Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear Market Rallies.

How quickly people forget the lessons from the past. Last week was a complete bear market rally. We had a few companies such as Google and Honeywell announce solid earnings but the banking sector is still in the shambles. Here is a quick tip for any amateur investors, when a company announces massive layoffs this typically is good for the stock but bad for the economy. It is becoming rather apparent that what is good for Wall Street is only going to exacerbate the common condition of the middle class of America. If stealth inflation wasn’t enough they now have to deal with watching a class of speculators make money on mal-investment in financially engineered products that do nothing for the well being of our country. Citigroup Inc. announced a $5.11 billion quarterly loss and future job cuts of 9,000 but rallied 7.49 percent during the week:

“NEW YORK (Reuters) – Citigroup Inc posted a $5.11 billion quarterly loss on Friday and said it will cut another 9,000 jobs after suffering billions of dollars of write-downs tied to mortgages, other debt and a slumping economy.

The loss was larger than expected and reflected more than $16 billion of write-downs and credit-related costs at the largest U.S. bank.

Investors nevertheless took comfort that the bank and its new chief executive, Vikram Pandit, are taking steps to get past credit problems, drive down expenses, and restore luster to a stock down by about half over the last year.”

This wasn’t the only good for Wall Street bad for employee announcements. Merrill Lynch posted its 3rd consecutive quarterly loss and announced plans to cut 2,900 workers. This was good enough news to make the stock rally 8.4 percent for the week:

“NEW YORK (Reuters) – Merrill Lynch & Co posted its third straight quarterly loss on Thursday and said it planned to cut 2,900 more jobs after recording more than $6.5 billion in write-downs on subprime mortgages and other risky assets.

The $2 billion loss was worse than Wall Street analysts’ gloomy expectations, but Merrill Lynch’s shares rose 4 percent amid hopes the world’s largest brokerage was closer to seeing improvement.

“My sense is, they tried to clean the bad stuff off the shelves, and they hope it’s mostly in the trash,” said Michael Holland, founder of Holland & Co, which oversees more than $4 billion of assets.”

Bwahaha! The rally was built on hope and this coming from folks that are knocking the idea of many Americans being hopeful about their country. If we let these yahoos on Wall Street run our country we’d see a 1,000 point rally on the same day they announce 1,000,000 job cuts. There was very little to be excited about during the week. The DOW, S&P 500, and NASDAQ were all up 4.2+ percent on the week. This apparently was good enough for people to jump back into the market once again to get another expensive lesson. Heck, these firms are cutting jobs and posting major losses and you are jumping back in? Did they not see the horrific housing numbers for California? Do you really think we are at the bottom? Take a look at these articles:

Lords of Housing: Believing in the $22.5 Trillion Housing Market.

Double Bubble: California Compared to the United States. Vacancy Rates up Homeownership Down.

Digging into Countrywide: When Half Your Loans are in California and Florida.

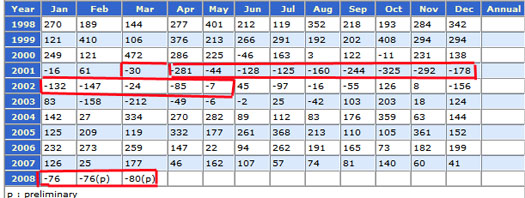

We are nowhere near a bottom. Most logical and objective folks are now saying we are going to have a recession. It will not be as light as the one in 2001. Let us take a look at some historical monthly employment job losses/gains for reference here:

The so-called mild recession of 2001 saw 15 straight months of job losses with 9 months straight of job losses between 100,000 and 325,000. Take a look at where we are currently. We are nowhere near the “mild” numbers of the previous recession and this one is expected to be worse. Now do you see why those large numbers at Citigroup and Merrill are more ominous than a fake bear market rally?

