San Francisco Tech Driven Real Estate Insanity: Current median home price at $1.3 million or $400,000 higher than the last housing bubble peak.

San Francisco tends to put Southern California to shame when it comes to real estate mania. The tech driven frenzy in the Bay Area is something to behold. What is so interesting is that San Francisco, being the hippie and alt-culture hub back in the baby boomers heyday, is now fully gentrified by tech and investor owners that really have little to do with the hippie and art subculture of the area. I mean how many hippies can afford a $1.3 million crap shack? The Bay Area continues to defy gravity when it comes to prices. People are having to “drive to qualify†if they aren’t the DINK tech couples or investors with large pockets. Of course by definition the ultra-wealthy are a small part of the market but with few properties for sale, if they have a desire to buy they are going to buy. This is why you hear of stories of Google employees living out of vans even though they make what most would view as a fantastic salary. San Francisco continues to march on a unique path.

San Francisco breaks through a new peak

San Francisco real estate has been as hot as the NASDAQ. There is an allure to being part of the new tech-uber wealthy class. Wearable tech, top of the line phones, cars that drive for you even when you are half awake. So it is interesting for a region so self-aware that they are more than happy to purchase $1.3 million crap shacks. Many younger tech workers are not falling for this and that is why the homeownership rate in San Francisco is among the lowest in the nation. Short of you wanting to mortgage your life away writing code for a company that might be out of fashion in two years, you need to be nimble and flexible with your ability to learn.

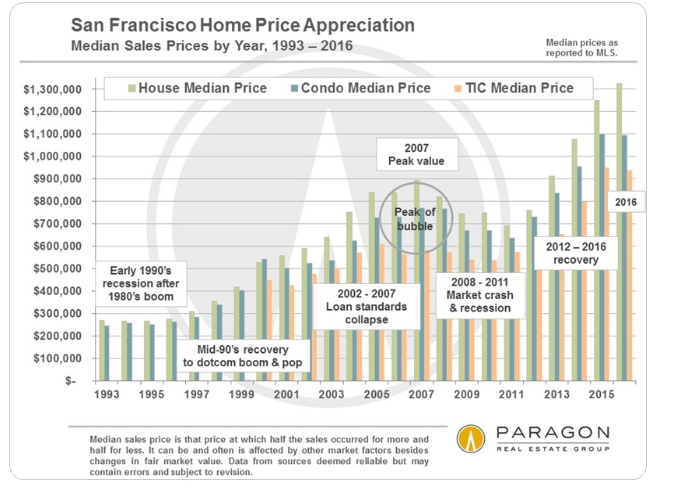

And there are so many instances of people being priced out with great incomes. But manias go beyond the rational. Take a look at the increase in prices below:

Home values seemed insane in 2007 when the median home price was $900,000. But just look at how things have turned. Now the median price is $1.3 million and the common response is “I wish I bought a crap shack then!â€Â It is funny that this is viewed as “safe†yet taking a “risky bet†on say Tesla over the same time is just plain crazy:

Do the math here. Let us say you are a genius and bought at the dip in 2010 or 2011 when the crap shack cost you $700,000:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $140,000

Equity gained:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $600,000

We’ll even say that this person bought with an interest only loan to keep the math simple. Now say you invested that $140,000 in Tesla:

$140,000 in 2010 would have bought you 5,600 shares of Tesla.

Those 5,600 shares today are now worth $1,533,896. Even after tax gains, you are way ahead making the risky bet on Tesla.

I mean that is the problem with real estate manias. Even when people rewrite history, they fail to mention all of the other alternative investments that would have made sense. And this is Tesla! These tech people are buying them left and right in San Francisco. You didn’t need to be a genius to know this company was going to do well.

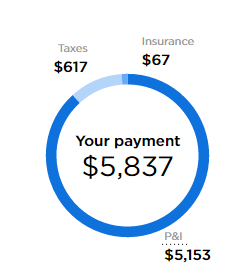

Yet that is my point here. For whatever reason, real estate is viewed as ultra-safe even though you are putting down a big amount of money that is locked down and can’t be used for other investments. This is the true nature of opportunity cost. Now is that crap shack worth $1.3 million today? Do the math here:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $260,000

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,040,000

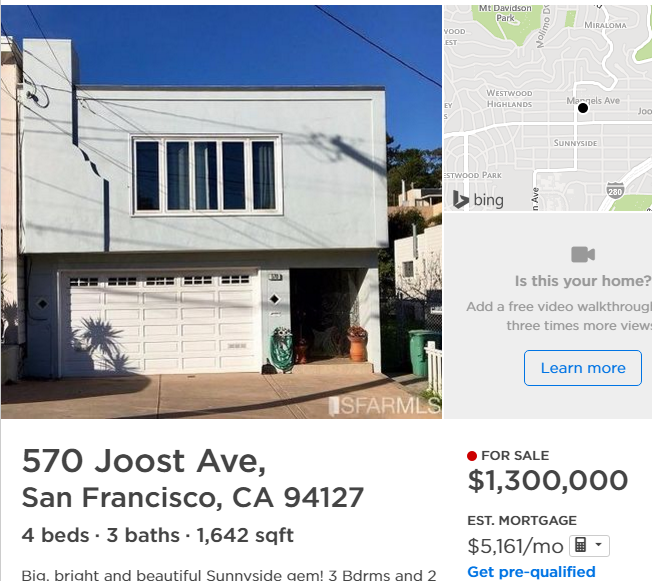

You are paying almost $6,000 a month after putting down a sizable down payment. Here is what $1.3 million will buy you:

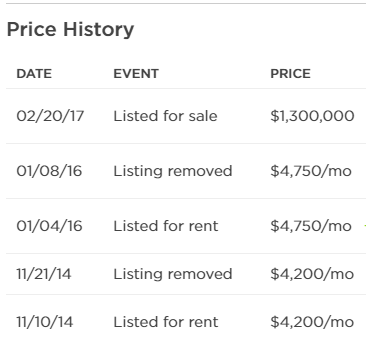

And this place even gives you a bit of rental history:

Notice how renters don’t stay that long? Could it be that other opportunities come along? Or do you want to be stuck here for 30 years with a big mortgage? And you can’t assume prices will simply keep going up but they can in a mania. But that is as risky as betting on the next Tesla. Then again, some like to believe there is no risk in buying a home in a mania. Try telling that to the 7,000,000+ people that lost homes in foreclosure over the last 10 years, 1,000,000 of those in California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

171 Responses to “San Francisco Tech Driven Real Estate Insanity: Current median home price at $1.3 million or $400,000 higher than the last housing bubble peak.”

Another good graph – graphs are pictures and a picture speaks more than a thousand words. Graphs are plotted based on numbers and numbers are not opinion or propaganda.

http://gainspainscapital.com/2017/02/22/is-it-autumn-2007-all-over-again/

Note: I suggest the bulls to go out in force and buy any crap shack in sight. I am not stopping anyone. I can’t explain though what are they doing on a blog like this if they are so busy locating the best deals. After all,….Trump is a real estate guy…isn’t that enough assurance???!!!

I predict warmer temperatures in Spring!

As I mentioned before, those who can’t, preach. I suspect a lot of RE bulls are urging others to buy now to rationalize the current value of their properties.

The water’s fine in Sacramento so dive right in wherever you are!

I agree 100%

I do recall back in 2000 with the dotcom meltdown that the crash started right before tax season on a trivial issue which was the Microsoft case. After that fiasco I think some things were set in motion after that event. I do recall a lot of IT were hurting after those days. Seems like something will need to trigger a correction soon. The salaries they are throwing at these people certainly can’t go on forever. I feel a correction maybe coming this year before a recession is realized. – all in my opinion

I bought a condo in Brooklyn in 2007 and my interest rate was 6.5% and I had a 2nd with an adjustable at 8.75%

youz can figure out the exact numbers, but $1.3 million

4.5% = $6590 + $1360 taxes = $7950

6.5% = $8217 + $938 taxes = $9154.5

I know you have the down payment and the lost opportunity of not investing that money in other places. I would suggest a lot more people were putting 0% down back in 2007. although they lowered DP requirements, a lot more people are putting 20% down than in 2007.

2 things about bulls: you can be a bull and not have the money to buy a house and you can be a bull and also want to read what the bears have to say, because at some point the bull will become a bear. It is important to hear other peoples views.

