Rich Dad, Underwater Dad: 21 Million Homeowners with Negative Equity or No Equity in Their Homes. 33 Percent of California Mortgages Underwater.

The latest Case-Shiller Index data had its first nationwide price bump up in nearly three years. I am astounded (but not shocked) by what this has done to the psychology of many. The most recent post highlighting the REO shadow inventory and how banks are keeping homes off the public view instead of convincing people that housing has a tumultuous path ahead, the post actually reinforced a group of people that now think the worst is over. Keep in mind the Case-Shiller data set for the LA/OC region is still declining. Yet people are extrapolating nationwide data and transferring it over to the dismal state of California. It may very well be the case that nationwide prices have hit a bottom but not for the mid and upper tier of California homes. Price corrections are virtually assured with the coming onslaught of Alt-A toxic dubious mortgages coming in full force in 2010.

The argument keeps shifting so let me be extremely clear. Some keep thinking that there will be some generalized and clean decline when the Alt-A loans implode. They keep obsessing over tiny details in the market and say, “I thought the implosion was going to happen now! Forget this, I’m jumping in.” Many people are simply impatient and choose to ignore certain facts at their own convenience. The same kind of reasoning occurred in 2006. Even almighty Ben Bernanke shrugged off the housing problems and didn’t see a recession being set off by the housing bubble. Housing in California will be in trouble for years to come. The distress market data tells us that. Yet if you use the median price as your indicator, you will be completely off. In fact, I wouldn’t be surprised to see the median price increase as the mid and upper tier markets implode…simultaneously.

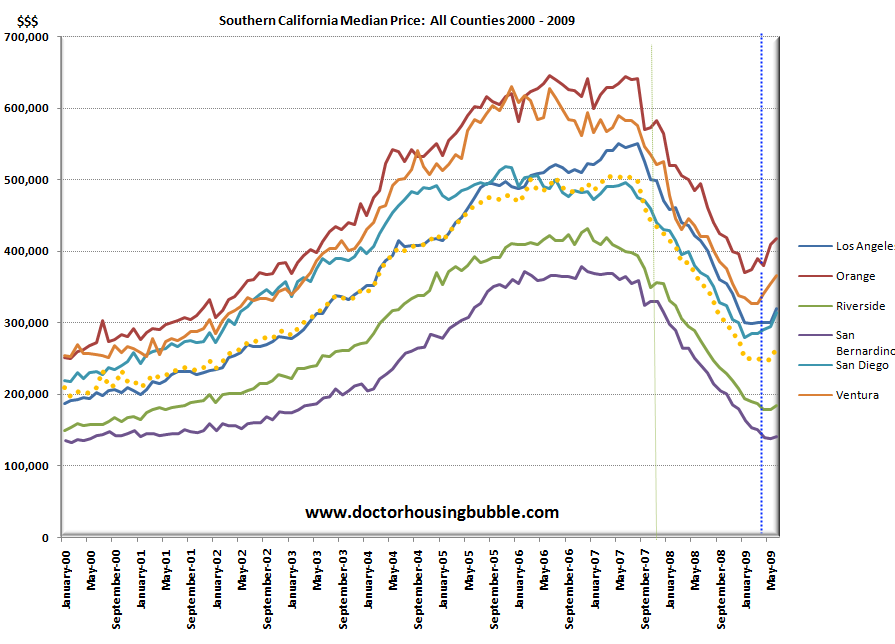

How can this be? Simply put, for the past year the bulk of the sales have occurred in the lower priced cities. Of course, the median price is principally concerned with volume and the volume has been with the low hanging fruit. Many in the mid to upper tier did not sell and still had prices at delusional levels so the volume at the mid to upper tier simply did not make a dent in the overall data. But now, we are seeing sales in these areas with more modest price cuts. Ironically, with more volume in these areas and the lower end working through its funk, prices may increase in terms of the median price. Let me give you a really simple example. Take a home in Pasadena. The hypothetical home might have sold for $700,000 during the peak but now will fetch $500,000. The homeowner bought for $300,000 so they still stand to profit. Life occurs (i.e., new job, divorce, etc) and they need to sell. The home moves for $500,000. Do this many times over and you can understand why you are seeing the median price in Southern California increase:

