Stop Saving Now and Spend Those Rebates! The Home Refinancing Well Has Run Dry.

I’m not sure at what exact point did “saving” become a four letter word. The predicament that we now find ourselves in has an origin in a decade long spending binge. For many decades in our nation’s history, we were a lender and large exporter to other countries so this is a relatively new phenomenon that we now have to borrow and go into deficits. I find it hard to believe that the market cheers when retail sales come in slightly lower and in another report, we find out that the public is utilizing credit cards at a higher rate to maintain these higher spending levels. What has occurred is the borrowing binge from real estate has now shifted to the last fortress of hope, the plastic credit card. And guess what? Your government doesn’t want you to save! In fact, it seems like policies are being put into place to force you back on the perpetual hamster wheel of spending. Just to give you some proof, let us look at the rate of U.S. Treasury I Savings Bonds:

I bonds are a relatively safe and good addition to any portfolio. They provide a fixed rate of return plus an inflation rate. Or I should say, they used to provide a fixed rate of return. Currently I Bonds are paying 4.84% which includes the abysmal 0% fixed rate. The government here can easily increase the demand for people to save but take a look at the above track record. If anything, they are making it more and more difficult for those looking for safe investments to actually park their money. It is a sad attempt to punish savers and force people out to consume more which has become 72 percent of our GDP. The rebate checks are now hitting bank accounts and only time will tell what kind of impact they will have.

Yet in 2007, they reduced the maximum amount a person can invest in I Bonds from $30,000 a year to $5,000:

“If 98 percent of all annual purchases of savings bonds by individuals are for $5,000 or less, why does the Treasury Department feel it necessary to reduce the amount of savings bonds purchased?

The Treasury press release identifies a desire to get the program back to its roots of serving individuals with small amounts to invest.

It’s hard to argue with that. However, if 98 percent of the purchases already fit that pattern, why bother with the revised standards?”

Actually, there are ways people can get around this by buying both the paper form and the electronic form ($10,000) but the point is that they are making it more complicated for people to save. The logic they give for the reduction is something I do not buy. The roots of saving simply are not in line with what the fixed rate did this month. It is down right maddening how policies are being taken to punish savers. Another reason for this is I Bonds are also linked to the CPI for inflation and have you noticed the price of things recently? It is very likely that if rates spiral out of control and the market starts unwinding further, these guaranteed investments may be very lucrative. And at that point we may find out that they simply discontinued these things altogether.

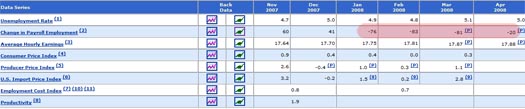

The employment numbers on Friday weren’t so encouraging either giving us our 4th straight month of employment contraction:

The market ended the day higher simply because the forecast was set for 70,000 job losses and we only got 20,000. This is the world we now live in. The market is simply cheering the fact that estimates weren’t as bad as projected but forget to examine the deeper meaning of this all. If we aren’t in a recession why is it that we are losing jobs?

No More Water in the Well

The absurd amount of mortgage equity withdrawals during this decade went hand and hand with the massive housing bubble. People for the most part used this new found money and pumped it back into the economy. Normally Americans used to keep most of their equity in their home but this psychological shift occurred and we saw marketing ads with messages such as:

“Why let your equity sit in your home and do nothing?”

“Tap the potential of your housing ATM!”

“Refinance and take cash out!”

“Take that trip or buy that new car with your HELOC!”

Here’s the chart to show you the insanity visually:

The amount of money being withdrawn has steadily been declining and now with the credit crunch and prices falling, the well is truly dry. In fact, some lenders are simply reducing home equity lines on customers in certain areas to protect themselves. So much for thinking that money was always going to be there. Given the negative savings rate and the golden goose not pumping out anymore gold, many Americans simply jumped to the final debt product, the credit card. The number is now somewhere near the $1 trillion mark:

“(Fortune Magazine) — This past summer’s subprime meltdown involved about $900 billion in now-suspect securitized debt, reckless lending, and consumers who buckled under the weight of loans they couldn’t afford. Now another link in the consumer debt chain – credit cards – is starting to show signs of strain. And the fear that the $915 billion in U.S. credit card debt (an uncannily similar figure) may blow up has major financial institutions like Citigroup, American Express, and Bank of America strapping on their Kevlar vests.”

This past decade saw Americans spending and avoiding saving because of massive consumption. But looking at this data, it looks like Americans are going to continue on avoiding saving but for another reason; this time many will not save because they simply cannot and have no where else to go. The credit unwinding will continue.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “Stop Saving Now and Spend Those Rebates! The Home Refinancing Well Has Run Dry.”

