The California Financial Gambler’s Fallacy – 5 Reasons Why the Budget and the Economy will Keep Home Prices Stagnant. Banks Paying Property Taxes on Shadow Inventory.

The California economy is still in a deep recession. The current unemployment rate stands at 12.4 percent but the underemployment rate is closer to 22 percent. We cannot separate real estate from the actual economy as many housing cheerleaders would like. It is actually amazing to see those jumping up and down proclaiming the real estate faux recovery while ignoring the fiscal mess that we are living in. The California budget is in another mess this fiscal year and if things don’t correct soon, we are facing more IOU extravaganzas later in the year. The current budget short fall is $19.9 billion. When the budget was released the state conveniently put in roughly $7 billion in federal government support but just recently that was shut down.

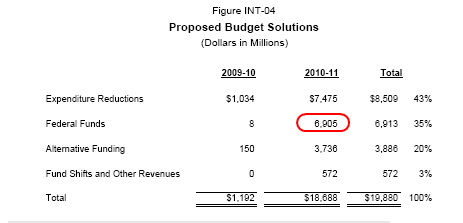

Here is how that projection looked in the budget proposal:

“(News Chief) Scarcely three weeks ago, Gov. Arnold Schwarzenegger unveiled his final budget, predicated on the outlandish notion that the federal government would cough up almost $7 billion more to cover California’s budget deficits.

Schwarzenegger and legislative leaders then jetted off to Washington to lobby for a federal bailout, but received – at best – a cool reception even from the state’s congressional delegation, much less other federales.

This week, President Barack Obama unveiled his own budget and it contains, at most, less than a quarter of what Schwarzenegger wants – such as no more than a token payment to the state to cover imprisoning illegal-immigrant felons.â€

Hey, they had to ask given the crony system is handing out bailouts like candy in D.C. However without a Wall Street address that request was denied. If we want to know why California is in such a budgetary mess we have to look at their delusional revenue projections made at the peak of the bubble. Let us go through five major reasons why California will have no real estate recovery in 2010:

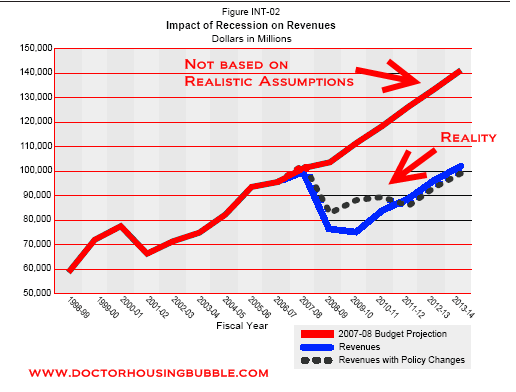

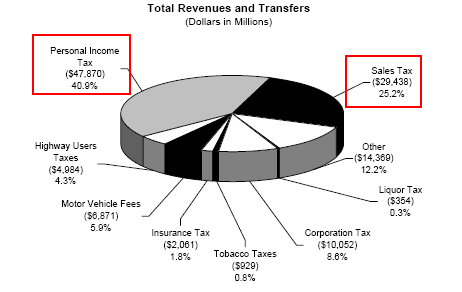

Reason #1 – Revenues Projections Off

As the blue line above highlights we sort of missed the perpetual revenue machine by believing in the fairy godmother of real estate. These projections were as delusional as those made with housing prices backed by Alt-A and option ARM toxic mortgage sludge. Now last year the state went through some major cuts and furloughed thousands of state workers. Now you would think that people would equate less money with less discretionary spending but somehow people think that less money equals more money for home buying. Right now a large part of California is fighting to stay afloat. The tunnel vision focus on real estate has ignored the real crisis at hand. The nation has followed in the same path putting housing before jobs. Now with a $19.9 billion budget short fall we are assured another budget circus in the next few months especially in a year when we will be electing a new governor that isn’t Kindergarten Cop. In Arnold’s defense (just a little) look at who he has to work with in Sacramento.

