Sexy Bottom: The Naked Truth of the 10 Percent Southern California Housing Drop.

In this article, we are going to put to rest this bottom talk regarding

|

October 2006 |

October 2007 |

Percent Drop |

|

23,745 |

12,999 |

-45.3% |

Now let us look at the “perking up†of the market that was released on Tuesday:

|

November 2006 |

November 2007 |

Percent Drop |

|

23,005 |

13,173 |

-42.7% |

They felt that a whopping sale of 174 more homes was justification to call it a perking up of the sales. By the way, that is a massive increase of 1.3 percent in sales over one month. Too bad they don’t focus too much on the astounding drop of 42+ percent year over year but hey, we are arriving at the bottom and it is time to get this party started. Let us take

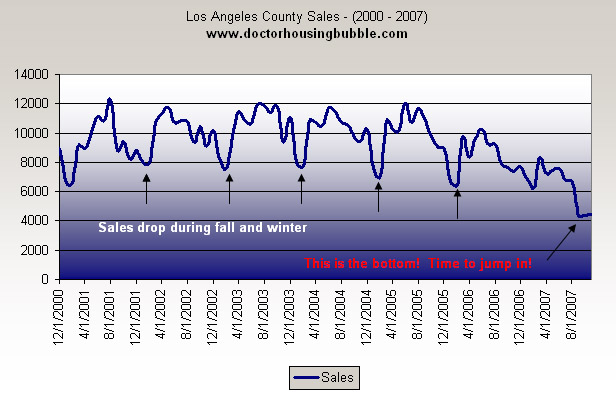

You’ll notice that there is seasonal component to housing as well. During the winter sales drop and this is normal. But you’ll notice that this year sales started dropping significantly during the peak spring and summer months and never recovered. Unless you can call this a recovery:

Remember that sales are always leading indicators and point to where housing is heading. Prices only show us where we have been. Let us take a look at the actual median price for various counties in

|

County |

Median Nov 06 |

Median Nov 07 |

Percent Change |

|

|

$517,000 |

$499,000 |

-3.5% |

|

|

$623,000 |

$582,750 |

-6.5% |

|

|

$427,000 |

$356,500 |

-16.5% |

|

|

$380,000 |

$330,000 |

-13.2% |

|

|

$487,000 |

$440,000 |

-9.7% |

|

|

$577,500 |

$521,250 |

-9.7% |

|

SoCal |

$485,000 |

$435,000 |

-10.3% |

Anyway you slice this information you start seeing how the drop in sales last year gave us a very clear indicator of where prices would be heading in 2007. That is why it was simply astounding to me how housing pundits in late 2006 where saying that

Maybe you’re not convinced. What stands out to you in the data above is the astounding double-digit loses in the

|

County |

Peak Date and Price |

Median Nov 2007 |

Nominal Drop |

Percent Change From Peak |

|

|

May 07 – $550,000 |

$499,000 |

$51,000 |

-9.2% |

|

|

June 07 – $645,000 |

$582,750 |

$62,250 |

-9.6% |

|

|

July 06 – $614,000 |

$521,250 |

$92,750 |

-15.1% |

|

SoCal |

July 07 – $505,000 |

$435,000 |

$70,000 |

-13.8% |

This really puts into perspective how deceiving the data can be on the upside but how devastating it can be on the downside if you simply look at year over year data without any context. Many of the so-called prime counties are already down in the double-digits from their recent peaks. You’ll notice aside from

If you are looking to buy you are in the complete drivers seat. You can offer 10, 15, or 20 percent below recent comps and you would be justified by the current data and sales trends. I think we have much further to go before we hit bottom but some people are going to jump into any market so might as well go at it with knowledge and data. So when you hear people talking about market bottoms, just remind yourself that these were the same folks who were predicting gains for 2007 in late 2006. Unless Santa brings us massive equity in the next two weeks, I’m afraid there is nothing bringing sexy equity back in SoCal for a very long time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “Sexy Bottom: The Naked Truth of the 10 Percent Southern California Housing Drop.”

I agree. I could buy easily even now, but will not even in my wildest dream (nightmare more like it).

There is no escaping income to housing price conundrum. That means (in today’s dollars), average price in SoCal must fall to approx 210K.

Everyone is pretending that incomes don’t matter. Paulson talks about ‘more affordable mortgages’, but never mentions ‘more affordable housing’.

US is going fast towards a time where you’ll be using your credit card only when you must, and cash otherwise (for various reasons).

Prices are supported currently by collective disbelief of many homeowners. This will take a bit of time and oscillation in sentiment, but invariably going down for a very hard ride. Considering how much it overshot the historical trends, it’s not inconceivable that it will undershoot historical trends as well. Typica SoCal house for less than 200K? Not an unlikely prospect.

