Saving Money is for Economic Girlie Men: 5 Reasons Why The United States Government Wants you to Remain a Broke Debt Hamster.

The U.S. Government wants you to stay perpetually broke. The lenders and banks want you to stay in the poor house. Why? Somewhere along the line the notion of saving money got perverted to the point that now people equate access to credit as actual money. This psychological shift didn’t happen overnight but there is no doubt that many of our current economic struggles are rooted in this misguided perception. Earlier this year a colleague called me up all worked up about something. I asked what was going on and he conveyed to me that his home equity line had just been reduced. Sacré bleu! How dare the lender take away his money!

I had a really positive response to a previous article stating that you should only purchase a home that is 3 times your gross income. One quick clarification is that I was referring to the actual mortgage amount and should have been clearer on that point. In essence, you should not buy a home that carries a mortgage 3 times your gross yearly income. However at the peak of the boom in California more and more people bought homes with no down payment:

We went from 3.9% of all homebuyers purchasing homes with no down payment to 21.1% of all homebuyers in 2006 at the peak of the bubble in California. This was simply unsupportable. Yet even given the current credit crisis, people are still able to buy homes with 10% down and this is data from last month. How can we figure that out? Let us look at some data:

“(DataQuick) The typical monthly mortgage payment that Southern California buyers committed themselves to paying was $1,458 last month, down from $1,566 the previous month, and down from $2,198 a year ago. Adjusted for inflation, current payments are 31.9 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle. They are 44.4 percent below the current cycle’s peak in June 2006.”

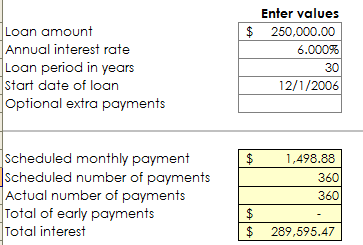

Since the vast majority of loans are now backed by the government, the prevailing rate for the summer was about 6%. It has gone up a bit but the above data would not reflect that. The current Southern California median price is $308,500. With that, we can get a rough estimate of how much home buyers are putting down:

That gives us a good idea. We are looking at 10 to 15 percent down for current homebuyers. We are simply returning to more old school standards. And this idea of no money down is another direct consequence of this notion that no one should save and delayed gratification is for chumps. We are going to see a major shift in the next few years especially when there is a silent and disturbing economic depression going on already in our country.

Today we are going to look at 5 reasons why the U.S. Government wants you to remain a perpetually broke debt hamster that is motivated by spending.

Reason #1 – U.S. Savings Instruments

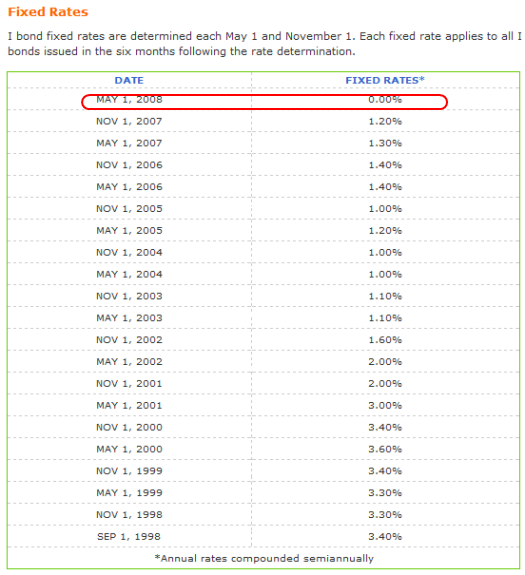

One of the best kept secrets was the U.S. Savings I-Bond. This simple instrument provided the purchaser a fixed rate and also a variable rate that adjusted with the CPI. You know that I think the CPI is a cooked stew of economic alchemy but hey, it is what it is. But at least this was a form for people to save money and be assured that they wouldn’t lose any money. I started purchasing these things earlier in the decade and at the time, the rates seemed low given the tech bubble (which bursted) and the subsequent housing bubble (which is now exploding). But take a look how the government has decreased the actual fixed rate over time:

In fact, some of the bonds in the portfolio are now earning 7% which isn’t a bad deal. But look at how the government has slashed the fixed component of the bond to zero. Now how does this encourage savings? So that is one strike. They can easily increase the rate of savings for Americans by simply upping this rate.

