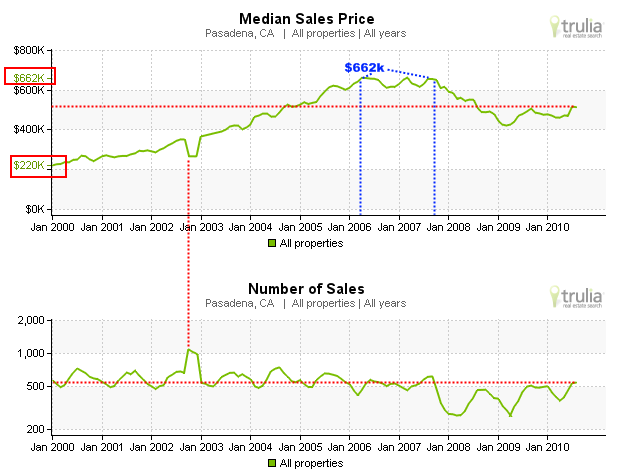

The anatomy of a housing bubble city – Pasadena California home prices expanded from $220,000 to $662,000 from 2000 to 2007. Why housing prices will correct in mid-tier California cities over the next few years.

People in California bubble cities have a hard time imagining a sizeable correction in their market. Maybe it is due to our nanosecond culture where if something doesn’t happen in one year (or one hour) then it is likely to never happen. Yet when we look at current market fundamentals in cities like Pasadena or Culver City it is undeniable that some sort of correction will occur over the next few years. The math simply cannot support the current price structure. This isn’t just us saying it but is being reflected by the number of distressed properties that rest in these areas. In other words, people are unable to make their current payments in a large number of cases even in select prime markets. There seems to be a large cohort of people in California that simply see no correction in these markets. Keep in mind that the state median price is off by over 40 percent yet somehow, nothing will happen in these areas. Let us examine the details of Pasadena with a magnifying glass.

The incredible increase in prices is dramatic when looked at over 10 years:

Pasadena is a large city in Los Angeles County with 56,000 housing units. In 2000 the median home price was $220,000. The peak price was reached in 2006 and dragged out to 2007 at a stunningly high $662,000. Prices have corrected and pushed the median lower but this is based on lower priced zip codes bringing prices lower:

Yet focus on the two top selling zip codes. In these areas we have a median price range of $545,000 all the way to $660,000. In other words, some markets never even corrected and are only masked by their lower end areas pulling median prices a bit lower. This in itself does not exempt the market from being in a bubble. In fact, all zip codes in Pasadena are in bubbles and we will show this why later in the article.

It is obvious that a large reason for the surge in home buying in this market came from exotic mortgages that were born and bred in California. This allowed prospective buyers maximum leverage to purchase homes. In fact, with no-doc and no-income loans it was theoretically possible to have infinite leverage if one didn’t even have a job to back up the home purchase. But today we operate in a world dominated by government backed loans like FHA insured loans that only require 3.5 percent down payments. Let us see how prices were able to triple in this 10 year timeframe.

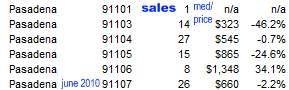

30 year fixed mortgage rate

The most obvious push was the lowering of interest rates by the Federal Reserve. Over this time, the 30 year fixed rate dropped from 8.15% in 2000 to 4.56% in 2010 where it currently stands. Aside from creating the nationwide housing bubble, this allowed people to buy more home than they could afford. Let us just run the numbers on a current home in Pasadena to give this some teeth:

Status:Â Bank owned

1468 NORTH GRAND OAKS AVENUE, Pasadena, CA 91104

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1939

Square feet:Â Â Â Â Â Â 1,633

List Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $669,900

Previous sales data:

March 2006:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $650,000

September 1997: $259,000

The interesting thing about this foreclosure is that it is selling for a higher price than the last sale price four years ago and is a bank owned home. It is selling in the 91104 zip code with a median price of $545,000 so this home is overpriced for the area. So let us assume someone is buying the place with current interest rates versus those back in 2000:

@8.15%

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $66,990

Mortgage amount:Â Â Â Â Â Â Â Â Â $602,910

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,184

Household income required to purchase:Â Â Â Â Â Â Â Â Â Â Â Â $200,970

@4.56

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $66,990

Mortgage amount:Â Â Â Â Â Â Â Â Â $602,910

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,773

Household income required to purchase:Â Â Â Â Â Â Â Â Â Â Â Â $200,970

For income and the upper-bound mortgage amount, it is smart to stick with the 3 times annual household income rule. Ignore points and other closing costs for the moment. For now, we just want to see how big of a difference 8.15 is to 4.56 percent. Overall the monthly payment drops by 27 percent. This is a significant amount of money. Yet current rates are an anomaly. Over 40 years of data (most of it without the Federal Reserve meddling to this extreme level) the average 30 year fixed rate has hovered closer to 8.5 and 9 percent. The current rate is artificial and the market clearly doesn’t want to buy current securities up at these rates (that is why the Fed is stepping in and being the ultimate buyer). What happens when you want to sell this home later in the future and rates are back up to their historical average?

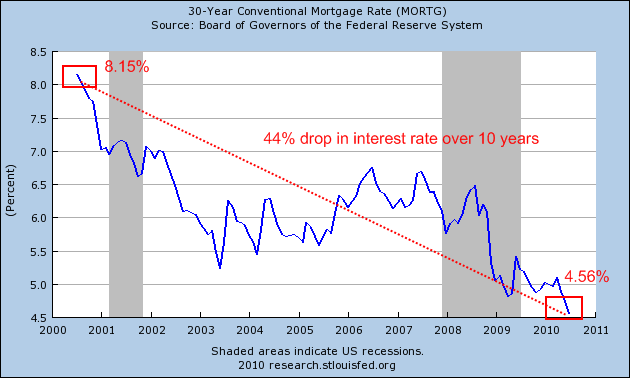

Household income

You would think that in a market where the median price is close to $600,000 that income would be flying off the charts. It is not:

Keep in mind over the same time frame home prices tripled. If the same pattern held with household income current households in Pasadena would have a median income of $138,000. Instead, it is $64,000. So the current ratio of household income and home price is completely skewed to levels seen during the bubble:

$600,000 (median price) / $64,000 (median household income) =9.375

There is simply no other way to put it but to say that the city of Pasadena remains in an extreme housing bubble. Take this example with a trend in lower priced areas like Riverside County. The median price in Riverside reached a stunning $432,000 back in December of 2006. At this time household income was at $58,000 (a ratio of 7.44). Today the median home price is back down to $210,000 bringing the ratio closer to 3.5 to 4 (depending on the lower income figures that come out in September).

Current sales trends

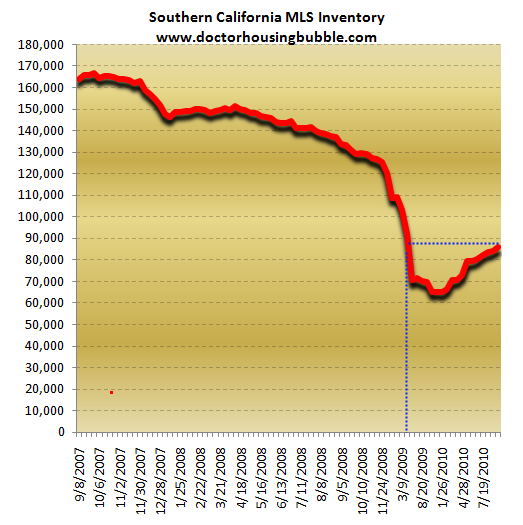

Markets always correct especially when fundamentals are so skewed. Inventory is growing in Southern California:

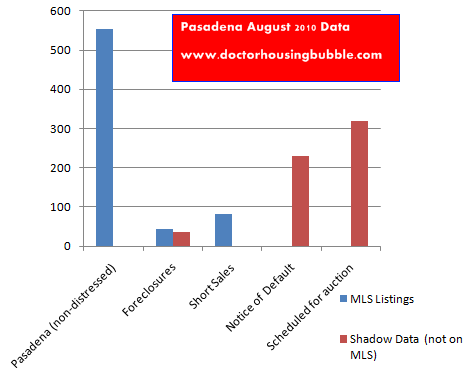

Much of the above has to do with a growing number of short sales on the MLS but also bank owned properties. But even in an area like Pasadena or even the Westside of L.A. shadow inventory remains high:

The above is a telling chart. Only 45 foreclosures show up on the MLS (in total there are officially 80 REOs in the area). But more telling, there are 318 homes scheduled for auction in Pasadena appearing nowhere but in distressed inventory figures. Another 231 homeowners have a notice of default filed against them (meaning at least 3 missed mortgage payments). Does that sound like a healthy market when you have the same number of distressed homes as you do with non-distressed homes for sale?