I think this is what is catching many people off guard. The median price for Southern California has been steady since January of 2009 and has increased in the last two months. You need to understand why this is occurring however. Given our previous example, you can understand that the home can sell for $400,000 or even $350,000 and the owner still will profit and the overall median price for the region will have more fuel to go up. And the Case-Shiller Index would increase in this case as well because it uses repeat home sales over time. The Alt-A implosion will force the hand of many banks to off load homes in these kinds of scenarios. So if you are looking at the region median price, we may have already bottomed. But make sure we are talking about the same kind of dynamics.

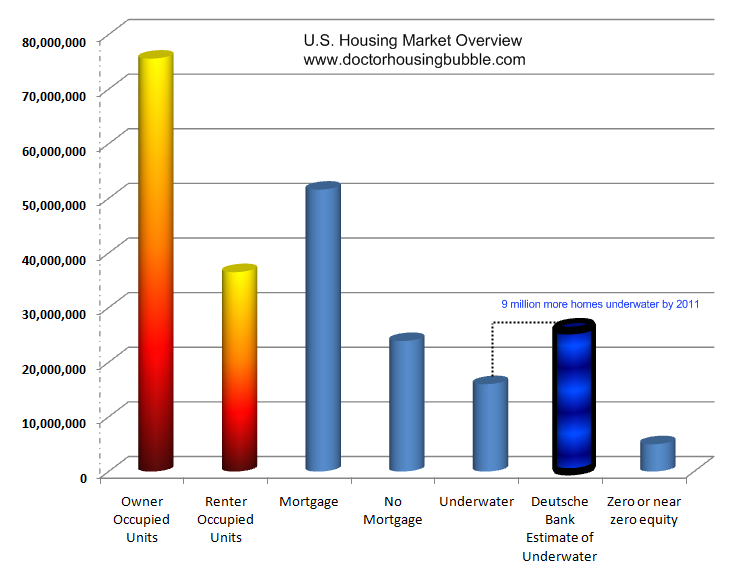

But let us look at the nationwide picture first. It helps to look at the entire U.S. housing market. Many of you sent the report from Deutsche Bank AG which stated that 48% of mortgage holders will be underwater by 2011. Interesting point since I have been saying for over a year that California will hit a housing bottom in 2011. Yet how extreme is this contention?

