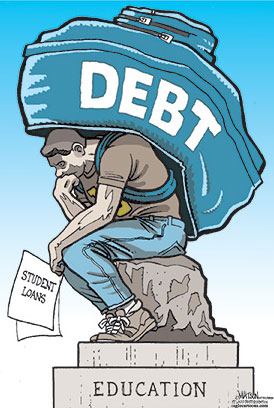

Subprime colleges – Student loan debt now equivalent to 7 percent of U.S. GDP. For-profits claim Harvard bragging rights and that barbers can make $150,000 to $250,000 a year to lure students.

The explosive growth of student loan debt is troubling for a variety of obvious and not so obvious reasons. More needed attention is being drawn to higher education and questions are being sharply directed at the way college education is financed. The bubble in higher education has similar parallels to the bubble experienced in housing. Owning a home is a good thing and has been part of our national identity for close to a century. Yet during the mania very few questioned the method of financing this otherwise solid financial investment. It all depends on how you finance the purchase. The same dilemma is occurring with pursuing a college degree. Very few will argue that going to college is a bad idea. Knowledge is power as we all know. Yet is it necessary to go to a school just because they added a $10 million Olympic sized pool? The additional bells and whistles are similar to the peak bubble days in California where sellers tried to convince buyers that the new whirlpool and granite counter tops added tens of thousands of dollars in value. Value by what standard? Most of the mania was fueled by easy access to debt greased by Wall Street and backed by the government. The fact that we are approaching $1 trillion in student loan debt is staggering.

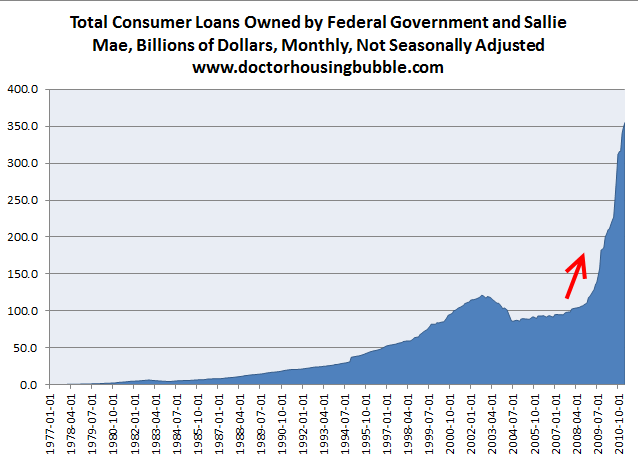

The chart of the student loan bubble

Source:Â Federal Reserve

The Federal Reserve now publishes a small snapshot of student loan debt encompassing debt covered by the Federal Government and Sallie Mae. The above chart should cause anyone to pause and consider what is happening. You can even run a quick measure to see where things stand today:

1990 GDP:Â Â Â Â Â Â Â Â Â Â $5.7 trillion

2000 GDP:Â Â Â Â Â Â Â Â Â Â $9.9 trillion

2009 GDP:Â Â Â Â Â Â Â Â Â Â $14.1 trillion

Now we can measure this against the student debt portion provided by the Federal Reserve data:

Fed/Sallie Mae student loan debt data:

1990:                    $19 billion          (0.33 percent of GDP)

2000:                    $84 billion          (0.84 percent of GDP)

2011:                    $355 billion       (2.5 percent of GDP)

Now keep in mind that we are only looking at the small fraction of loans covered by the above data. As stated before total student loan debt including debt from private banks is closer to $1 trillion which is over 7 percent of GDP. College tuition and fees are certainly outstripping inflation by many measures. What is troubling about this trend is that it is being financed by debt backed by the government. Banks are willing to loan money knowing the government is on the hook if students fail. The spin is also disturbing. The evaporation of blue collar industries does make college a more important tool for future economic success if one wishes to enter the middle class (i.e., purchase a home and save a bit of money to avoid eating off the dollar menu every day).

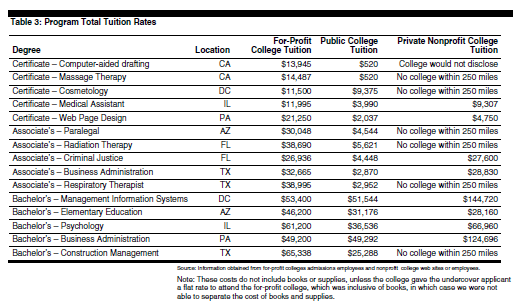

Just like in housing, every home benefitted during the housing bubble. A large portion of the money is being funneled to for-profit colleges. The Government Accountability Office put out a report showing the costs of various programs at different schools:

Source:Â GAO

Now look at the difference here. Take web page design. At a public college this should cost you $2,000. A reasonable amount of money. Yet the for-profit college is charging over $20,000! These institutions are nothing more than the Real Colleges of Genius that gouge students through deceptive loan practices and guess what? You remember that earlier chart showing the explosion of student loan debt owned by the government or Sallie Mae? A big player in that is coming from the for profits.

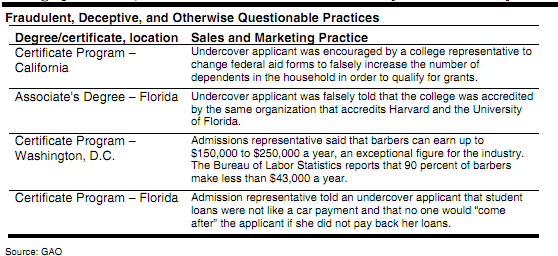

The GAO also found incredible amounts of fraud when they sent undercover agents to investigate these schools:

Same accreditation as Harvard? Barbers can earn up to $150,000 to $250,000 a year? This is the kind of misleading nonsense that is being financed with your government backed money. I think public colleges do serve a solid purpose and provide a great benefit. However the mania is exploding in these for-profit schools that are the subprime mortgage brokers of the college world. And this is where the growth is at:

Nice to sell a product where results are merely a marketing ploy and where close to 40 percent of students end up defaulting on their debt (debt that you cannot walk away from). The colleges don’t care because there is no accountability just like the mortgage brokers that pushed off junk loans to people during the housing bubble. Wall Street is happy because look at the above chart. And when it all goes boom it is the sucker taxpayer that is on the hook. This is the new model of economic growth in our nation. Wall Street has learned to turn everything into a bubble including education with the deep pockets of taxpayers. Yet measurable results are nowhere to be found. Wall Street doesn’t want money flowing into public schools because there is little profit to be had. The government here is merely the dumping ground for the bad loans as it is the case with the housing bubble.

