Southern California Housing Numbers Exposed: The Bottom Falls out of the Housing Market, Again.

“Anyone who lives within their means suffers from a lack of imagination” -Oscar Wilde

The housing market in Southern California is similar to skydiving, except with a small caveat of course. You are told by the expert skydiver that you are all ready to go once you reach maximum elevation. As you get ready to jump, starring at the open air, you are told that for maximum excitement you shouldn’t take a spare parachute. So you agree and remove the extra security measure. Right when you jump you hear a fainting voice, “there is no parachute!…” As you start to panic, free falling in descent you try to pull your ripcord and nothing. You try to be creative and make something out of your empty parachute holder. Nothing. Try as you may, there will be a crash.

Then I think of lifting caps, mortgage freezes, or dropping the Federal funds rate and I think of the above comparison. For a brief moment, we like to psychologically think that these measures will help but the end result is unavoidable; there will be a crash simply because that is the inherent nature of all bubbles. Trying to intervene will only force the historical economic river of reversion to find another way to correct itself. There has to be an adjustment simply because the fundamentals never existed to justify current prices. The irony of all the new proposals is that they now examine income, verify employment, and do all these fact finding measures after the person has jumped from the plane. It may feel like it is helping but the economic momentum is clear and it wants and needs to correct. We will continue to face problems because the fundamentals were never there to begin with. The Southern California housing numbers released on Wednesday show a free descent:

| County | Median Jan. 2007 | Median Jan. 2008 | Percent Change |

| Los Angeles | $520,000 | $458,000 | -11.9 |

| Orange | $600,000 | $520,000 | -13.3 |

| Riverside | $415,000 | $331,500 | -20.1 |

| San Bernardino | $370,000 | $298,500 | -19.3 |

| San Diego | $472,000 | $429,000 | -9.1 |

| Ventura | $565,000 | $477,750 | -15.4 |

| SoCal | $485,000 | $415,000 | -14.4 |

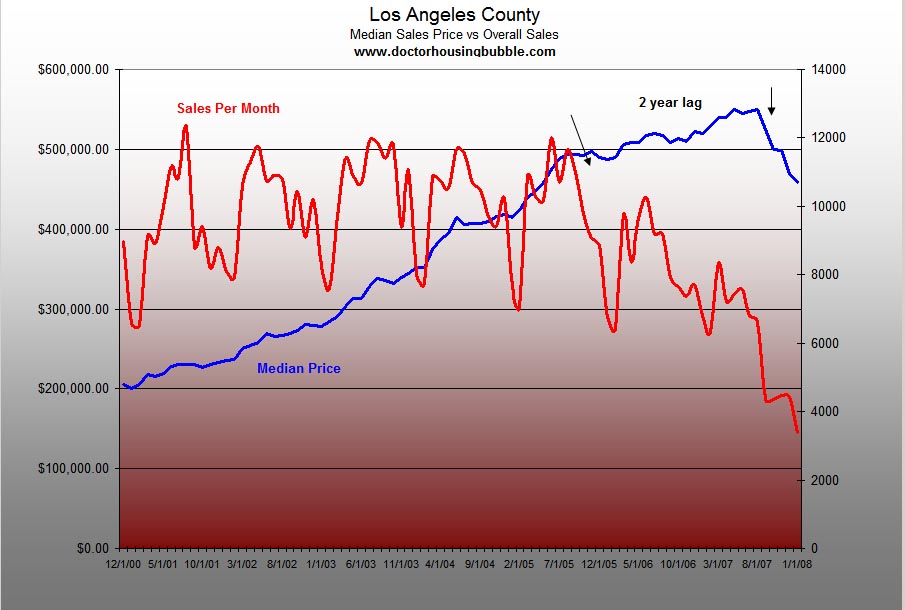

Aside from the reality that two of our counties are already seeing 20 percent year over year losses, we also notice that other counties are quickly following. We went into detail exposing the numbers for Southern California in January so this continued trend should not be a surprise to anyone that is paying attention to market indicators. These numbers without context do not examine the entire picture. In fact, Los Angeles County did not go year over year negative until October of 2007. Did housing problems only start at this time? Of course not. Even a few years ago, I was carefully examining sales numbers because this would be the first leading indicator to tell us where prices would be heading. Take a look at this chart comparing sales numbers versus the median sale price in Los Angeles County since December of 2000:

*Click to see full graph

What should be incredibly obvious is that the sales number trend broke in the forth quarter of 2005! I talked about the above cyclical sale trend in the following post:

When the Housing Clock Stops Ticking: Why the Median Price is Going up While Sales are Going down.

