The Bourgeoisie Crisis: Three Fascinating Stories from the Recession Front: Nationalization for the Oligarchs. When a Master Planned Community Meets the Crashing Housing Market. Where will the Proletariat Play?

Every reasonable economic indicator is pointing to a severe and prolonged contraction. Anyone looking at these data points would have to arrive at a similar conclusion unless they are willing to suspend belief. Just sit in a room in a yoga position and tell yourself, “a 6.2% drop in GDP is not bad…” and inhale deeply. If you convinced yourself about that point, you would have a hard time stomaching the fact that after the closing bell on Friday, the California employment numbers were released putting the state unemployment rate at a 26 year high of 10.1%. What that means is 1,863,000 Californians are out of work and who knows how many are working part-time or have given up looking for work. This convergence of factors solidifies a view that the housing market in California will not bottom until 2011.

Nationalization fit for a King

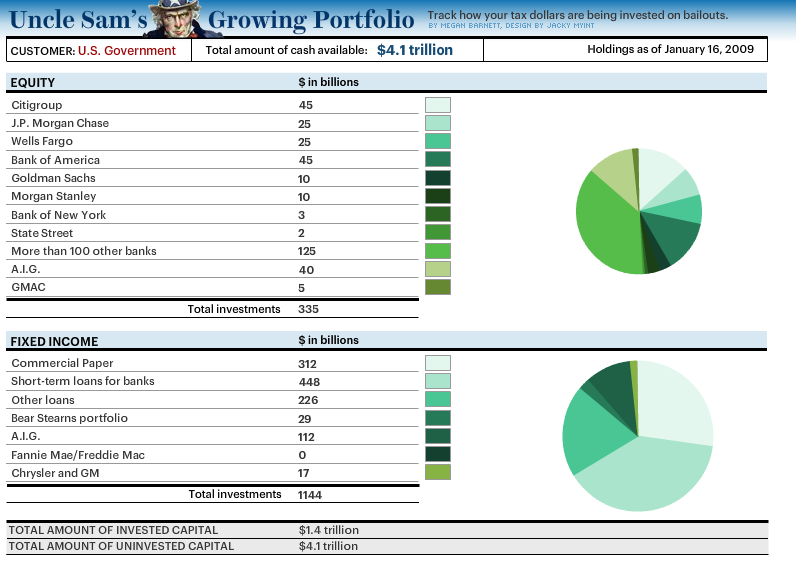

While we were arguing the merits of nationalization, we went ahead and did a nationalization-lite of Citigroup last week, which puts us at an incredible disadvantage. The market did not like this move and is already betting on a full nationalization:

Citigroup got a nice taste of reality plummeting 39% on this supposed good news for the company. Good news for who? The executives that will still be getting million dollar salaries until they figure out a way to get hefty bonuses before shoveling off a carcass of a former mighty bank to the majority of the population? Doesn’t this remind you of that scene in Titanic where everyone is trying to get on the lifeboats? Unfortunately, the U.S. taxpayer is the last to get any support here and is most likely going to freeze in the water with those toxic assets.  This was not a positive move. Now, the U.S. taxpayer is in a much more precarious situation because our money is now in common shares that makes it harder for us to wipe out Citigroup since we will be taking the hit ourselves. This is some twisted extortion and puts us in a Sophie’s Choice in what to do. Doesn’t change what is right. That is, nationalize and move on or gear up for a lost decade with zombie banks ala Japan.

All these programs being put forth, demonstrate who holds the massive power in the country. The Federal Reserve and U.S. Treasury are merely a lobbying firm for the biggest banks. Take a look at this stunning chart:

Source:Â Portfolio.com

So far $1.4 trillion has been committed with $4.1 trillion remaining untapped. Given the road we are following, expect to see that number decrease as banks suck up this taxpayer money. While many Americans are now seeing their credit cards shut off and employment is skyrocketing, they are now expected to offer generous loans and terms to these same banks. Who are we really protecting here?  In fact, all those retail investors who own common shares are realizing they were merely the icing on the true investors cake, the oligarchs are throwing common shareholders to the wolves while protecting bond holders. Why are bond holders sacred? They shouldn’t be. That will be the next battle. But expect the ruling class to fight hard to keep that power intact.

Coto de Caza – Prime Areas Getting Hit

Coto de Caza is a gated private community in Orange County. It is a suburban master planned community that has about 4,000 homes. It is one of Orange County’s oldest and what many would consider to be a prime community. The community was put together in 1968. The community also has two 18-hole golf courses.