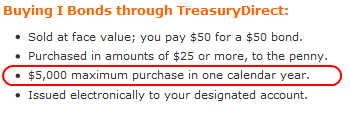

In addition, buyers were also able to purchase up to $30,000 worth of these bonds a year. So when I got an e-mail earlier this year that they were lowering the amount cap to $5,000 a year, I was getting a hint as to where the government was heading:

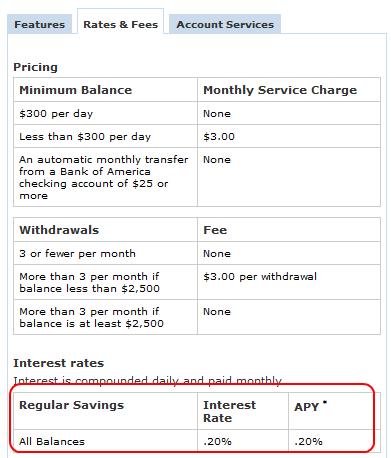

Okay, another strike. Now those few folks who actually have some money to save in this struggling economy would be capped at $5,000 per year. So if you had other money your options were to stick it into a mattress, stocks, or banks that seemed to be collapsing everyday. They were limiting options creating an environment were the consumer was forced into riskier products. Just look at the return on some institutional savings accounts:

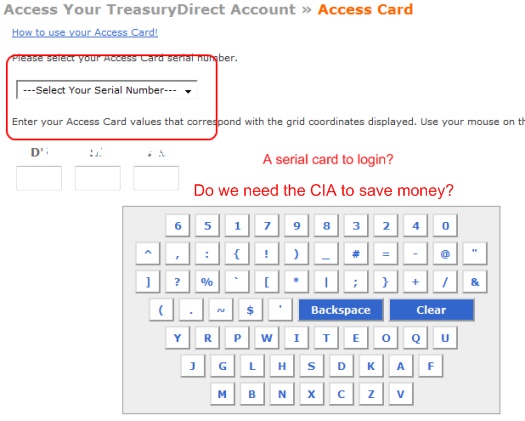

This is for your run of the mill Bank of America savings account. 0.20 percent is almost comically low. You might as well stuff your money into a mattress. But going back to the I-Bonds which are offered through the U.S. Treasury they also implemented this online security feature which makes it much more difficult to login:

For those who hold I-Bonds and other instruments you now need a plastic card to decode an online password that would make National Treasure seem like a walk in the park. This is also after an online keyboard where you have to click with a mouse your password. What this does is that it makes it utterly hard to save your account information in your browser to log back in. Maybe one day you get a nice little bonus and you want to save it. But your serial card is at home. Too bad! Why not log into your Amazon account and blow your money on reading Ben Bernanke’s book on the Great Depression. They’ll even ship it out tonight with a one-click ship! Where is the one-click save here?

I understand the need for security but even top notch brokers and high powered banks like JP Morgan and Bank of America don’t make it this hard to login. And for $5,000 this has now gone from being a viable option to a flash in the pan. Too bad. This was a good way to get Americans to save. I think many are looking at a 7% return as stellar given the current stock market shenanigans.

Reason #2 – U.S. Consumption Based Economy

Our economy is based on consumption for the most part. The GDP equation of:

GDP = consumption + gross investment + government spending + (exports – imports)

GDP has a heavy emphasis on consumption. That is why last month when retail sales fell 1.2% when the market expected a drop of 0.7% the economy when gaga. In fact, people should have been cheering that Americans are actually tempering their manic spending but this actually had the opposite effect of sending stocks into their proverbial corner which is now becoming a more common occurrence.

It is estimated that nearly 70% of our economy is fueled by consumption. That is, buying cars, homes, boats, computers, televisions, furniture, movie tickets, and all those other great consumerist items. And much of that consumption was fueled by debt. Many Americans during the bubble pulled out equity from their homes to upgrade the kitchen to something Emeirl would envy even if they rarely had the time to cook. Many also used the money to fund extravagant vacations and purchased numerous technological gadgets.

