Revisiting option ARM data – Bank of America, Wells Fargo, and JP Morgan still have over $160 billion in option ARM loans outstanding. Over 250,000 option ARMs in California still active.

In the last year, very little analysis has been done regarding the option ARMs floating out in the market. Part of this has to do with the fact that option ARMs are really a problem for a handful of states. California and Florida lead the charge with option ARMs so this may keep national analysts from digging deeper. As we all know, option ARMs are not made anymore but their legacy problems are still lingering in the market. Since 50 percent of these loans were made in California, I have an interest to see where things currently stand with these loans yet not much updated data is readily available. I went ahead and dug into the SEC financial filings of the top three banks in our country; Bank of America, JP Morgan, and Wells Fargo. The fact remains billions of dollars in option ARMs still remain.

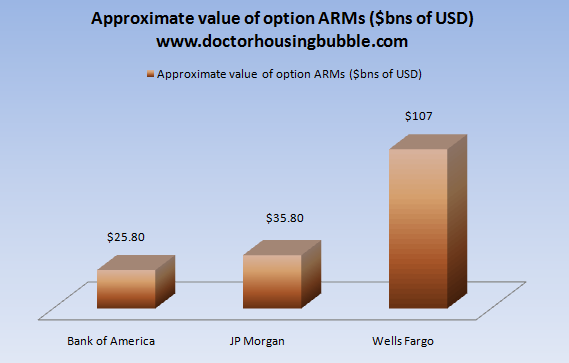

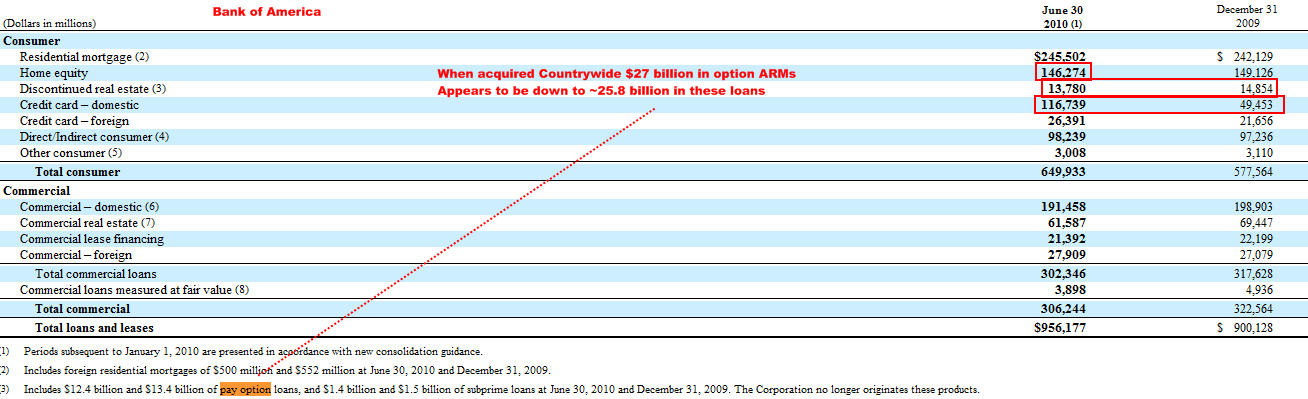

Let us take a look at the total option ARM nominal value for these top 3 banks:

Source:Â SEC, 10-K

It is hard to find an actual source within the banks own reports. For example, we don’t get a loan breakdown of where these loans reside or their average balance outstanding. From previous data we know that these are typically higher. Subprime seemed to be the choice in poorer low income areas while option ARMs were the loan of choice for over extending in middle class neighborhoods. Keep in mind that the above banks inherited the option ARM portfolios through their mergers with Countrywide, Wachovia, and WaMu. From what I can gather from these three banks it looks like $168.6 billion in option ARMs remain. If half of this is in California, that is a large amount. And keep in mind you have other option ARM lenders like Downey Savings and First Fed that are no longer here, but their loans remain. That data is buried deep in FDIC reports and hard to gather. So it is obvious that the option ARM loans are still out there and we see this through individual foreclosure filings.

