The Church of the Fed: Praying for Rate Cuts and SoCal Short Sales

As many of you are now aware, the economy slowed to a dismal forth quarter edging up only 0.6%. Of course the technicality of being in a recession has been played down by many well doers that seem to have a Kevlar vest protecting them from the real issues that many Americans face. The Fed is walking a very fine line and each and every rate cut that they propose, only makes them seem more and more like a tool of Wall Street and are at the behest of serving power brokers. Major banks say jump and the Fed says how high. However if it has not becoming glaringly obvious to you, these cuts are working less and less each and every time. Each vague hint that the Fed gives about cutting rates and injecting liquidity quickly dissipates like a junky high. First, the market rallies thinking this will be the HGH that will boost housing into super stardom. After a brief moment of ecstasy, the reality sets in that we have spent way beyond our means and a correction is simply necessary. It is odd this avoidance of reality. Debt does not equal wealth.

Case and point. Foreclosures jumped an amazing 75 percent in 2007. More than 2.2 million foreclosure filings occurred on 1.3 million individual properties. This number is simply staggering given that in 2006, 0.58 of all households found themselves in foreclosure while in 2007 the rate doubled with over 1 percent of households now reporting some stage of foreclosure. When last year, all eyes were heavily fixated on the amount of rates resetting we have suddenly gone into a housing free for all where rates are being slashed haphazardly, credit shenanigans are exposed on a weekly basis, and Real Homes of Genius are still popping up everywhere. Let us take a look at the mortgage reset chart:

The rhetoric seems to suggest that we now have “subprime” behind us and we soon will be out of the woods. This is not the case. We have two back to back waves that are poised to last throughout 2012. First, we are still battling with the subprime collapse. 2008 does not look like it will be a positive year for housing and recent estimates from Merrill Lynch state that housing values can drop by as much as 30 percent. This means a disappearance of $6 trillion in real estate wealth. Well, it may be hard to call it a disappearance since the money never really existed in the first place. What we are undergoing is the destruction of money which only leads to one conclusion, asset deflation. I was listening to a show on NPR this morning where they were talking about the Fed and their market actions and the guest stated, “the Fed needs to calm the market and act confident. The Fed doesn’t have credibility yet.” Say what? And this isn’t the first time that I have heard this assertion. That somehow the Fed is the fuel and the market is the fodder. Read this paragraph straight from the Fed’s website:

“The primary responsibility of the Board members is the formulation of monetary policy. The seven Board members constitute a majority of the 12-member Federal Open Market Committee (FOMC), the group that makes the key decisions affecting the cost and availability of money and credit in the economy. The other five members of the FOMC are Reserve Bank presidents, one of whom is the president of the Federal Reserve Bank of New York. The other Bank presidents serve one-year terms on a rotating basis. By statute the FOMC determines its own organization, and by tradition it elects the Chairman of the Board of Governors as its Chairman and the President of the New York Bank as its Vice Chairman.”

So their core mission is monetary policy. It also goes on to tell us that they share a responsibility of regulatory and supervisory responsibility over banks and members of the system. So the fact that banks ran amok literally giving loans to pretty much any person off the street does this not mean that the Fed failed in regulating or even at the most basal level, supervising the actions of the industry? After all, they were spending someone’s money and now they run around like some Benny Hill skit pointing fingers to everyone and tripping over their own flawed mission. Yet the reality is this false Wizard of Oz assertion that by simply creating a mortgage and allowing people to extract money from this newly created debt, that we were going to be able to continually create paper wealth forever. The premise had one problem in that it only worked so long as real estate always went up. No longer was real estate a store of wealth for the masses but a commodity to be flipped like oil, corn, or soybean futures. And now we are seeing the end result of this housing option market; many people are simply letting their homes expire worthless like useless put or call options. The only difference here is what do you do with the asset once you get it back? Where does the collateral fall? The pseudo wealth now meets economic fundamentals of tighter credit and incomes and it appears that we have a long way to correct.