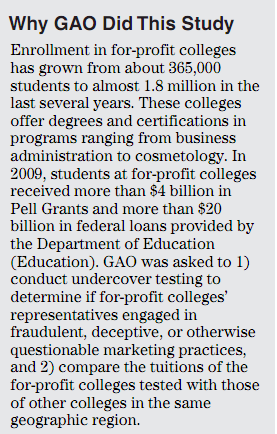

The GAO conducted the study because:

Think about the above. Many of the for-profit colleges derive 90 to 100 percent of their income because of federal student loans. Students are lured in with late night commercials or aggressive sales teams that simply do not care about the actual education a student will receive. It is all about churning sales and suckering people into a false mantra. “Every person should have a college degree†which rings eerily similar to “every person should own a home.â€Â At what cost? The only reason this is happening is because of Wall Street and government backed loans. Thanks to this new model, the for-profits are operating in the new world of subprime colleges. Yet there is no walking away from student loan debt which puts an albatross on an entire generation of college students. Will these people even be able to purchase a home in the future? Will their degree actually increase their earnings potential? Here is a case of a student out in Los Angeles:

“(CNN Money) I moved to Los Angeles when I was 21 to pursue a career in screenwriting. Now, I’m 34 years old and still barely getting by.

I’m a television writers’ assistant, and I’ve worked on some great shows like Desperate Housewives — but since I’m on a freelance basis, my income is far from steady.

I’ve taken side jobs waitressing, writing dating ads, and even pet-sitting. Since I’m not making enough money to pay rent, I gave up my apartment and decided to couch-surf with a different friend each week for 52 weeks.

It’s been more than a year now, and I’m still basically, homeless. To make matters worse, I have $99,000 in student loans to pay off (don’t go to two private schools in a row!).

The good news is, even though I still barely have an income, I am extremely happy and have started to write a book about the whole experience. I’m calling it 52 Weeks, 52 Couches: How I Slept my Way Through Hollywood (Without Sleeping with Anybody) and I hope to sell it soon. In the meantime, I’ll continue surfing from job to job, and couch to couch.â€

Nearly $100,000 in student loan debt and no secure job to be found. You tell me if we are in a student loan bubble?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

91 Responses to “Subprime colleges – Student loan debt now equivalent to 7 percent of U.S. GDP. For-profits claim Harvard bragging rights and that barbers can make $150,000 to $250,000 a year to lure students.”

Give money away for purchases in a certain industry and watch the prices skyrocket.

Easy access to money is the sign of a big rise to a bubble. I’d say most education is in a bubble right now.

The Politeers and Banksters care not the enslavement of young students, it’s all part of the plan to keep monetary liquidity flowing in the face of the Greater Depression.

Creation of onerous student debt is but one vehicle to defraud the American public at large, passing on newly printed money from nothin’ into the US economy, and thus far part of the failed plan to restart wage inflation.

Taking advantage of uneducated masses is all part of the scheme…

Faux-EDUcation for the uneducated (and uneducatable?)… oh, cruel irony!

Just curious, so when this thing pops, what will be the catalyst and what will be the after effects?

With the housing crisis, the “burst” seemed to be built in, as ARMs are basically five year ticking time bombs with the first lemons being issued after the tech bubble burst. Give the bun a few years to rise (aka the gov’t figuring out what the next bubble should be), stick it in the oven for five years, and bam! Just do the math and the timeline makes perfect sense.

With this one, though, please correct me if I’m wrong here, but there is no timer, and there is no easy way out. You can’t just walk away. It’ll screw over an entire generation for life.

The catalyst will be itself, fundamentally. Bubbles pop when the last of the money that can be sucked in, is. This one can go on for a while, but all bubbles pop, especially credit induced bubbles, as we have seen these past 30 years.

There’s strong pressure on the demand side, since people have a choice between reducing their lifestyle or taking free money and pretending that they are going to school. So my bet would be on the current credit collapse eventually overtaking this one, I.e. on the supply side. Note that student loans are the ONLY area where credit is growing, except for the Federal government. All other areas are still collapsing.

Or, more simply, the realization that money is tight, and that funding these is a waste since the loans are not going to be paid back.

The end result will be that all educational systems are severely hit, public and private. You’ll see more people willing to work for less money, and the number without a college degree skyrocketing. In many cases, having a degree will count against you, since such people are more likely to leave if they can get better pay.

All Universities will cut back, and tuition will increase. Many will collapse because they can’t handle their current debt load. University jobs will be cut significantly, and the public retirement schemes will be cut back as well, since they can’t be paid for.

In short, a general collapse of our higher educational system, once the easy credit evaporates. Along with a nation of eternal debt slaves.

Brick and mortar institutional learning will implode. Many majors can be aquired and refreshed through monitored online learning. It’s a concept that can be a reality as soon as it is socially accepted as a viable alternative.

Frat parties and deviant social behaviors will of course require campus attendance.

That sounds right. Bubbles are logarithmic–they can’t level off, once the stop growing geometrically they collapse with similar intensity, depending on how distorted things get. As soon as when the tide turns the Manhatta Monsters will look for another way to suck the life from the middle class.

Sad!

All I can say is sad!

It seems pretty clear to me that this country can be summed up in the following ways:

1. The rich continue to get richer. Some, not all, have earned their money, but as we have seen the last 4 years, many, esp. on Thieves Street, have not earned their money.

2. The middle class cannot keep up with the lifestyle they want, need, think they deserve, so they do whatever they can to keep up. Result, trucks loads of debt.

3. This economy produces so little, note I said so little, not “nothing”, that all we have left is debt and massive bubbles to keep #2 above going.

4. Many people cannot delay gratification or just go without. I realize that some things cannot wait, but spending 100s of Ks on education and housing and vacations is no way to live unless you have the means to pay it off very quickly and painlessly!

