Mirror, mirror on the wall, tell me what two counties are the bubbliest of them all. Orange County and Los Angeles County. Southland homes sales reach 6 year low while median price hits 6 year high.

I always found it fascinating that one of the most toxic mortgage products ever created, the option ARM was pushed heavily by California banking institutions. Places like WaMu, Countrywide Financial, First Fed, and other bygone institutions were heavily into this crack for housing mortgage. The premise of the loan was to free up cash for big money households. Of course, the unstated mission of the product was to push volume in a market where prices were out of reach for regular households yet boosted profits for banks. There simply wasn’t enough of those big income households (and they certainly weren’t buying in Torrance or parts of Pasadena). Today we still have only one out of three California households able to afford a house in the state in which they work and live. So it is no surprise that for the last half decade, one of the biggest buyers of homes in California has come in the form of investors chasing yield. Never have we seen such a high level of consistent buying from the investor class in the state. This has helped to mask stagnant incomes and has been a major player in pushing prices out of reach for most in spite of incredibly low interest rates. Trulia put out a “bubble watch†report and what a shock that Orange County and Los Angeles County lead the list in bubbliest looking counties in the nation.

The bubbliest counties

House horny buyers will always find a reason to buy. They don’t mind spending 50 percent or more of their net take home income on purchasing a California home. For some, housing is everything. Even in 2006 and 2007 when a bubble was clear as day, I was still getting e-mails from people about buying a home and justifying prices. The e-mail always came with a long justification as to why it made sense to buy and some even justified it with option ARM monthly payments. My response? Buy! You are the one that is going to carry that full mortgage payment every month. This includes the principal, interest, taxes, insurance, and maintenance. Yet these folks wanted a timing signal to buy to ease their house lusting desires. Psychologically what was surprising was these same people in the same breath were saying a stock bubble was clearly in place while paying outlandish prices for a shack in SoCal.

Today it is rather clear we are at an inflexion point. Recent data shows Southland home sales hit a 6 year low. We also have the median price hitting a 6 year high. What we are seeing is that the few sales that are occurring are going to “good†properties while homes priced with delusional real estate horny juices languish on the market. Last year, crap was selling at a premium. Not so much today. You can put away your sob story about getting your family into a home and trying to convince the seller that you will treat their pre-World War II home like a lost puppy in the wilderness and nurse it back to health.

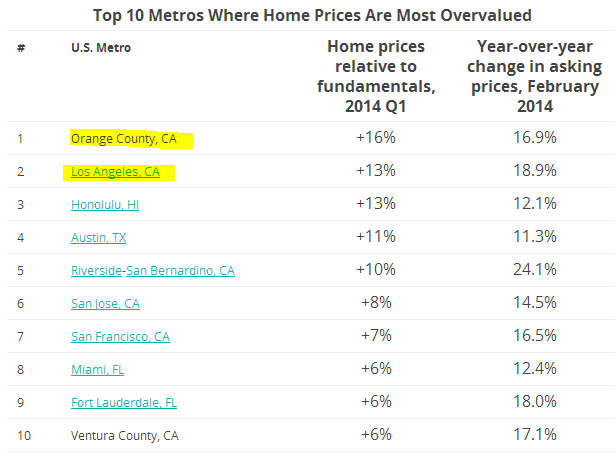

So how “overpriced†is Orange County and Los Angeles County according to the Trulia report?

What I found interesting in the report is that most housing markets in the US are fairly priced based on current mortgage rates and incomes. I agree. Yet we are talking about house lusting SoCal that has a hard time doing the math here. I still have people trying to justify cash flow with mega down payments. Well of course! You’ll cash flow on nearly any property in any market if your down payment is large enough. Never do we get the opportunity cost set into these equations. The above list is telling in many ways.

If we include the top 5 overpriced markets, we also find the Inland Empire. The Inland Empire is merely an offshoot of L.A. and Orange Counties. For example, something like 40 percent of those living in Riverside County drive into L.A. or O.C. for their work. Austin Texas is also on the list which might surprise many people since overall, Texas has some of the most affordable real estate in the country. Honolulu is obviously constrained by being part of a freaking Island that is a global resort city. You mean Westminster, Garden Grove, Fountain Valley, Anaheim, Fullerton, Costa Mesa, Stanton, and Santa Ana are not top destination places on your travel itinerary?

So 3 of the top 5 overvalued places are here in SoCal. What some might find surprising is that the Bay Area is more “affordable†than SoCal based on fundamentals. Why? Because of the tech boom that is going on. You legitimately have households with larger incomes there. Dual incomes from professionals in the tech industry. SoCal on the other hand when you dig deep enough does not have the big incomes to justify current prices contrary to what some will believe. You’ll also notice that Ventura County shows up on the list at number 10. So 4 of the top 10 most overpriced places are here in SoCal.

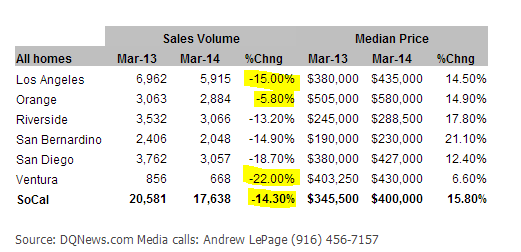

Let us look at the current sales and price data for the last month:

Sales are taking a big hit year-over-year. This signifies an inflexion point. Ventura County saw the biggest year-over-year drop of all SoCal counties. Prices are up but this is likely to sales going to more selective “prime†properties and foreclosure re-sales hitting multi-year lows. Investor buying continues to slow down since the potential gain versus risk is no longer appetizing.

Will people continue to buy to satisfy their housing lust? Absolutely. But current sales volume suggests that some folks are waking up to this mania. Of course the first to wake up are big money investors while small time players continue to think and act as if they are the next Donald Trump. Be our guest, buy up those crazy priced homes in the Southland. As we all know, real estate prices never go down in Southern California. There are more factors to consider when buying a home than simple cheap mantras.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

164 Responses to “Mirror, mirror on the wall, tell me what two counties are the bubbliest of them all. Orange County and Los Angeles County. Southland homes sales reach 6 year low while median price hits 6 year high.”

Janet Yellen today: “Interest rates will likely stay at current levels for a considerable time after asset purchase program ends.”

http://money.cnn.com/2014/04/16/investing/stocks-markets/index.html

Sigh. Free money for the banks.

The Fed is the posterchild for doublespeak. You can’t trust a word they say. It’s way past the point of getting old. I give statements from any of their mouthpieces zero consideration. Obscure and confuse is the name of their game.

Their actions are what you need to be listening to, period.

A considerable time could be 6 months… Which would put us right at April/May 2015 which is when they said they’d start raising rates anyway. They know they have to deflate this bubble. The only other option is a short while more faux prosperity and then ARMAGEDDON! LOL 🙂 Seriously though. If you look at the FED verbage since Bernanke left it skews heavily toward normalization. Though it is rather disgusting that a 2% FEd rate combined with an economy full of capital misallocation and on the verge of a deflationary spiral is closer to “normalization” than the current path…

The bond market has not spoken yet, Fed can only control so much

@Janum, there are two (primary) interest rates. One is the Federal funds rate (aka overnight rates) for short term interest. The short term rates are what Wall Street, hedge funds, savings accounts, certificate of deposits, adjustable rate mortgages (ARM) and interest only mortgages are based on.

The other is interest rates are the long term rates which includes the 10 year U.S. treasury, mortgages and most mortgage backed securities (MBS). The Federal Reserve used QE3 to take the garbage MBS’ off of the balance sheets of the banks. This helped to suppress long term interest rates. Now that all the trash MBS’ are off of the balance sheets of the banks, the Federal Reserve can pull the plug on QE3.

Janet Yellen said yesterday that the Federal funds (overnight) rates are going to be low for a long time. Otherwise a lot of investment banks, hedge funds and government entities would go belly up in a ball of fire without ZIRP.

The Federal Reserve couldn’t care less about the long term rates so they are winding down QE3.