This was great but buying on credit simply meant you dried up the well for future expenditures. Now, that debt is coming back home with a vengeance. We are spent out. That is why the world central bankers nearly had a heart attack when they saw the credit (debt) markets freeze up. See, we really can’t say debt since it carries a negative connotation. Credit seems much more pleasant. Sort of like interchanging high yielding bonds for junk bonds. Same thing, different name.

So the central banks encouraged by the government did what they know best. Loaded the system up with more debt. Now we are in a debtors spiral and they are hoping beyond all else that people will spend. One small caveat. People need freakin jobs! And many of these jobs were based on people spending money they never had! We need sustainable jobs and industries and not those that are fueled by debt spending.

Reason #3 – Our Government is in Massive Debt

Our government itself is in massive debt. With over $10 trillion already on the national debt book we have additional debt in every other imaginable area:

Home Mortgage Debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $10.54 trillion

Consumer Credit:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2.55 trillion

Corporate Debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6.8 trillion

State and Local Governments:Â Â Â Â Â Â Â Â Â Â $2.19 trillion

Everywhere you look there is this perpetual debt circle. The government doesn’t want you to save because they aren’t saving either! How can a government ask its own populace to be prudent when the are spending beyond their means? The people are merely taking note from their political leaders encouraged by the lending and banking apparatus. Frugality is now however making a comeback but not by choice. It is being forced down the throat of many. After all, you as an average American don’t have the same access as a Wall Street bank for a corporate crony and perverted capitalistic handout. This is not capitalism because this has nothing to do with the free markets. This is not socialism since the majority of the people will not be helped by these actions. This is an economic system fueled by a government that is now a plutocracy fueled by a very concentrated group of people and wealth.

The disconnect is even larger than it was during the Great Depression. Here is the gig. The lenders, Wall Street, and central bankers want you to continue to believe in a false economic system that has clearly failed. They want you to believe in those Barnes and Noble books that if you save 5% a month for 40 years, you’ll retire a millionaire. What they don’t tell you is the way we are currently spending money we don’t have, a million dollars in 20 years might only buy you a used vintage Hummer.

Most people right now that invest in a 401(k) plan trust their advisors to do the right thing. That is why so many have lost $2 trillion in their retirement accounts in the last few months. Where did they put this money? Into Fannie Mae/Freddie Mac, A.I.G., and across the board companies are having hard times. To lose 40% of your portfolio is not an easy thing to take especially when a large number of baby boomers are edging closer to retirement. Now imagine if there were no Social Security for example. Now according to the Social Security Administration we get these facts:

Retired Workers

Monthly Amount:Â $1,086 average monthly payment

32,113,000 fall in this category as of August of 2008

Keep in mind you also have 2,399,000 spouses and 499,000 children that fall under the “old-age” component of Social Security. Their payments are $534 and $539 respectively. Not big bucks at all. It also goes to show how inadequate this system is going to be in the future since our government is simply kicking this can down the road:

Now that you know the awfully low amount, this above chart should startle you. 33% of those aged 65 and older get 90% of their income from Social Security. 32% get more than 50% of their income from Social Security. Only about 35% of those aged 65 and older have other sources of income that supplement their Social Security payment. And they wanted to invest a portion in the stock market? Great idea.

What in the world is the government doing about this given that the tsunami of baby boomers is coming down the road? All the government is doing is bailing out toxic lenders and banks. Absurd and frankly disturbing.

Reason #4 – Psychologically People Need Instant Gratification

But are people also ready for a change in psychology? That is, can people accept the fact that we will not be able to spend as we did during the past decade? Many will have no choice but will the cultural mood be one of acceptance and sacrifice or of foot stomping on the ground because someone couldn’t buy a Kawasaki jet ski? I’m not sure. But if you flip around media stations I’m not sure we have the demeanor as a society of the 1930s. There is a much angrier sentiment and contingent in our culture. Clearly we have come a long way in many other areas since the early 1900s but in other areas, we have actually gone backwards.

Many who have grandparents from the Great Depression may laugh or mock the frugality by which they live. They live frugally because they realize at any given point, the system can come to a crashing halt and you need to be prepared to confront that. The biggest mocking is done by places like CNBC that skewered any tempered view during the heyday of the bubble. “Doomer” or “naysayer” where all words charged against anyone that didn’t buy into the Pollyanna religion of most anchors. Many have not seen an economic calamity like this one. Frankly, I have not lived through one myself but I’ve studied enough to realize that history can happen again and I am not arrogant enough to think that “this time it is different” when history clearly tells us where we may be heading.