With a population of 13,057 it isn’t your biggest Southern California city but shares much of the attributes of the prime enclaves that have been rather resistant to price falls. That is no longer the case. Coto de Caza is now down 33% on a year over year basis. The current median price for a home is $488,000. Let us look at what we are talking about here:

Now Coto would have been your young professional family starting point. You would go here, buy a place, wait 3 to 5 years and get your ridiculous equity and move up to another higher OC community. This worked for over a decade. That is no longer the case. The above home is a 3 bedroom 2 bath home with 2,000 square feet. The home has been on the market for 138 days. Let us see the sales history on this place:

Sale History

10/11/2006: $750,000

08/16/2001: $472,000

07/26/1996: $254,500

Nice appreciation! You can see how people got brainwashed into believing that California was somehow the eternal salvation of the housing market. It was in fact, ground zero for the deepest housing delusion I have ever seen. It will make for interesting case studies for future consumer behavior research. Let us now look at what a crashing housing market has on prices:

Price Reduced: 11/10/08 — $680,000 to $670,000

Price Reduced: 12/03/08 — $670,000 to $630,000

Price Reduced: 01/23/09 — $630,000 to $590,000

Price Reduced: 02/19/09 — $590,000 to $549,999

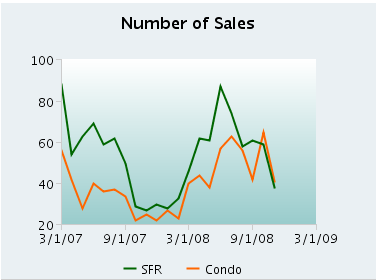

At the current price, the home is now down 26 percent from the peak price. As you can see, the median price is now guiding behavior of sellers. And this is also being reflected in the sales numbers:

This is only one example of many communities feeling the pain of the current economic contraction. There are many others throughout California.

Bohemian Big Box Playgrounds

It is rather silly to think that to develop a modern and hip city, all you needed were a few trendy shops, a handful of Starbucks, a Crate and Barrel, throw in a Macys, and you have yourself an upcoming SoCal neighborhood. At least this was the plan of the commercial real estate boom which will be the next major bubble to burst. In fact, there is some political capital to bailout homeowners as we are seeing although much of the money is staying with the banking oligarchs yet how would you even justify bailing out commercial projects? You really can’t.

The New York Times had a profile of one such city, that of Eagle Rock California:

“Over the last five to six years, Eagle Rock became the glamour girl of Northeast Los Angeles, a crescent where the asphalt jungle meets the foothills. The neighborhood of 35,000 or so has attracted screenwriters and composers, Web designers and animators, who labor on their laptops in cafes, discuss film projects at Friday night wine tastings, and let their children play with the handmade wooden toys in a Scandinavian-style coffee shop, Swork.

It is easy to sniff at such urban affectations. But the downturn endangers more than precious shops; residents worry that as stores close, the fabric of a bohemian utopia – with its Jane Jacobs mix of commerce and public spiritedness – will also unravel.

Less than a decade ago, Eagle Rock was an unlikely candidate for gentrification. For decades, students at Occidental College – who have included Luke Wilson, Ben Affleck and Barack Obama – complained to friends that there was nothing to do in their college town.

Tracy King, a real estate agent, said that when she moved to the neighborhood in 1983, “there were 79 auto-related businesses on Colorado and Eagle Rock Boulevards.”

So this was one of those areas deeply trying to come to its own like specific Pasadena enclaves. It had the location and it had the supposed allure of this new trendy market. Of course why should we let economics get in the way? That of course is all unraveling:

“But as housing prices rose, bohemia expanded beyond the Los Angeles neighborhoods of Venice on the Westside and Silver Lake east of Hollywood. Eagle Rock filled with parents needing a place to roost. Hair salons with monosyllabic names like Loft quickly followed. Density increased, and so did foot traffic; shoppers could walk from store to restaurant to bar.

Real estate followed the national boom: a three-bedroom house in Eagle Rock that sold for a median of about $260,000 in 2000 more than doubled to $620,000 in 2005, before slumping a bit (to about $570,000) over the last year.”

These are the next areas that will get hammered. With the state unemployment rate at 10.1% and growing, these areas like Coto de Caza will start crashing and crashing hard. They were built on the ever consuming middle class of America that just saw their stock equity evaporate and their home appreciation was merely an illusion. People are now having to pull back not by a conscious choice but because they have no other option. These communities were built around this constantly spending class. As many are now realizing, they were never really part of the wealthy class and have only been part of the ever growing debt class of Americans.