5. For most of us, we need to realize that we are entering an era where we have to ask ourselves what do we expect out of life? I am serious here. The federal, state, county, and local gubbermints are all broke, well, not all, but most, and are downsizing just like most of us in the U.S. The question is what can I expect out of life and if it has a cost, how will it be paid for?

6. Lastly, I see no way of turning this ship around, at least any time soon! Taxes, laws, morality, fair play, fair markets are all for the little people, which is us in the eyes of the elite!

If you want to see what is coming to most of America, again not all, but most, see Detroit, Camden, NJ, and NOLA.

My feeling is that less and simplicity will be better. It will take time getting used, but in the long run, I think we will come out stronger. Then again at the rate the goobermint keeps taking away rights (see recent Indiana State Supreme Court decision regarding police breakins), maybe not!!!

Politeer/Bankster Motto for 2011-2012:

The Looting Will Continue Until Moral Improves!

Keep voting for the (D) & (R) Free Crap Empireâ„¢, keep getting the same results…

Another day, another brilliant breakdown from Dr. HB. It’s outstanding to see you not merely covering the housing crisis and particularly its causation and results, but also other critical debt traps in our society that are damning our citizens. Good to see you taking the for-profit and even public higher education and in particular the higher education debt industry to task!

Even the high price Elite University as Yale, Havard, Princeton, Cornell

Of all to most prestige Univesities 1.Harvard University, 2.Stanford University 3. Massachusetts Institute of Technology (MIT) 4. Princeton University 5. Columbia University in the City of New York, 6. University of California, Berkeley 7.Yale University, 8.Dartmouth College, 9.Williams College, 10.University of Notre Dame, 11.Cornell University, 12.University of Pennsylvania, 13.Johns Hopkins University, 14.Carnegie Mellon University, 15.University of Virginia, Main Campus, 16.United States Naval Academy, 17.California Institute of Technology, 18.Smith College

19.Brown University, 20.Wellesley College. All the talent Combined with many other lower rated Universities cannot produce one single man nor woman that is able to solve our deep entrenched economic crisis that brings daily suffering to our most needed citizens. To solve a problem, you must first indentify it properly. Privately owned central banking. They create money out of thin air and charge usury interest. Publicly government controlled (not politicians) Pay the interest to yourselves, the citizens, and don’t over create money to cause inflation. Money increased based on GDP real growth, not inflation, and small factor of population growth. You can’t have too much money chasing fewer goods or services without inflation. You can’t have less money readily available to buy more goods and services available without deflation. End of story! 15,000 years of pitiful history. A simple computer in the right hands can solve this disaster in seconds providing you stop thinking you deserve more than fellow men. Yes some work harder, some work brighter than other men. These are variables and not constants. You may have work as dog in your early years or had moments of genius unparrelled at times. Ther are no records of homo sapiens, (human beings) have done one or both consistently at the exact same level in perpetuity. Motivation! The man that invented the cure for polio would not allowed to be patented, it was his gift to mankind, he had a moments of hard work and unknown genius. 60 years later we had no cure for any known major illness but millions of drugs to perpetuitly treat the symstoms non stop. “Should you not ask your Doctor if this big dildo really belongs lodged into your rectum?” If you answered yes! then side affects may ensue….

Chundini,

Excellent post!

Seriously!

This is what me and some friends have been discussing forever, as well as, what kind of living standards we will accept.

You see, this country has hundreds of millions of us with opinions and complaints, but no one in charge, if I can put it that way, wants to ask the tough questions.

How did we get here? Why are we where we are? What can be done? What can’t be done?

You see, w/o the questions, there can be no answers.

The other problem, you touched on w/regards to the polio vaccine patent. One of the ills in this country is too many people who think they are smart and pushed paper around for the last 30-35 years deserve everything and more.

I know one guy who is 75ish and works part time in FIRE. He says he works harder than me. Well he is wrong since he pushes paper and I am a librarian and push books and paper. However, the pissing match really should come down to the UPS delivery guy pushing 50 lb. boxes around.

I guess my point in the above paragraph is that as long as we all brag about how hard we work and don’t realize what are real impact is, of course, we won’t get any solutions, JUST MORE FRIGGIN’ GREED AND EXCESS!!!

Sorry for the rant at the end there! It is just that this gets my blood boiling because I see too many people willing to save their arse while Rome burns!

We paper screen out able candidates to hire the inept with the ‘correct’ credentials. A degree is only evidence of persistence.

torab:

a) PERSISTENCE (and focus) is actually quite valuable in just about every field, so not a bad thing to filter for;

b) a degree in engineering, physics, math, actuarial science, or chemistry, is evidence of more than mere persistence.

“In today’s headlines, asce.org reports that virtually every bridge in the continental US did NOT collapse today, even the really big ones, and the heavily traveled ones… mathematical analysis is believed to be the culprit… lawyers everywhere are crying… film at eleven!” ;’)

> All the talent Combined with many other lower rated Universities cannot produce one

> single man nor woman that is able to solve our deep entrenched economic crisis that

> brings daily suffering to our most needed citizens.

That is because it is not a problem with lack of intellectual success, but rather lack of power of smart people to do anything about it. The problem with the markets is fear. We are doing it to ourselves. We hold back, conserving resources. Consequently there is less consumption and less investment in risky enterprise. There is nothing actually wrong with the economy, except for fear and too much debt.

Look at the bright side. With less consumption comes less environmental destruction. More fear means less greedy investment in stupid ideas that aren’t going anywhere. We are, however briefly, sober.

I’m surprised you didn’t mention how this whole education bubble was funded by the housing bubble, i.e., many billions of dollars were taken out of home equity, and may still be, although at a much much slower pace, by parents to help little Billy and/or Nancy get a useless business degree or MA in English. This is why I think the education bubble will pop soon – the prices just cannot be sustained without that kind of easy money, and the kids (and parents) can’t borrow forever.

And, hey, Doctor, I love your blog, but, please, don’t support your arguments with examples like that not very bright twit who spent a hundred grand to be a screenwriter. You can’t fix stupid.

true, it was funded by the housing bubble. interesting point

True, all a symptom of the same disease–how can we use the gov to loot the masses?