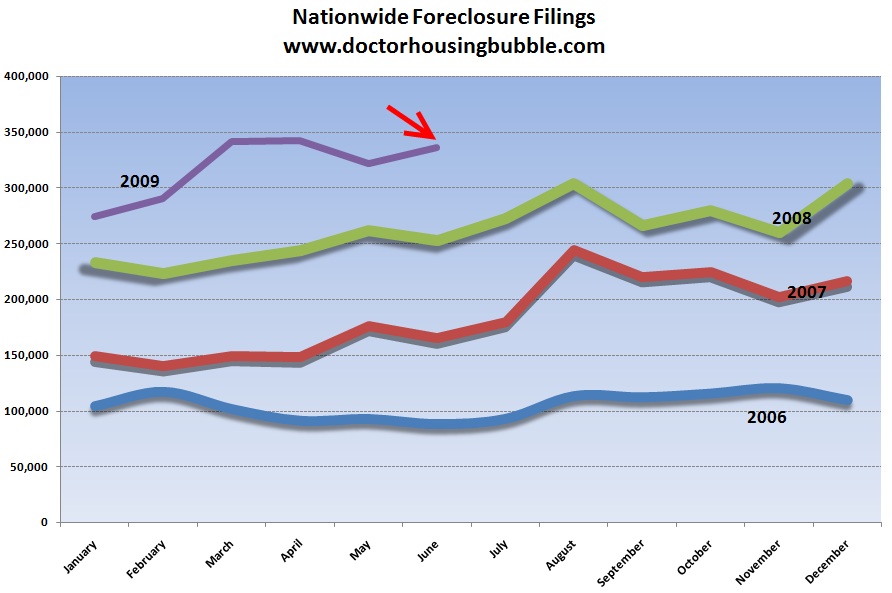

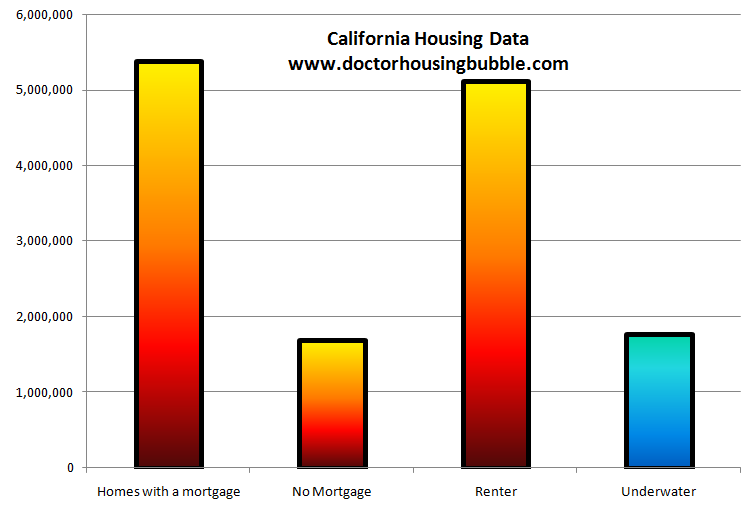

The above chart includes data from multiple sources including the Census Bureau, Deutsche Bank, and Moody’s. It helps to have it all in one spot to analyze. First, a couple of facts from the chart above. Some 31% of homeowners have no mortgage. Next, as things stand today some 16 million homeowners are underwater meaning they owe more than their home is worth and another 5 million have zero equity or a few percent in equity (which is irrelevant if you consider selling costs of 5 to 6 percent). The bottom line is some 21 million Americans already have negative equity or will have no equity in the coming months. What Deutsche Bank is predicting is we will have 25.8 million people with negative equity by 2011 which makes up about half of homeowners with a mortgage. Some see this as some mega epic doomer call. I don’t see it that way. The argument they present is that more issues will start occurring with prime mortgages (the data backs this up) since unemployment will stay elevated for sometime thus pushing up foreclosures. And right on time Fannie Mae announces another stunning loss this time to the tune of $14.8 billion. Keep in mind that most of the GSE stuff is supposedly prime paper. We are still running at record high foreclosures rates by the way:

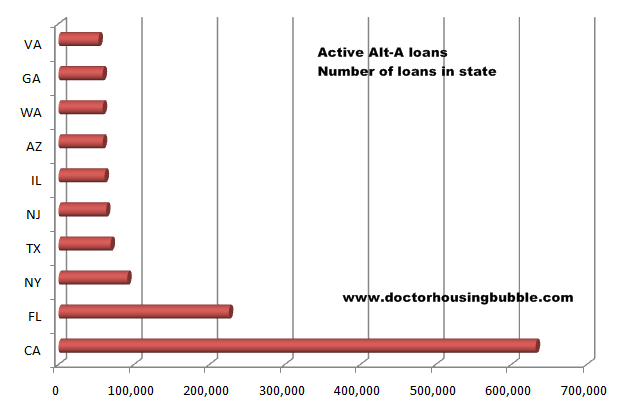

Nothing will push a home price lower than a foreclosure. And people forget about the impact that foreclosures have in an area. They force comp values lower so appraisers start valuing homes lower in general. I know some in the real estate industry hate this since they only think housing values go up but this is the reality. And with the Alt-A loans largely being based out of California, there is little reason to think that the mid and upper tier markets in the state will stabilize (the average balance is $440,000):

And for what it is worth, Deutsche Bank was early in calling subprime problems so I do give them some credit in their analysis. But you say California is different right? Well let us look into the California housing situation:

Of those homes with a mortgage in the chart above, 33 percent are estimated to be underwater by Moody’s. I would estimate a much higher number given the persistent delusion by many in the mid to upper tier areas. They somehow look at the Alt-A data and think that it will be swept under the rug as if it was a small amount of dirt. That is not the case. If you look at the above data, we now have more people underwater than people that have paid off their mortgage in California! Also, there is nothing wrong with renting in the state given that nearly as many people rent as those with a mortgage. And by the way, with the absurd loan modifications extending loans out to 40-years many homeowners that bought at the peak are basically realizing they have it worse than renters. A renter can pick up and leave. They cannot. Unless they strategically default and stop making payments which many are electing to do but will ruin their credit.

