make everyone a squatter with renters in open revolt against their landlords. I mean if that’s where your politics takes you fine ….

But don’t preach the glory of your precious double standard where you live rent free and renters pay a monthly check for a roof over their heads every month. And don’t become a hypocrite by becoming a landlord someday yourself when you yourself have lived years rent free (and I don’t mean at mommies house, I mean in your own place).

How many here have written to their congressional reps or senators to complain about the bailout? How many here vote and if you do, vote for the same politician? To make matters worse, FHA is only requiring a 3.5% down payment.

I wonder how long the banks can extend and pretend with the massive shadow inventory growing daily?

Wow – thanks for confirming I’m a double loser. Had to move for job reasons, but we rent out our house because we can’t sell. Prices declined 66% from peak, and we purchased in 2002 just as prices started to rise. We pay our mortgage, but get no tax deduction because we make too much. We don’t feel comfortable buying because we felt things were completely unaffordable and overvalued where we moved to. We’re renting, but we’re getting booted because our landlord decided not to pay his mortgage. And there’s not much housing inventory for renters here (although there’s a massive shaddow inventory), so rent prices are up over a year ago. So frustrating!

Winners for people that walked away is right. I know undocumented people that bought homes with minimal down then used their home as an ATM machine. They took out as much as possible then sold at peak prices after not paying for many months. They are renting now but drive around in a custom Chevy suburban with all the bells and whistles (key less entry, flat screen, custom rims…). about a $70,000 car or more. The mortgage broker that made those lier loans also made a killing.

That’s a good question and worth exploring. If enough of a bank’s customers organize, decide on an action, they can make banks negotiate or threaten to move their deposits to a competitor. Max Keiser talks about activism and trading stocks, imagine millions taking economic actions in unision around the globe against a particular corp/org/country/govt./etc.

Let us not forget that the “professional” banking industry made home purchasing and gambling as easy as picking up a Snickers Bar in the impulse aisle of the supermarket. The “professionals” set this table and “were allowed” to set this table for presentation to the public. Many of these buyers were only doing what they were told was the responsible, adult, conservative act; buy a house before you are priced out of the market for good.

.

David Lareah, the Baghdad Bob “economist” spokeshole for the Realtor Association admitted in his book that he was shilling for his master.

.

David Lereah – 25 People to Blame for the Financial Crisis – TIME

http://www.time.com/time/specials/packages/article/0,28804,1877351_1877350_1877336,00.html

.

Remember Baghdad Bob? How is he any different? http://www.youtube.com/watch?v=NkGG5fp2kPI&feature=related

.

These homebuyers simply did what all of the “experts” told them they needed to do to secure their family’s future, “Ge a grownup, buy a home.” The banks would get what’s coming to them if the banks’ representatives in the government would just let it happen. [ehh… looks really silly when you type it out]. They got their just deserts and were trapped between the rock of bad underwriting and the hard place of defaults and the banks’ representatives in the government took the hard place away. No justice. This was a massive global fraud and those that intentionally misrated Mortgage Backed Securities as “AAA” when they were trash should be held accountable for this planetary swindle [*theme to “The Sting” playing].

.

We can all just sit around getting continually “Stung” or we can recognize that the banks engaged in fraudulent inducement and facilitated the creation of a false market by abandoning longstanding underwriting requirements knowing that they would be exposing the housing market to gambling distortions. The lenders were the so-called “professionals” who, supported by their pseudo economists, attorneys and PH.Ds signed off on the notion that dispensing with the historical act of underwriting loans was a sound idea. They knew better. People are just people, they are not expected to be experts on housing or finance. If WAMU, Countrywide [you know those nice folks who have an entry in the Rose Parade every year – how could they be bad?] and every other household name in finance, real estate and government are making them feel like a loser for not buying a house how can you lay it on Mr. or Mrs. First Time Homebuyer to “do the right thing” and pay the tab to the scammer who scammed them. I think they would first want to see the hammer put to the scammer and then put the scammer in the slammer.

@AnnS

You know, that is a nice, clear, logical point by point. Yes, for renters wanting to buy, a markdown to fundamental values, however it takes place — foreclosure, principle reduction, short sale, whatever — will help. The ire should be directed at all the support being thrown at the housing market by the federal government. Obama is literally spending my tax dollars — and my son’s and (maybe someday) grandchild’s tax dollars — to keep the market inflated and beyond my reach. I’m paying for the privaledge of being locked out. And THAT’S truly enraging. I’m a life-long liberal Dem, but I’m as angry and disenchanted with this as by anything Bush ever did. His crimes were against my sense of what “America” should mean; Obama is knifing my financial survival.