As if home prices weren’t bad enough, LA is also the least affordable for rents according to this report put together by the NY Times. LA has the absolute worst ratio of median monthly rent to median monthly income, with rent coming in at 47% of the median monthly income.

http://www.nytimes.com/2014/04/15/business/more-renters-find-30-affordability-ratio-unattainable.html?_r=1

Rent too damn high; mortgage too damn high!

Supply and demand. RIP, Lord Blankfein.

I’ve been noticing a lot of these articles about the “sky high” and “soaring” rents. I read the NY times one, and believe the LA Times and even the LA Weekly had similar articles.

I just don’t buy it, at least not here in LA. Its price collusion IMO. I have a 10 mile drive to work across Hollywood and West Los Angeles. If I’m not passing another five story complex in the process of being built, I’m passing a building with a vacancy sign out front.

I think sites like Zillow and West Side Rentals just assist the collusion. Do a rent search on any of these sites and it looks like a rash. You can find a place anywhere in the city, although they ALL have the exact same “soaring!” asking price.

Perhaps some folks holding a lot of real estate are trying to swing the rent vs own ratio in a favorable direction for selling overpriced property?

Its a waiting game now, and unless WAGES “spike” or “soar” or go “to the moon” people will continue to double up, couch surf, or move in with Mom and Dad. Reality and arithmetic favors the buyers/renters.

Don’t believe hype!

^This exactly. In markets with sophisticated corporate landlords, the opportunity to play on information asymmetries between landlords and renters is huge. The large corporate landlords target a CAP rate for their properties. CAP rate = net rents/value of property. If value is high, asking rents will also go up. Since they are well-capitalized, they can site on vacant properties for a while. For example, if they ask $2000/mo, their yearly is $24K plus a higher basis for rent increases further down the line. If market clearing price is $1500, they only make 18K, so they can afford vacancies of up to 4 months or more depending on ability to increase rents in subsequent years. Just as you said, internet forms a way for landlords to signal price levels to each other. If they sat down and did this, it would be illegal, but the internet allows them to avoid this illegality. The $2K/mo now becomes the new price and other landlords price to this level or slightly below. I have seen this in Bay Area and LA repeatedly. Simple supply and demand would not account for these price levels since it is obvious that this much supply is not demanded at these prices. They get away with it because housing is the ultimate local monopoly: if you need to live in LA, you need to pay them – substitutes do not exist. Prop 13 makes it so paid off properties have little holding cost making it so landlords do not have to enter the market with their units.

Soon this will all come crashing down.

How will it come crashing down though? Even if there was this indirect collusion with enormous amounts of rentals sitting vacant due to high asking prices, the official and unofficial vacancy rates do not show that huge amount of properties sitting empty.

Vacancy rates have been and continue to be at ridiculously low percentages, well below 5%. If landlords were desperate to get their units rented they would be offering concessions and lowering rent, but this is not the case nor has been throughout the downturn from 2008 until now.

If the rent is too damn high for some people to afford, they need to lower their expectations and/or move somewhere cheaper. Nobody deserves a better rental, quality of life or lifestyle than they can reasonably afford just because they are deserving, “special” (they’re not), or some other bullshit reason. Life is NOT fair, never has been and never will be, sorry. If people can’t even afford a poverty rental here, there are plenty of cheap shithole rentals in the filler/flyover states or whatever shithole third world hellhole they crawled out of. They are welcome to leave and go the fuck back where they came from or find someplace new and cheap(er).

I agree with this, and I think it’s one of the flaws in the Trulia valuation model. Yes, they are factoring in price-income ratios, but they seem to be equally weighting price-rent ratios because of historical assumptions about the relationship between rents and purchase price.

But I’m skeptical that historical price-rent ratio assumptions don’t at least bear closer scrutiny or re-evaluation in this market.

Juan,

Did you get that 5% vacancy rate from Zillow or NAR?

Your “give them as little as possible and take as much as you can get” attitude isn’t very good for a prosperous city either.

Continue driving out the middle class. Film production is 50 percent of what it was twenty years ago. That almost sounds like Detroit without car manufacturing, but nicer weather.

Juan, I’m with you as far as folks setting proper expectations and accepting reasonable accountability for the state of their situation. However, the attitude that people can just leave if they don’t like a situation is short sighted. People are leaving SoCal. Mostly productive people based on my anecdotal observations. They are leaving behind in large part poor people with low value adding capabilities and wealthy rentiers. There will be costs to bear for this trend and that the outcome was encouraged by some will be of little comfort when SHTF.

Complaints are a natural byproduct of unsustainable events. To simply short circuit the process by claiming people can like it or leave it is a state of denial.

California is just to overpriced. A friend of mine bought an overpriced shack 3 years ago and it has increased 300k in those 3 years, I came to the realization I would never be able to buy in California and my rent kept continuing to rise while my income actually declined. I finally made the decision to leave for a a lower paying job out of state, but with that I also got a lower cost of living, significantly lower housing and rent prices. Here I could actually buy a house on an income lower than I made in California. Oh, and I am no longer paying taxes in California, what if there are a lot of people that think like me, how will the California economy survive without OUR tax revenue? Eventually the businesses will leave for lower cost states as well.

Funny seeing Austin up there. Isn’t that where most Cali expats go when they move to Texas? Seriously though median income is LOWER than it was in 2007! Despite an INSANE amount of FED intervention all we got was the mother-of-all dead cat bounces.

I’ll give the bulls Santa Monica, Irvine, South Bat Costal and condo gentrification near downtown. Those areas are going to reflect the New York Prime areas where all the financial criminals choose to lie. But the SFV, the SGV (the China bust is going to hurt especially there) and the IE are in for a strong correction back to 2010 prices and just might over shoot. We are looking at a 2.25% FED rate at the end of 2015 (Goldman and others projection). Mortgage rates will likely be in the 5’s next year. Employment is still ass…

There is NOTHING that can prevent another correction. the FED has gone all in on the “Recovery is sustainable, must prevent bubbles” narrative. Think the HFT scandal coverage is conveniently late? Well TPTB were just saving it as the scapegoat for the next stock downturn. HFT=Sub-Prime. You’ve got leverage at levels worse than 2007. 7 million underwater mortgages in CA alone. I know a lot of people are still buying “Hope and Change”, but reality is coming in hard and fast.

If you accept math for what it is, you know what’s coming. Hedge accordingly.

Desired LA will deflect any downturn. RIP, Lord Blankfein.

Now is this the math that caused you not to buy when prices were great, or is this some kind of new and improved math based on unvetted logic?

My fundamental question is this, where will the supply come from? Buyers over the past few years don’t need to sell. Boomers don’t want to sell, banks have no motivation to sell. What will make this anything other than a standoff?

What if Trulia’s math is wrong and the zero on their scale for fundamental value is in the wrong place? Home ownership rates in California are low. They are low in Germany too. So? Why are they low?

Here is another question. What would home prices need to be for housing to be “affordable” for 55% of the CA population using Dr.’s metrics. That would be the lowest we could go, right? Then the status quo could be maintained with current incomes only. Then you add in the old money, savings, equity, etc that people are willing to throw into housing in CA into the picture and you would get a more accurate depiction of where a bottom should be. Right? Otherwise, many people here will speculate and miss the next decent buying window. . . like they did last time.

A couple good earthquakes and a tsunami sure could make things turn south. Your thinking is exactly what the RE agents would have everyone think: “buy now or be priced out forever!” Good luck with that, it hasn’t ever lasted. There are booms and busts. BIG busts. As if you could foresee the future with your crystal ball.

“What will make this anything other than a standoff?”

This idea of a standoff by sellers seems like a good one although the argument ultimately rests on “this time is different.” That somehow everything will stand still and enough people aren’t forced to sell has not held water in the past.

“many people here will speculate and miss the next decent buying window. . . like they did last time.”

How nice of you to be concerned about the rest of us missing out on “decent” opportunities. Seeing how the last reasonable window in SoCal was over ten years ago, we’re actually getting along quite well avoiding speculative fervor and its sidekick, rhetoric.

@SAKMAN and @DFresh

In order to help out you, I have prepared some comments that you can use as a boilerplate to copy and paste responses to falling home prices in SoCal.

Feel free to use the following text (some of which is borrowed from the previous housing busts:

1.) Fundamentals do not matter. Local incomes do not matter.