The average person now can make more money from a job that they learn in trade school than go to four years of college (major in Mexican Studies or Literature) and be saddled with $50,000 in debt and work at McDonald’s. Smart people go to trade school like the Germans, dummies go to four year college.

Is that where you got your accounting degree from? A trade school?

Soon you will be able to get your law degree at Costco.

Vouchers – the plan to fix all that is wrong with Public Education.

In 20 years people will be taking out student loans to make sure their kid gets into that Harvard track kindergarten and the student loan dept will be 5% of GDP. Wealth helicopter parents are already taking out kindergarten loans.

A loan will be mandatory because their crummy government voucher will only pay a cost equivalent to educating the kid in a public school.

The dummy argument is that private business is better suited to educate the nation’s students. Private business is incentivized by profit – not higher test scores. It is a pipe dream to believe that private organizations will be able to profit and give students, who can’t afford a custom private education, a better education with teachers who will work harder for less.

Profitability can be eeked out by privatizing existing public school plants. Just put a company that has a proven track record of raising student scores into a low performing failing school in a low income area. They don’t have much overhead with an existing plant and can keep costs low by trimming the beauracracy and cutting costs top to bottom. Charters on vouchers will do great when they can bring in motivated students and their parents, but see them try to raise standardized scores if they don’t have the option of turning away low performing students. It is easy to be profitable without loans to build a new school. It is easy to for a charter school show positive results on tests when the voucher student population can be weeded out as is currently the case with many charter schools run by private education companies using public monies.

Cut the expensive teachers, manage competitive vendor relationships, downsize the administration/management, eliminate health care and retirement and there is room for profit. There will be high staff turnover without and underpaid employees, but the bottom line is your privately operated school is incentivized by the profit, not the education offered.

And forget incentivization by government funding based on test performance, that will only leed to unethical practices by the private – profit seeking schools and their employees.

Public higher education schools (Cal, Michigan, etc. ) need vast amounts of money from private individuals and corporations for research and scholarships. Conversely Stanford and Harvard both receive huge amounts of public funds.

Many trade and tech schools can be profitable and offer students value for their dollars spent, but easy access to govt. cash creates a problem with any efficient profitable model for offering education competitive in a lean environment with limited access to SallieMae dollars. It is a problem of conflict of interest between offering a valuable education that won’t pauper the student and profits for the corporations running the “educational institutions.”

Buyer beware when voting for vouchers or signing on the loan docs for that web designer certificate.

Ummm… nice try, but you are missing some very important factors. It is clear that you don’t like vouchers, but a voucher itself is not bias. A voucher simply means that a parent can choose a child’s school, public or private. True, private business is incentivised by profit, but a private school that does not teach and take care of it’s student will fail and disappear (unlike our current failing public schools that just keep getting more money thrown their way).

Also, my family doctor is “for-profit”. Are you going to tell me he is evil because of that? Bad things happen when there are monopolies, not when there is competition.

Go to a community college for 2 years, work a part time job, and bank the money for your transfer to a 4 year college. If you are frugal , you can still graduate debt free.

Do not major in journalism, psychology, sports, or other degrees that have no market anymore.

@Randy , true and do not major ina degree where your job can be shipped off to another country.

@caboy

Actually, you SHOULD get a job that can be shipped off as long as you are willing to be mobile. The world is a large place, it’s not just the USA anymore guys. There are opportunities around the globe and if you make sure that you have some skills that travel – medical, business, tech – you can keep on moving wherever your career takes you.

Americans generally have an anti-foreign bias – not on this blog but generally – and are hesitant to move to other nations to follow an opportunity. But if you have the right temperament, education, skills and most importantly passport (USA passport is the best in terms of getting foreign visas), you will never be stuck in some place in America without a job. Yeah, you could train to be a plumber, but if no one can afford plumbing services, that’s as good as your job being outsourced as far as your bank account is concerned.

Outsourcing is a fact of life. We can’t make businesses not send work overseas. Why not outsource yourself? Many companies in foreign markets are looking to hire Americans because they revere our work-ethic, innovation, intelligence, organizational skills, and the achievements our country has made over the years. If dumbass American companies won’t give us a chance, why not stick it to them and go work for their foreign competitor? I got laid off from a position due to corporate politics and could not find a steady job for years even though I had experience that very few people in the world had. No US employer in my large field would even look at my resume. Now, I have a job with a company in Asia that actually values my experience and is leveraging it to expand their business. They even created my position for me based on my experience. AND there are a ton of other Americans here doing the same thing. It feels good to be appreciated for what we can bring to the table.

Unfortunately, that leaves Politics. And while the standards there are low, and the benefits are high, the competition is cut throat.

It’s far better to learn to think for yourself and build your own niche. But that really isn’t taught in College as a major. You have to be proactive in it, and it involves multiple disciplines, especially History, Philosophy and a school of Economics which seldom is taught in the U.S.. I’d also add Mathematics and Physics.

But the benefits far outweigh any other approach..

I have an even better idea. Go to community college and take some courses on computer science. Start reading on your own, join programming forums and start writing your own blog. Start off in the industry to accumulate 1 or 2 years of experience. If you’re passionate and dedicated, you will make 100k+ in 4 years or so. I’d say that’s much better than attending any 4-year college.

Did Edison need a degree?

How many points of IQ would Einstein gain from attending a U.S. University, taking on enough debt to purchase a nice home in the process?

Should the Wright Brothers have gotten diplomas and then degrees so the U.S. Academic geniuses would have not scoffed at them and the Euro Trash not called them bluffers?

Not a whole lot of logic involved with the sheeple it appears, but that’s why they’re so easy to ripoff!

The education bubble is fascinating. Regardless of being debt based, it’s a different animal all together. You can’t sell a degree, like you can a house, a stock or a tulip. And if you borrow to get one, you can’t default. It looks like it could end up far worse for those who get caught holding this bag. Forced government employment? Slavery? Who knows…

Actually, the difference isn’t that great. The student loan is comparable to a home improvement loan. It is intended to increase the sellability of you rather than a house. If you spend the money on an educational fad, it is much like throwing money at a home modeling fad. You get the debt without an increase of value. Worse, it can decrease your value because it make people think you are a fool, just like atrocious decorating choices can spoil a walk through of your home by potential buyers.