Wells Fargo late last year announced that it was planning on converting option ARMs to interest only loans which is another variety of toxic mortgage. The bank as of last year had modified some 43,000 Pick-A-Pay loans into this new interest only conversion. So I’m not sure if in their accounting statements they are keeping the Pick-A-Pay modifications under their option ARM line item. Technically they are no longer option ARMs if they are converted to interest only loans. This is why the toxic mortgage Alt-A and option ARM issues are much bigger than merely one subset of loans. Banks are trying to comingle good loans with bad trying to hide the bad taste of these loans.

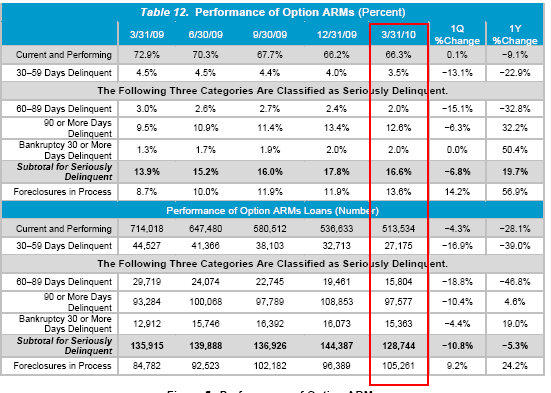

Let us take a bigger picture view of the option ARM market:

Source:Â OTS

As of April, there were 513,534 active option ARMs in the market. This is a reduction of nearly 200,000 from only the previous year of data. But again, are banks doing odd modifications like converting them into interest only loans and then, these loans aren’t categorized as option ARMs? The more disturbing point in this data is the absolute deterioration of this loan product. As of Q1 of 2010, roughly 4 out of 10 of these loans were either behind on payments or in foreclosure. Just assume that half of the 500,000 option ARMs are here in California. Do you think this will cause further problems?

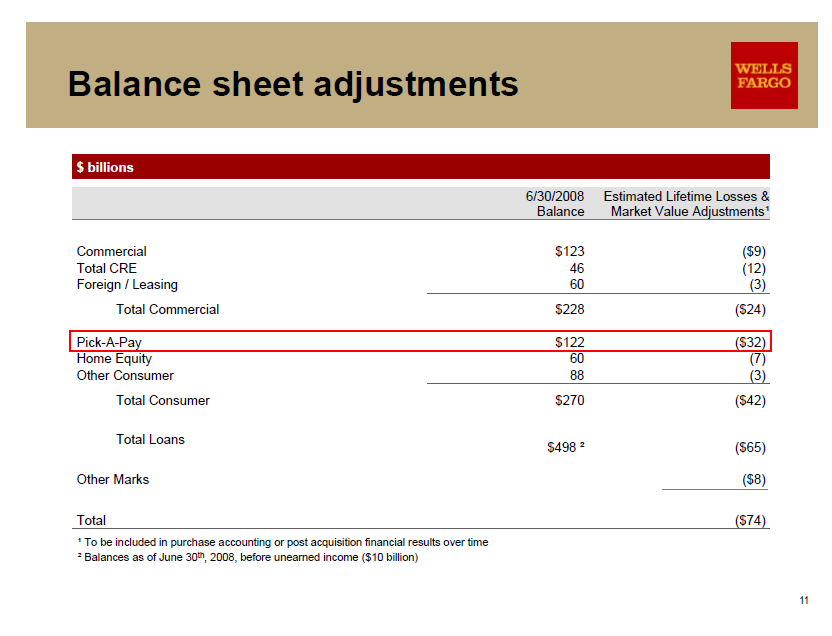

Wells Fargo by far acquired the biggest option ARM portfolio:

When Wells Fargo took over Wachovia it ate up $122 billion in option ARMs. As of last December, that number was down to $107 billion. Hard to tell how this portfolio now looks since not much data is released on this and banks won’t even be explicit on this data because this is the cream of the shadow inventory.