2.) Unemployment rates and underemployment rates do not matter in a place like SoCal. Los Angeles is different than anywhere else.

3.) Record poverty and SNAP (food stamp usage) is irrelevant when you have beautiful weather like we have. California has the highest taxes in the county. That doesn’t matter. This is the sunshine tax.

4.) Record levels of household debt do not matter in a place like California. This area is different.

5.) Anyone who hasn’t bought by now will be priced out forever. Their property prices will continue to increase 30% a year, every year, forever!!!!! This time is different.

6.) Renters, and anybody born in a future generation, will not be able to afford a $10,000,000 starter home in 15 years. They will live in tent cities and Hondas.

7.) This time is different. The gains are permanent. Home prices never ever go down.

“My fundamental question is this, where will the supply come from? Buyers over the past few years don’t need to sell. Boomers don’t want to sell, banks have no motivation to sell. What will make this anything other than a standoff?”

***

A few reasons:

A. I’m a Bank/Investor/Hedge Fund/Etc that can sit on this property for a bit and wait for the price upswing while supply drops. If this doesn’t happen soon, I’ll just dump the property and write off the loss on next year’s taxes like I already do with the carrying costs.

Low supply must mean high demand and higher prices, am I right?

B. I’m a homeowner who doesn’t need to move, but might as well hang a shingle on the front lawn and see if a bidding war starts. If the price goes high enough, I’ll cash out and move somewhere cheaper. I have the luxury of being able to reject any offer that isn’t the highest in that zip code.

D. I’m a landlord who has owned this property for a long time and now might be the last chance to cash out big on this house I bought for a fraction of the asking price 20+ years ago.

C. I’m buried in this house and need to sell it for as much as possible in order to avoid a short sale or strategic foreclosure and getting hammered on taxes for the debt forgiveness anyways.

D. I live in my home and don’t need to or plan to sell anytime soon. I’m fine where I’m at.

Ernst!

1) Go grab some data. Run the correlation coefficient between household income and prices. You will find that the R-squared for US house prices (depending on the data you pull) is only around 0.65 over the last 30 years. You will find that the correlation for CA prices drops BELOW 0.50 for depending on who’s data you use! So. . . Incomes do mater, but NOT ANYWHERE NEAR AS MUCH AS YOU THINK THEY DO. In CA it accounts for less than 50% of the game! The rest is inflation, credit expansion/recession, and old money. There are manuscripts on this topic. Go read them, it will expand your view.

2) Ha! If we has unemployment data that was worth anything we could run an analysis, but we don’t so this is a Red Herring. I never said it, you are building a strawman.

3) Strawman #2

4) Massive Credit expansion is unsustainable in my opinion. However, credit will expand, and it is quite difficult to estimate what the limits of the expansions are. Just because something is at a record level doesn’t mean it can’t increase from here. The length that it can go on is an enigma and it relates to the saying that “Markets can remain irrational a lot longer than you and I can remain solvent”. However, keep in mind, at this very moment we are at a record level of time since the beginning of the Universe!

5) Being priced out is a fear tactic. Recognizing that income gaps are widening, and that there are many places in the world where home ownership rates are much lower than the US should make people realize that it is within the sphere of possibility that home ownership rates could decline and that they might be part of that statistic given the environment.

6) See #5.

7) Home prices obviously go down. The relevant system to talk about is the US dollar. In the long run can it ever go up with a policy of X% inflation?

Bubble Pop!

A) I’m a bank – Nationwide it takes me 572 days to complete a foreclosure. I’m a bank in New York, it takes me 1103 days to complete a foreclosure. Those are real numbers. I’m a bank, and I’m still able to mark to fantasy. What you wrote is complete nonsense. They can’t complete the foreclosure in the time span of their yearly cycle, it’s not even on their radar, and there is no motivation.

B)Sure, I agree. If prices stay high, people will sell.

D#1) I’m a landlord with a property that I manage, it is near to me, and it is a source of cash flow. Unless, I’m getting out of property all together and retiring. This thing is making me droves of cash. I’m not selling.

C) I’m buried in this house. I’m not selling unless I’m above water. See my response to A for why I’m going to sit here for another three years if I can’t sell.

D) That’s right, people that bought at a good price that don’t need to move, aren’t selling for any reason.

Also bubble pop:

On A) The Hedge Funds? They stopped buying when the assets hit Rental Parity, which was a lot later than many people on this blog think. They aren’t losing anything anyway, they sold the shares of those houses into the global investment pool. Have you looked at the terms on buy to rent schemes? I have! Many of them are structured like Ponzi schemes are. 1) We have an asset 2) Your money is locked in for at least X years 3) You will make a yearly return of X%. That money is locked in place for a lot longer than you think it is. Those houses aren’t going anywhere. The cost to sell alone requires that these buy to rent schemes use such a structure.

The current L.A. Weekly has a story about some Chinese businessman, Huang, who bought his 23-year-old son a $5.8 million mansion in Pasadena.

Huang paid cash. His son is a USC student.

It’s the former Chandler mansion. The angle of the article was how ironic it is that Chandler hated Red China, and now a guy from the PRC is buying his mansion.

Last year Huang bought a nearby mansion in Pasadena for $3.7 million in cash, to serve as “interim housing” while he upgrades the $5.8 million mansion.

There’s apparently a Chinese website, Juwai.com, which advertises US houses for sale.

Huang is presented as a rags-to-riches story, a businessman who started from nothing, but I doubt that the L.A. Weekly vetted anything Huang told them. You don’t get that rich in China without corrupt ties to high places.

“Huang is presented as a rags-to-riches story, a businessman who started from nothing, but I doubt that the L.A. Weekly vetted anything Huang told them. You don’t get that rich in China without corrupt ties to high places.”

I’m curious as to how many “rags to riches” stories in the United States, if properly “vetted” and investigated, would ALSO reveal corruption and/or ties to high places.

Well, Huang like the rest of the Chinese carpetbaggers, better hope he stays in the favor of the powers that be over in the PRC (and that the powers that be remain the powers that be), otherwise he might end up having to flee here permanently or facing being “huanged” (terrible pun, I know).

Why do you guys seem to think home prices must come back down? QE inflated the money supply, that extra money has to go somewhere, currently it’s in stocks and real estate, and probably some offshore accounts. The cat’s out of the bag. It’s like waiting for the purchasing power of the 1913’s dollar to come back magically for some reason; no you can’t buy a gallon of gas for 8 cents anymore, don’t hold your breath.

You guys seem to have a lot of trust in green paper; green paper which can be infinitely printed at the whims of the Fiat rulers.

“QE inflated the money supply, that extra money has to go somewhere, currently it’s in stocks and real estate, and probably some offshore accounts.”

Wrong… It is sitting at the Fed in the member reserve accounts. So, no it does not have to go anywhere. The reason real estate and stocks are going up is because of supply constraints (stock buy back and mark to market suspension). It is all an illusion.

But housing and stocks can only go up. Look at history! It has only gone up so you need to buy now or forever be priced out you bunch of losers! I have all my money in stocks and real estate and that makes me smarter than all you loser sideline renters. You can’t get a date in “RED” China if you do not “own” property. I am sure there are many agent trolls on this sight that can help you get an interest only 5 year arm. It’s not too late! Act now you bunch of losers!!! You can be paper rich like me all we need is your John Hancock…

You missed something. What the Fed spills, it can also sop back up. It can create and extinguish money. Whatever it takes in the given moment to maintain the status quo.

But yes, you’re right that the value of dollars tend to go down over time. That’s why we distinguish between nominal and real prices.

“But housing and stocks can only go up. Look at history!”

Look at credit growth, it is at a historic low. The Fed does not inflate the money supply through QE, but only banks can do through credit creation.

Betting on high inflation for housing can be suicide for home owners, since the cost of owning the home (taxes, maintenance) is soaring while rents will not go up with inflation (rent controls to avoid social unrest).

So what you guys are saying is QE has been completely irrelevant to the real economy? Then why does everyone freak out, and stocks pull back, at the mere mention of a taper? Also have you guys seen that zerohedge graph comparing QE with stock charts? It’s like a perfect match, and don’t give me that “correlation does not equal causation” bull, especially in a “science” as hazy as economics.