I hold paper I-bonds and finally brokedown in late March and opted for the electronic kind in order to get my full, pitiful $10K. Funny, I sent in my registration 6 weeks ago, but my account hasn’t (as of 5/5) been activated on the treasury’s website. Hmmm… I wonder if I’ll be able to buy them now that the rate has dropped to 0%…

Apparently this has been developing since the 1970’s:

http://www.youtube.com/watch?v=akVL7QY0S8A

Link via eschaton.

So I take it 4.84% is the inflation rate? So lets for the sake of argument say that that 4.84% reallly and truly represents inflation. If you buy bonds and hold them for a year you are even with inflation, the purchasing power of your money is the same. Ok but that’s before TAXES. After taxes you’ve lost purchasing power. Now the bonds are state tax free, which matters in a high tax state like CA with a nearly 10% bracket kicking in at a middling income, but even so …. you’ve still LOST purchasing power after Federal taxes!! Or you could go out and buy something ….. spend it now before your money is worth even less …

Plain old saving is punished (some of this can be gotten around by saving exclusively in retirement accounts and at least avoiding the tax bite). But, any way you look at it, it’s no easy to task to even preserve principle these days. You’ll never get really rich just by saving even in an ideal world (sorry but this isn’t how the really rich got there) but you will provide yourself with a bit of economic security which is a good thing! The government is making it increasingly hard to even do that though. They don’t want you to save any money except in the form of mortgage payments it seems (they dont’ want real savings just debt you eventually pay down).

Save? I’m not saving these rapidly shrinking dollars, I want to spend them while they are still worth something! The way inflation is being understated and the rates of return on savings bonds and CD’s, any person that saves is getting skinned. I’ll buy something that I believe that I can use in the future, instead. If I had any debt, I’d pay it down first, since being in debt means you get skinned faster.

A few people at my job have confessed to me that they are now living off their credit cards and won’t be able to pay them off once they’re maxed out. They’re buying store wal-mart gift cards in case they start getting limit reductions.

Again, interesting, but depressing entry. The other day, I watched Bush tell the press corps that Americans needed to get out there with their checks and “consume”. That was the verb he used- the general idea being that it was the same old same old that would get us out of debt. Spend to get out of a credit crisis driven recession. Makes sense, right? Probably as much as suspending the gas tax for a few months, so that the highways would degenerate even more. Hey, its $30 or so people would save, right? Who cares about the infrastructure or the jobs created by this kind of sensible activity? Oh, that’s right, only the folks in Singapore, Japan, China and Europe. Wait- don’t we owe them tons of worthless dollars? Who cares- get out and spend. To paraphrase President Hoover- “God bless our children, for they shall inherit the national debt”. This further encumbrance makes no sense- unfortunately for most of America, economic reality may force logical back. A national “reality show’?

i think this is the first article that talks about the i-bonds and what’s happened to the amts we can purchase

lower rates haven’t been passed on down from the big banks to us in terms of mortgage rates, cc rates, etc

lower rates don’t encourage us to save for fear we’re falling behind inflation

lower savings don’t allow a person to purchase outright, interest/debt free

and not enough savings won’t allow a person to take advantage of (in the relativity of time) the deflation whiplash that almost always follows next

thus, a debt / asset double-head lock that’s hard to breathe in

good article; not enough written about the hardship of saving, the risk of saving, and the pitfall of (despite it all) not saving

after all, what are the biggest banks and invesment banks wanting and getting? :

treasuries – why? to bolster their capitol reserves, ie, savings

What are going to be the early signs that packages of “sub prime” credit card debt are going “non-performing” like the packages of “sub prime” mortgage debt? It seems to be hard to pinpoint who is holding the bad mortgage debt. Who is holding the packages of credit card debt? I’ve read Fannie May and Freddy Mac (the government) are 80% of the real estate loan business now. Who else would be stupid enough to loan on real estate? What happens when the credit card debt goes “non-performing” and nobody wants to buy packages of it any more? I’ve read the average car is 90% financed when it’s sold today. (Rolling the negative equity in the previous car into the new car loan can’t go on forever.) Who holds all those packages of over-financed car loans?

Maybe, I am just uneducated… but isnt’ it better to go into debt in a high inflation time…. isn’t inflation the nightmare of the banks, or am I talking nonsense.

On a totally different rant…. are we collectively spending our way towards a cliff of sorts. I think that in 30 to 60 days, you will be behind someone at a store when every card they own gets declined. Maybe that will be the true test, if we could get a report on the # of declines happening or police blotter of people getting arrested at restaurants for failure to pay.

So lets see if I have this right, if you save as I do you get screwed, & if you are in debt oh yeah you get screwed. Do the i bonds truely follow the rate of inflation or what is reported to be the inflation rate wich may not be so accurate.

