The Day Housing Faced the Plague of Locusts: Lessons from The Great Depression Part XIII. Facing our Own Economic Pilgrimage.

With the systemic problems facing the United States and now being officially in bear market territory, this will be a challenging holiday weekend for many Americans. Already many are planning to curtail any major traveling and are opting to stay at home and possibly doing a barbeque at home because of high fuel costs. Aside from the high cost of fuel, Americans are feeling the pinch of a demoralizing housing market that is causing equity to evaporate as each day goes by. The wealth effect is in full onslaught impacting the psyche of the American consumer. That ever resilient consumer is finally showing an Achilles Heel.

Americans are spending more money on basic necessities and moving away from all things real estate. Nothing can demonstrate this contrast more than comparing Family Dollar Store and Home Depot performance for the year:

Family Dollar Stores operate in 44 states and have 6,400 stores. They normally sell daily items for the house including food, cleaning and paper products, home décor, beauty products, toys, pet products, automotive items, and electronics. They cater to a lower income bracket in our population but are showing surprising strength. Just look at the above graph and nothing can highlight this more. Family Dollar Stores are up 14.14% for the year while Home Depot is down 16.41% for the year. What does this signify? It means families are spending more and more on cheaper daily cost of living items and foregoing big-ticket items. Expect this trend to continue. A family is going to put food on their table before putting a granite countertop in the kitchen.

Oil now seems to be taking the main stage as the topic du jour. I was watching CNBC after the market closed today and the progression of stories seemed to play out as follows: Oil, GM, Iran, Iraq, and finally housing. Keep in mind that the reason the dollar is falling is because of the horrific fiscal mismanagement which was played out in the world credit markets, much of it linked to real estate. In fact, real estate was the vector to spread the disease that is infecting the global economy.

Don’t Tase me Broad

Eli Broad, the billionaire founder of KB Home and philanthropist is now sounding like a doom and gloomer. Earlier this week Broad came out stating that “this is worse than any recession we’ve had since World War II.” As more and more people jump into the bear camp, Broad also mentioned that investors would be “better off in cash” although what form of cash he did not specify:

“July 1 (Bloomberg) — Billionaire investor Eli Broad said the U.S. economy is in the worst recession since World War II and a recovery in the housing market is “several years” away.

“This is worse than any recession we’ve had since World War II,” Broad, 75, said in an interview yesterday. Broad, the founder of homebuilder KB Home, said the U.S. should avoid a depression on the scale of the 1930s because the country now has sufficient “safety nets.”

With home sales and prices declining and consumer confidence at a 28-year low, “I don’t see it turning around very quickly,” Broad said. The economy expanded at an annual rate of 1 percent in the first quarter, the Commerce Department said last week. That caps the weakest six months of growth in five years.”

I think the point of “safety nets” is important because I’m starting to see this argument take hold. Now, instead of people denying the recession they are now trying to discuss the magnitude of the recession. I’ve read a few people make the point that we will not face problems like those that we had during the Great Depression because of safety nets. Now unless you’ve been living under a rock, we are having major problems:

*Click to watch brief clip

There is a growing number of homeless people. In fact, we have a few tent cities here in Southern California. How is this not a problem? Where is the safety net here?

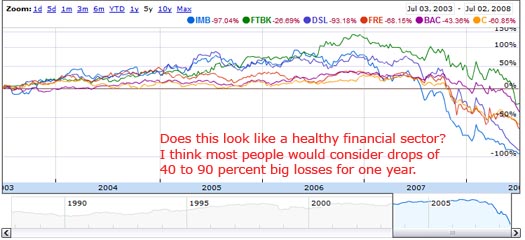

Also, they are telling us that no banks are imploding like during the Great Depression. Oh really?

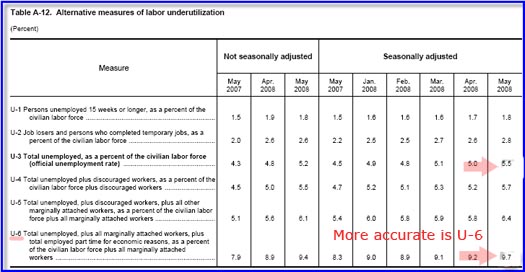

Unemployment in California is at 6.8%. If we actually look at the details of the BLS report more carefully, the national unemployment rate is near 10%:

Just because we won’t live through the exact same things as the first Great Depression doesn’t mean that this economic downturn will be a walk in the park. Try asking someone that has lost their job, has no access to credit, and has run out of unemployment benefits how easy things are. This is a tough economy and things will only get worse. You have to remember that during that time, the stock market crashed in October of 1929 yet the market bottom was in 1932. Many banks failed after 1932. You can view the stock market as a leading indicator of what will come on main street although many on main street are already feeling the pain.