Even if you assume there has been no fractional reserve credit creation as a result of QE, you can’t deny that stocks have risen, which investors have been using as collateral for huge real estate purchases. Blackstone, et al.

About rent control, you know owners can evict tenants, by moving themselves in, it’s called an owner move in eviction. This may also apply to close relatives of the owner. Also, unless there is a long term lease in place, or high regulation, rents can be increased. If it does become hopeless for landlords, stuck with low rent long term lease tenants, they can just stop paying their mortgage, and still pocket rent money as many did a few years ago, while the foreclosure slowly goes through the motions, with some landlords pocketing free rent for years, even to this day. Profit baby, profit.

Also, don’t forget about tax write offs.

Sure real estate does have some pull backs here and there, but look at the general trends. You guys are just trying to time the market. That tidal wave of dollars in foreign reserves will eventually come to roost. Sure keep believing those CPI numbers, and trust in green paper.

Fiat Value, a “move-in eviction” is hardly a panacea for landlords.

1. What if a landlord has many units, and only so many family members?

2. What if a landlord already has nice digs, and doesn’t want to move into his rental property?

3. Move-in evictions can be challenged. Here in Santa Monica, I read occasional news stories about tenants taking landlords to court for bogus move-in evictions, wherein the landlord only lived there for a brief spell before moving out and re-renting it.

4. Move-in evictions can be costly. Santa Monica imposes all sorts of fees and “relocation costs” which landlords must pay tenants.

5. Some jurisdictions don’t allow move-in evictions. Long ago — the 1990s or even 1980s — I read a news story about come guy who bought a rented condo in Massachusetts to live in. After he bought it, he was shocked to learn that Massachusetts forbade even move-in evictions. (Don’t know who accurate the story, or my memory is, but that’s how I recall it.)

And whatever the laws, they can always be changed even more in tenants favor — higher relocation costs, greater limits on a landlord’s move-in rights (e.g., a limit on the number of units he can move family members into), or even ending move-in evictions.

“So what you guys are saying is QE has been completely irrelevant to the real economy?”

I believe the answer is going to be based on your definition of “real economy”. Does QE have an impact on long term interest rates? Most likely yes, given that the majority of long term rates are based on the 10 year treasury which makes up a large part of QE. The real question would be did this increase GDP? Given that most data would point to no (growth in M0/M1 with little to no growth in M3). So my guess is that QE, at least the latest incarnation, has had little to no positive effect on economic growth.

“Also have you guys seen that zerohedge graph comparing QE with stock charts? It’s like a perfect match”.

Don’t you know that reading the gloom and doom site can be hazardous you your health? Is there a correlation to lowering rates and stock price increase? Well yes but not for the reason you would think. The biggest reason is that corporations which have access to the cheap money are borrowing at very low rates and buying back shares which make earning per share continue to rise during stagnant organic revenue growth. They also have increased M&A activities to increase “inorganic†revenue. The other impact is that the low return on “safe†money has chased some “investors†to more risky “investments†i.e. chasing yields. QE has not stimulated growth rather it has been an activity equivalent to moving deck chairs on the Titanic.

How-zing to go up fo-eh-vah!!!!

lololol I never said QE was beneficial to the economy, I am just saying that extra money is going somewhere, which means inflation; whether directly or indirectly QE is leading to rising nominal prices of stocks and homes, etc. Sure the fed could try to deflate the dollar by crunching credit, but they can only crunch it so much (and at what cost?). We all know the end game is to inflate the debt away as much as possible, so a deflating dollar supply is definitely not the goal and will be countered as much as possible. The principal amount of dollars has already been printed, and is in circulation. Maybe home prices will drop, due to the money going elsewhere (maybe food, gas, etc.) but the money is already out there, and it’s just a matter of time before people figure it out, and adjust prices accordingly, including home prices. Foreign cash reserves will be dumped, and when that happens, I’d rather be holding a house, rather than a pile of this green toilet paper.

The housing bubble was allowed to collapse to shake off a bunch of people from homes, so the black stones, et al. could buy em up then rent em out. They’ll crank up the prices to become the lords of everyone, why not? Plus you paid for it anyway via bailouts, what do they care?

What are you guys doing with your money that’s so great anyway? Savings account that gets .1% interest?

In gweeeen paaaaper we trust!!! Everyone needs this gween paper, they eat it, they live in it, they sleep with it, why wouldn’t anyone want this precious paper? You are so rich! You have paper! Me stupid, me only have shelter ;( and brass bullion.

As far as the China “bust” affecting the SGV. I agree it will affect the SGV it actually already is, but you are seeing it from the wrong side. Ever since the Chinese slow down starting making bigger headlines, just the last 2 years the SGV has seen an explosion of buying from the Chinese. I’m not just talking about residential either. It makes sense as the real estate market deflates back in china. People are also not allowed to buy property in China to park their investment cash, it’s a lot of red tape now. So we will continue to see the flow come this way. I’m gonna use a city like west covina for example. Leading up the first bubble it was the Latino population that was exploding. You could literally see the empty Budweiser cans pouring out of the new homeowners houses, and if you looked at public records your stereotypical and racial tendencies were proven right. As the boom carried on late in 2005,2006 the amount of option arm product in west covina was sky high. Again just by looking at public records it was confirmed. Then the bust came and West Covina led the SGV in foreclosures. All that brown was being washed out. You could once again literally see it with your own eyes. That’s when the Chinese money started pouring in. 2008 it started with the pioneers. Then the strip malls were being remodeled and low and behold new tenants have been popping up left and right and they are mostly Asian inspired businesses. The last 2 years has been a huge boom of Chinese money flooding in. Entire commercial properties turning into little Asian hubs. The residential real estate is following. I’ve been tracking closed sales and out of the 60 or so I have tracked in one zip code I’m confident when I say 59 were Chinese buyers.

Why does this surprise you, all of SGV will go from white and brown to yellow, all the way to LA County line and even further. You can’t outJoo a China man as they say

The FRB has been playing games and will do until a black swan event takes place. Interest rates will be kept low till then. Case in point is that Belgium is now one of the biggest buyers of UST Bonds this year over $300 Billion. Where are they coming up with this money. I think either the FED is buying the bonds themselves and just using Belgium as a name or the US is bullying these little puppet counutries to buy UST.

http://www.zerohedge.com/news/2014-04-15/shocking-buying-spree-americas-mysterious-third-largest-treasury-holder-ramps-higher

This game has lasted longer than I thought and it might go on for a while longer. Waiting on the sidelines for prices to go down, have good Down Payment stashed away. Don’t know how long i can convince the wife to rent. FN FED.

Oh boy, Shabfu, I feel you and feel for you when it comes to the nesting mentality of the wifey. Was right there from the start of the post bubble in 2008 through late 2011 when I finally capitulated and bought. Worked out great so far, but hindsight is 20/20 and future vision is very hazy.

All I can say is, endure. Endure as best you can, stand your ground as strongly as you can. If a decent deal comes up (HAHAHAHA, fat chance in today’s market, I know), let alone your perfect dream house or close to it, at a reasonable price (again, HAHAHAHA x 1,000,000), and you can sensibly afford it, then it might be worth it to appease the wife. After all, happy wife = happy life.

Thanks for sharing. there are enormous pools of money searching for investment opportunities. TBH, bonds are very dangerous in a low yield environment. In a perfect world, there won’t be inflation. But then, haven’t we seen prices go up for things that matter to us? Gas, property taxes, groceries, … http://www.youtube.com/watch?v=PTUY16CkS-k

Rising interest rates will cause a bloodbath in the bond market, especially at the long end. Buying 30 years treasuries is incredibly dangerous IMHO. and there are those REITS etc like ANH have them in their portfolio.

When every body is running for the same exit, you can figure out what that will mean.

