San Francisco real estate enters mania zone with median home price at $1.35 million: A household would need to make over a quarter of a million dollars per year just to buy.

San Francisco real estate has entered into terminal velocity madness. The median home price just reached $1.35 million. This is an increase of 103% from the first quarter of 2012. The NASDAQ itself is up 85% over this period and of course the hot money from the stock market is flowing directly into San Francisco real estate. The incredibly hot tech market has created ridiculous valuations on companies without any real profit. Ideas like delivering a $1 taco to your house for $20 via an app is all the rage. The ultimate goal for many startup companies is similar to what people are doing with real estate – hope the party goes long enough where you can sell-out and find another last sucker to hold the bag. With the wild run in the stock market valuations are out of control. Young wealthy tech workers at the upper-end of the spectrum are funneling money into a small number of houses. But you will be surprised at what $1 million will buy you in San Francisco.  Having prices double from an already high point in 3 years is simply insanity. San Francisco housing is looking extremely frothy and now with a correction in the stock market, we will see if real estate follows its typical lagging pattern.

A new record median price

Housing values in San Francisco have reached a stunning level. Very few can participate in the game and for this the Bay Area is in an epic housing crisis for buyers and renters. If you want to buy you better come in with a large down payment and have a very high household income. Or you can be part of the foreign investor crowd that buys all cash.

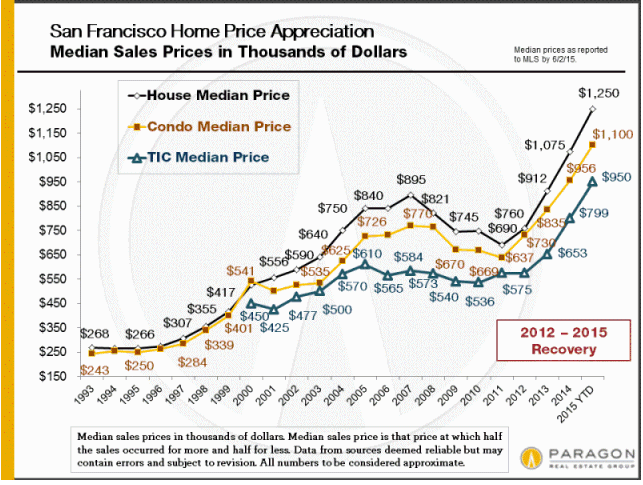

Just take a look at housing prices in San Francisco:

The latest report shows the median home price at $1.35 million (the above chart goes to June). This is for a simple entry level barebones property. People are chasing two bubbles here – the tech startup boom where VCs are looking for unicorns and newly minted tech wealth trying to chase the real estate dragon. But in the Bay Area, much of the boom is tied to stock market wealth. People forget that most people lost their homes because they didn’t have the income to pay the mortgage. How many startups will make it through the next correction? The biggest source of foreign investors is from China and the Chinese stock market isn’t doing all that well recently.

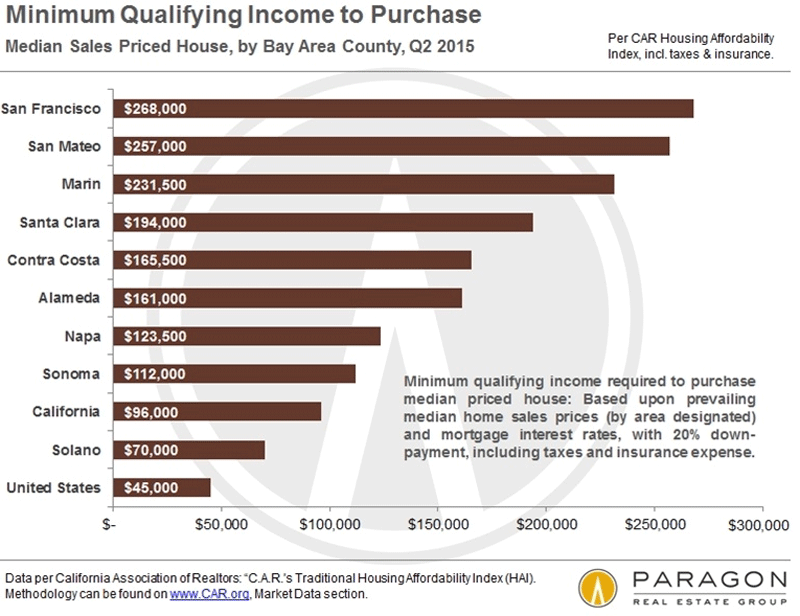

For a household in San Francisco looking to buy this typical starter home they will need over a quarter of a million dollars:

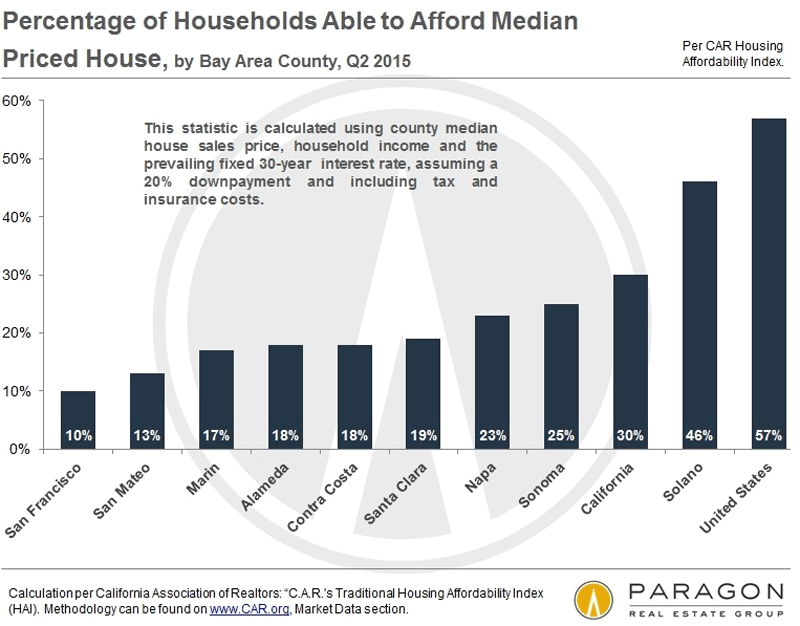

$268,000 of household income is the amount needed to comfortably buy a median priced home in San Francisco. This is why only 1 out of 10 households can realistically afford to purchase a home in the market today:

Hot money flows in and out of these markets extremely fast. So if you are looking to buy in San Francisco you will need $270,000 for the typical starter home as a down payment. Want to see what $1.2 million will buy you?

1032 Junipero Serra Blvd,

San Francisco, CA 94132

3 beds, 2 baths, 1,570 square feet

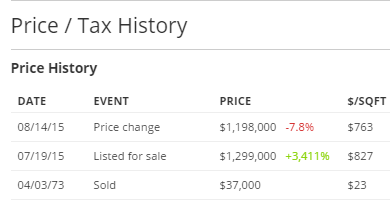

Let us take a look at the price history here:

Cashing in on that lottery ticket! The place was listed in July for nearly $1.3 million (close to the median market price of $1.35 million for July sales). No takers at this level. So they slashed over $100,000 in one month. Just like that. $100,000 evaporating into nothing. But as you know, in manias prices are pulled out of nowhere and people will ask for as much as they can get. In San Francisco this is clearly the case. Also, the current tax assessment values this place at $77,042 with annual property taxes of $1,243. The new buyer is going to be paying at least 10 times the amount in property taxes for the exact same services. Welcome to California tax logic.

First the market corrects, then real estate follows. We’ve seen this game before. People forget that we’ve been in a stock market bull run of epic proportions driven by low Fed rates since 2009. The Fed is out of ammo and valuations are entirely out of control in housing. Then again, we can all become Uber drivers and save some cash for tacos on Tuesdays just to make the mortgage payment.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “San Francisco real estate enters mania zone with median home price at $1.35 million: A household would need to make over a quarter of a million dollars per year just to buy.”

my brother in law pays $3400 a month for a 2 brm 1 bth house in albany. my sister is a stay at home mom with a baby

Here in Denver, a 3B/2Ba home will run you about $2,800 in a decent area of town. Studios are renting for $1,200 per month. Nutty.