In today’s article we are going to try and sneak a peak at the future. In our Lessons from the Great Depression series we are trying to educate ourselves from the past to avoid costly mistakes in the future. Today’s article will examine the transition from the Hoover administration to the Roosevelt administration. Here is a list of previous articles:

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

The country is quickly realizing how screwed up Wall Street is. I love how Charlie Gibson with his asinine questions tried to peg the Democratic candidates about the raising of capital gains taxes. Let us actually look at the numbers:

“The percentage of Americans who owned stocks, either directly or through a mutual fund, fell by 3.3 percentage points to 48.6 percent in 2004, down from 51.9 percent in 2001.

Stock ownership rates were highest in 2004 among families with higher incomes and families aged 55 to 64. Overall median stock holdings fell to $24,300 in 2004, down from $36,700 in 2001.

With baby boomers turning 60 this year and nearing retirement, the survey found that the percentage of families with some type of tax-deferred retirement account, such as a 401k, fell by 2.5 percentage points to 49.7 percent of all families.

However, those who had retirement accounts saw their holdings increase. The median for holdings in retirement accounts rose by 13.9 percent to $35,200.”

Of course Charlie Gibson in his liberal elite silo of friends and influence keeps forgetting that he asks questions that normally pertain to only 10 percent of the United States population:

“…So the rules in Washington — the tax code has been written on behalf of the well connected. Our trade laws have — same thing has happened. And part of how we’re going to be able to deliver on middle-class tax relief is to change how business is done in Washington. And that’s been a central focus of our campaign.

“MR. GIBSON: Senator Obama, you both have now just taken this pledge on people under $250,000 and 200-and-what, 250,000.

SENATOR OBAMA: Well, it depends on how you calculate it. But it would be between 200 and 250,000.

MR. GIBSON: All right.

You have however said you would favor an increase in the capital gains tax. As a matter of fact, you said on CNBC, and I quote, “I certainly would not go above what existed under Bill Clinton, which was 28 percent.”

It’s now 15 percent. That’s almost a doubling if you went to 28 percent. But actually Bill Clinton in 1997 signed legislation that dropped the capital gains tax to 20 percent.”

Did we not just look at the median stock holdings for most Americans? Let us say you kicked royal butt on that $24,300 stock holdings and gained 10 percent over the year. So now you decide to cash out and sell all your $26,730 of stock holdings. You are taxed on the gains of course and you made $2,430. The difference between 15 percent and 28 percent is a whopping $315! People are paying that in one month by:

1. Lost earning power and stagnant wages

2. U.S. Dollar going south to Cabo in Baja California

3. Higher fuel costs

4. Higher food costs

Yet the media again fails to look at the damn facts. In fact, most Americans have their wealth stored in the equity in their home. That is why the housing bubble bursting is so painful and why it is so utterly frustrating to hear the economically devoid media from digging deeper into the data. During the debate housing came up for about one minute! Yelling no more taxes is a pathetic rally cry that no longer holds water. Folks are wising up that inflation is a shadow tax that penalizes main street U.S.A and caters to those on Wall Street. Think this is only happening in Rust Belt states and not “elite” coastal regions. Well California is quickly catching up as it usually does:

L.A. Times – “SACRAMENTO — California’s unemployment rate hit 6.2% in March, the highest level in almost four years, spurred by a continuing downturn in construction and financial activities.

The Employment Development Department reported Friday that 1.13 million people were out of work last month, marking the state’s weakest economic performance since July 2004, when the jobless rate also stood at 6.2%.

Levy noted that California’s unemployment rate is the third-highest in the country, trailing Michigan with 7.2% and Alaska with 6.7%. California is doing worse than Pennsylvania and Ohio, Levy said, two Rust Belt states that have figured prominently in the presidential primary elections because of their manufacturing job losses.”

That’s right folks, the only two states with higher unemployment rates are Michigan and Alaska. No wonder why I had the urge to cling to my gun last month. Absolute media distortion and again they are focusing on the minutia while Rome is burning. Hey look! American Idol!