Personally, I would rather invest in Mobile Home Park REITS 😉

Didn’t buy in Feb 2012 thinking prices would drop more. NOw look at this SH*T. Fed is playing this better than i thought. I thought for sure black swan would have happened by now. Now Belgium is one of the biggest buyers of Treasuries? HAHA, its basically a backdoor for the Fed to buy Bonds while still “tapering.” They cannot tape in my opinion because of the trillions of derivatives that the banks hold that are dependent on low interest rates. If the FED really pulls the punch bowl, Interest will have to go up and that Banks will implode. Don’t see that happening thats why this Belgium buying Treasuries is so interesting. These Banking MOFOs have found another way to scam the avg joe.

http://www.zerohedge.com/news/2014-04-15/shocking-buying-spree-americas-mysterious-third-largest-treasury-holder-ramps-higher

With the amount of global currency debasement going on. Its not just the Fed that is playing well. I’m convinced that the view of local incomes does not account for what has been going on. Just because the average Joe doesn’t have the cash doesn’t mean the cash isn’t out there. The richest people I know will tell you that reported income is not the way to get rich. Yet we focus on reported income because we have that data. There can really be no other reason to focus on it. Yet if we come to the wrong conclusion over and over again it might be time to reevaluate.

“I’m convinced that the view of local incomes does not account for what has been going on. Just because the average Joe doesn’t have the cash doesn’t mean the cash isn’t out there”

I agree. There are so many older people with tons of money, that go to help their kids buy homes. More money than we can ever realize. There are no records for the vast wealth that has existed by people who cleaned up in the 20th century, and who’s net worths have only skyrocketed in this century.

Yeah, they could use Belgium as a backdoor to buy bonds and then make it look like the Fed is tapering, but I’m not convinced. Belgium may be buying bonds for the same reason that Germany buys Greek bonds. Because the fix is in.

China has known our bonds were junk for a long time but they kept buying. Why? Because they are in too deep, and so is the rest of the world. The nations have agreed to put all their muscle behind the illusion, the biggest bubble in the history of mankind, because they see no other way out… But I guarantee you, certain people are plotting a way out, such as a war or by delivering us to communism ( here I refer you to events in the Ukraine, do they sometimes smell a bit contrived? )

Anyway, the idea that interest rates will be kept low because otherwise the whole house of cards will collapse doesn’t seem accurate to me, though I see where you are coming from. I just think you are still treating this economy as if it were permitted to run normally, you aren’t thinking like the powers that be. You don’t understand, perhaps fortunately, just how Machiavellian and tenacious they are, and what they will do to survive and keep their power, which is severely threatened. Who threatens it? The mob, the masses. What is to keep them asleep when they no longer have anything to lose?

China and other nations are already buying our junk so why would higher interest rates stop them from buying it? They are stuck now. If they ever had an opportunity to drop the dollar and painfully but ultimately healthily correct, that time is over. Now if we raise interest rates, what are they going to do? It’s like when you jump in a volcano, are you going to be able to turn around and fly back out of it once you see it’s getting hotter?

And then with what is happening in the Ukraine, America will probably be positioned psychologically as our defense against Russia — and recall it was World War II and our ability to portray ourselves as the unstoppable world power that led to our becoming the world-reserve currency and to our fake prosperity. In this case, our bonds won’t even be junk, as the world sees it. The American illusion will have been temporarily restored to some degree, except without anyone really believing in it.

The dream factory is not done yet. But before it does close down, I do think we will see disinflation or deflation; definitely house prices will correct in SoCal considerably. Disinflation/deflation is unstoppable but a war or other very bad things is not unstoppable.

Sorry shabfu, you actually do understand how tenacious and Machiavellian the powers-that-be are, that is what you were talking about with the idea of using Belgium as a new Fed to buy bonds while the Fed appears to taper — we just disagree on the Machiavellian methods.

I don’t think they have the power to stop disinflation/deflation, but I do think they have the power to get out of bad investments, clean up ( and cook ) the books, and then survive the upcoming disinflation/deflation. I also think there is a strategic advantage for them if deflation happens. When people can buy houses again they will believe themselves prosperous and will be psychologically malleable once again, they may stop asking hard questions about the environment they live in, the critical sense may once again be dulled. And that is very important to the powers that be, more important than most could believe. Because they are not invincible, just very stubborn and clever.

In the upcoming correction, those in the know will have already gotten out of bad investments. The banks will have ensured that they can survive through stress tests and so on. It will only be patsies who are left holding the bag, flippers and people like that, small-time landlords.

American wages will fall to that of China and India due to Globalism(the international corporations stocks will go up). The H1 VISA folks will come here and take your high paying jobs(don’t blame them, blame Microsoft types). If you are retired and a consumer, this is all good, since things will be cheap. Us retired folks will trade the million dollar homes amongst ourselves, since third world wage earnings can’t afford it. L.A.’s middle class has been reduced so much. It is mostly just us rich and the poor with a few middle class suckers in between. Time to take my cruise with Captain Francesco Schettino on his new ship, the S.S. California at a price that I could not refuse.

You mean markets and economies are rigged and manipulated by powerful players, and there’s no such thing as the mythical “free market” so many of those riggers and manipulators like to talk about so much?

Say it ain’t so.

So the debate continues on reasons to stay or leave so cal. I commented a bit too late in previous post, so I’ll re-comment. There are strengths and weaknesses for every city. There are tons of things i hate about LA so it’s all about weighing what’s important to oneself. So here’s one aspect that i haven’t seen discussed here. I’m sure Texas love their full figured 180lb corn fed ladies, but I’m perfectly fine staying put w/ my 120lb tan line absent, golden skin beach babes. Just going to take a stroll down santa monica boardwalk this weekend and realize I’ll be mixing my gene pool w the right looking folks. We’d love to continue sending the 7’s n under out yonder, and retain the 7’s n up here in LA, where it’s sunny everyday. No regrets here. Absolutely none.

Sounds like you’re in the place with all the other boring and shallow mannequins of SoCal. If you want to pay that much to look at 9’s & 10’s you’ll never get because you don’t have a 7 Series and a McMansion in the hills, good for you.

I live in Santa Monica. Yeah, there are some pretty women. There are also plenty of women with the plastic surgery/Fox News bimbo look, even by their 30s.

And tons of women in their 40s and 50s with balloon-tire lips, stretched faces, and leathery sun-baked skin, trying too hard in their scant outfits.

And plenty of BBWs in SoCal too. Just go inland a bit, away from the coast.

Really, you have good and bad looking people everywhere.

It doesn’t matter where you live, it is always “money honey”. Unless you have the money, we don’t look at you. We know the posers in Newport(sorry Santa Monica, we go for where the big dollars are) and elsewhere. California has great divorce laws. Some 10’s work their way up and are multi millionaire cougars in Del Mar.

Don’t you mean work their way down? Yes, yes they certainly work their way up, but it almost always takes them a lot of work on their hands and knees and on their backs…

You’re delusional. SoCal has some of the worst women on earth. You fall for that trap and you’re in for a world of hurt. But hey, it’s your life and you have to live it. Good luck.

Thank you, Jason, for prompting the devolution of the conversation to locker room juvenility.

Shush now, let the grown-ups talk.

Exiting QE is somewhat like raising rates. Just by tapering, they risk asset valuations. Looks like we are begging to see the limits of demand. A simple supply demand curve would indicate that without lower prices there is not enough demand to have a viable market. Look at mortgage originations, they are terribly low. Also remember the weather that people talk about has not affected the bubbly areas.

I think people may still have a jobs, but for many they are crappy and don’t allow them to take 20% yearly price increases in stride. Simple economics says this is the limit to pricing. Cut your price and get out before everyone comes running for the door. This market is a rational sellers dream.

Yeah, or buyers are getting hit by sticker shock and it will take some time to acclaimate to the new normal.

Buyers might get hit with sticker shock, but they also set the market – NOT the sellers. If the sellers balk and walk en masse, there is no market…until sellers capitulate, which some inevitably will do.

“new normal” = real estate can only go up. Incomes do not matter because there is a lot of money out there. So buy now or be priced out forevah!!!

Sorry, meant to say “if the BUYERS balk and walk en masse…”

The squeeze is on, bubble squeeze that is. The proto buyers are unable to afford the costs of owning. With out the income and the household formation the market fundamentals are in uncharted waters. The ZIRP is like a car a depreciating asset. We find ousrselves chock-a-block in luxury foreign vehicles gagging on i-tech. Incredible the greatest advancements in human history commingle with inequality and general dis-ease the likes of which the world hath never known.