Amazing that people get so surprised about rising home prices. That comes with inflation. Suburban houses of L.A. that are now selling for $650k were once selling for $5k. And each jump along the way, the people declare “oh no, what’s this world coming to!” and “Those houses aren’t worth that much!” Well guess what; if the currency becomes less valuable, then it takes more of it to buy the same house. Not to mention that more people (including those from other countries) wanting the same limited amount of real estate, that more young people want to live in the city rather than the burbs, along with all of the other forces of inflation, and that’s what you get. Higher home prices.

Tall timbers, I think the problem is that wages aren’t raising at the same rate. If so, none of this would be as much of an issue.

“Amazing that people get so surprised about rising home prices. That comes with inflation.â€

I think most semi-intelligent people are perfectly cognizant of inflation and its effect on pricing (of everything). What is interesting is that So Cal housing prices are around their all-time highs relative to median and average incomes for most areas. It’s not so much that people are surprised that a house has appreciated from $5,000 to $650,000 over the course of 50+ years, it’s more that people are surprised that an old crap shack has appreciated 50 percent from $325,000 to $650,000 in a mere 4-5 years. Not to worry, though, this bubble will likely pop just like all the preceding bubbles.

@tall timbers inflation? What is that? According to Yellen et al. there hasn’t been any inflation for some time. It would be nice if the Fed would change their parameters used to measure inflation to things that us regular people that pump our own gas use. Probably hard for those that get chauffeured around in suburbans to understand what inflationary pressures (rent, milk, medical bills etc…) that the rest of us are constantly feeling.

Tall Timbers. Just got a nice laugh from your post.

A 300k house in 1999, using the inflation calculator, should be 429k. In San Diego, in 1999 I bought a house for 295k. I no longer own that house but going by comps it is easily a 850k house.

Sorry to hear about your brother in law. Sounds like hell.

he makes good money and they both have zero student debt and one paid off new car.

rent is little over 50% take home pay. just surviving in the new economy

from the chart “assuming a 20% down payment” now lets base this chart on reality and assume the least down payment possible and recalculate.

Interest rates people!!!!!!

It is hilarious reading all these posts that are totally irrelevant. Recessions are a part of the economic cycle, however in the past the fed could manipulate rates to keeping the economy moving forward. Iranian oil, realization of the total lack of relevance or income potential of social media, Apple unable to come up with anything new, and a whole generation saddled with subprime student debt, auto debt, and CC debt they have no means of paying back, and people living 10 to 20 years longer than anyone ever expected means we have a HUGE correction coming. 2008-2015 has just been the eye of the storm. We are now approaching the other side of the storm and God help anyone who has participated in this totally bogus and artificial economy created by central banks all over the globe. If we would have just left the economy find its natural rhythm and all the banks and insurance companies that took on insane amounts of risks go belly up, yes it would have been painful for some in 08 we would be coming out of it healthier than ever. Instead we kept the economy going on steroids and other drugs and now the pain is going to be exponentially worse. My prediction is a 50% haircut across the board on all asset classes. Adios Starbucks. We’ll see how comfortable people are paying $5 for an average cup of coffee when they realize just how bad our economy really is. Hasn’t anyone noticed that all the vacant commercial real estate has been occupied by banks. Did it occur to anyone that they did this because had they not there would still be millions of vacant sqft of retail space available. I have literally seen banks have four branches within a mile of each other. Sometimes on the same street. 4k sqft retail spaces with 4 employees and just ridiculous amts of unused space but if the banks didn’t take the space it would still be sitting vacant and therefore just feeding into the psychology that there is a lot of vacant space available.

Me, do you really think that your comment is so interesting that you need to post it within multiple articles?

I for one am glad that you’re doing yeoman’s work of educating us, the poor unwashed masses.

/sarc

Very well put. I can’t even imagine the counterparty risk. That’s the real problem when the SHTF. 50% haircut would be just about right. It could be a falling knife that is too sharp to catch. Perhaps this time, with $17,000,000,000,000 of gov’t debt the TBTF banks, insurance companies and hedge funds will have nobody to bail them out.

It’s all about the perception of Greed vs. Fear. Sound familiar?

http://www.westsideremeltdown.blogspot.com

You already posted this — word for word — in the previous thread.

Do you really think these observations are so uniquely brilliant and original that we need to see it a second time?