There is no way we can inflate ourselves out of this debt. All that has been done has been on the monetary front and has done little in achieving any stability. Now with the stimulus cut, we are attacking the issue with pretty much printing money out of thin air. I’ve talked with a few people and the reaction is usually, “that is great! I appreciate the government sending me $600. I can use that.” When you ask where the $600 comes from they usually think that the government dips into their massive savings account and simply gives us a slice of the pie. But guess what? There is no money! There is no savings! Bwahaha! The reality has to be laughed at or you will border on the verge of insanity. The government has zero money and we run deficits like Orange County Fashion Island mallrats. In fact, we have less than zero since we are massively in debt. Think of the problem facing the Fed or policy makers. If they run up the printing presses which is what is going to happen with the $150 billion stimulus package, you pose the risk of creating inflation because by default printing money is inflationary. Yet this runs in the face of cost of living indexes that of course are incredibly skewed and underreport the true magnitude of the problem. If for somehow this inflation does hit, what do you think that will do to Social Security payments that are pegged to cost of living indexes? Or what about our foreign debt that we owe? The ideal scenario is that we run shadow inflation letting wages catch up while shafting those on Social Security and foreigners that have graciously given us money to buy up modified shacks for billions of dollars. Thanks world! Come down to Florida or California sometime to see how your investments are doing. I’m sure you’ll be pleasantly surprised.

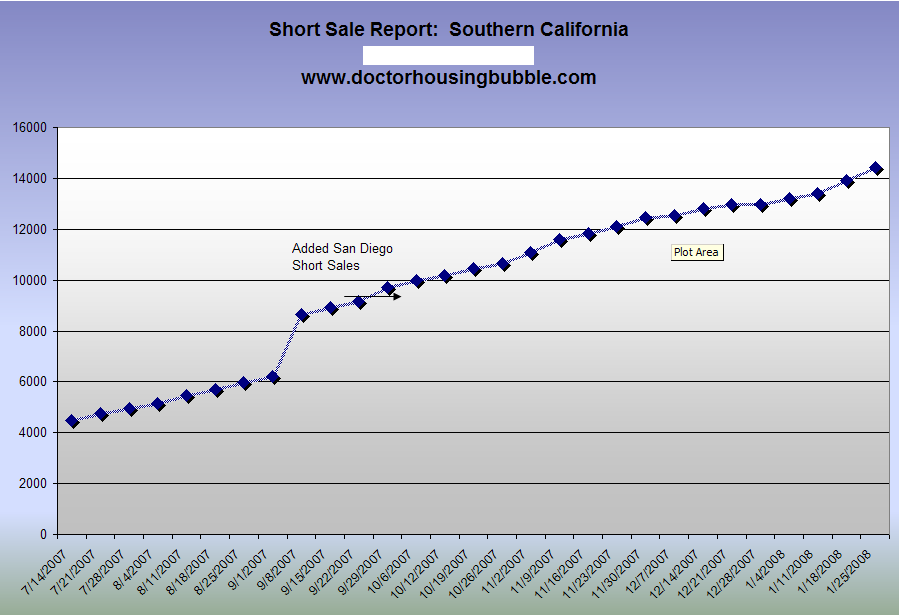

Short Sales and Sales

Let us take a look at Southern California for example. Short sales are consistently growing. Each week I take a look at short sales for the entire region. Since I started tracking numbers last summer there hasn’t been one week where the number has decreased. Why is this important? It is important for multiple reasons because these are heavily distressed properties. In fact, overall in the past few months inventory has edged lower yet short sales have consistently gone up. Those facing short sales do not have the luxury of waiting until the market settles down. They do not have a few short months to wait for the spring or summer selling season. The sheer increase in the numbers is perplexing and demonstrates that we are far from bottom. This is an incredible leading indicator and once we see a trend of decreasing short sales, we can start talking about a possible bottom. And one month does not make a trend! Unless you’re the Fed where cutting rates means you don’t need to say your sorry.