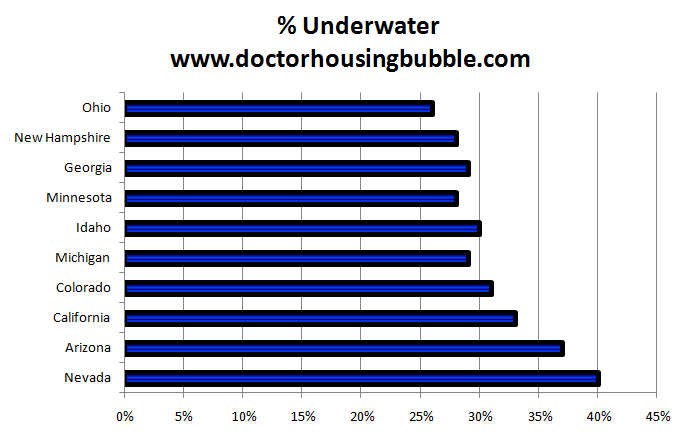

The above implications are rather clear to someone that has been following the California housing market for a decade and is also cognizant of its historical trends. One key factor not being addressed however is housing affordability. Clearly lower home prices will make prices more affordable – only if the assumption is based on a stable economy. Yet what use is having more affordable home prices if the economy is firing people left and right? And if you haven’t noticed, California’s economy with an 11.6 percent unemployment rate is still going up. Some analysts estimate a 13 to 14 percent peak. That is why when you look at what regions have underwater homeowners, you will also find economically depressed regions included with the bubble maniac states like Nevada and California:

There are two sides to the housing equation. First is the home price and second involves the local economy. This is simple to understand. Michigan has incredibly cheap housing prices. Heck, I’ve seen some homes going for $1 to $100 simply because the local governments want someone paying some property tax and maintenance for the home. So the price is fine since you can’t get cheaper than $1. Yet the second part of the equation is a disaster. Employment is in shambles. What use is it living in a gigantic cheap home if you have no job in the area? And we are a social bunch. You might think it prudent for you to live in your cheap mansion but what of your friends or family? You’ll need something else to do instead of sitting in your big empty home counting your cash while those around you struggle financially. That is why plans like those for Flint are openly talking about demolishing parts of towns. Like a Phoenix rising from the ashes except those ashes will be cemented over in a housing graveyard.

California has one of the highest unemployment rates in the country. We have the bulk of those toxic Alt-A loans which include the tasty option ARM variety. For this entire decade, most of the new high paying jobs revolved around the real estate industry in the state. Short of us having another bubble, that industry is gone forever. So what is going to replace that function in the equation? What is incredible is even after the major price adjustments, housing in California is still unaffordable. People say, “look at that $100,000 home in the Inland Empire” while failing to realize the near 20 percent unemployment rate in some cities in that area. The California is different argument held water when our economy was booming. That argument holds no water in a state with a $26 billion budget deficit and is chopping services left and right.

For many, the American dream of homeownership has become a nightmare. It really is too bad. Private property ownership has worked well for our country. I would argue that it is an important part of the stability of our economy over the last fifty years. Yet the perverse crony real estate industry tag teamed with Wall Street and decided to transform this once boring industry into a casino on the backs of the American public. Forget about long-term stability when you can sacrifice it all for short-term gain. They now openly chide the American public since they did after all sign on the bottom line while at the same time they are taking money from the Federal Reserve and the U.S. Treasury. It is the ultimate hypocrisy. I believe that those homeowners that overleveraged themselves should lose their homes. That is why I am adamant against using taxpayer money for loan modifications especially when they are designed more to protect the banks. I am even more adamant about letting those lenders who participated in this mess to fail. Too bad during the earlier days of this crisis we didn’t reward prudent lenders with taxpayer money since they were the ones who demonstrated how to actually conduct banking. Instead, the money flowed to the most culpable in creating this mess.