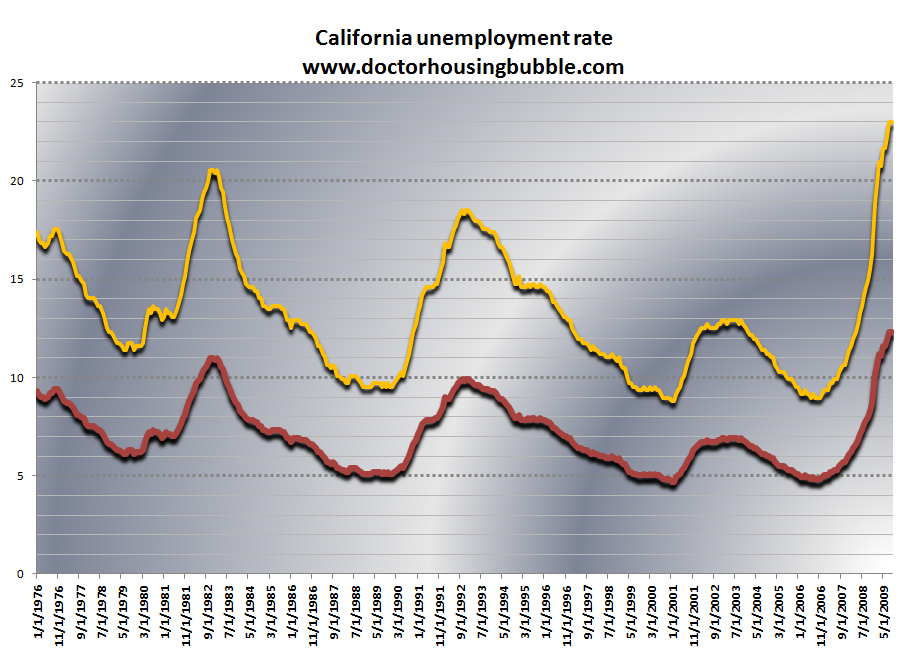

Reason #2 – Employment

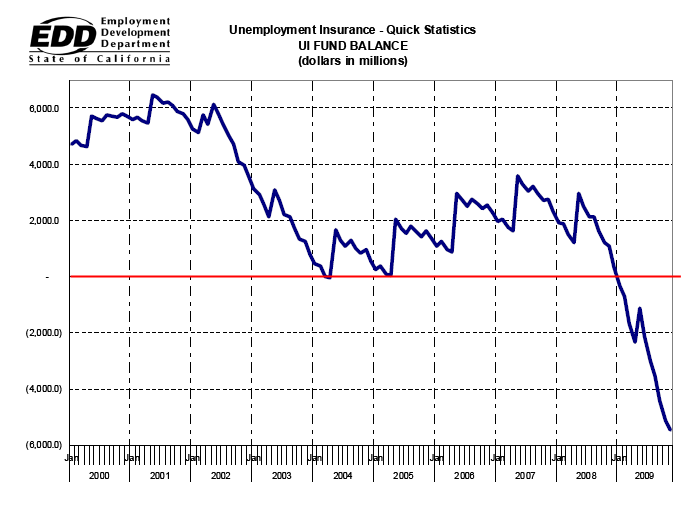

It should be obvious that without jobs or companies hiring that there will be little resources to buy a home. A home purchase is the biggest financial commitment most Americans will take in their lives. So why would people be making this commitment when unemployment in California is at the highest since the Great Depression? The underemployment rate is up to 22 percent and this is why the real economy is still faltering. Aside from wacky headline numbers, the real economy is fumbling left and right. Just take a look at those collecting unemployment insurance in California:

Now if the employment situation was getting any better why would we still be losing jobs and paying out more and more in unemployment insurance? It is hard to fake the above data because these are people that are filing every two weeks trying to get a paycheck. And it is hard to imagine someone running out of unemployment insurance with nearly 99 weeks of unemployment available but thousands are now confronting that reality with benefits running out. But that is the face of the new recession. Yet people still think that it is a good time to buy?

Reason #3 – Taxes

The state draws most of its revenue from personal income taxes. Personal income tax is such a volatile source of taxes. When things are good things look flush but when things go bad, people won’t be paying taxes on jobs they don’t have. It is a deep problem in how California raises funds. The next biggest revenue source comes from sales taxes which also fluctuate wildly with economic cycles. These are actually poor sources for stable revenue. Local property taxes are actually more stable sources of funding (i.e., Texas). However you do have exceptions like New Jersey that have high property taxes and other high taxes. But look how they are fairing in this recession. The bottom line is revenues have dried up in this cycle.