I like Trulia’s Bubble Reports and it’s methodology, especially at the national level where they have more data. They even went back and tested their predictions with the 2006 bubble and came up with a correlation of less than 1. Not bad, though it’s only one example.

I’m curious about the metro-level analysis since they only have two years worth of predictions (2013 and 2014) I wonder if Detroit has been “undervalued” for most of the 15 years while LA/SF/NYC “overvalued”. If so, that’s a red flag on the metro predictions.

LA @ +5% in 2013 and +16% in 2014 seem like a pretty accurate reflection of investor volume during those time periods.

I learned that there is no such thing as a bubble in my econ classes so I don’t know what you are talking about. Bubbles sound a lot like unicorns to me. I believe in straight upward sloping line supply curve and straight downward sloping demand curves which tells me that price is always determined by supply and demand so there is not such thing as a bubble. All selling and buying is conducted by “rational” man (sorry ladies this is how they taught it). This means that there is no such thing as bubbles including the ones in the tub…

2125 Vallejo St – our favorite Victorian charmer – still sitting, nearly six months now. Hilarious price confusion over the past week. It must feel great paying that hard money interest month after month. http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

2400 South Dunsmuir Ave – one of many 10 freeway adjacent flip jobs that have come about over the past couple of years – going on five months sitting. These guys play the delist/relist game. I guess they’re planning on some “house horny” moron to come along and be oblivious to the deception. Nice default photo with junk strewn about the entryway. http://www.redfin.com/CA/Los-Angeles/2400-S-Dunsmuir-Ave-90016/home/6900652

6115 South Harcourt Ave – Inglehood. “HUGE PRICE REDUCTION!!” In what world does 8% of 100% define huge? What this place also needs is a huge reduction of ghetto and ugly. The only thing huge here, besides the inflated asking prices, is the dose of karma and reality these flippers are getting.

I’m sure someone will be along soon enough to inform us that we’re dreaming if we think nominal prices are going to drop 90%. Maybe they will also throw in a few examples of sales over ask in Irvine and Arcadia while they’re at it.

Been noticing a lot more radio commercials for flipping houses and infomercials for foreclosure attorneys. This shit has officially jumped the shark.

link for the Harcourt Ave property http://www.redfin.com/CA/Los-Angeles/6115-S-Harcourt-Ave-90043/home/6411911

“long driveway for lots of off-street parking” whispers d’ hood like nothing else.

That house on Dunsmuir……. I would love to have that prize old palm tree in the back yard. That is one magnificent old palm.

It almost redeems this little shack…… almost.

Laura.. Nothing could redeem that house at $549k?

Except, Laura, you should know that more likely than not, the local power/telephone lines are running along that back property line right over that palm. I have some property in that area and throughout these old neighborhoods, the poles and lines straddle the rear property lines running parallel to the north/south streets and orientation of the blocks.

The result is that trimming such trees can be a huge hassle, although LADWP/SoCal Edison etc. have crews that usually do that sort of thing. But as that massive tree grows and the fronds push up, the wires can get to close and result in arcing and fires, power outages, etc. That palm probably grew wild as so many now do throughout SoCal.

Yes sir, that tired old “it has granite and stainless steel” the most over used upgrade in the history of housing.

Saw this one amongst the homes featured at the bottom of the page:

http://www.redfin.com/CA/Los-Angeles/1725-S-Ogden-Dr-90019/home/6902549

They used Photoshop filters to blow out the colors on every photo, which made this seriously overpriced and extremely FUGLY 80 year old house even uglier.

SoCal real estate is truly screwed. If this kinda sales data and listing prices don’t make Jim Taylor’s prediction more true, I don’t know what does.

Something during this latest round (past couple years) of flipping activity is the extreme level of color saturation and contrast that they manipulate the show photos with. I especially chuckle at the obviously over saturated blue skies on photos of SoCal houses considering that most of the time the sky is brown or gray. Next thing you know, they’ll start coloring everything with primary colors like fast food joints.

The future Donald Trumps flip in prime areas.

The wannabe Trumps buy freeway and airport adjacent shacks in the hood, and imagine they can make Trump-size profits on them. That IS what the flip-to-be-rich infomercial promised.

Love the “freeway close” location of Vallejo. May as well hit the bong – -can’t be any worse for you than freeway exhaust!

Here’s “A Must See! With a commanding first impression, this magnificent home … completely renovated & meticulously updated … stunning … impressive entry area … gorgeous oak hardwood floors … elegant living room … new chef’s kitchen … granite counter tops … Luxurious master suite … ”

Last sold FOUR MONTHS AGO at $810,000.

Now listed for $1,199,000 — a nearly $400,000 increase — 33% over FOUR MONTHS.

And it’s situated at the TIP OF THE AIRPORT RUNWAY in Santa Monica: http://www.redfin.com/CA/Santa-Monica/2376-Dewey-St-90405/home/6745167

Actually, this is a value added option! “Walk to the airport!” and “Watch the jets land and takeoff from your own private balcony!”

Actually, $800k + 50% = $1,200k

If you do that every 6 months that is over 125% increase per year!

Do you think that building will sell for over 11 Million in 3 years?

OMG you would never be able to use that deck or backyard thanks to constant small planes and jets coming and going. Add to that the lovely smell of jet fuel, contaminated ground water from that jet fuel/Avgas.

$1.2 million for 1400 sq ft at the end of a jet runway. Insanity at its best. If that was my only option to own (or even rent for that matter) on my budget I would just move out of LA for good. What a crap quality of life.

Housing to Tank Hard in 2014!!!!

Housing to go up forevah!!! This time is different , it really will be for-e-vah because tptb will make it so…

I’ve been frequenting open houses for many years now and visited quite a unique one recently driving around North Hollywood.

The sign in sheet was set up at a table on the driveway and you were only allowed to tour the house with the agent. He then said the house was being sold silent auction style and the current bid was $650k, which was $150k over the $500k listed on the details sheet they hand out. I asked who made the bid and he told me he couldn’t tell me, but the house next door (also on the market) was listed for $699k. I pointed out to him that it may be listed for for $699k but it hadn’t sold for that, and also that he was running a deaf and blind auction, not a silent auction.

I’ll admit his keeping people waiting to tour with him made it seem like quite a buzz as it accumulated people outside. Who knows, maybe they are looking for suckers who think they are getting a deal by bidding at a foreclosure auction or something. It was really quite a sad display. Just stooping to new lows.

Anyway, that was about 3 weeks ago and I just checked the listing and it is still active and listed for $650k. Gee, maybe they forgot about that $650k bid they already had?

This RE agent should have set up a cotton candy machine, some carnival rides and some clowns to go with his games during the “open house.”

Are people in SoCal really this stupid?

Money.. Fools.. Soon departed…

Next they’ll have elephant rides for the kids while the parents tour the house!

“This RE agent should have set up a cotton candy machine, some carnival rides and some clowns to go with his games during the “open house.—

I assure you there were plenty of clowns present including the agent. And to answer your second question… YES!!! That is why housing will only go up forevah!!!!

I don’t know which I hate more. Realtors, cars salesmen or lawyers.

I’ve heard just about every realtard speak line out there. But I’ve never heard the “silent auction” pitch.

They’d sell their own grandmother for a commission.

Calgirl, you forgot to mention Loan Officers. Remember we started this housing debate

Politicians always top the list, no matter which party. As a X car guy , I certainly know the reputation we have.

But when it comes down to your home, lawsuit, jail time, RE agents and lawyers run neck and neck for the two spot?

BWAHAHA, what a lying sack of shit. People in SoCal aren’t *THAT* stupid (outside of the moronic listing agent in that scenario), or some sucker would have taken his BS bait hook line and sinker and offered $650K cuz it’s a “steal” compared to the next door house “selling” for the crackhead asking price of $699K.

Neither home is selling anywhere near that range because the (A) the comps won’t justify it obviously and (B) the market is grinding to a halt and taking a nosedive just like in 2007/2008.