Today’s article is going to examine what happened after Hoover left office and the economy was in absolute shambles. It is important to note that there is a once in a lifetime bubble bursting here. The magnitude of the financial stupidty will cascade down and only increase the unemployment numbers. Even only looking at the previous mild recession we are miles away from facing the impact of the full economic onslaught that we will unavoidably go through. That will happen. The only question is what are we going to do after the fall to prevent this from happening to future generations? That is if people have sufficient desire to leave a world equally or better for the future.

This is a chapter from Lords of Creation examining the transition of the new administration:

“If the stroke of chance which closed the banks on Inauguration Day was bitterly tragic for Herbert Hoover, it was also staggering for Franklin Roosevelt. The country over which he was to govern was prostrate. The financial machinery had stopped. Most financial institutions were teetering on the edge of insolvency. Business was slumping fast to the low levels reached during the panicky spring of 1932. The farm population and the industrial population were in dire straits; unemployment and destitution were widespread. And who could be sure that the demoralization of the national economy had not only just begun?

Furthermore, Roosevelt’s plans, formulated at leisure, had not contemplated the meeting of any such extraordinary crisis as the collapse of the whole banking system; at the very outset of his administration he must improvise. He and his cabinet officers were now to their jobs, to their staffs, even to each other. At a moment of the gravest danger the command of the Ship of State was being turned over to a group of passengers none of whom had ever been on the bridge before.

Yet in another respect the stroke of chance favored the new President. It gave him, for the moment at least, an almost united country. The closing of the banks had thrown rich and poor, employer and employee, banker and depositor, Republican and Democrat, into a common predicament; and this predicament was so sudden and unprecedented that divergent opinions as to the way out had not had time to crystallize. There was even, for millions of Americans, a curious thrill in the completeness of the breakdown after so many months and years of foreboding: a feeling of Now it has happened: now for action. When Franklin Roosevelt stepped forward on the platform before the Capitol and began his Inaugural Address, not only the throng below him but a vastly greater throng of listeners at millions of radios were ready to listen hopefully, to follow eagerly, to welcome a New Deal.”

Ironically, one economic thing that currently holds all Americans together is housing. This infatuation has put the vast population in the same condition. You either own and see your equity evaporating or rent and are seeing your dollar get weaker and weaker. Why do you think the economy is now without a doubt the number one issue?

“He did not disappoint those first hopes. Whether or not events make men, certainly Franklin Roosevelt who assumed the Presidency on that eventful day seemed a wholly different man from the all-things-to-all-men candidate of 1932.

His Inaugural – delivered in a ringing voice – was clear, strong, confident; and citizens innumerable who had longed for action in the days when Hoover seemed to be doing nothing were thrilled as by the note of the fife when the new President pledged himself to ask Congress, if the need arose, for “broad executive power to wage a war against the emergency, as great as the power that would be given to me if we were in fact invaded by a foreign foe.”

His promise of action was immediately made good. He met the banking crisis boldly and with a wholly contagious confidence. He at once called Congress to meet in emergency session. He at once issued – with a few changes – the national bank-holiday proclamation which had been prepared for Hoover’s use a few days before. His smiling little Secretary of the Treasury, William H. Woodin, plunged into arduous preparations for the reopening of the banks – providing for a possible expansion of the currency based on the sound assets of the banks, and arranging to consider the condition of every bank and to decide which institutions could be opened, which must be placed under the direction of governmental “conservators,” and which must remain closed. When Congress assembled, Roosevelt asked it for virtually dictatorial power over transactions in credit, currency, gold, and silver. This power was granted him the very day he asked for it. Nine days after the Inauguration the first banks were ready to be opened. And on the evening before the opening, Roosevelt sat before a radio microphone in the White House and talked to the American people as one would talk to a group of friendly neighbors, explaining with admirable clarity and persuasiveness just what he had been doing and what he expected them to do. The address was a triumph of democratic statesmanship. The banks were opened without panic, and stayed open.