The above post discusses the above cyclical fall and winter drop in housing. Yet the drop in the winter of 2005/2006 was more than your typical seasonal downturn. This was the breaking point that led to the current slowdown. Amazingly, it took roughly two years before the median sales price in Los Angeles County caught up to what the sales numbers were telling us. Of course the pundits ignored the sales numbers at their own peril and now after only 4 negative year over year months, want every government measure to support the housing market. Keep in mind that we have seen month over month of amazing gains since 2000 without any hesitation; in fact 7 years of constant growth and only 4 negative months is enough to destroy a decade of appreciation? Clearly, this was a house of cards predicated on perpetual housing motion.

What is the bigger story is the drop in sales. I’ll leave it to DataQuick to summarize the information:

“Last month’s sales total was the lowest for any month in DataQuick’s statistics, which go back to 1988. Since September, sales for each calendar month were a record low for that particular month.”

In Los Angeles County, only 3,398 homes sold in January. Compare this to the peak high of 12,324 reached in August of 2001. In fact, I ran a quick average for the entire series from December of 2001 to the present and we arrive at the amazing number of 9,138 sales per month. Now, do you see us coming anywhere close to this average anytime soon? It looks like Los Angels County will continue to be a renting majority county.

And regarding the Oscar Wilde quote, it appears that our imagination led us to believe that exotic mortgages would give us the ability to fly on the wings of equity forever. And as Wilde unfortunately found out in his last three years of life going about penniless, even those who have great intelligence and wit cannot defeat economic laws. Eventually your spending habits do catch up with you. Even Sir Isaac Newton gambled in the South Sea Bubble telling us after his disastrous investment:

“I can calculate the motion of heavenly bodies, but not the madness of people.”

This is a quote all financial engineers should post above their workstations for a little perspective.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Southern California Housing Numbers Exposed: The Bottom Falls out of the Housing Market, Again.”

Another good post Dr.

My house in Tucson has been on the market for 3 months now. The price I listed it at, $260,000 was what my realtor, an experienced agent in Tucson, thought prudent. People looking average about 10 per month. I have had only one serious offer back before Christmas contingent on the buyer selling his place. $240,000. I countered but he was firm. I should have taken it! No other offers; not even a low-ball! Those few that are looking probably have real estate they need to sell. Comps in my area are 6-months old and as high as $300,000. Nothing in my area is selling! I paid $180,000 for the place 6 years back. I realistically think that is all it will bring. I am not complaining; I bought it to raise my family and not so much as an investment. I was burned good in real estate in Texas in 1984. Learned a good lesson!

Doctor, anyway to sift through that January number of 3398 sales to see how many were auctions, short sales, foreclosures? Heck, even buyers from abroad.

I just wonder how many of those sales were traditional market sales. Willing buyer, willing seller. In other words have we, in effect, got a ‘lock up’ in the real estate market similiar to the one the banks have in the CDO market with only ‘distress’ sales now occurring?

Doctor, you write “Aside from the reality that two of our counties are already seeing 20 percent year over year losses, we also notice that other counties are quickly following.”

You note what prices did do – you don’t include what prices did NOT do and that is keep up with the rate of inflation (around 4+% for 2007) or inflation plus up to 1.9% per historical prices. Ergo, the actual ‘price’ drop has been more like 24 – 25.9%. That means that the $415,000 in 2007 should have been $431,600 – $439,485 instead of the $331,500 that it is now.

Everyone always forgets to adjust for inflation………and it is so important when comparing YTY prices. BTW, $313,500 in Jan. 2008 is,at most, the equivalent of $260,365 in 2000.

Excellent Point DHB. It is true that the only thing keeping home prices absurdly high is the Madness of People. Now that banks have a hard time getting knife catchers approved for loans the speed of the crash is getting faster every month. It’s just funny how even REO properties are still being listed with unrealistic prices. I am beggining to see more properties putting up for sale signs in Downey and Bellflower and all are because of Shortsales or Foreclosures. Doesn’t anybody at the banks realize that they have to slash prices 50% to sale a home? That time will come within the next 3 years along with the slow agonizing pain of getting there.

As you have highlighted and preached, the bubble was VERY real and it has been puncture – however not “popped”.

I believe the REAL pain in the market will come when the inventory loads up too high on the books of the banks. I have experienced a “balance sheet cleansing” in my industry (not at all real-estate or bank related). Note: I work for a public traded company (Fortune 500) and there is a point when upper management looks at the books and tells lower management to get the overhead off the books – at any cost. My personal theory is that the coming foreclosures in spring/summer will set this up for fall of this year. I believe that is when the REAL drop will occur (at the very least the quickly downward drop, i.e the “panic”).