…the observations are wrong. http://www.zerohedge.com/news/2014-12-12/presenting-303-trillion-derivatives-us-taxpayers-are-now-hook

@Me wrote: “…we kept the economy going on steroids and other drugs…”

Not exactly. QE kept the stock markets and commodity markets inflated which also kept real estate inflated via margin loans (i.e. leverage through debt). This was a boon to the top 20%.

On paper (and on a macro economics level) it looks like the GDP and the economy is okay. But declining electricity usage and declining oil prices means the real economy is going down the rabbit hole.

Tech money: easy come, easy go

Well put. It’s going to evaporate like an ice cube on freshly paved Las Vegas asphalt during the peak of summer.

That is expensive for such a small plot of land. You can get a much better place in the Emerald Triangle and make good money off the land, provided you don’t use your own crop. I keep telling these farmers to stop using their own crop and they will make more money. Lying around all day and toking is no way to run a farm. You have to get up and take care of the crop. Yes, that is work, but that is the job of being a farmer. My farmers do God’s work raising the finest product there is. Google people are coming up here and buying the good farm land and too many of the share croppers are just the midnight tokers and not serious farmers. Forest Lady is calling, got to go.

I would strongly encourage all of the tech workers on the peninsula to take up Farmer John’s offer and move to the Emerald Triangle. Don’t worry about the commute to work, you’ll figure something out. Don’t worry about entertainment, the arts, nightlife, etc. – you’ll figure something out. The important thing to remember is, despite being employed in tech, get yourself some land to farm.

Thanks for the read. I’ve read the forest fires are taking a toll on crops though. What’s the latest news at ground zero?

I’ve read this “Emerald triangle” and “God’s work” post in a few other threads as well.

Am waiting for Carlos to pop in with his thoughts on Oxnard.

Not eveyone wants to grow pot. I used to work in logging for my summers in college. I think Eureka/Arcata and greater Humboldt County is one of the worst places I’ve lived. Meth, meth, meth and more meth…with some redneck 2nd generation pot growers mixed in…I want the 6 months I lived in Fortuna, Weaverville and Scotia back!!

Hell don’t even get me started on Mendocino County, what an awful hell that is…we should just bulldoze Willits and Ukiah.

Living in the Bay Area has it’s issues…and places like Sacramento are looking better and better…but moving to Humboldt to grow weed is not an option for 99.999% of the people here.

Also, weed prices have to been going down…all the huge growers have moved out to Denver and now that Oregon is legal to the north, I have friends that grow in Sonoma County and can’t get rid of it..Humboldt will soon be the Riverside of northern California…minus the hot tanned girls.

hey, lots of trees up there and water so it doesn’t sound so bad. Having just came down from some time there I enjoy your The Onion like description..

Meth is everywhere, just don’t hang out with that crowd and it will disappear..

East bay aint all that, some nice areas but many full of meth, gangs, murder and such…

East Bay Renter, you really show the dichotomy between The City and elsewhere, such as Eureka. Now where would one really want to live? You pay for nice places, such as The City. A quarter of a million dollar salary is not unusual in high tech, so two people with a half million income a year and can buy a correspondingly nice place. Eureka has a different economy. Meth is what you find throughout America in low income areas.

Bottom line, The City vs. Eureka. Two different worlds. If you have money, you live in The City. If you don’t have money, you live in the Eureka’s throughout America.

Places like Sacramento are looking better and better? Because housing is cheaper, Sacramento has become a magnet for those who have been priced out of the Bay Area. Crime and gangs are a growing problem. There aren’t too many well paying jobs in Sacramento other than state government. You had better think twice about moving to Sacramento.

Walt, there are no forest fires in the Emerald Triangle, Redwood forest country. Don’t worry, the weed will be satisfactory this year.

As always CA home prices go bonkers for many of the same variable reasons we have seen time and time again.

Now, the Fed is about to hike rates. Makes the more expensive housing market ( If Rates Rise) just a tad more expensive.

4 Key Charts, 3 key question to look at for housing demand in 2016

The Fed Rate Hike And The Housing Impact

http://loganmohtashami.com/2015/09/10/the-fed-rate-hike-and-the-housing-impact/

Farmer John, too funny, talking about those lazy stoners in a RE crash blog. Once my wife retires, we may move up there and get busy doing God’s work. Just need CA to legalize recreational like the other progressive states, before I commit to that life style.