And we saw what happened in the last go around for the budget circus. We had cuts and higher taxes. Here in Los Angeles County we are now paying 9.75 percent in sales taxes. People here have also seen their checks shrink with state withholding increases. So expect to see more of this in the upcoming cycle. More money to plug the gap and less money to blow on overpriced housing.

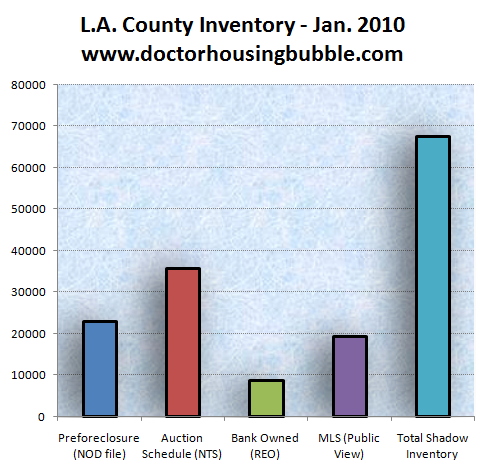

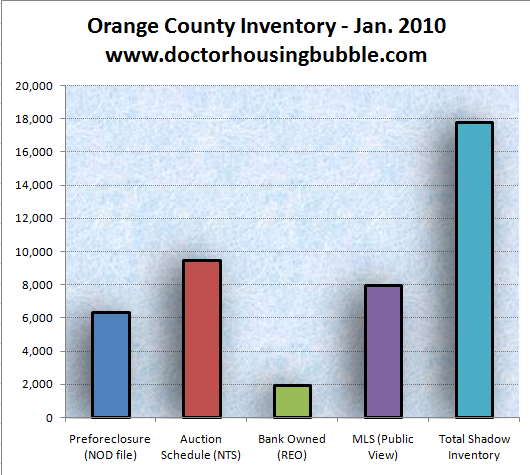

Reason #4 – Glut of Housing

Contrary to what the real estate industry wants you to believe, the market is flooded with distress properties. Just because banks are holding onto these properties doesn’t mean things are suddenly fine. The government is trying to buy more and more time. In a twist of real estate irony, tax delinquencies have actually fallen because banks are paying the taxes on shadow inventory:

“(NC Times) Property tax delinquency rates are down in both San Diego and Riverside counties, because banks are paying back taxes on foreclosures, officials said.

As the economy began to sour in 2007 and unemployment rose, the percentage of property tax delinquents in both counties jumped. But the past two years have seen a steady increase in the percentage of people who were paying on time —- mostly, tax officials said, because financial institutions have been taking over foreclosed properties and getting the taxes caught up.

In San Diego County, the percentage of properties with owners who were delinquent on property taxes for the December 2009 installment fell to 6.8 percent, or 66,448 properties, that owed a total of $133 million. The delinquency percentage was down from 7.7 percent in 2007, and 8.7 percent in 2006, the peak for the decade, said San Diego County Treasurer-Tax Collector Dan McAllister.â€

But this is money coming out of the too big to fail banks (aka the taxpayer funded banks). So by default, we as taxpayers are paying the delinquent taxes on empty homes that banks refuse to put on the market. The massive foreclosures and missed payments are simply a reflection of the horrible economy. Yet everyone should buy a home today because of low interest rates according to the housing industry.

Reason #5 – Gambler’s Fallacy

California suffers from a massive case of the gambler’s fallacy. Just think of a roulette table and the electronic scorecard above the wheel. There are times when you will see a number repeat multiple times (i.e,. the number 3 hits five times in a row). Yet technically if the game isn’t rigged, every number on the table has equal odds of popping up. But people suddenly think that because 3 came up that somehow the gambling gods will give them better luck on this number. It is a part of human nature and casinos exploit this weakness.

But California housing carries some of this logic. I can’t tell you how many times I have heard, “prices have come down so far that once they go back to appreciating I’ll be up big!â€Â Or another good one is, “California housing will always go up in the long-run so buying right now makes sense.â€Â This is like ignoring the statistics on the roulette table. Robert Shiller with over 130 years of data found that housing prices track inflation over the long run. As I pointed out in a recent article, California home prices in many counties are still way overpriced above rates of inflation.