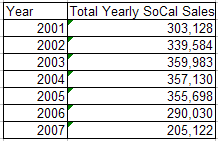

Also, overall sales for the region have been steadily declining:

In sheer sale transactions, 2003 was the peak year but we were running this engine full throttle until 2006. From 2005 to 2006 we see a significant drop but in 2007, we see the bottom fall out. Does a panicking Fed, a weak economy, and abysmal sales numbers look like a bottom to you? It is frustrating and absurd to hear from the housing camp, “okay, enough of these facts. We need to think positively and start believing in housing prices. If we believe it will come.” Sorry but I completely disagree. You have a decade long bubble like no other and you can’t face the prospect that we were in a bubble? In fact, the policies being espoused actually hurt the lower to middle class of America but apparently being in debt forever is okay and spending within your means is no longer a viable longterm philosophy. I care to disagree and the facts back this assertion.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

20 Responses to “The Church of the Fed: Praying for Rate Cuts and SoCal Short Sales”

Anybody speaking of the bottom has no clue. The sad thing is that Politicians think the solution to the housing problem is to keep prices inflated. I see 2 reasons for this, 1 – They don’t realize that the inflated prices are the problem or

2- They have money invested in realestate. Middle class america is still priced out of the market. Raising CAPS on Fannie Mae and Freddie Mac will do nothing because the difference in payments on from Jumbo loans to Conforming loans is a couple of hundred bucks. It does nothing for the Middle Class. I guess we have to come to our senses and realize that the government doesn’t care anymore about Middle Class America. The ones dictating policies it seems are the Corporations. We need Ron Paul desperately.

Isn’t the answer simply for the Govt to Decrease Spending? To start, how about a 10% cut, across the board, for every program, SS included? Better yet, decrease budget by the deficit amount. I dont know about you, but I think I can take a 10% hit to my spending this season, and I bet most of us will HAVE to. I was eye-balling the Twin Turbo, but I guess I’ll have to settle for the Carrera S at the Porsche dealer instead this year!!!

Doc, Another good read. Love your site. Having been in the mortgage business for the last 15 years I can tell you that a lot of the loans that are considered to be prime are really not very good. High loan to values and high debt to income ratios and some of the loans you can get approved with FHA/VA could not be approved through the subprime guys. Any economic hiccup in these people’s lifestyle is going to cause them to stumble. Add to that a depreciating asset and it will indeed be ugly. Fortunately, I am in the midwest and the appreciation in housing has only been about 3% over the last several years so no big bubble here.

Keep up the good work!

Dow ended up down 38 points today.

As the Wall St. boys have been saying the Fed is pushing on a string or maybe a rubber band. No sooner does the Fed try and spread a little sunshine than the ratings agencies say, not so fast, we’ve still got to clean up yesterday’s mess before we can go out and play. Problem is, as you mention there’s a few trillion dollars worth of mess to clean up and the Fed doesn’t have a big enough carpet to sweep it all under.

Those pesky mortgage and bond insurers just won’t go away and those CDOs are still radioactive. If one 31 year old French futures trader can send global markets tumbling we aren’t going to believe what happens if those house of cards fall.

The housing problem, while still fundamental, has become also most secondary to this global financial house that teeters no matter what the Central Banks do.

I have been pondering for a couple of months now. Who are these suckers still buying overpriced houses? Are homes still being sold because there are still ignorant people out there, or because of fraudulent activity. I say this because it makes no sense to me that people are still trying to buy homes. I have a co-worker who has plans, I educated him a little bit about the 2 ARM reset waves that are in progress and he is only ‘thinking’ about not buying…

The lone dissenter is the Dallas fed official Richard Fisher. His speech from Jan 18, 2008:

http://dallasfed.org/news/speeches/fisher/2008/fs080117.cfm

I guess Mozilo was a tad bit off when he said during the Q3 conference call that Countrywide would return to profitability in Q4. Countrywide only lost $422 million. BWAHAHAHAHAHAHAHAHA. This guy is the epitome of Corporate Greed.

Comment by surfaddict

Isn’t the answer simply for the Govt to Decrease Spending? To start, how about a 10% cut, across the board, for every program, SS included?

What a reprehensible person. DO you have the slighest idea what Social Security pays?

(1) Soc Sec Supplemental Income (SSI) is for those who are disabled and were never able to work (think born with it or developed it before entering the workforce) or who hadn’t worked in the 18 months before filing for disability (quite common as people keep hoping to get better and put it off)

GRAND PAYMENT OF $650 a month – and that is to pay for everything (food, housing, transportation….) If they work at all, for every $1 they earn, they lose $1. Their Medical coverage is Medicaid (state/federal.)