Or, can you also explain how the giant subsidies, bail-outs and proppings-up of dead banks is also okay?

AnnS, thanks for the bit of sane perspective. It’s very easy to get angry over what many perceive as being unfair. You are right, housing will have to correct at some point. I think that what most are angry about relates to “playing by the “rules”” and watching people like DG brag about saving 50K while someone else picks up the bill, ie. the taxpayer, bank, whomever… People like that are a big part of the problem, but that’s their karma, not mine.

uburoisc – You’re right about one thing…this country will fall apart if this kind of crap continues. Imagine a country where nobody honors debts or obligations and run around like deadbeats? It would be anarchy. It’s all such a slippery slope…

I just love driving around LA and seeing all the paper plates from Rusnak on Luxury cars while we still have over 10% unemployment… truly astounding…

“Conservative and traditional values have always espoused these ideals, and if one lives, lends and governs by them one can’t go wrong. Conservatives understands the core of human nature, and know that no matter what changes in our world human nature dosn’t change. A conservative lender would always require minimum 20% down, good credit, and a solid conservative appraisal. What went wrong was straying away from traditional and conservative practices of lending.”

You’re kidding, right?

There are so many people on this board that have a hatred for “liberals”, Obama, etc that it makes me wonder.

The so-called conservative ideas of requiring 20%, solid lending practices, bank regulation, and separation of deposit banks and investment houses were eviscerated in 1999 in the signing of the Gramm-Leach-Bliley Act, authored by Republican conservatives, Phil Gramm, Jim Leach, and Thomas Bliley Jr. and signed by Democrat Bill Clinton, “because the free market can police itself”. The separation had been in place through legislation passed in 1933 (a liberal era under FDR) called Glass-Steagall. It was in response to the banking problems caused under conservative Herbert Hoover.

Without Gramm-Leach-Bliley, no Subprimes, Options, Alt-As, no gaming of the system, none of this being discussed. The CDS industry could not have existed if the same people issuing mortgages werent able to package and chop them up and sell them as derivatives. And dont go on about the Community Reinvestment Act. Glass-Steagall worked for more than 60 yrs without problems. Lack of regulation enforcement during the Bush years, after Clinton signed this bill, is why we are where we are today.

I should add I am not happy with Obama continuing Bush’s TARP policy of socializing losses, so there is no party loyalty here.

Both Dems (Clinton) and Repubs (Gramm, Leach, and Bliley) are to blame here, but those conservatives who are on their high and mighty horse should know history better before assigning blame. They should also understand human psychology. Plenty of liberal AND conservative homeowners gamed this system.

BTW, the right thing would be to reinstitute Glass-Steagall, reregulate the banks, and imprison the crony banksters. However, Republicans in Congress are fighting this and most Dems havent pushed this either.

@Fred, you’re my hero.

Comment by dog-walker

Couldn’t have said it better. I too am an ex life long Democrat and don’t know who to vote for next time but it sure won’t be the incumbents. I have no doubt Republicans would have done the same so I guess my vote will be wasted on some third party. On the other hand I feel the need to punish my former party by seeing to it they are booted and the only way to do that would be to vote Republican.

.

The talk of escaping the bonds of servitude (in this case,mortgage debt servitude) is as old as civilization itself. It is after all, the founding principle of the American revolution. How are we as a modern society to deal with our current Wall Street overlords and economic tyranny? Yes of course we are talking about mortgage debt but is this the start of the second American revolution? It certainly feels like an awakening and the Tea Party would have you believe it is much, much more (they scare me frankly but they do have a point). Strategic defaults are individual decisions but collectively they make a potent statement. However this plays out, our current system is not sustainable so the only thing that we can say for sure is that big changes are coming.

Be brave Comrades!

Folks,

We are past the point of no return. In engineering, we use PID control: Proportion, Integral, Differential. All things move according to mathematical principles. The Integral windup with this bubble and the downside to letting someone call this 50-year bluff would be global financial devestation like the collapse of Rome or the Mets. (my estimation is that voodoo economics came to power in the coup that killed JFK with Johnson and the Vietnam War, but of course this stuff has been going on since Satan got Eve to pressure Adam into the first RHG with a liar loan).