I was so sure the real estate market was going to tank 2 years ago I sold my fixer upper in Glassell park after only owning for 18 months. I did not think the market would make it after the summer of 2014. I ‘made’ $150k after taxes, renovation costs, and agent fees.

Being addicted to the gambling of Real Estate I purchased another house 6 months later (2 years ago for those not keeping track) in Eagle Rock. I basically looked for properties that were on the market for 6 months or more and offered $100k less and after 5 houses we got one on the freeway. ok, 300ft from the freeway.

we paid $645k

it was build in 2008-2010 and is 24oo ft on a hillside with views of the 2 freeway, glendale cemetery, and downtown. with 9ft ceiling, zone a/c. WE illegally turned the master bedroom into a studio apartment with a kitchenette that we rent for $1575/month

So what your saying is buy the $SNAP IPO?

bwahahaha!

It appears to me the “tech” industry is already in decline. Very few IPOs in 2016, you have a few big players out on top.

Every industry goes into decline and has decreasing innovation. When the auto industry was first taking off I guarantee you people said the exact same things about Ford and AMC. That was “tech” back in the day.

Now you really don’t hear much about Ford stock and AMC is defunct.

Google and Facebook have come out on top and the rest of the noise will disappear. Onto the next thing. Lets just hope California figures it out and not China or Japan.

Innovation could happen anywhere. Apple was started in a garage. Maybe the next big players are some teens in Pismo Beach. Will Pismo Beach become the next $2M housing frenzy? I would feel better about that than “old news” San Franny. Maybe it’s not even in CA, how about Nome, AK?? INVEST HUGE IN NOME, PEOPLE. Get in now or be priced out forever. They don’t make more NOME.

I don’t know about Nome, but if the Chinese ever decide they want to pull a Vancouver in Alaska, Anchorage real estate is going to soar! That or if oil goes back up to above $100 barrel. Otherwise there short-term future looks bad (which is technically the best time to buy)

The current cycle is more representative of the .COM bubble rather than of innovation. Those money-losing enterprises have shifted from the web-based to mobile-based platforms. Solutions in search of problems and really haven’t created any new industries to drive the economy.

Twitter, Snapchat, Uber, Airbnb, etc., are basically living on investor desperation for yield and are hoping for a takeover as their long-term salvation.

I agree . From my view a majority of these dotcom IPO’s that have come out are essentially an acquisition target. Most of the internet services likely won’t be around or be morphed into something else over the next decade or sooner in my opinion.

But the area is just SOOOO DESIRABLE. Everyone in the world is drooling a Hoover Dam breach just to land this property” They’ll probably have thousands…no…MILLIONS of bids. Housing is global! There is no local market. There’s no end to where prices can go. We will be PRICED OUT FOREVER!!! (sarcasm)

And if I owned this property, I’d be feeling myself up in my driveway because of my wealth….(oops…more sarcasm

Tech industry pays a lot and the foreign money drive the home prices higher than the income of people born in The City. It is all about the money, not the quality of life. It is true, that L.A. homes look cheap in comparison, but then again, who would want to live in the city(L.A.) who has the worst traffic and infrastructure in the world.

Tech industry does *not* pay a lot, except for a very few people. As industries go, the pay scale is much “flatter” in things like government service (hey, they’re hiring 10,000 more immigration agents!) or a lot of “non-sexy” industries like HVAC, pipefitting/steamfitting, machine shop, etc. Tech has a tiny slice of superstars at the top, and a lot of $15 an hour grunts at the base. New BSEE, CS, IT grads making $15 an hour, no kidding. The ones who luck out, an amazing number go to work at Starbucks or Cold Stone.

Tech overall is 8% of San Francisco’s economy. Two companies, Safeway and Kaiser Permenante, are the two biggest employers here in San Jose.

Go into something you like to do. Assume it will pay shit, live frugally and wisely, and enjoy your life. The day will come when you’ll be at your local bar and the guy next to you will be sobbing. You’ll ask him what’s got him down and as he lifts his despair-ridden face from his folded arms, you’ll realize it was Mr. Hot Shot from high school. He went to college, for engineering, hated it but had the brains and it was supposed to be where the money is. He turned 40 last month and they laid him off. Now he’s out of work and you’re making custom boat propellers or making those wooden signs with a router or restoring old Chris-Crafts or something, not making much but enjoying life, and you realize you really dodged a bullet there with your string of solid C’s in high school.

Alex, you are a real “Debbie downer”. I gave the MSM line on the income structure. But as you know, the market price, with low volume is determined by the few transactions, that the people with money make. But the American IT worker, even if $15 an hour as you say, is still too high for the employers, hence they bring in on H1b Visas, the trainees from India that American workers must train to replace them. I know that for all the nice lovely commercials that the high tech industry comes out with, they are as ruthless capitalists as any JP Morgan, Koch Bros, or Soros. Greed is greed, whether it is me or JP Morgan.

You can continue posting that and it will continue to be untrue. Is it that you think people will take your word over the actual numbers? Because they don’t. Tech pays and it pays well – for anyone with more than two years experience. Right out of college you will pay your dues, as with any career.

Alex,

This is the biggest point you continually make that is dead wrong. I don’t disagree that a lot of people are getting substandard wages for tech in the bay area given the cost of living, but these wages you cite are easily refuted;

Systems Engineer Salaries in San Jose, CA

838 Salaries Updated Jan 26, 2017

National Avg $85,000

San Jose, CA Area Avg $95,007

https://www.glassdoor.com/Salaries/san-jose-systems-engineer-salary-SRCH_IL.0,8_IM761_KO9,25.htm

It sounds like they only offered / paid you $15 twenty years ago, and you are still bitter about it, or are just hating on the fact that you went into the wrong field, in the wrong time/place.

Ira I prefer to think of myself as a Ruth* Reality. The truth is, for the vast majority of workers in it, tech does not pay as well as going to work for the post office, water plant, something un-sexy.

For the hotshots, enjoy it while it lasts because you’ll almost certainly be “expired milk” by the time you’re 45.

For the vast majority, yeah, tech is a field where you normally aren’t getting grubby and dirty, lifting heavy things etc. Hence the low pay – you make less but you save your back.

But overall, even in Tech Central, where I am, tech is only 5% of workers.

I’m not sure how many times I’m gonna hafta say this, but **do what you like and assume you’ll get paid shit, then if you get paid decently, it’s a nice surprise**

*Nice Jewish name, I like it.

Jon, so San Jose only pays 13% for than the national average, but the cost of housing is like 200% plus, so the salaries may seem like $15 an hours in Texas.

“San Jose, CA Area Avg $95,007”

which is about 1/3 the income needed to qualify to buy the listed house. Just sayin.

Alex, these are SF postal salaries:

Mail Handler – $15.16/hr

Casual Mail Handler – $11.86/hr

City Letter Carrier – $19.69/hr

Postmaster – $73,743

Supervisor Customer Service – $64,467

Better benefits, certainly. Better pay? Not even close.

Age isn’t an excuse. Half the people in my department are over 45. I know a development director at a Fortune 200 company. Late 40’s, she makes at least $150k/year, without a degree. Not a single unit of college classes. Whip smart, crazy work ethic, and entirely self-taught. Any experienced, degreed tech person who is making $10-15/hour is not trying – period.

And the companies are welcome to outsource – maybe I’ll be around to pick up the pieces of that disaster in a few years.

I agree with the idea of doing what you love. Luckily I enjoy my work. If I didn’t, I would probably be a broke day trader.

Alex-

Thats a real fantasyland novel you wrote there…

I love my job and if they laid me off i would still be happy. Its business. Plus i would get unemployment and could pursue my hobbies until i find a new job. Everyone should always have a backup plan.

For the record I didn’t say housing wasn’t overpriced, in a bubble, or affordable for the VAST majority. As previously stated, it’s not just about the pay, its about the cost of living and quality of life. The job that I quoted is like a mid-range engineer, they scale up to about $170k for Sr. Developers;

https://www.glassdoor.com/Salaries/san-jose-senior-software-development-engineer-salary-SRCH_IL.0,8_IM761_KO9,45.htm

Still though, you would need to be programmer DINK’s with roomates to comfortably afford a 1+ million dollar crap shack.

Ira – “Silicon Valley” is not a “company town” like the oil fields or something, where there are a ton of people in one industry where they’re so desperate for people that even doing fairly lowly non-engineer jobs you can make da big bux.

