The Fed Scorecard: 9 Months of Cutting and Red Queen’s Race. Is the Fed Done Cutting Rates?

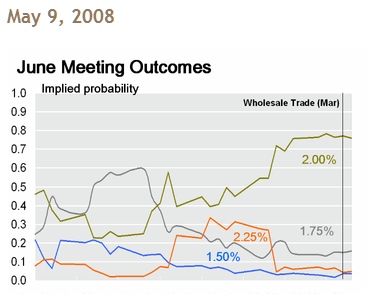

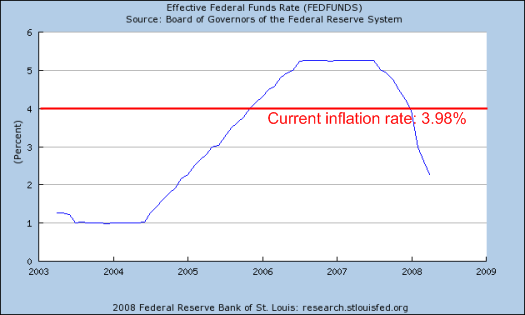

The Federal Reserve may be nearing an end to its manic cutting of the Federal Funds Rate which started in August of 2007. The rate in August stood at 5.25% and is now back at 2% bringing warmth to our heart as we reminisce our long gone friend and maestro, Alan Greenspan. The Fed in its infinite professorial wisdom felt that all the market needed was a bit of rate cutting and all would be well. Well guess what? The only thing that this irresponsible rate slashing has brought is a negative real Fed Funds Rate which if left unchecked is bound to cause stronger pressure on inflation. If we are to look at the real rate, which is the fed funds rate minus the inflation rate we are now negative by about 1.25%. Keep in mind the historical average has been positive 1.75% since 1975. So given that the Fed is on a mission to inject liquidity like a botox party, where are we now 9 months later? The Fed futures probability is at approximately 80 percent that there will be no rate cut in the next meeting in late June:

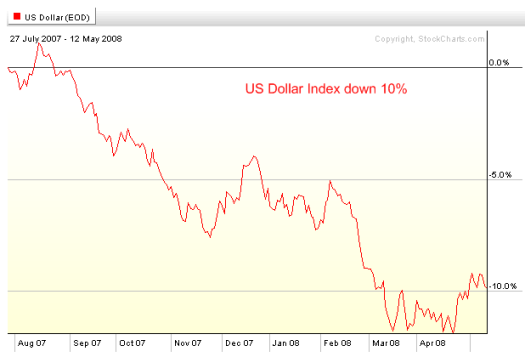

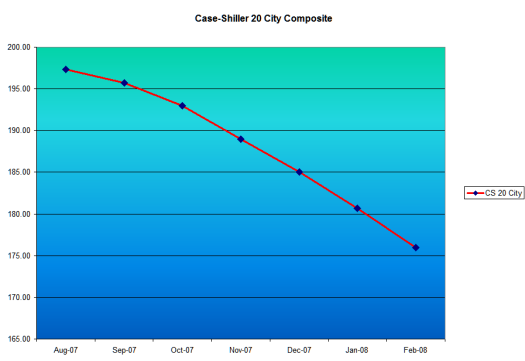

During this same timeframe, let us look at a few different key statistics to see how things have turned out since August of 2007. I think it is best to do a graphical post to highlight what has gone on in the past few months since everyone thinks the Fed has somehow fixed the current economy:

Dow Jones Industrial Average:

S&P 500:

Oil:

U.S. Dollar Index:

Fed Funds:

Case-Shiller 20 City Composite:

Now what exactly was the cutting of rates suppose to help with aside from the credit market Armageddon which is still unfolding? Clearly the dollar got hammered by 10 percent in this short timeframe. Housing is still continuing to correct. Oil has been on a record 60% tear during this same timeframe. Rice shortages anyone? And the DOW and S&P 500 are still below their levels in August. All that wasted ammunition and for what? To bailout the Wall Street firms and their irresponsible Ponzi Scheme of Collateralized Debt Obligations? Clearly the average American family from looking at the above charts is seriously worse off given the events of the last 9 months! Yet they keep resurrecting the boogie man saying that if they didn’t step in, things would be a lot worse. Well by looking above, if this is their idea of helping out I’d rather they get out of the way pronto.

Whenever I hear the Fed saying they are trying to help us I can’t help but to think of Wimpy from Popeye and him saying, “I’d gladly pay you Tuesday for a Hamburger today.”