This will be Part XIII in our continuing Great Depression series. Given that this year will showcase a very crucial election, I think it would serve us well to look at some key aspects of the inaugural talk of Franklin Delano Roosevelt in 1933. Amazingly you will find some of the rhetoric to the point and downright brutally honest.

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

8. Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear

9. A Bubble That Broke the World

10. The Sham of our Current Unemployment Numbers

11. Understanding the Impact of Asset Deflation and Consumer Inflation.

12. DOW down nearly 20 percent and in Bear Market Territory.

First Inaugural Address of 1933 – Nothing to Fear Except the Fed

“I am certain that my fellow Americans expect that on my introduction into the Presidency I will address them with a candor and a decision which the present situation of our Nation impels. This is preeminently the time to speak the truth, the whole truth, frankly and boldly. Nor need we shrink from honestly facing conditions in our country today. This great Nation will endure as it has endured, will revive and will prosper. So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself-nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance. In every dark hour of our national life a leadership of frankness and vigor has met with that understanding and support of the people themselves which is essential to victory. I am convinced that you will again give that support to leadership in these critical days.

In such a spirit on my part and on yours we face our common difficulties. They concern, thank God, only material things. Values have shrunken to fantastic levels; taxes have risen; our ability to pay has fallen; government of all kinds is faced by serious curtailment of income; the means of exchange are frozen in the currents of trade; the withered leaves of industrial enterprise lie on every side; farmers find no markets for their produce; the savings of many years in thousands of families are gone.

More important, a host of unemployed citizens face the grim problem of existence, and an equally great number toil with little return. Only a foolish optimist can deny the dark realities of the moment.”

Can you imagine any politician having the backbone to tell the American people this in our modern era? Most of the same problems hold. Values have shrunken. Government faces massive shortfalls in tax revenue. Income is hurting. In fact, there is nothing Pollyanna about this speech except the ability to confront the brutal facts of reality. Whatever your perspective both economically or politically, he was able to tell people the reality of the situation unlike Hoover who was trying to maintain the decadence and falsehood of Coolidge prosperity which was fading with each day of the Great Depression. And of course Hoover wasn’t to blame for the depression just like Bush isn’t solely to blame for our economic hardships, but make no mistakes, both sat idly by and did absolutely nothing as Wall Street raided the American piggybank and left the public holding the bag.

My belief is this is a once in a generation economic struggle. Time has sufficiently passed from the Great Depression that many have forgotten the lessons taught to us. The Gramm-Leach-Biliey Act repealed this safeguard in 1999, nearly 66 years later. I suppose enough time had passed to think human nature had somehow evolved. Let us continue with the inauguration:

“Yet our distress comes from no failure of substance. We are stricken by no plague of locusts. Compared with the perils which our forefathers conquered because they believed and were not afraid, we have still much to be thankful for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because rulers of the exchange of mankind’s goods have failed through their own stubbornness and their own incompetence, have admitted their failure, and have abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men….

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Happiness lies not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort. The joy and moral stimulation of work no longer must be forgotten in the mad chase of evanescent profits. These dark days will be worth all they cost us if they teach us that our true destiny is not to be ministered unto but to minister to ourselves and to our fellow men….Restoration calls, however, not for changes in ethics alone. This Nation asks for action, and action now.”

The money changers? Talk about taking it to the source. Instead of raking Hank Paulson and Ben Bernanke over their lack of backbone in helping the dollar, they have allowed them to continue on their current path. They have done nothing to help the dollar! You feel poorer because these people are allowing the depreciation of your currency with no intervention. They have the ability to raise rates but won’t. Low rates and lax enforcement of minimal lending standards got us into this mess and apparently they think this will still get us out. Paulson is now calling for more power for the Fed. Bwahahaha! You have got to be kidding me. Clearly in FDRs talk he was making a biblical parallel with the money changers but how many people would get that reference now a days? You’d have to say something like, “we will need to throw out the free loaders from the Real World home and vote off Ben Bernanke from the island. Please text your vote on your iPhone now!”