Saw a news story the other day reporting that consumer spending was holding up very well. Not because they were at the malls buying summer fashions, the new version of Grand Theft Auto or new cars. Rather consumer spending is up because the price of groceries and fuel is forcing them to spend more. You can’t

very well cut your food purchases and if a bag of rice or box of spaghetti that cost a dollar last month now costs $1.50 well you’ve just got to pay it. There is no lower cost food that I know of, at least food for human consumption. Just heard one of Kudlow’s guests announce natural gas is a good investment because it is underpriced relative to oil. Say what? $11 per million BTU’s is cheap? Calpine went bankrupt when it tried to sell electricity made from gas that cost half that 2 or 3 years ago. Of course coal has trebled since then too so gas IS relatively cheaper than when Calpine went bust but I can tell you right now if nat gas stays at this level or goes higher between now and next winter you are going to see home foreclosures soar in the states with real winters. Utility bills for many older homes will rival and even exceed the mortgage payment. We are

seeing a rise in delinquency rates in the gas industry already and this was from last winter when gas was 3 and 4 dollars cheaper than today. No way are people

going to be able to pay what’s coming if prices remain at this level. So add another debt crisis to the list. Delinquent gas and electric balances are building up just as have credit card, car loan and mortgage debt delinquencies. If you are a fan of Dr. H.B’s. Depression posts remember cash is king when credit dries up. So even if holding cash is a losing proposition right now when the music stops only those with cash will have a place to sit down.

Maybe I am missing something, but when the Fed lowered the prime interest rate, who exactly did they help? The only winners seem to be the banks who are still charging whatever rates they want for mortgages, credit cards, car loans and the like while anyone with money in the bank is being royally flushed.

Folks living off small fixed incomes rely on the interest to help them survive. Now with prices soaring and interest income drying up, what will they do?

As long as the government is focused on saving the corporate interests at the expense of the people we will never see the end of this kind of mess. Low interests rates encourage people to gamble with their savings since they can’t get a decent return – think bubbles – first tech stocks, then housing, now commodities.

Dr. – Fantastic post (as usual)… thank you for bringing out so many important topics and making them understandable. This situation of punishing savers is clearly forcing the “consumption” and further fueling the “empire of debt”. The situation is appalling… it is absolutely unbelievable how the government has allowed the credit industry, etc. to run absolutely rampant over us. Shame on our government for allowing corporations and the credit industry to take advantage of the foolishness of the herd. They sure are making it more and more difficult for anyone to ever save that 20% down payment, unless you want to risk it on wall street… good luck with that… better save it for that $6 per gallon gas that’s coming soon to a street corner near you.

p.s. nice link doug!

I don’t believe the middle class wiped out their savings and took on trillions in debt out of some suddenly perverse desire to owe more than they could ever hope to pay back. I think those actions are symptomatic of the increasing economic distress most ordinary Americans have been under as real wealth and income has flowed upward from the production of the workers into the hands of the richest investors over the past three decades.

I think it’s more about grotesquely skewed income inequality than it is about senses of entitlement. There’s a great lecture available on this subject by Robert Reich at:

http://youtube.com/watch?v=QCu-XnVxhfk

Since the 1970’s, so much of this great nation’s great wealth has been funneled to the richest 1% that everyone else has had to run faster and faster just to stay in place.

Sending women to work bought us some breathing room. Having fewer children bought us some more. We quit saving and got another short respite. Finally, the only way that the bottom 90 to 95% of the country could postpone a serious drop in the standard of living was to use home equity and credit and hope and pray that things would somehow get better before the bills came due.

Well, dang it, it didn’t turn out that way. I wonder what’s next – rescinding of child labor laws?

There is nothing wrong with the American worker, nothing wrong with the middle class. There is something terribly wrong with a democracy that allows a tiny but increasingly powerful, privileged elite to take for itself such a disproportionate share of the nation’s wealth.

Hi,

I am an Australian but I have to say my experience has been an absolute object lesson on how the debt was sold. Like our hypothetical $100,000 p.a. couple my wife and I also found ourselves going steadily backward to the point where in December 2004 the AMEX came due and we could not make the full payment. Stung by the excess fees we ran straight to the bank who were delighted to extend our line of credit on our home loan on the basis of our equity gained. We were encouraged to borrow more for an investment property – an offer we (rather foolishly as it turns out) declined. Since that time I have attempted to keep a rein on expenses but we are generally lucky to break even in any given month. On average we have been heading backwards at a rate of 2 to 3 thousand dollars a year. I would like to stress that we earn pre-tax around $140,000 per annum, send our three kids to public schools, we brought our house in 1998 when prices were approximately 1/3 – 1/4 of what they are today. If we can end up in this situation, I really cannot imagine how people on lower wages who bought later van possibly be coping. I am guessing the fact that our local after school care centre is thriving so much is an indication that a lot of people are turning to having both partners working full time – my version of hell! To me it looks increasingly like “wage earning” is a fools game. That has got to be an indication that the economy is going badly wrong

I am guessing the fact that our local after school care centre is thriving so much is an indication that a lot of people are turning to having both partners working full time – my version of hell! To me it looks increasingly like “wage earning†is a fools game. That has got to be an indication that the economy is going badly wrong

Leave a Reply