Bought during the bubble

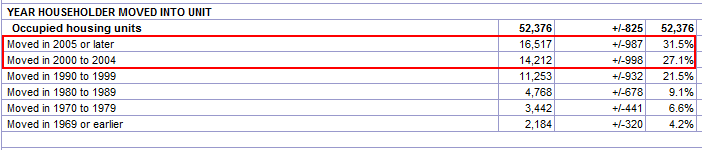

I have heard a few people say “well most people in Pasadena bought before the bubble took off.â€Â The data shows otherwise:

It is unfortunate that the data doesn’t break down owner occupied and renter occupied data further. However, most households in Pasadena moved in during the peak bubble years of 2000 onwards. And we know thousands of transactions occurred over this time as well. The data tells us hundreds of people are holding onto over valued real estate in this area.

So what happens now? Good question. Markets can stay irrational longer than people think. The housing bubble wasn’t built over night and we are still dealing with the problems today. Even low interest rates can’t help unless incomes support current prices. If you haven’t noticed, the economy isn’t so hot in California right now. It’ll be interesting to see how the housing market in Pasadena plays out over the next two years with Alt-A and option ARM loans peaking from 2010 to 2012. Many banks have put these into other mortgage structures but you wonder how many people bought with speculation in mind and are gearing up to walk away. Bottom line is home prices in Pasadena will correct unless incomes can triple in the next few years.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

40 Responses to “The anatomy of a housing bubble city – Pasadena California home prices expanded from $220,000 to $662,000 from 2000 to 2007. Why housing prices will correct in mid-tier California cities over the next few years.”

Thank you for that post Dr. Housing Bubble! I saw that house listing that you featured and thought it was an odd price for a bank-owned property. Looking at Pasadena and adjacent cities, I see such wildly divergent pricing it really gives the impression of a market under stress and ready to give at any moment. I don’t know why a buyer would enter into such a chaotic marketplace.

great post doc! please, please, please do this for manhattan beach!

I second that request, please. Would love to see this for South Bay cities — South Redondo, South Torrance, Manhattan Beach

I 3rd the request for MBeach, HBeach, RBeach and PV!

Your intelligent and informative articles have provided us an economics (re)education that has saved us hundreds of thousands of hard-earned $$$. Your column should be required reading for every high school in the country! THANK-YOU! YOU TOTALLY ROCK!

Doc, South Bay please…

Good info , as usual. But again, I doubt the median price was 3 times the median income for many cities in CA in the last 40 years. Even this example puts it at over 4 times in 1999. $46K income and $220K price.

Unemployment will be what causes this to get worse. Interest rates will probably stay low for quite a while as the economy is in the dumper.

I’m with RML. Would love to see what Manhattan Beach has goin’ on. I’ve been reading the Dr.’s articles religiously and looking in the South Bay area for over a year now. Lot’s of info on Culver City (mid tier). I guess Upper Tier is coming later. The realtors (the one I’m working with is very nice) say “now might be the time to buy…if you’re interested”. The mortgage brokers say: “NOW IS the absolute BEST time to BUY!!…Don’t loose out! Don’t miss this opportunity!” Kinda like shouting about elixirs from the back of a carnival wagon in the 1800’s. I get the feeling the brokers were saying that same thing back in 2007 as well. The good Dr. continues to help me through the brokers murky advise.

Shadow inventory is getting larger and larger each day. S&P says there is nearly 3 years of shadow inventory alone, at the current sales rate. Record low mortgage rates and still very little moving. Sooner or later, the banks’ hand will be forced, as more and more people stop paying their mortgage to live rent free. I guess the “Shadow Inventory” is no longer in the shadows now.