I told you so 2 years ago. Can’t remember? See my article: A Funny World (25): God gives you a chance to stand up again (http://activerain.com/blogsview/460409/a-funny-world-25-god-gives-you-a-chance-to-stand-up-again)

Thank you for telling me that it now has a updated fancy name “strategic default.”

The bailout of the TBTF banks is bad enough to destroy public confidence, but consider this. The USA has had a recent Treasury Secretary who sold fraudulent securities. A common criminal as Treasury Secretary, and he is not going to jail.

Now recall the shooting of the NYC Times Square huckster over the holidays who was ripping off passers-by for $10. He was pursued by police and shot and killed (and yes he appears to have been armed.)

Get the picture?

Wow DHB,

You sure get alot of comments to these sort of articles.

Not so much with the dryer, Perot-like articles.

But I likey!

I totally agree with a couple of the replies regarding the “short sale” nonsense.

Who the hell even started that madness?

Another bank con?

“Oh, pay your mortgage payment, and work like a slave for us to sell the house for as much as possible whie we make it a tough as we can for you”

“Yeah, we might not ding your credit history as bad, but we’re sure someone else will, perhaps our Credit Card division”

Give me a break.

I hear this refrain constantly about homeowners jumping through every imaginable hoop of behalf of the banks trying to short sale the “bank’s” home for them. Hell, sometimes the process of just getting permission to be their minion is a torture test.

I think that jig is up. People have wised up. Fuck that noice. I’ll sit here and string the bank along real nice and slow. Play their game, Make them think we care and are sweating bullets. Then, when the timing is right for us, we’ll leave them with their bag of crap to clean up.

I think this is the American public’s way of giving a big ole passive-agressive FU to the banksters and to some extent, the Govt.

People are just fed up with seeing two sets of rules. And trying to play by those defined for them and getting screwed.

In these times, it’s every man for himself, and to a certain extent, dog eat dog.

Credit score damage? Ha!

I think alot of people say, yeah mabye, But so is most everyone elses score. And it didn’t seem to be too bad for GM or AIG. And besides, in 3 or 4 years, all is well. Or, who cares. We don’t have any interest in “buying” a house anytime in our future. Overpriced SUV? Keep it.

Truth is, this strategic default phenomena is not even that new of a trend. It was seen during the late stages of the Alt-A boom, where people were moonwalking from their current and exhausted ATM machine/house, and buying a more reasonably priced home with a “NINJA” loan. Take that you silly banksters.

This is a great blog Doc – You are getting close to the core of our future truth, but you are not quite there yet. It should be obvious to all that with $13 Trillion invested (mostly with the financial sector), our government is not going to let these crooks fail. Given that banks know that by law the FDIC will shut them down if the capital on their books falls below a certain level, and that foreclosure is the surest, fastest way to remove capital from their balance sheets, why would they foreclose? Bottom line: Banks will parse homes out at a leisurely pace that minimizes further pricing erosion.

**

Next, regarding 10% or even 20% down, from a purely business perspective, this is sunk cost. Once the benefit of defaulting outweighs the benefit of paying, from a business perspective, one should simply default. Certainly one should consider the impact of default on their credit, but this is short lived. I do concede that humans are not driven only by logic, and that morally/emotionally many people will continue to pay as long as they can. Personally, I would default in a heartbeat if it was in my favor. I figure if your playing a game with cheaters, you either quit the game or cheat.

**

Finally, I think the best thing for the free market is for everyone who is underwater to stop paying. Look at the rules of the market: 1. The greed driven banks took high risk, bundled it & passed it on, and drove the market to bubble levels. 2. The government blinked, and bailed out the financial market when they should have been punished for their greed and lack of judgement. 3. The bailout has enabled banks to hold on to distressed inventory, even when home owner fail to pay for more than a year, keeping prices inflated.

**

Imagine, if every home owner who was underwater stopped paying, would the government be able to make up the loss? I doubt it. However, I predict that the next step would be that the government prints more money ( for bailout extension), and that they find a way to keep banks open that would otherwise by law be closed by the FDIC. What the hey, why not just pass a law telling the banks that they do not have to pay back anyone who bought Mortgage Backed Securities? Mark my words: “The government will not let the banks fail, and the banks will not let prices drop precipitously further”.