Buying a home today is a big gamble but that didn’t seem to stop many California buyers from getting in over their heads before and I’m sure it won’t stop many from doing it again. Banks and realtors are more than happy to indulge in your speculation.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “The California Financial Gambler’s Fallacy – 5 Reasons Why the Budget and the Economy will Keep Home Prices Stagnant. Banks Paying Property Taxes on Shadow Inventory.”

And yet, govenment workers get regular raises, and many enjoy retirement benefits of $100,000. or more. see

http://www.pensiontsunami.com

I would like to buy a house in SoCal, but as I watch prices drop I realize my down payment would have evaporated if I had bought one in the last two years.

With the shadow inventory, and sweetheart deals like One West got from the FDIC to buy Indy Mac it is just too risky.

Check out this video in the Indy Mac/One West situation.

http://www.thinkbigworksmall.com/mypage/player/tbws/23088/1111064

Arnold could have avoided this mess if he stuck to his election promises. Cut the spending in Sacramento. He could have vetoed every proposed budget on his desk and only approve it if the increase in spending was at an inflation rate say 2-4%. Instead he approved large spending increases every year because tax revenues were coming in very high. He could have put the extra funds in a reserve for the rainy day. What shocked me was that he got re-elected and continued his spending spree. When things went bad, he blamed the democratic legislators.

The banks will be sitting on the shadow inventory for quite some time. With real unemployment approx 20% in CA, there’s no chance of a real rise in prices that’s sustainable. In another year or two when homes have either fallen or stayed flat in price, no one will be interested in buying a home. This is how it works.

If California wanted to increase revenues and bring the state’s budget back from the brink, they would legalize pot, sell it out of dispensaries, regulate it, and tax the hell out of it. Not only would it stop the narco violence across the border, it would bring billions of dollars into California’s revenue stream. Pot is not nearly as dangerous as alcohol. And people can get it anyway, any time they want, so why not profit from it as a state? We all know the Governator smoked pot in his youth, he should push it as an initiative, and get the credit for the states rebound.

I respectfully disagree with Robert Cramer. Government workers are actually getting pay cuts. The State, LA City, and school districts are giving furlough days which are effective pay cuts. This will reduce the purchasing power of public employees and will further drive down housing prices.

Here’s a discerning warning on the subject that was said over 200 years ago from one of our founding fathers: “I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.†Thomas Jefferson (1743 – 1826) 3rd U.S. President Citizen Beware!

Edy,

From my own searching it seems that that particular Jefferson quote is actually not attributable to him. You might want to check it on snopes.com

Another great article. I do detect a pleasant increase in sarcasm lately. “Fairy Godmother of real estate”? Priceless.

If this is accurate, any IndyMac loan is likely to be going into high pressure mode for short sale of foreclosure.

http://www.thinkbigworksmall.com/mypage/player/tbws/23088/1122384

Looks like the banks and regulators are going for broke to keep prices high for years to come.

http://www.californiahousingforecast.com/commentary/

Dr. HB, this is one great column you continue to produce. I gives all readers the real story about what going on. I cant tell you how many times Ive seen some segment on CNBC from Diana Olick or Jane Wells telling watchers about the deteriorating state of housing in California, that DHB readers have known about for months. And the CNBC pair are always surprised at the news. My comment is always the same: “Dont they read Dr. HB?”

These back-tax payments are a big deal. And remember, the banks also have to pay insurance and maintenance if the properties stay vacant. They also forgo the returns to capital on whatever they would receive at sale.

But lets think about someone who’s not underwater, but who has some equity and is defaulting because of a job loss or some other personal issue. In the past, the banks would pursue foreclosure, eviction, repossession, marketing, and resale as soon as possible to encourage the individual to sell on his own, or at least mitigate the loss. Either way, a homeowner would still walk away with their equity.

But today, the bank would probably let it ride and convince people to stay put in the name of “keeping people in the homes” or “making efforts at modification” and try to recapitalize all the missed payments. If the individual doesn’t voluntarily try to sell the home as quickly as possible because they are hoping to get a new job, then they are essentially using this decline in equity as rent.

But penalties, fees, and variable interest would rapidly eat it up – at a rate much, much faster than rent on a comparable unit. It wouldn’t take long at all to lose 20% equity in a home this way. You wonder how many people are getting suckered in this way.

You can see whose fault it mostly is when you read the Governor’s new law to “reduce” the overcrowded prisons. (It’s basically a bunch of bull). Plus, there have been new parole laws that keep people in prison longer, with 15 years in between parole hearings! He needs to release especially non-violent female prisoners, for one thing. The California prison system is like a country unto itself and is costing much more than it needs to cost.