We’re more like a town, that has a few companies. Tech is 5%-8% of our economy depending on who you ask. Our average pay is not that much higher than the national average, and when you factor in COLA it’s not great at all.

Alex, even if you believe the BS that you spout about tech jobs, you really should consider just stopping any discussion of it, because you’re way too far off from reality.

You say that San Jose is only 5% tech workers. I say you’re wrong. It’s closer to 30%. See here: https://www.quora.com/What-percentage-of-SF-inhabitants-are-tech-workers

Do I really need to pull references for salary numbers again? I’ve given them to you before…

I am wondering now with Trumps new plan to bring business back to the US that it might make it easier to have H1b workers in these facilities? If the facility stays in the US would that be considered a safe house or “Sanctuary Office” for H1bs?

I was working in Santa Clara in 85, Sunnyvale flat tops were going for 140K

At the time 140K seemed like a million now. It’s where the jobs are.

You can find some lower priced homes in San Leandro and Hayward for 600-700K.

2 years ago they were going for 350K. I’m in Manteca and can’t get out.

I told Donald to have Ivanka tell her friends to gobble up SoCal homes. Silicon Beach has only just begun to drive up LA home prices, the latest will be the IPO of SnapChat at about only $20B. Then, San Diego, which will follow. You stupid American Trump supporters; he’s conned you again!

There are no Trump supporters here, only Gov Brown supporters. Gov Brown is a genius the way he manages the state. Unfortunately, in the land of the philistines, L.A., the infrastructure is hopeless. L.A. is number one in the world for gridlock.http://epicmagazine.com/silicon-is-just-sand/

I’m a gov. Brown fan but I’m happy as hell that Trump shot down that idiotic high speed rail project.

Alex,

You used to say that you do not like the massive invasion of illegals. Now you like Brown who supports that and even want to make the whole state a sanctuary state. Based on your prior comments I would have expected you to support Trump policies on illegals.

So, which one is your position?

Some of us support the President. Just really sick and tired of know it all hypocritical politicians taking more and more of our money and wasting it on high salaries and worthless services. I hope he can reduce 90% of that place to tiny pieces of rubble. Both parties both Houses and both branches.

Flyover – You hit on a very good point.

My position for years and years has been “NPI” – Nationalist, Protectionist, Isolationist.

By this, I meant just what it says, but in Nationalist I meant all races and ethnicities who are in the US and in many cases have been in the US for decades and often centuries. For instance, this is going to make a lot of heads explode but most Americans of African heritage have deeper roots in the US than most American whites, because they are the descendants of slaves brought here pre-1860, where a shitton of whites came here post-1860 in the vast waves of immigration from Europe and Eastern Europe (the Czar allowed people to leave post-1870 and tons left).

So, by “Nationalist” I meant not any one race, but the ethnicity we’ve all been encouraged to become, American.

But the Neo-Nazis/Trumpoids have actually set up something called NPI, for National Policy Institute, and behind this bland-sounding name is an actual organization aimed at making the US a white racial state. They want to kick out not only illegal immigrants, but pretty much everyone who isn’t their version of “white”.

Kick out illegal immigrants who have committed violent crimes – Obama – good idea.

Kick out illegal immigrants who have committed *any* crime – Trump – and I agree with this because if i wanted to move to another country and committed any crime, they’d kick me out too, so that’s fair and I think this is OK.

But what the Neo-Nazis/alt-right/NPI people want is to kick all nonwhites out and you’d better be their kind of white. Meanwhile because they’re big-business friendly, still allow tons of Indian H1B’s, tons of Chinese to park their ill-gotten gains in US real estate, etc.

Meanwhile if they pull it off, will the US become a world pariah? It’s already hurting our economy because we know Trump and is followers are going to push for the full NPI program – if you ain’t white, you ain’t right. And again, you’d better be the right kind of white; look at how the first-edition Nazis treated the Poles.

Putting an iPod jack into a new line of cars does not mask the fact that less and less people can afford cars, and that the economy is sinking. And in sinking economies you get things like we’re seeing. People becoming tribal and deciding to keep their own wealth and standard of living and well, too bad about their neighbors who had to leave in a hurry, who were dark-skinned, or of the wrong religion, etc. Maybe all we’re doing is returning to what’s the norm.

Ira, you are pretty ignorant.

There are trump supporters everywhere. In my neighborhood in West Hollywood my little 4 block district had 170 votes for trump, which was like 16% of the votes i believe.

wait……are you trying to imply that Obingo didn’t con everyone?

“if you like your health plan you can keep your health plan”

“this is not a tax” supreme court “it’s legal because it’s a tax”

I mean really dude, the Donald simply can NOT be any worse than Killary.

I really don’t get this hatred of Trump, I didn’t vote for the guy but these Donald haters are worse than the “he’s a Muslim” haters of the last 8 years. I just don’t get it, these clowns act like the fucking world is about to end because of Trump and he is Hitler.

The nation AND the world has gone insane.

wait……are you trying to imply that Obingo didn’t con everyone?

“if you like your health plan you can keep your health plan”

“this is not a tax” supreme court “it’s legal because it’s a tax”

I mean really dude, the Donald simply can NOT be any worse than Killary.

I really don’t get this hatred of Trump, I didn’t vote for the guy but these Donald haters are worse than the “he’s a Muslim” haters of the last 8 years. I just don’t get it, these clowns act like the fucking world is about to end because of Trump and he is Hitler.

The nation AND the world has gone insane.

I hated both candidates. Hillary and Trump are both terrible.

However, some things Trump is doing are OK. And, a few others are not so good. Time will tell. He might work out.

Somebody is afraid of losing power. That is the reason for demonizing the adversary.

People need to remember the story about the boy who cried Hitler.

From the AP headline: Americans Buy Existing Homes at the Fastest Pace in Decades: http://hosted.ap.org/dynamic/stories/U/US_HOME_SALES?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT&CTIME=2017-02-22-10-01-25

Americans shrugged off rising mortgage rates and bought existing homes in January at the fastest pace since 2007. That has set off bidding wars that have pushed up prices as the supply of available homes has dwindled to record lows.

Home sales rose 3.3 percent in January from December to a seasonally adjusted annual rate of 5.69 million, the National Association of Realtors said Wednesday.

Steady job gains, modest pay raises and rising consumer confidence are spurring healthy home buying even as borrowing costs have risen since last fall. Some potential buyers may be accelerating their home purchases to get ahead of any further increases in mortgage rates. With few homes available for sale, buyers are pressured to rapidly close a deal as they find a suitable property.

“Some potential buyers may be accelerating their home purchases to get ahead of any further increases in mortgage rates. With few homes available for sale, buyers are pressured to rapidly close a deal as they find a suitable property.”

Oh yes, because the best deals for buyers are performed under duress.

I have 3 friends who are RE brokers in SoCal. One in WLA, one in Irvine and one in Del Mar. Interesting, all 3 of them have intimated to me that they all have a bevvy of buyers drooling at the mouth to purchase a home in their respective areas. Any home that comes onto the market that is priced according to comp’s is sold in 1-2 weeks. Crazy.

No I am not a bull, I think today’s prices are unrealistic and the down cycle should begin soon. Nevertheless if you can afford the mortgage payment, taxes insurance, and maintenance (estimated at $1 per sqft per year) and plan to live in the same spot for 10+ years, you probably would not lose money.

On the other, hand my niece who had been a RE agent for the last dozen years in SoCal had to leave her job because she could not make money anymore. Too few homes for sale and the prices too high. You probably have to be a top real estate agent in a given area for many decades to get the listings. This would be no time to try to get a RE license.

There are just a ton of RE’s and not a lot of homes for sale. We live in Carmel Mnt San Diego and we have RE’s go door to door at our condo complex and drop pamphlets with recent sales to see if they can get more owners to sell. Prices have jumped quit a bit in just over 3 years.

My wifes cousin just got her RE license 4 months ago and has already sold 3 homes. So not sure your comment is accurate.

My friend is a RE agent who struggles. Most of his time is spent in eastside costa mesa. This area is between the 55 freeway and Newport Beach. He said he has a handful of phone numbers of people that want to buy, but no sellers. He said he has resorted to knocking on doors to find listings, but nothing. He is ready to look for a new job because he needs money to make his own house payment. Personally, such real estate conditions are unusual, but once a recession strikes, that should end. The question is when will the recession strike.