(2) Social Security Disability (worked enough quarters but became disabled.)

GRAND TOTAL PAYMENT ON AVERAGE: $900 a month (again to pay for everything plus the Medicare Part B premium at $95 and the Part D prescription at around $32 plus copays.)

(3) Social Security Retirement

GRAND TOTAL PAYMENT ON AVERAGE: $1200 a month (and out of that ocmes the Medicare B and D costs and a Medigap poicy of around $150 a month.)

How utterly revolting. Cut SS of $650 a month, $900 a month or $1200 a month!!

What, do you believe in just leaving people on the streets to die?

70% of people who are disabled (and that is 12% of all receiving a form of Social Security) have a household income BELOW Federal Poverty Level ($10,200 for 1 person.)

Close to 30% of those receiving Social Security retirement depend upon that as their sole income. (Many lost their pensions when their former employers went bankrupt or closed.)

Just hope YOU NEVER END UP disabled – you will learn the meaning of real poverty then, (And there is no other help – no housing, food stamps of maybe $35 and that is it – and jokers like you prefering that they just go off and die and get outof your way.)

Hope your 401K doesn’t take a dive 2 years before you retire. You’ll find out how to make 1 box of mac and chees last 2-3 meals living on Soc. Sec. alone.

There is no inflation? I just paid $16.47 for a pound of grilled vegetables, a salmon cake and some juice bottle at the Whole Food Market in Porter Ranch, CA. This was just an afternoon snack, mind you. Our dollars are worth less and less everyday… spend em’ if you got em’! A CA minimum wage… you’d have to work 2.5 hours to afford this snack. Absolutely absurd!

This is a classic Ponzi scheme… I seem to remember reading that the best Ponzi schemes have to have a law enforcement person set up to return money that keeps coming in (sometimes for years) after the scheme is broken up.

People watch these a**holes do the perp walk and they still send in money….

How many people are still trying to send checks to Jim and Tammy Bakker?

AnnScott

Thanks for the insults and personal attacks. I sugessted 10%, not 100%. I guess you are right, the govt doesnt need to reduce budget at all, but increase it!! (more sarcasm, just like my Porsche comments) Inflation is, and will continue to diminish the value of the gubmint cheese your bleeding heart aptly endorses anyway!! Here is some insight to me: My favorite meal is “Weenies & Beans” Im guessing you didnt eat that growing up.

Can you tell me if the above graph (Chart 6 – schedule resets on adjustable mortgages) is for the US or California? If it is for the US, how would I find info on California?

Thanks

link is for a pie chart of federal tax dollars catergories. Most folks dont realize where MOST of ourtax dollars get spent, this helps.

http://bp1.blogger.com/_4Ra86EZFyus/R3FbY-brWXI/AAAAAAAAAFI/tYDZCq0VGMc/s1600-h/2006budget.bmp

O.K. AnnScott, here we go:

SS was established and intended, as you point out, to keep the derelicts of society off the street. The crippled, elderly, mentally incapable of working, or contributing to society. It has ballooned into the majority of the federal budget, a red-herring that policy makers want to put in a “lock-box†because it is political suicide to even suggest any re-examination of it.

Newsflash: Most people on disability ARE able to work.

Sure, maybe they have an injury, they got while “working” at a prior occupation, but there is usually no excuse to get retrained to a non-physically demanding job.

Case studies:

My buddy became paralyzed while in college. He finished college bound to wheelchair. He works, supports wife and family today. All those handicap parking spots that get taken-up by people “fakingâ€, well those were intended for people like him, not them.

My wife’s cousin became quadriplegic while teen age. He worked til he died, as successful accountant from his bed in his livingroom, supporting a wife and son. He used straw and morse-code to operate his computer.

My friend’s son born with spinalbyfida (sp>) paralyzed from birth, hundreds of operations, etc. Out of three brothers, he IS the HARDEST working and most successful (ie not an addict / or convict, welfare recipient) out of all of them. He struggles to succeed in the challenging economy and workforce of Oahu.

