The Secret of Your Neighbor’s Housing Value. Drilling into Two Blocks in Burbank Highlights the California Housing Bubble History and Future – 15 Homes Including Sales Activity and Median Prices.

The California housing bubble will go down in the history books as one of the biggest manias rivaling the Florida real estate boom and bust of the 1920s. Yet much can be lost in the raw numbers and each new foreclosure simply turns into another statistic. Within a city block, there is much history that has gone unnoticed in this housing bubble. Many people did not participate in this bubble, even in California. We have a large number of people who bought prior to the bubble but also, there were many that bought at the peak. All this can be found on two blocks. Examining a block can highlight the trials and tribulations of what went on during the grand housing bubble. The exotic mortgages that brought California into the mania are still lingering throughout the market. Today we are going to focus on two blocks in Burbank California. We are going to try to pull sales history, foreclosure activity, and try to really go deep into the data of the current housing market.

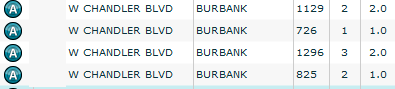

First, we are going to examine the 91501 zip code in Burbank:

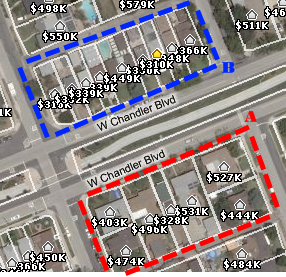

You might be wondering what is special about this area but really this is a reflection of many areas in Southern California. You’ll notice that I have traced out the two segments we’ll be looking at. In total we will be examining 15 homes on West Chandler Boulevard and a few homes that are on adjacent corners. The majority of homes on these blocks are smaller homes, typically less than 1,000 square feet.

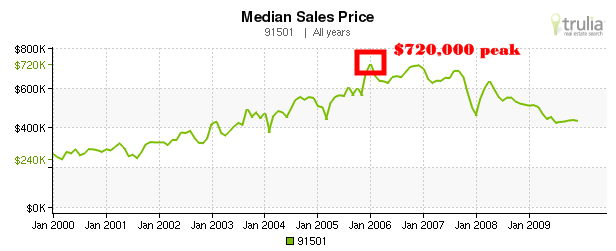

Before we pull data on each home, let us examine the median price of this zip code throughout the bubble:

The median price peaked in 2006 for this area at $720,000. If we look at the latest data through DataQuick we will find that the current median price for this area of Burbank is $485,000. This is a drop of 32 percent over a few years and is actually on the lower range for many areas in Southern California. One of the main questions people now have is whether we are near a housing bottom. Given the large amount of shadow inventory in Los Angeles County and the trend in Alt-A and option ARMs it might seem that some areas still have a way to go before reaching the trough of their correction. Let us now look at Block A traced out in red above in great detail:

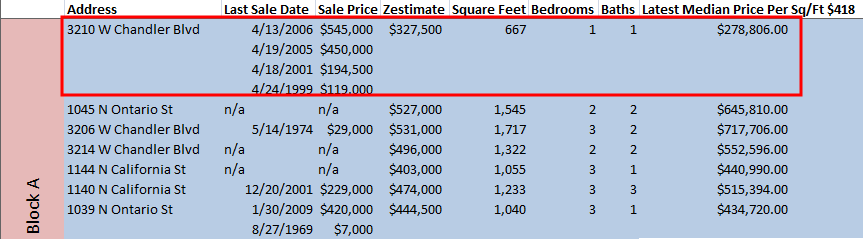

Now the above information is fascinating. Many of the homes that have no latest sales data available simply have not sold in the past decade. When I pulled up some of their current tax data the assessed value is so low that this reflects no sale activity in many years. But we do have activity in other properties. First, let us look at the 3210 property listed first. This home is a foreclosure and is currently listed on the MLS:

The home has been listed on the MLS for over six months. We should first refer back to the data gathered above. This home has seen a bit of sales activity in the last decade. The last four sales all occurred in the month of April. The earliest sale on record took place in 1999 and sold for $119,000. The home then sold again in 2001 for $194,500. Four years later in 2005 it sold for $450,000. Finally in 2006 the home sold for $545,000. Did we mention this was a 667 square foot property? So at the peak in 2006 this place sold for $817 per square foot. Like many homes in the California housing bust, it ended up as a foreclosure and this is the latest pricing data:

Price Reduced: 11/30/09 — $425,900 to $414,900

Price Reduced: 01/06/10 — $414,900 to $384,900

Price Reduced: 02/06/10 — $425,900 to $384,900

Price Reduced: 02/12/10 — $425,900 to $384,900

The current price is $384,900 which carries a $577 per square foot cost. The latest sales data for this zip code in Burbank has a median square foot sale cost coming in at $418. If you refer back to the above data, you’ll notice that one column multiplies each property out with the latest median square footage data. This isn’t to say that prices are reasonable but we are simply trying to dig deep into a line of homes in a city block. If we simply multiply the current square footage with the recent median square foot price for the zip code we get a price of $278,806. To come into line with the current square foot median price there needs to be another $100,000 price adjustment.

Four homes on the block have no recent sales activity. One of the homes sold in 2001 for $229,000. Another home sold in 2009 for $420,000 and was slightly larger coming in with 1,040 square feet. That works out to be $388 per square foot. So you can see that even within one block, prices are all over the map but recent sales activity points to lower prices.

This is one issue I have with how homes are valued with appraisals. If you look at the Zestimate you might think that prices are valued too high. During the housing bubble, appraisals kept coming in high because they were reflecting mania activity and using inflated home prices to keep adjusting prices upward. But like the data above, what if homes simply don’t sell for decades? Are you really using good comparables to make a solid value judgment? Then you add in loans like option ARMs that provided homeowners ultimate leverage with no money down. It all became a game of musical chairs. Keep in mind that someone sold the 3210 home for $545,000. That was a win. There were also many winners during this housing bubble, it was a matter of timing the exit correctly (and assuming they simply didn’t take their equity and buy a bigger more inflated property). In other words home buyers in the last decade became speculators whether they acknowledge it or not.

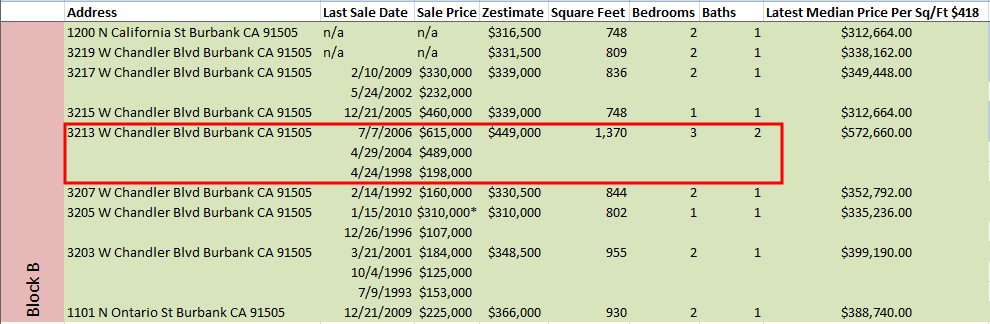

Let us now examine the blue outlined area in Block B:

In this block we have nine homes. Of these nine properties six sold in the 2000s so this area had more activity (and a few more homes). If we look at the highlighted home we see that it sold in 2006 for $615,000 coming out to be $448 per square foot. Two homes sold in 2009. The 3217 property sold for $339,000 and is listed at 836 square feet ($405 per sq/ft). The other property sold in December for $366,000 and is listed at 930 square feet ($393 per sq/ft). So we are seeing a trend to lower prices in this area and this is based on the latest sales data.