So don’t be fooled about this short-term delusion. Has the freefall stopped? Sure. But that doesn’t imply a robust recovery is around the corner (the stock market rallying 50 percent since the March low believes in the “V” shaped recovery). What industry is going to make up for the lost financial and real estate jobs? How much home can you afford while working a service job? The fact that we have 21 million Americans with negative equity or zero or little equity is simply astounding.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

30 Responses to “Rich Dad, Underwater Dad: 21 Million Homeowners with Negative Equity or No Equity in Their Homes. 33 Percent of California Mortgages Underwater.”

So, if my house is more than 30% underwater now, is it time to make the tough business decision and cease payments and let it be reclaimed?

I bought a house to live in, and I sunk about 1/2 my retirement (so far, I’m not ready any time soon) into it for safekeeping. I wasn’t expecting to get rich on it, and I certainly wasn’t expecting to lose such a big chunk of my nest egg in this way.

How does one go about making an INFORMED decision in this space?

And those of you who feel this is ethically challenged, my apologies in advance. If I hadn’t been screwed with an Alt-A that capped in the first year, I wouldn’t have refi’d and I’d still be on first money. I’ve since learned that was very dumb of me to do…

What is the price range for low, mid and upper tier homes in Southern Californina?

“Michigan has incredibly cheap housing prices. Heck, I’ve seen some homes going for $1 to $100 simply because the local governments want someone paying some property tax and maintenance for the home. So the price is fine since you can’t get cheaper than $1.”

As a Detroiter I can tell you that these cheap homes are NOT investment opportunities – they are all in the oldest, most run down neighborhoods in the city. A hundred years ago these were the neighborhoods that people blamed the decline of the carriage industry for, and they’ve only aged since then. Our unemployment rate is only slightly higher than Californias, and the idea that Michigan is swimming in a sea of ultra-cheap homes is wrong (although it would be nice if it were true).

The Alt-A and Prime Carnage will be very interesting going forward from here. As Dr. HB has illustrated over and over, the mid and upper tiers of Southern California will be hit hard. Take for instance Mailbu, since 2005 it’s sales volume has dropped 92% from July ’05 to July 09′. And this is before any loan resets or recasts. Not to mention, over 4 years of inventory listed. Throw in the shadow inventory lurking and you have a recipe for disaster.

http://www.westsideremeltdown.blogspot.com

I think Homeowners who owe more than their homes’ value are more likely to let the property fall into foreclosure. Negative equity is a big concern for lenders that are already seeing record home foreclosures across the country.

Check Out : http://www.housingnewslive.com/blog.php

I lived in Flint Michigan until a year ago when I sold my house and moved to Orange County CA. I have observed several things.

The Michigan RE market had been suffering long before the national bubble burst. The WTF loans that were an everyday occurance in the west are few and far between in the midwest. Employment contractions is what has driven their RE pricing down.

In SoCal there is some strange kind of “buy now or get left behind” mentality that has infected everyone and is held on to like a life jacket by a Titanic survivor.

I grew up in the Detroit area, but after college, had the sense to leave. Went back last year after 40 years to see my old high school buddies. In that area

(Sterling Heights, Warren, north of Detroit) you can still get a nice house for

$125,000. to $250,000. But the lack of employment opportunities makes it a poor move, unless you just want a cheaper retirement area.The auto industry WAS Michigan, and now it is becoming as economically depressed as West Virginia, after the mines closed.

The high tax, government red tape,anti business states(Calif., in particular) are hurting.

The low tax, business friendly states (Texas) are still growing.

Maybe there is a lesson there for the people who want every social program that anyone thinks up, to be funded by the state.