To be sure, not all the banks were permitted to resume business. At least a fifth of the deposits of the country were still tied up, and the purchasing power of the country was correspondingly reduced. But Franklin Roosevelt had done his first great task brilliantly – and he still had the whole nation with him.

Even the men of Wall Street, shaken by the experiences of the past few weeks and by the obvious anger and distrust of the general public, had little choice but to go along with the new President who moved through the crisis with so sure a step, and who so obviously held their future fortunes in his hands. They were the more disposed to go along with him when he asked Congress – before the banks were opened – for authority to cut Federal expenses to the bone (yes, even to cut the veterans’ allowances) in order to maintain the national credit. Even when Roosevelt, in April, issued an executive order prohibiting the export of gold, and Woodin formally admitted that the United States was off the gold standard (as in reality it had been ever since March 4) the financiers did not seem unduly dismayed; J.P. Morgan himself smilingly faced a group of reporters at 23 Wall Street and gave his approval to the move.”

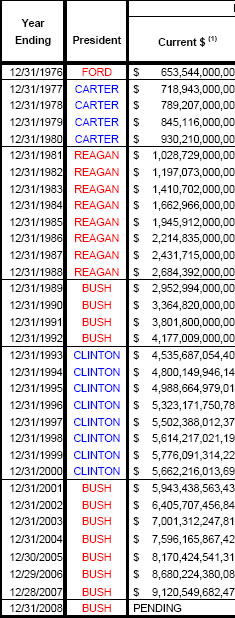

Clearly, with the current administration they can give 2 cents (which is probably going to be the value of the dollar once they leave office) how things will play out on the world stage. The U.S. Treasury and Federal Reserve currently is only willing to jawbone about a strong dollar yet is willing to bailout both overtly (Bear Stearns) and covertly (the Fed discount swap meet) those on Wall Street. In the mean time most Americans deal with the fallout of absolute incredible fiscal mismanagement. This president may leave office with the U.S. $10 trillion in the hole, nearly twice of what he came into office with:

“The country wanted action? Roosevelt gave it action. Throughout the spring of 1933 he showered recommendations and drafts of bills upon an astonished Congress which followed his requests as if in a trance. Bills to bring about financial reforms, bills to stimulate business in one way or another, bills to set up new governmental agencies: Congress passed them all – some of them before the members had even had a chance to read them, much less to ponder over them. There was every reason for the men of the Hill not to balk but to follow blindly. The Democratic majority was huge, the patronage was still undistributed; the country was in the mood for headlong change and was enchanted with Roosevelt; telegrams and letters urging Senators and Representatives to “support the President” were flooding in from all over the country.

The executive departments were in a fury of activity. Conferences were going on at all hours, bills were being drafted and revised and redrafted at breakneck speed, and in the mammoth new government buildings the lights burned late; the very atmosphere of the once placid city of Washington was electric with excitement. Officials and advisers representing the widest divergence of views were being pressed, helter-skelter, into the planning of the recovery program – hard-boiled business men, hard-boiled politicians, deserving Democrats, professors of economics, labor leaders, socialists, sentimental theorists of every hue. What would come of their furious labors was far from clear; but the country liked action, liked its smiling President, and liked to feel once more the sense of hope.

And it liked most of all the fact that a really definite improvement in the condition of the country was taking place.

As we look back upon the events of that spring of 1933, it is clear that to a considerable extent the improvement was due to the expectation of inflation. It did not really begin until after the Administration formally forsook the gold standard in April. It was given a distinct fillip by the action of Congress, in May, in giving the President permission to bring about inflation in any one of four ways. The fall of the dollar in foreign exchange was providing a temporary stimulus to exports; the prospect of higher prices (coupled with the prospect of governmental regulation through the N.R.A) was causing business men all over the country to stock up with goods.”