More signs of the Recovery…

U.S. Real Estate Delinquencies Top 10% for First Time…New bond offerings provide financing to borrowers with maturing loans. Still, property values are down 44.6 percent from October 2007, according to Moody’s Investors Service, making it difficult for property owners to come up with the difference when repaying the debt.

http://www.bloomberg.com/news/2011-05-18/u-s-real-estate-delinquencies-top-10-for-first-time-morgan-stanley-says.html

David Stockman Says US Has “Run Out Of Runway” On Debt, Compares The Treasury Market To A “Roach Hotel”…We have not had a two-way bond market. We have had a rigged market that has been dominated by not just the Fed, but all the central banks. Today over half of the $9 trillion in publicly-held debt is in central bank vaults.

http://www.zerohedge.com/article/david-stockman-says-us-has-run-out-runway-when-it-comes-raising-debt-ceiling-endorses-tobin-

Just like the Banksters and their henchmen the Politeers designed it….

Correction: Should have specified U.S. “Commercial” Real Estate Delinquencies Top 10% for First Time – Heads error from the journalismos @ BloomTurd…

Delinquencies on commercial mortgages packaged and sold as bonds surpassed 10 percent for the first time last month, according to Morgan Stanley.

DH please address the OC commercial market:

rent and vacancy trends since 2006,

purchase price/sq.ft. now v. 2006, and

loan defaults 2006 v. now.

1031 Exchanges created part of the commercial bubble.

Commercial real estate must pencil out based on rents for the most part. Many 1031 exchanges were to a larger property that did not pencil out based on rents — Investors bought in HOPES of appreciation which double-compounds the problem, as we’re in a down market for rents AND values.

Also the window in which to transact the 1031 exchange is I think only 45 days to get your property in escrow AND identify the up leg, AND you only have 180 days max to close the upleg escrow — the identification window is so short it resulted in hasty buying 2000 to 2006, in my opinion. The reverse exchange (when you don’t get to close the escrow on your first property first) is even more trickey as far as timing and funding.

Degrees are necessary, but not sufficient, for participation in a wide range of white collar jobs that pay high salaries, and will for the forseeable future. I don’t know any investment bankers, lawyers, or doctors that do not have (typically advanced) degrees. Of course studying Liberal Arts at a no-name private college funded entirely through loans is a separate matter indeed. . . .

“I don’t know any investment bankers, lawyers, or doctors that do not have (typically advanced) degrees.”

True, for advanced theft one requires an academic issued License to Steal…

Since the incept of the U.S. *Industrial Economy* collapse that started in the 70s, the perp skool predators have been working OT to keep the *illusion* of *prosperity* alive.

A chiclet in every pot; a credit card in every pocket; a home loan for every collective of suckers (i.e. families).

Now it’s a degree on every wall…

Just because bankers, lawyers and doctors have higher education degrees does not mean it is absolutely necessary to perform their jobs. Doctors become good doctors mainly because of apprenticeship during residency. Bankers and lawyers can easily get their training without doing to a 4-year undergraduate or MBA/JD. Even to be a pharmacist, they require you to get 4 years of schooling now. That is absolutely absurd. Pharmacists will become the next lawyers of America; out of jobs.

Spoken like a true non physician that has zero idea what goes into being a doctor. You have no basis to espouse your ridiculous opinion.

I am a lawyer who, among other things, represents health care employers in regard to physician employment.

The real primary requirement for both professions is intellect, which unfortunately cannot be taught. It is largely genetic and to a lesser degree is influenced by early childhood nutrition and environment. (I am not saying intellect is sufficient, only that it is necessary and the “weak link” for the vast majority.)

As a society, what we have unfortunately come around to is pushing folks of middling intellect into further and further levels of education. Nothing good comes of this.

Folks of insufficient intellect will end up incompetent in their professions, regardless of the level of training. Regulators seek to address this incompetence by adding additional levels of training; which of course helps none because it is not the source of the problem.

To your point though, an 18 year old high school graduate of sufficient intellect could learn how to do my job with about 1 year of academic training and 2 years of on-the-job training. Meanwhile, I practice alongside (and sometimes across the table from) people with 20+ years of practical legal experience who, because their intellect is insufficient, are incompetent.

As to doctors, the benefit of an undergraduate degree for the profession relative to the amount of time expended on said degree is highly doubtful (an 18 month pre-med crash course covering the medical school pre-reqs would make a lot more sense). So even assuming the length of medical school and residencies as they currently exist are somehow cost-justified, there is at least 2.5 years of ‘fat’ in the process that could be trimmed from the undergraduate degree. I have seen no empirical evidence or even a willingness to give empirical study to the question of whether, e.g., the fourth year of a surgical residency conveys any marginal benefit over the third year (beyond the marginal benefit that would have otherwise been gained by the extra year of experience). On the other hand, the idea that prolonged residencies are used as an artificial barrier to entry, and a means for providers to obtain heavily-discounted labor, is gaining a lot of traction.

Why hire someone “without” when I have 300 resumes of people “with” the education AND the experience.

I know their training — I know what I can give them to do without me spending my money and time training them. Sure some training becomes outdated. Everyone must stay current in their field and Change is the new norm.

What’s ironic is that one of the chief motivations for kids going to college is how it rates on the party-scale. So parents, beware… http://answers.yahoo.com/question/index?qid=20070226150628AAWN2Fy

All that money spent on “education,” and still almost no one in this country is able to think critically.

The collective IQ must be well under 40 at this point…

The way in which I.Q. is calculated is beyond absurd. If someone is good at math, then that goes a long way to boosting one’s I.Q. score. But some of the best at math invented nuclear weapons. How could any reasonable measure of intelligence not rate them as the stupidest persons ever to walk the Earth? Does survival of the species count for nothing?

In the case of Alan Greenspan, remember all that indecipherable gibberish he used to utter. So not only could the man not speak colloquial English, he pumped up some of the biggest asset bubbles of all time (dot.com, housing). How could any objective measure of intelligence rate him as having any intelligence what so ever?