There will be more correcting but this won’t impact all owners. Of course those who didn’t sell or didn’t buy in the last decade and plan to stay put might ignore what is going on in the market. Those who bought at the peak are very likely to walk away. And there is a good number of homes sitting in the shadow inventory. I ran a query on this street and found four homes scheduled for auction:

The four auctions are not in the red or blue areas but are very close by. We already have one foreclosure sale in the 15 homes data and you are seeing that only large price cuts will move the property. The latest data for the 91501 zip code is interesting:

December 2009 home sales:Â Â Â Â 24

MLS listed (non-distress):Â Â Â Â Â Â Â 37

MLS foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

MLS short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5

Shadow Data

Pre-foreclosure (NOD):Â Â Â Â Â Â Â Â Â Â Â 50

Scheduled for auction:Â Â Â Â Â Â Â Â Â Â Â Â 72

Bank Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 24

So what can we gather by all of this data? First, the market is extremely volatile in the short term. There is a large number of shadow inventory in this zip code. The trend in price and median square foot price is heading lower. As we know many of the HAMP extensions ended in January and there will be a push for more short sales. Short sales will undercut non-distress MLS listings and push prices lower. It is hard to envision mortgage rates staying low for an indefinite period of time and this will add additional pricing pressure.

When we dig deeper into an area, we can see the housing bubble in a better perspective. I’m sure if you run this analysis for any area in California you will yield similar results.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “The Secret of Your Neighbor’s Housing Value. Drilling into Two Blocks in Burbank Highlights the California Housing Bubble History and Future – 15 Homes Including Sales Activity and Median Prices.”

Awsome information.. I rent in Burbank (been for 10+ years ) and has been looking in 91505 and 91501. Doc, your review of Burbank has always helped me try to understand whats going on in my neck of the woods…. There is only one way for home prices to go.. and that is SOUTH.

Here in Ohio, that house sells for $85,000. Just what it is worth. “You can make ’em jump,… but yiu can’t make ’em fly.”

Could you possibly investigate the El Dorado Park neighborhood of Long Beach? I grew up there, and I’m dying to know what’s happening. Last I looked, they were in a perpetual bubble with older houses at $500,000.

Thanks..

Welcome to the neighborhood, Doc! I rent a house 1 block over from the blue area for $2000/month, a small 1000sq ft 2/1. This is a lower-middle-class section of Burbank–very modest homes on tiny lots. The 2006 median of $720,000 is mind-boggling. Burbank has good schools and an effective police force, but for that kind of money you could send your kids to Crossroads and hire Blackwater to patrol the block. Looking forward to an interesting 2010.

Now if only you had a data set for the resilience of human financial self delusion. A lot of people were sold a bill-of-goods about housing (primary) being a great investment, or the “best” investment that they could make. I will hazard to guess that for many a house is simply forced savings and with all the loan options and over buying that people have been doing in recent years it’s not even a great forced savings plan. Imagine if instead of buying a house in January of last year you purchased Ford (F:2.46), Bank or America(BAC:13.98), Star Bucks(SBUX: 9.84), and McDonalds(MAC:18.41). You would be up big, but you would have needed to have skin in the game, unlike real estate.

Maybe I’m missing the point, you can use someone else’s money to purchase a house, if the value increases you win, if it falls you can leverage government aid and debt forgiveness to hedge your loses.

I agree that prices have to go down in middle-class areas such as Burbank. However, I can tell you from anecdotal evidence that at least for right now, there are more people trying to buy than there are homes for sale. Supply and demand is on the demand side right now. A huge drop in prices will not come till the sun starts shining on the shadow inventory. And all these government programs cloud the real estate market.

If houses go for $85,000 in Ohio, what are the comparable wages?

>>Welcome to the neighborhood, Doc! I rent a house 1 block over from the blue area for $2000/month, a small 1000sq ft 2/1<<

That's ridiculous. I'm just lucky that most of you never heard of Grass Valley or Nevada City in No. Cal. Because if you knew what those beautiful, forested towns are like, all the people in SoCal would try to come up here!