This time is different however. First, according to government data inflation is largely controlled. The Fed would love nothing more to inflate away our debt, allow the dollar to tank to increase exports, and let everyone “feel” wealthier. Too bad they are running out of ammunition and since Ben Bernanke is a master student of the Great Depression, he’s probably trying to go down this road. Of course, more evidence is looking like we are going to have our own lost decade like Japan’s with a zero interest policy and propping up zombified banks longer than we should. This will annihilate productivity and will allocate Federal resources from more prudent usage such as fixing infrastructure and recapturing new industry to our country. This at least has a long-term benefit. Playing hide the credit default swaps from the public does nothing except keeps us from facing the truth.

“Nevertheless there was a new feeling in the air. Investors who in 1932 had rushed to sell because they thought there might be inflation now rushed to buy for the same reason. The rise in the price of wheat and other crops was restoring a measure of hope to the men and women of the farm belt. The wheels of industry were actually beginning to turn faster, the unemployed were actually beginning to be put back to work.

The rally had its disquieting features, and perhaps the most disquieting was the terrific outburst of speculation which accompanied it. Despite the public distrust of Wall Street, despite the widespread belief that prosperity on the 1929 pattern was false and dangerous, despite the grim experiences of 1930 and 1931 and 1932, the shorn lambs swarmed into the brokerage houses once more in incredible numbers. Where some of them got the money to speculate with was a mystery. More than a few of them, indeed, were shabbily clad; one had the feeling, as one watched the customers in a broker’s office, hanging over the chattering ticker or following with eager eyes the moving figures on the trans-lux screen, that perhaps some among them were desperately staking their last savings on the turn of the Wall Street wheel. The behavior of the market as it skyrocketed upward gave plenty of indication that even if the bankers were somewhat humbled by recent events, the pool managers on the Exchange were not. Some of the manipulative operations in which the alcohol stocks (which were supposed to be about to profit by the coming repeal of the Eighteenth Amendment) were pushed up to extravagant prices – and into the hands of the suckers – were as outrageous as the worst pool exploits of 1929.

As for volume of trading on the Stock Exchange, the amazing fact was that during the two successive months of June and July 1933, this was greater than it had been in any month of 1929 except the panic month of October. On no less than nineteen days during 1933 the daily volume of trading was more than six million shares – a strange phenomenon when one considers that there never had been even a single four-million share day until the bull-market frenzy of 1928. Speculation in the commodity markets was similarly feverish and unashamed.

It is true, of course, that the Administration, by dangling the idea of inflation before the public, was partly to blame for this debauch. Nevertheless the exaggerated form which the speculative campaign took was an ominous sign. The national economy seemed like an engine with a loose part: speed it up just a little, and it began to wrack itself to pieces.”

People just had to get back into the game again. This recent rally is nothing more than this kind of rally. There is no fundamentals to justify what is going on. All long-term indicators point to at least one to two years of strong to severe corrections. We are in massive debt (see above) unemployment will only keep increasing (see above) and the public is worried about capital gains taxes which the majority pay very little on anyways? Again we are talking distraction and avoiding the truth. That is, wages have been stagnant for a decade, we’ve lost our manufacturing base, and we’ve become a country built on trading paper and houses to one another in a game of financial musical chairs.

“Yet elsewhere the prospect was heartening. Even if the United States was not going back to work so fast as it was going back to speculation, the gain in economic activity in the brief interval since March was remarkable. By July the index of industrial production had regained about half the ground it had lost since 1929; and while the rise in employment and in payrolls was decidedly less spectacular, it was sharp.

There had taken place, too, another significant change. No one could fail to realize that the economic initiative was now in the hands of Franklin Roosevelt. At scores of points in the economic system of the country the government – with public opinion still overwhelmingly behind it – was intervening or promising to intervene. The economic capital of America had moved from Wall Street to Washington.”

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

7 Responses to “Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear Market Rallies.”

“The Fed would love nothing more to inflate away our debt, allow the dollar to tank to increase exports, and let everyone “feel†wealthier.”