Amazing how hot the SF market is. I left after 15 years of renting, thinking I would buy “next year”, as it always seemed too expensive, coming from the SouthEast. As it turns out, my best opportunity to buy was the first day I got there in ’98. The appreciation was well beyond my salary increases. BUT, I did save and invest well with the savings from renting, so “my house is in my bank”. I left this year for San Diego, and will buy and retire here, where at least I can get a view of the ocean for $1.3m instead of a parking lot and commuting nightmares with FAGs (FB,APPL,GOOG).

Wasn’t the internet age meant to mean we could telecommute and work from anywhere?

Why are all these tech millionaires gravitating to SF ? My guess is the financiers need to keep an eye on them rather than trust their capital to some guy living on a beach somewhere.

Lol

Reminds me of being lied to in grade school back in the late 1960s to early 1970s!

I remember being told the future meant we would all work 2 or 3 hours a day and still support our families because of the huge productivity gains that would benefit us all.

Little did us little kids know the FED was at that very moment plotting to use the productivity gains not to improve our future living standards but to mask future inflation.

I remember grade school in the late 1960s, early 1970s. The future was on everyone’s mind, partially due the 1968 film “2001: A Space Odyssey,” the 1969 moon landing, and 1970’s start of a new decade.

Everyone was making predictions for The Year 2000. I read those predictions in My Weekly Reader, a newspaper for grade school kids.

Some of the more common predictions for The Year 2000 were 1. a cure for cancer, 2. hotels on the moon, 3. video phones.

Now it’s 2015, and still no cure for cancer. No hotels on the moon. I guess laptop cameras are a sort of a video phone, but most people don’t use them.

When is this rate increase supposed to happen? These predictions have been made many times over the past 2 years and I don’t believe them anymore.

Doctor, you state that the median income to housing price ratio doesn’t make sense. Yet people are buying. So please tell us, what is going on? Perhaps very wealthy individuals are buying? Or are people using creative financing methods again? Or mom and dad are giving money to their kids? There has to be something going down underneath the surface.

Nimesh: Your guess is probably as good as anyone’s. It’s probably a combination of factors that you mentioned, along with people who are perfectly happy to take out the maximum mortgage they qualify for. The latter will probably be lamenting that decision when one of the breadwinners loses a job.

It’s been reported over and over again that financial groups using low-interest loans were the buying catalysts. Sprinkle in foreign money chasing investment opportunities during a low-interest global economy. Thus, you have the basis for asset over-speculation.

Yes, there are organic buyers. But not enough to lift home ownership from its multi-decade low. This despite record low interest rates and the return of low down payment mortgages.

Every time I read these posts I mention to my wife now’s the time to sell..

Had a contractor here the other day that dug the views. The unit is small but view of City, Ocean, GG park and Mt. Tam.. bet We could get 730K..we is key word

their is no water in California and I’m ready for ranch home and no stairs..though it keeps you in good shape

Actually, this SF home at 1.2M is not that expensive. In Southern California, a home like this one in Manhattan Beach or northern Santa Monica would is well north of 2 million. Have you priced a small home in the Manhattan Beach walk streets? Teardowns are between 3 and 4 million on a tiny lot.

It seems you haven’t lived in SF. That house is so far away from “the City” it might as well be called Daly City. That area bears no resemblance to the parts of SF that people think of. It’s a nice area but it’s very suburban for SF. Hell, to get to North Beach, Marina, SoMa and other areas. Plus it’s not on a beach like Manhattan Beach. It’s really the middle of nowhere within SF.

Currently, there are 118 single family homes ( not condos ) available in SF for under 1M. Many of them are not that far from the best areas while others are not that far from the water. In LA, under 1M single family is impossible in a large number of areas. Impossible. Malibu. Pacific Pallisades. Santa Monica. Manhattan Beach. Hermosa Beach. Corona Del Mar. Newport Coast. Brentwood. Beverly Hills. Holywood Hills. There are many more zip codes. The difference with LA is the average looks lower because LA has many more 3rd world type areas than SF. However, a decent safe area is actually much higher than the bay area.