“If I read the temper of our people correctly, we now realize as we have never realized before our interdependence on each other; that we cannot merely take but we must give as well; that if we are to go forward, we must move as a trained and loyal army willing to sacrifice for the good of a common discipline, because without such discipline no progress is made, no leadership becomes effective. We are, I know, ready and willing to submit our lives and property to such discipline, because it makes possible a leadership which aims at a larger good. This I propose to offer, pledging that the larger purposes will bind upon us all as a sacred obligation with a unity of duty hitherto evoked only in time of armed strife.”

Clearly times were so tough, that many people psychologically were ready to commit to a new form of living their lives. The decadence of the Roaring 20s had brought on a major hangover and many were ready for the morning after remedy. We live in a similar parallel. Can you do without your Hummer? Do you really need three cars for your household? Must you have that plasma TV and put it on your credit card? Is consumption at the mall really the pinnacle of success for our country? Can you forego the family vacation this year? Do you need that McMansion? We have been on a once in a lifetime spending binge and we’ve just mortgaged our future for it. Was it worth it? Many people will be asking these questions at the kitchen table.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

35 Responses to “The Day Housing Faced the Plague of Locusts: Lessons from The Great Depression Part XIII. Facing our Own Economic Pilgrimage.”

The real question is what magnitude will the recession/depression be like.

The forecast is in. A financial Katrina is approaching, but the government will protect you. The financial levies will hold and you will be financially rescued if they fail. You must trust the government. Remain in your homes. Do not panic.

You should read this: http://www.berkshirehathaway.com/letters/2007ltr.pdf

and this: http://www.huffingtonpost.com/2008/07/02/nation-buys-porn-with-sti_n_110457.html

As you can see, Buffet agrees with you 🙂

The 2nd link will explain where Bush’ stimulus package went 🙂

I hear Tent prices in California are increasing at double digit appreciation! Buy one now before you are priced out of the market forever!!

I have not forgotten and I do understand the references in the speech. I am, however, not old enough to have lived through it. On the other hand, I did listen to my great-grandfather talk about the depression of ’93 (that is 1893) that happened when he was in his late teens – and he lived until I started college. I alos listened to my grandparents who were in their mid to late 20s when the Crash of ’29 occurred. (All managed pretty well and my maternal grandparents started a business in 1930 that survived and lasted until 1990 when my parents retired and closed it.) I listened to them so well that I designed my undergrad degree to study that time – multi-disciplinary split of applied economics, political science and history specializing in the political, social and economic history of the 1930s (and that meant also having expertise in the 1920’s and 1940’s to put it all in context.)

****It will be very very bad. I was worried 7 years ago when it dawned on me how people were acquiring McMansions, Hummers, and taking bi-annual trips to the Carribean through the use of credit rather than income. I have long seen gotten to the point of terrified about what will be happening since the merry-go-round has slowed and then screeched to a halt.

**** The difference between then and now is we don’t have the means of production as it has all been shipped to Mexico, China and India. The US economy revolved around selling each other houses and junk made in China , and providing ‘personal services’ such a massages, personal trainers, party planners and running restaurants and canoe trips and other nonsense and doing it all on credit. There are no idle factories or means of production for real goods (as opposed to inchoate frou-frou services) to which workers can return and produce goods that are necessary to society as opposed to frivolous extras.

I forget to add that another difference between then and now is the redistribution of wealth AWAY from the US due to globalization when in the 20s it was flowing to the US.

**** Do the math.

COUNTRY POPULATION PER CAPITA INCOME

China 1,300,000,000 $1740

India 1,129,000,000 $800

US 310,000,000 $20500

**** Multiply the population of a country by the per capita income. Add up the total incomes for each country. Add up the total populations of just those 3 countries. Divide the total incomes by the total populations. Welcome to the brave new world. For income to be equalized, all would have an income of $3475. India per capita goes up over 4 times from where it is. China’s per capita income doubles. And in the US, the per capita income drops to become almost 1/6th of what Americans are use to having.

****Now can you live as you do on 1/6th of your current income?

BLS = Bureau of Lying Statics, But that is the norm for the US Goverment

I agree with almost everything in this article except the part about the November election being crucial. It makes absolutely no difference. Obama or McCain, neither has the guts to let the big banks fail and make the US take its bitter medicine of economic austerity. Govt has to get spending under control and let those who speculated wildly suffer the consequences.