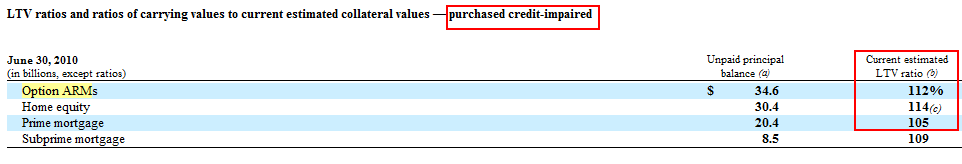

If we look at JP Morgan, the LTV ratios just show that more defaults are on the horizon:

For option ARMs the LTV ratio is 112%! Even more interesting is in their home equity impairment issues. Option ARMs and home equity loans are all products that focused on destroying equity or at least avoided building any of it. More and more write-downs will be coming forward but banks are buffering these problems through their access to the Federal Reserve and speculation on Wall Street.

I’m sure all of you heard that the recession is now over. After that news was released, the California unemployment rate went up again to 12.4 percent meaning we have an underemployment rate of over 23 percent. Not that it matters but people should now realize how disconnected Wall Street is from the actual real economy. Let us examine the option ARM data for Bank of America:

In total it looks like BofA has nearly $26 billion in option ARMs from their Countrywide acquisition. This is still a sizeable number especially when most of it is concentrated in one state. This can disrupt the market conditions of one market since many areas were heavily favored and sprinkled with option ARMs. Many banks are benefitting simply because the Fed has artificially pushed rates lower thus making the COFI, COSI, and other indexes used to adjust option ARMs lower:

But again, the reset issue with Alt-A and option ARM loans isn’t the problem so much as the recast issues. That is why the default rate on option ARMs is now following the path of subprime debt. In other words, option ARMs are still here hidden in the attic of bank balance sheets but that doesn’t mean they are gone.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

38 Responses to “Revisiting option ARM data – Bank of America, Wells Fargo, and JP Morgan still have over $160 billion in option ARM loans outstanding. Over 250,000 option ARMs in California still active.”

Dr. HB,

Do you have estimate when these option will recast? Or is it impossible to predict due to the loan mods by the lenders?

Thanks

Not to flog the obvious, but some of the LTV on the still-standing loans reflects the downturn in housing values (if you borrow at an 80% LTV at purchase, with 20% down, and your house’s value plummets, your loan suddenly goes very sour and your down payment is eaten up). So even the prudent get burned.

But wasn’t that the whole idea here–to use debt deflation to destroy the capital invested in housing by the prudent, who have the last untapped mother lode of money that needs to be destroyed?

This is just an excellent piece. Thank you, DHB. I’ve been wondering what’s up with more recent ARM numbers, given so much of it was handed around by the crony capitalists in a hideous game of Russian Roulette Musical Chairs Hot Potato Time Bomb.

rose

Here is what I would do with the non-performing loans if I were the bank:

I would determine the market rental value for the homes of all the non-performing loans. I would use this market rental value to determine the payments to charge the homeowner. For example…mortgage payment is currently $5,000 a month. If the home were to be rented out one would pay $2,500 a month. So this is what your charge the homeowner!! Allow them to have their monthly payment reduced to $2,500 a month for three years.

Yes, the bank would lose money, but it would be a much lower loss than a foreclosure. If the loan balance was $1 million and the bank foreclosed, they would probably end up getting 500k for the property and lose 500k. By modifying the loan for 3 years they would lose only 90k while giving the market a chance to recover. This would stop the snowball affect of foreclosures and lower prices.

It would also workout for the homeowner. Here is the other option the homeowner would have. They could let the house foreclose/ short sell, go rent the house across the street for $2,500, and have their credit destroyed. Why not stay in the same home, pay the same monthly payment, not have credit damaged, still be able to take a mortgage interest deduction, still own the home, and have 3 years to get back on track!? Win win!

You can call it kicking the can down the road but I think it is the best way to minimize losses and prevent the snowball effect of more foreclosures and lower real estate values.