This will be the “big” catalyst for housing price correction (possibly capitulation), and setting up a not-so distant rebound (shaking out all).

Strangely enough, this market needs such a shake-out to help put it back on firm foundation (similar to cutting of a gangue-green limb to save the body). Currently our govenment is satisfied with letting the condition fester, which will prove to be worse (bleeding people dry rather than forcing them into a quick BK which they will be forced with later on anyway).

Dear oilwelldoctor,

You are quite realistic about the situation and that is to your great advantage. Due to various circumstances I have been a renter for 35 years, despite many years of high net worth. (I could buy) So I consider housing an expense, like buying food. I never expect to get paid for living somewhere.

And that is the whole problem with what has gone on this decade. People think they are entitled to get paid for living in a house and wearing out the carpet. They aren’t. Buying a house is nothing more than a long term rental agreement (if not with a lender, with the local government that collects the property taxes). Even if you sell for what you paid, no money was thrown away. You received six years of housing on terms you agreed to when you bought the house.

Hey, we have the lowest month since 1998, that still makes sales this year to be the 20th highest year in (recorded) history. 🙂

Message from Congress:

High prices good, forecloses not so good, we are doing everything we can to prevent foreclosure and nothing to prevent high prices.

new york transit bonds yeilding 20 percent means that 260,000 house in addition to all the costs to keep , is costing you 55,000 in lost oppturtunity costs..i would not rent it for 1000 a month i doubt, but that says you own it outright>>>

Oscar Wilde was outed as a “gay” person and spent about two years in prison. Prison conditions were worse than today and he lost his health and was penniless in his mid to late 40’s. He moved to France, but died within about a year of the move.

While in prison Wilde wrote De Profundis, a dramatic and powerful monologue that was addressed to Alfred Douglas, the person that led him to his professional downfall. Even in some of his letters, you can see the co-dependency of their relationship and he accuses Douglas of destroying his own life. In fact, he was funding and thus enabling the irresponsible spending of Douglas:

“At a time when I should have been in London taking wise counsel… you insisted on my taking you to Monte Carlo, of all revolting places on God’s earth, that all day, and all night as well, you might gamble as long as the Casino was open. As for me … I was left alone outside to myself.â€

Wilde despised gambling but allowed his partner to take him literally to the poor house. In the long letter, he goes back and forth discussing how he should have left but kept coming back. So Wilde was already heading down this path even before he was incarcerated. How many times have you seen either husband or wife, take one partner into financial ruin given their spending habits? Normally the other partner doesn’t say a word for fear of being deserted. We have seen so much of this in this credit consumption era. Financially irresponsible partners that lead their spouses into financial (and other) ruin. When you talk to some of these people, they will tell you that, “they do it out of love.†Please. If they would dig deeper, they would realize that spending or allowing unmitigated financial disease to spread, is a financial therapeutic defense mechanism to cover up and avoid addressing the deeper problems.

When you enter credit bubbles, tulip bubbles, technology bubbles, or other concoctions that feed the flames of greed, psychology is the main driving force and not economics. Think of really famous people that have squandered their life away. The response you always get is, “but they had everything! Why would they throw it all away.†The premise is always that the observed actually valued what they had from the vantage point of the observer. Wealth is a magnifying glass. It will expand the virtuous and allow the damaged souls to wallow in their vices. Extravagant parties that have drugs and booze flowing like the falls of Niagara, are now accessible with fame [wealth] and power. The housing bubble has unfortunately shed a light on financial irresponsibility of many and credit was extended to a public who really has very little regard for financial prudence. Is it any wonder why so many now find themselves in their own financial prison?

Its been about a year since Dr Housing bubble saved me from my life as a knife catcher and, on one hand, it seems like only yesterday.

On the other, I can’t even imagine my pre-bubble-educated self, before I found what a Real Home of Genius was. Its seems like years and years ago.

Anyway, thanks and keep up the good work.

To me this was the leading indicator that the bubble quietly ended, the clues were out there but only people with a trained eye could join the dots:

http://www.nytimes.com/2005/10/04/business/04builders.html

And the Real Estate market officialy crased on 02/07/07 when HSBC increased its fund for prevention of losses and New Century Financial disclosed their first problems.

And it was criminal that the next day the NAR tried to calm the markets saying that the worst was certainly over, David Lerah will be in the history books for that.

does anyone have any ideas as to why san diego county is below double digits in home price decline in the above chart?

Leave a Reply