I agree with you Doc, on the inflated value of housing. However, I think that the crony banking system has too much at stake to let the system collapse. We won’t see a truly catastrophic collapse in housing, beyond where we are today. The government realizes that a sudden bottoming out in housing would destabilize our society. Tens of millions of homeless, broke, angry people with nothing to lose? That’s not good for re-election or stock prices. There is indeed a new normal coming, but it has to come as softly as possible.

The government must to find a way to let the system fail gracefully over time. Meanwhile, the crony banks will do their part to make money on the slide down, just like they did on the climb up.

“That’s ridiculous. I’m just lucky that most of you never heard of Grass Valley or Nevada City in No. Cal. Because if you knew what those beautiful, forested towns are like, all the people in SoCal would try to come up here!”

Don’t be too sure on that! Soon to be retired in the pride of the sierra foothills…: )

Great forensics, though I think it would more interesting to see the price history graphs using non-logarithmic scales.

@KZ $2000/month is about what it would cost to service just the loan on a $400k house. You are still paying less to rent then to own. (1000 sq. ft. x $410/sq. ft. = $410k)

Mark wrote:

Comment by Mark

February 15th, 2010 at 9:23 am

Here in Ohio, that house sells for $85,000. Just what it is worth. “You can make ‘em jump,… but yiu can’t make ‘em fly.â€

I ran a slightly different metric on the house. $96.00 a sq ft. Houses in Temecula, CA are being offered short sale at this price point (can’t call it value). Let’s see Temecula, CA or Dayton, OH? Hmmmm… In any event I would not pay more than $64,000 and change for that Burbank cracker box. Then again I would not buy it at all. Patience and diligence and I will get a better value for my dollar.

From talking to other people, dinner parties, going out, etc… I have heard a new lexicon that is adopted into our collective lexicon; “The Great Recession” and “The New Normal”.

I went to a family friend’s anniversary party and the young bartender who has a degree in finance told me “well I guess this is the new normal. I know I will find a job in my field, but it will just take a lot longer and I may have to downgrade my lifestyle”.

My mechanic said “whew! I can tell my grand kids that I survived The Great Recession”.

We are living in interesting times indeed. I can not tell what 2010 will be like but it won’t be boring!

Nevada City is a nice little town. Having lived in the area for several years, I can say that the region is very nice. Proximity to Tahoe if you are a skier or hiker is great. But California is bankrupt, and has a dysfunctional government. Prop 13 was the beginning of the end.

Comment by KZ

February 15th, 2010 at 10:54 am

Welcome to the neighborhood, Doc! I rent a house 1 block over from the blue area for $2000/month, a small 1000sq ft 2/1.

KZ

isnt that too much for a 1000 sq ft home.. I live closer to Toluca Lake on Pass ave and I dont pay that much for a 900 sq ft apartment..

Houses have a garage and a yard. Something I am guessing your apartment does not. Houses also do not have common walls. All these will lead to a higher price for a similarly sized apartment.

In my city in No. Calif., janitors for the city make $90,000. in salary, medical, and retirement benefits.

Gardeners for the city make $80,000, in salary, medical, and retirement.

If you have a married couple, both working for the city or state, even with a high school education, they bring home $150,000.plus.

No wonder house prices are high in CA.

“Stabilize the society?” Haha! If they wanted a stable society, they wouldn’t have allowed the bubble in the first place! You’re a comedian. Truth is, the propping up is for the banks, and the rest of us can go to hell for all they care.

I rent a 1600 sq ft house a few blocks over for $1750. My street (keystone in 91506) saw a lot of crazy bubble sales for shacks and now is seeing foreclosures and forced sales galore.

Prices in this area may have fallen some, but they still have a ways to go before buying makes sense. Burbank isn’t a fancy place, you know? Well situated if you work for the studios, but not much draw otherwise.

One half To three quarters of a million dollars for this sort of charmless pre-war (WWII) worker housing? Please.

p.s.