**

Break the hierarchy! Stop paying your mortgage!

Love love love the attitudes here!!! Guess what…I’m such an “idiot” I didn’t pay my mortgage for 5 months this year, and now that I have a modification, I can get at LEAST another 6 months without paying and probably many more months without paying. I’ve looked at both short term and long term to come up with my financial plan. The only thing “idiotic” I did during *this* time owning a home (unlike most of you, I’ve owned THREE in So. Cal over 16 years)…..the only thing idiotic I did, was put 20% DOWN! I should have GAMED THE SYSTEM when I had ample opportunity….damnit! Now, I’ll just have to settle on defaulting on a 2nd (no payment in 6 months…or ever now), and no payment on CC debt (why pay when your credit rating is 500?). Do you honestly think I give 2 shi1ts about how you view me surviving in this environment?? When the sh1t hits the fan, I also support the 2nd amendment so don’t try and break into my house, it will be your last. Eat it you judgmental pricks!

@ Kid Charlemagne, you can youtube “JFK and secret societies” and LISTEN to his speech on them. I agree it started with JFK, but you have to follow the money. JFK printed REAL dollars backed by REAL silver, any president that has opposed a central bank has been killed or attempted to be killed.

It was fraud from the top down, but not everyone “gamed the system”, yet anyone that bought in the last few years and decides to default gets abused here in these comments. Instead of blaming the people who masterminded this, you blame the victims (not all home buyers were victims, I’ve seen some here on So Cal walk away with hundreds of thousands, they don’t care about keeping a “home”). You’re ignorant and this country will not change with people organically ignorant or WILLFULLY ignorant. Keep blaming your fellow citizen, buy into either “we conservatives know all and are correct with our moral crusade” or the “we liberals have to take from the wealthy and share with the undeserving” and vote the same way. Keep voting the same two parties in!!!!

If you’re happy and you know it clank your chains!

KIdding right,

The Gramm-Leach-Bliley act. was authored by republicans, but was definatly not an act of conservatism. I agree with you it definately is a very black mark on the Republican party. I do though make a huge distinction between conservatives and the republican party. The Republican party often espouses conservatism in name only, thus we get rancid practices like the Gramm-Leach-Bliley act, as well as Comprehensive immigration reform (aka amnesty for illegal aliens).

<My goal is to keep the Republican party conservative, unfortunatly the elite such as Bush/ McCain and a host of republican senators do not see it that way.

Kidding, I am glad that you brought up the GLB act, I went to wikipedia, and found many interesting things like the deal was brokerd by Robert Rubin who then became ceo of Citi Group.

Politically that rancid act was sponsered by three liberal Republicans, brokered by Dem. treasury secretary Robert Rubin, passed bi-partisan 343-86 Republican ,138-69 Democrat and signed into law by Democrat Bill Clinton.

<

If that isn't an example of the coveted "Bi-partisanship" I don't know what is. A pox on both their houses.

<

What is striking to me is what the hell are so many Republicans doing joining forces with so many liberals? I thought the two parties were suppose to have such different ideologies and bold differences. What I see is a lot of Republicans acting like liberals and crashing the country.

The bail-outs under Bush showed the same type of rancid bipartisanship, thank god that all the new bail-outs under Obama are 100% liberal Democrat. That shows me that the Republicans may be starting to regain their senses and conservativism, lets hope that they are.

HAHA! Look at these idiots in San Diego Trying to flip their house for an 885,000 profit in only 18 months!! They bought for $900 in late June 2007 and are listing it now for $1,775,000!!!! Amazing what a little Granite can do!!!!

http://www.redfin.com/CA/San-Diego/1920-Beryl-St-92109/home/5137412

WOW!!! I have seen some crazy flips, but never anything as ridiculous as this!

Let me get this straight. The government is now encouraging people to leverage themselves into a property up to $750,000 with less than 2% down (including the tax credt + FHA) in hopes of stoking the bubble back to life. Then, if it doesn’t happen, no worries, just stay in your house rent free for 18 months, and bank your mortgage payments before having to move. Is our situation that desperate? I guess so. Those wanting to invest in a market such as this, have to be nuts. They would’nt be giving these opportunities unless they are scared shitless of what happens next.