My friend’s dad was the owner of Bar One in Hollywood. He was one of the first to put the velvet rope up in LA and create a buzz. It worked then why not now! Tell folks that they are not good enough to get in (Bernie Madoff) and they will beat down your door… At least that is the thinking…

My friend’s dad was the owner of Bar One in Hollywood. He was one of the first to put the velvet rope up in LA and create a buzz. It worked then why not now! Tell folks that they are not good enough to get in (Bernie Madoff) and they will beat down your door… At least that is the thinking…

Ah, Bar One. Never paid to get in there either. Maybe not buying into the housing mania has something to do with being a jaded local.

Every Sat. night on AETV ‘Flipping Vegas’, he (Scott) buys trashy houses at auctions sight-unseen, and each house is a disaster but at the end of each show, he makes 30-80k profit on each home. Even during the bust years

And Jeff Lewis of ‘Flipping Out’ has been doing remodeling on his shows since the bust, but last week he said he’s getting back into flipping cause everyone’s making a fortune but him. It’s strange that he doesn’t realize he already missed the boat.

But flipping is back on tv in full force which is the best indication that this bubble coming to an end.

Right! I told my husband the same thing. Jeff keeps talking about how crazy it is BOW and how he wants to jump back in. Huh? Something is def up with that.

I caught the tail end of a show where Jeff said he wanted to sell his home but wasn’t getting his asking. My guess is he is not getting back into flipping (despite statements otherwise) because he knows there is no money in it now.

Except inventory is less than half of what it was 6 years ago. Housing to continue to climb for few more years.

…and completed/closed transactions are a miniscule fraction of what they were during the bubble years, much like when the bubble burst in 2007/2008. Inventory is shit, true, but so is demand.

Housing to go up FOREVAH!!!!

I’ll tell you about a sure way to lose money. Just bet that the FED will stop the easy money policy. That is how you lose money. That is why most people on this blog are falling further and further behind. You bet against the FED and lost.

The FED will never stop the easy money policy. Never. They will talk about ending it, because the must do that to support the dollar. But, they will never stop. And, the prices of everything will continue to rise as the government continues to publish CPI numbers showing no inflation. They must publish the bogus lowball CPI to justify the easy money policy.

So, go ahead and rent. Keep that money in the bank. Watch inflation grind higher and higher. Get on this blog and continue to tell everyone you are smart by waiting for the collapse. Some day, real estate will fall again. It always does. But it has more to rise before the next drop. And, you will be disappointed again since the next low might be higher than the current level. The question is … how much more pain can you take by watching the continued rise in real estate prices?

Thanks for the comment jt. You are right if you are all in on a collapse you are a market timer and probably will mistime the market. I agree you need to be careful and try to plan for many eventualities. Though you also have to consider you do not have all the information that the FED does and we all may be misinterpreting their motives. Mo money does not always translate into higher asset prices. Look at Japans experiment with ZIRP and their housing market (no full bubble re-inflation). Prices can rise high enough it chokes demand, because people expect low inflation. It takes a long time for higher price levels to sink in. Usually about the time they demand higher wages. Higher wages have not happened and this in my opinion can restrain asset appreciation.

However I can’t speak for everyone on here, but I am not hurting with the grinding of inflation. Nor do I feel pressured to buy after a 20% jump in prices and a massive drop in sales. The beauty of a market (if we have one) is that money talks and BS walks. I personally have no interest in funding someones 20% jump. So enjoy the ink on the paper. If it worth more in the future, I can live with it. If you don’t have what I want at the price I want you simply cannot have my money. If that is called fighting the Fed we simply have no “free” market.

Though I disagree with you and wrote above about how I believe disinflation/deflation will happen, the scenario you describe is also possible.

The market could continue to be totally disconnected from reality, thus forcing people to change their living habits, i.e. 30 people living in one house, “respectable” women becoming covert prostitutes to stay afloat, etc. This stuff has already been happening, I’m sure. To say it couldn’t happen here is dead wrong, this is more or less what has happened in places like Ukraine or Romania, and now the PIGS states. It threatens to happen almost everywhere, because we have elite enriching themselves at the expensive of almost everyone else.

However, I believe at least a little air will be let out of the bubble. My reasoning is that one thing the said elite are terrified of is that the people will wake up to how they are being led slowly into this nightmare. I think reducing their expectations and then throwing a few bones at them is a ploy that we will see put into action. If deflation happens, people will psychologically feel prosperous once again.

I learned a long time ago that you can’t trust the claims of someone who states something will “never” happen.

Exactly. It is almost always uneducated fools that make absolute claims and statements utilizing words such as never, only, always, nobody, every etc.

Never is closer than you think, jt.

Juanito – Housing will absolutely go up forevah! It will never end!

jt – you are my hero!!! Tell me how I can get into this get rich real estate thing. I want to be just like you because you are sooooooo smaht!!! Real estate will go up forevah!!! Stagnant incomes are meaningless because the member banks reserves have gone up. Green grass and high tides forevah!!!!

jt is starting his new “get (me) rich” program buying rundown beach bungalows for great (negative) cashflow. Introductory conference is free, every Saturday 9 am to 12 noon at the airport Hilton in the “sloppy swingers” conference room, followed by free lunch at the Taco Bell next door. 4 week program is $999.99, 8 week “bend over for jt to personally give it to you sans lube” course is currently available for the super discounted rate of $1799, get in ASAP because classes are filling up fast!

Actually, What, I think stagnant incomes are meaningless — to some extent.

I agree with those who say that L.A. is turning into a Third World city. Stagnant incomes means the rich get richer, the poor poorer, and the middle class shrinks.

Crappy and marginal neighborhoods will decline in price.

But there will always be the rich. Rich areas (not the middle class areas) will stay steady or go up. I’m talking Malibu, Pacific Palisades, the hills of Brentwood, Bel Air, Beverly Glen, Coldwater Canyon, and those hilly SFV areas south of Ventura Blvd.

I wish it weren’t so. I keep hoping that housing will crash. But foreign wealth keeps pushing up the better areas. It’s not only the Chinese. You have wealthy Russian and Iranian Jews in Tarzana and Beverly Hills, escaping with their wealth, like the Chinese. And with socialist Europe in economic crisis, I expect that rich Greeks, Italians, and Spaniards are also parking some money in L.A. (although perhaps more so in New York).

The U.S. is in economic trouble, but so is the world. And this is still one of the safest countries for the uber-rich to park money.

Sacramento inventory is up 27% from this time last year. Yet the media is still churning out this BS:

http://www.sacbee.com/2014/04/16/6331084/sellers-market-has-few-homes.html

The two biggest factors are still low rates and very small inventory. But the prices levels have risen to the point where homes are starting to sit on the market a lot longer than just months ago. Rent parity has slipped away and economic gains are lagging. This keeps people on the fence longer.

Rent parity. RIP, Lord Blankfein.

This is why you need to buy now or be price out forevah!!!

Banks are being allowed to keep foreclosures on the books almost forever. Add 30% cash buyers and you’ve got a market that’s going to have small inventory well into the future.

High equity owners can now get reverse mortgages again as well. These are factors that will keep a lot of inventory off the market for quite a while.

How-zing will go up fo-eh-vah!!!!

Housing To Take Hard in 2015!!!!

You gotta be kidding.

Exactly! Housing to go up forevah!!!!

Imposter. That wasn’t me above. Hijackers. It wil be 2014.

They must be feeling rather desperate in order to hijack others’ handles at this point.

Stock crashed in 2000 that could lead to recession and Allen Greenspan tried to dodge the bullet by lowering interest rate and kept it low for couple years. This created the last real estate bubble and took us to the Great Recession. Ben Bernanske tried to dodge the bullet and did the same thing by lowering rate to near zero and kept it low for the past 5 years. This creates a new real estate bubble. This one is going on now, and will last for a while due to shortage of inventory. Once the government come out with zero down loan program to promote housing and economy, all investors will sell and dump all to this new group of buyers with bad credit, zero down. It will end badly, but not this year. Everyone will be surprised price continues to go up substantially this year. The Feds is a bubble making machine. They must make new bubble to keep economy going. We lost all manufacturing jobs to China. We don’t produce, only consume. Thus, we need bubbles so that people can take out line of credit from the house and buy new cars. The Feds will continue to print money, buying bond to keep rate low until everything pop all at once. The RE bubble, bond bubble, stock bubble, government debt bubble all pop at same time. Don’t know when but it will come (maybe 2016 – 2018).