For people who think that this time is different because there are fewer subprime mortgages:

“subprime loans accounted for only a bare majority of defaults at the beginning of the housing crisis. Between the third quarter of 2006 and the third quarter of 2012, twice as many prime borrowers lost their homes as subprime borrowers.”

http://www.bloombergview.com/articles/2015-09-14/turns-out-the-housing-crisis-wasn-t-all-about-subprime?cmpid=yhoo

The bubble has and always will be in the price.

Been offering up that point for the past several years. Most attention is often given to sub primers over leveraging. People seem to forget (or not understand) the extent that so-called prime borrowers used cash out refis and creative financing to fund consumption, business ventures and second home/income properties – especially in SoCal.

This is true. It was mostly affluent, upper middle class to the uber rich (with little skin in the game), many of whom had multiple investment properties, that CHOSE to walk away from their home once their home was worth less than what they paid. Using the term “lost their home” is inaccurate for a lot of cases, in that people walked away from mortgages they could afford, but chose to walk away and squat for months, even years, payment-free. Then you save and buy cash. Aint life grand?

This flip seems to have trouble finding a asking price. Check out the price history.

https://www.redfin.com/CA/Los-Angeles/4576-W-23rd-St-90016/home/6899678

At $519 per square feet is a great bargain. Let’s go bidding for this crapshack 🙂

First, I think it is a stretch to try to correlate stocks, the deficit, and real estate, to some apocalypse event! Real estate is more locally driven by supply and demand and to some extent the ability of people to pay those prices. The median price of a home in the U.S. is still under $200k while the median sales price is around $230k. Factors that will impact future prices in places like San Francisco will be the sustainability of high salaries, foreign buyers, and to some extent, interest rates. By some accounts a 6% 30- year mortgage would mean a 20% drop in home prices. High salaries may be fickle … remember the dot com bust … I hired tech people that were making $150k before the bust for $75k after the bust! Finally, how long can money migrate from overseas? Globally, out of over 7 billion people, only about 15 million have investible assets of over $1 million, and not even someone with just a $ million can afford those California prices …

For Big Tex, who is always running down California and telling us what a wonderful and superior place Texas is:

http://www.dallasnews.com/news/community-news/northwest-dallas-county/headlines/20150915-irving-ninth-grader-arrested-after-taking-homemade-clock-to-school.ece

This is why the California experience is so expensive. You cannot put a price tag on relatively evolved and cosmopolitan individual and collective mindsets, and California, compared to most of the country, has these in spades.

Yeah, go live in cheaper $hitsville, U.S.A., and get your big house for a fraction of what you’d pay for it in California. And also enjoy the dumb$hit rubes and yahoos that will be your neighbors.

Because it’s so evolved and cosmo to point to a sensationalized media headline as measurable proof of anything although it certainly does nail the collective mindset. Not defending Texas by the way but it sounds as if people getting more property for less money and being content enough with whatever else comes along with it in other areas really bothers you.

Doesn’t bother me at all. But I’m tired of hearing these same dumb$hit rubes and yahoos run down California, . . . which, BTW, subsidizes these rubes’ and yahoos’ sorry assess by way of the amount of money California citizens pay into the federal treasury each year relative to how much they get back per each dollar of federal taxes paid . . . and how such ratios compare to the red states.

BTW, I’ve lived in those “red” states. For years. I’ve lived in these cultures where social conformity is a religion and where independent, educated, adventurous, and enlightened thought is viewed with suspicion because it does not fit within the little “bubble worlds” these people live in, with all their limitations in terms of the paucity of outside influences and a narrow range of cultural and intellectual options.

it’s ain’t much fun living in most of those places.

So, if you want to live in rube land because it’s cheaper, then be my guest. But I do feel the need to warn you that what you will be gaining in terms of bottom line, dollars and cents prosperity (wow, a BIGGER house, for a fraction of the cost!!!), you will more than pay for in terms of the overall lower level of intellectual and cultural development and the greater predominance of parochial and provincial mindsets.

If that’s a trade you are willing to make, then be my guest. But understand, beforehand, the nature of the trade you will be making.