I know people who know they are upside down on their home, but will keep paying because they can and they are hopeful that they can wait this whole downtrend and in a few years will be able to sell for a profit.

I know others who think they still have equity, when in reality they are just deluding themselves.

All in all, each day makes me happier that I don’t own a home.

>>What industry is going to make up for the lost financial and real estate jobs? How much home can you afford while working a service job? <<

Ummm, First of all finance and pimping real estate is not an industry. Second these people are a most of the problem. Inflating the cost of houses and land does not provide anything to our economy. The finance cartel is just a hidden tax on productive people.

The economy will not start to come around till we start to reward productive jobs and real industry. As long as flipping houses and day trading are considered as anything other than dishonest parasitism our country will not heal. The finance, insurance, real estate tail needs to quit wagging the dog of manufacturing, construction, mining, agriculture, etc. A balance of reward for real effort and productivity needs to be returned to our society. The message now is that anyone who works productively for a living is a fool. Who am I to disagree?

How can I get a copy of the Deutsche Bank report mentionned?

In due time, all of the more desirable areas in California will quietly be owned by the people from other countries who we sold ourselves out to. It will be hard to compete with cash buyers using cheap U.S. Dollars. Much of their income does not directly come from the California economy. There will be a few good deals out there, but don’t fool yourselves thinking you are going to get a steal deal on a nice property. How is the price of a home going to decline if it’s paid for in cash along with most of the neighborhood? Taint going to happen that easy. Just look at San Marino, Arcadia, Temple City, etc. Junkers are still going for 500-600K up…..cash! Folks are buying this stuff up have absolutely no connection with the American way of consumption and destructive credit usage. These people would rather commit suicide than foreclose. They save not just for their families, but for the next generation! The goody properties will always be tuff to obtain. Of course you can always pick up big newer house in Valencia or Corona for a song. In those “credit crunch” areas, there are thousands of folks living in their houses that should have had NOD’s sent out to them over 6 mos ago! Those homes will be dropping for quite awhile.

Yep, foreign cash. I see it in just about every open house here in Silicon Valley. I’m looking in the “lower middle” segment, 3/2, single family, 6000 sq. ft lot, decent schools.

Of course you can always pick up big newer house in Valencia or Corona for a song. In those “credit crunch†areas, there are thousands of folks living in their houses that should have had NOD’s sent out to them over 6 mos ago! Those homes will be dropping for quite awhile.

I agree, I live in Corona. But, why is it that just 2 miles from me in Yorba Linda prices are still not dropping? Those owners in YL breathe the same air we do in Corona, yet they are still living in 2007. By the way, Corona prices are still very high, most of the people buying are still hoping that the real estate prices will be coming back up to 2006 prices in a couple of years.

Why should us renters subsidize homeowners? Isn’t that what happens

when homeowners get a mortgage deduction on their Federal income tax.

Has this contributed to the housing bubble? I don’t buy the old line that

homeownership helps to stabilize a community. I say that is BS, especially

when people just flipped houses. Maybe losing that tax break would help

to prevent more housing bubbles in the future.

“I agree, I live in Corona. But, why is it that just 2 miles from me in Yorba Linda prices are still not dropping? Those owners in YL breathe the same air we do in Corona, yet they are still living in 2007. By the way, Corona prices are still very high, most of the people buying are still hoping that the real estate prices will be coming back up to 2006 prices in a couple of years.”

Living in Corona usually means your life revolves around the 91 freeway. No thanks. I live in yorba linda (rent), and have always had the opportunity to buy in corona for cheaper. But the traffic there is some of the worst in the world. I have co-workers that live in corona off of ontario/green river.

Mike,

Yorba Linda has quite few Asian cash buyers (mostly Korean) It’s also is a close hook up to Irvine………….

“I don’t buy the old line that homeownership helps to stabilize a community.”

It’s pretty insulting when you think about it. While many renters do come and go frequently, many other renters take up long term residence, or even when they do change buildings still stay in the same general community. But people who don’t buy a $600k tiny box have no value to the community (I guess only if you define value = property taxes), which of course includes people in a lot of perfectly worthy professions that can’t afford $600k boxes.