Heavy investors on the Westside should be more than worried.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Human beings are part of the animal kingdom and will do whatever it takes to survive. You see that sentiment so clearly here. If we see others getting ahead by cheatnig, we decide it’s “smart” to cheat, and we forget about so-called personal ethics. The only ethic with humans is survive at any cost, and the capitalist system (a great one for wealth building and innovation), at it’s core, believes that greed is good. Only the rule of law keeps us from thrashing each other’s throats. But, as we see with this RE bubble and aftermath, it is greed (i.e. “survival”), not ethics which, rules the day.

I think that the morales of this country are starting to reset. It’s sort of unspoken at the moment, but during a depression, people tend to put up with less and less immorality. Everyone’s either mad or desperately acting like nothing is wrong. The Housing Bubble will collapse even further for sure, but I think that something else will come out of the woodwork and surprise us all. I wouldn’t be surprised to see the dollar dropped this year as the Reserve Currency over some crisis yet to make it on most people’s radar.

@Greg

Repulicans Conservative? Democrats Liberal? They’ve both become Goldman yes-men,.

I know what you mean. Fox is not conservative–just appologists for the pro-‘investment banking’ crew; which is a psuedonym for corrupt destroyers of American wealth. The never did invest–only look for companies that were productive and figure out ways to steal their wealth. If taking two sound companies, putting them both in irresolvable debt, firing half the staff of the combined company and dumping their looted pension plan on the government is investing, than please stop investing. Too much work so they had their parties clear all the obstacles so they could loot the entire nation at will. That whole ‘regulation is the problem’ argument just enabled them to push all that through. There is nothing new under the sun–welcome to the new Dark Ages.

I know some might think it is strange to mix politics and the real estate market, but by now it must be obvious to everyone that the Federal gov. is controlling the entire market. Atleast everything in regard to interest rates, lending, foreclosures, loan modifications and inventory.

<

Some think it is strange to support conservative Republicans, but now that we have total liberal control of the USA, the Conservatives are the opposition.

<

Could one of the liberals reading this please explain to me why it is a good thing that Barney Frank gives another $400 billion to Fannie and Freddie.

Could someone please explain to me why having the government controll the mortgage lending industry, the American auto industry, the health care industry, and insuring the profitability of major banks is a good thing ?

<

If the Democratic party is suppose to be kind of like the "labor" party why is it so important to liberals that we have rising housing prices while unemployment is sky rocketing? Why also does the Democratic party want to give illegal aliens amnesty and equal access to our jobs, especially at a time we have a17% unemployment rate?

<

Would one of the liberals here please explain this to me? I guess I just don't understand.

I’m with Swiller. I never intended to game the system, but when I bought a house for almost $400,000 that the bank swore would never go down.. I stopped caring about morals or karma when it lost $250,000 in 2 years. As the good doctor has pointed out many times it isn’t coming back anytime soon. Its not my fault that the government decided to use taxpayer money to support banks. My only point was not everyone who bought at bubble prices with no money down is incapable of saving money. If I hold my spending pattern steady I’ll still be able to save $30k/yr even after renting. Some of us were freshly out of college with our first good paying job and knew it would take 6-8 years to save up a 20% down payment when prices were $400k+ in this state. Meanwhile all the banksters were saying prices would double again before you could even save the money.

I may have been an idiot to buy that line of bs from the bank and sign onto a loa,. but I’d be an even bigger idiot if I paid it back at their insane bubble price. With the money I save I’ll be able to pay for both of my kids to go to college and fund a chunk of my retirement. Sorry but my financial moral obligation comes to my family before it comes to the bank. I admit I’m getting off fairly easy, but I haven’t done anything to prevent the banks from kicking me out after 90 days and legally I’m obligated to take care of the property until they do. If it makes you judgmental pricks feel better, I had 50k in available credit on cards a year ago and now I’m down to $3000(gogo discover card). I also won’t be financing anything for at least 7 years.

Greg,

The answer to your question is that the Democrats are not the liberal party. They are corporatists. Compare politics in this country to any other Western Civilization… we are the most conservative 100 times over. Liberals are nearly non-existent here. Just look at health care… another big wrapped gift to the insurance industry that won’t do a lick of good for most American Families.

All this talk really demonstrates how good a time it is to buy a home if you do not already own one or are looking to invest.

Homes are so cheap right now that it is beginning to make sense for people to walk away from a house they bought only 3 years ago and look to purchase a new one at the current market price.

Leave a Reply