So are we ready as a nation to become savers? It is amazing when we realize we have a negative savings rate. If this were another smaller country our foreign credit card would have been taken away a long time ago. Either way, we don’t have a choice on the coming austerity. The only choice we do have is how we adjust to it.

Reason #5 – Saving Money is Good for You

Most importantly, saving is good for you. It does the body and country good. It creates a buffer zone from calamity. It provides a piece of mind and cautious optimism which is necessary. Make no mistake, those prophets on CNBC are nothing more than a person jumping off a cliff with no parachute saying things are good in mid-air simply because they have yet to hit the ground. They preach diversification but when someone comes on the show during good times and mentions bonds or U.S. Treasuries they get laughed off the show. Talk about practicing what you preach.

Finally it is your responsibility to educate yourself and see the system for what it is. The government doesn’t want you to save. Lenders and Wall Street don’t want you to save. You may be fighting the environment here and going against the current but like those that decided not to buy a home at the peak, they knew that something was wrong when most of their money would be going to finance debt. We are going through a major cultural and economic shift and those that expect this thing to be over in a few months are going to be in for a major shock.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

34 Responses to “Saving Money is for Economic Girlie Men: 5 Reasons Why The United States Government Wants you to Remain a Broke Debt Hamster.”

Absolutely spot on! I think you have hit on an important element in your article. The populace faced with the current economic disaster is psychologically very different from the Americans who encourted the Great Depression. We are on the tail end of a mantra that began in the Reagn years: You can have anything you want, and you can have it right now! What’s more, there’s plenty more where that came from, and we will never run out of (fill in the blank: – resources, jobs, prospertiy, good times, whatever.)

The people how faced the Great Depression had indeed been through the high times of the Twenties, but the Roaring Twenties had been preceeded by a number of boom and bust cycles. These people were used to the idea that good times didn’t last long, and that tough times often followed good times. Furthermore, in the America of the Depression, almost half the popultion either lived on the land or in small towns. These were tough people, and they were willing to do without when they had to. In addition, frugality had been a way of life for them in the past. The entire idea of buying things on credit was alien to them. They saved up when they needed something, and if they could scrape enough money together, they bought it. There was no instant gratification of every consumer whim.

Great post! I agree 100%. It seems like Bernanke and company seem to still believe that what will get our government out of this mess is to spend more, hence the suggestion for another fiscal stimulus package to give us more money to spend to fuel the economy. I don’t know if he quite gets it yet. It is scary that he wields so much power in our government, and yet can’t seem to see the big picture.

Saw a great article in this week’s Business Week talking about this exact same thing. Our country’s economy’s growth is a mirage based on borrowing. It suggested that if our country were to actually try to do something, it should be spending on infrastructure and things that will actually produce goods/technology/jobs, not just more consumerism and debt.

It’s starting to looks like Obama may win. With a Democratic controlled congress and President there is talk they will want to pass bankruptcy court cramdowns on loan remodification. Doctor HB, I was curious on your thoughts on what this might do to the housing market.

Daily lurker, first time poster.

You finally gave voice to some of the thoughts I have been having for the past half-decade. As a guy who has been an adult through a couple of recessions, I have been aghast at the rampant excesses of credit and conspicuous consumption.

You are correct that savings is implicitly (never explicitly!!!) discouraged. There are rewards for spending future earnings, like zero interest loans. There are also punishments for saving of current earnings like zero interest savings combined with inflation.

I think that one of the reasons for discouraging savings is because we are in a post-industrial economy. There is no economic advantage (for the big playas in gov’t and industry anyway) in having our citizens save money – and if anything it will result in a loss of many service-sector jobs if that happens.

Instead we are encouraged to “invest” in real estate, stocks, or take out a loan to start our own (tax avoidance scheme) small business.

Lastly, it’s not an accident that people coming out of college have tens of thousands of dollars of debt as they start their adult life – it’s to get people into the harness of debt at a young age, and keep them there.