California has many problems. Yes it does. But I grew up here, and moved away and lived in rube land for many years. And then came back. And before I did move back, I concluded that California–relatively speaking–is one of the sanest, free-est, and most enlightened places in the country. Granted, that may not be saying that much. But for me, I’m at the point in my life where I cannot put a price tag on that relative sanity and relative enlightenment and relative freedom.

Plus, it offers economic options, job options, educational options, entertainment options, and great whether options that these people in these other places can’t even begin to imagine. It didn’t become the 8th largest economy in the world for no reason. There’s a reason the Apple MacIntosh was invented in California and not in, say, Indiana or even Texas. There’s a reason the entertainment industry is headquartered in Los Angeles. There’s a reason tons of creative people live in this state, employed in IT, tech, software development, entertainment, media, and the arts . . . and why they continue to want leave the $hitholes they grew up in, and continue to want to come here. I see it every day.

Try to put a price tag on those intangibles and see if they easily translate into dollars-and-cents, “real estate value” considerations.

Other places are cheaper because fewer people–especially fewer people with means–want to live there. After living in California and after living in many other ‘red’ parts of the country, it’s no mystery to me why fewer people want to live in those other places.

Dude it doesn’t bother you at all but you’re posting about it?

You don’t want dumbshit rubes and yahoos as your neighbors if you are not white

ben, so you are saying that white people like that type of people? It all comes down to priorities in life. The City has it share of homeless people acting impolite and gangsters that take sharing too seriously. Any place you go, you can point to people you don’t like. At least in The City, you have the smug satisfaction of knowing that other people wish that they could live like you do, with the weather, and other people who share your ideas that you are just a little better than the poor “dumbshit rubes and yahoos”(not the people who work for yahoo, of course) that are not privileged enough to afford to live in The City.

ira – one of my best friends is from south carolina. engineer at rhytheon. forget tibet, free dixie

. . . ESPECIALLY NOT if you’re not white.

As it is, I AM white, and even I had a hard time living with such types.

Oh, and yes, there are rubes and yahoos and idiots even in California. It’s just that in those other places, the rubes and yahoos and their ignorant, unenlightened mindsets are much more predominant. IN those other places, they make up larger proportions of the overall social mixes.

“This is why the California experience is so expensive. You cannot put a price tag on relatively evolved and cosmopolitan individual and collective mindsets, and California, compared to most of the country, has these in spades.”

Is this a joke or sarcasm?

Idiots abound wherever you live. California is no exception. There are rubes and yahoos (or their equivalents) in all income brackets and in all areas. And in CA, where houses are packed closely together, you will definitely have one for a neighbor regardless of how much you pay for your house.

Responder, there is a world of difference between life in The City and the rest of California. In fact, we believe that most of California is like Fort Worth TX with the “rubes and yahoos(not to be confused with the people who work at Yahoo). Yes, there are cheaper spots like “cow town” Sacramento and Riverside county(people with red neck mentality). I could go on. Any body else want to list their favorite city or county in California that has the “rubes and yahoos”?

You have no case.

http://www.autoevolution.com/news/laferrari-owned-by-qatar-sheikh-drives-recklessly-in-beverly-hills-scrapes-engine-overheats-video-99854.html

Case closed.

The demographics of Beverly Hills has changed to substantially Middle Eastern. I hope that the minorities there are more understanding of Moslems than the people in Dallas, or they will be called rubes and yahoos too. Of course, southern(I do emphasis the word southern) California is a whole different world to those that live in The City. They are a bunch of philistines from our standpoint, a place to avoid, if at all possible.

And this proves . . . . . . what, exactly??

And if this is indicative of your logical reasoning ability and the level of your analytical skills, I suspect you are one of those that dwells in rube-land.

“And this proves . . . . . . what, exactly??”

It proves that there’s bullshit everywhere. One would think a “more enlightened” person would understand that.

“And if this is indicative of your logical reasoning ability and the level of your analytical skills, I suspect you are one of those that dwells in rube-land.”

A “more enlightened” person doesn’t use ad hominem attacks, much less resort to childish name calling to make their point. If by “rube-land” you mean Los Angeles, you’d be right.

Ira, I think most of those Middle Easterners you see in Beverly Hills are Jews, not Muslims. Many are Persian Jews, but also Israelis.

That’s why cheaper states like Fl, CO, TX and booming.