Which is why I was banging my head against a wall when everyone was milking themselves over Google’s earnings. The reason they were so much higher is because the dollar is losing so much value compared to the foreign money they’re receiving. It’s not a hard concept to understand but it’s hard to accept that you can make more money and be worse off because inflation is so bad. The Fed should just go straight to 0% and kill the dollar. We could be at DOW 20,000 in no time!

The threadbare nature of the typical American’s investments is the PROBLEM. We have ginned up real estate to the point that it is the major asset, often, the ONLY asset a family has. The idea that the house would pay for everything else

including their retirement has been the false god too many have been worshipping before. As we are seeing housing is not always liquid and not always

a good investment. For this reason we need to de-emphasize housing and offer incentives for people to save liquid assets- cash, stocks, bonds etc. A faux Georgian mansion with vinyl on three sides as your ‘nest egg’ is a tragedy unfolding. That Americans have such puny stock holdings in an era where the defined benefit pension has vanished and Social Security benefits of uncertain value needs to change. Capital gains should be tax free for the small investor as should interest on savings. Why should Joe who put $10,000 into his mutual fund or a CD pay tax on his savings while Jane gets to deduct the interest on the money she BORROWED to buy more house than she needs?

As usual Doc. a great interweave of past and present. The idea that a cheap dollar will increase exports and reduce debt is a fallacy. It may have been the solution years back when the Dow Industrials were actually goods producing industries. However, today that is not the case, eight of the companies listed on the Dow are there more because of capital requirement than their ability to produce goods. The loss of dollar value results from excess supply being pumped int o the system daily by the Fed. (as you have often noted)

Doctor, thank you for the great service that you are doing here with the excellent analysis found on your site, bringing out truth from history… so glad to see sites like yours that are consistently informing the public. I feel that it’s going to take nothing short of major pain (which may soon be coming) for people to wake up to the realities of basic economics and how screwed the current economic environment is. What continues to amaze me is how we got here. This used to be a country of laws and of values, where savings and financial stewardship was valued. Also, how did we get to the point where the Media is allowed to provide such misleading information, and people are allowed to make such terrible decisions with credit, and their future? Finally, Doctor, any thoughts on last August’s meltdown, and what this coming August might look like based on what is happening?

Every real estate pundit in the country should be required to read this article.

May make them realize just how screwed up things are right now with no

end in sight for years to come.

This really has more to do with your last article, but anyway… The days of a 5% down, 30 year fixed mortgage are really just fancy fantasies now. The numbers you used ($465,000 would require an income of $113,162) won’t work anymore. You need to add from one-half to 3/4 of a percent to your interest rate for having less than 20% down, then you have to add another half percentage for having what they are calling a ‘Jumbo Conforming’ mortgage (over $417k but less than the new max $729k). So you are really looking at a percentage rate of closer to 7 to 7.25. On top of that, you have PMI insurance – what you now have is a total mortgage payment (including tax and insurance) of around $3,400 something a month. This is well above the recommended 28% of the monthly income of someone earning $113k a year.

PMI is nearly impossible to avoid – piggyback loans are not an option. One other option is to add another half percentage to your rate – but that is locked into the 30 year fixed. So unless you can refinance later at a lower rate, the punishment for not having 20% will continue through the life of the loan.

OUCH!

The US, and the world, aren’t even close to the end of the problem.

15X times your annual income for a house is impossible to sustain. I haven’t even gone beyond 1.5 and I don’t suffer any consequences for living within my means.

Savings and Loan debacle (1987); hedge funds (1998); internet bubble (2001); housing debacle (2007); and commodities in a few years are just the latest “tulip frenzy” (1634). And all the so-called “smart” people and political “leaders” keep selling the latest unsustainable “ponzi” scheme.

As this Credit Suisse articles predicts we have a lot more pain to go through:

http://seekingalpha.com/article/73814-6-5-million-foreclosures-is-there-a-behavioral-problem?source=yahoo

Leave a Reply