The whole industry was a house of cards built on a swamp filled with desert sand. Maybe they can prop it up a little while longer, but when you try to build a dike to keep the flood from the tsunami out, it will just be all the more devastating when the dike fails (no San-Francisco innuendo intended). Fortunately, the plan is to gradually bring the entire world economy down so we will no be so disappointed with how far we fall. Or maybe they can keep it propped up a few more years. It’s obvious that no plan, no matter how absurd, is off the table.

To DrHB’s statement – “Many people are simply impatient and choose to ignore certain facts at their own convenience.” I just want to add: Many people don’t even KNOW the facts and aren’t seeking them out because they have this tunnel vision focused on buying.

It’s puzzling, but you would think that people would do a LOT of research before they commit half a million bucks, but I have college educated friends making good $ whose entire research is comprised of watching the nightly news and surfing Zillow.

I’ve thought about this and it seems in the end, the perception in most people’s minds is that if you own a house, this means you are successful. Just as owning a BMW makes certain people feel successful.

Another factor that may come into play in the housing market winners and losers: gas prices. Goldman Sachs is predicting $200/barrel oil in 2010. They were one of the first to predict the 2008 oil bubble. Better get that cash for clunkers before it dries up or move closer to your job. I’m just saying…

Be brave Comrades

One has to travel around the world to really learn why good properties in So Cal haven’t dropped much. Although the west side is in a crazy class in of it self. Unfortunately, Americans are some of the least travelled people in the developed world. We spend too much time and money latching on to that new BMW, or boat, 70″ TV, Etc. In Shanghi or Bejing a townhouse or condo close to work cost 500-700K. In India the same is true to some extent. Property with land is very expensive and quite a rich man’s luxury there. Outside of town you can purchase farmhouse type property cheap and there’s lots of that stuff around (like a property here in Lancaster without gangs). For a person from there to see properties here with LAND close to work for 500K up is a steal. The currency in China has steadily become stronger against the weak dollar making Cal properties even cheaper (for them, not us). They could care less about the mess of debt we have made for ourselves. With the discipline of saving along with a great education, they will own most all the desirable properties in Cal. sooner or later. They don’t care about interest rates either. All they do care about is when the dollar crashes, they want to be in a good stable position. They are sitting on so many Dollars, they would rather take a smaller hit on a good property than do nothing and watch their Dollars shrink in half or more. It’s a tuff call, but sitting on your ass waiting for a nice property to drop in your lap is a little too optimistic. Competition for good stuff is strong. There will be deals, but you are going to have to work at it, even if you have a good chunk of cash to put down.

There is something very disturbing about the implicit messages the government has been sending. They’ll say they had no such intention, of course. But all the talk of housing bailouts, moratoriums, reworked mortages, is filtering down to the public as “we will help you, even reward you if you spend and risk and even buy beyond your means. If you are careful and frugal and try to save, we have nothing helpful for you.” So even more fiscally conservative people may now be starting to think that if they buy now, at the slight housing dip, no harm can come to them. If the house appreciates, they have a cash cow; if it doesn’t, they can get out cheaply enough; look at all these people now who are getting to live rent-free (and socking away the extra earnings) for a year or two, before they have to leave, and they can just buy another house. And what’s a credit hit, if millions of others are similarly hit; it becomes mostly meaningless then.

To me, this is the worst aspect of what is happening now. If the government really wanted to discourage bubble behavior, and buying things you can’t afford, they would stop doing everything they can to help these “underwater homeowners” (many of whom made out like bandits on the refinancings, and just did one too many). But people can read the tea leaves. They see that lying on your loan forms and acting like a greedy idiot doesn’t seem to have too much of a price, at least so far. And let’s not even consider the bailed-out banks, which are essentially being encouraged to take all the stupid risks all over again, like a foolish gambler who sees all his losses magically restored, and believes that he is impervious to harm.