Banks have barely started to release some properties on the Werstside of Los Angeles, as we are seeing more short sales and few REOs popping up. Perhaps, it is the beginning of some property liquidation, as the banks realize the market isn’t coming back.

http://www.westsideremeltdown.blogspot.com

Prices will correct in about 20 years with deflation or inflation. The Government is owned by the crony banking industry. There is no change coming and things will stay the same for decades. People will be given modified interest only loans to keep the banks books clean and people will not mind because the loan mod is cheaper than rent. The banks will keep getting bailouts. Freddie and Fannie will never be abolished. Yes the Dr is right that prices will correct in the upper middle class areas but not in this decade. Maybe in the 2020s.

Thanks for this information. I’ve been looking to buy in CA, San Fernando Valley but prices on decent properties are still high. A 800 sq feet 2/1 property is listed for $240K. Another 3 bedroom 2 bath listed for 295K later sold for 255K. Please discuss current bubble status in this area and what to expect in the next few months and next year. Thanks Dr.

You’re much better off renting for the time being. Wages are not going to get a significant boost in the coming years, and it is wages that set the amount that a person can afford to borrow. With interest rates as low as they are, maxing out the mortgage dollars in the current conditions will lead to an underwater position as interest rates return to historically normal levels.

For instance, assuming a $50,000 income, one could currently qualify for 4.25% on a $300,000 loan with 20% down. This would put payments at about $1450/month. If rates increase to 10%, that same loan would cost about $2350/month, requiring an income of about $85,000 to service. Or conversely, at 10% interest, 20% down, that same wage of $50,000 paying 1450/month would only be borrowing about $180000.

So that debt of $240,000 on today’s purchase of a $300,000 property will be held against an asset that can be expect to fall to a value of $180,000 or less in the next 3-5 years as things return to equilibrium.

That is similar to home prices around the grove as well. In 1999 homes were going for between 280,000-350,000 today they want 1.2 million. Rents went up too, but they are beginning to go down off as unemployment reduces the amount of people looking to move into the area.

Most houses in somewhat desirable Socal areas have at least doubled in price since 2000. The low rates today remove some of the sting to the monthly payment. The thing most people don’t talk about is the big downpayment required. Ten years ago, it was pretty common to use between 20 and 50K for a downpayment…this was in the ballpark of 10 to 20% of what house went for (in the mid 200K range). Fast forward to today where the same house is 650K and you almost need a 100K+ downpayment to keep the monthly payments affordable. And you would need to put down 130K (20%) just to avoid PMI. Unless you have bubble equity or very generous parents…where is this downpayment money going to come from? The average person could never save that type of money in this high cost of living area. Where are the next buyers going to come from? That is the million dollar question.

Everyone I know who’s buying now is using mommy and daddy’s money for the down payment. Nice way to help your parents have a comfortable retirement…

I have been saying that about properties in long beach and frankly this seems to have happened the world over….fiat currency. I expect this to take a decade or longer b/c the fed has said they intend to keep interest rates low, savers be damned.

I cannot refute anything the DOC stated. Of course most people today cannot afford to put 10-20% down on a house that averages over 400K in price and comfortably afford the monthly payment anywhere. But all the bubble talk all this time doesn’t hold much weight in areas where folks are buying houses with 50% + or all cash. Some parts of Pasadena will always hold a good strong price, but many areas appear to be dropping fast. Pasadena has a crappy school system. Show me a big price drop on properties in South Pasadena (superior school system) and I will be shocked!

Hi, Could you show us Thousand Oaks, we are looking to buy there.

I’ve lived in T.O. for 20+ years and can tell you that it suffers from the same “price stickiness” that you’ll find in many of the other upper income areas in SoCal. Prices have come down perhaps 25% from peak for high end homes and as much as 35% for lower/mid-tier homes. If you’re looking for a small starter home (3/2, 1200-1500 sqft) in a decent area then expect to pay at least in the low $400s. There was a fair amount of sales activity during the tax credit that ended in June, but properties have mostly sat since then. Unfortunately, most local home sellers don’t appear to be desperate to sell and are pulling properties off the market after a few months rather than dropping prices.

I agree, it does appear like what you indicated. Not as many desparate sellers. But, there is a lot of foreclosure in Thousand Oaks, over 500 or so.