So says the National Association of Realtors based on a survey using an unpublished adjustment model! In other fake news, China reports 8% GDP growth.

Son of a Landlord, I would not waste my time reading fake news. I started reading the article and stopped when it said “The NAR said Wednesday”. We all know 80% of all realtors lie and need to trick you into buying an overpriced crapshack because otherwise they make no money. The NAR (National Association of Realtors) is the head of the snake. So you can be certain that 80% (I would say more like 90%) that comes from the NAR is alternative facts. They need to spread the propaganda in order to keep the bubble alive. In my experience, if you do exactly the opposite from what a realtor is telling you, you are on the safe side.

Frankly, you need to spend 2 million for a small home in a great area in either city. Manhattan Beach is no different than Palo Alto. Santa Monica north of Montana is far higher than Palo Alto. I just don’t see the difference.

My brother in law lives in Mountain View. He actually thought he would sell that then move to Manhattan Beach with extra cash in the bank. However, he found it was the other way around … he needed to add money to get into Manhattan Beach.

However, when it comes to the important things in life, like hot women and sunshine, hard to imagine anyone living in the bay area.

I disagree with most of what you say but you are dead on about the bay area, and its lack of sun and babes. F that noise!

Buy Now!

1) Next crash will only be a 5% drop so its not worth it to wait. Buy now!

2) Buy now or be priced out forever!

3) Buy now and stop throwing you money away by renting!

4) 1,3MIo is cheap compared to what prices will be in 5years. So buy now!

5) You can only accumulate true wealth by buying RE. Buy now!

6) Grow up Millennials and get out of the basement. Buy now!

7) Almost forgot stable retirement! Buy now so you can enjoy a stable retirement!

8) Nobody got ever rich by renting. Buy now and get rich!

9) Sweat equity is great. Buy now!

10) Trump is a real estate guy. He will make this housing market even greater. Buy now!

Let me help you.

11. They ain’t makin’ any new land!

12. Your city, [insert city name], is undergoing gentrification!

13. Your city, [insert city name], will become a destination for international cash buyers!

14. There never will be a better time to buy! Or until the next time you have to buy.

15. The Fed will do everything to make prices go up! Who cares if a slice of bread costs $10 as long as a 3/2 Santa Ana SFR is worth $10 Billion.

Thanks Prince of Heck! I love it! I’ll make sure I remember these!

Just thought of a few more.

16. Interest rates are still low! Buy now before rates are going up. Buy now and save money!

17. Rents are skyrocketing! Rents are skyrocketing!! And rents are going even higher next year! Buy now!

18. Buying RE is a forced savings plan. Buy now and start build equity!

19. Buying is cheaper than renting! (fine print: if you put 30% down)

20. Housing market is expected to increase by 12% next year. Buy now or lose out. Renters have nothing to show.

21. Arent you tired of looking at the same colored walls? Well if you owned you could PAINT them! What better way to spend what little time you have off from work (necessary due to an insane mortgage on a suicidally overpriced shoebox) than to be indoors huffing paint all day! Sunburnt sand anyone?

No, no, no, you guys got it all wrong. 1) No tank in sight. That is all. Because I said so. I’m the most foresightful person ever, believe me.

You guys forgot about the KIDS! How can they be expected to grow up in a rental and bounce around from school to school. Don’t forget about the KIDS!

You’re too late. We are already priced out forever for at least the next 300 years. One house will be more expensive than the combined global GDP.

I take exception on that land thing. There will be plenty of land when we colonize Mars next week. We’ll just divert water from the Colorado river to irrigate it.

You sound like a typical real estate agent!!!

@Tony the tiger!

Thank you! I’ve heard the same BS from every realtor (just worded slightly differently) and many RE bulls on this blog repeat the same RE cheer-leading phrases so I thought its entertaining to list them here all. Maybe you know one that I missed, that should be included?

Notankin son

Your comment reminds me of those cash for gold commercials that used to be on all the time. Or a car dealer commercial where they are very aggressive about discounts and i feel like i am being yelled at.

I hope you aren’t serious

The whole thread has been a parody of NoTankingInSight’s posts. So take its seriousness with a grain of salt.

Isn’t capitalism great? As soon as the price of gold fell because of ZIRP, cash for gold stores were replaced by overnight lending companies.

I’d say it’s not mania, just simple stratification of society. There are plenty of highly compensated folks in the Bay Area making several hundred $K/yr. These are the folks buying houses anywhere close to San Francisco. The rest are the new class of technoserfs who either rent or else buy a home out in the hinterlands east of the 99 and do the daily death commute. While the median income may indeed be an average between these two very distinct classes, the median income home buyer in the Bay Area is a myth.

BTW I am very familiar with the Bay Area scene. Got my degree on the Peninsula 30 years ago and had job offers from some of the major players. Even then I was sick of the “we’re smarter than you” snootiness and could see the beginnings of the crowding and distortions of concentrated wealth that have ruined the area. I bailed south, am probably several $M poorer for it and don’t regret it for one second. I have a sibling who stayed in the area and ended up as a corporate executive. Beautiful house with a commanding view of the whole Bay, but constant stress, traffic, crowds. Every time I visit I can’t wait to escape…

I say it’s Yellen megabucks blowing hot air into tech bubble 2.0. Except for a very select few, the new class of tech companies have little or no business model and therefore make little or no profit. Offering your product at a loss to increase market share only works as long your rich sugar daddies don’t pull the plug. When this happens, a lot of tech executives will have to downsize their lifestyles.

That mania is common wherever Central Bank “benevolence” is felt —

The people in The City are very different than the philistines that live in L.A. There is just no comparison. The climate is also so different. There is limited real estate in The City, unlike in the land of the philistines, and it is simply a case of supply and demand. The City is known world wide as a desirable place, unlike L.A., so there is plenty of foreign money to increase the prices. Vancouver is a poor substitute for The City.

I love the way you capitalize both The and City. Your mockery of the Bay Aryan attitude is razor sharp. I applaud you sir.

apolitical scientist: I love the way you capitalize both The and City. Your mockery of the Bay Aryan attitude is razor sharp.

Why do you say Bay Aryan attitude? You mean the SF Bay tech attitude? Isn’t tech heavily Jewish and Asian?

Tech is heavily Asian, about Jewish, I kinda doubt it. In the whole Bay Area we have 1/2 of a Kosher market, and very few Jewish resources. Now if you want Jewish tech, go to Israel, where there are actually tech jobs, too. Not just a well-paid upper crust, but good jobs for the degreed, the non-degreed, and those who just want to turn a wrench.

SOL, Just a small pun to emphasize the ‘we are the master race” insufferability of the Bay Area ‘tude. No actual racial implication intended. But darn it, it stops being funny once I explain it.

apolitical – I know “Bay Aryan” didn’t start out to be a play on Nazism, it’s just that if you say “Bay Arean” it looks like “Bay Areen” and wut’s that? So we use Bay Aryan, but to mean anyone living out here esp. those yuppie assholes of the “Screw you, I’ve got mine” way of thought.

I am not in Tech, but real estate, a hated landlord, with a few properties. I know that Tech people have big salaries, so they can pay my big rent. I only see green(like in dollars) not their ethnicity. But L.A. is a land of philistines(a person who is hostile or indifferent to culture, intellectual pursuits, aesthetic refinement, and the arts, or who has no understanding of them, or is contentedly commonplace in ideas and tastes.) compared to us in The City.

I’m one of those guys making $300k and can’t imagine how I’m supposed to buy at $1.3M – where does one get the $250k in cash when you’re spending $6k/mo on rent? And I’m supposed to bet that rates don’t rise dramatically to still well below the historical mean at 5 or 6%, which would absolutely slaughter these prices? I’m looking to leave the state…

Cut your rent payment in half, you are paying way too much!

As you have shown, buying in the mania has been great for some. Unfortunately, to realize that gain you have to cash out and sell. That’s the new market where housing stock is a financialized, speculative asset.

That asset is not as liquid as many think it is, and when this next bubble deflates it will be painful as well. U.S. housing markets are now akin to the stock market, highly leveraged and priced as though everything is awesome, when nothing could be further from the truth.