MY oldest son is down syndrome, read: MENTALLY Retarded. One of those originally intended to receive FDR’s Govt handouts. I take care of him, as he’s MY responsibility, not the taxpayers.

A Neighbor’s niece, one of those “disabled, below poverty line gubmint cheese recipients you think is hurting†Worked on a cruise ship, physically demanding, cocktail waitress job, and undoubtedly the occupation took a toll on her spine, as she has been collecting disability for years, resides in her (responsible dead) Father’s house. Not an atypical case. As long as she only works “under the table†she can continue to live off of YOU and I (taxpayers)

Firefighter injured skiing or dirtbiking over weekend comes into firehouse Monday, and crawls under the fire engine to fake injury occurring at work (as witnessed by MY Brother, a firefighter) Another Disability Recipient.

Mom’s Widowed co-worker, received SSN checks for her 2 kids, she blew it on rent in high-priced beach condo until the kids reached 18 instead of investing it in the children.

Nobody starves in this country. Abundance is so prevalent, we can pay high taxes, provide food stamps and housing for anybody that needs / or asks for it, House & Feed 2MILLION prisoners, field a powerful military, and on and on, and folks like you think we can’t tighten the belt a measly 10%?? That is just UNBELIEVABLE to me. Sorry to be so long-winded, but I guess YOU “Touched a Nerveâ€

According to this Real Estate “expert” on the “The Today Show” this morning we can all sit back and relax because, “THE GOOD OLD DAYS WE’VE ALL BEEN DREAMING ABOUT ARE BACK” because of the recent Fed rate cuts!!! As she says, “IT’S A GOOD SHOT IN THE ARM FOR THE REAL ESTATE MARKET THAT WILL PUSH NERVOUS BUYERS OFF OF THE FENCE AND INTO THE MARKET!” WOW!!! I’m so excited!!! YIPPIE!!! See this BREAKING NEWS right here:

http://www.msnbc.msn.com/id/21134540/vp/22931159#22931159

With the talk of “living within your means” we also need to talk about “investing is not saving”. 401ks, IRAs, and such are no more saving than turning your money into chips and giving them to a blackjack addict in Vegas.

I love Jon Stewart’s insightful comment to Alan “bubbles” Greenspan: “It seems to me that we favor investment, but we don’t favor workâ€.

As long as our economy is driven by consumption, rather than production, and “investment” is the key to “financial security” while your “money works for you”, we’re still just playing the shell game of redistributing wealth from the poor to the rich. Just keep dangling that carrot of “hitting it big with the right investment portfolio”, and the Ponzi scheme grows.

surfaddict, you say near the end of your post “we can pay high taxes”. It may be true that we could handle paying “high taxes”, but if you are suggesting that we currently do pay “high taxes” that is a fallacy. The US has one of the lowest tax rates in the industrialized world.

JC,

My husband and I enjoy a nice lifestyle in spite of the fact that the government charges a premium of over 40% of our income to do so. You’re kidding yourself, though, if you think that we enjoy the 60% the government allows us to keep. We pay property tax, sales tax, fees to register our vehicles, b.s. govermnent fees tacked on to home and cell phone bills and on and on and on. All of our utility bills include various fees and taxes, some that add up to nearly 50% of each bill!

Our businesses are also heavily burdened by taxation. We pay taxes to the city, the state and the feds. We pay licensing fees based on our revenue; we pay property taxes on properties that we LEASE, but which the city chooses to impose property tax anyhow. We pay payroll and social security taxes for our employees, etc.

Americans may enjoy a lower official tax rate than the rest of the world, but I think it’s naive to assume that the official word on anything is true.

JC

That still dont make it right!!

Didn’t your folks ever say to you” Just cuzz Johnny’s doing it, doesnt mean you should too. If Johnny jumped off a cliff, would you?

That is the logic of your argument.

History lesson: Pilgrims came to America to get away from high taxation, and religous persecution. Well i guess we had a few good hundred years, now we (USA) are almost as bad our ancestry’s monarchys from which we escaped!!

Leave a Reply