All I keep hearing is, “I’m from the govt and I’m here to help you”!

I wouldn’t worry about the means of production. A factory in China or Mexico goes from vacant lot to on-line production in less than 2 months. Most of the means of production are human capital. China and Mexico had a lot more idle hands than the US, hence the labor advantage. (Not to mention governments willing to eat the energy costs, though that also happens in the US where states outbid each other in handing out corporate welfare.)

The bigger problem the US has is having its entrepreneur spirit crushed from within. Think of the hassle one encounters trying to build an oil refinery in the US versus building it in Mexico. The extra labor costs of running the refinery in the US are miniscule compared to the mountains of regulations/bribery required. Health Care is a luxury item, environmentalism is a luxury service, but you won’t hear any presidential candidate in the last 50 years speak in those realistic terms. There are practical limits to such luxuries – clean water and clean air are attainable, but living landfill-free and solar-powered are not. Health insurance may be a great idea, but people using it when they have the sniffles, turns it into an expensive luxury.

Let’s also not lose sight of the fact that FDR’s policies helped create the mess we have today. One hundred years ago the 30-year mortgage was looked at with the disdain the Option ARM is today.

The 30-year nmortgage itself isn’t a problem, it’s the abuse/overuse of it that changed the market – and now we look fondly at the days when the 30-year fixed was the norm when we should be looking fondly at the days when the 10 and 15 year fixed was the norm. Why pay interest for 30 years when you can pay it for only 15? The usual response to that over the last few decades was a leverage complication answer – “I’ll put that money into higher paying investments (read: gambles) and the interest I make will more than cover the interest I pay on the mortgage.” Which might be useful and wise for the upper 1%, but it’s a fairy tale for the middle and lower classes.

We’ll be moving those lower classes into 40 and 50 year terms fairly soon. Getting them to pay interest for the rest of their lives, a kind of serfdom which is what turns meaningful work into stressful drudgery.

Now can you live as you do on 1/6th of your current income?

When my house is paid off, YES.

But 1/6 of my income wouldn’t even come CLOSE to what I already pay in taxes. Which begs the question…

Can we live with 1/6th the amount of government we have today? I can, heck I could live with about 1/10 the amount we have today.

The Great Depression seems to have been primarily a monetary problem caused

by a credit bubble bursting. We have plenty of that around today and even seem to be replaying the exchange rate shenanigans that exacerbated recovery back in the 1930’s. Yet we, like the European economies of that era, were pretty self sufficient, i.e. we could restart our economic engines independantly of one another. War debts ( and deaths) hobbled Europe to be sure and were a drain on their economic resources but as Germany showed you could regenerate even a collapsed economy without outside help or even much foreign trade .That Hitler

was far more successful at this than Roosevelt ( or anyone else) despite having far fewer resources and starting from a lower baseline is an interesting if unsavory fact. Today, however, we are far more globalized meaning our economic

engines are no longer purely national entities. Ford is dying in North America but doing OK in Europe. What we once thought of as “our” companies are really and truly multinational now. Any allegiance they have to the nation they are HQ’d in or originated from is vestigial and fast disappearing. Worse, even our unions are adopting the same stance. Some have begun merging with those in Europe.The California Teachers Union pension fund is planning on dropping its preference for US investments and putting more of its funds overseas. Guess they see the handwriting on the wall! Add to this the hemorhagging of funds to pay for our oil and merchandise imports, something Roosevelt did not face, and the danger and problem we face is far more acute should the bottom fall out. Whether or not the US should be such a credit intensive economy is a good question but the fact is we are. We are no longer the industrial, resource rich nation we were up until the mid sixties. Allow the financial system to falter and millions of people in make believe jobs will have to get up from their cubicles and fight to get a real one in a coal mine or drilling rig. They might yet anyway but this is, in my opinion, why Bernanke and Paulson are trying so hard to preserve the status quo. They’ve looked into the abyss and it’s scary.

Ann scott,

I think you are making it to simple though. In other countries on a much smaller income you have access to a great deal of goods and services at a very low price.

Purchase power parity is what I think it is called. The real question is what happens to our ppp, not our percent of world gross gdp.

I do agree with your general sentiment.