I could not agree more with you. I believe in saving for a rainy day, charity, and the debt free lifestyle. I save 15% of my income, whether in short term savings, or long term retirement accounts. Since my time horizon is 25 years away, I do not worry about the stock market’s gyrations. I also give away 15% of my income to charity, to help the less fortunate than I. While I make more than than the median wage in America, I do not make anywhere near the top 10% of Americans. Thus to live on 70% of my gross pay, and still pay taxes, means that I have to live a frugal life.

While the iPhone is a neat gadget, my old cell phone works just fine. While a new car would be nice, our 10 year old van still runs. My one soft spot is for books. I love buying books and reading them.

I am still working on being totally debt free. Only 9 more years left on this fixed 15 year mortgage @ 4.875%. I am living frugally to pay it off early.

Great work, as always.

I loved today’s post. We were buying up savings bonds during the stock bubble and people thought we were nuts. We maxed them out for ourselves and our children. They are paying for their college educations. I wish I could have gotten more of them.

Focus not on the economic issues. There is a much larger and more ominous picture here. Uncensored can be found at whatdoesitmean.com. Read Enoch and free books by Ronald Weinland. America get out of the market and prepare for martial law, The North American Union and Amero. Illuminati/fallen angels/demons/alien to us……………………PENTECOST 2012 creeps….see you at Armageddon love your worst nightmare, an alert, critical thinking, non chemtrail sedated member of the remnant of Christ. our stolen goods and futures will be of no comfort to you in this tribulation. Love and blessings to all others Pamela

they have no savings cause they have invested all their moneys and savings have lost purchace power due to the price inflations that were not included in the inflation calculations and by manipulative purpose.

It must be over a decade ago that I heard a business report that said a major retailer made more money from its financing division than it did from its retail operations. This raised a flag in my business oriented mind. If these retailers are making such a big profit off financing, then that money is coming out of their shoppers pockets. After that I was dead set against consumer credit.

I think this could be a sixth reason why we’re supposed to keep spending on credit. Because it enhances the profitability of big companies even if it’s hurting us. Of course, the tables have turned as people default and the big companies get hurt.

I completely support the majority of your knowledge on this article. Although i wonder how the 5th reason relates to the topic. You state that “saving money is good” yet you back up that statement with no direct facts. I do agree that it provides a sense of personal optimism but it doesn’t completely reassure an individual that saving money in a bank, (or mattress. ha ha) is worry free. Id say that with the government ready to drop 700billion on bailing out companies, then they should very well be ready to drop the same amount on the individual if a similar occurance may happen.

This article is absolutely spot on! It points up an area of concern that others in the financial sector have not raised – focused as they are on $$$$ instead of people.

That issue is the reaction of the American public to tough times. Dr HB points out that there is a kind of anger in response to the loss of easy credit and any inference that individuals are now going to be forced into sacrifices they do not want to make.

Of course, no one wants to sacrifice if they don’t have to. But that’s the problem here – sacrifice is not going to be requested – it is going to be required to cope with the tough times ahead. And this is where, as DrHB points out, there is a different psychology at play.

The Americans who faced the Great Depression had indeed lived through the excesses of the Roaring Twenties. However, the decades preceeding the Twenties were filled with binge and bust cycles in the economic system – and people were not unaccustomed to that. Furthermore, the majority of Americans at the time of the Great Depression either lived on the land or lived in small, rural communities. We weren’t yet a completely ubanized society. Also, the concept of frugality was deeply ingrained in the American psyche. People who spent excessively and lived beyond their means weren’t admired – they were scorned as profligate and wasteful.

In addition, the Americans who faced the Great Depression had never seen anything like the credit availalbe today! If a family wanted a luxury of some sort, they saved for it until the had the money for the purchase. No money – no purchase. No instant gratification.

As a nation, we now have an entirely different mind set. Beginning with the Reagan years, Americans we told they could have anything, and have it when they wanted it, and the supply of ……prosperity …. natural resources……. plastic junk….. cheap oil….. would never run out!

I agree that saving is good. But I also have a doubt about the future of the dollar. All fiat currencies crash.

Outstanding article. Thank you.