You are totally correct Dr. when you said, “In fact, all zip codes in Pasadena are in bubbles and we will show this why later in the article.” All zip codes in Pasadena are in a bubble. Even in the high crime areas of Pasadena, houses are listed for $300,000-$500,000 dollars. Do the research. Here’s the messed up part. These houses sold for between $100,000-$200,000 in the late 1990s. So, what has changed in this country and state since the late 1990s Mr. or Mrs. Prospective Pasadena Home Buyer? Have wages doubled or tripled? No. Was easy credit available through crazy exotic loans? Yes. Have FHA loans become a large proportion of recent home loans. Yes. Was this country hit with the worst recession since the Great Depression? Yes. Is California experiencing one of the worst recessions in history. Yes? Are wages expected to increase drastically in the next several years? No. Is the unemployment rate high in California? Yes. Does this look like the best time to buy a home in Pasadena? No. Could it be the best time to buy in other areas of California or the US where prices make sense economically? Yes. So Mr. or Mrs. Prospective Pasadena Home Buyer, do some research before you buy that overpriced Pasadena home you want so badly.

So the question is, when is this bubble going to end in most of the cities in LA county? When will the manipulation of the housing market by the federal government end? How long can the federal government pump money into the housing market? This bubble can only last as long as the federal government can support it. Bottom line, home prices in Pasadena are out of control. Anyone who buys now in Pasadena will be underwater very soon and may never see their purchase value return. It is unfortunate that some of these future foreclosures in Pasadena that were purchased with FHA loans will be at the expense of the federal government (taxpayers). I think every home buyer should be required to visit the doctorhousingbubble blog before purchasing a home.

Well said Sideliner!

I think I finally got confirmation today that the upper middleclass in the south bay is experiencing the recession. I got off work today and it was gorgeous, this was perfect for my usual Redondo to Hermosa run and back. On by way back I saw the most bizarre thing in years. There was a nice looking Asian lady in her late 40s/early 50s who stopped her Lexus SUV on the side of the road (turned the hazard lights on and got out). Then I couldn’t believe my eyes, she had a big plastic garbage bag and was pulling aluminum cans out of a trashcan on the side of the road. WTF! I don’t think she was out to save the environment or help the kids with their UC Berkely tuition, I honestly think her gravy train must have ran off the tracks. I thought for sure the south bay was immune…I guess not!

I think the issue is this:

1) a verifiable but relatively small percentage of the population has plenty of cash on hand for a home purchase. These are the wealthy or savers.

2) there is a much bigger portion of the population trying to live like those in #1 but without substantial savings and using a combination of high income paycheck and debt. These do not have money for a large down payment and a break in their employment instantly becomes catastrophic (although I guess living for a few years in the house not paying your mortgage lessens the blow these days)

3) there are people with more moderate incomes who one day aspire to be #2 and #3. If you aren’t 1-3 you aren’t in the market for a house so we’ll call that out of market and disregard other than saying that this contingent is growing and absorbing many fallen 3s or people on their way up spend a lot more time there so think excess inventory fundamentals and low household formation/growth.

4) Here we go: there are not enough #1s to absorb the housing inventory. They can set a few comparable prices but there are wayyyy too many houses priced far too high and simply too little savings and income per household for many people to be 1s. There are also not enough #2s to nearly sustain this as the housing book required 1,2, and 3s to have blind faith and 2s and 3s to leverage to the hilt just to get in. 2 and 3 have been hurt badly and typically that ‘home equity’ they’ve been rolling up the ladder from bigger home to bigger home is now heavily drawn down or impaired. For most people that was their lifetime of savings (should have taken money off the table or delevered the bet at some point rather than doubling until you got wiped out).

5) Eventually some kind of parity develops here. While real estate is regional and by area you can’t have disparites that far out of whack. Even for a school system, the cost of a high quality private school will normalize housing to some degree (and resale factors associated – extreme example saving $1m up front on equivalent home/commute buys a lot of education over time and it doesn’t need to be that big, just the marginal dollar and what its worth to people). Housing is more a gradient and that gradient is moving down but not linearly across the board. Think about those #1s…some are “filthy” rich and housing means nothing to them even in high end areas but some have less and many became wealthy being prudent with their money. Don’t think they won’t be savvy about home purchases where big price differentials appear on relatively small value determinants

I think that SOME zip codes, at a given moment in time, are impervious to ratios and reality.. Boulder Colorado, Santa Monica CA, etc. attracts folks with family money, trusts, what have you, who just want to live “in the scene”. Same in Berkeley. However, that item assumed to be true, it is not enough to sustain entire regions and cities, and when you look at income based buys, must be a drop in the cards.