It’s not that bad. Most of us are just focused on Dancing with the Stars. Once the season is over we’ll re-deploy that brain power to solving problems ahead of pre-season football.

After DWTS ends, the populus will focus there atention on the next big event, The Batchlerette. All the while more importent events are taking place right under their noses.

There’s truth in that. The knowledge of the average person does not seem to increasing despite how much is spent on education.

Thinking criticly semes to have devolved to who to vote for on AI or DWTS. Also as a Jeopardy! fan, I’ve noticed a lot of the catagories & clues have become too pop colture focused.

You are right on target Paula!

What is the collateral on a student loan? Your future labor you poor debt slave!

As DHB points out, the biggest problem causing this bubble is the fact that banks are once again free to make loans (and collect the fees, interest and ridiculous penalties) but don’t have to take the risk of default for them. The risk is left to the suckers, uh, I mean all of us.

All potential gain, no pain – great setup if you are a bank executive but it sucks as a tax payer. Banks need to be restored to being private enterprises that can and do fail if they place too many bad bets. Until that time, the banks will continue to rape and pillage.

A way to get around paying your student loans for a woman is to marry someone, agree not to be a stay at home mom, and keep everything in the husbands name.

I meant to say.. AGREE to be a stay-at-home mom.. And never earn a penny. Then the government can’t come after you if you aren’t working….

Begs the question of why go to college to begin with if you’re going to be a debt-encumbered stay-at-home housewife who owns nothing in her own name and is totally dependent on the husband’s income. Young women contemplating borrowing to major in impractical, elitist bullshit such as art history, English lit, fine art, and other such “soft” subjects should ask themselves if this is their goal and might there be a cheaper way to accomplish it.

And it might not shelter you from your debt anyway. Somehow, college lenders seem to be able to do things to borrowers that no other type of creditor is allowed to do, like call your relatives to find you and tell them lies about you, hound you at any hour of the day or night, and attach your SS, disability or widow’s pension income.

The only escape from the student loan nightmare is to change our laws and treat college debt like other debt, and give college borrowers the same rights as other borrowers, including the right to bankrupt. Then admit that the student loan programs do not work and shut them down to prevent recurrence of the problem.

One thing is clear: We are not progressing as a race of beings. We think that because we have more information and new technology that we are more advanced, but we are not–we are declining as a species and the trend should be horrifying, but it has happened so gradually we are not shocked. Everyone should watch Idiocracy by Mike Judge (Office Space). Although it is a comedy, there is a very true and relevant message underneath. As we become less engaged and more apathetic, the parasites of the world are become emboldened predators. We are really on our own trying to survive while others are surviving by becoming cannibals. Entropy disguised as technological advancement is occurring daily.

How right you are, darkages.

We have declined because we no longer have a vision or goals, and we no longer have visions or goals or any idea who we want to be or why, because we have no philosophy.

We have allowed philosophy to deteriorate into word games that have no import for our lives or activities while the vacuum it left is being rapidly filled by Old Tyme Religion and New Age nonsense and astrology and feel-good slogans. A tower of babble have we become.

We’ve allowed this because we believe that somehow “technology” will solve all our problems and relieve us of the necessity of thought and effort, and we’ve let our former prosperity and ease lull us into becoming a bunch of sulky, self-indulgent crybabies who expect to be spoon-fed their lives.

Just step back and take a look at the big picture of our political system that created this mess, and you realise that public funding of political campaigns is the first step to real change. Take corporate money out of politics and get rid of our moneywhipped politicians, and let the people run government for the public good, not what’s best for corporate America, and maybe there’s hope for us, otherwise, we’re at the beginning of the end of democracy in this country.

Education will be devalued forever, degrees will be worthless, and that’s far worse than housing prices falling into that “lost decade” the Doctor refers to so much.

Unfortunately, political power to the highest bidder appears no where near approaching a burning issue for the dumbed-down-to-succumb electorate.

Really, with the sheer stupidity enabling theft at the highest levels, I see no need to even have hope that the USofA will ever be a fair country to live in again…

Good luck all!

‘It’s been more than a year now, and I’m still basically, homeless. To make matters worse, I have $99,000 in student loans to pay off (don’t go to two private schools in a row!).’

Seriously – this guy moved to LA at 21 to go to school and still has 100K in student loan debt 13 years later? I don’t get it – this guy has either had his loans in forbearance for 10 years or took out loans for $200k for school. I agree that tuition costs are out of hand – but we live in a free country in which price is set to a large degree by simple supply and demand economics. If school is too expensive – go somewhere cheaper or don’t go at all. If college enrollment at expensive schools decline they will have to cut tuition costs. Take responsibility for your own actions people – nobody forces you to take out 200k in student loans.

But… the financial advisor and recruiter told him that he would be making half a million a year being a partner at a top law firm right now!

It’s because he works in the entertainment industry. Now, I know what people on other housing boards say, everyone in the entertainment industry is a millionaire. You know how they keep housing prices out of reach because they are buying up everything in sight with their huge paychecks without even thinking about price. The truth is closer to that dude’s reality. Low pay, unsteady work without guarantee of ever moving up to a decent paying position.

I guess since that myth has been debunked, we can go on to debunk other myths like the fabulously wealthy yet somehow financially ignorant Asian buyer, lawyers and other unimaginably wealthy professionals and my favorite, the entire population of global trust-funders descending on Santa Monica to buy houses. I love hearing these stories because they take as fact that rich people are dead set on wasting money by purchasing housing in LA meaning that spending 800K on a doghouse is a good investment!

College costs started exploding back in about the year 2000 when I graduated, I got a deal, 5 years, 10 semesters, 10 thousand. I borrowed the 10k, worked to pay rent, and lived cheap, cheap like, weird room mates, cheap food, cheap beer, cheap women, junk car. Seems to me, my fellow college pals were just starting to be shipped on over to Iraq at the time. Still, it took another 5 years before I could get a decent job in my field of work. To be honest, those 5 years of jumping from job to job were kind of fun. Still, it’s fun reading these stories from whiny college students.