Many of my friends, colleagues and family used to give me a wary eye when I told them I was heavily invested in physical gold and shorting the market in my stock accounts. Now they are asking me for advice but aren’t yet ready to make the switch even after losing most of their investment money.

Trying to convince someone that cash and gold held outside the banking/government system are great investments for the times ahead is like trying to convince the average brainwashed American that terrorism is not and has never been a big threat to our country.

For some reason, most people simply want to keep drinking the Kool-Aid. Once they finally figure out that it’s laced with cyanide, it’ll be a little too late…

I guess I’m a girlie man Doc. Wife is mid 30’s, I just turned 40 and we are saving

a good chunk of our net each month. We have the mindset that the market

is no were near a bottom. We have no debt, repeat, no debt. So when the stars

align for us, we will have at least 20% down maybe even more for our home purchase.

As I am writing this CNBC is on in the background and the discussion is California Dreamin’ with dumb comments about how the thought is now that San Diego and Stockton have “bottomed” out. My question is, were does the media find these fools for these shows? I hope in the future shows like this and others will have commentators who have not become punch drunk on the govt kool aid that’s been going around for the past decade. Get folks that speak the truth no matter how painful it may be to hear.

I enjoy your articles and keep up the good work.

Well put, I just published a post today encouraging my readers to open online savings accounts and to stash away some cash, even if it’s only a few dollars at a time. Over the history of the stock market, the gain is not so extravagant. When we take into consideration inflation and the ups and downs of the market the average return hovers around 5-6%, making a 3-4% savings rate seem damn logical, especially since it is guaranteed!

Luckily (for me) both my parents grew up in Communist Poland so I’ve developed a sense of frugality from them. Anyone who thought our consumer credit based society could last just does not understand basic economics.

RE: the TreasuryDirect card login, I’d bet that’s merely Federal security protocol (even a law?) driven. Dept of Defense employees and Servicemembers have all replaced their old ID Cards with new ones referred to as “CAC” (Common Access Cards) which have a microchip with personally identifiable information loaded on it. When servicemen log into their online military pay website they must now have the CAC, a CAC reader (usually attached to a PC via USB), and use the same “screen keyboard” to prevent computer hackers from stealing your password via a keystroke-saving program/virus. I’ve heard of other Fed agencies (DoJ, DoS, DHS) also instituting these types of security protocols in an effort to prevent hackings etc.

I agree with the overall point of poor user-friendliness and 100% with your overall assessment of the disincentives gov’t (and society) has in place towards savings. In the private sector, I know but don’t mind people trying to blood-suck on me; it’s my decision to allow it or not. I do not, however, attribute it in gov’t to some type of sinister intent; my experience leads me to conclude that no one (of relevance) in gov’t thinks of these things at all. Incompetence, ignorance, and lack of attention to 2nd & 3rd order effects throughout higher level gov’t is horrific nowadays. The Fed gov’t (and many a state, too) has been careening along on whichever way the wind has been blowing, and we’ve managed to pin the sail-driven Ship of State in a rocky cove with a head-on hurricane wind blocking our escape. We’ll run aground shortly; I hope everyone’s picked out their favorite piece of flotsam to keep themselves afloat.

Great post, I really appreciate the macroeconomics thrown in for good measure.

These are truly frightening times for savers in particular, because I believe we are the people who eventually will be called upon to sacrifice for the collective good. Whats really bothersome is the way other governments namely Argentina, appropriate peoples life savings so glibly under the camouflage of “protecting retirees interests” when in fact they’re doing it to pay for the national debt, I fear their precedent may be followed here.

I think this economic event is going to be SOCIALLY disruptive. I think a whole new culture is going to be somewhat violently birthed. It will be a culture that resembles other past cultures and will have such quant things as values, frugality, honesty and integrity. No more will relativism be the celebrated and vaunted philosophy. Ideas such as those will be despised, boorish un-civility will be severly punished by social contract.

This all is going to be a good thing eventually. We have went too far off of what can be described as a normal societal vector and de-evolved into yet another historical cautionary tale rivaling Sodom and Gomorra.

I am not a religious person in the least, but I do understand that societal organization is a fragile and time honored construct, and all religiouns appear to have components of societal guidance. With the addition of easy credit and an expansionary bubble, I think we’ve forgotten how to run a just society based on cause and effect. Credit buffers and delays the effects of poor decisions and in our case, due to a multitude of factors we had QUITE a delay, now its time for the consequences.