What do you think?

Who will pay the property tax? HOA? Gardener? Pool service (if have one)? Maintenance and repairs?

you idea maybe sound as a good idea in theory but not practically.

Matthew,

Your math is correct, but your suggestion is totally dependent on one vital assumption… That within the next 3 years housing prices will recover to (or even close to) the levels seen in the bubble days.

For my own selfish reasons, I would personally love to believe that this could happen, but (as hard as I try) I can’t find any reason to believe that it will.

We witnessed an unprecedented combination of factors that fueled home prices to totally unsustainable highs. In the history of the US, housing has never appreciated this much over the similar period of time as in the early/ mid 2000’s.

Yes, anything can happen, but I hope that government policy makers, and the bank where I deposit my savings don’t make plans based on such a low probability event.

I really don’t want to sound like an @#% in this post, but I think we (collectively) need to come up with solutions that have at least a reasonable probability of succeeding.

Regards to all

“Yes, the bank would lose money, but it would be a much lower loss than a foreclosure.”

Yes, but why settle with that when you can sell whole loan to Federal bank on the face value and win a lot?

That’s the policy banks _really_ want, now.

A lot of folks don’t realize that many lenders that did these loans were taken over by the FDIC, i.e, they failed in 08/09…and loss share agreements are executed with the banks/investors that bought up the option arm loans that the FDIC took on in their takeovers………..what that means is the lenders won’t modify these loans at all! They are monetarily incentivized by our own gov’t to foreclose on these homeonwers–google loss share agreements–as a taxpayer it will piss you off! I’m a lender, and the taxpayer is on the hook for so many misdeeds of the banks in the heyday market, it is absolutely disgusting! The option arms are done among the top 10% wae earners primarily, who are responsible for 40% of the consumption in the US—AND they are done on primarily high end homes, so we are talking BIG loan amounts! When these loans reset, and the payments double, these borrowers will walk, or stop consuming so they can make their mortgage payment—–which will be devastating to our economy…………..these loans are a disaster, but part of the problem, is the FDIC through the back door has the taxpayer on the hook, and the investors that bought the loan actually MAKE MONEY IN A FORECLOSURE from the taxpayer!

The problem with most loan mod programs is that “the bank” doesn’t really own the loan. It’s been sold out to any number of clients as an investment product. It may be partially owned by many securities and each would have agree to the mod.

Also, the value on the books is the sales price of the home. By declining to foreclose or mark to to market, the “value” remains intact and the losses are composed of the missed payments. I’m not certain if it is indeed the case, but I would expect that if a loan is modified it would include some sort of appraisal that is used to adjust the payment. In many cases, it might be worthwhile to lose a few dozen $3000 payments over the course of a few years than to take a quarter million dollar hit all at once.

Interest only is not as bad as an option arm, since at least the balance is not going up (assuming only minimum payment made). An interest only loan is really a long term lease with maint. responsibilities transfered to the owner. (Assuming taxes and insurance are paid by the owner also). Its sort of like a lot of land in the UK where houses are build on plots that have a 99 year lease, so the lease payment amounts to an interest only loan. Perhaps thats the model for the future a 99 year lease on a house, now if the bank gets to depreciate the house then you could tear it down as it would be on the books for nothing after 27.5 years. (Suggests a 27.5 year lease as an option)

Take out another $1,250 a month for property tax and maintenance. This brings the total loss over 3 years to 135k.

I forgot to add in to the calculation the 2 years of payments the bank is missing out on by stalling the foreclosure process under the current method (this adds another 120k loss to the 500k loss)

Ok, let me take a stab at understanding this. The FDIC will cover a lenders losses up to 80% or even 95%, if the loan fails. If the lender agrees to a “modification” with the home owner, that would reduce the amount of money expected from the investment, or WORSE, forgive principal and lose also money on the interest rate.

Is it any wonder why banks take forever to foreclose? The longer the banksters stave off foreclosure, the higher their “losses”, and the higher the amount to fraudulantly claim, er I mean to lawfully claim.