Hate to burst your bubble, but actually, California NOW leads the nation in job growth:

http://www.cbsnews.com/news/california-leads-nation-in-job-creation/

What are the numbers per capita? Details matter.

Most of those jobs are non-benefitted and low paying. The real way to know how the economy is to observe the numbers of real people who are living in their cars or on the streets. These numbers are growing. If the economy is so great, why interest rates are so low? The Fed is afraid to raise rates to 0.25%, which is very minimal. I know several folks in my apartment who are unemployed for years. One is a CPA and another one is an attorney. They cannot afford to pay their association dues let alone their mortgage. Anyhow, they are no longer homeowners. I have friends who hold two to three jobs just to make ends meet. The only good news I hear are from those Wall Street investors and hedge fund managers on TV. The reality, however, is the opposite. One of my co worker is moving to Florida. She bought a big house there for $600k near Orlando. She sold her place in Torrance for $525k. She bought it in 2008 for $500k. She got 15 bidders. Eight of them are investors with cash. I guess making money on Wall Street is not enough to sustain 🙂

They way things have been going, those states won’t be cheap for too much longer.

News just in: Fed does NOT raise rates.

Who could have ever guessed? Fighting the Fed is futile!

I don’t see Vallejo on that list of Bay Area prices … 😉

I have noticed on this board there usually is a big debate between those who value money and want cheaper living vs those who are content with spending a boat load of money for a house.

If your value is to save money and live frugally then fine. That is your personal value. You place importance on that. If your value is to spend money lavishly and spend and buy the best latest gadgets then fine. That is your personal value and you place an importance on that.

There is really nothing wrong with either of those two life choices. It’s usually the frugal people calling out the free spending people. Who cares? If you want to live in a basement counting your stacks of money in the dark then fine. If you want to spend every single dime you earn then that is fine too.

Nimesh:

In principle, I completely agree with you. In practice, however, it seems that savers are forced to subsidize the spendthrifts in one fashion or another, directly and/or indirectly. That’s probably why savers are not inclined to view spendthrifts in a positive light.

I will concede that spendthrifts are a necessary component of society. After all, if they didn’t waste all of their money, my money might be less valuable.

The trouble is, the free-spenders feed off of the frugal people.

The free-spenders don’t just spend their own money — they borrow to the max. Taking out the largest mortgages they can get. The biggest student loans. Maxing out their credit cards. Buying items on “no money down” store credit.

Then when the free-spenders default, they want loan forgiveness and govt bailouts (i.e., increased taxes and deficit spending, which devalues the dollar).

Thus the free-spenders (i.e., borrow-and-defaulters) destroy the frugal people’s savings, through inflation and higher taxes.

It’s because the people over leveraging themselves and not saving will eventually come to a point where the frugal people, likely via government, will have to bail them out.

The issue is not the free-spending lifestyle itself but its consequences. We all know what happened when people took out HELOCs on their mortgages only to find themselves upside down. Or when home “buyers” assume mortgages larger than they could possibly support.

The more frugal, who have enough sense and money to not live in basements, are stuck with the costs of bailing out the financially irresponsible.

Fed 0% rate shows the very anemic ecomony is even worse than we imagined. 1/4% raise terrified these folks, look folks be very carefull what you spend your hard earned money on, one morning we may all wake up to a Greece moment in this nation?

Yep. The Fed is either cowardly or disingenuous in thinking that financial engineering can solve economic problems that are deeply structural in nature. ZIRP will not be effective against a global slowdown.

The longer they delay normalizing rates, the worse the ensuing fallout will be. Kicking the can down the road as no one wants to be blamed for the inevitable mess.

Here’s an interesting article on central banks love affair with debt.

http://viableopposition.blogspot.ca/2015/09/have-central-banks-created-crisis-that.html

Real Homes of Genius … This is what 350k gets you in San Francisco: http://www.dailymail.co.uk/news/article-3239257/In-America-s-expensive-city-350K-buys-San-Francisco.html

It pays to be stupid. Why are these idiots continue to make a killing in spite of their stupid decisions? If I were to to make the same mistake, I would have gotten fired already.

http://www.motherjones.com/politics/2010/01/wall-street-bailout-executive-compensation

Leave a Reply