So get your wallet out and get ready to pay for the past 30 years of excess, but in the end we are going to be a much more attractive society based on time honored societal constructs. How, when and if we get there is anybodys guess, but this must happen for us to again thrive and to revive our perpetual progress.

Schwarzenegger just came out for a Mc Cain-style bailout plan-

I am pretty convinced that the reason is the realization that property values are the base of property taxes without which we have not just a national and state crisis but a VERY local one.

Gotta pay the cops in times like these…

wow! the Californian number make fascinating reading but you should see the numbers over here in the UK . I am in Oxford one of the most expensive housing areas anywhere in the UK . Three times gross income? We haven’t be able to do that since 1990! 6 or 7or even more is the norm for a lot of folk and in dollar/sterling terms your prices look like bargains. We would kill for your house prices and kill even more for your mortgage rates ! its mad yes but what choice do we have ..those who rented during the last 5 years locally have lost £250,000 in equity growth in a 4 bedded house in nice location. That went straight to the landlord- thanks very much! most folk are sitting tight in the belief that market fundamentals remain strong eg huge demand for housing , limited supply . No one can see way out of the circle of debt.

I agree 100% with your general outlook. But I disagree with the idea that our national debt is being “foisted” upon us. Simply put, Americans like getting something for nothing – whether that is government “services,” a house, or SUV’s, Americans have taken to heart the concept of “default.” It is no longer just for Wall street (a so called conservative government that “believes” in capitalism whole plan is to bail out people whose excuse is that they didn’t know what they were doing) – most Americans, taught by the government (that they elected) now believe that repudiating debt is a solution. Because the sonsequences are not immediate, it will seem like its easy and will enjoy support. But at some point, the bill will come due.

I’m an economic girlie man!

Dave

http://daveeriqat.wordpress.com/

So I find that my online saving bank, ING just had a few billion shoveled into by the Dutch government….WTF?

http://calculatedrisk.blogspot.com/2008/10/netherlands-injects-134-billion-in-ing.html

Great article.

Great post, a wealth of information you’ve gathered together here.

The whole economy has resided in a “grab and go” mentality, witness the quote below. This creates a national climate that is the antithesis of saving for tomorrow. Now the house of (credit) cards is collapsing.

The future is going to be enormously difficult for everyone but particularly bad for the elderly who have little chance of generating more income. It’s heartbreaking to see some geezer hanging for dear life onto a broom at Walmart. And those jobs won’t exist soon, in any case.

And even for those who have saved, the money is going to be devalued. Consumption? Based on what? It just looks like “game over” no matter how you slice it, doesn’t it? Hate to be all doom and gloom but where is the ray of sunshine in all this:

Oct. 22 (Bloomberg) — Employees at Moody’s Investors Service and Standard & Poor’s privately questioned the value of some mortgage-backed securities that were given creditworthy ratings, saying they created a “monster,” according to e-mails released by a U.S. House panel.

“Let’s hope we are all wealthy and retired by the time this house of cards falters,” one e-mail from an S&P employee said.

http://www.bloomberg.com/apps/news?pid=20601087&sid=a_GhN6Ihrky0&refer=home

Ok, doc, I’m generally supportive of your posts, but the comment about TreasuryDirect’s use of the password card was really out of line. I comment them on their adoption of enhanced security mechanisms — in today’s world of ridiculous secuirity compromises, I WELCOME the additional security measures they’ve implemented, which prevent key loggers from stealing your financial information. Believe me, once you’ve gone through getting hacked, you’ll beg for these types of measures for all your online account access.

Truth truth and more truth. I wonder how low the dow will actualy go 6k? or even 5k or 4k? At what point will the media admit getting out of the craps table stock market and actualy saving as you said is a good idea? Who knows but I have a feeling by the time they do come clean about that it wont matter any more, there will be nothing left. I have a feeling next on the bailout list will be GM, Ford, Crystler, a few big retial chains, a couple states and maybe Iceland?

Man the dollar is going to look so good in about 2 years. Perhaps our next get rich quick bubble can be recycling penny’s for coper, getting dollars, going to the bank and getting more penny’s, rins and repeat. WE ARE ALL RICH!

wow…sobering, but oh so true.