So while americans blame other americans for living in a property for free, it really wouldn’t matter, because lenders won’t foreclose anyhow whether there are squatter or not, because they are padding the “losses”.

There are people like DG who even post here that have moved from their home out of frustration waiting for the banksters to foreclose…and even then, will still not foreclose on the property with not a soul living in it.

How about we all pay what we owe. What a concept you might say. You took out a big loan you make a big mortgage payment. I took out a relatively small loan, I make a small mortgage payment. Simply math people, simple math. You can’t make your payments, well then you die financially. I survive financially cause I did not buy into a housing bubble. Good things DO come to those who wait, it’s not just a saying.

If you paid more than three times your annual income on a house then you’re likely broke. Sucks to be you. Next time you’ll be more prudent in your purchases. Your financial problem certainly isn’t my financial problem.

Foreclosure is not too bad, it goes off your credit record in 7 years I hear. You made you bed now lie in it.

Kind of funny isn’t it how 3x income went from the upper limit for solvency to a lower limit guideline. I still maintain that there is one core lesson that would be worthwhile to learn: “think for yourself”.

People need to stop following and doing everything others do in some kind of quasi-competitive purposeless self entitled existence. On top of that, people need to live with their decisions and accept responsibility, maybe learn a bit so they are more successful the next time. Unless they have wealthy parents no one is coming to save them from idiot decisions so they should endeavor not to go to zero, it’s painful to rebuild but that too can be survived. Even if one does have wealthy parents, it’s a sad way to live depending on them for a bail out – time to grow up, be your own man. They can start that process by thinking for themselves and not relying on others. We only live one – think carefully about your decisions and how you want to spend your time and resources.

“People need to stop following and doing everything others do in some kind of quasi-competitive purposeless self entitled existence. On top of that, people need to live with their decisions and accept responsibility, maybe learn a bit so they are more successful the next time. ”

I second that but go one step further. People MUST learn to make rational cost-benefit based decisions again. If we cannot do this, then any system we devise will not be sustainable. Currently, we have an economy based on consumerism and shell games with money. This economy, which has an undue amount of control over the legislative body, virtually depends on consumers making emotional decisions. Have you noticed how most big buying decisions are advertised in ways that appeal to your emotional side rather than any rational need/benefit?

Previous Foreclosure: Usually a Borrower is not eligible for an FHA mortgage if a previous residence went into foreclosure (or deed in lieu of foreclosure) within the most previous 3 years. Chapter 7: Borrower’s discharge of bankruptcy should be 2 years or more previous to the loan application and the Borrower should show reestablished credit with all recent credit accounts paid as agreed since the bankruptcy.

LOL. Oh no, they aren’t eligible for an FHA loan for 3 years. As if we are all entitled to that. And as if renting for 3 years is such a death sentence! Your post is just such an unintentionally spot-on indictment of what is wrong with our current system. The FHA program used to be for a minority of mortgages for those borrowers who wouldn’t qualify for other traditional mortgages. Now nobody qualifies (b/c prices still haven’t corrected and no one saves money for down payments anymore) for the traditional, so WE’RE ALL FHA NOW. Laughable. And why housing ain’t going to bottom for YEARS.

“Your financial problem certainly isn’t my financial problem. ”

Unfortunately it is. When banks, who gave these loans, are saved with taxpayers, i.e. yours, money.

Banks, not those individuals who took these loans. They don’t matter.

Trying to solve this at individual level doesn’t work at all: Many people who don’t pay their loans ruins the bank and who saves the bank when the lenders can’t/won’t do?

Washington says that taxpayers and you’re not asked.

john c. holmes…. well at least you choose an appropriate ‘euphemism’ to frame your narrow minded comment, and shed light on the activities you engage in, that nurture your backwoods attitudes.