California is now running in the red with its unemployment insurance fund with over 700,000 people taking claims. This is a record. Many of the industries in the state depended on a conspicuously consuming middle class culture that was spending happy because of rising housing values. This is now over. Anyone expecting this to change in the upcoming years is out of their mind. Read the 10 Reasons why California won’t see a housing bottom until 2011. If that still doesn’t convince you keep in mind many of these prime areas were hub central for Option ARMs that will be hitting in full force this year. Here is an updated chart from Credit Suisse:

Most of those toxic loans are here in California. The supposed bohemian class is going to realize that they are more like the proletariat than the tiny bourgeoisie class organizing bank bailouts that are convenient only for them while trying to play on the financial ignorance of the population by scaring them regarding full on nationalization. There is now a push to cap mortgage deductions at $250,000. I say about time to that. This is another wet towel on the obsessive California housing bubble mentality.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “The Bourgeoisie Crisis: Three Fascinating Stories from the Recession Front: Nationalization for the Oligarchs. When a Master Planned Community Meets the Crashing Housing Market. Where will the Proletariat Play?”

Thank you for pointing out the NY TImes article on Eagle Rock. I’m 30 yrs old and I live and own a business in Echo Park, another rapidly growing boho community. I see property values are still high in the area and every Sunday tons of cars circle my area searching for open houses and now, rental open houses. The freelance hipster realtors in these areas (Silverlake, EP, Downtown, Eagle Rock, Atwater, Mt. Washington, Glassell and Highland Park) have made new businesses as third-party rental property brokers and have managed to monopolize the advertising of available units in the area to attract “quality” renters, thus keeping prices insanely high. I’m looking to move to rent a larger place but when the average one bedroom in the area averages $1400 (often with no utilities, no parking, no appliances) I’m going to either have to wait longer or move farther away. In fact, on the average, rents are more affordable on the Westside, Studio City or even Los Feliz than it is to live in Echo Park. When I address this to the realtors/property managers they shrug and rattle of the local nightlife, the artistic scenes and the new shops, etc and that its sooo worth it and EP delivers. I get it. In fact I own an therapeutic massage therapy business on Sunset. The article you mention highlights exactly the problem with such inflated thinking: “These communities were built around this constantly spending class.” This is true. My clients are scaling back. I have scaled back. I may need to get a larger apartment unit to move my business to my home once my office lease is up. I just don’t understand why it’s taking EP so long to drop prices on home and rentals. It’s taking forever.

echoparkgal I feel your pain. I rent a 1b1b in Sunset Beach (by Huntington beach) 1300 bucks and I rent a storage place a few miles away. Looking to move to Rossmoor in Los Alamitos. Rent or buy. Prices are dropping, just not fast enough for me as a potential buyer. Rents for 3b2b are 2400 to 3000. I know housing is going to be cheaper I just wish it would hurry up and get there in the neighborhood I want to live in.

Thanks for the upbeat story Doc.

Your Revival-2011 looked like doom-and-gloom a year ago–now Pollyanna herself would require suspension of disbelief to imagine such a quick turnaround. If the only problems were the one’s already disclosed, it would be a nightmare. WTF is behind door #3? Maybe the Alt-Apes, Option-Arms and Jumbo’s with Big-Assed fries will be over by 2011, but what will be left to rebuild from the ashes? Tom Joad has gone as far west as he can. Ain’t nothing but Ocean from SoCal west…

Anybody about sick of AIG-GIECO’s freakin’ lizard commercial yet? Evidently, they think this is all funny. Less and less are laughing now. Maybe the caveman one’s will come back, because that will be all that the middle class will be able to afford in a few years, if we can come up with the down payment for a cave.

Maybe Arnold needs to go find the Terminator in the past rather than the future, and stop this monster before it gets started. As Jackson Browne pointed out “The future’s there for anyone to change, still you know, it might be easier sometimes to change the past…”

@Echo & Andy

It’s a siege: These guys are underwater if the have to mark their properties to market rather than mirage. A lot of them probably have complex wrap-around’s and such, and their only equity is in the bubble price–not the cash they put into the game (why would they use their own cash?) Besides, their cat’s probably took second’s on the units. These guys are dead if the market doesn’t rebound, so it’s a waiting game. Try chanting “bring out your dead”.

I think the term “Bobo” short for “Bohemian Bourgeois” best describes the artistically inclined folks who are well-heeled enough to afford a house in an already hip area. The real bohemians/artists go where the rent is cheap and they can afford to live and work. They eventually make a community that is hip and attracts the clients who aren’t artists, but want to pretend they are (bobos). Once the Bobo’s and their realtors get there, the artists are priced out and the hip is long gone. All that are left is a bunch of housewife artists painting shells and running dress shops.

The realtors see this desire for “Hip” and exploited it to the hilt in the past years- and the silly bobos bought and bought, making a pit like Eagle Rock (a place where no one would live if they could help it, when I was a kid) “desirable” only as long as the bubble lasted.

I wish them all well, silly buggers. But hopefully the market will reward us simple sensible folks with realistic prices in the next few years.

Thank you for an other good post Doctor.