Doctor – great investigating, compiling, and delivery of excelent statistics that truely paint on honest picture of the trouble with CA. Houseing!

As for the folks posting thiers two cents… Lately you put me to sleep! You wander all over the place. Focus people! Let’s offer solutions based on how each of us use what we learn here. Build solutions with the Docs information, and implement a plan of action, other wise don’t waste our time. Try to keep your replies on subject and positive! please

or are you afraid to be held to your answers? Tough questions deserve great

investigation and this site has provided you and I with all we need. Come on people, participate and profit or move on.

Build solutions with the Docs information…

What solutions?

A third party that will hold the politeers and banksters accountable for looting the USofA in broad daylight?

Personally, as one that has been awake to the unfolding fraud instituted and spread by the DC/NYC/Boston corridor, the only solutions that would change devolving demographics such as reported by the good Doctor are out-of-reach due to the lack of a critically thinking unified culture.

IMHO, truth telling sites like this are more about helping people become aware of hard truths and prepare accordingly so they won’t be washed away by the Sea of Lies propagated by the politeers and banksters and regurgitated by the lame stream press…

At this point it’s not about solutions, it’s about discerning what’s likely to happen near-term and not becoming another victimized sheeple statistic!

The Doctor beats the NYT by a few days.

http://www.nytimes.com/2011/05/19/business/economy/19grads.html?hp

In 1979 when I hit the age of school or work, I had to by neccesity go commercial fishing, then travel came with that, cannery work, ship yards and eventually a captains licence and years of commercial maritime, now at 50 im stable in a good paying waterfront job that should carry me to the golden watch. The difference i think is that in the 70’s young people were more adventure prone, less hung up with the model.

I loved the experience of taking anything that I could get, gratitude every day. I have to agree that trade school, and especially anything medical ie. Nursing is probably a great avenue for consistant employment for a whole lifetime.

My lady a PT has just payed off her house at 47 years of age in a really nice area of Long Beach, a focused person with an even average wage level can do a lot for themselves.

Bubblicious, The American Way. The American Dream has turned into the American Nightmare as Capitalism on steroids without any regulations. It’s eat or be eaten now. Just look at cratering prices in the real estate market. Banks are still thriving, while everyone else is thrown to the wolves.

What a country!

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe 90402. blogspot.com

An ignorant population behooves the power elite, so rather than more funding for education, expect to see less.

Actually, the opportunity to extract masses of wealth from student loan debt slavery has a VERY finite window of opportunity.

Outside of technically advanced specialist training, if one is motivated ALL the information needed to “educate” yourself is already online, for free.

Education at this point is a dying monopoly – In fact, one could learn FAR more than the curriculum that Universities offer currently right now:

http://ocw.mit.edu/index.htm

http://www.khanacademy.org/

If you’re above average intelligence, and a fast learner that devours learning goals, you can absolutely eclipse the least common denominator approach currently in vogue.

Rather than rely on a diploma mill as some type of bellwether indicated an “intelligent” individual (usually false in my experience), aptitude tests should be employed to determine employability and worth!

Don’t fall for scams, think for yourself 😉

Bill Gates said it best–the exciting things are happening in the companies–not in the universities. Most of us are in some sort of serices to Americans. We need to balance trade because our counterfitting scheme is up-the whole world knows we’re not going to pay them Tuesday for a hamburger today.

Love the comment newsboy – instead of protesting and complaining about the system -why not turn it on it’s head and use it to your advantage. I agree with your statement that the Internet is an amazing tool and those who want to can learn more than those in college …. All you need is desire and a little hard work.

Wow… in the last month, the talk of an education bubble has really skyrocketed, and even recently been featured prominently mainstream.

College is good for the country. Think of them as wells of knowledge. We are all welcome to have a drink when thirsty, and we get our choice of flavors. That is the wonderful thing about the developed world.

The problem is Uncle Sam’s guarantee on the loans. Take them away, and you’ll see the bubble quickly burst. Unfortunately, Americans are addicted to spending, so when someone else guarantees the bill, you can be 100% certain the demand will skyrocket and the supply will be right on demand’s trail.

In a perfect world, rational consumers would make wise purchasing decisions. Smith’s invisible hand is giving us all the finger…

Uncle Sam may be backing these loans, but, these poor kids are stuck with them until the last breath, unless congress relieves them somehow with an act, which could very well happen down the line when the s**t hits the fan, and stick us, the taxpayer, with the bills.

But, that would never happen, right? When has the government ever done that?

“In a perfect world, rational consumers would make wise purchasing decisions. Smith’s invisible hand is giving us all the finger…”

In a perfect world investors would make “wise” decisions regarding allocation of capital v. risk, but as you can see by the smoke & mirror debt-based Ponzi scheme the U.S. economy has become, that is not reality.

That’s AOK by me…I’m NOT waiting for the market to reflect what I already know – The United States is insolvent at all levels and has made promises it can’t possibly mathematically keep.

If I wait for the market to tell me this, then my money will disappear along with everyone elses.

Trust me my friends, that day is soon approaching…

I agree with the poster above that the collateral for the student loan is the future labour of the debt slave. This leads me to think that the point the bubble is going to burst is when the future labour of the student (till death) is not valuable as the debt. I can see this point being reached in the near future.

I live in LA, and the above story is quite common, unfortunately.

We just need one “blue ribbon”-digital(edit as needed)-Webinar-teacher

per topic

in the US to create

nearly free, ivy league education for all.

But, BUT… you’re overlooking the motivation provided by all the horny women aged 18-22 running around most college campuses… I know they “helped” me get my Elec & Comp Eng degree… by clearing out my… mind. ;’)

It’s analogous to the RE “premium” paid for property in So-Cal… it’s mostly about the babes, but no one wants to admit it. Men tend to pour $$ into milieus where hot young women congregate. I think Pliny the Elder said much the same thing about downtown Rome 2,000 years ago… but in Latin, lol.

The lecture is the (relatively) easy part. Someone still has to grade papers. Multiple-choice and true-false testing only goes so far, you still need human beings to determine whether the students are actually learning anything.