Just came back from the affluent city of Rocklin, CA today. While leaving Winco supermarket, I saw a woman holding a sign at the corner: “I have $34,954 of bills, anything will help.” Nobody was stopping for her. And her head was turned away so that she didn’t have to make eye contact with people passing by.

My former boss was recently preaching how I should buy a house soon because it’s the only thing that’s going to keep it’s value with the coming inflation, and that investors are snatching up property on the cheap. His receptionist was thinking of buying two homes, a spare and one to rent. The bubble mentality is still alive and well.

My husband and I were recently talking about buying some rentals. But I don’t see the economy or housing recovering any time soon. My concern is if we see an oversell in housing that matches the over-buy, or if all hell breaks loose and we see Great Depression II, we could end up with such an oversurplus of housing that the average rent would be driven down. People who bought homes as investment property while prices were falling, may not be able to keep the rent up high enough to see a profit or may simply have trouble finding people to rent at all. We’re going to wait and see. I’m definitely not worried about being priced out forever.

Prop 13 is the real culprit for CA’s revenue instability. With coporations able to legally evade property taxes and others paying almost nothing, California’s low, low property taxes make us reliant on the other, less stable sources of revenue. Just another subsidy to keep the market artificially inflated.

Repeal Prop 13, Eliminate all tax subsidies (mortgage interest deduction and various tax credits) and we’ll eventually see a healthy and sane real estate marker, and an non-distorted economy and budget. Those are extraordinarily unpopular ideas, but then again, so is cutting of heroin supplies to a house full of junkies who are killing themselves. It will be awful at the beginning, but it’s the only rational way to survive.

Robert Precter echoes this piece with herd mentality. Most of us are pack animals waiting for instructions from the alpha dog, but there isn’t one–just pundits with an agenda that (like NAR) and most of us are too stupid to realize we are being jerked around. Idiocracy should be mandatory viewing. We are declining in intelligence but surrounded by information. And being directed into a life of obedient payments to the alpha dogs.

Release just female prisoners? WTF!?!? Is this 1880 where we view women as “lesser” than men? Equal treatment, enough WOMEN fought for it, now live with it. Next step is combat positions so you can DIE like men.

How about releasing every single person in prison and/or jail for non-victim crimes. Drug possession, drug sales (not to youth, they stay), prostitution. We need to flush the system and only imprison those whom pose a REAL danger to society, not people who engage in questionable moral or ethical behavior.

However, the more people that are imprisoned, the more POWER the POLICE STATE OF CALIFORNIA amasses. Take a gander at how much of the budget is spent on prisons and prison guards. They are in lock-step and unionized with the beat cops. So, cops get power by arresting and imprisoning people, yet THEY are the ones doing the arresting. Hmmm, doesn’t take a genius to figure that one out.

If you make stupid laws to make stupid crimes, you can arrest anyone pretty much at anytime….but it seems to many that giving up your freedom and rights are a small price to pay in order to be safe.

I hope people remove their heads from their posterior before it’s too late.

2 commenters are dead wrong on their critiques of Arnold. You don’t win Mr universe/olympia, and hold the guiness book of world records for the “Most perfectly Developed Human Body” by smoking dope. He came to LA with nothing, Lived out of a backpack, and worked diligently to be the best. The very first election cycle after taking office, He had SEVERAL ballot measures to CUT taxes, REDUCE spending and govt waste, but ALL were voted down by the citizens!! Voting fools endorsed HUGE waste, the bullet train which just broke ground. Sheep are easliy swayed by the advertisments and promises of bliss. The irony is he married into the elite Kennedy family of democrats. Fame and success got him the gate key into the club of “powers that be”!!!

Agree with you on the matter of releasing only female prisoners, Swiller. Might I add that many of these women are likely just as violent and dangerous as the males.

Regarding women in combat, may I mention that a number of female soldiers HAVE been killed or badly injured in combat in both Iraqi wars. Notable among them is Tammy Duckworth, a Chicago political contender of Asian descent who lost both her legs flying a helicopter in the conflict. Numerous female soldiers have died in eplosions and bombings there.

ALL inmates imprisoned for “victimless” crimes such as drug offenses (except sales to underage children) should be released, and the laws that made their offenses “felonies” should be repealed.