Hypothetically speaking, lets say in 2006 your house was worth $200K, and you being the financial guru that you are put 50K down! and you have your tiny 150K mortgage. Your house is now worth 60-70K less then in 2006, that wiped out your down payment, and you paid approximately 38K in interest @ 6%, you lost close to 100K! Now when we finally bottom; possibly as much as 12-18% lower, how long do you think it will take you to get back to ZERO!

We applaud you! Without the john c. holmes of the world, how will my banker be able to afford his kids Yale education, and continue the tradition of fleecing America; the next generation.

First of all, he said he didn’t buy into the housing bubble. So he didn’t buy in 2006. He bought in 2001 or before. Second of all, I don’t think he made mention of down payments, but 20% of 200k is only 40k not 50. Third of all, you’re making John’s point exactly. A home is a place to live in, not prosper by. You were not guaranteed a return on your “investment.”

78M Americans are headed towards a fixed income life style that most are nowhere near ready for, financially speaking. Under 30’s can find jobs and have huge college debt. Anyone who thinks these things are positive for the housing market is sadly misinformed.

The growing risk of disappearing equity invites more strategic defaults on mortgages. Homeowners with negative equity are tempted simply to mail in their keys to their friendly lender even if they can afford the mortgage payment. Banks don’t want to take the deflated properties onto their books because they will then have to declare a financial loss and still have to worry about maintaining the properties.

Little wonder foreclosure has not been enforced on a quarter of the people who haven’t made a single mortgage payment in the last two years. A staggering 8 million home loans are in some state of delinquency, default, or foreclosure. Another 8 million homeowners are estimated to have mortgages representing 95 percent or more of the value of their homes, leaving them with 5 percent or less equity in their homes and thus vulnerable to further price declines. A huge percentage will never be able to catch up on their payment deficits

The pace of foreclosures was briefly slowed by loan modifications brought on by government programs. Alas, the programs have not been working as hoped. Half of the borrowers have been redefaulting within 12 months, even after monthly payments were cut by as much as 50 percent. The foreclosure pipeline remains completely clogged. As it unclogs, a new wave of homes will come on the market and precipitate additional downward pressure on prices. The number of foreclosed homes put on the market by banks will be a more powerful influence on the further decline of home prices than either consumer demand or interest rates. The most critical factor subduing the demand for housing is that home ownership is no longer seen as the great, long-term buildup in equity value it once was. So it is not too difficult to understand why demand for housing has declined and will not revive anytime soon.

“The most critical factor subduing the demand for housing is that home ownership is no longer seen as the great, long-term buildup in equity value it once was.”

This is the beginnings of pedulum swing in psychological sentiment in home ownership. We just saw the second slowest sales of new homes on record in August. And interest rates are, what, 4.4%? In Summer? The more people call a bottom, or a bottoming, and the more these people are proven wrong, the more dire the psychology will get. People are always going to want to buy a house because it’s their home. The change in pscyhology will result in people not believing their houses are investments, and also killing speculation (Ah, what will the world be without those adorable flippers). Those who bought the last couple of years in CA with 3% down FHA loans are going to add fuel to the negative psychology when they slip under-water like so many others who bought post-2005. At it’s peak (or nadir), we’ll have +35% of active American mortgages under water.

The economy is stabilizing. Soon, it will begin a slow, grinding recovery. The Fed will move in preemptively with interest rate rises. And we all know what will happen once interest rates move to their historical mean.

Housing bulls talk “affordability” all they want, the argument is true….with these historically low interest rates. Houses will become more affordable, even with interest rate rises, by prices going down.

John,

I haven’t been here in a while. I am glad to see that you have changed your posts and maybe even mindset to be a little bit more realistic? In previous months you where painting a more then rosy picture of the current economic situation.

May I ask what was the flipping point for you personally?

Thanks,

Eric

Matt,

Love your idea. I think it might work for other areas in the country, where homes are actually affordable, but not in SoCal. I would have to agree with Tokyo – the big assumption is that the housing prices will increase again in SoCal. With the current lending requirements and salary, there’s no way the CURRENT price can hold for this area. If you go to Phoenix, you can buy a 2,400 sf house for $150K- $250K, that would cost you $500K here easily. But the average salary is not that much different. Good idea, but I think it’s better to let the market correct itself – no need for intervention. bite the bullent and move on.