One of these years these foreclosures will be on the market. They are non-producing assets banks will need to sell. At that time prices should fall. I would like to see statistics on Huntington Beach.

Slim……

You are pretty much right on except for the fact that there are just not enough nice pocket properties to fill the niche for the number 1’s that are still pouring over here from countries with 10-12% GNP’s.

Am I missing something?

In the example you show, why does the “household income required to purchase” stay the same when the PITI drops by 30%?

Great site by the way. I stumbled across Real Homes of Genius in 2006 and I got the same feeling I got during the Tech Bubble whe that IPO came out for a new portal with a revolutionary business model…giving anybody who signed on for a year at $75 a free $400 PC. Oh SNAP! It’s a BUBBLE!!

Just like Burbank, Pasadena is a pocket neighborhood. The whites lives in “pockets” that are worth $600 grand+, and the “ethnic” neighborhoods are $300 grand or less. It’s the two for one theory. You can own two homes in an ethnic neighborhood or one home in an anglo neighborhood. It sucks to have to pay double just to live around your own damn people…. LA sucks. It too expensive and like the Balkins. Fragmented according to Race, Class & Status. Sad but true.

Remember my friends, there’s always a sucker out there who will buy an overpriced home if he or she is allowed to. We saw this happen during the “housing bubble” years, and it is still happening now during the current housing bubble. The question is , how long will these suckers be allowed to purchase homes? The FHA program as it is set up now is unsustainable. Many of these FHA loans are defaulting and will default in the future, especially for those who purchase wildly overpriced homes. The FHA loan program as it is set up now, is only going to contribute to a vicious cycle of foreclosures. Unless higher down payments are required or prices go down drastically in many areas, the foreclosure cycle will continue. Wages are not expected to go up drastically or at all in the next several years. Unemployment is expected to be high for quite some time. This is not a recipe for an increase in home prices or a low foreclosure rate.

So what is going on with a lot of these current and recent homebuyers? The realtor is telling the sucker that it’s a great time to buy. The loan officer is telling the sucker it’s a great time to buy. The bank is telling the sucker, yeah we’ll loan you this FHA backed loan because we’re not going to take the loss if you default on your loan. These three entities, the realtor, the loan officer, and the bank need the suckers to buy overpriced homes in order to obtain their income or profits. So unless they are honest, they will tell the sucker whatever bs they need to, so they can earn their income or profits. Period. So what is the moral of this story. DONT BE A SUCKER!

Hello Dr.

I am a Realtor in Pasadena, I sell REO’s and I have my own theories about our market including the fall of $MM home values… so I read your article with some interest.

You lost my attention almost immediately however, when you chose a property that is listed but not sold. How can you possibly make a credible theory using Anything other than recently SOLD property????

It is owned by a small investor group who held largely 2nd trust deeds. Carrington Mortgage 2006 Nc2 Trust and New Century Tc. is another. Very overpriced and not the normal REO.

Secondly, of course the credit bubble fueled spiraling prices, however, there are many valid reasons for a rise in values in Pasadena over the last 10 years. With improved air quality, new metro access to downtown, new shopping and live work complexes, several Fortune 500 companies in proximity, architecture and estates that rival anything found in Bev Hills… just to name a few.

We have seen prices bottom out in Jan. 2009 only to rise as the banks (and gov. intervention) withheld foreclosures. They have resumed slightly with more short sales and mods in the mix. We will probably see prices decline but only if there is an increase in inventory.

My two cents!

Jan

How can a train to go downtown and “live work complexes” fix a market wherethe average income can’t afford an average house?

The super-wealthy live in Geneva, Paris, Aspen, etc. And are not buying 600,000 dollar 1500 sq ft houses in Pasadena.

Jan, you are ignorant and errogant as our president, who is distoing our country.

Keepping home prices artificially high never worked. Buble burst, but because the bubble was so huge it is bleedding slowly. You’ll see prices will drop 40-50% down in next 2-3 years.