Oops! Guess I should have read Ann Scott’s comments before posting my own. I think I just echoed her. I would say as well that while India and China are not yet as desirable a place to live and work as the USA ( judging from the new

accounts we get for gas service those Indian software engineers just love our suburban McMansions and are about the only ones still buying) there has been the beginning of a trend for Chinese and Indian entreprenuers to head back to their homelands to do build their careers there. There is nothing written in stone or the constitution that says the US has to be the center of the global economy forever and ever.

OK, so were these inaugural comments from Roosevelt before or after the U.S. government, under his leadership, stole all its’ citizens gold by declaring the individual right to possess gold illegal? Oh yeah, then after the gold was stolen from the citizens, didn’t the government, under his leadership, then declare the price of gold increased by 50% or so so they could make a paper profit off the money they stole from their citizens? Roosevelt blames the money changers, but then steals money from innocent citizens who were smart enough to protect themselves from the moneychangers!?

Got gold? (If you do, don’t freakin’ tell anybody!!!)

Once again, I feel sorry for the kids and four or five responsable adults still left in America. As your the rest of you, I have one thing to say:

HA HA HA

And the worst part is, you are now going to triple HELOC your kid’s future to print and buy your way out of having a recession. Bubble, bubble. Inflation! War!

And you think taxes can be lowered!

You are very articulate Doctor. Thanks for another good read.

Afraid I am turning into a gloom and doom hate-monger reading this stuff, although I do sincerely believe it.

An article in a Tucson newspaper was criticizing the tentative opening of a copper mine in the nearby Santa Rita mountains. Used to be people would be glad to get the work! A geologist in the article said in 1994 America exported copper; now we import 40%. Why drill for oil in Alaska or offshore CA? Why build a LNG plant or refinery? Why work and exploit natural resources when the government will give it for free?

Never understimate war Expat. Whether it be dumping hundreds of F-4U Corsairs

off the decks of our carriers in 1945 or putting an artificial limb on the body of a US Marine today, it is economic stimulus.Keynes on steriods because there is no inflationary pressure. What you shoot at the enemy has no impact on the domestic economy. Your neighbor might make mortar shells but when a dozen or so 105mm mortar rounds go off on the Afghan/Pakistan border they either find there mark of they don’t. I like it if they do but that is a political choice not an economic one.

Military spending is the crutch that keeps us afloat. Obama is being taught that right now. Spending money or Head Start or some FHA program is a fool’s game.

You want to use fiscal policy and have results? Put 5 new Army divisions in the field, 5 new Air Force wings and 50 more Navy ships. Not only will you get the economy bustling you can win friends and influence people abroad.

Showing up at a G-8 meeting with a suggestion for this that or the other thing is all well and good but when you arrive at the meeting on the deck of a new nuclear

powered aircraft carrier it says I’m not suggesting it Trichet.

Oh for heavens sakes – enough with the nonsense spouted by Adam B and Al Smith.

**** Adam – NO ONE “STOLE” GOLD FROM ANYONE. The US was one of the last major countries to go off the gold standard in the 1930s. Great Britain had already done long before the US. NO ONE TOOK THE GOLD out of people’s bank accounts or secret cellars. They still had their silly junks of metal. When the world economy was “on the gold standard”, that meant that a piece of paper called a dollar, a franc, a pound or whatever represented so many micro-ounces of a junk of yellowish metal that was sitting in a vault somewhere. And all that junk of metal represented was the amount of goods or services that a person had produced and traded away in exchange for something else. It was jsut a whole lot easier 30 centuries ago to cart around a piece of metal that represented the value of a herd of 1000 cattle than to herd around the 1000 cattle too trade to buy wheat. Then it became easier to leave that chunk of metal in a room and stored and carry around a piece of paper representing the value of the junk of metal which represented the value of the 1000 cows that sold. (Think around the time of Henry II that a form of ‘bank’ arose.)

*****It could have been anything that represented the value of the 1000 cows – a chunk of rock that was the metal called gold a junk of rock that slate; a piece of carved wood, anything at all….

*****Going off the gold standard meant that the chunk of rock compposed of certain mineral elements was no longer accepted as the equivalent of a franc, a dollar or a pound. It no longer represented the a franc, a dollar or pound which represented the value of those 1000 cattle. Something else represented thoe 1000 cattle – and it was piece of paper that was not representing how many chunks of rock were in a vault. That chunk of rock wa then only worth what some damn fool would pay for it.

**** When England and then the US went off the gold standard, each offerred to exchange the thing that now solely represented the value of those 1000 cows (piece of paper marked pound, dollars etc) for those chunks of rocks sitting in vaults for what those rocks had been represented in terms of the number of cows on the day the country stopped using chunks of rock as money along with pieces of paper.