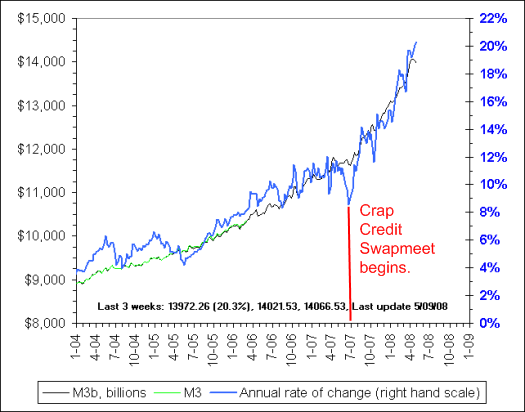

We haven’t even looked at all the Fed TAF, TSLF and PDCF “tools” which is just a cover for crap credit swapmeet or CCS. Take a look at this reconstructed chart by Now and Futures:

I’ve added a line to draw your attention to the credit crisis birth moment. So even though the Fed is about to stop with its pointless rate cutting which has done very little in terms of helping the average American, it has been dolling out Treasuries in exchange for banana republic notes. Even though we keep hearing that we are now approaching the end of this crisis, the Fed is shaking in its boots because it has essentially used all its capabilities and things are actually worse today. So much ammunition lost and not much has changed; unless you have crap CDOs and worthless mortgages you’d like to exchange. In that case, you are much better off. And I say worthless with every sense of the word because some mortgages in places like Detroit, Cleveland, or even Atlanta are flat out not even selling. Some areas will actually need rebuilding. There is zero market in some areas.

Welcome to the last 9 months; your consolation prize is the Fed will now stop cutting rates. Now seeing how well the Fed has done for the American people these last 9 months, do you really trust the government to bail us out from the housing and credit mess? Unfortunately the Fed is willing to sacrifice the dollar for the stability of Wall Street. The only problem is Wall Street does not reflect main street USA and the disconnect grows wider and wider. Think of the $729,500 raise in caps which by the time it hit the market in California, values were already down by 30% statewide!

I don’t think people object to frivolous spending. After all, this is a free country right? Yet the problem with this entire mess is the ultimate get out of jail card that many Wall Street firms and lenders were operating under. This “too big to fail” idea needs to, well fail. If a bank was forced to keep mortgages on their books, I assure you they would not have made the loans that they did over this past decade. This is the equivalent of you eating twenty In-n-Out burgers, and then getting frustrated that you feel bloated and sick. Then you proceed to ask for help from your neighbor who only ate one burger. The government is trying to lead folks to believe that there is a “green pill” that’ll somehow miraculously cure your indigestion, make you thin while you eat those burgers, all the while your neighbor gets the bill. There is no animal style for the housing market and there is no pill to take away the credit gluttony. People hate hearing the solution. It will take time and a lot of hard work and a radically new lifestyle. There is no credit market liposuction.

Of course all that is going on is not the Fed’s fault. Yet you have to ask yourself, is the only thing we’ve gotten out of this last 9 months is Wall Street putting the fear of a Wile E. Coyote moment in the heart of the public? Well guess what, we’re already flying off the cliff but we’ve just given some nice golden parachutes to a lucky few. We are now running faster and harder to stay in the same place like the Red Queen’s race from Alice in Wonderland:

“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else — if you run very fast for a long time, as we’ve been doing.”

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

Contact your representatives and let them know that you will not stand for anymore golden parachutes!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “The Fed Scorecard: 9 Months of Cutting and Red Queen’s Race. Is the Fed Done Cutting Rates?”

DHB,

Actually the Fed is not doing too bad other than it is destroying the dollar:

. Low debt service

. Low social security payment

. Keep the lenders and the economy flowing

. Increase export, balance trade

For anybody on the other side of the Fed it is a different story.

“Capitalism without failure is like Christianity without hell.” – Warren Buffett

Your burger analogy is not quite right. As a toddler, my grandmother read me the story of the Little Red Hen. The Little Red Hen worked hard and planted, and all the other barnyard animals made fun of her. Then her wheat grew and she baked bread, and everybody wanted some.

Well, like the Little Red Hen, many Americans spent the 1990’s and 2000’s driving used cars, getting an education (at ever increasing rates), and renting, while others were leasing SUV’s and buying “Cribs” that cost 10x or more of theri income, and a few were living the high life on Wall Street or as mortgage brokers.

We, the Little Red Hens of the world worked as engineers and nurses and such, doing useful work for society, only to be told “YOU MUST COMPETE IN THE GLOBAL ECONOMY,” and “NO RAISE FOR YOU, BUT WE’RE SPONSORING MORE H1-B’s.” And we saw ourselves priced out of housing and unable to live the American Dream, while uneducated mortgage brokers and construction contractors who hired illegal immigrants earned multiples of our salaries.

And now we who lived conservatively and never experienced the bling lifestyle are being sucked to bail out those who did.

(Here is one example of an MIT graduate working for high school graduates in mortgage brokering:

http://blogs.law.harvard.edu/philg/2005/11/19/the-value-of-an-mit-education/

“# Age: 23

# Occupation: Selling mortgages to people with poor credit records who are buying houses worth $700,000 to $1 million

# Income: Over $150,000 per year (commission-based)

# Boss: High school graduate; never attended college.

# Colleagues: Mostly high school graduates.”

A neglected topic is how will the major players be viewed in the future?