As a subspecialized physician with 20 years of practice, 4 years of medical school, 6 years of post graduate training, I can tell you that after college every single test I took was multiple choice, true/false.

It is not just the young generation that is getting conned by the “a degree will buy you the American dream” marketing. I know many older adults who, displaced from their career, chose to borrow money to pursue that “golden goose”. They now have large student loans on top of previous mortgages to service in the future. Their future is not likely to include a retirement phase.

We are definitely neck deep in a student loan debt bubble. Easy credit plus the fact that student loans cannot be forgiven in bankruptcy have been the main force driving up the cost of education since the early nineties.

Jim the RealTard is out pumping for his Masters at the NAR, again:

http://www.bubbleinfo.com/2011/05/19/re-industrial-complex

“As you may know, there is a proposal before regulators to require a minimum of 20 percent down on all residential transactions.

If allowed to take effect, the rule would put home ownership out of reach for middle-income Americans.

It would take the average family 14 years to save up the down payment to buy a home.

We just don’t need more hurdles.

So please take time to visit the REALTOR® Action Center to answer the Call for Action and tell Congress this does not work for our industry or our country.”

RealTards = Licensed Confidence Artists!

Daughter graduates after 5 years on June 10th. We scrimped and saved and paid tuition bills and living expenses monthly and did without. She helped and now she graduates, debt free with a great degree, from a great school. This month will be the last money put out for this expense. It should be a huge raise for my wife and myself. Like so many parents this is a big relief. Alleluia! Alleluia!

Now however she will have to find employment in this very poor job market. In the past recruiters would come to the campus and interview graduating students for various positions. Those days are over. Hopefully she can secure a lower paid position or even part time work. Its a very tough environment for these newly minted grads entering the work force. I can’t imagine doing it and having to service a student loan at the same time!

I sort of missed the whole education bubble. I graduated in 1999 with zero debt: I spent the first 2 years in community college and those 2 years transferred over and I was able to graduate from a 4 year college in 2 more years. 12 years later the school I went to is unaffordable. I’d say none of the community college credits would transfer either.

Some of these for profit college ads really bother me. Seems like about 95% of their focus is churning people into nurses, physical therapists, and so on. The people often portrayed in the ads are almost always lower income folks who probably worked minimum wage for a few years and just want a degree to make money versus doing it because they feel passionate about the job.

Government will probably enact some Fresh Start student loan forgiveness program within five years to wipe the slate clean of students loans, gotta keep twenty somethings racking up debt buying houses, electronic devices, shoes and purses, etc.

I’ll guess govt will also create a new program (funded by US taxpayers) to assist with down payments/loans for people who were foreclosed. The program could provide down payment grants, or design creative, govt backed home loans “tailored to the clients specific needs” so people with bad credit can buy another house. Govt will spin it as “for the family”, because No Child should have to grow up in a Rental, it’s UnAmerican.

At the root of this is the idea tha do is aboutt Manhattan is part of the US–it’s not. These creatures use Manhattan to enslave the whole world. Everything they do is to direct the foolish to forge their own leg irons.

The ultimate bubble is mankind itself. We are so successful that there are now seven billion of us and we are trashing the planet. Intelligence is the key to success. It gravitates to fields that produce the goodies of life, aka money. Technology is one of those, and it has decreased the need for unskilled labor. Finance is another, a complex game where math and technology win the game and collect the money. Only a relatively small number of people are going to succeed in these games. Wages are going down because of supply and demand — more people than work needed, worldwide and especially in overpriced America.

We all know where bubbles wind up: overshoot and crash. We are no exception.

This is a very interesting idea. I like the concept a lot.

One way of thinking about a bubble, is the oversupply of a previously scarce and valuable resource, those change of supply results in the eventual re-evaluation of the value of that resource.

I would say that under this definition, you have a point that “life” is something of a bubble right now. We see this in the labor market now, there are way too many applicants for jobs, which keeps wages low and stagnant. In the future though, as the baby boomers age and pass on all over the world, this will somewhat self correct. In the meantime though, it will be a rough decade or so.

Good observation. We really do have to begin with the end in mind. Manhattan probably has a plan for genocide of the useless middle-class and poor though. If US can no longer counterfeit their way to prosperity things will surely get interesting. We have to learn to defend ourselves from the Manhattan mob, but most don’t even acknowledge them as predators.

I don’t buy a push by any college for-profit or non-for-profit. Most non-for-profit private big universities have huge endowments many in the multi-millions of dollars. Why are some of their tuitinos 50K a year? And still take every government penny they can milk? How much do their administrators and their professors take home? How much do their students really wind up making in the end? You have this entire issue a bit slanted in my view.

Exactly.

Everybody should be “educated” just as everybody should be “homeful.”

Marketers just luv that stuff.

Methinks that the 5% or so at the top have studied shifting rules wisely (or made them up as they go along.)

The other 95% haven’t caught up to the shift.

We’re about to wind up with a ton of reasonably literate pissed off po’ folks.

Should be interesting.

I’m guessing the architects of this mess knew they had no shame, but were counting on all those good Americans who thought the best of them, trusted them, and didn’t really think that U.S. BIZ inc. could really be that slimy.

Well………………… guess what. It’s the American way (well-practised around the planet, but with perhaps less gay abandon.)

Competition ain’t so very bad when there’s reasonable consolation prizes, a level playing field, and reasonable odds.

But when the whole damned Ponzied overfed and overfat mess tilts, then the little dears (I’m talking 18 year-olds, folks) need to know just what kind of gamble they’re really taking. I’d say upwards of 90% of the losers actually believed in and trusted their elders (and I mean the parents, priests, teachers, guidance counsellors, and whoever else it was that slotted them onto that conveyor belt headed into the machine.)

Horrors! They were actually greedy enough to believe this was a ticket to consumer heaven? Middle class status? How evil of them…

They’ve been righteously mulched for their misdemeanors.

Hardly their fault – they’ve been astonishingly compliant.

When I was their age, we burnt flags, dissed the national ego, and otherwise failed to comply.

(which proves, perhaps, that the suits and cons won after all.)

But what a way for a nation to eat its young…..just like a poppa grizzly. Ow!

Leave a Reply