****No one came and seized the chunks of rocks hoarded in some fruit loop’s basement. If the hoarders had wanted to keep their pretty chunks of rock, they were free to do so and then if later they wanted negotiable currency they could try to find some fool who would pay then money for a junk of rock that serves very little useful purpose other than to make jewelry (and now some kinds of electronic sort of parts.) If they turned down the pieces of paper in favor of keeping a piece of rock, oh well, more fool them.

*****Only someone ignorant of the historical develoopment of the concept of currency and its representational function would spout such nonsense. Only a neo-con hater would keep it up once familarized with the concepts.

*****AL SMITH – do try to find a better source to quote than a senile actor who turned from a very very strong supporter of the New Deal into an arch conservative first because he hated to pay his share of the taxes (even those imposed by Eisenhower at far higher rates than in the 30s and 40s) and then in order to win elections during the backlash against the civil rights legislation of the 1960s. That is one of the senile actor’s more moronic comments – given the fact that he and many of his close friends and associates personally benefitted from the WPA’s programs which employed artists of all varieties.

****Quoting a senile actor who simply recited lines that had been prepared for him as if they were the Delphic oracle does lead one to question the depth of your knowledge of political and social philosophy. You might want to go back and do some basic reading of Locke, Burke, Paine, Rousseau, and Hobbes for a start. Then you might be able to come up with more sophisticated comments than quoting a senile actor playing a part. May want to familarize yourself with a concept called “the social contract.”

*****Pretty funny how the so-called conservatives and neo-conservatives who suppposedly loathe government action scream for help really really fast when (1) they are so stupid that they get themselves fleeced by a Wall St con artist or any con artist at all (2) have their businesses slamming into bankruptcy (Bear Sterns) (3) have their mansions threatened by fires and floods because they stupidly built in the wrong place and now they need the help of the police, fire crews and the National Guard and (4) want to protect their money by having their business in the form of a corporation (a thing created by law) rather than putting themselves at risk as they claim everyone else should by doing business as a sole proprietor or partnership……and the list continues…….

I find it a little funny that there is a John McCain ad on this website, considering that his chief economic adviser is none other than Phil Gramm.

I wish people would lose their bizarre belief that financial responsibility and competence is a characteristic of the “conservatives.”

I have personally hoped for a watershed event to change the insane materialism of this culture for all of my adult years (I am 51). I suppose I’m about to get my wish. It doesn’t look like it’s going to be a fun process.

Like always a nice read…….

http://discovermagazine.com/2008/may/07-want-to-help-the-environment-eat-insects/?searchterm=insect%20as%20food

I’m just saying….

Get ready for crunchy locusts, when income is 83% off.

If you haven’t read this book, http://en.wikipedia.org/wiki/The_Sheep_Look_Up, I suggest you look it up.

Hot stock tip! Invest in wheelbarrows. We will soon need them to carry our lunch money, ala Weimar Republic.

Re: Ann Scott’s comment about the history of the US going off the gold standard. Just a few days ago at a garage sale there happened to be a poster. As I recall it was from 1933, but I could be wrong. It had been issued by the government and it required all citizens to turn in any gold bullion, coinage, or gold certificates on penalty of a $100,000 fine (that was real money then!). I believe, but couldn’t swear to it, that there was also a jail term for failure to comply. Ms. Scott seems quite outraged by others supposed ignorance of history. Now who am I supposed to believe, Ms. Scott, or the faded government poster I saw at the yard sale? And who is the ignorant one spouting nonsense? I’m so confused. I should have bought the poster. I was looking at it and wondering, “Could it happen again?”

AnnScott is the “senile” “frootloop”. What a nut.

And Greenspan’s Body Count claims another victim as a bitter bubble buyer murders his realtor:

http://wcvarones.blogspot.com/2008/07/greenspans-body-count-revenge-of-geezer.html

It’s great to see an honest, open and lively debate on this subject and I’m glad that the Doctor is providing the fuel.

I hope the Doctor and his followers will begin the discussion on solutions. They seem to be in even shorter supply than the understanding of the problems.

Cheers!

Ann Scott presented a pretty good overview of the ridiculous nature of gold speculation.

.