@John CPA

You hit the nail on the head. I know the fundamentals and I understand that things will get bad, but how bad? And how long of a time frame are we looking at?

Despite the fundamentals indicating otherwise, stocks are still up and going up higher. I listened to people who said not to buy when the stock market was at 7k and look where it’s at today. I missed a hell of a run-up.

I understand that the market recovered many losses during the Depression only to lose it again, but it’s either different this time or it isn’t. When it comes to housing, people say that you can’t predict the market today and nothing will recover because it’s different. Yet when it comes to stocks, people are saying look at the Depression and history is an indicator. I have no choice but to wait it out to buy a home but am extremely frustrated.

I cannot invest my money in stocks because I do feel a massive pump and dump, and I definitely cannot invest in housing. Metals may or may not be a bubble so who knows. Seems the only choice is to let the Fed reduce my hard-earned money into nothing.

I hear ya, Phil. I feel exactly the same way. I think that’s just life, though. I’ve had stocks that have tanked, I’ve had metals that have depreciated, and now I have dollars that could tank, too.

How much of your gold, silver, platinum has depreciated again? Did you bury it under a swamp and it eroded? The only place you could have bought gold for more than$1,300 an ounce is from glen beck’s show.

Thomas,

Your answer makes the most sense. Why would the banks do it my way when they can simply screw the taxpayer. It’s unfortunate because the current system is just causing more foreclosures and even lower home values.

As a life time Cali resident, I can attest things are still very tough. I live in a So Cal beach city and have seen more and more neighbors home mid-day as they recently got their walking papers. Professional types such as accountants, interior designers, sales reps, etc.

No home rescue till they all go back to work. I myself got my walking papers 3 years ago when the bank i was working for went sideways due to liberal lending criteria and the option arm. A bad combination. I still can’t believe BofA got rid of all Countrywide Option Arms- those were really stinko!

It’s not rocket science what’s going on. Just look at the big banks insider activity. Brian Moynihan (BofA CEO), Thomas Montag (BofA Officer), John Stumpf (WFC CEO), Howard Atkins (WFC CFO), and the list goes on and on. Just look at insider activity at every TARP recipient. These individuals are selling at an alarming rate. You don’t see any of these big dogs buying their own stock do you? Take WFC for example. They have a great plan, make your SEC filings to the public as non-transparent as possible. Look at pages 28-31 of their 2010 second quarter 10-Q (https://www.wellsfargo.com/downloads/pdf/invest_relations/2Q10_10Q.pdf). They currently show $40B in CA and FL option arms that haven’t been modified with an average LTV of 140%. I have a friend that works at a hedge fund that buys pools of distressed home loans. He said Goldman Sachs (one of their advisers on purchases) expects 75-80% of all option arms will default at some point in time. Many of these people continue to make payments on time until it recasts as they are renting at below market rates. The real red flag on WFC’s 10-Q (pages 82-85) is the almost 2 TRILLION in off balance sheet assets (VIE’s and SPE’s). They simply package loans originated and sell them to themselves at the end of quarters to help pad their earnings. WFC states 1.15T of these VIE/SPE’s are Fannie/Freddie debt which the tax payer is basically on the hook for. They were the biggest originator of Alt-A loans during the bubble years. They don’t mention anywhere in 146 pages of their 10-Q where these are located. Obviously they are off balance sheet in this non-transparent cesspool of trash. If your dog poops on your living room carpet you clean it up. WFC has simply decided to kick that turd under the couch so no one can see it, either way your house still smells like dog poop! There’s nothing like only using four pages to disclose 2 TRILLION in assets. This has simply become an extend and pretend game.