You know things are getting troublesome when even NAR is discussing the lack of affordability…http://aaronlayman.com/2017/02/nar-home-affordability-distribution-curve/

So the previous real estate peak was fueled by corruption from top to bottom. No standards existed. The biggest real estate bubble in history was created then collapsed.

Fast forward almost ten years and prices are now where they were when artificially inflated. The Fed engineered another bubble by flooding the banks with free money and keeping rates too low for too long. Our government (taxpayers) continues to buy up all the mortgage debt, doubling the national debt in 8 years. How does anyone not see issues with this?

Once peak ‘affordability’ has been reached and prices stop increasing they will violently shift downward. The system has been built on the necessity of increasing prices. Sideways prices do not work anymore. They are using a flawed model that cannot be sustained long term.

+1. The only thing I disagree with is that both bubbles are different from one another. They are one in the same. Prices never reached a natural floor as the previous bubble was reflated into what it is now with more CB-enabled debt.

Yes, I tend to forget that the first crisis never ended. Just smoke and mirrors. Real estate was never allowed to reach it’s true market value.

If the crisis did end then why is the system so fragile that the world panics over 1/4 point rate hike?

I’m guessing Europe may be a catalyst that can throw a wrench into the global recovery. Elections are just around the corner.

Dean – Indeed. For instance, we “know” Marine Le Pen isn’t going to win, but then we “knew” Trump wasn’t gonna win. Brexit wasn’t gonna go through … until it did. We don’t know which way Europe is going to go but it looks like they’re going to go more nationalist and that can change things quite a bit.

The bond market is 3 times the stock market. The inflation rate is already higher than what the bonds pay. The FED does not have a choice except to follow the market in raising the rates. It lost the power to set rates.

Today the Treasury boss said he wants a strong dollar – translated=we can’t let the inflation out of control. Higher rates next month???….

At this point in the game, because the FED did not act for 8 years, they lost control. They just react to the market at this point. So much for FED intervention and Trump is a RE guy. I am a RE guy, too….and I have zero impact on the market. The first priority for the FED is to preserve the dollar reserve currency status and then the rest. They can’t keep that if they don’t react to market signals. That is also the reason Trump does not have too much choice to start infrastructure spending. Obama got Trump trapped pretty good with 10 Trillion dollar more in debt. Not too many options left.

From the Wikipedia article “Tulip Mania”

“At the peak of tulip mania, in March 1637, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftsman”.

But but but can you live inside a tulip?

Nope, but you can live inside if it was inflated enough!

Should have been: Nope, but you can live inside a bubble if it was inflated enough!

Excellent comment! I had no idea there was a Tulip Mania.

Makes you think, today its housing and art, 400 years ago it was tulips, what will be the next “mania?”

It honestly would make more sense for a plant because you can’t just build a seed. Whoever controls the seed controls the market. People eat corn, wheat, kale. They are necessities. Shelter is a necessity but in SOCAL you won’t die from living outside. You would, however, die without food.

ManBearPig – you have the right idea about a job. Do what you like, assume pay-wise you’ll eat shit, if you get laid off treat it as a vacation, and always have a plan B.

Yes, tulip mania was a definite thing, and there was also something called the South Sea Bubble that’s worth reading up on, also RE in Florida in the 1920s was absolutely batshit crazy. All make for entertaining reading.

Or, pick a profession that pays well and will be neither off-shored nor taken over by robotics.

Save lots, retire early, and post on blogs. Easy peasy.

I think it would be instructive as well as fun to see the history of us posters laughing our butts off at the high priced real estate in Coastal California over the years. After all, the good doctor has been blogging for over 15 years here. Yeah, I thought $800 was an insane amount for a house in the Bay Area ten years ago. After all, I bought a new house in San Jose in ’89 and was bitching and crabbing about no house being worth over $200K.

Perspective is a funny thing. I wonder what looking back to 2017 in 10 years will look like?

Based on history, my guess is 10 years from now, we will be in another boom market with us old people with 3.5% mortgages eating caviar tacos on Tuesday. 3 years from now, however, will likely be a much different story. My theory based on history is that even if you buy at an incredibly bubbly peak, you will be OK if you can hang on for 8-10 years. In 10 years, Jim Taylor Jr will be predicting an imminent crash and his dad will be retired satisfied that he was right(eventually).

Inventory is so low — buyers so desperate — houses are being snapped up sight unseen.

Both these Woodland Hills houses announced Open Houses for the following weekend, yet both sold within days of their listing, before the Open House.

https://www.redfin.com/CA/Los-Angeles/22718-Crespi-St-91364/home/3557036

https://www.redfin.com/CA/Los-Angeles/4407-Canoga-Dr-91364/home/4307207

In San Diego listing in suburbs 15 miles away from work still take a few months or sometimes nearly a year to sell…

Its only in prime wealthy areas and renting hotbeds that places sell in a few days to a week. UTC/La Jolla, Carmel Valley, Del Mar. All prime areas to rent out to college students and tech workers.

Prices are high in both areas, but in the suburbs you can generally negotiate a price down. In La Jolla they will ignore you if you don’t offer above asking. Our family bought us a 2 bedroom condo to rent. When we tried to shop in Carmel Valley and La Jolla we couldn’t get anything for asking price condos flew off the market in about 1 week.

That was 3 years ago.

Nice, that’s a good thing that they are buying sight unseen (for selfish reasons). If people buy at the peak of the bubble and most likely foreclose soon after, they are no competition when the market crashes by 40%. So listen up potential buyers, go out and buy now!

You mean San Transcisco! 🙁 At least the recent rains washed some of the piss away…

In my opinion, it seems like the mania is just feeding off of itself. The more people hear reports of “homes selling at all time rates and all time highs” the more they want to hurry up and get in on it. So they clamour to buy at higher and higher prices. There is no rational logic to it.

It’s disappointing for me because I’m finding out that I can’t afford to buy or rent, so I sit tight. I don’t want to drop my life savings on a house right now when it’s such a scary market.

I have too much riding on it and it’s just too risky.

If not for the restrictions of child custody, I would gladly escape to another state. I’m sure there are countless WAY better places to raise my kids than California.

Risk aversion is for loser renters. Sad!

Great pick comparing/contrasting Tesla…the business which bleeds money and remains on life support through elon’s cash transfusions. Very entertaining times we live in.

I have to imagine the combination of people not willing to sell, few new constructions of anything but high end homes, and low interest rates are letting price continue to push upwards as a handful of native Californians sell and trade up, and investors swoop in and buy the cheaper 2 bedroom places to rent.

New home buyers are getting pushed out because we don’t have a home equity line to trade into a new crazy mortgage and some of us don’t want to spend over 50% net income on a home… (we are in San Diego)

They say you need 20% down to buy a house now, but I know for a fact that a lot of new home buyers still work around this and buy with a lot less down. Which means they are likely to get trapped in their homes.

I don’t know where the cycle will break next but current prices are totally unrealistic if at some point there is a need for young people to become home owners. Hoping to see a dip in the next 5-10 years so we can buy a place then if its still worth living here.

Rent prices are going to continue to fall. Then overtime neighborhoods will turn to shit as deferred maintenance on all those rentals occurs. Then home prices follow as many neighborhoods will quickly become undesirable.

If investors have somewhere better to go, if interest rates rise, it will change quickly.

Remember when oil was $100 a barrel? Now there is such a massive glut they have to fight to keep it above $50. This apartment boom reminds me of that.

Real estate has crashed in California many many times before and the reasons were all different all the time…

It is a matter of time..

the current valuations of real estate is not at all sustainable and it s a matter of time.

The obliteration of high paying jobs because of automation and outsourcing is gonna only increase with time as I do work in hi-tech and I see this first hand.

My wife and I are in escrow on an Anaheim Hills pool home. 2000 sqft, 4Bed 3bath 13500 sqft lot for 675K. I do believe that prices are going to drop as rates rise though. We have two little ones and basically wanted the good schools in the area so we jumped in. We managed to save for 5 years for this purchase. My thought is we will be there until the kids get out of school so who knows what will happen by then to prices.

In a few years, you may find you screwed up and should have waited. Or you might find prices rose strongly and you are grateful you did not wait.

But 25 years from now, you will be glad you bought the house. You will be telling the kids how long ago you could get a home like yours for only 675K. People will be paying seven figures or more for every home in the OC.