To Allan: What an insightful and in-depth response. (Sarcasm.) This is typical of how a neocon ‘rebuts’ facts — by attacking the messenger. (Another way is to just make things up.) Perhaps Allan will be able to give us more of “his” insight into this once Rush tells him what to think. Until then, we’re left with his well-thought-out one-sentence attack.

Yeah, use multiple screen names to compliment and defend yourself. Hey, you forgot the M’s in psps.

That Allan really knows his stuff. He’s the greatest. Fantastic! See how easy it is.

AnnScott claims to be an attorney, political pollster, and god knows what else. Ha. That ranting and raving would give Ted Kaczynski a run for his money. At least he had a college degree. Based on AnnScott’s writing ability, I put her at a high school diploma (hey, that’s all I got). Probably an ex-realtor or ex-mortgage peddler, hence the interest in realestate. As far as “psps”, notice how “psps” encapsulates entire sentences (including period) with parentheses. How unusual and quirky. Just like AnnScott. Notice the use of hyphens to connect multiple words. Just like AnnScott. AnnScott, you are bizarre, yet strangely entertaining. Keep up the good work.

Why is it that the poor and the middle class have to sacrifice for the common good while the elites and bankers get to keep all their loot? People see what is happening. The banks are getting to feed at the trough while Social Security is left on its own. Even the trust fund was looted! Vets benefits and solders pay are an embarrassment. Were it not for their dedication and commitment to the constitution the armed services would be the laughing stock of third world dictators. When ever there is talk of sacrifice we know who the lambs will be. Well guess what, the sheep are tired of bleeding while the wolves sail their yachts, drink their champagne, live in their mansions and drive their fancy cars! All the while telling us we have to sacrifice! Well until I see those responsible for this mess arrested, convicted and hauled off to jail, and their ill gotten gains totally confiscated, I’m taking care of myself and mine. If the banker bail out plan gets passed then every corrupted SOB in congress must be voted out! Otherwise this country will never heal and our children will pay the price.

By the way there is a social safety net, but it is not for the middle class nor the poor. Want proof, just look at those tent cities. You wont see a banker among them. The safety net is for the banks via the Fed and the Treasury. And it’s being implemented as we sleep. That’s the safety net those billionaires are talking about. Joke’s on us.

Allan

YOu are an idiot. That is obvious from your degeneration into attacks because you disagree with concepts. I have never said idid political polling – your delusions are showing, I do hold a degrees in economcis, history, political science and a law degree. do not however claim to be a good typist – that is what I used to pay my staff to do from dictation. Comments on a board like this are not worth running a word doc to do.

Grow up and go away.

The right wing crackers are out in force. They really need to go do some basic reading. Sstart with some high school econ texts and move up to college freshman level . (A process which should only take you around 6 years given your ignorance of such matters .) Then try history. First begin with the development of civilzations and the early days of economic systems and then move on up through the medieval then then the reformation and finally to the industrial revolution. Once you get through that, you may finally begin to grasp the rudiments of the development of economic systems and social systems.

ANyone who thinks gold is fundamentally valuable is crackers. You can’t eat it, you can’t wear it and it doesn’t provide shelter.

AnnScott –

That word you used: Neocon? What does it mean exactly? I heard somewhere that it is a really stupid word that was used to describe anyone that voted against Gore/Liberman, or Kerry/Edwards. Both of which would have been even more disasterous Presidents than W.

SO there is no confusion, I am a Libertarian.

As far as that shiney substance, I see gold as having it’s first bubble in 30 years. Again, at the end of gold’s little bubble, (later this year, or early next)people will once again realize that it is not really worth what it sold for, and will again sink to the level of being that metal that people use to fill teeth, or make “Grills” for rap stars.

Pick the gold ETF called DZZ. Put your money where your beliefs are if you believe gold will go down in value, as I do. Take a look at DUG too. I believe oil will pop after the Chinese Olympics. And, did anyone notice that their stock market is down 60% over that last year? Also, next investment will be a short against China’s currency, which will tank in value after the Olympics as well. (Same as the Spanish Peseta going from 92 to 137 per dollar from 1992 to 1994.)

Anyone have any thoughts?

Hey AnnScott. Here’s a link to one of you rants. You go girl. http://64.233.167.104/search?q=cache:cE8XpaCa96sJ:tpmelectioncentral.talkingpointsmemo.com/profile/AnnScott+annscott+obama&hl=en&ct=clnk&cd=1&gl=us

Leave a Reply