I think we are seeing volumes that are so low that we could see up and down months through all of next year. You have to put it into context, S. Cal would need to have a 15% to 20% increase in sales transactions to reach the worst levels of the early 1990’s. That is not adjusted for population.

what was the show on npr? i’d like to have a listen.

Even I don’t think that real estate prices are done falling yet. Riverside~16.5%? From the areas that I’ve been perusing, I thought it was worse than that. It may spiral lower before prices level off. San Diego is still unaffordable to homeowners and investors alike. It’ll have to drop by 50%, at least, before it can be considered reasonable. Then I would consider reentering the market with a rental.

“Overcoming Real Estate Losses”

http://WhineCountryRealEstate.blogspot.com/

Are we hearing the NAR propaganda? “Have prices bottomed?!!” Tip of the iceberg duh! Bailouts – rate freeze – people are cash strapped at their int only payments. Ben’s proposed loan limits – let the taxpayers be the largest subprime lender. Greenspan statement about helping homeowners with cash is less damaging than price and interest adjustments – it is all too surreal!

It’s just a matter of time now. People who are selling their homes are still in disbelief that it is not worth what they paid for. I am now seeing houses at Homes.com in middle class towns like Lakewood, Long Beach, and Norwalk selling for under 375K that were bought in 2006 during the peak for up to 585K.

Looks like the Middle Class Neighborhoods prices will be dropping sharply in 2008.I make over a 100K a year and it’s ridiculous to think the only place I could afford to buy (Using true ecenomic fundamentals) right now is Compton and Watts.

I don’t see the bottom until 2012.

I think reality will set in sooner than that. The market will heavily tank followed by being dead in the water in a few years.

CompaJD: I agree! I earn a good deal more than you (not getting into a wee-wee measuring contest) and I too can’t afford to buy anything decent (family of 5, can’t move into an 1100 sqft fixer-upper) on my income.

These houses have to & will drop a lot, until prices are aligned with incomes. The cheap money in these crap mortgages enabled people to buy homes that they couldn’t afford. This pushed prices up to ridiculous levels. I remember telling a co-worker, “just because money is cheaper [so to speak], doesn’t mean the home itself just appreciated by 20%”

Anyway no sympathy for those on the ass-end of this deal. Home prices will continue to plummet, and those of us who are/were responsible will be waiting to pick up the pieces.

What do you see for areas like San Marino, South Pasadena and Arcadia? We’re looking for a bigger place as my wife and I would like to start our family; but we’ve been hesitant to jump into the market.

It’s funny how Paulson and the Governator showed up in Stockton trying to reassure homeowners who are in the middle of the mortgage crisis urrrrrr Price Correction, to discuss predatory loan practices and affordable mortgages. Not once did they mention affordable housing.

My own guess is that adjusted for inflation prices will declline substantially in the next five years. However using published information to support any conclusion is almost meaningless because of all of the garbage in the numbers. Are forclosures recorded as sales at the mortgage amount when the lender takes the property back? My guess is that you will find that the mix of housing has also changed to include a higher ratio of homes (smaller ) under $418,000.

“Southland prices fall again; sales perk up.â€

A 1.33% change is not a statistically significant deviation – or at least as I recall from my grad school courses in stats.

A truly desperate headline writer.

Fascinating on the ground reports! Texas had a much less proportional runup and has experienced hot money from California in the Hill Country. Texas had a large real estate bust tied to oil prices in the mid to late 80’s but recovery began in less than 10 years. Southern California was hit then by closing and downsizing of military contractors and that coincided with the last California real estate downturn. I think this one is bigger and will last far longer. We must view California as a sign of some things to come in much of Texas. Thanks for your reports.

The show is AirTalk and one of the clips is available online at:

http://www.scpr.org/programs/airtalk/

It is the show that aired on Wednesday December 19th title “Southern California Home Sales Down 43% In 2007.â€

It’s actually a good show. They were also talking about the underground economy (i.e., cash deals, barter, etc).

I was digging through some of the foreclosure numbers from RealtyTrac and we are now at 2 million foreclosure filings for 2007. The big difference is the sharp increase in REOs since this only adds to inventory and depresses prices further. We have yet to be fully tested and the first quarter of 2008 will be the true test of the markets resilience. It will be the heart of winter, high inventories, and tightening credit. I wouldn’t be surprised if we see many counties in SoCal seeing 20+ percent drops by the end of 2008. In fact, I just don’t see how it can be any other way by looking at future trends and data.

Well lets see, Stock market crashing, Govt interferance, Federal investigationssssss, Lowering of interest, Inflation (cheap dollar) etc

” To my sheer astonishment, some of these people were asking if we have reached the bottom”

Wow I guess these people are just plain greedy and stupid. They must have an IQ of a rock to get a license.