Based on these price extrapolations, a slice of bread will cost $10 25 years from now. And his kids and grandkids will all be living with him.

that’s called normalcy bias……the next 25 years are going to look nothing like the last 25 years…….book mark this post.

I’ll bet you a $1

An economy can only last so long when the vast majority of the population doesn’t work and the vast majority of the immigrants are poor and uneducated.

The 20th century has passed. Nobody stays in a house for 25 years anymore.

JT, “25 years from now, you will be glad you bought the house”.

Mhm, after the last bubble burst we had 7 million foreclosures. Oh the people who lost their homes must be so glad that they bought. Instead of foreclosing and seeing the equity vaporize they should have just kept the house because according to JT, once you hit the 25 year mark you will be glad you bought!! If JT would just have told them!

There’s nothing quite like diving into a pissed-in pool when trying to beat the heat.

Here’s a lovely FREEWAY ADJACENT home for only $1.8 million: https://www.redfin.com/CA/Culver-City/11911-Aneta-St-90230/home/6730300

It’s in Del Rey. According to the listing: Have you heard? Del Rey is the new up & coming neighborhood.

Yes, the house is newly built in 2016. And there’s a pool. But still, it’s freeway adjacent. And Del Rey is the worst area west of the 405.

@son of a landlord.

Gentrification is happening in Del Rey. Foreign investors are coming to Del Rey soon. Prices will dramatically increase according to a recent study. It will be the new Bel Air. Freeways have a bad reputation but wrongfully so. The noise can be quite comforting. We have more electric cars now which means less pollution! Also, its seen as an advantage to have a freeway close by. Save time on your two hour commute by living closer to the freeway! If I were you, I would invest in this prime estate. You can probably flip it within two or three weeks and make 200k in profit. What is keeping you from buying? Get rich now!

9000 a month?! Good gravity…

Some comments from a Washington Post article:

For years, millennials looked at owning a home as a distant fantasy. Student debt and a weak job market seemed to conspire to keep this generation stuck in their parents’ basements, if not permanently locked out of the housing market.

But as millennials find better-paying jobs, start families and begin searching for their first homes, they’re encountering an unfortunate reality: Just as they’re finally ready to buy, the housing market has the fewest homes available for sale on record. And those that are for sale are increasingly priced at values inaccessible to first-time buyers.

As a result, the housing market is booming for those with cash to spare — but not for millennials looking to own their first home.

Keona and Cameron Morrison, both 31 and with a combined income of $150,000, have been looking to buy in Los Angeles for two years.

“There’s stuff that comes [on the market]; literally, a couple days later, it’s pending,†Keona said. “It’s crazy.â€

Teree Warren, a 31-year-old forensic scientist who grew up in Prince George’s County, isn’t faring much better in the Dallas-Fort Worth area.

“The houses go so quickly,†she said.

Overall millennials are falling behind other generations in homeownership, with first-time home buyers, who usually consist of 40 percent of the market, stuck at 34 percent.

That could become damaging to this generation’s future prosperity. Housing experts say homeownership remains one of the primary ways for the middle class to build wealth, despite the ups and downs of the past decade. And with mortgage rates beginning to creep up, millennials who have to wait to buy could miss out on historically low rates.

“Owning a home for a longer period of time creates more wealth,†said Christopher E. Herbert, managing director of the Harvard Joint Center for Housing Studies. “If you shrink that amount of time, you’re going to shrink how much wealth it creates.â€

Read the entire article here. It is good reading:

https://www.washingtonpost.com/realestate/for-millennials-ready-to-buy-a-home-the-pickings-are-slim/2017/02/23/29a2259c-e3e2-11e6-a453-19ec4b3d09ba_story.html?utm_term=.4976ca7651ef

JT, This is all great news but why does it sound so depressing?? All we need to do is lower lending standards for Millennials (and all others). You should not have to pay down money when purchasing a home! Every American should be able to buy the American Dream! Lower standards. Here is an idea that will help First-Time-Buyers and lenders at the same time. Create a loan where you get cash upfront so you can buy some furniture. Create a loan with an adjustable NEGATIVE rate upfront. That will lower your payments in the first two years. Brilliant! Bundle these loans with a triple A rating and sell the MBS to Europe. Also, 30year loans seem so archaic. How about having 50-60 year loans? Overall, we should have less regulations and focus on creating financial vehicles that help lenders and buyers at the same time. Homeowners are much happier than renters. If you have happy Millennials than you have less protests. Why is that so hard to understand?

The Dodd-Frank banking regulations are too complicated and a headwind to lending, said Mnuchin, TREASURY SECRETARY and a Wall Street veteran

Mnuchin said interest rates are likely to stay low for a few years, but the recent rise in bond yields make sense. “We’ll look at potentially extending maturity of the debt because eventually we’re going to have higher interest rates.”

Federal Reserve Chair Janet Yellen has done a good job, said Mnuchin.”

With the continuation of cheap mortgages, real estate should continue to go up.

What are you waiting for, buy as many properties as you can. You can never over-leverage yourself in the era of perpetual price growth.

Over 100 major development projects underway in Downtown LA.

So many people crying the blues about the tipsy economy. Yet how and where is the money coming from for all these commercial, residential projects in DTLA. Hard to imagine a crash in RE prices given the demand for workers to fill those office towers. Further is the insane rents these apt bldgs will command and the sale price of the condos…

http://www.ladowntownnews.com/development/downtown-development-the-latest-info-on-downtown-projects/article_ca6e00dc-f863-11e6-812c-9fb87ab40bd3.html

China is well known for building ghost towns for a clientele that never could afford them. At least the Communist regime has the excuse of being unfamiliar with capitalism and its excesses. Developers in the Western world have no such excuses for creating a glut of luxury properties for which demand is very limited.

I also see “Irrational Exuberance” from current homeowners who bought their house in the early 2000’s for 500K. Their house is now worth 1.5M and they now bragging that they have “plans” to retire in 5-6 years from a CA government job with a 100K+ pension, cash out on their 1.5M+ and move to a state where they can retire like royalty. They don’t remember that in 2010, that their house was only worth 350K. Timing is everything and seems to benefit the lucky few but gives the rest irrationality.

Mega-mansions in this L.A. suburb used to sell to Chinese buyers in days. Now they’re sitting empty for months:

http://www.latimes.com/business/la-fi-san-gabriel-housing-20170223-story.html

Hi,

Really enjoy reading the comments and articles on here. My question for the commentators. What should you do? I agree the markets/real estate is rigged but what would you recommend? The more I look i to it the less I understand!/? Not saying I will take peoples advice but interested to know their opinions.

Thanks

Cromwelluk,

“What should you do?” Clearly there are only two options here. 1.) Buy any house you can get your hands on, make improvements (a nice vase strategically placed in the middle of the table or wall paintings – use warm colors) and sell after 3-4 weeks with a 300k profit (avg). Or option two, if you are really smart, you buy two and double your profit.

Hilarious! But do you need to make any improvements?

Cromwelluk,

There’s not a thing i can do. I can only work so many hours as there is only 24 in a day and there is no way to charge anymore per hour so I’m pretty much fucked and priced out “forever” as they say…..a 30% correction wouldn’t help me one bit at these nose bleed levels of insanity.

like i said, I can afford a $170K home.

As I said before, if you are not able to afford home, then so be it. As long as you are alive with reasonable health, you are winning. Worst case, you get old, you never make much money, and you live of government programs. So what. Do what you got to do and don’t let it get to you.

Maybe circumstances prevent you. However have you thought about moving to a different part of the country? I have moved to a cheap part of the UK. Enabled me to be able to afford a house.

Everyone can afford to buy. The only issue I see is bad marketing and unnecessary regulations and outdated loan structures. Easy fix. “Buy your dream home today and get a 100 dollar gift card. Lock in your interest rate only loan for 24 month. No credit and downpayment required.” You should not have to pay principal. Make it an interest only loan. Your monthly payment will be soo much less without principal. I can’t believe nobody has thought about this brilliant idea yet.

To the ‘Americans buy existing homes at fastest pace in a decade (AP)’ article published in almost every paper across the nation (talk about propaganda), there are only a few MSM sites that allow comments. I suggest posting your thoughts to the LA times-

http://www.latimes.com/business/la-fi-home-sales-20170222-story.html

I posted this Woodland Hills home — on this site,TWO YEARS ago — when it last sold: https://www.redfin.com/CA/Los-Angeles/4253-Morro-Dr-91364/home/4212155

I was shocked that it sold for $865,000.