~

I still suspect prices are artificially high. I read an article that a considerable amount of foreclosures are not making it to the MLS. Think banks may be afraid to mark many mortgages to market as liberal fractional banking rules will cause the bank’s demise.

There’s no cheap rent anywhere in southern CA really. The artists could probably live better in Kansas, really we all could!

And I don’t see what’s so wrong with Eagle Rock except for the Los Angeles school district (and face it most of the east side is bad school districts). The location is fairly central for the eastside, 10 minutes drive to Pasadena, not too far from downtown or the San Fernando Valley. Does it justify completely unaffordable housing prices? Of course not, but that’s all of Los Angeles that has that problem.

I still talk to people saying they looking to buy. They don’t get it. They don’t understand what is happening. Perhaps we’ll know we’ve reached bottom when the average person refers to a house as a burden, rather than an investment.

“The World is Not Going Back to Normal After the Magnitude of What They Have Done”

.

You are a fountain of knowledge and insight Dr. Housing. Hell, even the boobs who comment have something to offer. Thanks to all.

One thing I would like to see you touch on is interest rates. Where do you see them headed? How long can they stay as low as they are? What will be the effect on the housing market when they inevitably start moving up? Obviously it wont be good, but as someone looking to buy, my gut tells me that this may be the sweet spot for both prices AND interest rates. I agree that prices have more room to fall, but what I am having trouble gauging is where interest rates will be in 3, 6, 12 months. Any insight here?

10.1 million unemployed? In California? I guess they are not counting the 5 million undocumented workers who figured it out and went home.

DHB is truly the best tonic. I’ve been seeing on various lists and forums the assertion that you have nothing to worry about if you consider yourself part of the “cultural creatives,” the “new class,” the bohos, bobos, and bonobos…in short, the spendy, trendy, educated consumer classes of the past 20-30 years.

~

For two decades my work took me to enclaves of people whose notion of work involved showing up, or not, to stroke other people of similar inclinations into a general agreement that they all were smarter, better, nicer, and prettier than the working stiffs. In San Francisco in 1999 there was a huge flap because a handful of Muni (transit) drivers had earned in the six figures! Horrors! All my dot-com acquaintances agreed this was wrong.

~

These few workers had worked the equivalent of two full-time positions, because the city wasn’t allowed to hire more drivers for budgetary reasons if I recall correctly. In other words, these working women and men were out there driving routes that I didn’t even like to ride on (like the 22-Fillmore bus line, which the drivers all called the “22 Fellini”), 60 to 80 or more hours per week.

madguru writes “One thing I would like to see you touch on is interest rates. Where do you see them headed? How long can they stay as low as they are? What will be the effect on the housing market when they inevitably start moving up?”

>>>>

Yes the realtor chant of “record low interest rates” makes no sense. Sooner or later – and it could be 2, 5 or 8 years from now, interest rates will rise. Now that is important if you buy something and have to sell in the future. What people can afford to buy depends upon their income and that monthly payment. The payment is made up of interest and principal.

>>.

If you buy a $250,000 house with 10% down you will br carrying a $225,000 mortgage. Say it is a 30 year fixed at 5.26% (the rate Bankrate gives today.) The pricipal & interest payment will be $1243 and the income needed for the entire PITI including taxes and insurance would be around $60,000 so the PITI is not more than 31% of gross (and that is STILL ver high for most people.)

>>>

Now say you go to sell 5 years from now and the interest rates are now up to 6.75%. If the house is priced at $250,000, that principal and interest with 10% down will now be $1460 and the income needed for the entire PITI will be around $69,000 or 15% more than you make. That means FEWER potential buyers with the higher price.

>>>

For someone else to buy that house with a 6.75% interest rate, 10% down and not have the principal and interets payment be more than $1243, you would have to DROP the price to $213,300 so their mortgage was not more than $192,000.

>>>

You can ALWAYS refinance and interest rate – you can NOT reduce the price you paid (unless you are willing to lose money.)

>>

High interest rates and a lower price are far far far better than low interest and a higher price. And if you think sellers are not keeping their prices higher because interest rates are lower, think again as the bottom line is always how much buyers can afford to pay each month. When interest rates rsie – and they will – unless incomes go up a commensurate amount, the price of houses will have to drop.

Quite Honestly, I still can’t believe that CitiGroup is doing as bad as it is doing, About a year ago, I had thought that Citi was doing quite well compared to some of the other banks, but I guess not.

Scary stuff…but you are right on the money. No one seems to have a solution either.

This is a great post, and looking at it in retrospect…there still are no real answers. What we have witnessed is a government intervention and stimulus that has saled the free fall. What remains to be seen now…is rising unemployment, commercial failures, and bank failures.

Leave a Reply