The government’s actions in the last year have temporarily re-inflated home values and the stock market. This gives all their big nuts buddies (yes the same banks/insurance companies/big four CPA’s that have contributed handsomely to politicians coffers before/during/after the economic bubble) just enough time to cash out one last time before we fall flat on our face again. With 18-20% real unemployment (Yes that’s the real number. The government doesn’t count people on extended unemployment benefits, people working part-time that want to work full-time, people who want to work but benefits have run out, etc. into their unemployment calculations) we are not out of the recession as congress and their hand-picked economists say; we are simply slipping into a depression. Home prices are tied to interest rates and household income. Rates can’t go much lower and household incomes have been relatively flat for 10 years and aren’t going up with so many people desperate for employment. Jobs will not come back until Baby Boomers leave the work force, plain and simple. Get ready for a lost decade, it’s coming.

Curtis,

I think you might end up being 100% correct on all counts.

Just prepare yourself for people to be saying 3, 5, and 10 years from now…

Who could have seen this coming and why didn’t we know these banks had so much toxic debt?

Curtis,

Thanks for your post. I think your insights hit the nail on the head and I’m in total agreement with you. I hope to buy puts on WFC. When do you expect the extend and pretend game to be up? I mean, one can’t expect real finance reform in a country where the “finance” (shell games with money) industry fronts the biggest lobby on K Street and it looks like Dept of Treasury is permanently staffed with Wall Streeters or incompetent clowns like Geithner. What do you think of Phil Angeledes’ findings so far? If you like, write to me at hikerdadlvp at y*hoo.

I maintain that instead of “how disconnected Wall Street is from the actual real economy.”, that comment should be modified to read “how disconnected California is and has been from the actual real world or real economy”.

I also submit we should start releasing housing stats EX-Calif/NV/FL (throw in Michigan while you’re at it)

Sort of like Durable Goods orders; EX-Aircraft/Transportation which really skews those data points.

Those Big Three (four actually) markets really screw with the data.

I also snicker when I read those three words – “Pick A Payment” – Snicker.

Housing Will Reach Bottom In 2014, followed By A Decade Of Stagnation!

Oh by the way, forgot to mention, for Californians, bottom will be 2015!

I haven’t followed Phil Angeledes much. All I’ve figured out is CA is the biggest mess if you compare states by contribution to GDP. There is nothing positive going in their direction.

I think WFC can keep playing the “extend and pretend game” for a while, but eventually they will have to have a coming to Jesus. As long as they don’t have to disclose exactly what’s off balance sheet and the FDIC has no way of taking over a company of that size they could be in the clear, which makes the timing tough for buying puts. I would probably buy Jan 2012 or 2013 to be on the safe side. Investors seem to accept the “dancing moves” Howard Atkins throws out there when asked about the off balance sheet assets. He always says the same thing, “a majority of the assets are Fannie/Freddie debt that we simply service.” I also think a large percentage of their loans are tied to CA which is evident from what they do disclose. If home prices start to fall off a cliff in CA that’s going to be the best time. Investors that are short get spooked quick with FED/Govt involvement and with no volume the market runs quick the other way. Short pinches get get sold as bullish signals by the CNBC government propaganda machine which makes the market frustrating to trade.

Do the banks have to pay the property tax on foreclosed or abandoned properties?

Is there a State of Calif. metric on that? Or did they payoff the legislature so they don’t have to pay cause I was just wondering what the carrying costs are when someone moves out. Like, can Randy Quaid move in to take care of the place? I mean while the bank doesn’t have to pay itself a mortgage payment, what bills pile up so the bank is forced to sell at a huge discount and is part of that required to payoff outstanding property taxes and other liens first.

I have an option arm I have been trying to mod for 18 months, today they advised me after being temp. approved I would need 4x the income to qualify. Though when I bought the home I did not have that income nor when it was temp. approved for a mod.

Crazy – they created a bad product and should be held accountable to to fix it, can you say toyota, etc. Reading the OCC report Wamu targetted SoCal w/something like 80% of their loans sold to socal.There is only one reason they will not turn a non-performing asset into a performing asset and that is they get a better deal by foreclosing. Who can qualify, when they are fully amortizing the loan at a higher value though the property value is often half. better question why should we.

Leave a Reply