It’s now listed at $1,187,000.

A $322,000 markup after only two years!

http://www.nytimes.com/1984/12/08/opinion/the-day-los-angeles-s-bubble-burst.html

Beautiful home, nevertheless.

Nice but I thought the realtor looked good.

Looks like Warren Buffett’s Laguna Beach home is for sale.

http://www.ocregister.com/articles/warren-744324-buffett-.html

Bought in 1971 for 150K. For sale today for 11M.

Here is something for all the Prop 13 haters to chew on:

2015 taxable value: $2775 per year

New buyer will pay taxes of over 130K per year!

An investment of $1,000 into Berkshire Hathaway would have generated close to $10M today. A greater rate of return than most RE investments could generate.

http://www.investopedia.com/articles/markets/020916/if-you-had-invested-right-after-berkshire-hathaways-ipo-brka.asp

When he was looking for investors initially he was considered an unemployed “loser” to most. If you give $1,000 to your unemployed neighbor that’s at your own discretion. If i knew the guy well enough i would but from what i can gather through bios about his life people thought he was weird and had very poor social skills when first starting out.

Very interesting man but would be hard pressed to see that happen today with all the time people spend on the internet.

Sometimes, the least social people are the ones that you should trust your investments with. Michael Burry, one of the principle engineers of “The Big Short”, has Asperger syndrome. I’ve seen too many documentaries where investors were swindled through the sheer magnetism and personality of the perpetrators.

“New buyer will pay taxes of over 130K per year!” There is great news though. These taxes will be locked in and don’t increase significantly year over year.

I think the Dr should enable a “Like” button on this blog so we can take a vote on how people really feel the housing market will go.

http://www.realtytrac.com/news/company-news/analyzing-the-who-behind-recent-real-estate-boom/

https://www.bloomberg.com/news/articles/2017-02-23/landlords-are-taking-over-the-u-s-housing-market

Interesting report here purporting to explain how “Home Prices Are Near New All-Time Highs Despite Record-Low Homeownership Rates.” The short answer? Homes are being bought up by mom&pop/mid-level investors to flip or rent out. What caught my eye was the memo about the Bay Area engineer who was buying up “cheap” homes elsewhere in the US. So the California bubble is farting out mini-bubbles throughout the USA.

More and more people are beginning to realize that inflation is the only way the big sovereign debts of the world can be tamed. Therefore, central banks will create inflation, and real estate is an asset that should benefit. So, the landlording is a solid strategy.

The only problem is once inflation really gets going, a severe severe recession will follow that up. So, if you stack up homes, make sure you have enough powder left to hang on when the recession hits.

Mom and pop are the last suckers in this game of musical chairs.

JT: “make sure you have enough powder left to hang on when the recession hits.”

I do have enough power to use when the recession hits. However, I want to use this power to buy more properties. In 2010, I was able to buy a foreclosed condo, 2BR, 2 BA, one block from the ocean in HI, next to golf course, for $100,000. That was 75% off from the last sale many years before. That is what I call buying on sale, not the 10-15% off. In Phoenix area, I was also able to buy at 50% off. It takes time to get prepared, but in the end there are always more deals than there are money to invest.

Therefore, get the powder ready to buy at fire sale not to buy at the top and be able to hang on. Everything going up, eventually goes down.

Flyover, the only problem is no one knows if this is a top or not. It is possible the housing market could run up another 30% before it trades off, and the result might be a higher price than today. No one knows what the future holds.

The only certain is the central banks will be trying to make sure we have inflation. That is the only thing you can count on. Betting on deflation, like you are, is going against the FED. Betting against the FED is usually a losing proposition.

Flyover it’s the old story: When your shoeshine boy starts giving you stock tips, it’s time to get out of the market.

@ JT,

Aaah got it! buy an overpriced crapshack now because the FED wants inflation and not deflation!

buy now! market could go up by 30%.

Last week the story was next drop will only be 10%. Buy now

I admire your creativity. So many reasons why we should buy now!

The influx of mom-and-pop investors is an indication that the top may be in. I’m noticing that while the large condo “de-conversions” to rental, of huge downtown condo towers, were done two years ago, the smaller, older, more marginal buildings, like mine, are being purchased and converted to rental by small, local investors. Many of these buildings are being “deconverted” because they haven’t worked terribly well as condominiums due to high operating expenses and lack of scale- the very reasons they were converted to condos in the 70s and 80s, to begin with. Right now, the fad for condo-to-rental conversions is shrinking the available supply of condos and driving up prices for the remaining stock, but I expect that as more rental units are added along with those being built new, the market will become glutted and we will have another wave of commercial defaults and foreclosed rental buildings.

I was out in Temecula yesterday and stopped by some model homes for fun. The development was called Kite Ridge, starting in the $700’s and it was all sold out! Temecula in the $700’s is insane, but people bought them. When we were leaving I can see tractors on the neighboring hills clearing large portions of land for more homes. Another note Corona/ Eastvale area will have built 30,000 new homes when it’s all built out and complete. Insane! That 91 FRWY will be a nightmare even with the new expansion project.

Bob, “Temecula in the $700’s is insane, but people bought them.”

These buyers are smart. They can sell these houses in the spring with a 300k profit!

“91 FRWY will be a nightmare.”

I would not worry about the traffic. We will soon have self driving cars. The three hour commute can be utilized for speed dating, working, napping, eating and buying houses online.

Bob,

If you are an early riser, checkout the traffic southbound on I-15 from SW Riv Co. into SD County. Insane – river of lights.

Temecula/Murrieta is the jewel of Riverside county with low crime and great schools. You can still get a very decent home for 300-400K. Yes the traffic sucks and it’s hot as h#ll, but with numerous hospitals and industries moving in the jobs will be coming soon. Current properties still haven’t hit the previous peaks and sre appreciating 10%+ YOY. With a bullet train stop on the SD route planned for Murrieta, property values should skyrocket.

Buy now!

Inland empire housing market will skyrocket soon! buy now!

Low crime, great schools, a train station and hospitals! Why would it not skyrocket! buy now!

prices are going up 10% and never down! Buy now

Kite Ridge is a planned housing community in Corona NOT Temecula.For 700K you could buy 2 homes in Temecula or one 4,000 sq ft quasi-mansion on an acre.

You’re right. It’s deep Corona. I assumed it was Temecula.

Perspective … Tesla is a a bad or good example for comparing performance … they still have’t turned a profit!!! The analogy to housing … you haven’t made a profit until you actually sell the house or condo, subtracted out all your expenses and costs, and have cash in hand! So, like Tesla, what is that home’s true worth?

A Realtor, a very good honest Realtor told me “Not everyone can afford paradise; its not fair, but that’s the way it is.” I wonder if younger generations will define paradise differently? I think there will be more companies moving to NV and other states and employees will follow. Maybe some companies can compete less on price, but most companies are facing more widespread competition, even grocery stores, drug stores…There are no state taxes in WA and NV. My buddy told me there are big tech companies relocating to 25 miles east of Reno.

Triple-Q – If you’re a white, right-wing Christian, I’d say most of the US can be defined as Paradise. Just tons and tons and tons of places you could raise your big God-fearing family, without any access to any ocean or your kids growing up with the knowledge that bikinis exist. There are areas in the Midwest with tons and tons and tons of lakes; there’s a reason the Sunfish, a small sailboat/sailboard, is the most popular sailing vessel in the US by an order of magnitude beyond its nearest competitor, the Laser I believe. There’s camping, canoeing, Klan rallies … heh-heh only joking about that last one folks … or am I? In any case, you do not need the Pacific Ocean and sushi, to have a place be Paradise. If it’s a place where you’ve got meaningful work, security, room for your kids, pets, livestock if you want them, a town where you won’t get hassled for the crime of walking down the street, where your kids can get a good education (for the purpose of getting them good jobs, no one cares about history or the unluckily-named “liberal” arts any more) and so on, that’s pretty much Paradise.

Many call Hawaii Paradise, some even non-jokingly. I grew up there. I could not walk down the street safely. Education there is horrible unless your parents have money to put you into a private school and then, at great expense, you’re all the way up to “meh” on Mainland US terms. (Because the Japanese, an Axis power who lost in WWII, own and run the place, WWII was not mentioned, nevermind the Holocaust, the Scopes trial, etc. They don’t exist in Hawaii schools.) There are jobs depending on who you are related to, who you know, and your skin color. That also “included me out”. Hawaii, if you are of the ruling class/ethnicity, is indeed Paradise, but you can see that it being Paradise has nothing to do with the waterfalls, the beautiful ocean, the tropical plants, etc.