I could add that the War on Drugs has cost more lives and money than all our foreign wars combined, and has additionally caused more drug addiction while corrupting our political leaders and law enforcement people completely.

Again, agree with your post 100%.

I second the Prop 13 as the real culprit in California! It makes no sense!

Prop 13 was a badly written law that did not attack the malaise at its source, which is reckless and ever escalating government spending. A sane law would have placed caps on spending and borrowing by municipalities and taxing districts.

Personally, I would like to end property taxes. This is the most viciously regressive tax there is. Property taxes mean you do not own your own home, and ever-escalating property taxes mean that you can do everything right- buy and borrow modestly and pay your loan off quickly- and still be confronted with surprises you can’t handle. It renders property ownership not only meaningless but downright dangerous, and wipes out the only real advantage of home ownership, which is that you can, by buying and paying off a home, control your housing expense and have a secure roof over your head that no one can move you out of.

CA and its equally broke sister IL have arrived at this pass by means of reckless spending on entitlement programs and “gimmes” for corporations who are subsidized extensively. Politicians have continued to vote themselves pay hikes in spite of the deterioration in the incomes and opportunities of most citizens. And all our government bodies taken together- federal, state, county, and municipal governments, AND industries that rely on extensive government subsidies (defense, transportation, energy, housing) employ 50% of our population. The other 50% who are reliant strictly upon the shrinking private sector must pay for all of this.

If we want to survive economically we are going to have to make some very nasty choices very soon. We will have to ruthlessly cut unnecessary public spending- and about 60% is unnecessary- and trim our array of welfare programs. Do cash-strapped CA school districts that cannot pay their teachers or provide the instruction necessary to get top ratings really afford glitzy school houses designed by Starchitects like Frank Gehry? Does any town or city need another Walmart or Target badly enough to justify tossing a $4M subsidy at the corporation to build one of these stores 3 miles down the road from another one that was built with similar subsidies 5 years ago?

Subsidies for housing and higher education should be off the table altogether- housing subsidies in all their various forms (Section 8, FHA, FNMA, GNMA, mortgage interest tax deductions) have only driven housing prices northward while creating the biggest pile of unrepayable debt ever to exist, and the Sallie Mae student loan program has only encouraged students to run up $100K-$200K in non-dischargeable debt, driven up tuition costs into the stratosphere, and fostered the degradation of upper education through “college for everybody”,and the formation of low-quality colleges that charge outrageous tuition while delivering education (if that is the apt word) that will mostly be useless in the economy we are becoming. Money allocated to all of this was taken from your municipality.

This country needs badly to go on a spending diet, and it might as well start with the biggest spendthrifts, our taxing authorities and federal, state, county, and municipal governments. Just as we citizens who are dealing with layoffs and/or reduced incomes must question every expenditure, right down to an occasional stop at Starbucks or new towels for the bath to replace ones that look like shop-rags, our government bodies need to ruthlessly cut every single questionable expenditure, from a new library down to new furniture for some department head’s office, to another subsidy for yet another redundant big box store.

I truly believe that the state/counties/cities has been overpaying and overpensioning individuals for years. This will all change this decade.

NON OWNER OCCUPIED homes SHOULDN”T BE PROTECTED UNDER PROP 13 REGULATIONS.

If the Bankrupt state of CA had any common sense they would reassess annual property taxes to a market rate on NON OWNER OCCUPIED homes to increase state revenues. Sorry folks but PROP 13 was meant to protect the Homeowner not the INVESTOR.

Hey, Arnold, are you reading this?????

Prop 13 will naturally die out with age. The property can only be tax protected to the second generation (grandchildren). After that it is taxed on the purchased price.

I’d love to see a citation for the claim that corporations are legally able to evade property taxes through Prop 13. This is a very popular misconception parroted by multiple people with nothing to back it up. There was a guest editorial written by San Francisco’s Assessor (of all the people who should know better) that repeated this same claim. It simply isn’t true.

Also, the comment by Aaron above me is also false, transfers between parents and children are, in fact exempt from reassessment with no generational limitation. There are certain requirements for eligibility, but no cap, as is implied in his statement.

When Greenspan was in office before Bernanke, is it my imagination, or did it seem that Greenspan was a lot more visible and proactive?

Leave a Reply