The best investments outside real estate is beans, bullets and bullion. The only way real estate works is to get “right side up” quickly. I bought with 5% down in 1995, and now I owe less tha 25% of home value. I did this by putting every extra cent I had against the principal. I made more money this way than I ever would have had in a retirement fund. My Mom and Dad lived through the depression. They taught me how to do this.

” those who do not remember the past are doomed to repeat it!”

One fact to state that there is about $7 trillion in savings accounts in banks throughout USA.

I think you are basically correct, but there is a disconnect – you want people to stop spending, but you also want more jobs. But the workers in those jobs have to make something, and if no one buys it, no job. The problem, a huge one, is finding a substitute for consumer spending as a job engine.

A lesser point – you wrote the figure of $2.19 trilliion in local government debt, implying (I believe) that you think it’s a bad thing. However, with some experience in local government, I can say that it is not. Capital projects by local governments are properly financed by bonds, which are paid by future tax revenues. In this way, those who get the future benefit of the project actually pay for it. If a local government chose instead to save money out of tax revenues for a project, present taxpayers would be paying for a project in the future whihch they might never get to use. So bonding (debt) is ethically correct for local governments. And such bonds are essentially always paid off.

>Maybe if we spread this idea it can get to somebody that can implement it.

>It is based on a successful implementation that they did in the 70’s.

>This deleveraging problem has three fundamental issues:

>The market has recognized that energy production and other essential materials are not going to be in expanding supply. Therefore the model for economic expansion is not going to be sustainable anymore. America will have to think about sharing the resources of the planet or follow the path of war and self destruction. The new focus has to be in sustainability.

>In USA the baby boomer generation is starting to retire and the following X and Y generation don’t have the capital to buy the asset that the previous generation has amassed. There is a generational shift happening.

>Credit creation and management has been the focus on this economy, credit has been our main product and a big part of the problem.

>So, to stabilize the markets there has to be a focus on the assets the system is based on, and that is housing.

>Government has a key roll in propping up demand, but at the same time let some of the natural correction to continue.

>Create a tax incentive to new home buyers (Between $10,000 to $25,000) depending of the value of the home.

>Support a mortgage plan backed by the government (Fannie and Freddy). 30 yr. fixed only!! with 4% to 5% annual interest rate.

And some of the restrictions should be:

>Buyers will need a 10% to 20% down. And the more you put down the more you can move the interest rate.

>For the incentive to work the buyer should not be able to sell the house in three years.

>And finally it should have a cap in the mortgaged amount of 5 times the amount of gross income. Use tax return in 2007 for proof.

>Now, for the stock market, we should move the cap for the ROTH IRA accounts and 401K to double what they are.

There is one way to have a lot more jobs without people having to “buy” anything: infrastructure. We are a first-world nation of riches but we’ve had bridges collapse within the last 5 years. We need public transportation, roads, renewable energy. And that’s just assuming that we just update what we have. We could be radical and redesign our communities to be walkable, or something else creative.

America needs a remodel. There is plenty to do. Maybe instead of a bailout, the feds should have sold 700 Billion dollars worth of bonds to pay for it.

Katja,

Off course you are right, many people could be employed rebuilding our infrastructure, But who would pay their salaries?

In part, this can be privatized – the Golden Gate Bridge is famously privately owned, as is the Ambassador Bridge from Detroit to Canada. Bridges are profitable, but it is hard to think of a way to charge someone for using the pavement on Main Street, or the sewers underneath it. It seems that infrastructure is a public good and the only realistic employer for infrastructure is the government, but then Americans will have to be willing to pay more taxes for the work. With both Presidential candidates vying to cut taxes, it seems unlikely.

However, it is nevertheless possible. There is the example of good ol’ Bill Clinton, whose first act as President was to raise taxes, setting the stage for a balanced budget and (I would contend) a prolonged economic expansion. So we can hope that whoever becomes President will follow this good example, and sneak the bitter medicine in while no one is paying attention.

That graph on the dwindling down payment is really telling. Personally, I put 10% down, so it’s good to know I’m not in a hole, even if home prices dip a little bit.

Leave a Reply