But for 70% of Americans, most of the US is Paradise or can be made so. I was watching a thing on YouTube, I think originally a PBS show, about poor whites living in Kentucky or Arkansas or someplace, and yeah they were poor, but they had big, if messy, houses, owned their land, owned their vehicles if however ramshackle, their neighbors weren’t plotting to rob and perhaps kill them in the middle of the night, they took odd jobs and casual work but hey, it gave them a lot of free time off and they met their needs and could save (even if for dumb things like truck rims) and well, they didn’t seem to realize it but they were living pretty close to Paradise.

If you’re a white, right-wing Christian, I’d say most of the US can be defined as Paradise.

Alex, you have a stereotyped view of middle America. The interior of this nation is full of black communities, Jewish communities, liberal communities, Latino communities, even some Muslim communities.

Furthermore, many Christians are liberal, moderate, or even left-wing. I’ve known some.

son of a landlord – I’ve never seen ’em. The only Christians I’ve seen who even seem to make an effort to do what their god says are the Catholics. Ironic that, the Catholics.

Triple-Q — Look up a YouTube channel by a group called “Flite Test”. You can’t watch their videos without smiling and being cheered up, and they have SO much fun! They’re out in the middle of bumfuct nowhere, Iowa or someplace where if you get a divorce, she’s still your cousin … they have flat farm land, and land and buildings are so cheap they have a huge place to do their business.

And what’s their business? They post videos about R/C planes, and more importantly, the theory you need to know to fly them, and tons and tons and tons on how to make them, with plans they have for cheap or free, I think cheap, you can get just the plans or a kit for a bit more, the planes are all made from Foamcore board, the stuff you use for your background for your science fair project, available everywhere. The motors and props and controllers and stuff are expensive, so they work on making the rest of it cheap, and with today’s modern electronics and battery tech a TON is possible and they just have a freakin’ ton of fun. They have so much fun, and have so many people having fun with them, that they’ve built a happy company out of it, employing several people.

Now tell me they’ve not found their own Paradise, out in cheap-as-hell bumfuct Nowhere. I’m sure they have fishing holes and swimming holes and family cookouts and Klan meetings … woops just kidding about that last one folks… heh. They have a good ol’ time. Of course it helps if you’ve got Christian verses tattooed in BIG LETTERS running down your arm, as one guy does. And I doubt you’d want to be caught skipping church in that area … try to do that and get or keep your job. But IF you are with the program, it’s paradise. (If not, better have good fire insurance just sayin’.)

Alex, Iowa is a lot more mellow and genial than people think, and the Klan does not hold sway there. It is, after all, a northern place. While the state leans red and is rural in character, the people are not hateful and there are some wonderful outposts of social liberalism there, notably Iowa City, which is very art-oriented and has been a refuge for artists and other creative types as long as I remember. The people you speak of are probably located very near it. And the Quad Cities area is one of the friendliest places I’ve ever visited.

The weather sucks, though. It’s COLD out there. So cold it makes Chicago seem like a tropical paradise compared. Cold and mostly rather empty.

Laura, Iowa is great… if you’re white. Try going there with a little extra tan and you’ll find the “hateful” real fast.

SoCal you’re full of crap. I was talking with a Mexican guy at a dinner in Mexico City years ago and he told me he and his family loved living in Iowa. I also knew a couple of black people from Des Moines who liked where they were from.

Sorry GettingOut, but your anecdotal story of your 1 black friend is not only sad, but doesn’t match reality…

Maybe you should “get out” more?

https://www.thetoptens.com/most-racists-states-us/iowa-459689.asp

http://www.desmoinesregister.com/story/news/education/2016/10/27/campus-police-investigating-racist-posters-iowa-state-university/92838150/

http://www.desmoinesregister.com/story/news/politics/2016/07/18/steve-king-creates-uproar-salute-to-contributions-of-white-people/87270220/

http://thehill.com/blogs/blog-briefing-room/news/196418-iowa-gop-posts-racism-flowchart-on-facebook

My company in San Diego is laying off people who are paid $150k per year and moving jobs to india

Advancements in technology has shrunk a lot of high paying knowledge jobs as working in front of computer and over telephone can be done by someone very easily in india for a fraction of salary

Sometimes outsourcing works – but it frequently doesn’t. My current employer found that out the hard way. We’re still repairing/rewriting the code seven years later. The problem is extreme distance combined with the language barrier. Sure, most can speak English well – a lot better than I speak Hindi. The issue is with nuance and rarely used words that are nonetheless very important for mutual understanding. The amount of time spent making them understand (and the ridiculous number of times a feature has to go through the QA cycle when they claimed to understand but really didn’t) is a colossal waste and ends up costing just as much as a developer who is standing right there, who understands the first time and quickly cranks out well-commented code – but also has instant access (no time zone difference) to designers and users in case he/she has a question. Time is money, and that’s where outsourcing falls short.

You should see the online “help” they came up with. I spent weeks lol’ing while writing the replacement.

For bigger companies, they already have big established presence in countries like India. They can hire 2 or 3 engineers in India or hire one engineer in San Diego/SoCal.

Even in San Diego, most of the engineers are Indians.

It’s a matter of establishing proper processes, have them mature and have the proper checks and balances in place to make outsourcing work. For bigger companies, the pay offs are much higher and thus they have maturity in this space.

But I am surprised to see even the smaller to midsize companies are into this since the $$ savings are quite big.

India has lot of people’s manager who have experience working in USA for decade or plus and they work as a bridge between USA and India thus making communication gap as small as possible.

Even managers in USA are all Indians and are thus well versed with all the nuances.

This makes management of outsourcing viable and feasible. My company is moving thousands of jobs from San Diego and they already have big presence in San Diego and in India as well. For them, it’s not a problem, they have been doing it for a decade or so but this time it is accelerating because of many factors.

For software that requires daily updates (as with an internal database app), with the primary user base here, the design/project management staff must also be here, so it can’t ever be ideal – and in my opinion isn’t worth the cost savings, which are eaten up by lost productivity. Especially for small to mid-sized companies. I’m at work now (7:15am), and in India they’re getting ready to go to sleep – at the time when our users would need them the most. I work for a giant of a company. We tried outsourcing our internal app to India, and it was a disaster.

For software that doesn’t require daily updates, I can see it working if done right. But again, the company has to accept that the cost savings comes with another price. For some it is worth it.

I suspect that eventually the cost of development will balance out. Salaries will decrease here and increase in India.

A lot of people seem unaware of how many Indian firms operate. They have an A, B and C team. The A team make the face-to-face pitch and the initial setup, Then they hand off to the B team (poor English, lesser skills) and then later still they role the tasks off again to the C team who are often not even employees but at-home contractors with a headset, remedial skill-set earning appalling, abusive wages. That structure is planned and built-in before you even start.

QQQBall, “A Realtor, a very good honest Realtor told me”

Please don’t contradict yourself within the same sentence. Only Our president is allowed to do that.

There’s no such thing as paradise although convincing people to believe so is part of the real estate agent’s marketing game. Well…. whatever…. in Los Angeles some people think paradise includes paying out the nose to be stuck in traffic congestion and stepping over bums camped out on the sidewalk.

@QQQBall.. SoCal is so so over rated. The only reason I am here is because I happen to have a good job otherwise I’d not have come to CA at all.

Most of the time,, honest realtor is an oxymoron

you realize we have the same handle, right? I guess I could change mine to Jon_in_Irvine

Used to be a “plus” if a house was located near a Starbucks, Whole Foods, or art gallery. Now it seems that being near activists allegedly raises property values.

From the listing: Montecito Heights boasts activists, lovers of all thing nature, artists and a close very close knit community.

https://www.redfin.com/CA/Los-Angeles/998-Montecito-Dr-90031/home/7000072

Silicon Valley tech workers earn six figures, yet feel poor: https://www.theguardian.com/technology/2017/feb/27/silicon-aa-cost-of-living-crisis-has-americas-highest-paid-feeling-poor

#1stworldproblems

Leave a Reply