I just wanted to let you know that I enjoy your blog immensly. Very informative, well written and funny. One wonders how possible that big Ponzi scheme could hold up for so long and still does to a certain extent, when so much sensible information and discussion is available on the internet. Don’t people read? Don’t people think? Probably not. Too busy trying to get rich.

The event that confirmed for me that SoCal (and everywhere else) was headed for a huge world of hurt was when I sold my house in Long Beach in 2005. We purchased the house in Dec 2003 for $485,000, did some remodeling (nothing extravagant, and no kitchens or bathrooms), then sold it for $675,000 in Dec 2005. I as astonished, beside myself, and a little ashamed that we could make nearly $200,000 profit in less than two years without doing much at all to the house.

We were not comfortable with our payment at $485, the guy who bought it put little down, and had HALF our income. I can’t even imagine how he’s still in the house.

Needless to say, we’ve been renting ever since, and will continue to rent until prices reach fundamentals. They will. Naples on the water anyone? It should be within reach.

Smart man JB. Some % cashed out of this market like you did. The NAR deserves nothing but scorn for their Ministry of Propaganda ways. Every time in the next five years they try to analyze the market, everyone should scream “Manipulative Bubble Deniers!” at them like a scene out of Invasion of the Body Snatchers.

In 1996, in Central New York, we couldn’t get pre-approved for a loan for a house at 1.8 times our household income. We are now in one at 75% of our annual income (because our income has grown, and frankly, it was a cheap house, and nearly paid off.) Every sale on that house in the preceding 20 years had been for exactly the same price. I have never assumed we would get any different, and I still don’t assume that. If we did like JB, I’d be thrilled and probably a little guilty feeling too, but I’d see as it as an unexpected windfall and have made no other financial bets on it. (Well, beyond adjusting the house insurance amount.) People have to realize with any investment (stocks, RE, metals, ANYTHING). Until you realize the gain, in cash, it isn’t really a gain.

Curious as to typical SoCal percentage of income spent on mortgage/tax/ins. Homes seem to be priced 300-400% more than midwest or south. Wondering if salaries are commensurate.

There is an extremely interesting story of a family that bought their house in 1977, should have had it paid off for but instead pulled over 600k from the equity and are now pleading for the OC register to publish their story, These people spent over half a million and are now upset that they WILL lose their home. The link to the story is http://www.ocregister.com/money/loan-countrywide-coffmans-1937672-home-borrowers. If you can’t follow, the title is Tapped out family, in the Orange County Register.

I’ve put up the weekly short sale report for Southern California:

http://www.doctorhousingbubble.com/forum/viewtopic.php?p=349#349

Short sales are up by 152 homes for the week and are nearly 3 times as many as the number of short sales in early July, once we started tracking inventory.

Comment by FromTheSouth

December 21st, 2007 at 11:31 am

Curious as to typical SoCal percentage of income spent on mortgage/tax/ins. Homes seem to be priced 300-400% more than midwest or south. Wondering if salaries are commensurate.

Go here: http://factfinder.census.gov/home/saff/main.html?_lang=en

Enter the name of the counties in which you are interested. For CA, the data is current through 2006.

On the page with the county data that comes up, open the links for “Economic Characteristics” and “Housing Chacteristics” to get the expanded date.

“Economic Characteristics” will give you the number of households in the 10 income groups .

“Housing Characteristics” has 2 items which will help answer your question. The first is “Mortgage Status and Selected Monthly Owner Costs” and the other is “Selected Monthly Owner Costs as a Percentage of Income.” In LA county, for example, fully 43%+ of those who have a mortgage are spending in excess of 35% of income. That is considered risky as 30% of income is considered to be the maximum in affordability.

CompaJD: My family is in the same boat. A salary of near-$100k has not been enough to touch a mortgage in the Boston area for a modest home (3bed, 1ba, tiny yard) for our family of 4 without doing interest-only. I’ve added a 2nd job to build up a down payment, since I’ll be betting that in 2009 the 10-20% down will be standard once again. Fortunately with falling prices that percentage will be much less $ in a year.

I’m seeing ads frequently here in MA where sellers are knocking $100k off of homes in very desirable towns. The bottom is nowhere in sight.

Just saw a bank-owned property in a upper-class neighborhood in Diamond Bar California just go on the market at $539,000 (12-21-07). It was previously purchased for $745,000 in late 2006. That’s just about a 30% drop from the high is this desirable area in Southern California. These houses could not be bought just 12-24 months ago!

Dr.:

Good stuff.

Where did you get the data on home sales volume for LA County?

Thanks,

RD

Leave a Reply