This goes back to the experiment in 1973 when we defaulted on the Bretton Woods agreement to stabilize the world’s financial system, post WW II (aka ‘going off the gold standard’). They suspected how it would go and it basically has–wild swings between boom and bust with wealth being transferred to the wealthy. Every nation in the world knows, but they are helpless to do anything. We are now a service nation with no possible hope of every balancing our trade. We are a paper-printing, service-sector nation/empire. Expect to be serviced a bit more as the years go by. We can continue to live in opulence with ever expanding credit as long as all the other nations continue to accept our paper for their commodities and manufactured goods–until they don’t. This is the road we have chosen.

Yes, I totally agree Dr. HB that the prices for anywhere “normal” in SoCal are still way higher than justified, compared to prices just 10 years ago. And even worse is watching the government bail out the bad players in the industry that caused this mess, and the (mostly) irresponsible mortgage holders in a bad attempt to continue the artificial inflation of home prices, at the cost of affordable housing for the responsible taxpayers that are forced to fund their own inability to buy.

This should be a crime.

Raffi:

Totally agree, it sucks that the Goverment is forcing me (and millions more) to PAY for the luxury of NOT being able to buy a home at a reasonable price. Promoting and protecting the debt slave way of life at all costs, on behalf of the Banksters.

Are any of you suspicious of unemployment numbers that we hear daily? What I mean is, sometimes I don’t think those numbers accurately reflect the reality of unemployment because they only take into account those workers who apply for unemployment benefits (as I understand it) and whose employers pay into the system. But what about all those real estate folks (loan officers, RE agents, realtors, developers, builders, contractors, tradesmen, etc) who were self-employed/1099 workers and who are not currently making enough to survive each month? Are they counted in the unemployment numbers? If not, I would guess that true unemployment in Cali is closer to 20%. Any thoughts?

I know there must be many Real estate a-holes selling half the houses they were used to, at half the previous commissions. (a 75% hit?) That has GOT to be hurting if not now, eventually. I say good! The real estate profession partakes in legal price fixing and is an utter scam. I hope this downturn thoroughly re-shapes that industry into a fee-for-service or something more reasonable than a fixed 3% for each idiot. (I know there are exceptions.) I’m sure that many, many high-end RE A’s are living off credit cards, defaulting on the mortgage, as we speak and are waiting for the next sale to make them whole. That’s not a sustainable way to live, and the dam will burst at some point. As for loan officers, etc…..many have turned into loan modification officers, and are scamming their way along the bottom. They might actually might not be in that bad shape, but for how long will these scams put food on the table?

Just remember next time you go to the ballot box that things started collapsing about the time the Democrat Party got majorities in the House and Senate. The Republicans are stupid–extremely stupid–but they don’t hate anybody. The Democrats are evil and they hate whites and businesses. If they CAN shaft them they WILL shaft them. What do you think Obama is doing right now? If he openly announced it was his intention to completely destroy the American economy, what would he do differently than he is already doing?

Business people saw Obama coming, which is why the economy is in the state it’s in, and it won’t get better until there is at least one House of Congress that is back in Republican hands. The Democrats are the fast road to bankruptcy for businesses, and both the businesses and the Demos know it. Who could blame the businesses for running scared?

@thedog

Plus the conveyor belt. How did the rate go down when 275,000 jobs were lost? Because discouraged workers fell off the conveyor belt into the trash bin. Every week thousands more lose their benefits. I’ve seen engineers working at Radio Shack and Staples, but they’re employed! Green shoots you say? It’s an obamanation.

J6P–

You are putting political ideology before commonsense. Partisan political arguments are convenient, but have little to do with our current economic straights–this is an argument of class struggle, not left or right. Moreover, the seeds of collapse were sown in the 1970s, and have little to do with either Democratic or Republican majority. Both parties are guilty of hasty, shortsighted, and biased legislation that rarely represents fully the interests of our country’s majority. After all, when was the last time anyone in government was willing to imperil his or her career to do what is right for America? Don’t pigeonhole yourself with political arguments–honestly consider what government is doing for you and I think you’ll discover that, unless you are a powerful lobby with unlimited purse strings, neither is on your side.

Leave a Reply