Wow, why the emotional responses? You may want to take the time to read my original message without a preconceived notion of what it said. Where did you read that I am or suggest keeping prices artificially high? I did not offer my opinion on pricing and value. I do try to form an opinion based on educated, thought provoking dialog, not sound bite headlines. We did have a credit bubble. Homes are likely to fall in value everywhere as a result. In terms of the Pasadena market… I can tell you what the market is doing… it is not a judgement or a recommendation…and I don’t represent every buyer in the city! People are buying and moreover, they are getting loans based on their incomes, not speculations on the market so they are obviously choosing to live here…. and right or wrong, with foresite or not, those buyers create the market value…. Will that change? If more of the defaulted homes are foreclosed on, maybe, but my beaf is with the fundamentals of Dr.Bubbles thesis. Don’t use faulty data to draw a conclusion that serves your agenda.

Firstly, that home will not sell for anywhere close to its asking (and is more a reflection of the investor (secondary market) chaos.) This is not my opinion on value… it is my awareness of my market.

Secondly, Pasadena is irrefutably a different city to 15 years ago.

Bottom line, give me data that is meaningful to create my compass.

Pasadena homes are grossly overpriced. Period! You buyers out there should be skeptical of any realtor trying to get you to buy a house in Pasadena. Yes, if the property is priced realistically and based on economic principles, then I would say go ahead and buy it. Look up the property values and sales histories of properties around the late 1990s timeframe, and you will get a better idea of how much you should be paying for a property in Pasadena. By doing the research people, you will see how Pasadena home prices increased to unrealistic and unsustainable levels after year 2000. You will also learn that home prices have not fully corrected to historical levels. Do the research!

It’s not just Pasadena homes that are grossly overpriced. After doing my own research, it seems to me that most areas in Los Angeles county are overpriced and should see drastic price reductions.

You are absolutely right! Here’s a good example. I know this house, it is really small.

http://www.redfin.com/CA/Pasadena/537-California-Ter-91105/home/7186073

Yes, you are right, the city of Pasadena is a different city compared to 15 years ago. The city overall is facing much worse budget constraints than it was 15 years ago. The state and federal governments are facing much worse budget deficits. Unemployment levels in LA county and the State of California are much worse than 15 years ago. Credit is less available. Wages are being cut or eliminated (lay offs). Pasadena home prices are being held up by banks and owners who are unwilling to take a large loss, shadow inventory, FHA loans, uninformed emotional buyers, tax credits, and government intervention. They’re not being held up by the metro rail, new shopping and live work complexes, or architecture rivaling that found in Beverly Hills.

UNbelievable to see even an ASKING price touching $600/sq. ft. for small SFRs at this late date. As my slapped-back-to-reality appraiser buddy likes to say, that price is HIGH-larious!”.

@ Native Pasadenan

That’s funny isn’t it? Whoever buys that house for that price is a complete idiot. It sold for a little over $300,000 back in 1994. People buying now in Pasadena are delusional. Maybe some investors paying with cash may be getting some deals, but everyone else who is trying to buy will be paying way too much for a home in Pasadena. It’s not just Pasadena either, the story is the same in Altadena and the surrounding cities.

There are only 5 types of buyers in this rigged market.

#1 The FHA/Fannie/Freddie Lemmings: John and Jane Publich who believe what they are told. Sink 20%-3.5% down and hope for the best, while passively doing the bidding of those in charge to stay in debt forever.

#2 The investor who pays cash (about a third of all sales) and thinks we won’t have deflation. Good luck to them when they end up having to charge per person rents when 12 out-of-work poor folks try to keep warm in one rental.

#3 The rich guy who got that teeny tiny 5% of loans not guaranteed by the gov. And the only reason the bank gave him even 1 cent is that they are convinced that that 20%-50% they forced him to put down and swear on the necks of his children to pay back will keep him steady on the payments but when TSHTF they can call the loan or pledge the note to the FED as collateral in QE#2,#3,#4,…..

#4 The galacticly stupid who don’t fit in these categories

and…

#5 The cynical hedger/arb player. The one that will hunt around for a sweet deal, forthcoming, and drop only 3.5% on an FHA and ride this circus out paying rent to the FED until the market returns to set prices after the FED gives up trying to party like its 1999.

Pasadena is still waiting…and waiting…and waiting…

Leave a Reply