One thing your readers should know- Chandler used to be a rail corridor. These houses right on Chandler are smaller houses on smaller lots than most nearby houses, so the average home price for the zip code is a little misleading if you don’t realize that.

@M Nair & Melanie: My place is definitely overpriced. Especially since it has 15 different faux wood panel finishes inside and has a persistent, peculiar smell. I was desperate to find a place (moved cross-country w/kids & dog) and settled for the first thing that wasn’t a total dump. Interestingly, the landlord had just reduced the price by $100 and this was the first time he wasn’t able to find a renter. If I hadn’t shown up I bet it would have gone down to $1800.

@JohnnyBurbank: Agreed that it’s cheaper than buying, with the added benefit of not having to own this glorified utility shed.

So is that $70K and $60K respectively? That is about the same as a Federal GS11 in San Francisco starting out with a Ph.D. Which city is that? Must be between Walnut Creek and Pleasanton! GS janitors certainly don’t earn half that, even in SF.

Having said that, I now live in Appalachia, near Oak Ridge, TN and work at Oak Ridge National Lab., our janitors make about $50K (excl. benefits) and fortunately are not on the GS scale’ as the lab, as are all DOE labs, is contracted to UT Batelle so that the wages mirror industry.

I have been watching this site for a while and all I can say is – I am glad I did not buy when I lived there (If I could have on a GS12)! However, I am glad I bought my home on two acres, on top of a hill overlooking the Cumberland mountains, with no bars or security in a small, well spaced and friendly neighborhood.

OT:

Real Estate

Housing Shortage Predicted in 2010

http://www.upi.com/Real-Estate/2010/02/15/Housing-Shortage-Predicted-in-2010/5241266252708/

With healthy inventories, 3 million foreclosures, more and more short sales, falling values, rising vacancy rates, shrinking rents and one third of all homeowners underwater, could we possibly be heading for a national housing shortage this year?

Get ready, say several leading economists.

Brian Wesbury, chief economist at First Trust Advisors, told Forbes this week that we’re building only one-third of the houses we need just to keep up with population growth.

Wesbury figures America needs to add 1.5 million housing units per year just to keep up with population growth plus another 100,000 for fires and tear-downs, et al, we need 1.6 million or more per year. Right now we’re down to about six and a half, seven months’ inventory, whether you look at new homes or existing homes. Housing starts are now between 500,000 and 600,000 a year.

“I think one of the secret investments, if you will, over the next decade is going to be housing. It is extremely cheap, inflation is on the way. But people are running away from it. You know, it’s that old adage, ‘When there’s blood in the streets, that’s when you invest.’ And this is the time, I think, for real estate,” Wesbury said.

Wesbury, dubbed “Mr. Sunshine” for his sunny forecasts, including his prediction that by the third quarter of this year there could be a seller’s market for new homes, is not alone in expectation of a housing shortage.

(more at link)

—————————————————————————————————————

Methinks Mr. Sunshine is off his meds.

I somehow doubt any JANITOR makes $90K a year and GARNDERS for the city make $80K… Any evidence of this?

I know loads of working white collar professionals with Ivy League educations that make half….

Why don’t I see any $80K for Govt Janitor jobs posted on CRAIGSLIST? haha.. because they don’t exist… 🙂

As a matter of record, the following is the official salary information on the NY City school website:

22 years experience, Masters degree = $100,049 annually. The “per diem” rate for additional work is $154.97 per hour. That’s an annualized salary rate on the per diem of $309,940.

Now, that’s not janitor salaries and it is NYC, but the budget must include hundreds or thousands of these teachers and I can’t imagine the salary and benefits cost of the “administrative staff” who are always going to be paid more than the typical teacher. After all, they develop the salary schedules. All these folks retire at 60-70% of average pay, adjusted annually for inflation, plus lifetime medical benefits.

It would be interesting to see the California statistics.

Leave a Reply