Bank America, JP Morgan, Standard & Poor’s, Moody’s, Goldman Sachs, etc, etc. etc.

Impaired goodwill anyone?

Selling debt from any of these companies should be harder, shouldn’t it? No matter what the terms are.

Ok, I’m sold, things don’t look so good. Any suggestions on what to do with the money I’m saving for investments today to make sure I’m positioned in the best way possible when we begin to take the Wile E. Coyote fall?

Bwahahaha: “the Fed isn’t doing too bad other than it’s destroying the dollar”. Cancer isn’t too bad except that it often kills people after much suffering.

I mean hello, most people here are PAID IN dollars. So it kind of matters if it’s losing purchasing power every day ….

Many central banks have as their prime responsibility maintaining stability in the value of their currency. But not us.

It is true the current situation has been a long time building.

Just bought my airline ticket for my yearly vacation to Switzerland. I got a free place to bunk down but I’m going to need a hotel room for the 1st night or 2. Last year the easy conversion was what ever something was in Swiss francs take a third or a quarter off and that was what it was in dollars. I checked hotel rates and I’m thinking is this right? Now $100 = 105 Swiss francs.

What’s wrong with a lower dollar? IMO, the country could do with a bit more exporting, and a bit less importing. Further, as the price of oil continues to rise people are starting to think about alternatives again. All of this is a good thing. Sure it’s going to cost you a bit more to vacation in Europe, but that’s to bad, lol.

I’m not sure what cutting the fed rate has done that is beneficial for regular citizens. Now there is literally no where to put ones money where it can grow. Put it in one’s 401k? All the elections are down for the year. Put it in a savings account? They are offering crazy percentages like .03%. And even if one is capable of socking away a few dollars for retirement or for their children’s education the falling value of the dollar wipes it out. The rise in energy and food is most unwelcome under the circumstances. If interest rates were raised wouldn’t there at least be CD’s with a decent interest rate?

I’m having trouble seeing this Wall St bailout you speak of. Yeah, Charlie Prince, Stan O’Neil and a few others lost their jobs and got ridiculous severance packages but you aren’t going to find many shareholders of banks and other financial services companies smiling or thinking they were ‘bailed out’ . The Fed did intervene to keep them ‘solvent’ with its lending facilities even though many were/are not but Central banks always have to do this when the big banks blow it. May not be fair but unless you were willing to see what happens if Citi, UBS, Wamu, Merrill Lynch, Lehman etc don’t open for business one morning the Fed,

like the Bank of England and the ECB had to start pouring a few hundred billion in or that’s exactly what would have happened. As you note, a few trillion in home valuations has melted away. A lot of that value was on the banks balance

sheets. The Central banks are merely playing for time hoping that over time the banks can generate enough new capital ( and profit from the lower interest rates) to absorb the huge losses they have taken. It is also the case that by trying to force rates down the Fed was trying to prevent a total collapse in the real estate

market which would be likely if the prime rate was 3% or so higher than it currently is. Annoys me for sure because I have a large cash position that will soon be earning negative real interest but against the backdrop of a total financial meltdown which was staring the Central Banks in the face I’m not sure what other course they could have taken.

Contact your representative? And say what? Give me a break. If you don’t pay these guys thousands of dollars, you get NO say in the running of this country. On average, a Congressman represents about 700,000 people. They don’t care about YOU specifically.

So, unless you can really convince them you mean business, and that means organizing enough people who threaten them with losing the next election, they really, truly don’t give a rat’s ass what you think or say.

And frankly, everyone has their hand out to them…no one wants the pain. We all want more credit, lower taxes, and McMansions. They know that. They know that a few cranks will call up and complain. A few bloggers will castigate them. But, in the end, the fat, lazy Cheez Doodle eating hordes will not go to the polls or will simply vote for the fat, white guy who says he loves Jesus.

Another good post Dr. Frankly, I don’t know where you get the energy. Please remember Mr. Ben does not work for the American people, he works for the Federal Reserve which is owned by private banks. He will do whatever is necessary to keep private banking afloat; which is not bad in and of itself. Given the choice, I would much rather have the dollar in the hands of private bankers than in the hands of Washington! The oil price is just beginning to effect our economy. The Arabs don’t like what Mr. Helicopter is doing with their dollars either (the peg) and will raise their price for oil accordingly. BTW, gasoline is $0.80/gallon here in Qatar.

They all have long records of criminality and no one cares. I have Chase and Citi credit cards, and I know they are insolvent, morally bankrupt institutions who would (and do) kill if it is profitable and they can get away with it.

CNN Money has a couple of interesting articles today.

http://tinyurl.com/45s6k9 – MSM seems to be getting the idea about bad stats, and even quotes shadowstats.

http://tinyurl.com/5o9sx6 – the Fed might raise rates?

Leave a Reply