So the same GOP House whose grassroots wants to tear down Fannie and Freddie are going to vote in a new subsidy program of zero down mortgages? Right before a mid term where they might gain the Senate? And this hypothetical zero down, which isn’t all that far off from the 3.5% down available now, is supposed to extend this bubble? As for the FED I’ve addressed this in many posts, they aren’t going to destroy their power base by destroying the dollar. Sure they’ve come close, but rates are rising in 2015. They can’t not raise rates or the FED loses ALL credibility and the bond and stock markets go ape shit. End of Times stuff. If they wanted to destroy the dollar they would have never raised last decade and popped the first bubble.

Simple math is for simple minds…

RE:What?

Sometimes the most complex intelligence is required to confirm the simplicity before you 😉

Math is overrated. Give me Marketing baby!!! This is how you get rich quick!

Great report on KPCC SoCal radio about LA rents, rents are sky high, rents stretched to 70 percent of income, inability to save for down payments, depressed wages in the region.

http://www.scpr.org/programs/take-two/2014/04/17/36989/high-rent-few-options-angelenos-weigh-their-choice/

^^^ A different Anon.

I’m not sure if this is hilarious or tragic, but the little hunk of Eastern Ventura County I watch has just gone saturated with inventory.

I’ve been looking for a move up home in this area since before the bubble burst – particularly in a couple of neighborhoods with 2200 – 2700 sqft homes built in the ’90s. At the bubble peak in 2006 these were selling for $750 – 900K, and at bottom in 2011 or so for maybe $500 – 550K if you could find one, but mostly the owners just were biding their time. Then a few lucky sellers hit the crest of the buying panic of 2013 and three of these homes sold in the low to mid-$600s.

And like magic, greed and desperation drove all the pent up sellers out of the woodwork. At last count there are now 6 homes in these neighborhoods for sale (more than the total that sold in the last 2 years). They’re asking from $620 to about $690K and, delightfully, no suckers seem to be biting. Despite the risk of further declines I’d actually be willing to buy one of these if the prices dropped by 10-15% to 2012 levels, but I suspect that they’ll need to stew for the summer before considering drops like that.

In the meantime I’m just spiteful enough to enjoy the show.

And some idiot just bought the most expensive one. Grrrr.

Inglewood – any buyer should drive around at night. When I stayed at a motel, at 2 am a burglar climbed into my room.

Stop for gas and folks will beg and ask for gas money etc. Then there are the hookers waiving their plastic fingernails at you. Yeah, Inglewood is THE place to buy – not.

So they put lipstick on a pig. As if new paint really fools anyone.

Lots of flippers are becoming desperate when they have hard money rates to pay…

I’m suddenly seeing price per square foot dropping in the south OC zip codes I’ve been watching. A month ago there was nothing in the mid-tier under $300/sq ft. Today alone I saw three new postings for well under that, and the houses were decent, with good locations. Interesting.

Nice observation Ruby. The only thing that is rising is oil prices, food prices, electricity, water, medical insurance prices (just wait for your renewal), and education. What is falling is housing prices and soon to be equities because the Federal Reserve can’t allow out of control food inflation (and its out of control already).

Business rising, growth and real recovery in this environment… dream on.

Interest rates are rising, inflation is rising, retail sales is dropping, as is real estate.

The dollar looks to keep weakening and inflation to keep rising even if the US economy weakens right now. That is what happens when you ease throughout the entire economic cycle. You end up having to raise rates even if you are facing an economic downturn much like Bernanke had to in 2007 even as the economy crashed.

With food prices surging in the US it’s no wonder the Fed is curtaining QE even against those who wish to make an zoombie economy with continued easy money to rich bankers with the hopes some of it dribbles down to the poor masses without igniting inflation.

Higher interest rates are the only medicine to this madness and insanity.

When inflation works its way down to food inflation is bad, really bad. Even the Federal Reserve can’t allow nothing to be done about it because if they don’t contain it, rising out of control inflation will spread to every corner of the economy in less than 12 months and will make economic bubbles catastrophically bad (like housing in 2007).

“Prices for foods, feeds, and beverages rose 3.7% in March, the largest monthly gain for the index since a 4.3% increase in March 2011,” said the U.S. Bureau of Labor Statistics earlier this month. ” The March 2014 advance was driven by a 14.0% rise in fruit prices, the largest one-month increase for that index since the index was first published monthly in December 1993.”

Interesting times ahead indeed:)

ahhhh, the rise in fruit costs may have something to do with the drought in California that has impacted the entire “salad basket” which also produces the majority of the berries and other fruits. The rise in cost of fruits and vegetables is no surprise to someone living in my area. We have had almost no rain and the farmers are feeling it. I am not convinced that this is due to the increased reserves of the Fed member banks. The almighty Oz may be powerful but not that powerful… Yet…

How-zing to go up fo-eh-vah!!!

OK peeps I am about to capitulate and make a purchase. If you’ve read my posts before I made money on the last one and I am about to roll the dice again. I am only risking about 80% of the profit I made on the last deal so I feel the risk is minimal. After 20% down payment I am at rental parity but I actually plan to occupy.

The markets I follow in the SGV are tough to find a deal in because of the heavy hitting Asian all cash crowd. These buyers really seem not to care about price in my neck of the woods. Freaking people are STILL overbidding on houses, though much less now as compared to when I sold this past May. It’s almost like they just want to unload the dirty cash they’re sitting on in exchange for some tangible asset.

Anyway, it’s a short sale and the purchase price is a SOLID 20% under recent comps. Frankly, it is a lot more house than I thought I would be able to get. I have been following the listing for months and the agent got the short sale approved. This is one of those hilarious properties where NOTS was filed in 2012 and they never followed through on it. They released liz pendens in 2013 and nothing since then. Seller has probably not made a payment since 2010-2011.

In fact, as part of the deal I have to pay the squatters outside of escrow to get them to leave; straight up cash for keys. Thankfully they haven’t trashed the place. In addition to that I went directly to the listing agent and am not getting paid my cut on the deal (I’m a broker). The things you have to do to eck out a deal in this market are un-freaking believable.

But anyway, enough of my rant. I’m curious to hear what “da bears” think. Also, 20% under current market is a conservative estimate of the PP. That number includes the amount I am paying the squatter.

Hard to have a specific opinion without seeing the actual purchase, but you’re describing that you’re playing with house money, and as someone experienced in this sort of business you managed to find what you think is a deal. So far, that’s all good news.

On a micro basis, a deal is entirely possible, especially if it’s true that the large-scale organized buyers have rolled out of the market. Stealing a deal would have been harder a year ago, or in a locale where the large buyers are active because they almost certainly would have beat you to the punch.

If you’re diversified into other assets and can swallow a potential loss, by all means, invest.

Bler-

thanks for the legit comment.

Good luck.

F’ing genus!!! You are perfectly positioned for some real gains!!! Congrats!!!

Robert Shiller is catching up to the good Dr it appears.

“Momentum may be Changing in the Housing Market”

http://finance.yahoo.com/blogs/daily-ticker/momentum-may-be-changing-in-the-housing-market–robert-shiller-142559836.html

Main point is that momentum plays a large part in house prices. Fed’s eye on Disinflation along with numerous factors limiting SoCal inventory are the tailwinds keeping the Mo Mo. That’s why Tank Hard Jim is wrong.

Do you remember Joe-mentum? Housing to go up forevah!

When the market is exhausted, low supply can accompany with falling prices. The basic law of economics “Supply + Demand = Price” isn’t always true. When hedge funds, investors & flippers wise up and see that the median income cannot buy at the current median prices, they’ll exit the market and inventory will rise and prices will plummet.

The era of day-trading RE in SoCal is over. Sorry, but Jim Taylor might be right.

“The basic law of economics “Supply + Demand = Price†isn’t always true.â€

Actually it is not a law rather it is a theory that has be debunked. There is no such thing as an upward sloping straight-line supply curve and any polynomial can be a demand curve. Therefore price is not based on a fictitious straight upward sloping supply curve intersecting a fictitious straight downward sloping demand curve. This would be the equivalent to predicting the weather with temperature and wind velocity alone.